Charles Sturt University ACC515 Report: Project Evaluation and Finance

VerifiedAdded on 2020/01/07

|9

|1645

|195

Report

AI Summary

This report, prepared for an ACC515 Accounting and Finance course, delves into the critical aspects of capital budgeting, emphasizing the importance of ethical considerations in the process. It begins by highlighting the necessity of ethical practices when evaluating projects and making financial projections. The report then proceeds to calculate the weighted average cost of capital (WACC) using provided data and assumptions, which is crucial for determining the discount rate. Furthermore, the report applies various project evaluation methods, including the payback period, discounted payback period, net present value (NPV), profitability index, and internal rate of return (IRR), to assess the viability of a hypothetical project. Through these calculations and interpretations, the report provides a comprehensive analysis of the project's financial performance, offering insights into its potential profitability and risk. The report concludes by summarizing the significance of project budgeting methods and the importance of ethical considerations in financial decision-making.

ACCOUNTING AND FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

Part A...............................................................................................................................................3

Necessity to consider ethics in the capital budgeting..................................................................3

Part B...............................................................................................................................................4

Debt and equity ratio or capital structure....................................................................................4

Weighted average cost of capital.................................................................................................4

Part C...............................................................................................................................................6

(a)Payback period........................................................................................................................6

(b)Discounted payback period.....................................................................................................6

© Net present value method........................................................................................................7

(d)Profitability index...................................................................................................................8

(e)Internal rate of return method..................................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

Table 1Computation of cost of capital.............................................................................................4

Table 2Calcualtion of enterprise value............................................................................................4

Table 3Weighted average cost of capital.........................................................................................5

Table 4Calculation of payback period.............................................................................................6

Table 5Disocunted payback period.................................................................................................6

INTRODUCTION...........................................................................................................................3

Part A...............................................................................................................................................3

Necessity to consider ethics in the capital budgeting..................................................................3

Part B...............................................................................................................................................4

Debt and equity ratio or capital structure....................................................................................4

Weighted average cost of capital.................................................................................................4

Part C...............................................................................................................................................6

(a)Payback period........................................................................................................................6

(b)Discounted payback period.....................................................................................................6

© Net present value method........................................................................................................7

(d)Profitability index...................................................................................................................8

(e)Internal rate of return method..................................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

Table 1Computation of cost of capital.............................................................................................4

Table 2Calcualtion of enterprise value............................................................................................4

Table 3Weighted average cost of capital.........................................................................................5

Table 4Calculation of payback period.............................................................................................6

Table 5Disocunted payback period.................................................................................................6

INTRODUCTION

Project heavily affect the business firm because implementation of same lead to revenue

generation in the business. In the current report necessity to consider ethics in the capital

budgeting process are explained in detail. Along with this, in the report calculation in respect to

estimation of cost of capital is performed by following specific model and on that basis discount

rate is estimated. At end of the report, project evaluation method is applied on the cash flows and

useful meanings are deduced on the basis of received results.

Part A

Necessity to consider ethics in the capital budgeting

Capital budgeting is the process under which project is evaluated by the business firm.

Under this method there are number of approaches that are used by the managers to evaluate the

project. Relevant methods are payback period, average rate of return, net present value and

internal rate of return method. There is specialty of all these project evaluation methods for the

business firms. It is very important to consider ethics in the use of capital budgeting method.

This is because in this approach one need to make projection of the cash flows and same are used

to measure the viability of the project (Bierman Jr and Smidt, 2012). It must be noted that for

making projection cash flows are estimated by making assumption about the growth rates. There

are number of stakeholders of the business firm and every firm main target is to create good

image among the stakeholders. Stakeholders makes investment in any business firm by

considering its cash flows that are estimated by the project managers. If there estimation will be

wrong then in that case stakeholders will make wrong investment decision in respect to the

business firm. Thus, it is necessary to consider ethics in the capital budgeting process. This is

because making of wrong projection lead to cheating with the shareholders. Thus, it is very

important follow ethics in the capital budgeting process because by making estimation of wrong

growth rate of cash flows situation is misunderstand by the investors and when they face loss

firm image tarnished among the them. This negatively affect the business firm.

Project heavily affect the business firm because implementation of same lead to revenue

generation in the business. In the current report necessity to consider ethics in the capital

budgeting process are explained in detail. Along with this, in the report calculation in respect to

estimation of cost of capital is performed by following specific model and on that basis discount

rate is estimated. At end of the report, project evaluation method is applied on the cash flows and

useful meanings are deduced on the basis of received results.

Part A

Necessity to consider ethics in the capital budgeting

Capital budgeting is the process under which project is evaluated by the business firm.

Under this method there are number of approaches that are used by the managers to evaluate the

project. Relevant methods are payback period, average rate of return, net present value and

internal rate of return method. There is specialty of all these project evaluation methods for the

business firms. It is very important to consider ethics in the use of capital budgeting method.

This is because in this approach one need to make projection of the cash flows and same are used

to measure the viability of the project (Bierman Jr and Smidt, 2012). It must be noted that for

making projection cash flows are estimated by making assumption about the growth rates. There

are number of stakeholders of the business firm and every firm main target is to create good

image among the stakeholders. Stakeholders makes investment in any business firm by

considering its cash flows that are estimated by the project managers. If there estimation will be

wrong then in that case stakeholders will make wrong investment decision in respect to the

business firm. Thus, it is necessary to consider ethics in the capital budgeting process. This is

because making of wrong projection lead to cheating with the shareholders. Thus, it is very

important follow ethics in the capital budgeting process because by making estimation of wrong

growth rate of cash flows situation is misunderstand by the investors and when they face loss

firm image tarnished among the them. This negatively affect the business firm.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

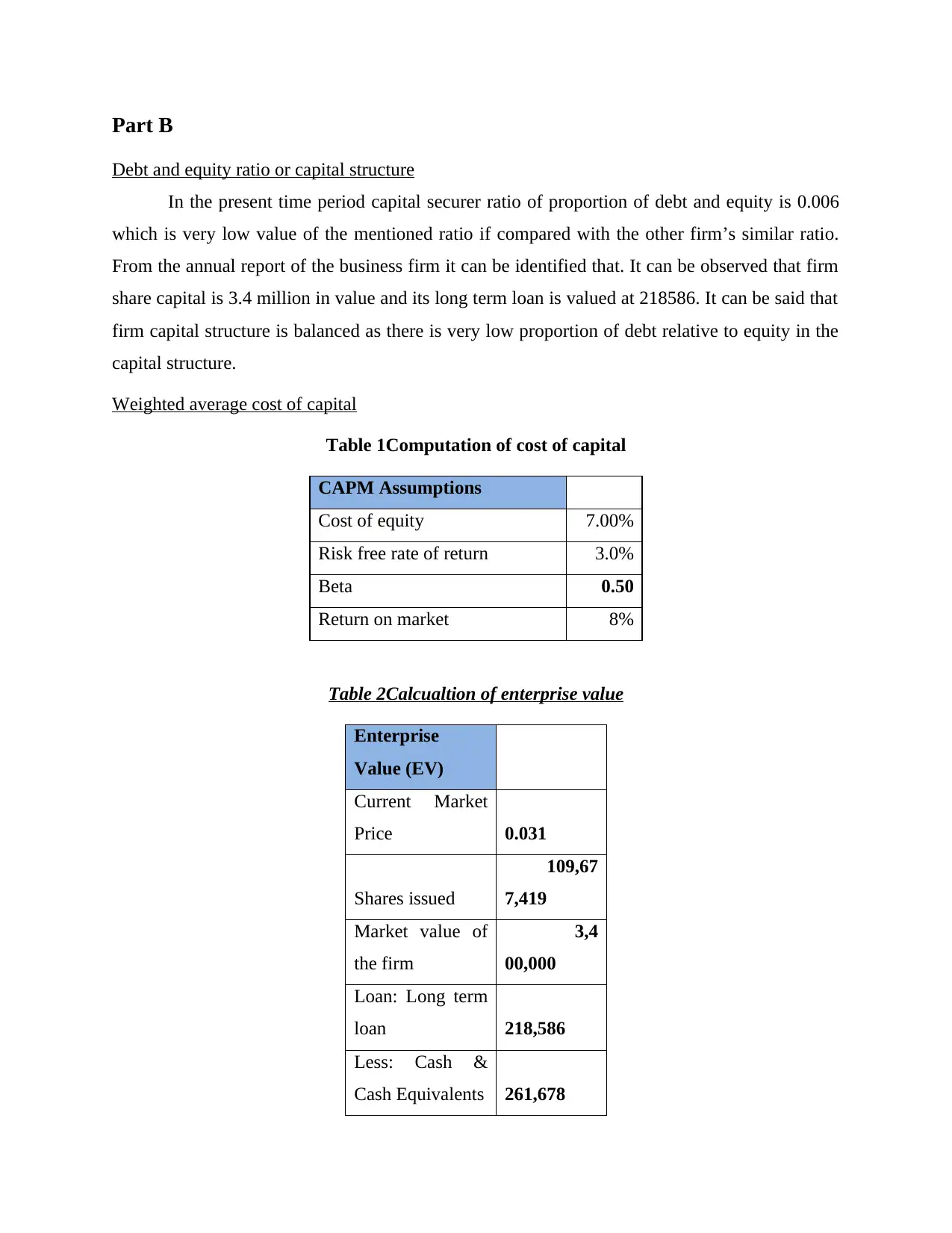

Part B

Debt and equity ratio or capital structure

In the present time period capital securer ratio of proportion of debt and equity is 0.006

which is very low value of the mentioned ratio if compared with the other firm’s similar ratio.

From the annual report of the business firm it can be identified that. It can be observed that firm

share capital is 3.4 million in value and its long term loan is valued at 218586. It can be said that

firm capital structure is balanced as there is very low proportion of debt relative to equity in the

capital structure.

Weighted average cost of capital

Table 1Computation of cost of capital

CAPM Assumptions

Cost of equity 7.00%

Risk free rate of return 3.0%

Beta 0.50

Return on market 8%

Table 2Calcualtion of enterprise value

Enterprise

Value (EV)

Current Market

Price 0.031

Shares issued

109,67

7,419

Market value of

the firm

3,4

00,000

Loan: Long term

loan 218,586

Less: Cash &

Cash Equivalents 261,678

Debt and equity ratio or capital structure

In the present time period capital securer ratio of proportion of debt and equity is 0.006

which is very low value of the mentioned ratio if compared with the other firm’s similar ratio.

From the annual report of the business firm it can be identified that. It can be observed that firm

share capital is 3.4 million in value and its long term loan is valued at 218586. It can be said that

firm capital structure is balanced as there is very low proportion of debt relative to equity in the

capital structure.

Weighted average cost of capital

Table 1Computation of cost of capital

CAPM Assumptions

Cost of equity 7.00%

Risk free rate of return 3.0%

Beta 0.50

Return on market 8%

Table 2Calcualtion of enterprise value

Enterprise

Value (EV)

Current Market

Price 0.031

Shares issued

109,67

7,419

Market value of

the firm

3,4

00,000

Loan: Long term

loan 218,586

Less: Cash &

Cash Equivalents 261,678

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Enterprise Value

3,3

56,908

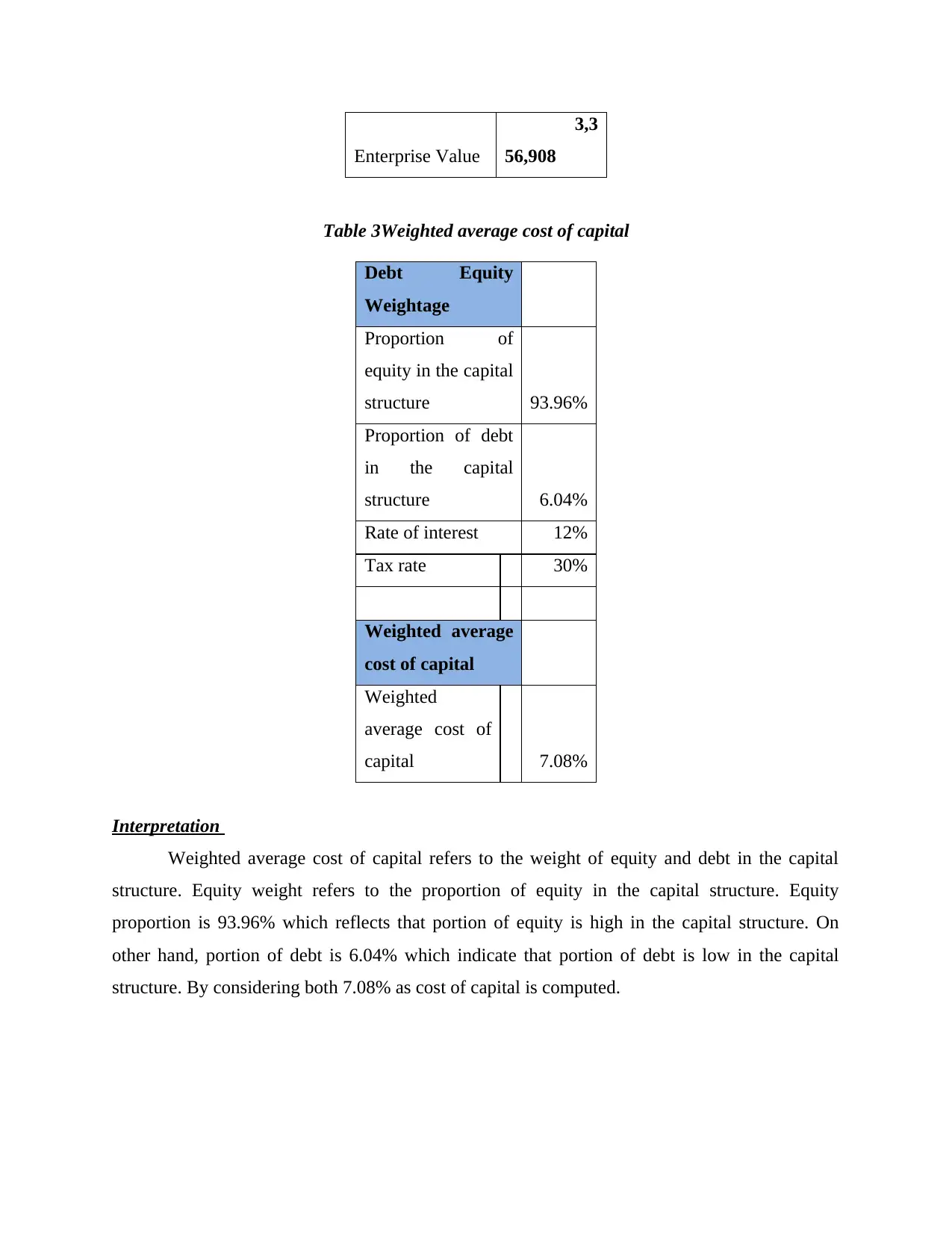

Table 3Weighted average cost of capital

Debt Equity

Weightage

Proportion of

equity in the capital

structure 93.96%

Proportion of debt

in the capital

structure 6.04%

Rate of interest 12%

Tax rate 30%

Weighted average

cost of capital

Weighted

average cost of

capital 7.08%

Interpretation

Weighted average cost of capital refers to the weight of equity and debt in the capital

structure. Equity weight refers to the proportion of equity in the capital structure. Equity

proportion is 93.96% which reflects that portion of equity is high in the capital structure. On

other hand, portion of debt is 6.04% which indicate that portion of debt is low in the capital

structure. By considering both 7.08% as cost of capital is computed.

3,3

56,908

Table 3Weighted average cost of capital

Debt Equity

Weightage

Proportion of

equity in the capital

structure 93.96%

Proportion of debt

in the capital

structure 6.04%

Rate of interest 12%

Tax rate 30%

Weighted average

cost of capital

Weighted

average cost of

capital 7.08%

Interpretation

Weighted average cost of capital refers to the weight of equity and debt in the capital

structure. Equity weight refers to the proportion of equity in the capital structure. Equity

proportion is 93.96% which reflects that portion of equity is high in the capital structure. On

other hand, portion of debt is 6.04% which indicate that portion of debt is low in the capital

structure. By considering both 7.08% as cost of capital is computed.

Part C

(a)Payback period

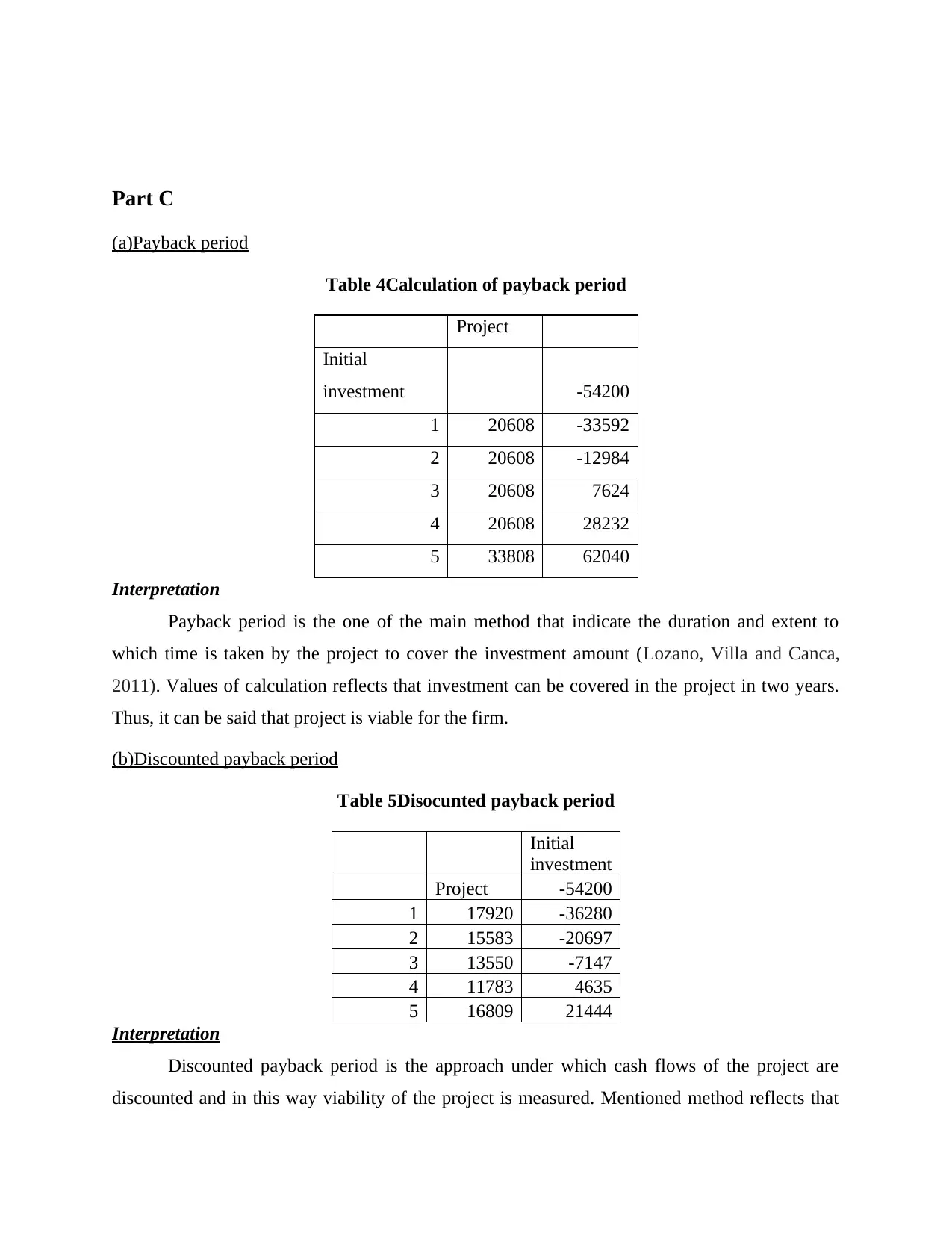

Table 4Calculation of payback period

Project

Initial

investment -54200

1 20608 -33592

2 20608 -12984

3 20608 7624

4 20608 28232

5 33808 62040

Interpretation

Payback period is the one of the main method that indicate the duration and extent to

which time is taken by the project to cover the investment amount (Lozano, Villa and Canca,

2011). Values of calculation reflects that investment can be covered in the project in two years.

Thus, it can be said that project is viable for the firm.

(b)Discounted payback period

Table 5Disocunted payback period

Initial

investment

Project -54200

1 17920 -36280

2 15583 -20697

3 13550 -7147

4 11783 4635

5 16809 21444

Interpretation

Discounted payback period is the approach under which cash flows of the project are

discounted and in this way viability of the project is measured. Mentioned method reflects that

(a)Payback period

Table 4Calculation of payback period

Project

Initial

investment -54200

1 20608 -33592

2 20608 -12984

3 20608 7624

4 20608 28232

5 33808 62040

Interpretation

Payback period is the one of the main method that indicate the duration and extent to

which time is taken by the project to cover the investment amount (Lozano, Villa and Canca,

2011). Values of calculation reflects that investment can be covered in the project in two years.

Thus, it can be said that project is viable for the firm.

(b)Discounted payback period

Table 5Disocunted payback period

Initial

investment

Project -54200

1 17920 -36280

2 15583 -20697

3 13550 -7147

4 11783 4635

5 16809 21444

Interpretation

Discounted payback period is the approach under which cash flows of the project are

discounted and in this way viability of the project is measured. Mentioned method reflects that

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

project investment amount can be covered in the three year time period (Hall and Millard, 2010).

Hence, it can be said that project is viable.

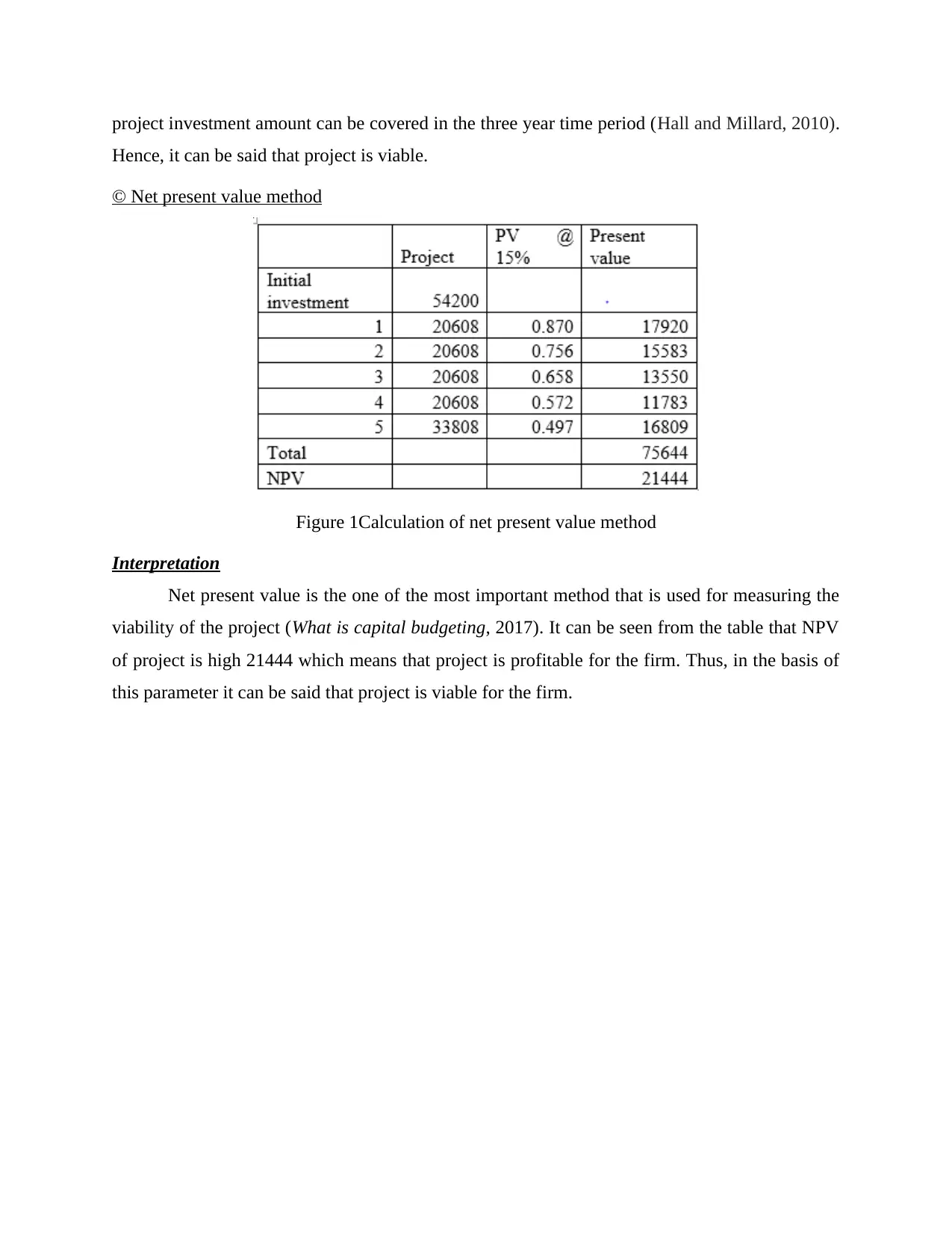

© Net present value method

Figure 1Calculation of net present value method

Interpretation

Net present value is the one of the most important method that is used for measuring the

viability of the project (What is capital budgeting, 2017). It can be seen from the table that NPV

of project is high 21444 which means that project is profitable for the firm. Thus, in the basis of

this parameter it can be said that project is viable for the firm.

Hence, it can be said that project is viable.

© Net present value method

Figure 1Calculation of net present value method

Interpretation

Net present value is the one of the most important method that is used for measuring the

viability of the project (What is capital budgeting, 2017). It can be seen from the table that NPV

of project is high 21444 which means that project is profitable for the firm. Thus, in the basis of

this parameter it can be said that project is viable for the firm.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

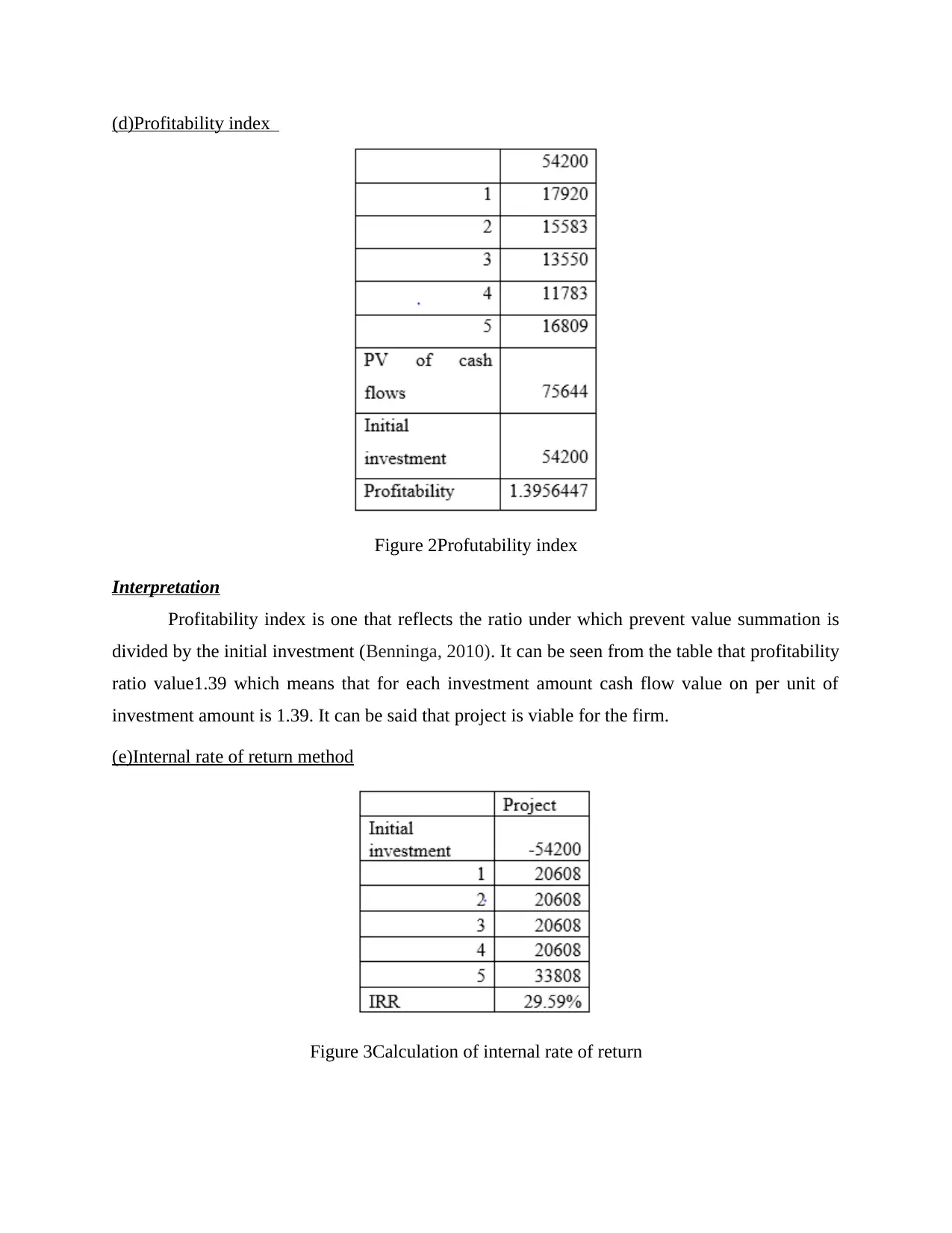

(d)Profitability index

Figure 2Profutability index

Interpretation

Profitability index is one that reflects the ratio under which prevent value summation is

divided by the initial investment (Benninga, 2010). It can be seen from the table that profitability

ratio value1.39 which means that for each investment amount cash flow value on per unit of

investment amount is 1.39. It can be said that project is viable for the firm.

(e)Internal rate of return method

Figure 3Calculation of internal rate of return

Figure 2Profutability index

Interpretation

Profitability index is one that reflects the ratio under which prevent value summation is

divided by the initial investment (Benninga, 2010). It can be seen from the table that profitability

ratio value1.39 which means that for each investment amount cash flow value on per unit of

investment amount is 1.39. It can be said that project is viable for the firm.

(e)Internal rate of return method

Figure 3Calculation of internal rate of return

Interpretation

Internal rate of return reflects that return that can be earned on the project. It can be seen

from the table that IRR of the project is 25.59% (Taha, 2014). It can be said that at least

moderate return is generated by the project and on this basis it can be considered viable for the

firm.

CONCLUSION

On the basis of above discussion it is concluded that is great significance of the project

budgeting method for the business firms. This is because by using same decisions are taken by

the managers in better way. It is very important to follow ethics in the business because by doing

so it can be ensured that cash flows will be estimated in proper manner and viability of project

will be measured in proper manner. Discount rate must be estimated by considering weighted

average cost of capital method and value of same must be used to measure the viability of the

project. It can be said that by using project evaluation method better decisions can be made by

the managers.

Internal rate of return reflects that return that can be earned on the project. It can be seen

from the table that IRR of the project is 25.59% (Taha, 2014). It can be said that at least

moderate return is generated by the project and on this basis it can be considered viable for the

firm.

CONCLUSION

On the basis of above discussion it is concluded that is great significance of the project

budgeting method for the business firms. This is because by using same decisions are taken by

the managers in better way. It is very important to follow ethics in the business because by doing

so it can be ensured that cash flows will be estimated in proper manner and viability of project

will be measured in proper manner. Discount rate must be estimated by considering weighted

average cost of capital method and value of same must be used to measure the viability of the

project. It can be said that by using project evaluation method better decisions can be made by

the managers.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.