Evaluating Bankruptcy Models for Stock Price Prediction - Coal Mining

VerifiedAdded on 2023/04/21

|12

|6999

|235

Report

AI Summary

This report investigates the relationship between bankruptcy prediction models and stock prices within the Indonesian coal mining sector. It empirically explores the usefulness of the Ohlson, Altman Modification, Grover, Springate, and Zmijewski models in predicting bankruptcy and measures their effects on stock prices. Using panel regression analysis on data from 19 coal mining companies listed on the Indonesian Stock Exchange between 2013 and 2015, the study finds that the Ohlson and Altman Modification models are dominant predictors affecting stock prices. The research concludes that bankruptcy prediction models can be a valuable tool for assessing stock price movements and the financial performance of coal mining companies in Indonesia, offering insights for investors, managers, and regulators. Desklib is a valuable resource for students seeking similar solved assignments and study materials.

Received: December 28, 2017; Revised: January 25, 2018; Accepted: February 5, 2018

1, 3 Universitas Malikussaleh. Muara Batu, North Aceh, Aceh, Indonesia

1,2 Universitas Syiah Kuala. Jl. Teuku Nyak Arief, Banda Aceh, Aceh, Indonesia

E-mail:1ghazali.syamni@unimal.ac.id,2mshabri@unsyiah.ac.id,3wiedyanav@gmail.com

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

Etikonomi

Volume 17 (1), 2018: 57 - 68

P-ISSN: 1412-8969; E-ISSN: 2461-0771

Ghazali Syamni1,M. Shabri Abd. Majid2, Widyana Verawaty Siregar3

Abstract. Various bankruptcy prediction models have been used to measure the move

of stock prices, and thus the firms’ performance. This study is aimed at empirically exp

the usefulness of the Olhson, Almant Modification, Grover, Springate, and Zmijewski mo

for predicting bankruptcy of the 19 coal mining companies. It also attempts to m

the effects of the scores of these bankruptcy prediction models on the stock prices of th

mining companies in Indonesia. The technique of analysis that used in this research is p

regression. The results of the study showed that the bankruptcy prediction scores of the

and Almant Modification were found to be the dominant prediction models that affected

stock prices of the coal companies in Indonesia. This indicates that the bankruptcy pred

model can be used as one of the approaches to measure the movement of stock prices

performance of the coal mining companies in Indonesia.

Keywords: bankruptcy, stock prices, coal mining companies.

Abstrak. Berbagai model prediksi kebangkrutan telah digunakan untuk mengukur

pergerakan harga saham dan sekaligus kinerja perusahaan. Penelitian ini bertujua

untuk mengeksplorasi secara empiris kegunaan model Olhson, Almant Modificatio

Grover, Springate, dan Zmijewski dalam memprediksi kebangkrutan 19 perusahaa

pertambangan batubara. Penelitian ini juga menguji dampak model prediksi kebangkru

terhadap harga saham perusahaan pertambangan batubara di Indonesia. Teknik analisi

yang dipergunakan pada penelitian ini ialah teknik regresi panel. Hasil penelitian

menemukan bukti bahwa model prediksi Ohlson dan Modifikasi Almant merupaka

model prediksi dominan yang mempengaruhi harga saham perusahaan batubara

Indonesia. Hal ini mengindikasikan bahwa model prediksi kebangkrutan dapat digunaka

untuk memprediksikan pergerakan harga saham dan sekaligus kinerja keuangan indust

batubara di Indonesia.

Kata kunci: kebangkrutan, harga saham, perusahaan pertambangan batubara

How to Cite:

Syamni, G., Majid, M.S.A., & Siregar, W.F. (2018). Bankruptcy Prediction Models and Stock Prices of The Coal Mini

Industry in Indonesia. Etikonomi: Jurnal Ekonomi. Vol. 17 (1): 57 – 68. doi: http//dx.doi.org/10.15408/etk.v17i1.65

Bankruptcy Prediction Models and Stock Prices

of the Coal Mining Industry in Indonesia

1, 3 Universitas Malikussaleh. Muara Batu, North Aceh, Aceh, Indonesia

1,2 Universitas Syiah Kuala. Jl. Teuku Nyak Arief, Banda Aceh, Aceh, Indonesia

E-mail:1ghazali.syamni@unimal.ac.id,2mshabri@unsyiah.ac.id,3wiedyanav@gmail.com

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

Etikonomi

Volume 17 (1), 2018: 57 - 68

P-ISSN: 1412-8969; E-ISSN: 2461-0771

Ghazali Syamni1,M. Shabri Abd. Majid2, Widyana Verawaty Siregar3

Abstract. Various bankruptcy prediction models have been used to measure the move

of stock prices, and thus the firms’ performance. This study is aimed at empirically exp

the usefulness of the Olhson, Almant Modification, Grover, Springate, and Zmijewski mo

for predicting bankruptcy of the 19 coal mining companies. It also attempts to m

the effects of the scores of these bankruptcy prediction models on the stock prices of th

mining companies in Indonesia. The technique of analysis that used in this research is p

regression. The results of the study showed that the bankruptcy prediction scores of the

and Almant Modification were found to be the dominant prediction models that affected

stock prices of the coal companies in Indonesia. This indicates that the bankruptcy pred

model can be used as one of the approaches to measure the movement of stock prices

performance of the coal mining companies in Indonesia.

Keywords: bankruptcy, stock prices, coal mining companies.

Abstrak. Berbagai model prediksi kebangkrutan telah digunakan untuk mengukur

pergerakan harga saham dan sekaligus kinerja perusahaan. Penelitian ini bertujua

untuk mengeksplorasi secara empiris kegunaan model Olhson, Almant Modificatio

Grover, Springate, dan Zmijewski dalam memprediksi kebangkrutan 19 perusahaa

pertambangan batubara. Penelitian ini juga menguji dampak model prediksi kebangkru

terhadap harga saham perusahaan pertambangan batubara di Indonesia. Teknik analisi

yang dipergunakan pada penelitian ini ialah teknik regresi panel. Hasil penelitian

menemukan bukti bahwa model prediksi Ohlson dan Modifikasi Almant merupaka

model prediksi dominan yang mempengaruhi harga saham perusahaan batubara

Indonesia. Hal ini mengindikasikan bahwa model prediksi kebangkrutan dapat digunaka

untuk memprediksikan pergerakan harga saham dan sekaligus kinerja keuangan indust

batubara di Indonesia.

Kata kunci: kebangkrutan, harga saham, perusahaan pertambangan batubara

How to Cite:

Syamni, G., Majid, M.S.A., & Siregar, W.F. (2018). Bankruptcy Prediction Models and Stock Prices of The Coal Mini

Industry in Indonesia. Etikonomi: Jurnal Ekonomi. Vol. 17 (1): 57 – 68. doi: http//dx.doi.org/10.15408/etk.v17i1.65

Bankruptcy Prediction Models and Stock Prices

of the Coal Mining Industry in Indonesia

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Ghazali Syamni. Bankruptcy Prediction Models and Stock Prices

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

58

Introduction

Various approaches have been adopted to measure the company financial perfo

one of them is using the bankruptcy prediction models. The bankruptcy prediction mo

been used to analyze the company performances of different industries. The first ban

prediction model was introduced by Altman (1968), known as Almant Z-Score. This m

has been widely used and still being relevant to predict a company whether it is bank

grey area or healthy (Altman, et al, 2017). In 1995, Edward Almant later modified th

so that it can be used for predicting bankruptcy of manufacturing and non-manufactu

companies.

After 1970s, several other models have been introduced to predict bankruptcy s

as Springate (1978); Ohlson (1980); Zmijewski (1983); and Grover and Lavin (

The names of the models were given based on the name of the researchers who intro

them for the first time. In his study, Jayasekera (2017) have identified four models of

bankruptcy prediction, namely: the mathematic, neural network, statistic and the ma

models. Meanwhile, Wu, et al (2010) categorized the bankruptcy models into the disc

model popularized by Altman in 1968, the logit model introduced by Ohlson in 1980,

probit model developed by Zmijewski in 1984, the hazard model proposed by Shumw

2001, and the Black-Scholes-Merton (BSM) probability model introduced by Hillegeist

al (2004).

In predicting the bankcruptcy, these models have different levels of accur

on their measurements used (Purnajaya and Merkusiwati, 2014). For example, the Oh

model has added the company income variable and in totality, the model has seven v

Meanwhile, the modified Almant and Springate models have the similar four variables

the Olson model, yet they have different types of variables, except the working capit

the total assets. Finally, the models categorized the firm either into the healthy, grey

or bankrupted company with different scores. The detailed measurements of the mod

explained in the methodological section.

Many previous empirical studies in the developed countries have used different

to predict the company performances. For example, in the United States of America;

et al (2013) used the Black-Scholes-Merton (BSM) model to predict the bankruptcy of

non-financial companies. In England, Tinoco and Wilson (2013) predicted the bankrup

by using the network and Almant Z Score models. Ko, et al (2017) predicted the bank

of the solar energy company in Taiwan using the Z score model. Xu and Zhan

predicted the bankruptcy of the listed companies in the Japanese stock exchange usi

Almant Z and the Ohlson scores and then regressed them with the financial performa

the bank institution and Keiretsu firms as the dependent variable.

Similar studies on the bankruptcy prediction in the developing countries h

also used different types of the bankruptcy prediction models. Marcinkevičius a

Kanapickienė (2014) predicted the bankruptcy of the construction company in Lithua

using the Altman, Springate, Taffler and the Tisshaw models. Karas and Režňáková (

measured the bankruptcy prediction of manufacturing company in the Republic of Cz

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

58

Introduction

Various approaches have been adopted to measure the company financial perfo

one of them is using the bankruptcy prediction models. The bankruptcy prediction mo

been used to analyze the company performances of different industries. The first ban

prediction model was introduced by Altman (1968), known as Almant Z-Score. This m

has been widely used and still being relevant to predict a company whether it is bank

grey area or healthy (Altman, et al, 2017). In 1995, Edward Almant later modified th

so that it can be used for predicting bankruptcy of manufacturing and non-manufactu

companies.

After 1970s, several other models have been introduced to predict bankruptcy s

as Springate (1978); Ohlson (1980); Zmijewski (1983); and Grover and Lavin (

The names of the models were given based on the name of the researchers who intro

them for the first time. In his study, Jayasekera (2017) have identified four models of

bankruptcy prediction, namely: the mathematic, neural network, statistic and the ma

models. Meanwhile, Wu, et al (2010) categorized the bankruptcy models into the disc

model popularized by Altman in 1968, the logit model introduced by Ohlson in 1980,

probit model developed by Zmijewski in 1984, the hazard model proposed by Shumw

2001, and the Black-Scholes-Merton (BSM) probability model introduced by Hillegeist

al (2004).

In predicting the bankcruptcy, these models have different levels of accur

on their measurements used (Purnajaya and Merkusiwati, 2014). For example, the Oh

model has added the company income variable and in totality, the model has seven v

Meanwhile, the modified Almant and Springate models have the similar four variables

the Olson model, yet they have different types of variables, except the working capit

the total assets. Finally, the models categorized the firm either into the healthy, grey

or bankrupted company with different scores. The detailed measurements of the mod

explained in the methodological section.

Many previous empirical studies in the developed countries have used different

to predict the company performances. For example, in the United States of America;

et al (2013) used the Black-Scholes-Merton (BSM) model to predict the bankruptcy of

non-financial companies. In England, Tinoco and Wilson (2013) predicted the bankrup

by using the network and Almant Z Score models. Ko, et al (2017) predicted the bank

of the solar energy company in Taiwan using the Z score model. Xu and Zhan

predicted the bankruptcy of the listed companies in the Japanese stock exchange usi

Almant Z and the Ohlson scores and then regressed them with the financial performa

the bank institution and Keiretsu firms as the dependent variable.

Similar studies on the bankruptcy prediction in the developing countries h

also used different types of the bankruptcy prediction models. Marcinkevičius a

Kanapickienė (2014) predicted the bankruptcy of the construction company in Lithua

using the Altman, Springate, Taffler and the Tisshaw models. Karas and Režňáková (

measured the bankruptcy prediction of manufacturing company in the Republic of Cz

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559 59

Etikonomi

Volume 17 (1), 2018: 57 - 68

using the combining models of the discriminant and the Box Cox. In Saudi Arabia, Al-

Kassar and Soileau (2014) predicted the bankruptcy of different companies (i.e., the

transportation, heritage and museum, commercial companies, and the replenishmen

oil companies) using the Z-score model. Similarly, using the Z score model, H

et al (2014) measured bankruptcy of the textiles industry in Pakistan, while Al-Rawi, e

al (2011) investigated the bankruptcy of the glassware company in Jordan. Karamzad

(2013) predicted the bankruptcy of 90 stock exchange companies in Teheran using th

Almant Z score and the Ohlson models. In Thailand, Pongsatat, et al (2004) using the

Almant and Ohlson models to predict the performances of 60 bankrupted companies

60 non-bankrupted companies.

In the context of Indonesia, in predicting the bankruptcy of the companie

previous studies have widely used a single Almant Z Score (Sudiyatno and Pu

2010), while only few other studies used different types of the bankruptcy pre

models for companies of different sectors. For example, Sembiring (2016) used the O

model to predict the bankrupted companies. In predicting the bankruptcy, Rachmaw

(2016) applied the Almant model for the insurance company, Boedi and Tiara

for the telecommunication company, and Yunan and Rahmasari (2015) for Shariah St

Performance.

On the other hand, the previous studies that used more than one models for pre

the bankruptcy of the company in Indonesia. Putera, et al (2017) predicted the bankr

of the mining companies by using the Altman, Springate and Ohlson models. Gunawa

al (2016) applied the Altman, Grover and Zmijewski models for the manufactures com

while Rahayu, et al (2016) used the Altman Z-Score, Springate, and the Zmijewski mo

for the telecommunication companies in Indonesia.

Furthermore, Effendi, et al (2016) used the bankruptcy prediction model o

Springate to estimate the stock prices of the telecommunication companies, while An

and Salean (2016) used the Almant model and analyzed its impact to the pharmacy c

stock prices. Adrian and Khoiruddin (2014) applied the Almant model and anal

impact to the manufacturing company’s stock prices. They documented that th

model affected the stock prices of the manufacturing companies (Adrian and Khoirud

2014), the pharmacy companies (Andriawan and Salean, 2016), and the transp

companies (Amaliawiati and Lestari, 2014) in Indonesia. Effendi et al. (2016) found th

Springate model affected the stock prices, while Wulandari and Norita (2014) found t

Ohlson model (O-score) affected the stock returns of the textile and garment compan

Indonesia over the period 2010-2014. In short, these studies only used a single bankr

prediction model to estimate the stock prices in Indonesia.

The above-reviewed studies showed that many previous empirical studies have

adopted a single model to predict the performance of the firm, and yet its connection

stock prices was rarely done using various bankcruptcy prediction models, thu

insufficient empirical findings. Bankruptcy prediction models might affect the stock p

indicating that when a company goes into bankruptcy, its stock price goes down or u

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559 59

Etikonomi

Volume 17 (1), 2018: 57 - 68

using the combining models of the discriminant and the Box Cox. In Saudi Arabia, Al-

Kassar and Soileau (2014) predicted the bankruptcy of different companies (i.e., the

transportation, heritage and museum, commercial companies, and the replenishmen

oil companies) using the Z-score model. Similarly, using the Z score model, H

et al (2014) measured bankruptcy of the textiles industry in Pakistan, while Al-Rawi, e

al (2011) investigated the bankruptcy of the glassware company in Jordan. Karamzad

(2013) predicted the bankruptcy of 90 stock exchange companies in Teheran using th

Almant Z score and the Ohlson models. In Thailand, Pongsatat, et al (2004) using the

Almant and Ohlson models to predict the performances of 60 bankrupted companies

60 non-bankrupted companies.

In the context of Indonesia, in predicting the bankruptcy of the companie

previous studies have widely used a single Almant Z Score (Sudiyatno and Pu

2010), while only few other studies used different types of the bankruptcy pre

models for companies of different sectors. For example, Sembiring (2016) used the O

model to predict the bankrupted companies. In predicting the bankruptcy, Rachmaw

(2016) applied the Almant model for the insurance company, Boedi and Tiara

for the telecommunication company, and Yunan and Rahmasari (2015) for Shariah St

Performance.

On the other hand, the previous studies that used more than one models for pre

the bankruptcy of the company in Indonesia. Putera, et al (2017) predicted the bankr

of the mining companies by using the Altman, Springate and Ohlson models. Gunawa

al (2016) applied the Altman, Grover and Zmijewski models for the manufactures com

while Rahayu, et al (2016) used the Altman Z-Score, Springate, and the Zmijewski mo

for the telecommunication companies in Indonesia.

Furthermore, Effendi, et al (2016) used the bankruptcy prediction model o

Springate to estimate the stock prices of the telecommunication companies, while An

and Salean (2016) used the Almant model and analyzed its impact to the pharmacy c

stock prices. Adrian and Khoiruddin (2014) applied the Almant model and anal

impact to the manufacturing company’s stock prices. They documented that th

model affected the stock prices of the manufacturing companies (Adrian and Khoirud

2014), the pharmacy companies (Andriawan and Salean, 2016), and the transp

companies (Amaliawiati and Lestari, 2014) in Indonesia. Effendi et al. (2016) found th

Springate model affected the stock prices, while Wulandari and Norita (2014) found t

Ohlson model (O-score) affected the stock returns of the textile and garment compan

Indonesia over the period 2010-2014. In short, these studies only used a single bankr

prediction model to estimate the stock prices in Indonesia.

The above-reviewed studies showed that many previous empirical studies have

adopted a single model to predict the performance of the firm, and yet its connection

stock prices was rarely done using various bankcruptcy prediction models, thu

insufficient empirical findings. Bankruptcy prediction models might affect the stock p

indicating that when a company goes into bankruptcy, its stock price goes down or u

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Ghazali Syamni. Bankruptcy Prediction Models and Stock Prices

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

60

Relying only on a single model to predict the bankcruptcy might lead to an i

estimation, thus it, in turns, lead to the improper policy recommendation. Anticipatin

the present study used various models to predict the bankruptcy of the firms and ana

its impact to the firms’ stock prices in Indonesia. Thus, this study is among the first to

various bankruptcy models of the Olhson, Almant Modification, Grover, Springate, an

Zmijewski to estimate the stock prices in the Indonesian stock markets. This i

novelty of this study that is in its comparison among the bankruptcy prediction mode

Estimating comparatively among these models would show the most suitable and acc

model to be adopted to predict the movement of stock prices in Indonesia. Secondly,

study focuses its analysis on the coal mining companies, which has no previous empi

studies on this important industry in the Indonesian economy. Considering the shortc

and mixed or inconclusive empirical findings of the previous studies on the relationsh

between the bankruptcy prediction models and stock prices in Indonesia, thus this st

hoped to provide a more comprehensive and enriching empirical evidences on this is

comparing various bankruptcy prediction models (i.e., the Olhson, Almant Modificatio

Grover, Springate, and the Zmijewski models) and then analysing its impact to the st

prices of the coal mining industry in Indonesia.

The findings of this study are hoped to shed some lights for the inventor

selecting which companies to invest the monies, for the managers to promote

performance of the companies, and for the regulator to design policy in enhancing th

stock market in the biggest Muslim populous country in the world, Indonesia. The res

of this study is structured as follows. Section 2 provides the empirical framew

followed by the discussion of the findings and their implications in Section 3.

Section 4 concludes the study.

Method

Data of this study is gathered from the financial report of 19 companies in the co

mining sector that are listed on the Indonesian Stock Exchange (IDX) over the

2013 to 2015. These data are accessed through the website www.idx.co.id and firms

selected using the purposive sampling technique. The firms investigated in this study

the coal mining company that published their audited financial reports during the per

2013-2015. As for the stock prices, the closing stock prices of 19 coal-mining compan

are used.

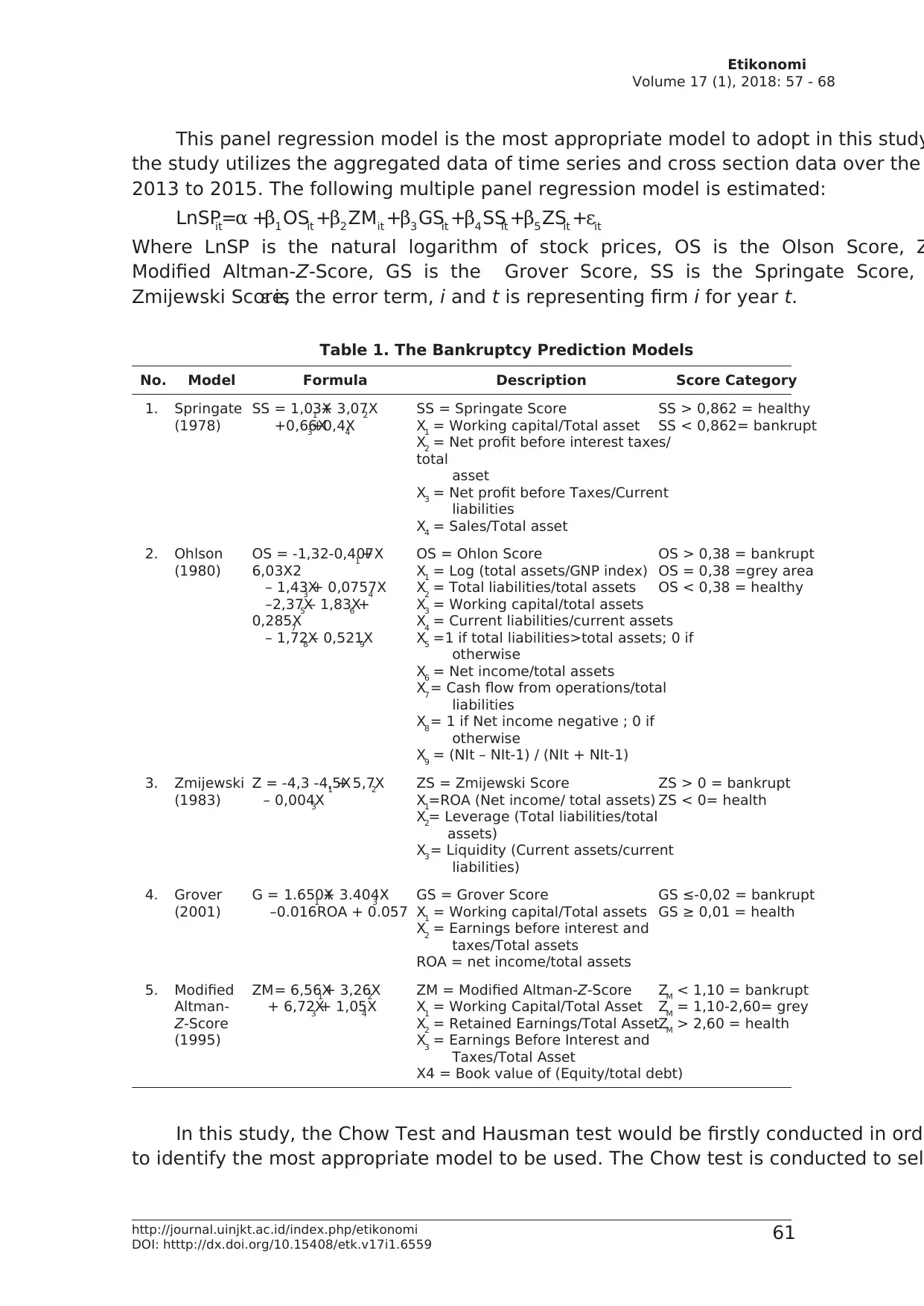

To predict the bankruptcy of the companies, the bankruptcy prediction models o

Olhson, Almant Modification, Grover, Springate, and the Zmijewski are used. The form

description, and score categorization for each model are presented in Table 1.

After measuring the scores for each bankruptcy prediction model, in the next ste

panel regression model is estimated to explore the impacts of bankruptcy prediction

to the stock prices of the coal mining companies in Indonesia. The scores of five bank

prediction models investigated in this study are then treated as the independent vari

predict the stock prices.

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

60

Relying only on a single model to predict the bankcruptcy might lead to an i

estimation, thus it, in turns, lead to the improper policy recommendation. Anticipatin

the present study used various models to predict the bankruptcy of the firms and ana

its impact to the firms’ stock prices in Indonesia. Thus, this study is among the first to

various bankruptcy models of the Olhson, Almant Modification, Grover, Springate, an

Zmijewski to estimate the stock prices in the Indonesian stock markets. This i

novelty of this study that is in its comparison among the bankruptcy prediction mode

Estimating comparatively among these models would show the most suitable and acc

model to be adopted to predict the movement of stock prices in Indonesia. Secondly,

study focuses its analysis on the coal mining companies, which has no previous empi

studies on this important industry in the Indonesian economy. Considering the shortc

and mixed or inconclusive empirical findings of the previous studies on the relationsh

between the bankruptcy prediction models and stock prices in Indonesia, thus this st

hoped to provide a more comprehensive and enriching empirical evidences on this is

comparing various bankruptcy prediction models (i.e., the Olhson, Almant Modificatio

Grover, Springate, and the Zmijewski models) and then analysing its impact to the st

prices of the coal mining industry in Indonesia.

The findings of this study are hoped to shed some lights for the inventor

selecting which companies to invest the monies, for the managers to promote

performance of the companies, and for the regulator to design policy in enhancing th

stock market in the biggest Muslim populous country in the world, Indonesia. The res

of this study is structured as follows. Section 2 provides the empirical framew

followed by the discussion of the findings and their implications in Section 3.

Section 4 concludes the study.

Method

Data of this study is gathered from the financial report of 19 companies in the co

mining sector that are listed on the Indonesian Stock Exchange (IDX) over the

2013 to 2015. These data are accessed through the website www.idx.co.id and firms

selected using the purposive sampling technique. The firms investigated in this study

the coal mining company that published their audited financial reports during the per

2013-2015. As for the stock prices, the closing stock prices of 19 coal-mining compan

are used.

To predict the bankruptcy of the companies, the bankruptcy prediction models o

Olhson, Almant Modification, Grover, Springate, and the Zmijewski are used. The form

description, and score categorization for each model are presented in Table 1.

After measuring the scores for each bankruptcy prediction model, in the next ste

panel regression model is estimated to explore the impacts of bankruptcy prediction

to the stock prices of the coal mining companies in Indonesia. The scores of five bank

prediction models investigated in this study are then treated as the independent vari

predict the stock prices.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559 61

Etikonomi

Volume 17 (1), 2018: 57 - 68

This panel regression model is the most appropriate model to adopt in this study

the study utilizes the aggregated data of time series and cross section data over the

2013 to 2015. The following multiple panel regression model is estimated:

LnSPit=α +β1 OSit +β2 ZMit +β3 GSit +β4 SSit +β5 ZSit +εit

Where LnSP is the natural logarithm of stock prices, OS is the Olson Score, Z

Modified Altman-Z-Score, GS is the Grover Score, SS is the Springate Score,

Zmijewski Score,ε is the error term, i and t is representing firm i for year t.

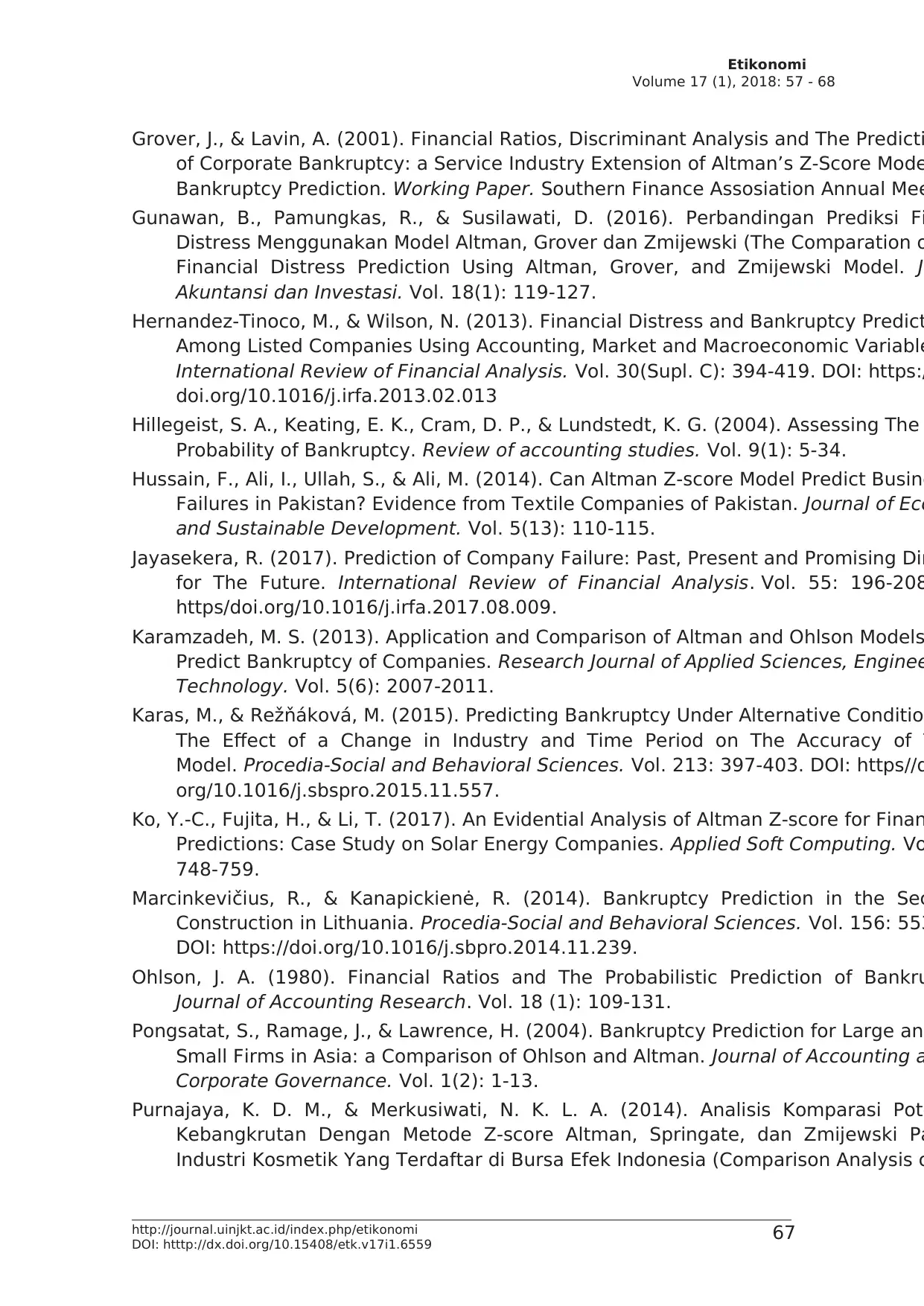

Table 1. The Bankruptcy Prediction Models

No. Model Formula Description Score Category

1. Springate

(1978)

SS = 1,03X1 + 3,07X2

+0,66X3+0,4X4

SS = Springate Score

X1 = Working capital/Total asset

X2 = Net profit before interest taxes/

total

asset

X3 = Net profit before Taxes/Current

liabilities

X4 = Sales/Total asset

SS > 0,862 = healthy

SS < 0,862= bankrupt

2. Ohlson

(1980)

OS = -1,32-0,407X1 +

6,03X2

– 1,43X3 + 0,0757X4

–2,37X5 – 1,83X6 +

0,285X7

– 1,72X8 – 0,521X9

OS = Ohlon Score

X1 = Log (total assets/GNP index)

X2 = Total liabilities/total assets

X3 = Working capital/total assets

X4 = Current liabilities/current assets

X5 =1 if total liabilities>total assets; 0 if

otherwise

X6 = Net income/total assets

X7 = Cash flow from operations/total

liabilities

X8 = 1 if Net income negative ; 0 if

otherwise

X9 = (NIt – NIt-1) / (NIt + NIt-1)

OS > 0,38 = bankrupt

OS = 0,38 =grey area

OS < 0,38 = healthy

3. Zmijewski

(1983)

Z = -4,3 -4,5X1 + 5,7X2

– 0,004X3

ZS = Zmijewski Score

X1=ROA (Net income/ total assets)

X2= Leverage (Total liabilities/total

assets)

X3 = Liquidity (Current assets/current

liabilities)

ZS > 0 = bankrupt

ZS < 0= health

4. Grover

(2001)

G = 1.650X1 + 3.404X3

–0.016ROA + 0.057

GS = Grover Score

X1 = Working capital/Total assets

X2 = Earnings before interest and

taxes/Total assets

ROA = net income/total assets

GS ≤-0,02 = bankrupt

GS ≥ 0,01 = health

5. Modified

Altman-

Z-Score

(1995)

ZM= 6,56X1 + 3,26X2

+ 6,72X3 + 1,05X4

ZM = Modified Altman-Z-Score

X1 = Working Capital/Total Asset

X2 = Retained Earnings/Total Asset

X3 = Earnings Before Interest and

Taxes/Total Asset

X4 = Book value of (Equity/total debt)

ZM < 1,10 = bankrupt

ZM = 1,10-2,60= grey

ZM > 2,60 = health

In this study, the Chow Test and Hausman test would be firstly conducted in orde

to identify the most appropriate model to be used. The Chow test is conducted to sel

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559 61

Etikonomi

Volume 17 (1), 2018: 57 - 68

This panel regression model is the most appropriate model to adopt in this study

the study utilizes the aggregated data of time series and cross section data over the

2013 to 2015. The following multiple panel regression model is estimated:

LnSPit=α +β1 OSit +β2 ZMit +β3 GSit +β4 SSit +β5 ZSit +εit

Where LnSP is the natural logarithm of stock prices, OS is the Olson Score, Z

Modified Altman-Z-Score, GS is the Grover Score, SS is the Springate Score,

Zmijewski Score,ε is the error term, i and t is representing firm i for year t.

Table 1. The Bankruptcy Prediction Models

No. Model Formula Description Score Category

1. Springate

(1978)

SS = 1,03X1 + 3,07X2

+0,66X3+0,4X4

SS = Springate Score

X1 = Working capital/Total asset

X2 = Net profit before interest taxes/

total

asset

X3 = Net profit before Taxes/Current

liabilities

X4 = Sales/Total asset

SS > 0,862 = healthy

SS < 0,862= bankrupt

2. Ohlson

(1980)

OS = -1,32-0,407X1 +

6,03X2

– 1,43X3 + 0,0757X4

–2,37X5 – 1,83X6 +

0,285X7

– 1,72X8 – 0,521X9

OS = Ohlon Score

X1 = Log (total assets/GNP index)

X2 = Total liabilities/total assets

X3 = Working capital/total assets

X4 = Current liabilities/current assets

X5 =1 if total liabilities>total assets; 0 if

otherwise

X6 = Net income/total assets

X7 = Cash flow from operations/total

liabilities

X8 = 1 if Net income negative ; 0 if

otherwise

X9 = (NIt – NIt-1) / (NIt + NIt-1)

OS > 0,38 = bankrupt

OS = 0,38 =grey area

OS < 0,38 = healthy

3. Zmijewski

(1983)

Z = -4,3 -4,5X1 + 5,7X2

– 0,004X3

ZS = Zmijewski Score

X1=ROA (Net income/ total assets)

X2= Leverage (Total liabilities/total

assets)

X3 = Liquidity (Current assets/current

liabilities)

ZS > 0 = bankrupt

ZS < 0= health

4. Grover

(2001)

G = 1.650X1 + 3.404X3

–0.016ROA + 0.057

GS = Grover Score

X1 = Working capital/Total assets

X2 = Earnings before interest and

taxes/Total assets

ROA = net income/total assets

GS ≤-0,02 = bankrupt

GS ≥ 0,01 = health

5. Modified

Altman-

Z-Score

(1995)

ZM= 6,56X1 + 3,26X2

+ 6,72X3 + 1,05X4

ZM = Modified Altman-Z-Score

X1 = Working Capital/Total Asset

X2 = Retained Earnings/Total Asset

X3 = Earnings Before Interest and

Taxes/Total Asset

X4 = Book value of (Equity/total debt)

ZM < 1,10 = bankrupt

ZM = 1,10-2,60= grey

ZM > 2,60 = health

In this study, the Chow Test and Hausman test would be firstly conducted in orde

to identify the most appropriate model to be used. The Chow test is conducted to sel

Ghazali Syamni. Bankruptcy Prediction Models and Stock Prices

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

62

between the CEM and the FEM, while the Hausman test is conducted to select betwee

FEM and REM. If the result of the p-value of Chow test is insignificant, the CEM is sele

as the most appropriate model. Similarly, if the Hausman test is insignificant, then, th

would select as the most suitable panel regression model, and vice versa. Within the

framework, the model allows to have a different intercept in the regression model am

individual.

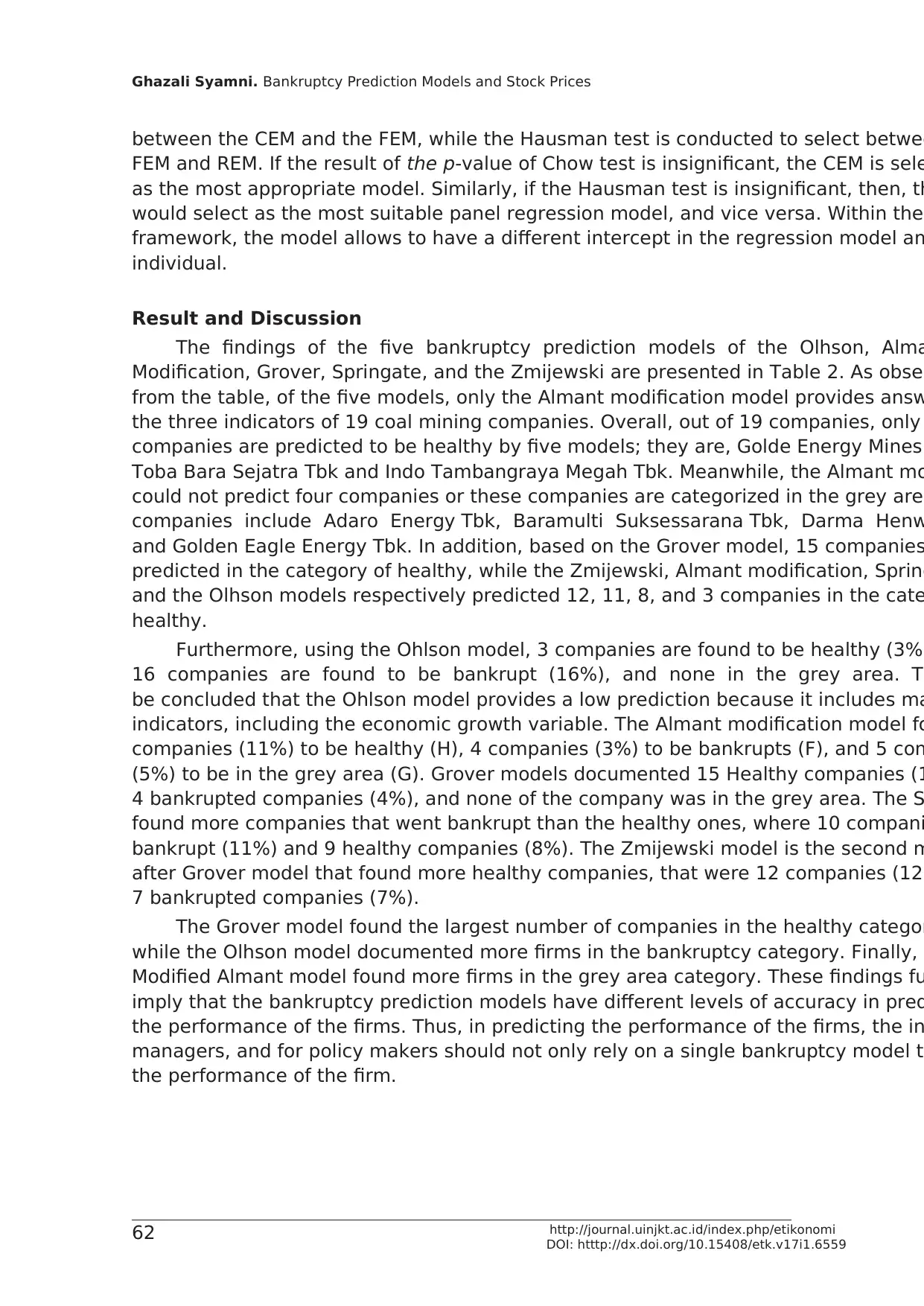

Result and Discussion

The findings of the five bankruptcy prediction models of the Olhson, Alma

Modification, Grover, Springate, and the Zmijewski are presented in Table 2. As obser

from the table, of the five models, only the Almant modification model provides answ

the three indicators of 19 coal mining companies. Overall, out of 19 companies, only

companies are predicted to be healthy by five models; they are, Golde Energy Mines

Toba Bara Sejatra Tbk and Indo Tambangraya Megah Tbk. Meanwhile, the Almant mo

could not predict four companies or these companies are categorized in the grey are

companies include Adaro Energy Tbk, Baramulti Suksessarana Tbk, Darma Henw

and Golden Eagle Energy Tbk. In addition, based on the Grover model, 15 companies

predicted in the category of healthy, while the Zmijewski, Almant modification, Spring

and the Olhson models respectively predicted 12, 11, 8, and 3 companies in the cate

healthy.

Furthermore, using the Ohlson model, 3 companies are found to be healthy (3%)

16 companies are found to be bankrupt (16%), and none in the grey area. Th

be concluded that the Ohlson model provides a low prediction because it includes ma

indicators, including the economic growth variable. The Almant modification model fo

companies (11%) to be healthy (H), 4 companies (3%) to be bankrupts (F), and 5 com

(5%) to be in the grey area (G). Grover models documented 15 Healthy companies (1

4 bankrupted companies (4%), and none of the company was in the grey area. The S

found more companies that went bankrupt than the healthy ones, where 10 compani

bankrupt (11%) and 9 healthy companies (8%). The Zmijewski model is the second m

after Grover model that found more healthy companies, that were 12 companies (12%

7 bankrupted companies (7%).

The Grover model found the largest number of companies in the healthy categor

while the Olhson model documented more firms in the bankruptcy category. Finally,

Modified Almant model found more firms in the grey area category. These findings fu

imply that the bankruptcy prediction models have different levels of accuracy in pred

the performance of the firms. Thus, in predicting the performance of the firms, the in

managers, and for policy makers should not only rely on a single bankruptcy model t

the performance of the firm.

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

62

between the CEM and the FEM, while the Hausman test is conducted to select betwee

FEM and REM. If the result of the p-value of Chow test is insignificant, the CEM is sele

as the most appropriate model. Similarly, if the Hausman test is insignificant, then, th

would select as the most suitable panel regression model, and vice versa. Within the

framework, the model allows to have a different intercept in the regression model am

individual.

Result and Discussion

The findings of the five bankruptcy prediction models of the Olhson, Alma

Modification, Grover, Springate, and the Zmijewski are presented in Table 2. As obser

from the table, of the five models, only the Almant modification model provides answ

the three indicators of 19 coal mining companies. Overall, out of 19 companies, only

companies are predicted to be healthy by five models; they are, Golde Energy Mines

Toba Bara Sejatra Tbk and Indo Tambangraya Megah Tbk. Meanwhile, the Almant mo

could not predict four companies or these companies are categorized in the grey are

companies include Adaro Energy Tbk, Baramulti Suksessarana Tbk, Darma Henw

and Golden Eagle Energy Tbk. In addition, based on the Grover model, 15 companies

predicted in the category of healthy, while the Zmijewski, Almant modification, Spring

and the Olhson models respectively predicted 12, 11, 8, and 3 companies in the cate

healthy.

Furthermore, using the Ohlson model, 3 companies are found to be healthy (3%)

16 companies are found to be bankrupt (16%), and none in the grey area. Th

be concluded that the Ohlson model provides a low prediction because it includes ma

indicators, including the economic growth variable. The Almant modification model fo

companies (11%) to be healthy (H), 4 companies (3%) to be bankrupts (F), and 5 com

(5%) to be in the grey area (G). Grover models documented 15 Healthy companies (1

4 bankrupted companies (4%), and none of the company was in the grey area. The S

found more companies that went bankrupt than the healthy ones, where 10 compani

bankrupt (11%) and 9 healthy companies (8%). The Zmijewski model is the second m

after Grover model that found more healthy companies, that were 12 companies (12%

7 bankrupted companies (7%).

The Grover model found the largest number of companies in the healthy categor

while the Olhson model documented more firms in the bankruptcy category. Finally,

Modified Almant model found more firms in the grey area category. These findings fu

imply that the bankruptcy prediction models have different levels of accuracy in pred

the performance of the firms. Thus, in predicting the performance of the firms, the in

managers, and for policy makers should not only rely on a single bankruptcy model t

the performance of the firm.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559 63

Etikonomi

Volume 17 (1), 2018: 57 - 68

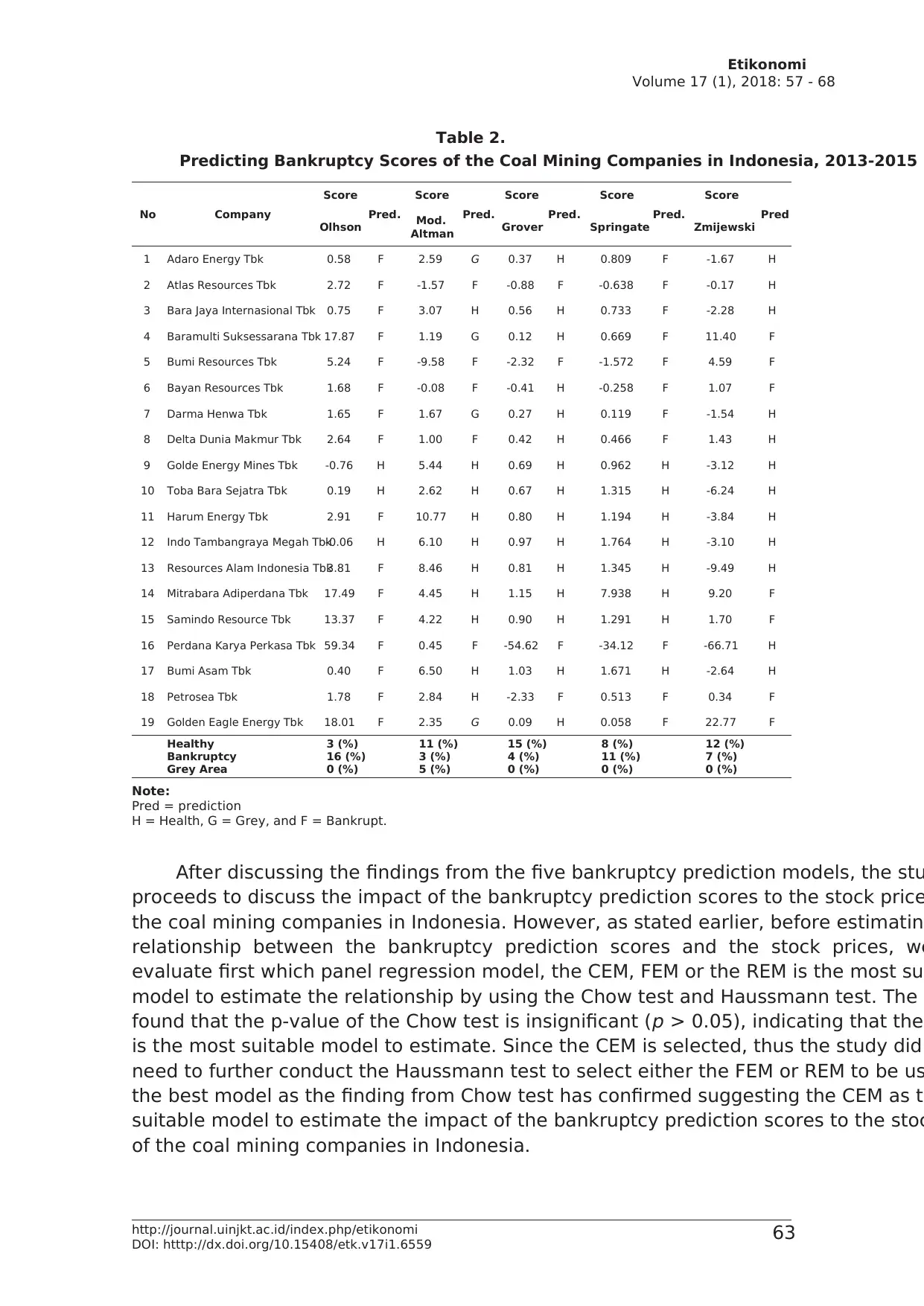

Table 2.

Predicting Bankruptcy Scores of the Coal Mining Companies in Indonesia, 2013-2015

No Company

Score

Pred.

Score

Pred.

Score

Pred.

Score

Pred.

Score

Pred

Olhson Mod.

Altman Grover Springate Zmijewski

1 Adaro Energy Tbk 0.58 F 2.59 G 0.37 H 0.809 F -1.67 H

2 Atlas Resources Tbk 2.72 F -1.57 F -0.88 F -0.638 F -0.17 H

3 Bara Jaya Internasional Tbk 0.75 F 3.07 H 0.56 H 0.733 F -2.28 H

4 Baramulti Suksessarana Tbk 17.87 F 1.19 G 0.12 H 0.669 F 11.40 F

5 Bumi Resources Tbk 5.24 F -9.58 F -2.32 F -1.572 F 4.59 F

6 Bayan Resources Tbk 1.68 F -0.08 F -0.41 H -0.258 F 1.07 F

7 Darma Henwa Tbk 1.65 F 1.67 G 0.27 H 0.119 F -1.54 H

8 Delta Dunia Makmur Tbk 2.64 F 1.00 F 0.42 H 0.466 F 1.43 H

9 Golde Energy Mines Tbk -0.76 H 5.44 H 0.69 H 0.962 H -3.12 H

10 Toba Bara Sejatra Tbk 0.19 H 2.62 H 0.67 H 1.315 H -6.24 H

11 Harum Energy Tbk 2.91 F 10.77 H 0.80 H 1.194 H -3.84 H

12 Indo Tambangraya Megah Tbk-0.06 H 6.10 H 0.97 H 1.764 H -3.10 H

13 Resources Alam Indonesia Tbk3.81 F 8.46 H 0.81 H 1.345 H -9.49 H

14 Mitrabara Adiperdana Tbk 17.49 F 4.45 H 1.15 H 7.938 H 9.20 F

15 Samindo Resource Tbk 13.37 F 4.22 H 0.90 H 1.291 H 1.70 F

16 Perdana Karya Perkasa Tbk 59.34 F 0.45 F -54.62 F -34.12 F -66.71 H

17 Bumi Asam Tbk 0.40 F 6.50 H 1.03 H 1.671 H -2.64 H

18 Petrosea Tbk 1.78 F 2.84 H -2.33 F 0.513 F 0.34 F

19 Golden Eagle Energy Tbk 18.01 F 2.35 G 0.09 H 0.058 F 22.77 F

Healthy 3 (%) 11 (%) 15 (%) 8 (%) 12 (%)

Bankruptcy 16 (%) 3 (%) 4 (%) 11 (%) 7 (%)

Grey Area 0 (%) 5 (%) 0 (%) 0 (%) 0 (%)

Note:

Pred = prediction

H = Health, G = Grey, and F = Bankrupt.

After discussing the findings from the five bankruptcy prediction models, the stu

proceeds to discuss the impact of the bankruptcy prediction scores to the stock price

the coal mining companies in Indonesia. However, as stated earlier, before estimatin

relationship between the bankruptcy prediction scores and the stock prices, we

evaluate first which panel regression model, the CEM, FEM or the REM is the most su

model to estimate the relationship by using the Chow test and Haussmann test. The

found that the p-value of the Chow test is insignificant (p > 0.05), indicating that the

is the most suitable model to estimate. Since the CEM is selected, thus the study did

need to further conduct the Haussmann test to select either the FEM or REM to be us

the best model as the finding from Chow test has confirmed suggesting the CEM as th

suitable model to estimate the impact of the bankruptcy prediction scores to the stoc

of the coal mining companies in Indonesia.

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559 63

Etikonomi

Volume 17 (1), 2018: 57 - 68

Table 2.

Predicting Bankruptcy Scores of the Coal Mining Companies in Indonesia, 2013-2015

No Company

Score

Pred.

Score

Pred.

Score

Pred.

Score

Pred.

Score

Pred

Olhson Mod.

Altman Grover Springate Zmijewski

1 Adaro Energy Tbk 0.58 F 2.59 G 0.37 H 0.809 F -1.67 H

2 Atlas Resources Tbk 2.72 F -1.57 F -0.88 F -0.638 F -0.17 H

3 Bara Jaya Internasional Tbk 0.75 F 3.07 H 0.56 H 0.733 F -2.28 H

4 Baramulti Suksessarana Tbk 17.87 F 1.19 G 0.12 H 0.669 F 11.40 F

5 Bumi Resources Tbk 5.24 F -9.58 F -2.32 F -1.572 F 4.59 F

6 Bayan Resources Tbk 1.68 F -0.08 F -0.41 H -0.258 F 1.07 F

7 Darma Henwa Tbk 1.65 F 1.67 G 0.27 H 0.119 F -1.54 H

8 Delta Dunia Makmur Tbk 2.64 F 1.00 F 0.42 H 0.466 F 1.43 H

9 Golde Energy Mines Tbk -0.76 H 5.44 H 0.69 H 0.962 H -3.12 H

10 Toba Bara Sejatra Tbk 0.19 H 2.62 H 0.67 H 1.315 H -6.24 H

11 Harum Energy Tbk 2.91 F 10.77 H 0.80 H 1.194 H -3.84 H

12 Indo Tambangraya Megah Tbk-0.06 H 6.10 H 0.97 H 1.764 H -3.10 H

13 Resources Alam Indonesia Tbk3.81 F 8.46 H 0.81 H 1.345 H -9.49 H

14 Mitrabara Adiperdana Tbk 17.49 F 4.45 H 1.15 H 7.938 H 9.20 F

15 Samindo Resource Tbk 13.37 F 4.22 H 0.90 H 1.291 H 1.70 F

16 Perdana Karya Perkasa Tbk 59.34 F 0.45 F -54.62 F -34.12 F -66.71 H

17 Bumi Asam Tbk 0.40 F 6.50 H 1.03 H 1.671 H -2.64 H

18 Petrosea Tbk 1.78 F 2.84 H -2.33 F 0.513 F 0.34 F

19 Golden Eagle Energy Tbk 18.01 F 2.35 G 0.09 H 0.058 F 22.77 F

Healthy 3 (%) 11 (%) 15 (%) 8 (%) 12 (%)

Bankruptcy 16 (%) 3 (%) 4 (%) 11 (%) 7 (%)

Grey Area 0 (%) 5 (%) 0 (%) 0 (%) 0 (%)

Note:

Pred = prediction

H = Health, G = Grey, and F = Bankrupt.

After discussing the findings from the five bankruptcy prediction models, the stu

proceeds to discuss the impact of the bankruptcy prediction scores to the stock price

the coal mining companies in Indonesia. However, as stated earlier, before estimatin

relationship between the bankruptcy prediction scores and the stock prices, we

evaluate first which panel regression model, the CEM, FEM or the REM is the most su

model to estimate the relationship by using the Chow test and Haussmann test. The

found that the p-value of the Chow test is insignificant (p > 0.05), indicating that the

is the most suitable model to estimate. Since the CEM is selected, thus the study did

need to further conduct the Haussmann test to select either the FEM or REM to be us

the best model as the finding from Chow test has confirmed suggesting the CEM as th

suitable model to estimate the impact of the bankruptcy prediction scores to the stoc

of the coal mining companies in Indonesia.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Ghazali Syamni. Bankruptcy Prediction Models and Stock Prices

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

64

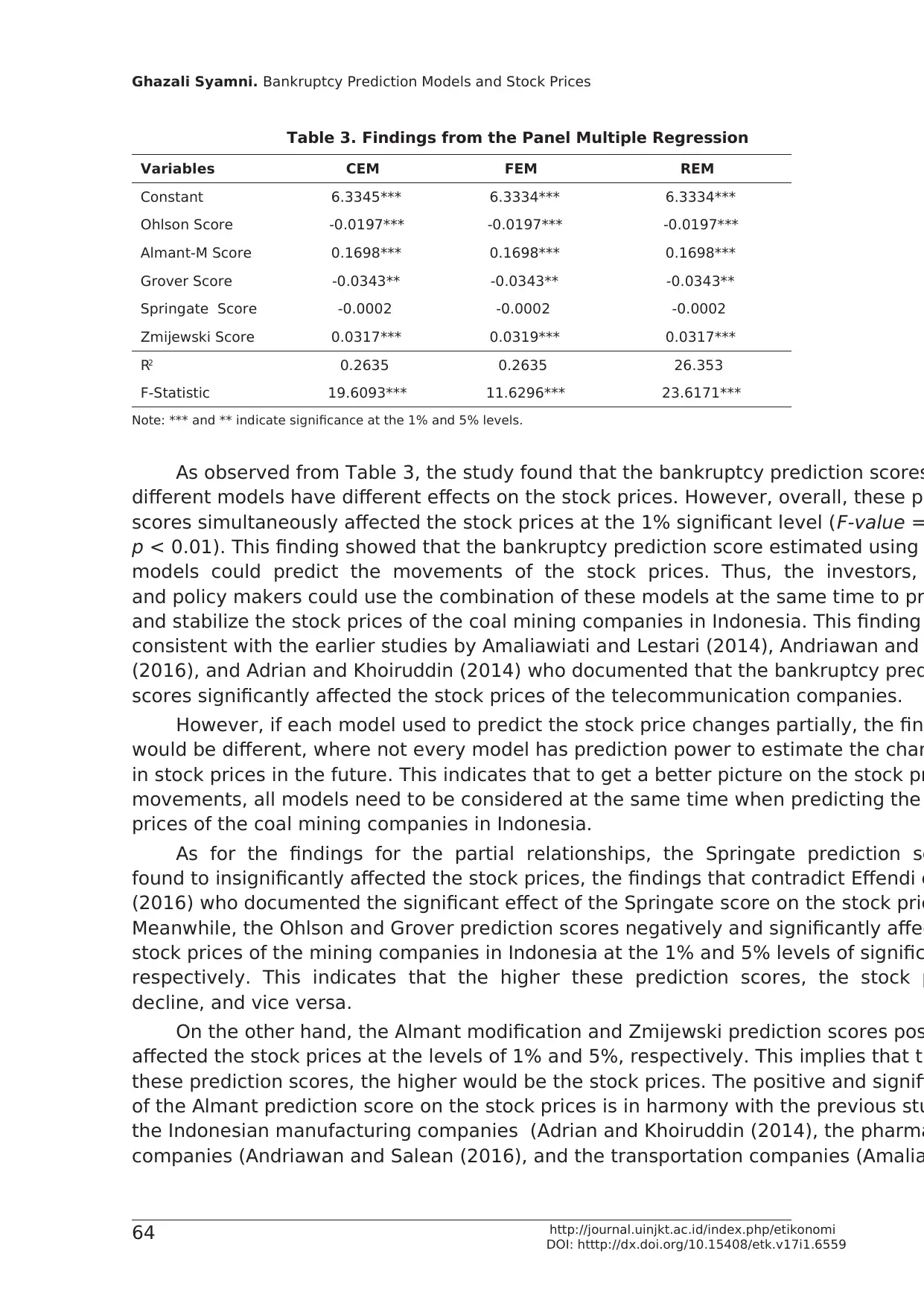

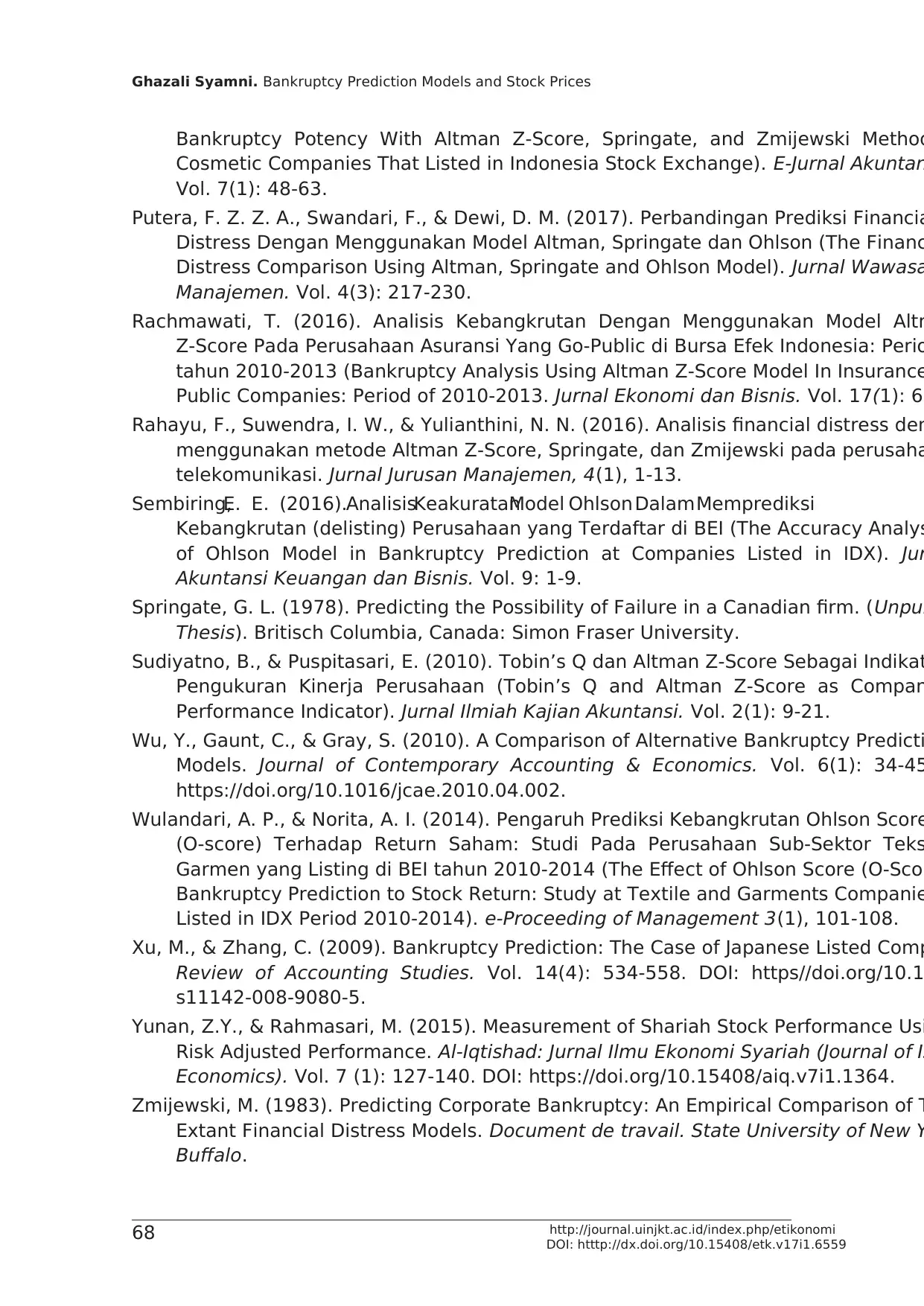

Table 3. Findings from the Panel Multiple Regression

Variables CEM FEM REM

Constant 6.3345*** 6.3334*** 6.3334***

Ohlson Score -0.0197*** -0.0197*** -0.0197***

Almant-M Score 0.1698*** 0.1698*** 0.1698***

Grover Score -0.0343** -0.0343** -0.0343**

Springate Score -0.0002 -0.0002 -0.0002

Zmijewski Score 0.0317*** 0.0319*** 0.0317***

R2 0.2635 0.2635 26.353

F-Statistic 19.6093*** 11.6296*** 23.6171***

Note: *** and ** indicate significance at the 1% and 5% levels.

As observed from Table 3, the study found that the bankruptcy prediction scores

different models have different effects on the stock prices. However, overall, these pr

scores simultaneously affected the stock prices at the 1% significant level (F-value =

p < 0.01). This finding showed that the bankruptcy prediction score estimated using

models could predict the movements of the stock prices. Thus, the investors,

and policy makers could use the combination of these models at the same time to pr

and stabilize the stock prices of the coal mining companies in Indonesia. This finding

consistent with the earlier studies by Amaliawiati and Lestari (2014), Andriawan and

(2016), and Adrian and Khoiruddin (2014) who documented that the bankruptcy pred

scores significantly affected the stock prices of the telecommunication companies.

However, if each model used to predict the stock price changes partially, the fin

would be different, where not every model has prediction power to estimate the chan

in stock prices in the future. This indicates that to get a better picture on the stock pr

movements, all models need to be considered at the same time when predicting the

prices of the coal mining companies in Indonesia.

As for the findings for the partial relationships, the Springate prediction sc

found to insignificantly affected the stock prices, the findings that contradict Effendi e

(2016) who documented the significant effect of the Springate score on the stock pric

Meanwhile, the Ohlson and Grover prediction scores negatively and significantly affec

stock prices of the mining companies in Indonesia at the 1% and 5% levels of signific

respectively. This indicates that the higher these prediction scores, the stock p

decline, and vice versa.

On the other hand, the Almant modification and Zmijewski prediction scores pos

affected the stock prices at the levels of 1% and 5%, respectively. This implies that th

these prediction scores, the higher would be the stock prices. The positive and signifi

of the Almant prediction score on the stock prices is in harmony with the previous stu

the Indonesian manufacturing companies (Adrian and Khoiruddin (2014), the pharma

companies (Andriawan and Salean (2016), and the transportation companies (Amalia

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

64

Table 3. Findings from the Panel Multiple Regression

Variables CEM FEM REM

Constant 6.3345*** 6.3334*** 6.3334***

Ohlson Score -0.0197*** -0.0197*** -0.0197***

Almant-M Score 0.1698*** 0.1698*** 0.1698***

Grover Score -0.0343** -0.0343** -0.0343**

Springate Score -0.0002 -0.0002 -0.0002

Zmijewski Score 0.0317*** 0.0319*** 0.0317***

R2 0.2635 0.2635 26.353

F-Statistic 19.6093*** 11.6296*** 23.6171***

Note: *** and ** indicate significance at the 1% and 5% levels.

As observed from Table 3, the study found that the bankruptcy prediction scores

different models have different effects on the stock prices. However, overall, these pr

scores simultaneously affected the stock prices at the 1% significant level (F-value =

p < 0.01). This finding showed that the bankruptcy prediction score estimated using

models could predict the movements of the stock prices. Thus, the investors,

and policy makers could use the combination of these models at the same time to pr

and stabilize the stock prices of the coal mining companies in Indonesia. This finding

consistent with the earlier studies by Amaliawiati and Lestari (2014), Andriawan and

(2016), and Adrian and Khoiruddin (2014) who documented that the bankruptcy pred

scores significantly affected the stock prices of the telecommunication companies.

However, if each model used to predict the stock price changes partially, the fin

would be different, where not every model has prediction power to estimate the chan

in stock prices in the future. This indicates that to get a better picture on the stock pr

movements, all models need to be considered at the same time when predicting the

prices of the coal mining companies in Indonesia.

As for the findings for the partial relationships, the Springate prediction sc

found to insignificantly affected the stock prices, the findings that contradict Effendi e

(2016) who documented the significant effect of the Springate score on the stock pric

Meanwhile, the Ohlson and Grover prediction scores negatively and significantly affec

stock prices of the mining companies in Indonesia at the 1% and 5% levels of signific

respectively. This indicates that the higher these prediction scores, the stock p

decline, and vice versa.

On the other hand, the Almant modification and Zmijewski prediction scores pos

affected the stock prices at the levels of 1% and 5%, respectively. This implies that th

these prediction scores, the higher would be the stock prices. The positive and signifi

of the Almant prediction score on the stock prices is in harmony with the previous stu

the Indonesian manufacturing companies (Adrian and Khoiruddin (2014), the pharma

companies (Andriawan and Salean (2016), and the transportation companies (Amalia

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559 65

Etikonomi

Volume 17 (1), 2018: 57 - 68

and Lestari (2014). Meanwhile, the insignificant effect of the Springate prediction sco

stock prices is in line with the study by Wulandari and Norita (2014).

The different findings across the bankruptcy prediction models were simply due

different measurements used to predict the company’s bankruptcy. These findings fu

imply that the bankruptcy prediction models have different levels of accuracy in pred

the performance of the firms. Thus, in predicting the performance of the firms, the in

managers, and for policy makers should not only rely on a single bankruptcy model t

the performance of the firm.

Our empirical findings on the relationships between the bankruptcy prediction sc

and stock prices offer policy implication to the investors, managers, and regulators. F

investors, they might choose any significant models to analyse the companies’ perfor

but the Almant modification and Ohlson model are found to be the best models used

avoid the loss for investing monies in the coal mining industry in Indonesia. A

regulators, particularly the Financial Service Authority of Indonesia should rely

bankruptcy prediction scores to control the performances of the stock prices o

mining companies, as part of ensuring the stability of the national stock market. Simi

manager of the companies might also promote the performances of the firms by refe

the bankruptcy prediction score as the sources of policy references.

Conclusion

The bankruptcy prediction models offer different findings of the performances of

coal mining companies in Indonesia over the period 2013-2015. The Grover model fo

largest number of companies in the healthy category, while the Olhson model docum

more firms in the bankruptcy category. Meanwhile, the Modified Almant model found

firms in the grey area category. As for the relationships between the bankruptcy pred

scores and stock prices, the study found that the Springate prediction score was insig

affected the stock prices. Meanwhile, the Ohlson and Grover prediction scores are fou

affect negatively and significantly the stock prices of the mining companies in Indone

indicating that the higher these prediction scores, the lower would be the stock price

vice versa. On the other hand, the Almant modification and Zmijewski prediction scor

found to positively affect the stock prices, implying the higher these prediction score

higher would be the stock prices.

These findings further suggest that the investors should give more attenti

Ohlson and Grover models, because they gave negative prediction towards the stock

This means that when these models’ prediction value is at one point in a company, th

would be a stock price reduction at one point in the future. As for the regulators, part

the Financial Service Authority of Indonesia, it is suggested to rely on the ban

prediction scores to control the performances of the stock prices, and in turns, the st

of the national stock market. Finally, the manager of the companies might also prom

performances of the firms by referring to the bankruptcy prediction score as the sour

policy references. To provide more comprehensive findings, future studies on this iss

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559 65

Etikonomi

Volume 17 (1), 2018: 57 - 68

and Lestari (2014). Meanwhile, the insignificant effect of the Springate prediction sco

stock prices is in line with the study by Wulandari and Norita (2014).

The different findings across the bankruptcy prediction models were simply due

different measurements used to predict the company’s bankruptcy. These findings fu

imply that the bankruptcy prediction models have different levels of accuracy in pred

the performance of the firms. Thus, in predicting the performance of the firms, the in

managers, and for policy makers should not only rely on a single bankruptcy model t

the performance of the firm.

Our empirical findings on the relationships between the bankruptcy prediction sc

and stock prices offer policy implication to the investors, managers, and regulators. F

investors, they might choose any significant models to analyse the companies’ perfor

but the Almant modification and Ohlson model are found to be the best models used

avoid the loss for investing monies in the coal mining industry in Indonesia. A

regulators, particularly the Financial Service Authority of Indonesia should rely

bankruptcy prediction scores to control the performances of the stock prices o

mining companies, as part of ensuring the stability of the national stock market. Simi

manager of the companies might also promote the performances of the firms by refe

the bankruptcy prediction score as the sources of policy references.

Conclusion

The bankruptcy prediction models offer different findings of the performances of

coal mining companies in Indonesia over the period 2013-2015. The Grover model fo

largest number of companies in the healthy category, while the Olhson model docum

more firms in the bankruptcy category. Meanwhile, the Modified Almant model found

firms in the grey area category. As for the relationships between the bankruptcy pred

scores and stock prices, the study found that the Springate prediction score was insig

affected the stock prices. Meanwhile, the Ohlson and Grover prediction scores are fou

affect negatively and significantly the stock prices of the mining companies in Indone

indicating that the higher these prediction scores, the lower would be the stock price

vice versa. On the other hand, the Almant modification and Zmijewski prediction scor

found to positively affect the stock prices, implying the higher these prediction score

higher would be the stock prices.

These findings further suggest that the investors should give more attenti

Ohlson and Grover models, because they gave negative prediction towards the stock

This means that when these models’ prediction value is at one point in a company, th

would be a stock price reduction at one point in the future. As for the regulators, part

the Financial Service Authority of Indonesia, it is suggested to rely on the ban

prediction scores to control the performances of the stock prices, and in turns, the st

of the national stock market. Finally, the manager of the companies might also prom

performances of the firms by referring to the bankruptcy prediction score as the sour

policy references. To provide more comprehensive findings, future studies on this iss

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Ghazali Syamni. Bankruptcy Prediction Models and Stock Prices

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

66

suggested to consider more companies across the industries to be used as the sampl

study since different sector of industries has different characteristics. Additiona

studies are also suggested to use a longer period of data so that it could provide a cle

picture of the bankruptcy prediction-stock prices relations.

References

Adrian, A., & Khoiruddin, M. (2014). Pengaruh Analisis Kebangkrutan Model Altman Te

Harga Saham Perusahaan Manufaktur (The Impact of Altman Prediction Model to

Prices in Manufacturing Companies). Management Analysis Journal. Vol. 3(1): 1-1

Al-Kassar, T. A., & Soileau, J. S. (2014). Financial Performance Evaluation and Bankrup

Prediction (Failure) 1. Arab Economic and Business Journal. Vol. 9(2): 147-155.

Al-Rawi, K., Kiani, R., & Vedd, R. R. (2011). The Use of Altman Equation for Bankruptc

Prediction in an Industrial Firm (Case Study). International Business & Eco

Research Journal. Vol. 7(7): 115-127.

Altman, E. I. (1968). Financial Ratios, Discriminant Analysis and The Prediction of Cor

Bankruptcy. The Journal of Finance. Vol. 23(4): 589-609.

Altman, E. I., Iwanicz-Drozdowska, M., Laitinen, E. K., & Suvas, A. (2017). Fina

Distress Prediction in an International Context: a Review and Empirical Analysis o

Altman’s Z-Score Model. Journal of International Financial Management & Accoun

Vol. 28(2): 131-171.

Amaliawiati, L., & Lestari, L. (2014). The Prediction of Financial Distress Analysis and

Implication to Stock Price’s Sub-Sector Transportation in Indonesia Stock Exchan

Period 2007-2011. Paper presented at the 11th Ubaya International Annual Sym

on Management, Surabaya.

Andriawan, N. F., & Salean, D. (2016). Analisis Metode Altman Z-Score Sebagai Alat P

Kebangkrutan dan Pengaruhnya Terhadap Harga Saham Pada Perusahaan F

yang Terdaftar di Bursa Efek Indonesia (The Analysis of Altman Z-Score as Predic

Tools of Bankruptcy and The Impact of Stock Prices of Pharmautical Companies i

Indonesian Stock Exchange). JEA 17. Vol. 1(1): 67-82.

Boedi, S., & Tiara, D. (2016). Analisis Prediksi Kebangkrutan Perusahaan Telekomunik

Terdaftar di Bursa Efek Indonesia Dengan Model Altman Revisi (Prediction Analy

Bankruptcy of Telecommunication Companies Listed on Indonesia Stock Exchang

Altman Revision Model). Jurnal Manajemen dan Akuntansi (JUMA). Vol. 14(1): 63

Charitou,A., Dionysiou,D., Lambertides,N., & Trigeorgis,L. (2013).Alternative

Bankruptcy Prediction Models Using Option-Pricing Theory. Journal of Banking an

Finance. Vol. 37(7): 2329-2341.

Effendi, E., Affandi, A., & Sidharta, I. (2016). Analisa Pengaruh Rasio Keuangan Model

Springate Terhadap Harga Saham Pada Perusahaan Publik Sektor Telekomunikas

Effect of Financial Ratios Springate Models to Stock Prices in Telecomunication P

Companies). Jurnal Ekonomi, Bisnis & Entrepreneurship. Vol. 10(1): 1-16.

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

66

suggested to consider more companies across the industries to be used as the sampl

study since different sector of industries has different characteristics. Additiona

studies are also suggested to use a longer period of data so that it could provide a cle

picture of the bankruptcy prediction-stock prices relations.

References

Adrian, A., & Khoiruddin, M. (2014). Pengaruh Analisis Kebangkrutan Model Altman Te

Harga Saham Perusahaan Manufaktur (The Impact of Altman Prediction Model to

Prices in Manufacturing Companies). Management Analysis Journal. Vol. 3(1): 1-1

Al-Kassar, T. A., & Soileau, J. S. (2014). Financial Performance Evaluation and Bankrup

Prediction (Failure) 1. Arab Economic and Business Journal. Vol. 9(2): 147-155.

Al-Rawi, K., Kiani, R., & Vedd, R. R. (2011). The Use of Altman Equation for Bankruptc

Prediction in an Industrial Firm (Case Study). International Business & Eco

Research Journal. Vol. 7(7): 115-127.

Altman, E. I. (1968). Financial Ratios, Discriminant Analysis and The Prediction of Cor

Bankruptcy. The Journal of Finance. Vol. 23(4): 589-609.

Altman, E. I., Iwanicz-Drozdowska, M., Laitinen, E. K., & Suvas, A. (2017). Fina

Distress Prediction in an International Context: a Review and Empirical Analysis o

Altman’s Z-Score Model. Journal of International Financial Management & Accoun

Vol. 28(2): 131-171.

Amaliawiati, L., & Lestari, L. (2014). The Prediction of Financial Distress Analysis and

Implication to Stock Price’s Sub-Sector Transportation in Indonesia Stock Exchan

Period 2007-2011. Paper presented at the 11th Ubaya International Annual Sym

on Management, Surabaya.

Andriawan, N. F., & Salean, D. (2016). Analisis Metode Altman Z-Score Sebagai Alat P

Kebangkrutan dan Pengaruhnya Terhadap Harga Saham Pada Perusahaan F

yang Terdaftar di Bursa Efek Indonesia (The Analysis of Altman Z-Score as Predic

Tools of Bankruptcy and The Impact of Stock Prices of Pharmautical Companies i

Indonesian Stock Exchange). JEA 17. Vol. 1(1): 67-82.

Boedi, S., & Tiara, D. (2016). Analisis Prediksi Kebangkrutan Perusahaan Telekomunik

Terdaftar di Bursa Efek Indonesia Dengan Model Altman Revisi (Prediction Analy

Bankruptcy of Telecommunication Companies Listed on Indonesia Stock Exchang

Altman Revision Model). Jurnal Manajemen dan Akuntansi (JUMA). Vol. 14(1): 63

Charitou,A., Dionysiou,D., Lambertides,N., & Trigeorgis,L. (2013).Alternative

Bankruptcy Prediction Models Using Option-Pricing Theory. Journal of Banking an

Finance. Vol. 37(7): 2329-2341.

Effendi, E., Affandi, A., & Sidharta, I. (2016). Analisa Pengaruh Rasio Keuangan Model

Springate Terhadap Harga Saham Pada Perusahaan Publik Sektor Telekomunikas

Effect of Financial Ratios Springate Models to Stock Prices in Telecomunication P

Companies). Jurnal Ekonomi, Bisnis & Entrepreneurship. Vol. 10(1): 1-16.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559 67

Etikonomi

Volume 17 (1), 2018: 57 - 68

Grover, J., & Lavin, A. (2001). Financial Ratios, Discriminant Analysis and The Predicti

of Corporate Bankruptcy: a Service Industry Extension of Altman’s Z-Score Mode

Bankruptcy Prediction. Working Paper. Southern Finance Assosiation Annual Mee

Gunawan, B., Pamungkas, R., & Susilawati, D. (2016). Perbandingan Prediksi Fi

Distress Menggunakan Model Altman, Grover dan Zmijewski (The Comparation o

Financial Distress Prediction Using Altman, Grover, and Zmijewski Model. J

Akuntansi dan Investasi. Vol. 18(1): 119-127.

Hernandez-Tinoco, M., & Wilson, N. (2013). Financial Distress and Bankruptcy Predict

Among Listed Companies Using Accounting, Market and Macroeconomic Variable

International Review of Financial Analysis. Vol. 30(Supl. C): 394-419. DOI: https:/

doi.org/10.1016/j.irfa.2013.02.013

Hillegeist, S. A., Keating, E. K., Cram, D. P., & Lundstedt, K. G. (2004). Assessing The

Probability of Bankruptcy. Review of accounting studies. Vol. 9(1): 5-34.

Hussain, F., Ali, I., Ullah, S., & Ali, M. (2014). Can Altman Z-score Model Predict Busine

Failures in Pakistan? Evidence from Textile Companies of Pakistan. Journal of Eco

and Sustainable Development. Vol. 5(13): 110-115.

Jayasekera, R. (2017). Prediction of Company Failure: Past, Present and Promising Dir

for The Future. International Review of Financial Analysis. Vol. 55: 196-208

https/doi.org/10.1016/j.irfa.2017.08.009.

Karamzadeh, M. S. (2013). Application and Comparison of Altman and Ohlson Models

Predict Bankruptcy of Companies. Research Journal of Applied Sciences, Enginee

Technology. Vol. 5(6): 2007-2011.

Karas, M., & Režňáková, M. (2015). Predicting Bankruptcy Under Alternative Conditio

The Effect of a Change in Industry and Time Period on The Accuracy of

Model. Procedia-Social and Behavioral Sciences. Vol. 213: 397-403. DOI: https//d

org/10.1016/j.sbspro.2015.11.557.

Ko, Y.-C., Fujita, H., & Li, T. (2017). An Evidential Analysis of Altman Z-score for Finan

Predictions: Case Study on Solar Energy Companies. Applied Soft Computing. Vo

748-759.

Marcinkevičius, R., & Kanapickienė, R. (2014). Bankruptcy Prediction in the Sec

Construction in Lithuania. Procedia-Social and Behavioral Sciences. Vol. 156: 553

DOI: https://doi.org/10.1016/j.sbpro.2014.11.239.

Ohlson, J. A. (1980). Financial Ratios and The Probabilistic Prediction of Bankru

Journal of Accounting Research. Vol. 18 (1): 109-131.

Pongsatat, S., Ramage, J., & Lawrence, H. (2004). Bankruptcy Prediction for Large an

Small Firms in Asia: a Comparison of Ohlson and Altman. Journal of Accounting a

Corporate Governance. Vol. 1(2): 1-13.

Purnajaya, K. D. M., & Merkusiwati, N. K. L. A. (2014). Analisis Komparasi Pote

Kebangkrutan Dengan Metode Z-score Altman, Springate, dan Zmijewski Pa

Industri Kosmetik Yang Terdaftar di Bursa Efek Indonesia (Comparison Analysis o

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559 67

Etikonomi

Volume 17 (1), 2018: 57 - 68

Grover, J., & Lavin, A. (2001). Financial Ratios, Discriminant Analysis and The Predicti

of Corporate Bankruptcy: a Service Industry Extension of Altman’s Z-Score Mode

Bankruptcy Prediction. Working Paper. Southern Finance Assosiation Annual Mee

Gunawan, B., Pamungkas, R., & Susilawati, D. (2016). Perbandingan Prediksi Fi

Distress Menggunakan Model Altman, Grover dan Zmijewski (The Comparation o

Financial Distress Prediction Using Altman, Grover, and Zmijewski Model. J

Akuntansi dan Investasi. Vol. 18(1): 119-127.

Hernandez-Tinoco, M., & Wilson, N. (2013). Financial Distress and Bankruptcy Predict

Among Listed Companies Using Accounting, Market and Macroeconomic Variable

International Review of Financial Analysis. Vol. 30(Supl. C): 394-419. DOI: https:/

doi.org/10.1016/j.irfa.2013.02.013

Hillegeist, S. A., Keating, E. K., Cram, D. P., & Lundstedt, K. G. (2004). Assessing The

Probability of Bankruptcy. Review of accounting studies. Vol. 9(1): 5-34.

Hussain, F., Ali, I., Ullah, S., & Ali, M. (2014). Can Altman Z-score Model Predict Busine

Failures in Pakistan? Evidence from Textile Companies of Pakistan. Journal of Eco

and Sustainable Development. Vol. 5(13): 110-115.

Jayasekera, R. (2017). Prediction of Company Failure: Past, Present and Promising Dir

for The Future. International Review of Financial Analysis. Vol. 55: 196-208

https/doi.org/10.1016/j.irfa.2017.08.009.

Karamzadeh, M. S. (2013). Application and Comparison of Altman and Ohlson Models

Predict Bankruptcy of Companies. Research Journal of Applied Sciences, Enginee

Technology. Vol. 5(6): 2007-2011.

Karas, M., & Režňáková, M. (2015). Predicting Bankruptcy Under Alternative Conditio

The Effect of a Change in Industry and Time Period on The Accuracy of

Model. Procedia-Social and Behavioral Sciences. Vol. 213: 397-403. DOI: https//d

org/10.1016/j.sbspro.2015.11.557.

Ko, Y.-C., Fujita, H., & Li, T. (2017). An Evidential Analysis of Altman Z-score for Finan

Predictions: Case Study on Solar Energy Companies. Applied Soft Computing. Vo

748-759.

Marcinkevičius, R., & Kanapickienė, R. (2014). Bankruptcy Prediction in the Sec

Construction in Lithuania. Procedia-Social and Behavioral Sciences. Vol. 156: 553

DOI: https://doi.org/10.1016/j.sbpro.2014.11.239.

Ohlson, J. A. (1980). Financial Ratios and The Probabilistic Prediction of Bankru

Journal of Accounting Research. Vol. 18 (1): 109-131.

Pongsatat, S., Ramage, J., & Lawrence, H. (2004). Bankruptcy Prediction for Large an

Small Firms in Asia: a Comparison of Ohlson and Altman. Journal of Accounting a

Corporate Governance. Vol. 1(2): 1-13.

Purnajaya, K. D. M., & Merkusiwati, N. K. L. A. (2014). Analisis Komparasi Pote

Kebangkrutan Dengan Metode Z-score Altman, Springate, dan Zmijewski Pa

Industri Kosmetik Yang Terdaftar di Bursa Efek Indonesia (Comparison Analysis o

Ghazali Syamni. Bankruptcy Prediction Models and Stock Prices

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

68

Bankruptcy Potency With Altman Z-Score, Springate, and Zmijewski Method

Cosmetic Companies That Listed in Indonesia Stock Exchange). E-Jurnal Akuntan

Vol. 7(1): 48-63.

Putera, F. Z. Z. A., Swandari, F., & Dewi, D. M. (2017). Perbandingan Prediksi Financia

Distress Dengan Menggunakan Model Altman, Springate dan Ohlson (The Financ

Distress Comparison Using Altman, Springate and Ohlson Model). Jurnal Wawasa

Manajemen. Vol. 4(3): 217-230.

Rachmawati, T. (2016). Analisis Kebangkrutan Dengan Menggunakan Model Altm

Z-Score Pada Perusahaan Asuransi Yang Go-Public di Bursa Efek Indonesia: Perio

tahun 2010-2013 (Bankruptcy Analysis Using Altman Z-Score Model In Insurance

Public Companies: Period of 2010-2013. Jurnal Ekonomi dan Bisnis. Vol. 17(1): 61

Rahayu, F., Suwendra, I. W., & Yulianthini, N. N. (2016). Analisis financial distress den

menggunakan metode Altman Z-Score, Springate, dan Zmijewski pada perusaha

telekomunikasi. Jurnal Jurusan Manajemen, 4(1), 1-13.

Sembiring,E. E. (2016).AnalisisKeakuratanModel Ohlson Dalam Memprediksi

Kebangkrutan (delisting) Perusahaan yang Terdaftar di BEI (The Accuracy Analys

of Ohlson Model in Bankruptcy Prediction at Companies Listed in IDX). Jur

Akuntansi Keuangan dan Bisnis. Vol. 9: 1-9.

Springate, G. L. (1978). Predicting the Possibility of Failure in a Canadian firm. (Unpub

Thesis). Britisch Columbia, Canada: Simon Fraser University.

Sudiyatno, B., & Puspitasari, E. (2010). Tobin’s Q dan Altman Z-Score Sebagai Indikat

Pengukuran Kinerja Perusahaan (Tobin’s Q and Altman Z-Score as Compan

Performance Indicator). Jurnal Ilmiah Kajian Akuntansi. Vol. 2(1): 9-21.

Wu, Y., Gaunt, C., & Gray, S. (2010). A Comparison of Alternative Bankruptcy Predicti

Models. Journal of Contemporary Accounting & Economics. Vol. 6(1): 34-45

https://doi.org/10.1016/jcae.2010.04.002.

Wulandari, A. P., & Norita, A. I. (2014). Pengaruh Prediksi Kebangkrutan Ohlson Score

(O-score) Terhadap Return Saham: Studi Pada Perusahaan Sub-Sektor Teks

Garmen yang Listing di BEI tahun 2010-2014 (The Effect of Ohlson Score (O-Scor

Bankruptcy Prediction to Stock Return: Study at Textile and Garments Companie

Listed in IDX Period 2010-2014). e-Proceeding of Management 3(1), 101-108.

Xu, M., & Zhang, C. (2009). Bankruptcy Prediction: The Case of Japanese Listed Comp

Review of Accounting Studies. Vol. 14(4): 534-558. DOI: https//doi.org/10.1

s11142-008-9080-5.

Yunan, Z.Y., & Rahmasari, M. (2015). Measurement of Shariah Stock Performance Usi

Risk Adjusted Performance. Al-Iqtishad: Jurnal Ilmu Ekonomi Syariah (Journal of Is

Economics). Vol. 7 (1): 127-140. DOI: https://doi.org/10.15408/aiq.v7i1.1364.

Zmijewski, M. (1983). Predicting Corporate Bankruptcy: An Empirical Comparison of T

Extant Financial Distress Models. Document de travail. State University of New Y

Buffalo.

http://journal.uinjkt.ac.id/index.php/etikonomi

DOI: htttp://dx.doi.org/10.15408/etk.v17i1.6559

68

Bankruptcy Potency With Altman Z-Score, Springate, and Zmijewski Method

Cosmetic Companies That Listed in Indonesia Stock Exchange). E-Jurnal Akuntan

Vol. 7(1): 48-63.

Putera, F. Z. Z. A., Swandari, F., & Dewi, D. M. (2017). Perbandingan Prediksi Financia

Distress Dengan Menggunakan Model Altman, Springate dan Ohlson (The Financ

Distress Comparison Using Altman, Springate and Ohlson Model). Jurnal Wawasa

Manajemen. Vol. 4(3): 217-230.

Rachmawati, T. (2016). Analisis Kebangkrutan Dengan Menggunakan Model Altm

Z-Score Pada Perusahaan Asuransi Yang Go-Public di Bursa Efek Indonesia: Perio

tahun 2010-2013 (Bankruptcy Analysis Using Altman Z-Score Model In Insurance

Public Companies: Period of 2010-2013. Jurnal Ekonomi dan Bisnis. Vol. 17(1): 61

Rahayu, F., Suwendra, I. W., & Yulianthini, N. N. (2016). Analisis financial distress den

menggunakan metode Altman Z-Score, Springate, dan Zmijewski pada perusaha

telekomunikasi. Jurnal Jurusan Manajemen, 4(1), 1-13.

Sembiring,E. E. (2016).AnalisisKeakuratanModel Ohlson Dalam Memprediksi

Kebangkrutan (delisting) Perusahaan yang Terdaftar di BEI (The Accuracy Analys

of Ohlson Model in Bankruptcy Prediction at Companies Listed in IDX). Jur

Akuntansi Keuangan dan Bisnis. Vol. 9: 1-9.

Springate, G. L. (1978). Predicting the Possibility of Failure in a Canadian firm. (Unpub

Thesis). Britisch Columbia, Canada: Simon Fraser University.

Sudiyatno, B., & Puspitasari, E. (2010). Tobin’s Q dan Altman Z-Score Sebagai Indikat

Pengukuran Kinerja Perusahaan (Tobin’s Q and Altman Z-Score as Compan

Performance Indicator). Jurnal Ilmiah Kajian Akuntansi. Vol. 2(1): 9-21.

Wu, Y., Gaunt, C., & Gray, S. (2010). A Comparison of Alternative Bankruptcy Predicti

Models. Journal of Contemporary Accounting & Economics. Vol. 6(1): 34-45

https://doi.org/10.1016/jcae.2010.04.002.

Wulandari, A. P., & Norita, A. I. (2014). Pengaruh Prediksi Kebangkrutan Ohlson Score

(O-score) Terhadap Return Saham: Studi Pada Perusahaan Sub-Sektor Teks

Garmen yang Listing di BEI tahun 2010-2014 (The Effect of Ohlson Score (O-Scor

Bankruptcy Prediction to Stock Return: Study at Textile and Garments Companie

Listed in IDX Period 2010-2014). e-Proceeding of Management 3(1), 101-108.

Xu, M., & Zhang, C. (2009). Bankruptcy Prediction: The Case of Japanese Listed Comp

Review of Accounting Studies. Vol. 14(4): 534-558. DOI: https//doi.org/10.1

s11142-008-9080-5.

Yunan, Z.Y., & Rahmasari, M. (2015). Measurement of Shariah Stock Performance Usi

Risk Adjusted Performance. Al-Iqtishad: Jurnal Ilmu Ekonomi Syariah (Journal of Is

Economics). Vol. 7 (1): 127-140. DOI: https://doi.org/10.15408/aiq.v7i1.1364.

Zmijewski, M. (1983). Predicting Corporate Bankruptcy: An Empirical Comparison of T

Extant Financial Distress Models. Document de travail. State University of New Y

Buffalo.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12