Report: Analysis of the European Financial Crisis and Mitigation

VerifiedAdded on 2023/06/03

|6

|1521

|50

Report

AI Summary

This report provides a comprehensive analysis of the European Financial Crisis, beginning with its origins in 2008 and the subsequent spread to several European countries. The report delves into the causes, including excessive private and public debts, misallocation of resources, and low economic growth in certain countries. It explores the significant impacts, such as public deficits, economic recession, unemployment, and the weakening of the banking system. Furthermore, it examines the mitigation strategies employed, including financial injections, government-licensed special purpose vehicles, and reforms by international authorities. The report also discusses the pros and cons of the European policies implemented to address the crisis, offering a balanced perspective on their effectiveness. Finally, it concludes with a discussion on the importance of educating German nationals on the relevance of Europe.

EUROPEAN FINANCIAL CRISIS

(COURSE)

(STUDENT ID)

(SUBMISSION DATE)

(COURSE)

(STUDENT ID)

(SUBMISSION DATE)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

This started in the year 2008 where most of the financial institutions collapsed, government debts

increased and the cost of borrowing through the purchase of government bonds increased.The European

financial crisis resulted from the disintegration of Iceland’s financial system which thereafter, spread the

effect to countries like Portugal, Ireland, Italy and Greece in the following year, (Carmassi, Gros &

Micossi, 2009 p. 977-996).

The countries such as Iceland, Greece and Italy were unable to finance government repay or finance

government's debts without the assistant from Imperial Monetary Fund, European Central Bank and the

European Financial Stability Facility.

United State Congress report of 2012 stated that the European financial crisis started in 2009 when

Greece government realized that the previous government had been misrepresenting budget data of the

government. This led to a loss of confidence by the business sectors, ( Pisani, 2012 No. 2012/01).

Causes of the Financial Crisis

The European financial crisis was geared by misplacing confidence and assessment of risks. The

countries like Greece initially offered high interest when lending loans but to encourage investors, they

reduced their interest rates in that the borrowing became so cheap, enticing even private sectors to

borrow leading to building up of government debts.

The leading cause of the European financial crisis was not necessarily public debt but excessive private

debts whereby, the borrowed money was not invested in productive ventures but consumption and real

estate investment. Some states used the capital account surplus to finance the spending. Borrowed fund

was used in housing whereby the proportion of housing investment to the total GDP was recorded as

follows: Spain with 18% and Ireland with 22%. The two countries have their housing pricing bubble which

burst shortly after the subprime mortgage bubble, "crisis (No. 9-222). International Monetary Fund," (Zoli

& Sgherri,2009).

Another cause was excess government expenditure. Some countries like Portugal and Greece have the

public deficit above the target every year as far as the European target. Even country like German failed

to meet the criterion of deficit most of the times, (Carmassi, Gros, & Micossi, 2009 p.977- 996).

Some countries like German have low economic growth. That led to European Central Bank to charge

low interest on its lending which was not necessarily low for some well thriving countries like Greece and

Spain, and that led to the creation of massive housing market bubble there, (Carmassi, Gros & Micossi,

2009 p. 977-996).

This started in the year 2008 where most of the financial institutions collapsed, government debts

increased and the cost of borrowing through the purchase of government bonds increased.The European

financial crisis resulted from the disintegration of Iceland’s financial system which thereafter, spread the

effect to countries like Portugal, Ireland, Italy and Greece in the following year, (Carmassi, Gros &

Micossi, 2009 p. 977-996).

The countries such as Iceland, Greece and Italy were unable to finance government repay or finance

government's debts without the assistant from Imperial Monetary Fund, European Central Bank and the

European Financial Stability Facility.

United State Congress report of 2012 stated that the European financial crisis started in 2009 when

Greece government realized that the previous government had been misrepresenting budget data of the

government. This led to a loss of confidence by the business sectors, ( Pisani, 2012 No. 2012/01).

Causes of the Financial Crisis

The European financial crisis was geared by misplacing confidence and assessment of risks. The

countries like Greece initially offered high interest when lending loans but to encourage investors, they

reduced their interest rates in that the borrowing became so cheap, enticing even private sectors to

borrow leading to building up of government debts.

The leading cause of the European financial crisis was not necessarily public debt but excessive private

debts whereby, the borrowed money was not invested in productive ventures but consumption and real

estate investment. Some states used the capital account surplus to finance the spending. Borrowed fund

was used in housing whereby the proportion of housing investment to the total GDP was recorded as

follows: Spain with 18% and Ireland with 22%. The two countries have their housing pricing bubble which

burst shortly after the subprime mortgage bubble, "crisis (No. 9-222). International Monetary Fund," (Zoli

& Sgherri,2009).

Another cause was excess government expenditure. Some countries like Portugal and Greece have the

public deficit above the target every year as far as the European target. Even country like German failed

to meet the criterion of deficit most of the times, (Carmassi, Gros, & Micossi, 2009 p.977- 996).

Some countries like German have low economic growth. That led to European Central Bank to charge

low interest on its lending which was not necessarily low for some well thriving countries like Greece and

Spain, and that led to the creation of massive housing market bubble there, (Carmassi, Gros & Micossi,

2009 p. 977-996).

Impacts of European financial crisis

European financial crisis led to the public deficit and high debt level. Countries with high debt level like

Greece, Portugal and Spain were forced to change their government to correct their high debt level under

a harsh environment (Alter, & Schüler, 2012 p.3444-3468.

It also led to the economic recession leading to high Level of unemployment. In countries like Greece and

Portugal, inflation there was increased inflation leading to a decrease in purchasing power thus demand

for goods and service went down.

Thirdly, it has led to the isolation of German from the European community which witnessed even now.

German does not assume that what if good for her is suitable for all other members of the European and

vice verse, (Hall, 2012 p. 355-371).

The crisis led to the weakness collapse of the banking system in Europe. This was steered by default of

subprime loans and loss if values of asset market prices like corporate bond thus making investing and

financing activities difficult ( Lane, 2012 p.49-68).

Lastly, the crisis led to the weakness of the Brussels commission whose power relative to Europeans

countries was declining for about 20 years. Upon emergence of financial crisis back 2008, there has been

sidelining of the commission. Although the commission has designed many packages, European

countries have taken in charge of controlling the International Monetary Fund, European Central Bank

and European Financial Stability Facility, Åslund, 2010. “The last shall be the first: the East European

financial crisis” .Peterson Institute.

Financial Crisis Mitigation Strategies and Analysis

The governments/ Europeans Central Bank put into place several strategies to tackle the crisis. They

include;

When the crisis was noticed on 9th August 2007, through default of subprime mortgage, the bank

recorded an injection of 9.48 billion Euros in the banking system. It reduced its key by 0.5 to prevent

worsening and made Jean-Claude Trichet the president of European Central Bank, “European Company

and Financial Law Review", 6(4), 440-475.

Countries in Eurozone established the government licensed special purpose vehicles and companies

whose function was to statues and officers. Their function was to launch and lend loans to banks

guaranteed by the government. Ultimately, the banks are refinanced by the European Central bank, and

the reason this is most preferred is that the banks rarely the borrowed directly from the European Central

Bank, it also lowers securities' level rates and the contribution, if government we enable it to transfer the

risk to the states, "Lane, 2012 p.49-68).

European financial crisis led to the public deficit and high debt level. Countries with high debt level like

Greece, Portugal and Spain were forced to change their government to correct their high debt level under

a harsh environment (Alter, & Schüler, 2012 p.3444-3468.

It also led to the economic recession leading to high Level of unemployment. In countries like Greece and

Portugal, inflation there was increased inflation leading to a decrease in purchasing power thus demand

for goods and service went down.

Thirdly, it has led to the isolation of German from the European community which witnessed even now.

German does not assume that what if good for her is suitable for all other members of the European and

vice verse, (Hall, 2012 p. 355-371).

The crisis led to the weakness collapse of the banking system in Europe. This was steered by default of

subprime loans and loss if values of asset market prices like corporate bond thus making investing and

financing activities difficult ( Lane, 2012 p.49-68).

Lastly, the crisis led to the weakness of the Brussels commission whose power relative to Europeans

countries was declining for about 20 years. Upon emergence of financial crisis back 2008, there has been

sidelining of the commission. Although the commission has designed many packages, European

countries have taken in charge of controlling the International Monetary Fund, European Central Bank

and European Financial Stability Facility, Åslund, 2010. “The last shall be the first: the East European

financial crisis” .Peterson Institute.

Financial Crisis Mitigation Strategies and Analysis

The governments/ Europeans Central Bank put into place several strategies to tackle the crisis. They

include;

When the crisis was noticed on 9th August 2007, through default of subprime mortgage, the bank

recorded an injection of 9.48 billion Euros in the banking system. It reduced its key by 0.5 to prevent

worsening and made Jean-Claude Trichet the president of European Central Bank, “European Company

and Financial Law Review", 6(4), 440-475.

Countries in Eurozone established the government licensed special purpose vehicles and companies

whose function was to statues and officers. Their function was to launch and lend loans to banks

guaranteed by the government. Ultimately, the banks are refinanced by the European Central bank, and

the reason this is most preferred is that the banks rarely the borrowed directly from the European Central

Bank, it also lowers securities' level rates and the contribution, if government we enable it to transfer the

risk to the states, "Lane, 2012 p.49-68).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

International authorities like the International Monetary Fund and national authorities formulated reform to

respond to the situation. Such reform can be summarized in as "more transparency more regulating,

more competing ". More transparency in financial information to avoid reduced confidence and

uncertainty, more regulating to ensure that the financial actors are working in line with financial stability

and more competing in that the financial information is accurate and not biased.The policy of educating

Germany on the importance of the Euro ZoneGerman nationals need to be educated thereon the

relevance of Europe, (Pisani- Ferry, 2012 No. 2012/01).

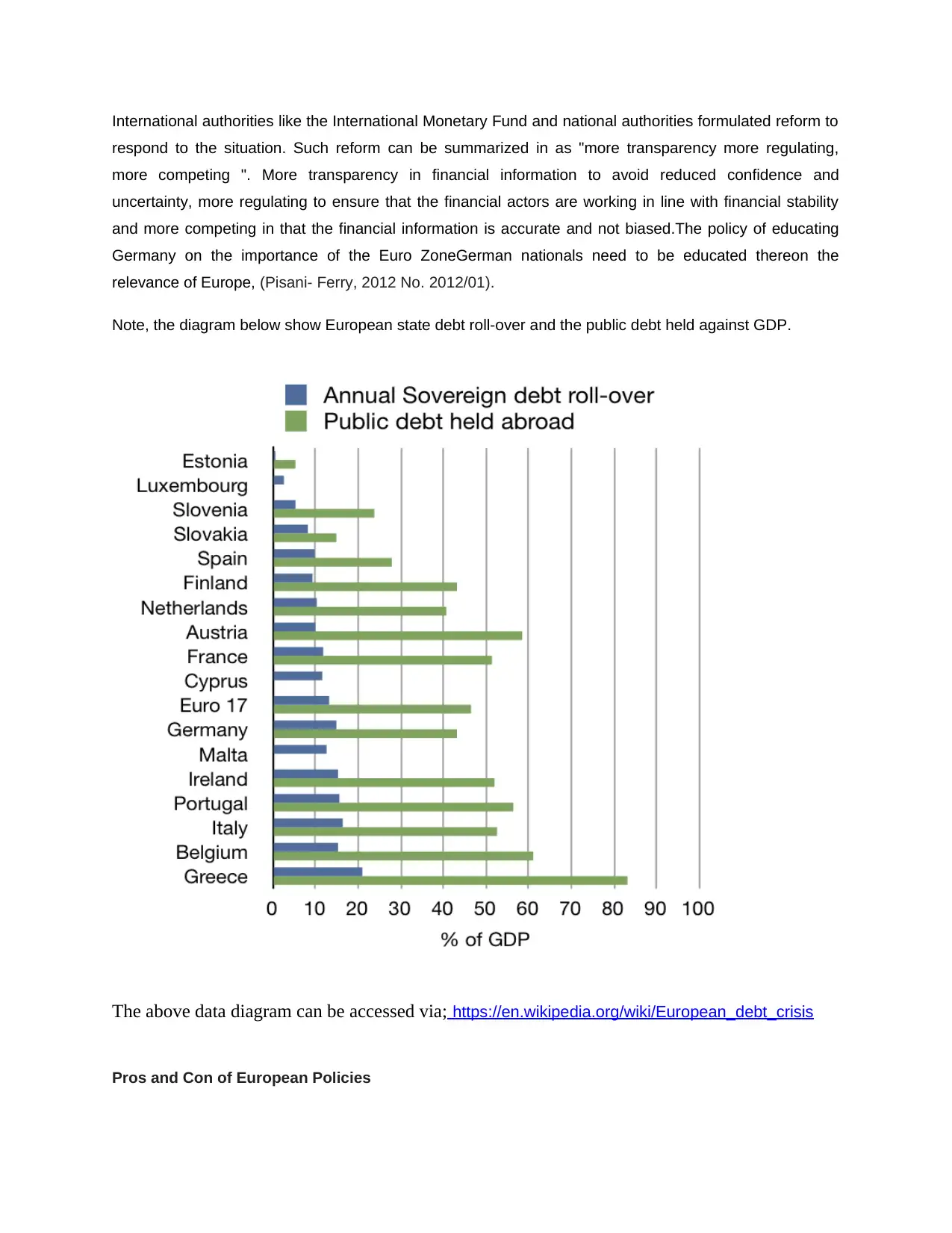

Note, the diagram below show European state debt roll-over and the public debt held against GDP.

The above data diagram can be accessed via; https://en.wikipedia.org/wiki/European_debt_crisis

Pros and Con of European Policies

respond to the situation. Such reform can be summarized in as "more transparency more regulating,

more competing ". More transparency in financial information to avoid reduced confidence and

uncertainty, more regulating to ensure that the financial actors are working in line with financial stability

and more competing in that the financial information is accurate and not biased.The policy of educating

Germany on the importance of the Euro ZoneGerman nationals need to be educated thereon the

relevance of Europe, (Pisani- Ferry, 2012 No. 2012/01).

Note, the diagram below show European state debt roll-over and the public debt held against GDP.

The above data diagram can be accessed via; https://en.wikipedia.org/wiki/European_debt_crisis

Pros and Con of European Policies

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PROS AND CONS OF EUROPEAN FINANCIAL POLICIES

The European financial policies such as reorganization of the European banking system and European

financial stability facility among others were intended to end debt crisis that was destabilizing European

states, reducing the interest rate to allow countries like Iceland a greater ability to pay their debt, to

prevent member countries from falling into the bailout packages in future, and to create harmonization

within European financial markets. Policies were also intended to creating trade trust and confidence

among European states and international community. On the other side, if no financial policies proposed,

then the European debts would rapidly spread over, leading to economic recession and then loss of Euro

currency value, and also it would difficulty to convince non-European states to do business with European

member states.

The European financial policies such as reorganization of the European banking system and European

financial stability facility among others were intended to end debt crisis that was destabilizing European

states, reducing the interest rate to allow countries like Iceland a greater ability to pay their debt, to

prevent member countries from falling into the bailout packages in future, and to create harmonization

within European financial markets. Policies were also intended to creating trade trust and confidence

among European states and international community. On the other side, if no financial policies proposed,

then the European debts would rapidly spread over, leading to economic recession and then loss of Euro

currency value, and also it would difficulty to convince non-European states to do business with European

member states.

References

Alter, A., & Schüler, Y. S. (2012). Credit spread interdependencies of European states and banks during

the financial crisis. Journal of Banking & Finance, 36(12), 3444-3468.

Åslund, A. (2010). The last shall be the first: the East European financial crisis. Peterson Institute.

Avgouleas, E. (2009). The global financial crisis and the disclosure paradigm in European Financial

Regulation: The case for reform. European Company and Financial Law Review, 6(4), 440-475.

Carmassi, J., Gros, D., & Micossi, S. (2009). The global financial crisis: Causes and cures. JCMS: Journal

of Common Market Studies, 47(5), 977-996.

Hall, P. A. (2012). The economics and politics of the Lane, P. R. 2012 crisis. German Politics, 21(4), 355-

371.

Lane, P. R. (2012). The European sovereign debt crisis, Journal of Economic Perspectives, 26(3), 49-68.

Pisani-Ferry, J.(2012). The euro crisis and the new impossible trinity (No. 2012/01). Brussels Policy

Contribution

Reinhart, C. M., & Rogoff, K. S.(2009). The aftermath of financial crisis, American Economic

Review,99(2), 466-72.

Zoli, M. E., & Sgherri, M. S. (2009). Euro area sovereign risk during the crisis (No. 9-222). International

Monetary Fund

Alter, A., & Schüler, Y. S. (2012). Credit spread interdependencies of European states and banks during

the financial crisis. Journal of Banking & Finance, 36(12), 3444-3468.

Åslund, A. (2010). The last shall be the first: the East European financial crisis. Peterson Institute.

Avgouleas, E. (2009). The global financial crisis and the disclosure paradigm in European Financial

Regulation: The case for reform. European Company and Financial Law Review, 6(4), 440-475.

Carmassi, J., Gros, D., & Micossi, S. (2009). The global financial crisis: Causes and cures. JCMS: Journal

of Common Market Studies, 47(5), 977-996.

Hall, P. A. (2012). The economics and politics of the Lane, P. R. 2012 crisis. German Politics, 21(4), 355-

371.

Lane, P. R. (2012). The European sovereign debt crisis, Journal of Economic Perspectives, 26(3), 49-68.

Pisani-Ferry, J.(2012). The euro crisis and the new impossible trinity (No. 2012/01). Brussels Policy

Contribution

Reinhart, C. M., & Rogoff, K. S.(2009). The aftermath of financial crisis, American Economic

Review,99(2), 466-72.

Zoli, M. E., & Sgherri, M. S. (2009). Euro area sovereign risk during the crisis (No. 9-222). International

Monetary Fund

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.