MBA Financial Management: Evaluating Aunt Chiara's Business Venture

VerifiedAdded on 2023/04/22

|15

|2969

|371

Report

AI Summary

This assignment provides a detailed financial analysis of Aunt Chiara's prospective venture, focusing on the development of a profit and loss statement and a cash budget for the first year of operations. The analysis begins with projected financial statements, including monthly income statements and cost of goods sold calculations, based on various assumptions and estimates related to sales growth, material costs, and operating expenses. Key assumptions include a 16% monthly sales growth, consistent sales to Marco, and a four-year useful life for tangible assets. The report evaluates the venture's profitability, cash flow, and potential risks, such as foreign exchange exposure, and suggests hedging strategies to mitigate these risks. The analysis concludes with a critical appreciation of the venture, highlighting both its potential and areas for improvement. This student-contributed document is available on Desklib, offering valuable insights for students studying financial management.

Student Number: 1552665

Master of Business Administration

CRKC7003 Financial Management

Interim Assignment

Unit 3

1

Master of Business Administration

CRKC7003 Financial Management

Interim Assignment

Unit 3

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

In this particular assignment, evaluation of a prospective venture has to be made and a report

is made to evaluate the viability of a prospective venture. So in order to evaluate the viability of

the venture projected Profit & Loss Account has been made based on certain estimates. These

accounting estimates and assumption has been taken based on market survey as referred in the

case study keeping in mind the assumptions that generally operate in an efficient market. Cash

Budgets and Analysis of the cash flows will reflect the key takeaway with respect to the viability

of the venture.

2

In this particular assignment, evaluation of a prospective venture has to be made and a report

is made to evaluate the viability of a prospective venture. So in order to evaluate the viability of

the venture projected Profit & Loss Account has been made based on certain estimates. These

accounting estimates and assumption has been taken based on market survey as referred in the

case study keeping in mind the assumptions that generally operate in an efficient market. Cash

Budgets and Analysis of the cash flows will reflect the key takeaway with respect to the viability

of the venture.

2

Contents

Introduction...............................................................................................................................................3

Projected statement of profit and loss for the first year of operations..................................................4

Monthly Projected Income Statement....................................................................................................5

Analysis of profit & loss statement for the 1st year of operations.........................................................9

Assumptions & Estimates.......................................................................................................................9

Projected Cash Budget............................................................................................................................10

Cash Flow and Financial Analysis......................................................................................................11

Assumptions & Estimates.....................................................................................................................11

Analysis of the Assumptions and Estimates.........................................................................................12

Critical Appreciation of the Venture of Aunt Chiara...........................................................................13

References:...............................................................................................................................................14

3

Introduction...............................................................................................................................................3

Projected statement of profit and loss for the first year of operations..................................................4

Monthly Projected Income Statement....................................................................................................5

Analysis of profit & loss statement for the 1st year of operations.........................................................9

Assumptions & Estimates.......................................................................................................................9

Projected Cash Budget............................................................................................................................10

Cash Flow and Financial Analysis......................................................................................................11

Assumptions & Estimates.....................................................................................................................11

Analysis of the Assumptions and Estimates.........................................................................................12

Critical Appreciation of the Venture of Aunt Chiara...........................................................................13

References:...............................................................................................................................................14

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

The purpose of the Interim Assignment is to develop a Profit and Loss Statement for the first

year of operations of an opportunity, with clear explanation of any assumptions made in the P &

L Statement.

Details for ease as per below;

Total amount of capital available in hand = € 450,000

Price per pound of nuts in retail in USA = $27.50

Discount offered to Chiara = 40%

Information relating to expenses:

Cost Per unit

Price per pound of nuts Retail Price – Discount = $27.50 – 40% $16.50 per pound

Freight $2.70 per pound

Local Packing and Shipping $3.00 per pound

Credit Card Charges 1.50% on total sales

through credit card

Salaries $11,500 per annum

Salary to additional assistant $300 per month x 12 months $3,600 per annum

Decorative Box 0.80 per 600 grams

pack

Market Survey Expenditure € 5,000

Capital Expenditure:

Refrigerator = €4750

Website = €8000

4

The purpose of the Interim Assignment is to develop a Profit and Loss Statement for the first

year of operations of an opportunity, with clear explanation of any assumptions made in the P &

L Statement.

Details for ease as per below;

Total amount of capital available in hand = € 450,000

Price per pound of nuts in retail in USA = $27.50

Discount offered to Chiara = 40%

Information relating to expenses:

Cost Per unit

Price per pound of nuts Retail Price – Discount = $27.50 – 40% $16.50 per pound

Freight $2.70 per pound

Local Packing and Shipping $3.00 per pound

Credit Card Charges 1.50% on total sales

through credit card

Salaries $11,500 per annum

Salary to additional assistant $300 per month x 12 months $3,600 per annum

Decorative Box 0.80 per 600 grams

pack

Market Survey Expenditure € 5,000

Capital Expenditure:

Refrigerator = €4750

Website = €8000

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

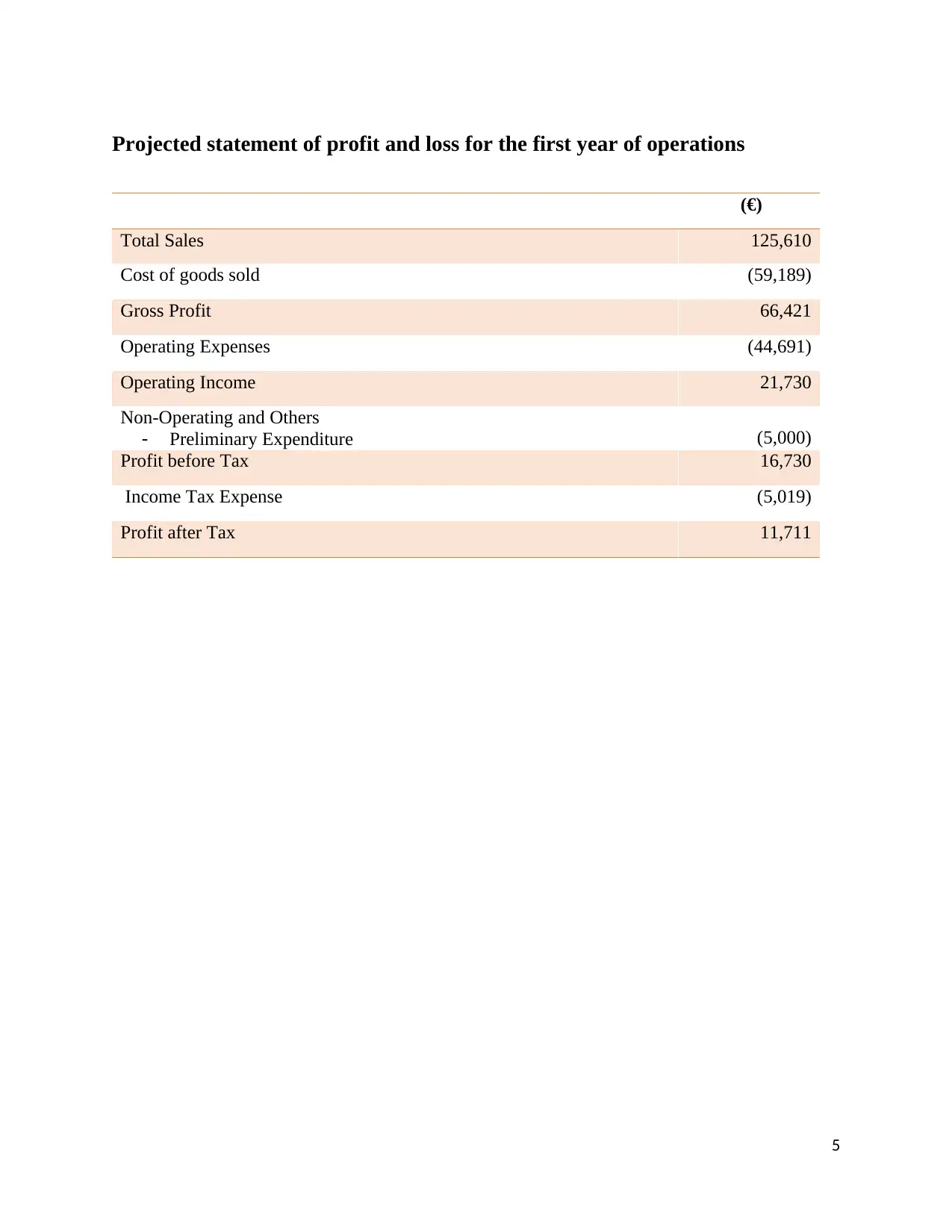

Projected statement of profit and loss for the first year of operations

(€)

Total Sales 125,610

Cost of goods sold (59,189)

Gross Profit 66,421

Operating Expenses (44,691)

Operating Income 21,730

Non-Operating and Others

- Preliminary Expenditure (5,000)

Profit before Tax 16,730

Income Tax Expense (5,019)

Profit after Tax 11,711

5

(€)

Total Sales 125,610

Cost of goods sold (59,189)

Gross Profit 66,421

Operating Expenses (44,691)

Operating Income 21,730

Non-Operating and Others

- Preliminary Expenditure (5,000)

Profit before Tax 16,730

Income Tax Expense (5,019)

Profit after Tax 11,711

5

Monthly Projected Income Statement

Month 1 2 3 4 5 6 7 8 9 10 11 12 Total

Online Sales (in

Kgs)

40 46 54 62 73 83 98 112 132 151 178 200 1,229

Sale to Marco 30 30 30 30 30 30 30 30 30 30 30 30 360

Total Sales 70 76 84 92 103 113 128 142 162 181 208 230 1,589

Revenue 4,850 5,390 6,110 6,830 7,820 8,720 10,070 11,330 13,130 14,840 17,270 19,250 125,610

Expenditure

Direct Material (2,607) (2,831) (3,129) (3,427

)

(3,837) (4,209) (4,768) (5,289) (6,034) (6,742

)

(7,748) (8,567) (59,189)

Salaries (1,258) (1,258) (1,258) (1,258

)

(1,258) (1,258) (1,258) (1,258) (1,258) (1,258

)

(1,258) (1,258) (15,100)

Rent (550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (6,600)

Packing Charges (144) (162) (186) (210) (243) (273) (318) (360) (420) (477) (558) (624) (3,975)

Credit Card Charges

1.5%

(54) (62) (73) (84) (99) (112) (132) (151) (178) (204) (240) (270) (1,659)

Total Monthly

Expenditure

(4,614) (4,863) (5,196) (5,529

)

(5,987) (6,403) (7,027) (7,609) (8,441) (9,231

)

(10,354) (11,270

)

(86,523)

Depreciation (17,357)

Preliminary

Expenditure

(5,000)

Profit before Tax 16,730

Tax @ 30% (5,019)

Profit after Tax 11,711

6

Month 1 2 3 4 5 6 7 8 9 10 11 12 Total

Online Sales (in

Kgs)

40 46 54 62 73 83 98 112 132 151 178 200 1,229

Sale to Marco 30 30 30 30 30 30 30 30 30 30 30 30 360

Total Sales 70 76 84 92 103 113 128 142 162 181 208 230 1,589

Revenue 4,850 5,390 6,110 6,830 7,820 8,720 10,070 11,330 13,130 14,840 17,270 19,250 125,610

Expenditure

Direct Material (2,607) (2,831) (3,129) (3,427

)

(3,837) (4,209) (4,768) (5,289) (6,034) (6,742

)

(7,748) (8,567) (59,189)

Salaries (1,258) (1,258) (1,258) (1,258

)

(1,258) (1,258) (1,258) (1,258) (1,258) (1,258

)

(1,258) (1,258) (15,100)

Rent (550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (6,600)

Packing Charges (144) (162) (186) (210) (243) (273) (318) (360) (420) (477) (558) (624) (3,975)

Credit Card Charges

1.5%

(54) (62) (73) (84) (99) (112) (132) (151) (178) (204) (240) (270) (1,659)

Total Monthly

Expenditure

(4,614) (4,863) (5,196) (5,529

)

(5,987) (6,403) (7,027) (7,609) (8,441) (9,231

)

(10,354) (11,270

)

(86,523)

Depreciation (17,357)

Preliminary

Expenditure

(5,000)

Profit before Tax 16,730

Tax @ 30% (5,019)

Profit after Tax 11,711

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Selling price per kg for sale to Marco

Price per box of 600 grams $25.00

Price per kg $41.67

Cost of goods sold

$ €

Selling Price in USA 27.50 Per Pound 24.20 Per Pound

Discount offered to Client 40% of $27.50 (11.00) Per Pound (9.68) Per Pound

Cost to Client 16.50 Per Pound 14.52

Add: Freight 2.70 Per Pound 2.38 Per Pound

Total Direct Material Cost 19.20 Per Pound 16.90 Per Pound

Pounds per Kilo 2.20462

Total Direct Material Cost 37.25 Per Kilo

As per IAS – 2, the cost of inventory should include all cost of purchase; therefore, freight is included in cost of direct materials.

Exchange Rate assumed €/$ 0.88

7

Price per box of 600 grams $25.00

Price per kg $41.67

Cost of goods sold

$ €

Selling Price in USA 27.50 Per Pound 24.20 Per Pound

Discount offered to Client 40% of $27.50 (11.00) Per Pound (9.68) Per Pound

Cost to Client 16.50 Per Pound 14.52

Add: Freight 2.70 Per Pound 2.38 Per Pound

Total Direct Material Cost 19.20 Per Pound 16.90 Per Pound

Pounds per Kilo 2.20462

Total Direct Material Cost 37.25 Per Kilo

As per IAS – 2, the cost of inventory should include all cost of purchase; therefore, freight is included in cost of direct materials.

Exchange Rate assumed €/$ 0.88

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Monthly Statement of Cost of goods sold

Month 1 2 3 4 5 6 7 8 9 10 11 12 Total

Online Sales (in Kgs) 40 46 54 62 73 83 98 112 132 151 178 200 1,229

Sale to Marco 30 30 30 30 30 30 30 30 30 30 30 30 360

Total Sales 70 76 84 92 103 113 128 142 162 181 208 230 1,589

Material Cost (€) 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25

Cost of Goods Sold

(2,607)

(2,831

)

(3,129

)

(3,427

)

(3,837

)

(4,209

)

(4,768

)

(5,289

)

(6,034

) (6,742)

(7,748

)

(8,567

)

(59,189

)

Notes and Assumptions:

- It is assumed that the sales will increase at a growth rate of 16% per month till they reach 200 units at the end of the year as

per the results of market survey

- Marco required 50 packets of 600 grams each per month, requirement in Kgs = 50 packets x 600 grams = 30 Kgs.

8

Month 1 2 3 4 5 6 7 8 9 10 11 12 Total

Online Sales (in Kgs) 40 46 54 62 73 83 98 112 132 151 178 200 1,229

Sale to Marco 30 30 30 30 30 30 30 30 30 30 30 30 360

Total Sales 70 76 84 92 103 113 128 142 162 181 208 230 1,589

Material Cost (€) 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25

Cost of Goods Sold

(2,607)

(2,831

)

(3,129

)

(3,427

)

(3,837

)

(4,209

)

(4,768

)

(5,289

)

(6,034

) (6,742)

(7,748

)

(8,567

)

(59,189

)

Notes and Assumptions:

- It is assumed that the sales will increase at a growth rate of 16% per month till they reach 200 units at the end of the year as

per the results of market survey

- Marco required 50 packets of 600 grams each per month, requirement in Kgs = 50 packets x 600 grams = 30 Kgs.

8

Operating Expenses

€

Salaries:

Operating Staff

Packing Assistant 300 x 12 months

11,500.00

3,600.00 15,100.00

Rent 550 x 12 months 6,600.00

Packing Charges

Packing Material 360 packs x €0.80

Local Packing & Shipping 1,229 Kgs x €3.00

288.00

3,687.00 3,975.00

Credit Card Expense 1,659.00

Depreciation 17,357.00

Total Operating Expenses 44,691.00

Depreciation

€

Refrigerator 1,188.00 Per annum

Website 2,000.00 Per annum

Exclusivity 14,169.00 Per annum

Total 17,357.00 Per annum

Notes and Assumptions:

- It is assumed that the tangible assets acquired have a useful economic life which lasts only the period for which the exclusivity

was obtained by the client. (4 years)

- Since the upfront payment made for obtaining the exclusivity is unavailable, it is assumed that the amount paid is $100,000 or

€88,000

- While online sale quantity is treated as appropriate for computing

- It is further assumed that the refrigerator is depreciated on straight-line basis. It is inherently assumed that there will be no

salvage value left after the end of useful economic life.

9

€

Salaries:

Operating Staff

Packing Assistant 300 x 12 months

11,500.00

3,600.00 15,100.00

Rent 550 x 12 months 6,600.00

Packing Charges

Packing Material 360 packs x €0.80

Local Packing & Shipping 1,229 Kgs x €3.00

288.00

3,687.00 3,975.00

Credit Card Expense 1,659.00

Depreciation 17,357.00

Total Operating Expenses 44,691.00

Depreciation

€

Refrigerator 1,188.00 Per annum

Website 2,000.00 Per annum

Exclusivity 14,169.00 Per annum

Total 17,357.00 Per annum

Notes and Assumptions:

- It is assumed that the tangible assets acquired have a useful economic life which lasts only the period for which the exclusivity

was obtained by the client. (4 years)

- Since the upfront payment made for obtaining the exclusivity is unavailable, it is assumed that the amount paid is $100,000 or

€88,000

- While online sale quantity is treated as appropriate for computing

- It is further assumed that the refrigerator is depreciated on straight-line basis. It is inherently assumed that there will be no

salvage value left after the end of useful economic life.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Analysis of profit & loss statement for the 1st year of operations

The statement profit & loss statement basically shows all the revenues and expenses generated by the entity in a nutshell over the

particular accounting period. The statement of profit & loss is often referred as known as the income statement.

We calculate the profit/surplus by deducting the expenses from the revenue. In the given case study, we find that the total revenue

generated by the venture is € 1,25,610 which is arrived based on the estimated selling price prevailing in the market. The total profit

from the venture during the first year of operations is € 11,711. While calculating the profit following accounting estimates and

assumptions were taken into consideration

Assumptions & Estimates

• While calculating the cost of goods sold as shown in income statement it should include all conveyance charges that were necessary

to use the inventory to generate sales. As per IAS – 2, the cost of inventory should include all cost of purchase therefore, freight is

included in cost of direct materials. (International Accounting Standards Board (2003)

• It is assumed that the sales will increase at a growth rate of 16% per month till they reach 200 units at the end of the year as per the

results of market survey

• Marco required 50 packets of 600 grams each per month, requirement in Kgs = 50 packets x 600 grams = 30 Kgs.

• While calculating depreciation the useful life assumed is 4 years as the tangible assets acquired have a useful economic life which

lasts only the period for which the exclusivity was obtained by the client. The total amount paid for acquisition is € 88,000.

10

The statement profit & loss statement basically shows all the revenues and expenses generated by the entity in a nutshell over the

particular accounting period. The statement of profit & loss is often referred as known as the income statement.

We calculate the profit/surplus by deducting the expenses from the revenue. In the given case study, we find that the total revenue

generated by the venture is € 1,25,610 which is arrived based on the estimated selling price prevailing in the market. The total profit

from the venture during the first year of operations is € 11,711. While calculating the profit following accounting estimates and

assumptions were taken into consideration

Assumptions & Estimates

• While calculating the cost of goods sold as shown in income statement it should include all conveyance charges that were necessary

to use the inventory to generate sales. As per IAS – 2, the cost of inventory should include all cost of purchase therefore, freight is

included in cost of direct materials. (International Accounting Standards Board (2003)

• It is assumed that the sales will increase at a growth rate of 16% per month till they reach 200 units at the end of the year as per the

results of market survey

• Marco required 50 packets of 600 grams each per month, requirement in Kgs = 50 packets x 600 grams = 30 Kgs.

• While calculating depreciation the useful life assumed is 4 years as the tangible assets acquired have a useful economic life which

lasts only the period for which the exclusivity was obtained by the client. The total amount paid for acquisition is € 88,000.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Projected Cash Budget

Month 0 1 2 3 4 5 6 7 8 9 10 11 12

Opening Balance 450,000 329,64

3

326,66

8

326,91

4

327,37

1

328,10

3

329,13

9

330,56

1

332,30

3

334,58

8

337,34

7

340,81

5

345,06

8

Cash Receipts

from Sales

0 0 4,796 5,328 6,037 6,746 7,721 8,608 9,938 11,179 12,952 14,636 17,030

Cash Payments

to Supplier (2,607) (2,831) (3,129) (3,427) (3,837) (4,209) (4,768) (5,289) (6,034) (6,742) (7,748) (8,567)

Purchase of

refrigerator

(4,750)

Payment for

exclusivity

(100,000

)

Payment for

website

(8,000)

Payment for

market survey

(5,000)

Payment for

salary

(1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258)

Payment for

packing

(144) (162) (186) (210) (243) (273) (318) (360) (420) (477) (558) (624)

Payment for

interest

towards payment

of rent

(550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (550)

Closing Cash

Balance

329,643 326,66

8

326,91

4

327,37

1

328,10

3

329,13

9

330,56

1

332,30

3

334,58

8

337,34

7

340,81

5

345,06

8

360,21

5

11

Month 0 1 2 3 4 5 6 7 8 9 10 11 12

Opening Balance 450,000 329,64

3

326,66

8

326,91

4

327,37

1

328,10

3

329,13

9

330,56

1

332,30

3

334,58

8

337,34

7

340,81

5

345,06

8

Cash Receipts

from Sales

0 0 4,796 5,328 6,037 6,746 7,721 8,608 9,938 11,179 12,952 14,636 17,030

Cash Payments

to Supplier (2,607) (2,831) (3,129) (3,427) (3,837) (4,209) (4,768) (5,289) (6,034) (6,742) (7,748) (8,567)

Purchase of

refrigerator

(4,750)

Payment for

exclusivity

(100,000

)

Payment for

website

(8,000)

Payment for

market survey

(5,000)

Payment for

salary

(1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258)

Payment for

packing

(144) (162) (186) (210) (243) (273) (318) (360) (420) (477) (558) (624)

Payment for

interest

towards payment

of rent

(550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (550)

Closing Cash

Balance

329,643 326,66

8

326,91

4

327,37

1

328,10

3

329,13

9

330,56

1

332,30

3

334,58

8

337,34

7

340,81

5

345,06

8

360,21

5

11

Notes and Assumptions for the above calculation

- It is assumed that the first payment was made to suppliers exactly 3 weeks before

commencement of financial year so that the payment for nuts required for first month (4

weeks) is paid at time.

- It is assumed that expenses like rent and salaries which are accrued in a month are paid in

the first day of month.

- It is assumed that packing expenses are paid in the month in which the nuts are sold.

- The website and upfront fee towards exclusivity satisfied the conditions to be recognized

as Intangible assets. Hence they are classified as Intangible Assets

Cash Flow and Financial Analysis

A cash budget is prepared to breakdown the estimated cash inflows and outflows for the

business during the current accounting period. It helps the business to assess whether the

business has adequate cash to meet the working capital expenditure. Different ventures

also prepare sales and production budget which facilitates the preparation of cash budget,

along with assumptions about the necessary outstanding expenses and cash receivable

from debtors. In this particular venture we find that the entity has sufficient cash balance

at the end of each month. It started with a cash balance of € 4,50,000. The total outflows

that took place along with cash payments made didn’t exceed even 10% of the total

balance held by the business. This clearly shows that the opportunity cost that the venture

is suffering as huge amount is held as idle cash in hand. It is advisable that for the

gestation period until break even the money to be invested in risk free investments so as

to generate surplus from the idle cash held by the entity.

Assumptions & Estimates

It is assumed that the first payment was made to suppliers exactly 3 weeks before

commencement of financial year so that the payment for nuts required for first

month (4 weeks) is paid at time.

It is assumed that expenses like rent and salaries which are accrued in a month

are paid in the first day of month.

It is assumed that packing expenses are paid in the month in which the nuts are

sold.

12

- It is assumed that the first payment was made to suppliers exactly 3 weeks before

commencement of financial year so that the payment for nuts required for first month (4

weeks) is paid at time.

- It is assumed that expenses like rent and salaries which are accrued in a month are paid in

the first day of month.

- It is assumed that packing expenses are paid in the month in which the nuts are sold.

- The website and upfront fee towards exclusivity satisfied the conditions to be recognized

as Intangible assets. Hence they are classified as Intangible Assets

Cash Flow and Financial Analysis

A cash budget is prepared to breakdown the estimated cash inflows and outflows for the

business during the current accounting period. It helps the business to assess whether the

business has adequate cash to meet the working capital expenditure. Different ventures

also prepare sales and production budget which facilitates the preparation of cash budget,

along with assumptions about the necessary outstanding expenses and cash receivable

from debtors. In this particular venture we find that the entity has sufficient cash balance

at the end of each month. It started with a cash balance of € 4,50,000. The total outflows

that took place along with cash payments made didn’t exceed even 10% of the total

balance held by the business. This clearly shows that the opportunity cost that the venture

is suffering as huge amount is held as idle cash in hand. It is advisable that for the

gestation period until break even the money to be invested in risk free investments so as

to generate surplus from the idle cash held by the entity.

Assumptions & Estimates

It is assumed that the first payment was made to suppliers exactly 3 weeks before

commencement of financial year so that the payment for nuts required for first

month (4 weeks) is paid at time.

It is assumed that expenses like rent and salaries which are accrued in a month

are paid in the first day of month.

It is assumed that packing expenses are paid in the month in which the nuts are

sold.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.