Comparative Analysis of NPV and IRR in Investment Project Evaluation

VerifiedAdded on 2023/06/15

|2

|715

|381

Report

AI Summary

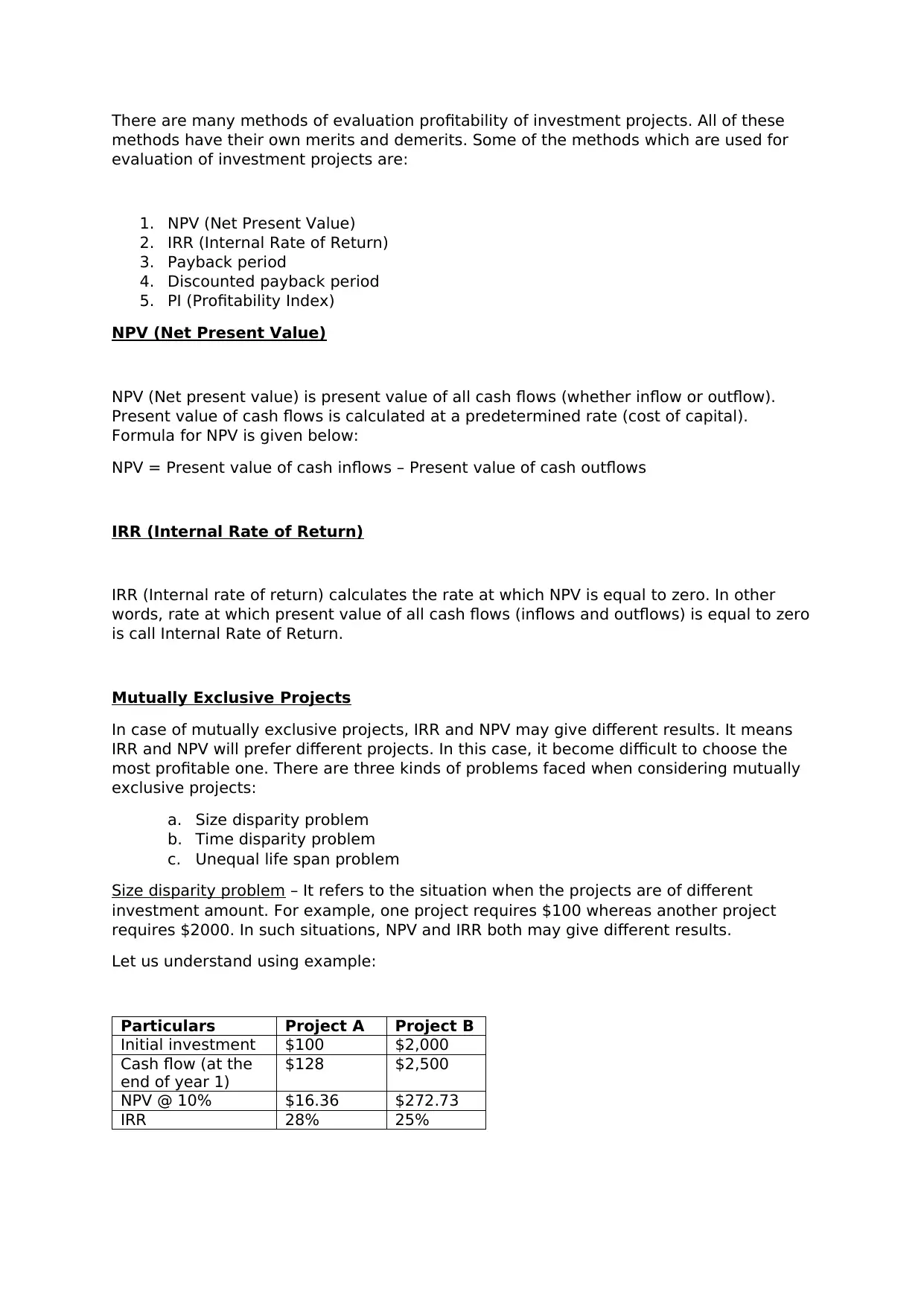

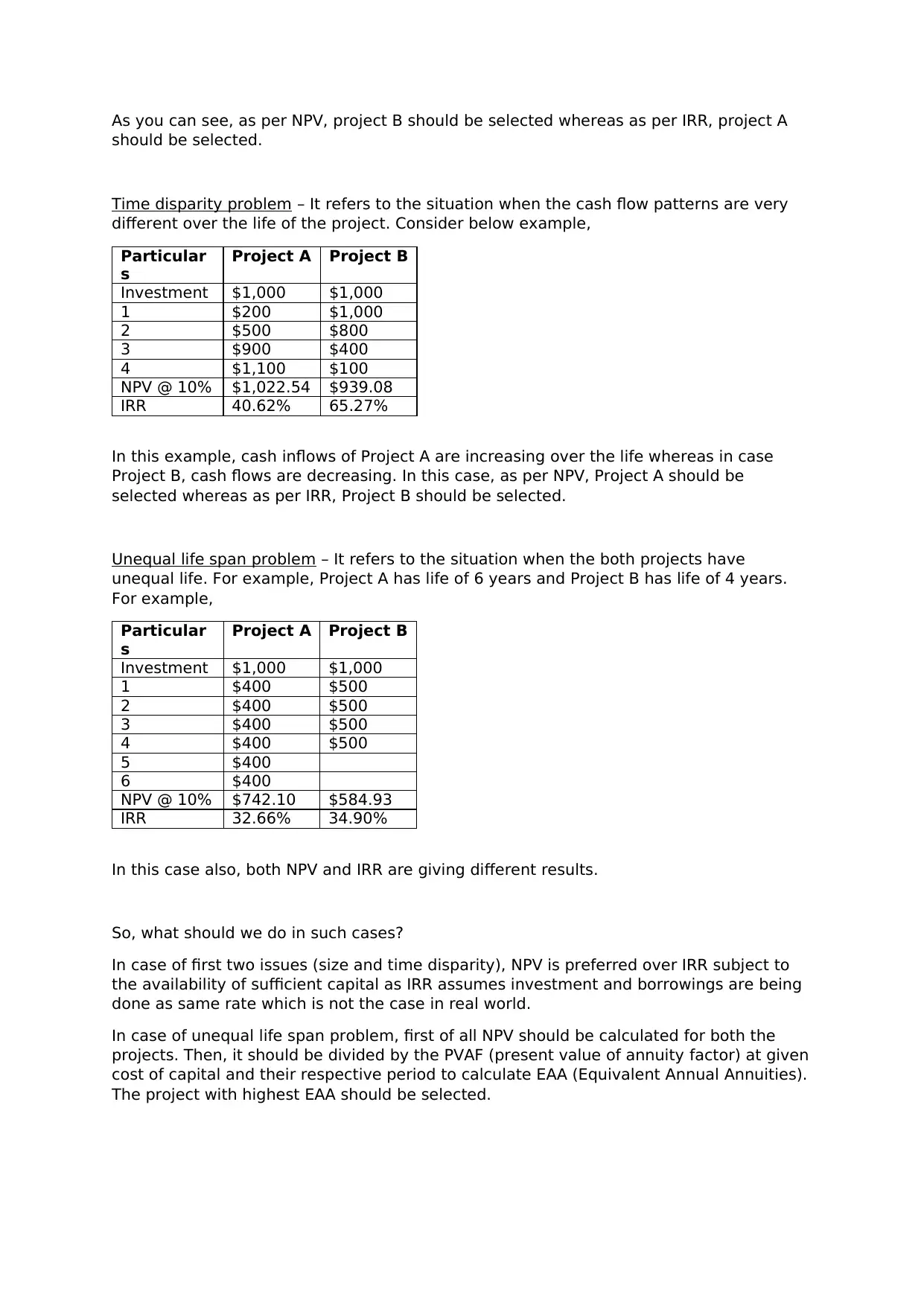

This assignment provides a detailed explanation of Net Present Value (NPV) and Internal Rate of Return (IRR) methods for evaluating the profitability of investment projects. It discusses the formulas for calculating NPV and highlights the challenges that arise when dealing with mutually exclusive projects, specifically addressing size disparity, time disparity, and unequal life span problems. The document emphasizes that NPV is generally preferred over IRR when size and time disparities exist, assuming sufficient capital is available. For projects with unequal lifespans, it recommends calculating Equivalent Annual Annuities (EAA) to facilitate a more accurate comparison and selection of the most profitable project. Desklib is your go-to platform for accessing solved assignments and past papers.

1 out of 2

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)