Economics Report: AUD/EURO Exchange Rate Analysis and Forecast

VerifiedAdded on 2019/10/31

|11

|1489

|296

Report

AI Summary

This report offers an in-depth analysis of the AUD/EURO exchange rate, examining its behavior over a three-month period and its relationship with various economic indicators. The study investigates the influence of real interest rates on currency valuation, comparing the real interest rates of Austra...

Running head: EXCHANGE RATE

EXCHANGE RATE

Name of student

Name of University

Author note

EXCHANGE RATE

Name of student

Name of University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1EXCHANGE RATE

Table of Contents

Part 1................................................................................................................................................2

Part 2................................................................................................................................................4

Part 3................................................................................................................................................6

References......................................................................................................................................10

Table of Contents

Part 1................................................................................................................................................2

Part 2................................................................................................................................................4

Part 3................................................................................................................................................6

References......................................................................................................................................10

2EXCHANGE RATE

Part 1

Exchange rates mainly show the amount by which one currency can be purchased for

another currency. This section of the study mainly aims to explore the behavior of exchange

rates in coming months . For showing the behavior of exchange rates study included pair wise

exchange rate of Australia and European Union. This study included this pair since they are

renowned exchange rates in all over the world. Australian dollar is the currency of Australia. In

2016 Australian foreign exchange market stood at the eight positions in the world. It also has one

of the highest turnovers in global markets. Now EURO shows the currency of Eurozone. It is the

second largest reserve currency.

Currency pair shows the quotation of relative value of a currency against the currency of

another currency. Currency pair AUD/EURO is the most traded pair of currencies. Pair does not

include USD .

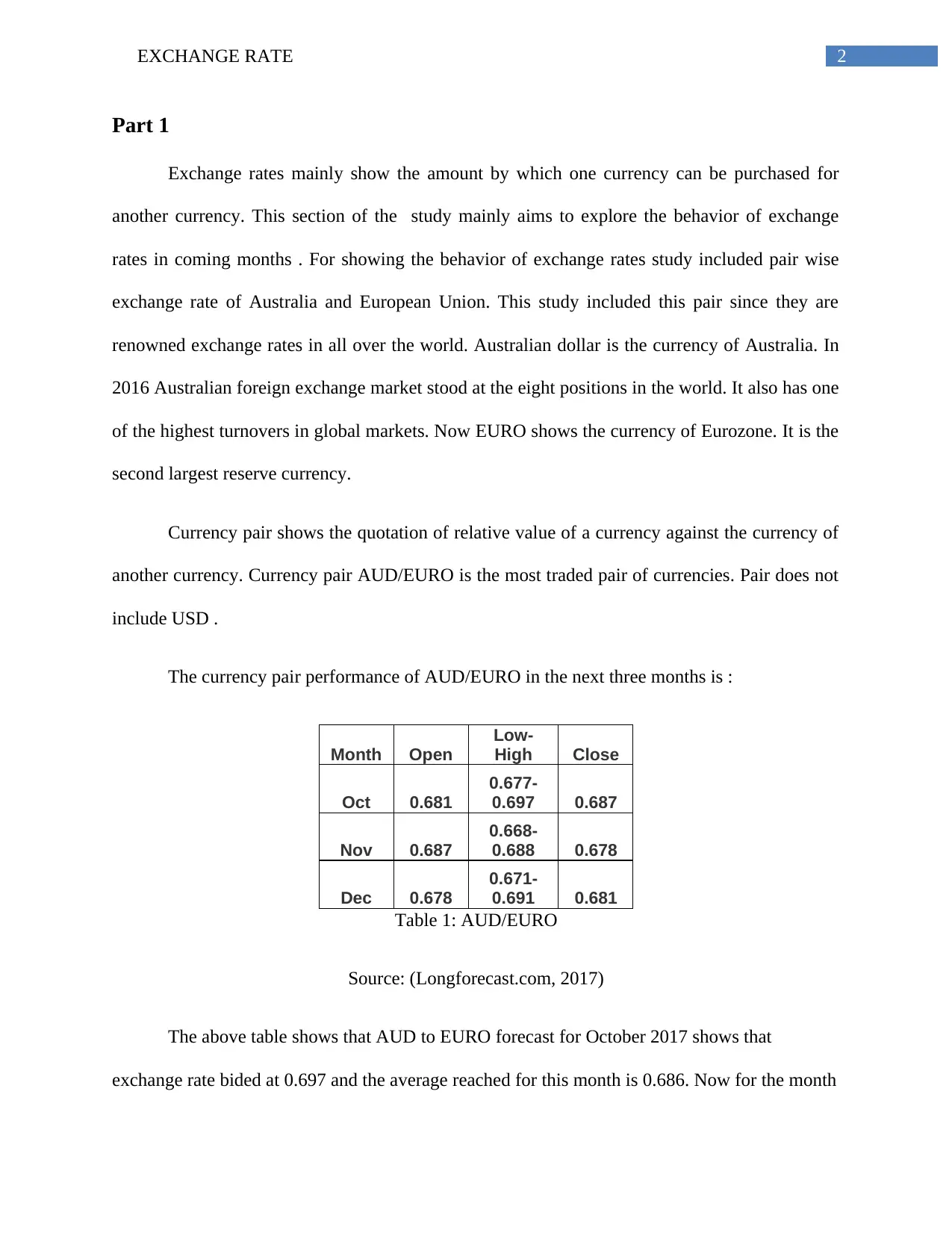

The currency pair performance of AUD/EURO in the next three months is :

Month Open

Low-

High Close

Oct 0.681

0.677-

0.697 0.687

Nov 0.687

0.668-

0.688 0.678

Dec 0.678

0.671-

0.691 0.681

Table 1: AUD/EURO

Source: (Longforecast.com, 2017)

The above table shows that AUD to EURO forecast for October 2017 shows that

exchange rate bided at 0.697 and the average reached for this month is 0.686. Now for the month

Part 1

Exchange rates mainly show the amount by which one currency can be purchased for

another currency. This section of the study mainly aims to explore the behavior of exchange

rates in coming months . For showing the behavior of exchange rates study included pair wise

exchange rate of Australia and European Union. This study included this pair since they are

renowned exchange rates in all over the world. Australian dollar is the currency of Australia. In

2016 Australian foreign exchange market stood at the eight positions in the world. It also has one

of the highest turnovers in global markets. Now EURO shows the currency of Eurozone. It is the

second largest reserve currency.

Currency pair shows the quotation of relative value of a currency against the currency of

another currency. Currency pair AUD/EURO is the most traded pair of currencies. Pair does not

include USD .

The currency pair performance of AUD/EURO in the next three months is :

Month Open

Low-

High Close

Oct 0.681

0.677-

0.697 0.687

Nov 0.687

0.668-

0.688 0.678

Dec 0.678

0.671-

0.691 0.681

Table 1: AUD/EURO

Source: (Longforecast.com, 2017)

The above table shows that AUD to EURO forecast for October 2017 shows that

exchange rate bided at 0.697 and the average reached for this month is 0.686. Now for the month

You're viewing a preview

Unlock full access by subscribing today!

3EXCHANGE RATE

of November exchange rate bided at 0.688 but finally it is settled at 0.680, lastly the month of

December shows that bided exchange rate is 0.691 while it averaged at 0.68.

Oct Nov Dec

0.672

0.674

0.676

0.678

0.68

0.682

0.684

0.686

0.688

AUD/EUR

AUD/EUR

Graph 1: AUD/EURO

Source: (Longforecast.com, 2017)

The above graph shows the furcated value of exchange rate for the period of three

months. It can seen from the graph that in October the exchange rate is higher but in the month

of November it is expected to be lower again in the month of December it is expected to reach

high. Thus in the month of November exchange rate is expected to depreciate and this may lead

to less worth of Australian dollars , also Australia exports will become cheaper and imports will

be expensive. Thus Australia will become competitive in November. However, the month of

December shows appreciation in exchange rate.

of November exchange rate bided at 0.688 but finally it is settled at 0.680, lastly the month of

December shows that bided exchange rate is 0.691 while it averaged at 0.68.

Oct Nov Dec

0.672

0.674

0.676

0.678

0.68

0.682

0.684

0.686

0.688

AUD/EUR

AUD/EUR

Graph 1: AUD/EURO

Source: (Longforecast.com, 2017)

The above graph shows the furcated value of exchange rate for the period of three

months. It can seen from the graph that in October the exchange rate is higher but in the month

of November it is expected to be lower again in the month of December it is expected to reach

high. Thus in the month of November exchange rate is expected to depreciate and this may lead

to less worth of Australian dollars , also Australia exports will become cheaper and imports will

be expensive. Thus Australia will become competitive in November. However, the month of

December shows appreciation in exchange rate.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4EXCHANGE RATE

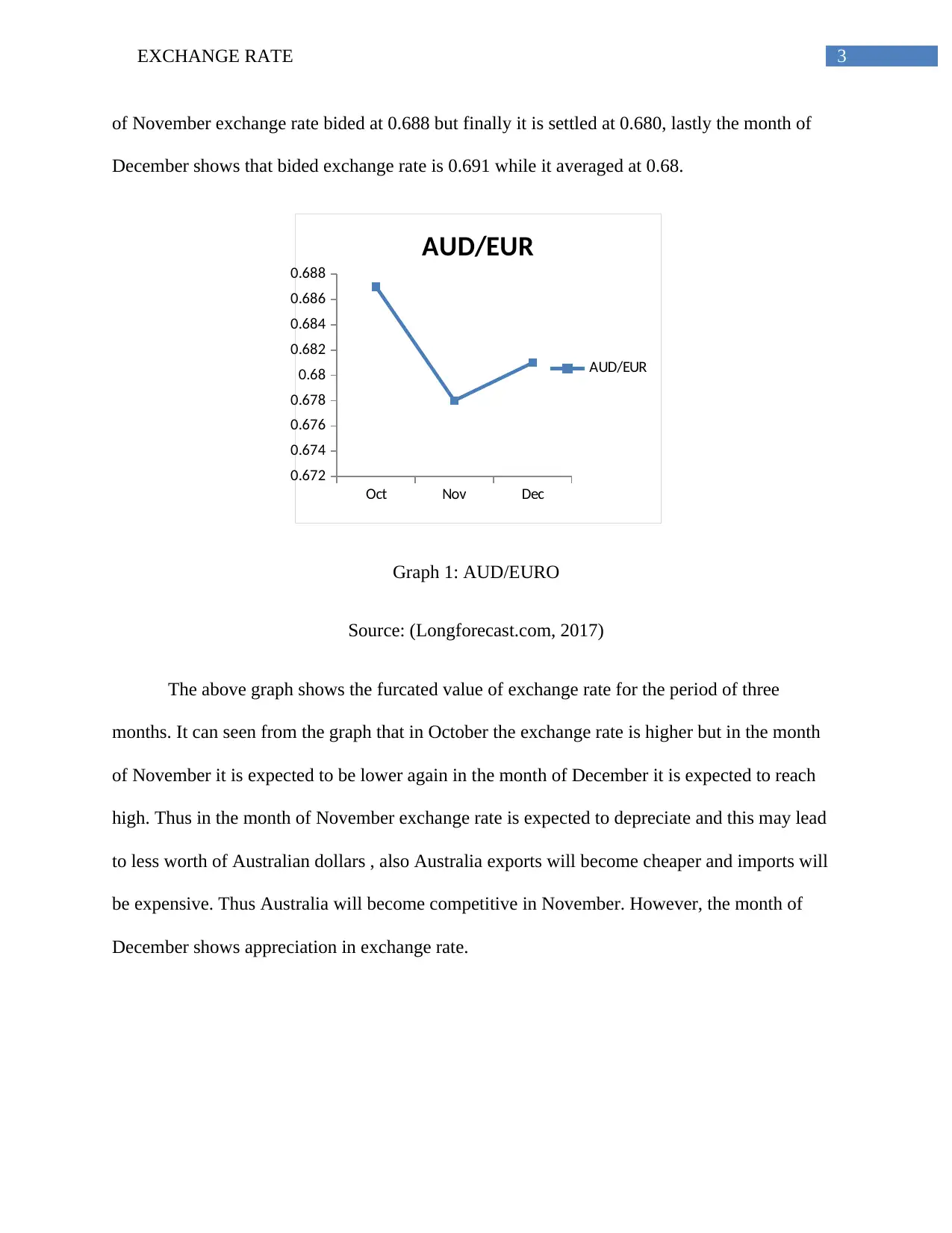

Diagram 1: Fall in exchange rate

Thus aggregate demand may rise in November due to devaluation. National income

rises.

Part 2

Exchange rate can be analyzed with respect to economic indicators , in this study real

interest rate is considered to reach the result. A real interest rate is the rate that is shown after

considering the effect of inflation and this is done because it will show the real cost to investor

and return to investor. Thus real interest rate is the difference of nominal interest rate and

inflation.

Considering the real interest rate of these two nations a idea about the exchange rate can

be obtained.

Diagram 1: Fall in exchange rate

Thus aggregate demand may rise in November due to devaluation. National income

rises.

Part 2

Exchange rate can be analyzed with respect to economic indicators , in this study real

interest rate is considered to reach the result. A real interest rate is the rate that is shown after

considering the effect of inflation and this is done because it will show the real cost to investor

and return to investor. Thus real interest rate is the difference of nominal interest rate and

inflation.

Considering the real interest rate of these two nations a idea about the exchange rate can

be obtained.

5EXCHANGE RATE

2009 2010 2011 2012 2013 2014 2015 2016

0

1

2

3

4

5

6

7

AUS(RIR)

EA(RIR)

Graph 2: Australian & Euroarea real interest rate

Source: (TheGlobalEconomy.com, 2017)

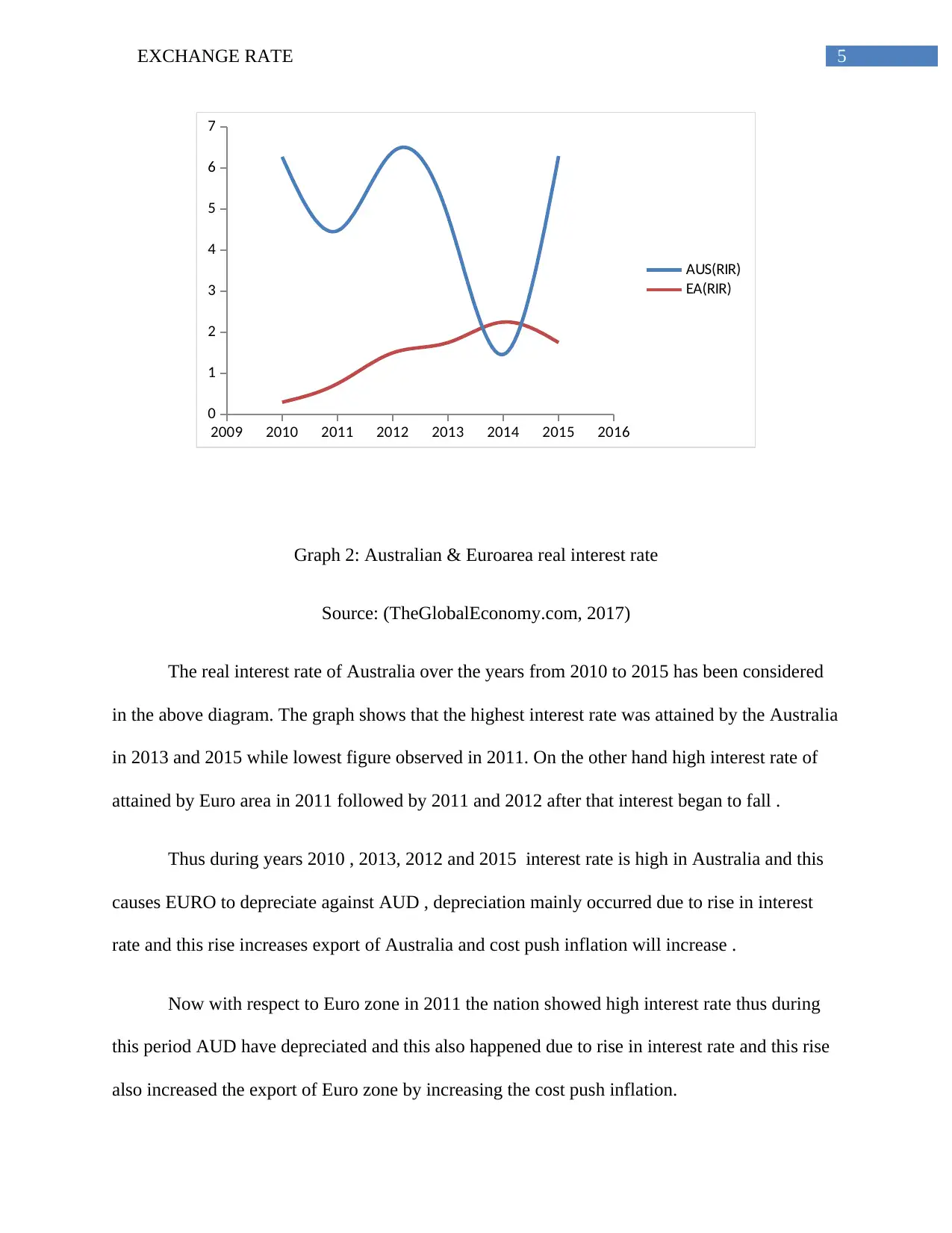

The real interest rate of Australia over the years from 2010 to 2015 has been considered

in the above diagram. The graph shows that the highest interest rate was attained by the Australia

in 2013 and 2015 while lowest figure observed in 2011. On the other hand high interest rate of

attained by Euro area in 2011 followed by 2011 and 2012 after that interest began to fall .

Thus during years 2010 , 2013, 2012 and 2015 interest rate is high in Australia and this

causes EURO to depreciate against AUD , depreciation mainly occurred due to rise in interest

rate and this rise increases export of Australia and cost push inflation will increase .

Now with respect to Euro zone in 2011 the nation showed high interest rate thus during

this period AUD have depreciated and this also happened due to rise in interest rate and this rise

also increased the export of Euro zone by increasing the cost push inflation.

2009 2010 2011 2012 2013 2014 2015 2016

0

1

2

3

4

5

6

7

AUS(RIR)

EA(RIR)

Graph 2: Australian & Euroarea real interest rate

Source: (TheGlobalEconomy.com, 2017)

The real interest rate of Australia over the years from 2010 to 2015 has been considered

in the above diagram. The graph shows that the highest interest rate was attained by the Australia

in 2013 and 2015 while lowest figure observed in 2011. On the other hand high interest rate of

attained by Euro area in 2011 followed by 2011 and 2012 after that interest began to fall .

Thus during years 2010 , 2013, 2012 and 2015 interest rate is high in Australia and this

causes EURO to depreciate against AUD , depreciation mainly occurred due to rise in interest

rate and this rise increases export of Australia and cost push inflation will increase .

Now with respect to Euro zone in 2011 the nation showed high interest rate thus during

this period AUD have depreciated and this also happened due to rise in interest rate and this rise

also increased the export of Euro zone by increasing the cost push inflation.

You're viewing a preview

Unlock full access by subscribing today!

6EXCHANGE RATE

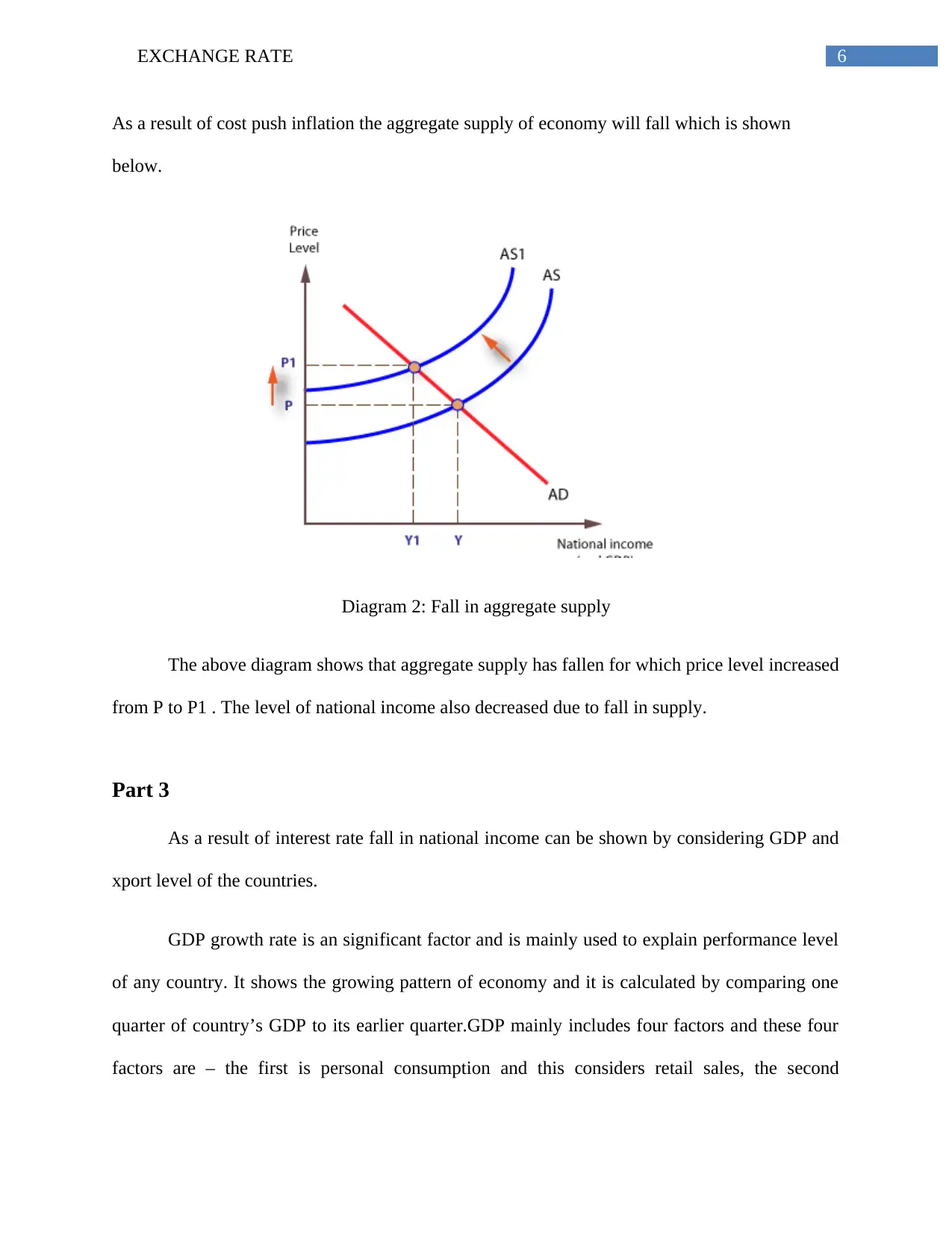

As a result of cost push inflation the aggregate supply of economy will fall which is shown

below.

Diagram 2: Fall in aggregate supply

The above diagram shows that aggregate supply has fallen for which price level increased

from P to P1 . The level of national income also decreased due to fall in supply.

Part 3

As a result of interest rate fall in national income can be shown by considering GDP and

xport level of the countries.

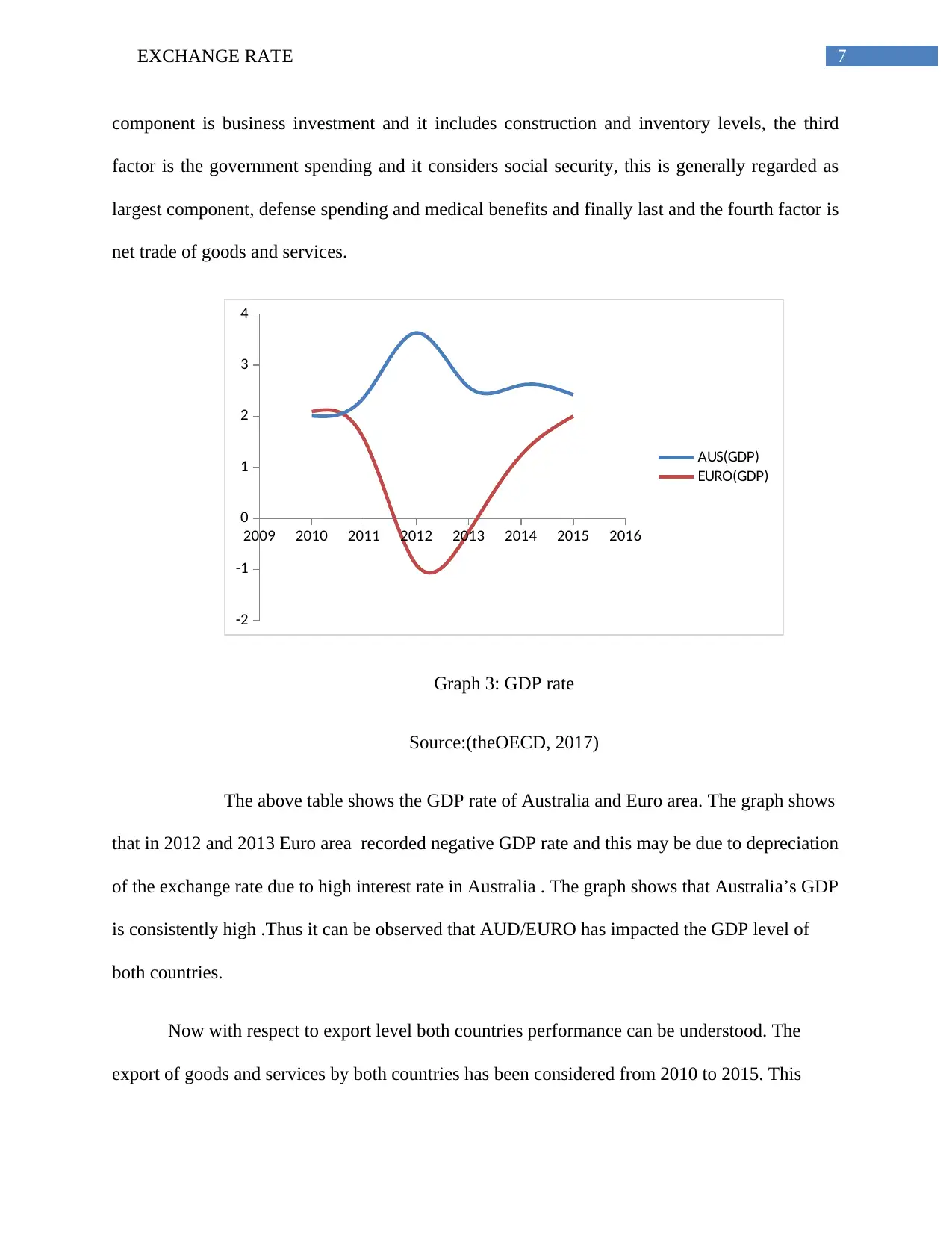

GDP growth rate is an significant factor and is mainly used to explain performance level

of any country. It shows the growing pattern of economy and it is calculated by comparing one

quarter of country’s GDP to its earlier quarter.GDP mainly includes four factors and these four

factors are – the first is personal consumption and this considers retail sales, the second

As a result of cost push inflation the aggregate supply of economy will fall which is shown

below.

Diagram 2: Fall in aggregate supply

The above diagram shows that aggregate supply has fallen for which price level increased

from P to P1 . The level of national income also decreased due to fall in supply.

Part 3

As a result of interest rate fall in national income can be shown by considering GDP and

xport level of the countries.

GDP growth rate is an significant factor and is mainly used to explain performance level

of any country. It shows the growing pattern of economy and it is calculated by comparing one

quarter of country’s GDP to its earlier quarter.GDP mainly includes four factors and these four

factors are – the first is personal consumption and this considers retail sales, the second

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7EXCHANGE RATE

component is business investment and it includes construction and inventory levels, the third

factor is the government spending and it considers social security, this is generally regarded as

largest component, defense spending and medical benefits and finally last and the fourth factor is

net trade of goods and services.

2009 2010 2011 2012 2013 2014 2015 2016

-2

-1

0

1

2

3

4

AUS(GDP)

EURO(GDP)

Graph 3: GDP rate

Source:(theOECD, 2017)

The above table shows the GDP rate of Australia and Euro area. The graph shows

that in 2012 and 2013 Euro area recorded negative GDP rate and this may be due to depreciation

of the exchange rate due to high interest rate in Australia . The graph shows that Australia’s GDP

is consistently high .Thus it can be observed that AUD/EURO has impacted the GDP level of

both countries.

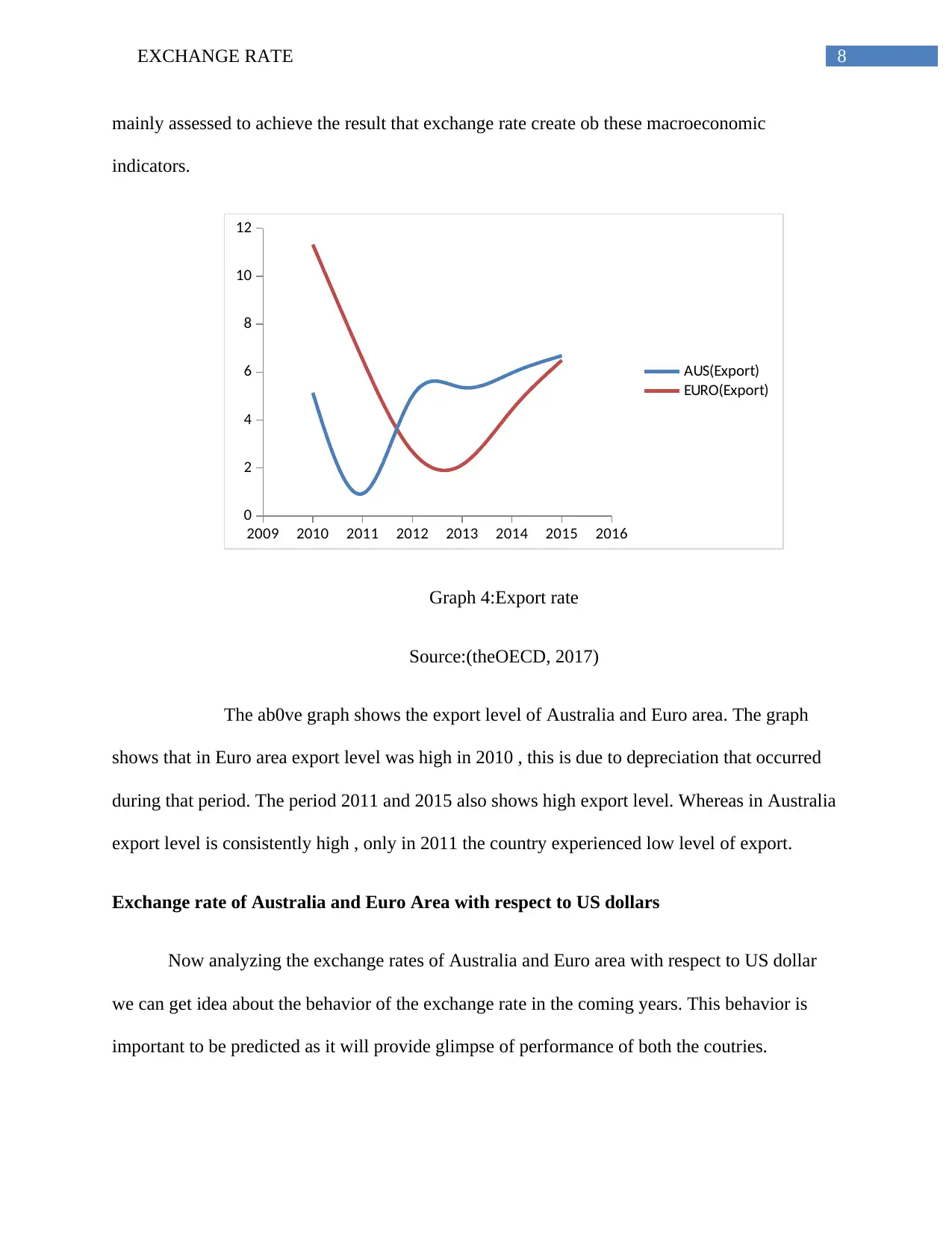

Now with respect to export level both countries performance can be understood. The

export of goods and services by both countries has been considered from 2010 to 2015. This

component is business investment and it includes construction and inventory levels, the third

factor is the government spending and it considers social security, this is generally regarded as

largest component, defense spending and medical benefits and finally last and the fourth factor is

net trade of goods and services.

2009 2010 2011 2012 2013 2014 2015 2016

-2

-1

0

1

2

3

4

AUS(GDP)

EURO(GDP)

Graph 3: GDP rate

Source:(theOECD, 2017)

The above table shows the GDP rate of Australia and Euro area. The graph shows

that in 2012 and 2013 Euro area recorded negative GDP rate and this may be due to depreciation

of the exchange rate due to high interest rate in Australia . The graph shows that Australia’s GDP

is consistently high .Thus it can be observed that AUD/EURO has impacted the GDP level of

both countries.

Now with respect to export level both countries performance can be understood. The

export of goods and services by both countries has been considered from 2010 to 2015. This

8EXCHANGE RATE

mainly assessed to achieve the result that exchange rate create ob these macroeconomic

indicators.

2009 2010 2011 2012 2013 2014 2015 2016

0

2

4

6

8

10

12

AUS(Export)

EURO(Export)

Graph 4:Export rate

Source:(theOECD, 2017)

The ab0ve graph shows the export level of Australia and Euro area. The graph

shows that in Euro area export level was high in 2010 , this is due to depreciation that occurred

during that period. The period 2011 and 2015 also shows high export level. Whereas in Australia

export level is consistently high , only in 2011 the country experienced low level of export.

Exchange rate of Australia and Euro Area with respect to US dollars

Now analyzing the exchange rates of Australia and Euro area with respect to US dollar

we can get idea about the behavior of the exchange rate in the coming years. This behavior is

important to be predicted as it will provide glimpse of performance of both the coutries.

mainly assessed to achieve the result that exchange rate create ob these macroeconomic

indicators.

2009 2010 2011 2012 2013 2014 2015 2016

0

2

4

6

8

10

12

AUS(Export)

EURO(Export)

Graph 4:Export rate

Source:(theOECD, 2017)

The ab0ve graph shows the export level of Australia and Euro area. The graph

shows that in Euro area export level was high in 2010 , this is due to depreciation that occurred

during that period. The period 2011 and 2015 also shows high export level. Whereas in Australia

export level is consistently high , only in 2011 the country experienced low level of export.

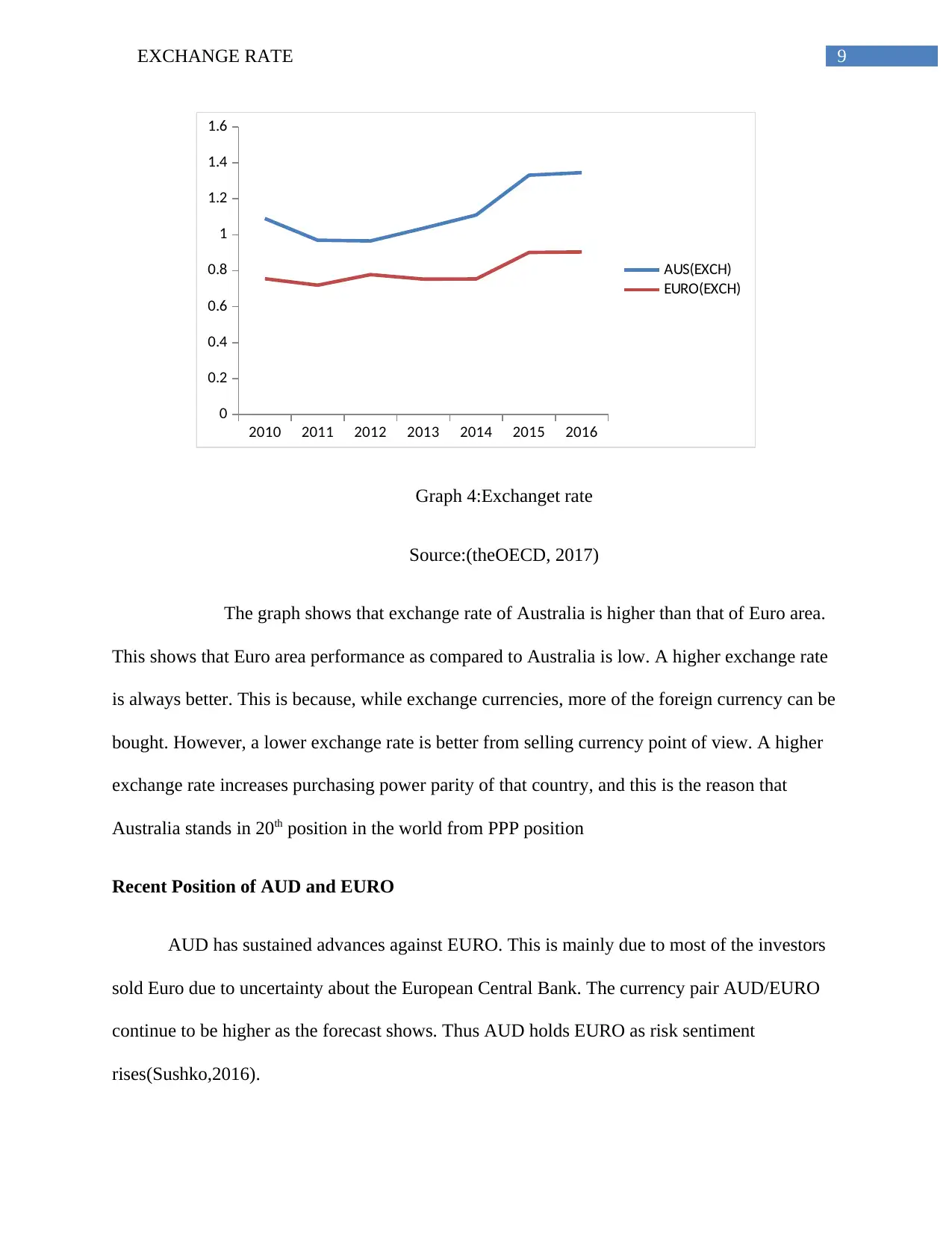

Exchange rate of Australia and Euro Area with respect to US dollars

Now analyzing the exchange rates of Australia and Euro area with respect to US dollar

we can get idea about the behavior of the exchange rate in the coming years. This behavior is

important to be predicted as it will provide glimpse of performance of both the coutries.

You're viewing a preview

Unlock full access by subscribing today!

9EXCHANGE RATE

2010 2011 2012 2013 2014 2015 2016

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

AUS(EXCH)

EURO(EXCH)

Graph 4:Exchanget rate

Source:(theOECD, 2017)

The graph shows that exchange rate of Australia is higher than that of Euro area.

This shows that Euro area performance as compared to Australia is low. A higher exchange rate

is always better. This is because, while exchange currencies, more of the foreign currency can be

bought. However, a lower exchange rate is better from selling currency point of view. A higher

exchange rate increases purchasing power parity of that country, and this is the reason that

Australia stands in 20th position in the world from PPP position

Recent Position of AUD and EURO

AUD has sustained advances against EURO. This is mainly due to most of the investors

sold Euro due to uncertainty about the European Central Bank. The currency pair AUD/EURO

continue to be higher as the forecast shows. Thus AUD holds EURO as risk sentiment

rises(Sushko,2016).

2010 2011 2012 2013 2014 2015 2016

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

AUS(EXCH)

EURO(EXCH)

Graph 4:Exchanget rate

Source:(theOECD, 2017)

The graph shows that exchange rate of Australia is higher than that of Euro area.

This shows that Euro area performance as compared to Australia is low. A higher exchange rate

is always better. This is because, while exchange currencies, more of the foreign currency can be

bought. However, a lower exchange rate is better from selling currency point of view. A higher

exchange rate increases purchasing power parity of that country, and this is the reason that

Australia stands in 20th position in the world from PPP position

Recent Position of AUD and EURO

AUD has sustained advances against EURO. This is mainly due to most of the investors

sold Euro due to uncertainty about the European Central Bank. The currency pair AUD/EURO

continue to be higher as the forecast shows. Thus AUD holds EURO as risk sentiment

rises(Sushko,2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10EXCHANGE RATE

References

Longforecast.com. (2017). AUD TO EURO AND EURO to AUD FORECAST 2017, 2018, 2019,

2020, 2021 - Long Forecast. [online] Available at: https://longforecast.com/aud-to-euro-forecast-

2017-20-2018-2019-2020-2021-euro-to-aud [Accessed 21 Sep. 2017].

Sushko, V., Borio, C., McCauley, R. and McGuire, P., 2016. BIS Working Papers

TheGlobalEconomy.com. (2017). Australia Real interest rate - data, chart |

TheGlobalEconomy.com.[online]Availableat:http://www.theglobaleconomy.com/Australia/

Real_interest_rate/ [Accessed 21 Sep. 2017].

TheOECD. (2017). Conversion rates - Exchange rates - OECD Data. [online] Available at:

https://data.oecd.org/conversion/exchange-rates.htm [Accessed 17 Sep. 2017].

References

Longforecast.com. (2017). AUD TO EURO AND EURO to AUD FORECAST 2017, 2018, 2019,

2020, 2021 - Long Forecast. [online] Available at: https://longforecast.com/aud-to-euro-forecast-

2017-20-2018-2019-2020-2021-euro-to-aud [Accessed 21 Sep. 2017].

Sushko, V., Borio, C., McCauley, R. and McGuire, P., 2016. BIS Working Papers

TheGlobalEconomy.com. (2017). Australia Real interest rate - data, chart |

TheGlobalEconomy.com.[online]Availableat:http://www.theglobaleconomy.com/Australia/

Real_interest_rate/ [Accessed 21 Sep. 2017].

TheOECD. (2017). Conversion rates - Exchange rates - OECD Data. [online] Available at:

https://data.oecd.org/conversion/exchange-rates.htm [Accessed 17 Sep. 2017].

1 out of 11

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.