Report on the Acquisition of J Barbour by JD Sports Fashion PLC

VerifiedAdded on 2021/04/17

|21

|4020

|449

Report

AI Summary

This report provides a comprehensive analysis of a potential acquisition scenario, focusing on JD Sports Fashion PLC's plan to acquire J Barbour and Sons Limited. The executive summary outlines the key aspects of the report, including company overviews of both JD Sports and J Barbour, financial analyses of their profitability, liquidity, capital structure, and market ratios. The report delves into the cost of capital for JD Sports and calculates the purchase consideration for acquiring J Barbour using a discounted cash flow method. It also assesses the impact of the acquisition on JD Sports' financial statements and share price. The analysis suggests that the acquisition could strengthen JD Sports' financial performance and market position, with detailed calculations of purchase consideration and the potential sources of funding. The report concludes with a summary of the findings and recommendations regarding the acquisition, emphasizing the potential benefits for JD Sports, including market expansion and diversification. The report also contains detailed financial calculations and appendices supporting the analysis.

Running Head: MBA assignment

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MBA assignment

2

Executive summary

The report explains about the acquisition concept. The report focuses on 2 companies,

J D fashion limited and J Barbour and sons limited. The report identifies and evaluates

various aspects related to both the companies and it evaluated that whether the JS should

acquire the J Barbour and sons limited or not. The report evaluates that JD sports fashion plc

wants to diversify its product and expand the market and that is why it is planning to acquire

J Barbour and Sons limited which is operating its business in British market. It would assist

the company to run its business in British market as well. The report explains about the total

purchase consideration which would be required by the company to pay J Barbour and Sons

limited. And it also evaluates the impact of acquisition on the financial statement of JD sports

and on the share price of JD sports.

2

Executive summary

The report explains about the acquisition concept. The report focuses on 2 companies,

J D fashion limited and J Barbour and sons limited. The report identifies and evaluates

various aspects related to both the companies and it evaluated that whether the JS should

acquire the J Barbour and sons limited or not. The report evaluates that JD sports fashion plc

wants to diversify its product and expand the market and that is why it is planning to acquire

J Barbour and Sons limited which is operating its business in British market. It would assist

the company to run its business in British market as well. The report explains about the total

purchase consideration which would be required by the company to pay J Barbour and Sons

limited. And it also evaluates the impact of acquisition on the financial statement of JD sports

and on the share price of JD sports.

MBA assignment

3

Contents

Introduction.......................................................................................................................3

Company overview...........................................................................................................3

JD sports fashion plc.....................................................................................................3

J Barbour and Sons Limited.........................................................................................4

Financial analysis of both companies...............................................................................4

Profitability position.....................................................................................................4

Liquidity position..........................................................................................................5

Capital structure ratio...................................................................................................6

Market ratio..................................................................................................................7

Cost of capital...................................................................................................................8

Purchase consideration.....................................................................................................9

Impact on financial statement of JD sports.....................................................................10

Share price movements...................................................................................................11

Conclusion......................................................................................................................12

References.......................................................................................................................13

Appendix.........................................................................................................................15

3

Contents

Introduction.......................................................................................................................3

Company overview...........................................................................................................3

JD sports fashion plc.....................................................................................................3

J Barbour and Sons Limited.........................................................................................4

Financial analysis of both companies...............................................................................4

Profitability position.....................................................................................................4

Liquidity position..........................................................................................................5

Capital structure ratio...................................................................................................6

Market ratio..................................................................................................................7

Cost of capital...................................................................................................................8

Purchase consideration.....................................................................................................9

Impact on financial statement of JD sports.....................................................................10

Share price movements...................................................................................................11

Conclusion......................................................................................................................12

References.......................................................................................................................13

Appendix.........................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MBA assignment

4

Introduction:

When a company take over the other company and clearly established that the

operations and the business of buying comapny would be operated under the name of the

company which has acquired it, than this process is called acquisition. Acquisition is a

corporate process in which an organization bought a firm’s ownership stock to make a control

over the firm and run the business of the company under the name of acquiring company.

Usually, the acquiring company buys the assets and the stock of acquired company to make

decisions about the company and its operations (Madhura, 2011). There are various reasons

due to which the acquisition process is performed by the companies. The few reasons of

acquisition are increased synergy, greater market share, economies of scale, cost reduction,

new niche offering, diversification and expansion of market etc. (Williams et al, 2005).

In the report, JD sports fashion plc is making a plan to buy J Barbour and sons

limited, a British private company. This evaluates that JD sports fashion plc wants to

diversify its product and expand the market and that is why it is planning to acquire J Barbour

and Sons limited which is operating its business in British market. It would assist the

company to run its business in British market as well. The report explains about the total

purchase consideration which would be required by the company to pay J Barbour and Sons

limited. And it also evaluates the impact of acquisition on the financial statement of JD sports

and on the share price of JD sports.

Company overview:

The history, mission, objectives, products and services of both the companies, JD

sports fashion plc and J Barbour and sons limited are as follows:

JD sports fashion plc:

JD sports fashion plc is mostly known as JD. It is a sports fashion company which

retails the sports clothes and it is mainly based in Bury, England. It sells its products and

clothes throughout the UK market. The company is listed on London stock exchange and the

company is FTSE 2520 index’s constituent. The company has been founded in 1981 at Bury

in England (JD sports, 2018). The main products of the company are clothing and sportswear

accessories. The main mission and vision of the company is to offer the best quality clothing

sportswear to its customers as well as diversify and expand the market at international level.

The main competitor of the company is sports direct international plc.

4

Introduction:

When a company take over the other company and clearly established that the

operations and the business of buying comapny would be operated under the name of the

company which has acquired it, than this process is called acquisition. Acquisition is a

corporate process in which an organization bought a firm’s ownership stock to make a control

over the firm and run the business of the company under the name of acquiring company.

Usually, the acquiring company buys the assets and the stock of acquired company to make

decisions about the company and its operations (Madhura, 2011). There are various reasons

due to which the acquisition process is performed by the companies. The few reasons of

acquisition are increased synergy, greater market share, economies of scale, cost reduction,

new niche offering, diversification and expansion of market etc. (Williams et al, 2005).

In the report, JD sports fashion plc is making a plan to buy J Barbour and sons

limited, a British private company. This evaluates that JD sports fashion plc wants to

diversify its product and expand the market and that is why it is planning to acquire J Barbour

and Sons limited which is operating its business in British market. It would assist the

company to run its business in British market as well. The report explains about the total

purchase consideration which would be required by the company to pay J Barbour and Sons

limited. And it also evaluates the impact of acquisition on the financial statement of JD sports

and on the share price of JD sports.

Company overview:

The history, mission, objectives, products and services of both the companies, JD

sports fashion plc and J Barbour and sons limited are as follows:

JD sports fashion plc:

JD sports fashion plc is mostly known as JD. It is a sports fashion company which

retails the sports clothes and it is mainly based in Bury, England. It sells its products and

clothes throughout the UK market. The company is listed on London stock exchange and the

company is FTSE 2520 index’s constituent. The company has been founded in 1981 at Bury

in England (JD sports, 2018). The main products of the company are clothing and sportswear

accessories. The main mission and vision of the company is to offer the best quality clothing

sportswear to its customers as well as diversify and expand the market at international level.

The main competitor of the company is sports direct international plc.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MBA assignment

5

J Barbour and Sons Limited:

J Barbour and sons limited is a luxury fashion brand which retails the fashion clothes

and it is mainly based in South Shields, England. It manufactures and sells its products and

clothes throughout the UK market (J Barbour, 2018). The company has been founded in 1894

at South Shield in England. The main products of the company are water proof outwears,

ready to wear, shoes, leather goods and accessories for children, women and men. The

company has not listed itself on any stock exchange and thus it is a private company. The

study explains about the financial position and purchase consideration for the company.

Financial analysis of both companies:

Financial analysis is process that identifies and evaluates the business, projects,

investment opportunity, budgets and various other financial transactions of the company to

determine the suitability, position and performance of an organization. Financial analysis is

mainly used by the financial analyst, financial manager and the investors to evaluate that

whether the organization is suitable, liquid, solvent or profitable (Weygandt, Kimmel and

Kieso, 2009). The financial analysis of JD sports fashion, J Barbour and sons limited and the

competitive company, sports international direct plc has been evaluated to determine the

financial performance and evaluation of the company. Ratio analysis study has been

conducted on all the three companies to determine the suitable, liquid, solvent or profitable

position of the companies.

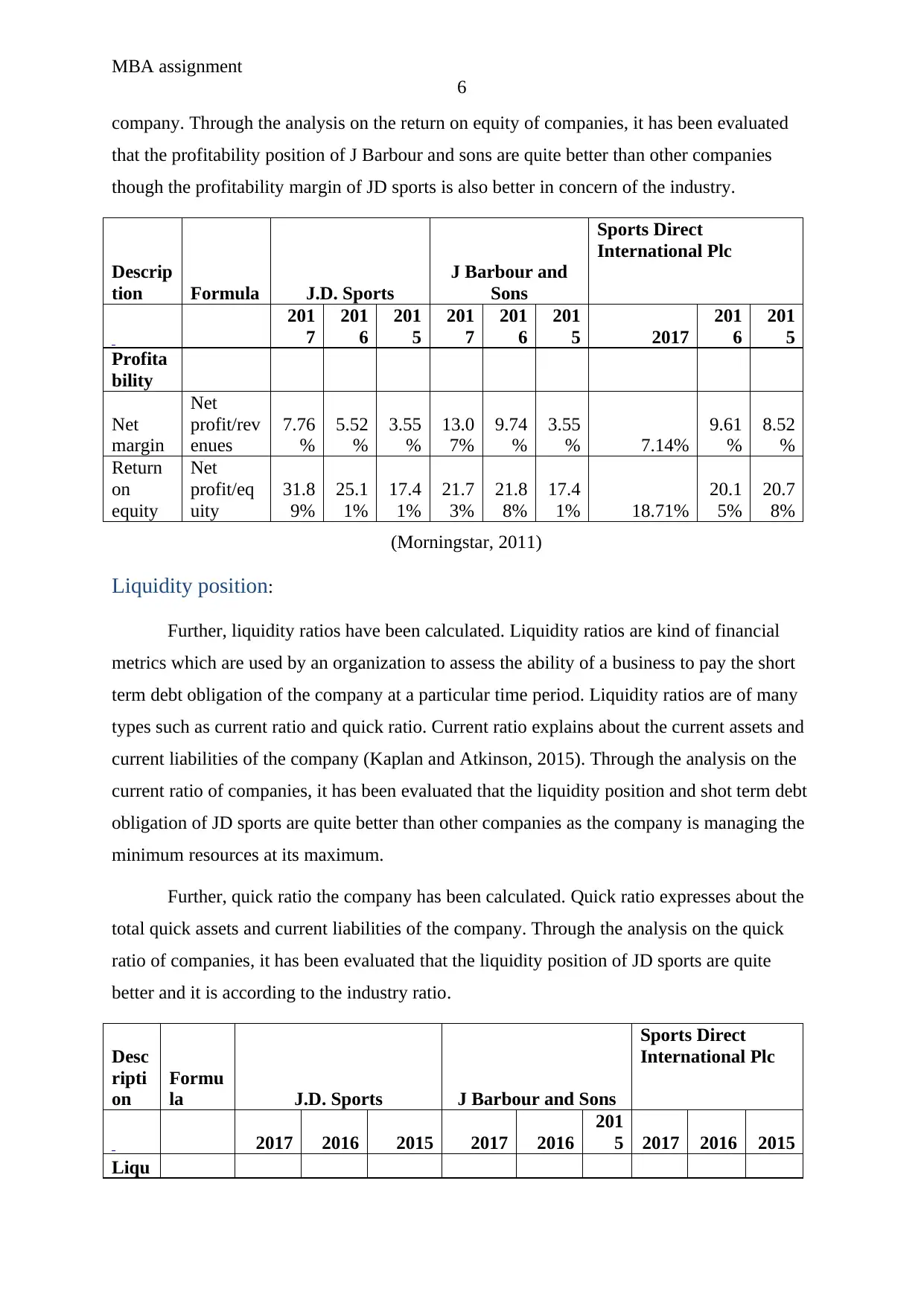

Profitability position:

Firstly, profitability ratios have been calculated. Profitability ratios are kind of

financial metrics which are used by an organization to assess the ability of a business to

generate the earnings that are compared to the expenses and other cost of the company at a

particular time period. Profitability ratios are of many types such as net margin and return on

equity. Net margin ratio explains about the total net profit of the company in context with the

total revenue (Kinsky, 2011). Through the analysis on the net margin of companies, it has

been evaluated that the profit margin of J Barbour and sons are quite better than other

companies though the profitability margin of JD sports is also better in concern of the

industry.

Further, return on equity of the company has been calculated. Return on equity

expresses about the total net profit of an organization in context with the total equity of the

5

J Barbour and Sons Limited:

J Barbour and sons limited is a luxury fashion brand which retails the fashion clothes

and it is mainly based in South Shields, England. It manufactures and sells its products and

clothes throughout the UK market (J Barbour, 2018). The company has been founded in 1894

at South Shield in England. The main products of the company are water proof outwears,

ready to wear, shoes, leather goods and accessories for children, women and men. The

company has not listed itself on any stock exchange and thus it is a private company. The

study explains about the financial position and purchase consideration for the company.

Financial analysis of both companies:

Financial analysis is process that identifies and evaluates the business, projects,

investment opportunity, budgets and various other financial transactions of the company to

determine the suitability, position and performance of an organization. Financial analysis is

mainly used by the financial analyst, financial manager and the investors to evaluate that

whether the organization is suitable, liquid, solvent or profitable (Weygandt, Kimmel and

Kieso, 2009). The financial analysis of JD sports fashion, J Barbour and sons limited and the

competitive company, sports international direct plc has been evaluated to determine the

financial performance and evaluation of the company. Ratio analysis study has been

conducted on all the three companies to determine the suitable, liquid, solvent or profitable

position of the companies.

Profitability position:

Firstly, profitability ratios have been calculated. Profitability ratios are kind of

financial metrics which are used by an organization to assess the ability of a business to

generate the earnings that are compared to the expenses and other cost of the company at a

particular time period. Profitability ratios are of many types such as net margin and return on

equity. Net margin ratio explains about the total net profit of the company in context with the

total revenue (Kinsky, 2011). Through the analysis on the net margin of companies, it has

been evaluated that the profit margin of J Barbour and sons are quite better than other

companies though the profitability margin of JD sports is also better in concern of the

industry.

Further, return on equity of the company has been calculated. Return on equity

expresses about the total net profit of an organization in context with the total equity of the

MBA assignment

6

company. Through the analysis on the return on equity of companies, it has been evaluated

that the profitability position of J Barbour and sons are quite better than other companies

though the profitability margin of JD sports is also better in concern of the industry.

Descrip

tion Formula J.D. Sports

J Barbour and

Sons

Sports Direct

International Plc

201

7

201

6

201

5

201

7

201

6

201

5 2017

201

6

201

5

Profita

bility

Net

margin

Net

profit/rev

enues

7.76

%

5.52

%

3.55

%

13.0

7%

9.74

%

3.55

% 7.14%

9.61

%

8.52

%

Return

on

equity

Net

profit/eq

uity

31.8

9%

25.1

1%

17.4

1%

21.7

3%

21.8

8%

17.4

1% 18.71%

20.1

5%

20.7

8%

(Morningstar, 2011)

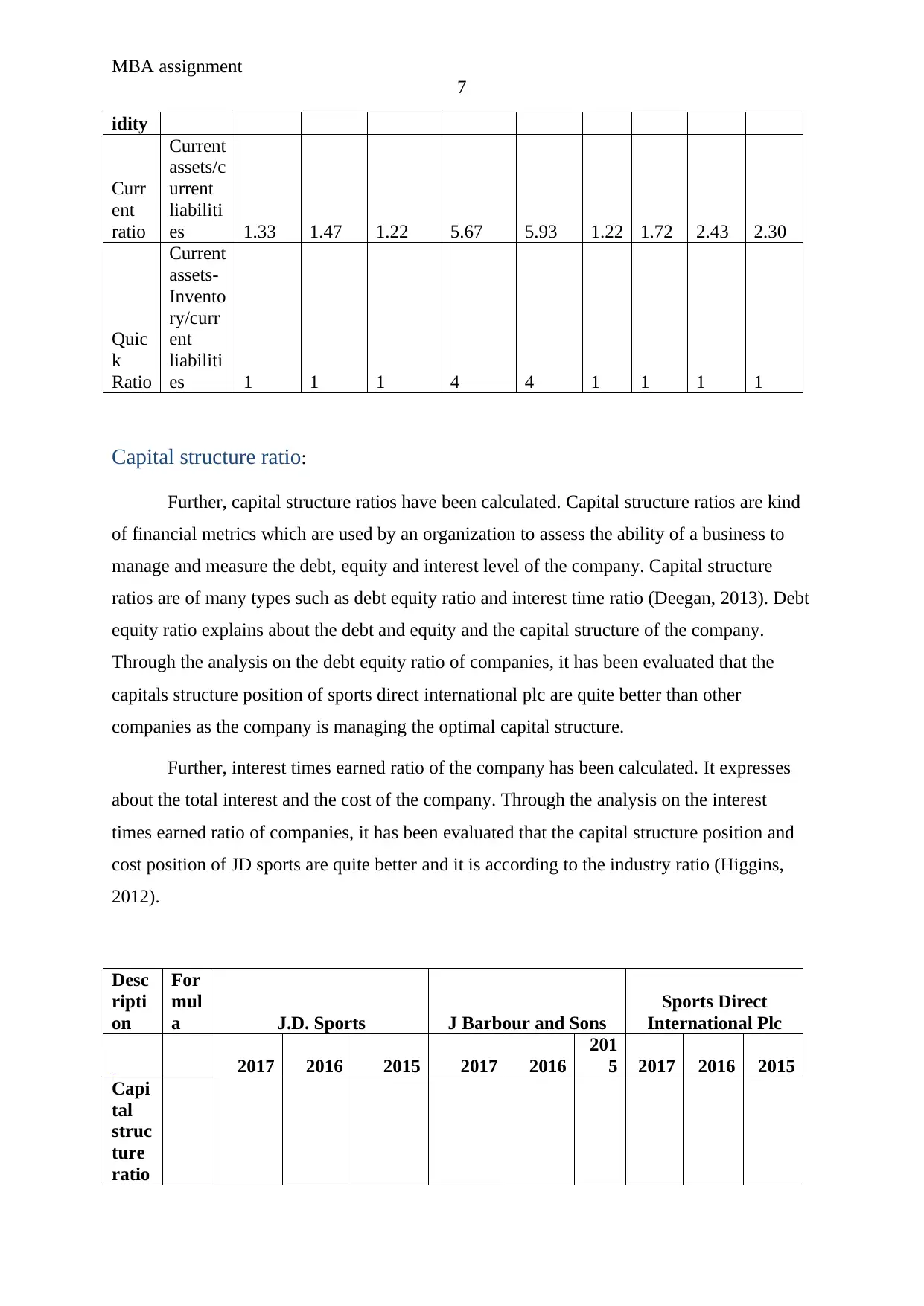

Liquidity position:

Further, liquidity ratios have been calculated. Liquidity ratios are kind of financial

metrics which are used by an organization to assess the ability of a business to pay the short

term debt obligation of the company at a particular time period. Liquidity ratios are of many

types such as current ratio and quick ratio. Current ratio explains about the current assets and

current liabilities of the company (Kaplan and Atkinson, 2015). Through the analysis on the

current ratio of companies, it has been evaluated that the liquidity position and shot term debt

obligation of JD sports are quite better than other companies as the company is managing the

minimum resources at its maximum.

Further, quick ratio the company has been calculated. Quick ratio expresses about the

total quick assets and current liabilities of the company. Through the analysis on the quick

ratio of companies, it has been evaluated that the liquidity position of JD sports are quite

better and it is according to the industry ratio.

Desc

ripti

on

Formu

la J.D. Sports J Barbour and Sons

Sports Direct

International Plc

2017 2016 2015 2017 2016

201

5 2017 2016 2015

Liqu

6

company. Through the analysis on the return on equity of companies, it has been evaluated

that the profitability position of J Barbour and sons are quite better than other companies

though the profitability margin of JD sports is also better in concern of the industry.

Descrip

tion Formula J.D. Sports

J Barbour and

Sons

Sports Direct

International Plc

201

7

201

6

201

5

201

7

201

6

201

5 2017

201

6

201

5

Profita

bility

Net

margin

Net

profit/rev

enues

7.76

%

5.52

%

3.55

%

13.0

7%

9.74

%

3.55

% 7.14%

9.61

%

8.52

%

Return

on

equity

Net

profit/eq

uity

31.8

9%

25.1

1%

17.4

1%

21.7

3%

21.8

8%

17.4

1% 18.71%

20.1

5%

20.7

8%

(Morningstar, 2011)

Liquidity position:

Further, liquidity ratios have been calculated. Liquidity ratios are kind of financial

metrics which are used by an organization to assess the ability of a business to pay the short

term debt obligation of the company at a particular time period. Liquidity ratios are of many

types such as current ratio and quick ratio. Current ratio explains about the current assets and

current liabilities of the company (Kaplan and Atkinson, 2015). Through the analysis on the

current ratio of companies, it has been evaluated that the liquidity position and shot term debt

obligation of JD sports are quite better than other companies as the company is managing the

minimum resources at its maximum.

Further, quick ratio the company has been calculated. Quick ratio expresses about the

total quick assets and current liabilities of the company. Through the analysis on the quick

ratio of companies, it has been evaluated that the liquidity position of JD sports are quite

better and it is according to the industry ratio.

Desc

ripti

on

Formu

la J.D. Sports J Barbour and Sons

Sports Direct

International Plc

2017 2016 2015 2017 2016

201

5 2017 2016 2015

Liqu

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MBA assignment

7

idity

Curr

ent

ratio

Current

assets/c

urrent

liabiliti

es 1.33 1.47 1.22 5.67 5.93 1.22 1.72 2.43 2.30

Quic

k

Ratio

Current

assets-

Invento

ry/curr

ent

liabiliti

es 1 1 1 4 4 1 1 1 1

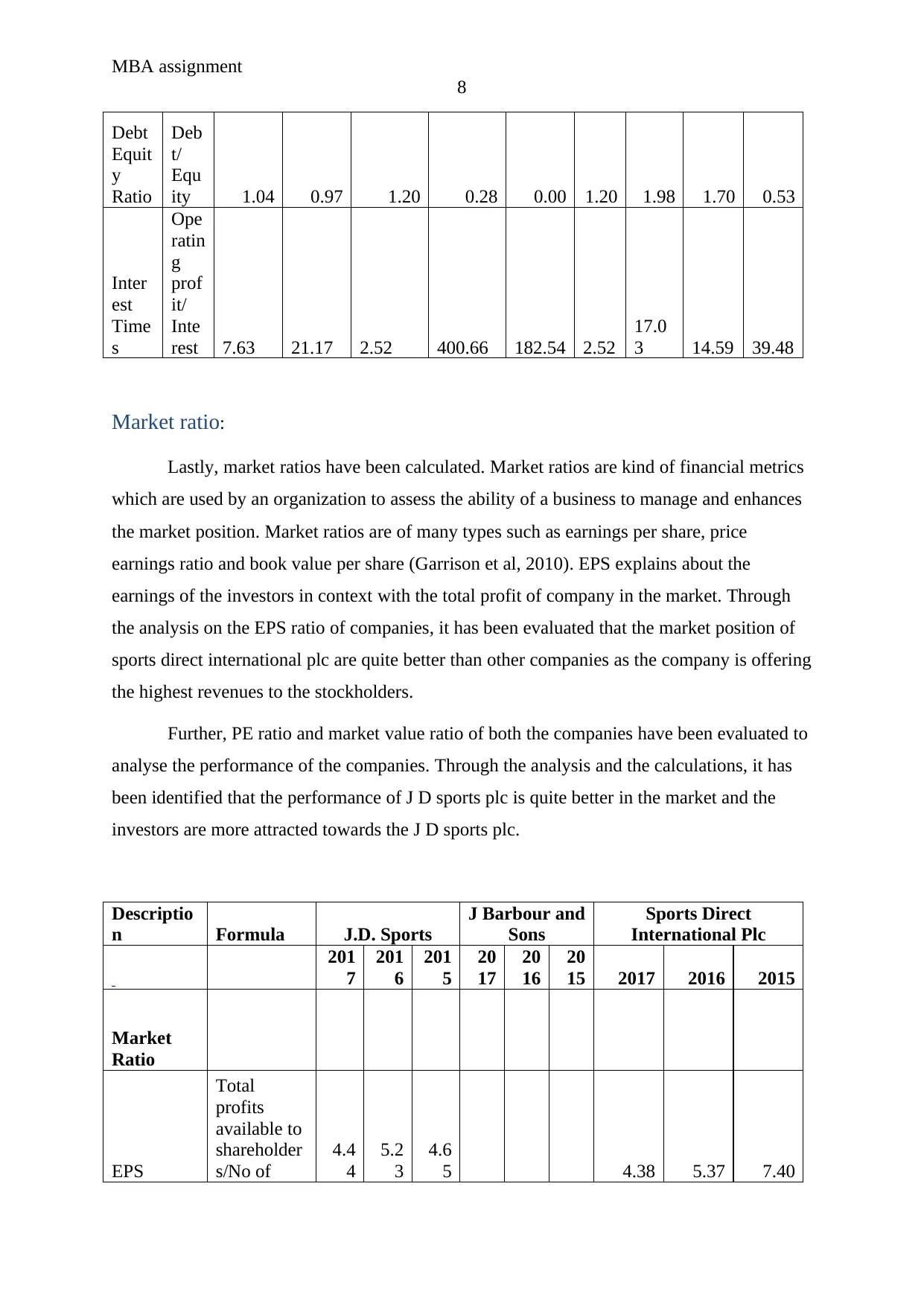

Capital structure ratio:

Further, capital structure ratios have been calculated. Capital structure ratios are kind

of financial metrics which are used by an organization to assess the ability of a business to

manage and measure the debt, equity and interest level of the company. Capital structure

ratios are of many types such as debt equity ratio and interest time ratio (Deegan, 2013). Debt

equity ratio explains about the debt and equity and the capital structure of the company.

Through the analysis on the debt equity ratio of companies, it has been evaluated that the

capitals structure position of sports direct international plc are quite better than other

companies as the company is managing the optimal capital structure.

Further, interest times earned ratio of the company has been calculated. It expresses

about the total interest and the cost of the company. Through the analysis on the interest

times earned ratio of companies, it has been evaluated that the capital structure position and

cost position of JD sports are quite better and it is according to the industry ratio (Higgins,

2012).

Desc

ripti

on

For

mul

a J.D. Sports J Barbour and Sons

Sports Direct

International Plc

2017 2016 2015 2017 2016

201

5 2017 2016 2015

Capi

tal

struc

ture

ratio

7

idity

Curr

ent

ratio

Current

assets/c

urrent

liabiliti

es 1.33 1.47 1.22 5.67 5.93 1.22 1.72 2.43 2.30

Quic

k

Ratio

Current

assets-

Invento

ry/curr

ent

liabiliti

es 1 1 1 4 4 1 1 1 1

Capital structure ratio:

Further, capital structure ratios have been calculated. Capital structure ratios are kind

of financial metrics which are used by an organization to assess the ability of a business to

manage and measure the debt, equity and interest level of the company. Capital structure

ratios are of many types such as debt equity ratio and interest time ratio (Deegan, 2013). Debt

equity ratio explains about the debt and equity and the capital structure of the company.

Through the analysis on the debt equity ratio of companies, it has been evaluated that the

capitals structure position of sports direct international plc are quite better than other

companies as the company is managing the optimal capital structure.

Further, interest times earned ratio of the company has been calculated. It expresses

about the total interest and the cost of the company. Through the analysis on the interest

times earned ratio of companies, it has been evaluated that the capital structure position and

cost position of JD sports are quite better and it is according to the industry ratio (Higgins,

2012).

Desc

ripti

on

For

mul

a J.D. Sports J Barbour and Sons

Sports Direct

International Plc

2017 2016 2015 2017 2016

201

5 2017 2016 2015

Capi

tal

struc

ture

ratio

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MBA assignment

8

Debt

Equit

y

Ratio

Deb

t/

Equ

ity 1.04 0.97 1.20 0.28 0.00 1.20 1.98 1.70 0.53

Inter

est

Time

s

Ope

ratin

g

prof

it/

Inte

rest 7.63 21.17 2.52 400.66 182.54 2.52

17.0

3 14.59 39.48

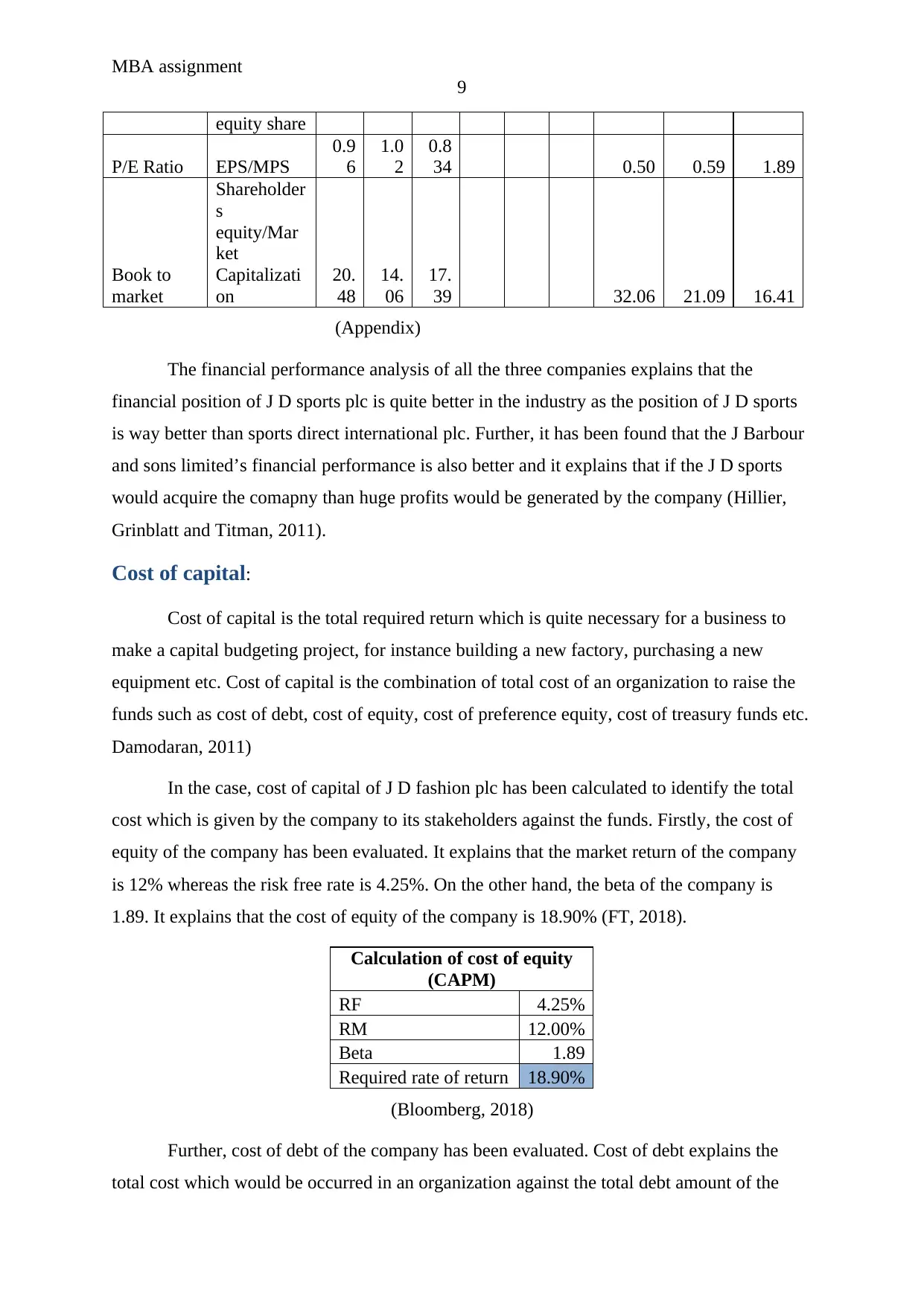

Market ratio:

Lastly, market ratios have been calculated. Market ratios are kind of financial metrics

which are used by an organization to assess the ability of a business to manage and enhances

the market position. Market ratios are of many types such as earnings per share, price

earnings ratio and book value per share (Garrison et al, 2010). EPS explains about the

earnings of the investors in context with the total profit of company in the market. Through

the analysis on the EPS ratio of companies, it has been evaluated that the market position of

sports direct international plc are quite better than other companies as the company is offering

the highest revenues to the stockholders.

Further, PE ratio and market value ratio of both the companies have been evaluated to

analyse the performance of the companies. Through the analysis and the calculations, it has

been identified that the performance of J D sports plc is quite better in the market and the

investors are more attracted towards the J D sports plc.

Descriptio

n Formula J.D. Sports

J Barbour and

Sons

Sports Direct

International Plc

201

7

201

6

201

5

20

17

20

16

20

15 2017 2016 2015

Market

Ratio

EPS

Total

profits

available to

shareholder

s/No of

4.4

4

5.2

3

4.6

5 4.38 5.37 7.40

8

Debt

Equit

y

Ratio

Deb

t/

Equ

ity 1.04 0.97 1.20 0.28 0.00 1.20 1.98 1.70 0.53

Inter

est

Time

s

Ope

ratin

g

prof

it/

Inte

rest 7.63 21.17 2.52 400.66 182.54 2.52

17.0

3 14.59 39.48

Market ratio:

Lastly, market ratios have been calculated. Market ratios are kind of financial metrics

which are used by an organization to assess the ability of a business to manage and enhances

the market position. Market ratios are of many types such as earnings per share, price

earnings ratio and book value per share (Garrison et al, 2010). EPS explains about the

earnings of the investors in context with the total profit of company in the market. Through

the analysis on the EPS ratio of companies, it has been evaluated that the market position of

sports direct international plc are quite better than other companies as the company is offering

the highest revenues to the stockholders.

Further, PE ratio and market value ratio of both the companies have been evaluated to

analyse the performance of the companies. Through the analysis and the calculations, it has

been identified that the performance of J D sports plc is quite better in the market and the

investors are more attracted towards the J D sports plc.

Descriptio

n Formula J.D. Sports

J Barbour and

Sons

Sports Direct

International Plc

201

7

201

6

201

5

20

17

20

16

20

15 2017 2016 2015

Market

Ratio

EPS

Total

profits

available to

shareholder

s/No of

4.4

4

5.2

3

4.6

5 4.38 5.37 7.40

MBA assignment

9

equity share

P/E Ratio EPS/MPS

0.9

6

1.0

2

0.8

34 0.50 0.59 1.89

Book to

market

Shareholder

s

equity/Mar

ket

Capitalizati

on

20.

48

14.

06

17.

39 32.06 21.09 16.41

(Appendix)

The financial performance analysis of all the three companies explains that the

financial position of J D sports plc is quite better in the industry as the position of J D sports

is way better than sports direct international plc. Further, it has been found that the J Barbour

and sons limited’s financial performance is also better and it explains that if the J D sports

would acquire the comapny than huge profits would be generated by the company (Hillier,

Grinblatt and Titman, 2011).

Cost of capital:

Cost of capital is the total required return which is quite necessary for a business to

make a capital budgeting project, for instance building a new factory, purchasing a new

equipment etc. Cost of capital is the combination of total cost of an organization to raise the

funds such as cost of debt, cost of equity, cost of preference equity, cost of treasury funds etc.

Damodaran, 2011)

In the case, cost of capital of J D fashion plc has been calculated to identify the total

cost which is given by the company to its stakeholders against the funds. Firstly, the cost of

equity of the company has been evaluated. It explains that the market return of the company

is 12% whereas the risk free rate is 4.25%. On the other hand, the beta of the company is

1.89. It explains that the cost of equity of the company is 18.90% (FT, 2018).

Calculation of cost of equity

(CAPM)

RF 4.25%

RM 12.00%

Beta 1.89

Required rate of return 18.90%

(Bloomberg, 2018)

Further, cost of debt of the company has been evaluated. Cost of debt explains the

total cost which would be occurred in an organization against the total debt amount of the

9

equity share

P/E Ratio EPS/MPS

0.9

6

1.0

2

0.8

34 0.50 0.59 1.89

Book to

market

Shareholder

s

equity/Mar

ket

Capitalizati

on

20.

48

14.

06

17.

39 32.06 21.09 16.41

(Appendix)

The financial performance analysis of all the three companies explains that the

financial position of J D sports plc is quite better in the industry as the position of J D sports

is way better than sports direct international plc. Further, it has been found that the J Barbour

and sons limited’s financial performance is also better and it explains that if the J D sports

would acquire the comapny than huge profits would be generated by the company (Hillier,

Grinblatt and Titman, 2011).

Cost of capital:

Cost of capital is the total required return which is quite necessary for a business to

make a capital budgeting project, for instance building a new factory, purchasing a new

equipment etc. Cost of capital is the combination of total cost of an organization to raise the

funds such as cost of debt, cost of equity, cost of preference equity, cost of treasury funds etc.

Damodaran, 2011)

In the case, cost of capital of J D fashion plc has been calculated to identify the total

cost which is given by the company to its stakeholders against the funds. Firstly, the cost of

equity of the company has been evaluated. It explains that the market return of the company

is 12% whereas the risk free rate is 4.25%. On the other hand, the beta of the company is

1.89. It explains that the cost of equity of the company is 18.90% (FT, 2018).

Calculation of cost of equity

(CAPM)

RF 4.25%

RM 12.00%

Beta 1.89

Required rate of return 18.90%

(Bloomberg, 2018)

Further, cost of debt of the company has been evaluated. Cost of debt explains the

total cost which would be occurred in an organization against the total debt amount of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MBA assignment

10

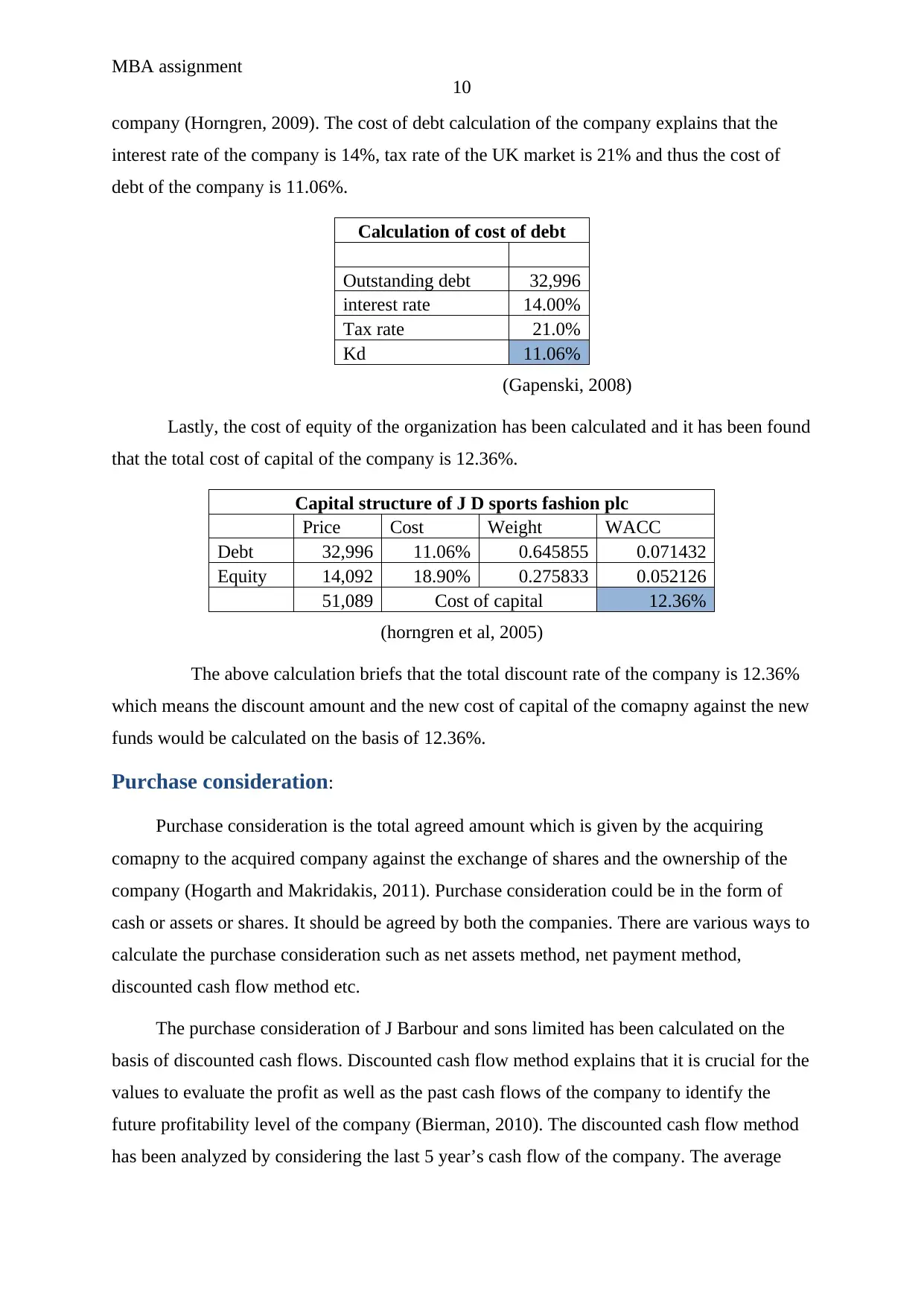

company (Horngren, 2009). The cost of debt calculation of the company explains that the

interest rate of the company is 14%, tax rate of the UK market is 21% and thus the cost of

debt of the company is 11.06%.

Calculation of cost of debt

Outstanding debt 32,996

interest rate 14.00%

Tax rate 21.0%

Kd 11.06%

(Gapenski, 2008)

Lastly, the cost of equity of the organization has been calculated and it has been found

that the total cost of capital of the company is 12.36%.

Capital structure of J D sports fashion plc

Price Cost Weight WACC

Debt 32,996 11.06% 0.645855 0.071432

Equity 14,092 18.90% 0.275833 0.052126

51,089 Cost of capital 12.36%

(horngren et al, 2005)

The above calculation briefs that the total discount rate of the company is 12.36%

which means the discount amount and the new cost of capital of the comapny against the new

funds would be calculated on the basis of 12.36%.

Purchase consideration:

Purchase consideration is the total agreed amount which is given by the acquiring

comapny to the acquired company against the exchange of shares and the ownership of the

company (Hogarth and Makridakis, 2011). Purchase consideration could be in the form of

cash or assets or shares. It should be agreed by both the companies. There are various ways to

calculate the purchase consideration such as net assets method, net payment method,

discounted cash flow method etc.

The purchase consideration of J Barbour and sons limited has been calculated on the

basis of discounted cash flows. Discounted cash flow method explains that it is crucial for the

values to evaluate the profit as well as the past cash flows of the company to identify the

future profitability level of the company (Bierman, 2010). The discounted cash flow method

has been analyzed by considering the last 5 year’s cash flow of the company. The average

10

company (Horngren, 2009). The cost of debt calculation of the company explains that the

interest rate of the company is 14%, tax rate of the UK market is 21% and thus the cost of

debt of the company is 11.06%.

Calculation of cost of debt

Outstanding debt 32,996

interest rate 14.00%

Tax rate 21.0%

Kd 11.06%

(Gapenski, 2008)

Lastly, the cost of equity of the organization has been calculated and it has been found

that the total cost of capital of the company is 12.36%.

Capital structure of J D sports fashion plc

Price Cost Weight WACC

Debt 32,996 11.06% 0.645855 0.071432

Equity 14,092 18.90% 0.275833 0.052126

51,089 Cost of capital 12.36%

(horngren et al, 2005)

The above calculation briefs that the total discount rate of the company is 12.36%

which means the discount amount and the new cost of capital of the comapny against the new

funds would be calculated on the basis of 12.36%.

Purchase consideration:

Purchase consideration is the total agreed amount which is given by the acquiring

comapny to the acquired company against the exchange of shares and the ownership of the

company (Hogarth and Makridakis, 2011). Purchase consideration could be in the form of

cash or assets or shares. It should be agreed by both the companies. There are various ways to

calculate the purchase consideration such as net assets method, net payment method,

discounted cash flow method etc.

The purchase consideration of J Barbour and sons limited has been calculated on the

basis of discounted cash flows. Discounted cash flow method explains that it is crucial for the

values to evaluate the profit as well as the past cash flows of the company to identify the

future profitability level of the company (Bierman, 2010). The discounted cash flow method

has been analyzed by considering the last 5 year’s cash flow of the company. The average

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MBA assignment

11

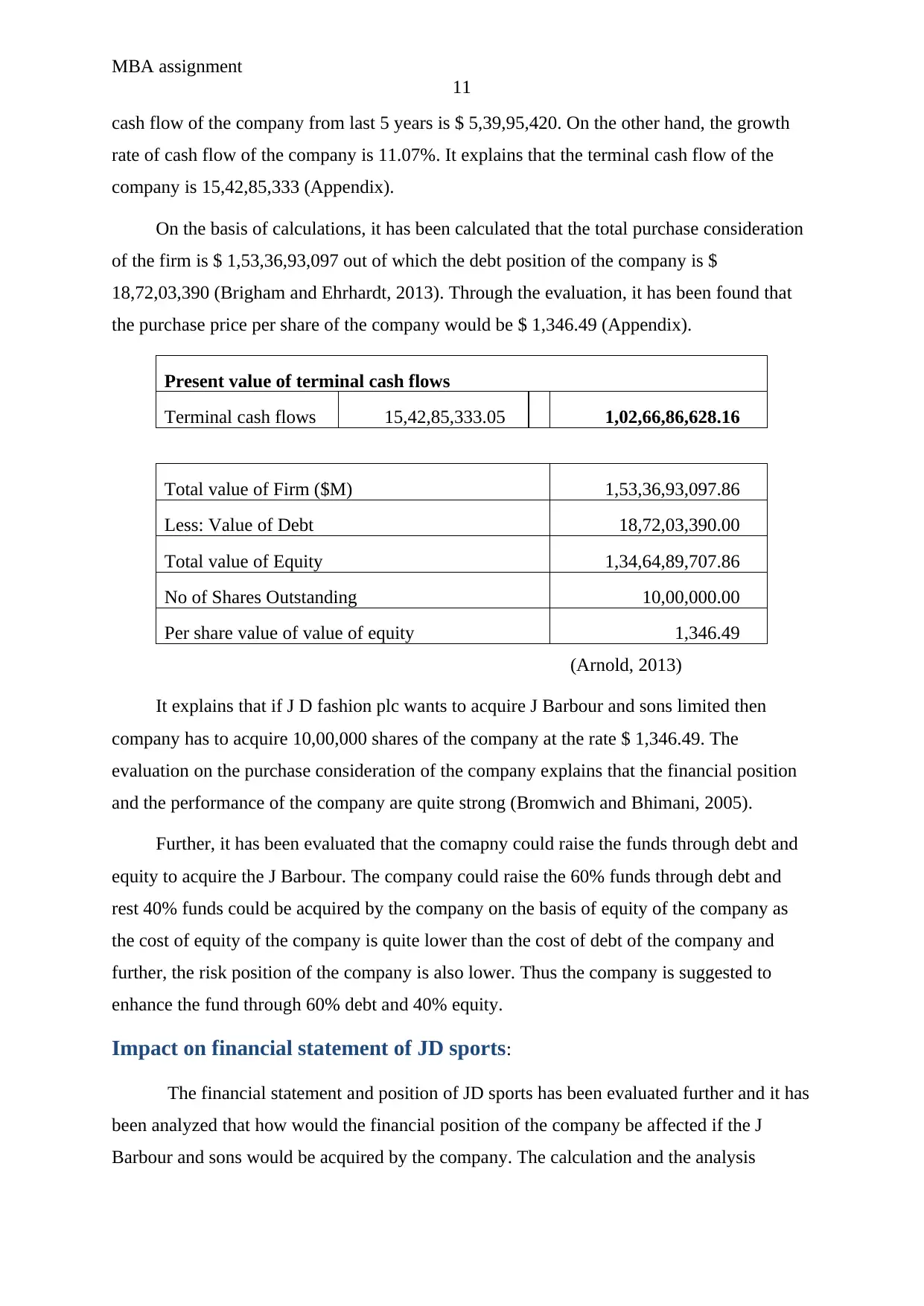

cash flow of the company from last 5 years is $ 5,39,95,420. On the other hand, the growth

rate of cash flow of the company is 11.07%. It explains that the terminal cash flow of the

company is 15,42,85,333 (Appendix).

On the basis of calculations, it has been calculated that the total purchase consideration

of the firm is $ 1,53,36,93,097 out of which the debt position of the company is $

18,72,03,390 (Brigham and Ehrhardt, 2013). Through the evaluation, it has been found that

the purchase price per share of the company would be $ 1,346.49 (Appendix).

Present value of terminal cash flows

Terminal cash flows 15,42,85,333.05 1,02,66,86,628.16

Total value of Firm ($M) 1,53,36,93,097.86

Less: Value of Debt 18,72,03,390.00

Total value of Equity 1,34,64,89,707.86

No of Shares Outstanding 10,00,000.00

Per share value of value of equity 1,346.49

(Arnold, 2013)

It explains that if J D fashion plc wants to acquire J Barbour and sons limited then

company has to acquire 10,00,000 shares of the company at the rate $ 1,346.49. The

evaluation on the purchase consideration of the company explains that the financial position

and the performance of the company are quite strong (Bromwich and Bhimani, 2005).

Further, it has been evaluated that the comapny could raise the funds through debt and

equity to acquire the J Barbour. The company could raise the 60% funds through debt and

rest 40% funds could be acquired by the company on the basis of equity of the company as

the cost of equity of the company is quite lower than the cost of debt of the company and

further, the risk position of the company is also lower. Thus the company is suggested to

enhance the fund through 60% debt and 40% equity.

Impact on financial statement of JD sports:

The financial statement and position of JD sports has been evaluated further and it has

been analyzed that how would the financial position of the company be affected if the J

Barbour and sons would be acquired by the company. The calculation and the analysis

11

cash flow of the company from last 5 years is $ 5,39,95,420. On the other hand, the growth

rate of cash flow of the company is 11.07%. It explains that the terminal cash flow of the

company is 15,42,85,333 (Appendix).

On the basis of calculations, it has been calculated that the total purchase consideration

of the firm is $ 1,53,36,93,097 out of which the debt position of the company is $

18,72,03,390 (Brigham and Ehrhardt, 2013). Through the evaluation, it has been found that

the purchase price per share of the company would be $ 1,346.49 (Appendix).

Present value of terminal cash flows

Terminal cash flows 15,42,85,333.05 1,02,66,86,628.16

Total value of Firm ($M) 1,53,36,93,097.86

Less: Value of Debt 18,72,03,390.00

Total value of Equity 1,34,64,89,707.86

No of Shares Outstanding 10,00,000.00

Per share value of value of equity 1,346.49

(Arnold, 2013)

It explains that if J D fashion plc wants to acquire J Barbour and sons limited then

company has to acquire 10,00,000 shares of the company at the rate $ 1,346.49. The

evaluation on the purchase consideration of the company explains that the financial position

and the performance of the company are quite strong (Bromwich and Bhimani, 2005).

Further, it has been evaluated that the comapny could raise the funds through debt and

equity to acquire the J Barbour. The company could raise the 60% funds through debt and

rest 40% funds could be acquired by the company on the basis of equity of the company as

the cost of equity of the company is quite lower than the cost of debt of the company and

further, the risk position of the company is also lower. Thus the company is suggested to

enhance the fund through 60% debt and 40% equity.

Impact on financial statement of JD sports:

The financial statement and position of JD sports has been evaluated further and it has

been analyzed that how would the financial position of the company be affected if the J

Barbour and sons would be acquired by the company. The calculation and the analysis

MBA assignment

12

expresses that the financial performance and financial position of J Barbour was quite string

and if the J D acquire this company than the financial position and performance of the

company would be stronger. The net profit level of the company would be enhanced as the

company would be able to capture the new market and thus the market share and revenue of

the company would be enhanced (Baker and Nofsinger, 2010). Further, it has been found that

the total assets level of the company would also be higher and the company would have

enough funds to invest into new projects or resources.

The evaluation and the analysis on financial statement explains that the profitability

level, solvency level, efficiency level and the capital structure position of the organization

would be strong after acquiring the company. The profitability level of the organization

would be around 13% after the acquisition. Further, it has been found that the capital

structure position of the company would also be better after raising more funds for the

acquisition (Ackert and Deaves, 2009). The financial strength of the company would be

better. On the other hand, the cash flow position of the company would also be better.

Share price movements:

Further, the stock price of the company has been evaluated and it has been found that

the current market share of the company is $ 1004.24 which explains about a better position

of the company in the market. The stock price and position of JD sports has been evaluated

after acquisition and it has been analyzed that how would the stock price of the company be

affected if the J Barbour and sons would be acquired by the company. The calculation and the

analysis expresses that the J Barbour was quite strong limited was a private company though

the market share and the position of the company were quite strong (Brewer, Garrison and

Noreen, 2005). And if the J D acquires this company than the stock price and performance of

the company would be stronger. The MPS and EPS level of the company would be enhanced

as the company would be able to capture the new market and thus the investors would be

attracted towards the company (Companies house 2018).

The company would be able to meet the investor’s exceptions by offering them high

dividend. Further, the corporate governance of the comapny would also be changed which

makes it easier for the other people to invest into the organization (Brown, Beekes and

Verhoeven, 2011). The risk level of the company would also be lower and eventually, the

growth exceptions of the company would also be higher which makes it easier for the

12

expresses that the financial performance and financial position of J Barbour was quite string

and if the J D acquire this company than the financial position and performance of the

company would be stronger. The net profit level of the company would be enhanced as the

company would be able to capture the new market and thus the market share and revenue of

the company would be enhanced (Baker and Nofsinger, 2010). Further, it has been found that

the total assets level of the company would also be higher and the company would have

enough funds to invest into new projects or resources.

The evaluation and the analysis on financial statement explains that the profitability

level, solvency level, efficiency level and the capital structure position of the organization

would be strong after acquiring the company. The profitability level of the organization

would be around 13% after the acquisition. Further, it has been found that the capital

structure position of the company would also be better after raising more funds for the

acquisition (Ackert and Deaves, 2009). The financial strength of the company would be

better. On the other hand, the cash flow position of the company would also be better.

Share price movements:

Further, the stock price of the company has been evaluated and it has been found that

the current market share of the company is $ 1004.24 which explains about a better position

of the company in the market. The stock price and position of JD sports has been evaluated

after acquisition and it has been analyzed that how would the stock price of the company be

affected if the J Barbour and sons would be acquired by the company. The calculation and the

analysis expresses that the J Barbour was quite strong limited was a private company though

the market share and the position of the company were quite strong (Brewer, Garrison and

Noreen, 2005). And if the J D acquires this company than the stock price and performance of

the company would be stronger. The MPS and EPS level of the company would be enhanced

as the company would be able to capture the new market and thus the investors would be

attracted towards the company (Companies house 2018).

The company would be able to meet the investor’s exceptions by offering them high

dividend. Further, the corporate governance of the comapny would also be changed which

makes it easier for the other people to invest into the organization (Brown, Beekes and

Verhoeven, 2011). The risk level of the company would also be lower and eventually, the

growth exceptions of the company would also be higher which makes it easier for the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.