Economics Assignment: Expenditure Multiplier and Economic Analysis

VerifiedAdded on 2023/03/29

|8

|1424

|257

Homework Assignment

AI Summary

This economics assignment provides a comprehensive overview of the expenditure multiplier, explaining its impact on economic activity and the circular flow of expenditure. It defines key economic indicators like GDP and NDP. The assignment then delves into fiscal and monetary policies, illustrating their effects with diagrams. It also covers various types of unemployment, demand-pull and cost-push inflation, and the application of aggregate demand and supply to economic situations. Furthermore, the assignment explains cost reconciliation, cost curves (fixed, variable, and total), production possibility frontiers, and profit maximization determination. The assignment uses diagrams and references to support the concepts discussed, offering a well-rounded analysis of core economic principles.

Expenditure multiplier application

In simple words, expenditure multiplier said to be in play when an investment fell by $100

billion, its impact on an economy not remain only limited $ 100 billion, in fact, its impact felt

many times more than $ 100 billion that is what multiplier mean. It can be 2 times, 3 times or

even 5 times, it depends on multiplier number. Investment or expenditure can be of many

types, it can be consumption, investment, Government expenditure or net of exports and

imports, its impact on an economy have more than proportional change in expenditure or

investment. (Ceteris paribus) This is what multiplier mean for an economy. As per the

Keynsean economics, higher the aggregate demand, higher will be economic activity.

Aggregate expenditure circulates in an economy: that is popularly known as circular flow of

expenditure/income in an economy. It works like this, households buy from firms, firms pay

workers and suppliers, workers and suppliers buy goods from other firms, those firms pay

their workers and suppliers, and so on so forth. In this way original expenditure converted to

many time through the impact of multiplier, this is what expenditure multiplier mean.

GDP (Gross Domestic Product):

Monetary value of final (not intermediate) Goods and Services produced in an economy

(domestic territory) in a financial year.

GDP = C + I + G + (X – M) = Private consumption + gross consumption +

government spending + (export-imports)

NDP (Net Domestic Product):

NDP = GDP - Depreciation or (wear and tear)

Fiscal Policy and Monetary policy with diagram

(ceteris paribus applicable wherever it is required)

Fiscal policy is implemented by government of that country: It is done by influencing

investment, employment, output and income, (ceteris paribus) through following two ways:

a) Increase/decrease in expenditure and

In simple words, expenditure multiplier said to be in play when an investment fell by $100

billion, its impact on an economy not remain only limited $ 100 billion, in fact, its impact felt

many times more than $ 100 billion that is what multiplier mean. It can be 2 times, 3 times or

even 5 times, it depends on multiplier number. Investment or expenditure can be of many

types, it can be consumption, investment, Government expenditure or net of exports and

imports, its impact on an economy have more than proportional change in expenditure or

investment. (Ceteris paribus) This is what multiplier mean for an economy. As per the

Keynsean economics, higher the aggregate demand, higher will be economic activity.

Aggregate expenditure circulates in an economy: that is popularly known as circular flow of

expenditure/income in an economy. It works like this, households buy from firms, firms pay

workers and suppliers, workers and suppliers buy goods from other firms, those firms pay

their workers and suppliers, and so on so forth. In this way original expenditure converted to

many time through the impact of multiplier, this is what expenditure multiplier mean.

GDP (Gross Domestic Product):

Monetary value of final (not intermediate) Goods and Services produced in an economy

(domestic territory) in a financial year.

GDP = C + I + G + (X – M) = Private consumption + gross consumption +

government spending + (export-imports)

NDP (Net Domestic Product):

NDP = GDP - Depreciation or (wear and tear)

Fiscal Policy and Monetary policy with diagram

(ceteris paribus applicable wherever it is required)

Fiscal policy is implemented by government of that country: It is done by influencing

investment, employment, output and income, (ceteris paribus) through following two ways:

a) Increase/decrease in expenditure and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Source: http://www.economicsdiscussion.net/keynesian-economics/policies/monetary-and-

fiscal-policy-effects-and-changes-with-diagram/15779

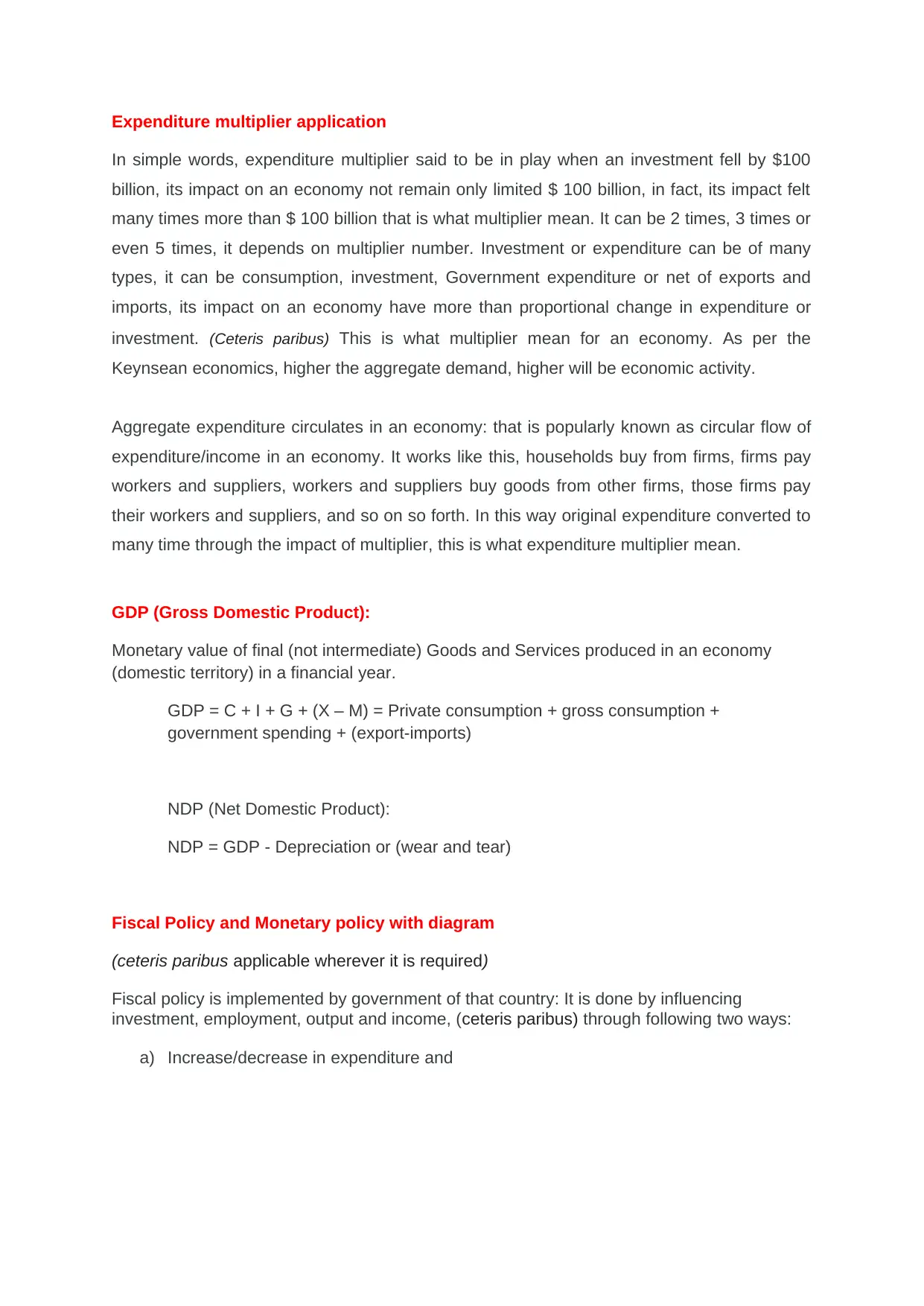

When government increases the expenditure, we see that there is a shifts in the IS

curve from IS0 to IS1, i.e. toward right as shown in Fig. 10.1. And as a result, there is

rise in income from Y0to Y1. Just opposite happens when government decreases their

expenditure.

b) Increase/decrease in taxes

Source: http://www.economicsdiscussion.net/keynesian-economics/policies/monetary-and-

fiscal-policy-effects-and-changes-with-diagram/15779

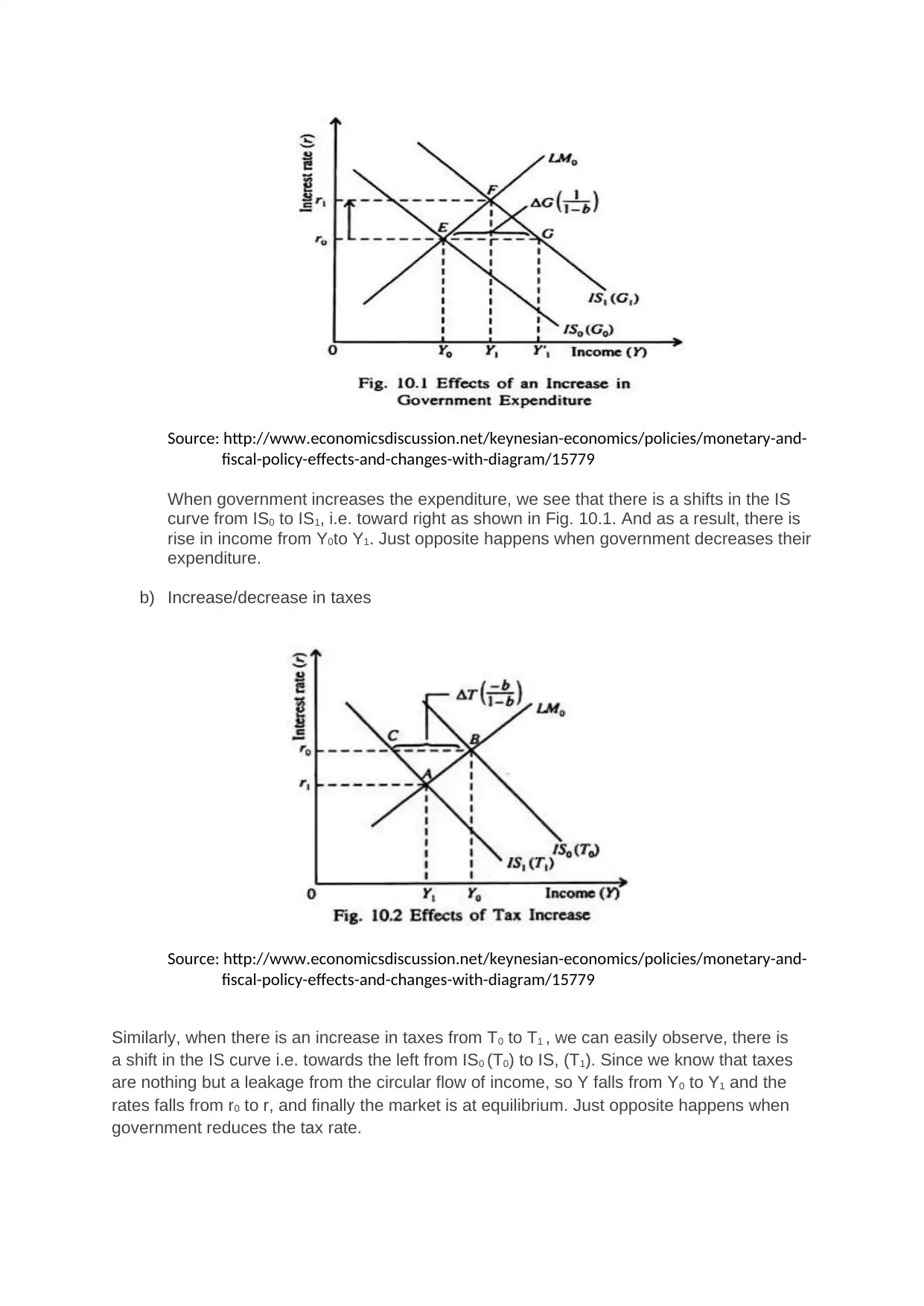

Similarly, when there is an increase in taxes from T0 to T1 , we can easily observe, there is

a shift in the IS curve i.e. towards the left from IS0 (T0) to IS, (T1). Since we know that taxes

are nothing but a leakage from the circular flow of income, so Y falls from Y0 to Y1 and the

rates falls from r0 to r, and finally the market is at equilibrium. Just opposite happens when

government reduces the tax rate.

fiscal-policy-effects-and-changes-with-diagram/15779

When government increases the expenditure, we see that there is a shifts in the IS

curve from IS0 to IS1, i.e. toward right as shown in Fig. 10.1. And as a result, there is

rise in income from Y0to Y1. Just opposite happens when government decreases their

expenditure.

b) Increase/decrease in taxes

Source: http://www.economicsdiscussion.net/keynesian-economics/policies/monetary-and-

fiscal-policy-effects-and-changes-with-diagram/15779

Similarly, when there is an increase in taxes from T0 to T1 , we can easily observe, there is

a shift in the IS curve i.e. towards the left from IS0 (T0) to IS, (T1). Since we know that taxes

are nothing but a leakage from the circular flow of income, so Y falls from Y0 to Y1 and the

rates falls from r0 to r, and finally the market is at equilibrium. Just opposite happens when

government reduces the tax rate.

Monetary policy implemented by Central Bank of a country:

The government, through their Central Bank implement monetary policy, which ultimately

effects employment, investment, output and income in an economy (ceteris paribus). Central

bank of a country reduces or increases rate of interest for bank borrowing and lending in an

economy. This is done after looking at all macro economic data and other aspects of an

economy which can make impact on recessionary or inflationary condition of an economy.

Inflationary situation can lead to increase in bank rate and deflationary situation can lead to

cut/reduction in bank rate.

Unemployment types

Cyclical Unemployment

Classical Unemployment

Frictional Unemployment

Regional Unemployment

Seasonal Unemployment

Structural Unemployment

Voluntary Unemployment

Disguised Unemployment

Demand Pull Inflation and Cost Push Inflation:

Demand pull inflation:

It occurred due to rise in demand of products and shortage of supply lead to an

increase in inflation rate. (ceteris paribus)

Cost push inflation:

It is a phenomenon where due to increase in cost of products and fall in supply

inflation rises. (ceteris paribus)

Application of AD-AS to economic situations

The aggregate supply (AS) is provided by the firm in an economy through its total production

of goods and services for selling into the market. The aggregate demand (AD) is the total

amounts of goods and services purchased by consumer in market at all possible prices.

(ceteris paribus)

Gradual reduction in aggregate demand can lead to recessionary situation in an economy,

while, gradual decrease or decrease in aggregate supply can lead to inflationary situation.

So to be in equilibrium condition AD should remain equal to AS. It is called position of

equilibrium in an economy and most ideal for an economy. (ceteris paribus)

Change in quantity demanded Vs change in demand

The government, through their Central Bank implement monetary policy, which ultimately

effects employment, investment, output and income in an economy (ceteris paribus). Central

bank of a country reduces or increases rate of interest for bank borrowing and lending in an

economy. This is done after looking at all macro economic data and other aspects of an

economy which can make impact on recessionary or inflationary condition of an economy.

Inflationary situation can lead to increase in bank rate and deflationary situation can lead to

cut/reduction in bank rate.

Unemployment types

Cyclical Unemployment

Classical Unemployment

Frictional Unemployment

Regional Unemployment

Seasonal Unemployment

Structural Unemployment

Voluntary Unemployment

Disguised Unemployment

Demand Pull Inflation and Cost Push Inflation:

Demand pull inflation:

It occurred due to rise in demand of products and shortage of supply lead to an

increase in inflation rate. (ceteris paribus)

Cost push inflation:

It is a phenomenon where due to increase in cost of products and fall in supply

inflation rises. (ceteris paribus)

Application of AD-AS to economic situations

The aggregate supply (AS) is provided by the firm in an economy through its total production

of goods and services for selling into the market. The aggregate demand (AD) is the total

amounts of goods and services purchased by consumer in market at all possible prices.

(ceteris paribus)

Gradual reduction in aggregate demand can lead to recessionary situation in an economy,

while, gradual decrease or decrease in aggregate supply can lead to inflationary situation.

So to be in equilibrium condition AD should remain equal to AS. It is called position of

equilibrium in an economy and most ideal for an economy. (ceteris paribus)

Change in quantity demanded Vs change in demand

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Change in demand: When the entire demand curve shifts either towards left or right, we

call it as, Change in demand (ceteris paribus). As depicted in diagram given below:

Change in quantity demanded:

When due to change in price, demand movement happens at same demand curve, it is

called change in quantity demanded (ceteris paribus). In this case demand curve does not

sift right or left side of existing demand curve rather it move in same demand curve from one

point to another point. As given in diagram below.

Reconciliation of accounting and economic costs

Cost reconciliation statement is actually the statement which we prepare for “reconciling the

profit between financial account and cost account .Or we can say that a cost reconciliation

statement is a statement which is used for reconciling the profits or losses that are shown by

cost accounts and financial accounts. It is a statement wherein the causes responsible for

the difference in net profit or loss between cost and financial accounts are established and

suitable adjustments are made to remove them. In other words, cost reconciliation statement

is prepared for the purpose of reconciling or agreeing the results of financial accounts with

the results of cost accounts by making suitable adjustments for the items responsible for the

disagreement.” (accountlearning.blogspot.com, Accounting Management)

Cost curves (with diagram)

(ceteris paribus is applicable wherever it is necessary)

call it as, Change in demand (ceteris paribus). As depicted in diagram given below:

Change in quantity demanded:

When due to change in price, demand movement happens at same demand curve, it is

called change in quantity demanded (ceteris paribus). In this case demand curve does not

sift right or left side of existing demand curve rather it move in same demand curve from one

point to another point. As given in diagram below.

Reconciliation of accounting and economic costs

Cost reconciliation statement is actually the statement which we prepare for “reconciling the

profit between financial account and cost account .Or we can say that a cost reconciliation

statement is a statement which is used for reconciling the profits or losses that are shown by

cost accounts and financial accounts. It is a statement wherein the causes responsible for

the difference in net profit or loss between cost and financial accounts are established and

suitable adjustments are made to remove them. In other words, cost reconciliation statement

is prepared for the purpose of reconciling or agreeing the results of financial accounts with

the results of cost accounts by making suitable adjustments for the items responsible for the

disagreement.” (accountlearning.blogspot.com, Accounting Management)

Cost curves (with diagram)

(ceteris paribus is applicable wherever it is necessary)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

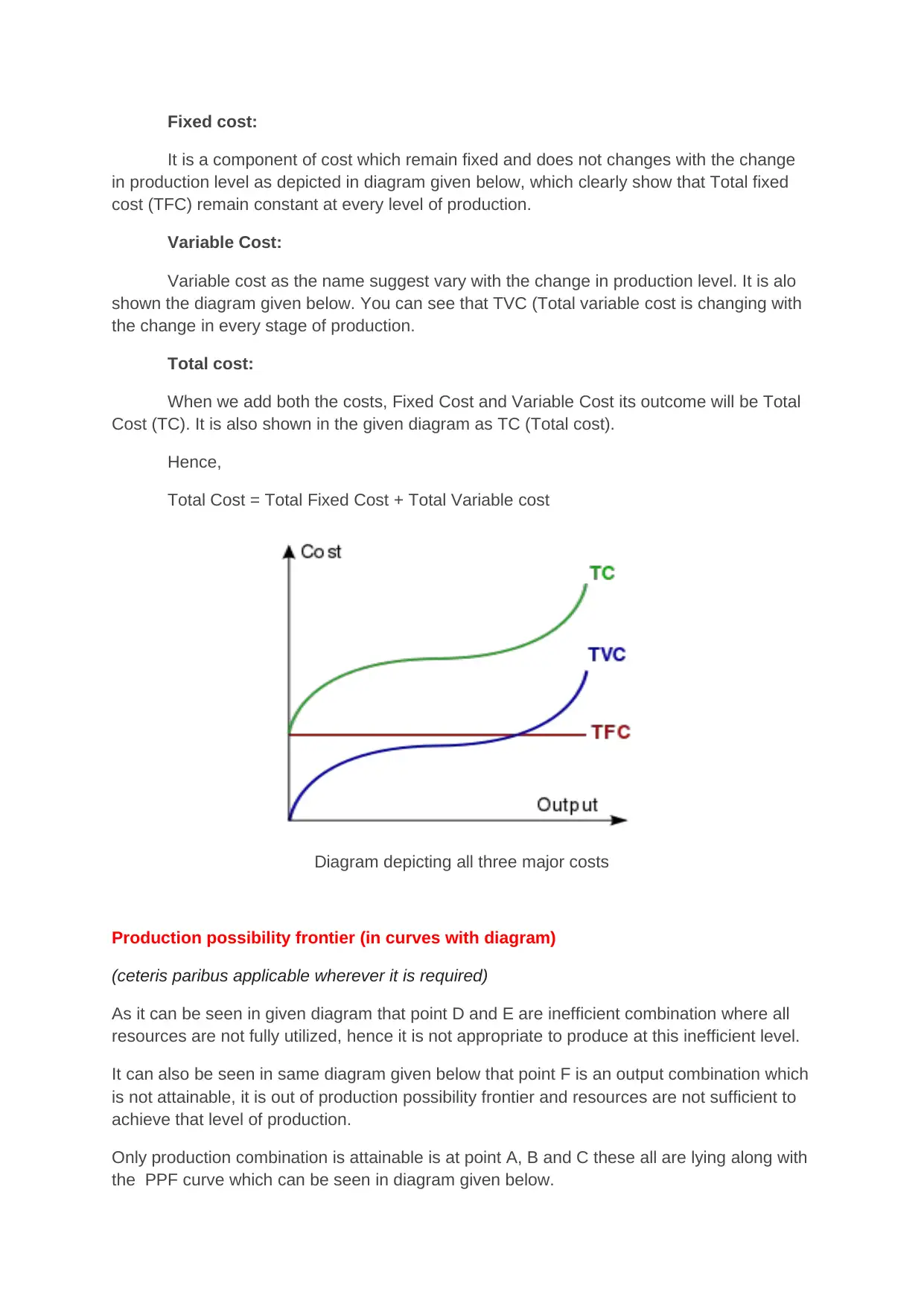

Fixed cost:

It is a component of cost which remain fixed and does not changes with the change

in production level as depicted in diagram given below, which clearly show that Total fixed

cost (TFC) remain constant at every level of production.

Variable Cost:

Variable cost as the name suggest vary with the change in production level. It is alo

shown the diagram given below. You can see that TVC (Total variable cost is changing with

the change in every stage of production.

Total cost:

When we add both the costs, Fixed Cost and Variable Cost its outcome will be Total

Cost (TC). It is also shown in the given diagram as TC (Total cost).

Hence,

Total Cost = Total Fixed Cost + Total Variable cost

Diagram depicting all three major costs

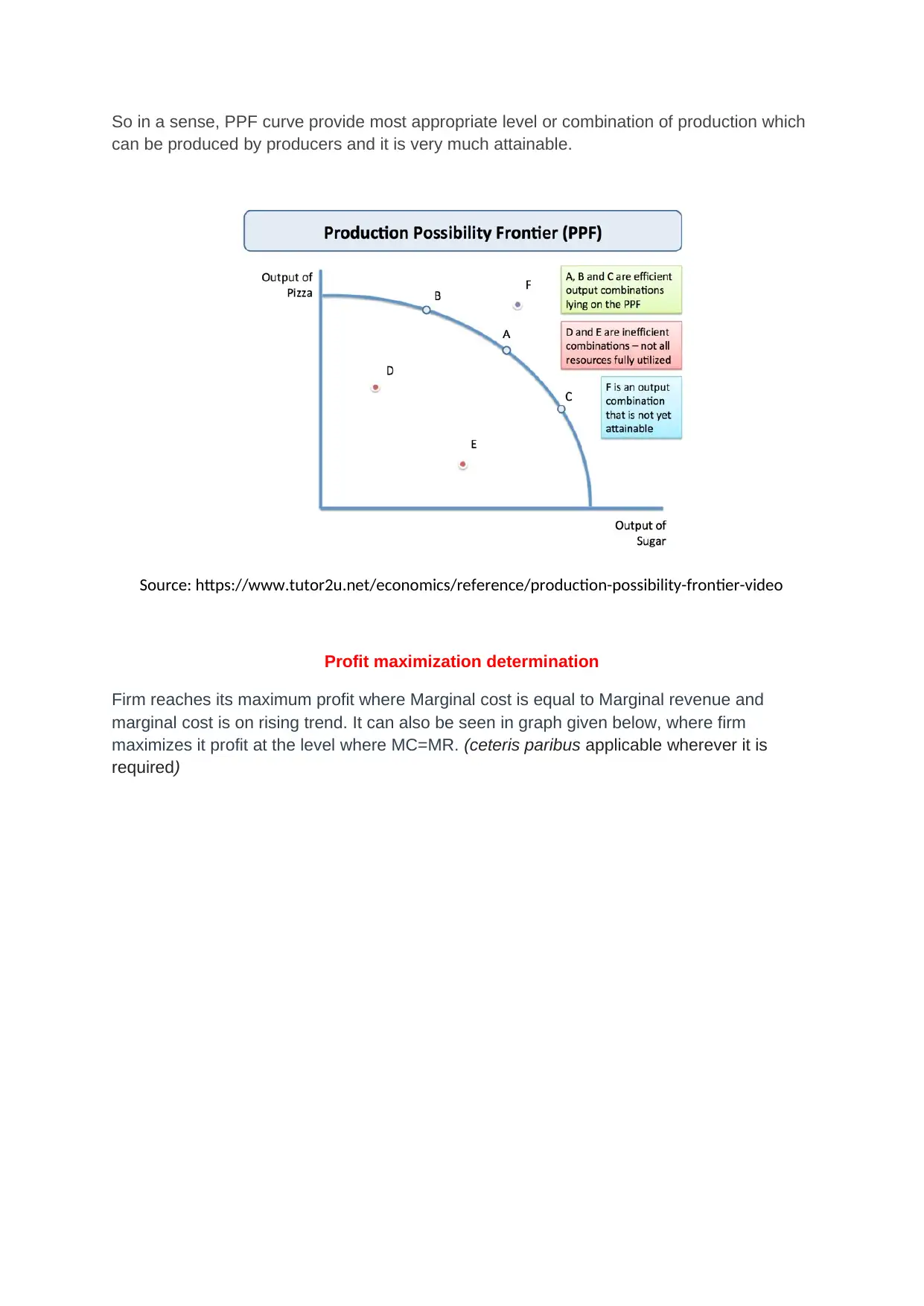

Production possibility frontier (in curves with diagram)

(ceteris paribus applicable wherever it is required)

As it can be seen in given diagram that point D and E are inefficient combination where all

resources are not fully utilized, hence it is not appropriate to produce at this inefficient level.

It can also be seen in same diagram given below that point F is an output combination which

is not attainable, it is out of production possibility frontier and resources are not sufficient to

achieve that level of production.

Only production combination is attainable is at point A, B and C these all are lying along with

the PPF curve which can be seen in diagram given below.

It is a component of cost which remain fixed and does not changes with the change

in production level as depicted in diagram given below, which clearly show that Total fixed

cost (TFC) remain constant at every level of production.

Variable Cost:

Variable cost as the name suggest vary with the change in production level. It is alo

shown the diagram given below. You can see that TVC (Total variable cost is changing with

the change in every stage of production.

Total cost:

When we add both the costs, Fixed Cost and Variable Cost its outcome will be Total

Cost (TC). It is also shown in the given diagram as TC (Total cost).

Hence,

Total Cost = Total Fixed Cost + Total Variable cost

Diagram depicting all three major costs

Production possibility frontier (in curves with diagram)

(ceteris paribus applicable wherever it is required)

As it can be seen in given diagram that point D and E are inefficient combination where all

resources are not fully utilized, hence it is not appropriate to produce at this inefficient level.

It can also be seen in same diagram given below that point F is an output combination which

is not attainable, it is out of production possibility frontier and resources are not sufficient to

achieve that level of production.

Only production combination is attainable is at point A, B and C these all are lying along with

the PPF curve which can be seen in diagram given below.

So in a sense, PPF curve provide most appropriate level or combination of production which

can be produced by producers and it is very much attainable.

Source: https://www.tutor2u.net/economics/reference/production-possibility-frontier-video

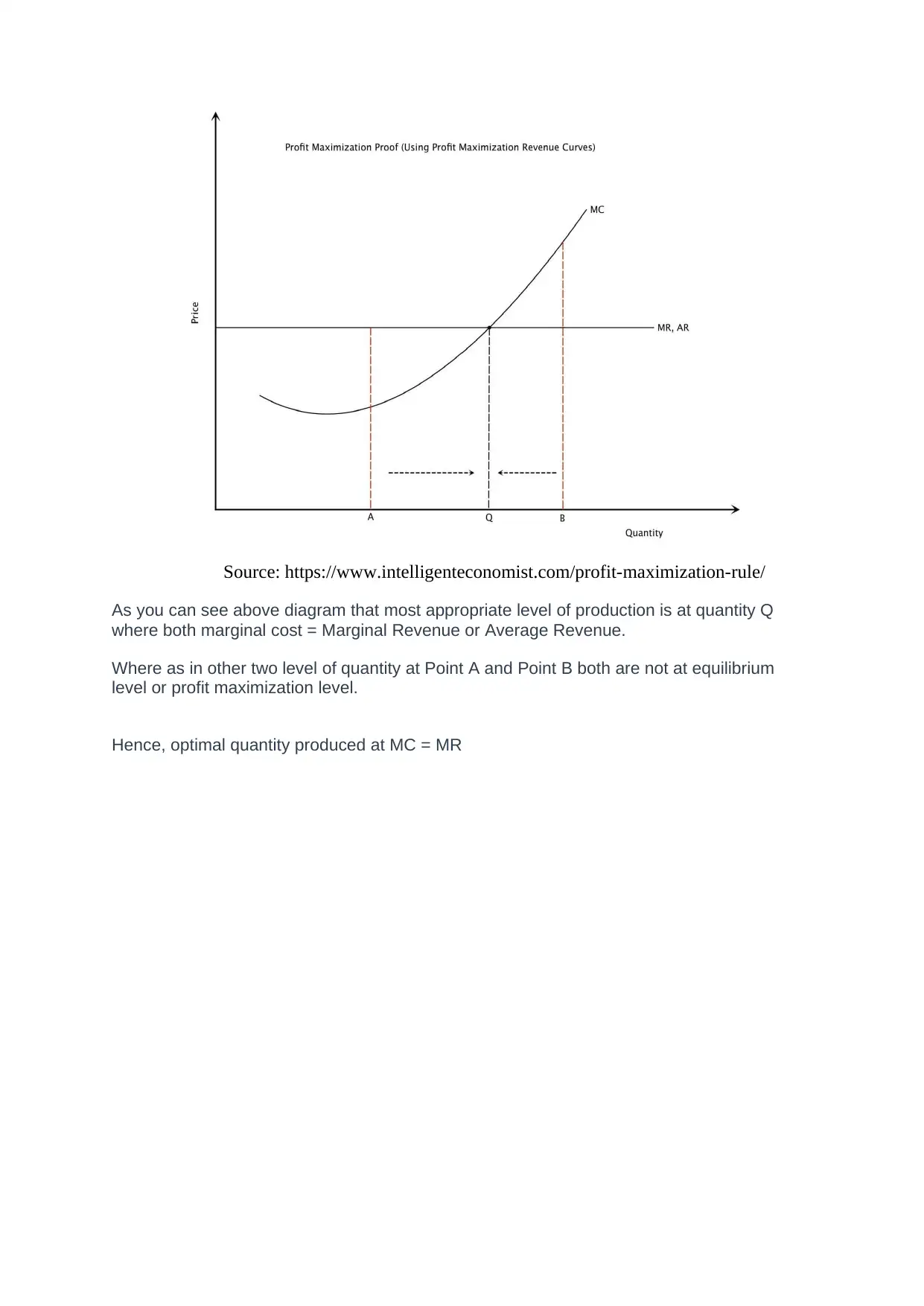

Profit maximization determination

Firm reaches its maximum profit where Marginal cost is equal to Marginal revenue and

marginal cost is on rising trend. It can also be seen in graph given below, where firm

maximizes it profit at the level where MC=MR. (ceteris paribus applicable wherever it is

required)

can be produced by producers and it is very much attainable.

Source: https://www.tutor2u.net/economics/reference/production-possibility-frontier-video

Profit maximization determination

Firm reaches its maximum profit where Marginal cost is equal to Marginal revenue and

marginal cost is on rising trend. It can also be seen in graph given below, where firm

maximizes it profit at the level where MC=MR. (ceteris paribus applicable wherever it is

required)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Source: https://www.intelligenteconomist.com/profit-maximization-rule/

As you can see above diagram that most appropriate level of production is at quantity Q

where both marginal cost = Marginal Revenue or Average Revenue.

Where as in other two level of quantity at Point A and Point B both are not at equilibrium

level or profit maximization level.

Hence, optimal quantity produced at MC = MR

As you can see above diagram that most appropriate level of production is at quantity Q

where both marginal cost = Marginal Revenue or Average Revenue.

Where as in other two level of quantity at Point A and Point B both are not at equilibrium

level or profit maximization level.

Hence, optimal quantity produced at MC = MR

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References:

courses.lumenlearning.com, The Expenditure Multiplier Effect. Retrieved June 06, 2019, From

https://courses.lumenlearning.com/wm-macroeconomics/chapter/the-expenditure-multiplier-effect/

accountlearning.blogspot.com, Accounting Management. Retrieved June 06, 2019, From

https://accountlearning.blogspot.com/2011/12/concept-and-meaning-of-cost.html

Kari, Diptimai, Monetary and Fiscal Policy: Effects and Changes (With Diagram). Retrieved June 06,

2019, From http://www.economicsdiscussion.net/keynesian-economics/policies/monetary-and-fiscal-

policy-effects-and-changes-with-diagram/15779

Chand, Smriti, Effectiveness of Monetary and Fiscal Policy (explained with diagram). Retrieved June

06, 2019, From http://www.yourarticlelibrary.com/policies/effectiveness-of-monetary-and-fiscal-policy-

explained-with-diagram-economics/29271

Boundless Economics, Introducing Aggregate Demand and Aggregate Supply. Retrieved June 06,

2019, From https://courses.lumenlearning.com/boundless-economics/chapter/introducing-aggregate-

demand-and-aggregate-supply/

Intelligent Economist, (2019). Profit Maximization Rule. Retrieved June 06, 2019, From

https://www.intelligenteconomist.com/profit-maximization-rule/

courses.lumenlearning.com, The Expenditure Multiplier Effect. Retrieved June 06, 2019, From

https://courses.lumenlearning.com/wm-macroeconomics/chapter/the-expenditure-multiplier-effect/

accountlearning.blogspot.com, Accounting Management. Retrieved June 06, 2019, From

https://accountlearning.blogspot.com/2011/12/concept-and-meaning-of-cost.html

Kari, Diptimai, Monetary and Fiscal Policy: Effects and Changes (With Diagram). Retrieved June 06,

2019, From http://www.economicsdiscussion.net/keynesian-economics/policies/monetary-and-fiscal-

policy-effects-and-changes-with-diagram/15779

Chand, Smriti, Effectiveness of Monetary and Fiscal Policy (explained with diagram). Retrieved June

06, 2019, From http://www.yourarticlelibrary.com/policies/effectiveness-of-monetary-and-fiscal-policy-

explained-with-diagram-economics/29271

Boundless Economics, Introducing Aggregate Demand and Aggregate Supply. Retrieved June 06,

2019, From https://courses.lumenlearning.com/boundless-economics/chapter/introducing-aggregate-

demand-and-aggregate-supply/

Intelligent Economist, (2019). Profit Maximization Rule. Retrieved June 06, 2019, From

https://www.intelligenteconomist.com/profit-maximization-rule/

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.