Ask a question from expert

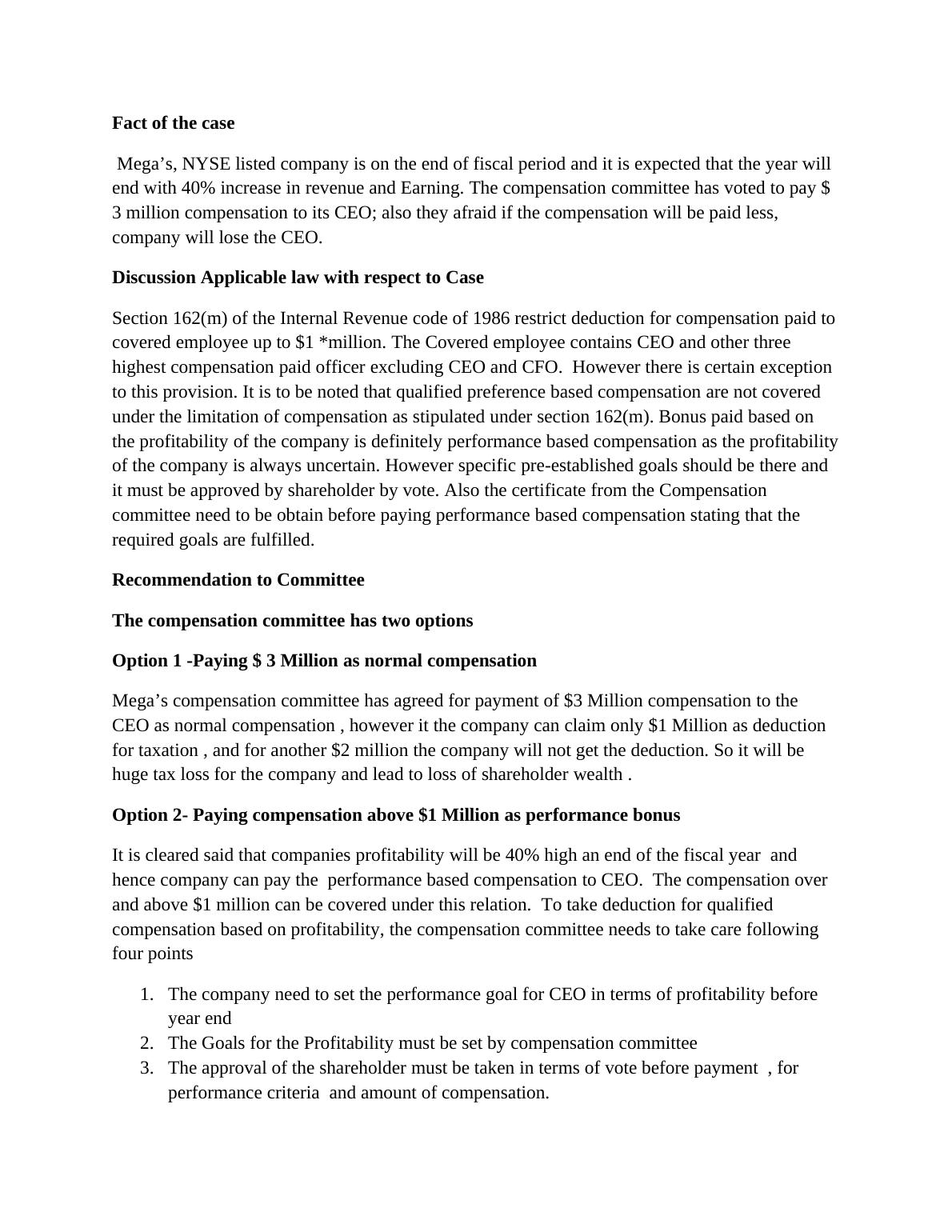

Fact of the case.

2 Pages484 Words204 Views

Added on 2019-09-13

Fact of the case.

Added on 2019-09-13

BookmarkShareRelated Documents

End of preview

Want to access all the pages? Upload your documents or become a member.

As a CPA with PWC, you advise the Compensation Committee of the

|1

|239

|506

Accounting Theory Sample Assignment (Doc)

|5

|1333

|26

Equity and Executive Pay

|8

|2042

|44

Financial Management: Impact of COVID-19, Dividend Cuts, and Raising Finance

|10

|3221

|72