FE5001: Factors Influencing Import Expenditure in the UK (1985-2015)

VerifiedAdded on 2022/08/18

|15

|2384

|24

Report

AI Summary

This report presents an econometric analysis of UK import expenditure from 1985 to 2015, focusing on the relationships between import expenditure, GDP, and CPI. The study employs both simple and multiple linear regression models, examining the influence of GDP and CPI on import expenditure. The report begins by outlining the assumptions of the Classical Linear Regression Model (CLRM) and the properties of OLS estimators. Scatterplots are used to visualize the relationships, and regression equations are estimated to quantify the impact of GDP and CPI on import expenditure. The analysis includes hypothesis testing, coefficient of determination (R2) calculations, and F-tests to assess the explanatory power of the models. Furthermore, the report explores different functional forms, including log-transformed variables, to determine the most appropriate model. A multiple regression analysis is conducted to assess the combined impact of GDP and CPI on import expenditure. The results are compared, and the significance of correlation coefficients is evaluated. The study concludes that there is a linear relationship between import expenditure, GDP, and CPI, with the log-transformed variables providing more meaningful results due to a higher coefficient of determination. The multiple regression analysis further enhances the results and their reliability.

Running Header: Factors influencing the import expenditure 1

Factors influencing the import expenditure

Students name:

ID:

Institution:

Factors influencing the import expenditure

Students name:

ID:

Institution:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Factors influencing the import expenditure 2

Introduction

The study examines the relationship between import expenditure (IMPORTS), Consumer

Price Index (CPI) and GDP in the UK from 1985 to 2015. The study examines the import

function while evaluating the significance of the variables (CPI and GDP) which influences

the import expenditure. Simple linear regression models were used in investigating the

relationship between import expenditure and CPI and GDP separately while a multiple

regression analysis was used in investigating the relationship between import expenditure and

CPI and GDP together.

Part (A): Simple Linear Regression Model

Assumptions of Classical Linear Regression Model (CLRM)

According to Hose & Hans (2019), there are seven assumptions of CLRM.

First Assumption: The parameters of a regression model are. Violating this assumption

produces errors during extrapolation of the assumed model.

Second Assumption: The regressors are not stochastic or fixed. Violating this assumption

produces unreasonable predictions especially beyond the range of sample data.

Third Assumption: The mean value of the error term is 0 given the values of the independent

variables. Violation of this assumption biases the regression coefficient produced by the OLS.

Forth Assumption: Each error term variance given the independent variables values is

homoscedastic. Violating this assumption leads to the regression coefficient produced to be

less reliable since the data point across each independent variable does not influence equally.

Fifth Assumption: The error terms belonging to two different observations have no

correlation.

Sixth Assumption: The independent variables have no perfect linear relationship. Hence there

is no multicollinearity. Violating assumptions 5 and 6 causes the regression coefficient

variance to increase.

Introduction

The study examines the relationship between import expenditure (IMPORTS), Consumer

Price Index (CPI) and GDP in the UK from 1985 to 2015. The study examines the import

function while evaluating the significance of the variables (CPI and GDP) which influences

the import expenditure. Simple linear regression models were used in investigating the

relationship between import expenditure and CPI and GDP separately while a multiple

regression analysis was used in investigating the relationship between import expenditure and

CPI and GDP together.

Part (A): Simple Linear Regression Model

Assumptions of Classical Linear Regression Model (CLRM)

According to Hose & Hans (2019), there are seven assumptions of CLRM.

First Assumption: The parameters of a regression model are. Violating this assumption

produces errors during extrapolation of the assumed model.

Second Assumption: The regressors are not stochastic or fixed. Violating this assumption

produces unreasonable predictions especially beyond the range of sample data.

Third Assumption: The mean value of the error term is 0 given the values of the independent

variables. Violation of this assumption biases the regression coefficient produced by the OLS.

Forth Assumption: Each error term variance given the independent variables values is

homoscedastic. Violating this assumption leads to the regression coefficient produced to be

less reliable since the data point across each independent variable does not influence equally.

Fifth Assumption: The error terms belonging to two different observations have no

correlation.

Sixth Assumption: The independent variables have no perfect linear relationship. Hence there

is no multicollinearity. Violating assumptions 5 and 6 causes the regression coefficient

variance to increase.

Factors influencing the import expenditure 3

Assumption 7: Correct specification of the regression model in use. Hence, there is no bias or

specific error. Violating this assumption makes the regression coefficient to be less reliable.

Properties of OLS Estimators

The linear property of the OLS estimators suggest than the OLS belongs in an estimator class

which is linear to the dependent variable (Rahman et al,, 2018). The estimator needs to be an

unbiased estimator of the true population or parameter values making it the most desirable

property of any estimator. The best minimum variance property places an estimator as being

efficient. Thus, the estimator will have the variance that is the least when taking all unbiased

estimators of the unknown population parameter. The asymptotic unbiasedness means when

the sample size of an OLS estimator increases, the unbiasedness disappears. Finally, an

estimator is pointed out to be coherent if its value approached the true parameter population

value when there is an increase in the sample size.

Scatterplots

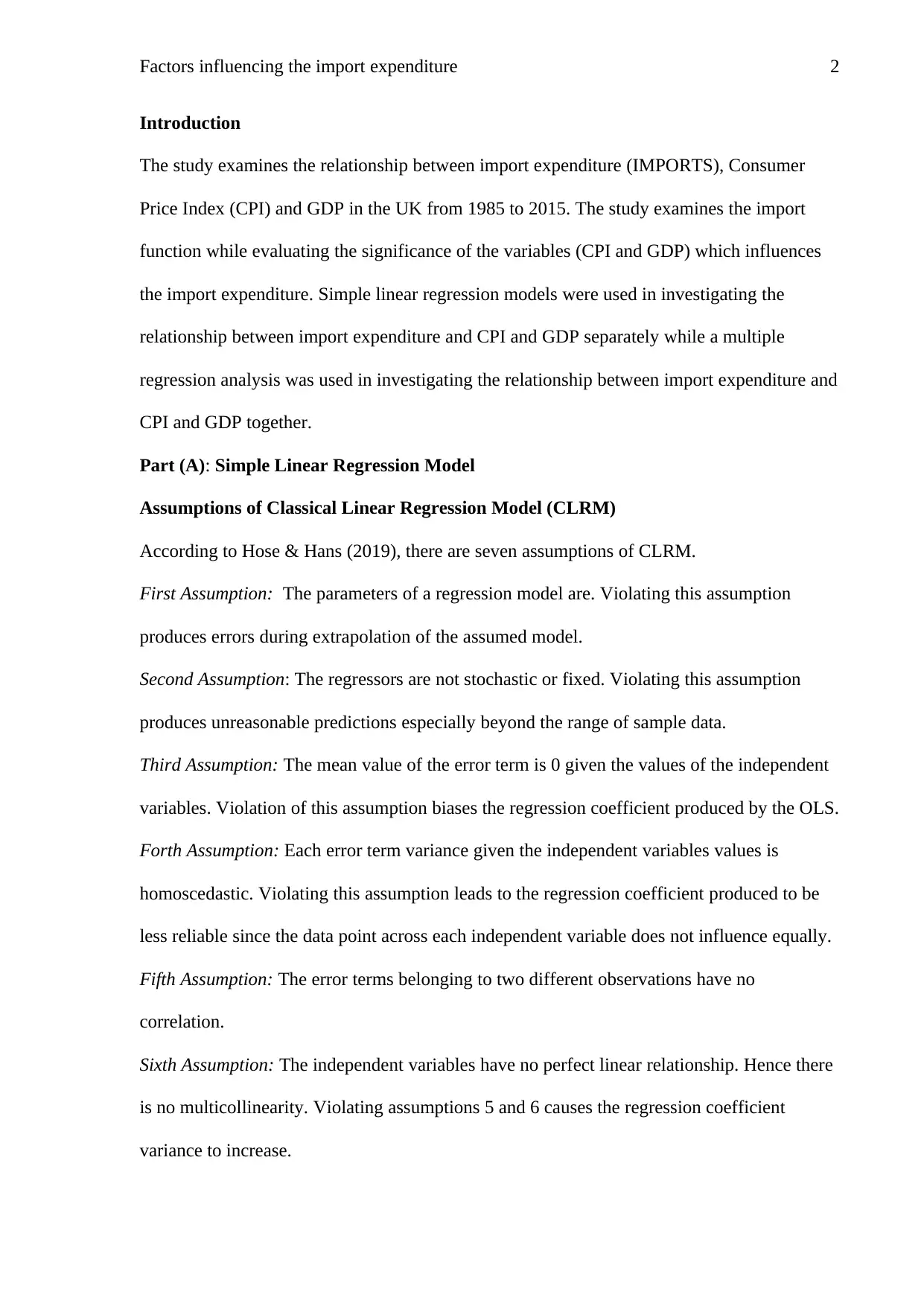

Figure 1: Scatterplot for Imports Expenditure against GDP

0 2000 4000 6000 8000 10000 12000 14000

0

200000

400000

600000

800000

1000000

1200000

1400000

1600000

1800000

Scatterplot for Imports Expenditure against GDP

GDP

Impors Expenditure

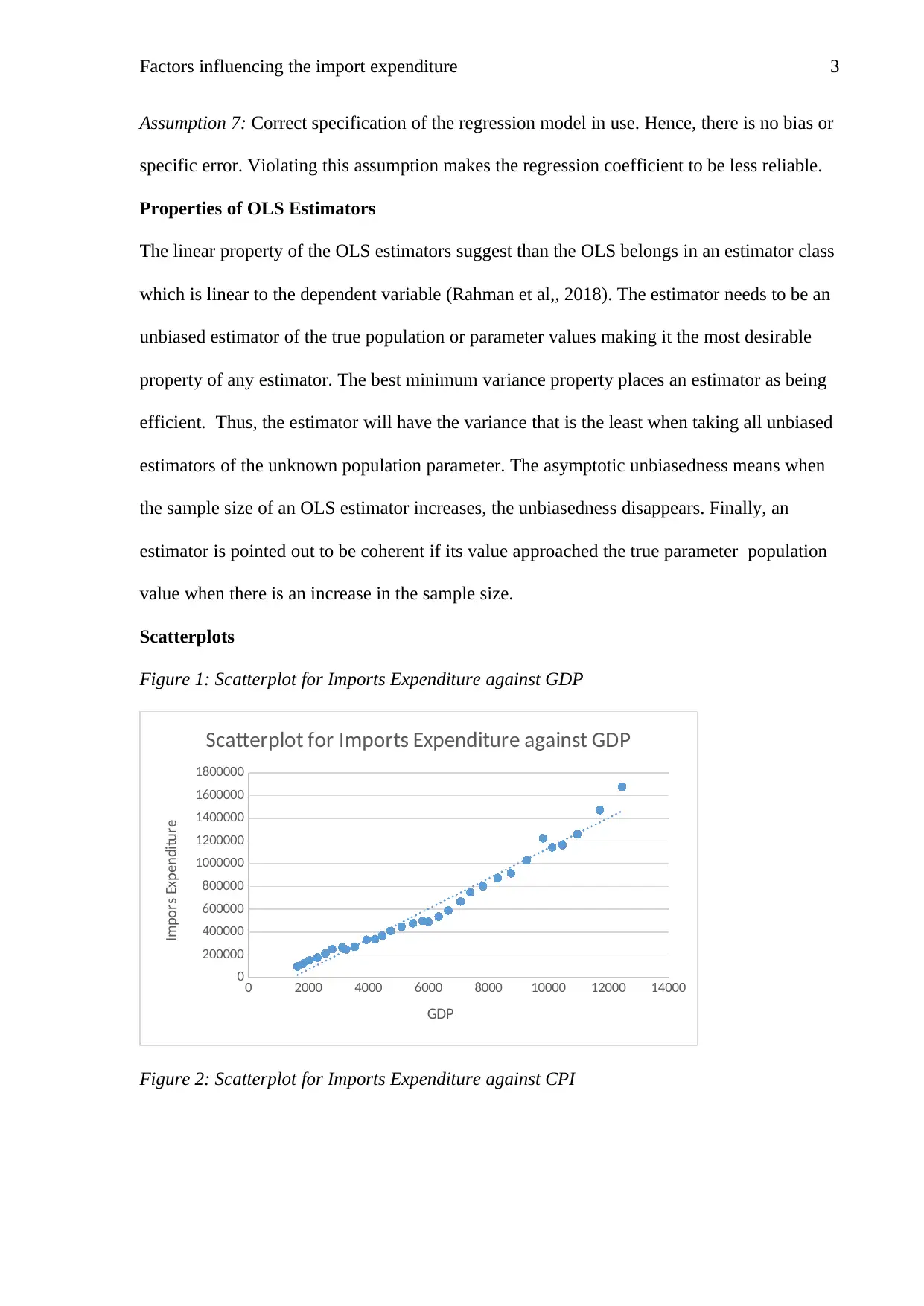

Figure 2: Scatterplot for Imports Expenditure against CPI

Assumption 7: Correct specification of the regression model in use. Hence, there is no bias or

specific error. Violating this assumption makes the regression coefficient to be less reliable.

Properties of OLS Estimators

The linear property of the OLS estimators suggest than the OLS belongs in an estimator class

which is linear to the dependent variable (Rahman et al,, 2018). The estimator needs to be an

unbiased estimator of the true population or parameter values making it the most desirable

property of any estimator. The best minimum variance property places an estimator as being

efficient. Thus, the estimator will have the variance that is the least when taking all unbiased

estimators of the unknown population parameter. The asymptotic unbiasedness means when

the sample size of an OLS estimator increases, the unbiasedness disappears. Finally, an

estimator is pointed out to be coherent if its value approached the true parameter population

value when there is an increase in the sample size.

Scatterplots

Figure 1: Scatterplot for Imports Expenditure against GDP

0 2000 4000 6000 8000 10000 12000 14000

0

200000

400000

600000

800000

1000000

1200000

1400000

1600000

1800000

Scatterplot for Imports Expenditure against GDP

GDP

Impors Expenditure

Figure 2: Scatterplot for Imports Expenditure against CPI

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Factors influencing the import expenditure 4

40 60 80 100 120 140 160 180 200 220

0

200000

400000

600000

800000

1000000

1200000

1400000

1600000

1800000

Scatterplot for Imports Expenditure against CPI

CPI

Imports Expenditure

There exists a linear relationship between imports expenditure and CPI and imports

expenditure and GDP since the estimated regression lines are linear. Conversely, the

correlation coefficients of the two can be deduced to be between 0 and 1.

Relationship between imports expenditure and GDP

The estimated regression equation is:

IMPORTS=133.36*GDP–195,427.9

The import expenditure when all other factors are kept constant is -195,427.9 units. Notably,

a unit increase in GDP leads to a 133.36 unit increase in the import expenditure.

The developed hypothesis of the slope coefficient is as shown below:

H0: There is no association between Imports expenditure and GDP

H1: There is an association between Imports expenditure and GDP

From the output, it is seen that the p-value of the slope coefficient is less than the significance

level (p<0.05).

40 60 80 100 120 140 160 180 200 220

0

200000

400000

600000

800000

1000000

1200000

1400000

1600000

1800000

Scatterplot for Imports Expenditure against CPI

CPI

Imports Expenditure

There exists a linear relationship between imports expenditure and CPI and imports

expenditure and GDP since the estimated regression lines are linear. Conversely, the

correlation coefficients of the two can be deduced to be between 0 and 1.

Relationship between imports expenditure and GDP

The estimated regression equation is:

IMPORTS=133.36*GDP–195,427.9

The import expenditure when all other factors are kept constant is -195,427.9 units. Notably,

a unit increase in GDP leads to a 133.36 unit increase in the import expenditure.

The developed hypothesis of the slope coefficient is as shown below:

H0: There is no association between Imports expenditure and GDP

H1: There is an association between Imports expenditure and GDP

From the output, it is seen that the p-value of the slope coefficient is less than the significance

level (p<0.05).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Factors influencing the import expenditure 5

Since the p-value lies in the rejection region, we choose to reject the null hypothesis. Hence,

there is a statistically significant relationship between imports expenditure and GDP.

Coefficient of Determination

The R2 is 0.97. Hence, 97% of the variability in the model is accounted for by factors within

the model while 3% is accounted for by factors not within the model.

The hypotheses developed for the F-test for the explanatory power of the model are:

H0: Model with no independent variables fits the data together with the model

H1: The model with an independent variable fits the data better than the model with an

intercept only

The value of the F-statistic was 933.69, as shown in the output summary table. Consequently,

the p-value of the f-statistic was 0.00.

Since p<0.05, we choose to reject the null hypothesis. Hence, the model with an independent

variable fits the data better than the model with an intercept only.

Since the p-value lies in the rejection region, we choose to reject the null hypothesis. Hence,

there is a statistically significant relationship between imports expenditure and GDP.

Coefficient of Determination

The R2 is 0.97. Hence, 97% of the variability in the model is accounted for by factors within

the model while 3% is accounted for by factors not within the model.

The hypotheses developed for the F-test for the explanatory power of the model are:

H0: Model with no independent variables fits the data together with the model

H1: The model with an independent variable fits the data better than the model with an

intercept only

The value of the F-statistic was 933.69, as shown in the output summary table. Consequently,

the p-value of the f-statistic was 0.00.

Since p<0.05, we choose to reject the null hypothesis. Hence, the model with an independent

variable fits the data better than the model with an intercept only.

Factors influencing the import expenditure 6

Relationship between imports expenditure and CPI

The estimated regression equation is:

IMPORTS=9,545.7*CPI–595,264

The import expenditure when all other factors are kept constant is -595,264 units. Moreover,

a unit increase in CPI leads to a 9,545.7 unit increase in the import expenditure.

The developed hypothesis of the slope coefficient statistical significance is as shown below:

H0: IMPORTS = CPI

H1: IMPORTS ≠ CPI

The p-value of the slope coefficient is less than the significance level (p<0.05).

Since the p-value lies in the rejection region, we choose to reject the null hypothesis. Hence,

there is a relationship between imports expenditure and CPI.

Coefficient of Determination

The R2 is 0.88. Hence, 88% of the variability in the model is accounted for by factors within

the model while 12% is accounted by factors which are not within the model.

The hypotheses developed for the F-test for the explanatory power of the model are:

H0: Model with no independent variables fits the data together with the model

H1: The model with an independent variable fits the data better than the model with an

intercept only

The value of the F-statistic and its p-value were 209.94 and 0.00 respectively.

Relationship between imports expenditure and CPI

The estimated regression equation is:

IMPORTS=9,545.7*CPI–595,264

The import expenditure when all other factors are kept constant is -595,264 units. Moreover,

a unit increase in CPI leads to a 9,545.7 unit increase in the import expenditure.

The developed hypothesis of the slope coefficient statistical significance is as shown below:

H0: IMPORTS = CPI

H1: IMPORTS ≠ CPI

The p-value of the slope coefficient is less than the significance level (p<0.05).

Since the p-value lies in the rejection region, we choose to reject the null hypothesis. Hence,

there is a relationship between imports expenditure and CPI.

Coefficient of Determination

The R2 is 0.88. Hence, 88% of the variability in the model is accounted for by factors within

the model while 12% is accounted by factors which are not within the model.

The hypotheses developed for the F-test for the explanatory power of the model are:

H0: Model with no independent variables fits the data together with the model

H1: The model with an independent variable fits the data better than the model with an

intercept only

The value of the F-statistic and its p-value were 209.94 and 0.00 respectively.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Factors influencing the import expenditure 7

Since p<0.05, we choose to reject the null hypothesis. Hence, model with an independent

variable fits the data better than the model with an intercept only.

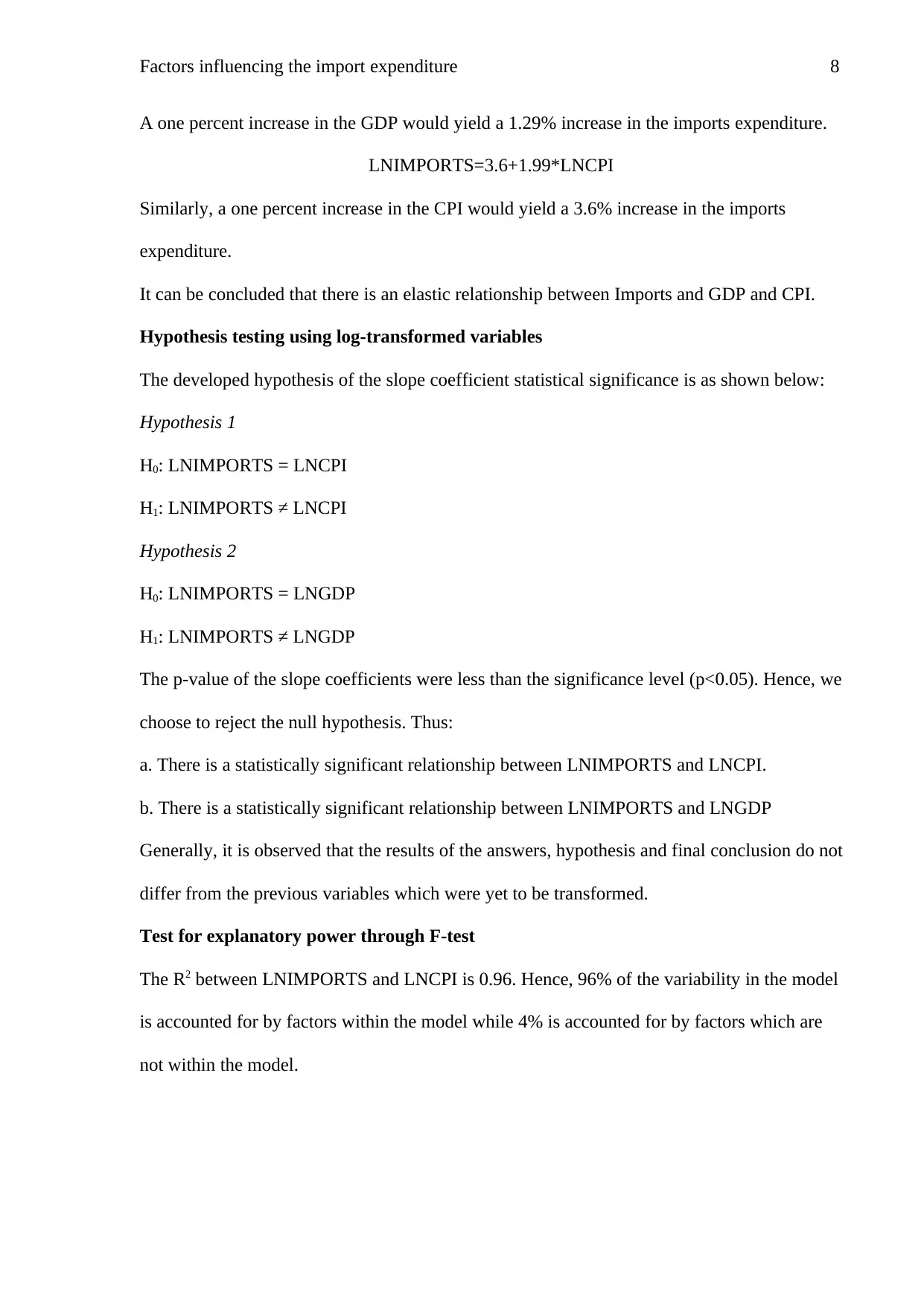

Predicted Import Expenditure

Sample regression equation (1) is as shown:

IMPORTS=133.36*GDP–195,427.9

The predicted import expenditure for years 2010, 2011 and 2012 are as shown in the table

below.

Table 1: Imports prediction from model

Unlike the actual imports expenditure, the predicted imports expenditure is seen to be

increasing linearly whereas the actual imports fluctuated within the three years. Hence, the

predicted model is linear in nature and does not consider uncertainties in the market.

Regression through function forms

The slope coefficients in both simple linear regressions mean that the two variables are a

function of the dependent variable as both models have shown that they are positive. Hence,

they are meaningful in the context of import expenditure and CPI and GDP.

Different function forms were adopted by taking the natural logarithm of all variables.

LNIMPORTS=2+1.29*LNGDP

Since p<0.05, we choose to reject the null hypothesis. Hence, model with an independent

variable fits the data better than the model with an intercept only.

Predicted Import Expenditure

Sample regression equation (1) is as shown:

IMPORTS=133.36*GDP–195,427.9

The predicted import expenditure for years 2010, 2011 and 2012 are as shown in the table

below.

Table 1: Imports prediction from model

Unlike the actual imports expenditure, the predicted imports expenditure is seen to be

increasing linearly whereas the actual imports fluctuated within the three years. Hence, the

predicted model is linear in nature and does not consider uncertainties in the market.

Regression through function forms

The slope coefficients in both simple linear regressions mean that the two variables are a

function of the dependent variable as both models have shown that they are positive. Hence,

they are meaningful in the context of import expenditure and CPI and GDP.

Different function forms were adopted by taking the natural logarithm of all variables.

LNIMPORTS=2+1.29*LNGDP

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Factors influencing the import expenditure 8

A one percent increase in the GDP would yield a 1.29% increase in the imports expenditure.

LNIMPORTS=3.6+1.99*LNCPI

Similarly, a one percent increase in the CPI would yield a 3.6% increase in the imports

expenditure.

It can be concluded that there is an elastic relationship between Imports and GDP and CPI.

Hypothesis testing using log-transformed variables

The developed hypothesis of the slope coefficient statistical significance is as shown below:

Hypothesis 1

H0: LNIMPORTS = LNCPI

H1: LNIMPORTS ≠ LNCPI

Hypothesis 2

H0: LNIMPORTS = LNGDP

H1: LNIMPORTS ≠ LNGDP

The p-value of the slope coefficients were less than the significance level (p<0.05). Hence, we

choose to reject the null hypothesis. Thus:

a. There is a statistically significant relationship between LNIMPORTS and LNCPI.

b. There is a statistically significant relationship between LNIMPORTS and LNGDP

Generally, it is observed that the results of the answers, hypothesis and final conclusion do not

differ from the previous variables which were yet to be transformed.

Test for explanatory power through F-test

The R2 between LNIMPORTS and LNCPI is 0.96. Hence, 96% of the variability in the model

is accounted for by factors within the model while 4% is accounted for by factors which are

not within the model.

A one percent increase in the GDP would yield a 1.29% increase in the imports expenditure.

LNIMPORTS=3.6+1.99*LNCPI

Similarly, a one percent increase in the CPI would yield a 3.6% increase in the imports

expenditure.

It can be concluded that there is an elastic relationship between Imports and GDP and CPI.

Hypothesis testing using log-transformed variables

The developed hypothesis of the slope coefficient statistical significance is as shown below:

Hypothesis 1

H0: LNIMPORTS = LNCPI

H1: LNIMPORTS ≠ LNCPI

Hypothesis 2

H0: LNIMPORTS = LNGDP

H1: LNIMPORTS ≠ LNGDP

The p-value of the slope coefficients were less than the significance level (p<0.05). Hence, we

choose to reject the null hypothesis. Thus:

a. There is a statistically significant relationship between LNIMPORTS and LNCPI.

b. There is a statistically significant relationship between LNIMPORTS and LNGDP

Generally, it is observed that the results of the answers, hypothesis and final conclusion do not

differ from the previous variables which were yet to be transformed.

Test for explanatory power through F-test

The R2 between LNIMPORTS and LNCPI is 0.96. Hence, 96% of the variability in the model

is accounted for by factors within the model while 4% is accounted for by factors which are

not within the model.

Factors influencing the import expenditure 9

Conversely, the R2 between LNIMPORTS and LNGDP is 0.989. Thus, 98.9% of the

variability in the model is accounted by factors within the model while 1.1% is accounted by

factors which are not within the model.

The hypotheses developed for the two F-test for the explanatory power of the model are:

H0: Model with no independent variables fits the data together with the model

H1: The model with an independent variable fits the data better than the model with an

intercept only

The values of the F-statistic and the p-value were 750.46 and 0.00; and 2686.48 and 0.00

respectively. Since p<0.05, we choose to reject the null hypothesis. Hence, the model with an

independent variable fits the data better than the model with an intercept only.

Appropriate functional form

The regression functional form with the log-transformed variable is better and more

appropriate. The R2 of the two simple linear regression increased once the variables were

transformed. Thus, the regression was able to contain majority of the variability while the

instances of variabilities being explained by factors not within the model being minimised.

Part (B): Multiple Regression Analysis

Multiple Regression using the log-transformed variables

LNIMPORTS=1.41+1.85*LNGDP+0.87*LNCPI

All factors kept constant, a 1% increase in the GDP would yield a 1.85% increase in the

imports expenditure. However, keeping all factors constant, a 1% increase in the CPI yields a

0.87% decrease in the imports expenditure.

Comparing LNGDP in simple linear regression and multiple regression

The R2 of LNGDP are not different since they both have a positive influence on the log

transformed Imports expenditure. Consequently, the two coefficients remain to be statistically

significant influencers of LNGDP.

Conversely, the R2 between LNIMPORTS and LNGDP is 0.989. Thus, 98.9% of the

variability in the model is accounted by factors within the model while 1.1% is accounted by

factors which are not within the model.

The hypotheses developed for the two F-test for the explanatory power of the model are:

H0: Model with no independent variables fits the data together with the model

H1: The model with an independent variable fits the data better than the model with an

intercept only

The values of the F-statistic and the p-value were 750.46 and 0.00; and 2686.48 and 0.00

respectively. Since p<0.05, we choose to reject the null hypothesis. Hence, the model with an

independent variable fits the data better than the model with an intercept only.

Appropriate functional form

The regression functional form with the log-transformed variable is better and more

appropriate. The R2 of the two simple linear regression increased once the variables were

transformed. Thus, the regression was able to contain majority of the variability while the

instances of variabilities being explained by factors not within the model being minimised.

Part (B): Multiple Regression Analysis

Multiple Regression using the log-transformed variables

LNIMPORTS=1.41+1.85*LNGDP+0.87*LNCPI

All factors kept constant, a 1% increase in the GDP would yield a 1.85% increase in the

imports expenditure. However, keeping all factors constant, a 1% increase in the CPI yields a

0.87% decrease in the imports expenditure.

Comparing LNGDP in simple linear regression and multiple regression

The R2 of LNGDP are not different since they both have a positive influence on the log

transformed Imports expenditure. Consequently, the two coefficients remain to be statistically

significant influencers of LNGDP.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Factors influencing the import expenditure 10

The R2 from the multiple regression model is 0.992. Hence 99.2% of the variability is

explained by factors within the model while 0.8% is explained by factors not within the

model.

The R2 from the estimated linear regression of LNIMPORTS on LNGDP is 0.989 while the

one calculated in the multiple regression is 0.992. The multiple regression with the

transformed variable is the most appropriate since its R2 is greater than the coefficient of

determination of LNIMPORTS on LNGDP.

Significance of correlation coefficients

The developed hypothesis of the slope coefficient of LNGDP is as shown below:

H0: β2=0

H1: β2≠0

From the output, the p-value of the slope coefficient is less than the significance level

(p<0.05).

Since the p-value lies in the rejection region, we choose to reject the null hypothesis. Hence,

the LNGDP correlation coefficient is statistically significant.

The developed hypothesis of the slope coefficient of LNCPI is as shown below:

H0: β3 = 0

H1: β3 ≠ 0

The R2 from the multiple regression model is 0.992. Hence 99.2% of the variability is

explained by factors within the model while 0.8% is explained by factors not within the

model.

The R2 from the estimated linear regression of LNIMPORTS on LNGDP is 0.989 while the

one calculated in the multiple regression is 0.992. The multiple regression with the

transformed variable is the most appropriate since its R2 is greater than the coefficient of

determination of LNIMPORTS on LNGDP.

Significance of correlation coefficients

The developed hypothesis of the slope coefficient of LNGDP is as shown below:

H0: β2=0

H1: β2≠0

From the output, the p-value of the slope coefficient is less than the significance level

(p<0.05).

Since the p-value lies in the rejection region, we choose to reject the null hypothesis. Hence,

the LNGDP correlation coefficient is statistically significant.

The developed hypothesis of the slope coefficient of LNCPI is as shown below:

H0: β3 = 0

H1: β3 ≠ 0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Factors influencing the import expenditure 11

From the output, the p-value of the slope coefficient is less than the significance level

(p<0.05). Since the p-value lies in the rejection region, we choose to reject the null

hypothesis. Hence, the LNCPI correlation coefficient is statistically significant.

F-test of Overall Significance

The hypotheses developed for the F-test for the explanatory power of the model are:

H0: Model with no independent variables fits the data together with the model

H1: The model with an independent variable fits the data better than the model with an

intercept only

The value of the F-statistic and its p-value were 1,737.19 and 0.00 respectively.

Since p<0.05, we choose to reject the null hypothesis. Hence, the model with an independent

variable fits the data better than the model with an intercept only.

Conclusion

The study found out that the there is a linear relationship between the imports expenditure and

CPI and GDP. All the regression models in parts A and B were valid since the models were

statistically significant at the significance level of 0.05. The two regression models were

meaningful. However, the regression model with the log-transformed variables has more

meaningful answers since the coefficient of determination is higher than the model without

the log transformed variables. On the other hand, it was noted that using a multiple regression

analysis improves the results and their reliability due to the increase in the value of the

coefficient of determination.

From the output, the p-value of the slope coefficient is less than the significance level

(p<0.05). Since the p-value lies in the rejection region, we choose to reject the null

hypothesis. Hence, the LNCPI correlation coefficient is statistically significant.

F-test of Overall Significance

The hypotheses developed for the F-test for the explanatory power of the model are:

H0: Model with no independent variables fits the data together with the model

H1: The model with an independent variable fits the data better than the model with an

intercept only

The value of the F-statistic and its p-value were 1,737.19 and 0.00 respectively.

Since p<0.05, we choose to reject the null hypothesis. Hence, the model with an independent

variable fits the data better than the model with an intercept only.

Conclusion

The study found out that the there is a linear relationship between the imports expenditure and

CPI and GDP. All the regression models in parts A and B were valid since the models were

statistically significant at the significance level of 0.05. The two regression models were

meaningful. However, the regression model with the log-transformed variables has more

meaningful answers since the coefficient of determination is higher than the model without

the log transformed variables. On the other hand, it was noted that using a multiple regression

analysis improves the results and their reliability due to the increase in the value of the

coefficient of determination.

Factors influencing the import expenditure 12

Reference

Hose, D. and Hanss, M., 2019. Fuzzy linear least squares for the identification of possibilistic

regression models. Fuzzy Sets and Systems, 367, pp.82-95.

Rahman, M.N., Das, S., Yadav, I., Kumar, P., Sophia, S.F., Gayathri, J., Mirabi, V.R.,

Ardestani, A.S., Pirbasti, M.F., Rao, P.H. and Arora, H., 2018. Macroeconomic

variables of India and finite sample properties of OLS under classical

assumptions. Pacific Business Review International, 10(8), pp.7-14.

Reference

Hose, D. and Hanss, M., 2019. Fuzzy linear least squares for the identification of possibilistic

regression models. Fuzzy Sets and Systems, 367, pp.82-95.

Rahman, M.N., Das, S., Yadav, I., Kumar, P., Sophia, S.F., Gayathri, J., Mirabi, V.R.,

Ardestani, A.S., Pirbasti, M.F., Rao, P.H. and Arora, H., 2018. Macroeconomic

variables of India and finite sample properties of OLS under classical

assumptions. Pacific Business Review International, 10(8), pp.7-14.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.