FIN80005 Corporate Financial Management: Investment Decision Analysis

VerifiedAdded on 2023/06/14

|12

|2276

|237

Report

AI Summary

This report examines the feasibility of a balloon replacement project for Branson Ltd, utilizing capital budgeting techniques such as Net Present Value (NPV), Internal Rate of Return (IRR), Accounting Rate of Return (ARR), payback period, and present value index. Two scenarios are analyzed: replacing the current balloon with a small balloon and replacing it with a large balloon. The analysis reveals that the small balloon option has a positive NPV and IRR, while the large balloon option has a negative NPV and IRR. Therefore, the report recommends that Branson Ltd should opt for replacing the current balloon with the small balloon based on the capital budgeting analysis performed. The report also includes calculations for WACC and sensitivity analysis.

1

FIN80005 Corporate Financial Management - Individual

FIN80005 Corporate Financial Management - Individual

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Executive Summary

The report has been undertaken for examining the feasibility of the replacement project

of current balloons with large and small balloons by Branson Ltd. The report has examined the

feasibility of both the scenarios through the use of capital budgeting techniques. In this context,

the capital budgeting techniques of Net Present Value (NPV), Internal Rate of Return (IRR),

Accounting Rate of Return (ARR), payback period and present value index is applied for

assessing the potential profitability of both the type of investment options planned to be

undertaken by the company. The first scenario analyzes the feasibility of replacement of current

balloon with the small balloon whereas the second scenario analyses feasibility of replacing it

with large balloon. It has been calculated through the use of capital budgeting techniques that

small balloon option has a positive NPV and IRR whereas the option of large balloon is

associated with negative NPV and IRR and therefore the option of replacing current balloon with

small balloon should be selected by the company.

Executive Summary

The report has been undertaken for examining the feasibility of the replacement project

of current balloons with large and small balloons by Branson Ltd. The report has examined the

feasibility of both the scenarios through the use of capital budgeting techniques. In this context,

the capital budgeting techniques of Net Present Value (NPV), Internal Rate of Return (IRR),

Accounting Rate of Return (ARR), payback period and present value index is applied for

assessing the potential profitability of both the type of investment options planned to be

undertaken by the company. The first scenario analyzes the feasibility of replacement of current

balloon with the small balloon whereas the second scenario analyses feasibility of replacing it

with large balloon. It has been calculated through the use of capital budgeting techniques that

small balloon option has a positive NPV and IRR whereas the option of large balloon is

associated with negative NPV and IRR and therefore the option of replacing current balloon with

small balloon should be selected by the company.

3

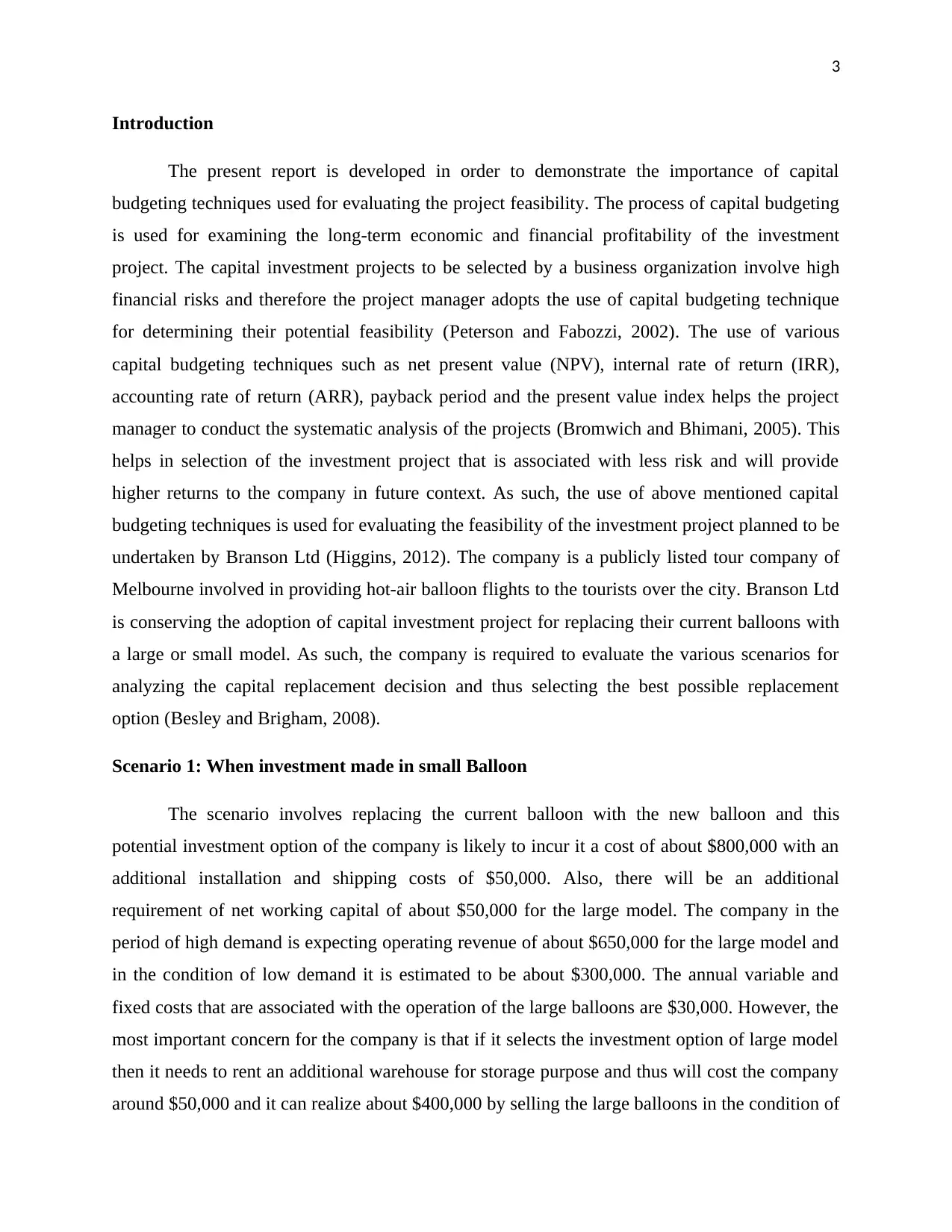

Introduction

The present report is developed in order to demonstrate the importance of capital

budgeting techniques used for evaluating the project feasibility. The process of capital budgeting

is used for examining the long-term economic and financial profitability of the investment

project. The capital investment projects to be selected by a business organization involve high

financial risks and therefore the project manager adopts the use of capital budgeting technique

for determining their potential feasibility (Peterson and Fabozzi, 2002). The use of various

capital budgeting techniques such as net present value (NPV), internal rate of return (IRR),

accounting rate of return (ARR), payback period and the present value index helps the project

manager to conduct the systematic analysis of the projects (Bromwich and Bhimani, 2005). This

helps in selection of the investment project that is associated with less risk and will provide

higher returns to the company in future context. As such, the use of above mentioned capital

budgeting techniques is used for evaluating the feasibility of the investment project planned to be

undertaken by Branson Ltd (Higgins, 2012). The company is a publicly listed tour company of

Melbourne involved in providing hot-air balloon flights to the tourists over the city. Branson Ltd

is conserving the adoption of capital investment project for replacing their current balloons with

a large or small model. As such, the company is required to evaluate the various scenarios for

analyzing the capital replacement decision and thus selecting the best possible replacement

option (Besley and Brigham, 2008).

Scenario 1: When investment made in small Balloon

The scenario involves replacing the current balloon with the new balloon and this

potential investment option of the company is likely to incur it a cost of about $800,000 with an

additional installation and shipping costs of $50,000. Also, there will be an additional

requirement of net working capital of about $50,000 for the large model. The company in the

period of high demand is expecting operating revenue of about $650,000 for the large model and

in the condition of low demand it is estimated to be about $300,000. The annual variable and

fixed costs that are associated with the operation of the large balloons are $30,000. However, the

most important concern for the company is that if it selects the investment option of large model

then it needs to rent an additional warehouse for storage purpose and thus will cost the company

around $50,000 and it can realize about $400,000 by selling the large balloons in the condition of

Introduction

The present report is developed in order to demonstrate the importance of capital

budgeting techniques used for evaluating the project feasibility. The process of capital budgeting

is used for examining the long-term economic and financial profitability of the investment

project. The capital investment projects to be selected by a business organization involve high

financial risks and therefore the project manager adopts the use of capital budgeting technique

for determining their potential feasibility (Peterson and Fabozzi, 2002). The use of various

capital budgeting techniques such as net present value (NPV), internal rate of return (IRR),

accounting rate of return (ARR), payback period and the present value index helps the project

manager to conduct the systematic analysis of the projects (Bromwich and Bhimani, 2005). This

helps in selection of the investment project that is associated with less risk and will provide

higher returns to the company in future context. As such, the use of above mentioned capital

budgeting techniques is used for evaluating the feasibility of the investment project planned to be

undertaken by Branson Ltd (Higgins, 2012). The company is a publicly listed tour company of

Melbourne involved in providing hot-air balloon flights to the tourists over the city. Branson Ltd

is conserving the adoption of capital investment project for replacing their current balloons with

a large or small model. As such, the company is required to evaluate the various scenarios for

analyzing the capital replacement decision and thus selecting the best possible replacement

option (Besley and Brigham, 2008).

Scenario 1: When investment made in small Balloon

The scenario involves replacing the current balloon with the new balloon and this

potential investment option of the company is likely to incur it a cost of about $800,000 with an

additional installation and shipping costs of $50,000. Also, there will be an additional

requirement of net working capital of about $50,000 for the large model. The company in the

period of high demand is expecting operating revenue of about $650,000 for the large model and

in the condition of low demand it is estimated to be about $300,000. The annual variable and

fixed costs that are associated with the operation of the large balloons are $30,000. However, the

most important concern for the company is that if it selects the investment option of large model

then it needs to rent an additional warehouse for storage purpose and thus will cost the company

around $50,000 and it can realize about $400,000 by selling the large balloons in the condition of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

business not profitable. As such, the use of capital budgeting techniques will help in determining

the feasibility of this investment option for determining whether it should be accepted or rejected

(Bierman and Smidt, 2007).

Scenario 2: When investment made in Large Balloon

This scenario analyses the investment option of selecting small model for replacement of

current balloon by the company. The initial capital investment expected to be incurred with the

selection of small model is about $500,000 and the installation cost will be about $30,000. The

working capital requirement is of about $50,000 and the operating revenue expected to be

realized is $300,000. The variable and fixed costs that will be incurred are $300,000 and in the

condition of the option undertaken to be not profitable the small balloons can be sold for $80,000

(Bierman, 2012).

Application of capital budgeting techniques in both scenarios

Calculation of WACC in order to find the discount rate

Debt Equity ratio 1.50

Debt proportion 0.60

Equity proportion 0.40

Equity

Average return on Company 8.37%

Average return on Market 9.13%

Average Risk free return 4.84%

Beta of Branson 1.56

Cost of Equity 11.54%

Debentures

Annual Coupon Rate 10%

Face Value

$

1,000.00

Duration 5 years

Similar Debenture yield 12%

business not profitable. As such, the use of capital budgeting techniques will help in determining

the feasibility of this investment option for determining whether it should be accepted or rejected

(Bierman and Smidt, 2007).

Scenario 2: When investment made in Large Balloon

This scenario analyses the investment option of selecting small model for replacement of

current balloon by the company. The initial capital investment expected to be incurred with the

selection of small model is about $500,000 and the installation cost will be about $30,000. The

working capital requirement is of about $50,000 and the operating revenue expected to be

realized is $300,000. The variable and fixed costs that will be incurred are $300,000 and in the

condition of the option undertaken to be not profitable the small balloons can be sold for $80,000

(Bierman, 2012).

Application of capital budgeting techniques in both scenarios

Calculation of WACC in order to find the discount rate

Debt Equity ratio 1.50

Debt proportion 0.60

Equity proportion 0.40

Equity

Average return on Company 8.37%

Average return on Market 9.13%

Average Risk free return 4.84%

Beta of Branson 1.56

Cost of Equity 11.54%

Debentures

Annual Coupon Rate 10%

Face Value

$

1,000.00

Duration 5 years

Similar Debenture yield 12%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

Market Price of Debenture

$

833.33

Annual Coupon Rate

$

100.00

Annual Effective Rate 8.40%

Calculation of WACC

Capital Weights Rate AT Weighted Cost

Debt Part 0.60 8.40% 5.04%

Equity Part 0.40 11.54% 4.62%

1.0000 9.66%

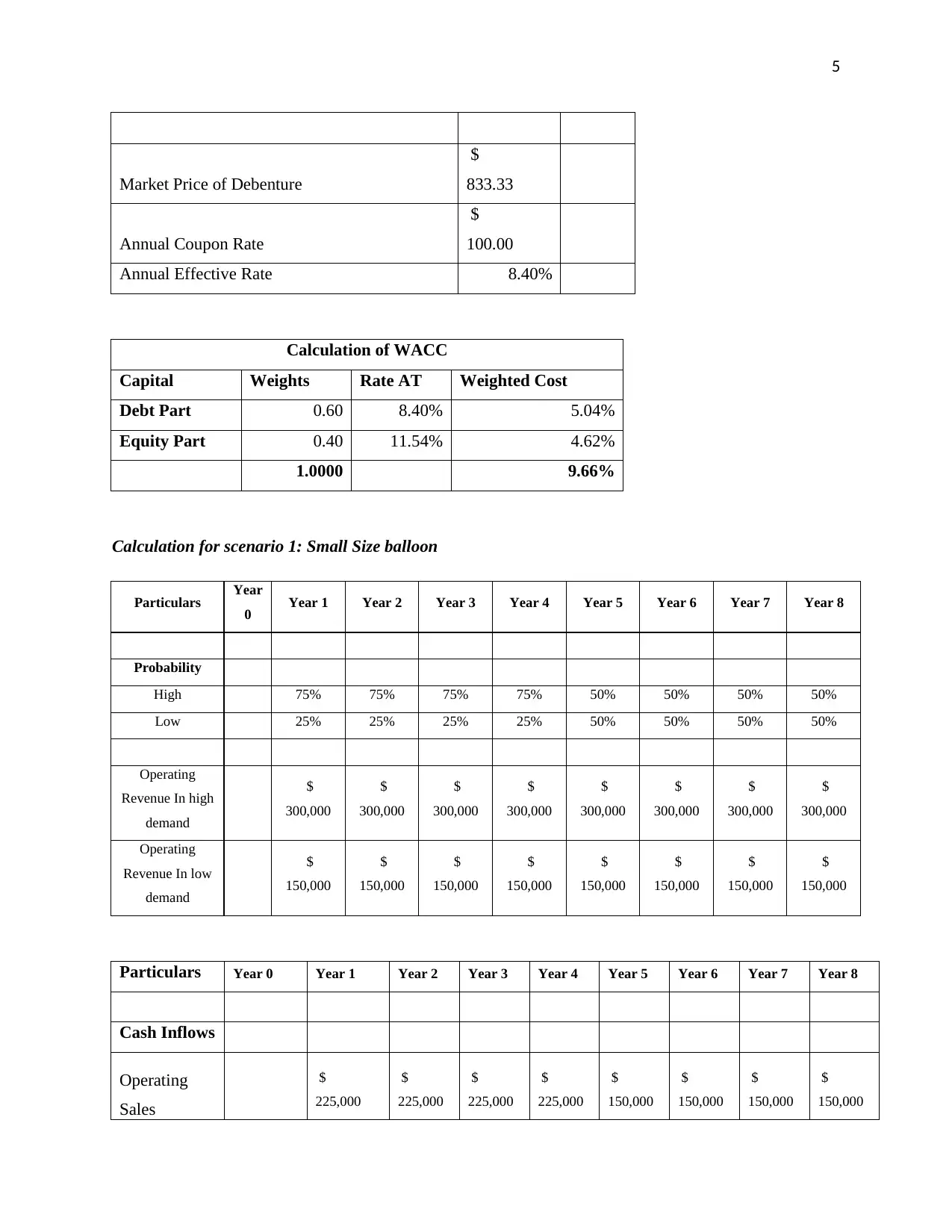

Calculation for scenario 1: Small Size balloon

Particulars Year

0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8

Probability

High 75% 75% 75% 75% 50% 50% 50% 50%

Low 25% 25% 25% 25% 50% 50% 50% 50%

Operating

Revenue In high

demand

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

Operating

Revenue In low

demand

$

150,000

$

150,000

$

150,000

$

150,000

$

150,000

$

150,000

$

150,000

$

150,000

Particulars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8

Cash Inflows

Operating

Sales

$

225,000

$

225,000

$

225,000

$

225,000

$

150,000

$

150,000

$

150,000

$

150,000

Market Price of Debenture

$

833.33

Annual Coupon Rate

$

100.00

Annual Effective Rate 8.40%

Calculation of WACC

Capital Weights Rate AT Weighted Cost

Debt Part 0.60 8.40% 5.04%

Equity Part 0.40 11.54% 4.62%

1.0000 9.66%

Calculation for scenario 1: Small Size balloon

Particulars Year

0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8

Probability

High 75% 75% 75% 75% 50% 50% 50% 50%

Low 25% 25% 25% 25% 50% 50% 50% 50%

Operating

Revenue In high

demand

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

Operating

Revenue In low

demand

$

150,000

$

150,000

$

150,000

$

150,000

$

150,000

$

150,000

$

150,000

$

150,000

Particulars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8

Cash Inflows

Operating

Sales

$

225,000

$

225,000

$

225,000

$

225,000

$

150,000

$

150,000

$

150,000

$

150,000

6

Revenue

(High

Demand)

Operating

Sales

Revenue Low

Demand)

$

37,500

$

37,500

$

37,500

$

37,500

$

75,000

$

75,000

$

75,000

$

75,000

Total Sales

$

262,500

$

262,500

$

262,500

$

262,500

$

225,000

$

225,000

$

225,000

$

225,000

Less:

Annual

Variable and

Fixed cost

$

120,000

$

120,000

$

120,000

$

120,000

$

120,000

$

120,000

$

120,000

$

120,000

Depreciation

$

106,000

$

84,800

$

67,840

$

54,272

$

43,418

$

34,734

$

27,787

$

22,230

Total

$

226,000

$

204,800

$

187,840

$

174,272

$

163,418

$

154,734

$

147,787

$

142,230

Profit Before

tax after dep

$

36,500

$

57,700

$

74,660

$

88,228

$

61,582

$

70,266

$

77,213

$

82,770

Less: Tax

$

10,950

$

17,310

$

22,398

$

26,468

$

18,475

$

21,080

$

23,164

$

24,831

Profit after

tax after dep

$

25,550

$

40,390

$

52,262

$

61,760

$

43,108

$

49,186

$

54,049

$

57,939

Add:

Depreciation

$

106,000

$

84,800

$

67,840

$

54,272

$

43,418

$

34,734

$

27,787

$

22,230

Profit before

dep after tax

$

131,550

$

125,190

$

120,102

$

116,032

$

86,525

$

83,920

$

81,836

$

80,169

Salvage of

Balloon

$

30,000

Working

Capital

Recover

$

30,000

Revenue

(High

Demand)

Operating

Sales

Revenue Low

Demand)

$

37,500

$

37,500

$

37,500

$

37,500

$

75,000

$

75,000

$

75,000

$

75,000

Total Sales

$

262,500

$

262,500

$

262,500

$

262,500

$

225,000

$

225,000

$

225,000

$

225,000

Less:

Annual

Variable and

Fixed cost

$

120,000

$

120,000

$

120,000

$

120,000

$

120,000

$

120,000

$

120,000

$

120,000

Depreciation

$

106,000

$

84,800

$

67,840

$

54,272

$

43,418

$

34,734

$

27,787

$

22,230

Total

$

226,000

$

204,800

$

187,840

$

174,272

$

163,418

$

154,734

$

147,787

$

142,230

Profit Before

tax after dep

$

36,500

$

57,700

$

74,660

$

88,228

$

61,582

$

70,266

$

77,213

$

82,770

Less: Tax

$

10,950

$

17,310

$

22,398

$

26,468

$

18,475

$

21,080

$

23,164

$

24,831

Profit after

tax after dep

$

25,550

$

40,390

$

52,262

$

61,760

$

43,108

$

49,186

$

54,049

$

57,939

Add:

Depreciation

$

106,000

$

84,800

$

67,840

$

54,272

$

43,418

$

34,734

$

27,787

$

22,230

Profit before

dep after tax

$

131,550

$

125,190

$

120,102

$

116,032

$

86,525

$

83,920

$

81,836

$

80,169

Salvage of

Balloon

$

30,000

Working

Capital

Recover

$

30,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

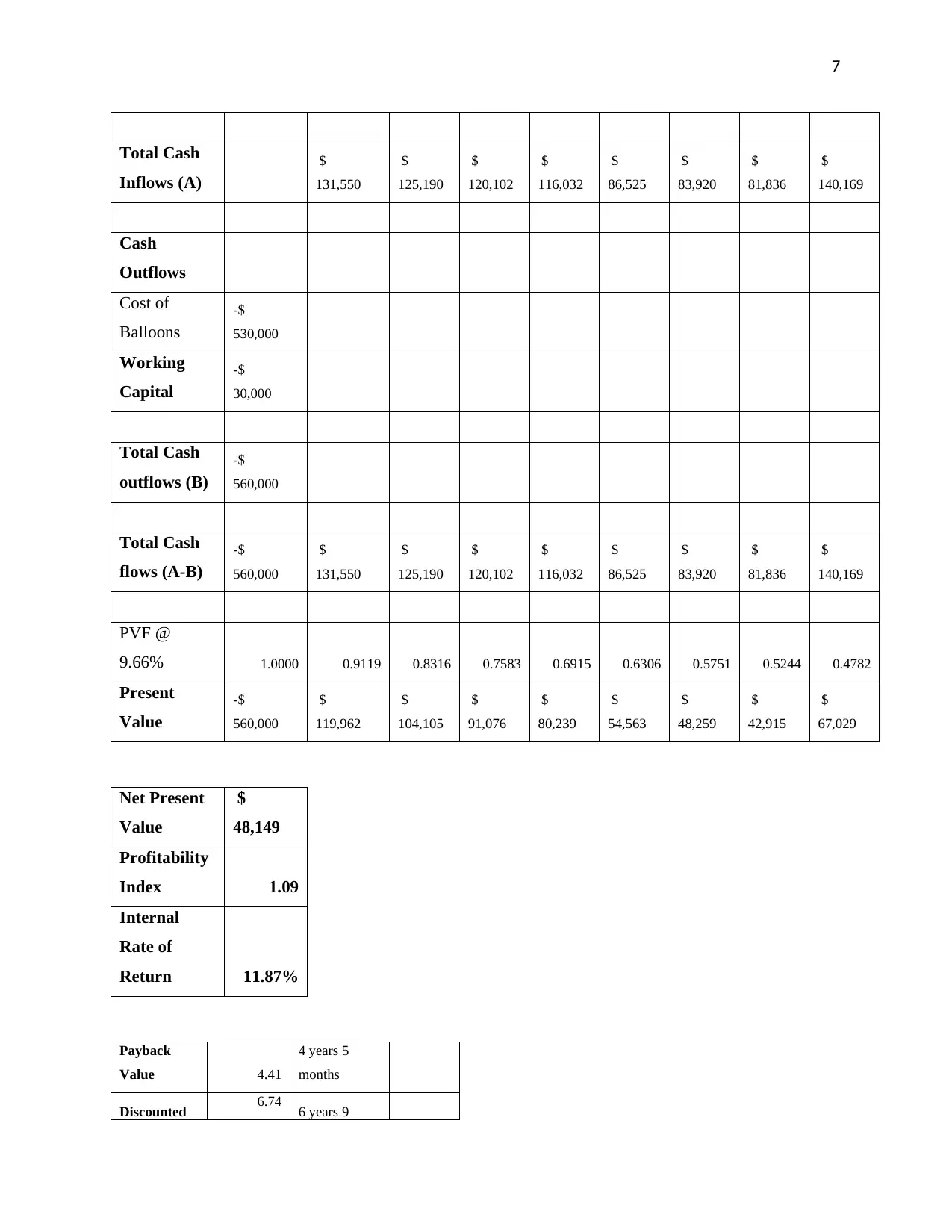

7

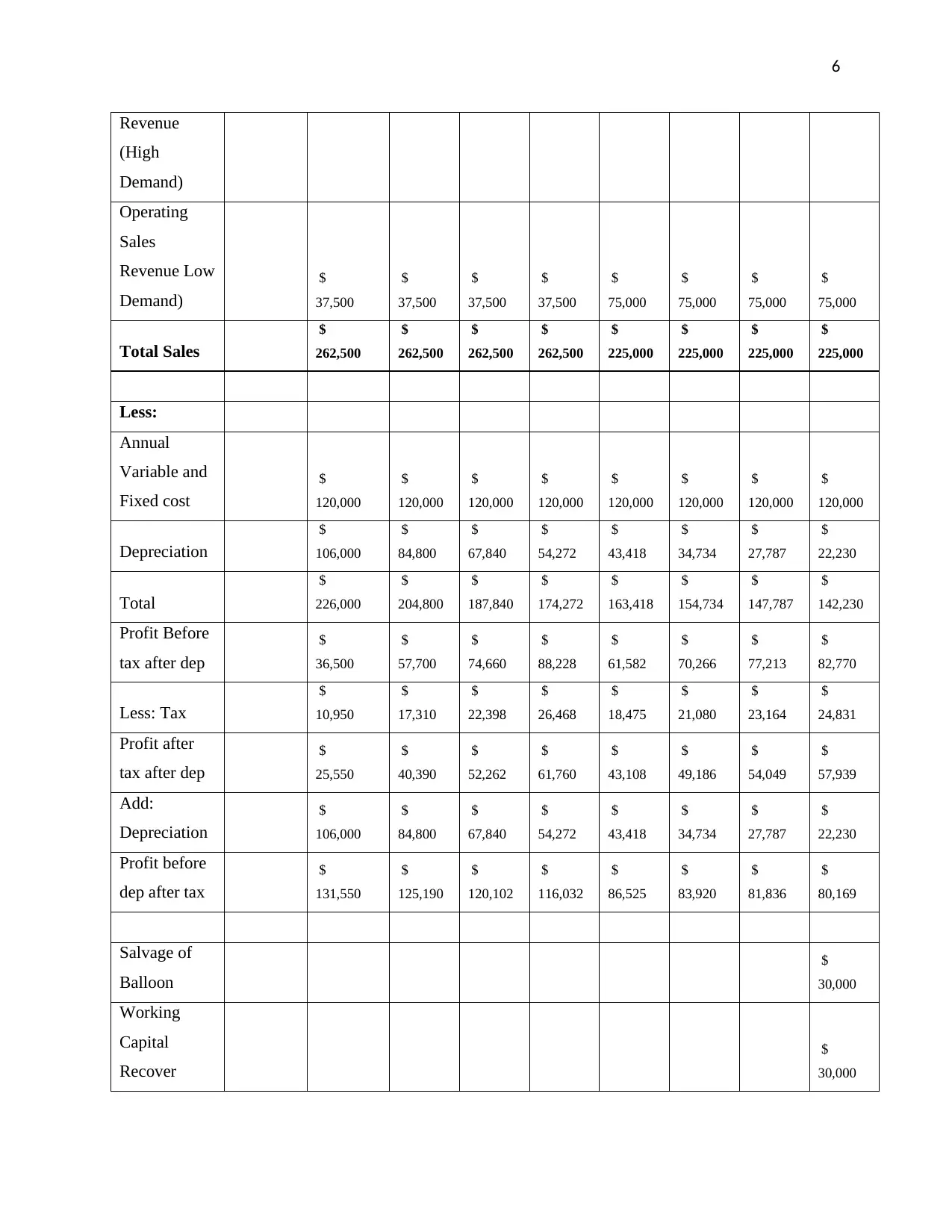

Total Cash

Inflows (A)

$

131,550

$

125,190

$

120,102

$

116,032

$

86,525

$

83,920

$

81,836

$

140,169

Cash

Outflows

Cost of

Balloons

-$

530,000

Working

Capital

-$

30,000

Total Cash

outflows (B)

-$

560,000

Total Cash

flows (A-B)

-$

560,000

$

131,550

$

125,190

$

120,102

$

116,032

$

86,525

$

83,920

$

81,836

$

140,169

PVF @

9.66% 1.0000 0.9119 0.8316 0.7583 0.6915 0.6306 0.5751 0.5244 0.4782

Present

Value

-$

560,000

$

119,962

$

104,105

$

91,076

$

80,239

$

54,563

$

48,259

$

42,915

$

67,029

Net Present

Value

$

48,149

Profitability

Index 1.09

Internal

Rate of

Return 11.87%

Payback

Value 4.41

4 years 5

months

Discounted 6.74 6 years 9

Total Cash

Inflows (A)

$

131,550

$

125,190

$

120,102

$

116,032

$

86,525

$

83,920

$

81,836

$

140,169

Cash

Outflows

Cost of

Balloons

-$

530,000

Working

Capital

-$

30,000

Total Cash

outflows (B)

-$

560,000

Total Cash

flows (A-B)

-$

560,000

$

131,550

$

125,190

$

120,102

$

116,032

$

86,525

$

83,920

$

81,836

$

140,169

PVF @

9.66% 1.0000 0.9119 0.8316 0.7583 0.6915 0.6306 0.5751 0.5244 0.4782

Present

Value

-$

560,000

$

119,962

$

104,105

$

91,076

$

80,239

$

54,563

$

48,259

$

42,915

$

67,029

Net Present

Value

$

48,149

Profitability

Index 1.09

Internal

Rate of

Return 11.87%

Payback

Value 4.41

4 years 5

months

Discounted 6.74 6 years 9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

Payback

Value months

Average

investment

$

530,000

Average

accounting

income

$

103,166

Accounting

Rate of

Return 19.47%

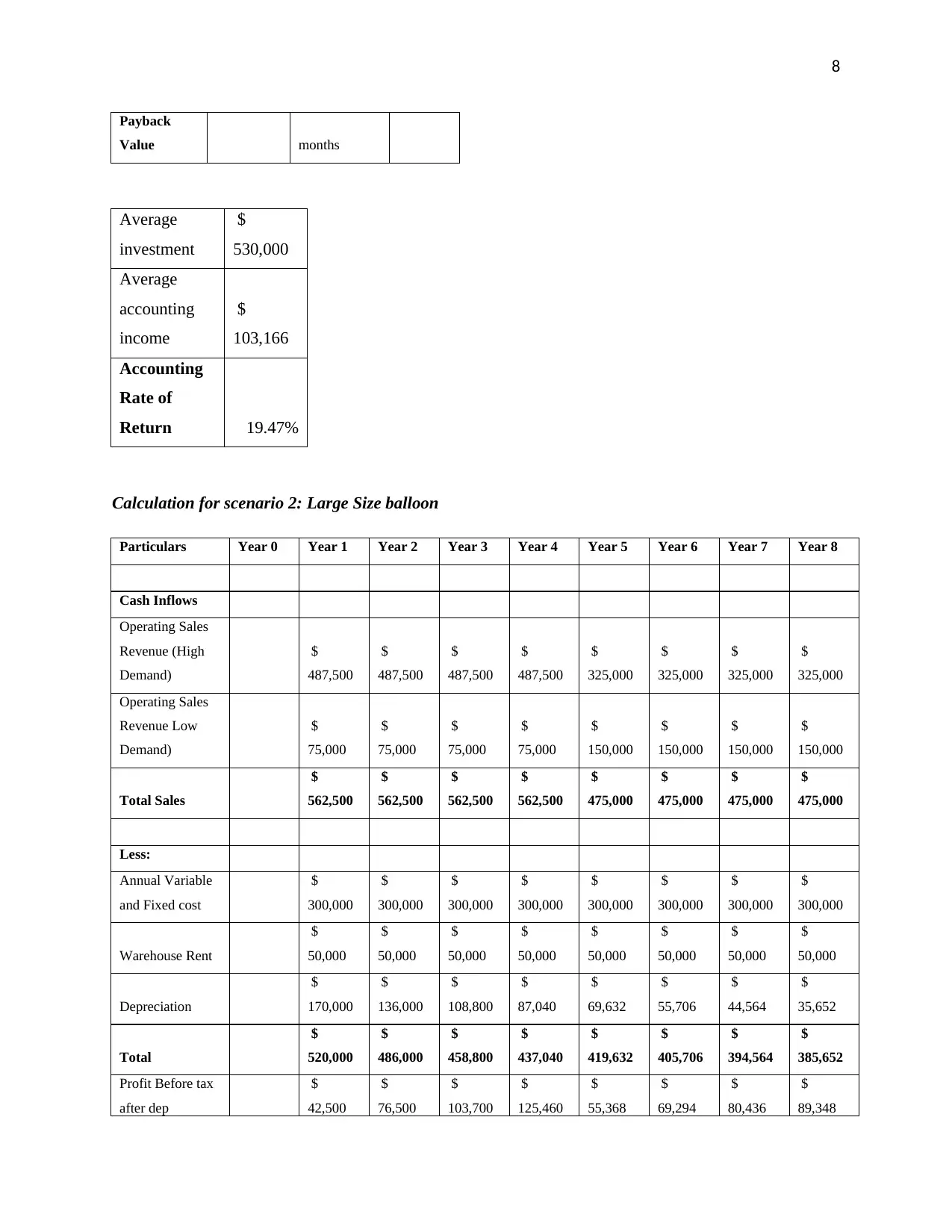

Calculation for scenario 2: Large Size balloon

Particulars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8

Cash Inflows

Operating Sales

Revenue (High

Demand)

$

487,500

$

487,500

$

487,500

$

487,500

$

325,000

$

325,000

$

325,000

$

325,000

Operating Sales

Revenue Low

Demand)

$

75,000

$

75,000

$

75,000

$

75,000

$

150,000

$

150,000

$

150,000

$

150,000

Total Sales

$

562,500

$

562,500

$

562,500

$

562,500

$

475,000

$

475,000

$

475,000

$

475,000

Less:

Annual Variable

and Fixed cost

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

Warehouse Rent

$

50,000

$

50,000

$

50,000

$

50,000

$

50,000

$

50,000

$

50,000

$

50,000

Depreciation

$

170,000

$

136,000

$

108,800

$

87,040

$

69,632

$

55,706

$

44,564

$

35,652

Total

$

520,000

$

486,000

$

458,800

$

437,040

$

419,632

$

405,706

$

394,564

$

385,652

Profit Before tax

after dep

$

42,500

$

76,500

$

103,700

$

125,460

$

55,368

$

69,294

$

80,436

$

89,348

Payback

Value months

Average

investment

$

530,000

Average

accounting

income

$

103,166

Accounting

Rate of

Return 19.47%

Calculation for scenario 2: Large Size balloon

Particulars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8

Cash Inflows

Operating Sales

Revenue (High

Demand)

$

487,500

$

487,500

$

487,500

$

487,500

$

325,000

$

325,000

$

325,000

$

325,000

Operating Sales

Revenue Low

Demand)

$

75,000

$

75,000

$

75,000

$

75,000

$

150,000

$

150,000

$

150,000

$

150,000

Total Sales

$

562,500

$

562,500

$

562,500

$

562,500

$

475,000

$

475,000

$

475,000

$

475,000

Less:

Annual Variable

and Fixed cost

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

$

300,000

Warehouse Rent

$

50,000

$

50,000

$

50,000

$

50,000

$

50,000

$

50,000

$

50,000

$

50,000

Depreciation

$

170,000

$

136,000

$

108,800

$

87,040

$

69,632

$

55,706

$

44,564

$

35,652

Total

$

520,000

$

486,000

$

458,800

$

437,040

$

419,632

$

405,706

$

394,564

$

385,652

Profit Before tax

after dep

$

42,500

$

76,500

$

103,700

$

125,460

$

55,368

$

69,294

$

80,436

$

89,348

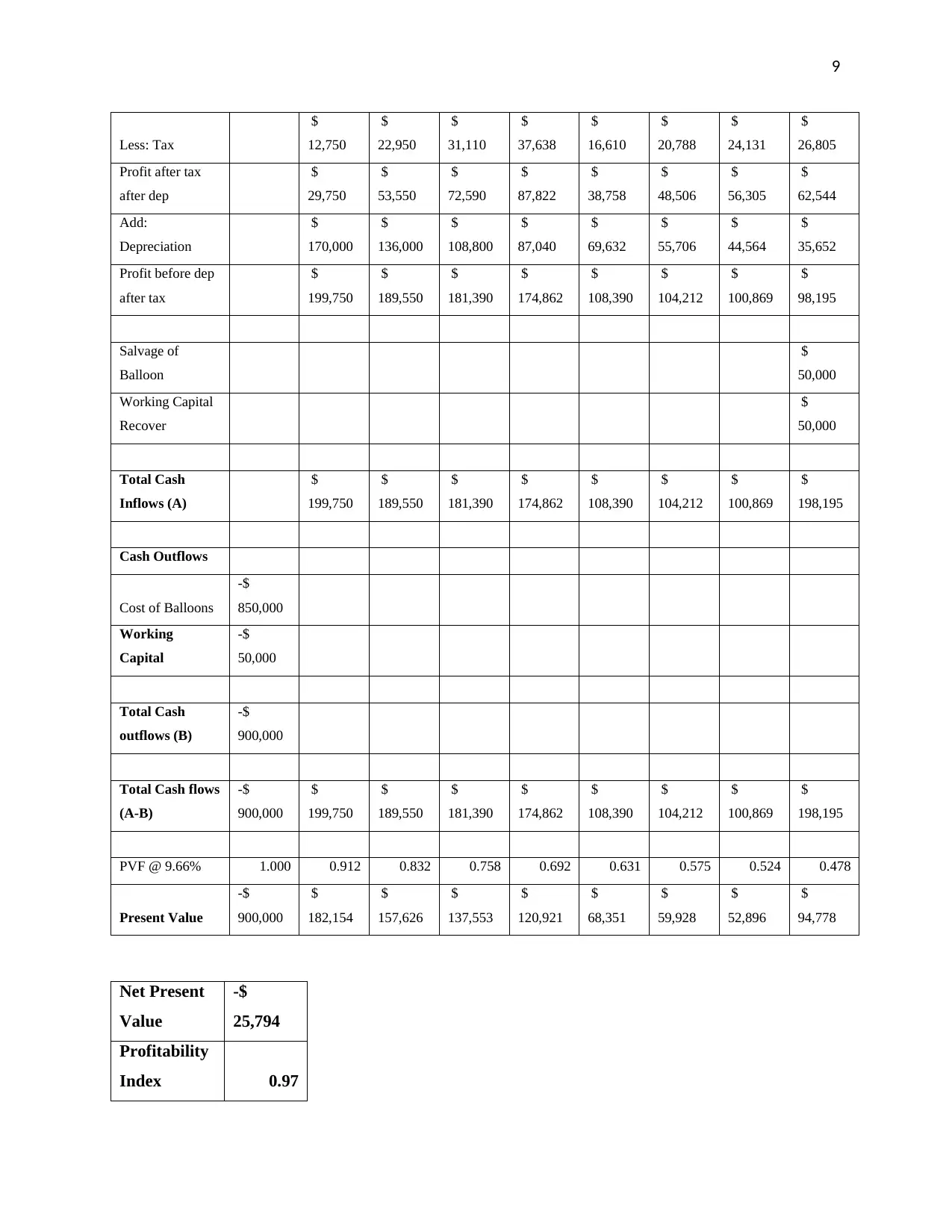

9

Less: Tax

$

12,750

$

22,950

$

31,110

$

37,638

$

16,610

$

20,788

$

24,131

$

26,805

Profit after tax

after dep

$

29,750

$

53,550

$

72,590

$

87,822

$

38,758

$

48,506

$

56,305

$

62,544

Add:

Depreciation

$

170,000

$

136,000

$

108,800

$

87,040

$

69,632

$

55,706

$

44,564

$

35,652

Profit before dep

after tax

$

199,750

$

189,550

$

181,390

$

174,862

$

108,390

$

104,212

$

100,869

$

98,195

Salvage of

Balloon

$

50,000

Working Capital

Recover

$

50,000

Total Cash

Inflows (A)

$

199,750

$

189,550

$

181,390

$

174,862

$

108,390

$

104,212

$

100,869

$

198,195

Cash Outflows

Cost of Balloons

-$

850,000

Working

Capital

-$

50,000

Total Cash

outflows (B)

-$

900,000

Total Cash flows

(A-B)

-$

900,000

$

199,750

$

189,550

$

181,390

$

174,862

$

108,390

$

104,212

$

100,869

$

198,195

PVF @ 9.66% 1.000 0.912 0.832 0.758 0.692 0.631 0.575 0.524 0.478

Present Value

-$

900,000

$

182,154

$

157,626

$

137,553

$

120,921

$

68,351

$

59,928

$

52,896

$

94,778

Net Present

Value

-$

25,794

Profitability

Index 0.97

Less: Tax

$

12,750

$

22,950

$

31,110

$

37,638

$

16,610

$

20,788

$

24,131

$

26,805

Profit after tax

after dep

$

29,750

$

53,550

$

72,590

$

87,822

$

38,758

$

48,506

$

56,305

$

62,544

Add:

Depreciation

$

170,000

$

136,000

$

108,800

$

87,040

$

69,632

$

55,706

$

44,564

$

35,652

Profit before dep

after tax

$

199,750

$

189,550

$

181,390

$

174,862

$

108,390

$

104,212

$

100,869

$

98,195

Salvage of

Balloon

$

50,000

Working Capital

Recover

$

50,000

Total Cash

Inflows (A)

$

199,750

$

189,550

$

181,390

$

174,862

$

108,390

$

104,212

$

100,869

$

198,195

Cash Outflows

Cost of Balloons

-$

850,000

Working

Capital

-$

50,000

Total Cash

outflows (B)

-$

900,000

Total Cash flows

(A-B)

-$

900,000

$

199,750

$

189,550

$

181,390

$

174,862

$

108,390

$

104,212

$

100,869

$

198,195

PVF @ 9.66% 1.000 0.912 0.832 0.758 0.692 0.631 0.575 0.524 0.478

Present Value

-$

900,000

$

182,154

$

157,626

$

137,553

$

120,921

$

68,351

$

59,928

$

52,896

$

94,778

Net Present

Value

-$

25,794

Profitability

Index 0.97

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

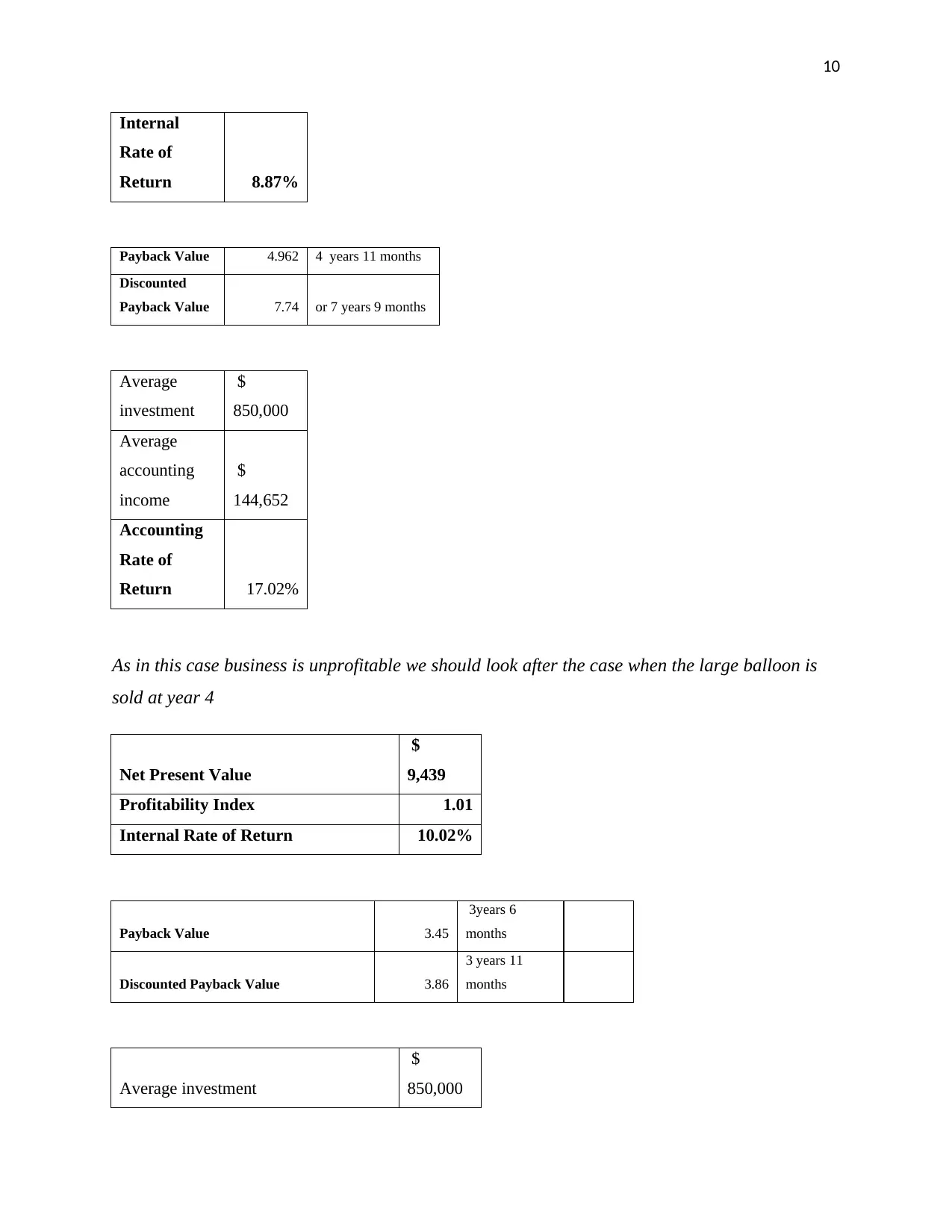

10

Internal

Rate of

Return 8.87%

Payback Value 4.962 4 years 11 months

Discounted

Payback Value 7.74 or 7 years 9 months

Average

investment

$

850,000

Average

accounting

income

$

144,652

Accounting

Rate of

Return 17.02%

As in this case business is unprofitable we should look after the case when the large balloon is

sold at year 4

Net Present Value

$

9,439

Profitability Index 1.01

Internal Rate of Return 10.02%

Payback Value 3.45

3years 6

months

Discounted Payback Value 3.86

3 years 11

months

Average investment

$

850,000

Internal

Rate of

Return 8.87%

Payback Value 4.962 4 years 11 months

Discounted

Payback Value 7.74 or 7 years 9 months

Average

investment

$

850,000

Average

accounting

income

$

144,652

Accounting

Rate of

Return 17.02%

As in this case business is unprofitable we should look after the case when the large balloon is

sold at year 4

Net Present Value

$

9,439

Profitability Index 1.01

Internal Rate of Return 10.02%

Payback Value 3.45

3years 6

months

Discounted Payback Value 3.86

3 years 11

months

Average investment

$

850,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

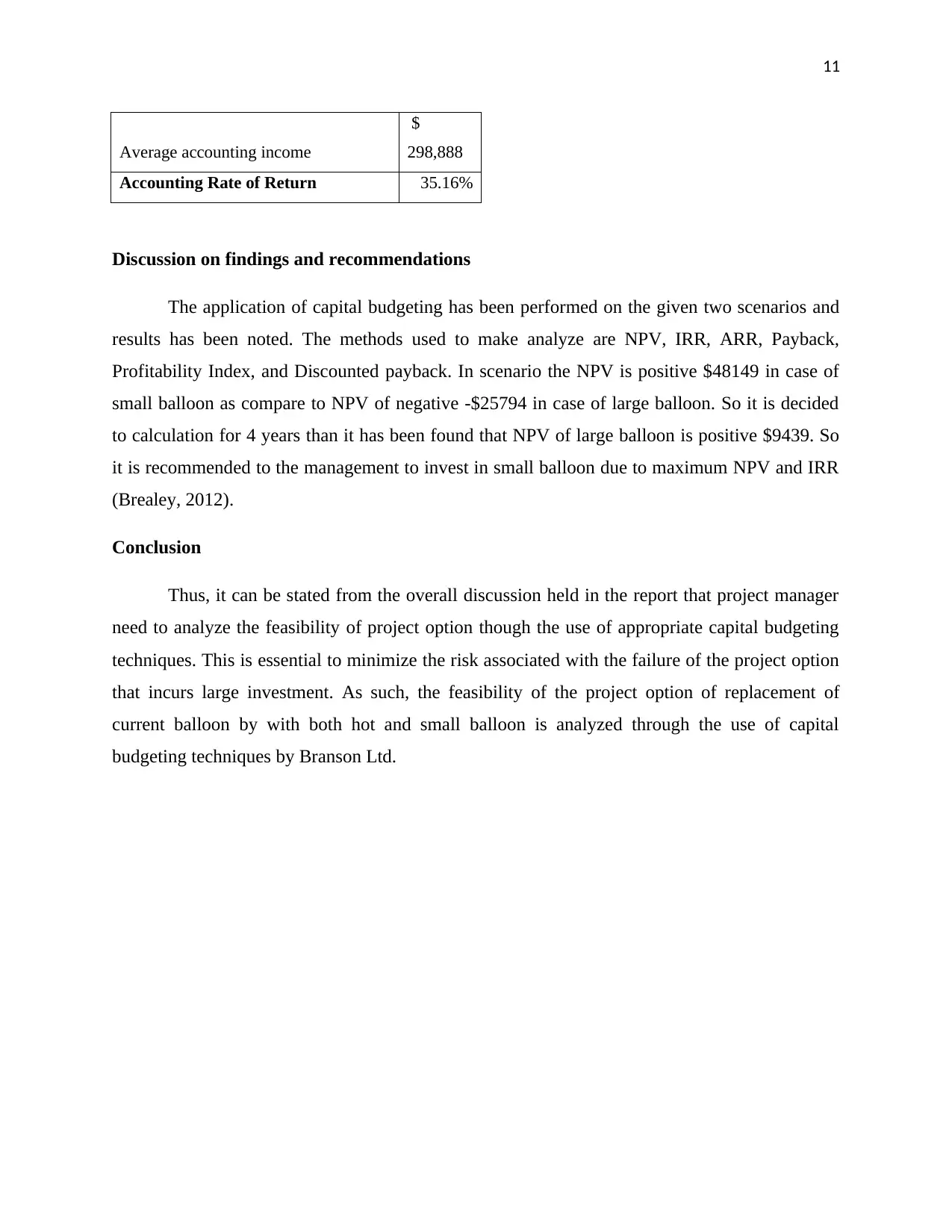

Average accounting income

$

298,888

Accounting Rate of Return 35.16%

Discussion on findings and recommendations

The application of capital budgeting has been performed on the given two scenarios and

results has been noted. The methods used to make analyze are NPV, IRR, ARR, Payback,

Profitability Index, and Discounted payback. In scenario the NPV is positive $48149 in case of

small balloon as compare to NPV of negative -$25794 in case of large balloon. So it is decided

to calculation for 4 years than it has been found that NPV of large balloon is positive $9439. So

it is recommended to the management to invest in small balloon due to maximum NPV and IRR

(Brealey, 2012).

Conclusion

Thus, it can be stated from the overall discussion held in the report that project manager

need to analyze the feasibility of project option though the use of appropriate capital budgeting

techniques. This is essential to minimize the risk associated with the failure of the project option

that incurs large investment. As such, the feasibility of the project option of replacement of

current balloon by with both hot and small balloon is analyzed through the use of capital

budgeting techniques by Branson Ltd.

Average accounting income

$

298,888

Accounting Rate of Return 35.16%

Discussion on findings and recommendations

The application of capital budgeting has been performed on the given two scenarios and

results has been noted. The methods used to make analyze are NPV, IRR, ARR, Payback,

Profitability Index, and Discounted payback. In scenario the NPV is positive $48149 in case of

small balloon as compare to NPV of negative -$25794 in case of large balloon. So it is decided

to calculation for 4 years than it has been found that NPV of large balloon is positive $9439. So

it is recommended to the management to invest in small balloon due to maximum NPV and IRR

(Brealey, 2012).

Conclusion

Thus, it can be stated from the overall discussion held in the report that project manager

need to analyze the feasibility of project option though the use of appropriate capital budgeting

techniques. This is essential to minimize the risk associated with the failure of the project option

that incurs large investment. As such, the feasibility of the project option of replacement of

current balloon by with both hot and small balloon is analyzed through the use of capital

budgeting techniques by Branson Ltd.

12

References

Besley, S. and Brigham, E. F. 2008. Essentials of Managerial Finance. Cengage Learning.

Bierman, H. 2012. The Capital Structure Decision. Springer Science & Business Media.

Bierman, H. and Smidt, S. 2007. The Capital Budgeting Decision: Economic Analysis of

Investment Projects. Routledge.

Brealey, R. 2012. Principles of Corporate Finance. Tata McGraw-Hill Education.

Bromwich, M. and Bhimani, A., 2005. Management accounting: Pathways to progress. Cima

publishing.

Peterson, P,P and Fabozzi,F, J,. 2002. Capital budgeting: theory and practice. John Wiley &

sons.

Higgins, R. C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

References

Besley, S. and Brigham, E. F. 2008. Essentials of Managerial Finance. Cengage Learning.

Bierman, H. 2012. The Capital Structure Decision. Springer Science & Business Media.

Bierman, H. and Smidt, S. 2007. The Capital Budgeting Decision: Economic Analysis of

Investment Projects. Routledge.

Brealey, R. 2012. Principles of Corporate Finance. Tata McGraw-Hill Education.

Bromwich, M. and Bhimani, A., 2005. Management accounting: Pathways to progress. Cima

publishing.

Peterson, P,P and Fabozzi,F, J,. 2002. Capital budgeting: theory and practice. John Wiley &

sons.

Higgins, R. C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.