Financial Performance of Barratt Developments Plc

VerifiedAdded on 2023/01/16

|15

|2969

|29

AI Summary

This document analyzes the financial performance of Barratt Developments Plc, including liquidity ratios, profitability ratios, and solvency ratios. It also compares the financial position of Barratt Developments Plc with Persimmon plc. The document provides insights into the company's performance and offers recommendations for enhancing financial performance in the future.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

PRINCIPLES OF FINANCE

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Barratt Developments plc............................................................................................................1

Ratio Analysis .............................................................................................................................1

I ) Financial Performance of Barratt Developments Plc..............................................................4

II) Comparison of financial position of companies ....................................................................6

Trend analysis .................................................................................................................................7

Comment on the business from an investor’s point of view in terms of movements in ratios......11

Overall conclusions and recommendations for enhancing financial performance in future.........12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Barratt Developments plc............................................................................................................1

Ratio Analysis .............................................................................................................................1

I ) Financial Performance of Barratt Developments Plc..............................................................4

II) Comparison of financial position of companies ....................................................................6

Trend analysis .................................................................................................................................7

Comment on the business from an investor’s point of view in terms of movements in ratios......11

Overall conclusions and recommendations for enhancing financial performance in future.........12

REFERENCES..............................................................................................................................13

INTRODUCTION

Financial reporting refers to the presentation of financial information in manner given

stated under the regulations. To assess whether the business has proved profitable or not during

the financial statements are prepared. These financial reports or statements include income

statement, balance sheet and cash flows statements (Aman, 2016). The performance of the

business can be analysed using the tool of ratio analysis. The report will include the analysis of

financial position and performance of the company during 4 years. The analysis will be done of

Barratt Developments plc as the host company of the house-holding industry. The comparison of

performance will be made with the competitor of the same industry that is Persimmon plc. Both

companies are serving the industry from many years. The report will be giving understanding

about the financial analysis of the statements of companies using appropriated ratios like

profitability, liquidity, activity and solvency. Report will also provide trend analysis on the

dynamic performance of the companies.

MAIN BODY

Barratt Developments plc

It is among the largest developer of residential properties in United Kingdom. Company

is operating over more than 30 divisions. Company is serving the house-holding industry since

62 years. It is a publicly listed company over the London stock exchange. The financial

statements of company show steady increase in level of revenues and profits. During the past

four years the earnings per share of the company have also increased. Financial position of

company is showing that the performance of company is appropriate. The company has paid

dividends during last four years. The share capital of the company is raising every year.

Company is excelling in he market with income of 671.5 millions against the revenues of 4874.8

million. Core business of company is house building and commercial construction through

Wilson Bowden Developments.

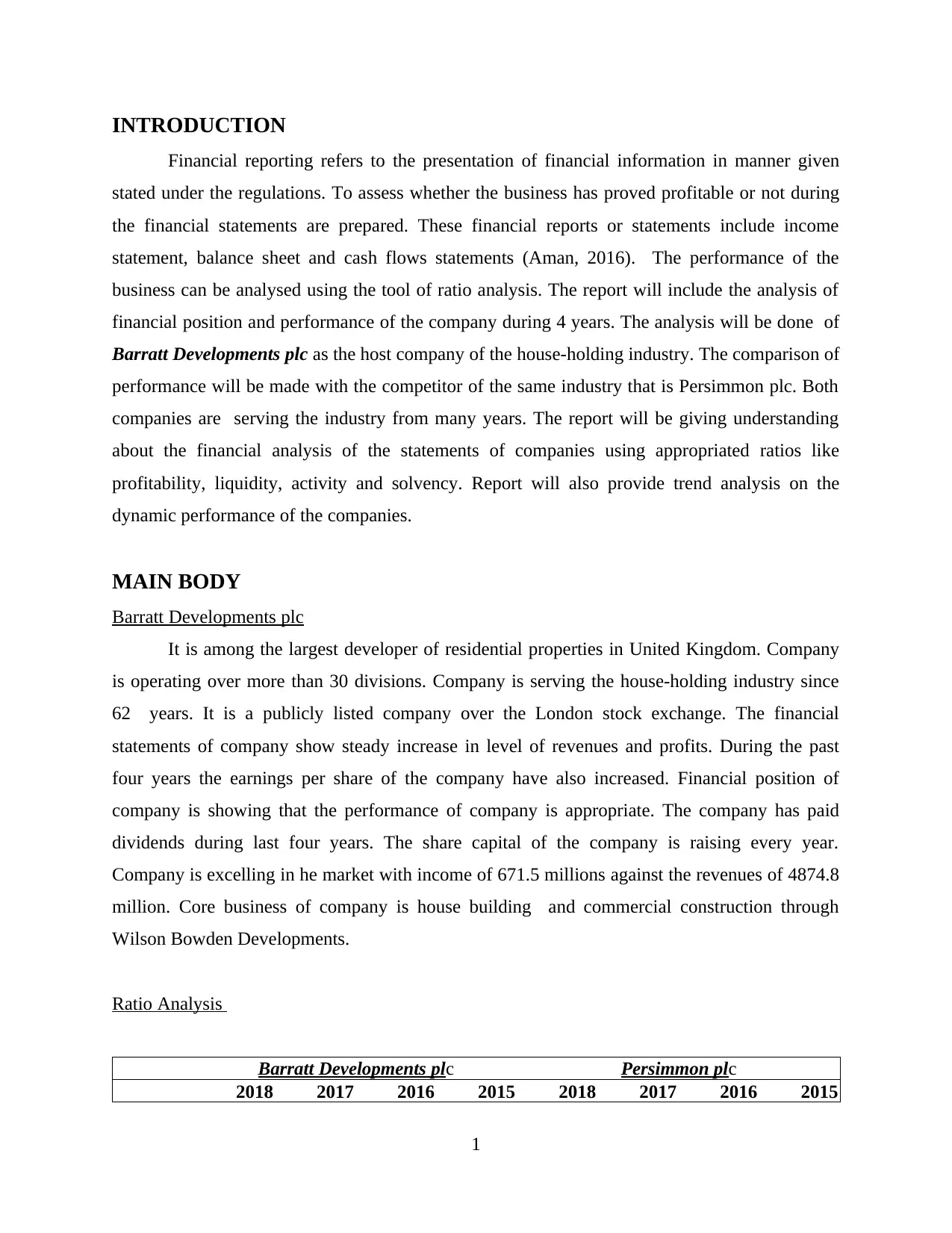

Ratio Analysis

Barratt Developments plc Persimmon plc

2018 2017 2016 2015 2018 2017 2016 2015

1

Financial reporting refers to the presentation of financial information in manner given

stated under the regulations. To assess whether the business has proved profitable or not during

the financial statements are prepared. These financial reports or statements include income

statement, balance sheet and cash flows statements (Aman, 2016). The performance of the

business can be analysed using the tool of ratio analysis. The report will include the analysis of

financial position and performance of the company during 4 years. The analysis will be done of

Barratt Developments plc as the host company of the house-holding industry. The comparison of

performance will be made with the competitor of the same industry that is Persimmon plc. Both

companies are serving the industry from many years. The report will be giving understanding

about the financial analysis of the statements of companies using appropriated ratios like

profitability, liquidity, activity and solvency. Report will also provide trend analysis on the

dynamic performance of the companies.

MAIN BODY

Barratt Developments plc

It is among the largest developer of residential properties in United Kingdom. Company

is operating over more than 30 divisions. Company is serving the house-holding industry since

62 years. It is a publicly listed company over the London stock exchange. The financial

statements of company show steady increase in level of revenues and profits. During the past

four years the earnings per share of the company have also increased. Financial position of

company is showing that the performance of company is appropriate. The company has paid

dividends during last four years. The share capital of the company is raising every year.

Company is excelling in he market with income of 671.5 millions against the revenues of 4874.8

million. Core business of company is house building and commercial construction through

Wilson Bowden Developments.

Ratio Analysis

Barratt Developments plc Persimmon plc

2018 2017 2016 2015 2018 2017 2016 2015

1

Liquidity

ratio

Current

assets 5726 5478 5235 4703 4215.7 4228.8 3661.7 3307

Current

liability 1548.2 1683.6 1588 1412 1123.9 1198.6 1014.5 930.5

Current

ratio 3.70 3.25 3.30 3.33 3.75 3.53 3.61 3.55

Current

assets /

current

liabilities

Current

assets 5726 5478 5235 4703 4215.7 4228.8 3661.7 3307

Inventory 4517 4475 4326 4173 3059.5 2825.9 2645 2645

Current

liability 1548.2 1683.6 1588 1412 1123.9 1198.6 1014.5 930.5

Liquid

ratio 0.78 0.60 0.57 0.38 1.03 1.17 1.00 0.71

Current

assets -

(stock +

prepaid

expenses)

Activity

ratio

Trade

Receivabl

es 226.8 204.5 149.6 158.8 91.8 86.1 103.7 91.5

Sales 4874.8 4650.2 4235.2 3759.5 3737.6 3597.8 3136.7 2901.7

Account

receivabl

e

turnover

ratio 4.65% 4.40% 3.53% 4.22% 2.46% 2.39% 3.31% 3.15%

Sales 4874.8 4650.2 4235.2 3759.5 3737.6 3597.8 3136.7 2901.7

Net

Assets 4597.7 4322.2 4010 3711 3194.5 3201.6 2737.4 2455.8

Asset

turnover

ratio 106.03% 107.59% 105.62% 101.31% 117.00% 112.38% 114.59% 118.16%

Sales /

2

ratio

Current

assets 5726 5478 5235 4703 4215.7 4228.8 3661.7 3307

Current

liability 1548.2 1683.6 1588 1412 1123.9 1198.6 1014.5 930.5

Current

ratio 3.70 3.25 3.30 3.33 3.75 3.53 3.61 3.55

Current

assets /

current

liabilities

Current

assets 5726 5478 5235 4703 4215.7 4228.8 3661.7 3307

Inventory 4517 4475 4326 4173 3059.5 2825.9 2645 2645

Current

liability 1548.2 1683.6 1588 1412 1123.9 1198.6 1014.5 930.5

Liquid

ratio 0.78 0.60 0.57 0.38 1.03 1.17 1.00 0.71

Current

assets -

(stock +

prepaid

expenses)

Activity

ratio

Trade

Receivabl

es 226.8 204.5 149.6 158.8 91.8 86.1 103.7 91.5

Sales 4874.8 4650.2 4235.2 3759.5 3737.6 3597.8 3136.7 2901.7

Account

receivabl

e

turnover

ratio 4.65% 4.40% 3.53% 4.22% 2.46% 2.39% 3.31% 3.15%

Sales 4874.8 4650.2 4235.2 3759.5 3737.6 3597.8 3136.7 2901.7

Net

Assets 4597.7 4322.2 4010 3711 3194.5 3201.6 2737.4 2455.8

Asset

turnover

ratio 106.03% 107.59% 105.62% 101.31% 117.00% 112.38% 114.59% 118.16%

Sales /

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

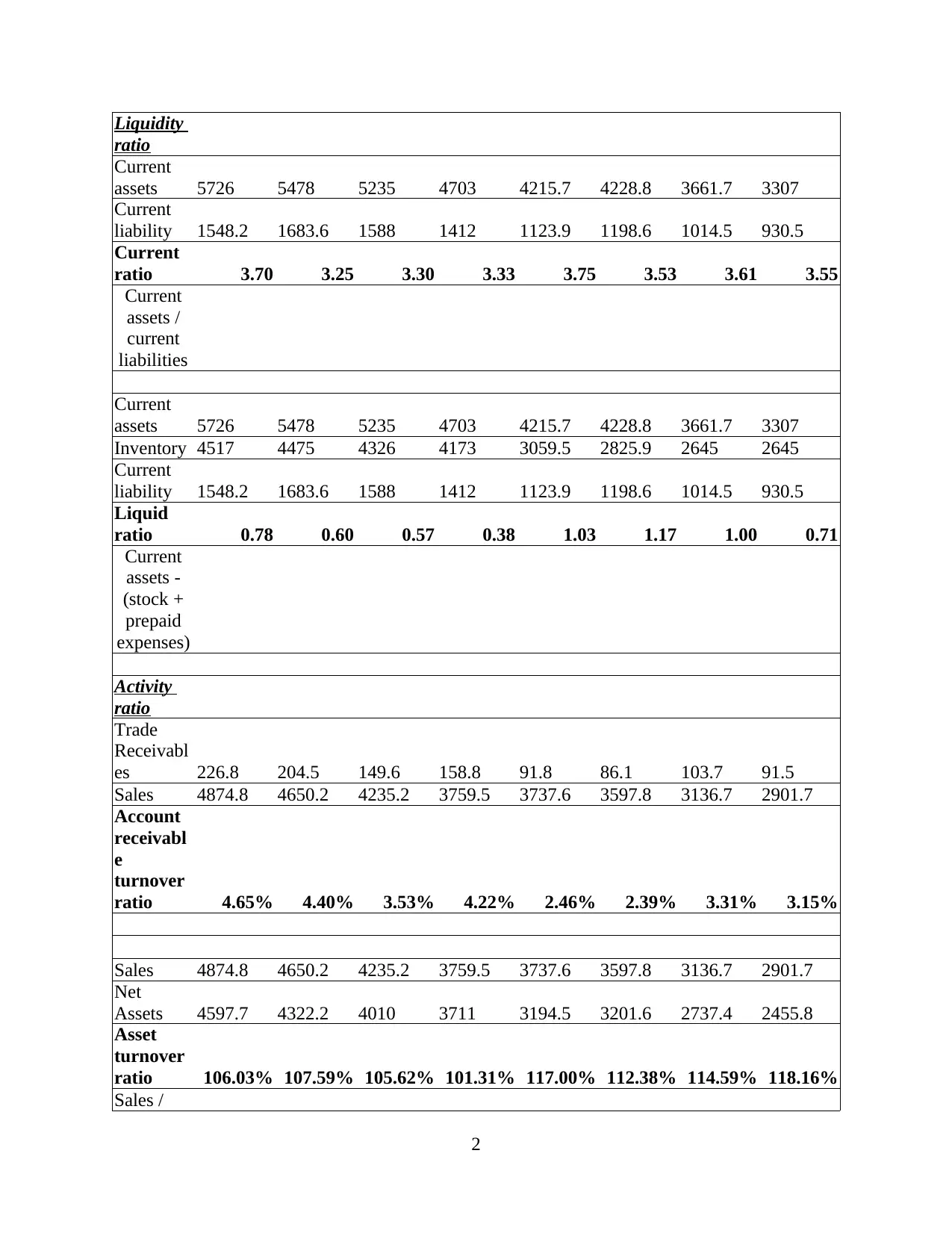

Net assets

Profitabil

ity ratio

Employed

Capital 5380.8 4928.4 4829.6 4499 3527.8 3558.2 3130.1 2890.5

Net

operating

profit 835.5 765.1 682.3 565.5 1090.8 966.1 774.8 629.5

Return

on

capital

employed 15.53% 15.52% 14.13% 12.57% 30.92% 27.15% 24.75% 21.78%

Net

operating

profit/Em

ployed

Capital

Net

Income 835.5 765.1 682.3 565.5 1090.8 966.1 774.8 629.5

Sharehold

er's

Equity 4597.7 4322.2 4010.2 3711.3 3194.5 3201.6 2737.4 2455.8

Return

on

Equity 18.17% 17.70% 17.01% 15.24% 39.30% 41.10% 30.80% 35.10%

Net

Income /

Sharehold

er's

Equity

Cost of

Sales 3865.9 3718.2 3434.8 3045.2 2557.7 2526.1 2265.4 2164.4

Sales 4874.8 4650.2 4235.2 3759.5 3737.6 3597.8 3136.7 2901.7

Gross

Margin 20.70% 20.04% 18.90% 19.00% 31.57% 29.79% 27.78% 25.41%

Total

Sales –

COGS/To

tal Sales

Operating

profit 835.5 765.1 682.3 565.5 1090.8 966.1 774.8 629.5

Sales 4874.8 4650.2 4235.2 3759.5 3737.6 3597.8 3136.7 2901.7

3

Profitabil

ity ratio

Employed

Capital 5380.8 4928.4 4829.6 4499 3527.8 3558.2 3130.1 2890.5

Net

operating

profit 835.5 765.1 682.3 565.5 1090.8 966.1 774.8 629.5

Return

on

capital

employed 15.53% 15.52% 14.13% 12.57% 30.92% 27.15% 24.75% 21.78%

Net

operating

profit/Em

ployed

Capital

Net

Income 835.5 765.1 682.3 565.5 1090.8 966.1 774.8 629.5

Sharehold

er's

Equity 4597.7 4322.2 4010.2 3711.3 3194.5 3201.6 2737.4 2455.8

Return

on

Equity 18.17% 17.70% 17.01% 15.24% 39.30% 41.10% 30.80% 35.10%

Net

Income /

Sharehold

er's

Equity

Cost of

Sales 3865.9 3718.2 3434.8 3045.2 2557.7 2526.1 2265.4 2164.4

Sales 4874.8 4650.2 4235.2 3759.5 3737.6 3597.8 3136.7 2901.7

Gross

Margin 20.70% 20.04% 18.90% 19.00% 31.57% 29.79% 27.78% 25.41%

Total

Sales –

COGS/To

tal Sales

Operating

profit 835.5 765.1 682.3 565.5 1090.8 966.1 774.8 629.5

Sales 4874.8 4650.2 4235.2 3759.5 3737.6 3597.8 3136.7 2901.7

3

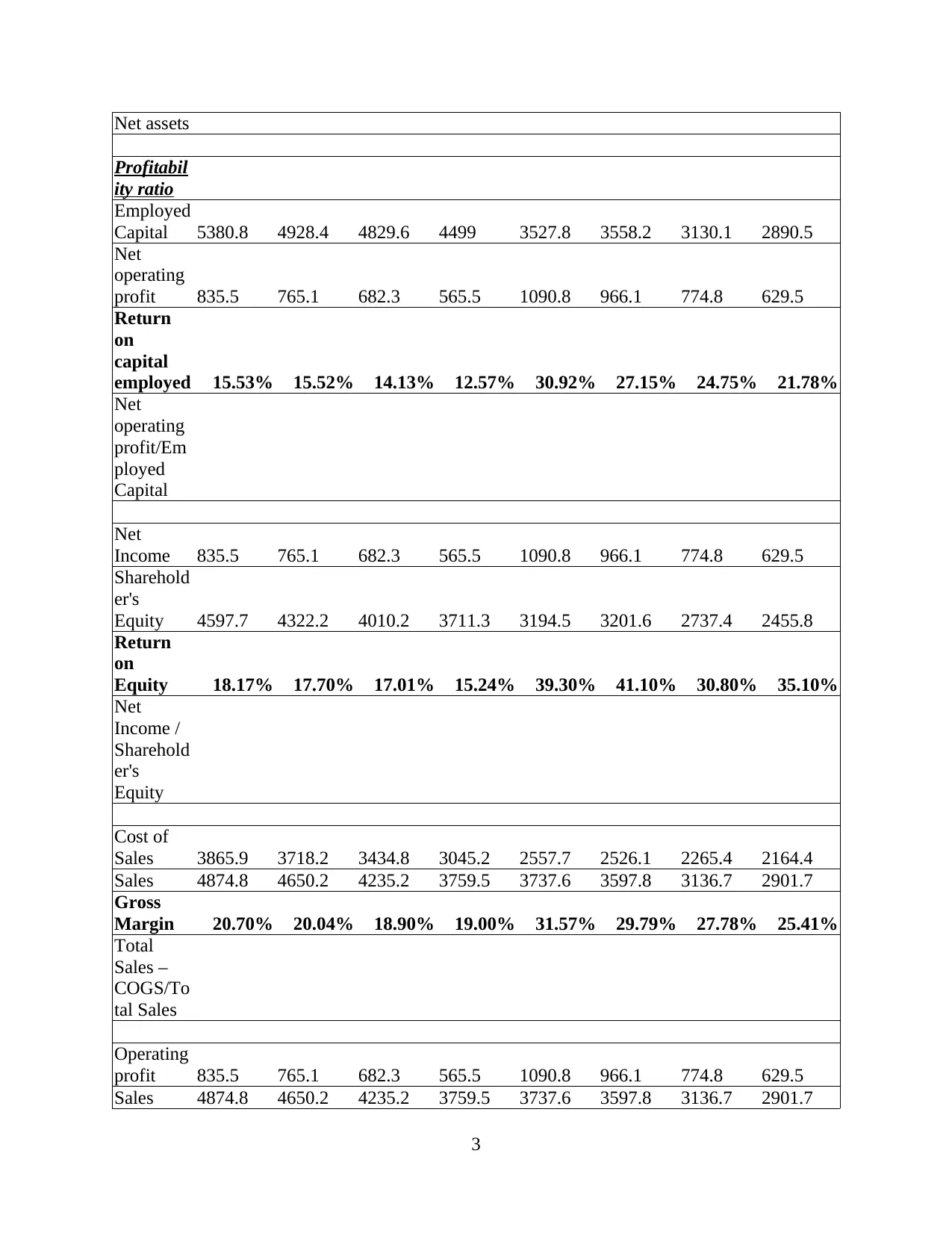

Operatin

g profit

ratio 17.14% 16.45% 16.11% 15.04% 29.18% 26.85% 24.70% 21.69%

Operating

Income/

Net Sales

Debt

Debt 191.1 1.4 171.5 163.3 333.3 356.6 392.7 435.5

Equity 4597.7 4322.2 4010.2 3711.3 3194.4 3201.6 2737.4 2455.8

Debt

equity

ratio 4.16% 0.03% 4.28% 4.40% 10.43% 11.14% 14.35% 17.73%

Debt/

Equity

EBIT 869.6 808 668.4 576.8 1082.7 955.1 770.5 626.2

Interest

expense 64.1 64.6 10.6 15.7 12.3 13.5 15.5 18.8

Interest

coverage

ratio 7.37% 8.00% 1.59% 2.72% 1.14% 1.41% 2.01% 3.00%

Interest /

EBIT

Market

ratio

Net profit 671.5 616 550.3 450.3 886.4 786.9 633.3 521.9

Shares

outstandin

g 1010.7 1004.3 1013 1008.4 312.9 308.6 308 306.4

EPS 0.664 0.613 0.543 0.447 2.833 2.550 2.056 1.703

Net

profit /

shares

outstandin

g

I ) Financial Performance of Barratt Developments Plc

Interpretations

4

g profit

ratio 17.14% 16.45% 16.11% 15.04% 29.18% 26.85% 24.70% 21.69%

Operating

Income/

Net Sales

Debt

Debt 191.1 1.4 171.5 163.3 333.3 356.6 392.7 435.5

Equity 4597.7 4322.2 4010.2 3711.3 3194.4 3201.6 2737.4 2455.8

Debt

equity

ratio 4.16% 0.03% 4.28% 4.40% 10.43% 11.14% 14.35% 17.73%

Debt/

Equity

EBIT 869.6 808 668.4 576.8 1082.7 955.1 770.5 626.2

Interest

expense 64.1 64.6 10.6 15.7 12.3 13.5 15.5 18.8

Interest

coverage

ratio 7.37% 8.00% 1.59% 2.72% 1.14% 1.41% 2.01% 3.00%

Interest /

EBIT

Market

ratio

Net profit 671.5 616 550.3 450.3 886.4 786.9 633.3 521.9

Shares

outstandin

g 1010.7 1004.3 1013 1008.4 312.9 308.6 308 306.4

EPS 0.664 0.613 0.543 0.447 2.833 2.550 2.056 1.703

Net

profit /

shares

outstandin

g

I ) Financial Performance of Barratt Developments Plc

Interpretations

4

Liquidity ratios are used for measuring the liquidity position of company. Liquidity of

company is assessed using the current ratio and quick ratio (Dicle and Meyer, 2018). Current

ratios of company during the past four years is more than 2 that shows the company is having

strong liquidity position considering all the current assets including inventory. Current ratio of

the company should be high as it represents the ability of company to meet its short term

obligations. Quick ratio of company is significantly lower. This should be higher than 1.5 as it do

not considers. This shows major part of current assets of company comprises of the inventory.

However seeing the 4 years trend it is improving continuously.

Profitability ratios are very important to know the financial performance of company. Barratt plc

shows the profitability of company is above the average industry standards.

Return over capital employed of company does not shows major increase during the last

four years. Rise was seen mainly in 2016 as the profit levels of company raised from the

previous year. Company should have adequate returns over capital employed for motivating the

business and its employees to perform better.

Return over equity of company has raised to 18.17% from 15.24% in 2015 during the last

four years. Company is showing growth and therefore is able to provide more returns to its

equity holders. This helps in satisfying the equity investors by providing adequate returns over

their investments. The returns have to be improved further by using the appropriate strategies

that helps company in raising the returns.

Gross profit margin of company during the last four years has remained between 19 -

21%. the gross profit margin of company is not very high but has continuously increasing. Gross

profit is the amount left with the company after carrying out its cost of sales. Since they are

involved in house building and construction they involve high costs of production. They can use

cost controls strategies so that the cost of sales can be controlled by company.

Operating profit margin of company is showing a rising trend. The net profit margin of

company as against its revenues can be improved further using appropriate steps (Boyas and

Teeter, 2017). Profits have to be increased by controlling the operating expenses. Since the

company operates over increased number of divisions it has higher operational costs. It can use

centralized approach for managing the operations of company.

Solvency of the company is assessed using the debt equity and interest coverage ratio. It

is essential for company to have appropriate mix of debt and equity so that the capital structure

5

company is assessed using the current ratio and quick ratio (Dicle and Meyer, 2018). Current

ratios of company during the past four years is more than 2 that shows the company is having

strong liquidity position considering all the current assets including inventory. Current ratio of

the company should be high as it represents the ability of company to meet its short term

obligations. Quick ratio of company is significantly lower. This should be higher than 1.5 as it do

not considers. This shows major part of current assets of company comprises of the inventory.

However seeing the 4 years trend it is improving continuously.

Profitability ratios are very important to know the financial performance of company. Barratt plc

shows the profitability of company is above the average industry standards.

Return over capital employed of company does not shows major increase during the last

four years. Rise was seen mainly in 2016 as the profit levels of company raised from the

previous year. Company should have adequate returns over capital employed for motivating the

business and its employees to perform better.

Return over equity of company has raised to 18.17% from 15.24% in 2015 during the last

four years. Company is showing growth and therefore is able to provide more returns to its

equity holders. This helps in satisfying the equity investors by providing adequate returns over

their investments. The returns have to be improved further by using the appropriate strategies

that helps company in raising the returns.

Gross profit margin of company during the last four years has remained between 19 -

21%. the gross profit margin of company is not very high but has continuously increasing. Gross

profit is the amount left with the company after carrying out its cost of sales. Since they are

involved in house building and construction they involve high costs of production. They can use

cost controls strategies so that the cost of sales can be controlled by company.

Operating profit margin of company is showing a rising trend. The net profit margin of

company as against its revenues can be improved further using appropriate steps (Boyas and

Teeter, 2017). Profits have to be increased by controlling the operating expenses. Since the

company operates over increased number of divisions it has higher operational costs. It can use

centralized approach for managing the operations of company.

Solvency of the company is assessed using the debt equity and interest coverage ratio. It

is essential for company to have appropriate mix of debt and equity so that the capital structure

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

of the company is also adequate. Company has maintained a range of 4-5% of debt against its

equity. Company in year 2017 was having almost negligible debt against equity. Higher debt

represents higher financial risks. If the risks is high investors do not invest in such companies.

However the significantly lower debts allocates profits to larger number of shareholders. The

interest coverage ratio of company is has raised during the last two years (Bragg, 2018). It has

increased over the short term borrowings not over the long term borrowings.

Activity ratio of company shows the activities of company during the year. Asset

turnover ratio of company is in relation with standard of industry. Higher the ratio better for

company. Revenues generated against still have be increased by the enterprise. Account

receivable turnover is adequate of company. This shows that cash collection period of company

is adequate.

Market ratio of company shows that the industry is running in accordance with the

market. The earning ratio of company shows the earnings of the shareholders who have invested

funds in company. Company is having high equity capital therefore the earnings per share of the

company are splitted to larger number of shares.

II) Comparison of financial position of companies

Persimmon plc is serving the same industry of house-holding developments. Company

has comparatively by lower level of revenues than also able to earn higher returns in terms of

gross profit and operating profit margins (Williams and Dobelman, 2017). Other probability

ratios have higher returns than Barratt but the increase is seen as the invested capital and

shareholder equity is lower in comparison to Barratt plc. The Persimmon is having adequate

liquidity levels as company manages the assets properly. Activity ratios of company does not

shows higher variations between the two companies. Persimmon plc have adequate capital mix

with lower finance costs. This brings cost benefits to the company. The earning ratio of

Persimmon is higher than Barratt that helps I attracting new investors but company has lower

share capital as compared with Baratt plc. Company is tough competitor of Baratt plc and can

also move forward from it.

6

equity. Company in year 2017 was having almost negligible debt against equity. Higher debt

represents higher financial risks. If the risks is high investors do not invest in such companies.

However the significantly lower debts allocates profits to larger number of shareholders. The

interest coverage ratio of company is has raised during the last two years (Bragg, 2018). It has

increased over the short term borrowings not over the long term borrowings.

Activity ratio of company shows the activities of company during the year. Asset

turnover ratio of company is in relation with standard of industry. Higher the ratio better for

company. Revenues generated against still have be increased by the enterprise. Account

receivable turnover is adequate of company. This shows that cash collection period of company

is adequate.

Market ratio of company shows that the industry is running in accordance with the

market. The earning ratio of company shows the earnings of the shareholders who have invested

funds in company. Company is having high equity capital therefore the earnings per share of the

company are splitted to larger number of shares.

II) Comparison of financial position of companies

Persimmon plc is serving the same industry of house-holding developments. Company

has comparatively by lower level of revenues than also able to earn higher returns in terms of

gross profit and operating profit margins (Williams and Dobelman, 2017). Other probability

ratios have higher returns than Barratt but the increase is seen as the invested capital and

shareholder equity is lower in comparison to Barratt plc. The Persimmon is having adequate

liquidity levels as company manages the assets properly. Activity ratios of company does not

shows higher variations between the two companies. Persimmon plc have adequate capital mix

with lower finance costs. This brings cost benefits to the company. The earning ratio of

Persimmon is higher than Barratt that helps I attracting new investors but company has lower

share capital as compared with Baratt plc. Company is tough competitor of Baratt plc and can

also move forward from it.

6

Trend analysis

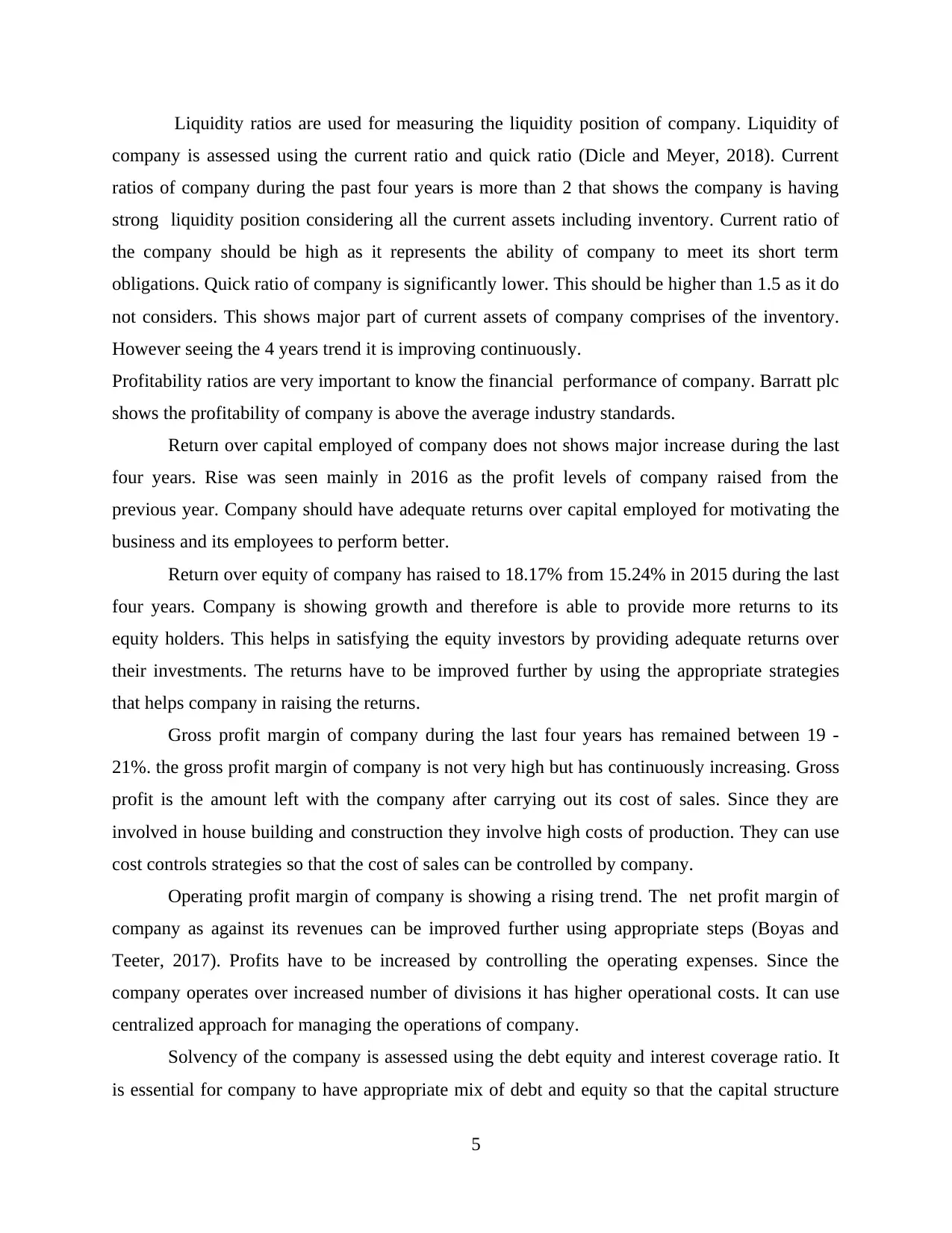

Figure 1Current ratio

Current ratio of the Barrat Development decline sligtly in the year 2016 and 2017 from 3.33 to

3.25. However, then it rise to 3.75 in the year 2018. It can be said that performance improved.

However, decline in the performance was also not matter of concern because value of current

ratio each year is already above standard value 2.

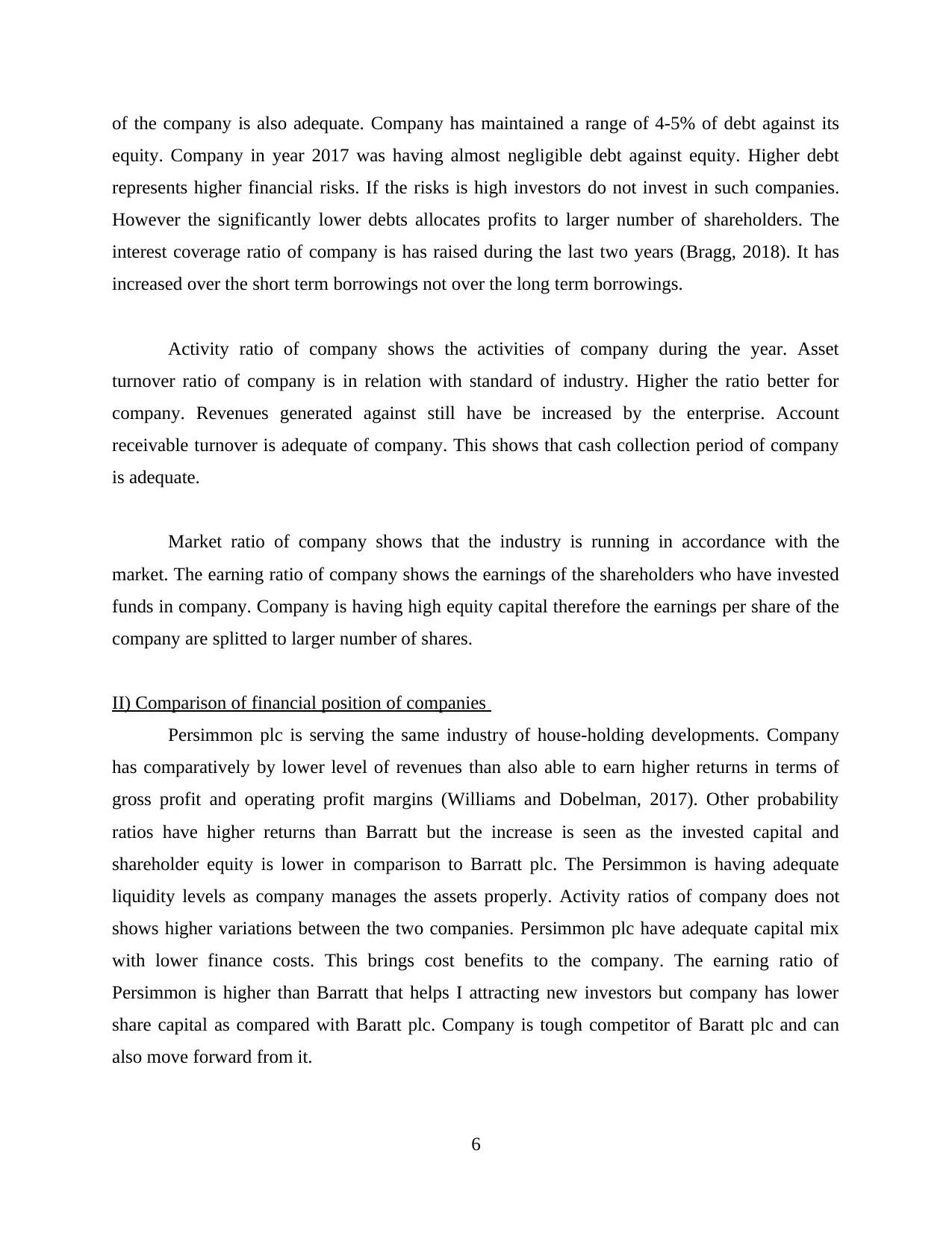

Figure 2Liquid ratio

7

Figure 1Current ratio

Current ratio of the Barrat Development decline sligtly in the year 2016 and 2017 from 3.33 to

3.25. However, then it rise to 3.75 in the year 2018. It can be said that performance improved.

However, decline in the performance was also not matter of concern because value of current

ratio each year is already above standard value 2.

Figure 2Liquid ratio

7

Value of liquid ratio is increasing consistently and its growth rate is also increasing on yearly

basis. In the year 2015 value of the ratio was 0.38 which increased to 0.57 in the year 2016. In

the year 2017 value become 0.60 which elevate to 0.78 in the year 2018. It can be said that if

inventory not considered then in that case liquidity is slightly below standard.

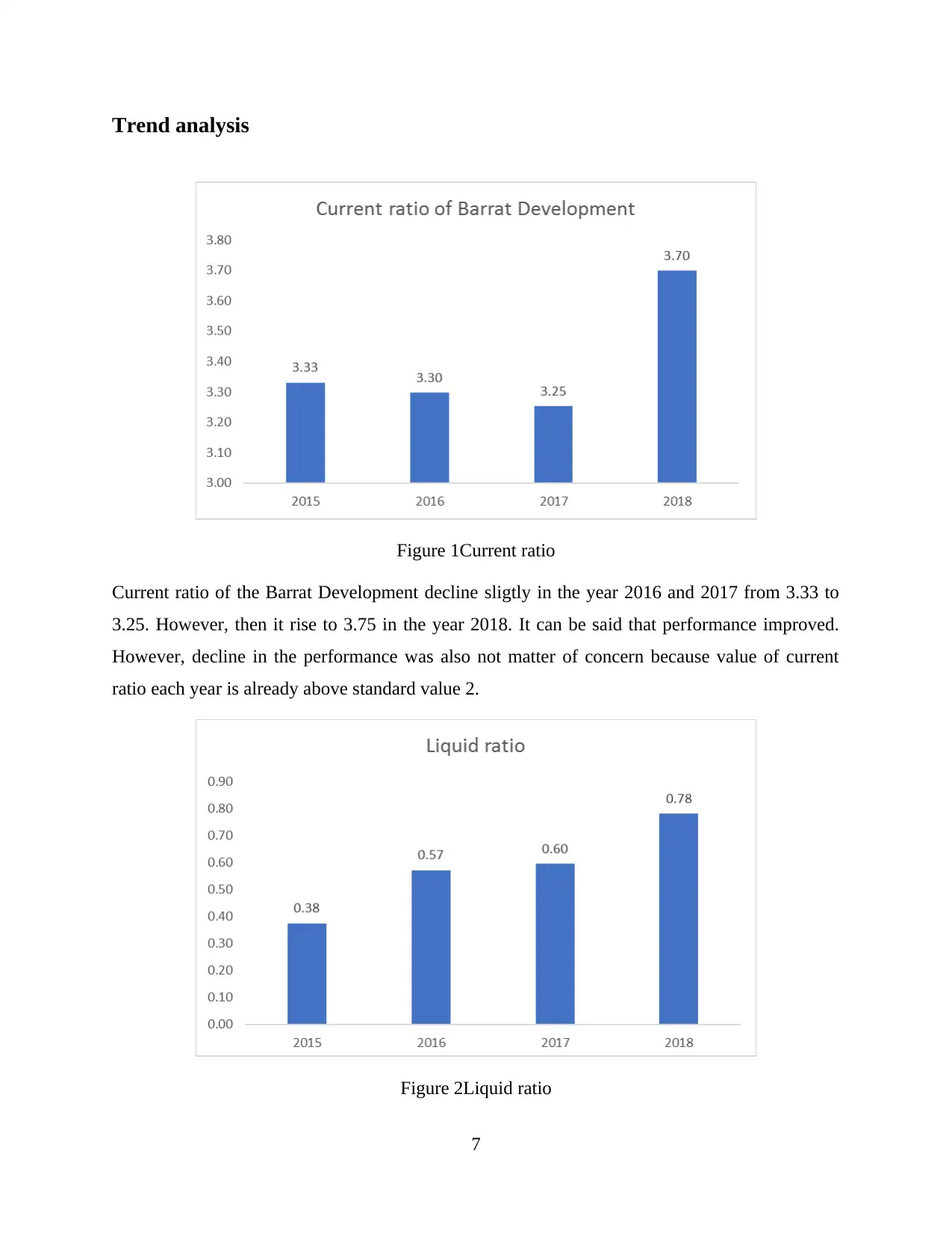

Figure 3Asset turnover ratio

Asset turnover ratio value increased sharply from the year 2015 to 2017 from 1.01 to

1.08. This change is not big and it can be said that asset turnover ratio remains constant in

mentioned time period. In the year 2018 ratio value decline slightly to 1.06. Low value of the

ratio reflects that firm failed to make effective use of asset in its business.

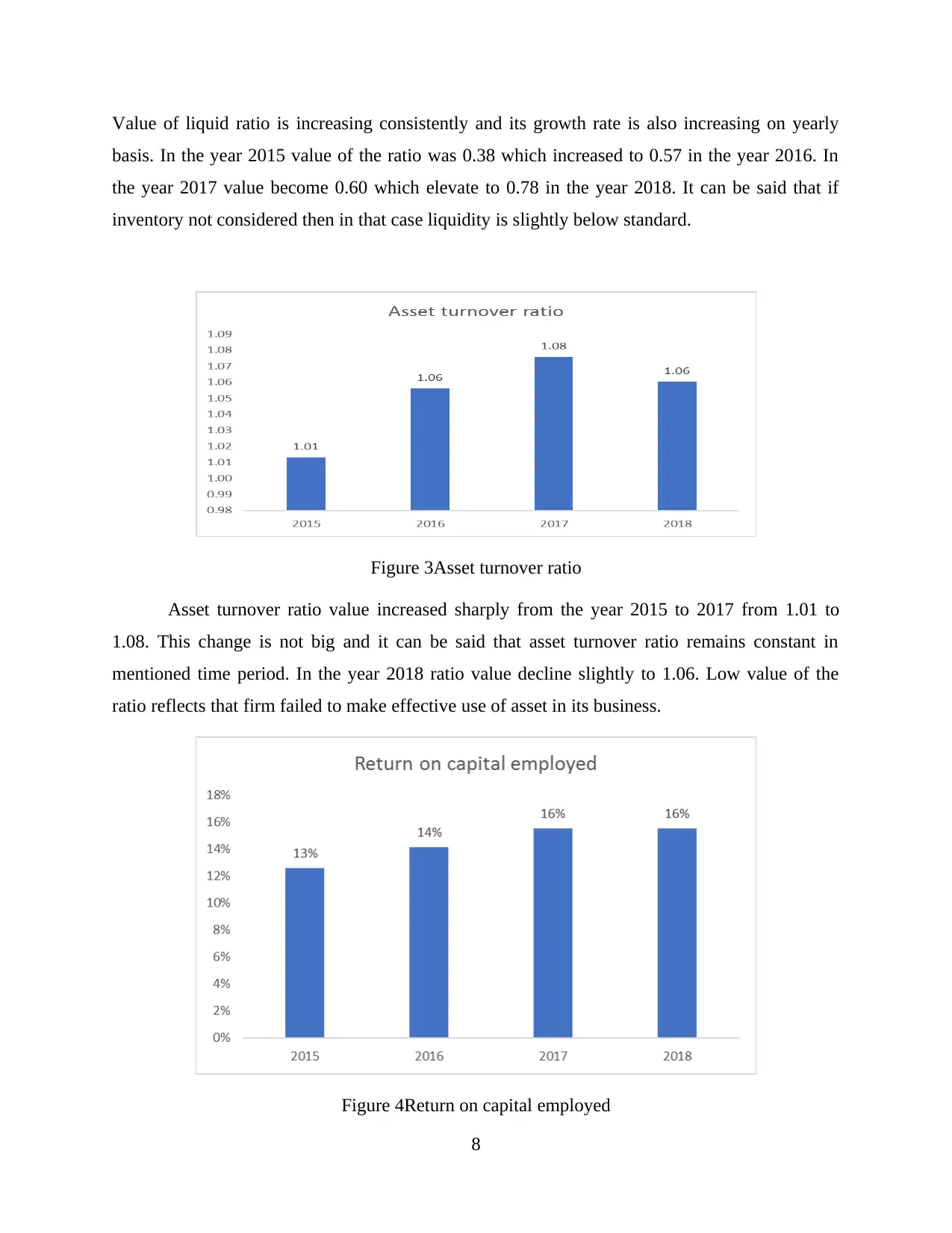

Figure 4Return on capital employed

8

basis. In the year 2015 value of the ratio was 0.38 which increased to 0.57 in the year 2016. In

the year 2017 value become 0.60 which elevate to 0.78 in the year 2018. It can be said that if

inventory not considered then in that case liquidity is slightly below standard.

Figure 3Asset turnover ratio

Asset turnover ratio value increased sharply from the year 2015 to 2017 from 1.01 to

1.08. This change is not big and it can be said that asset turnover ratio remains constant in

mentioned time period. In the year 2018 ratio value decline slightly to 1.06. Low value of the

ratio reflects that firm failed to make effective use of asset in its business.

Figure 4Return on capital employed

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ROCE or return on capital employed increase from 13% to 16% from the year 2015 to 2017. It

remain constant at 16%. ROCE percentage is apprioporiate and currently constant. Hence, it can

be said that firm perform moderate on this front.

Figure 5Return on equity

Return on equity increased from 15% to 18% from the year 2015 to 2018. Each year increase of

1% is observed. Growth is not satisfactory and it can be said that firm failed to generate efficient

return for its investors.

Figure 6Gross margin percentage

9

remain constant at 16%. ROCE percentage is apprioporiate and currently constant. Hence, it can

be said that firm perform moderate on this front.

Figure 5Return on equity

Return on equity increased from 15% to 18% from the year 2015 to 2018. Each year increase of

1% is observed. Growth is not satisfactory and it can be said that firm failed to generate efficient

return for its investors.

Figure 6Gross margin percentage

9

There is stability in the firm gross profit ratio and its value increased from 19% to 21%. Such

kind of growth is not so big and it can be said that gross profit ratio remain in the specific range.

However, gross profit ratio is not satisfatory and it need to be improved.

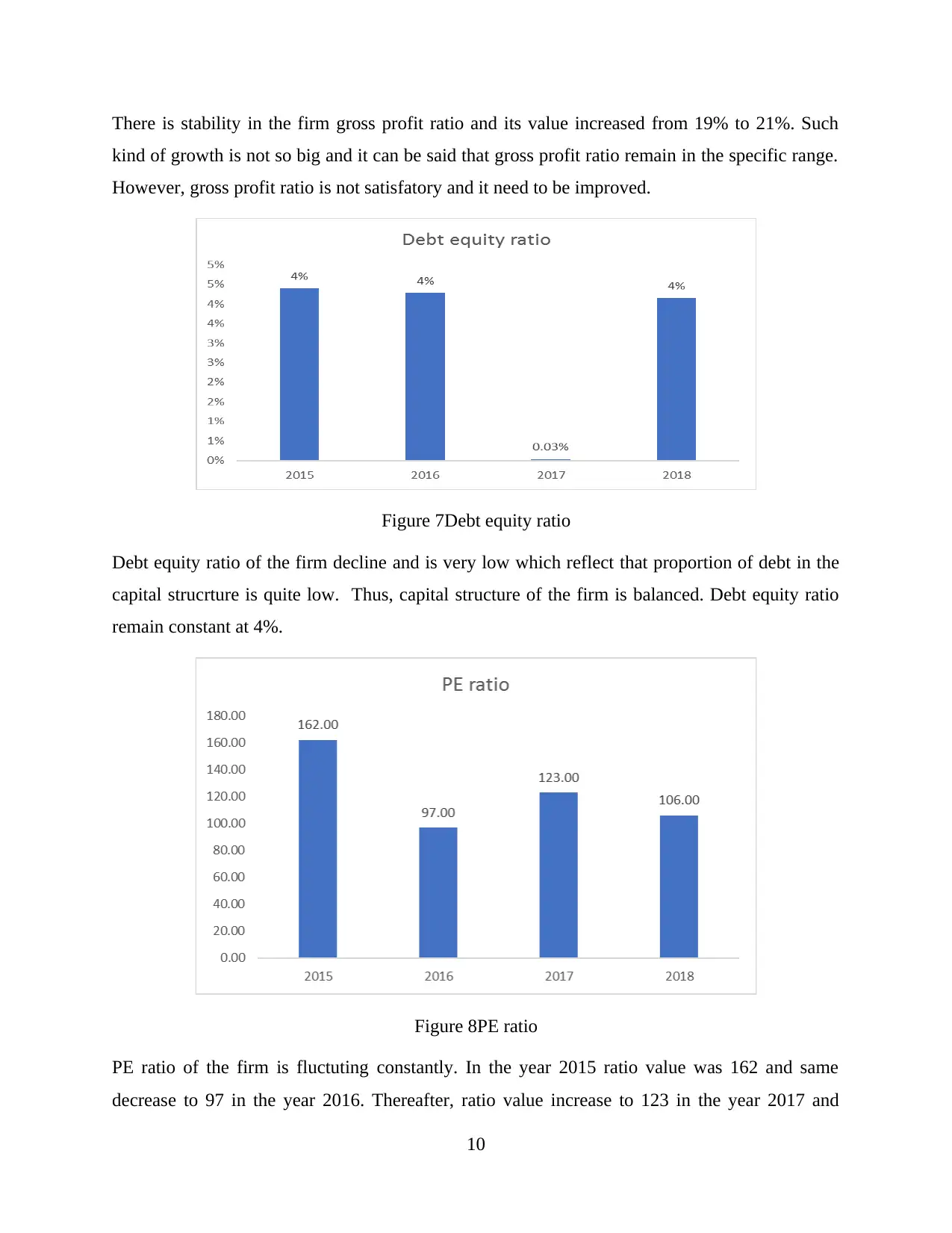

Figure 7Debt equity ratio

Debt equity ratio of the firm decline and is very low which reflect that proportion of debt in the

capital strucrture is quite low. Thus, capital structure of the firm is balanced. Debt equity ratio

remain constant at 4%.

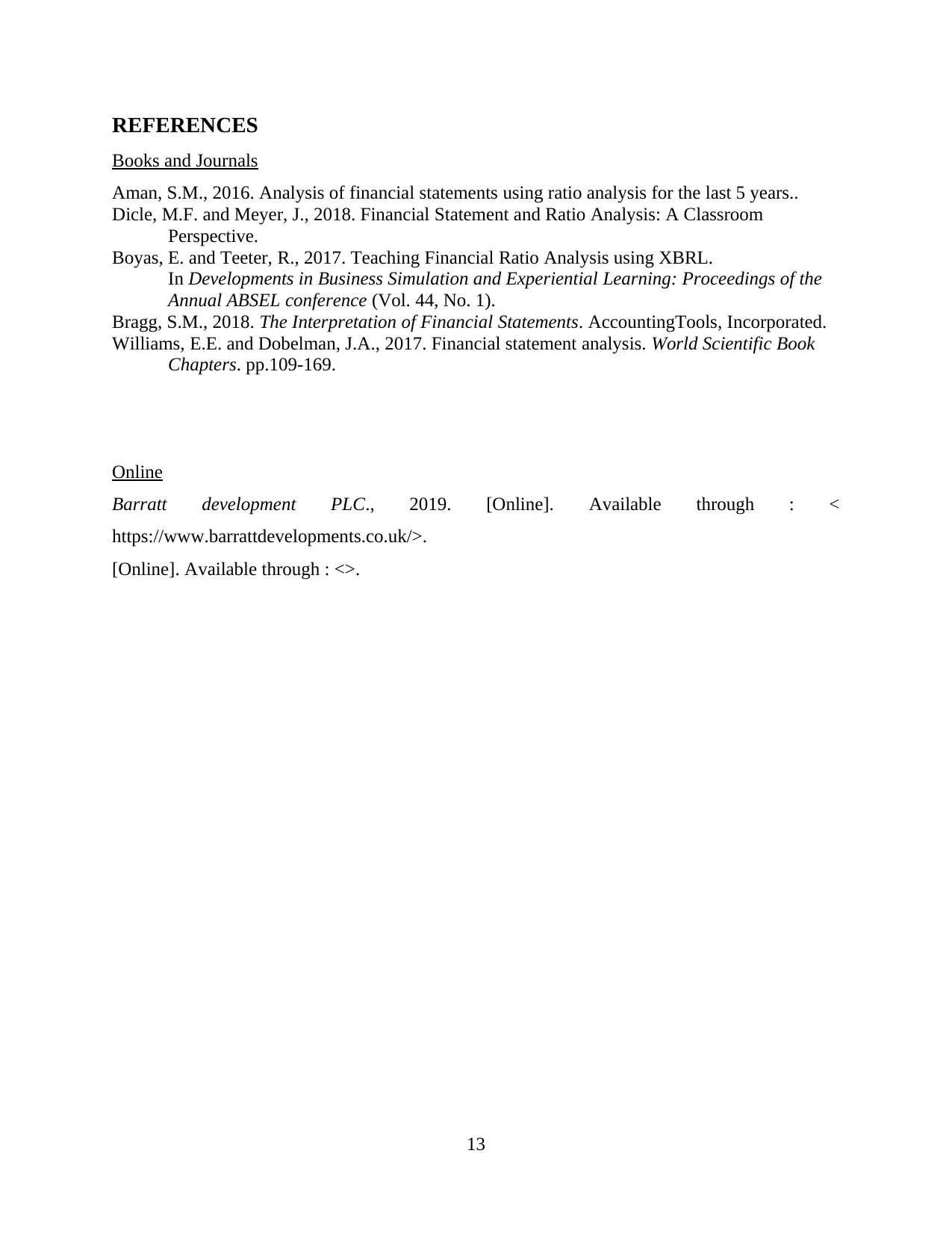

Figure 8PE ratio

PE ratio of the firm is fluctuting constantly. In the year 2015 ratio value was 162 and same

decrease to 97 in the year 2016. Thereafter, ratio value increase to 123 in the year 2017 and

10

kind of growth is not so big and it can be said that gross profit ratio remain in the specific range.

However, gross profit ratio is not satisfatory and it need to be improved.

Figure 7Debt equity ratio

Debt equity ratio of the firm decline and is very low which reflect that proportion of debt in the

capital strucrture is quite low. Thus, capital structure of the firm is balanced. Debt equity ratio

remain constant at 4%.

Figure 8PE ratio

PE ratio of the firm is fluctuting constantly. In the year 2015 ratio value was 162 and same

decrease to 97 in the year 2016. Thereafter, ratio value increase to 123 in the year 2017 and

10

decline to 106 in the year 2018. It can be said that valuation of equity of the company is

fluctuating sharply.

Comment on the business from an investor’s point of view in terms of

movements in ratios

From investor point of view on analysis of results it is identified that company fundamentals

are strong and its financial condition is good. It can be observed that there is abundant amount of

current assets in the company business and it can easily pay its current liabilities. Even after

payment of current liability firm will have sufficient amount of current assets in its business.

Barratt Development is making efficient and effective use of cash in its business and due to this

reason return on capital employed increased over years (Barratt development PLC., 2019). Not

return on capital employed but return on equity also increased at rapid pace in the business. This

indicate that people are receiving sufficient amount of return on investment and from this point

of view company is in good position. Profitability percentage is also increasing consistently

which indicate that firm control on expenses in the business increased at rapid pace which is

good from the investors point of view. It can be said that there are good growth prospects in the

company and investors must made investment in the company. UK economy and world economy

is also improving consistently which will lead to elevation in housing demand and boom again

will be observed in the construction industry. Thus, it can be said that in the upcoming time

period plunge can be observed in the sales revenue. It will be profitable for the company to make

investment in the Barratt Development.

Limitation of analysis

One of the main limitation of the analysis is that economic analysis is not done. It is well

known fact that economic condition of the nation and world greatly affect people expenditure on

the products which ultimately affect profitability of the firm. If economy is not in the good

condition then in that case ratios can not perform well. In such a situation without consideirng

current economic condition if results are interpreted then in that case firm performance can be

wrongly accessed. Hence, it is very important to analyze ratios performance by considering

present economic condition.

11

fluctuating sharply.

Comment on the business from an investor’s point of view in terms of

movements in ratios

From investor point of view on analysis of results it is identified that company fundamentals

are strong and its financial condition is good. It can be observed that there is abundant amount of

current assets in the company business and it can easily pay its current liabilities. Even after

payment of current liability firm will have sufficient amount of current assets in its business.

Barratt Development is making efficient and effective use of cash in its business and due to this

reason return on capital employed increased over years (Barratt development PLC., 2019). Not

return on capital employed but return on equity also increased at rapid pace in the business. This

indicate that people are receiving sufficient amount of return on investment and from this point

of view company is in good position. Profitability percentage is also increasing consistently

which indicate that firm control on expenses in the business increased at rapid pace which is

good from the investors point of view. It can be said that there are good growth prospects in the

company and investors must made investment in the company. UK economy and world economy

is also improving consistently which will lead to elevation in housing demand and boom again

will be observed in the construction industry. Thus, it can be said that in the upcoming time

period plunge can be observed in the sales revenue. It will be profitable for the company to make

investment in the Barratt Development.

Limitation of analysis

One of the main limitation of the analysis is that economic analysis is not done. It is well

known fact that economic condition of the nation and world greatly affect people expenditure on

the products which ultimately affect profitability of the firm. If economy is not in the good

condition then in that case ratios can not perform well. In such a situation without consideirng

current economic condition if results are interpreted then in that case firm performance can be

wrongly accessed. Hence, it is very important to analyze ratios performance by considering

present economic condition.

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Overall conclusions and recommendations for enhancing financial

performance in future

On the basis of above discussion, it is concluded that Barratt development perform well and,

on some fronts, it need to improve its performance so that profitability can be maximized.

Company is making effective use of resources in its business and this is reason due to which

profit is increasing consistently in the business. Persimmon performance is very poor relative to

Barratt development and in multiple areas it need to do extensive work so as to survive in rapidly

changing business conditions.

It is recommended that economic analysis and industry analysis must also be done so that

investor can see clearer picture of the current condition and accordingly can estimate company

performance. Economic analysis and industry analysis will also assist investors in estimating

future business conditions. Thus, on basis of all these relevant information’s they can make

investment decisions in better way.

12

performance in future

On the basis of above discussion, it is concluded that Barratt development perform well and,

on some fronts, it need to improve its performance so that profitability can be maximized.

Company is making effective use of resources in its business and this is reason due to which

profit is increasing consistently in the business. Persimmon performance is very poor relative to

Barratt development and in multiple areas it need to do extensive work so as to survive in rapidly

changing business conditions.

It is recommended that economic analysis and industry analysis must also be done so that

investor can see clearer picture of the current condition and accordingly can estimate company

performance. Economic analysis and industry analysis will also assist investors in estimating

future business conditions. Thus, on basis of all these relevant information’s they can make

investment decisions in better way.

12

REFERENCES

Books and Journals

Aman, S.M., 2016. Analysis of financial statements using ratio analysis for the last 5 years..

Dicle, M.F. and Meyer, J., 2018. Financial Statement and Ratio Analysis: A Classroom

Perspective.

Boyas, E. and Teeter, R., 2017. Teaching Financial Ratio Analysis using XBRL.

In Developments in Business Simulation and Experiential Learning: Proceedings of the

Annual ABSEL conference (Vol. 44, No. 1).

Bragg, S.M., 2018. The Interpretation of Financial Statements. AccountingTools, Incorporated.

Williams, E.E. and Dobelman, J.A., 2017. Financial statement analysis. World Scientific Book

Chapters. pp.109-169.

Online

Barratt development PLC., 2019. [Online]. Available through : <

https://www.barrattdevelopments.co.uk/>.

[Online]. Available through : <>.

13

Books and Journals

Aman, S.M., 2016. Analysis of financial statements using ratio analysis for the last 5 years..

Dicle, M.F. and Meyer, J., 2018. Financial Statement and Ratio Analysis: A Classroom

Perspective.

Boyas, E. and Teeter, R., 2017. Teaching Financial Ratio Analysis using XBRL.

In Developments in Business Simulation and Experiential Learning: Proceedings of the

Annual ABSEL conference (Vol. 44, No. 1).

Bragg, S.M., 2018. The Interpretation of Financial Statements. AccountingTools, Incorporated.

Williams, E.E. and Dobelman, J.A., 2017. Financial statement analysis. World Scientific Book

Chapters. pp.109-169.

Online

Barratt development PLC., 2019. [Online]. Available through : <

https://www.barrattdevelopments.co.uk/>.

[Online]. Available through : <>.

13

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.