City and Islington College - Final Accounts Project - L3 Business

VerifiedAdded on 2022/12/27

|14

|2438

|33

Project

AI Summary

This project presents a comprehensive solution to a final accounts assignment, addressing key aspects of financial accounting. The project includes the completion of fill-in-the-gaps exercises, preparation of balance sheets and profit and loss accounts, and detailed comments on the results. It covers topics such as depreciation of fixed assets, provision for depreciation, accruals, and prepayments, with explanations and examples. The assignment involves calculations of profit or loss on disposal, comparisons of straight-line and reducing balance depreciation methods, and analysis of the effects of accruals and prepayments on net profit. The student provides trading, profit and loss accounts and balance sheets for different periods, followed by detailed commentary on the financial performance and position of the businesses. The project also includes the importance of depreciation and its application to final accounts and why provision for depreciation is needed. References from academic journals and books are also included to support the arguments.

Final Accounts

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

PROJECT.........................................................................................................................................3

1. Fill in the gaps:...................................................................................................................3

2. Balance sheet as at 30 June 2019 and comment on result:.................................................3

3. Trading profit and loss account and balance sheet and comment on your result...............5

4. Trading profit and loss account and balance sheet and comment on result:.....................6

TASK 1: Depreciation of Fixed Assets and Provision for Depreciation ........................................8

1. Explain the importance of depreciation and its application to final accounts:...................8

2. Why is provision for depreciation needed and how is it worked out:................................8

3. Aggregate depreciation:......................................................................................................8

4. Net book value:...................................................................................................................8

5. Calculate the profit or loss on disposal...............................................................................8

Straight Line Method or Reducing Balance Method:.............................................................8

6. Why the reducing balance method is more realistic than the straight line method:...........9

TASK 2: Pre-Payment and Accrual...............................................................................................10

1. Describe an accrual and give example to support reasoning:...........................................10

2. Give details of pre-payment and provide an example to back up description:................10

3. Complete the table:...........................................................................................................11

4. Effect would the pre-payments and accruals have on the net profit:...............................11

REFERENCES..............................................................................................................................12

2

PROJECT.........................................................................................................................................3

1. Fill in the gaps:...................................................................................................................3

2. Balance sheet as at 30 June 2019 and comment on result:.................................................3

3. Trading profit and loss account and balance sheet and comment on your result...............5

4. Trading profit and loss account and balance sheet and comment on result:.....................6

TASK 1: Depreciation of Fixed Assets and Provision for Depreciation ........................................8

1. Explain the importance of depreciation and its application to final accounts:...................8

2. Why is provision for depreciation needed and how is it worked out:................................8

3. Aggregate depreciation:......................................................................................................8

4. Net book value:...................................................................................................................8

5. Calculate the profit or loss on disposal...............................................................................8

Straight Line Method or Reducing Balance Method:.............................................................8

6. Why the reducing balance method is more realistic than the straight line method:...........9

TASK 2: Pre-Payment and Accrual...............................................................................................10

1. Describe an accrual and give example to support reasoning:...........................................10

2. Give details of pre-payment and provide an example to back up description:................10

3. Complete the table:...........................................................................................................11

4. Effect would the pre-payments and accruals have on the net profit:...............................11

REFERENCES..............................................................................................................................12

2

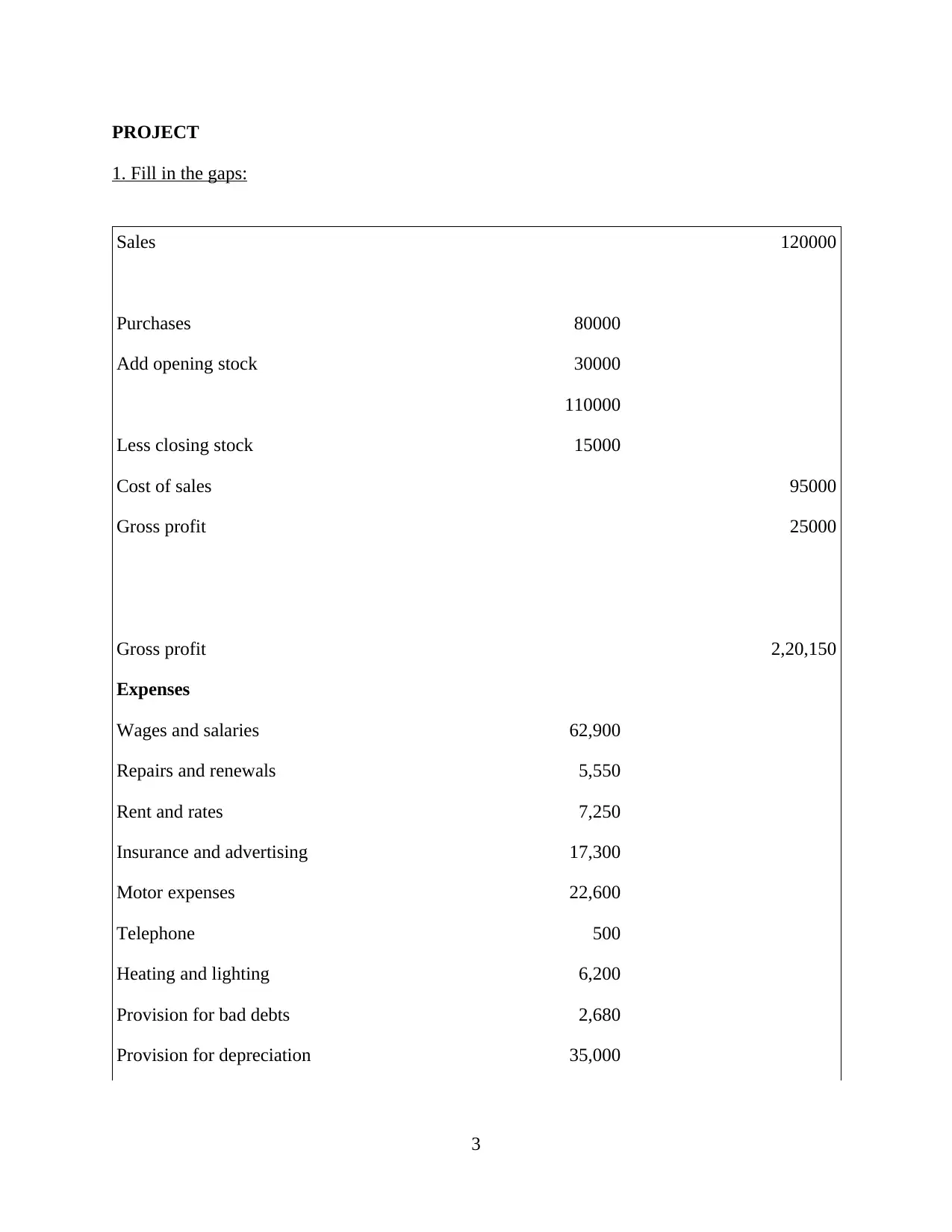

PROJECT

1. Fill in the gaps:

Sales 120000

Purchases 80000

Add opening stock 30000

110000

Less closing stock 15000

Cost of sales 95000

Gross profit 25000

Gross profit 2,20,150

Expenses

Wages and salaries 62,900

Repairs and renewals 5,550

Rent and rates 7,250

Insurance and advertising 17,300

Motor expenses 22,600

Telephone 500

Heating and lighting 6,200

Provision for bad debts 2,680

Provision for depreciation 35,000

3

1. Fill in the gaps:

Sales 120000

Purchases 80000

Add opening stock 30000

110000

Less closing stock 15000

Cost of sales 95000

Gross profit 25000

Gross profit 2,20,150

Expenses

Wages and salaries 62,900

Repairs and renewals 5,550

Rent and rates 7,250

Insurance and advertising 17,300

Motor expenses 22,600

Telephone 500

Heating and lighting 6,200

Provision for bad debts 2,680

Provision for depreciation 35,000

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Discount allowed 680

Totals 1,60,660

............ 59490

2. Balance sheet as at 30 June 2019 and comment on result:

Profit and loss

account for the

year ended 30th

June 2019

Particulars Amount

Sales 35600

Purchases 30970

Add opening stock 0

30970

Less closing stock 9960

Cost of sales 21010

Gross profit 14590

Less: Expenses

Rent 1560

Insurance 305

Lighting &

heating

expenses 516

Motor expenses 1960

4

Totals 1,60,660

............ 59490

2. Balance sheet as at 30 June 2019 and comment on result:

Profit and loss

account for the

year ended 30th

June 2019

Particulars Amount

Sales 35600

Purchases 30970

Add opening stock 0

30970

Less closing stock 9960

Cost of sales 21010

Gross profit 14590

Less: Expenses

Rent 1560

Insurance 305

Lighting &

heating

expenses 516

Motor expenses 1960

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

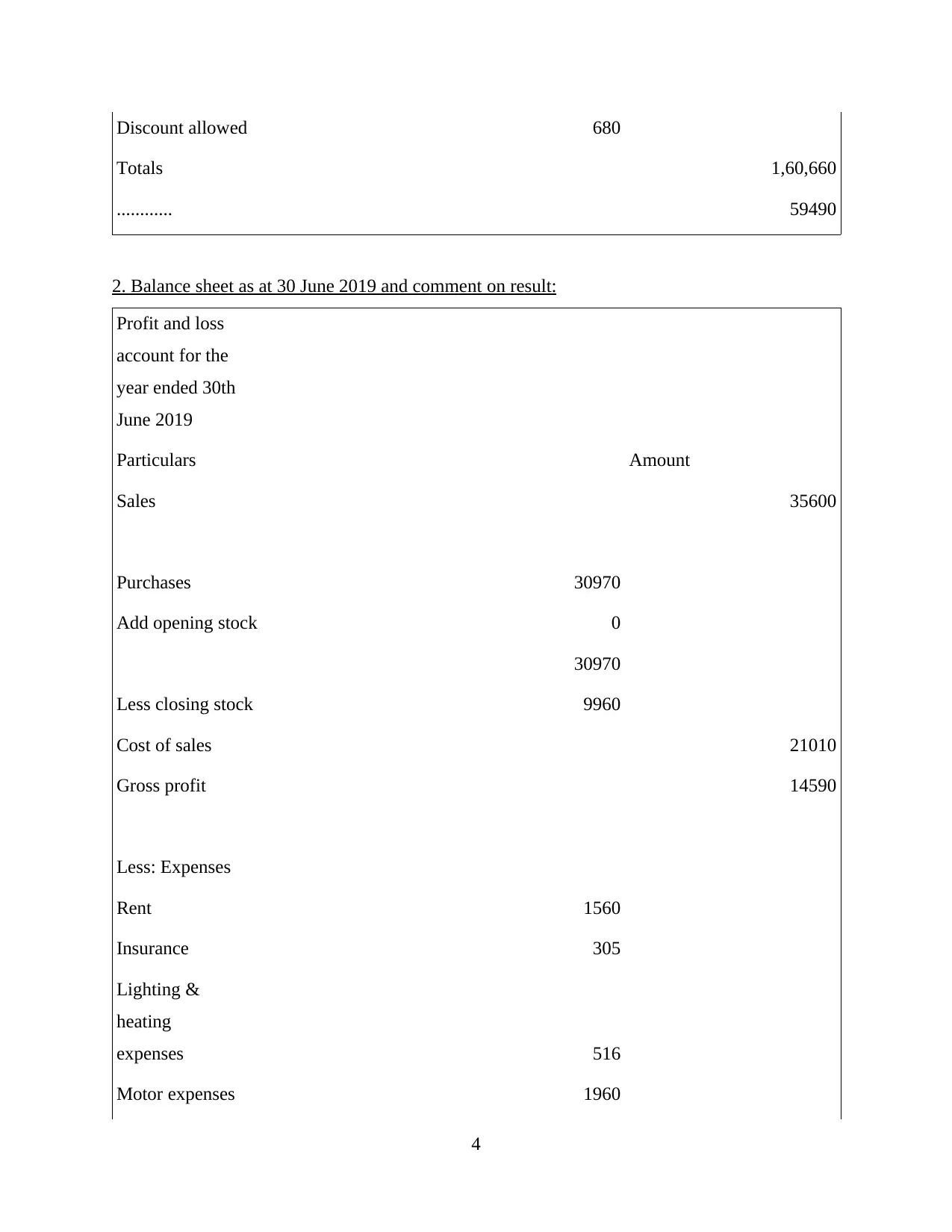

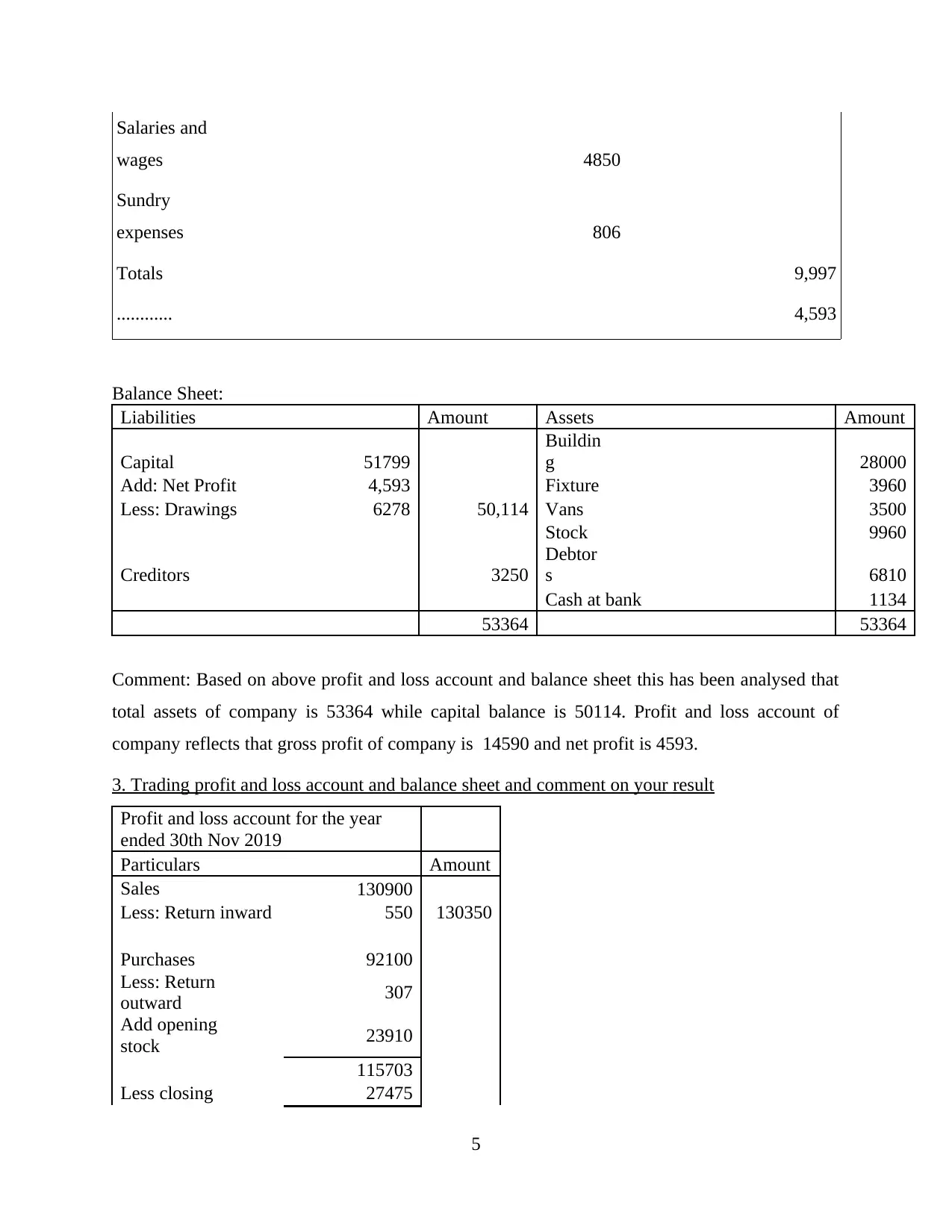

Salaries and

wages 4850

Sundry

expenses 806

Totals 9,997

............ 4,593

Balance Sheet:

Liabilities Amount Assets Amount

Capital 51799

Buildin

g 28000

Add: Net Profit 4,593 Fixture 3960

Less: Drawings 6278 50,114 Vans 3500

Stock 9960

Creditors 3250

Debtor

s 6810

Cash at bank 1134

53364 53364

Comment: Based on above profit and loss account and balance sheet this has been analysed that

total assets of company is 53364 while capital balance is 50114. Profit and loss account of

company reflects that gross profit of company is 14590 and net profit is 4593.

3. Trading profit and loss account and balance sheet and comment on your result

Profit and loss account for the year

ended 30th Nov 2019

Particulars Amount

Sales 130900

Less: Return inward 550 130350

Purchases 92100

Less: Return

outward 307

Add opening

stock 23910

115703

Less closing 27475

5

wages 4850

Sundry

expenses 806

Totals 9,997

............ 4,593

Balance Sheet:

Liabilities Amount Assets Amount

Capital 51799

Buildin

g 28000

Add: Net Profit 4,593 Fixture 3960

Less: Drawings 6278 50,114 Vans 3500

Stock 9960

Creditors 3250

Debtor

s 6810

Cash at bank 1134

53364 53364

Comment: Based on above profit and loss account and balance sheet this has been analysed that

total assets of company is 53364 while capital balance is 50114. Profit and loss account of

company reflects that gross profit of company is 14590 and net profit is 4593.

3. Trading profit and loss account and balance sheet and comment on your result

Profit and loss account for the year

ended 30th Nov 2019

Particulars Amount

Sales 130900

Less: Return inward 550 130350

Purchases 92100

Less: Return

outward 307

Add opening

stock 23910

115703

Less closing 27475

5

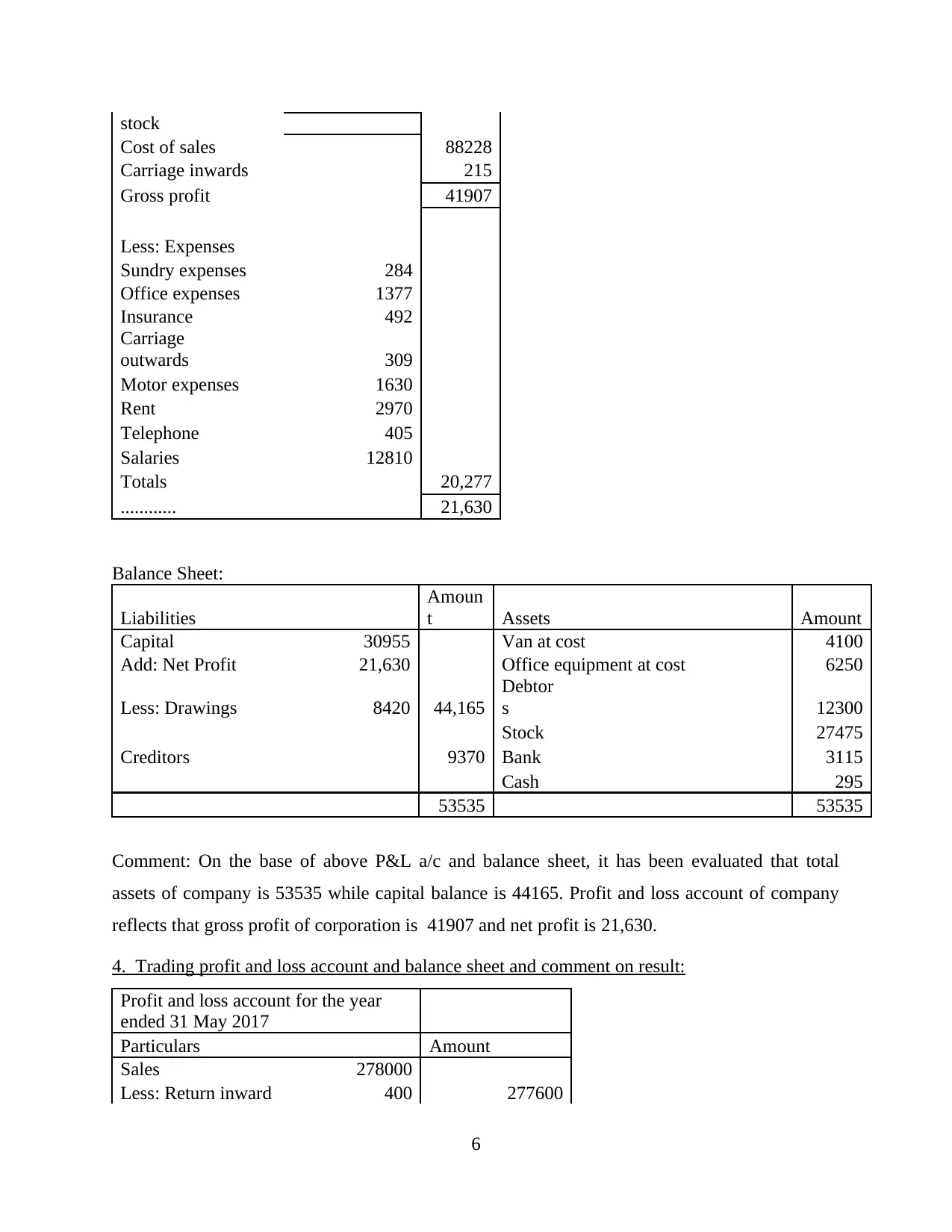

stock

Cost of sales 88228

Carriage inwards 215

Gross profit 41907

Less: Expenses

Sundry expenses 284

Office expenses 1377

Insurance 492

Carriage

outwards 309

Motor expenses 1630

Rent 2970

Telephone 405

Salaries 12810

Totals 20,277

............ 21,630

Balance Sheet:

Liabilities

Amoun

t Assets Amount

Capital 30955 Van at cost 4100

Add: Net Profit 21,630 Office equipment at cost 6250

Less: Drawings 8420 44,165

Debtor

s 12300

Stock 27475

Creditors 9370 Bank 3115

Cash 295

53535 53535

Comment: On the base of above P&L a/c and balance sheet, it has been evaluated that total

assets of company is 53535 while capital balance is 44165. Profit and loss account of company

reflects that gross profit of corporation is 41907 and net profit is 21,630.

4. Trading profit and loss account and balance sheet and comment on result:

Profit and loss account for the year

ended 31 May 2017

Particulars Amount

Sales 278000

Less: Return inward 400 277600

6

Cost of sales 88228

Carriage inwards 215

Gross profit 41907

Less: Expenses

Sundry expenses 284

Office expenses 1377

Insurance 492

Carriage

outwards 309

Motor expenses 1630

Rent 2970

Telephone 405

Salaries 12810

Totals 20,277

............ 21,630

Balance Sheet:

Liabilities

Amoun

t Assets Amount

Capital 30955 Van at cost 4100

Add: Net Profit 21,630 Office equipment at cost 6250

Less: Drawings 8420 44,165

Debtor

s 12300

Stock 27475

Creditors 9370 Bank 3115

Cash 295

53535 53535

Comment: On the base of above P&L a/c and balance sheet, it has been evaluated that total

assets of company is 53535 while capital balance is 44165. Profit and loss account of company

reflects that gross profit of corporation is 41907 and net profit is 21,630.

4. Trading profit and loss account and balance sheet and comment on result:

Profit and loss account for the year

ended 31 May 2017

Particulars Amount

Sales 278000

Less: Return inward 400 277600

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

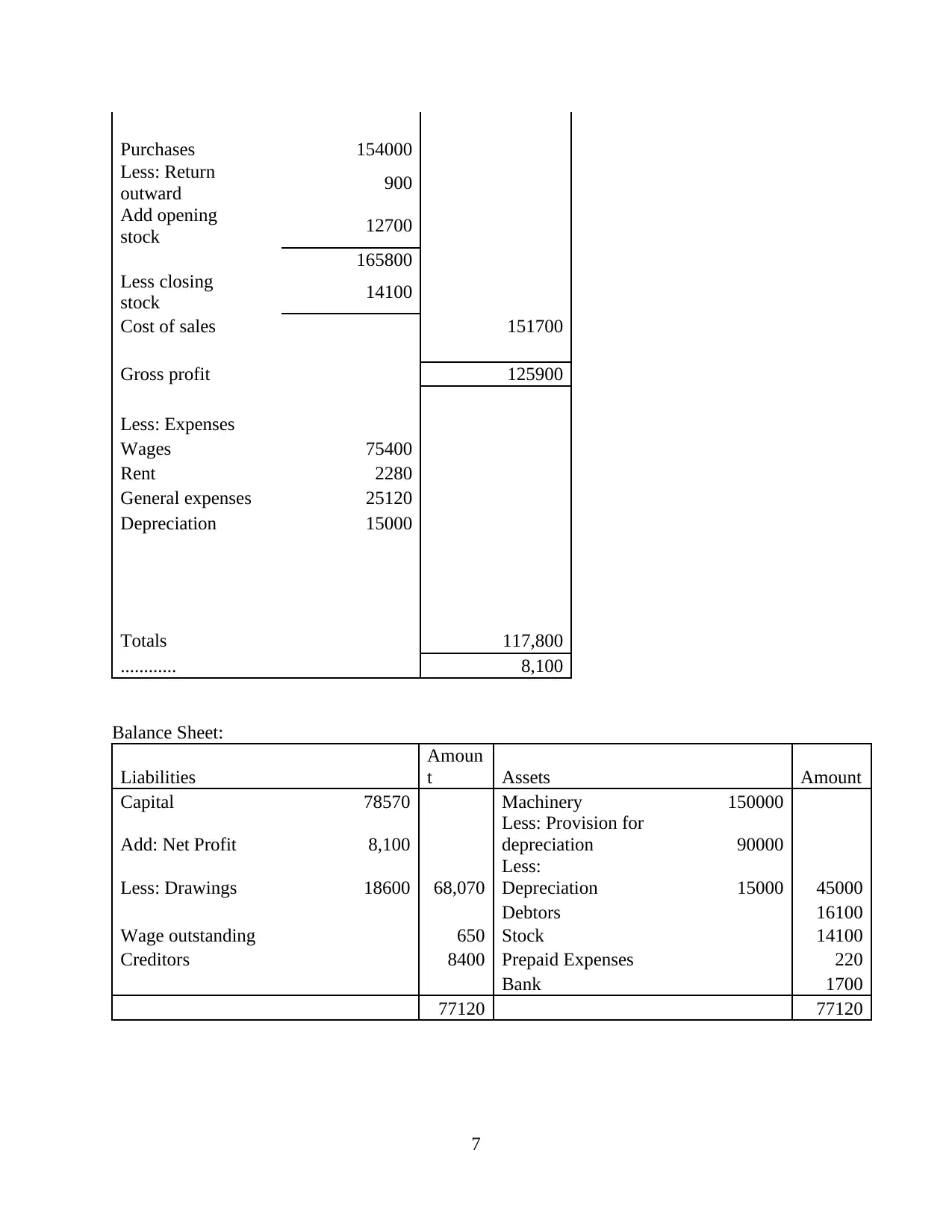

Purchases 154000

Less: Return

outward 900

Add opening

stock 12700

165800

Less closing

stock 14100

Cost of sales 151700

Gross profit 125900

Less: Expenses

Wages 75400

Rent 2280

General expenses 25120

Depreciation 15000

Totals 117,800

............ 8,100

Balance Sheet:

Liabilities

Amoun

t Assets Amount

Capital 78570 Machinery 150000

Add: Net Profit 8,100

Less: Provision for

depreciation 90000

Less: Drawings 18600 68,070

Less:

Depreciation 15000 45000

Debtors 16100

Wage outstanding 650 Stock 14100

Creditors 8400 Prepaid Expenses 220

Bank 1700

77120 77120

7

Less: Return

outward 900

Add opening

stock 12700

165800

Less closing

stock 14100

Cost of sales 151700

Gross profit 125900

Less: Expenses

Wages 75400

Rent 2280

General expenses 25120

Depreciation 15000

Totals 117,800

............ 8,100

Balance Sheet:

Liabilities

Amoun

t Assets Amount

Capital 78570 Machinery 150000

Add: Net Profit 8,100

Less: Provision for

depreciation 90000

Less: Drawings 18600 68,070

Less:

Depreciation 15000 45000

Debtors 16100

Wage outstanding 650 Stock 14100

Creditors 8400 Prepaid Expenses 220

Bank 1700

77120 77120

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

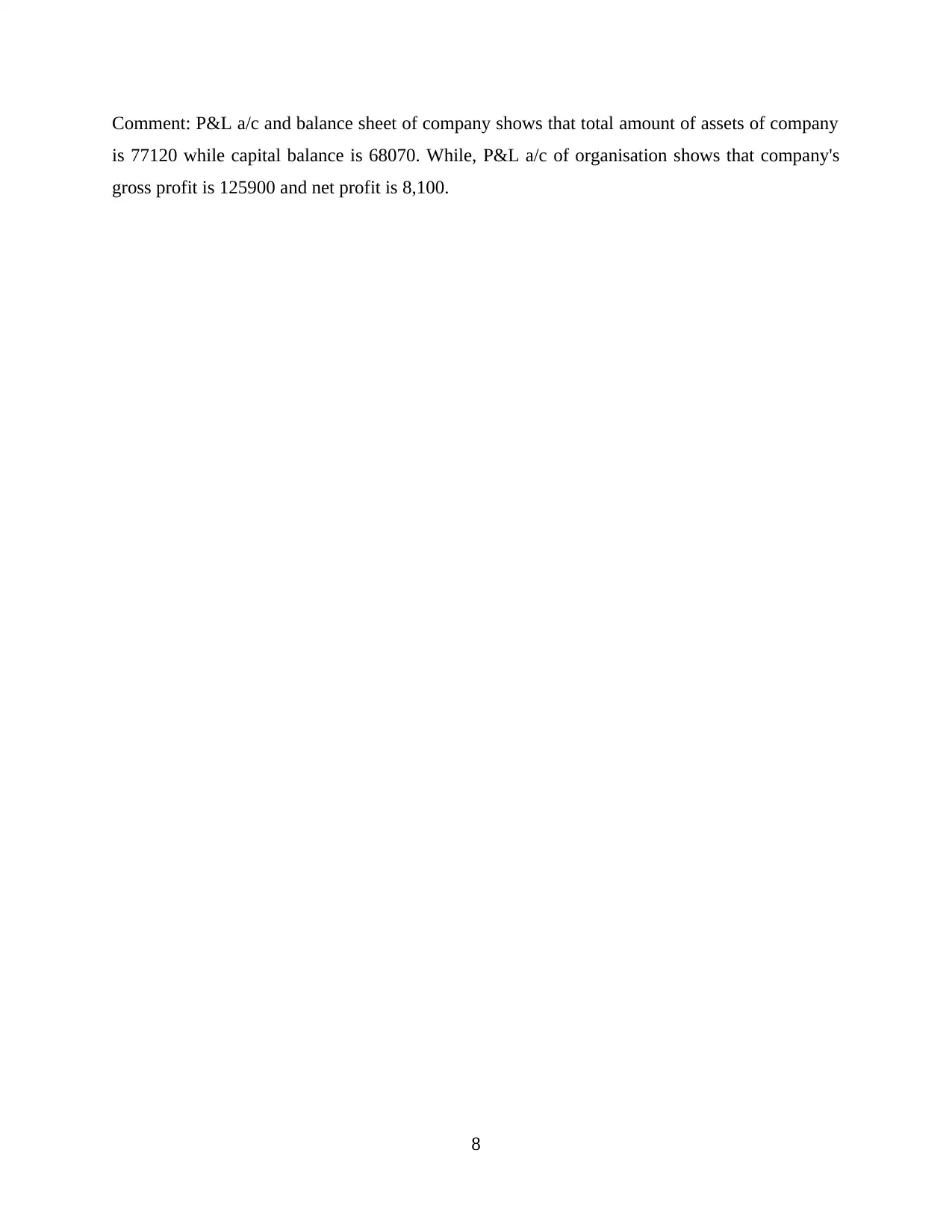

Comment: P&L a/c and balance sheet of company shows that total amount of assets of company

is 77120 while capital balance is 68070. While, P&L a/c of organisation shows that company's

gross profit is 125900 and net profit is 8,100.

8

is 77120 while capital balance is 68070. While, P&L a/c of organisation shows that company's

gross profit is 125900 and net profit is 8,100.

8

TASK 1: Depreciation of Fixed Assets and Provision for Depreciation

1. Explain the importance of depreciation and its application to final accounts:

Depreciation for assets allows for corporations to retrieve cost of fixed asset at the time of

purchase. This procedure allows for corporation for covering up aggregate asset cost over total

useful life rather than immediately retrieving purchase cost. It enables corporations to effectively

replace potential assets applying appropriate revenue sum. Application of depreciation in final

accounts reflected as deduction in fixed asset and showing depreciation amount in profit and loss

as expense (BeU, 2018).

2. Why is provision for depreciation needed and how is it worked out:

Primarily provision for depreciation is required to make corporation’s balance sheet as

accurately reflecting actual current value figure of overall investments corporation made in

company’s fixed assets for specific period of time.

For instance, if a organisation invests $600 million in new plant, that sum will reflect on

balance sheet as longer-term fixed asset. Although, if such sum is not optimised every year over

period to represent ageing cycle, wears, tear as well as obsolescence, then company's balance

sheet will be reflected this value too higher as specific measure of organisation's assets.

Depreciation for the provision lowers such book-value over period to embrace its reducing real-

value.

3. Aggregate depreciation:

Aggregate or cumulative depreciation reflects overall amount of asset that has been continuously

depreciated until specific point. For each period, amount of depreciation expense reported in that

accounting period is accumulated to opening aggregate depreciation balance (Tsamis and Liapis,

2017).

4. Net book value:

This is also regarded as the net-asset value which implies to value that a corporation reports fixed

asset on their annual balance sheet. This is assessed as actual original asset cost after deducting

aggregate depreciation, aggregate amortization, depletion or aggregate impairment.

5. Calculate the profit or loss on disposal

Net book value: 5000

Less: Asset Sold for: 3500

9

1. Explain the importance of depreciation and its application to final accounts:

Depreciation for assets allows for corporations to retrieve cost of fixed asset at the time of

purchase. This procedure allows for corporation for covering up aggregate asset cost over total

useful life rather than immediately retrieving purchase cost. It enables corporations to effectively

replace potential assets applying appropriate revenue sum. Application of depreciation in final

accounts reflected as deduction in fixed asset and showing depreciation amount in profit and loss

as expense (BeU, 2018).

2. Why is provision for depreciation needed and how is it worked out:

Primarily provision for depreciation is required to make corporation’s balance sheet as

accurately reflecting actual current value figure of overall investments corporation made in

company’s fixed assets for specific period of time.

For instance, if a organisation invests $600 million in new plant, that sum will reflect on

balance sheet as longer-term fixed asset. Although, if such sum is not optimised every year over

period to represent ageing cycle, wears, tear as well as obsolescence, then company's balance

sheet will be reflected this value too higher as specific measure of organisation's assets.

Depreciation for the provision lowers such book-value over period to embrace its reducing real-

value.

3. Aggregate depreciation:

Aggregate or cumulative depreciation reflects overall amount of asset that has been continuously

depreciated until specific point. For each period, amount of depreciation expense reported in that

accounting period is accumulated to opening aggregate depreciation balance (Tsamis and Liapis,

2017).

4. Net book value:

This is also regarded as the net-asset value which implies to value that a corporation reports fixed

asset on their annual balance sheet. This is assessed as actual original asset cost after deducting

aggregate depreciation, aggregate amortization, depletion or aggregate impairment.

5. Calculate the profit or loss on disposal

Net book value: 5000

Less: Asset Sold for: 3500

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Loss on disposal: 1500

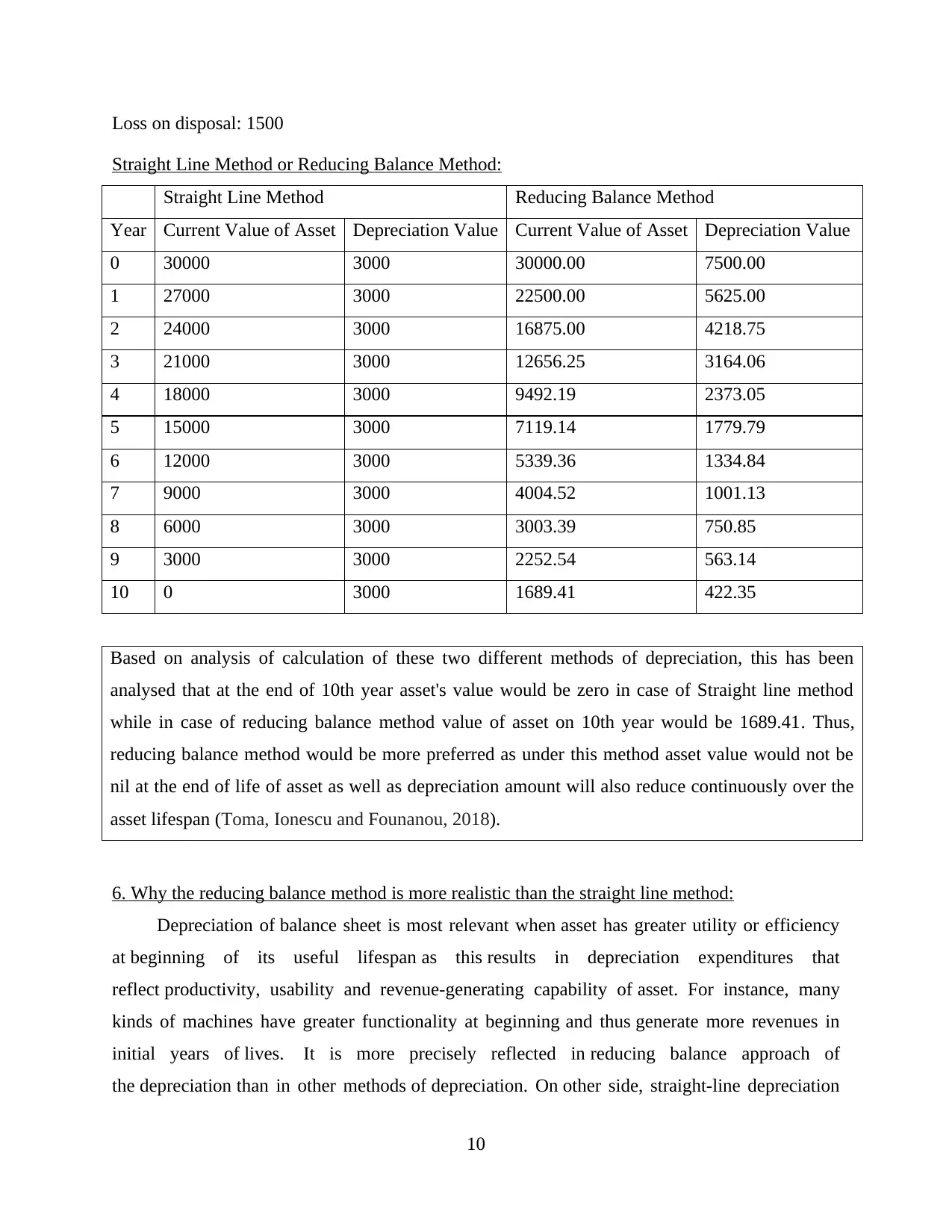

Straight Line Method or Reducing Balance Method:

Straight Line Method Reducing Balance Method

Year Current Value of Asset Depreciation Value Current Value of Asset Depreciation Value

0 30000 3000 30000.00 7500.00

1 27000 3000 22500.00 5625.00

2 24000 3000 16875.00 4218.75

3 21000 3000 12656.25 3164.06

4 18000 3000 9492.19 2373.05

5 15000 3000 7119.14 1779.79

6 12000 3000 5339.36 1334.84

7 9000 3000 4004.52 1001.13

8 6000 3000 3003.39 750.85

9 3000 3000 2252.54 563.14

10 0 3000 1689.41 422.35

Based on analysis of calculation of these two different methods of depreciation, this has been

analysed that at the end of 10th year asset's value would be zero in case of Straight line method

while in case of reducing balance method value of asset on 10th year would be 1689.41. Thus,

reducing balance method would be more preferred as under this method asset value would not be

nil at the end of life of asset as well as depreciation amount will also reduce continuously over the

asset lifespan (Toma, Ionescu and Founanou, 2018).

6. Why the reducing balance method is more realistic than the straight line method:

Depreciation of balance sheet is most relevant when asset has greater utility or efficiency

at beginning of its useful lifespan as this results in depreciation expenditures that

reflect productivity, usability and revenue-generating capability of asset. For instance, many

kinds of machines have greater functionality at beginning and thus generate more revenues in

initial years of lives. It is more precisely reflected in reducing balance approach of

the depreciation than in other methods of depreciation. On other side, straight-line depreciation

10

Straight Line Method or Reducing Balance Method:

Straight Line Method Reducing Balance Method

Year Current Value of Asset Depreciation Value Current Value of Asset Depreciation Value

0 30000 3000 30000.00 7500.00

1 27000 3000 22500.00 5625.00

2 24000 3000 16875.00 4218.75

3 21000 3000 12656.25 3164.06

4 18000 3000 9492.19 2373.05

5 15000 3000 7119.14 1779.79

6 12000 3000 5339.36 1334.84

7 9000 3000 4004.52 1001.13

8 6000 3000 3003.39 750.85

9 3000 3000 2252.54 563.14

10 0 3000 1689.41 422.35

Based on analysis of calculation of these two different methods of depreciation, this has been

analysed that at the end of 10th year asset's value would be zero in case of Straight line method

while in case of reducing balance method value of asset on 10th year would be 1689.41. Thus,

reducing balance method would be more preferred as under this method asset value would not be

nil at the end of life of asset as well as depreciation amount will also reduce continuously over the

asset lifespan (Toma, Ionescu and Founanou, 2018).

6. Why the reducing balance method is more realistic than the straight line method:

Depreciation of balance sheet is most relevant when asset has greater utility or efficiency

at beginning of its useful lifespan as this results in depreciation expenditures that

reflect productivity, usability and revenue-generating capability of asset. For instance, many

kinds of machines have greater functionality at beginning and thus generate more revenues in

initial years of lives. It is more precisely reflected in reducing balance approach of

the depreciation than in other methods of depreciation. On other side, straight-line depreciation

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

contributes in the equal depreciation costs and thus cannot account for greater scale of

productivity and usability at the initial stages of useful life of asset. However, straight-line

approach is much simpler to assess and could therefore be more appropriate alternative for small

business who handle their own funds (ZADOROZHNII and Kafka, 2017).

11

productivity and usability at the initial stages of useful life of asset. However, straight-line

approach is much simpler to assess and could therefore be more appropriate alternative for small

business who handle their own funds (ZADOROZHNII and Kafka, 2017).

11

TASK 2: Pre-Payment and Accrual

1. Describe an accrual and give example to support reasoning:

Accrual is basis of accrual accounting concept, which shifts revenues earned

and expenditure incurred by company at year ending when no actual cash is being exchanged.

Transactions will not be reported in the corporation's accounting books on cash basis of

the accounting, as there is no cash inflows or outflows. Accrual has direct effect on corporation's

income statement as well as balance sheet through preparation of modifying journal entries

recorded at ending of each accounting cycle. Accrual accounting aims to

align organization's revenues and expenditures with time period in which they were accrued,

instead of time period of actual cash flows linked with them (Lemishovska, 2017).

An illustration of accrued expenditures is salesperson collecting commission on the items

sold at time product is sold. Here, commission would be recorded by the organization as an

expenditure in the year in which this occurred, even if salesperson will pay commission at later

point in next accounting year. The expenditure will be reported in the corporation 's present

income statement as well as the accumulated expenses for commission will appear

on corporation 's balance sheet for delivery time, not if the commission being paid to salesperson

(Faccia and Mosco, 2019).

2. Give details of pre-payment and provide an example to back up description:

Prepaid expenses are expenses paid in one accounting year, but for which underlying asset would

not be utilized till a subsequent period. When asset is ultimately consumed, this is charged at the

value of asset. If consumed over number of years, there could be a sequence of subsequent

charges to the expenditure.

The prepaid expenditure shall be kept on balance sheet of company as current asset

before this is consumed. The explanation for the current classification of assets here is that most

of prepaid assets being consumed within several months of initial registration. If prepaid cost is

not prone to be actually consumed in next year, this will instead be listed as a longer-term asset

on balance sheet (Sulaiman and Adam, 2020).

An instance of prepaid expenditure is insurance, that is often paid advance for number of

future cycles; entity initially reports this expenditure as prepaid expense (assets) as well as

12

1. Describe an accrual and give example to support reasoning:

Accrual is basis of accrual accounting concept, which shifts revenues earned

and expenditure incurred by company at year ending when no actual cash is being exchanged.

Transactions will not be reported in the corporation's accounting books on cash basis of

the accounting, as there is no cash inflows or outflows. Accrual has direct effect on corporation's

income statement as well as balance sheet through preparation of modifying journal entries

recorded at ending of each accounting cycle. Accrual accounting aims to

align organization's revenues and expenditures with time period in which they were accrued,

instead of time period of actual cash flows linked with them (Lemishovska, 2017).

An illustration of accrued expenditures is salesperson collecting commission on the items

sold at time product is sold. Here, commission would be recorded by the organization as an

expenditure in the year in which this occurred, even if salesperson will pay commission at later

point in next accounting year. The expenditure will be reported in the corporation 's present

income statement as well as the accumulated expenses for commission will appear

on corporation 's balance sheet for delivery time, not if the commission being paid to salesperson

(Faccia and Mosco, 2019).

2. Give details of pre-payment and provide an example to back up description:

Prepaid expenses are expenses paid in one accounting year, but for which underlying asset would

not be utilized till a subsequent period. When asset is ultimately consumed, this is charged at the

value of asset. If consumed over number of years, there could be a sequence of subsequent

charges to the expenditure.

The prepaid expenditure shall be kept on balance sheet of company as current asset

before this is consumed. The explanation for the current classification of assets here is that most

of prepaid assets being consumed within several months of initial registration. If prepaid cost is

not prone to be actually consumed in next year, this will instead be listed as a longer-term asset

on balance sheet (Sulaiman and Adam, 2020).

An instance of prepaid expenditure is insurance, that is often paid advance for number of

future cycles; entity initially reports this expenditure as prepaid expense (assets) as well as

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.