Final Accounts: Sole Trader & Partnership Businesses - Analysis

VerifiedAdded on 2021/01/01

|16

|4335

|418

Report

AI Summary

This report provides a comprehensive overview of preparing final accounts for sole proprietorships and partnerships. It begins by identifying the reasons for closing accounts and preparing a trial balance, detailing the process of creating final accounts from a trial balance, and describing methods for constructing accounts from incomplete records. The report also addresses imbalances resulting from incorrect double entries and incomplete data. Task 2 focuses on preparing accounting records from incomplete information, calculating cash/bank balances, and preparing sales and purchase ledger control accounts. Task 3 covers the components of final accounts for sole traders, including profit and loss representation and balance sheet preparation. Tasks 4, 5, and 6 delve into partnership accounting, explaining partnership agreements, components of partnership accounts, profit and loss appropriation, profit determination, and the representation of partners' capital and current accounts, concluding with the measurement of closing balances and balance sheet presentation. The report aims to provide a detailed understanding of financial accounting principles for both sole traders and partnerships.

PRPARATION OF FINAL

ACCOUNTS OF SOLE TRADER-

SHIP AND PARTNERSHIP

BUSINESSES

1

ACCOUNTS OF SOLE TRADER-

SHIP AND PARTNERSHIP

BUSINESSES

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Identifying the reasons behind the closing off accounts and preparation of trial balance ....3

1.2 Explanation of the process of preparing the final accounts on the basis of trial balance .....3

1.3 Describing the methods of constructing accounts from incomplete records.........................4

1.4 Reasons behind imbalances resulting from incorrect double entries.....................................4

1.5 Describing results of incomplete records arising from incomplete and inconsistent data ...5

TASK 2............................................................................................................................................5

2.1 Preparation of accounting records from incomplete information..........................................5

2.2 Calculation of opening/closing cash/bank account balance...................................................6

2.3 Preparation of sales and purchase ledger control accounts....................................................7

TASK 3............................................................................................................................................7

3.1 Components of final accounts of the sole trader....................................................................7

3.2 Representation of profit and loss accounts according to the given information ...................8

3.3 Representation of the balance sheet as per the given information ........................................9

TASK 4..........................................................................................................................................10

4.1 Explanation regarding the key elements of a partnership agreement..................................10

4.2 Explanation regarding the key components of partnership accounts...................................10

TASK 5..........................................................................................................................................12

5.1 Preparation of profit and loss appropriation account for the partnership firm....................12

5.2 Determination of profits of partners profits.........................................................................13

5.3 Representation of partners current and capital accounts......................................................13

TASK 6..........................................................................................................................................14

6.1 & 6.2 Measuring the closing balance on each partner’s current and capital account which

includes drawings and presenting balance sheet in compliance to partnership agreements......14

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

2

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Identifying the reasons behind the closing off accounts and preparation of trial balance ....3

1.2 Explanation of the process of preparing the final accounts on the basis of trial balance .....3

1.3 Describing the methods of constructing accounts from incomplete records.........................4

1.4 Reasons behind imbalances resulting from incorrect double entries.....................................4

1.5 Describing results of incomplete records arising from incomplete and inconsistent data ...5

TASK 2............................................................................................................................................5

2.1 Preparation of accounting records from incomplete information..........................................5

2.2 Calculation of opening/closing cash/bank account balance...................................................6

2.3 Preparation of sales and purchase ledger control accounts....................................................7

TASK 3............................................................................................................................................7

3.1 Components of final accounts of the sole trader....................................................................7

3.2 Representation of profit and loss accounts according to the given information ...................8

3.3 Representation of the balance sheet as per the given information ........................................9

TASK 4..........................................................................................................................................10

4.1 Explanation regarding the key elements of a partnership agreement..................................10

4.2 Explanation regarding the key components of partnership accounts...................................10

TASK 5..........................................................................................................................................12

5.1 Preparation of profit and loss appropriation account for the partnership firm....................12

5.2 Determination of profits of partners profits.........................................................................13

5.3 Representation of partners current and capital accounts......................................................13

TASK 6..........................................................................................................................................14

6.1 & 6.2 Measuring the closing balance on each partner’s current and capital account which

includes drawings and presenting balance sheet in compliance to partnership agreements......14

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

2

INTRODUCTION

Financial accounts are the most important part of the accounting cycle. The final accounts

are mandatory or required to be prepared by all kinds of organisation either it is sole

proprietorship business or partnership business. The preparation of final accounts processing

with the motive to know the final status of revenues and expenses incurred throughout the

accounting period (Reid, 2018). Besides this before preparation of final accounts all debit and

credit accounts are to settle by closing off and analyse under the preparation of trial balance

which are to be necessary for quantifying the exact figure of each accounts. This report pertains

the understanding about the preparation of the final accounts, final accounting for sole trader,

legislative and accounting requirements of the partnerships, consolidate statement of profit and

loss accounts as well as the consolidate balance preparation. Overall, the report pertains the

knowledge about the final accounts for sole trading and partnership businesses.

TASK 1

1.1 Identifying the reasons behind the closing off accounts and preparation of trial balance

At the end of an accounting era, the revenue and expense account balances are transferred

to income summary account. This, is because by doing this, all the revenues and expenses

accounts will have the zero balance at the end of the year and will start the next accounting

period as well as all the recording of transaction is been done on correctly basis. After passing

the journal entries, all the temporary accounts have been closed, it is the requirement for the

preparation of the trial balance (Bull, 2014).

The trail balance is a kind of statement that can be made with the motive of recording all

the transactions that are made during the period and the balance has been required to be equal all

together at the either side. The purpose of preparing the trial balance is to verify the temporary

accounts that have been shut down properly and total of credits and debits must be equal to the

closing entries in accounting system.

1.2 Explanation of the process of preparing the final accounts on the basis of trial balance

In accounting the trial balance is prepared with the motive to identify the equality of

debits and credits. Trial balance is the list of ledger accounts and their debit and credit balances

to determining the recording process as the debits must be equal to credits. Trial balance acts as

the base of preparation of final accounts (Zeff, 2016). The trial balance accounts must be

3

Financial accounts are the most important part of the accounting cycle. The final accounts

are mandatory or required to be prepared by all kinds of organisation either it is sole

proprietorship business or partnership business. The preparation of final accounts processing

with the motive to know the final status of revenues and expenses incurred throughout the

accounting period (Reid, 2018). Besides this before preparation of final accounts all debit and

credit accounts are to settle by closing off and analyse under the preparation of trial balance

which are to be necessary for quantifying the exact figure of each accounts. This report pertains

the understanding about the preparation of the final accounts, final accounting for sole trader,

legislative and accounting requirements of the partnerships, consolidate statement of profit and

loss accounts as well as the consolidate balance preparation. Overall, the report pertains the

knowledge about the final accounts for sole trading and partnership businesses.

TASK 1

1.1 Identifying the reasons behind the closing off accounts and preparation of trial balance

At the end of an accounting era, the revenue and expense account balances are transferred

to income summary account. This, is because by doing this, all the revenues and expenses

accounts will have the zero balance at the end of the year and will start the next accounting

period as well as all the recording of transaction is been done on correctly basis. After passing

the journal entries, all the temporary accounts have been closed, it is the requirement for the

preparation of the trial balance (Bull, 2014).

The trail balance is a kind of statement that can be made with the motive of recording all

the transactions that are made during the period and the balance has been required to be equal all

together at the either side. The purpose of preparing the trial balance is to verify the temporary

accounts that have been shut down properly and total of credits and debits must be equal to the

closing entries in accounting system.

1.2 Explanation of the process of preparing the final accounts on the basis of trial balance

In accounting the trial balance is prepared with the motive to identify the equality of

debits and credits. Trial balance is the list of ledger accounts and their debit and credit balances

to determining the recording process as the debits must be equal to credits. Trial balance acts as

the base of preparation of final accounts (Zeff, 2016). The trial balance accounts must be

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

preparing in this order that, assets, liabilities, equity, dividends, revenues and expenses. This

sequence of trial balance beneficial in quantification of exact figures of balance sheet and p& l

account not only this, it helps in identifying the errors also. The specific process of formulating

final accounts from the trail balance is given below:

Read all the list of trail balance transaction and adjustment carefully.

Record all the debit items those are given in the trail balance on either expenditure side of

Trading as well as P&L account are taken into account.

Record of all the credit items given in the trail balance on either income or trading P&L

or liabilities side of balance sheet is also analysed before preparing final accounts.

After that posting of all the transaction, but after making all kind of adjustments items

twice.

Balance trading P&L A/c first and determine profit / loss.

Adding this profit obtained with the specific capital on the debt side of the balance sheet

Take the total of the balance sheet.

1.3 Describing the methods of constructing accounts from incomplete records

There are three methods of preparing accounts from the incomplete records, which are as

follows.

Accounting equation: by using the accounting equation with some figures, the

calculation of value of capital and can be quantify. If the assets and liability amount is

known, then by applying the equation (Assets -liabilities = capital).

Control Accounts method: It includes completion of the control account like bank

control account according to the associated details.

Margin or mark-up method: in complete record, if the sales figure and the profit

margin of sales in percent is known then the cost of goods sold can be find out by

adapting the mark-up or margin method the cost of goods sold can be quantify (Kumar

and Sharma, 2015).

1.4 Reasons behind imbalances resulting from incorrect double entries

There are some reasons behind the imbalances of the resulting from the incorrect double

entries, some of them are as follows.

If the transaction is posted one side of an account and omitted to post on second side of

the account.

4

sequence of trial balance beneficial in quantification of exact figures of balance sheet and p& l

account not only this, it helps in identifying the errors also. The specific process of formulating

final accounts from the trail balance is given below:

Read all the list of trail balance transaction and adjustment carefully.

Record all the debit items those are given in the trail balance on either expenditure side of

Trading as well as P&L account are taken into account.

Record of all the credit items given in the trail balance on either income or trading P&L

or liabilities side of balance sheet is also analysed before preparing final accounts.

After that posting of all the transaction, but after making all kind of adjustments items

twice.

Balance trading P&L A/c first and determine profit / loss.

Adding this profit obtained with the specific capital on the debt side of the balance sheet

Take the total of the balance sheet.

1.3 Describing the methods of constructing accounts from incomplete records

There are three methods of preparing accounts from the incomplete records, which are as

follows.

Accounting equation: by using the accounting equation with some figures, the

calculation of value of capital and can be quantify. If the assets and liability amount is

known, then by applying the equation (Assets -liabilities = capital).

Control Accounts method: It includes completion of the control account like bank

control account according to the associated details.

Margin or mark-up method: in complete record, if the sales figure and the profit

margin of sales in percent is known then the cost of goods sold can be find out by

adapting the mark-up or margin method the cost of goods sold can be quantify (Kumar

and Sharma, 2015).

1.4 Reasons behind imbalances resulting from incorrect double entries

There are some reasons behind the imbalances of the resulting from the incorrect double

entries, some of them are as follows.

If the transaction is posted one side of an account and omitted to post on second side of

the account.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

If wrong amount is posted in ledger.

When amount is posted wrong side and sometimes the transaction is posted twice in

ledger accounts.

Omission to post the ledger balance also resulting from the incomplete entries.

1.5 Describing results of incomplete records arising from incomplete and inconsistent data

There are some results of incomplete records which are arises from the incomplete

records are as follows.

Lack of information regarding finalising financial statements (Steingold, 2017).

Information like sales, purchase, doubtful debts or depreciation etc.

Errors while recording transactions like omission, underacting or overcasting of ledger

accounts.

There is certain other reach such as errors in calculating equity and assets at the time of

revaluation.

TASK 2

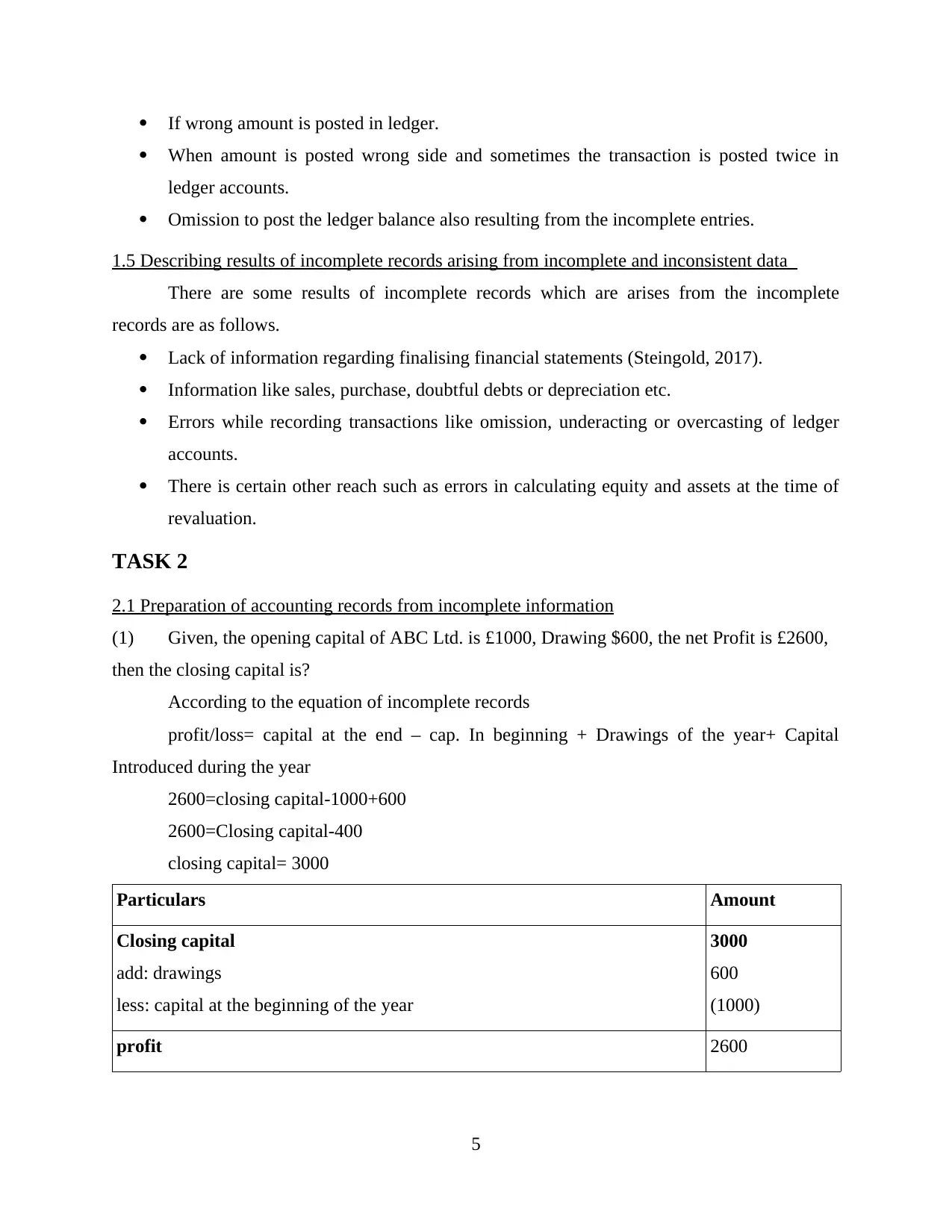

2.1 Preparation of accounting records from incomplete information

(1) Given, the opening capital of ABC Ltd. is £1000, Drawing $600, the net Profit is £2600,

then the closing capital is?

According to the equation of incomplete records

profit/loss= capital at the end – cap. In beginning + Drawings of the year+ Capital

Introduced during the year

2600=closing capital-1000+600

2600=Closing capital-400

closing capital= 3000

Particulars Amount

Closing capital

add: drawings

less: capital at the beginning of the year

3000

600

(1000)

profit 2600

5

When amount is posted wrong side and sometimes the transaction is posted twice in

ledger accounts.

Omission to post the ledger balance also resulting from the incomplete entries.

1.5 Describing results of incomplete records arising from incomplete and inconsistent data

There are some results of incomplete records which are arises from the incomplete

records are as follows.

Lack of information regarding finalising financial statements (Steingold, 2017).

Information like sales, purchase, doubtful debts or depreciation etc.

Errors while recording transactions like omission, underacting or overcasting of ledger

accounts.

There is certain other reach such as errors in calculating equity and assets at the time of

revaluation.

TASK 2

2.1 Preparation of accounting records from incomplete information

(1) Given, the opening capital of ABC Ltd. is £1000, Drawing $600, the net Profit is £2600,

then the closing capital is?

According to the equation of incomplete records

profit/loss= capital at the end – cap. In beginning + Drawings of the year+ Capital

Introduced during the year

2600=closing capital-1000+600

2600=Closing capital-400

closing capital= 3000

Particulars Amount

Closing capital

add: drawings

less: capital at the beginning of the year

3000

600

(1000)

profit 2600

5

(2) The profit of ABC Ltd is £360 and the closing capital is £4200 while Drawing is £800 what

is the Opening Capital for the period.

Particulars Amount

Closing capital

add: drawings

less: capital at the beginning of the year

4200

800

(4640)

profit 360

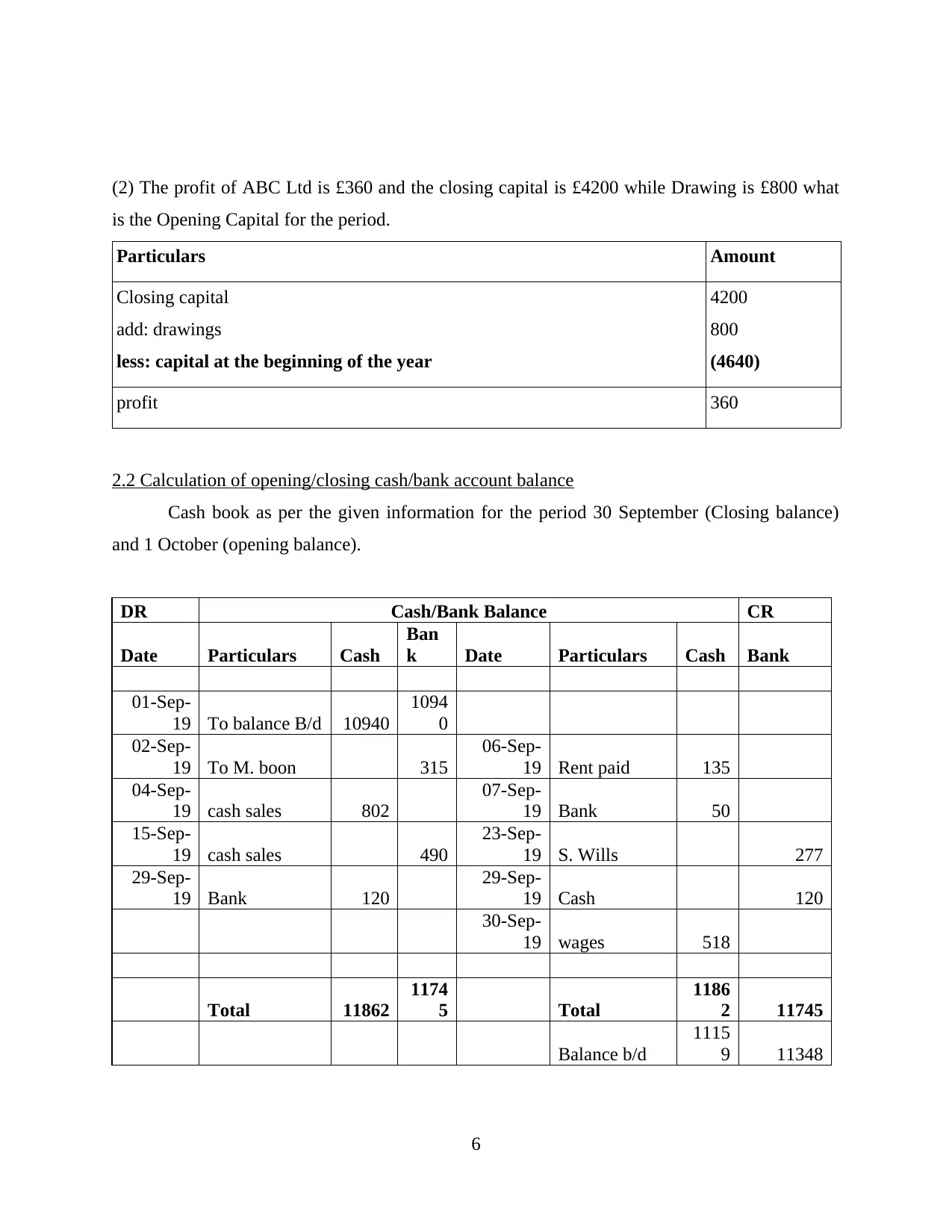

2.2 Calculation of opening/closing cash/bank account balance

Cash book as per the given information for the period 30 September (Closing balance)

and 1 October (opening balance).

DR Cash/Bank Balance CR

Date Particulars Cash

Ban

k Date Particulars Cash Bank

01-Sep-

19 To balance B/d 10940

1094

0

02-Sep-

19 To M. boon 315

06-Sep-

19 Rent paid 135

04-Sep-

19 cash sales 802

07-Sep-

19 Bank 50

15-Sep-

19 cash sales 490

23-Sep-

19 S. Wills 277

29-Sep-

19 Bank 120

29-Sep-

19 Cash 120

30-Sep-

19 wages 518

Total 11862

1174

5 Total

1186

2 11745

Balance b/d

1115

9 11348

6

is the Opening Capital for the period.

Particulars Amount

Closing capital

add: drawings

less: capital at the beginning of the year

4200

800

(4640)

profit 360

2.2 Calculation of opening/closing cash/bank account balance

Cash book as per the given information for the period 30 September (Closing balance)

and 1 October (opening balance).

DR Cash/Bank Balance CR

Date Particulars Cash

Ban

k Date Particulars Cash Bank

01-Sep-

19 To balance B/d 10940

1094

0

02-Sep-

19 To M. boon 315

06-Sep-

19 Rent paid 135

04-Sep-

19 cash sales 802

07-Sep-

19 Bank 50

15-Sep-

19 cash sales 490

23-Sep-

19 S. Wills 277

29-Sep-

19 Bank 120

29-Sep-

19 Cash 120

30-Sep-

19 wages 518

Total 11862

1174

5 Total

1186

2 11745

Balance b/d

1115

9 11348

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

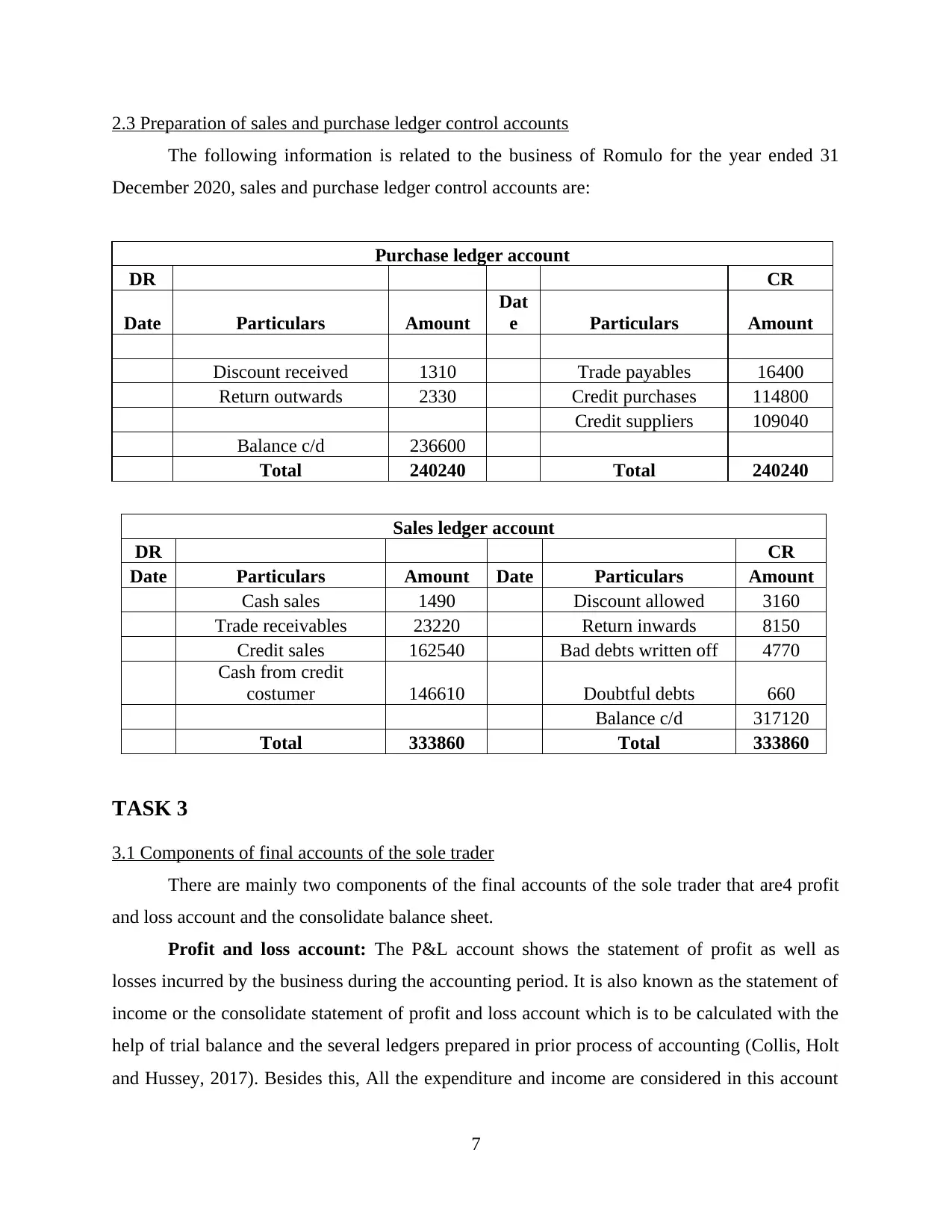

2.3 Preparation of sales and purchase ledger control accounts

The following information is related to the business of Romulo for the year ended 31

December 2020, sales and purchase ledger control accounts are:

Purchase ledger account

DR CR

Date Particulars Amount

Dat

e Particulars Amount

Discount received 1310 Trade payables 16400

Return outwards 2330 Credit purchases 114800

Credit suppliers 109040

Balance c/d 236600

Total 240240 Total 240240

Sales ledger account

DR CR

Date Particulars Amount Date Particulars Amount

Cash sales 1490 Discount allowed 3160

Trade receivables 23220 Return inwards 8150

Credit sales 162540 Bad debts written off 4770

Cash from credit

costumer 146610 Doubtful debts 660

Balance c/d 317120

Total 333860 Total 333860

TASK 3

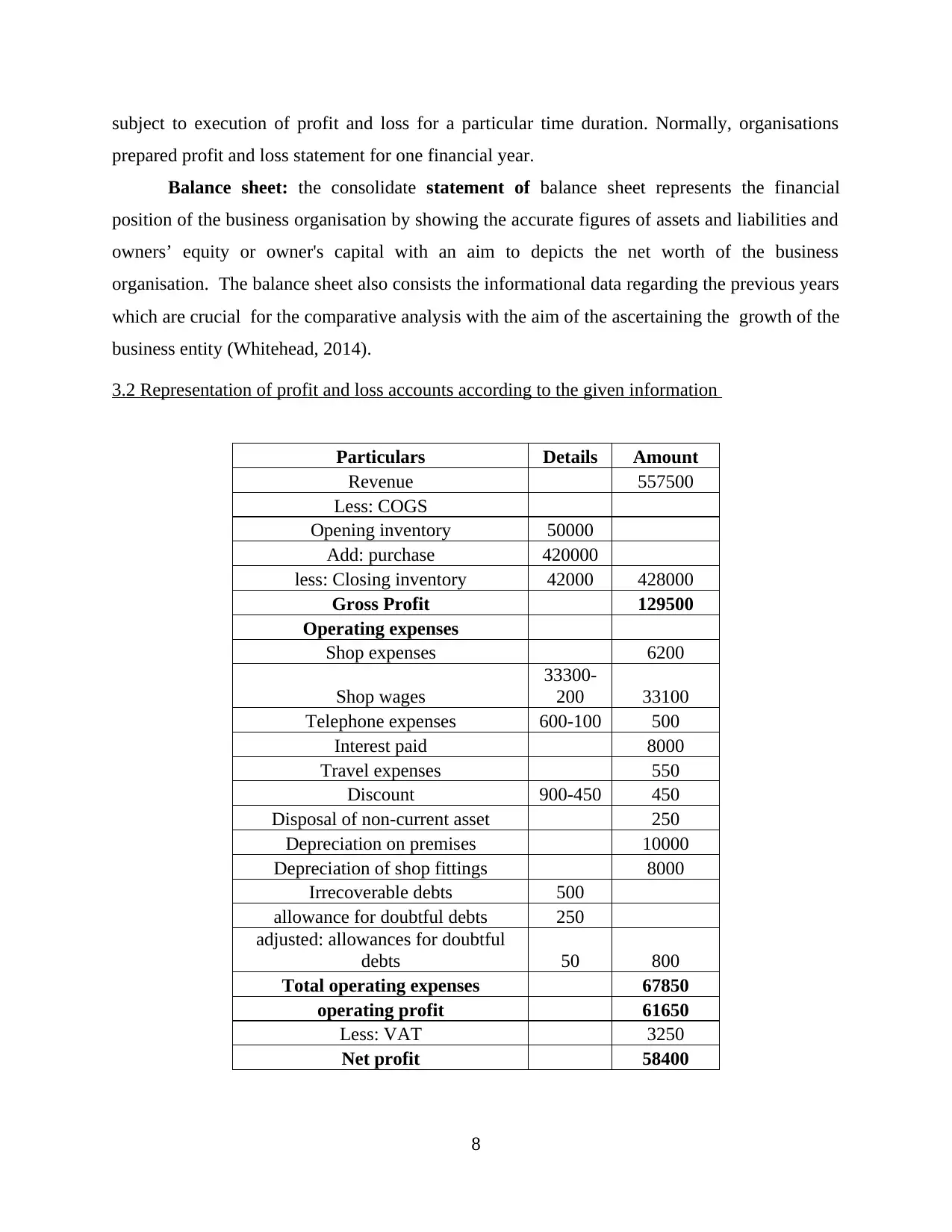

3.1 Components of final accounts of the sole trader

There are mainly two components of the final accounts of the sole trader that are4 profit

and loss account and the consolidate balance sheet.

Profit and loss account: The P&L account shows the statement of profit as well as

losses incurred by the business during the accounting period. It is also known as the statement of

income or the consolidate statement of profit and loss account which is to be calculated with the

help of trial balance and the several ledgers prepared in prior process of accounting (Collis, Holt

and Hussey, 2017). Besides this, All the expenditure and income are considered in this account

7

The following information is related to the business of Romulo for the year ended 31

December 2020, sales and purchase ledger control accounts are:

Purchase ledger account

DR CR

Date Particulars Amount

Dat

e Particulars Amount

Discount received 1310 Trade payables 16400

Return outwards 2330 Credit purchases 114800

Credit suppliers 109040

Balance c/d 236600

Total 240240 Total 240240

Sales ledger account

DR CR

Date Particulars Amount Date Particulars Amount

Cash sales 1490 Discount allowed 3160

Trade receivables 23220 Return inwards 8150

Credit sales 162540 Bad debts written off 4770

Cash from credit

costumer 146610 Doubtful debts 660

Balance c/d 317120

Total 333860 Total 333860

TASK 3

3.1 Components of final accounts of the sole trader

There are mainly two components of the final accounts of the sole trader that are4 profit

and loss account and the consolidate balance sheet.

Profit and loss account: The P&L account shows the statement of profit as well as

losses incurred by the business during the accounting period. It is also known as the statement of

income or the consolidate statement of profit and loss account which is to be calculated with the

help of trial balance and the several ledgers prepared in prior process of accounting (Collis, Holt

and Hussey, 2017). Besides this, All the expenditure and income are considered in this account

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

subject to execution of profit and loss for a particular time duration. Normally, organisations

prepared profit and loss statement for one financial year.

Balance sheet: the consolidate statement of balance sheet represents the financial

position of the business organisation by showing the accurate figures of assets and liabilities and

owners’ equity or owner's capital with an aim to depicts the net worth of the business

organisation. The balance sheet also consists the informational data regarding the previous years

which are crucial for the comparative analysis with the aim of the ascertaining the growth of the

business entity (Whitehead, 2014).

3.2 Representation of profit and loss accounts according to the given information

Particulars Details Amount

Revenue 557500

Less: COGS

Opening inventory 50000

Add: purchase 420000

less: Closing inventory 42000 428000

Gross Profit 129500

Operating expenses

Shop expenses 6200

Shop wages

33300-

200 33100

Telephone expenses 600-100 500

Interest paid 8000

Travel expenses 550

Discount 900-450 450

Disposal of non-current asset 250

Depreciation on premises 10000

Depreciation of shop fittings 8000

Irrecoverable debts 500

allowance for doubtful debts 250

adjusted: allowances for doubtful

debts 50 800

Total operating expenses 67850

operating profit 61650

Less: VAT 3250

Net profit 58400

8

prepared profit and loss statement for one financial year.

Balance sheet: the consolidate statement of balance sheet represents the financial

position of the business organisation by showing the accurate figures of assets and liabilities and

owners’ equity or owner's capital with an aim to depicts the net worth of the business

organisation. The balance sheet also consists the informational data regarding the previous years

which are crucial for the comparative analysis with the aim of the ascertaining the growth of the

business entity (Whitehead, 2014).

3.2 Representation of profit and loss accounts according to the given information

Particulars Details Amount

Revenue 557500

Less: COGS

Opening inventory 50000

Add: purchase 420000

less: Closing inventory 42000 428000

Gross Profit 129500

Operating expenses

Shop expenses 6200

Shop wages

33300-

200 33100

Telephone expenses 600-100 500

Interest paid 8000

Travel expenses 550

Discount 900-450 450

Disposal of non-current asset 250

Depreciation on premises 10000

Depreciation of shop fittings 8000

Irrecoverable debts 500

allowance for doubtful debts 250

adjusted: allowances for doubtful

debts 50 800

Total operating expenses 67850

operating profit 61650

Less: VAT 3250

Net profit 58400

8

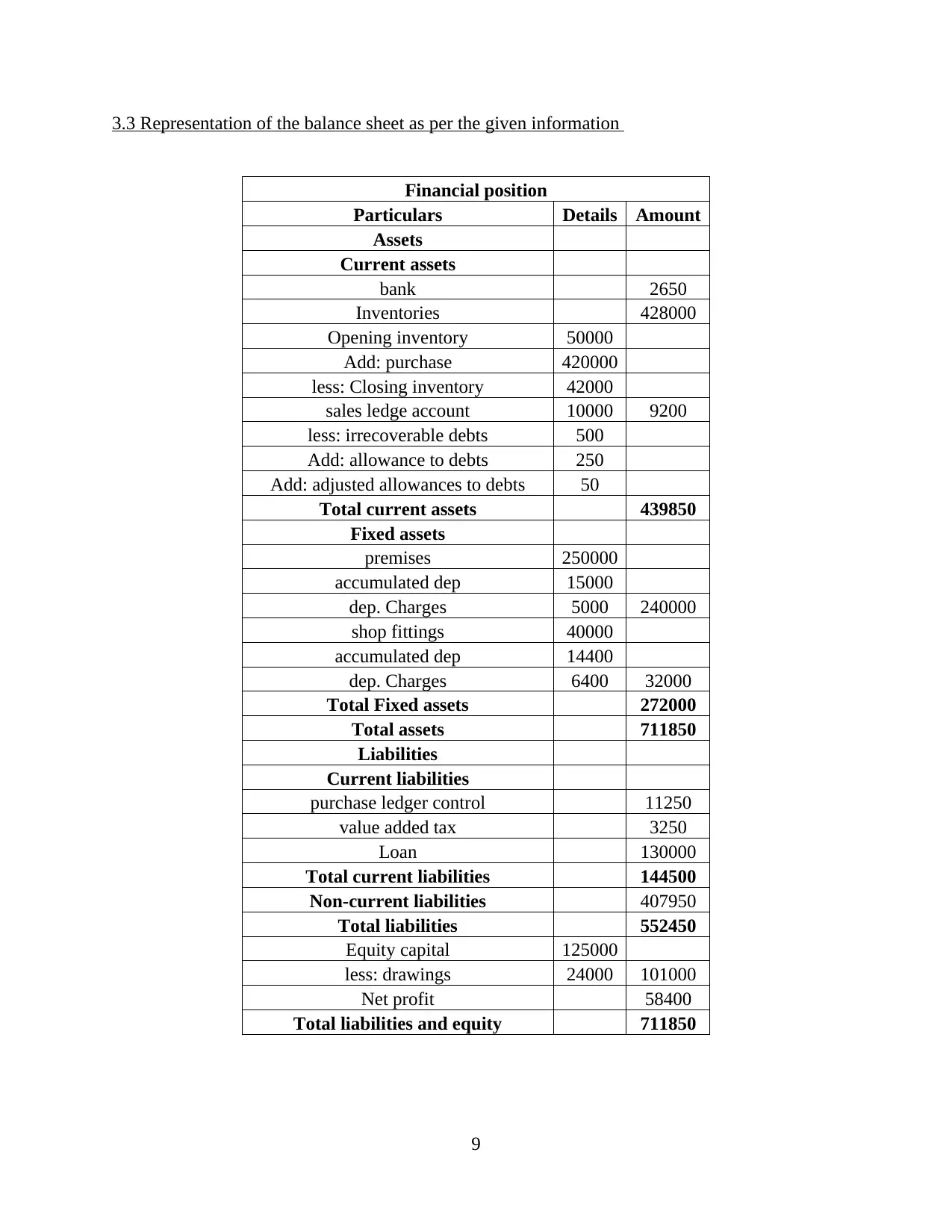

3.3 Representation of the balance sheet as per the given information

Financial position

Particulars Details Amount

Assets

Current assets

bank 2650

Inventories 428000

Opening inventory 50000

Add: purchase 420000

less: Closing inventory 42000

sales ledge account 10000 9200

less: irrecoverable debts 500

Add: allowance to debts 250

Add: adjusted allowances to debts 50

Total current assets 439850

Fixed assets

premises 250000

accumulated dep 15000

dep. Charges 5000 240000

shop fittings 40000

accumulated dep 14400

dep. Charges 6400 32000

Total Fixed assets 272000

Total assets 711850

Liabilities

Current liabilities

purchase ledger control 11250

value added tax 3250

Loan 130000

Total current liabilities 144500

Non-current liabilities 407950

Total liabilities 552450

Equity capital 125000

less: drawings 24000 101000

Net profit 58400

Total liabilities and equity 711850

9

Financial position

Particulars Details Amount

Assets

Current assets

bank 2650

Inventories 428000

Opening inventory 50000

Add: purchase 420000

less: Closing inventory 42000

sales ledge account 10000 9200

less: irrecoverable debts 500

Add: allowance to debts 250

Add: adjusted allowances to debts 50

Total current assets 439850

Fixed assets

premises 250000

accumulated dep 15000

dep. Charges 5000 240000

shop fittings 40000

accumulated dep 14400

dep. Charges 6400 32000

Total Fixed assets 272000

Total assets 711850

Liabilities

Current liabilities

purchase ledger control 11250

value added tax 3250

Loan 130000

Total current liabilities 144500

Non-current liabilities 407950

Total liabilities 552450

Equity capital 125000

less: drawings 24000 101000

Net profit 58400

Total liabilities and equity 711850

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TASK 4

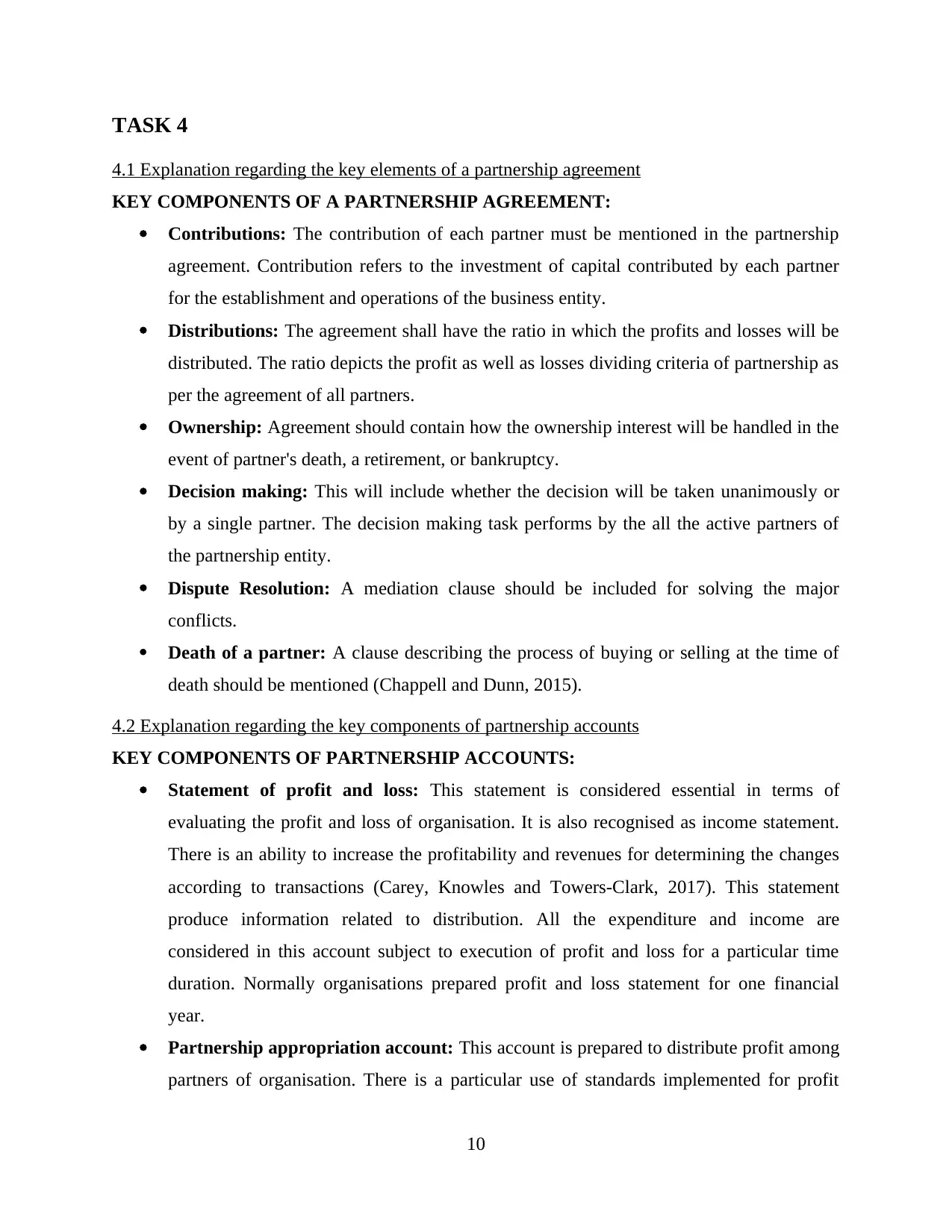

4.1 Explanation regarding the key elements of a partnership agreement

KEY COMPONENTS OF A PARTNERSHIP AGREEMENT:

Contributions: The contribution of each partner must be mentioned in the partnership

agreement. Contribution refers to the investment of capital contributed by each partner

for the establishment and operations of the business entity.

Distributions: The agreement shall have the ratio in which the profits and losses will be

distributed. The ratio depicts the profit as well as losses dividing criteria of partnership as

per the agreement of all partners.

Ownership: Agreement should contain how the ownership interest will be handled in the

event of partner's death, a retirement, or bankruptcy.

Decision making: This will include whether the decision will be taken unanimously or

by a single partner. The decision making task performs by the all the active partners of

the partnership entity.

Dispute Resolution: A mediation clause should be included for solving the major

conflicts.

Death of a partner: A clause describing the process of buying or selling at the time of

death should be mentioned (Chappell and Dunn, 2015).

4.2 Explanation regarding the key components of partnership accounts

KEY COMPONENTS OF PARTNERSHIP ACCOUNTS:

Statement of profit and loss: This statement is considered essential in terms of

evaluating the profit and loss of organisation. It is also recognised as income statement.

There is an ability to increase the profitability and revenues for determining the changes

according to transactions (Carey, Knowles and Towers-Clark, 2017). This statement

produce information related to distribution. All the expenditure and income are

considered in this account subject to execution of profit and loss for a particular time

duration. Normally organisations prepared profit and loss statement for one financial

year.

Partnership appropriation account: This account is prepared to distribute profit among

partners of organisation. There is a particular use of standards implemented for profit

10

4.1 Explanation regarding the key elements of a partnership agreement

KEY COMPONENTS OF A PARTNERSHIP AGREEMENT:

Contributions: The contribution of each partner must be mentioned in the partnership

agreement. Contribution refers to the investment of capital contributed by each partner

for the establishment and operations of the business entity.

Distributions: The agreement shall have the ratio in which the profits and losses will be

distributed. The ratio depicts the profit as well as losses dividing criteria of partnership as

per the agreement of all partners.

Ownership: Agreement should contain how the ownership interest will be handled in the

event of partner's death, a retirement, or bankruptcy.

Decision making: This will include whether the decision will be taken unanimously or

by a single partner. The decision making task performs by the all the active partners of

the partnership entity.

Dispute Resolution: A mediation clause should be included for solving the major

conflicts.

Death of a partner: A clause describing the process of buying or selling at the time of

death should be mentioned (Chappell and Dunn, 2015).

4.2 Explanation regarding the key components of partnership accounts

KEY COMPONENTS OF PARTNERSHIP ACCOUNTS:

Statement of profit and loss: This statement is considered essential in terms of

evaluating the profit and loss of organisation. It is also recognised as income statement.

There is an ability to increase the profitability and revenues for determining the changes

according to transactions (Carey, Knowles and Towers-Clark, 2017). This statement

produce information related to distribution. All the expenditure and income are

considered in this account subject to execution of profit and loss for a particular time

duration. Normally organisations prepared profit and loss statement for one financial

year.

Partnership appropriation account: This account is prepared to distribute profit among

partners of organisation. There is a particular use of standards implemented for profit

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

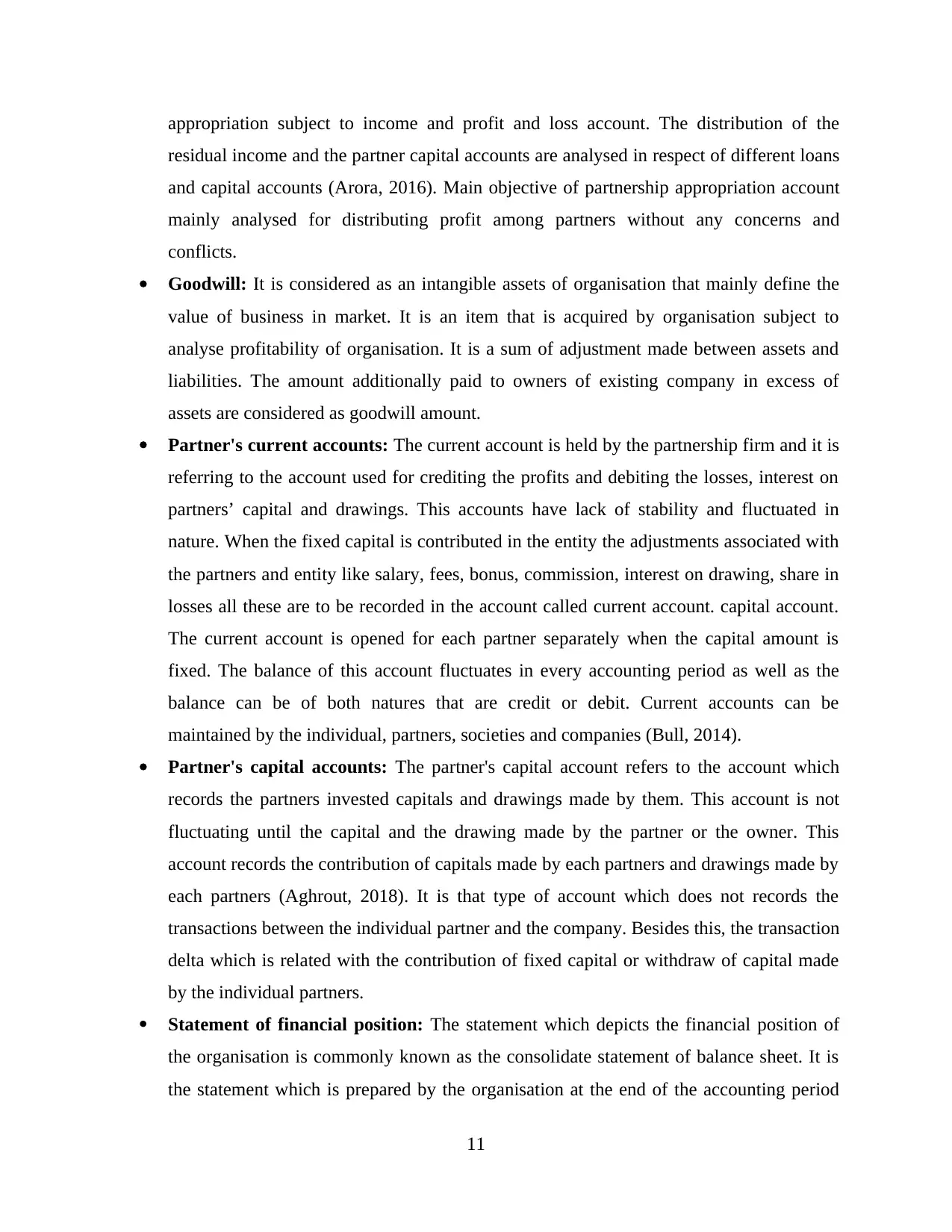

appropriation subject to income and profit and loss account. The distribution of the

residual income and the partner capital accounts are analysed in respect of different loans

and capital accounts (Arora, 2016). Main objective of partnership appropriation account

mainly analysed for distributing profit among partners without any concerns and

conflicts.

Goodwill: It is considered as an intangible assets of organisation that mainly define the

value of business in market. It is an item that is acquired by organisation subject to

analyse profitability of organisation. It is a sum of adjustment made between assets and

liabilities. The amount additionally paid to owners of existing company in excess of

assets are considered as goodwill amount.

Partner's current accounts: The current account is held by the partnership firm and it is

referring to the account used for crediting the profits and debiting the losses, interest on

partners’ capital and drawings. This accounts have lack of stability and fluctuated in

nature. When the fixed capital is contributed in the entity the adjustments associated with

the partners and entity like salary, fees, bonus, commission, interest on drawing, share in

losses all these are to be recorded in the account called current account. capital account.

The current account is opened for each partner separately when the capital amount is

fixed. The balance of this account fluctuates in every accounting period as well as the

balance can be of both natures that are credit or debit. Current accounts can be

maintained by the individual, partners, societies and companies (Bull, 2014).

Partner's capital accounts: The partner's capital account refers to the account which

records the partners invested capitals and drawings made by them. This account is not

fluctuating until the capital and the drawing made by the partner or the owner. This

account records the contribution of capitals made by each partners and drawings made by

each partners (Aghrout, 2018). It is that type of account which does not records the

transactions between the individual partner and the company. Besides this, the transaction

delta which is related with the contribution of fixed capital or withdraw of capital made

by the individual partners.

Statement of financial position: The statement which depicts the financial position of

the organisation is commonly known as the consolidate statement of balance sheet. It is

the statement which is prepared by the organisation at the end of the accounting period

11

residual income and the partner capital accounts are analysed in respect of different loans

and capital accounts (Arora, 2016). Main objective of partnership appropriation account

mainly analysed for distributing profit among partners without any concerns and

conflicts.

Goodwill: It is considered as an intangible assets of organisation that mainly define the

value of business in market. It is an item that is acquired by organisation subject to

analyse profitability of organisation. It is a sum of adjustment made between assets and

liabilities. The amount additionally paid to owners of existing company in excess of

assets are considered as goodwill amount.

Partner's current accounts: The current account is held by the partnership firm and it is

referring to the account used for crediting the profits and debiting the losses, interest on

partners’ capital and drawings. This accounts have lack of stability and fluctuated in

nature. When the fixed capital is contributed in the entity the adjustments associated with

the partners and entity like salary, fees, bonus, commission, interest on drawing, share in

losses all these are to be recorded in the account called current account. capital account.

The current account is opened for each partner separately when the capital amount is

fixed. The balance of this account fluctuates in every accounting period as well as the

balance can be of both natures that are credit or debit. Current accounts can be

maintained by the individual, partners, societies and companies (Bull, 2014).

Partner's capital accounts: The partner's capital account refers to the account which

records the partners invested capitals and drawings made by them. This account is not

fluctuating until the capital and the drawing made by the partner or the owner. This

account records the contribution of capitals made by each partners and drawings made by

each partners (Aghrout, 2018). It is that type of account which does not records the

transactions between the individual partner and the company. Besides this, the transaction

delta which is related with the contribution of fixed capital or withdraw of capital made

by the individual partners.

Statement of financial position: The statement which depicts the financial position of

the organisation is commonly known as the consolidate statement of balance sheet. It is

the statement which is prepared by the organisation at the end of the accounting period

11

that is quarterly, half-yearly or yearly. This is the statement which depicts the assets and

liabilities of the business held with the business. Moreover, the balance sheet is the

statement of financial position of the business entity as it depicts the amount of assets and

liabilities as well as the owners’ equity with the motive to illustrate the net worth of the

business entity (Pride, Hughes and Kapoor, 2014). The balance sheet also pertains the

information about the previous years which is essential for the comparative analysis with

the aim of the ascertaining the growth of the business entity.

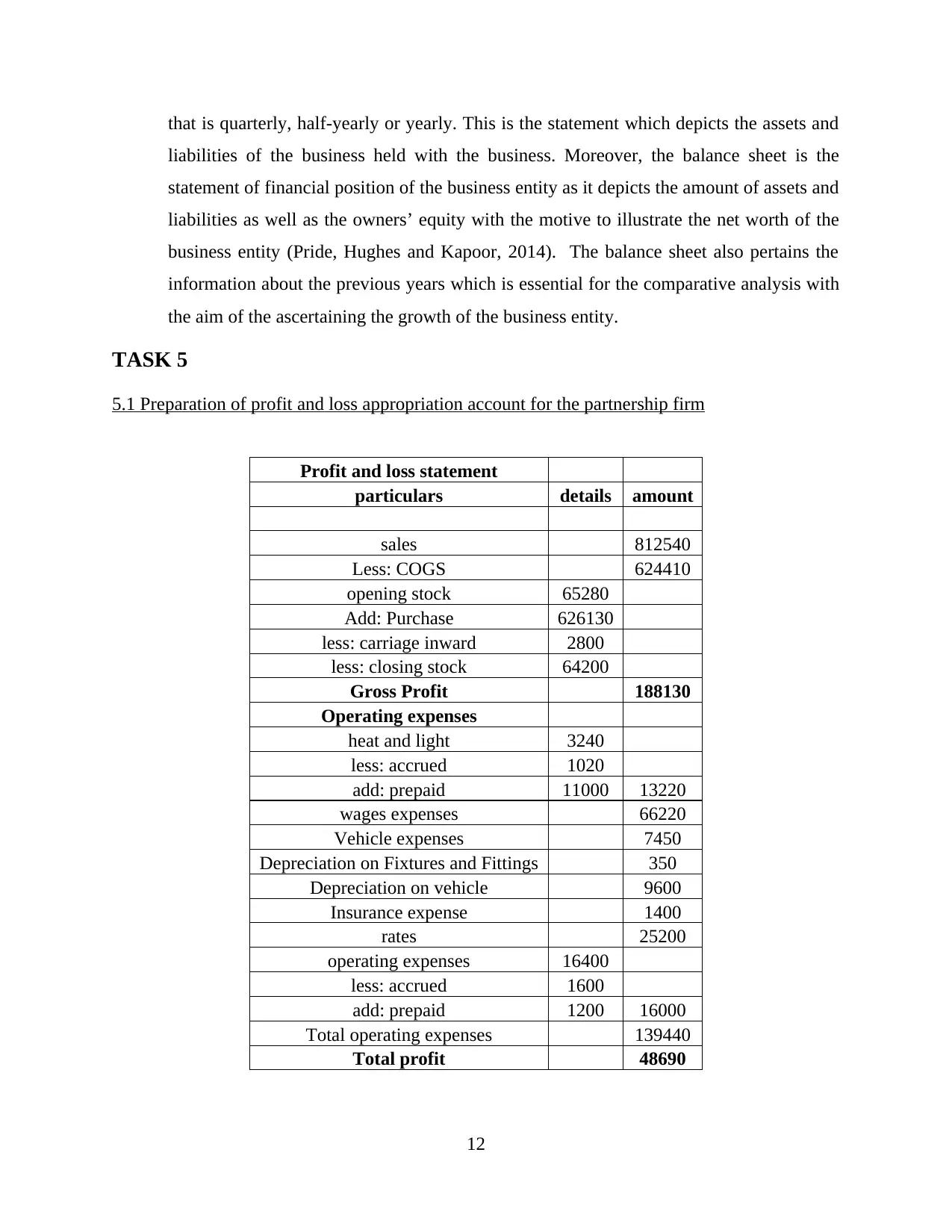

TASK 5

5.1 Preparation of profit and loss appropriation account for the partnership firm

Profit and loss statement

particulars details amount

sales 812540

Less: COGS 624410

opening stock 65280

Add: Purchase 626130

less: carriage inward 2800

less: closing stock 64200

Gross Profit 188130

Operating expenses

heat and light 3240

less: accrued 1020

add: prepaid 11000 13220

wages expenses 66220

Vehicle expenses 7450

Depreciation on Fixtures and Fittings 350

Depreciation on vehicle 9600

Insurance expense 1400

rates 25200

operating expenses 16400

less: accrued 1600

add: prepaid 1200 16000

Total operating expenses 139440

Total profit 48690

12

liabilities of the business held with the business. Moreover, the balance sheet is the

statement of financial position of the business entity as it depicts the amount of assets and

liabilities as well as the owners’ equity with the motive to illustrate the net worth of the

business entity (Pride, Hughes and Kapoor, 2014). The balance sheet also pertains the

information about the previous years which is essential for the comparative analysis with

the aim of the ascertaining the growth of the business entity.

TASK 5

5.1 Preparation of profit and loss appropriation account for the partnership firm

Profit and loss statement

particulars details amount

sales 812540

Less: COGS 624410

opening stock 65280

Add: Purchase 626130

less: carriage inward 2800

less: closing stock 64200

Gross Profit 188130

Operating expenses

heat and light 3240

less: accrued 1020

add: prepaid 11000 13220

wages expenses 66220

Vehicle expenses 7450

Depreciation on Fixtures and Fittings 350

Depreciation on vehicle 9600

Insurance expense 1400

rates 25200

operating expenses 16400

less: accrued 1600

add: prepaid 1200 16000

Total operating expenses 139440

Total profit 48690

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.