FIN3CSF: Investment Portfolio Construction Case Study Solution

VerifiedAdded on 2023/04/17

|19

|2091

|383

Case Study

AI Summary

This case study solution addresses the investment portfolio construction scenario faced by a boutique wealth management firm, given changes to Australian superannuation rules. It covers the current investment environment in Australia and internationally, highlighting the benefits of portfolio diversification using ETFs. The solution discusses the firm's investment philosophy and process, including equity and fixed income strategies, and provides examples of investment portfolios with equities, LICs/ETPs, and index options. It also explains how to calculate portfolio returns, including weighted returns and standard deviation, demonstrating the risk reduction benefits of diversification. This document is available on Desklib, a platform providing study tools and solved assignments for students.

Finance

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Current investment environment both in Australia and internationally..........................................3

The benefits of portfolio diversification with ETFs........................................................................7

Investment environment in the international market.......................................................................9

Investment philosophy and process...............................................................................................11

How to calculate portfolio returns?...............................................................................................16

References......................................................................................................................................18

2

Current investment environment both in Australia and internationally..........................................3

The benefits of portfolio diversification with ETFs........................................................................7

Investment environment in the international market.......................................................................9

Investment philosophy and process...............................................................................................11

How to calculate portfolio returns?...............................................................................................16

References......................................................................................................................................18

2

Current investment environment both in Australia and internationally

Australia is now generally welcoming to foreign investment in the country. These investments

are widely considered to be an important contributor to Australia’s economic productivity and

growth. Australia provides a simple and low- risk environment to invest and do business in an

effective manner. Australia is a globally integrated economy with strong trade and investment

links with investors. To protect the interest of the investors the Australian shares and assets are

reviewed by the Australian Foreign Investment Review Board (FIRB). Australia provides

various benefits for investors (Jayawardena, Todorova & Su, 2016). These include:

Highly skilled workforce

Consistent economic growth

Strong governance

Strategic location

World class infrastructure

3

Australia is now generally welcoming to foreign investment in the country. These investments

are widely considered to be an important contributor to Australia’s economic productivity and

growth. Australia provides a simple and low- risk environment to invest and do business in an

effective manner. Australia is a globally integrated economy with strong trade and investment

links with investors. To protect the interest of the investors the Australian shares and assets are

reviewed by the Australian Foreign Investment Review Board (FIRB). Australia provides

various benefits for investors (Jayawardena, Todorova & Su, 2016). These include:

Highly skilled workforce

Consistent economic growth

Strong governance

Strategic location

World class infrastructure

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

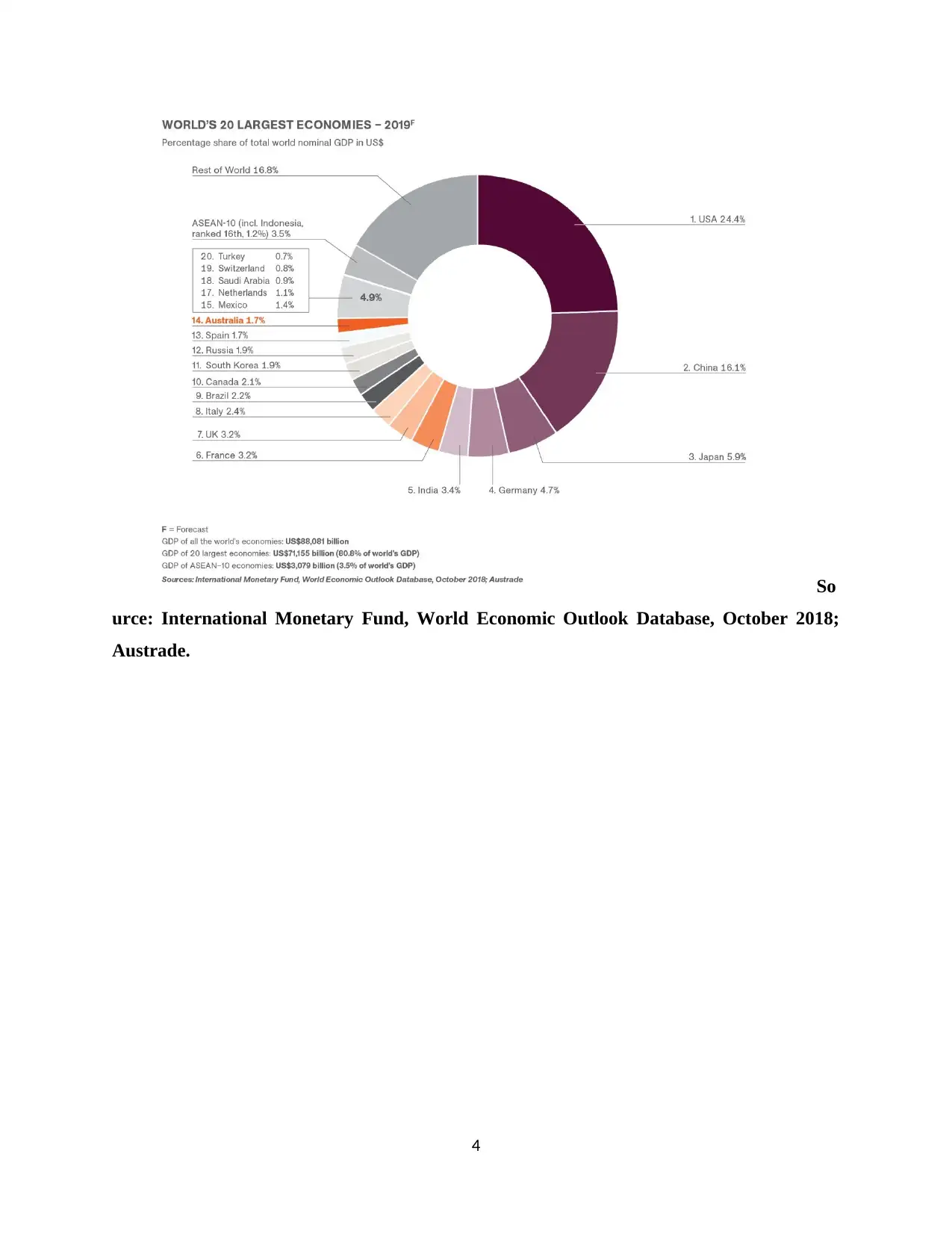

So

urce: International Monetary Fund, World Economic Outlook Database, October 2018;

Austrade.

4

urce: International Monetary Fund, World Economic Outlook Database, October 2018;

Austrade.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The Australian Government welcomes foreign investment and domestic investment to the

country’s growth and development. Australian Government investment promotion agency,

AUSTRADE works as an agent which provides information to investors about growth

opportunities in five areas which play an important role in Australia (Deo, et. al., 2017). These

five areas are listed below:

Major infrastructure

Advanced manufacturing, services, and technology

Food and agriculture business

Energy and resources

Tourism

Australian share market to continue the positive trend

Australia’s S&P/ASX 200 Accumulation Index increased by 11.8% during 2018, and the

small ordinaries Accumulation Index increased by 20%.

Better performing sectors included Information Technology (+23.2%), Metals and

Mining (+22.3%) and Healthcare (+23.6%).

Poorer performing sectors of the Australian share market over the previous year included

Retail (-16.6%), Telecommunications (-26.0%) and Financials (-0.2%).

During 2018 the banking sector will be under the spotlight with the federal government

announcing a “Royal Commission” into Financial Services and banks (Bianchi, et. al.,

2017).

5

country’s growth and development. Australian Government investment promotion agency,

AUSTRADE works as an agent which provides information to investors about growth

opportunities in five areas which play an important role in Australia (Deo, et. al., 2017). These

five areas are listed below:

Major infrastructure

Advanced manufacturing, services, and technology

Food and agriculture business

Energy and resources

Tourism

Australian share market to continue the positive trend

Australia’s S&P/ASX 200 Accumulation Index increased by 11.8% during 2018, and the

small ordinaries Accumulation Index increased by 20%.

Better performing sectors included Information Technology (+23.2%), Metals and

Mining (+22.3%) and Healthcare (+23.6%).

Poorer performing sectors of the Australian share market over the previous year included

Retail (-16.6%), Telecommunications (-26.0%) and Financials (-0.2%).

During 2018 the banking sector will be under the spotlight with the federal government

announcing a “Royal Commission” into Financial Services and banks (Bianchi, et. al.,

2017).

5

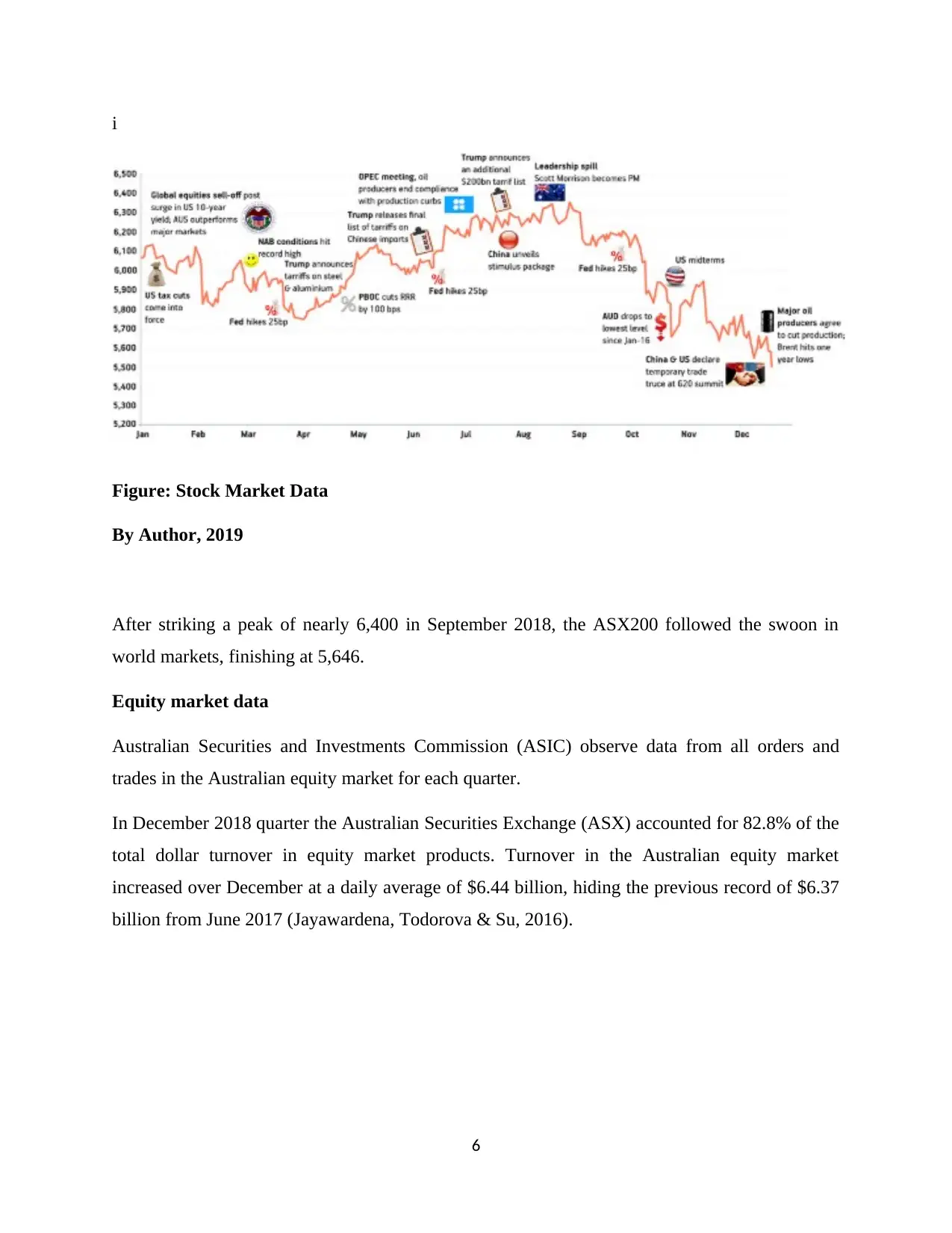

i

Figure: Stock Market Data

By Author, 2019

After striking a peak of nearly 6,400 in September 2018, the ASX200 followed the swoon in

world markets, finishing at 5,646.

Equity market data

Australian Securities and Investments Commission (ASIC) observe data from all orders and

trades in the Australian equity market for each quarter.

In December 2018 quarter the Australian Securities Exchange (ASX) accounted for 82.8% of the

total dollar turnover in equity market products. Turnover in the Australian equity market

increased over December at a daily average of $6.44 billion, hiding the previous record of $6.37

billion from June 2017 (Jayawardena, Todorova & Su, 2016).

6

Figure: Stock Market Data

By Author, 2019

After striking a peak of nearly 6,400 in September 2018, the ASX200 followed the swoon in

world markets, finishing at 5,646.

Equity market data

Australian Securities and Investments Commission (ASIC) observe data from all orders and

trades in the Australian equity market for each quarter.

In December 2018 quarter the Australian Securities Exchange (ASX) accounted for 82.8% of the

total dollar turnover in equity market products. Turnover in the Australian equity market

increased over December at a daily average of $6.44 billion, hiding the previous record of $6.37

billion from June 2017 (Jayawardena, Todorova & Su, 2016).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

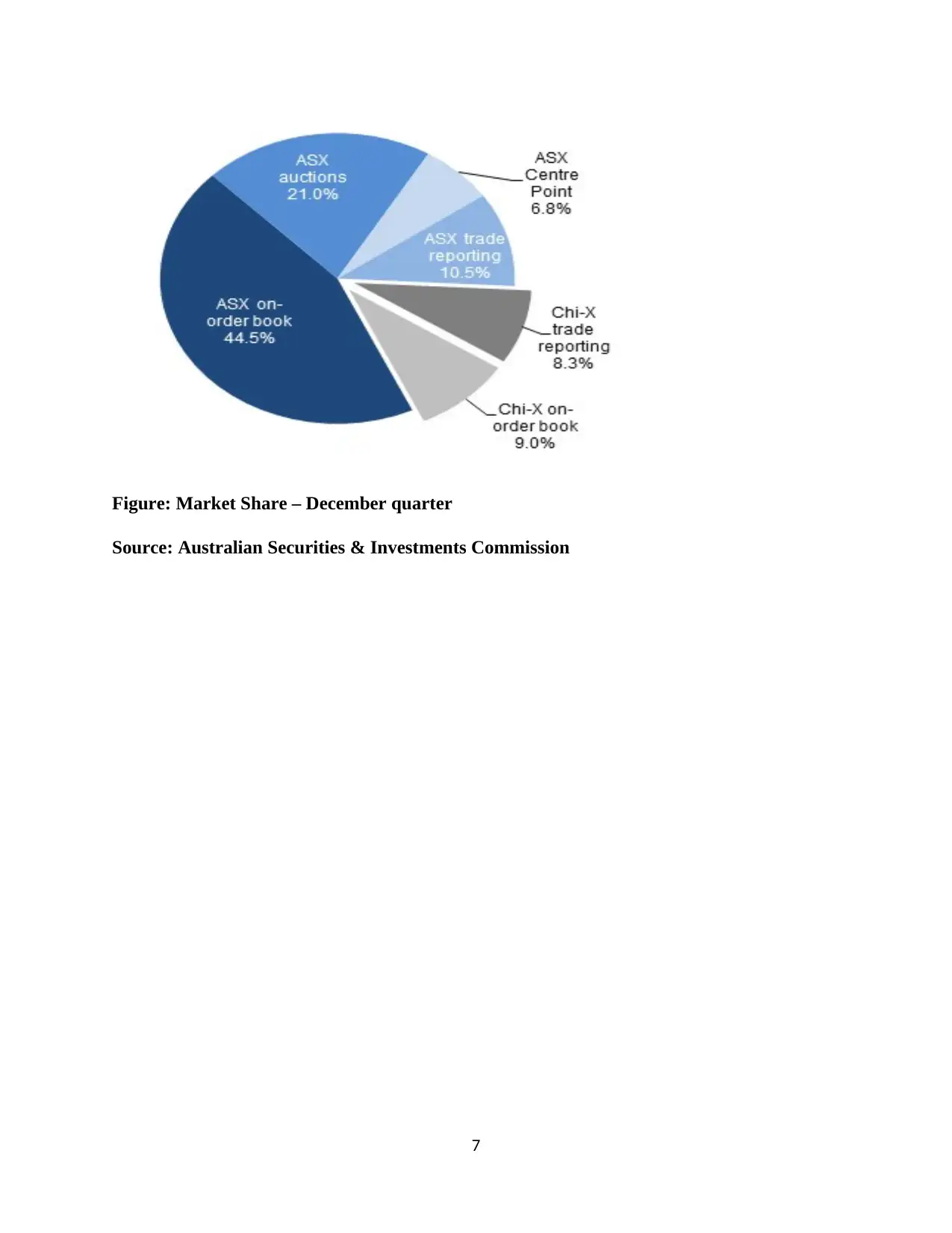

Figure: Market Share – December quarter

Source: Australian Securities & Investments Commission

7

Source: Australian Securities & Investments Commission

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

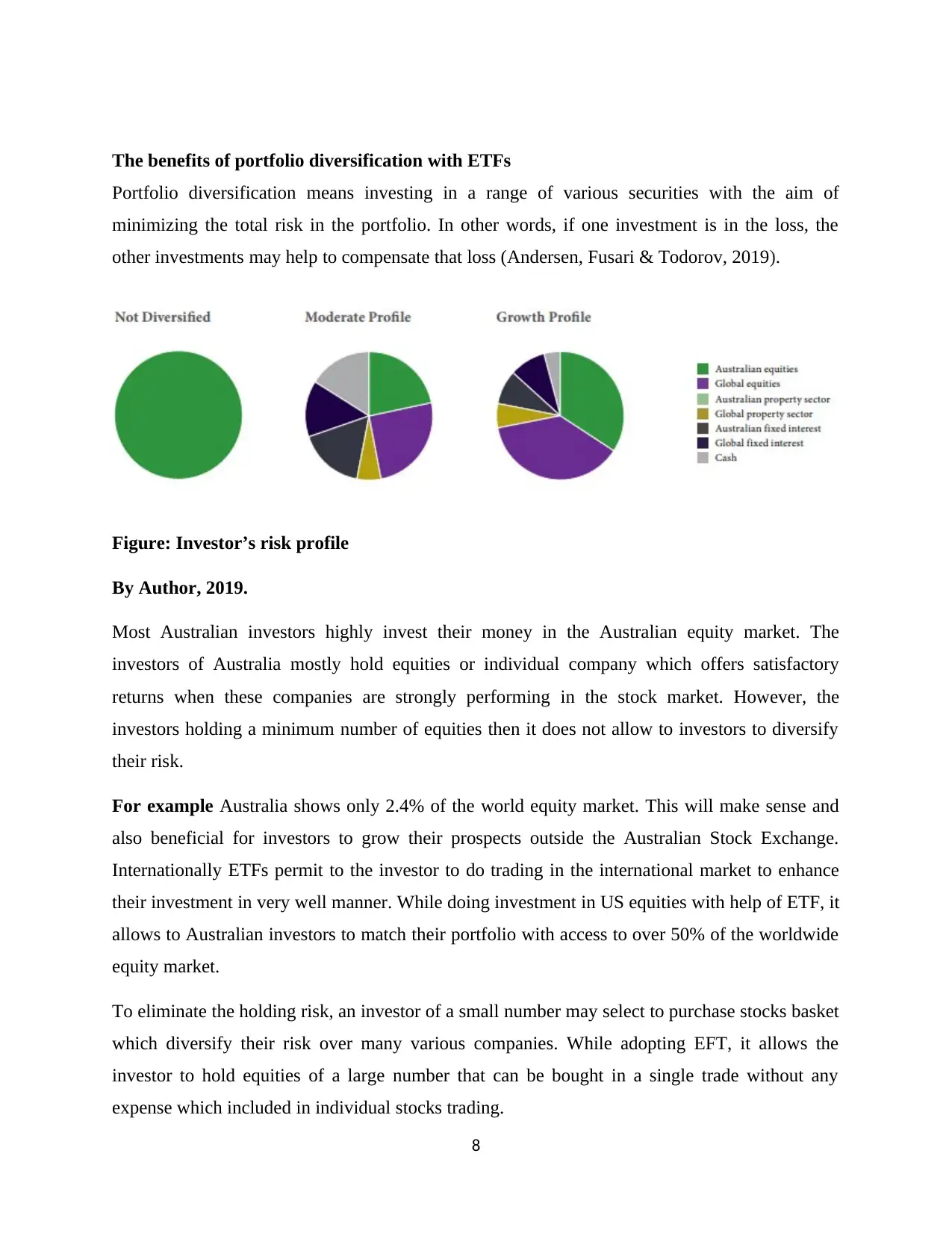

The benefits of portfolio diversification with ETFs

Portfolio diversification means investing in a range of various securities with the aim of

minimizing the total risk in the portfolio. In other words, if one investment is in the loss, the

other investments may help to compensate that loss (Andersen, Fusari & Todorov, 2019).

Figure: Investor’s risk profile

By Author, 2019.

Most Australian investors highly invest their money in the Australian equity market. The

investors of Australia mostly hold equities or individual company which offers satisfactory

returns when these companies are strongly performing in the stock market. However, the

investors holding a minimum number of equities then it does not allow to investors to diversify

their risk.

For example Australia shows only 2.4% of the world equity market. This will make sense and

also beneficial for investors to grow their prospects outside the Australian Stock Exchange.

Internationally ETFs permit to the investor to do trading in the international market to enhance

their investment in very well manner. While doing investment in US equities with help of ETF, it

allows to Australian investors to match their portfolio with access to over 50% of the worldwide

equity market.

To eliminate the holding risk, an investor of a small number may select to purchase stocks basket

which diversify their risk over many various companies. While adopting EFT, it allows the

investor to hold equities of a large number that can be bought in a single trade without any

expense which included in individual stocks trading.

8

Portfolio diversification means investing in a range of various securities with the aim of

minimizing the total risk in the portfolio. In other words, if one investment is in the loss, the

other investments may help to compensate that loss (Andersen, Fusari & Todorov, 2019).

Figure: Investor’s risk profile

By Author, 2019.

Most Australian investors highly invest their money in the Australian equity market. The

investors of Australia mostly hold equities or individual company which offers satisfactory

returns when these companies are strongly performing in the stock market. However, the

investors holding a minimum number of equities then it does not allow to investors to diversify

their risk.

For example Australia shows only 2.4% of the world equity market. This will make sense and

also beneficial for investors to grow their prospects outside the Australian Stock Exchange.

Internationally ETFs permit to the investor to do trading in the international market to enhance

their investment in very well manner. While doing investment in US equities with help of ETF, it

allows to Australian investors to match their portfolio with access to over 50% of the worldwide

equity market.

To eliminate the holding risk, an investor of a small number may select to purchase stocks basket

which diversify their risk over many various companies. While adopting EFT, it allows the

investor to hold equities of a large number that can be bought in a single trade without any

expense which included in individual stocks trading.

8

For example ABC an investor which holds 5 companies and out of which 2 is performing very

poorly in the stock market. This could be having a big impact on the whole performance of their

portfolio. But if those 2 companies were part of a portfolio of 20 or 30 companies, then this

effect can be reduced with these securities. If the investor trade in a large number of companies

can be expensive to him, so ETFs helpful to minimize a single company risk because ETFs

allows an investor to purchase a large number of companies in a trade which is single.

ETFs following the S&P/ASX 100, for instance, if an investor purchase any security then they

pay brokerage at once and then an investor has an exposure to the 100 largest companies in

Australia. If ABC an investor tried to purchase the companies individually then they would need

to pay 100 times brokerage.

For a retired person or an individual investor looking for extra income from their investments, by

receiving income from multiple sources minimizes the dependence on a single source to manage

their level of income. ETFs can assist investors to minimize the risk by permitting them to invest

in other incomes which are produce from stock markets or securities.

For example: When the market of Australia suffers a depression, investors who produce most of

their income by investing in Australian equities could search their own income levels to reduce

such situation. The investors can get an attractive level of income by investing in other income

producing assets or in international equities. An investor also spread the risk of their level of

income falling under the Australian stock market which experiences a downturn (Jayawardena,

Todorova & Su, 2016).

9

poorly in the stock market. This could be having a big impact on the whole performance of their

portfolio. But if those 2 companies were part of a portfolio of 20 or 30 companies, then this

effect can be reduced with these securities. If the investor trade in a large number of companies

can be expensive to him, so ETFs helpful to minimize a single company risk because ETFs

allows an investor to purchase a large number of companies in a trade which is single.

ETFs following the S&P/ASX 100, for instance, if an investor purchase any security then they

pay brokerage at once and then an investor has an exposure to the 100 largest companies in

Australia. If ABC an investor tried to purchase the companies individually then they would need

to pay 100 times brokerage.

For a retired person or an individual investor looking for extra income from their investments, by

receiving income from multiple sources minimizes the dependence on a single source to manage

their level of income. ETFs can assist investors to minimize the risk by permitting them to invest

in other incomes which are produce from stock markets or securities.

For example: When the market of Australia suffers a depression, investors who produce most of

their income by investing in Australian equities could search their own income levels to reduce

such situation. The investors can get an attractive level of income by investing in other income

producing assets or in international equities. An investor also spread the risk of their level of

income falling under the Australian stock market which experiences a downturn (Jayawardena,

Todorova & Su, 2016).

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

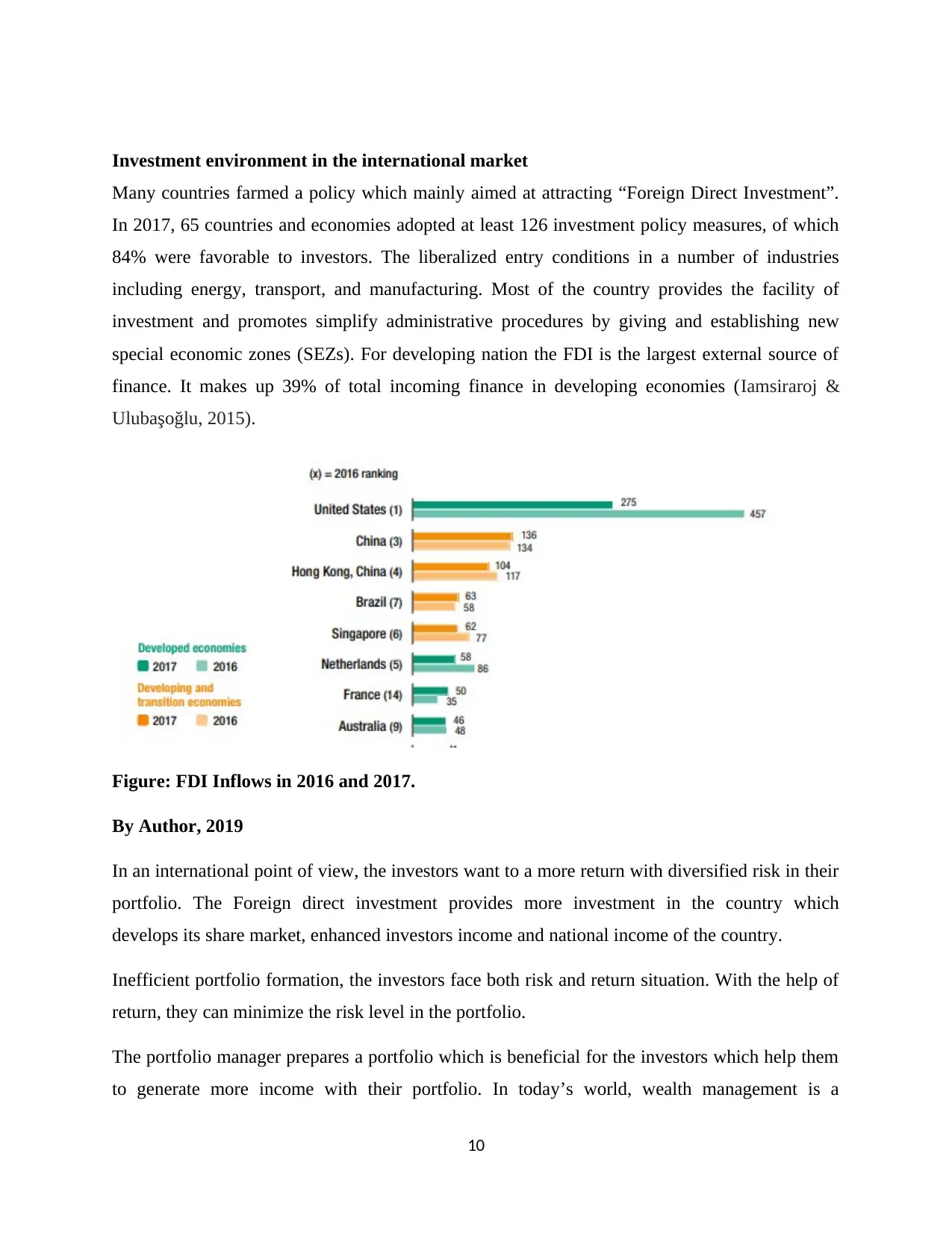

Investment environment in the international market

Many countries farmed a policy which mainly aimed at attracting “Foreign Direct Investment”.

In 2017, 65 countries and economies adopted at least 126 investment policy measures, of which

84% were favorable to investors. The liberalized entry conditions in a number of industries

including energy, transport, and manufacturing. Most of the country provides the facility of

investment and promotes simplify administrative procedures by giving and establishing new

special economic zones (SEZs). For developing nation the FDI is the largest external source of

finance. It makes up 39% of total incoming finance in developing economies (Iamsiraroj &

Ulubaşoğlu, 2015).

Figure: FDI Inflows in 2016 and 2017.

By Author, 2019

In an international point of view, the investors want to a more return with diversified risk in their

portfolio. The Foreign direct investment provides more investment in the country which

develops its share market, enhanced investors income and national income of the country.

Inefficient portfolio formation, the investors face both risk and return situation. With the help of

return, they can minimize the risk level in the portfolio.

The portfolio manager prepares a portfolio which is beneficial for the investors which help them

to generate more income with their portfolio. In today’s world, wealth management is a

10

Many countries farmed a policy which mainly aimed at attracting “Foreign Direct Investment”.

In 2017, 65 countries and economies adopted at least 126 investment policy measures, of which

84% were favorable to investors. The liberalized entry conditions in a number of industries

including energy, transport, and manufacturing. Most of the country provides the facility of

investment and promotes simplify administrative procedures by giving and establishing new

special economic zones (SEZs). For developing nation the FDI is the largest external source of

finance. It makes up 39% of total incoming finance in developing economies (Iamsiraroj &

Ulubaşoğlu, 2015).

Figure: FDI Inflows in 2016 and 2017.

By Author, 2019

In an international point of view, the investors want to a more return with diversified risk in their

portfolio. The Foreign direct investment provides more investment in the country which

develops its share market, enhanced investors income and national income of the country.

Inefficient portfolio formation, the investors face both risk and return situation. With the help of

return, they can minimize the risk level in the portfolio.

The portfolio manager prepares a portfolio which is beneficial for the investors which help them

to generate more income with their portfolio. In today’s world, wealth management is a

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

necessary step for the individual and portfolio provides a way to manage the wealth of an

individual in an appropriate manner (Duarte, Kedong & Xuemei, 2017).

11

individual in an appropriate manner (Duarte, Kedong & Xuemei, 2017).

11

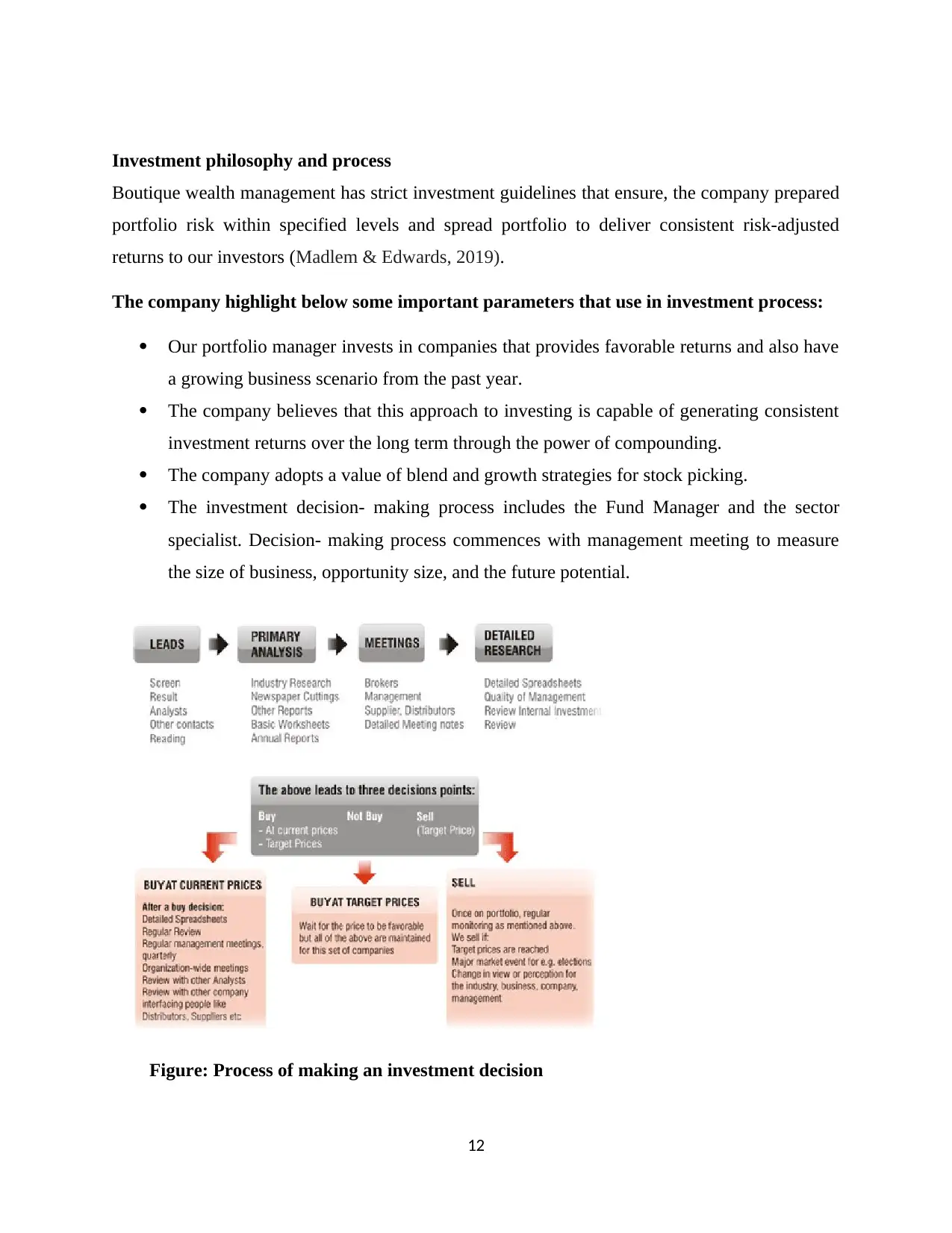

Investment philosophy and process

Boutique wealth management has strict investment guidelines that ensure, the company prepared

portfolio risk within specified levels and spread portfolio to deliver consistent risk-adjusted

returns to our investors (Madlem & Edwards, 2019).

The company highlight below some important parameters that use in investment process:

Our portfolio manager invests in companies that provides favorable returns and also have

a growing business scenario from the past year.

The company believes that this approach to investing is capable of generating consistent

investment returns over the long term through the power of compounding.

The company adopts a value of blend and growth strategies for stock picking.

The investment decision- making process includes the Fund Manager and the sector

specialist. Decision- making process commences with management meeting to measure

the size of business, opportunity size, and the future potential.

Figure: Process of making an investment decision

12

Boutique wealth management has strict investment guidelines that ensure, the company prepared

portfolio risk within specified levels and spread portfolio to deliver consistent risk-adjusted

returns to our investors (Madlem & Edwards, 2019).

The company highlight below some important parameters that use in investment process:

Our portfolio manager invests in companies that provides favorable returns and also have

a growing business scenario from the past year.

The company believes that this approach to investing is capable of generating consistent

investment returns over the long term through the power of compounding.

The company adopts a value of blend and growth strategies for stock picking.

The investment decision- making process includes the Fund Manager and the sector

specialist. Decision- making process commences with management meeting to measure

the size of business, opportunity size, and the future potential.

Figure: Process of making an investment decision

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.