Finance Assignment - ACC00716: Risk, Return, and Valuation Analysis

VerifiedAdded on 2023/01/19

|7

|1860

|83

Homework Assignment

AI Summary

This finance assignment, ACC00716, analyzes financial concepts through a business case study. It begins with calculations on time value of money and bond valuation. The core of the assignment focuses on risk and return analysis, including the application of the Capital Asset Pricing Model (CAPM) to estimate expected returns for a case company (MYOB) and a hypothetical company. It involves calculating portfolio returns and beta, and comparing risk-return profiles of individual stocks and a formed portfolio. The assignment also delves into the relationship between risk and return, discussing systematic and unsystematic risk, and the benefits of diversification. The student uses S&P Capital IQ data to support their calculations and analysis, and the assignment concludes with a comparison of risk-adjusted returns, demonstrating the superiority of a diversified portfolio in accordance with Modern Portfolio Theory (MPT).

FINANCE

ACC00716

STUDENT ID:

[Pick the date]

ACC00716

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

a) $1,094,117.28

b) $720.26 million

c) 5.55%

d) $12,670.25

e) 5.36%

f) $35

Question 2

a) The key aim is to estimate the returns that the equity investors of given companies would

expect on the underlying shares. In this regards, an appropriate approach is provided by

Capital Asset Pricing Model. The mathematical representation of this model is captured

suing the equation highlighted below (Ross et. al., 2015).

Expected return on equity shares = Risk free Rate + Beta * Risk Premium of Market

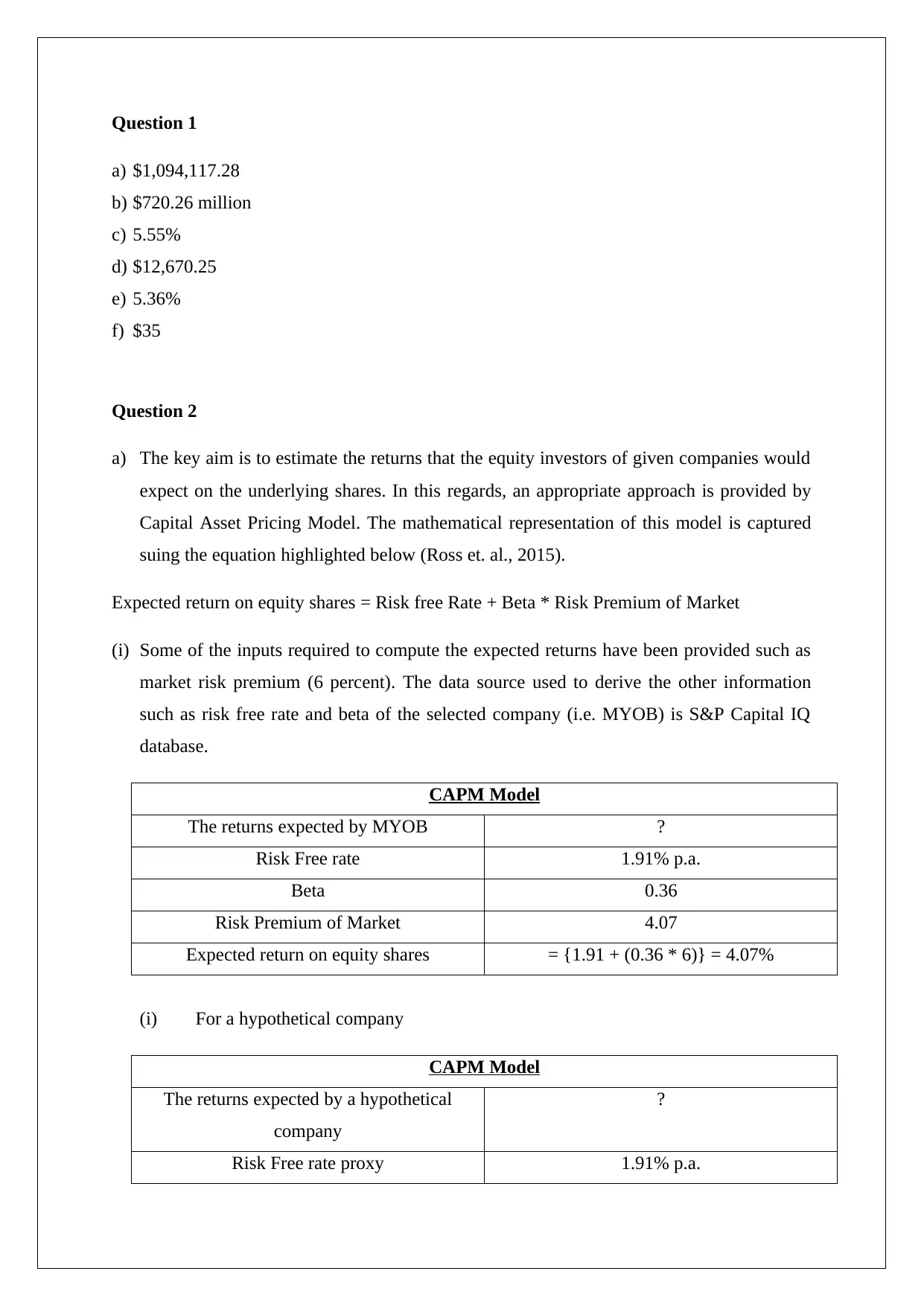

(i) Some of the inputs required to compute the expected returns have been provided such as

market risk premium (6 percent). The data source used to derive the other information

such as risk free rate and beta of the selected company (i.e. MYOB) is S&P Capital IQ

database.

CAPM Model

The returns expected by MYOB ?

Risk Free rate 1.91% p.a.

Beta 0.36

Risk Premium of Market 4.07

Expected return on equity shares = {1.91 + (0.36 * 6)} = 4.07%

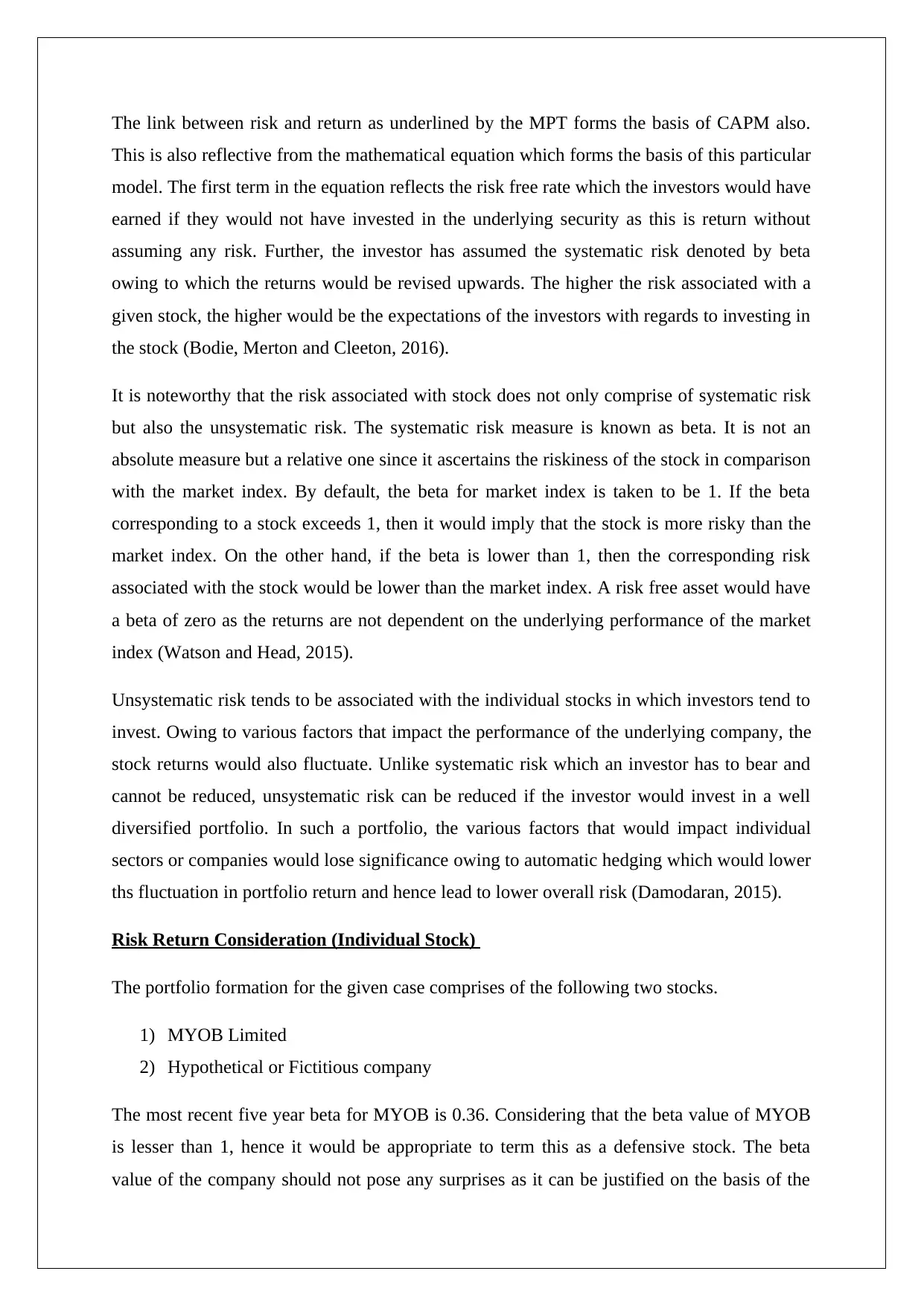

(i) For a hypothetical company

CAPM Model

The returns expected by a hypothetical

company

?

Risk Free rate proxy 1.91% p.a.

a) $1,094,117.28

b) $720.26 million

c) 5.55%

d) $12,670.25

e) 5.36%

f) $35

Question 2

a) The key aim is to estimate the returns that the equity investors of given companies would

expect on the underlying shares. In this regards, an appropriate approach is provided by

Capital Asset Pricing Model. The mathematical representation of this model is captured

suing the equation highlighted below (Ross et. al., 2015).

Expected return on equity shares = Risk free Rate + Beta * Risk Premium of Market

(i) Some of the inputs required to compute the expected returns have been provided such as

market risk premium (6 percent). The data source used to derive the other information

such as risk free rate and beta of the selected company (i.e. MYOB) is S&P Capital IQ

database.

CAPM Model

The returns expected by MYOB ?

Risk Free rate 1.91% p.a.

Beta 0.36

Risk Premium of Market 4.07

Expected return on equity shares = {1.91 + (0.36 * 6)} = 4.07%

(i) For a hypothetical company

CAPM Model

The returns expected by a hypothetical

company

?

Risk Free rate proxy 1.91% p.a.

(10years Australian bonds)

Beta -0.20

Risk Premium of Market 6

Expected return on equity shares = {1.91 + (-0.20 * 6)} = 0.71%

PART B

As per the information provided, a portfolio has been formed with the above two companies

with equal representation from each company.

Portfolio (Expected Returns) ¿ 4.07∗(1

2 )+0.71∗( 1

2 )=2.39 %

Portfolio (Expected Beta) ¿ 0.36∗( 1

2 )+−0.2∗(1

2 )=0.08

Question 3

Risk Return Consideration

A noteworthy aspect with regards to portfolio investment is that the asset allocation must not

be performed on the basis of one of the parameters i.e. risk and return. This may be

misleading and lead the investor into making sub-optimal choices. For instance, if two

investment opportunities having beta of 1.4 and 2.4 are compared and the opportunity with

the lower beta is selected driven by the endeavour to lower risk would lead to wrong

decision. The key aspect which Modern Portfolio Theory (MPT) highlights is that risk and

return must not be looked at in isolation owing to the underlying relationship between them.

To highlight this relation, Henry Markowitz has highlighted the assumption that humans tend

to behave rationally and are risk averse (Damodaran, 2015). The fact that investors are risk

averse would imply that if they are offered investment choices with similar returns, they

would tend to choose the one which offers the lowest amount of risk. The investors would

only assume a higher amount of risk when some reward is provided to them in the form of

higher returns. Driven by the potential of these superior returns, the investors may take

position in risky stocks. This clearly highlights that risk and returns tend to be interrelated. As

a result, usually risky assets would lead to higher amount of returns which is essential so that

investors tend to show buying interest in these assets (Brealey, Myers and Allen, 2014).

Beta -0.20

Risk Premium of Market 6

Expected return on equity shares = {1.91 + (-0.20 * 6)} = 0.71%

PART B

As per the information provided, a portfolio has been formed with the above two companies

with equal representation from each company.

Portfolio (Expected Returns) ¿ 4.07∗(1

2 )+0.71∗( 1

2 )=2.39 %

Portfolio (Expected Beta) ¿ 0.36∗( 1

2 )+−0.2∗(1

2 )=0.08

Question 3

Risk Return Consideration

A noteworthy aspect with regards to portfolio investment is that the asset allocation must not

be performed on the basis of one of the parameters i.e. risk and return. This may be

misleading and lead the investor into making sub-optimal choices. For instance, if two

investment opportunities having beta of 1.4 and 2.4 are compared and the opportunity with

the lower beta is selected driven by the endeavour to lower risk would lead to wrong

decision. The key aspect which Modern Portfolio Theory (MPT) highlights is that risk and

return must not be looked at in isolation owing to the underlying relationship between them.

To highlight this relation, Henry Markowitz has highlighted the assumption that humans tend

to behave rationally and are risk averse (Damodaran, 2015). The fact that investors are risk

averse would imply that if they are offered investment choices with similar returns, they

would tend to choose the one which offers the lowest amount of risk. The investors would

only assume a higher amount of risk when some reward is provided to them in the form of

higher returns. Driven by the potential of these superior returns, the investors may take

position in risky stocks. This clearly highlights that risk and returns tend to be interrelated. As

a result, usually risky assets would lead to higher amount of returns which is essential so that

investors tend to show buying interest in these assets (Brealey, Myers and Allen, 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The link between risk and return as underlined by the MPT forms the basis of CAPM also.

This is also reflective from the mathematical equation which forms the basis of this particular

model. The first term in the equation reflects the risk free rate which the investors would have

earned if they would not have invested in the underlying security as this is return without

assuming any risk. Further, the investor has assumed the systematic risk denoted by beta

owing to which the returns would be revised upwards. The higher the risk associated with a

given stock, the higher would be the expectations of the investors with regards to investing in

the stock (Bodie, Merton and Cleeton, 2016).

It is noteworthy that the risk associated with stock does not only comprise of systematic risk

but also the unsystematic risk. The systematic risk measure is known as beta. It is not an

absolute measure but a relative one since it ascertains the riskiness of the stock in comparison

with the market index. By default, the beta for market index is taken to be 1. If the beta

corresponding to a stock exceeds 1, then it would imply that the stock is more risky than the

market index. On the other hand, if the beta is lower than 1, then the corresponding risk

associated with the stock would be lower than the market index. A risk free asset would have

a beta of zero as the returns are not dependent on the underlying performance of the market

index (Watson and Head, 2015).

Unsystematic risk tends to be associated with the individual stocks in which investors tend to

invest. Owing to various factors that impact the performance of the underlying company, the

stock returns would also fluctuate. Unlike systematic risk which an investor has to bear and

cannot be reduced, unsystematic risk can be reduced if the investor would invest in a well

diversified portfolio. In such a portfolio, the various factors that would impact individual

sectors or companies would lose significance owing to automatic hedging which would lower

ths fluctuation in portfolio return and hence lead to lower overall risk (Damodaran, 2015).

Risk Return Consideration (Individual Stock)

The portfolio formation for the given case comprises of the following two stocks.

1) MYOB Limited

2) Hypothetical or Fictitious company

The most recent five year beta for MYOB is 0.36. Considering that the beta value of MYOB

is lesser than 1, hence it would be appropriate to term this as a defensive stock. The beta

value of the company should not pose any surprises as it can be justified on the basis of the

This is also reflective from the mathematical equation which forms the basis of this particular

model. The first term in the equation reflects the risk free rate which the investors would have

earned if they would not have invested in the underlying security as this is return without

assuming any risk. Further, the investor has assumed the systematic risk denoted by beta

owing to which the returns would be revised upwards. The higher the risk associated with a

given stock, the higher would be the expectations of the investors with regards to investing in

the stock (Bodie, Merton and Cleeton, 2016).

It is noteworthy that the risk associated with stock does not only comprise of systematic risk

but also the unsystematic risk. The systematic risk measure is known as beta. It is not an

absolute measure but a relative one since it ascertains the riskiness of the stock in comparison

with the market index. By default, the beta for market index is taken to be 1. If the beta

corresponding to a stock exceeds 1, then it would imply that the stock is more risky than the

market index. On the other hand, if the beta is lower than 1, then the corresponding risk

associated with the stock would be lower than the market index. A risk free asset would have

a beta of zero as the returns are not dependent on the underlying performance of the market

index (Watson and Head, 2015).

Unsystematic risk tends to be associated with the individual stocks in which investors tend to

invest. Owing to various factors that impact the performance of the underlying company, the

stock returns would also fluctuate. Unlike systematic risk which an investor has to bear and

cannot be reduced, unsystematic risk can be reduced if the investor would invest in a well

diversified portfolio. In such a portfolio, the various factors that would impact individual

sectors or companies would lose significance owing to automatic hedging which would lower

ths fluctuation in portfolio return and hence lead to lower overall risk (Damodaran, 2015).

Risk Return Consideration (Individual Stock)

The portfolio formation for the given case comprises of the following two stocks.

1) MYOB Limited

2) Hypothetical or Fictitious company

The most recent five year beta for MYOB is 0.36. Considering that the beta value of MYOB

is lesser than 1, hence it would be appropriate to term this as a defensive stock. The beta

value of the company should not pose any surprises as it can be justified on the basis of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

business model of the company. The company is a leading player in the software for finance ,

tax and accounting. The company has a strong brand developed over the years besides an

impressive product portfolio which are already in use by various medium and small

businesses. This leads to a stable earnings profile of the company which is not subject to

much risk resulting in low stock price fluctuation (Petty et. al., 2016).

The beta value for the fictitious company is known to be -0.20. Considering that beta of the

stock is negative, hence it would imply that the given stock belongs to a class of stocks called

contrarian stock. The movement of these stocks typically is against the movement of index

and hence these are often used to reduce the overall risk exposure owing to the natural

hedging in the portfolio with presence of positive beta stocks. Also, it is apparent that

expectations of returns on the two stocks tend to differ significantly which flows directly

from their respective beta which is a measure of risk. The systematic risk is used as the

measure of risk considering that unsystematic risk can be eliminated through diversification

but the same is not true for systematic risk (Brigham and Houston, 2014).

Risk Return Consideration (Portfolio)

The portfolio formed in the given case has been estimated to provide a return of 2.39%

annually. The systematic risk measure i.e. beta for the portfolio has been computed as 0.08.

As per the discussion with regards to systematic risk and unsystematic risk, it was highlighted

that formation of diversified portfolio would lead to lowering of unsystematic risk as there

would be a natural hedge against extreme movement. This is quite true in the given portfolio

where MYOB has a positive beta but the fictitious company has a negative beta. As a result,

the extreme movement incidence of the portfolio returns would be minimised. This is

reflected in the value of beta which has decreased (Brealey, Myers and Allen, 2014).

However, the returns of the portfolio have also declined if compared with MYOB. To

evaluate the effectiveness of thee portfolio, it makes sense to compare the risk return

parameters simultaneously for the portfolio and the two individual stocks. This has been

summarised in the tabular manner indicated as follows.

Hypothetical company stock

( Return

Risk )=( 0.71

−0.2 )=−3.55

MYOB company stock

( Return

Risk )=( 4.07

0.36 )=11.31

tax and accounting. The company has a strong brand developed over the years besides an

impressive product portfolio which are already in use by various medium and small

businesses. This leads to a stable earnings profile of the company which is not subject to

much risk resulting in low stock price fluctuation (Petty et. al., 2016).

The beta value for the fictitious company is known to be -0.20. Considering that beta of the

stock is negative, hence it would imply that the given stock belongs to a class of stocks called

contrarian stock. The movement of these stocks typically is against the movement of index

and hence these are often used to reduce the overall risk exposure owing to the natural

hedging in the portfolio with presence of positive beta stocks. Also, it is apparent that

expectations of returns on the two stocks tend to differ significantly which flows directly

from their respective beta which is a measure of risk. The systematic risk is used as the

measure of risk considering that unsystematic risk can be eliminated through diversification

but the same is not true for systematic risk (Brigham and Houston, 2014).

Risk Return Consideration (Portfolio)

The portfolio formed in the given case has been estimated to provide a return of 2.39%

annually. The systematic risk measure i.e. beta for the portfolio has been computed as 0.08.

As per the discussion with regards to systematic risk and unsystematic risk, it was highlighted

that formation of diversified portfolio would lead to lowering of unsystematic risk as there

would be a natural hedge against extreme movement. This is quite true in the given portfolio

where MYOB has a positive beta but the fictitious company has a negative beta. As a result,

the extreme movement incidence of the portfolio returns would be minimised. This is

reflected in the value of beta which has decreased (Brealey, Myers and Allen, 2014).

However, the returns of the portfolio have also declined if compared with MYOB. To

evaluate the effectiveness of thee portfolio, it makes sense to compare the risk return

parameters simultaneously for the portfolio and the two individual stocks. This has been

summarised in the tabular manner indicated as follows.

Hypothetical company stock

( Return

Risk )=( 0.71

−0.2 )=−3.55

MYOB company stock

( Return

Risk )=( 4.07

0.36 )=11.31

Portfolio formed

( Return

Risk )=( 2.39

0.08 )=29.88

The computations carried in the table highlighted above clearly establish the superiority of

the portfolio over MYOB stock and hypothetical company stock. This is because in

accordance with the MPT the investors do not seek to minimise risk or maximise returns.

Instead, the investor aims to choose the investment which tends to provide the highest risk

adjusted returns where the portfolio is evidently superior owing to diversification (Petty et.

al., 2016).

( Return

Risk )=( 2.39

0.08 )=29.88

The computations carried in the table highlighted above clearly establish the superiority of

the portfolio over MYOB stock and hypothetical company stock. This is because in

accordance with the MPT the investors do not seek to minimise risk or maximise returns.

Instead, the investor aims to choose the investment which tends to provide the highest risk

adjusted returns where the portfolio is evidently superior owing to diversification (Petty et.

al., 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

Bodie, Z., Merton, R. C., and Cleeton, D. L. (2016) Financial economics, 2nd ed. New York:

Pearson, pp. 144

Brealey, R. A., Myers, S. C., and Allen, F. (2014) Principles of corporate finance, 2nd ed.

New York: McGraw-Hill Inc, pp.155-156

Brigham, E. F. and Houston, J. F., (2014) Fundamentals of Financial Management.14thed.

Boston: Cengage Learning, pp. 178

Damodaran, A. (2015). Appl0ied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons, pp. 133

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M., and Nguyen, H. (2016)

Financial Management, Principles and Applications. 6th ed. NSW: Pearson Education, French

Forest Australia,pp. 203-204

Ross,S.A., Trayler,R., Bird, R.,Westerfield, R.W. and Jorden,B.D. (2015) Essentials of

Corporate Finance. 2nd ed. New York City: McGraw-Hill. pp.178

Watson. D., and Head, A., (2015) Corporate Finance – Principles and Practice.6th ed.

London: Pearson, pp. 134-13

Bodie, Z., Merton, R. C., and Cleeton, D. L. (2016) Financial economics, 2nd ed. New York:

Pearson, pp. 144

Brealey, R. A., Myers, S. C., and Allen, F. (2014) Principles of corporate finance, 2nd ed.

New York: McGraw-Hill Inc, pp.155-156

Brigham, E. F. and Houston, J. F., (2014) Fundamentals of Financial Management.14thed.

Boston: Cengage Learning, pp. 178

Damodaran, A. (2015). Appl0ied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons, pp. 133

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M., and Nguyen, H. (2016)

Financial Management, Principles and Applications. 6th ed. NSW: Pearson Education, French

Forest Australia,pp. 203-204

Ross,S.A., Trayler,R., Bird, R.,Westerfield, R.W. and Jorden,B.D. (2015) Essentials of

Corporate Finance. 2nd ed. New York City: McGraw-Hill. pp.178

Watson. D., and Head, A., (2015) Corporate Finance – Principles and Practice.6th ed.

London: Pearson, pp. 134-13

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.