Financial Analysis of AMEX and VISA Stocks using Gordon Growth Model

VerifiedAdded on 2023/05/30

|19

|4143

|171

AI Summary

This assignment conducts a financial analysis on the two banking stocks AMEX and VISA using the Gordon Growth Model. The intrinsic value of the stock was compared with the true market value of the stock and the analyst opinion on the same was given for the stock.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: FINANCE

Finance

Name of the Student:

Name of the University:

Author’s Note:

Finance

Name of the Student:

Name of the University:

Author’s Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1FINANCE

Executive Summary

The aim of the assignment is to conduct a financial analysis on the two banking stocks AMEX

and VISA. The analysis and the valuation of the stock was done in accordance with the usage

and the application of the Gordon Growth Model. The intrinsic value of the stock was compared

with the true market value of the stock and the analyst opinion on the same was given for the

stock. The beta of the stock was calculated using regression analysis and the same was calculated

in order to determine the volatility of the stock with respect to the market index.

Executive Summary

The aim of the assignment is to conduct a financial analysis on the two banking stocks AMEX

and VISA. The analysis and the valuation of the stock was done in accordance with the usage

and the application of the Gordon Growth Model. The intrinsic value of the stock was compared

with the true market value of the stock and the analyst opinion on the same was given for the

stock. The beta of the stock was calculated using regression analysis and the same was calculated

in order to determine the volatility of the stock with respect to the market index.

2FINANCE

Table of Contents

Introduction......................................................................................................................................4

Discussion........................................................................................................................................4

Beta Analysis...............................................................................................................................4

Required Rate of Return..............................................................................................................5

Gordon Growth Model................................................................................................................6

Comparison of Intrinsic and Market Value of the Shares...........................................................6

Gordon Growth Model Assumptions and Limitations................................................................7

Analyst Opinion...........................................................................................................................7

Discrepancies between Computed and Actual Stock Returns.....................................................7

Capital Market Theory.................................................................................................................8

Diversified Portfolio....................................................................................................................8

Stocks in Diversified Portfolio....................................................................................................9

Systematic Risk and Unsystematic Risk......................................................................................9

Capital Market Line and Security Market Line.........................................................................10

Fundamental Analysis and Technical Analysis.........................................................................10

Expected Return.........................................................................................................................11

Recommendations..........................................................................................................................11

Reference.......................................................................................................................................13

Appendix........................................................................................................................................16

Table of Contents

Introduction......................................................................................................................................4

Discussion........................................................................................................................................4

Beta Analysis...............................................................................................................................4

Required Rate of Return..............................................................................................................5

Gordon Growth Model................................................................................................................6

Comparison of Intrinsic and Market Value of the Shares...........................................................6

Gordon Growth Model Assumptions and Limitations................................................................7

Analyst Opinion...........................................................................................................................7

Discrepancies between Computed and Actual Stock Returns.....................................................7

Capital Market Theory.................................................................................................................8

Diversified Portfolio....................................................................................................................8

Stocks in Diversified Portfolio....................................................................................................9

Systematic Risk and Unsystematic Risk......................................................................................9

Capital Market Line and Security Market Line.........................................................................10

Fundamental Analysis and Technical Analysis.........................................................................10

Expected Return.........................................................................................................................11

Recommendations..........................................................................................................................11

Reference.......................................................................................................................................13

Appendix........................................................................................................................................16

3FINANCE

Appendix 2.....................................................................................................................................17

Appendix 2.....................................................................................................................................17

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4FINANCE

Introduction

Financial Analysis is the process of the evaluating the asset class and the characteristics

of the asset class depending on the type of the nature of the asset class and the risk return

characteristic of the stocks. The stock valuation was done using the Gordon Growth Dividend

Discount Model and the same was compared with the actual true market price of the stock. The

valuation of the stock helped us determine whether they were undervalued or overvalued. The

analyst view about the stocks opinion with the relation to the future prospects of the company

was evaluated. The beta for the stocks was calculated and the same was determined using the

regression analysis for evaluating the volatility in the stock (Liow & Ye 2017). The reason

behind the true fair market value of the stock and the intrinsic market value was covered on the

different assumptions and factors involved in the same. The assumptions behind the capital

market theory band the application of the same in the evaluation of the stocks and various other

asset class were covered. Diversification plays an important role in the portfolio and the same

was well discussed in the context of the assignment (Vivanco, Gonzalez & Martinez, 2018). The

difference between the systematic and unsystematic risk and the influence of the same in the

application of the portfolio analysis was the key factor involved in the assignment. There are

various kinds of investment management strategy that are applied by the fund manager which are

like applying the principles of technical and fundamental analysis in order to identify the

potential of the asset class and derive the risk return strategy for the portfolio.

Introduction

Financial Analysis is the process of the evaluating the asset class and the characteristics

of the asset class depending on the type of the nature of the asset class and the risk return

characteristic of the stocks. The stock valuation was done using the Gordon Growth Dividend

Discount Model and the same was compared with the actual true market price of the stock. The

valuation of the stock helped us determine whether they were undervalued or overvalued. The

analyst view about the stocks opinion with the relation to the future prospects of the company

was evaluated. The beta for the stocks was calculated and the same was determined using the

regression analysis for evaluating the volatility in the stock (Liow & Ye 2017). The reason

behind the true fair market value of the stock and the intrinsic market value was covered on the

different assumptions and factors involved in the same. The assumptions behind the capital

market theory band the application of the same in the evaluation of the stocks and various other

asset class were covered. Diversification plays an important role in the portfolio and the same

was well discussed in the context of the assignment (Vivanco, Gonzalez & Martinez, 2018). The

difference between the systematic and unsystematic risk and the influence of the same in the

application of the portfolio analysis was the key factor involved in the assignment. There are

various kinds of investment management strategy that are applied by the fund manager which are

like applying the principles of technical and fundamental analysis in order to identify the

potential of the asset class and derive the risk return strategy for the portfolio.

5FINANCE

Discussion

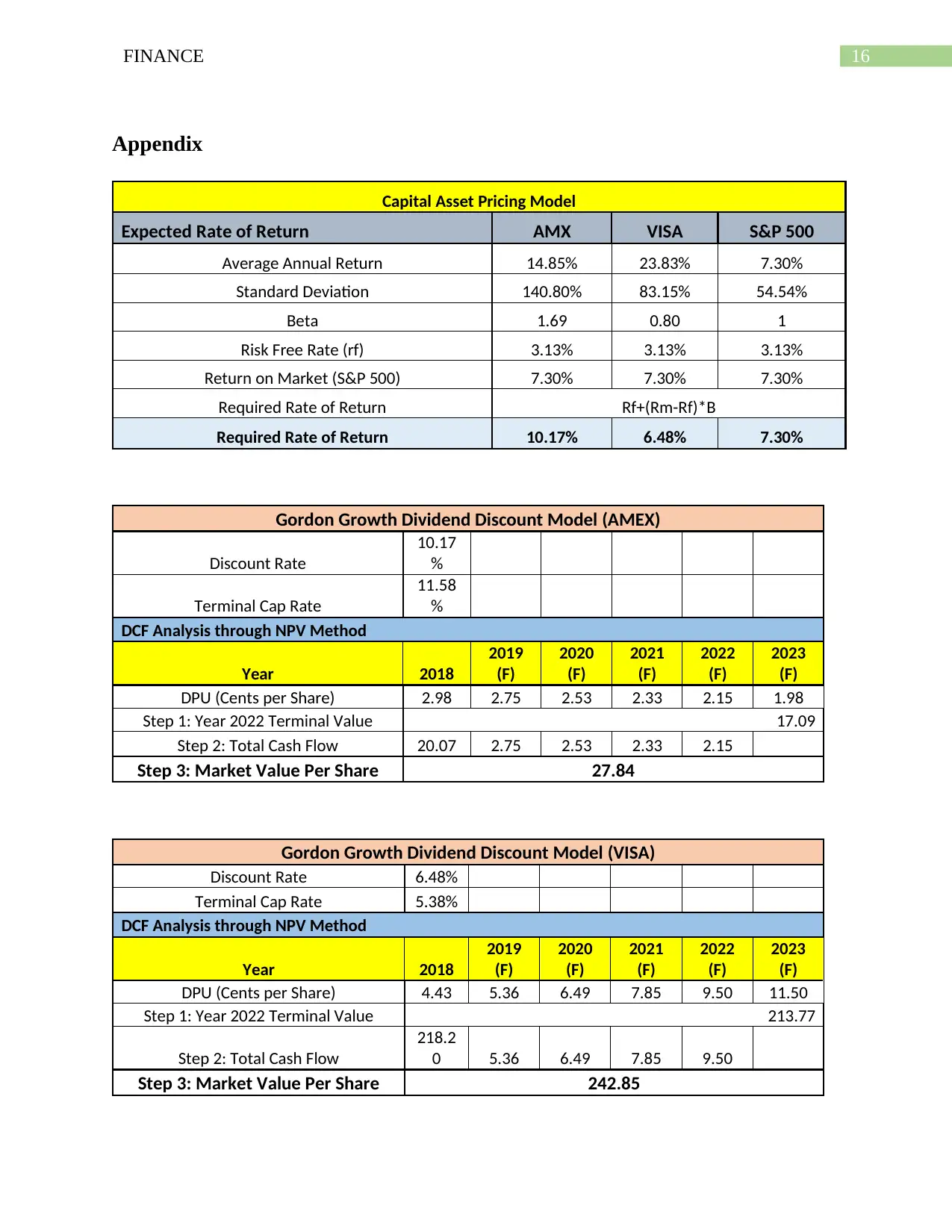

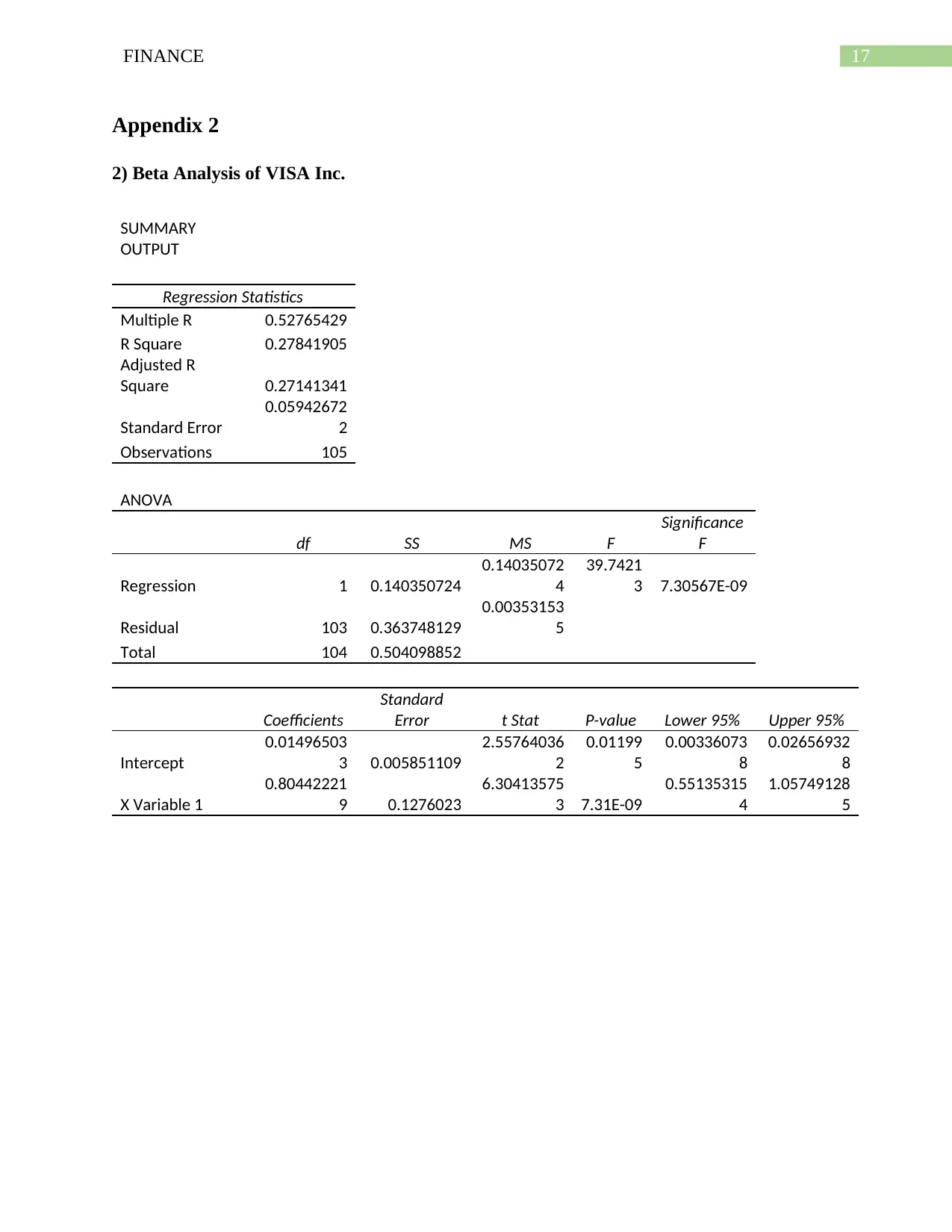

Beta Analysis

The Beta shows the volatility and the rate of the movement of the stock or the asset class

with respect to the movement in the benchmark. The beta was determined for the AMEX and

VISA stock using the historical share price data where S&P 500 Index was taken as the

benchmark Index for calculating the beta of the stock. The beta analysis for the stock was taken

into consideration so that the sensitivity of the stock with respect to the benchmark index could

be better assessed and understood (Allen, Powell & Singh, 2015). The beta of the AMEX stock

with the benchmark Index S&P 500 Index was quite high. The beta for the stocks was calculated

using the ordinary lease square regression method where the market index return was taken as

the independent variable and the returns on the stock was taken as the dependent variable. The

beta of the AMEX stocks was around 1.69 times and the beta of the VISA stock with respect to

the Market Index was around 0.80 times. High beta stock such as AMEX are highly volatile

stocks which says that if the market index moves by 1 the stock is expected to move by 1.69

times.

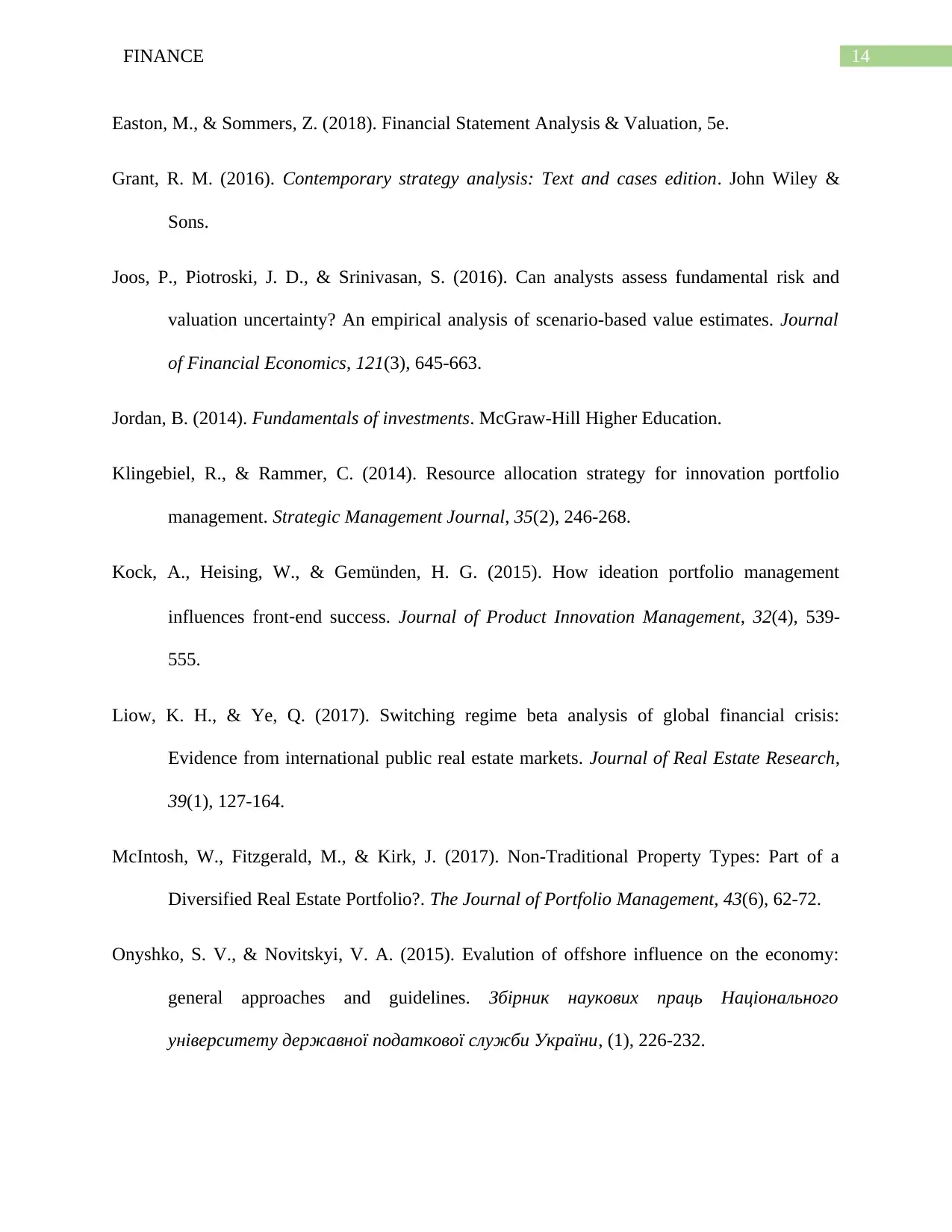

Required Rate of Return

The required rate of return for the stock was calculated using the Capital Asset Pricing

Mode where the Required Rate of Return was derived using the formula:

Required Rate of Return (Re) = Risk Free Rate of Return + (Return on Market- Risk Free Rate

of Return)*Beta.

The required rate of return for both stocks AMEX and VISA was calculated using the above

formula. The risk free rate of return taken for the analysis of the same was the 10 Year Treasury

Discussion

Beta Analysis

The Beta shows the volatility and the rate of the movement of the stock or the asset class

with respect to the movement in the benchmark. The beta was determined for the AMEX and

VISA stock using the historical share price data where S&P 500 Index was taken as the

benchmark Index for calculating the beta of the stock. The beta analysis for the stock was taken

into consideration so that the sensitivity of the stock with respect to the benchmark index could

be better assessed and understood (Allen, Powell & Singh, 2015). The beta of the AMEX stock

with the benchmark Index S&P 500 Index was quite high. The beta for the stocks was calculated

using the ordinary lease square regression method where the market index return was taken as

the independent variable and the returns on the stock was taken as the dependent variable. The

beta of the AMEX stocks was around 1.69 times and the beta of the VISA stock with respect to

the Market Index was around 0.80 times. High beta stock such as AMEX are highly volatile

stocks which says that if the market index moves by 1 the stock is expected to move by 1.69

times.

Required Rate of Return

The required rate of return for the stock was calculated using the Capital Asset Pricing

Mode where the Required Rate of Return was derived using the formula:

Required Rate of Return (Re) = Risk Free Rate of Return + (Return on Market- Risk Free Rate

of Return)*Beta.

The required rate of return for both stocks AMEX and VISA was calculated using the above

formula. The risk free rate of return taken for the analysis of the same was the 10 Year Treasury

6FINANCE

Yield. The return on the benchmark index S&P 500 Index was taken as the return on market and

the beta of each stock was determined in order to evaluate the required rate of return. The

required rate of return on the AMEX stock was around 10.17% and the required rate of return on

the VISA stock was around 6.48% respectively.

Gordon Growth Model

The Gordon Growth Model takes the forecasted dividend and the required rate of return

to determine the intrinsic value of the share price of the company. The Gordon Growth Dividend

Discount Model was applied in the case of VISA and AMEX shares were the intrinsic value for

the shares were determined in order to calculate and evaluate the pricing of the stock. The

formula used for determining the intrinsic value of the shares was:

Intrinsic Value (I.V) = (D1/(1+Re)+(D2/(1+Re)+(D3/(1+Re))+(D4/(1+Re))+(P4/(Re-g)).

The Gordon growth model was taken into consideration for determining the intrinsic

value of the share and the above formula was used for determining the current intrinsic value of

the share and the required rate of return was also use in the evaluation of the same. The intrinsic

value of the AMEX share was derived as $27.84 and the value of the VISA share was

determined as $242.85.

Comparison of Intrinsic and Market Value of the Shares

The intrinsic value of the shares was determined using the GGM model and the intrinsic

price of the AMEX share was determined to be around $27.84 however the current market value

of the share was around $112.89. The current market value of the share was currently high,

which shows the overvaluation of the share in the current given market situation. The intrinsic

value of the share for VISA share was evaluated to be around $242.85 and the market value of

Yield. The return on the benchmark index S&P 500 Index was taken as the return on market and

the beta of each stock was determined in order to evaluate the required rate of return. The

required rate of return on the AMEX stock was around 10.17% and the required rate of return on

the VISA stock was around 6.48% respectively.

Gordon Growth Model

The Gordon Growth Model takes the forecasted dividend and the required rate of return

to determine the intrinsic value of the share price of the company. The Gordon Growth Dividend

Discount Model was applied in the case of VISA and AMEX shares were the intrinsic value for

the shares were determined in order to calculate and evaluate the pricing of the stock. The

formula used for determining the intrinsic value of the shares was:

Intrinsic Value (I.V) = (D1/(1+Re)+(D2/(1+Re)+(D3/(1+Re))+(D4/(1+Re))+(P4/(Re-g)).

The Gordon growth model was taken into consideration for determining the intrinsic

value of the share and the above formula was used for determining the current intrinsic value of

the share and the required rate of return was also use in the evaluation of the same. The intrinsic

value of the AMEX share was derived as $27.84 and the value of the VISA share was

determined as $242.85.

Comparison of Intrinsic and Market Value of the Shares

The intrinsic value of the shares was determined using the GGM model and the intrinsic

price of the AMEX share was determined to be around $27.84 however the current market value

of the share was around $112.89. The current market value of the share was currently high,

which shows the overvaluation of the share in the current given market situation. The intrinsic

value of the share for VISA share was evaluated to be around $242.85 and the market value of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCE

the share at same time was around $141.38 which shows that the stock is currently undervalued

under the given market situation (Damodaran, 2016).

Gordon Growth Model Assumptions and Limitations

The Gordon growth model was used above to determine the intrinsic value of the share

price and the same was done by forecasting the dividends for the company. The key factor

involved in the valuation of the same was the usage of the forecasted dividend and the growth

rate used for the valuation of the shares. The forecasted dividend was calculated using the

average growth rate of the dividend in the five-year historical trend rate and the same was

applied in the case of forecasted dividends. The key limitation identified in the application of the

GGM model and determining the intrinsic value of the shares was the usage of the growth factor

and the forecaster dividend, which are based on the assumptions of the analyst determining the

true value of the shares (Jordan, 2014).

Analyst Opinion

The analyst opinion for the firm’s stock value has been dependent on the derived intrinsic

value of the shares. The AMEX share was currently seen as overpriced when the same was

compared with the true market value of the shares (Grant, 2016). The overvaluation of the

AMEX share with the true market value of the share makes the stock unfavorable for the purpose

of investment. However, the true market value for the VISA Inc. share was less than the intrinsic

value determined for the shares, which makes the stock favorable for the purpose of investment.

The undervaluation of the stock shows the stock potential for growing and outperforming (Joos,

Piotroski, & Srinivasan, 2016).

the share at same time was around $141.38 which shows that the stock is currently undervalued

under the given market situation (Damodaran, 2016).

Gordon Growth Model Assumptions and Limitations

The Gordon growth model was used above to determine the intrinsic value of the share

price and the same was done by forecasting the dividends for the company. The key factor

involved in the valuation of the same was the usage of the forecasted dividend and the growth

rate used for the valuation of the shares. The forecasted dividend was calculated using the

average growth rate of the dividend in the five-year historical trend rate and the same was

applied in the case of forecasted dividends. The key limitation identified in the application of the

GGM model and determining the intrinsic value of the shares was the usage of the growth factor

and the forecaster dividend, which are based on the assumptions of the analyst determining the

true value of the shares (Jordan, 2014).

Analyst Opinion

The analyst opinion for the firm’s stock value has been dependent on the derived intrinsic

value of the shares. The AMEX share was currently seen as overpriced when the same was

compared with the true market value of the shares (Grant, 2016). The overvaluation of the

AMEX share with the true market value of the share makes the stock unfavorable for the purpose

of investment. However, the true market value for the VISA Inc. share was less than the intrinsic

value determined for the shares, which makes the stock favorable for the purpose of investment.

The undervaluation of the stock shows the stock potential for growing and outperforming (Joos,

Piotroski, & Srinivasan, 2016).

8FINANCE

Discrepancies between Computed and Actual Stock Returns

The discrepancies between the computed and actual stock returns is mainly due to the

opinion and assumptions used by the one for determining the prospects of the share and the value

of the investment in the future for the company. The difference between the actual and the

computed returns may also be on the ground of different factors such as the market forces,

business conditions and the macroeconomic environment under which the company operates.

The difference between the actual return may also been seen due to the different valuation

models and the techniques applied by the investors depending on the growth prospect taken and

forecasted for the company (Easton & Sommers, 2018). The common valuation techniques and

tools used by the investors are the application of the Gordon Growth Model, Residual Income

Valuation and the usage of the Free Cash flow model for determining the intrinsic value of the

share (Duncan et al. 2017).

Capital Market Theory

The main assumptions underlying the application of the Capital Market theory is that the

investors are rational i.e., efficient investors. The investors follows the Markowitz Idea where the

follow and apply the principles of investment based on the efficient frontier where the asset

allocation between the market portfolio and the risk free asset is primarily based on the investors

risk and return preference (Kock, Heising & Gemünden, 2015). The investment goals and

objectives and the risk return characteristic help the investors identify the amount of investment

and the allocation of the investible amount between the Cash and Market Portfolio (Charbonneau

et al. 2016).

Discrepancies between Computed and Actual Stock Returns

The discrepancies between the computed and actual stock returns is mainly due to the

opinion and assumptions used by the one for determining the prospects of the share and the value

of the investment in the future for the company. The difference between the actual and the

computed returns may also be on the ground of different factors such as the market forces,

business conditions and the macroeconomic environment under which the company operates.

The difference between the actual return may also been seen due to the different valuation

models and the techniques applied by the investors depending on the growth prospect taken and

forecasted for the company (Easton & Sommers, 2018). The common valuation techniques and

tools used by the investors are the application of the Gordon Growth Model, Residual Income

Valuation and the usage of the Free Cash flow model for determining the intrinsic value of the

share (Duncan et al. 2017).

Capital Market Theory

The main assumptions underlying the application of the Capital Market theory is that the

investors are rational i.e., efficient investors. The investors follows the Markowitz Idea where the

follow and apply the principles of investment based on the efficient frontier where the asset

allocation between the market portfolio and the risk free asset is primarily based on the investors

risk and return preference (Kock, Heising & Gemünden, 2015). The investment goals and

objectives and the risk return characteristic help the investors identify the amount of investment

and the allocation of the investible amount between the Cash and Market Portfolio (Charbonneau

et al. 2016).

9FINANCE

Diversified Portfolio

A diversified portfolio is one where the unsystematic risk in the portfolio is reduced by

investing the portfolio amount into various kind and categories of assets so that the unsystematic

risk of the portfolio is reduced. A diversified portfolio is one where the investible amount is

diversified into various asset class so that risk and return derived from the same is modified. The

risk and return from the portfolio are modified, as the weights of the stocks will be put according

to the risk return profile of the asset class (Bollen, Joenväärä & Kauppila, 2018).

Stocks in Diversified Portfolio

Portfolio with diversified stocks usually modifies the risk and return strategy and the

same will create a better-diversified portfolio reducing the risk and return characteristics of the

stocks. The portfolio will be created on the base of the different stocks, which will provide a risk

diversification and return generation for the stocks (Auerbach, 2015). As such, there are no

limitation on the number of stocks required for creation of a diversified portfolio but the number

of stocks to be included in the portfolio should be based on the cost benefit analysis in the

portfolio. However, the number of stocks required for a portfolio should at least be 5-6 stocks,

which should be uncorrelated and should be from different industries and sectors (Campbell et

al. 2018).

Systematic Risk and Unsystematic Risk

There are primary two common risk faced by the investors during the investment process,

which are primarily systematic risk and unsystematic risk (McIntosh, Fitzgerald & Kirk 2017).

Systematic risk is the type of risk, where the risk and return of the stock is dependent on the

performance of the economy or the market risk, which is faced by the investors at the time of

investing the same with the stocks. Systematic risk may be referred to the daily volatility faced

Diversified Portfolio

A diversified portfolio is one where the unsystematic risk in the portfolio is reduced by

investing the portfolio amount into various kind and categories of assets so that the unsystematic

risk of the portfolio is reduced. A diversified portfolio is one where the investible amount is

diversified into various asset class so that risk and return derived from the same is modified. The

risk and return from the portfolio are modified, as the weights of the stocks will be put according

to the risk return profile of the asset class (Bollen, Joenväärä & Kauppila, 2018).

Stocks in Diversified Portfolio

Portfolio with diversified stocks usually modifies the risk and return strategy and the

same will create a better-diversified portfolio reducing the risk and return characteristics of the

stocks. The portfolio will be created on the base of the different stocks, which will provide a risk

diversification and return generation for the stocks (Auerbach, 2015). As such, there are no

limitation on the number of stocks required for creation of a diversified portfolio but the number

of stocks to be included in the portfolio should be based on the cost benefit analysis in the

portfolio. However, the number of stocks required for a portfolio should at least be 5-6 stocks,

which should be uncorrelated and should be from different industries and sectors (Campbell et

al. 2018).

Systematic Risk and Unsystematic Risk

There are primary two common risk faced by the investors during the investment process,

which are primarily systematic risk and unsystematic risk (McIntosh, Fitzgerald & Kirk 2017).

Systematic risk is the type of risk, where the risk and return of the stock is dependent on the

performance of the economy or the market risk, which is faced by the investors at the time of

investing the same with the stocks. Systematic risk may be referred to the daily volatility faced

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10FINANCE

by the investors, which may compose of the fluctuations in the stock price of the company.

Generally, the systematic risk faced by the investors is non-diversifiable. However, the

unsystematic risk is associated with the particular industry or sector faced by the stock. The

unsystematic risk of the stock may be diversified by investing into various categories and types

of stocks so that the risk and return from the portfolio are modified (Klingebiel & Rammer,

2014).

Capital Market Line and Security Market Line

The Capital Market Line and the Security line are the two common graphical

presentation, which are used and applied in the portfolio analysis. The Capital Market Line is a

type of graphical representation that shows the relationship between the expected return on the

portfolio risk and the risks, which are taken by the investors. However, the Security Market Line

or the SML is the graphical representation that shows the relationship between the required

return on the individual stocks after comparing the systematic risk and the non-diversifiable risk

of a portfolio. The investors in the application of the portfolio analysis use both the graphical

representation (Onyshko & Novitskyi, 2015).

Fundamental Analysis and Technical Analysis

The fundamental and technical analysis are the common investment strategies used by the

portfolio fund managers for evaluating and assessing the various kinds of asset class.

Fundamental Analysis for the stocks include assessing the stocks based on the background

information of the company and the financial performance of the stocks (Satyanarayana &

Naresh, 2015). The management of the company, profitability return generated by the stock are

some of the common factors that are taken into consideration while evaluating the stock

fundamentally. Technical Analysis is the identification of the investment strategy that are applied

by the investors, which may compose of the fluctuations in the stock price of the company.

Generally, the systematic risk faced by the investors is non-diversifiable. However, the

unsystematic risk is associated with the particular industry or sector faced by the stock. The

unsystematic risk of the stock may be diversified by investing into various categories and types

of stocks so that the risk and return from the portfolio are modified (Klingebiel & Rammer,

2014).

Capital Market Line and Security Market Line

The Capital Market Line and the Security line are the two common graphical

presentation, which are used and applied in the portfolio analysis. The Capital Market Line is a

type of graphical representation that shows the relationship between the expected return on the

portfolio risk and the risks, which are taken by the investors. However, the Security Market Line

or the SML is the graphical representation that shows the relationship between the required

return on the individual stocks after comparing the systematic risk and the non-diversifiable risk

of a portfolio. The investors in the application of the portfolio analysis use both the graphical

representation (Onyshko & Novitskyi, 2015).

Fundamental Analysis and Technical Analysis

The fundamental and technical analysis are the common investment strategies used by the

portfolio fund managers for evaluating and assessing the various kinds of asset class.

Fundamental Analysis for the stocks include assessing the stocks based on the background

information of the company and the financial performance of the stocks (Satyanarayana &

Naresh, 2015). The management of the company, profitability return generated by the stock are

some of the common factors that are taken into consideration while evaluating the stock

fundamentally. Technical Analysis is the identification of the investment strategy that are applied

11FINANCE

by the investors for identifying the trade opportunities by analyzing the statistical trends, charts,

volume of the shares and other tools to determine and forecast the share price of the company.

Forecasting of market prices and the study of the market prices of the data given for the company

are some of the factors taken into consideration while conducting the technical analysis for the

stock.

Expected Return

There are two common ways where the required rate of return for the stocks could be determined

are by using:

Capital Asset Pricing Model (CAPM): The Capital Asset Pricing model is the

commo0n techniques used for determining the expected required rate of return. The

formula used for determining the same is as follows:

Required Rate of Return (Re) = Risk Free Rate of Return + (Return on Market- Risk

Free Rate of Return)*Beta (Barberis et al. 2015).

Weighted Average Cost of Capital (WACC): The weighted average cost of capital for

the firm is the other technique applied for the usage of determining the required rate of

return from the stock (Chandra, 2017). The formula used for the same is as follow:

WACC: Weight of Equity*Cost of Equity+ Weight of Debt* Cost of Debt.

Recommendations

The current valuation for the AMEX and VISA shares were determined using the Gordon

Growth Model and the same was determined in order to determine the undervaluation or the

overvaluation of the share price of the company. The intrinsic price of the AMEX share was

determined to be around $27.84 however the current market value of the share was around

by the investors for identifying the trade opportunities by analyzing the statistical trends, charts,

volume of the shares and other tools to determine and forecast the share price of the company.

Forecasting of market prices and the study of the market prices of the data given for the company

are some of the factors taken into consideration while conducting the technical analysis for the

stock.

Expected Return

There are two common ways where the required rate of return for the stocks could be determined

are by using:

Capital Asset Pricing Model (CAPM): The Capital Asset Pricing model is the

commo0n techniques used for determining the expected required rate of return. The

formula used for determining the same is as follows:

Required Rate of Return (Re) = Risk Free Rate of Return + (Return on Market- Risk

Free Rate of Return)*Beta (Barberis et al. 2015).

Weighted Average Cost of Capital (WACC): The weighted average cost of capital for

the firm is the other technique applied for the usage of determining the required rate of

return from the stock (Chandra, 2017). The formula used for the same is as follow:

WACC: Weight of Equity*Cost of Equity+ Weight of Debt* Cost of Debt.

Recommendations

The current valuation for the AMEX and VISA shares were determined using the Gordon

Growth Model and the same was determined in order to determine the undervaluation or the

overvaluation of the share price of the company. The intrinsic price of the AMEX share was

determined to be around $27.84 however the current market value of the share was around

12FINANCE

$112.89 which shows that the stock is currently overvalued and the same should be given with a

“ Sell” recommendation for the stock. The revenue for the companies and the operating income

for the companies is said to be decreasing and the future prospect of the company is said to be

volatile showing a falling trend for the company. The economic conditions and the business

factors for the stocks has been the key factor for the analysis of the same and the same is

expected to be unfavorable for the stock. The intrinsic value of the share for VISA share was

evaluated to be around $242.85 and the market value of the share at same time was around

$141.38, which shows that the stock is currently undervalued and should be given a buy

recommendation so that the investors can enjoy the future prospect of the company. The rising

operating income for the company and the rising profitability of the company are some of the

key factors, which shows that the future prospect of the company looks favorable.

$112.89 which shows that the stock is currently overvalued and the same should be given with a

“ Sell” recommendation for the stock. The revenue for the companies and the operating income

for the companies is said to be decreasing and the future prospect of the company is said to be

volatile showing a falling trend for the company. The economic conditions and the business

factors for the stocks has been the key factor for the analysis of the same and the same is

expected to be unfavorable for the stock. The intrinsic value of the share for VISA share was

evaluated to be around $242.85 and the market value of the share at same time was around

$141.38, which shows that the stock is currently undervalued and should be given a buy

recommendation so that the investors can enjoy the future prospect of the company. The rising

operating income for the company and the rising profitability of the company are some of the

key factors, which shows that the future prospect of the company looks favorable.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13FINANCE

Reference

Allen, D., Powell, R. J., & Singh, A. K. (2015). Quantile regression, VaR and CVAR. An

empirical beta comparison of the techniques in relation to credit risk.

Auerbach, J. (2015). Creating incentives to move upstream: developing a diversified portfolio of

population health measures within payment and health care reform. American journal of

public health, 105(3), 427-431.

Barberis, N., Greenwood, R., Jin, L., & Shleifer, A. (2015). X-CAPM: An extrapolative capital

asset pricing model. Journal of financial economics, 115(1), 1-24.

Bollen, N. P., Joenväärä, J., & Kauppila, M. (2018). Picking winners? Selecting hedge funds for

a diversified portfolio.

Campbell, J. Y., Giglio, S., Polk, C., & Turley, R. (2018). An intertemporal CAPM with

stochastic volatility. Journal of Financial Economics, 128(2), 207-233.

Chandra, P. (2017). Investment analysis and portfolio management. McGraw-Hill Education.

Charbonneau, M. R., O’Donnell, D., Blanton, L. V., Totten, S. M., Davis, J. C., Barratt, M. J., ...

& Muehlbauer, M. J. (2016). Sialylated milk oligosaccharides promote microbiota-

dependent growth in models of infant undernutrition. Cell, 164(5), 859-871.

Damodaran, A. (2016). Damodaran on valuation: security analysis for investment and corporate

finance (Vol. 324). John Wiley & Sons.

Duncan, J., Anderson, S. C., Price, S., & Thomas, C. (2017). The Gordon Growth Model: A

Teaching Case. Journal of Business Case Studies (Online), 13(1), 23.

Reference

Allen, D., Powell, R. J., & Singh, A. K. (2015). Quantile regression, VaR and CVAR. An

empirical beta comparison of the techniques in relation to credit risk.

Auerbach, J. (2015). Creating incentives to move upstream: developing a diversified portfolio of

population health measures within payment and health care reform. American journal of

public health, 105(3), 427-431.

Barberis, N., Greenwood, R., Jin, L., & Shleifer, A. (2015). X-CAPM: An extrapolative capital

asset pricing model. Journal of financial economics, 115(1), 1-24.

Bollen, N. P., Joenväärä, J., & Kauppila, M. (2018). Picking winners? Selecting hedge funds for

a diversified portfolio.

Campbell, J. Y., Giglio, S., Polk, C., & Turley, R. (2018). An intertemporal CAPM with

stochastic volatility. Journal of Financial Economics, 128(2), 207-233.

Chandra, P. (2017). Investment analysis and portfolio management. McGraw-Hill Education.

Charbonneau, M. R., O’Donnell, D., Blanton, L. V., Totten, S. M., Davis, J. C., Barratt, M. J., ...

& Muehlbauer, M. J. (2016). Sialylated milk oligosaccharides promote microbiota-

dependent growth in models of infant undernutrition. Cell, 164(5), 859-871.

Damodaran, A. (2016). Damodaran on valuation: security analysis for investment and corporate

finance (Vol. 324). John Wiley & Sons.

Duncan, J., Anderson, S. C., Price, S., & Thomas, C. (2017). The Gordon Growth Model: A

Teaching Case. Journal of Business Case Studies (Online), 13(1), 23.

14FINANCE

Easton, M., & Sommers, Z. (2018). Financial Statement Analysis & Valuation, 5e.

Grant, R. M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley &

Sons.

Joos, P., Piotroski, J. D., & Srinivasan, S. (2016). Can analysts assess fundamental risk and

valuation uncertainty? An empirical analysis of scenario-based value estimates. Journal

of Financial Economics, 121(3), 645-663.

Jordan, B. (2014). Fundamentals of investments. McGraw-Hill Higher Education.

Klingebiel, R., & Rammer, C. (2014). Resource allocation strategy for innovation portfolio

management. Strategic Management Journal, 35(2), 246-268.

Kock, A., Heising, W., & Gemünden, H. G. (2015). How ideation portfolio management

influences front‐end success. Journal of Product Innovation Management, 32(4), 539-

555.

Liow, K. H., & Ye, Q. (2017). Switching regime beta analysis of global financial crisis:

Evidence from international public real estate markets. Journal of Real Estate Research,

39(1), 127-164.

McIntosh, W., Fitzgerald, M., & Kirk, J. (2017). Non-Traditional Property Types: Part of a

Diversified Real Estate Portfolio?. The Journal of Portfolio Management, 43(6), 62-72.

Onyshko, S. V., & Novitskyi, V. A. (2015). Evalution of offshore influence on the economy:

general approaches and guidelines. Збірник наукових праць Національного

університету державної податкової служби України, (1), 226-232.

Easton, M., & Sommers, Z. (2018). Financial Statement Analysis & Valuation, 5e.

Grant, R. M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley &

Sons.

Joos, P., Piotroski, J. D., & Srinivasan, S. (2016). Can analysts assess fundamental risk and

valuation uncertainty? An empirical analysis of scenario-based value estimates. Journal

of Financial Economics, 121(3), 645-663.

Jordan, B. (2014). Fundamentals of investments. McGraw-Hill Higher Education.

Klingebiel, R., & Rammer, C. (2014). Resource allocation strategy for innovation portfolio

management. Strategic Management Journal, 35(2), 246-268.

Kock, A., Heising, W., & Gemünden, H. G. (2015). How ideation portfolio management

influences front‐end success. Journal of Product Innovation Management, 32(4), 539-

555.

Liow, K. H., & Ye, Q. (2017). Switching regime beta analysis of global financial crisis:

Evidence from international public real estate markets. Journal of Real Estate Research,

39(1), 127-164.

McIntosh, W., Fitzgerald, M., & Kirk, J. (2017). Non-Traditional Property Types: Part of a

Diversified Real Estate Portfolio?. The Journal of Portfolio Management, 43(6), 62-72.

Onyshko, S. V., & Novitskyi, V. A. (2015). Evalution of offshore influence on the economy:

general approaches and guidelines. Збірник наукових праць Національного

університету державної податкової служби України, (1), 226-232.

15FINANCE

Satyanarayana, I., & Naresh, N. S. A. (2015). Evalution of Fixed Assets Management.

International Journal of Scientific Research and Management, 3(3).

Vivanco, J. S., Gonzalez, M., & Martinez, D. C. (2018, May). Social Effects For Using The

Index Beta For Investment Risk Prediction As A Base Of Enterprise Sustainability In

Developing Countries. In ICPESS (International Congress on Politic, Economic and

Social Studies) (No. 4).

Satyanarayana, I., & Naresh, N. S. A. (2015). Evalution of Fixed Assets Management.

International Journal of Scientific Research and Management, 3(3).

Vivanco, J. S., Gonzalez, M., & Martinez, D. C. (2018, May). Social Effects For Using The

Index Beta For Investment Risk Prediction As A Base Of Enterprise Sustainability In

Developing Countries. In ICPESS (International Congress on Politic, Economic and

Social Studies) (No. 4).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16FINANCE

Appendix

Capital Asset Pricing Model

Expected Rate of Return AMX VISA S&P 500

Average Annual Return 14.85% 23.83% 7.30%

Standard Deviation 140.80% 83.15% 54.54%

Beta 1.69 0.80 1

Risk Free Rate (rf) 3.13% 3.13% 3.13%

Return on Market (S&P 500) 7.30% 7.30% 7.30%

Required Rate of Return Rf+(Rm-Rf)*B

Required Rate of Return 10.17% 6.48% 7.30%

Gordon Growth Dividend Discount Model (AMEX)

Discount Rate

10.17

%

Terminal Cap Rate

11.58

%

DCF Analysis through NPV Method

Year 2018

2019

(F)

2020

(F)

2021

(F)

2022

(F)

2023

(F)

DPU (Cents per Share) 2.98 2.75 2.53 2.33 2.15 1.98

Step 1: Year 2022 Terminal Value 17.09

Step 2: Total Cash Flow 20.07 2.75 2.53 2.33 2.15

Step 3: Market Value Per Share 27.84

Gordon Growth Dividend Discount Model (VISA)

Discount Rate 6.48%

Terminal Cap Rate 5.38%

DCF Analysis through NPV Method

Year 2018

2019

(F)

2020

(F)

2021

(F)

2022

(F)

2023

(F)

DPU (Cents per Share) 4.43 5.36 6.49 7.85 9.50 11.50

Step 1: Year 2022 Terminal Value 213.77

Step 2: Total Cash Flow

218.2

0 5.36 6.49 7.85 9.50

Step 3: Market Value Per Share 242.85

Appendix

Capital Asset Pricing Model

Expected Rate of Return AMX VISA S&P 500

Average Annual Return 14.85% 23.83% 7.30%

Standard Deviation 140.80% 83.15% 54.54%

Beta 1.69 0.80 1

Risk Free Rate (rf) 3.13% 3.13% 3.13%

Return on Market (S&P 500) 7.30% 7.30% 7.30%

Required Rate of Return Rf+(Rm-Rf)*B

Required Rate of Return 10.17% 6.48% 7.30%

Gordon Growth Dividend Discount Model (AMEX)

Discount Rate

10.17

%

Terminal Cap Rate

11.58

%

DCF Analysis through NPV Method

Year 2018

2019

(F)

2020

(F)

2021

(F)

2022

(F)

2023

(F)

DPU (Cents per Share) 2.98 2.75 2.53 2.33 2.15 1.98

Step 1: Year 2022 Terminal Value 17.09

Step 2: Total Cash Flow 20.07 2.75 2.53 2.33 2.15

Step 3: Market Value Per Share 27.84

Gordon Growth Dividend Discount Model (VISA)

Discount Rate 6.48%

Terminal Cap Rate 5.38%

DCF Analysis through NPV Method

Year 2018

2019

(F)

2020

(F)

2021

(F)

2022

(F)

2023

(F)

DPU (Cents per Share) 4.43 5.36 6.49 7.85 9.50 11.50

Step 1: Year 2022 Terminal Value 213.77

Step 2: Total Cash Flow

218.2

0 5.36 6.49 7.85 9.50

Step 3: Market Value Per Share 242.85

17FINANCE

Appendix 2

2) Beta Analysis of VISA Inc.

SUMMARY

OUTPUT

Regression Statistics

Multiple R 0.52765429

R Square 0.27841905

Adjusted R

Square 0.27141341

Standard Error

0.05942672

2

Observations 105

ANOVA

df SS MS F

Significance

F

Regression 1 0.140350724

0.14035072

4

39.7421

3 7.30567E-09

Residual 103 0.363748129

0.00353153

5

Total 104 0.504098852

Coefficients

Standard

Error t Stat P-value Lower 95% Upper 95%

Intercept

0.01496503

3 0.005851109

2.55764036

2

0.01199

5

0.00336073

8

0.02656932

8

X Variable 1

0.80442221

9 0.1276023

6.30413575

3 7.31E-09

0.55135315

4

1.05749128

5

Appendix 2

2) Beta Analysis of VISA Inc.

SUMMARY

OUTPUT

Regression Statistics

Multiple R 0.52765429

R Square 0.27841905

Adjusted R

Square 0.27141341

Standard Error

0.05942672

2

Observations 105

ANOVA

df SS MS F

Significance

F

Regression 1 0.140350724

0.14035072

4

39.7421

3 7.30567E-09

Residual 103 0.363748129

0.00353153

5

Total 104 0.504098852

Coefficients

Standard

Error t Stat P-value Lower 95% Upper 95%

Intercept

0.01496503

3 0.005851109

2.55764036

2

0.01199

5

0.00336073

8

0.02656932

8

X Variable 1

0.80442221

9 0.1276023

6.30413575

3 7.31E-09

0.55135315

4

1.05749128

5

18FINANCE

Beta Analysis of AMEX

SUMMARY

OUTPUT

Regression Statistics

Multiple R

0.65439650

8

R Square 0.42823479

Adjusted R

Square

0.42268367

1

Standard Error

0.08957645

7

Observations 105

ANOVA

df SS MS F

Significance

F

Regression 1 0.618997948

0.61899

8

77.1438

7 3.71517E-14

Residual 103 0.826465996

0.00802

4

Total 104 1.445463944

Coefficients

Standard

Error t Stat P-value Lower 95% Upper 95%

Intercept

0.00210399

2 0.008819629

0.23855

8

0.81192

2

-

0.01538766

2

0.01959564

5

X Variable 1

1.68935660

6 0.192340443

8.78315

9 3.72E-14

1.30789470

2 2.07081851

Beta Analysis of AMEX

SUMMARY

OUTPUT

Regression Statistics

Multiple R

0.65439650

8

R Square 0.42823479

Adjusted R

Square

0.42268367

1

Standard Error

0.08957645

7

Observations 105

ANOVA

df SS MS F

Significance

F

Regression 1 0.618997948

0.61899

8

77.1438

7 3.71517E-14

Residual 103 0.826465996

0.00802

4

Total 104 1.445463944

Coefficients

Standard

Error t Stat P-value Lower 95% Upper 95%

Intercept

0.00210399

2 0.008819629

0.23855

8

0.81192

2

-

0.01538766

2

0.01959564

5

X Variable 1

1.68935660

6 0.192340443

8.78315

9 3.72E-14

1.30789470

2 2.07081851

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.