Finance and Accounting Report: AASB Standards and Applications

VerifiedAdded on 2022/09/26

|12

|1174

|17

Report

AI Summary

This finance and accounting report provides a detailed analysis of impairment losses, asset revaluation, and share capital transactions. The report begins by calculating and allocating impairment losses across various assets, including buildings, equipment, inventory, land, and receivables. It then addresses the accounting treatment of asset revaluation, demonstrating the journal entries for revaluation of plant assets and the subsequent accounting for revaluation losses. The report also covers share capital transactions, including share applications, allotments, and calls, along with journal entries for each transaction. The report also differentiates between impairment loss and revaluation decrement, and compares cost and revaluation models for asset valuation, offering insights into the advantages of the revaluation model for a growing business. Finally, the report concludes with a bibliography citing relevant sources, including AASB standards.

Running head: FINANCE AND ACCOUNTING

Finance and Accounting

Name of the Student

Name of the University

Author Note

Finance and Accounting

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

FINANCE AND ACCOUNTING

Table of Contents

Answer to Question 1...................................................................................................................2

Answer to Question 2...................................................................................................................2

Answer to Question 3...................................................................................................................2

Answer to Question 4...................................................................................................................3

Bibliography.................................................................................................................................4

FINANCE AND ACCOUNTING

Table of Contents

Answer to Question 1...................................................................................................................2

Answer to Question 2...................................................................................................................2

Answer to Question 3...................................................................................................................2

Answer to Question 4...................................................................................................................3

Bibliography.................................................................................................................................4

2

FINANCE AND ACCOUNTING

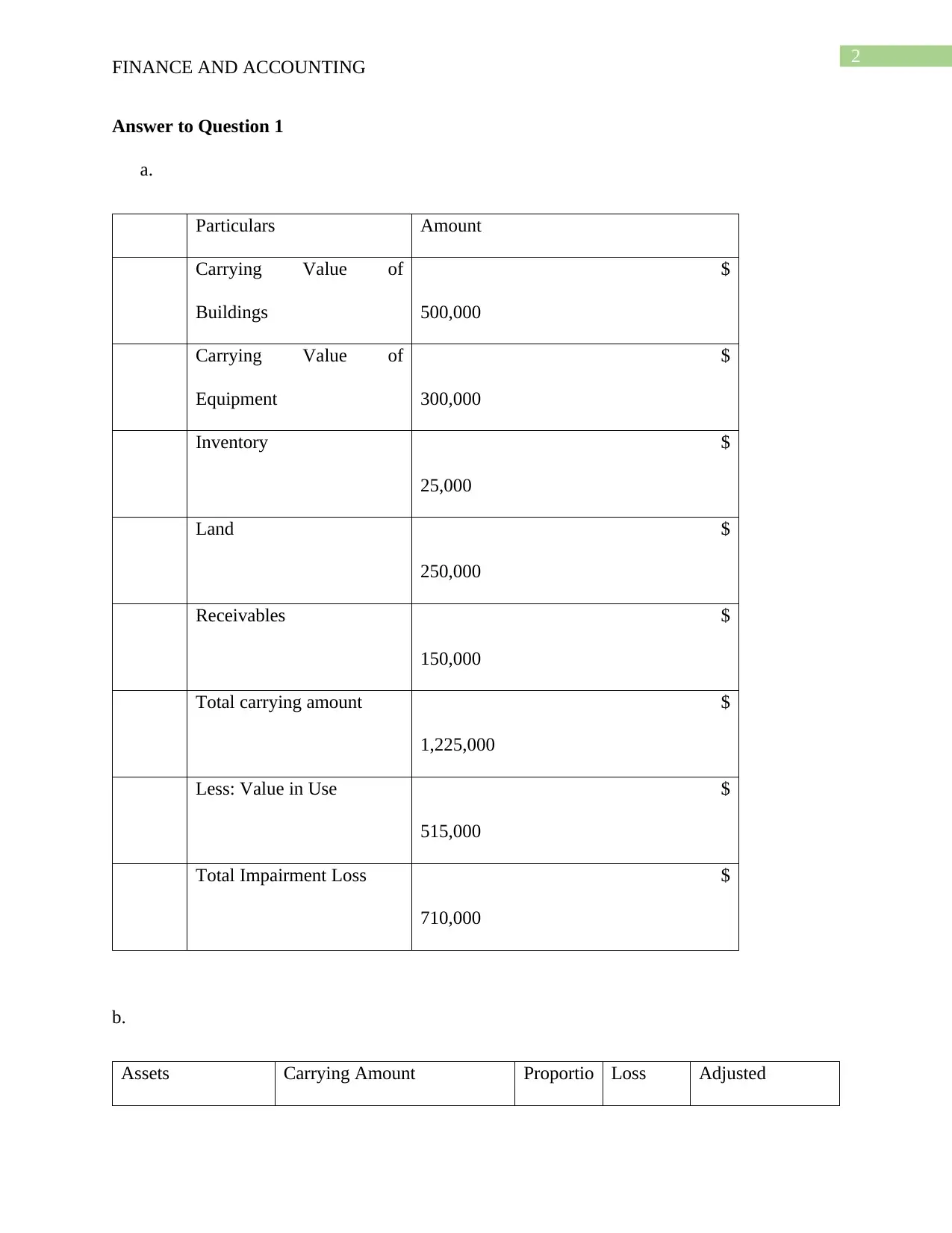

Answer to Question 1

a.

Particulars Amount

Carrying Value of

Buildings

$

500,000

Carrying Value of

Equipment

$

300,000

Inventory $

25,000

Land $

250,000

Receivables $

150,000

Total carrying amount $

1,225,000

Less: Value in Use $

515,000

Total Impairment Loss $

710,000

b.

Assets Carrying Amount Proportio Loss Adjusted

FINANCE AND ACCOUNTING

Answer to Question 1

a.

Particulars Amount

Carrying Value of

Buildings

$

500,000

Carrying Value of

Equipment

$

300,000

Inventory $

25,000

Land $

250,000

Receivables $

150,000

Total carrying amount $

1,225,000

Less: Value in Use $

515,000

Total Impairment Loss $

710,000

b.

Assets Carrying Amount Proportio Loss Adjusted

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

FINANCE AND ACCOUNTING

n allocated Carrying amount

Buildings $

500,000

0.41 $

289,795.

92

$

210,204.08

Equipment $

300,000

0.24 $

173,877.

55

$

126,122.45

Inventory $

25,000

0.02 $

14,489.8

0

$

10,510.20

Land $

250,000

0.20 $

144,897.

96

$

105,102.04

Receivables $

150,000

0.12 $

86,938.7

8

$

63,061.22

Totals $

1,225,000

$

1

$

710,000

$

515,000.00

c.

Date Details Debit Credit

30.6.2020 Loss on Impairment $

FINANCE AND ACCOUNTING

n allocated Carrying amount

Buildings $

500,000

0.41 $

289,795.

92

$

210,204.08

Equipment $

300,000

0.24 $

173,877.

55

$

126,122.45

Inventory $

25,000

0.02 $

14,489.8

0

$

10,510.20

Land $

250,000

0.20 $

144,897.

96

$

105,102.04

Receivables $

150,000

0.12 $

86,938.7

8

$

63,061.22

Totals $

1,225,000

$

1

$

710,000

$

515,000.00

c.

Date Details Debit Credit

30.6.2020 Loss on Impairment $

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

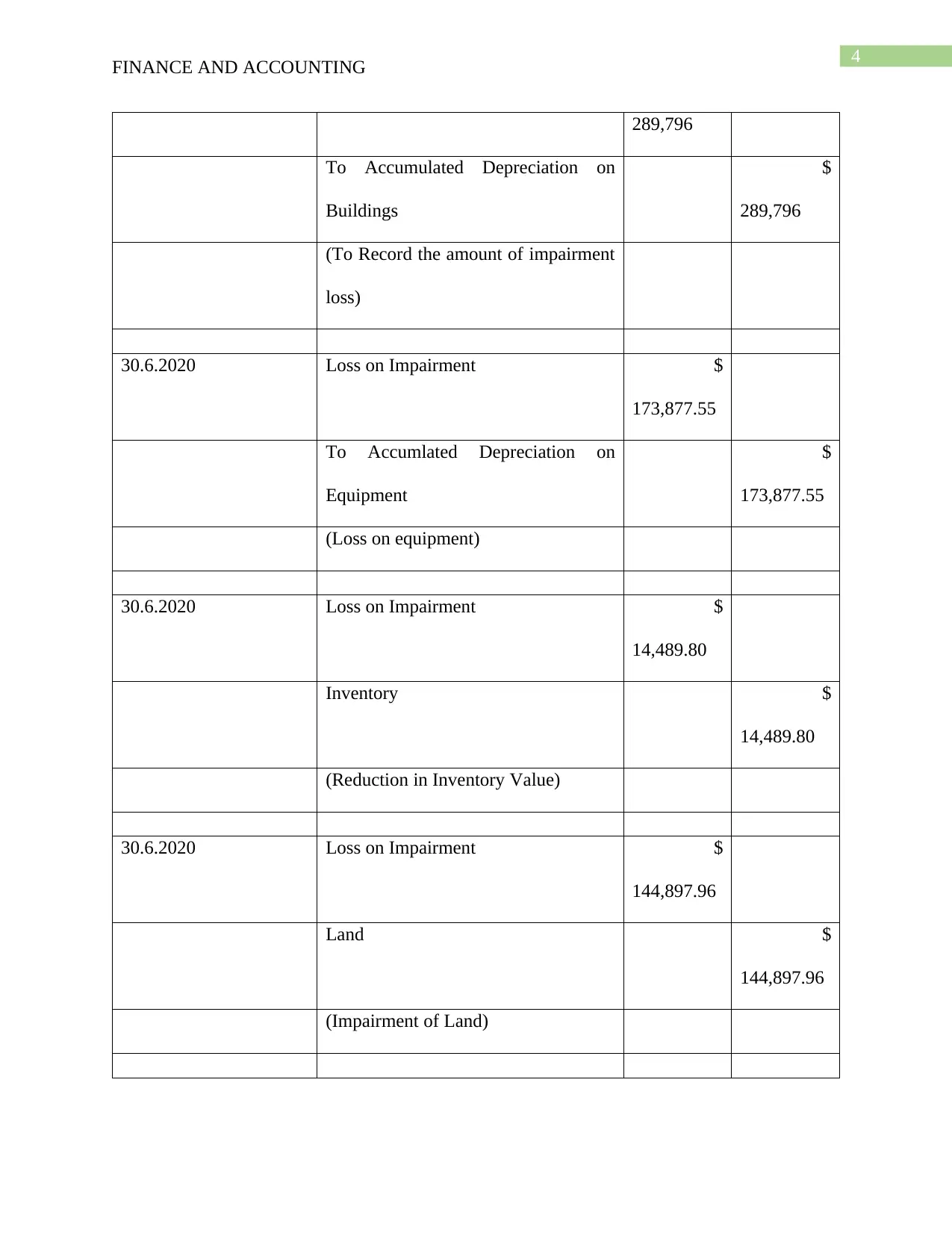

FINANCE AND ACCOUNTING

289,796

To Accumulated Depreciation on

Buildings

$

289,796

(To Record the amount of impairment

loss)

30.6.2020 Loss on Impairment $

173,877.55

To Accumlated Depreciation on

Equipment

$

173,877.55

(Loss on equipment)

30.6.2020 Loss on Impairment $

14,489.80

Inventory $

14,489.80

(Reduction in Inventory Value)

30.6.2020 Loss on Impairment $

144,897.96

Land $

144,897.96

(Impairment of Land)

FINANCE AND ACCOUNTING

289,796

To Accumulated Depreciation on

Buildings

$

289,796

(To Record the amount of impairment

loss)

30.6.2020 Loss on Impairment $

173,877.55

To Accumlated Depreciation on

Equipment

$

173,877.55

(Loss on equipment)

30.6.2020 Loss on Impairment $

14,489.80

Inventory $

14,489.80

(Reduction in Inventory Value)

30.6.2020 Loss on Impairment $

144,897.96

Land $

144,897.96

(Impairment of Land)

5

FINANCE AND ACCOUNTING

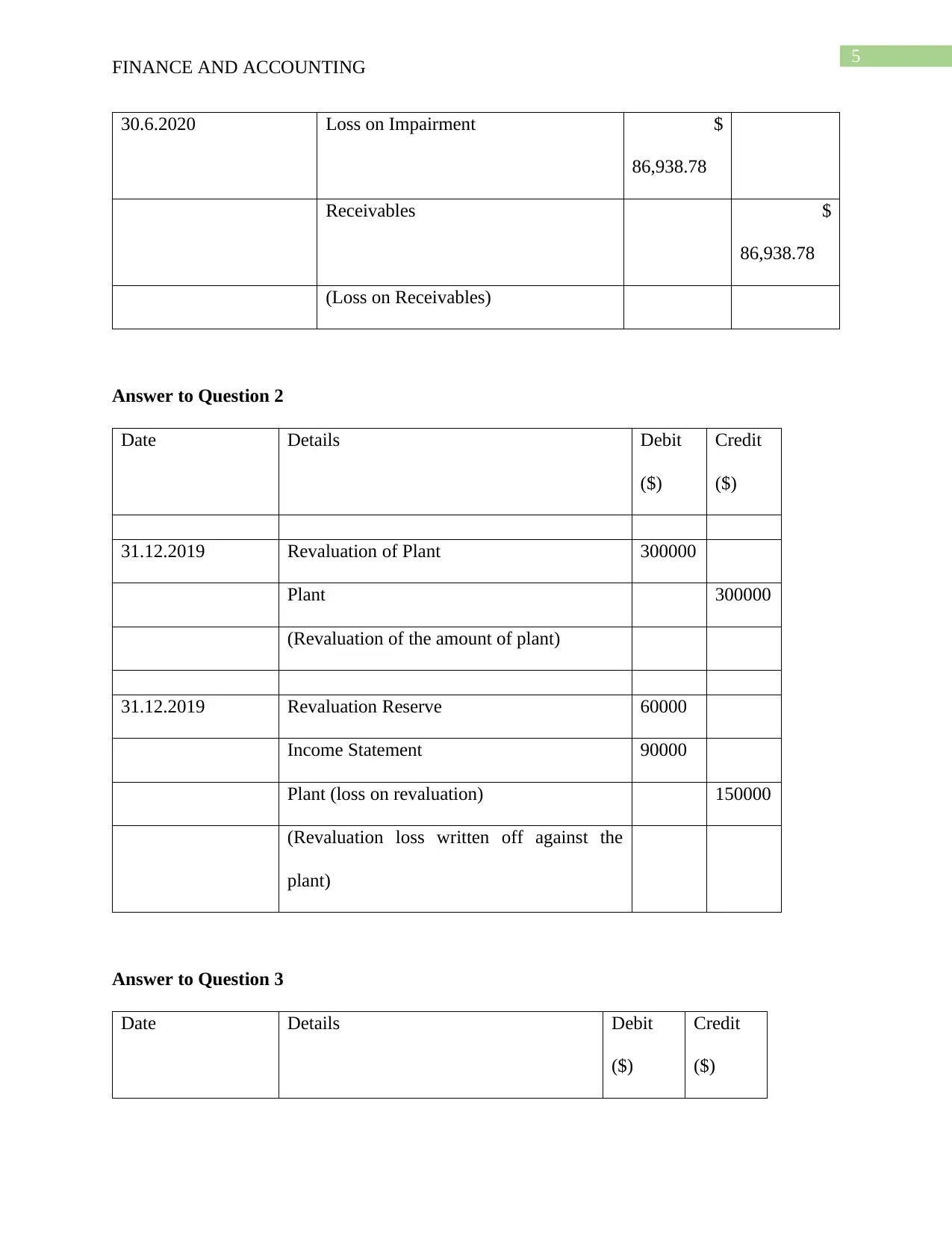

30.6.2020 Loss on Impairment $

86,938.78

Receivables $

86,938.78

(Loss on Receivables)

Answer to Question 2

Date Details Debit

($)

Credit

($)

31.12.2019 Revaluation of Plant 300000

Plant 300000

(Revaluation of the amount of plant)

31.12.2019 Revaluation Reserve 60000

Income Statement 90000

Plant (loss on revaluation) 150000

(Revaluation loss written off against the

plant)

Answer to Question 3

Date Details Debit

($)

Credit

($)

FINANCE AND ACCOUNTING

30.6.2020 Loss on Impairment $

86,938.78

Receivables $

86,938.78

(Loss on Receivables)

Answer to Question 2

Date Details Debit

($)

Credit

($)

31.12.2019 Revaluation of Plant 300000

Plant 300000

(Revaluation of the amount of plant)

31.12.2019 Revaluation Reserve 60000

Income Statement 90000

Plant (loss on revaluation) 150000

(Revaluation loss written off against the

plant)

Answer to Question 3

Date Details Debit

($)

Credit

($)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

FINANCE AND ACCOUNTING

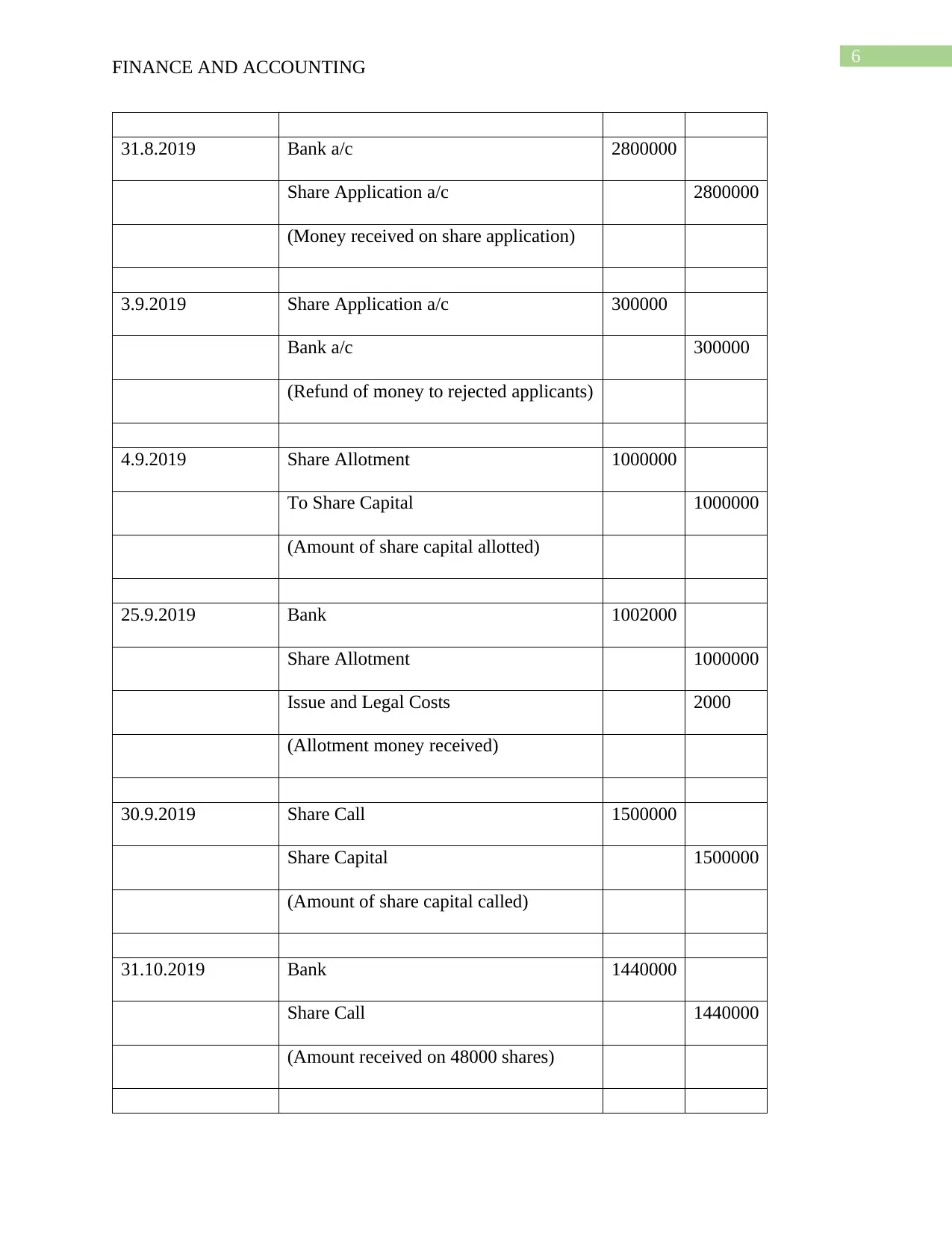

31.8.2019 Bank a/c 2800000

Share Application a/c 2800000

(Money received on share application)

3.9.2019 Share Application a/c 300000

Bank a/c 300000

(Refund of money to rejected applicants)

4.9.2019 Share Allotment 1000000

To Share Capital 1000000

(Amount of share capital allotted)

25.9.2019 Bank 1002000

Share Allotment 1000000

Issue and Legal Costs 2000

(Allotment money received)

30.9.2019 Share Call 1500000

Share Capital 1500000

(Amount of share capital called)

31.10.2019 Bank 1440000

Share Call 1440000

(Amount received on 48000 shares)

FINANCE AND ACCOUNTING

31.8.2019 Bank a/c 2800000

Share Application a/c 2800000

(Money received on share application)

3.9.2019 Share Application a/c 300000

Bank a/c 300000

(Refund of money to rejected applicants)

4.9.2019 Share Allotment 1000000

To Share Capital 1000000

(Amount of share capital allotted)

25.9.2019 Bank 1002000

Share Allotment 1000000

Issue and Legal Costs 2000

(Allotment money received)

30.9.2019 Share Call 1500000

Share Capital 1500000

(Amount of share capital called)

31.10.2019 Bank 1440000

Share Call 1440000

(Amount received on 48000 shares)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

FINANCE AND ACCOUNTING

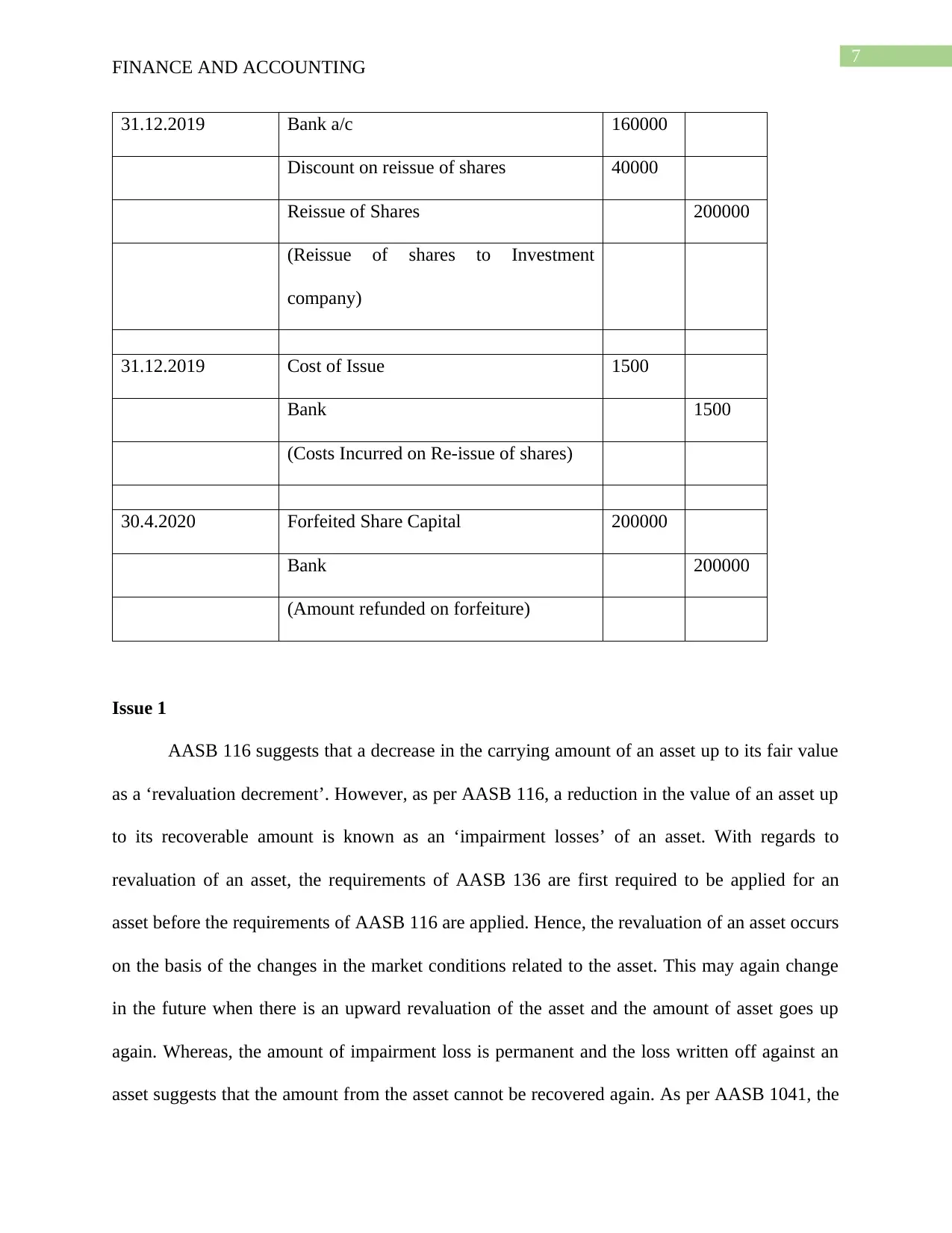

31.12.2019 Bank a/c 160000

Discount on reissue of shares 40000

Reissue of Shares 200000

(Reissue of shares to Investment

company)

31.12.2019 Cost of Issue 1500

Bank 1500

(Costs Incurred on Re-issue of shares)

30.4.2020 Forfeited Share Capital 200000

Bank 200000

(Amount refunded on forfeiture)

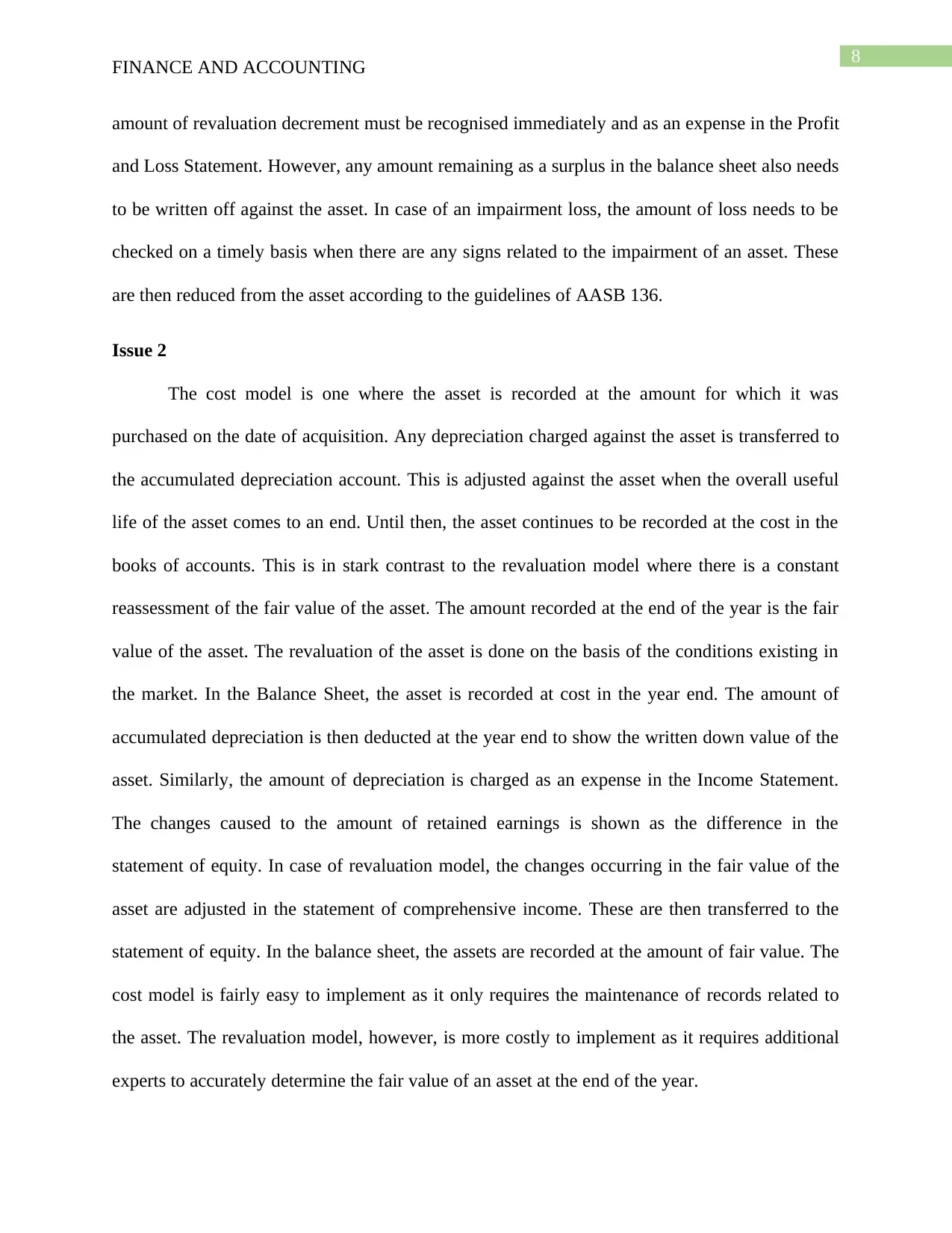

Issue 1

AASB 116 suggests that a decrease in the carrying amount of an asset up to its fair value

as a ‘revaluation decrement’. However, as per AASB 116, a reduction in the value of an asset up

to its recoverable amount is known as an ‘impairment losses’ of an asset. With regards to

revaluation of an asset, the requirements of AASB 136 are first required to be applied for an

asset before the requirements of AASB 116 are applied. Hence, the revaluation of an asset occurs

on the basis of the changes in the market conditions related to the asset. This may again change

in the future when there is an upward revaluation of the asset and the amount of asset goes up

again. Whereas, the amount of impairment loss is permanent and the loss written off against an

asset suggests that the amount from the asset cannot be recovered again. As per AASB 1041, the

FINANCE AND ACCOUNTING

31.12.2019 Bank a/c 160000

Discount on reissue of shares 40000

Reissue of Shares 200000

(Reissue of shares to Investment

company)

31.12.2019 Cost of Issue 1500

Bank 1500

(Costs Incurred on Re-issue of shares)

30.4.2020 Forfeited Share Capital 200000

Bank 200000

(Amount refunded on forfeiture)

Issue 1

AASB 116 suggests that a decrease in the carrying amount of an asset up to its fair value

as a ‘revaluation decrement’. However, as per AASB 116, a reduction in the value of an asset up

to its recoverable amount is known as an ‘impairment losses’ of an asset. With regards to

revaluation of an asset, the requirements of AASB 136 are first required to be applied for an

asset before the requirements of AASB 116 are applied. Hence, the revaluation of an asset occurs

on the basis of the changes in the market conditions related to the asset. This may again change

in the future when there is an upward revaluation of the asset and the amount of asset goes up

again. Whereas, the amount of impairment loss is permanent and the loss written off against an

asset suggests that the amount from the asset cannot be recovered again. As per AASB 1041, the

8

FINANCE AND ACCOUNTING

amount of revaluation decrement must be recognised immediately and as an expense in the Profit

and Loss Statement. However, any amount remaining as a surplus in the balance sheet also needs

to be written off against the asset. In case of an impairment loss, the amount of loss needs to be

checked on a timely basis when there are any signs related to the impairment of an asset. These

are then reduced from the asset according to the guidelines of AASB 136.

Issue 2

The cost model is one where the asset is recorded at the amount for which it was

purchased on the date of acquisition. Any depreciation charged against the asset is transferred to

the accumulated depreciation account. This is adjusted against the asset when the overall useful

life of the asset comes to an end. Until then, the asset continues to be recorded at the cost in the

books of accounts. This is in stark contrast to the revaluation model where there is a constant

reassessment of the fair value of the asset. The amount recorded at the end of the year is the fair

value of the asset. The revaluation of the asset is done on the basis of the conditions existing in

the market. In the Balance Sheet, the asset is recorded at cost in the year end. The amount of

accumulated depreciation is then deducted at the year end to show the written down value of the

asset. Similarly, the amount of depreciation is charged as an expense in the Income Statement.

The changes caused to the amount of retained earnings is shown as the difference in the

statement of equity. In case of revaluation model, the changes occurring in the fair value of the

asset are adjusted in the statement of comprehensive income. These are then transferred to the

statement of equity. In the balance sheet, the assets are recorded at the amount of fair value. The

cost model is fairly easy to implement as it only requires the maintenance of records related to

the asset. The revaluation model, however, is more costly to implement as it requires additional

experts to accurately determine the fair value of an asset at the end of the year.

FINANCE AND ACCOUNTING

amount of revaluation decrement must be recognised immediately and as an expense in the Profit

and Loss Statement. However, any amount remaining as a surplus in the balance sheet also needs

to be written off against the asset. In case of an impairment loss, the amount of loss needs to be

checked on a timely basis when there are any signs related to the impairment of an asset. These

are then reduced from the asset according to the guidelines of AASB 136.

Issue 2

The cost model is one where the asset is recorded at the amount for which it was

purchased on the date of acquisition. Any depreciation charged against the asset is transferred to

the accumulated depreciation account. This is adjusted against the asset when the overall useful

life of the asset comes to an end. Until then, the asset continues to be recorded at the cost in the

books of accounts. This is in stark contrast to the revaluation model where there is a constant

reassessment of the fair value of the asset. The amount recorded at the end of the year is the fair

value of the asset. The revaluation of the asset is done on the basis of the conditions existing in

the market. In the Balance Sheet, the asset is recorded at cost in the year end. The amount of

accumulated depreciation is then deducted at the year end to show the written down value of the

asset. Similarly, the amount of depreciation is charged as an expense in the Income Statement.

The changes caused to the amount of retained earnings is shown as the difference in the

statement of equity. In case of revaluation model, the changes occurring in the fair value of the

asset are adjusted in the statement of comprehensive income. These are then transferred to the

statement of equity. In the balance sheet, the assets are recorded at the amount of fair value. The

cost model is fairly easy to implement as it only requires the maintenance of records related to

the asset. The revaluation model, however, is more costly to implement as it requires additional

experts to accurately determine the fair value of an asset at the end of the year.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

FINANCE AND ACCOUNTING

In conclusion, it can be suggested that it is better to implement the revaluation model in

the business. This is because the nature of the modern day business is dynamic and the

conditions prevailing in the modern day operating environment tend to change constantly.

Hence, any differences occurring in the valuation of the assets needs to be reflected in the

financial statements. As the company is in its growth stage, this model provides the business

with required information about the correct valuation of the assets. Any changes to the valuation

should be known in advance to ensure the company purchases new assets when required.

FINANCE AND ACCOUNTING

In conclusion, it can be suggested that it is better to implement the revaluation model in

the business. This is because the nature of the modern day business is dynamic and the

conditions prevailing in the modern day operating environment tend to change constantly.

Hence, any differences occurring in the valuation of the assets needs to be reflected in the

financial statements. As the company is in its growth stage, this model provides the business

with required information about the correct valuation of the assets. Any changes to the valuation

should be known in advance to ensure the company purchases new assets when required.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

FINANCE AND ACCOUNTING

Bibliography

(2020). Aasb.gov.au. Retrieved 17 April 2020, from

https://www.aasb.gov.au/admin/file/content102/c3/AASB1041_07-01.pdf

IFRS Policy Option: Cost Model Vs. Revaluation Model . (2018). Linkedin.com. Retrieved 17

April 2020, from https://www.linkedin.com/pulse/ifrs-policy-option-cost-model-vs-

revaluation-daniel-hailegiorgis

FINANCE AND ACCOUNTING

Bibliography

(2020). Aasb.gov.au. Retrieved 17 April 2020, from

https://www.aasb.gov.au/admin/file/content102/c3/AASB1041_07-01.pdf

IFRS Policy Option: Cost Model Vs. Revaluation Model . (2018). Linkedin.com. Retrieved 17

April 2020, from https://www.linkedin.com/pulse/ifrs-policy-option-cost-model-vs-

revaluation-daniel-hailegiorgis

11

FINANCE AND ACCOUNTING

Bibliography

FINANCE AND ACCOUNTING

Bibliography

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.