Comprehensive Financial Analysis of AstraZeneca (2018-2019) Report

VerifiedAdded on 2023/01/05

|12

|3326

|24

Report

AI Summary

This report presents a financial analysis of AstraZeneca for the years 2018 and 2019. It begins with an introduction to financial statement analysis and its importance in making informed decisions. The main body of the report involves the calculation of various financial ratios, including profitability (Return on Equity, Gross Profit Margin, Operating Profit Margin), liquidity (Current Ratio, Acid Test Ratio), efficiency (Asset Turnover Ratio, Inventory Days, Debtor Days, Creditor Period), and gearing ratios (Interest Cover). These ratios are calculated for both years and then used to analyze AstraZeneca's performance and financial position. The analysis covers trends in profitability, liquidity, and efficiency, highlighting strengths and weaknesses. The report also evaluates AstraZeneca's reporting of Deferred Tax with reference to IAS 12 Income Taxes. The conclusion summarizes the key findings and implications of the analysis, providing an overall assessment of AstraZeneca's financial health and performance. Finally, the report includes a list of references used in the analysis.

Finance

And

Accounting

And

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

Calculate ratios for profitability, liquidity, efficiency and gearing for the years to 31 December

2019 and 31 December 2018:......................................................................................................3

Analysing performance and position of AstraZeneca based on the above ratios:.......................6

Evaluate AstraZeneca reporting of Deferred Tax with reference to IAS 12 Income Taxes:.......9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................12

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

Calculate ratios for profitability, liquidity, efficiency and gearing for the years to 31 December

2019 and 31 December 2018:......................................................................................................3

Analysing performance and position of AstraZeneca based on the above ratios:.......................6

Evaluate AstraZeneca reporting of Deferred Tax with reference to IAS 12 Income Taxes:.......9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................12

INTRODUCTION

Analysis of corporation's financial statements is method of evaluating and examining financial

statements of corporation in order to make informed monetary decisions regarding potential

earnings. Such statements comprise statement of income, balance sheet, cash-

flows statement, notes to the reports and statement of movements in capital (Easton and et.al.,

2018). financial statement evaluation is technique or mechanism that includes particular

strategies for determining the risks, results, financial stability and future potential of the

corporation. The study covers different aspects of financial-statement analysis through ratio

analysis of company AstraZeneca plc for year 2018-19 including company’s reporting of

Deferred-tax as per IAS 12.

MAIN BODY

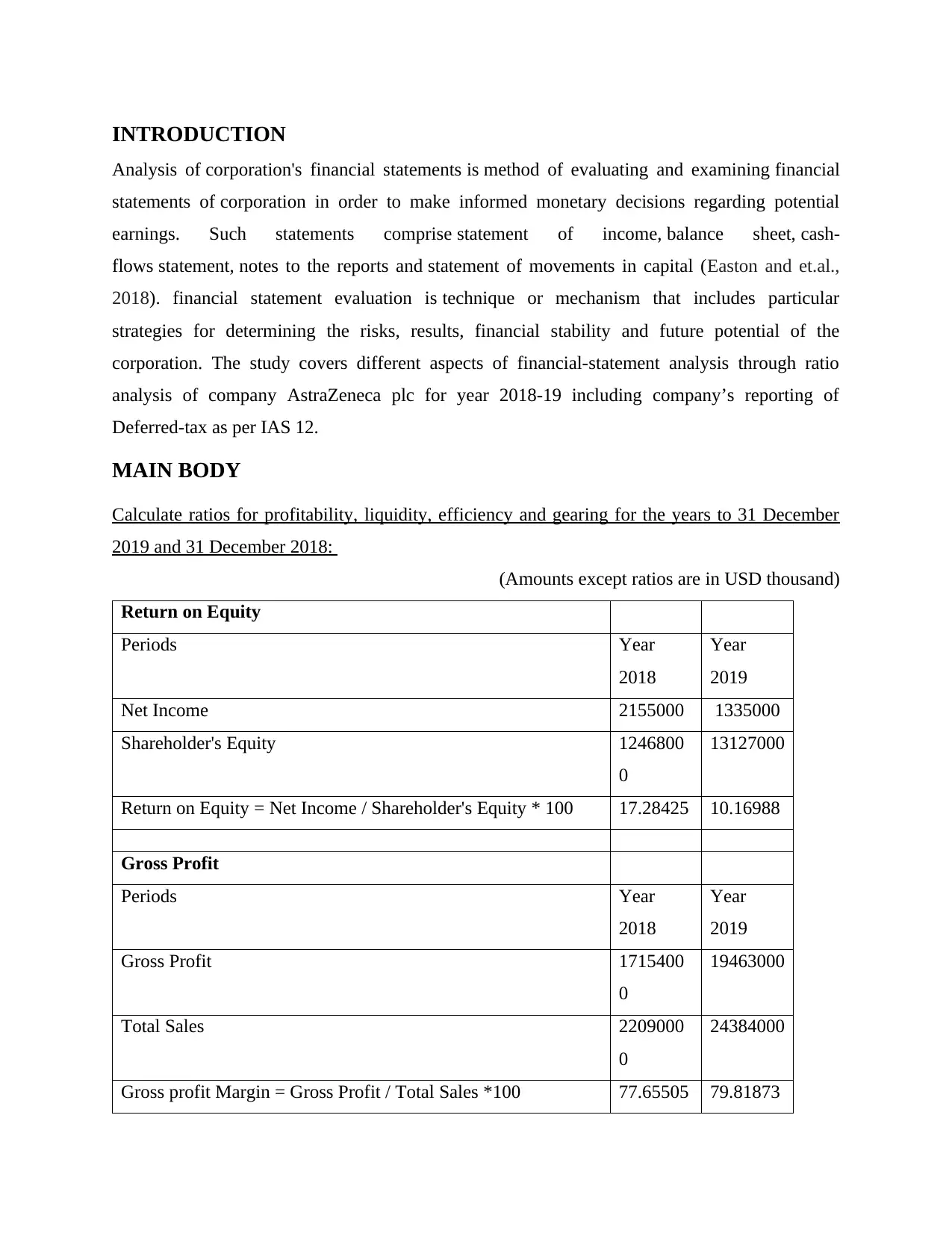

Calculate ratios for profitability, liquidity, efficiency and gearing for the years to 31 December

2019 and 31 December 2018:

(Amounts except ratios are in USD thousand)

Return on Equity

Periods Year

2018

Year

2019

Net Income 2155000 1335000

Shareholder's Equity 1246800

0

13127000

Return on Equity = Net Income / Shareholder's Equity * 100 17.28425 10.16988

Gross Profit

Periods Year

2018

Year

2019

Gross Profit 1715400

0

19463000

Total Sales 2209000

0

24384000

Gross profit Margin = Gross Profit / Total Sales *100 77.65505 79.81873

Analysis of corporation's financial statements is method of evaluating and examining financial

statements of corporation in order to make informed monetary decisions regarding potential

earnings. Such statements comprise statement of income, balance sheet, cash-

flows statement, notes to the reports and statement of movements in capital (Easton and et.al.,

2018). financial statement evaluation is technique or mechanism that includes particular

strategies for determining the risks, results, financial stability and future potential of the

corporation. The study covers different aspects of financial-statement analysis through ratio

analysis of company AstraZeneca plc for year 2018-19 including company’s reporting of

Deferred-tax as per IAS 12.

MAIN BODY

Calculate ratios for profitability, liquidity, efficiency and gearing for the years to 31 December

2019 and 31 December 2018:

(Amounts except ratios are in USD thousand)

Return on Equity

Periods Year

2018

Year

2019

Net Income 2155000 1335000

Shareholder's Equity 1246800

0

13127000

Return on Equity = Net Income / Shareholder's Equity * 100 17.28425 10.16988

Gross Profit

Periods Year

2018

Year

2019

Gross Profit 1715400

0

19463000

Total Sales 2209000

0

24384000

Gross profit Margin = Gross Profit / Total Sales *100 77.65505 79.81873

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

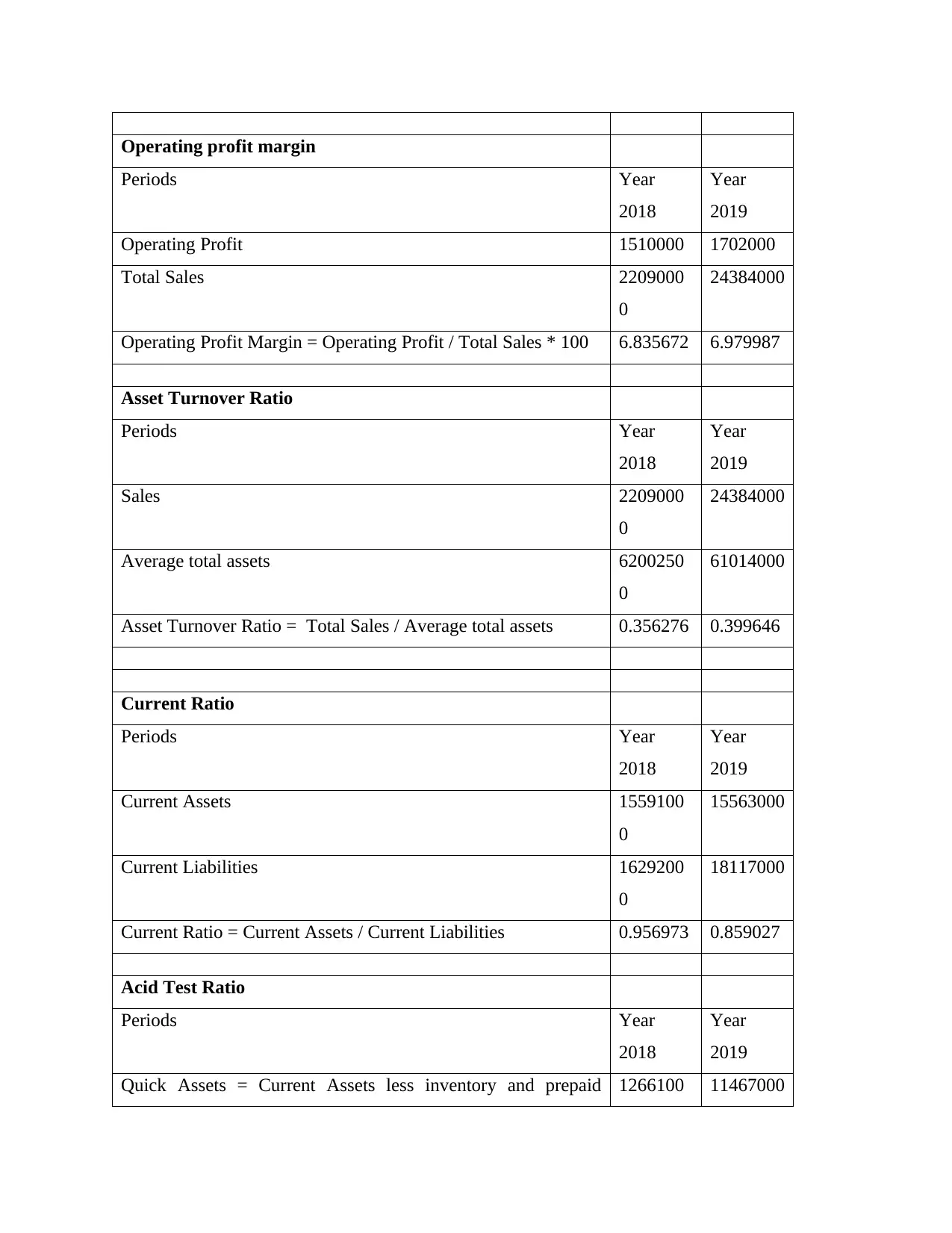

Operating profit margin

Periods Year

2018

Year

2019

Operating Profit 1510000 1702000

Total Sales 2209000

0

24384000

Operating Profit Margin = Operating Profit / Total Sales * 100 6.835672 6.979987

Asset Turnover Ratio

Periods Year

2018

Year

2019

Sales 2209000

0

24384000

Average total assets 6200250

0

61014000

Asset Turnover Ratio = Total Sales / Average total assets 0.356276 0.399646

Current Ratio

Periods Year

2018

Year

2019

Current Assets 1559100

0

15563000

Current Liabilities 1629200

0

18117000

Current Ratio = Current Assets / Current Liabilities 0.956973 0.859027

Acid Test Ratio

Periods Year

2018

Year

2019

Quick Assets = Current Assets less inventory and prepaid 1266100 11467000

Periods Year

2018

Year

2019

Operating Profit 1510000 1702000

Total Sales 2209000

0

24384000

Operating Profit Margin = Operating Profit / Total Sales * 100 6.835672 6.979987

Asset Turnover Ratio

Periods Year

2018

Year

2019

Sales 2209000

0

24384000

Average total assets 6200250

0

61014000

Asset Turnover Ratio = Total Sales / Average total assets 0.356276 0.399646

Current Ratio

Periods Year

2018

Year

2019

Current Assets 1559100

0

15563000

Current Liabilities 1629200

0

18117000

Current Ratio = Current Assets / Current Liabilities 0.956973 0.859027

Acid Test Ratio

Periods Year

2018

Year

2019

Quick Assets = Current Assets less inventory and prepaid 1266100 11467000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

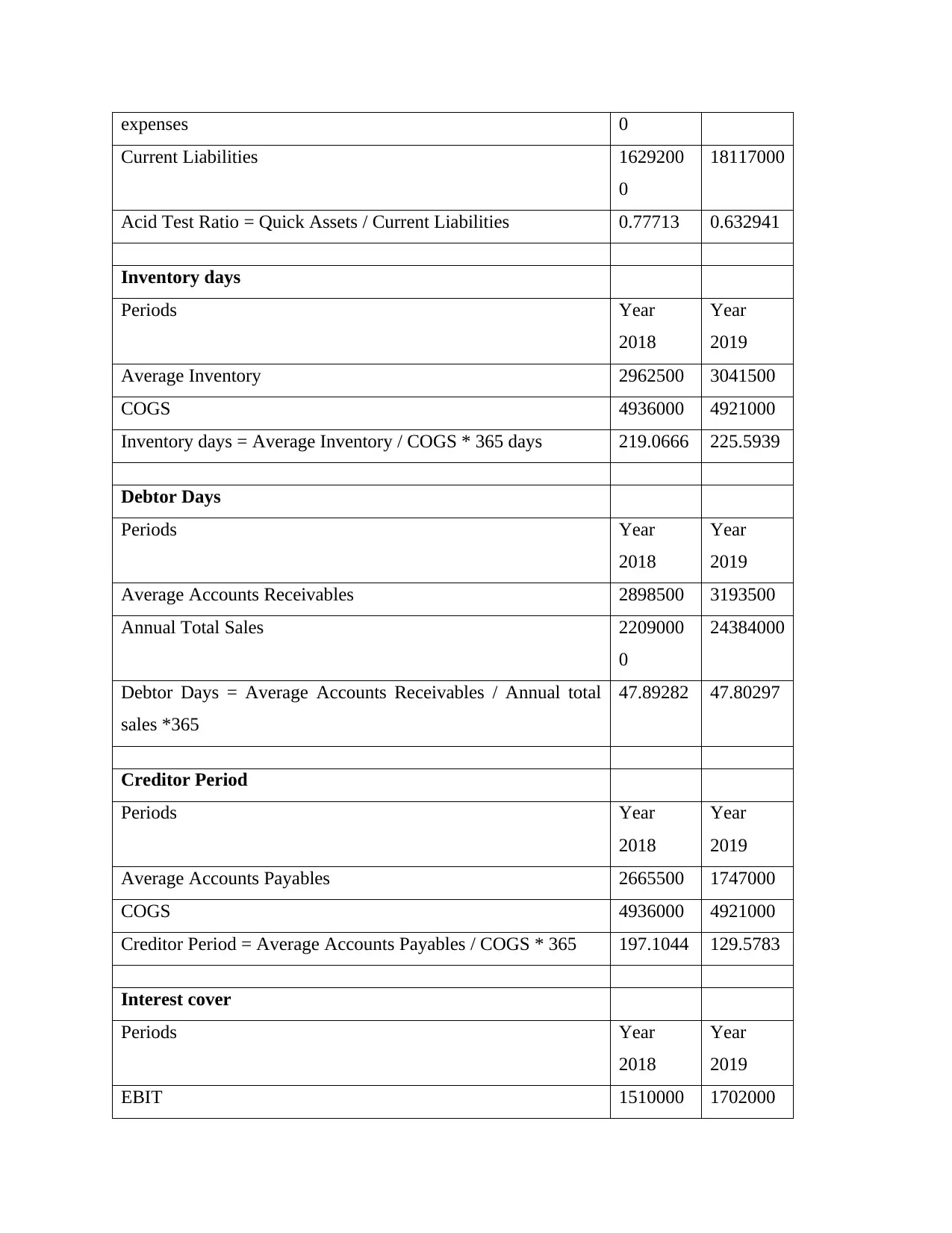

expenses 0

Current Liabilities 1629200

0

18117000

Acid Test Ratio = Quick Assets / Current Liabilities 0.77713 0.632941

Inventory days

Periods Year

2018

Year

2019

Average Inventory 2962500 3041500

COGS 4936000 4921000

Inventory days = Average Inventory / COGS * 365 days 219.0666 225.5939

Debtor Days

Periods Year

2018

Year

2019

Average Accounts Receivables 2898500 3193500

Annual Total Sales 2209000

0

24384000

Debtor Days = Average Accounts Receivables / Annual total

sales *365

47.89282 47.80297

Creditor Period

Periods Year

2018

Year

2019

Average Accounts Payables 2665500 1747000

COGS 4936000 4921000

Creditor Period = Average Accounts Payables / COGS * 365 197.1044 129.5783

Interest cover

Periods Year

2018

Year

2019

EBIT 1510000 1702000

Current Liabilities 1629200

0

18117000

Acid Test Ratio = Quick Assets / Current Liabilities 0.77713 0.632941

Inventory days

Periods Year

2018

Year

2019

Average Inventory 2962500 3041500

COGS 4936000 4921000

Inventory days = Average Inventory / COGS * 365 days 219.0666 225.5939

Debtor Days

Periods Year

2018

Year

2019

Average Accounts Receivables 2898500 3193500

Annual Total Sales 2209000

0

24384000

Debtor Days = Average Accounts Receivables / Annual total

sales *365

47.89282 47.80297

Creditor Period

Periods Year

2018

Year

2019

Average Accounts Payables 2665500 1747000

COGS 4936000 4921000

Creditor Period = Average Accounts Payables / COGS * 365 197.1044 129.5783

Interest cover

Periods Year

2018

Year

2019

EBIT 1510000 1702000

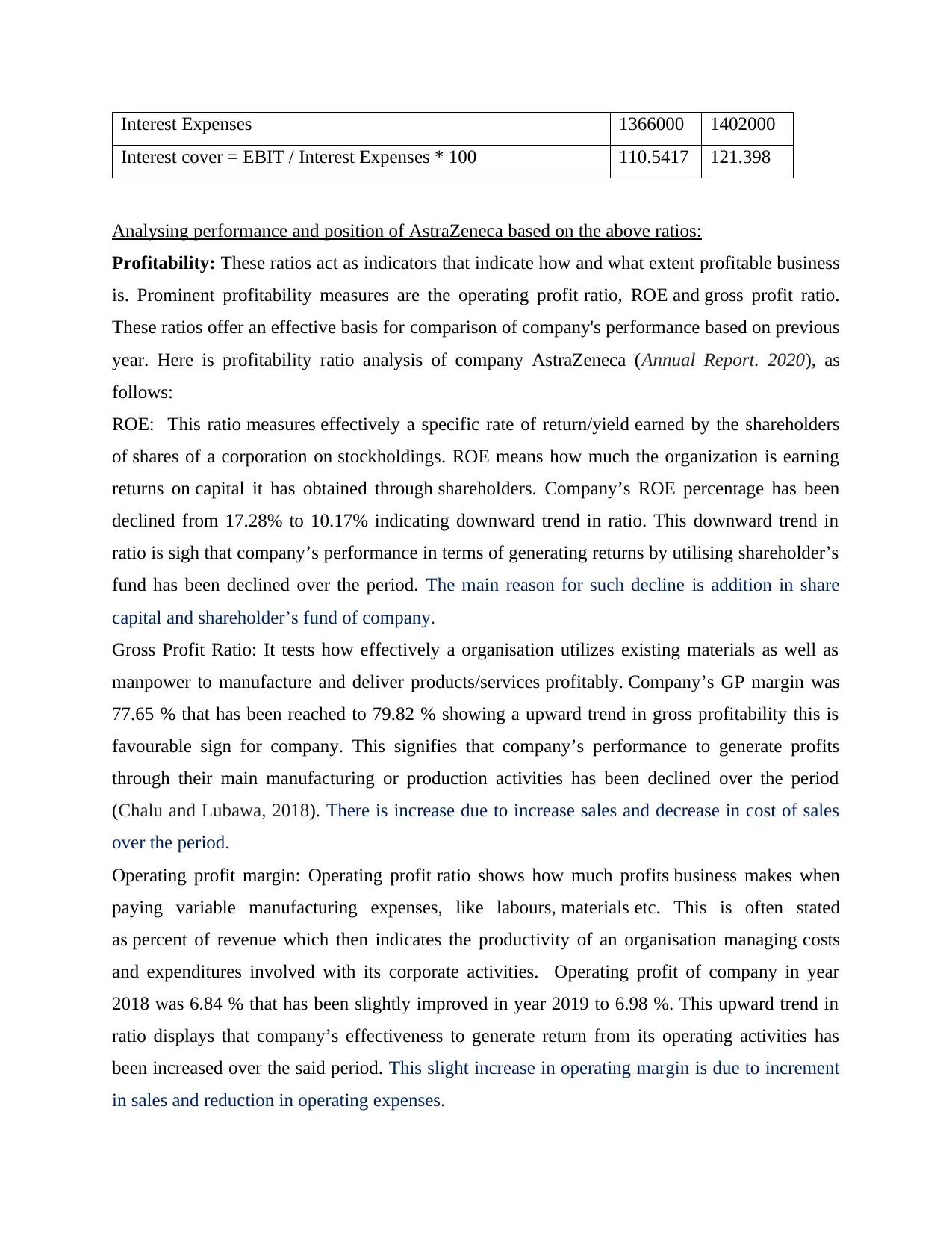

Interest Expenses 1366000 1402000

Interest cover = EBIT / Interest Expenses * 100 110.5417 121.398

Analysing performance and position of AstraZeneca based on the above ratios:

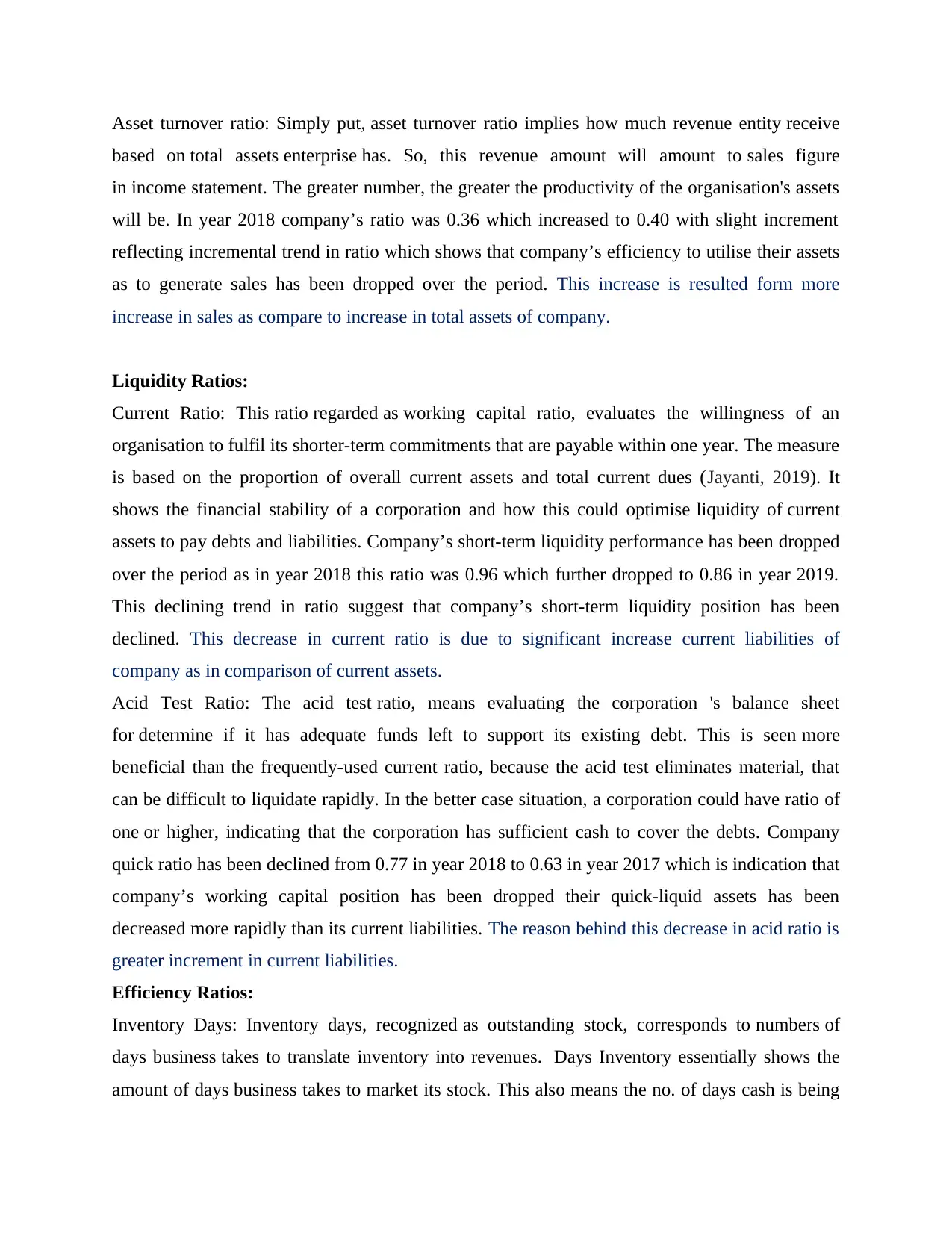

Profitability: These ratios act as indicators that indicate how and what extent profitable business

is. Prominent profitability measures are the operating profit ratio, ROE and gross profit ratio.

These ratios offer an effective basis for comparison of company's performance based on previous

year. Here is profitability ratio analysis of company AstraZeneca (Annual Report. 2020), as

follows:

ROE: This ratio measures effectively a specific rate of return/yield earned by the shareholders

of shares of a corporation on stockholdings. ROE means how much the organization is earning

returns on capital it has obtained through shareholders. Company’s ROE percentage has been

declined from 17.28% to 10.17% indicating downward trend in ratio. This downward trend in

ratio is sigh that company’s performance in terms of generating returns by utilising shareholder’s

fund has been declined over the period. The main reason for such decline is addition in share

capital and shareholder’s fund of company.

Gross Profit Ratio: It tests how effectively a organisation utilizes existing materials as well as

manpower to manufacture and deliver products/services profitably. Company’s GP margin was

77.65 % that has been reached to 79.82 % showing a upward trend in gross profitability this is

favourable sign for company. This signifies that company’s performance to generate profits

through their main manufacturing or production activities has been declined over the period

(Chalu and Lubawa, 2018). There is increase due to increase sales and decrease in cost of sales

over the period.

Operating profit margin: Operating profit ratio shows how much profits business makes when

paying variable manufacturing expenses, like labours, materials etc. This is often stated

as percent of revenue which then indicates the productivity of an organisation managing costs

and expenditures involved with its corporate activities. Operating profit of company in year

2018 was 6.84 % that has been slightly improved in year 2019 to 6.98 %. This upward trend in

ratio displays that company’s effectiveness to generate return from its operating activities has

been increased over the said period. This slight increase in operating margin is due to increment

in sales and reduction in operating expenses.

Interest cover = EBIT / Interest Expenses * 100 110.5417 121.398

Analysing performance and position of AstraZeneca based on the above ratios:

Profitability: These ratios act as indicators that indicate how and what extent profitable business

is. Prominent profitability measures are the operating profit ratio, ROE and gross profit ratio.

These ratios offer an effective basis for comparison of company's performance based on previous

year. Here is profitability ratio analysis of company AstraZeneca (Annual Report. 2020), as

follows:

ROE: This ratio measures effectively a specific rate of return/yield earned by the shareholders

of shares of a corporation on stockholdings. ROE means how much the organization is earning

returns on capital it has obtained through shareholders. Company’s ROE percentage has been

declined from 17.28% to 10.17% indicating downward trend in ratio. This downward trend in

ratio is sigh that company’s performance in terms of generating returns by utilising shareholder’s

fund has been declined over the period. The main reason for such decline is addition in share

capital and shareholder’s fund of company.

Gross Profit Ratio: It tests how effectively a organisation utilizes existing materials as well as

manpower to manufacture and deliver products/services profitably. Company’s GP margin was

77.65 % that has been reached to 79.82 % showing a upward trend in gross profitability this is

favourable sign for company. This signifies that company’s performance to generate profits

through their main manufacturing or production activities has been declined over the period

(Chalu and Lubawa, 2018). There is increase due to increase sales and decrease in cost of sales

over the period.

Operating profit margin: Operating profit ratio shows how much profits business makes when

paying variable manufacturing expenses, like labours, materials etc. This is often stated

as percent of revenue which then indicates the productivity of an organisation managing costs

and expenditures involved with its corporate activities. Operating profit of company in year

2018 was 6.84 % that has been slightly improved in year 2019 to 6.98 %. This upward trend in

ratio displays that company’s effectiveness to generate return from its operating activities has

been increased over the said period. This slight increase in operating margin is due to increment

in sales and reduction in operating expenses.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

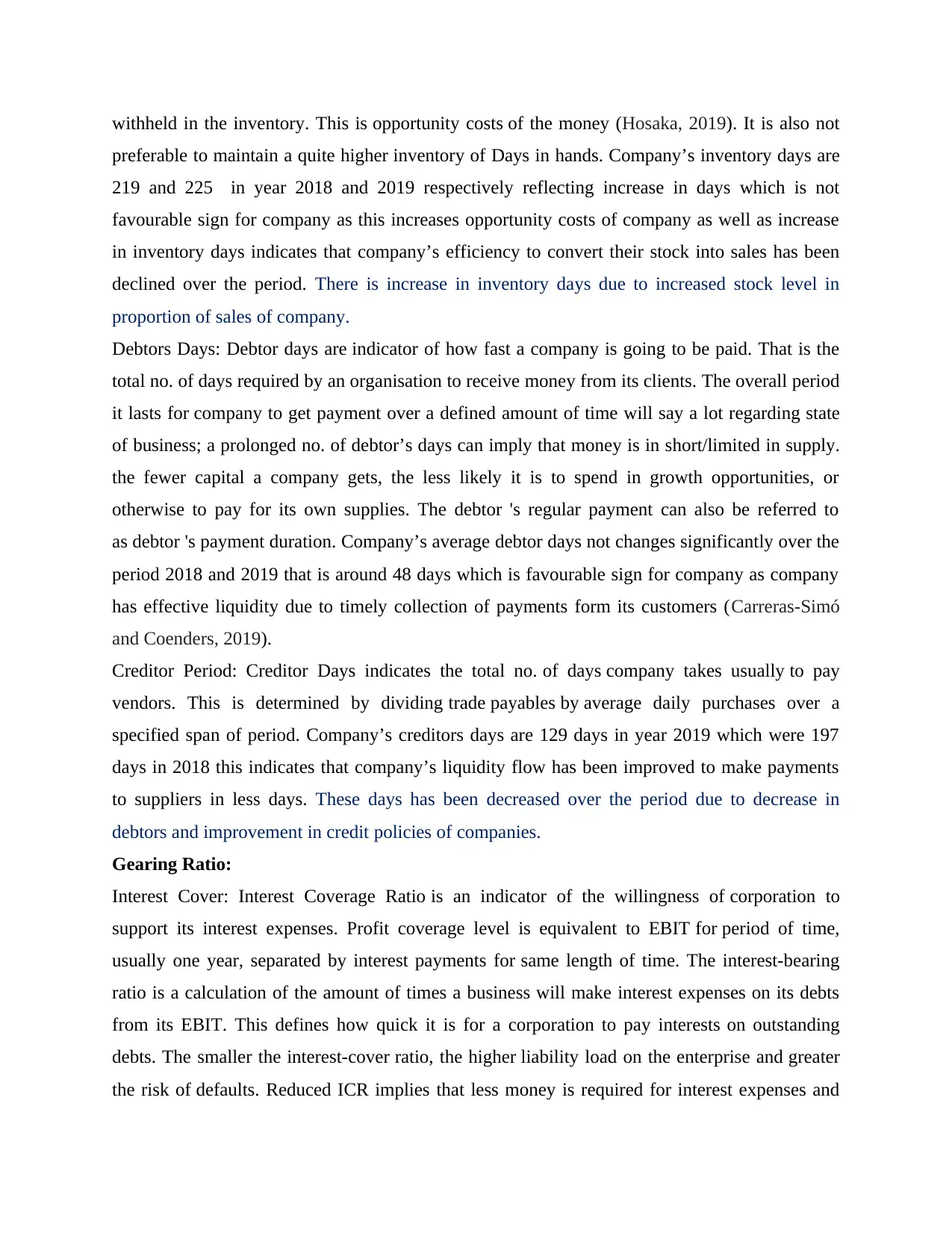

Asset turnover ratio: Simply put, asset turnover ratio implies how much revenue entity receive

based on total assets enterprise has. So, this revenue amount will amount to sales figure

in income statement. The greater number, the greater the productivity of the organisation's assets

will be. In year 2018 company’s ratio was 0.36 which increased to 0.40 with slight increment

reflecting incremental trend in ratio which shows that company’s efficiency to utilise their assets

as to generate sales has been dropped over the period. This increase is resulted form more

increase in sales as compare to increase in total assets of company.

Liquidity Ratios:

Current Ratio: This ratio regarded as working capital ratio, evaluates the willingness of an

organisation to fulfil its shorter-term commitments that are payable within one year. The measure

is based on the proportion of overall current assets and total current dues (Jayanti, 2019). It

shows the financial stability of a corporation and how this could optimise liquidity of current

assets to pay debts and liabilities. Company’s short-term liquidity performance has been dropped

over the period as in year 2018 this ratio was 0.96 which further dropped to 0.86 in year 2019.

This declining trend in ratio suggest that company’s short-term liquidity position has been

declined. This decrease in current ratio is due to significant increase current liabilities of

company as in comparison of current assets.

Acid Test Ratio: The acid test ratio, means evaluating the corporation 's balance sheet

for determine if it has adequate funds left to support its existing debt. This is seen more

beneficial than the frequently-used current ratio, because the acid test eliminates material, that

can be difficult to liquidate rapidly. In the better case situation, a corporation could have ratio of

one or higher, indicating that the corporation has sufficient cash to cover the debts. Company

quick ratio has been declined from 0.77 in year 2018 to 0.63 in year 2017 which is indication that

company’s working capital position has been dropped their quick-liquid assets has been

decreased more rapidly than its current liabilities. The reason behind this decrease in acid ratio is

greater increment in current liabilities.

Efficiency Ratios:

Inventory Days: Inventory days, recognized as outstanding stock, corresponds to numbers of

days business takes to translate inventory into revenues. Days Inventory essentially shows the

amount of days business takes to market its stock. This also means the no. of days cash is being

based on total assets enterprise has. So, this revenue amount will amount to sales figure

in income statement. The greater number, the greater the productivity of the organisation's assets

will be. In year 2018 company’s ratio was 0.36 which increased to 0.40 with slight increment

reflecting incremental trend in ratio which shows that company’s efficiency to utilise their assets

as to generate sales has been dropped over the period. This increase is resulted form more

increase in sales as compare to increase in total assets of company.

Liquidity Ratios:

Current Ratio: This ratio regarded as working capital ratio, evaluates the willingness of an

organisation to fulfil its shorter-term commitments that are payable within one year. The measure

is based on the proportion of overall current assets and total current dues (Jayanti, 2019). It

shows the financial stability of a corporation and how this could optimise liquidity of current

assets to pay debts and liabilities. Company’s short-term liquidity performance has been dropped

over the period as in year 2018 this ratio was 0.96 which further dropped to 0.86 in year 2019.

This declining trend in ratio suggest that company’s short-term liquidity position has been

declined. This decrease in current ratio is due to significant increase current liabilities of

company as in comparison of current assets.

Acid Test Ratio: The acid test ratio, means evaluating the corporation 's balance sheet

for determine if it has adequate funds left to support its existing debt. This is seen more

beneficial than the frequently-used current ratio, because the acid test eliminates material, that

can be difficult to liquidate rapidly. In the better case situation, a corporation could have ratio of

one or higher, indicating that the corporation has sufficient cash to cover the debts. Company

quick ratio has been declined from 0.77 in year 2018 to 0.63 in year 2017 which is indication that

company’s working capital position has been dropped their quick-liquid assets has been

decreased more rapidly than its current liabilities. The reason behind this decrease in acid ratio is

greater increment in current liabilities.

Efficiency Ratios:

Inventory Days: Inventory days, recognized as outstanding stock, corresponds to numbers of

days business takes to translate inventory into revenues. Days Inventory essentially shows the

amount of days business takes to market its stock. This also means the no. of days cash is being

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

withheld in the inventory. This is opportunity costs of the money (Hosaka, 2019). It is also not

preferable to maintain a quite higher inventory of Days in hands. Company’s inventory days are

219 and 225 in year 2018 and 2019 respectively reflecting increase in days which is not

favourable sign for company as this increases opportunity costs of company as well as increase

in inventory days indicates that company’s efficiency to convert their stock into sales has been

declined over the period. There is increase in inventory days due to increased stock level in

proportion of sales of company.

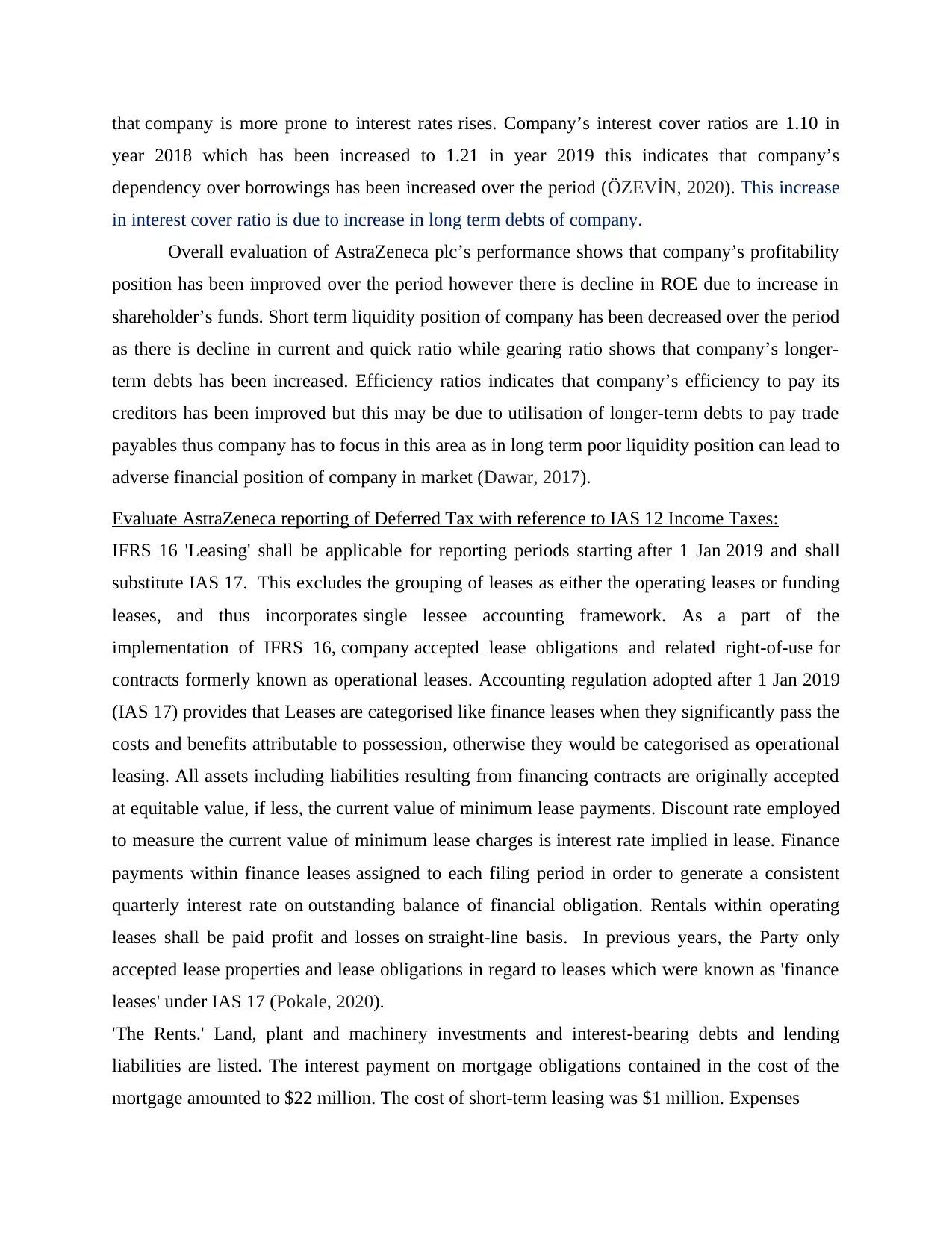

Debtors Days: Debtor days are indicator of how fast a company is going to be paid. That is the

total no. of days required by an organisation to receive money from its clients. The overall period

it lasts for company to get payment over a defined amount of time will say a lot regarding state

of business; a prolonged no. of debtor’s days can imply that money is in short/limited in supply.

the fewer capital a company gets, the less likely it is to spend in growth opportunities, or

otherwise to pay for its own supplies. The debtor 's regular payment can also be referred to

as debtor 's payment duration. Company’s average debtor days not changes significantly over the

period 2018 and 2019 that is around 48 days which is favourable sign for company as company

has effective liquidity due to timely collection of payments form its customers (Carreras-Simó

and Coenders, 2019).

Creditor Period: Creditor Days indicates the total no. of days company takes usually to pay

vendors. This is determined by dividing trade payables by average daily purchases over a

specified span of period. Company’s creditors days are 129 days in year 2019 which were 197

days in 2018 this indicates that company’s liquidity flow has been improved to make payments

to suppliers in less days. These days has been decreased over the period due to decrease in

debtors and improvement in credit policies of companies.

Gearing Ratio:

Interest Cover: Interest Coverage Ratio is an indicator of the willingness of corporation to

support its interest expenses. Profit coverage level is equivalent to EBIT for period of time,

usually one year, separated by interest payments for same length of time. The interest-bearing

ratio is a calculation of the amount of times a business will make interest expenses on its debts

from its EBIT. This defines how quick it is for a corporation to pay interests on outstanding

debts. The smaller the interest-cover ratio, the higher liability load on the enterprise and greater

the risk of defaults. Reduced ICR implies that less money is required for interest expenses and

preferable to maintain a quite higher inventory of Days in hands. Company’s inventory days are

219 and 225 in year 2018 and 2019 respectively reflecting increase in days which is not

favourable sign for company as this increases opportunity costs of company as well as increase

in inventory days indicates that company’s efficiency to convert their stock into sales has been

declined over the period. There is increase in inventory days due to increased stock level in

proportion of sales of company.

Debtors Days: Debtor days are indicator of how fast a company is going to be paid. That is the

total no. of days required by an organisation to receive money from its clients. The overall period

it lasts for company to get payment over a defined amount of time will say a lot regarding state

of business; a prolonged no. of debtor’s days can imply that money is in short/limited in supply.

the fewer capital a company gets, the less likely it is to spend in growth opportunities, or

otherwise to pay for its own supplies. The debtor 's regular payment can also be referred to

as debtor 's payment duration. Company’s average debtor days not changes significantly over the

period 2018 and 2019 that is around 48 days which is favourable sign for company as company

has effective liquidity due to timely collection of payments form its customers (Carreras-Simó

and Coenders, 2019).

Creditor Period: Creditor Days indicates the total no. of days company takes usually to pay

vendors. This is determined by dividing trade payables by average daily purchases over a

specified span of period. Company’s creditors days are 129 days in year 2019 which were 197

days in 2018 this indicates that company’s liquidity flow has been improved to make payments

to suppliers in less days. These days has been decreased over the period due to decrease in

debtors and improvement in credit policies of companies.

Gearing Ratio:

Interest Cover: Interest Coverage Ratio is an indicator of the willingness of corporation to

support its interest expenses. Profit coverage level is equivalent to EBIT for period of time,

usually one year, separated by interest payments for same length of time. The interest-bearing

ratio is a calculation of the amount of times a business will make interest expenses on its debts

from its EBIT. This defines how quick it is for a corporation to pay interests on outstanding

debts. The smaller the interest-cover ratio, the higher liability load on the enterprise and greater

the risk of defaults. Reduced ICR implies that less money is required for interest expenses and

that company is more prone to interest rates rises. Company’s interest cover ratios are 1.10 in

year 2018 which has been increased to 1.21 in year 2019 this indicates that company’s

dependency over borrowings has been increased over the period (ÖZEVİN, 2020). This increase

in interest cover ratio is due to increase in long term debts of company.

Overall evaluation of AstraZeneca plc’s performance shows that company’s profitability

position has been improved over the period however there is decline in ROE due to increase in

shareholder’s funds. Short term liquidity position of company has been decreased over the period

as there is decline in current and quick ratio while gearing ratio shows that company’s longer-

term debts has been increased. Efficiency ratios indicates that company’s efficiency to pay its

creditors has been improved but this may be due to utilisation of longer-term debts to pay trade

payables thus company has to focus in this area as in long term poor liquidity position can lead to

adverse financial position of company in market (Dawar, 2017).

Evaluate AstraZeneca reporting of Deferred Tax with reference to IAS 12 Income Taxes:

IFRS 16 'Leasing' shall be applicable for reporting periods starting after 1 Jan 2019 and shall

substitute IAS 17. This excludes the grouping of leases as either the operating leases or funding

leases, and thus incorporates single lessee accounting framework. As a part of the

implementation of IFRS 16, company accepted lease obligations and related right-of-use for

contracts formerly known as operational leases. Accounting regulation adopted after 1 Jan 2019

(IAS 17) provides that Leases are categorised like finance leases when they significantly pass the

costs and benefits attributable to possession, otherwise they would be categorised as operational

leasing. All assets including liabilities resulting from financing contracts are originally accepted

at equitable value, if less, the current value of minimum lease payments. Discount rate employed

to measure the current value of minimum lease charges is interest rate implied in lease. Finance

payments within finance leases assigned to each filing period in order to generate a consistent

quarterly interest rate on outstanding balance of financial obligation. Rentals within operating

leases shall be paid profit and losses on straight-line basis. In previous years, the Party only

accepted lease properties and lease obligations in regard to leases which were known as 'finance

leases' under IAS 17 (Pokale, 2020).

'The Rents.' Land, plant and machinery investments and interest-bearing debts and lending

liabilities are listed. The interest payment on mortgage obligations contained in the cost of the

mortgage amounted to $22 million. The cost of short-term leasing was $1 million. Expenses

year 2018 which has been increased to 1.21 in year 2019 this indicates that company’s

dependency over borrowings has been increased over the period (ÖZEVİN, 2020). This increase

in interest cover ratio is due to increase in long term debts of company.

Overall evaluation of AstraZeneca plc’s performance shows that company’s profitability

position has been improved over the period however there is decline in ROE due to increase in

shareholder’s funds. Short term liquidity position of company has been decreased over the period

as there is decline in current and quick ratio while gearing ratio shows that company’s longer-

term debts has been increased. Efficiency ratios indicates that company’s efficiency to pay its

creditors has been improved but this may be due to utilisation of longer-term debts to pay trade

payables thus company has to focus in this area as in long term poor liquidity position can lead to

adverse financial position of company in market (Dawar, 2017).

Evaluate AstraZeneca reporting of Deferred Tax with reference to IAS 12 Income Taxes:

IFRS 16 'Leasing' shall be applicable for reporting periods starting after 1 Jan 2019 and shall

substitute IAS 17. This excludes the grouping of leases as either the operating leases or funding

leases, and thus incorporates single lessee accounting framework. As a part of the

implementation of IFRS 16, company accepted lease obligations and related right-of-use for

contracts formerly known as operational leases. Accounting regulation adopted after 1 Jan 2019

(IAS 17) provides that Leases are categorised like finance leases when they significantly pass the

costs and benefits attributable to possession, otherwise they would be categorised as operational

leasing. All assets including liabilities resulting from financing contracts are originally accepted

at equitable value, if less, the current value of minimum lease payments. Discount rate employed

to measure the current value of minimum lease charges is interest rate implied in lease. Finance

payments within finance leases assigned to each filing period in order to generate a consistent

quarterly interest rate on outstanding balance of financial obligation. Rentals within operating

leases shall be paid profit and losses on straight-line basis. In previous years, the Party only

accepted lease properties and lease obligations in regard to leases which were known as 'finance

leases' under IAS 17 (Pokale, 2020).

'The Rents.' Land, plant and machinery investments and interest-bearing debts and lending

liabilities are listed. The interest payment on mortgage obligations contained in the cost of the

mortgage amounted to $22 million. The cost of short-term leasing was $1 million. Expenses

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The leasing of low-value properties not stated above because short-term rentals amounted to $1

million. Expenditures relating to contingent lease fees amount included in the lease liabilities

is $nil. Revenue through subleasing has been $4 m. In year 2018 , Company

updated presentation of the operating leases from year 2017 to incorporate operating leases

defined as historically excluded from this reporting during transition to the IFRS 16. This

culminated in a rise from $137 m towards $175 m in year 2017 (Annual Report. 2020).

The organisation 's key lease agreements are for property, in particular the office establishments

portfolio, including for global vehicle legs, used mainly by our selling and advertising

departments. The Organization implemented IFRS 16 using a updated retrospective procedure

with the combined effect of originally introducing the norm as an amendment to opening

balances of retained earnings on 1 Jan 2019. The norms provide the alternative, on initial

implementation, on lease-by-lease grounds, to calculate right-of-use asset on either all its

carrying value as when IFRS 16 applied before the start of lease, or amount equivalent to lease

obligation, modified for prepayments/accruals. The Company has opted to calculate right of

use asset relative to lease obligation, with really no net effect on opening of remaining profits

and no re-establishment of the previous comparable period. Initial adoption culminated in the

identification of $722 million in the right-of-use reserves and around $720 million in lease

obligations. The weighted aggregate incremental lending rate applicable to lease commitments

on 1 Jan 2019 were 3%. The company uses one or even more realistic forms of transfer of leases

formerly known operating leases, by preferring not to provide retroactive care of leases upon

which term expires within Twelve months of original request, preferring to provide single

discount rates of leases with identical characteristics, depending on prior judgments about

whether or not manage. Judgments taken in the assessment of initial effect of adoption shall

require the estimation of the duration of lease if an expansion or dismissal option occurs. In such

situations, all evidence and conditions which could give rise to an economic opportunity to

execute an option of expansion or not execute an option of revocation have been regarded to

decide the duration of the contract. Extension terms (or terms following expiration alternatives)

shall only be specified in the contract term if the contract is fairly likely to be renewed (or not

revoked). Estimates require the estimation of the interest rate dependent on incremental loan rate

(Agustina and Suprayitno, 2020). The Organization extends the lower-value and shorter-term

exemptions to IFRS 16. Although IFRS 16 OL liability is measured separately from previous

million. Expenditures relating to contingent lease fees amount included in the lease liabilities

is $nil. Revenue through subleasing has been $4 m. In year 2018 , Company

updated presentation of the operating leases from year 2017 to incorporate operating leases

defined as historically excluded from this reporting during transition to the IFRS 16. This

culminated in a rise from $137 m towards $175 m in year 2017 (Annual Report. 2020).

The organisation 's key lease agreements are for property, in particular the office establishments

portfolio, including for global vehicle legs, used mainly by our selling and advertising

departments. The Organization implemented IFRS 16 using a updated retrospective procedure

with the combined effect of originally introducing the norm as an amendment to opening

balances of retained earnings on 1 Jan 2019. The norms provide the alternative, on initial

implementation, on lease-by-lease grounds, to calculate right-of-use asset on either all its

carrying value as when IFRS 16 applied before the start of lease, or amount equivalent to lease

obligation, modified for prepayments/accruals. The Company has opted to calculate right of

use asset relative to lease obligation, with really no net effect on opening of remaining profits

and no re-establishment of the previous comparable period. Initial adoption culminated in the

identification of $722 million in the right-of-use reserves and around $720 million in lease

obligations. The weighted aggregate incremental lending rate applicable to lease commitments

on 1 Jan 2019 were 3%. The company uses one or even more realistic forms of transfer of leases

formerly known operating leases, by preferring not to provide retroactive care of leases upon

which term expires within Twelve months of original request, preferring to provide single

discount rates of leases with identical characteristics, depending on prior judgments about

whether or not manage. Judgments taken in the assessment of initial effect of adoption shall

require the estimation of the duration of lease if an expansion or dismissal option occurs. In such

situations, all evidence and conditions which could give rise to an economic opportunity to

execute an option of expansion or not execute an option of revocation have been regarded to

decide the duration of the contract. Extension terms (or terms following expiration alternatives)

shall only be specified in the contract term if the contract is fairly likely to be renewed (or not

revoked). Estimates require the estimation of the interest rate dependent on incremental loan rate

(Agustina and Suprayitno, 2020). The Organization extends the lower-value and shorter-term

exemptions to IFRS 16. Although IFRS 16 OL liability is measured separately from previous

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

operating lease duty measured in compliance with the previous norm, there have been no

material variations between the roles. The implementation of IFRS 16 did not have an effect

on Group's net money flows, since a shift in presentation was mirrored, wherein cash

outflows $186 million are now viewed as funding rather than operating. There seems to

be intangible gain to Running profit and a related rise in cost of financing from presentation

of part of leasing expenses as interest expenses. PBT, taxes and EPS were not significantly

affected.

CONCLUSION

Form above study this has been articulated that Financial statement review allows the

revenue officer to determine the corporation 's organisational performance and management

efficacy. Companies should compile financial statements to serve their responsibilities and to

receive aid in their strategical decision-making. Conversely, their intent is overlooked without

any of the opportunity to draw concrete results from such statements.

material variations between the roles. The implementation of IFRS 16 did not have an effect

on Group's net money flows, since a shift in presentation was mirrored, wherein cash

outflows $186 million are now viewed as funding rather than operating. There seems to

be intangible gain to Running profit and a related rise in cost of financing from presentation

of part of leasing expenses as interest expenses. PBT, taxes and EPS were not significantly

affected.

CONCLUSION

Form above study this has been articulated that Financial statement review allows the

revenue officer to determine the corporation 's organisational performance and management

efficacy. Companies should compile financial statements to serve their responsibilities and to

receive aid in their strategical decision-making. Conversely, their intent is overlooked without

any of the opportunity to draw concrete results from such statements.

REFERENCES

Books and Journals:

Easton, P.D., and et.al., 2018. Financial statement analysis & valuation. Boston, MA:

Cambridge Business Publishers.

Chalu, H. and Lubawa, G., 2018. Using financial statements to analyze the effects of multiple

Borrowings on SMEs financial performance in Tanzania. Inter. J. Res. Methodol. Soc.

Sci, 1(4), pp.87-107.

Hosaka, T., 2019. Bankruptcy prediction using imaged financial ratios and convolutional neural

networks. Expert systems with applications, 117, pp.287-299.

Jayanti, E., 2019, August. Analysis of Financial Statements to Assess Financial Performance of

Cooperative Loan in Gianyar Regency. In ICTMT 2019: Proceedings of the First

International Conference on Technology Management and Tourism, ICTMT, 19 August,

Kuala Lumpur, Malaysia (p. 165). European Alliance for Innovation.

Carreras-Simó, M. and Coenders, G., 2019. Principal component analysis of financial statements.

A compositional approach. Revista de Métodos Cuantitativos para la Economía y la

Empresa, 29.

ÖZEVİN, O., 2020. A Model Recommendation On Determination Of Manipulation Risk In

Financial Statements: BIST Application. Journal of Accounting & Finance, (87).

Dawar, V., 2017. Amtek auto: Analysis of financial statements. SAGE Publications: SAGE

Business Cases Originals.

Pokale, V., 2020. ANALYSIS OF FINANCIAL STATEMENTS.

Agustina, Y.N. and Suprayitno, H., 2020. ANALYSIS OF FINANCIAL STATEMENTS

USING LIQUIDITY RATIO TO MEASURE FINANCIAL PERFORMANCE IN

2017-2019. JOSAR (Journal of Students Academic Research), 5(2), pp.32-39.

Online:

Annual Report. 2019. [Online]. Available through: <

https://www.astrazeneca.com/content/dam/az/Investor_Relations/annual-report-2019/

pdf/AstraZeneca_AR_2019_Financial_Statements>

Books and Journals:

Easton, P.D., and et.al., 2018. Financial statement analysis & valuation. Boston, MA:

Cambridge Business Publishers.

Chalu, H. and Lubawa, G., 2018. Using financial statements to analyze the effects of multiple

Borrowings on SMEs financial performance in Tanzania. Inter. J. Res. Methodol. Soc.

Sci, 1(4), pp.87-107.

Hosaka, T., 2019. Bankruptcy prediction using imaged financial ratios and convolutional neural

networks. Expert systems with applications, 117, pp.287-299.

Jayanti, E., 2019, August. Analysis of Financial Statements to Assess Financial Performance of

Cooperative Loan in Gianyar Regency. In ICTMT 2019: Proceedings of the First

International Conference on Technology Management and Tourism, ICTMT, 19 August,

Kuala Lumpur, Malaysia (p. 165). European Alliance for Innovation.

Carreras-Simó, M. and Coenders, G., 2019. Principal component analysis of financial statements.

A compositional approach. Revista de Métodos Cuantitativos para la Economía y la

Empresa, 29.

ÖZEVİN, O., 2020. A Model Recommendation On Determination Of Manipulation Risk In

Financial Statements: BIST Application. Journal of Accounting & Finance, (87).

Dawar, V., 2017. Amtek auto: Analysis of financial statements. SAGE Publications: SAGE

Business Cases Originals.

Pokale, V., 2020. ANALYSIS OF FINANCIAL STATEMENTS.

Agustina, Y.N. and Suprayitno, H., 2020. ANALYSIS OF FINANCIAL STATEMENTS

USING LIQUIDITY RATIO TO MEASURE FINANCIAL PERFORMANCE IN

2017-2019. JOSAR (Journal of Students Academic Research), 5(2), pp.32-39.

Online:

Annual Report. 2019. [Online]. Available through: <

https://www.astrazeneca.com/content/dam/az/Investor_Relations/annual-report-2019/

pdf/AstraZeneca_AR_2019_Financial_Statements>

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.