Finance and Accounting Report: BHP and MKT Stock Analysis

VerifiedAdded on 2023/01/19

|14

|2208

|44

Report

AI Summary

This finance and accounting report provides a comprehensive analysis of various financial concepts and applications. It begins with calculations for holiday funding, NPV, and cash flow projections. The report then explores real interest rates, negative gearing in the Australian housing market, and the definition of investment risk. It delves into the dividend imputation credit system and its impact on investors. Furthermore, the report analyzes BHP and MKT stock returns, including average monthly returns, annual holding returns for both international and Australian shareholders, and graphs of returns. It calculates standard deviations, evaluates BHP's risk, and determines its CAPM value. The report also presents the SML in a scatter graph and analyzes actual returns. Finally, the report concludes with a portfolio analysis, calculating return and beta values, and provides a list of relevant references and bibliography.

Running head: FINANCE AND ACCOUNTING

Finance and Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Finance and Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCE AND ACCOUNTING

Table of Contents

Question 1:.......................................................................................................................................3

a) Holiday funding calculation:.......................................................................................................3

bi) NPV value of the project:...........................................................................................................3

bii) Cash flow at the end of year 2:..................................................................................................4

ci) Gaye’s financial assets at the age of 60:.....................................................................................4

cii) Gaye’s monthly retirement amount:..........................................................................................5

Question 2:.......................................................................................................................................6

i) Evaluating and providing examples of Real Rate of Interest:......................................................6

ii) Negative gearing used in Australian housing market:................................................................7

Question 3:.......................................................................................................................................7

i) Defining risk in terms of investment:...........................................................................................7

ii) Dividend imputation credit system having impact on Australian resident and international

investors:..........................................................................................................................................8

iii) Monthly returns of BHP in $ and %:.........................................................................................8

iv) BHP average monthly return:.....................................................................................................9

v) International shareholders Annual holding return:......................................................................9

vi) Australian shareholders annual return from BHP:.....................................................................9

vii) MKT monthly returns:............................................................................................................10

viii) MKT average monthly return:...............................................................................................10

ix) Australian annual holding:.......................................................................................................10

x) Graph of returns BHP and MKT:..............................................................................................11

xi) Standard deviation for both BHP and MKT:...........................................................................11

Table of Contents

Question 1:.......................................................................................................................................3

a) Holiday funding calculation:.......................................................................................................3

bi) NPV value of the project:...........................................................................................................3

bii) Cash flow at the end of year 2:..................................................................................................4

ci) Gaye’s financial assets at the age of 60:.....................................................................................4

cii) Gaye’s monthly retirement amount:..........................................................................................5

Question 2:.......................................................................................................................................6

i) Evaluating and providing examples of Real Rate of Interest:......................................................6

ii) Negative gearing used in Australian housing market:................................................................7

Question 3:.......................................................................................................................................7

i) Defining risk in terms of investment:...........................................................................................7

ii) Dividend imputation credit system having impact on Australian resident and international

investors:..........................................................................................................................................8

iii) Monthly returns of BHP in $ and %:.........................................................................................8

iv) BHP average monthly return:.....................................................................................................9

v) International shareholders Annual holding return:......................................................................9

vi) Australian shareholders annual return from BHP:.....................................................................9

vii) MKT monthly returns:............................................................................................................10

viii) MKT average monthly return:...............................................................................................10

ix) Australian annual holding:.......................................................................................................10

x) Graph of returns BHP and MKT:..............................................................................................11

xi) Standard deviation for both BHP and MKT:...........................................................................11

2FINANCE AND ACCOUNTING

xii) BHP risk evaluation:...............................................................................................................11

xiii) CAPM value for BHP:...........................................................................................................12

xiv) SML in scatter graph:.............................................................................................................12

xv) Actual return of BHP in SML:................................................................................................13

xvi) Return and beta for portfolio:.................................................................................................13

References and Bibliography:........................................................................................................14

xii) BHP risk evaluation:...............................................................................................................11

xiii) CAPM value for BHP:...........................................................................................................12

xiv) SML in scatter graph:.............................................................................................................12

xv) Actual return of BHP in SML:................................................................................................13

xvi) Return and beta for portfolio:.................................................................................................13

References and Bibliography:........................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCE AND ACCOUNTING

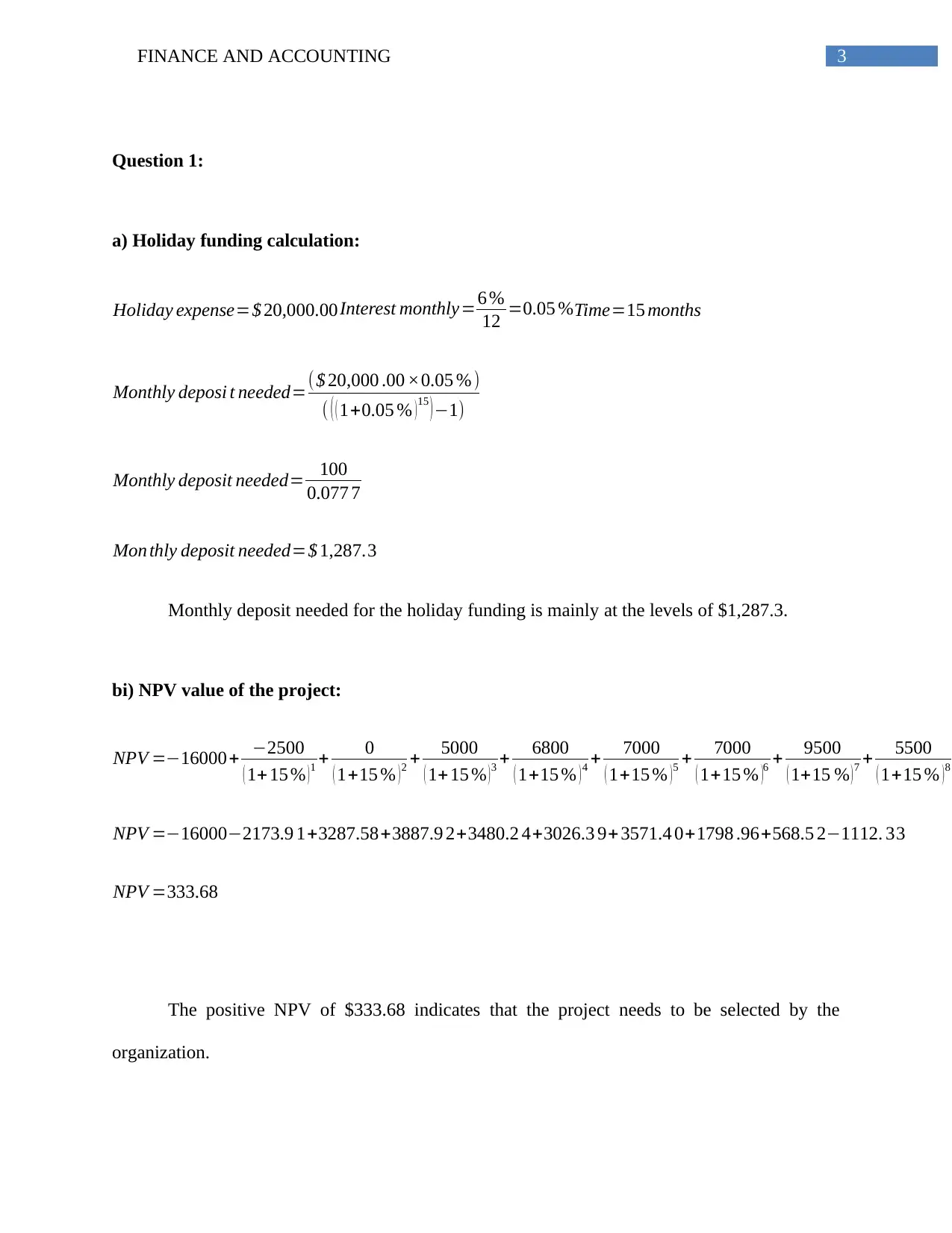

Question 1:

a) Holiday funding calculation:

Holiday expense=$ 20,000.00Interest monthly=6 %

12 =0.05 % Time=15 months

Monthly deposi t needed=($ 20,000 .00 ×0.05 % )

( ( ( 1+0.05 % ) 15 ) −1)

Monthly deposit needed= 100

0.077 7

Mon thly deposit needed=$ 1,287.3

Monthly deposit needed for the holiday funding is mainly at the levels of $1,287.3.

bi) NPV value of the project:

NPV =−16000+ −2500

( 1+ 15 % ) 1 + 0

( 1+15 % ) 2 + 5000

( 1+ 15 % ) 3 + 6800

( 1+15 % ) 4 + 7000

( 1+15 % ) 5 + 7000

( 1+15 % )6 + 9500

( 1+15 % ) 7 + 5500

( 1+15 % ) 8

NPV =−16000−2173.9 1+3287.58+3887.9 2+3480.2 4+3026.3 9+3571.4 0+1798 .96+568.5 2−1112. 33

NPV =333.68

The positive NPV of $333.68 indicates that the project needs to be selected by the

organization.

Question 1:

a) Holiday funding calculation:

Holiday expense=$ 20,000.00Interest monthly=6 %

12 =0.05 % Time=15 months

Monthly deposi t needed=($ 20,000 .00 ×0.05 % )

( ( ( 1+0.05 % ) 15 ) −1)

Monthly deposit needed= 100

0.077 7

Mon thly deposit needed=$ 1,287.3

Monthly deposit needed for the holiday funding is mainly at the levels of $1,287.3.

bi) NPV value of the project:

NPV =−16000+ −2500

( 1+ 15 % ) 1 + 0

( 1+15 % ) 2 + 5000

( 1+ 15 % ) 3 + 6800

( 1+15 % ) 4 + 7000

( 1+15 % ) 5 + 7000

( 1+15 % )6 + 9500

( 1+15 % ) 7 + 5500

( 1+15 % ) 8

NPV =−16000−2173.9 1+3287.58+3887.9 2+3480.2 4+3026.3 9+3571.4 0+1798 .96+568.5 2−1112. 33

NPV =333.68

The positive NPV of $333.68 indicates that the project needs to be selected by the

organization.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCE AND ACCOUNTING

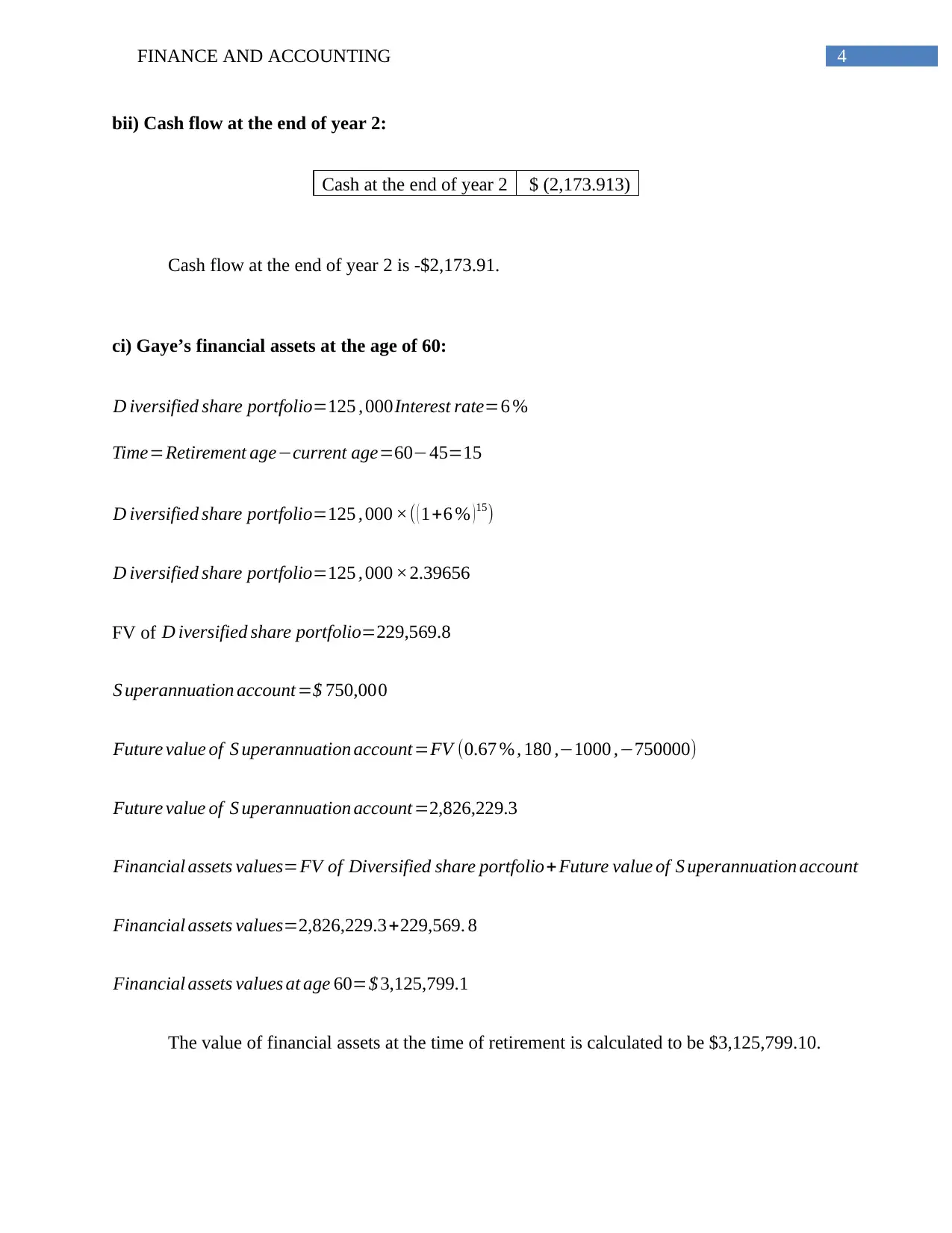

bii) Cash flow at the end of year 2:

Cash at the end of year 2 $ (2,173.913)

Cash flow at the end of year 2 is -$2,173.91.

ci) Gaye’s financial assets at the age of 60:

D iversified share portfolio=125 , 000 Interest rate=6 %

Time=Retirement age−current age=60−45=15

D iversified share portfolio=125 , 000 ×( ( 1+6 % ) 15)

D iversified share portfolio=125 , 000 ×2.39656

FV of D iversified share portfolio=229,569.8

S uperannuation account=$ 750,000

Future value of S uperannuation account=FV (0.67 %, 180 ,−1000 ,−750000)

Future value of S uperannuation account=2,826,229.3

Financial assets values=FV of Diversified share portfolio+ Future value of S uperannuation account

Financial assets values=2,826,229.3+229,569. 8

Financial assets values at age 60=$ 3,125,799.1

The value of financial assets at the time of retirement is calculated to be $3,125,799.10.

bii) Cash flow at the end of year 2:

Cash at the end of year 2 $ (2,173.913)

Cash flow at the end of year 2 is -$2,173.91.

ci) Gaye’s financial assets at the age of 60:

D iversified share portfolio=125 , 000 Interest rate=6 %

Time=Retirement age−current age=60−45=15

D iversified share portfolio=125 , 000 ×( ( 1+6 % ) 15)

D iversified share portfolio=125 , 000 ×2.39656

FV of D iversified share portfolio=229,569.8

S uperannuation account=$ 750,000

Future value of S uperannuation account=FV (0.67 %, 180 ,−1000 ,−750000)

Future value of S uperannuation account=2,826,229.3

Financial assets values=FV of Diversified share portfolio+ Future value of S uperannuation account

Financial assets values=2,826,229.3+229,569. 8

Financial assets values at age 60=$ 3,125,799.1

The value of financial assets at the time of retirement is calculated to be $3,125,799.10.

5FINANCE AND ACCOUNTING

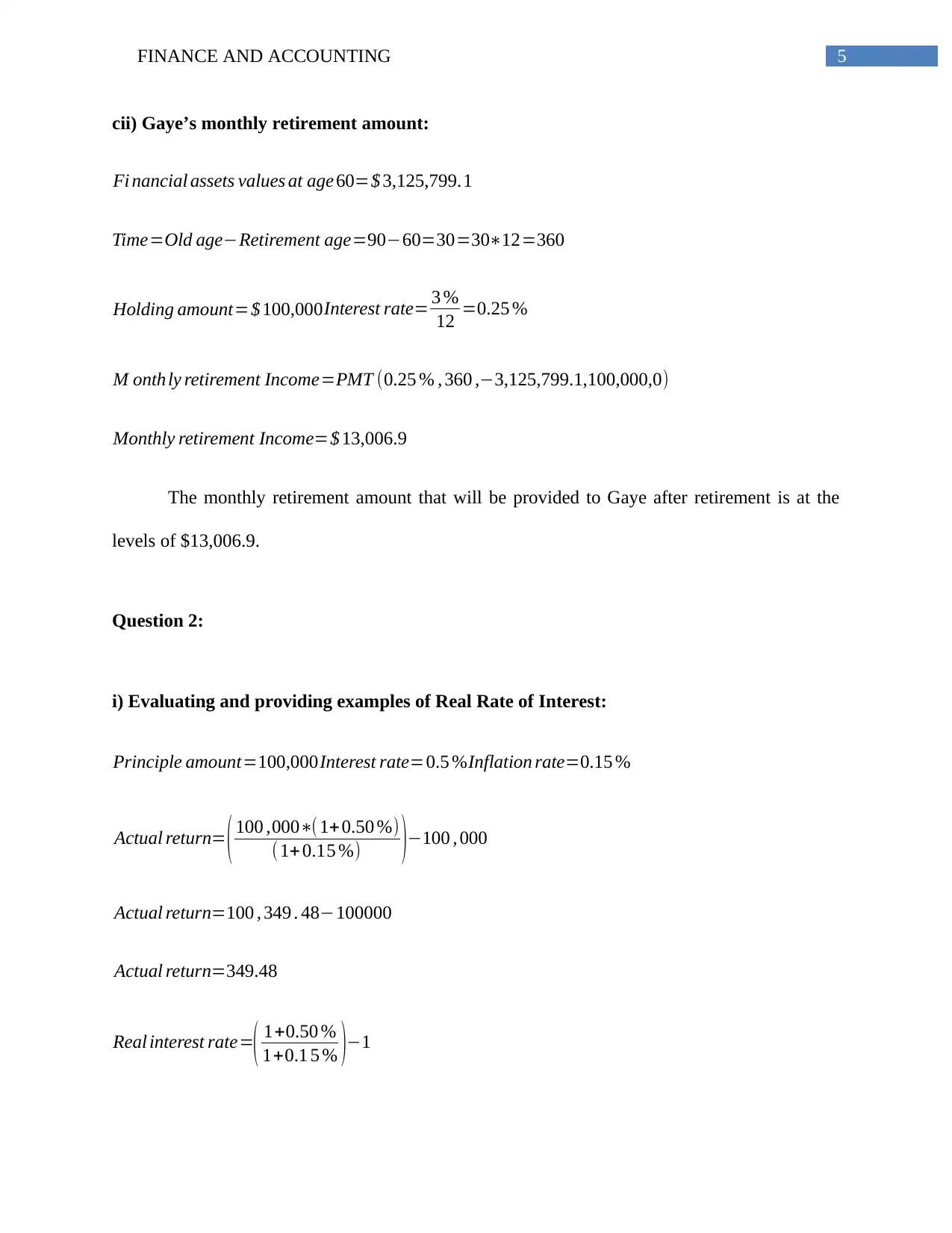

cii) Gaye’s monthly retirement amount:

Fi nancial assets values at age 60=$ 3,125,799.1

Time=Old age−Retirement age=90−60=30=30∗12=360

Holding amount=$ 100,000 Interest rate= 3 %

12 =0.25 %

M onthly retirement Income=PMT (0.25 % , 360 ,−3,125,799.1,100,000,0)

Monthly retirement Income=$ 13,006.9

The monthly retirement amount that will be provided to Gaye after retirement is at the

levels of $13,006.9.

Question 2:

i) Evaluating and providing examples of Real Rate of Interest:

Principle amount=100,000 Interest rate=0.5 %Inflation rate=0.15 %

Actual return= ( 100 ,000∗( 1+ 0.50 %)

(1+ 0.15 %) )−100 , 000

Actual return=100 , 349 . 48−100000

Actual return=349.48

Real interest rate=( 1+0.50 %

1+0.1 5 % )−1

cii) Gaye’s monthly retirement amount:

Fi nancial assets values at age 60=$ 3,125,799.1

Time=Old age−Retirement age=90−60=30=30∗12=360

Holding amount=$ 100,000 Interest rate= 3 %

12 =0.25 %

M onthly retirement Income=PMT (0.25 % , 360 ,−3,125,799.1,100,000,0)

Monthly retirement Income=$ 13,006.9

The monthly retirement amount that will be provided to Gaye after retirement is at the

levels of $13,006.9.

Question 2:

i) Evaluating and providing examples of Real Rate of Interest:

Principle amount=100,000 Interest rate=0.5 %Inflation rate=0.15 %

Actual return= ( 100 ,000∗( 1+ 0.50 %)

(1+ 0.15 %) )−100 , 000

Actual return=100 , 349 . 48−100000

Actual return=349.48

Real interest rate=( 1+0.50 %

1+0.1 5 % )−1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCE AND ACCOUNTING

Real interest rate=0.3 49 %

The detection of real interest rate is a major concern for investors, as it helps them to

understand the actual return that would be generated from an investment. The real interest rate is

subject to the inflation rate, which mainly reduces the actual value of money in time. In addition,

it is also detected that purchasing power of money is dependent on the inflation rate, where high

inflation can reduce its purchasing power and vice-versa (Beyer & Wieland, 2019). The above

example indicates that the actual return is 349.48 instead of 500 due to the impact of inflation

rate, while the real interest rate is calculated to be at the levels of 0.349%.

ii) Negative gearing used in Australian housing market:

Wealthy individuals in Australia mainly use the negative gearing method, which directly

reduce their taxes and improves their returns on investment. Negative gearing method is an

approach, where individuals buy housing property and sell them at higher prices. This increases

the prices in the housing market and could lead to a bubble, which was previously seen in the

2008 financial crisis. Hence, the Australian government needs to abolish the negative gearing

method, which allows the rich individual to get the extra benefits. The investment in property

comes with annual expenses, which is deducted from tax, while hefty gains are made after the

sale of the investment property. This way the prices of the housing market would increase and

negatively affect the middle and poor class of citizens.

Real interest rate=0.3 49 %

The detection of real interest rate is a major concern for investors, as it helps them to

understand the actual return that would be generated from an investment. The real interest rate is

subject to the inflation rate, which mainly reduces the actual value of money in time. In addition,

it is also detected that purchasing power of money is dependent on the inflation rate, where high

inflation can reduce its purchasing power and vice-versa (Beyer & Wieland, 2019). The above

example indicates that the actual return is 349.48 instead of 500 due to the impact of inflation

rate, while the real interest rate is calculated to be at the levels of 0.349%.

ii) Negative gearing used in Australian housing market:

Wealthy individuals in Australia mainly use the negative gearing method, which directly

reduce their taxes and improves their returns on investment. Negative gearing method is an

approach, where individuals buy housing property and sell them at higher prices. This increases

the prices in the housing market and could lead to a bubble, which was previously seen in the

2008 financial crisis. Hence, the Australian government needs to abolish the negative gearing

method, which allows the rich individual to get the extra benefits. The investment in property

comes with annual expenses, which is deducted from tax, while hefty gains are made after the

sale of the investment property. This way the prices of the housing market would increase and

negatively affect the middle and poor class of citizens.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCE AND ACCOUNTING

Question 3:

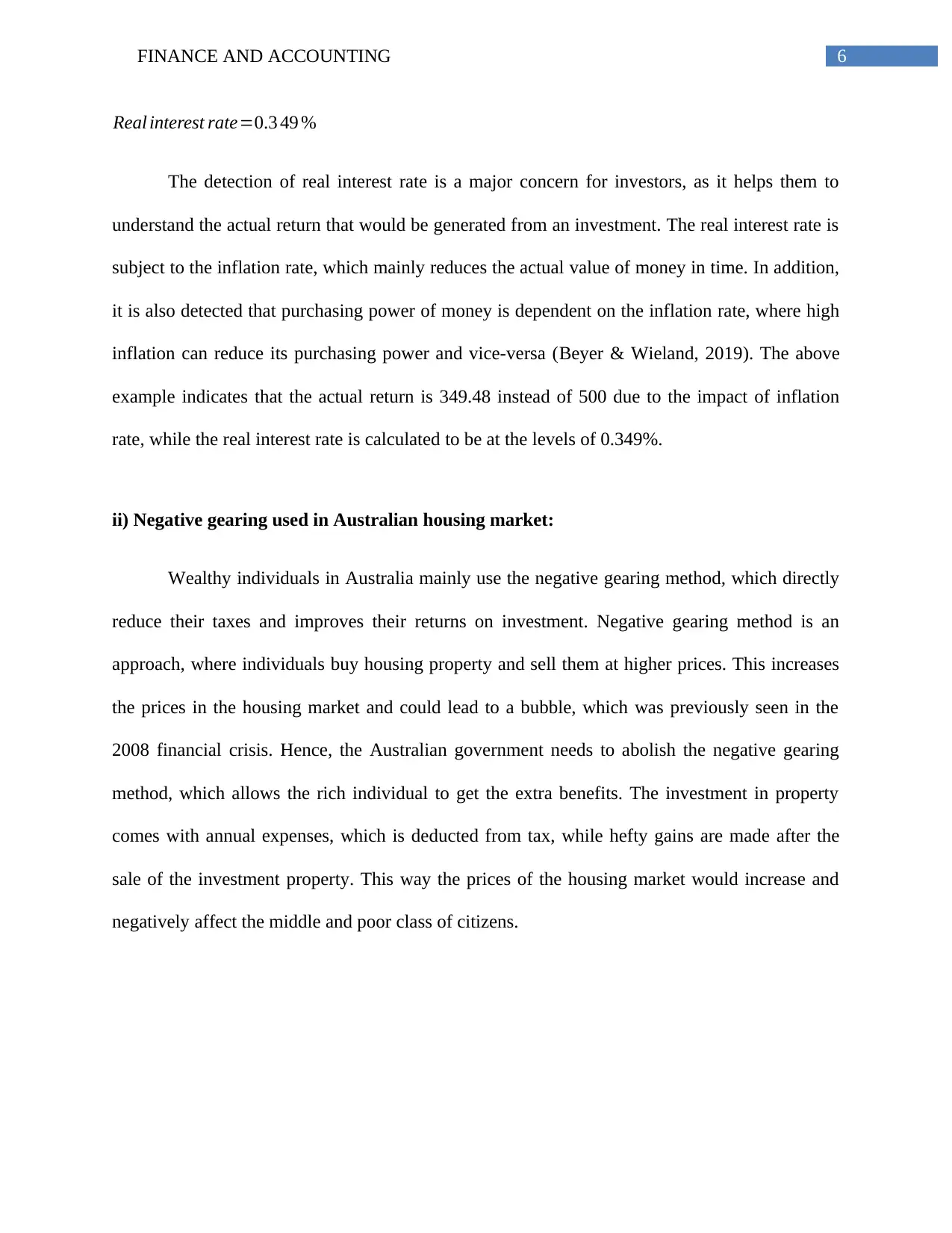

i) Defining risk in terms of investment:

Risk in one of the major factors that is used by investors during their investment

decisions. Moreover, risk is considered to be bad for many investors, as it increases the

probability of losses, which can be incurred from an investment. Investor’s mainly aims for

getting an investment opportunity, which has the lowest risk and high returns (Montford &

Goldsmith, 2016).

ii) Dividend imputation credit system having impact on Australian resident and

international investors:

One of the major attributes of conducting investments in Australia is the dividend

imputations system, which is granted by the government to the residents of the country. The

dividend imputation system is mainly a measure, which reduces the possibility of double taxation

on the dividends that is been provided to the investors. The Australian investors get tax credit

from ATO, while the international investors are not provided the benefits, as they need to follow

the laws in their land (Davis, 2016). Moreover, the tax credit that is been provided to the

investors allow them to maximize their returns from investment.

iii) Monthly returns of BHP in $ and %:

Dat

e

Open (X) Close (Y) Dividends

(Z)

Return $ V=(Y-X+Z) Return% (V/X)

Jan 29.600 30.200 $ 0.600 2.027%

Feb 30.200 30.500 $ 0.300 0.993%

Mar 30.500 28.200 0.706 $ -1.594 -5.227%

Question 3:

i) Defining risk in terms of investment:

Risk in one of the major factors that is used by investors during their investment

decisions. Moreover, risk is considered to be bad for many investors, as it increases the

probability of losses, which can be incurred from an investment. Investor’s mainly aims for

getting an investment opportunity, which has the lowest risk and high returns (Montford &

Goldsmith, 2016).

ii) Dividend imputation credit system having impact on Australian resident and

international investors:

One of the major attributes of conducting investments in Australia is the dividend

imputations system, which is granted by the government to the residents of the country. The

dividend imputation system is mainly a measure, which reduces the possibility of double taxation

on the dividends that is been provided to the investors. The Australian investors get tax credit

from ATO, while the international investors are not provided the benefits, as they need to follow

the laws in their land (Davis, 2016). Moreover, the tax credit that is been provided to the

investors allow them to maximize their returns from investment.

iii) Monthly returns of BHP in $ and %:

Dat

e

Open (X) Close (Y) Dividends

(Z)

Return $ V=(Y-X+Z) Return% (V/X)

Jan 29.600 30.200 $ 0.600 2.027%

Feb 30.200 30.500 $ 0.300 0.993%

Mar 30.500 28.200 0.706 $ -1.594 -5.227%

8FINANCE AND ACCOUNTING

Apr 28.200 31.000 $ 2.800 9.929%

May 31.000 32.800 $ 1.800 5.806%

Jun 32.800 33.900 $ 1.100 3.354%

Jul 33.900 34.900 $ 1.000 2.950%

Aug 34.900 33.200 $ -1.700 -4.871%

Sep 33.200 34.600 0.856 $ 2.256 6.795%

Oct 34.600 32.200 $ -2.400 -6.936%

Nov 32.200 30.700 $ -1.500 -4.658%

Dec 30.700 34.200 $ 3.500 11.401%

iv) BHP average monthly return:

Average return= 2.027 +0.99 3−5.227+ 9.929+5.806+3.354+ 2.950−4.871+6.795−6.936−4.658+11.40 1

12

Average return= 21.563

12 =1.8 0

v) International shareholders Annual holding return:

Opening price=26.6Closing price=34.2 Dividend 1=0.706 Dividend 2=0.856

Annual holding international investors= 34.2−29.6 +0.70 6+0.85 6

29.6 =20.82 %

vi) Australian shareholders annual return from BHP:

Opening price=26.6Closing price=34.2 Dividend 1=0.706 Dividend 2=0.856

Dividend credit= 0.706+ 0.856

0.30 =5.21

Apr 28.200 31.000 $ 2.800 9.929%

May 31.000 32.800 $ 1.800 5.806%

Jun 32.800 33.900 $ 1.100 3.354%

Jul 33.900 34.900 $ 1.000 2.950%

Aug 34.900 33.200 $ -1.700 -4.871%

Sep 33.200 34.600 0.856 $ 2.256 6.795%

Oct 34.600 32.200 $ -2.400 -6.936%

Nov 32.200 30.700 $ -1.500 -4.658%

Dec 30.700 34.200 $ 3.500 11.401%

iv) BHP average monthly return:

Average return= 2.027 +0.99 3−5.227+ 9.929+5.806+3.354+ 2.950−4.871+6.795−6.936−4.658+11.40 1

12

Average return= 21.563

12 =1.8 0

v) International shareholders Annual holding return:

Opening price=26.6Closing price=34.2 Dividend 1=0.706 Dividend 2=0.856

Annual holding international investors= 34.2−29.6 +0.70 6+0.85 6

29.6 =20.82 %

vi) Australian shareholders annual return from BHP:

Opening price=26.6Closing price=34.2 Dividend 1=0.706 Dividend 2=0.856

Dividend credit= 0.706+ 0.856

0.30 =5.21

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCE AND ACCOUNTING

Annual holding Australian investors=34.2−29.6+0.7 06+ 0.85 6+5.21

29.6 =38.41 %

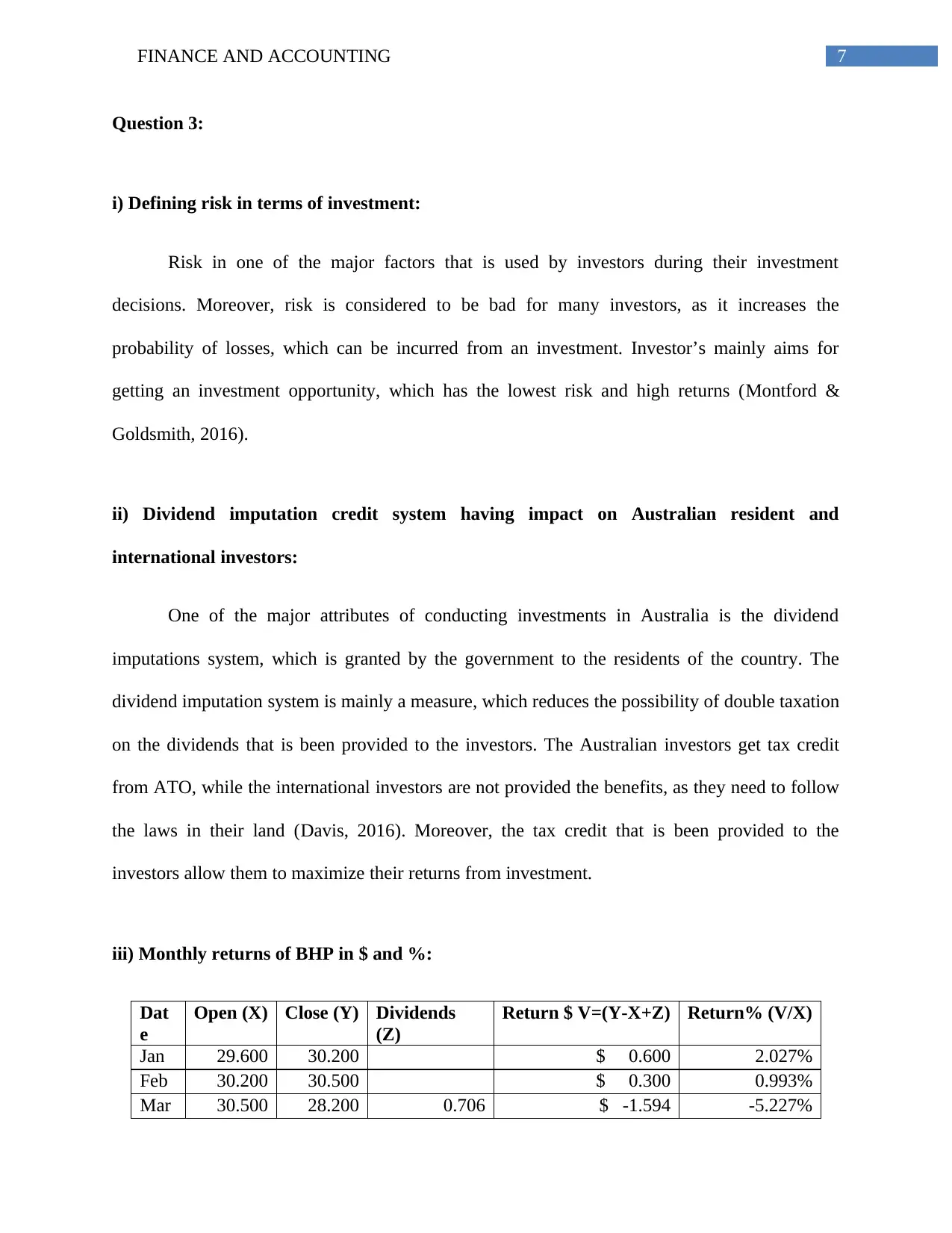

vii) MKT monthly returns:

Dat

e Open (X) Close (Y)

ALL ORDS Return%

((Y-X)/X)

Jan 6147.00 6117.00 -0.48804%

Feb 6117.00 5869.00 -4.05427%

Mar 5869.00 6072.00 3.45885%

Apr 6072.00 6124.00 0.85639%

May 6124.00 6290.00 2.71065%

Jun 6290.00 6366.00 1.20827%

Jul 6366.00 6428.00 0.97392%

Aug 6428.00 6326.00 -1.58681%

Sep 6326.00 5913.00 -6.52861%

Oct 5913.00 5749.00 -2.77355%

Nov 5749.00 5709.00 -0.69577%

Dec 5709.00 5783.00 1.29620%

viii) MKT average monthly return:

Annual holding=

−0.48804−4.05427+3.45885+0.85639+2.71065+0.97392

−1.58681−6.52861−2.77355−0.69577+1.29620

12

Average return=−5.62278

12 =−0.469

ix) Australian annual holding:

Opening price=6147 Closing price=5783 Australian Annual holding= 5783−6147

6147 =−5.92 %

Annual holding Australian investors=34.2−29.6+0.7 06+ 0.85 6+5.21

29.6 =38.41 %

vii) MKT monthly returns:

Dat

e Open (X) Close (Y)

ALL ORDS Return%

((Y-X)/X)

Jan 6147.00 6117.00 -0.48804%

Feb 6117.00 5869.00 -4.05427%

Mar 5869.00 6072.00 3.45885%

Apr 6072.00 6124.00 0.85639%

May 6124.00 6290.00 2.71065%

Jun 6290.00 6366.00 1.20827%

Jul 6366.00 6428.00 0.97392%

Aug 6428.00 6326.00 -1.58681%

Sep 6326.00 5913.00 -6.52861%

Oct 5913.00 5749.00 -2.77355%

Nov 5749.00 5709.00 -0.69577%

Dec 5709.00 5783.00 1.29620%

viii) MKT average monthly return:

Annual holding=

−0.48804−4.05427+3.45885+0.85639+2.71065+0.97392

−1.58681−6.52861−2.77355−0.69577+1.29620

12

Average return=−5.62278

12 =−0.469

ix) Australian annual holding:

Opening price=6147 Closing price=5783 Australian Annual holding= 5783−6147

6147 =−5.92 %

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCE AND ACCOUNTING

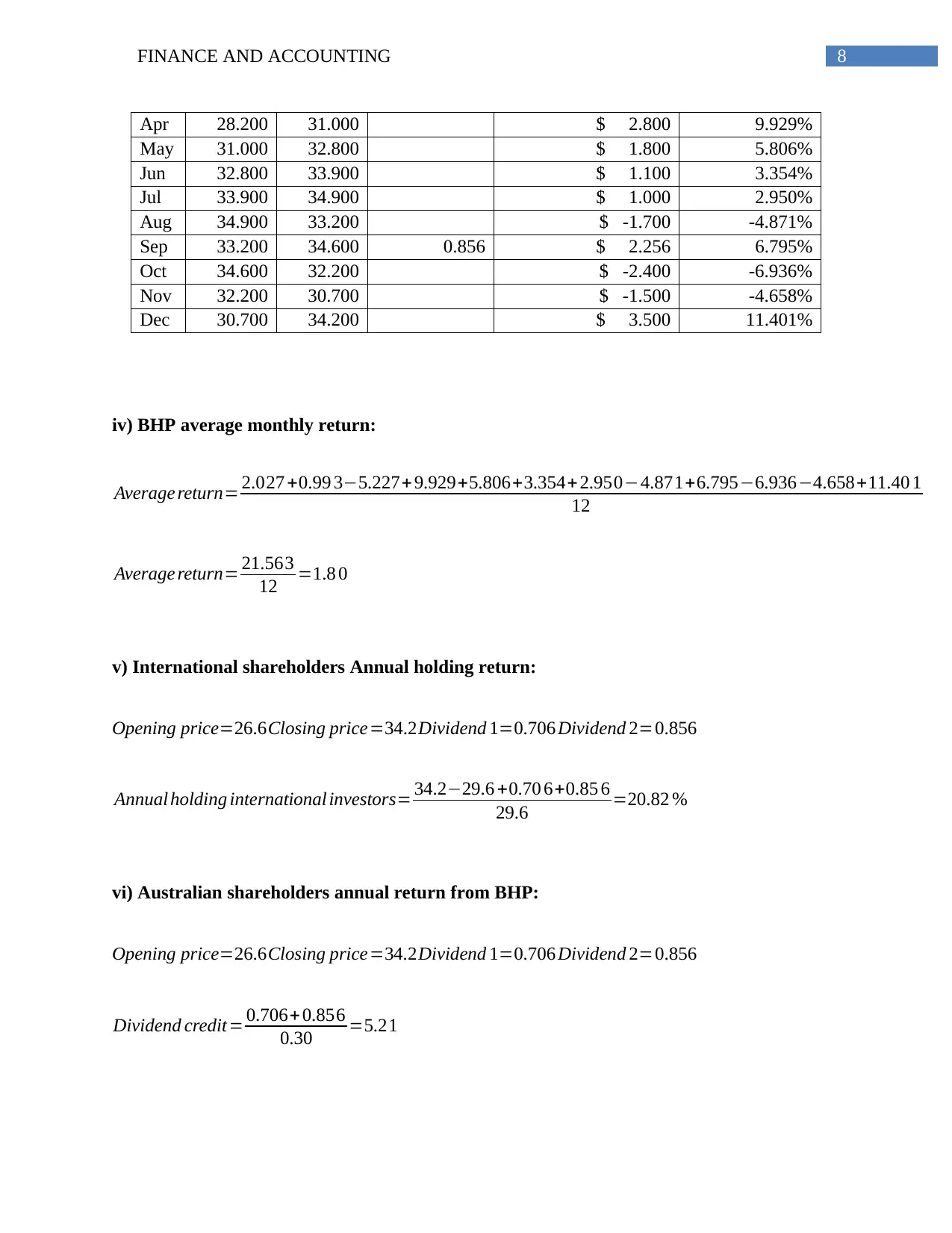

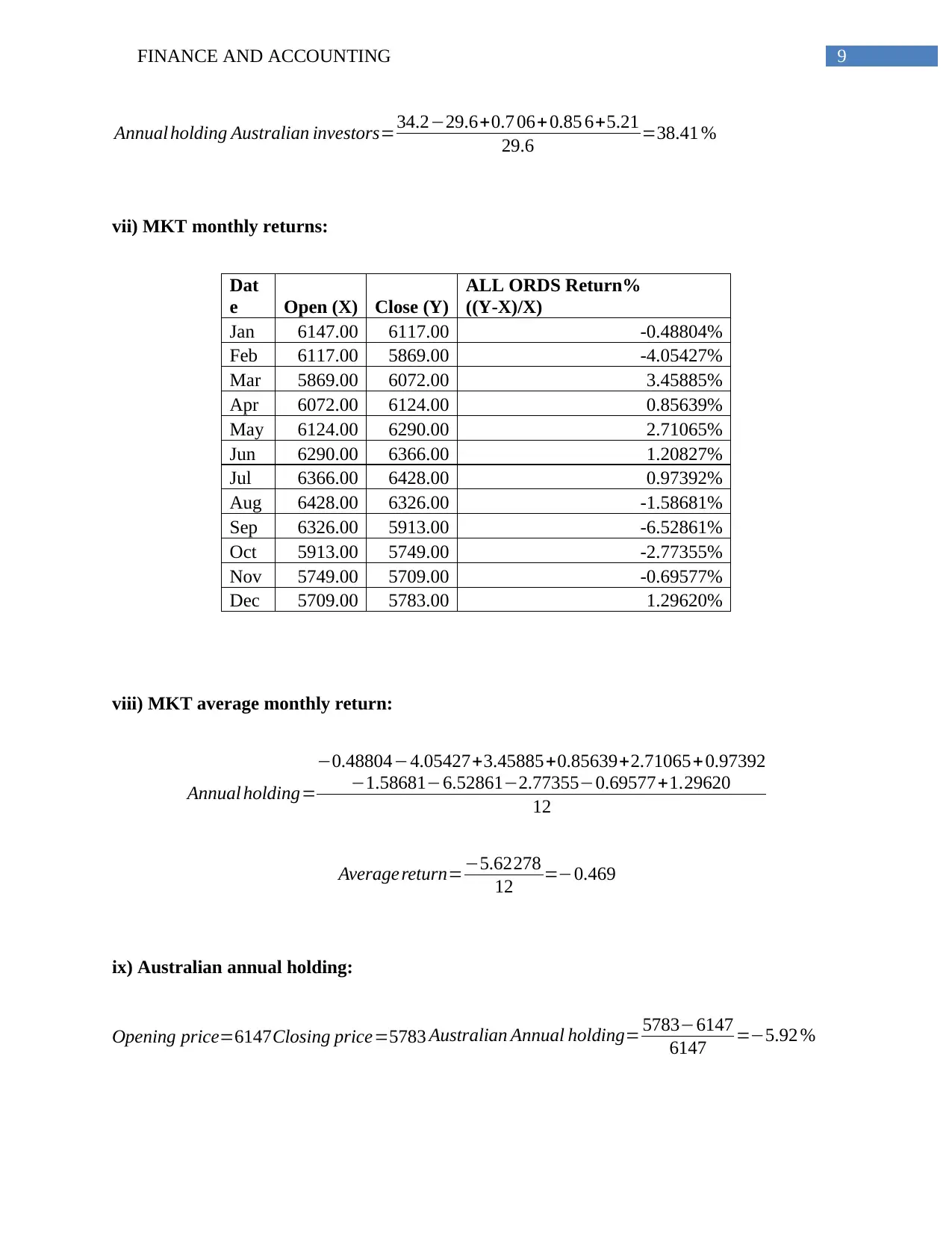

x) Graph of returns BHP and MKT:

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

-10.000%

-5.000%

0.000%

5.000%

10.000%

15.000%

BHP Return% ALL ORDS Return%

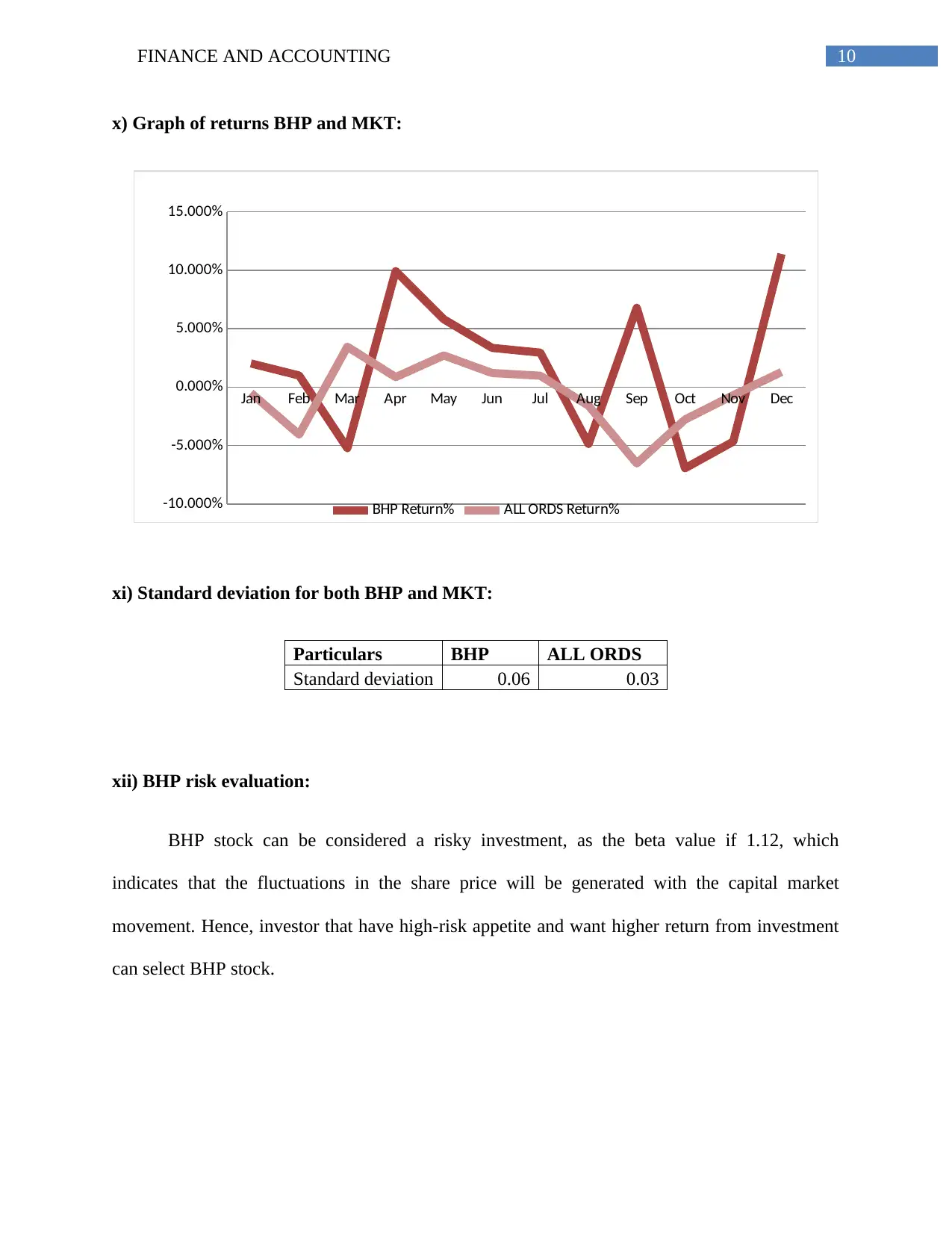

xi) Standard deviation for both BHP and MKT:

Particulars BHP ALL ORDS

Standard deviation 0.06 0.03

xii) BHP risk evaluation:

BHP stock can be considered a risky investment, as the beta value if 1.12, which

indicates that the fluctuations in the share price will be generated with the capital market

movement. Hence, investor that have high-risk appetite and want higher return from investment

can select BHP stock.

x) Graph of returns BHP and MKT:

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

-10.000%

-5.000%

0.000%

5.000%

10.000%

15.000%

BHP Return% ALL ORDS Return%

xi) Standard deviation for both BHP and MKT:

Particulars BHP ALL ORDS

Standard deviation 0.06 0.03

xii) BHP risk evaluation:

BHP stock can be considered a risky investment, as the beta value if 1.12, which

indicates that the fluctuations in the share price will be generated with the capital market

movement. Hence, investor that have high-risk appetite and want higher return from investment

can select BHP stock.

11FINANCE AND ACCOUNTING

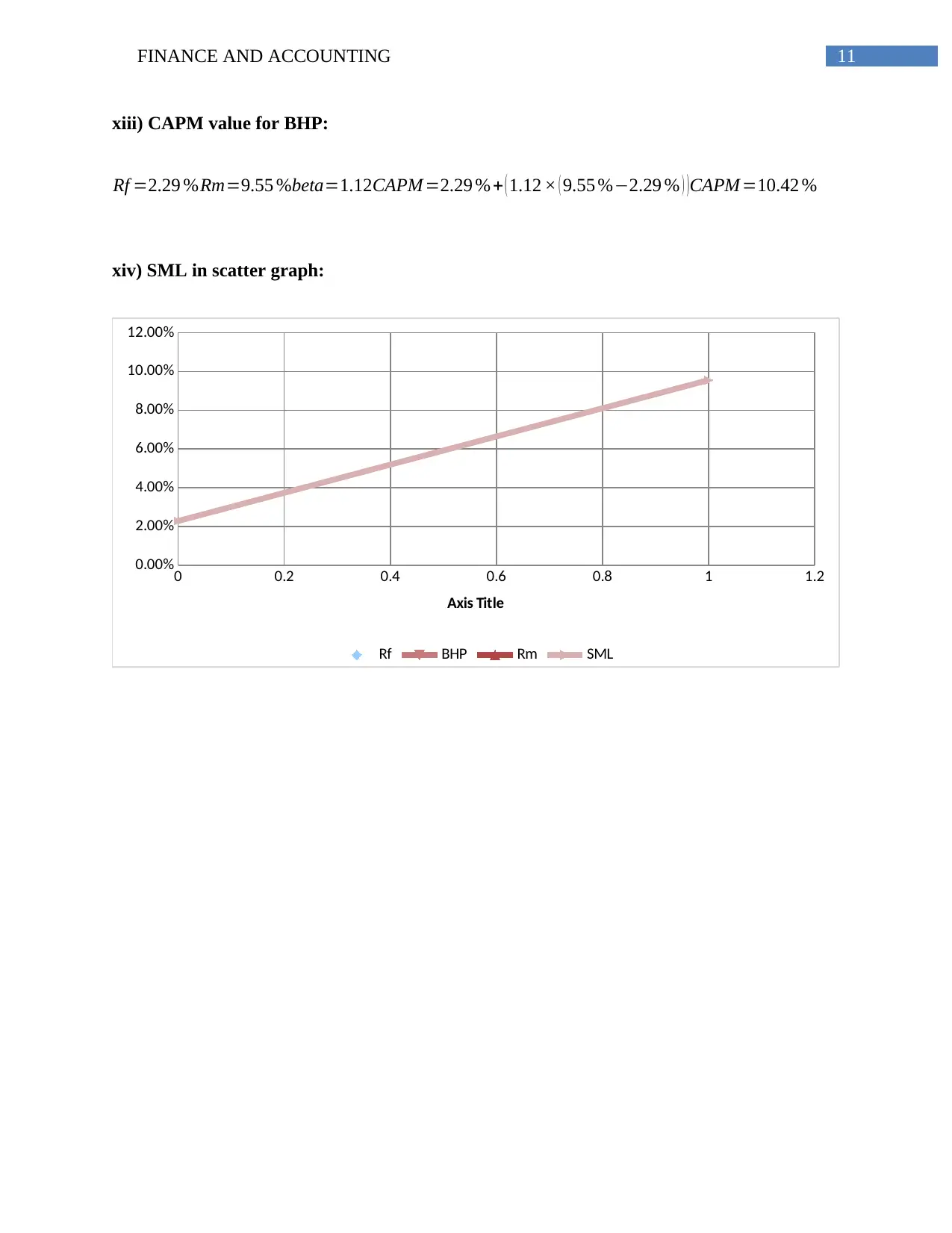

xiii) CAPM value for BHP:

Rf =2.29 %Rm=9.55 %beta=1.12CAPM =2.29 %+ ( 1.12 × ( 9.55 %−2.29 % ) )CAPM =10.42 %

xiv) SML in scatter graph:

0 0.2 0.4 0.6 0.8 1 1.2

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

Rf BHP Rm SML

Axis Title

xiii) CAPM value for BHP:

Rf =2.29 %Rm=9.55 %beta=1.12CAPM =2.29 %+ ( 1.12 × ( 9.55 %−2.29 % ) )CAPM =10.42 %

xiv) SML in scatter graph:

0 0.2 0.4 0.6 0.8 1 1.2

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

Rf BHP Rm SML

Axis Title

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.