Accounting and Finance for Managers: Company Performance and Financing

VerifiedAdded on 2022/12/29

|12

|3060

|48

Report

AI Summary

This report presents a detailed financial analysis and comparison of three companies: Green Core Group Plc, Hilton Food Group Plc, and Premier Foods Plc. Section A focuses on the overview, strategies, and financial and non-financial ratio analysis of each company, including ROE, ROCE, profit margin, and asset turnover, spanning three years. The analysis highlights key performance indicators and trends, offering insights into each company's strengths and weaknesses. Section B delves into financing methods, differentiating between internal and external sources, and discussing retained earnings, equity financing, and debt financing. The report provides a comprehensive understanding of financial performance, ratio analysis, and funding strategies, providing a basis for informed decision-making.

Accounting and Finance for

Managers

Managers

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................3

SECTION A ....................................................................................................................................3

SECTION B ....................................................................................................................................9

CONCLUSION .............................................................................................................................11

REFERENCE.................................................................................................................................12

INTRODUCTION ..........................................................................................................................3

SECTION A ....................................................................................................................................3

SECTION B ....................................................................................................................................9

CONCLUSION .............................................................................................................................11

REFERENCE.................................................................................................................................12

INTRODUCTION

The present report carried out a detailed analysis and appraisal of three companies i.e.

Green Core group company, the Hilton Group & the Premier food group, all of these belongs to

similar economy as well as are main competitors. In which the first potion of report consist the

determination of ratio analysis, development direction, aims and objective which are undertaken

by all these three companies. Further, the second section includes discussion about multiples

methods of lengthier financing.

SECTION A

1a.

Overview of Green Core Group Plc – This company belong to food and beverages and in

increasing food market this company wish to raise the level of competition based on two major

parts- increasing varieties of offerings and influencing them for purchasing that offerings. With

relevance to this the strategy of company is to further reinforces related to their consumers by

forcing income through a shared supply chain, raising values through their portfolios as well as

doing more for clients (Kim, Schmidgall and Damitio, 2017). Achievement of company goal

relies on four major strength are home cooked meals, power peoples, Green core honesty and the

organisation's performance. Implementation of plan needed high knowledgable company and

that could be Green Core, underpinned by a shared values and performance of company.

About Hilton Food Group Plc: This is a renowned company and has a strong brand

image along with huge consumer base within market. This company has been lively company

with high expectation. Behind success of this company is the satisfaction level of consumes as

well their faith in alliances has powered their increment in internationalism (Holm, 2018). The

main responsibility of this company is to help the corporate partners of company in order to cross

their revelries. Aim of company as a corporate is strong coordination. Business devotions,

engagements and aim is to do whatever that helps their employees for gaining success with one

job, one intent along with one shared aim. Managerial personnels are the core of everything that

company does. Corporate background are always different and significant. The principles of

company demonstrate the ways by which they things about themselves initially as entity and how

they behaves as individuals. Staff of organisation relies on general principles and established

strategies that works as relationships alliances.

The present report carried out a detailed analysis and appraisal of three companies i.e.

Green Core group company, the Hilton Group & the Premier food group, all of these belongs to

similar economy as well as are main competitors. In which the first potion of report consist the

determination of ratio analysis, development direction, aims and objective which are undertaken

by all these three companies. Further, the second section includes discussion about multiples

methods of lengthier financing.

SECTION A

1a.

Overview of Green Core Group Plc – This company belong to food and beverages and in

increasing food market this company wish to raise the level of competition based on two major

parts- increasing varieties of offerings and influencing them for purchasing that offerings. With

relevance to this the strategy of company is to further reinforces related to their consumers by

forcing income through a shared supply chain, raising values through their portfolios as well as

doing more for clients (Kim, Schmidgall and Damitio, 2017). Achievement of company goal

relies on four major strength are home cooked meals, power peoples, Green core honesty and the

organisation's performance. Implementation of plan needed high knowledgable company and

that could be Green Core, underpinned by a shared values and performance of company.

About Hilton Food Group Plc: This is a renowned company and has a strong brand

image along with huge consumer base within market. This company has been lively company

with high expectation. Behind success of this company is the satisfaction level of consumes as

well their faith in alliances has powered their increment in internationalism (Holm, 2018). The

main responsibility of this company is to help the corporate partners of company in order to cross

their revelries. Aim of company as a corporate is strong coordination. Business devotions,

engagements and aim is to do whatever that helps their employees for gaining success with one

job, one intent along with one shared aim. Managerial personnels are the core of everything that

company does. Corporate background are always different and significant. The principles of

company demonstrate the ways by which they things about themselves initially as entity and how

they behaves as individuals. Staff of organisation relies on general principles and established

strategies that works as relationships alliances.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Premier Foods Plc: Primary objective of this company is to offers quality, delicious,

healthy with multiple variety food products so that their potential consumers will able to received

full satisfaction. Due to this their clients see their offerings abut 94 % of overall part of British

households. The company promotes their big brand with excellent price in order to represent

why nutrition agency is at the heart of collaborates. This company majorly focuses on

developing a genuinely stunning operational sites (Lail and Martin, 2017). Common values of

company offer employees with a collective decision making process and motivates them so that

they will effectively performs well and help corporation to attain their goal within stipulated time

frame. Since last 3 years, substantial development has been achievement towards engagement of

corporate values and their priorities of company as well gaining success in collaboration &

effective communication with employees.

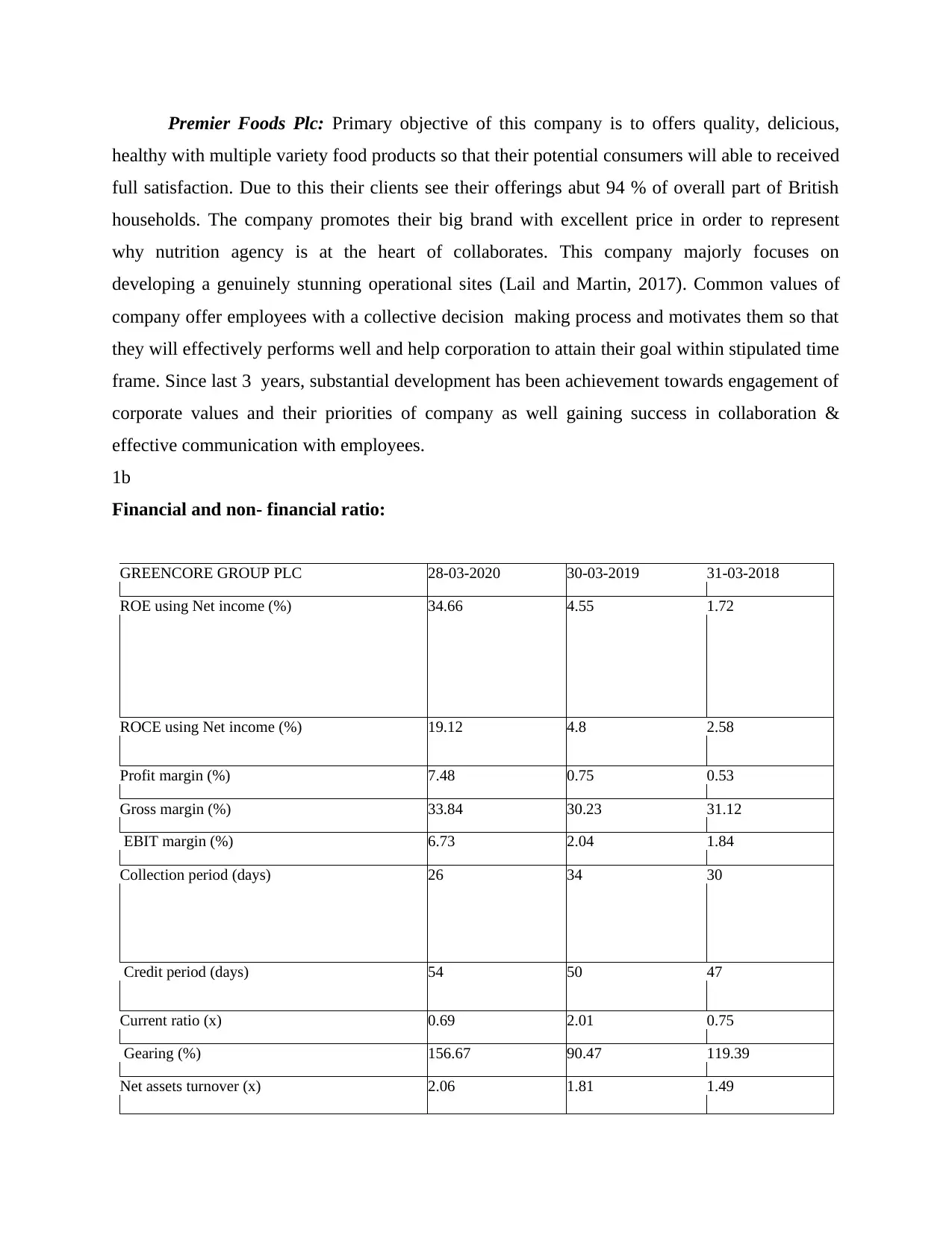

1b

Financial and non- financial ratio:

GREENCORE GROUP PLC 28-03-2020 30-03-2019 31-03-2018

ROE using Net income (%) 34.66 4.55 1.72

ROCE using Net income (%) 19.12 4.8 2.58

Profit margin (%) 7.48 0.75 0.53

Gross margin (%) 33.84 30.23 31.12

EBIT margin (%) 6.73 2.04 1.84

Collection period (days) 26 34 30

Credit period (days) 54 50 47

Current ratio (x) 0.69 2.01 0.75

Gearing (%) 156.67 90.47 119.39

Net assets turnover (x) 2.06 1.81 1.49

healthy with multiple variety food products so that their potential consumers will able to received

full satisfaction. Due to this their clients see their offerings abut 94 % of overall part of British

households. The company promotes their big brand with excellent price in order to represent

why nutrition agency is at the heart of collaborates. This company majorly focuses on

developing a genuinely stunning operational sites (Lail and Martin, 2017). Common values of

company offer employees with a collective decision making process and motivates them so that

they will effectively performs well and help corporation to attain their goal within stipulated time

frame. Since last 3 years, substantial development has been achievement towards engagement of

corporate values and their priorities of company as well gaining success in collaboration &

effective communication with employees.

1b

Financial and non- financial ratio:

GREENCORE GROUP PLC 28-03-2020 30-03-2019 31-03-2018

ROE using Net income (%) 34.66 4.55 1.72

ROCE using Net income (%) 19.12 4.8 2.58

Profit margin (%) 7.48 0.75 0.53

Gross margin (%) 33.84 30.23 31.12

EBIT margin (%) 6.73 2.04 1.84

Collection period (days) 26 34 30

Credit period (days) 54 50 47

Current ratio (x) 0.69 2.01 0.75

Gearing (%) 156.67 90.47 119.39

Net assets turnover (x) 2.06 1.81 1.49

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

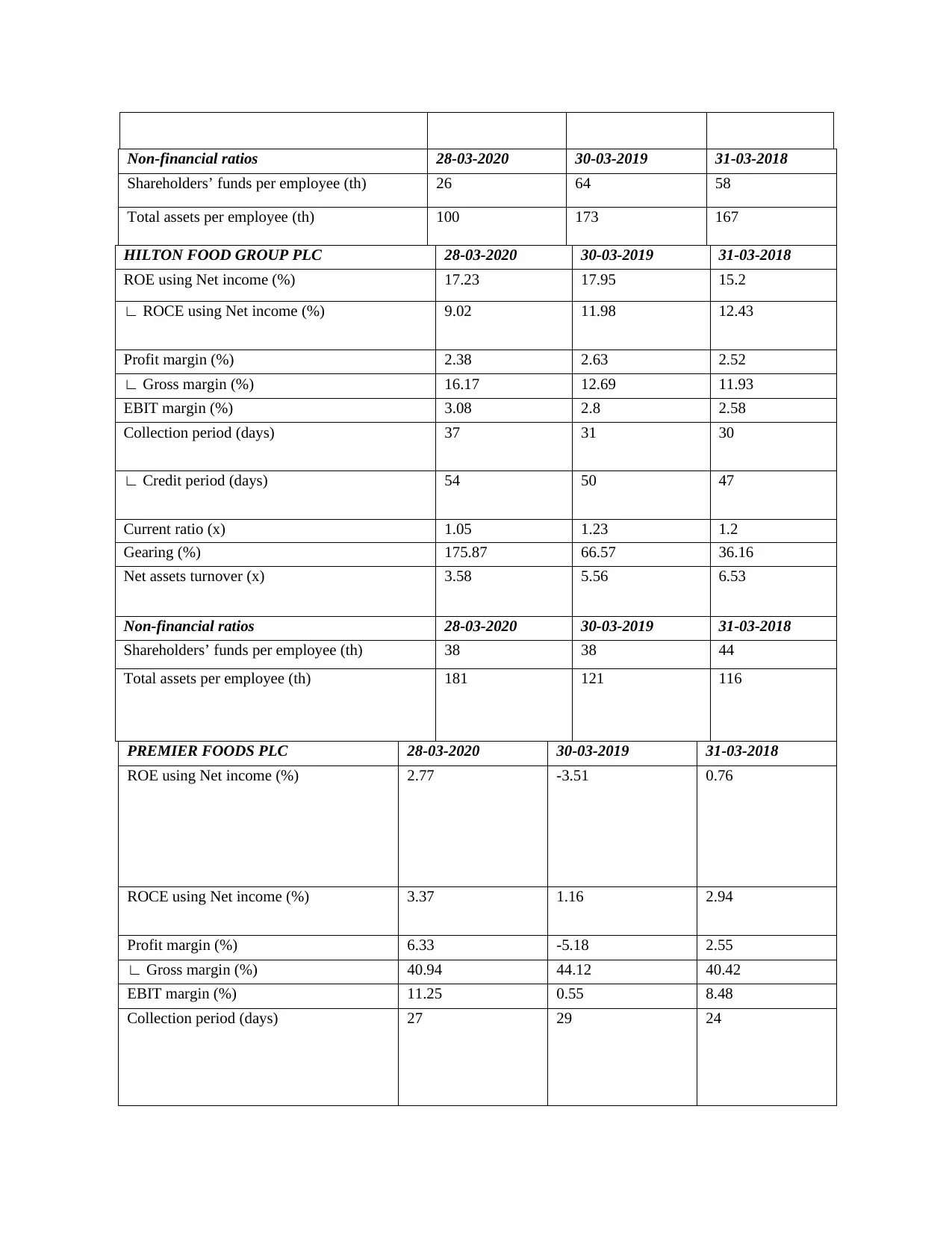

Non-financial ratios 28-03-2020 30-03-2019 31-03-2018

Shareholders’ funds per employee (th) 26 64 58

Total assets per employee (th) 100 173 167

HILTON FOOD GROUP PLC 28-03-2020 30-03-2019 31-03-2018

ROE using Net income (%) 17.23 17.95 15.2

∟ ROCE using Net income (%) 9.02 11.98 12.43

Profit margin (%) 2.38 2.63 2.52

∟ Gross margin (%) 16.17 12.69 11.93

EBIT margin (%) 3.08 2.8 2.58

Collection period (days) 37 31 30

∟ Credit period (days) 54 50 47

Current ratio (x) 1.05 1.23 1.2

Gearing (%) 175.87 66.57 36.16

Net assets turnover (x) 3.58 5.56 6.53

Non-financial ratios 28-03-2020 30-03-2019 31-03-2018

Shareholders’ funds per employee (th) 38 38 44

Total assets per employee (th) 181 121 116

PREMIER FOODS PLC 28-03-2020 30-03-2019 31-03-2018

ROE using Net income (%) 2.77 -3.51 0.76

ROCE using Net income (%) 3.37 1.16 2.94

Profit margin (%) 6.33 -5.18 2.55

∟ Gross margin (%) 40.94 44.12 40.42

EBIT margin (%) 11.25 0.55 8.48

Collection period (days) 27 29 24

Shareholders’ funds per employee (th) 26 64 58

Total assets per employee (th) 100 173 167

HILTON FOOD GROUP PLC 28-03-2020 30-03-2019 31-03-2018

ROE using Net income (%) 17.23 17.95 15.2

∟ ROCE using Net income (%) 9.02 11.98 12.43

Profit margin (%) 2.38 2.63 2.52

∟ Gross margin (%) 16.17 12.69 11.93

EBIT margin (%) 3.08 2.8 2.58

Collection period (days) 37 31 30

∟ Credit period (days) 54 50 47

Current ratio (x) 1.05 1.23 1.2

Gearing (%) 175.87 66.57 36.16

Net assets turnover (x) 3.58 5.56 6.53

Non-financial ratios 28-03-2020 30-03-2019 31-03-2018

Shareholders’ funds per employee (th) 38 38 44

Total assets per employee (th) 181 121 116

PREMIER FOODS PLC 28-03-2020 30-03-2019 31-03-2018

ROE using Net income (%) 2.77 -3.51 0.76

ROCE using Net income (%) 3.37 1.16 2.94

Profit margin (%) 6.33 -5.18 2.55

∟ Gross margin (%) 40.94 44.12 40.42

EBIT margin (%) 11.25 0.55 8.48

Collection period (days) 27 29 24

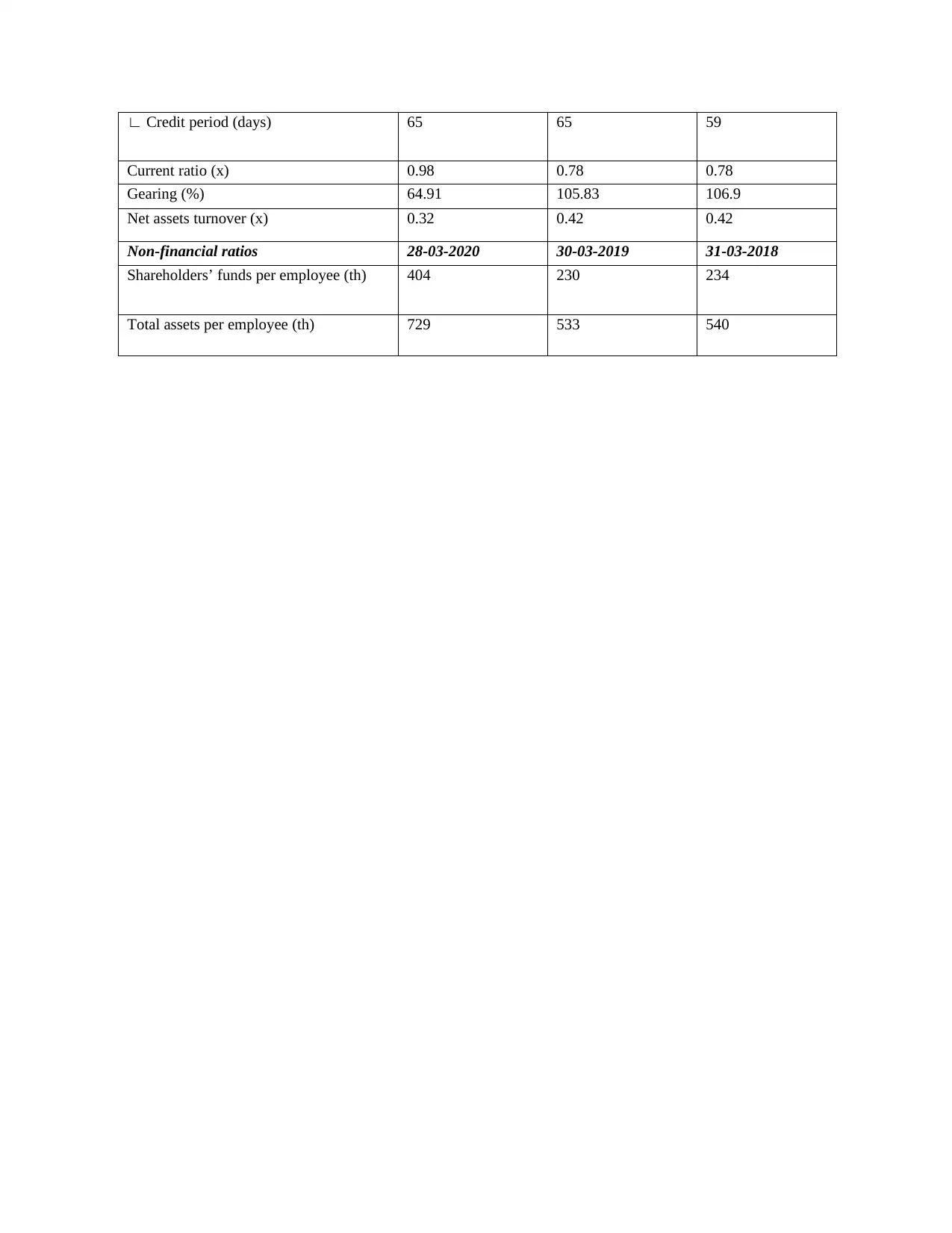

∟ Credit period (days) 65 65 59

Current ratio (x) 0.98 0.78 0.78

Gearing (%) 64.91 105.83 106.9

Net assets turnover (x) 0.32 0.42 0.42

Non-financial ratios 28-03-2020 30-03-2019 31-03-2018

Shareholders’ funds per employee (th) 404 230 234

Total assets per employee (th) 729 533 540

Current ratio (x) 0.98 0.78 0.78

Gearing (%) 64.91 105.83 106.9

Net assets turnover (x) 0.32 0.42 0.42

Non-financial ratios 28-03-2020 30-03-2019 31-03-2018

Shareholders’ funds per employee (th) 404 230 234

Total assets per employee (th) 729 533 540

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

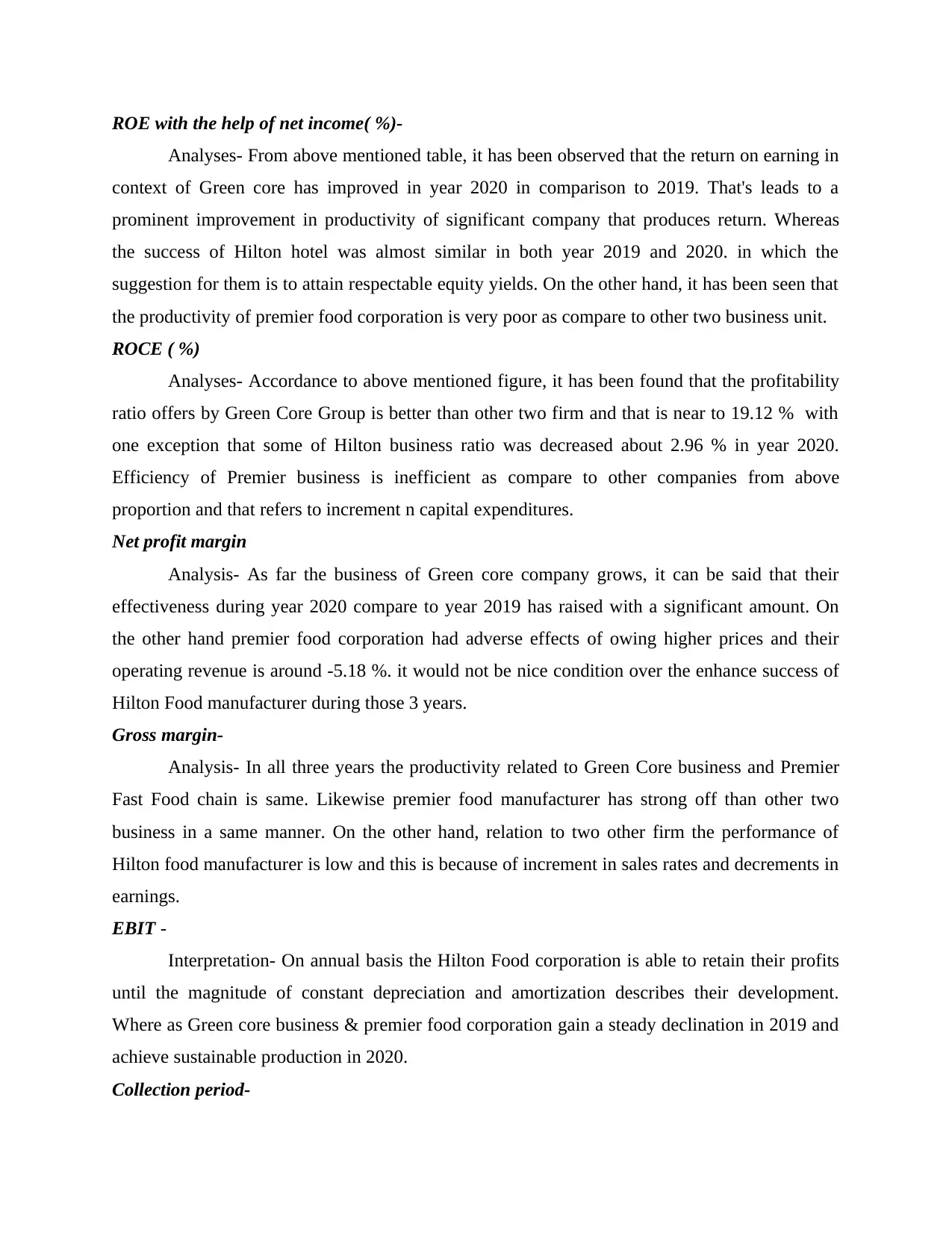

ROE with the help of net income( %)-

Analyses- From above mentioned table, it has been observed that the return on earning in

context of Green core has improved in year 2020 in comparison to 2019. That's leads to a

prominent improvement in productivity of significant company that produces return. Whereas

the success of Hilton hotel was almost similar in both year 2019 and 2020. in which the

suggestion for them is to attain respectable equity yields. On the other hand, it has been seen that

the productivity of premier food corporation is very poor as compare to other two business unit.

ROCE ( %)

Analyses- Accordance to above mentioned figure, it has been found that the profitability

ratio offers by Green Core Group is better than other two firm and that is near to 19.12 % with

one exception that some of Hilton business ratio was decreased about 2.96 % in year 2020.

Efficiency of Premier business is inefficient as compare to other companies from above

proportion and that refers to increment n capital expenditures.

Net profit margin

Analysis- As far the business of Green core company grows, it can be said that their

effectiveness during year 2020 compare to year 2019 has raised with a significant amount. On

the other hand premier food corporation had adverse effects of owing higher prices and their

operating revenue is around -5.18 %. it would not be nice condition over the enhance success of

Hilton Food manufacturer during those 3 years.

Gross margin-

Analysis- In all three years the productivity related to Green Core business and Premier

Fast Food chain is same. Likewise premier food manufacturer has strong off than other two

business in a same manner. On the other hand, relation to two other firm the performance of

Hilton food manufacturer is low and this is because of increment in sales rates and decrements in

earnings.

EBIT -

Interpretation- On annual basis the Hilton Food corporation is able to retain their profits

until the magnitude of constant depreciation and amortization describes their development.

Where as Green core business & premier food corporation gain a steady declination in 2019 and

achieve sustainable production in 2020.

Collection period-

Analyses- From above mentioned table, it has been observed that the return on earning in

context of Green core has improved in year 2020 in comparison to 2019. That's leads to a

prominent improvement in productivity of significant company that produces return. Whereas

the success of Hilton hotel was almost similar in both year 2019 and 2020. in which the

suggestion for them is to attain respectable equity yields. On the other hand, it has been seen that

the productivity of premier food corporation is very poor as compare to other two business unit.

ROCE ( %)

Analyses- Accordance to above mentioned figure, it has been found that the profitability

ratio offers by Green Core Group is better than other two firm and that is near to 19.12 % with

one exception that some of Hilton business ratio was decreased about 2.96 % in year 2020.

Efficiency of Premier business is inefficient as compare to other companies from above

proportion and that refers to increment n capital expenditures.

Net profit margin

Analysis- As far the business of Green core company grows, it can be said that their

effectiveness during year 2020 compare to year 2019 has raised with a significant amount. On

the other hand premier food corporation had adverse effects of owing higher prices and their

operating revenue is around -5.18 %. it would not be nice condition over the enhance success of

Hilton Food manufacturer during those 3 years.

Gross margin-

Analysis- In all three years the productivity related to Green Core business and Premier

Fast Food chain is same. Likewise premier food manufacturer has strong off than other two

business in a same manner. On the other hand, relation to two other firm the performance of

Hilton food manufacturer is low and this is because of increment in sales rates and decrements in

earnings.

EBIT -

Interpretation- On annual basis the Hilton Food corporation is able to retain their profits

until the magnitude of constant depreciation and amortization describes their development.

Where as Green core business & premier food corporation gain a steady declination in 2019 and

achieve sustainable production in 2020.

Collection period-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

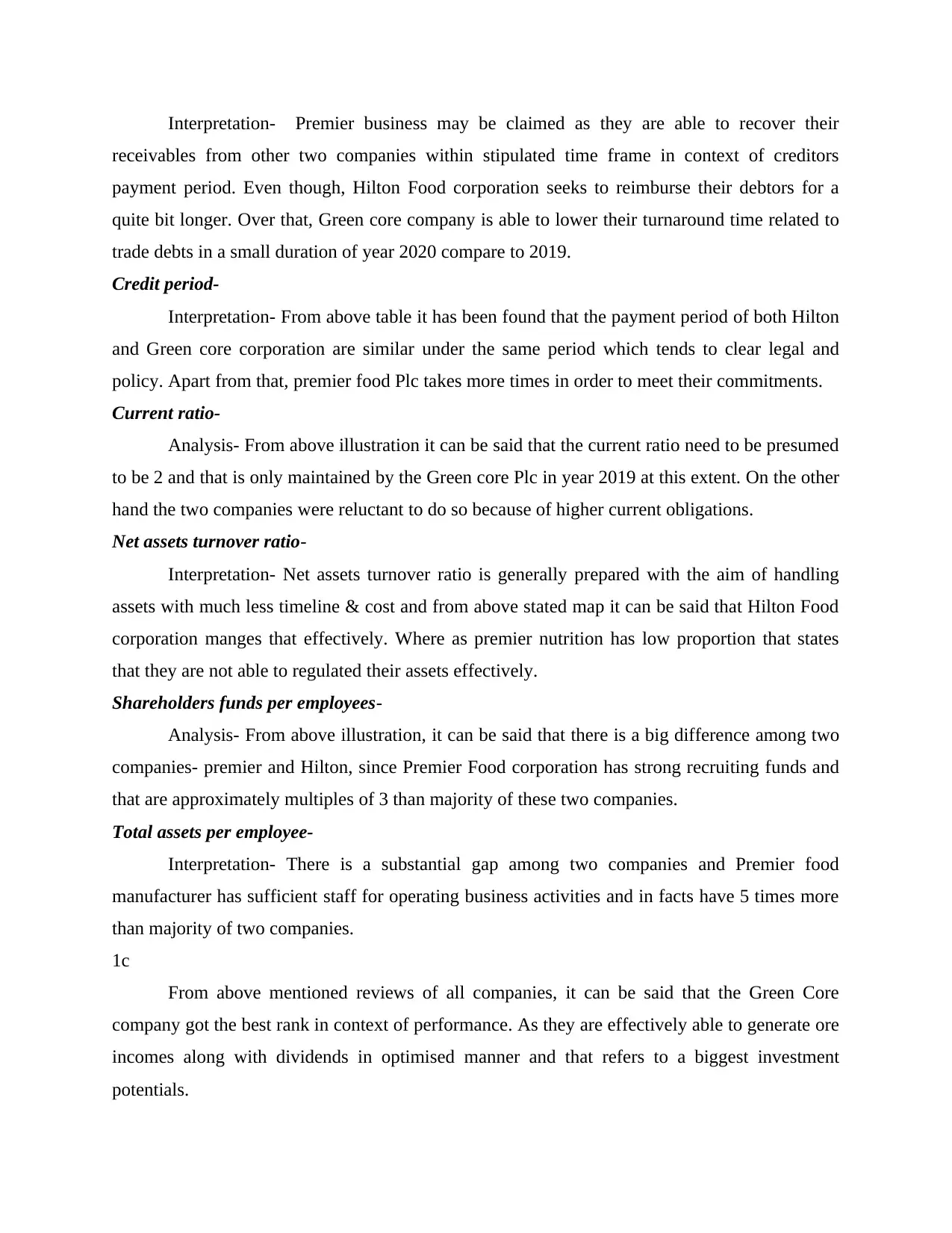

Interpretation- Premier business may be claimed as they are able to recover their

receivables from other two companies within stipulated time frame in context of creditors

payment period. Even though, Hilton Food corporation seeks to reimburse their debtors for a

quite bit longer. Over that, Green core company is able to lower their turnaround time related to

trade debts in a small duration of year 2020 compare to 2019.

Credit period-

Interpretation- From above table it has been found that the payment period of both Hilton

and Green core corporation are similar under the same period which tends to clear legal and

policy. Apart from that, premier food Plc takes more times in order to meet their commitments.

Current ratio-

Analysis- From above illustration it can be said that the current ratio need to be presumed

to be 2 and that is only maintained by the Green core Plc in year 2019 at this extent. On the other

hand the two companies were reluctant to do so because of higher current obligations.

Net assets turnover ratio-

Interpretation- Net assets turnover ratio is generally prepared with the aim of handling

assets with much less timeline & cost and from above stated map it can be said that Hilton Food

corporation manges that effectively. Where as premier nutrition has low proportion that states

that they are not able to regulated their assets effectively.

Shareholders funds per employees-

Analysis- From above illustration, it can be said that there is a big difference among two

companies- premier and Hilton, since Premier Food corporation has strong recruiting funds and

that are approximately multiples of 3 than majority of these two companies.

Total assets per employee-

Interpretation- There is a substantial gap among two companies and Premier food

manufacturer has sufficient staff for operating business activities and in facts have 5 times more

than majority of two companies.

1c

From above mentioned reviews of all companies, it can be said that the Green Core

company got the best rank in context of performance. As they are effectively able to generate ore

incomes along with dividends in optimised manner and that refers to a biggest investment

potentials.

receivables from other two companies within stipulated time frame in context of creditors

payment period. Even though, Hilton Food corporation seeks to reimburse their debtors for a

quite bit longer. Over that, Green core company is able to lower their turnaround time related to

trade debts in a small duration of year 2020 compare to 2019.

Credit period-

Interpretation- From above table it has been found that the payment period of both Hilton

and Green core corporation are similar under the same period which tends to clear legal and

policy. Apart from that, premier food Plc takes more times in order to meet their commitments.

Current ratio-

Analysis- From above illustration it can be said that the current ratio need to be presumed

to be 2 and that is only maintained by the Green core Plc in year 2019 at this extent. On the other

hand the two companies were reluctant to do so because of higher current obligations.

Net assets turnover ratio-

Interpretation- Net assets turnover ratio is generally prepared with the aim of handling

assets with much less timeline & cost and from above stated map it can be said that Hilton Food

corporation manges that effectively. Where as premier nutrition has low proportion that states

that they are not able to regulated their assets effectively.

Shareholders funds per employees-

Analysis- From above illustration, it can be said that there is a big difference among two

companies- premier and Hilton, since Premier Food corporation has strong recruiting funds and

that are approximately multiples of 3 than majority of these two companies.

Total assets per employee-

Interpretation- There is a substantial gap among two companies and Premier food

manufacturer has sufficient staff for operating business activities and in facts have 5 times more

than majority of two companies.

1c

From above mentioned reviews of all companies, it can be said that the Green Core

company got the best rank in context of performance. As they are effectively able to generate ore

incomes along with dividends in optimised manner and that refers to a biggest investment

potentials.

Investment enticement refers to a situation in which consumers has potential to benefits

something that is related to gaining except chances (De Villiers and Maroun, 2017). The aim to

developing wealth by functioning the advantages is related to management of money. Here,

Green Core manufacturer provides an excellent opportunities to their potential consumers as they

will able to produce greater yields in upcoming year.

SECTION B

2a.

From very ongoing existence of finances, the term internal data via finances are produces

by economic systems. These refers to borrowing/ lending or capital initially identified by

business as opposed to financing like loan issued by financial individual as various environment

(Makrani and Matoufi, 2019). Financial information channels are incomes generated,

investments/ assets disposition along with comprehensive managing of cash flow funds. Internal

organisational larger resources are acquirable to business entities are as:

Retained earning- Delayed revenue mentioned on financial statements are known as an

inherent financial resources for companies based on sole so that it will able to become final

income of institution. Retained earning refers to incomes that leftover after the distribution which

have been paid to shareholders or stockholders (Statman, 2018). Interest incomes except

lengthier rentals and obligation are lengthener resources of corporate financing in which no

mandatory maturity occurs. Earning related with the loaned funds are not specified as a fixed

obligation on annual fees or repayment period.

Equity financing- Equity investment refers to selling of sample weight for getting more

money. Shareholders who buy stocks also get right related to the voting. Equity capital may be

related with the selling of fair values, like new stocks, ordinary shares equity options etc. a

business unit which faces the needs of funds in order to expand business seeks to acquire in two

different manners and that are debt and equity (Fu-le, 2018). Equity finance demesne selling of

leftover values and provides a shares to consumers related to business unit in exchanges of cash.

The percentage of business that is offered in equity relies on how much investments has spent in

business in ending of funds and what are the valued expenditure. For instance an expenditure

who spend $ 600, 000 initially to a firm and then eventually own all the reaming stocks.

Debt financing- Debt funding occur when a company increase their funds by selling their

debts securities to peoples or to those firm who are interest in investments for cash flow or

something that is related to gaining except chances (De Villiers and Maroun, 2017). The aim to

developing wealth by functioning the advantages is related to management of money. Here,

Green Core manufacturer provides an excellent opportunities to their potential consumers as they

will able to produce greater yields in upcoming year.

SECTION B

2a.

From very ongoing existence of finances, the term internal data via finances are produces

by economic systems. These refers to borrowing/ lending or capital initially identified by

business as opposed to financing like loan issued by financial individual as various environment

(Makrani and Matoufi, 2019). Financial information channels are incomes generated,

investments/ assets disposition along with comprehensive managing of cash flow funds. Internal

organisational larger resources are acquirable to business entities are as:

Retained earning- Delayed revenue mentioned on financial statements are known as an

inherent financial resources for companies based on sole so that it will able to become final

income of institution. Retained earning refers to incomes that leftover after the distribution which

have been paid to shareholders or stockholders (Statman, 2018). Interest incomes except

lengthier rentals and obligation are lengthener resources of corporate financing in which no

mandatory maturity occurs. Earning related with the loaned funds are not specified as a fixed

obligation on annual fees or repayment period.

Equity financing- Equity investment refers to selling of sample weight for getting more

money. Shareholders who buy stocks also get right related to the voting. Equity capital may be

related with the selling of fair values, like new stocks, ordinary shares equity options etc. a

business unit which faces the needs of funds in order to expand business seeks to acquire in two

different manners and that are debt and equity (Fu-le, 2018). Equity finance demesne selling of

leftover values and provides a shares to consumers related to business unit in exchanges of cash.

The percentage of business that is offered in equity relies on how much investments has spent in

business in ending of funds and what are the valued expenditure. For instance an expenditure

who spend $ 600, 000 initially to a firm and then eventually own all the reaming stocks.

Debt financing- Debt funding occur when a company increase their funds by selling their

debts securities to peoples or to those firm who are interest in investments for cash flow or

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

capital spending. Person/ entities act as borrowers in exchange of loan money and they assured a

guarantee related with the principles and interest on loan will be returned. There are three

method could be acquired by companies related to security of funds by funding i.e. capital,

borrowing or combination of both. Equity tends a portion of companies share. It provides a

benefit related to profit to potential investors so that it will not become necessary to repaid in

full. If business goes in flop, then equity shares are those who comes in line for earning

compensation. Where as other path is debt financing, in this business increase their money by

issuing the debts.

Term loan- term loan refers to a loan that is taken by individual from back for a specific

amount for a specific repayments schedule, it is either fixed or floating interest rate. For a

existing small corporation with strong or solid financial reports, the rate of loan is also fixed

(Corrales, Fenwick and Haapio, 2019). Additionally, in order to decline the sum of interest as

well as overall cost of mortgage, loan rate could involve high lump sum. In financing business

the revolving loan is normally between one to 25 years for machinery, property development or

for system equipment written off. Sometime a small organisation uses money as a revolving loan

in order to purchase capital assets for operating the operation or function of company like

machinery or new home. Any company which borrow money according to their requirement on

monthly basis will be return by them after completion of month. Most of the bank have build

term-loan programs primarily to supports the company in effective manner.

2b

Retained earning- It is a predominated famous approach in order to lengthier the funds in

all chosen companies. This help in using the leftover income of company even though it has

certain consequences towards rights of present stakeholders of group (Jones and et.al., 2018).

Underneath is a comprehensive discussion in context of how this origin will influence the

interest of all parties with relevance to Green Core Group:

Stockholders or shareholders- Overall equity of investors along with financial trust of

investors would got affects if they are using retained earning as the retained earning leads to a

dispersed among existing managers.

Provider or lenders- allocation of cash flow would effects the image of companies along

with creditors an this is illustrated by shortcomings of company in current realistic situation.

guarantee related with the principles and interest on loan will be returned. There are three

method could be acquired by companies related to security of funds by funding i.e. capital,

borrowing or combination of both. Equity tends a portion of companies share. It provides a

benefit related to profit to potential investors so that it will not become necessary to repaid in

full. If business goes in flop, then equity shares are those who comes in line for earning

compensation. Where as other path is debt financing, in this business increase their money by

issuing the debts.

Term loan- term loan refers to a loan that is taken by individual from back for a specific

amount for a specific repayments schedule, it is either fixed or floating interest rate. For a

existing small corporation with strong or solid financial reports, the rate of loan is also fixed

(Corrales, Fenwick and Haapio, 2019). Additionally, in order to decline the sum of interest as

well as overall cost of mortgage, loan rate could involve high lump sum. In financing business

the revolving loan is normally between one to 25 years for machinery, property development or

for system equipment written off. Sometime a small organisation uses money as a revolving loan

in order to purchase capital assets for operating the operation or function of company like

machinery or new home. Any company which borrow money according to their requirement on

monthly basis will be return by them after completion of month. Most of the bank have build

term-loan programs primarily to supports the company in effective manner.

2b

Retained earning- It is a predominated famous approach in order to lengthier the funds in

all chosen companies. This help in using the leftover income of company even though it has

certain consequences towards rights of present stakeholders of group (Jones and et.al., 2018).

Underneath is a comprehensive discussion in context of how this origin will influence the

interest of all parties with relevance to Green Core Group:

Stockholders or shareholders- Overall equity of investors along with financial trust of

investors would got affects if they are using retained earning as the retained earning leads to a

dispersed among existing managers.

Provider or lenders- allocation of cash flow would effects the image of companies along

with creditors an this is illustrated by shortcomings of company in current realistic situation.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Employees: Use of reaming benefits directly affects the funds of company which are

allotted to employees. Each specific employees declines the wealth and that can affects the

performance of employees in order to get financial success (Scase and Goffee, 2017). This leads

to an increment in size of employees and that turn to unemployment.

CONCLUSION

From above discussed report it has been expressed that components of finance related

with the corporate plays essential roles in order to manage all function or activities of finance.

Companies run their operation with the help of assets along with funds and if company do not

posses any kind of funds then they do not have direct impact thorough market. Mangers of

organisation will guide and monitor related with the flow of resources as well as guide a course

of operation by effectively paying contribution towards profitability & expenditure of company.

allotted to employees. Each specific employees declines the wealth and that can affects the

performance of employees in order to get financial success (Scase and Goffee, 2017). This leads

to an increment in size of employees and that turn to unemployment.

CONCLUSION

From above discussed report it has been expressed that components of finance related

with the corporate plays essential roles in order to manage all function or activities of finance.

Companies run their operation with the help of assets along with funds and if company do not

posses any kind of funds then they do not have direct impact thorough market. Mangers of

organisation will guide and monitor related with the flow of resources as well as guide a course

of operation by effectively paying contribution towards profitability & expenditure of company.

REFERENCE

Books & Journal

Corrales, M., Fenwick, M. and Haapio, H. eds., 2019. Legal Tech, Smart Contracts and

Blockchain. Springer.

De Villiers, C. and Maroun, W. eds., 2017. Sustainability accounting and integrated reporting.

Routledge.

Fu-le, W. A. N. G., 2018. Does Managers' Moods Really Matter in Disclosure? Evidence from

IPOs Roadshow. Business Management Journal. (2). p.8.

Holm, L., 2018. Cost Accounting and Financial Management for Construction Project

Managers. Routledge.

Jones, C., and et.al., 2018. Financial Management for Nurse Managers and Executives-E-Book.

Elsevier Health Sciences.

Kim, M., Schmidgall, R. S. and Damitio, J. W., 2017. Key managerial accounting skills for

lodging industry managers: The third phase of a repeated cross-sectional

study. International Journal of Hospitality & Tourism Administration. 18(1). pp.23-40.

Lail, B. E. and Martin, G. W., 2017. Are entrenched managers’ accounting choices more

predictive of future cash flows?. Journal of Business Finance & Accounting. 44(5-6).

pp.593-610.

Makrani, S. V. M. and Matoufi, A., 2019. The impact of accounting estimates on performance-

emphasizing managers’ Myopia. SMART Journal of Business Management Studies. 15(1).

pp.29-38.

Scase, R. and Goffee, R., 2017. Reluctant Managers (Routledge Revivals): Their Work and

Lifestyles. Routledge.

Statman, M., 2018. Behavioral Finance Lessons for Asset Managers. The Journal of Portfolio

Management. 44(7). pp.135-147.

Books & Journal

Corrales, M., Fenwick, M. and Haapio, H. eds., 2019. Legal Tech, Smart Contracts and

Blockchain. Springer.

De Villiers, C. and Maroun, W. eds., 2017. Sustainability accounting and integrated reporting.

Routledge.

Fu-le, W. A. N. G., 2018. Does Managers' Moods Really Matter in Disclosure? Evidence from

IPOs Roadshow. Business Management Journal. (2). p.8.

Holm, L., 2018. Cost Accounting and Financial Management for Construction Project

Managers. Routledge.

Jones, C., and et.al., 2018. Financial Management for Nurse Managers and Executives-E-Book.

Elsevier Health Sciences.

Kim, M., Schmidgall, R. S. and Damitio, J. W., 2017. Key managerial accounting skills for

lodging industry managers: The third phase of a repeated cross-sectional

study. International Journal of Hospitality & Tourism Administration. 18(1). pp.23-40.

Lail, B. E. and Martin, G. W., 2017. Are entrenched managers’ accounting choices more

predictive of future cash flows?. Journal of Business Finance & Accounting. 44(5-6).

pp.593-610.

Makrani, S. V. M. and Matoufi, A., 2019. The impact of accounting estimates on performance-

emphasizing managers’ Myopia. SMART Journal of Business Management Studies. 15(1).

pp.29-38.

Scase, R. and Goffee, R., 2017. Reluctant Managers (Routledge Revivals): Their Work and

Lifestyles. Routledge.

Statman, M., 2018. Behavioral Finance Lessons for Asset Managers. The Journal of Portfolio

Management. 44(7). pp.135-147.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.