Financial Analysis: CVP, Pricing, and Funding for AHTC (Finance)

VerifiedAdded on 2019/12/03

|18

|4957

|22

Report

AI Summary

This report provides a comprehensive financial analysis of Angamah Happy Tours Company (AHTC). It examines the application of Cost-Volume-Profit (CVP) analysis in financial management, evaluating its importance in cost and pricing decisions within the travel and tourism sector. The report assesses various pricing methods, including cost-plus, mark-up, demand-based, and competition-based pricing, to determine optimal pricing strategies for AHTC's holiday trips. Furthermore, it analyzes factors influencing profit, such as changes in meal costs, tax rates, and fuel prices. The report also explores management accounting information, including forecasting and budgeting, and evaluates investment appraisal techniques such as NPV and payback period. Ratio analysis is conducted to interpret financial statements and assess profitability, liquidity, efficiency, and investment. Finally, the report identifies potential internal and external sources of funding for AHTC's development, including the expansion of a new hotel.

Finance and

Funding

Funding

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

introduction .....................................................................................................................................4

Task 1...............................................................................................................................................4

A. Examining the concept of CVP analysis along with evaluating its importance in the fiscal

management of a travel and tourism organization such as AHTC [P1.1]...................................4

B. Providing an evaluation of different pricing methods that can be used by AHTC to

determine the price to charge each tourist for one trip [P1.2].....................................................5

C. Analyzing the factors that will influence the profit AHTC will earn on the holiday trip

[P1.3]............................................................................................................................................6

D1 ................................................................................................................................................7

Task 2...............................................................................................................................................9

A. Explaining the wide range of management accounting information or data that are

considered in AHTC [P2.1].........................................................................................................9

B. Assessing the use of investment appraisal techniques as decision-making tools [P 2.2]......10

Task 3.............................................................................................................................................12

A. Interpreting the financial statements using appropriate ratios for profitability, liquidity,

efficiency, and investment [P3.1]..............................................................................................12

Task 4.............................................................................................................................................15

A. Analyzing the sources of funding that includes both internal and external that could help

the company for development of the new hotel [P4.1]..............................................................15

Conclusion ....................................................................................................................................16

REFERENCES..............................................................................................................................17

introduction .....................................................................................................................................4

Task 1...............................................................................................................................................4

A. Examining the concept of CVP analysis along with evaluating its importance in the fiscal

management of a travel and tourism organization such as AHTC [P1.1]...................................4

B. Providing an evaluation of different pricing methods that can be used by AHTC to

determine the price to charge each tourist for one trip [P1.2].....................................................5

C. Analyzing the factors that will influence the profit AHTC will earn on the holiday trip

[P1.3]............................................................................................................................................6

D1 ................................................................................................................................................7

Task 2...............................................................................................................................................9

A. Explaining the wide range of management accounting information or data that are

considered in AHTC [P2.1].........................................................................................................9

B. Assessing the use of investment appraisal techniques as decision-making tools [P 2.2]......10

Task 3.............................................................................................................................................12

A. Interpreting the financial statements using appropriate ratios for profitability, liquidity,

efficiency, and investment [P3.1]..............................................................................................12

Task 4.............................................................................................................................................15

A. Analyzing the sources of funding that includes both internal and external that could help

the company for development of the new hotel [P4.1]..............................................................15

Conclusion ....................................................................................................................................16

REFERENCES..............................................................................................................................17

INDEX OF TABLES

Table 1: Calculation of NPV for Proposal A..................................................................................9

Table 2: Calculation of NPV for Proposal B..................................................................................9

Table 3: Calculation of Payback period.........................................................................................10

Table 4: Ratio analysis ..................................................................................................................11

Table 1: Calculation of NPV for Proposal A..................................................................................9

Table 2: Calculation of NPV for Proposal B..................................................................................9

Table 3: Calculation of Payback period.........................................................................................10

Table 4: Ratio analysis ..................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

In the contemporary business environment, financial management is one of the most

crucial aspects of business management. In this context, it can be sated that every business entity

has to develop appropriate strategies in order to assess wide range of funds for attainment of

distinct business requirement such as expansion of business and new product development

(Lasher, 2010). In the process of financial management, the assessment of current profitability

and market position of company is playing vital role in selection of best source of finance as per

the ability of business to repay the loan value.

In the context of present assessment, this report tries to assess the importance of cost

value and profit analysis in various business decisions of Angamah Happy Tours Company. In

addition to that this report also evaluates different investment appraisal tactics through which the

management expands its hospitality and hotel business. It also determines different sources of

funds to meet business requirement. This report also carries out a ratio analysis to determine its

importance in business decision making process.

TASK 1

A. Examining the concept of CVP analysis along with evaluating its importance in the fiscal

management of a travel and tourism organization such as AHTC [P1.1]

Cost-Volume-Profit [CVP] analysis is being termed as analytical tool for studying the

relationship between volume, cost, prices, and profits. In the context of travel and tourism

business, this approach has been found very effective in evaluation of cost and pricing of

different services within hospitality business (Kaplan and Atkinson, 2015). It is very much an

extension, or even a part of marginal costing. It assists management in profit planning process as

per the distinct need of firm. With the help of CVP analysis, the management of Cost-Volume-

Profit is able to carry out foral profit planning and control in which management uses different

budgets and other forecasts. Therefore, it can be stated that the CVP analysis provides only an

overview of the profit planning process along with this approach examines the purpose and

reasonableness of such budgets and forecasts.

Importance of Cost-Volume-Profit [CVP] analysis in financial management of a travel and

tourism business such as AHTC

In the context of travel and tourism business, CVP analysis assists management by

providing an insight into the effects and inter-relationship of factors associated with

4

In the contemporary business environment, financial management is one of the most

crucial aspects of business management. In this context, it can be sated that every business entity

has to develop appropriate strategies in order to assess wide range of funds for attainment of

distinct business requirement such as expansion of business and new product development

(Lasher, 2010). In the process of financial management, the assessment of current profitability

and market position of company is playing vital role in selection of best source of finance as per

the ability of business to repay the loan value.

In the context of present assessment, this report tries to assess the importance of cost

value and profit analysis in various business decisions of Angamah Happy Tours Company. In

addition to that this report also evaluates different investment appraisal tactics through which the

management expands its hospitality and hotel business. It also determines different sources of

funds to meet business requirement. This report also carries out a ratio analysis to determine its

importance in business decision making process.

TASK 1

A. Examining the concept of CVP analysis along with evaluating its importance in the fiscal

management of a travel and tourism organization such as AHTC [P1.1]

Cost-Volume-Profit [CVP] analysis is being termed as analytical tool for studying the

relationship between volume, cost, prices, and profits. In the context of travel and tourism

business, this approach has been found very effective in evaluation of cost and pricing of

different services within hospitality business (Kaplan and Atkinson, 2015). It is very much an

extension, or even a part of marginal costing. It assists management in profit planning process as

per the distinct need of firm. With the help of CVP analysis, the management of Cost-Volume-

Profit is able to carry out foral profit planning and control in which management uses different

budgets and other forecasts. Therefore, it can be stated that the CVP analysis provides only an

overview of the profit planning process along with this approach examines the purpose and

reasonableness of such budgets and forecasts.

Importance of Cost-Volume-Profit [CVP] analysis in financial management of a travel and

tourism business such as AHTC

In the context of travel and tourism business, CVP analysis assists management by

providing an insight into the effects and inter-relationship of factors associated with

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

financial management such as costing of hospitality services, profit margin and etc.

Which influence the profits of the firm (Anderson and et.al, 2015). The relationship

between cost, volume and profit provides a basis to travel and tourism firm to determine

the profit structure that helps organization for handling of various aspects of financial

management as per the distinct needs of Angamah Happy Tours Company. Therefore, it

can be stated that the CVP relationship becomes essential for budgeting and profit

planning.

In the context of financial management, profit planning plays important role through

which management is able to good profit within good price. As a starting point in profit

planning, CVP analysis has been found very effective to assess the maximum sales

volume to avoid losses which is equal to cost of travel and tourism related services

(Chandra, 2011). Furthermore, this system assists tour operator to determine the sales

volume in the financial planning through which different objectives of the firm will be

achieved associated with profitability. As an ultimate objective it helps in evaluation of

various most profitable mixture that is related with costs and quantity that provides

assistance in determination of sales target as per the corporate goals.

The travel and tourism industry is greatly influenced by different seasonal element. In

this context, AHTC has to consider the dynamic management so as application of CVP

analysis helps manager in order to predict and evaluate the implications of its short run

decisions associated with the fixed costs, marginal costs, sales volume and selling price

for its profit plans on a continuous basis (Moyer and et.al, 2011).

B. Providing an evaluation of different pricing methods that can be used by AHTC to determine

the price to charge each tourist for one trip [P1.2].

In the context of travel and tourism sector, AHTC can use different kinds of pricing

tactics in order to determine reliable price to charge each tourist on the trip. In this regard, some

most important pricing tactics are evaluated below:

Cost plus pricing: It is termed as most widely used tool which is used by each business

entity to determine final price of products and services. It involves the addition of a

certain proportion to cost to determine an appropriate price (Petty and Gruber, 2011).

This approach has been found simpler approach in which AHTC determines the costs and

add a definite percentage to get at the selling price.

5

Which influence the profits of the firm (Anderson and et.al, 2015). The relationship

between cost, volume and profit provides a basis to travel and tourism firm to determine

the profit structure that helps organization for handling of various aspects of financial

management as per the distinct needs of Angamah Happy Tours Company. Therefore, it

can be stated that the CVP relationship becomes essential for budgeting and profit

planning.

In the context of financial management, profit planning plays important role through

which management is able to good profit within good price. As a starting point in profit

planning, CVP analysis has been found very effective to assess the maximum sales

volume to avoid losses which is equal to cost of travel and tourism related services

(Chandra, 2011). Furthermore, this system assists tour operator to determine the sales

volume in the financial planning through which different objectives of the firm will be

achieved associated with profitability. As an ultimate objective it helps in evaluation of

various most profitable mixture that is related with costs and quantity that provides

assistance in determination of sales target as per the corporate goals.

The travel and tourism industry is greatly influenced by different seasonal element. In

this context, AHTC has to consider the dynamic management so as application of CVP

analysis helps manager in order to predict and evaluate the implications of its short run

decisions associated with the fixed costs, marginal costs, sales volume and selling price

for its profit plans on a continuous basis (Moyer and et.al, 2011).

B. Providing an evaluation of different pricing methods that can be used by AHTC to determine

the price to charge each tourist for one trip [P1.2].

In the context of travel and tourism sector, AHTC can use different kinds of pricing

tactics in order to determine reliable price to charge each tourist on the trip. In this regard, some

most important pricing tactics are evaluated below:

Cost plus pricing: It is termed as most widely used tool which is used by each business

entity to determine final price of products and services. It involves the addition of a

certain proportion to cost to determine an appropriate price (Petty and Gruber, 2011).

This approach has been found simpler approach in which AHTC determines the costs and

add a definite percentage to get at the selling price.

5

Mark-up pricing: It is a variation of cost pricing in which mark-up values are evaluated

by considering a proportion of the selling price. In this process of percentage of the cost

price is not considered in determination selling price. It plays important role in the

pricing of high end goods and services.

Demand-based Pricing: According to this approach, the price of a product or service is

determined as per its market demand. When the demand of particular product is going up

than business entity sets high prices in order to gain more profit from different products

and services (Driouchi and Bennett, 2012). On the other hand, when the demand of

certain product is less than the low prices are used by companies in order to attract the

customers. This tool plays important role in pricing of tour packages of AHTC due to

great impact of seasonality factor. The success of demand-based pricing is mainly

associated with the ability of marketing department of company.

Competition-based Pricing: This approach is considered as an important tool through

which an organization sets the prices of different products and service as per the pricing

of competitors. In this context, the organization may charge higher, lower, or equal prices

by considering the prices of its competitors to handle market competition (Lusardi, 2012).

The aviation business is termed as the best illustration competition-based evaluation in

which airline companies charge the same or fewer prices for same routes as charged by

their competitors.

C. Analysing the factors that will influence the profit AHTC will earn on the holiday trip [P1.3].

As per the given case, The Angamah Happy Tours Company (AHTC) is planning a

summer holiday trip to a Caribbean Holiday Resort lasting one month. In this context, there have

been several factors are evaluated that influence the profit earning capacity of business entity

from particular holiday cost trip. In this context, some most important factors are explained

below:

Change in cost of meal: The cost of food products plays vital role in determination of

costing of different food products which are offered by Angamah Happy Tours Company

during breakfast, lunch and dinner (Merigó and Casanovas, 2011). In this context, it has

been analysed that it prices of food ingredients are raised than the tour operator faces

increase in cost that would reduce the profit business. Therefore, prices of food product

are creating great impact on the overall costing of holiday package. As per the given case,

6

by considering a proportion of the selling price. In this process of percentage of the cost

price is not considered in determination selling price. It plays important role in the

pricing of high end goods and services.

Demand-based Pricing: According to this approach, the price of a product or service is

determined as per its market demand. When the demand of particular product is going up

than business entity sets high prices in order to gain more profit from different products

and services (Driouchi and Bennett, 2012). On the other hand, when the demand of

certain product is less than the low prices are used by companies in order to attract the

customers. This tool plays important role in pricing of tour packages of AHTC due to

great impact of seasonality factor. The success of demand-based pricing is mainly

associated with the ability of marketing department of company.

Competition-based Pricing: This approach is considered as an important tool through

which an organization sets the prices of different products and service as per the pricing

of competitors. In this context, the organization may charge higher, lower, or equal prices

by considering the prices of its competitors to handle market competition (Lusardi, 2012).

The aviation business is termed as the best illustration competition-based evaluation in

which airline companies charge the same or fewer prices for same routes as charged by

their competitors.

C. Analysing the factors that will influence the profit AHTC will earn on the holiday trip [P1.3].

As per the given case, The Angamah Happy Tours Company (AHTC) is planning a

summer holiday trip to a Caribbean Holiday Resort lasting one month. In this context, there have

been several factors are evaluated that influence the profit earning capacity of business entity

from particular holiday cost trip. In this context, some most important factors are explained

below:

Change in cost of meal: The cost of food products plays vital role in determination of

costing of different food products which are offered by Angamah Happy Tours Company

during breakfast, lunch and dinner (Merigó and Casanovas, 2011). In this context, it has

been analysed that it prices of food ingredients are raised than the tour operator faces

increase in cost that would reduce the profit business. Therefore, prices of food product

are creating great impact on the overall costing of holiday package. As per the given case,

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

company charges £125 per tourist for meals. Henceforth, increase in cost of food

ingredients would increase price of food meals.

Change in tax rate: Several taxes are imposed by public authority on various elements of

travel and tourism business such as service tax on accommodation, air transportation etc.,

property tax, green tax etc. All these taxes have direct impact on the cost and pricing of

different services which are offered by Angamah Happy Tours Company. If the public

authority influences tax rates than business entity would face increment in costing and

reduction in profit margin (Brigham and Ehrhardt, 2013). This is because there is very

tough competition identified in travel and tourism business so as increase in price of

hospitality services could reduce the demand of travel or holiday packages of Angamah

Happy Tours Company.

Variation in fuel prices: The cost of air-ticket posses maximum share in the overall

costing of holiday package of (AHTC) related to holiday trip to a Caribbean Holiday

Resort lasting one month. A small increment in fuel price leads negative impact on profit

of business entity (Schroeder, Clark and Cathey, 2011). This is because the management

of (AHTC) cannot increase the price of tour package in comparison of fuel price.

Therefore, business entity develops appropriate strategies for managing the performance

and profitability as per the current market trends. This thing influences the current cost of

air-ticket and accommodation which is £50,000.

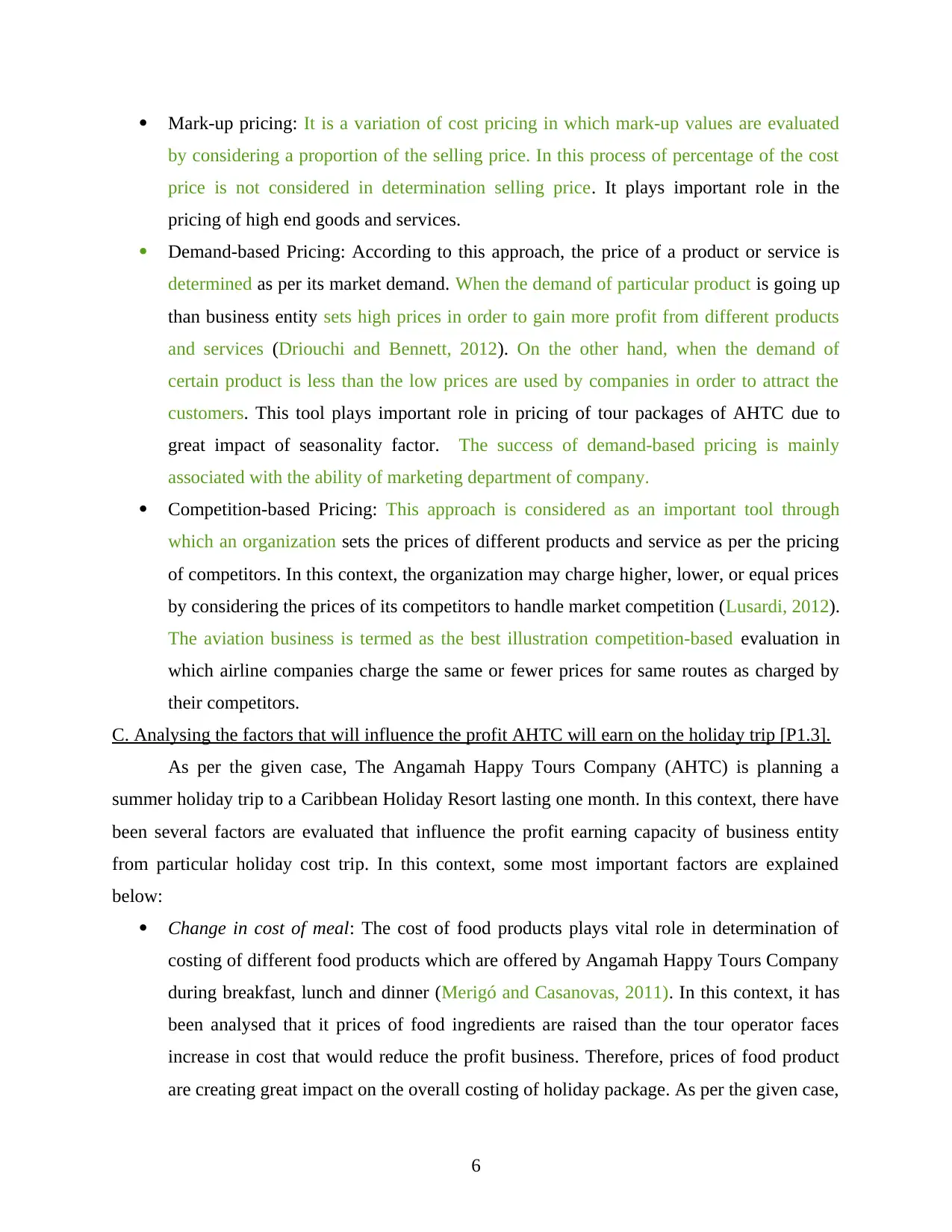

D1

Total number of

passenger 90

Price per member of

holiday trip 750

Meals cost charge by

company from

tourist 125

Total price 875

Total revenue of

company from 90

tourist 78750

Total cost of

company 50000

Profit of company 28750

7

ingredients would increase price of food meals.

Change in tax rate: Several taxes are imposed by public authority on various elements of

travel and tourism business such as service tax on accommodation, air transportation etc.,

property tax, green tax etc. All these taxes have direct impact on the cost and pricing of

different services which are offered by Angamah Happy Tours Company. If the public

authority influences tax rates than business entity would face increment in costing and

reduction in profit margin (Brigham and Ehrhardt, 2013). This is because there is very

tough competition identified in travel and tourism business so as increase in price of

hospitality services could reduce the demand of travel or holiday packages of Angamah

Happy Tours Company.

Variation in fuel prices: The cost of air-ticket posses maximum share in the overall

costing of holiday package of (AHTC) related to holiday trip to a Caribbean Holiday

Resort lasting one month. A small increment in fuel price leads negative impact on profit

of business entity (Schroeder, Clark and Cathey, 2011). This is because the management

of (AHTC) cannot increase the price of tour package in comparison of fuel price.

Therefore, business entity develops appropriate strategies for managing the performance

and profitability as per the current market trends. This thing influences the current cost of

air-ticket and accommodation which is £50,000.

D1

Total number of

passenger 90

Price per member of

holiday trip 750

Meals cost charge by

company from

tourist 125

Total price 875

Total revenue of

company from 90

tourist 78750

Total cost of

company 50000

Profit of company 28750

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

As per the above analysis, Angamah Happy Tours Company should organize a tip of 90

people. This is because company will generate good profit that could be £128750 which is more

than £10,000 as per the projected profit of company. By organizing a one month holiday trip to a

Caribbean Holiday Resort, organization would generate good return. Therefore, it can be

concluded a holiday plan from 90 people is beneficial of organization.

8

people. This is because company will generate good profit that could be £128750 which is more

than £10,000 as per the projected profit of company. By organizing a one month holiday trip to a

Caribbean Holiday Resort, organization would generate good return. Therefore, it can be

concluded a holiday plan from 90 people is beneficial of organization.

8

TASK 2

A. Explaining the wide range of management accounting information or data that are considered

in AHTC [P2.1].

The AHTC offers wide range of holiday packages as per the distinct needs of consumers.

In this context, the management of AHTC collects wide range of management accounting

information from distinct sources and accounting statements that play important role in strategic

planning process such as expansion of business in markets, new product development,

establishment of new ventures, mergers etc (Bierman Jr and Smidt, 2012). These entire elements

are playing important role for attainment of wide range of business objective. Different types of

management accounting information which are used by AHTC are evaluated below:

Forecasting: It is a most important approach which is used by each business for carrying

out strategic planning in order to assess the competitive edge over other firms. In the

planning for future operations, AHTC can carry out of forecasting. The primary objective

of the forecasting process is to predict or assess the result of future business operations

through trend analysis by evaluating the past revenue, sales as well as growth data (Adler,

2013). On the basis this information, AHTC is able to develop future plans associated

with business expansion and development of new products and services.

Budgeting: In the context of travel and tourism business, the budget process helps

management of Angamah Happy Tours Company in allocation capital future operations

as per the forecast. On the basis of this information, business entity allocates the funds for

new product development and merger along with acquisition of new firms.

Variance Analysis as well as Cost Accounting: The term variance analysis is termed as

procedure for carrying systematic comparison of the actual accomplished expenses with

reference to budgeted expenses. By assessing variation between actual and budgeted

expense of various services provided in holiday packages (Zager and Zager, 2006). Tour

operator firm is able to implement appropriate strategies for reducing cost and improving

service quality.

Ratio Analysis: Ratio analysis is considered as most important source of accounting

information. It provides wide range of information associated with liquidity, profitability

and efficiency of firm (Lasher, 2010). With reference to different ratio, AHTC is able to

predict profitability trends and current liquidity position of firm that lead significant

9

A. Explaining the wide range of management accounting information or data that are considered

in AHTC [P2.1].

The AHTC offers wide range of holiday packages as per the distinct needs of consumers.

In this context, the management of AHTC collects wide range of management accounting

information from distinct sources and accounting statements that play important role in strategic

planning process such as expansion of business in markets, new product development,

establishment of new ventures, mergers etc (Bierman Jr and Smidt, 2012). These entire elements

are playing important role for attainment of wide range of business objective. Different types of

management accounting information which are used by AHTC are evaluated below:

Forecasting: It is a most important approach which is used by each business for carrying

out strategic planning in order to assess the competitive edge over other firms. In the

planning for future operations, AHTC can carry out of forecasting. The primary objective

of the forecasting process is to predict or assess the result of future business operations

through trend analysis by evaluating the past revenue, sales as well as growth data (Adler,

2013). On the basis this information, AHTC is able to develop future plans associated

with business expansion and development of new products and services.

Budgeting: In the context of travel and tourism business, the budget process helps

management of Angamah Happy Tours Company in allocation capital future operations

as per the forecast. On the basis of this information, business entity allocates the funds for

new product development and merger along with acquisition of new firms.

Variance Analysis as well as Cost Accounting: The term variance analysis is termed as

procedure for carrying systematic comparison of the actual accomplished expenses with

reference to budgeted expenses. By assessing variation between actual and budgeted

expense of various services provided in holiday packages (Zager and Zager, 2006). Tour

operator firm is able to implement appropriate strategies for reducing cost and improving

service quality.

Ratio Analysis: Ratio analysis is considered as most important source of accounting

information. It provides wide range of information associated with liquidity, profitability

and efficiency of firm (Lasher, 2010). With reference to different ratio, AHTC is able to

predict profitability trends and current liquidity position of firm that lead significant

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

impact on various strategic decision such as assessment of new source of funds and

handling of market competition etc.

Accounting for Decision Making: Management accounting is termed as a process of in

which business entity uses wide range of accounting data through top management of

business is able to take appropriate business decisions with reference to current trends,

facts, etc. (Kaplan and Atkinson, 2015). All strategic decision such as improvement in

service quality, costing, business expansion, etc. are mainly based on different kinds

accounting data that have been gained through different accounting process.

B. Assessing the use of investment appraisal techniques as decision-making tools [P 2.2]

In the process business expansion, an organization uses wide range of investment

appraisal tactics to assess efficiency and profitability of investment project. Angamah Happy

Tours Company can consider below mentioned approaches to examine different investment

proposal to increase variety of services:

Net present value: This approach provides assistance to organization in order to measure

the present value of future cash inflow as per the particular discounted rate (Anderson

and et.al, 2015). This process is very help full in travel tourism business in assessment of

present value future cash inflow.

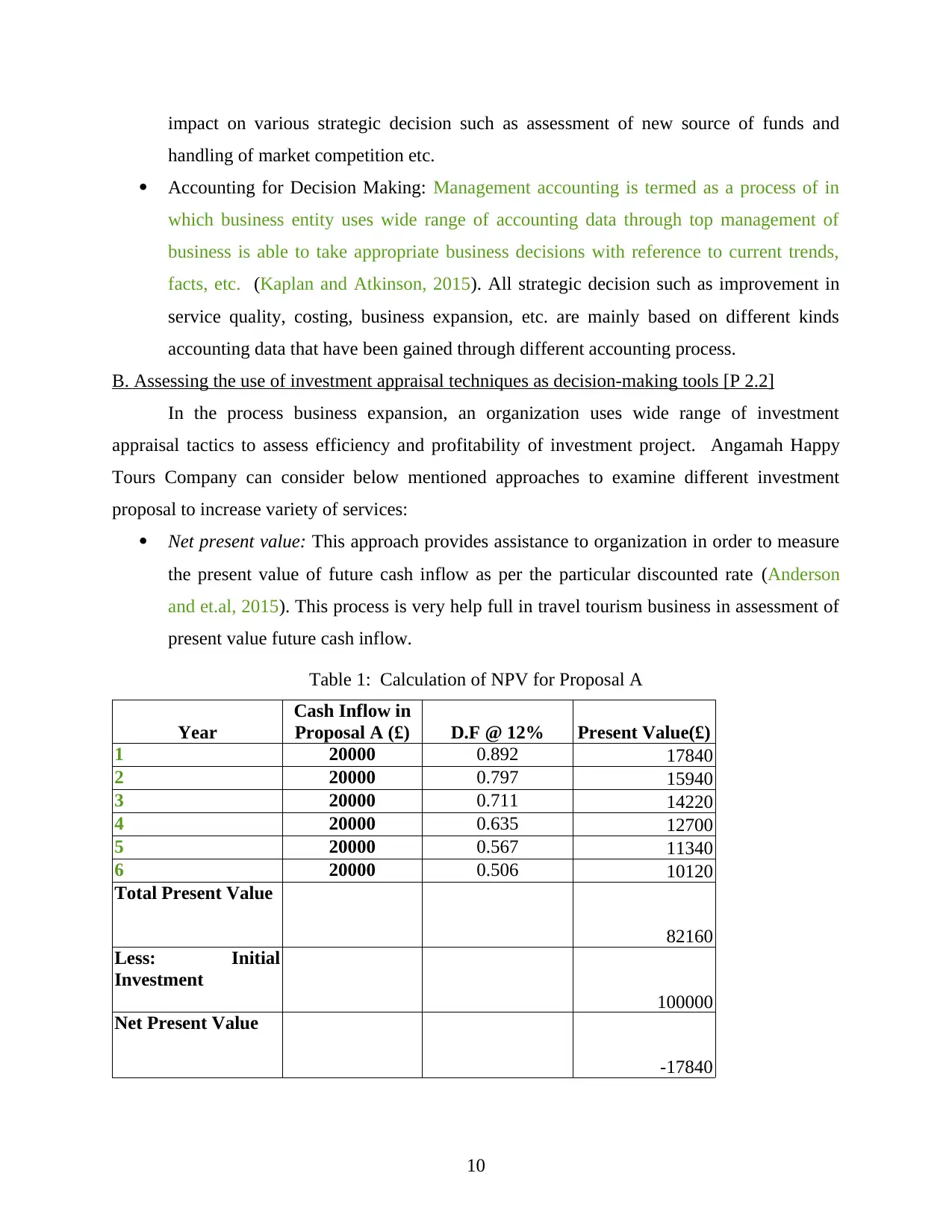

Table 1: Calculation of NPV for Proposal A

Year

Cash Inflow in

Proposal A (£) D.F @ 12% Present Value(£)

1 20000 0.892 17840

2 20000 0.797 15940

3 20000 0.711 14220

4 20000 0.635 12700

5 20000 0.567 11340

6 20000 0.506 10120

Total Present Value

82160

Less: Initial

Investment

100000

Net Present Value

-17840

10

handling of market competition etc.

Accounting for Decision Making: Management accounting is termed as a process of in

which business entity uses wide range of accounting data through top management of

business is able to take appropriate business decisions with reference to current trends,

facts, etc. (Kaplan and Atkinson, 2015). All strategic decision such as improvement in

service quality, costing, business expansion, etc. are mainly based on different kinds

accounting data that have been gained through different accounting process.

B. Assessing the use of investment appraisal techniques as decision-making tools [P 2.2]

In the process business expansion, an organization uses wide range of investment

appraisal tactics to assess efficiency and profitability of investment project. Angamah Happy

Tours Company can consider below mentioned approaches to examine different investment

proposal to increase variety of services:

Net present value: This approach provides assistance to organization in order to measure

the present value of future cash inflow as per the particular discounted rate (Anderson

and et.al, 2015). This process is very help full in travel tourism business in assessment of

present value future cash inflow.

Table 1: Calculation of NPV for Proposal A

Year

Cash Inflow in

Proposal A (£) D.F @ 12% Present Value(£)

1 20000 0.892 17840

2 20000 0.797 15940

3 20000 0.711 14220

4 20000 0.635 12700

5 20000 0.567 11340

6 20000 0.506 10120

Total Present Value

82160

Less: Initial

Investment

100000

Net Present Value

-17840

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

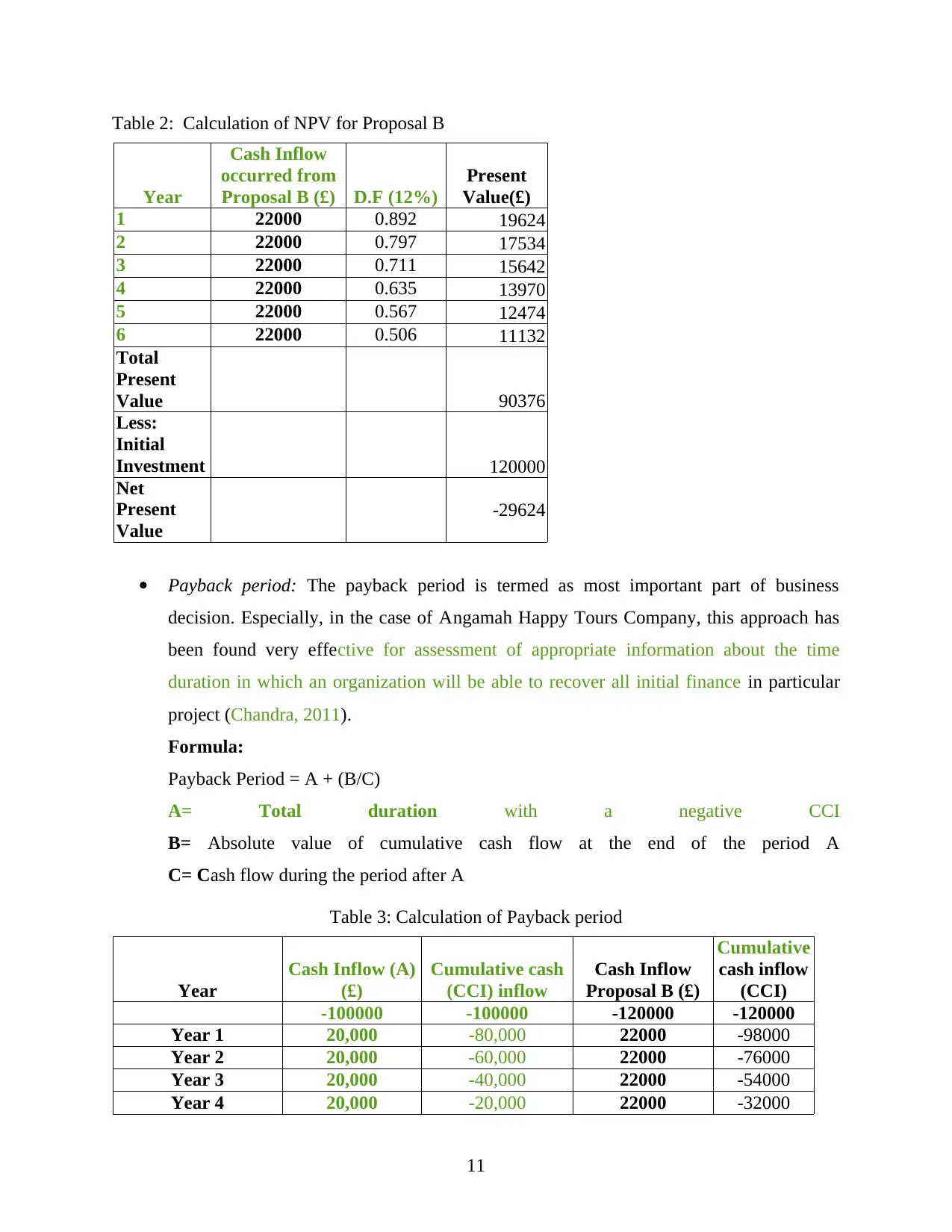

Table 2: Calculation of NPV for Proposal B

Year

Cash Inflow

occurred from

Proposal B (£) D.F (12%)

Present

Value(£)

1 22000 0.892 19624

2 22000 0.797 17534

3 22000 0.711 15642

4 22000 0.635 13970

5 22000 0.567 12474

6 22000 0.506 11132

Total

Present

Value 90376

Less:

Initial

Investment 120000

Net

Present

Value

-29624

Payback period: The payback period is termed as most important part of business

decision. Especially, in the case of Angamah Happy Tours Company, this approach has

been found very effective for assessment of appropriate information about the time

duration in which an organization will be able to recover all initial finance in particular

project (Chandra, 2011).

Formula:

Payback Period = A + (B/C)

A= Total duration with a negative CCI

B= Absolute value of cumulative cash flow at the end of the period A

C= Cash flow during the period after A

Table 3: Calculation of Payback period

Year

Cash Inflow (A)

(£)

Cumulative cash

(CCI) inflow

Cash Inflow

Proposal B (£)

Cumulative

cash inflow

(CCI)

-100000 -100000 -120000 -120000

Year 1 20,000 -80,000 22000 -98000

Year 2 20,000 -60,000 22000 -76000

Year 3 20,000 -40,000 22000 -54000

Year 4 20,000 -20,000 22000 -32000

11

Year

Cash Inflow

occurred from

Proposal B (£) D.F (12%)

Present

Value(£)

1 22000 0.892 19624

2 22000 0.797 17534

3 22000 0.711 15642

4 22000 0.635 13970

5 22000 0.567 12474

6 22000 0.506 11132

Total

Present

Value 90376

Less:

Initial

Investment 120000

Net

Present

Value

-29624

Payback period: The payback period is termed as most important part of business

decision. Especially, in the case of Angamah Happy Tours Company, this approach has

been found very effective for assessment of appropriate information about the time

duration in which an organization will be able to recover all initial finance in particular

project (Chandra, 2011).

Formula:

Payback Period = A + (B/C)

A= Total duration with a negative CCI

B= Absolute value of cumulative cash flow at the end of the period A

C= Cash flow during the period after A

Table 3: Calculation of Payback period

Year

Cash Inflow (A)

(£)

Cumulative cash

(CCI) inflow

Cash Inflow

Proposal B (£)

Cumulative

cash inflow

(CCI)

-100000 -100000 -120000 -120000

Year 1 20,000 -80,000 22000 -98000

Year 2 20,000 -60,000 22000 -76000

Year 3 20,000 -40,000 22000 -54000

Year 4 20,000 -20,000 22000 -32000

11

Year 5 20,000 0 22000 -10000

Year 6 20,000 20,000 22000 12000

Initial Investment 100000 120000

Payback period 5 years 5.45 years

Project A= 5+0/20000=5 years

Project B= 5+ (10000/22000) =5.45 years

As per the above assessment, it has been evaluated that the net present value of both

proposal A and B is negative. But, the assessment of payback period is determined that Proposal

A is beneficial for business entity. This is because the net present value of Proposal A is better

that Proposal B due to better net present value and lower payback period. So, travel and tourism

firm should select Proposal A.

TASK 3

A. Interpreting the financial statements using appropriate ratios for profitability, liquidity,

efficiency, and investment [P3.1]

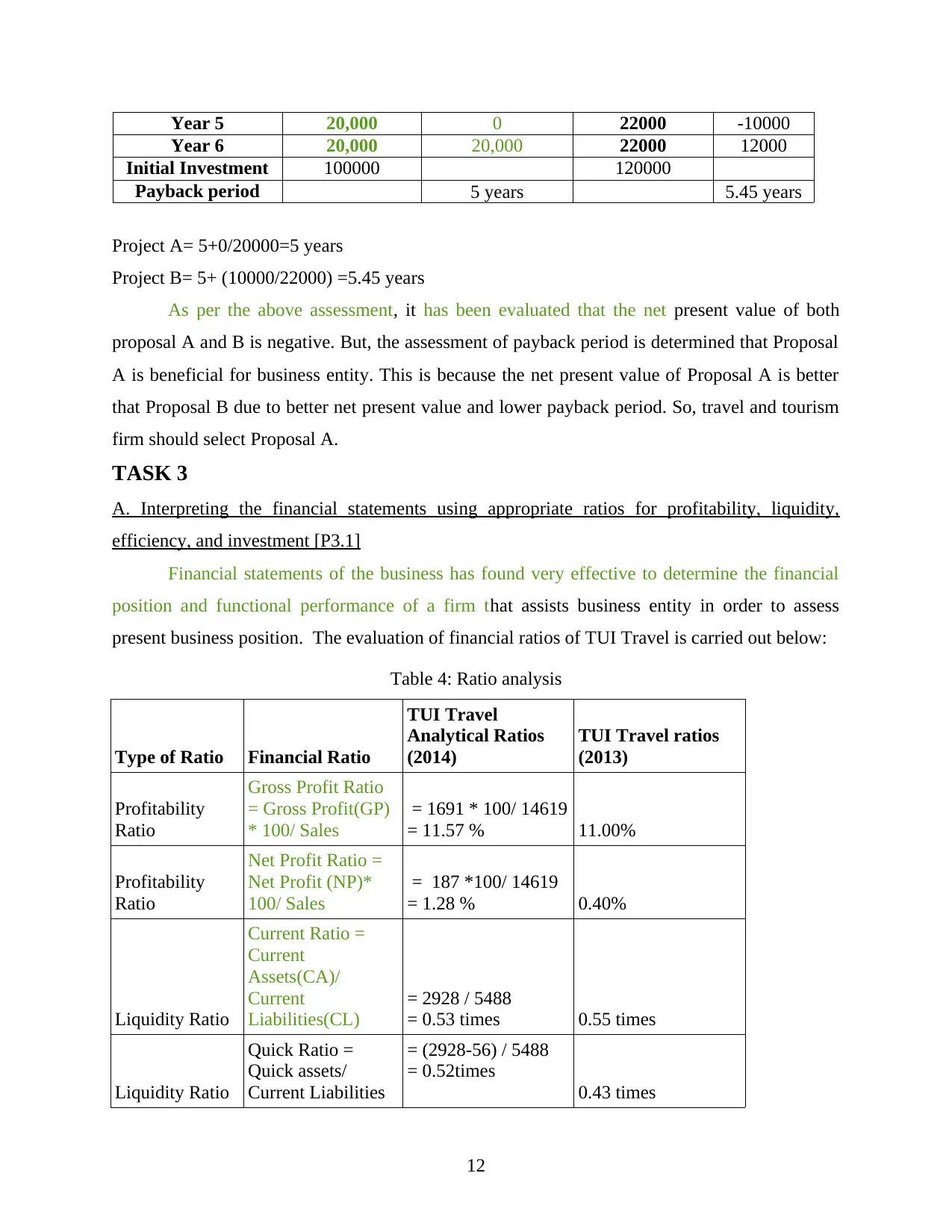

Financial statements of the business has found very effective to determine the financial

position and functional performance of a firm that assists business entity in order to assess

present business position. The evaluation of financial ratios of TUI Travel is carried out below:

Table 4: Ratio analysis

Type of Ratio Financial Ratio

TUI Travel

Analytical Ratios

(2014)

TUI Travel ratios

(2013)

Profitability

Ratio

Gross Profit Ratio

= Gross Profit(GP)

* 100/ Sales

= 1691 * 100/ 14619

= 11.57 % 11.00%

Profitability

Ratio

Net Profit Ratio =

Net Profit (NP)*

100/ Sales

= 187 *100/ 14619

= 1.28 % 0.40%

Liquidity Ratio

Current Ratio =

Current

Assets(CA)/

Current

Liabilities(CL)

= 2928 / 5488

= 0.53 times 0.55 times

Liquidity Ratio

Quick Ratio =

Quick assets/

Current Liabilities

= (2928-56) / 5488

= 0.52times

0.43 times

12

Year 6 20,000 20,000 22000 12000

Initial Investment 100000 120000

Payback period 5 years 5.45 years

Project A= 5+0/20000=5 years

Project B= 5+ (10000/22000) =5.45 years

As per the above assessment, it has been evaluated that the net present value of both

proposal A and B is negative. But, the assessment of payback period is determined that Proposal

A is beneficial for business entity. This is because the net present value of Proposal A is better

that Proposal B due to better net present value and lower payback period. So, travel and tourism

firm should select Proposal A.

TASK 3

A. Interpreting the financial statements using appropriate ratios for profitability, liquidity,

efficiency, and investment [P3.1]

Financial statements of the business has found very effective to determine the financial

position and functional performance of a firm that assists business entity in order to assess

present business position. The evaluation of financial ratios of TUI Travel is carried out below:

Table 4: Ratio analysis

Type of Ratio Financial Ratio

TUI Travel

Analytical Ratios

(2014)

TUI Travel ratios

(2013)

Profitability

Ratio

Gross Profit Ratio

= Gross Profit(GP)

* 100/ Sales

= 1691 * 100/ 14619

= 11.57 % 11.00%

Profitability

Ratio

Net Profit Ratio =

Net Profit (NP)*

100/ Sales

= 187 *100/ 14619

= 1.28 % 0.40%

Liquidity Ratio

Current Ratio =

Current

Assets(CA)/

Current

Liabilities(CL)

= 2928 / 5488

= 0.53 times 0.55 times

Liquidity Ratio

Quick Ratio =

Quick assets/

Current Liabilities

= (2928-56) / 5488

= 0.52times

0.43 times

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.