Finance and Funding in Travel and Tourism Sector - Eurocarib Tours

VerifiedAdded on 2021/02/18

|16

|4721

|13

Report

AI Summary

This report provides a comprehensive overview of finance and funding within the travel and tourism sector, using Eurocarib Tours as a case study. It explores the importance of cost and volume in financial management, examining cost reduction strategies, decision-making processes, and the application of break-even analysis, economies of scale, and CVP analysis. The report then delves into various pricing techniques employed in the sector, including cost-based, demand-based, and competition-oriented pricing, along with seasonal pricing strategies. Furthermore, it analyzes factors that influence profits in the context of a Caribbean holiday trip, such as airplane charges, accommodation costs, and the number of tourists. Finally, it discusses different types of management accounting information, including budget reports, financial statements, and variance analysis, and the use of investment appraisal techniques as decision-making tools. The report also includes an interpretation of financial statements of a tour and tourism company and an analysis of the source and distribution of funds for the development of capital projects associated with tourism.

Finance and Funding in

Travel and Tourism Sector

Travel and Tourism Sector

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1: Importance of cost and volume in financial management of T&T business........................1

1.2: Pricing techniques which are implemented in travel and tourism sector.............................2

1.3: Factors that influence profits earn on the holiday trip..........................................................3

TASK 2............................................................................................................................................4

2.1: Different type of management accounting information........................................................4

2.2: Use of investment appraisal techniques as decision-making tools ......................................5

TASK 3............................................................................................................................................5

3.1: Interpretation of financial statements of tour and tourism company....................................5

TASK 4............................................................................................................................................9

4.1:Analysis of source and distribution of funds for the development of capital project

associated with tourism................................................................................................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1: Importance of cost and volume in financial management of T&T business........................1

1.2: Pricing techniques which are implemented in travel and tourism sector.............................2

1.3: Factors that influence profits earn on the holiday trip..........................................................3

TASK 2............................................................................................................................................4

2.1: Different type of management accounting information........................................................4

2.2: Use of investment appraisal techniques as decision-making tools ......................................5

TASK 3............................................................................................................................................5

3.1: Interpretation of financial statements of tour and tourism company....................................5

TASK 4............................................................................................................................................9

4.1:Analysis of source and distribution of funds for the development of capital project

associated with tourism................................................................................................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Finance is defined as the systematic administration of fund and money and includes

activities like investing, borrowing, lending, budgeting, saving, and forecasting . Funding is an

activity which includes providing financial funds, usually in monetary term, or other amount

such as time or effort, to finance a demand, arrangements, and activity, by an enterprise.

Financing and funding are used in business to allocate its monetary or non monetary resources in

required areas and better utilisation of these available resources. This report describes finance

and funding activities in the context of travel and tourism sector company EUROCARIB

TOURS. Relevant approaches in relation to financing and funding are discussed and issues are

addressed in this context (Evans, Stonehouse and Campbell, 2012). This reports exhibits

importance of costs and volume in financial management of travel and tourism businesses, and a

systematic analysis of pricing methods and factors that will influence profits of an enterprise.

TASK 1

1.1: Importance of cost and volume in financial management of T&T business

Eurocarib tours : Eurocarib tours is a major London-based European tour operator

focusing on Caribbean holidays. Eurocarib tours is planning a summer holiday trip to a

Caribbean Holiday Resort lasting one month. The company will charter an air plane that carries

only its tourists. The company will also book a floor of a hotel at the resort to accommodate its

tourists. The travel and tourism industry provides an attractive profitability conditions in

business in present scenario. In this industry a major growth can be seen in weekends and

holidays. While working in this industry a business organisation go through various aspects

related with finance such as :

Cost: Cost is a major part of financing and funding, in travelling and tourism industry

cost is the amount occur in in financing of tour packages for customers. Estimation of cost helps

in achieving targeted profits, in tourism and travel business predetermination of cost helps to

organise a trip and for providing packages to customers (Kimbu and Ngoasong, 2013).

Volume: Volume refers to quantity of products and services. Cost and budget are

allocated to volume of product or service. Volume denotes the level of production in quantity

terms. In the context of tour and travel business it can be seen as number of tickets people are

purchasing from company.

1

Finance is defined as the systematic administration of fund and money and includes

activities like investing, borrowing, lending, budgeting, saving, and forecasting . Funding is an

activity which includes providing financial funds, usually in monetary term, or other amount

such as time or effort, to finance a demand, arrangements, and activity, by an enterprise.

Financing and funding are used in business to allocate its monetary or non monetary resources in

required areas and better utilisation of these available resources. This report describes finance

and funding activities in the context of travel and tourism sector company EUROCARIB

TOURS. Relevant approaches in relation to financing and funding are discussed and issues are

addressed in this context (Evans, Stonehouse and Campbell, 2012). This reports exhibits

importance of costs and volume in financial management of travel and tourism businesses, and a

systematic analysis of pricing methods and factors that will influence profits of an enterprise.

TASK 1

1.1: Importance of cost and volume in financial management of T&T business

Eurocarib tours : Eurocarib tours is a major London-based European tour operator

focusing on Caribbean holidays. Eurocarib tours is planning a summer holiday trip to a

Caribbean Holiday Resort lasting one month. The company will charter an air plane that carries

only its tourists. The company will also book a floor of a hotel at the resort to accommodate its

tourists. The travel and tourism industry provides an attractive profitability conditions in

business in present scenario. In this industry a major growth can be seen in weekends and

holidays. While working in this industry a business organisation go through various aspects

related with finance such as :

Cost: Cost is a major part of financing and funding, in travelling and tourism industry

cost is the amount occur in in financing of tour packages for customers. Estimation of cost helps

in achieving targeted profits, in tourism and travel business predetermination of cost helps to

organise a trip and for providing packages to customers (Kimbu and Ngoasong, 2013).

Volume: Volume refers to quantity of products and services. Cost and budget are

allocated to volume of product or service. Volume denotes the level of production in quantity

terms. In the context of tour and travel business it can be seen as number of tickets people are

purchasing from company.

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Importance of costs:

Cost in a business organisation helps its owner in making decisions that enhances the

scope of sustainable growth and profitability. To determine cost a systematic process is adopted

by a business organisation whether in formal manner or not. (Heung, Kucukusta and Song,

2011). An organisation always focuses towards optimisation of cost while maintaining quality of

service and product .

Cost reduction: It is most considerable area for a business organisation. In tour and travel

business company always tries to provide attractive and better services to customer while

maintaining cost that helps organisation to achieve goals and to increase profitability.

Decision-making: Cost analysis helps finance department in making important decisions

regrading performance of company as compare to their competitors. To achieve

sustainable growth and performance evaluation of cost is important for a business

organisation.

Increasing performance of managers: Using data provided in cost system by analysing

various facts assists managerial personnel to increase their performance.

Importance of volume:

Trading volume, is the number of shares or contracts that points shows the overall

activity of a security or market for a given period. Trading amount/quantity is an important

technical indicator for a person or business who gives money to help start a business uses to

confirm a scenario or trend reversal. Volume gives investor an idea of the price action of a

security and whether they should buy or sell the security, following are the major aspects of

volume:

BEP Analysis: This is tool used by an organisation to determine the level company or

product or service will be most profitable (Chio, 2014.). Break-even analysis assists in evaluating

the relation between the variable cost, fixed cost and revenue. In practical term a company with

low fixed costs will have a low break-even sale such as a company with no fixed cost will

automatically have broken even upon the first sale of its product.

Economical of scale: It is a level in cost analysis that shows a increase in results related

with product and service. It assist the company to optimise variable cost per units due to

operational efficiency and sustainable growth(Thakran and Verma, 2013).

2

Cost in a business organisation helps its owner in making decisions that enhances the

scope of sustainable growth and profitability. To determine cost a systematic process is adopted

by a business organisation whether in formal manner or not. (Heung, Kucukusta and Song,

2011). An organisation always focuses towards optimisation of cost while maintaining quality of

service and product .

Cost reduction: It is most considerable area for a business organisation. In tour and travel

business company always tries to provide attractive and better services to customer while

maintaining cost that helps organisation to achieve goals and to increase profitability.

Decision-making: Cost analysis helps finance department in making important decisions

regrading performance of company as compare to their competitors. To achieve

sustainable growth and performance evaluation of cost is important for a business

organisation.

Increasing performance of managers: Using data provided in cost system by analysing

various facts assists managerial personnel to increase their performance.

Importance of volume:

Trading volume, is the number of shares or contracts that points shows the overall

activity of a security or market for a given period. Trading amount/quantity is an important

technical indicator for a person or business who gives money to help start a business uses to

confirm a scenario or trend reversal. Volume gives investor an idea of the price action of a

security and whether they should buy or sell the security, following are the major aspects of

volume:

BEP Analysis: This is tool used by an organisation to determine the level company or

product or service will be most profitable (Chio, 2014.). Break-even analysis assists in evaluating

the relation between the variable cost, fixed cost and revenue. In practical term a company with

low fixed costs will have a low break-even sale such as a company with no fixed cost will

automatically have broken even upon the first sale of its product.

Economical of scale: It is a level in cost analysis that shows a increase in results related

with product and service. It assist the company to optimise variable cost per units due to

operational efficiency and sustainable growth(Thakran and Verma, 2013).

2

Diseconomies of scale: It is level just opposite to the economical scale in which an

organisation faces adverse condition in relation to the performance and capabilities to generate

profits. These conditions arises due to high competition, low performance, compromise with

quality of services etc.

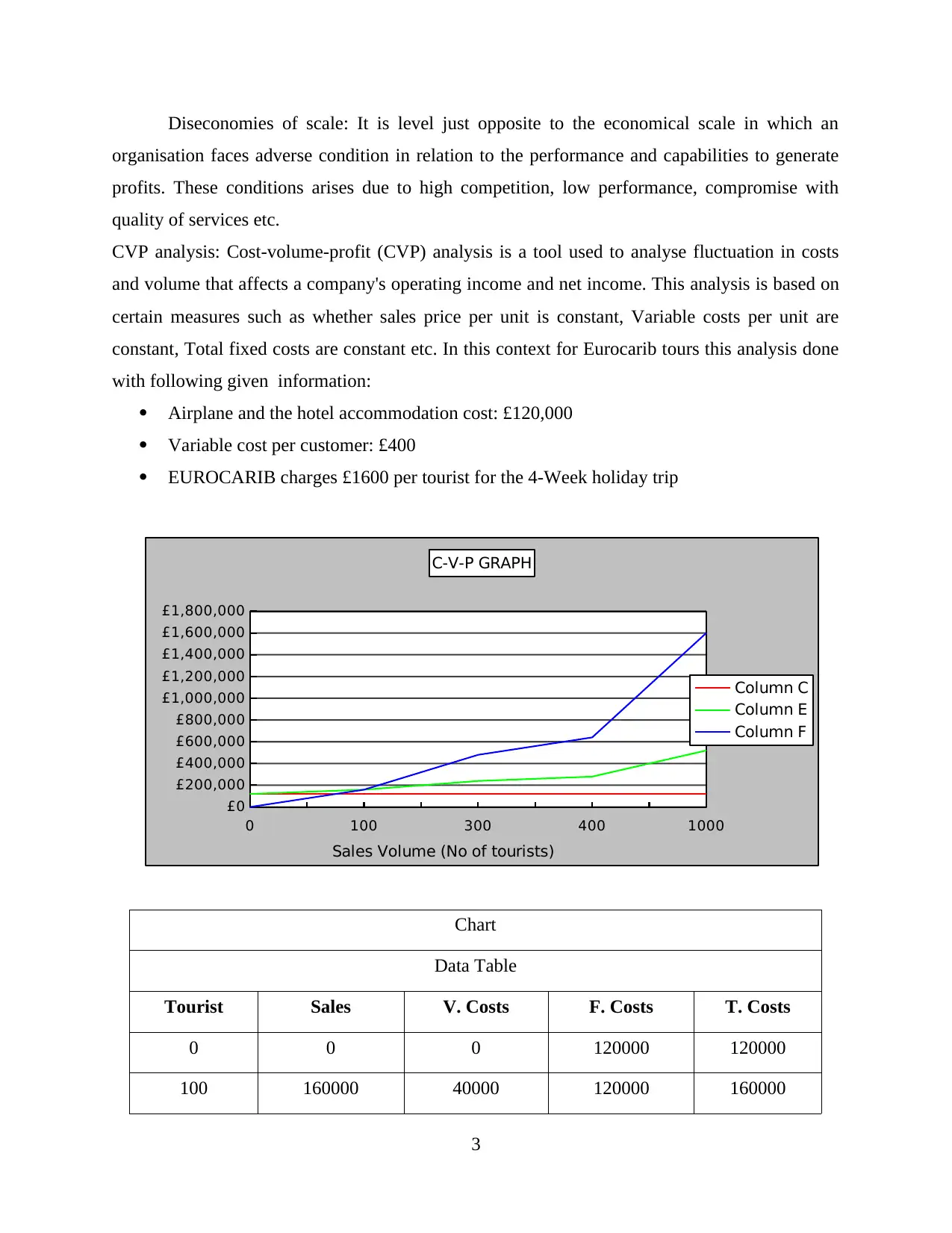

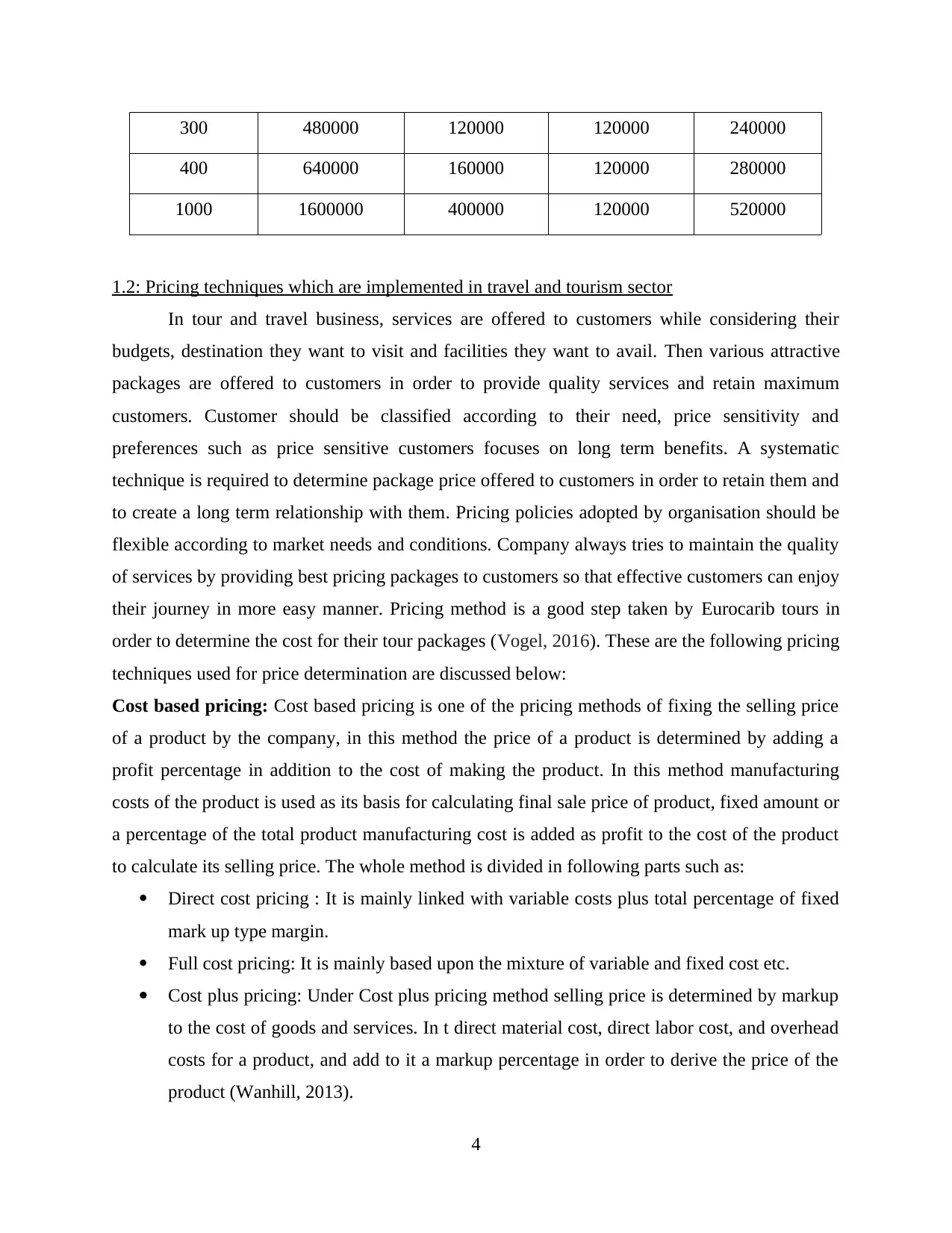

CVP analysis: Cost-volume-profit (CVP) analysis is a tool used to analyse fluctuation in costs

and volume that affects a company's operating income and net income. This analysis is based on

certain measures such as whether sales price per unit is constant, Variable costs per unit are

constant, Total fixed costs are constant etc. In this context for Eurocarib tours this analysis done

with following given information:

Airplane and the hotel accommodation cost: £120,000

Variable cost per customer: £400

EUROCARIB charges £1600 per tourist for the 4-Week holiday trip

Chart

Data Table

Tourist Sales V. Costs F. Costs T. Costs

0 0 0 120000 120000

100 160000 40000 120000 160000

3

0 100 300 400 1000

£0

£200,000

£400,000

£600,000

£800,000

£1,000,000

£1,200,000

£1,400,000

£1,600,000

£1,800,000

C-V-P GRAPH

Column C

Column E

Column F

Sales Volume (No of tourists)

organisation faces adverse condition in relation to the performance and capabilities to generate

profits. These conditions arises due to high competition, low performance, compromise with

quality of services etc.

CVP analysis: Cost-volume-profit (CVP) analysis is a tool used to analyse fluctuation in costs

and volume that affects a company's operating income and net income. This analysis is based on

certain measures such as whether sales price per unit is constant, Variable costs per unit are

constant, Total fixed costs are constant etc. In this context for Eurocarib tours this analysis done

with following given information:

Airplane and the hotel accommodation cost: £120,000

Variable cost per customer: £400

EUROCARIB charges £1600 per tourist for the 4-Week holiday trip

Chart

Data Table

Tourist Sales V. Costs F. Costs T. Costs

0 0 0 120000 120000

100 160000 40000 120000 160000

3

0 100 300 400 1000

£0

£200,000

£400,000

£600,000

£800,000

£1,000,000

£1,200,000

£1,400,000

£1,600,000

£1,800,000

C-V-P GRAPH

Column C

Column E

Column F

Sales Volume (No of tourists)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

300 480000 120000 120000 240000

400 640000 160000 120000 280000

1000 1600000 400000 120000 520000

1.2: Pricing techniques which are implemented in travel and tourism sector

In tour and travel business, services are offered to customers while considering their

budgets, destination they want to visit and facilities they want to avail. Then various attractive

packages are offered to customers in order to provide quality services and retain maximum

customers. Customer should be classified according to their need, price sensitivity and

preferences such as price sensitive customers focuses on long term benefits. A systematic

technique is required to determine package price offered to customers in order to retain them and

to create a long term relationship with them. Pricing policies adopted by organisation should be

flexible according to market needs and conditions. Company always tries to maintain the quality

of services by providing best pricing packages to customers so that effective customers can enjoy

their journey in more easy manner. Pricing method is a good step taken by Eurocarib tours in

order to determine the cost for their tour packages (Vogel, 2016). These are the following pricing

techniques used for price determination are discussed below:

Cost based pricing: Cost based pricing is one of the pricing methods of fixing the selling price

of a product by the company, in this method the price of a product is determined by adding a

profit percentage in addition to the cost of making the product. In this method manufacturing

costs of the product is used as its basis for calculating final sale price of product, fixed amount or

a percentage of the total product manufacturing cost is added as profit to the cost of the product

to calculate its selling price. The whole method is divided in following parts such as:

Direct cost pricing : It is mainly linked with variable costs plus total percentage of fixed

mark up type margin.

Full cost pricing: It is mainly based upon the mixture of variable and fixed cost etc.

Cost plus pricing: Under Cost plus pricing method selling price is determined by markup

to the cost of goods and services. In t direct material cost, direct labor cost, and overhead

costs for a product, and add to it a markup percentage in order to derive the price of the

product (Wanhill, 2013).

4

400 640000 160000 120000 280000

1000 1600000 400000 120000 520000

1.2: Pricing techniques which are implemented in travel and tourism sector

In tour and travel business, services are offered to customers while considering their

budgets, destination they want to visit and facilities they want to avail. Then various attractive

packages are offered to customers in order to provide quality services and retain maximum

customers. Customer should be classified according to their need, price sensitivity and

preferences such as price sensitive customers focuses on long term benefits. A systematic

technique is required to determine package price offered to customers in order to retain them and

to create a long term relationship with them. Pricing policies adopted by organisation should be

flexible according to market needs and conditions. Company always tries to maintain the quality

of services by providing best pricing packages to customers so that effective customers can enjoy

their journey in more easy manner. Pricing method is a good step taken by Eurocarib tours in

order to determine the cost for their tour packages (Vogel, 2016). These are the following pricing

techniques used for price determination are discussed below:

Cost based pricing: Cost based pricing is one of the pricing methods of fixing the selling price

of a product by the company, in this method the price of a product is determined by adding a

profit percentage in addition to the cost of making the product. In this method manufacturing

costs of the product is used as its basis for calculating final sale price of product, fixed amount or

a percentage of the total product manufacturing cost is added as profit to the cost of the product

to calculate its selling price. The whole method is divided in following parts such as:

Direct cost pricing : It is mainly linked with variable costs plus total percentage of fixed

mark up type margin.

Full cost pricing: It is mainly based upon the mixture of variable and fixed cost etc.

Cost plus pricing: Under Cost plus pricing method selling price is determined by markup

to the cost of goods and services. In t direct material cost, direct labor cost, and overhead

costs for a product, and add to it a markup percentage in order to derive the price of the

product (Wanhill, 2013).

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Demand based pricing: This pricing method is mostly based on the demand of customer as well

as supply of the tour plan. It is said to be more practical in nature.

Competition oriented pricing: This method of pricing is market oriented pricing which

includes prices that a competitors charges without considering client demand and with their own

costs such as premium pricing, discounted pricing and parity pricing.

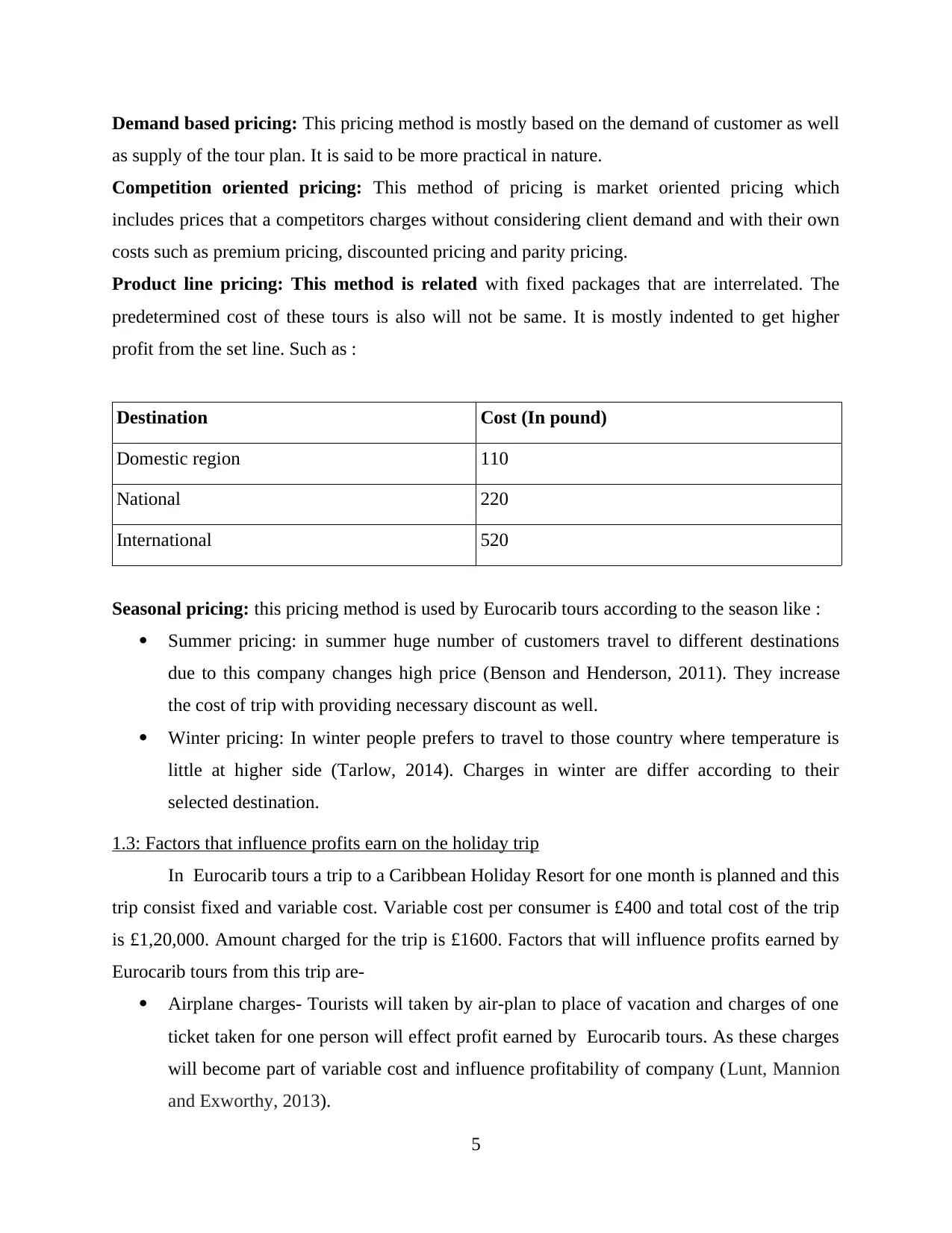

Product line pricing: This method is related with fixed packages that are interrelated. The

predetermined cost of these tours is also will not be same. It is mostly indented to get higher

profit from the set line. Such as :

Destination Cost (In pound)

Domestic region 110

National 220

International 520

Seasonal pricing: this pricing method is used by Eurocarib tours according to the season like :

Summer pricing: in summer huge number of customers travel to different destinations

due to this company changes high price (Benson and Henderson, 2011). They increase

the cost of trip with providing necessary discount as well.

Winter pricing: In winter people prefers to travel to those country where temperature is

little at higher side (Tarlow, 2014). Charges in winter are differ according to their

selected destination.

1.3: Factors that influence profits earn on the holiday trip

In Eurocarib tours a trip to a Caribbean Holiday Resort for one month is planned and this

trip consist fixed and variable cost. Variable cost per consumer is £400 and total cost of the trip

is £1,20,000. Amount charged for the trip is £1600. Factors that will influence profits earned by

Eurocarib tours from this trip are-

Airplane charges- Tourists will taken by air-plan to place of vacation and charges of one

ticket taken for one person will effect profit earned by Eurocarib tours. As these charges

will become part of variable cost and influence profitability of company (Lunt, Mannion

and Exworthy, 2013).

5

as supply of the tour plan. It is said to be more practical in nature.

Competition oriented pricing: This method of pricing is market oriented pricing which

includes prices that a competitors charges without considering client demand and with their own

costs such as premium pricing, discounted pricing and parity pricing.

Product line pricing: This method is related with fixed packages that are interrelated. The

predetermined cost of these tours is also will not be same. It is mostly indented to get higher

profit from the set line. Such as :

Destination Cost (In pound)

Domestic region 110

National 220

International 520

Seasonal pricing: this pricing method is used by Eurocarib tours according to the season like :

Summer pricing: in summer huge number of customers travel to different destinations

due to this company changes high price (Benson and Henderson, 2011). They increase

the cost of trip with providing necessary discount as well.

Winter pricing: In winter people prefers to travel to those country where temperature is

little at higher side (Tarlow, 2014). Charges in winter are differ according to their

selected destination.

1.3: Factors that influence profits earn on the holiday trip

In Eurocarib tours a trip to a Caribbean Holiday Resort for one month is planned and this

trip consist fixed and variable cost. Variable cost per consumer is £400 and total cost of the trip

is £1,20,000. Amount charged for the trip is £1600. Factors that will influence profits earned by

Eurocarib tours from this trip are-

Airplane charges- Tourists will taken by air-plan to place of vacation and charges of one

ticket taken for one person will effect profit earned by Eurocarib tours. As these charges

will become part of variable cost and influence profitability of company (Lunt, Mannion

and Exworthy, 2013).

5

Accommodation- Tourists of Eurocarib tours during their trip will stay in resort for which

a floor is booked and this will influence profits of the company. As when more

consumers will involve in the trip then this cost will be divided in all otherwise cost will

be born by company itself.

Number of tourists- When number of tourist is as per plan then cost of the trip will be

divided among all tourist and profits will be more.

When 90 tourist make bookings for trip then revenue generated from them is £144000

and cost incurred for this revenue is £120000. Profits generated from booking of 90 tourist is

£24000. Eurocarib tours wants to earn profits of at least £30000 which will not be achieved by

getting bookings of only 90 tourist. This target will be achieved when bookings are made by at

least 94 tourists. This is calculated as 94*1600= £150400 this will be reduced by total cost of

£120000 the profits will be £30400.

TASK 2

2.1: Different type of management accounting information

Accounting information in order to better inform themselves before deciding matters

within the organisation and also aids management and performance of control functions. This is

considered as a tool for decision making that makes comparison with trend and also helps in

making forecasting. Travel and tourism sector is the fastest growing industry in service sector

throughout the world. Types of management accounting information are Budget report, financial

statement, variance analyse and job cost report (Page, Song and Wu, 2012V).

Budget report- Budget is a roadmap and set of activities that is required to attain

Eurocarib tours goals. Managers can use it as a tool to compare activity with the budget to study

variance.

Financial statements- The managers of Eurocarib tours can use financial statements for

the purpose of making decision for the company on the basis of accounting information.

Managers of Eurocarib tours can make decision on the area where future investment can be made

on the basis of analysing financial information.

Variance analysis- Eurocarib tours can use variance analysis to compute the variation

of actual outcome from the targeted. Reason of variance should be examined and appropriate

6

a floor is booked and this will influence profits of the company. As when more

consumers will involve in the trip then this cost will be divided in all otherwise cost will

be born by company itself.

Number of tourists- When number of tourist is as per plan then cost of the trip will be

divided among all tourist and profits will be more.

When 90 tourist make bookings for trip then revenue generated from them is £144000

and cost incurred for this revenue is £120000. Profits generated from booking of 90 tourist is

£24000. Eurocarib tours wants to earn profits of at least £30000 which will not be achieved by

getting bookings of only 90 tourist. This target will be achieved when bookings are made by at

least 94 tourists. This is calculated as 94*1600= £150400 this will be reduced by total cost of

£120000 the profits will be £30400.

TASK 2

2.1: Different type of management accounting information

Accounting information in order to better inform themselves before deciding matters

within the organisation and also aids management and performance of control functions. This is

considered as a tool for decision making that makes comparison with trend and also helps in

making forecasting. Travel and tourism sector is the fastest growing industry in service sector

throughout the world. Types of management accounting information are Budget report, financial

statement, variance analyse and job cost report (Page, Song and Wu, 2012V).

Budget report- Budget is a roadmap and set of activities that is required to attain

Eurocarib tours goals. Managers can use it as a tool to compare activity with the budget to study

variance.

Financial statements- The managers of Eurocarib tours can use financial statements for

the purpose of making decision for the company on the basis of accounting information.

Managers of Eurocarib tours can make decision on the area where future investment can be made

on the basis of analysing financial information.

Variance analysis- Eurocarib tours can use variance analysis to compute the variation

of actual outcome from the targeted. Reason of variance should be examined and appropriate

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

measures are taken to control them. While preparing budget these variations should be

considered (on der Weppen and Cochrane, 2012).

Job cost report- Managers of Eurocarib tours can use the job cost report to show

expenses and check the profitability of the project. Units which are making higher profits or

incurring losses can be identified by job cost report.

2.2: Use of investment appraisal techniques as decision-making tools

Funds in a business are invested to increase value of investments and increase in value is

necessary to calculate that spendings are made in right directions. Capital budgeting and

investment appraisal techniques are used to assess the effect of spending money on business. It is

important to estimate benefit of investment in financial terms and techniques that is used to

calculate this are-

Accounting rate of return- ARR compares the profits that Eurocarib tours expected to

make from an investment to the amount needed to be invested. It is calculated as the average

profit that is expected over the life of an investment.

Payback period- This is a simple technique for assessing an investment by length of

time it will take to repay the amount invested. This technique focuses on cash flows not on

profits.

Discounted cashflows- Discount rate is applied to work out present day equivalent of

future cash flow. Two type of discounting methods can be followed by Eurocarib tours that is net

present value method and internal rate of return method.

Investment risk and sensitivity analysis- Investment risk and sensitivity analysis is a

realistic assessment of risk is essential. Biggest risk associated with investment is the disruption

in value of investment (Airey and et.al, 2015). For example- sensitivity analysis of Eurocarib

company will be carried out to determine how change in cost and revenue of the trip organised

by company can alter cash flow of the project. As cost of the project is fixed £120000 and with

more consumers more cash flow will be required to cover this cost. By additional one consumer

revenues will go up by £1600 where as variable cost is only £400 which means profits are

sensitive to number of consumers and cost involved.

7

considered (on der Weppen and Cochrane, 2012).

Job cost report- Managers of Eurocarib tours can use the job cost report to show

expenses and check the profitability of the project. Units which are making higher profits or

incurring losses can be identified by job cost report.

2.2: Use of investment appraisal techniques as decision-making tools

Funds in a business are invested to increase value of investments and increase in value is

necessary to calculate that spendings are made in right directions. Capital budgeting and

investment appraisal techniques are used to assess the effect of spending money on business. It is

important to estimate benefit of investment in financial terms and techniques that is used to

calculate this are-

Accounting rate of return- ARR compares the profits that Eurocarib tours expected to

make from an investment to the amount needed to be invested. It is calculated as the average

profit that is expected over the life of an investment.

Payback period- This is a simple technique for assessing an investment by length of

time it will take to repay the amount invested. This technique focuses on cash flows not on

profits.

Discounted cashflows- Discount rate is applied to work out present day equivalent of

future cash flow. Two type of discounting methods can be followed by Eurocarib tours that is net

present value method and internal rate of return method.

Investment risk and sensitivity analysis- Investment risk and sensitivity analysis is a

realistic assessment of risk is essential. Biggest risk associated with investment is the disruption

in value of investment (Airey and et.al, 2015). For example- sensitivity analysis of Eurocarib

company will be carried out to determine how change in cost and revenue of the trip organised

by company can alter cash flow of the project. As cost of the project is fixed £120000 and with

more consumers more cash flow will be required to cover this cost. By additional one consumer

revenues will go up by £1600 where as variable cost is only £400 which means profits are

sensitive to number of consumers and cost involved.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

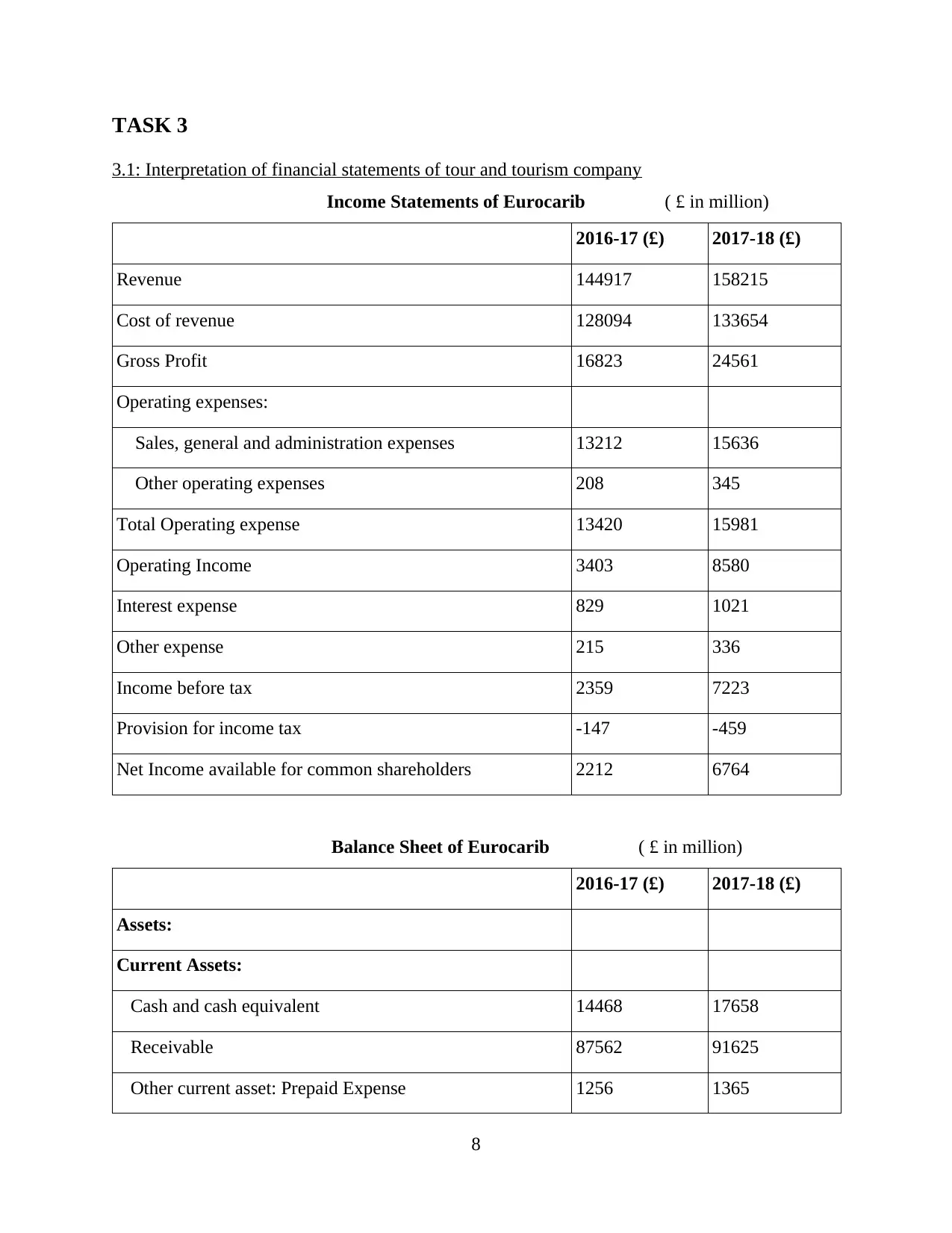

TASK 3

3.1: Interpretation of financial statements of tour and tourism company

Income Statements of Eurocarib ( £ in million)

2016-17 (£) 2017-18 (£)

Revenue 144917 158215

Cost of revenue 128094 133654

Gross Profit 16823 24561

Operating expenses:

Sales, general and administration expenses 13212 15636

Other operating expenses 208 345

Total Operating expense 13420 15981

Operating Income 3403 8580

Interest expense 829 1021

Other expense 215 336

Income before tax 2359 7223

Provision for income tax -147 -459

Net Income available for common shareholders 2212 6764

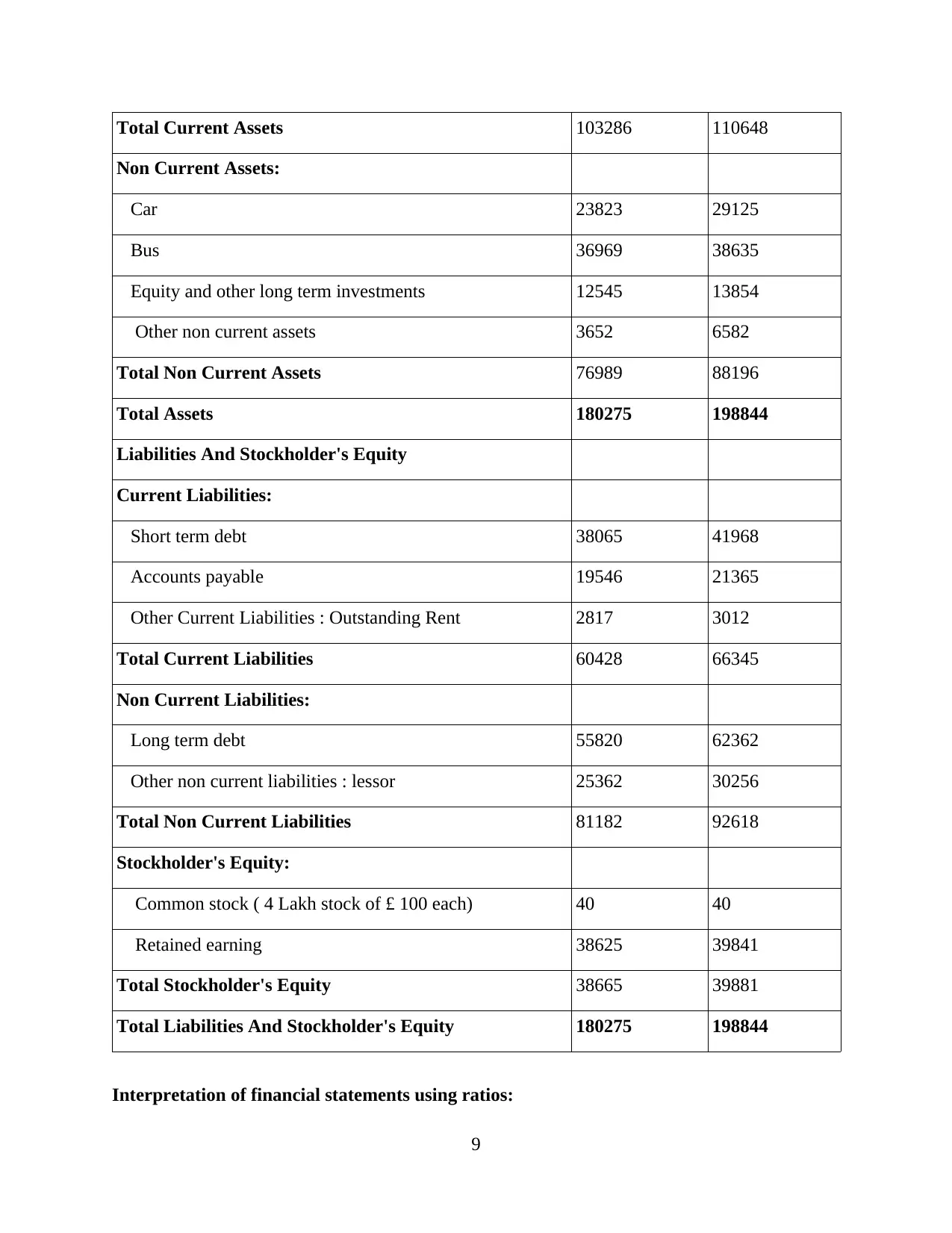

Balance Sheet of Eurocarib ( £ in million)

2016-17 (£) 2017-18 (£)

Assets:

Current Assets:

Cash and cash equivalent 14468 17658

Receivable 87562 91625

Other current asset: Prepaid Expense 1256 1365

8

3.1: Interpretation of financial statements of tour and tourism company

Income Statements of Eurocarib ( £ in million)

2016-17 (£) 2017-18 (£)

Revenue 144917 158215

Cost of revenue 128094 133654

Gross Profit 16823 24561

Operating expenses:

Sales, general and administration expenses 13212 15636

Other operating expenses 208 345

Total Operating expense 13420 15981

Operating Income 3403 8580

Interest expense 829 1021

Other expense 215 336

Income before tax 2359 7223

Provision for income tax -147 -459

Net Income available for common shareholders 2212 6764

Balance Sheet of Eurocarib ( £ in million)

2016-17 (£) 2017-18 (£)

Assets:

Current Assets:

Cash and cash equivalent 14468 17658

Receivable 87562 91625

Other current asset: Prepaid Expense 1256 1365

8

Total Current Assets 103286 110648

Non Current Assets:

Car 23823 29125

Bus 36969 38635

Equity and other long term investments 12545 13854

Other non current assets 3652 6582

Total Non Current Assets 76989 88196

Total Assets 180275 198844

Liabilities And Stockholder's Equity

Current Liabilities:

Short term debt 38065 41968

Accounts payable 19546 21365

Other Current Liabilities : Outstanding Rent 2817 3012

Total Current Liabilities 60428 66345

Non Current Liabilities:

Long term debt 55820 62362

Other non current liabilities : lessor 25362 30256

Total Non Current Liabilities 81182 92618

Stockholder's Equity:

Common stock ( 4 Lakh stock of £ 100 each) 40 40

Retained earning 38625 39841

Total Stockholder's Equity 38665 39881

Total Liabilities And Stockholder's Equity 180275 198844

Interpretation of financial statements using ratios:

9

Non Current Assets:

Car 23823 29125

Bus 36969 38635

Equity and other long term investments 12545 13854

Other non current assets 3652 6582

Total Non Current Assets 76989 88196

Total Assets 180275 198844

Liabilities And Stockholder's Equity

Current Liabilities:

Short term debt 38065 41968

Accounts payable 19546 21365

Other Current Liabilities : Outstanding Rent 2817 3012

Total Current Liabilities 60428 66345

Non Current Liabilities:

Long term debt 55820 62362

Other non current liabilities : lessor 25362 30256

Total Non Current Liabilities 81182 92618

Stockholder's Equity:

Common stock ( 4 Lakh stock of £ 100 each) 40 40

Retained earning 38625 39841

Total Stockholder's Equity 38665 39881

Total Liabilities And Stockholder's Equity 180275 198844

Interpretation of financial statements using ratios:

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.