Finance Report: Solved Assignment

VerifiedAdded on 2019/10/01

|10

|1548

|250

Report

AI Summary

This finance report presents solutions to a series of problems involving financial calculations and analysis. The report covers topics such as present and future value calculations, loan amortization, bond yield to maturity, and the capital asset pricing model (CAPM) for determining the cost of equity. Specific calculations are shown for various scenarios, including different loan options and company betas. The report also includes a discussion comparing the expected return on equity for two companies with differing betas, highlighting the relationship between beta, risk, and return. The report concludes by emphasizing the importance of the CAPM in assessing investment returns and noting the limitations of the model in predicting actual returns. The provided solution includes a table of contents and a bibliography.

Finance

Name of the Student:

Name of the University:

Authors Note:

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

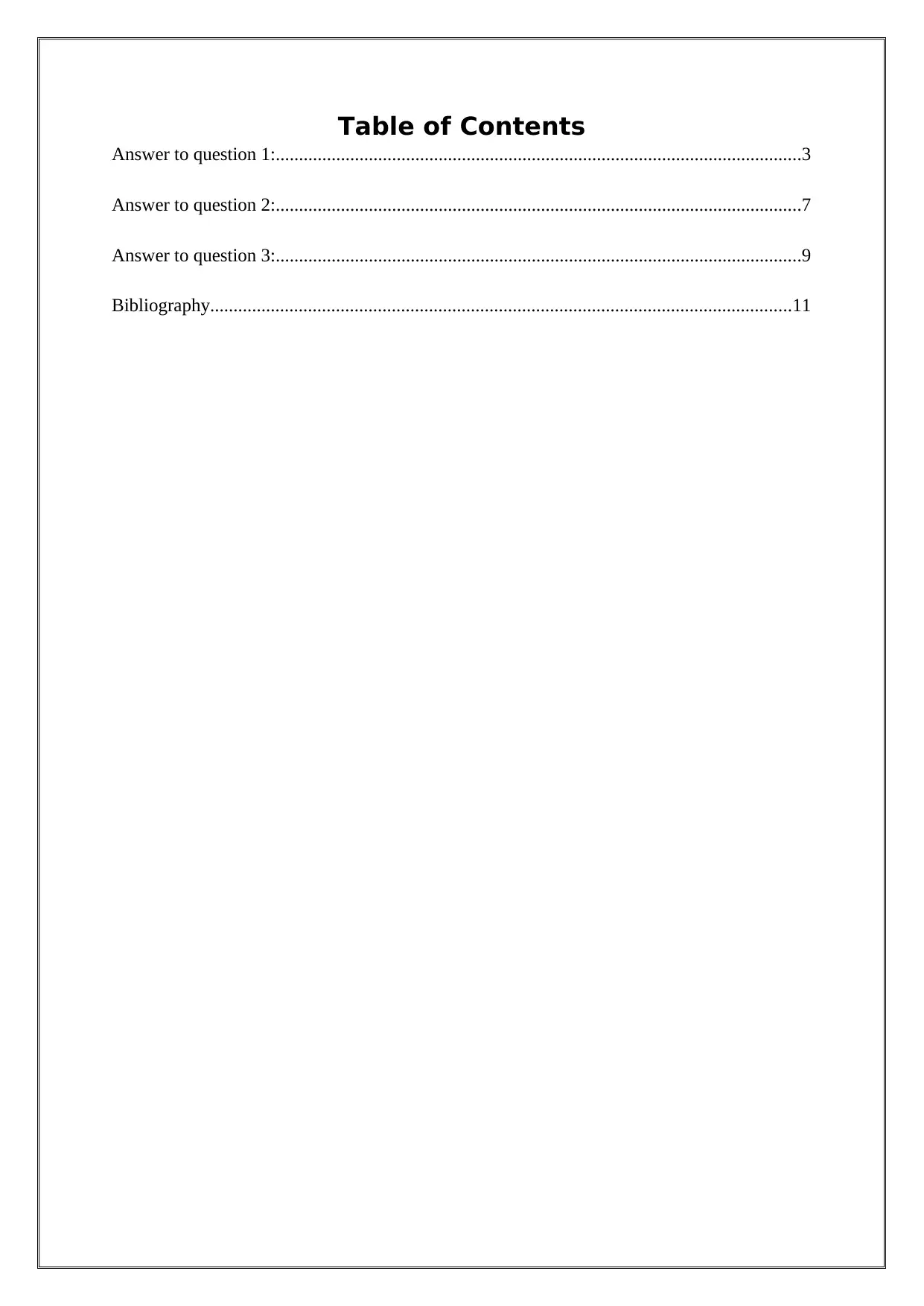

Table of Contents

Answer to question 1:.................................................................................................................3

Answer to question 2:.................................................................................................................7

Answer to question 3:.................................................................................................................9

Bibliography.............................................................................................................................11

Answer to question 1:.................................................................................................................3

Answer to question 2:.................................................................................................................7

Answer to question 3:.................................................................................................................9

Bibliography.............................................................................................................................11

Answer to question 1:

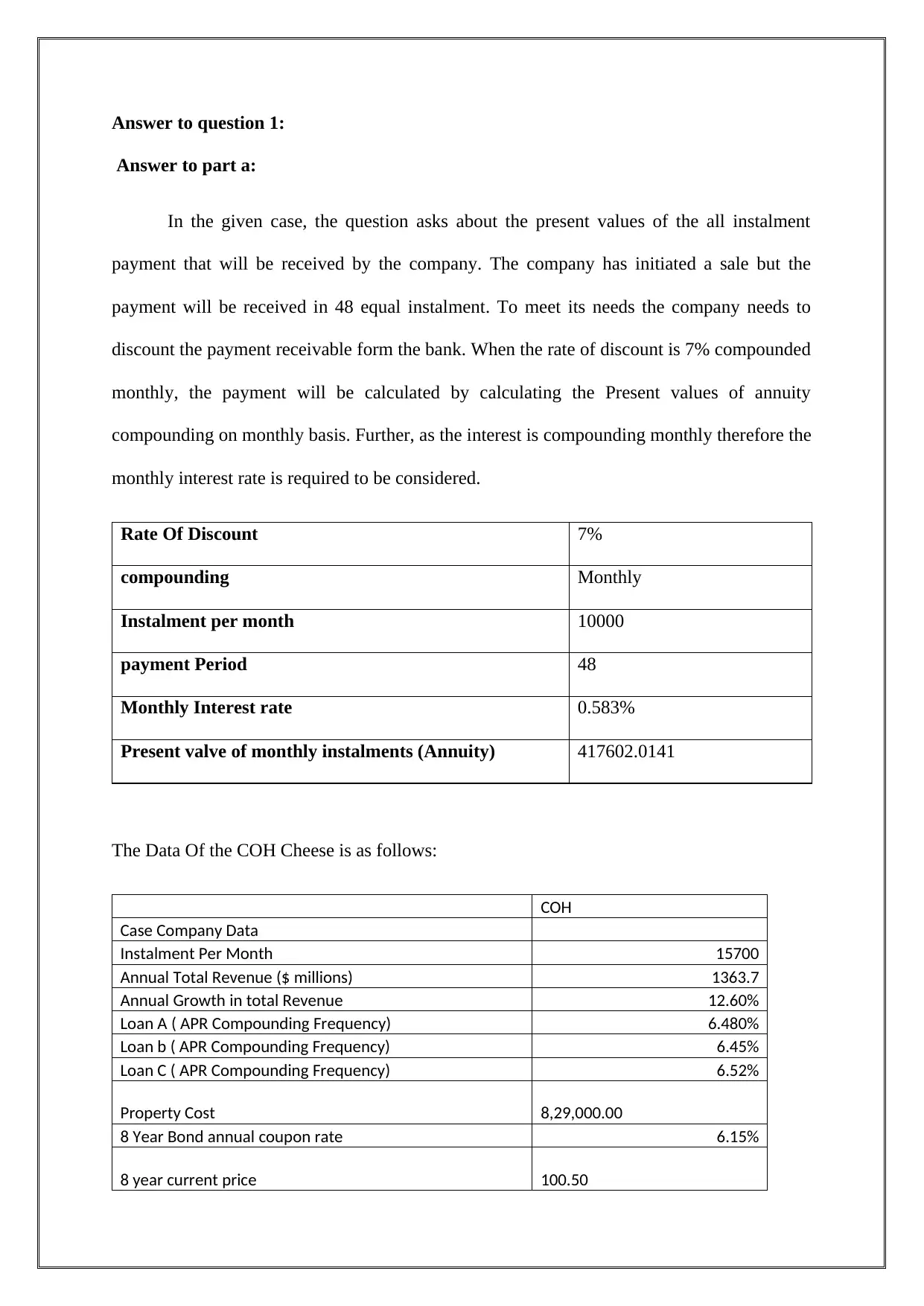

Answer to part a:

In the given case, the question asks about the present values of the all instalment

payment that will be received by the company. The company has initiated a sale but the

payment will be received in 48 equal instalment. To meet its needs the company needs to

discount the payment receivable form the bank. When the rate of discount is 7% compounded

monthly, the payment will be calculated by calculating the Present values of annuity

compounding on monthly basis. Further, as the interest is compounding monthly therefore the

monthly interest rate is required to be considered.

Rate Of Discount 7%

compounding Monthly

Instalment per month 10000

payment Period 48

Monthly Interest rate 0.583%

Present valve of monthly instalments (Annuity) 417602.0141

The Data Of the COH Cheese is as follows:

COH

Case Company Data

Instalment Per Month 15700

Annual Total Revenue ($ millions) 1363.7

Annual Growth in total Revenue 12.60%

Loan A ( APR Compounding Frequency) 6.480%

Loan b ( APR Compounding Frequency) 6.45%

Loan C ( APR Compounding Frequency) 6.52%

Property Cost 8,29,000.00

8 Year Bond annual coupon rate 6.15%

8 year current price 100.50

Answer to part a:

In the given case, the question asks about the present values of the all instalment

payment that will be received by the company. The company has initiated a sale but the

payment will be received in 48 equal instalment. To meet its needs the company needs to

discount the payment receivable form the bank. When the rate of discount is 7% compounded

monthly, the payment will be calculated by calculating the Present values of annuity

compounding on monthly basis. Further, as the interest is compounding monthly therefore the

monthly interest rate is required to be considered.

Rate Of Discount 7%

compounding Monthly

Instalment per month 10000

payment Period 48

Monthly Interest rate 0.583%

Present valve of monthly instalments (Annuity) 417602.0141

The Data Of the COH Cheese is as follows:

COH

Case Company Data

Instalment Per Month 15700

Annual Total Revenue ($ millions) 1363.7

Annual Growth in total Revenue 12.60%

Loan A ( APR Compounding Frequency) 6.480%

Loan b ( APR Compounding Frequency) 6.45%

Loan C ( APR Compounding Frequency) 6.52%

Property Cost 8,29,000.00

8 Year Bond annual coupon rate 6.15%

8 year current price 100.50

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6 yrear Bond Required rate of Return 3.40%

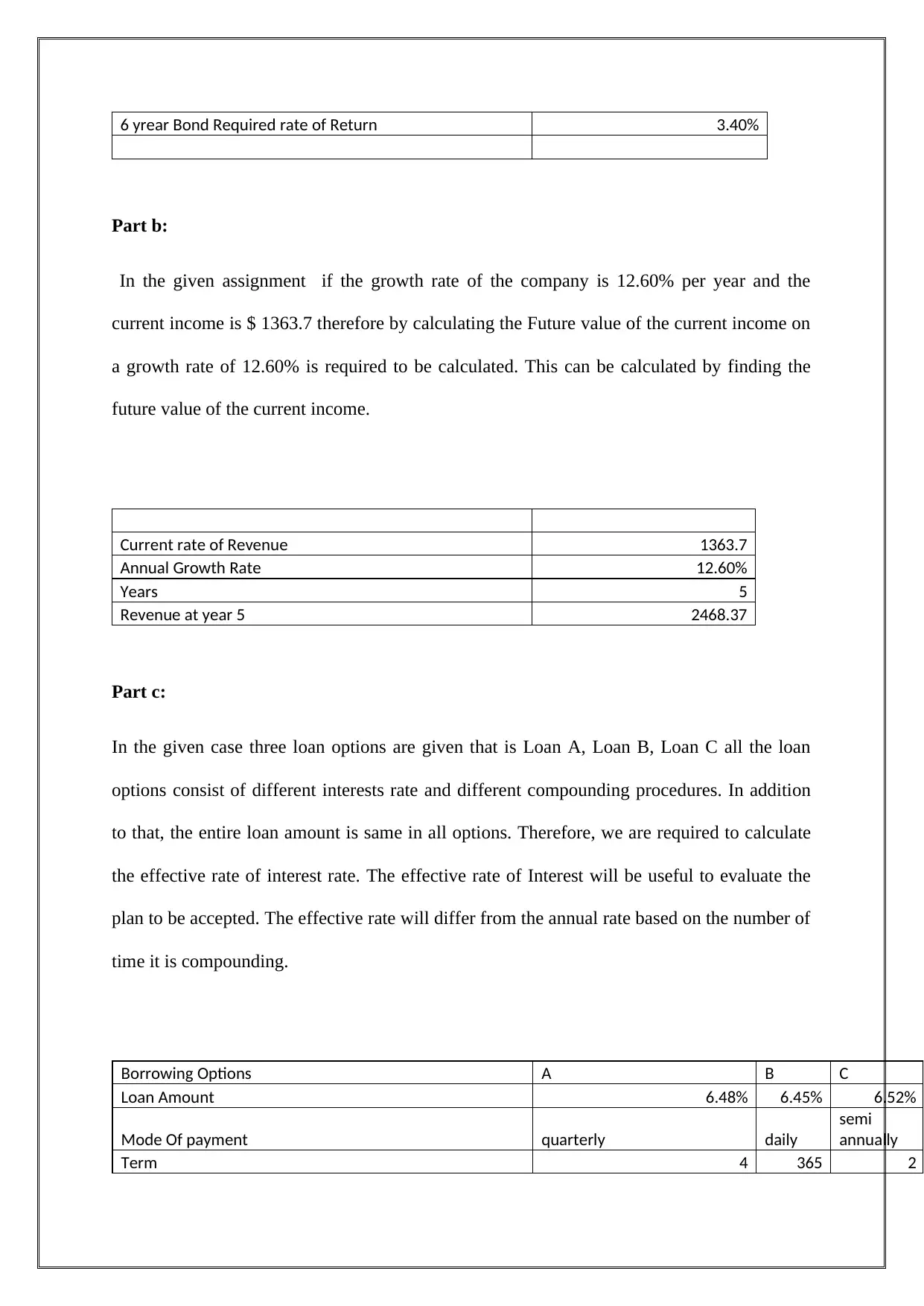

Part b:

In the given assignment if the growth rate of the company is 12.60% per year and the

current income is $ 1363.7 therefore by calculating the Future value of the current income on

a growth rate of 12.60% is required to be calculated. This can be calculated by finding the

future value of the current income.

Current rate of Revenue 1363.7

Annual Growth Rate 12.60%

Years 5

Revenue at year 5 2468.37

Part c:

In the given case three loan options are given that is Loan A, Loan B, Loan C all the loan

options consist of different interests rate and different compounding procedures. In addition

to that, the entire loan amount is same in all options. Therefore, we are required to calculate

the effective rate of interest rate. The effective rate of Interest will be useful to evaluate the

plan to be accepted. The effective rate will differ from the annual rate based on the number of

time it is compounding.

Borrowing Options A B C

Loan Amount 6.48% 6.45% 6.52%

Mode Of payment quarterly daily

semi

annually

Term 4 365 2

Part b:

In the given assignment if the growth rate of the company is 12.60% per year and the

current income is $ 1363.7 therefore by calculating the Future value of the current income on

a growth rate of 12.60% is required to be calculated. This can be calculated by finding the

future value of the current income.

Current rate of Revenue 1363.7

Annual Growth Rate 12.60%

Years 5

Revenue at year 5 2468.37

Part c:

In the given case three loan options are given that is Loan A, Loan B, Loan C all the loan

options consist of different interests rate and different compounding procedures. In addition

to that, the entire loan amount is same in all options. Therefore, we are required to calculate

the effective rate of interest rate. The effective rate of Interest will be useful to evaluate the

plan to be accepted. The effective rate will differ from the annual rate based on the number of

time it is compounding.

Borrowing Options A B C

Loan Amount 6.48% 6.45% 6.52%

Mode Of payment quarterly daily

semi

annually

Term 4 365 2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Effective Interest rate ® 6.64% 6.66% 6.63%

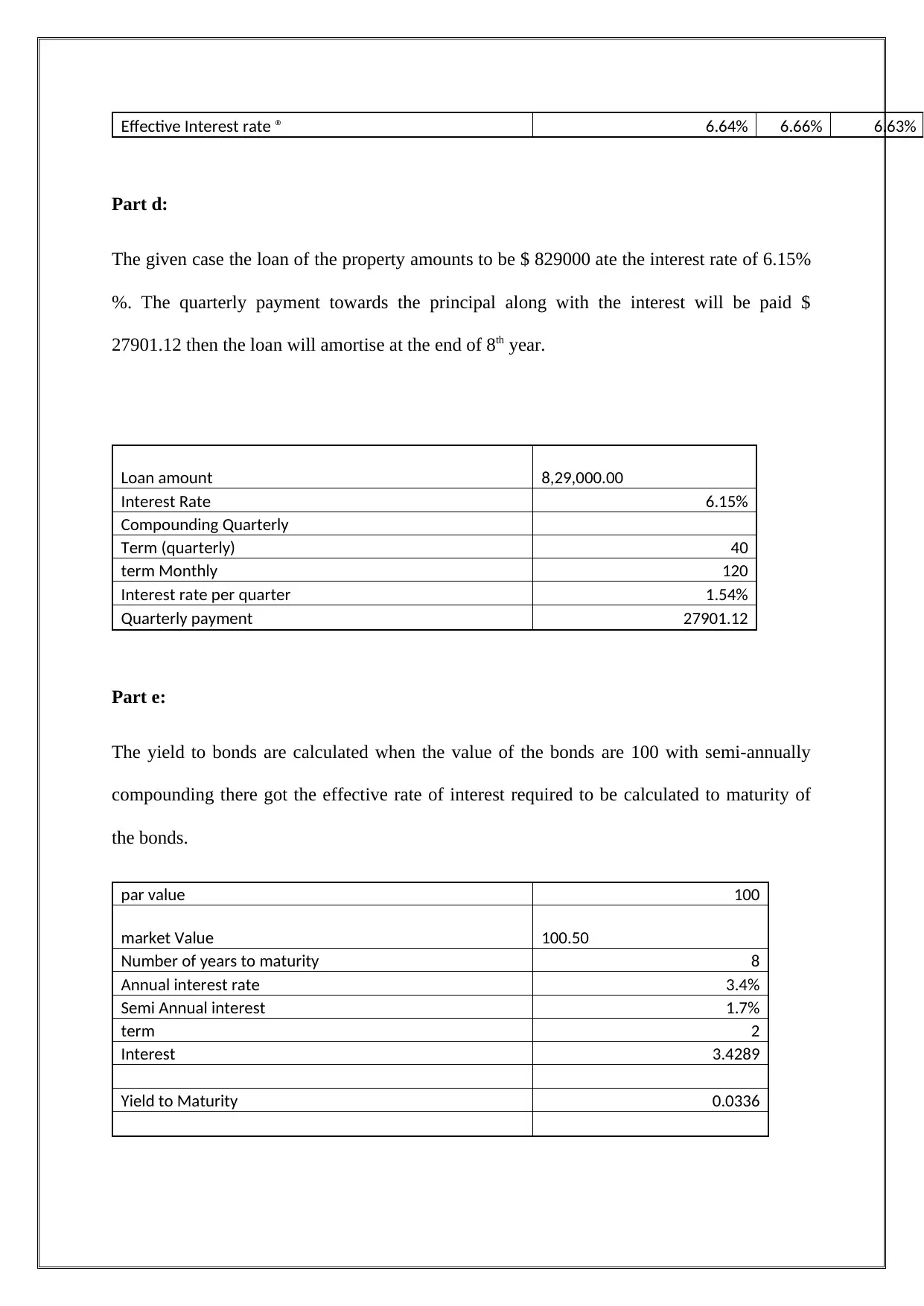

Part d:

The given case the loan of the property amounts to be $ 829000 ate the interest rate of 6.15%

%. The quarterly payment towards the principal along with the interest will be paid $

27901.12 then the loan will amortise at the end of 8th year.

Loan amount 8,29,000.00

Interest Rate 6.15%

Compounding Quarterly

Term (quarterly) 40

term Monthly 120

Interest rate per quarter 1.54%

Quarterly payment 27901.12

Part e:

The yield to bonds are calculated when the value of the bonds are 100 with semi-annually

compounding there got the effective rate of interest required to be calculated to maturity of

the bonds.

par value 100

market Value 100.50

Number of years to maturity 8

Annual interest rate 3.4%

Semi Annual interest 1.7%

term 2

Interest 3.4289

Yield to Maturity 0.0336

Part d:

The given case the loan of the property amounts to be $ 829000 ate the interest rate of 6.15%

%. The quarterly payment towards the principal along with the interest will be paid $

27901.12 then the loan will amortise at the end of 8th year.

Loan amount 8,29,000.00

Interest Rate 6.15%

Compounding Quarterly

Term (quarterly) 40

term Monthly 120

Interest rate per quarter 1.54%

Quarterly payment 27901.12

Part e:

The yield to bonds are calculated when the value of the bonds are 100 with semi-annually

compounding there got the effective rate of interest required to be calculated to maturity of

the bonds.

par value 100

market Value 100.50

Number of years to maturity 8

Annual interest rate 3.4%

Semi Annual interest 1.7%

term 2

Interest 3.4289

Yield to Maturity 0.0336

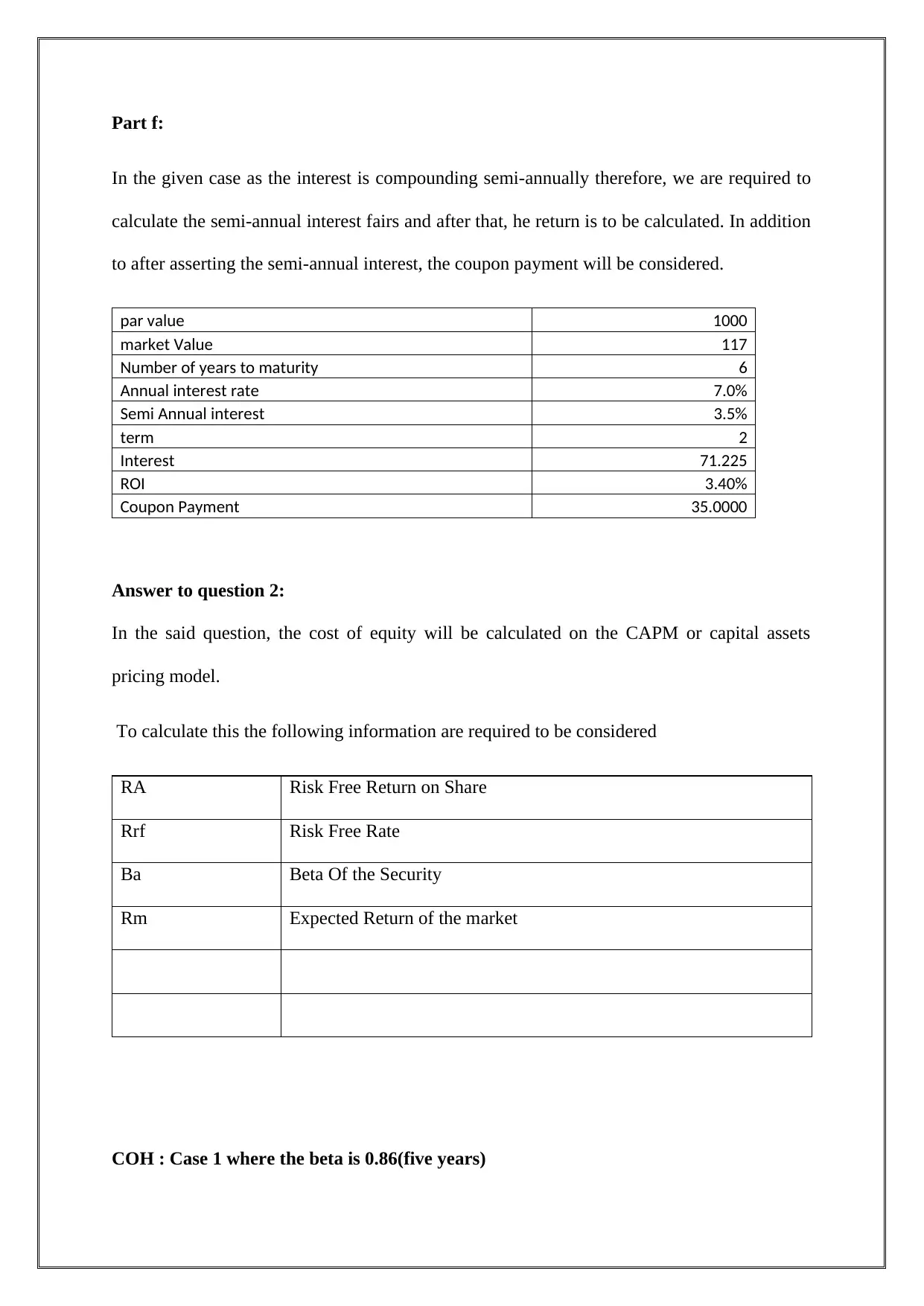

Part f:

In the given case as the interest is compounding semi-annually therefore, we are required to

calculate the semi-annual interest fairs and after that, he return is to be calculated. In addition

to after asserting the semi-annual interest, the coupon payment will be considered.

par value 1000

market Value 117

Number of years to maturity 6

Annual interest rate 7.0%

Semi Annual interest 3.5%

term 2

Interest 71.225

ROI 3.40%

Coupon Payment 35.0000

Answer to question 2:

In the said question, the cost of equity will be calculated on the CAPM or capital assets

pricing model.

To calculate this the following information are required to be considered

RA Risk Free Return on Share

Rrf Risk Free Rate

Ba Beta Of the Security

Rm Expected Return of the market

COH : Case 1 where the beta is 0.86(five years)

In the given case as the interest is compounding semi-annually therefore, we are required to

calculate the semi-annual interest fairs and after that, he return is to be calculated. In addition

to after asserting the semi-annual interest, the coupon payment will be considered.

par value 1000

market Value 117

Number of years to maturity 6

Annual interest rate 7.0%

Semi Annual interest 3.5%

term 2

Interest 71.225

ROI 3.40%

Coupon Payment 35.0000

Answer to question 2:

In the said question, the cost of equity will be calculated on the CAPM or capital assets

pricing model.

To calculate this the following information are required to be considered

RA Risk Free Return on Share

Rrf Risk Free Rate

Ba Beta Of the Security

Rm Expected Return of the market

COH : Case 1 where the beta is 0.86(five years)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

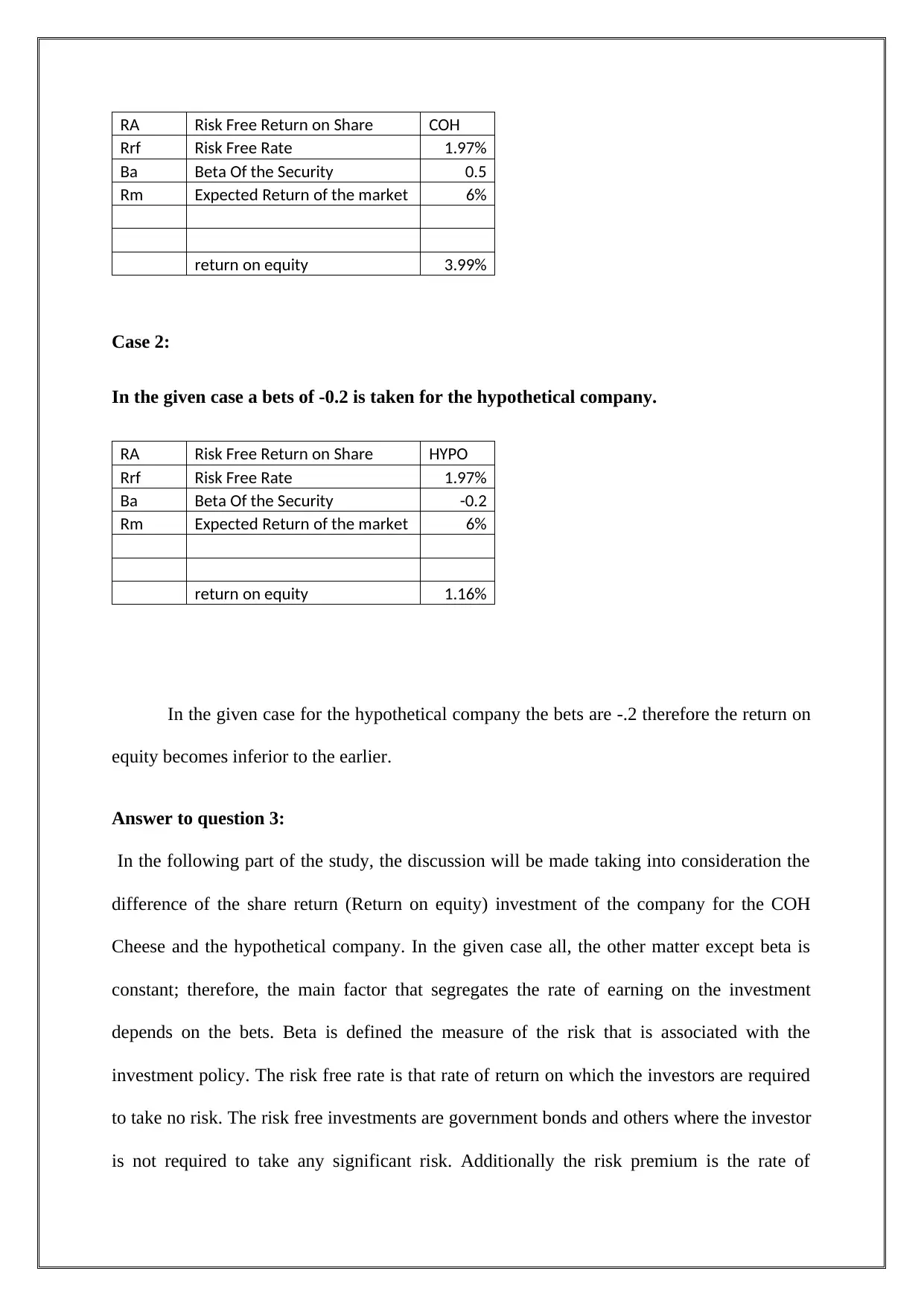

RA Risk Free Return on Share COH

Rrf Risk Free Rate 1.97%

Ba Beta Of the Security 0.5

Rm Expected Return of the market 6%

return on equity 3.99%

Case 2:

In the given case a bets of -0.2 is taken for the hypothetical company.

RA Risk Free Return on Share HYPO

Rrf Risk Free Rate 1.97%

Ba Beta Of the Security -0.2

Rm Expected Return of the market 6%

return on equity 1.16%

In the given case for the hypothetical company the bets are -.2 therefore the return on

equity becomes inferior to the earlier.

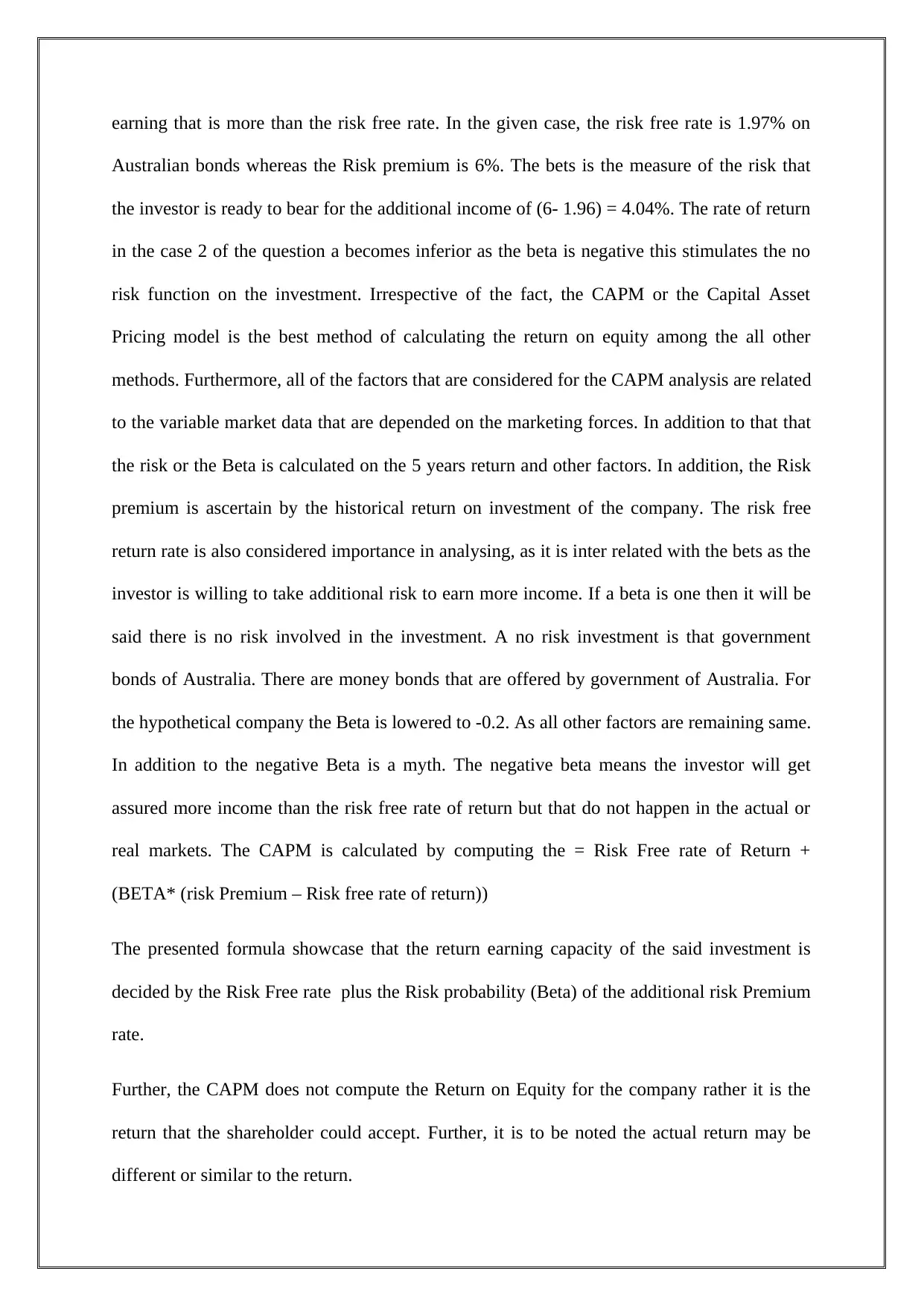

Answer to question 3:

In the following part of the study, the discussion will be made taking into consideration the

difference of the share return (Return on equity) investment of the company for the COH

Cheese and the hypothetical company. In the given case all, the other matter except beta is

constant; therefore, the main factor that segregates the rate of earning on the investment

depends on the bets. Beta is defined the measure of the risk that is associated with the

investment policy. The risk free rate is that rate of return on which the investors are required

to take no risk. The risk free investments are government bonds and others where the investor

is not required to take any significant risk. Additionally the risk premium is the rate of

Rrf Risk Free Rate 1.97%

Ba Beta Of the Security 0.5

Rm Expected Return of the market 6%

return on equity 3.99%

Case 2:

In the given case a bets of -0.2 is taken for the hypothetical company.

RA Risk Free Return on Share HYPO

Rrf Risk Free Rate 1.97%

Ba Beta Of the Security -0.2

Rm Expected Return of the market 6%

return on equity 1.16%

In the given case for the hypothetical company the bets are -.2 therefore the return on

equity becomes inferior to the earlier.

Answer to question 3:

In the following part of the study, the discussion will be made taking into consideration the

difference of the share return (Return on equity) investment of the company for the COH

Cheese and the hypothetical company. In the given case all, the other matter except beta is

constant; therefore, the main factor that segregates the rate of earning on the investment

depends on the bets. Beta is defined the measure of the risk that is associated with the

investment policy. The risk free rate is that rate of return on which the investors are required

to take no risk. The risk free investments are government bonds and others where the investor

is not required to take any significant risk. Additionally the risk premium is the rate of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

earning that is more than the risk free rate. In the given case, the risk free rate is 1.97% on

Australian bonds whereas the Risk premium is 6%. The bets is the measure of the risk that

the investor is ready to bear for the additional income of (6- 1.96) = 4.04%. The rate of return

in the case 2 of the question a becomes inferior as the beta is negative this stimulates the no

risk function on the investment. Irrespective of the fact, the CAPM or the Capital Asset

Pricing model is the best method of calculating the return on equity among the all other

methods. Furthermore, all of the factors that are considered for the CAPM analysis are related

to the variable market data that are depended on the marketing forces. In addition to that that

the risk or the Beta is calculated on the 5 years return and other factors. In addition, the Risk

premium is ascertain by the historical return on investment of the company. The risk free

return rate is also considered importance in analysing, as it is inter related with the bets as the

investor is willing to take additional risk to earn more income. If a beta is one then it will be

said there is no risk involved in the investment. A no risk investment is that government

bonds of Australia. There are money bonds that are offered by government of Australia. For

the hypothetical company the Beta is lowered to -0.2. As all other factors are remaining same.

In addition to the negative Beta is a myth. The negative beta means the investor will get

assured more income than the risk free rate of return but that do not happen in the actual or

real markets. The CAPM is calculated by computing the = Risk Free rate of Return +

(BETA* (risk Premium – Risk free rate of return))

The presented formula showcase that the return earning capacity of the said investment is

decided by the Risk Free rate plus the Risk probability (Beta) of the additional risk Premium

rate.

Further, the CAPM does not compute the Return on Equity for the company rather it is the

return that the shareholder could accept. Further, it is to be noted the actual return may be

different or similar to the return.

Australian bonds whereas the Risk premium is 6%. The bets is the measure of the risk that

the investor is ready to bear for the additional income of (6- 1.96) = 4.04%. The rate of return

in the case 2 of the question a becomes inferior as the beta is negative this stimulates the no

risk function on the investment. Irrespective of the fact, the CAPM or the Capital Asset

Pricing model is the best method of calculating the return on equity among the all other

methods. Furthermore, all of the factors that are considered for the CAPM analysis are related

to the variable market data that are depended on the marketing forces. In addition to that that

the risk or the Beta is calculated on the 5 years return and other factors. In addition, the Risk

premium is ascertain by the historical return on investment of the company. The risk free

return rate is also considered importance in analysing, as it is inter related with the bets as the

investor is willing to take additional risk to earn more income. If a beta is one then it will be

said there is no risk involved in the investment. A no risk investment is that government

bonds of Australia. There are money bonds that are offered by government of Australia. For

the hypothetical company the Beta is lowered to -0.2. As all other factors are remaining same.

In addition to the negative Beta is a myth. The negative beta means the investor will get

assured more income than the risk free rate of return but that do not happen in the actual or

real markets. The CAPM is calculated by computing the = Risk Free rate of Return +

(BETA* (risk Premium – Risk free rate of return))

The presented formula showcase that the return earning capacity of the said investment is

decided by the Risk Free rate plus the Risk probability (Beta) of the additional risk Premium

rate.

Further, the CAPM does not compute the Return on Equity for the company rather it is the

return that the shareholder could accept. Further, it is to be noted the actual return may be

different or similar to the return.

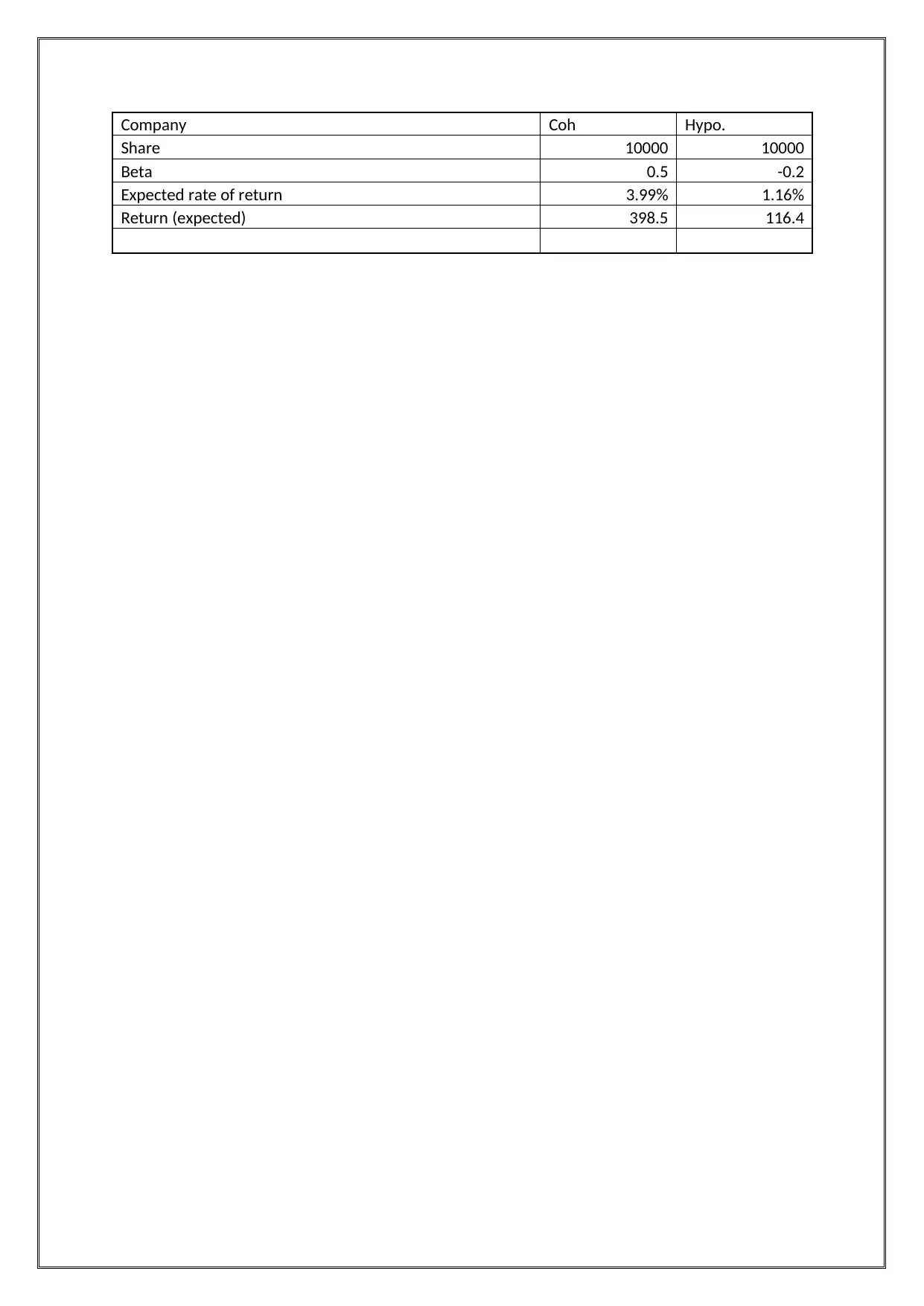

Company Coh Hypo.

Share 10000 10000

Beta 0.5 -0.2

Expected rate of return 3.99% 1.16%

Return (expected) 398.5 116.4

Share 10000 10000

Beta 0.5 -0.2

Expected rate of return 3.99% 1.16%

Return (expected) 398.5 116.4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Bibliography

Banks, E. (2015). Finance: the basics. Routledge.

Brunnermeier, M. K., & Sannikov, Y. (2016). The I theory of money (No. w22533). National

Bureau of Economic Research.

Lagoarde-Segot, T. (2015). Diversifying finance research: From financialization to

sustainability. International Review of Financial Analysis, 39, 1-6.

Banks, E. (2015). Finance: the basics. Routledge.

Brunnermeier, M. K., & Sannikov, Y. (2016). The I theory of money (No. w22533). National

Bureau of Economic Research.

Lagoarde-Segot, T. (2015). Diversifying finance research: From financialization to

sustainability. International Review of Financial Analysis, 39, 1-6.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.