BUSI 4079 Finance Assignment 1: Arbitrage, Options, and FX Analysis

VerifiedAdded on 2023/04/21

|8

|1165

|277

Homework Assignment

AI Summary

This finance assignment, completed by a student and available on Desklib, explores several key concepts in international finance. The assignment begins with a currency arbitrage problem, calculating potential profits from exploiting exchange rate discrepancies across different currency pairs (USD, JPY, and GBP). It then delves into forward exchange rates, calculating premiums and discounts for USD and CAD. The assignment utilizes the Black-Scholes model to price currency options, calculating option values for AUD and NZD options, incorporating factors like spot rates, forward rates, interest rates, volatility, and time to maturity. The assignment demonstrates the application of financial formulas and concepts in real-world scenarios, providing a comprehensive overview of foreign exchange and options trading.

FINANCE

ASSIGNMENT

ASSIGNMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

By student name

Professor

University

Date: 25 April 2018.

1 | P a g e

By student name

Professor

University

Date: 25 April 2018.

1 | P a g e

2

Contents

Question 1...................................................................................................................................................3

Question 2...................................................................................................................................................4

Question 3...................................................................................................................................................5

Question 4...................................................................................................................................................6

References...................................................................................................................................................7

2 | P a g e

Contents

Question 1...................................................................................................................................................3

Question 2...................................................................................................................................................4

Question 3...................................................................................................................................................5

Question 4...................................................................................................................................................6

References...................................................................................................................................................7

2 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Question 1

Given:

S(JPY/GBP) = 144.21

S(JPY/USD) = 109.50

S(USD/GBP) = 1.3099

Arbitrage Process

Path 1 USD>JPY>GBP>USD

Sell $ 500,000 at the rate given S(JPY/USD), getting (500000*109.5)

JPY 54750000

Sell JPY 54750000 at the rate given S(JPY/GBP), getting (54750000/144.21)

GBP 379654.67

Sell GBP at the rate given S(USD/GBP), getting (379654.67*1.3099)

USD 497309.652

Loss from arbitrage = 500000-497309.652 = USD 2690.348

Path 2 USD>GBP>JPY>USD

Sell $ 500,000 at the rate given S(USD/GBP), getting (500000/1.3099)

GBP 381708.527

Sell GBP 381708.527 at the rate given S(JPY/GBP), getting

(381708.527*144.21)

JPY 55046186.67

Sell JPY 55046186.67 at the rate given S(JPY/USD), getting

(55046186.67/109.50)

USD 502704.90

Gain from arbitrage = 502704.90-500000 = USD 2704.90

Therefore, in the given case, path 2 helps in making the arbitrage profit of USD 2704.90

3 | P a g e

Question 1

Given:

S(JPY/GBP) = 144.21

S(JPY/USD) = 109.50

S(USD/GBP) = 1.3099

Arbitrage Process

Path 1 USD>JPY>GBP>USD

Sell $ 500,000 at the rate given S(JPY/USD), getting (500000*109.5)

JPY 54750000

Sell JPY 54750000 at the rate given S(JPY/GBP), getting (54750000/144.21)

GBP 379654.67

Sell GBP at the rate given S(USD/GBP), getting (379654.67*1.3099)

USD 497309.652

Loss from arbitrage = 500000-497309.652 = USD 2690.348

Path 2 USD>GBP>JPY>USD

Sell $ 500,000 at the rate given S(USD/GBP), getting (500000/1.3099)

GBP 381708.527

Sell GBP 381708.527 at the rate given S(JPY/GBP), getting

(381708.527*144.21)

JPY 55046186.67

Sell JPY 55046186.67 at the rate given S(JPY/USD), getting

(55046186.67/109.50)

USD 502704.90

Gain from arbitrage = 502704.90-500000 = USD 2704.90

Therefore, in the given case, path 2 helps in making the arbitrage profit of USD 2704.90

3 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

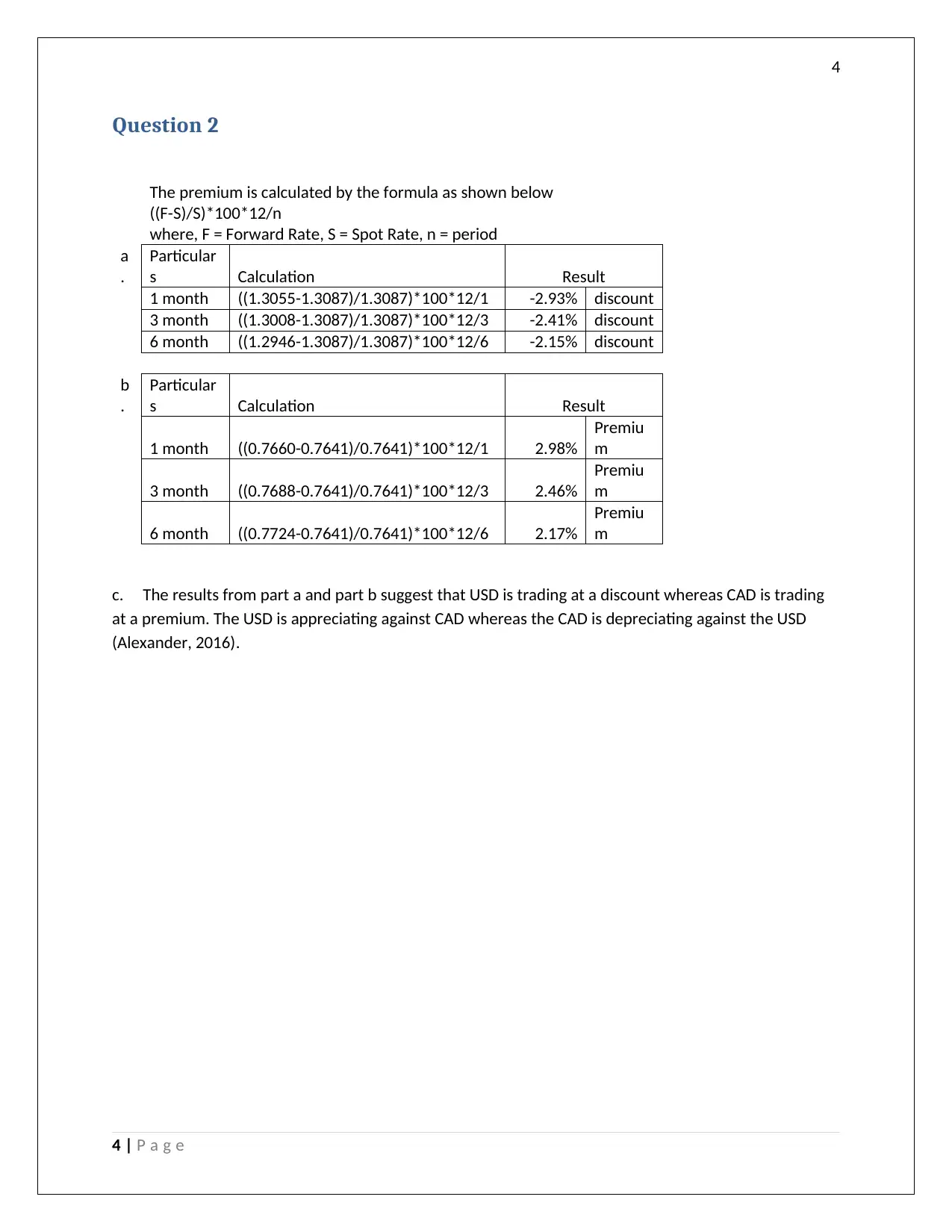

Question 2

The premium is calculated by the formula as shown below

((F-S)/S)*100*12/n

where, F = Forward Rate, S = Spot Rate, n = period

a

.

Particular

s Calculation Result

1 month ((1.3055-1.3087)/1.3087)*100*12/1 -2.93% discount

3 month ((1.3008-1.3087)/1.3087)*100*12/3 -2.41% discount

6 month ((1.2946-1.3087)/1.3087)*100*12/6 -2.15% discount

b

.

Particular

s Calculation Result

1 month ((0.7660-0.7641)/0.7641)*100*12/1 2.98%

Premiu

m

3 month ((0.7688-0.7641)/0.7641)*100*12/3 2.46%

Premiu

m

6 month ((0.7724-0.7641)/0.7641)*100*12/6 2.17%

Premiu

m

c. The results from part a and part b suggest that USD is trading at a discount whereas CAD is trading

at a premium. The USD is appreciating against CAD whereas the CAD is depreciating against the USD

(Alexander, 2016).

4 | P a g e

Question 2

The premium is calculated by the formula as shown below

((F-S)/S)*100*12/n

where, F = Forward Rate, S = Spot Rate, n = period

a

.

Particular

s Calculation Result

1 month ((1.3055-1.3087)/1.3087)*100*12/1 -2.93% discount

3 month ((1.3008-1.3087)/1.3087)*100*12/3 -2.41% discount

6 month ((1.2946-1.3087)/1.3087)*100*12/6 -2.15% discount

b

.

Particular

s Calculation Result

1 month ((0.7660-0.7641)/0.7641)*100*12/1 2.98%

Premiu

m

3 month ((0.7688-0.7641)/0.7641)*100*12/3 2.46%

Premiu

m

6 month ((0.7724-0.7641)/0.7641)*100*12/6 2.17%

Premiu

m

c. The results from part a and part b suggest that USD is trading at a discount whereas CAD is trading

at a premium. The USD is appreciating against CAD whereas the CAD is depreciating against the USD

(Alexander, 2016).

4 | P a g e

5

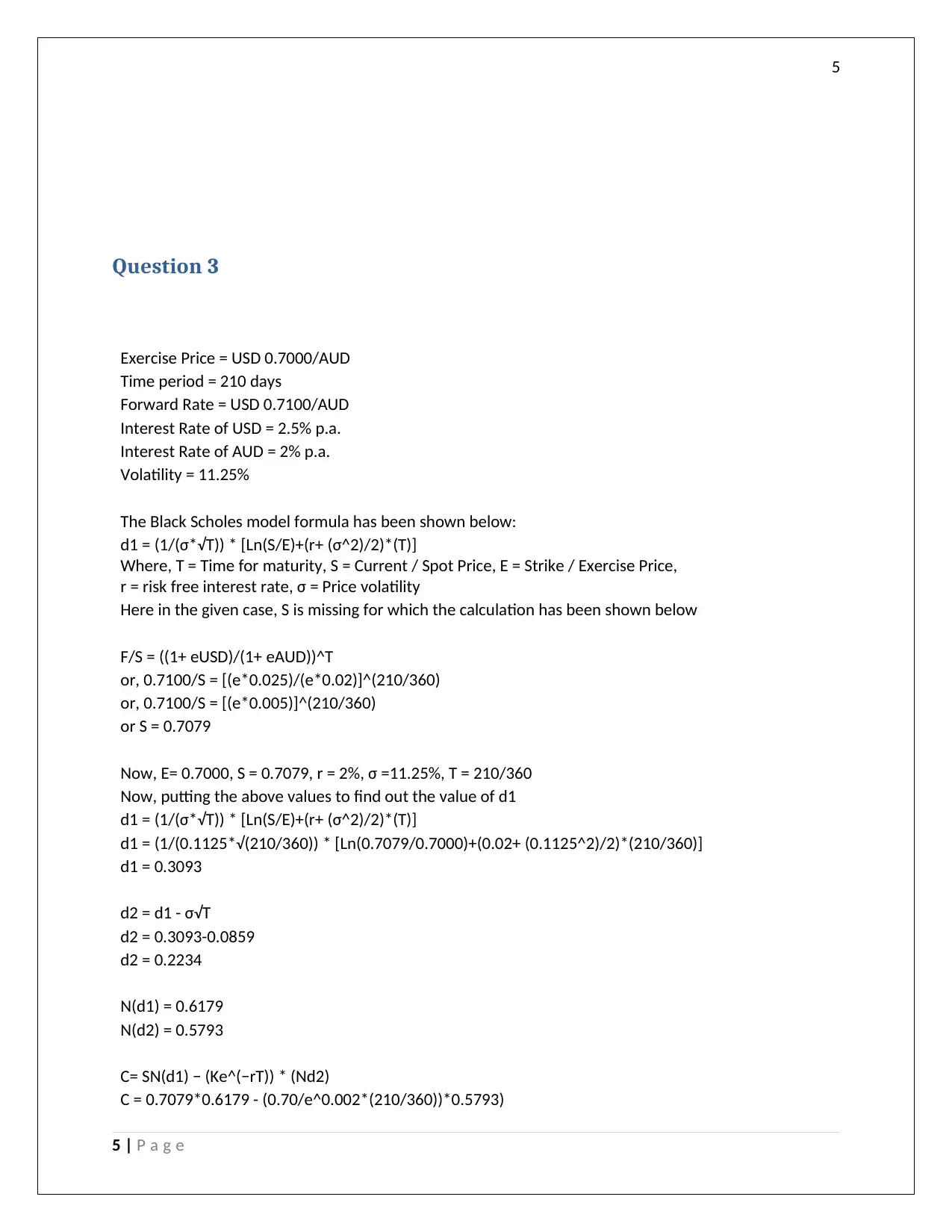

Question 3

Exercise Price = USD 0.7000/AUD

Time period = 210 days

Forward Rate = USD 0.7100/AUD

Interest Rate of USD = 2.5% p.a.

Interest Rate of AUD = 2% p.a.

Volatility = 11.25%

The Black Scholes model formula has been shown below:

d1 = (1/(σ*√T)) * [Ln(S/E)+(r+ (σ^2)/2)*(T)]

Where, T = Time for maturity, S = Current / Spot Price, E = Strike / Exercise Price,

r = risk free interest rate, σ = Price volatility

Here in the given case, S is missing for which the calculation has been shown below

F/S = ((1+ eUSD)/(1+ eAUD))^T

or, 0.7100/S = [(e*0.025)/(e*0.02)]^(210/360)

or, 0.7100/S = [(e*0.005)]^(210/360)

or S = 0.7079

Now, E= 0.7000, S = 0.7079, r = 2%, σ =11.25%, T = 210/360

Now, putting the above values to find out the value of d1

d1 = (1/(σ*√T)) * [Ln(S/E)+(r+ (σ^2)/2)*(T)]

d1 = (1/(0.1125*√(210/360)) * [Ln(0.7079/0.7000)+(0.02+ (0.1125^2)/2)*(210/360)]

d1 = 0.3093

d2 = d1 - σ√T

d2 = 0.3093-0.0859

d2 = 0.2234

N(d1) = 0.6179

N(d2) = 0.5793

C= SN(d1) − (Ke^(−rT)) * (Nd2)

C = 0.7079*0.6179 - (0.70/e^0.002*(210/360))*0.5793)

5 | P a g e

Question 3

Exercise Price = USD 0.7000/AUD

Time period = 210 days

Forward Rate = USD 0.7100/AUD

Interest Rate of USD = 2.5% p.a.

Interest Rate of AUD = 2% p.a.

Volatility = 11.25%

The Black Scholes model formula has been shown below:

d1 = (1/(σ*√T)) * [Ln(S/E)+(r+ (σ^2)/2)*(T)]

Where, T = Time for maturity, S = Current / Spot Price, E = Strike / Exercise Price,

r = risk free interest rate, σ = Price volatility

Here in the given case, S is missing for which the calculation has been shown below

F/S = ((1+ eUSD)/(1+ eAUD))^T

or, 0.7100/S = [(e*0.025)/(e*0.02)]^(210/360)

or, 0.7100/S = [(e*0.005)]^(210/360)

or S = 0.7079

Now, E= 0.7000, S = 0.7079, r = 2%, σ =11.25%, T = 210/360

Now, putting the above values to find out the value of d1

d1 = (1/(σ*√T)) * [Ln(S/E)+(r+ (σ^2)/2)*(T)]

d1 = (1/(0.1125*√(210/360)) * [Ln(0.7079/0.7000)+(0.02+ (0.1125^2)/2)*(210/360)]

d1 = 0.3093

d2 = d1 - σ√T

d2 = 0.3093-0.0859

d2 = 0.2234

N(d1) = 0.6179

N(d2) = 0.5793

C= SN(d1) − (Ke^(−rT)) * (Nd2)

C = 0.7079*0.6179 - (0.70/e^0.002*(210/360))*0.5793)

5 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

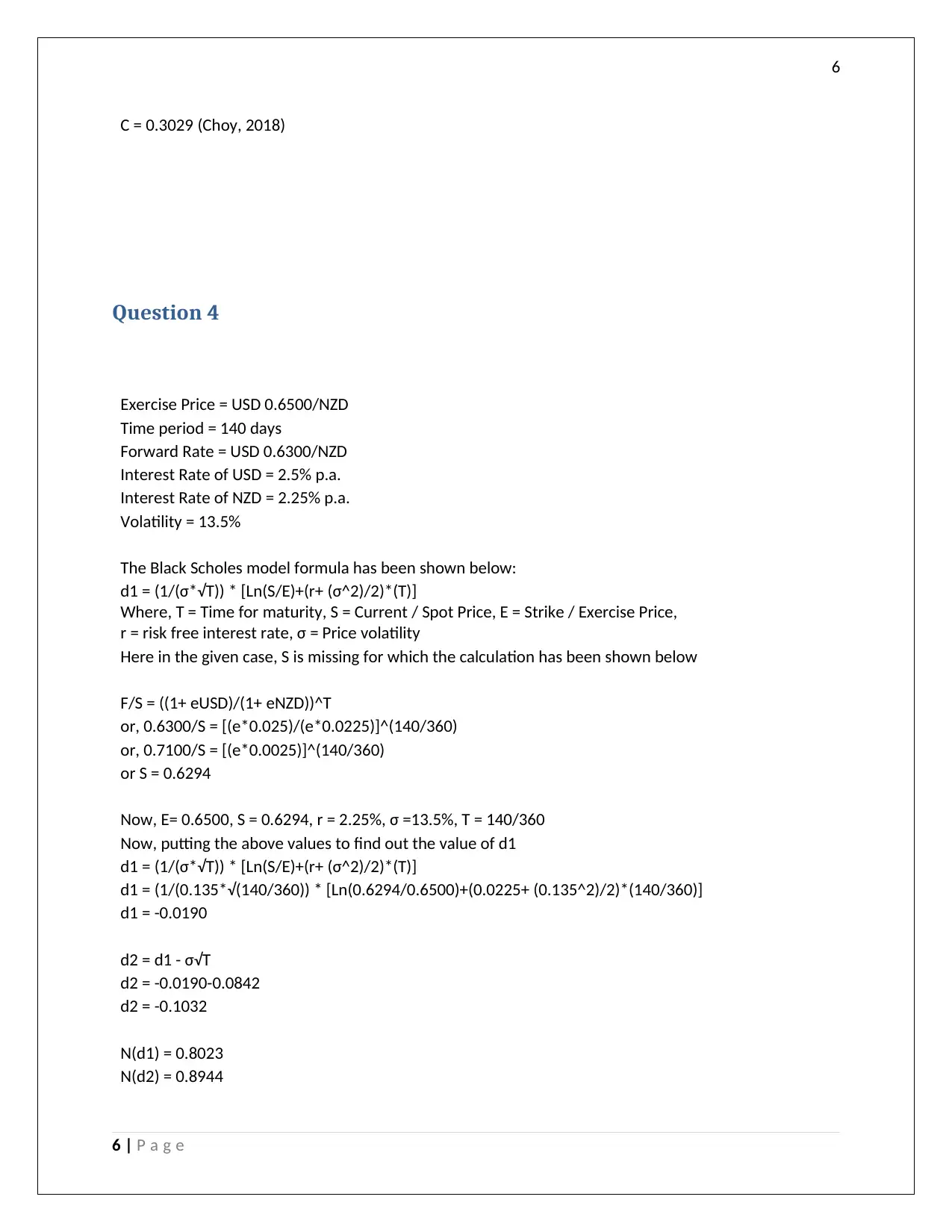

C = 0.3029 (Choy, 2018)

Question 4

Exercise Price = USD 0.6500/NZD

Time period = 140 days

Forward Rate = USD 0.6300/NZD

Interest Rate of USD = 2.5% p.a.

Interest Rate of NZD = 2.25% p.a.

Volatility = 13.5%

The Black Scholes model formula has been shown below:

d1 = (1/(σ*√T)) * [Ln(S/E)+(r+ (σ^2)/2)*(T)]

Where, T = Time for maturity, S = Current / Spot Price, E = Strike / Exercise Price,

r = risk free interest rate, σ = Price volatility

Here in the given case, S is missing for which the calculation has been shown below

F/S = ((1+ eUSD)/(1+ eNZD))^T

or, 0.6300/S = [(e*0.025)/(e*0.0225)]^(140/360)

or, 0.7100/S = [(e*0.0025)]^(140/360)

or S = 0.6294

Now, E= 0.6500, S = 0.6294, r = 2.25%, σ =13.5%, T = 140/360

Now, putting the above values to find out the value of d1

d1 = (1/(σ*√T)) * [Ln(S/E)+(r+ (σ^2)/2)*(T)]

d1 = (1/(0.135*√(140/360)) * [Ln(0.6294/0.6500)+(0.0225+ (0.135^2)/2)*(140/360)]

d1 = -0.0190

d2 = d1 - σ√T

d2 = -0.0190-0.0842

d2 = -0.1032

N(d1) = 0.8023

N(d2) = 0.8944

6 | P a g e

C = 0.3029 (Choy, 2018)

Question 4

Exercise Price = USD 0.6500/NZD

Time period = 140 days

Forward Rate = USD 0.6300/NZD

Interest Rate of USD = 2.5% p.a.

Interest Rate of NZD = 2.25% p.a.

Volatility = 13.5%

The Black Scholes model formula has been shown below:

d1 = (1/(σ*√T)) * [Ln(S/E)+(r+ (σ^2)/2)*(T)]

Where, T = Time for maturity, S = Current / Spot Price, E = Strike / Exercise Price,

r = risk free interest rate, σ = Price volatility

Here in the given case, S is missing for which the calculation has been shown below

F/S = ((1+ eUSD)/(1+ eNZD))^T

or, 0.6300/S = [(e*0.025)/(e*0.0225)]^(140/360)

or, 0.7100/S = [(e*0.0025)]^(140/360)

or S = 0.6294

Now, E= 0.6500, S = 0.6294, r = 2.25%, σ =13.5%, T = 140/360

Now, putting the above values to find out the value of d1

d1 = (1/(σ*√T)) * [Ln(S/E)+(r+ (σ^2)/2)*(T)]

d1 = (1/(0.135*√(140/360)) * [Ln(0.6294/0.6500)+(0.0225+ (0.135^2)/2)*(140/360)]

d1 = -0.0190

d2 = d1 - σ√T

d2 = -0.0190-0.0842

d2 = -0.1032

N(d1) = 0.8023

N(d2) = 0.8944

6 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

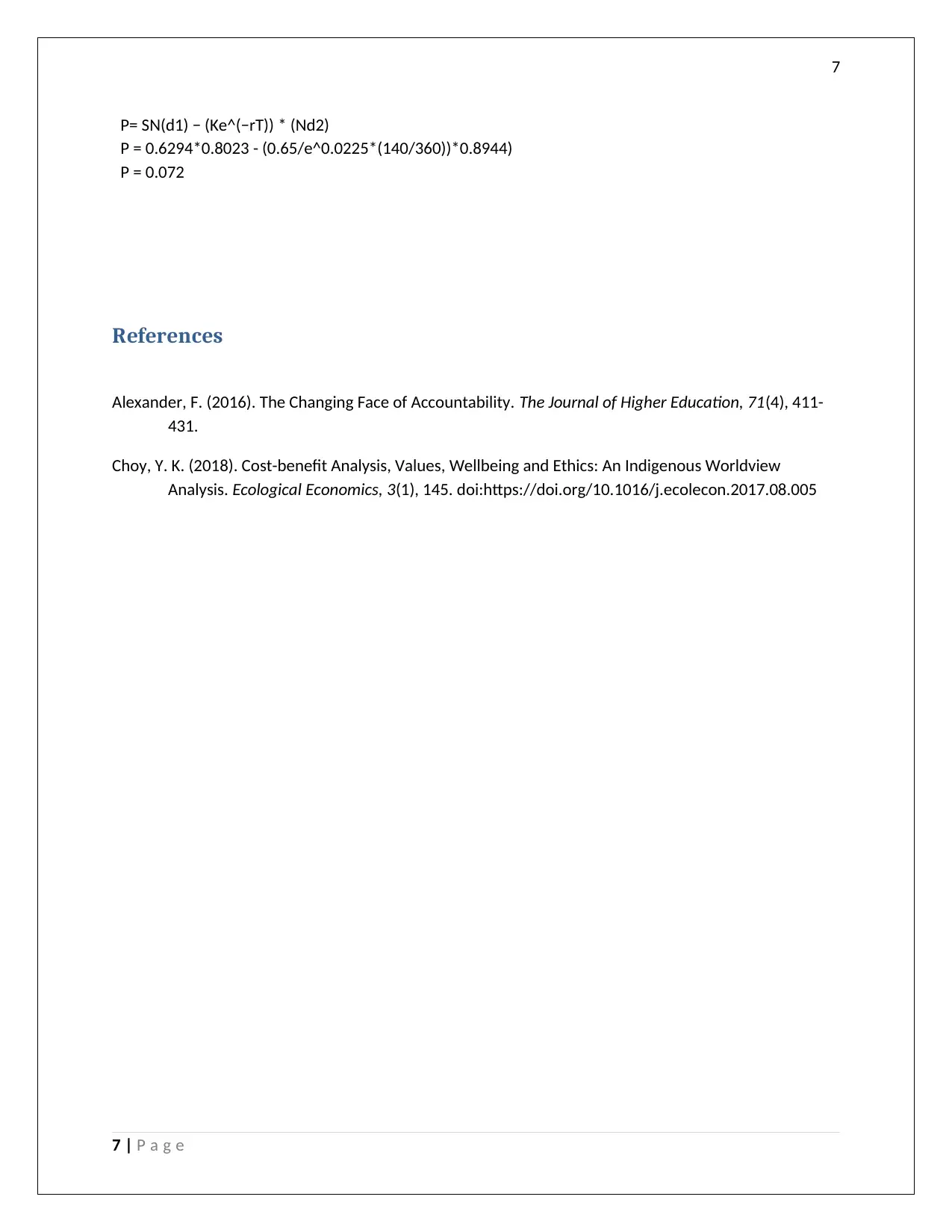

P= SN(d1) − (Ke^(−rT)) * (Nd2)

P = 0.6294*0.8023 - (0.65/e^0.0225*(140/360))*0.8944)

P = 0.072

References

Alexander, F. (2016). The Changing Face of Accountability. The Journal of Higher Education, 71(4), 411-

431.

Choy, Y. K. (2018). Cost-benefit Analysis, Values, Wellbeing and Ethics: An Indigenous Worldview

Analysis. Ecological Economics, 3(1), 145. doi:https://doi.org/10.1016/j.ecolecon.2017.08.005

7 | P a g e

P= SN(d1) − (Ke^(−rT)) * (Nd2)

P = 0.6294*0.8023 - (0.65/e^0.0225*(140/360))*0.8944)

P = 0.072

References

Alexander, F. (2016). The Changing Face of Accountability. The Journal of Higher Education, 71(4), 411-

431.

Choy, Y. K. (2018). Cost-benefit Analysis, Values, Wellbeing and Ethics: An Indigenous Worldview

Analysis. Ecological Economics, 3(1), 145. doi:https://doi.org/10.1016/j.ecolecon.2017.08.005

7 | P a g e

1 out of 8

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.