Finance Assignment: Daedulus Wings and Bitforth Co. Analysis

VerifiedAdded on 2023/06/09

|8

|901

|457

Report

AI Summary

This report provides a detailed financial analysis of two scenarios. The first part assesses whether Daedulus Wings should refund and replace an existing bond issue with a new debt issue, considering factors like interest rates, call provisions, and tax rates. It calculates the savings and net present value to determine the financial viability of the refunding. The second part evaluates investment projects for Bitforth Co., utilizing investment appraisal techniques such as payback period, net present value (NPV), internal rate of return (IRR), and profitability index to determine the optimal project. The report also analyzes a machine purchase decision, considering cash flows, depreciation, and salvage value to determine the best course of action. The analysis includes calculations and recommendations for each scenario, providing insights into financial decision-making.

Running head: FINANCE

Finance

Name of the Student:

Name of the University:

Authors Note:

Finance

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

1

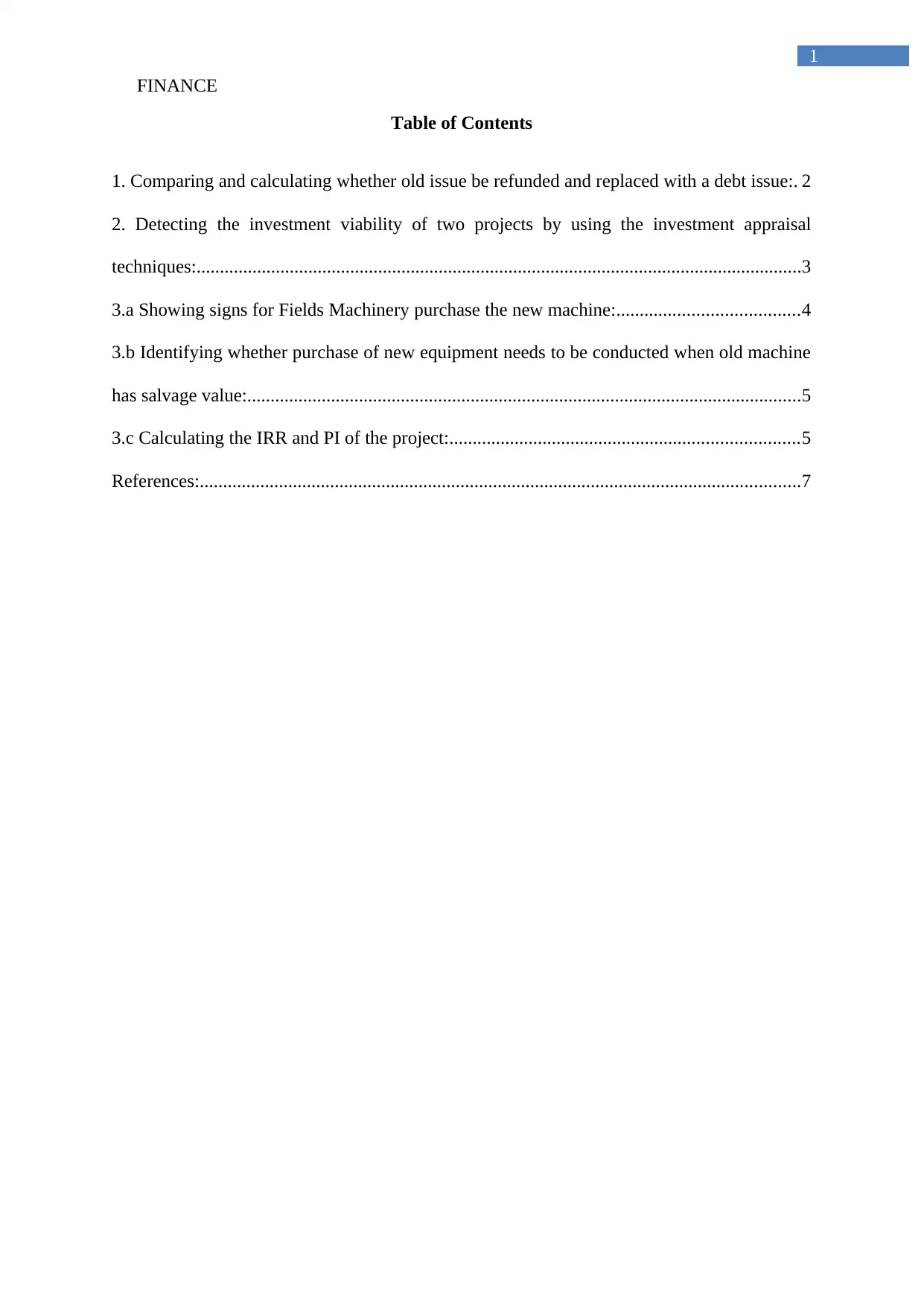

Table of Contents

1. Comparing and calculating whether old issue be refunded and replaced with a debt issue:. 2

2. Detecting the investment viability of two projects by using the investment appraisal

techniques:..................................................................................................................................3

3.a Showing signs for Fields Machinery purchase the new machine:.......................................4

3.b Identifying whether purchase of new equipment needs to be conducted when old machine

has salvage value:.......................................................................................................................5

3.c Calculating the IRR and PI of the project:...........................................................................5

References:.................................................................................................................................7

1

Table of Contents

1. Comparing and calculating whether old issue be refunded and replaced with a debt issue:. 2

2. Detecting the investment viability of two projects by using the investment appraisal

techniques:..................................................................................................................................3

3.a Showing signs for Fields Machinery purchase the new machine:.......................................4

3.b Identifying whether purchase of new equipment needs to be conducted when old machine

has salvage value:.......................................................................................................................5

3.c Calculating the IRR and PI of the project:...........................................................................5

References:.................................................................................................................................7

FINANCE

2

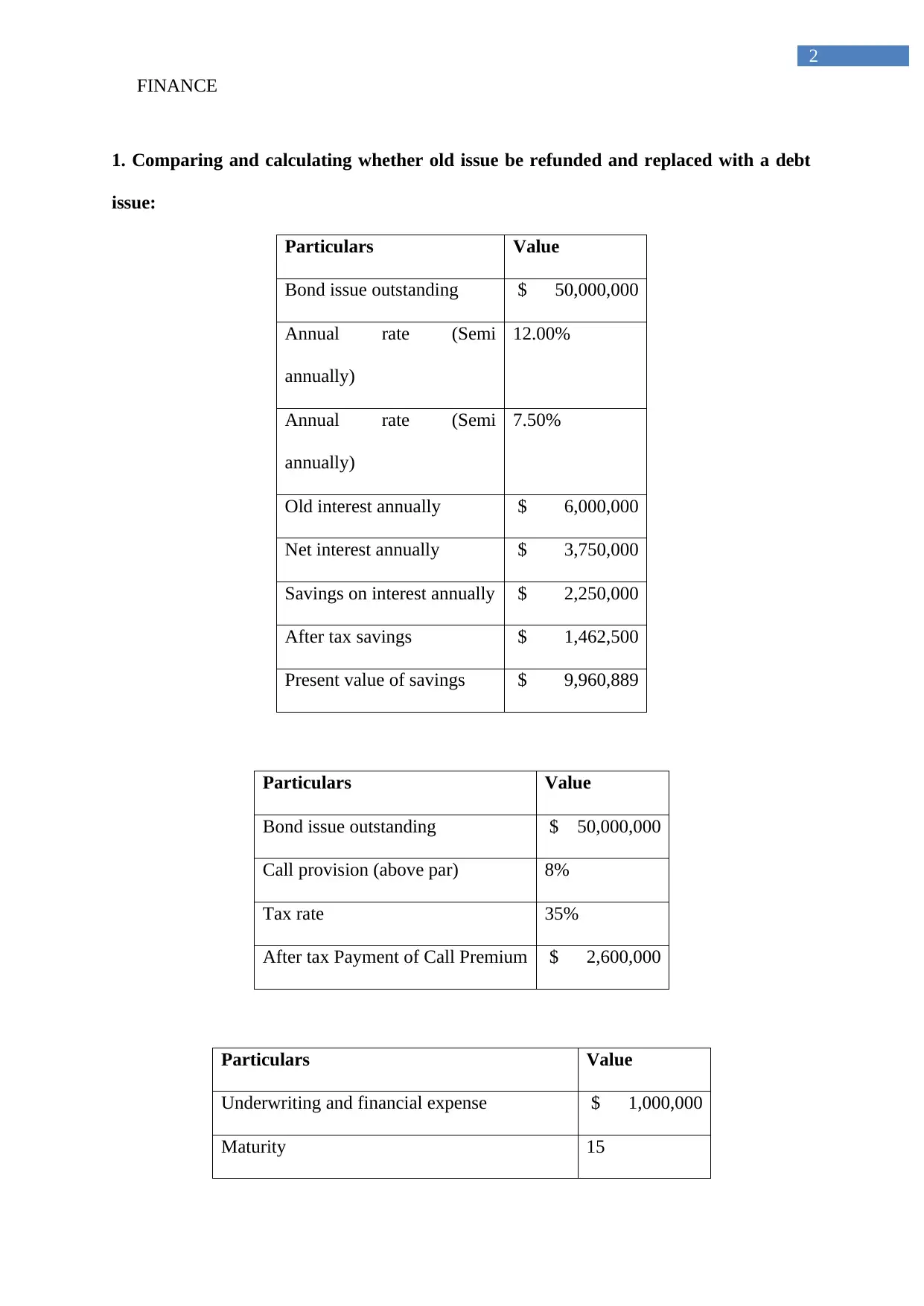

1. Comparing and calculating whether old issue be refunded and replaced with a debt

issue:

Particulars Value

Bond issue outstanding $ 50,000,000

Annual rate (Semi

annually)

12.00%

Annual rate (Semi

annually)

7.50%

Old interest annually $ 6,000,000

Net interest annually $ 3,750,000

Savings on interest annually $ 2,250,000

After tax savings $ 1,462,500

Present value of savings $ 9,960,889

Particulars Value

Bond issue outstanding $ 50,000,000

Call provision (above par) 8%

Tax rate 35%

After tax Payment of Call Premium $ 2,600,000

Particulars Value

Underwriting and financial expense $ 1,000,000

Maturity 15

2

1. Comparing and calculating whether old issue be refunded and replaced with a debt

issue:

Particulars Value

Bond issue outstanding $ 50,000,000

Annual rate (Semi

annually)

12.00%

Annual rate (Semi

annually)

7.50%

Old interest annually $ 6,000,000

Net interest annually $ 3,750,000

Savings on interest annually $ 2,250,000

After tax savings $ 1,462,500

Present value of savings $ 9,960,889

Particulars Value

Bond issue outstanding $ 50,000,000

Call provision (above par) 8%

Tax rate 35%

After tax Payment of Call Premium $ 2,600,000

Particulars Value

Underwriting and financial expense $ 1,000,000

Maturity 15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE

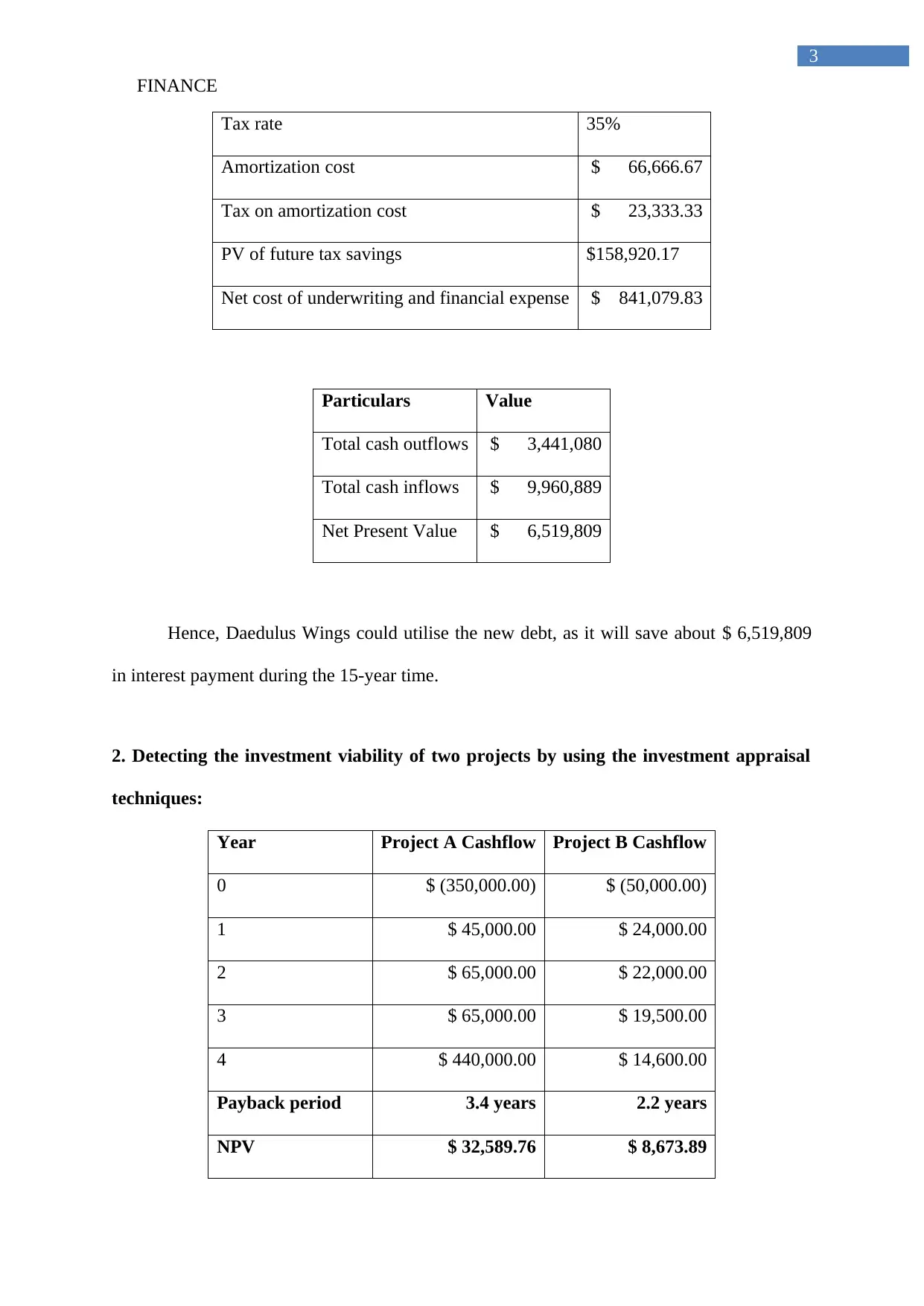

3

Tax rate 35%

Amortization cost $ 66,666.67

Tax on amortization cost $ 23,333.33

PV of future tax savings $158,920.17

Net cost of underwriting and financial expense $ 841,079.83

Particulars Value

Total cash outflows $ 3,441,080

Total cash inflows $ 9,960,889

Net Present Value $ 6,519,809

Hence, Daedulus Wings could utilise the new debt, as it will save about $ 6,519,809

in interest payment during the 15-year time.

2. Detecting the investment viability of two projects by using the investment appraisal

techniques:

Year Project A Cashflow Project B Cashflow

0 $ (350,000.00) $ (50,000.00)

1 $ 45,000.00 $ 24,000.00

2 $ 65,000.00 $ 22,000.00

3 $ 65,000.00 $ 19,500.00

4 $ 440,000.00 $ 14,600.00

Payback period 3.4 years 2.2 years

NPV $ 32,589.76 $ 8,673.89

3

Tax rate 35%

Amortization cost $ 66,666.67

Tax on amortization cost $ 23,333.33

PV of future tax savings $158,920.17

Net cost of underwriting and financial expense $ 841,079.83

Particulars Value

Total cash outflows $ 3,441,080

Total cash inflows $ 9,960,889

Net Present Value $ 6,519,809

Hence, Daedulus Wings could utilise the new debt, as it will save about $ 6,519,809

in interest payment during the 15-year time.

2. Detecting the investment viability of two projects by using the investment appraisal

techniques:

Year Project A Cashflow Project B Cashflow

0 $ (350,000.00) $ (50,000.00)

1 $ 45,000.00 $ 24,000.00

2 $ 65,000.00 $ 22,000.00

3 $ 65,000.00 $ 19,500.00

4 $ 440,000.00 $ 14,600.00

Payback period 3.4 years 2.2 years

NPV $ 32,589.76 $ 8,673.89

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

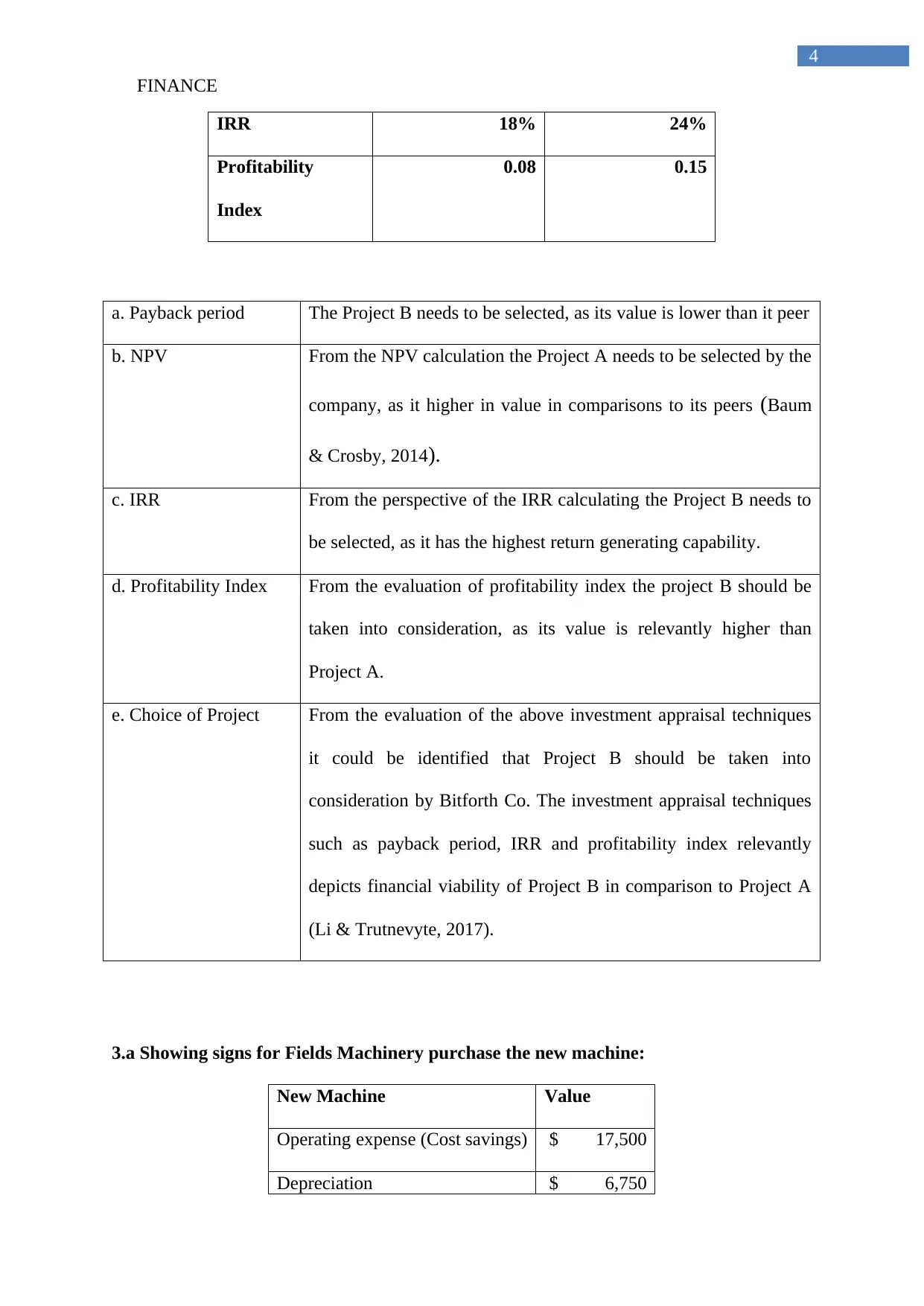

4

IRR 18% 24%

Profitability

Index

0.08 0.15

a. Payback period The Project B needs to be selected, as its value is lower than it peer

b. NPV From the NPV calculation the Project A needs to be selected by the

company, as it higher in value in comparisons to its peers (Baum

& Crosby, 2014).

c. IRR From the perspective of the IRR calculating the Project B needs to

be selected, as it has the highest return generating capability.

d. Profitability Index From the evaluation of profitability index the project B should be

taken into consideration, as its value is relevantly higher than

Project A.

e. Choice of Project From the evaluation of the above investment appraisal techniques

it could be identified that Project B should be taken into

consideration by Bitforth Co. The investment appraisal techniques

such as payback period, IRR and profitability index relevantly

depicts financial viability of Project B in comparison to Project A

(Li & Trutnevyte, 2017).

3.a Showing signs for Fields Machinery purchase the new machine:

New Machine Value

Operating expense (Cost savings) $ 17,500

Depreciation $ 6,750

4

IRR 18% 24%

Profitability

Index

0.08 0.15

a. Payback period The Project B needs to be selected, as its value is lower than it peer

b. NPV From the NPV calculation the Project A needs to be selected by the

company, as it higher in value in comparisons to its peers (Baum

& Crosby, 2014).

c. IRR From the perspective of the IRR calculating the Project B needs to

be selected, as it has the highest return generating capability.

d. Profitability Index From the evaluation of profitability index the project B should be

taken into consideration, as its value is relevantly higher than

Project A.

e. Choice of Project From the evaluation of the above investment appraisal techniques

it could be identified that Project B should be taken into

consideration by Bitforth Co. The investment appraisal techniques

such as payback period, IRR and profitability index relevantly

depicts financial viability of Project B in comparison to Project A

(Li & Trutnevyte, 2017).

3.a Showing signs for Fields Machinery purchase the new machine:

New Machine Value

Operating expense (Cost savings) $ 17,500

Depreciation $ 6,750

FINANCE

5

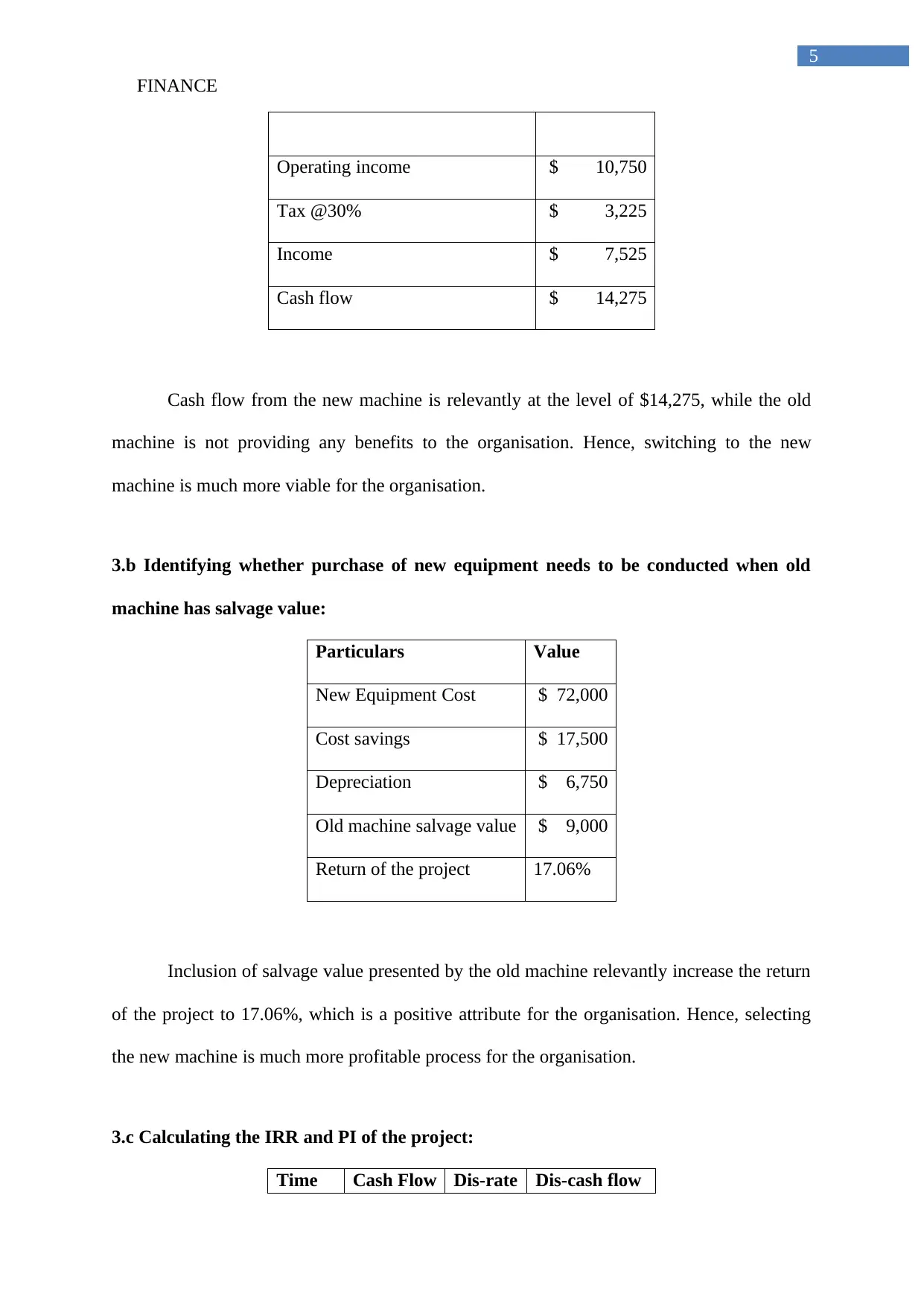

Operating income $ 10,750

Tax @30% $ 3,225

Income $ 7,525

Cash flow $ 14,275

Cash flow from the new machine is relevantly at the level of $14,275, while the old

machine is not providing any benefits to the organisation. Hence, switching to the new

machine is much more viable for the organisation.

3.b Identifying whether purchase of new equipment needs to be conducted when old

machine has salvage value:

Particulars Value

New Equipment Cost $ 72,000

Cost savings $ 17,500

Depreciation $ 6,750

Old machine salvage value $ 9,000

Return of the project 17.06%

Inclusion of salvage value presented by the old machine relevantly increase the return

of the project to 17.06%, which is a positive attribute for the organisation. Hence, selecting

the new machine is much more profitable process for the organisation.

3.c Calculating the IRR and PI of the project:

Time Cash Flow Dis-rate Dis-cash flow

5

Operating income $ 10,750

Tax @30% $ 3,225

Income $ 7,525

Cash flow $ 14,275

Cash flow from the new machine is relevantly at the level of $14,275, while the old

machine is not providing any benefits to the organisation. Hence, switching to the new

machine is much more viable for the organisation.

3.b Identifying whether purchase of new equipment needs to be conducted when old

machine has salvage value:

Particulars Value

New Equipment Cost $ 72,000

Cost savings $ 17,500

Depreciation $ 6,750

Old machine salvage value $ 9,000

Return of the project 17.06%

Inclusion of salvage value presented by the old machine relevantly increase the return

of the project to 17.06%, which is a positive attribute for the organisation. Hence, selecting

the new machine is much more profitable process for the organisation.

3.c Calculating the IRR and PI of the project:

Time Cash Flow Dis-rate Dis-cash flow

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE

6

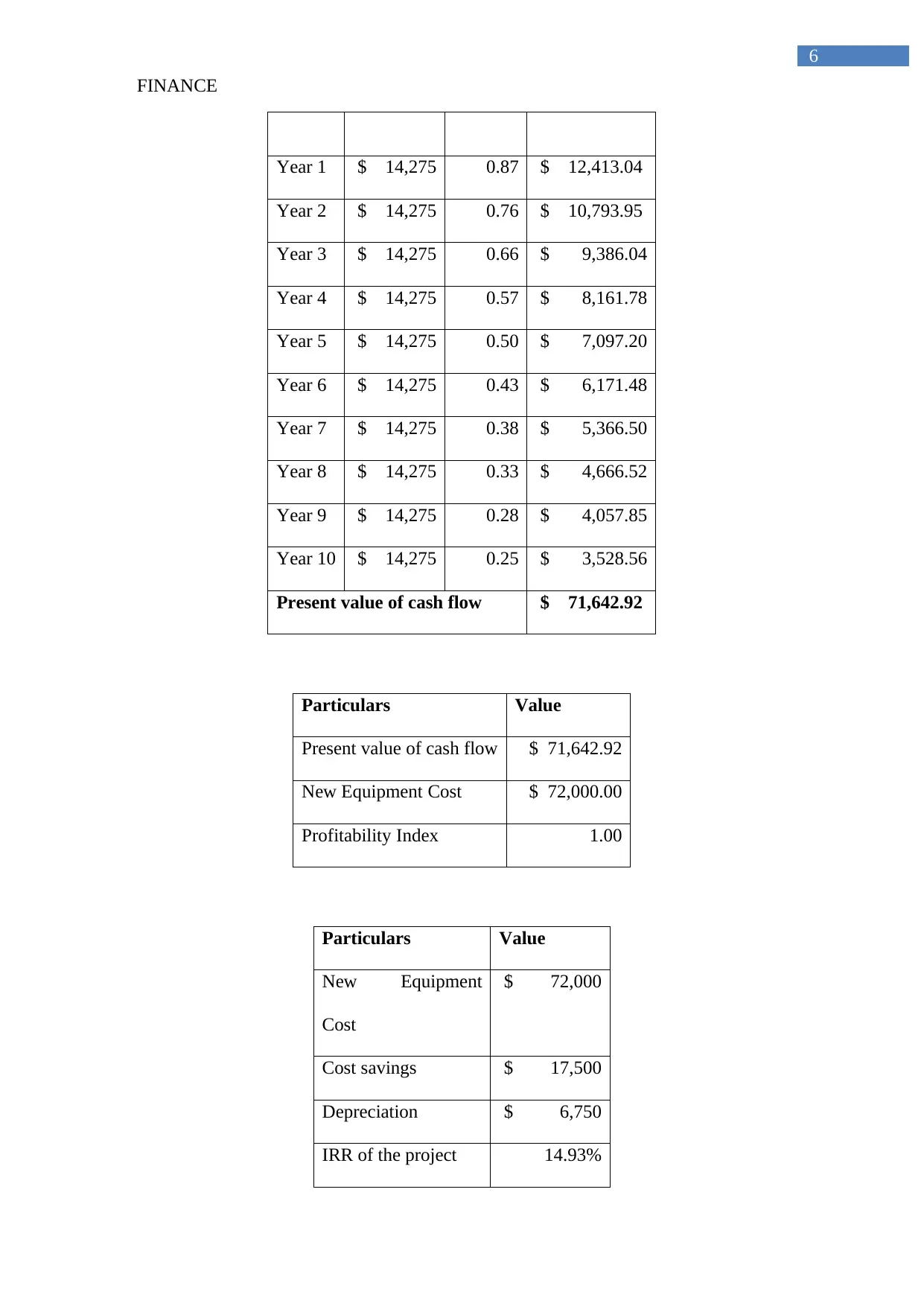

Year 1 $ 14,275 0.87 $ 12,413.04

Year 2 $ 14,275 0.76 $ 10,793.95

Year 3 $ 14,275 0.66 $ 9,386.04

Year 4 $ 14,275 0.57 $ 8,161.78

Year 5 $ 14,275 0.50 $ 7,097.20

Year 6 $ 14,275 0.43 $ 6,171.48

Year 7 $ 14,275 0.38 $ 5,366.50

Year 8 $ 14,275 0.33 $ 4,666.52

Year 9 $ 14,275 0.28 $ 4,057.85

Year 10 $ 14,275 0.25 $ 3,528.56

Present value of cash flow $ 71,642.92

Particulars Value

Present value of cash flow $ 71,642.92

New Equipment Cost $ 72,000.00

Profitability Index 1.00

Particulars Value

New Equipment

Cost

$ 72,000

Cost savings $ 17,500

Depreciation $ 6,750

IRR of the project 14.93%

6

Year 1 $ 14,275 0.87 $ 12,413.04

Year 2 $ 14,275 0.76 $ 10,793.95

Year 3 $ 14,275 0.66 $ 9,386.04

Year 4 $ 14,275 0.57 $ 8,161.78

Year 5 $ 14,275 0.50 $ 7,097.20

Year 6 $ 14,275 0.43 $ 6,171.48

Year 7 $ 14,275 0.38 $ 5,366.50

Year 8 $ 14,275 0.33 $ 4,666.52

Year 9 $ 14,275 0.28 $ 4,057.85

Year 10 $ 14,275 0.25 $ 3,528.56

Present value of cash flow $ 71,642.92

Particulars Value

Present value of cash flow $ 71,642.92

New Equipment Cost $ 72,000.00

Profitability Index 1.00

Particulars Value

New Equipment

Cost

$ 72,000

Cost savings $ 17,500

Depreciation $ 6,750

IRR of the project 14.93%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

7

References:

Baum, A. E., & Crosby, N. (2014). Property investment appraisal. John Wiley & Sons.

Li, F. G., & Trutnevyte, E. (2017). Investment appraisal of cost-optimal and near-optimal

pathways for the UK electricity sector transition to 2050. Applied energy, 189, 89-

109.

7

References:

Baum, A. E., & Crosby, N. (2014). Property investment appraisal. John Wiley & Sons.

Li, F. G., & Trutnevyte, E. (2017). Investment appraisal of cost-optimal and near-optimal

pathways for the UK electricity sector transition to 2050. Applied energy, 189, 89-

109.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.