Airline Financial Performance Analysis

VerifiedAdded on 2020/04/21

|5

|428

|148

AI Summary

This assignment tasks students with evaluating the financial health of four prominent airlines: WestJet, Air Canada, Delta, and Southwest Airlines. Students will utilize various financial ratios to assess performance based on provided quarterly and annual earnings forecasts. The analysis should consider trends and comparisons across these airlines.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: FINANCE

Finance

Name of the Student:

Name of the University:

Author’s Note:

Finance

Name of the Student:

Name of the University:

Author’s Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1FINANCE

Table of Contents

Exhibit 1:.........................................................................................................................................2

Exhibit 2:.........................................................................................................................................2

Exhibit 3:.........................................................................................................................................2

Exhibit 4:.........................................................................................................................................3

Exhibit 5:.........................................................................................................................................3

Bibliography:...................................................................................................................................4

Table of Contents

Exhibit 1:.........................................................................................................................................2

Exhibit 2:.........................................................................................................................................2

Exhibit 3:.........................................................................................................................................2

Exhibit 4:.........................................................................................................................................3

Exhibit 5:.........................................................................................................................................3

Bibliography:...................................................................................................................................4

2FINANCE

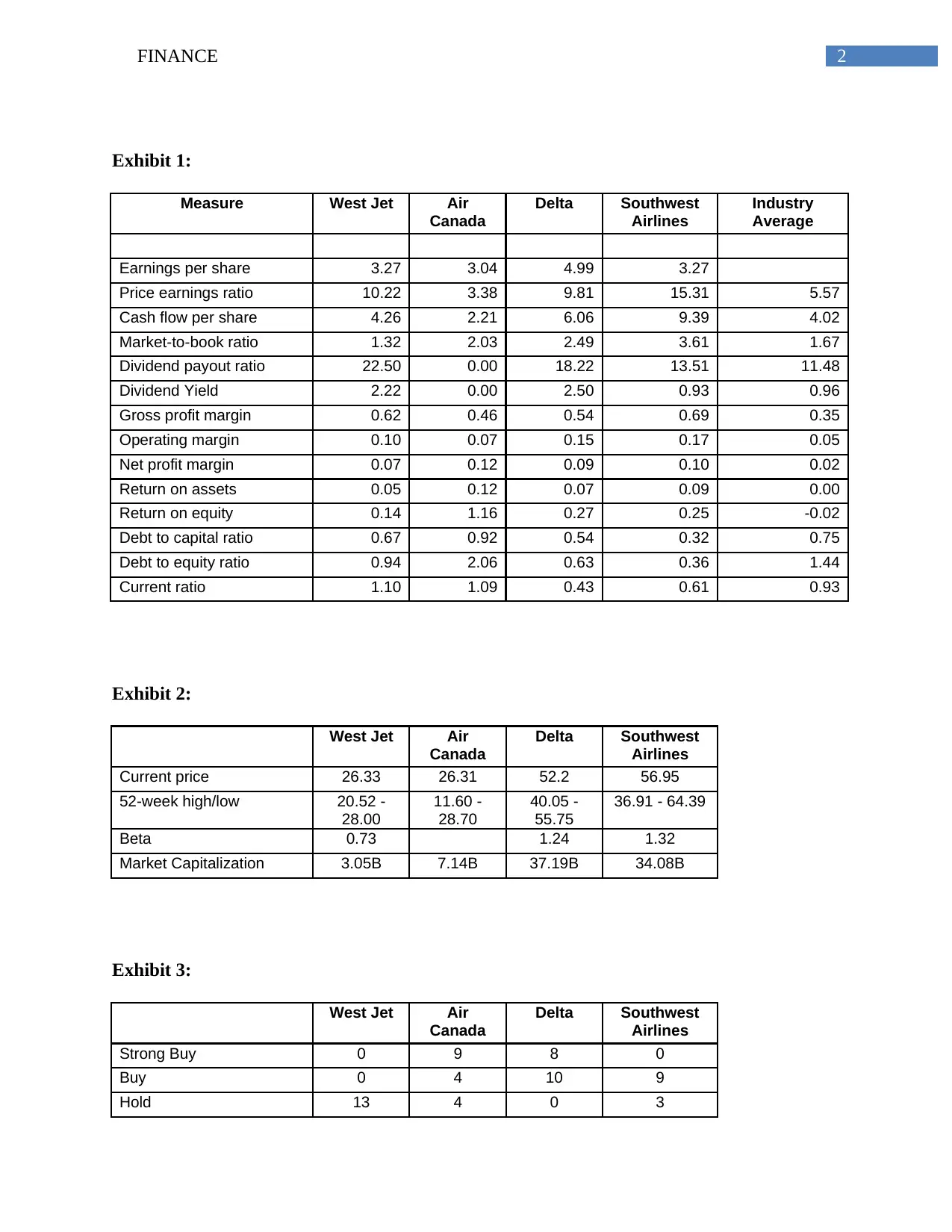

Exhibit 1:

Measure West Jet Air

Canada

Delta Southwest

Airlines

Industry

Average

Earnings per share 3.27 3.04 4.99 3.27

Price earnings ratio 10.22 3.38 9.81 15.31 5.57

Cash flow per share 4.26 2.21 6.06 9.39 4.02

Market-to-book ratio 1.32 2.03 2.49 3.61 1.67

Dividend payout ratio 22.50 0.00 18.22 13.51 11.48

Dividend Yield 2.22 0.00 2.50 0.93 0.96

Gross profit margin 0.62 0.46 0.54 0.69 0.35

Operating margin 0.10 0.07 0.15 0.17 0.05

Net profit margin 0.07 0.12 0.09 0.10 0.02

Return on assets 0.05 0.12 0.07 0.09 0.00

Return on equity 0.14 1.16 0.27 0.25 -0.02

Debt to capital ratio 0.67 0.92 0.54 0.32 0.75

Debt to equity ratio 0.94 2.06 0.63 0.36 1.44

Current ratio 1.10 1.09 0.43 0.61 0.93

Exhibit 2:

West Jet Air

Canada

Delta Southwest

Airlines

Current price 26.33 26.31 52.2 56.95

52-week high/low 20.52 -

28.00

11.60 -

28.70

40.05 -

55.75

36.91 - 64.39

Beta 0.73 1.24 1.32

Market Capitalization 3.05B 7.14B 37.19B 34.08B

Exhibit 3:

West Jet Air

Canada

Delta Southwest

Airlines

Strong Buy 0 9 8 0

Buy 0 4 10 9

Hold 13 4 0 3

Exhibit 1:

Measure West Jet Air

Canada

Delta Southwest

Airlines

Industry

Average

Earnings per share 3.27 3.04 4.99 3.27

Price earnings ratio 10.22 3.38 9.81 15.31 5.57

Cash flow per share 4.26 2.21 6.06 9.39 4.02

Market-to-book ratio 1.32 2.03 2.49 3.61 1.67

Dividend payout ratio 22.50 0.00 18.22 13.51 11.48

Dividend Yield 2.22 0.00 2.50 0.93 0.96

Gross profit margin 0.62 0.46 0.54 0.69 0.35

Operating margin 0.10 0.07 0.15 0.17 0.05

Net profit margin 0.07 0.12 0.09 0.10 0.02

Return on assets 0.05 0.12 0.07 0.09 0.00

Return on equity 0.14 1.16 0.27 0.25 -0.02

Debt to capital ratio 0.67 0.92 0.54 0.32 0.75

Debt to equity ratio 0.94 2.06 0.63 0.36 1.44

Current ratio 1.10 1.09 0.43 0.61 0.93

Exhibit 2:

West Jet Air

Canada

Delta Southwest

Airlines

Current price 26.33 26.31 52.2 56.95

52-week high/low 20.52 -

28.00

11.60 -

28.70

40.05 -

55.75

36.91 - 64.39

Beta 0.73 1.24 1.32

Market Capitalization 3.05B 7.14B 37.19B 34.08B

Exhibit 3:

West Jet Air

Canada

Delta Southwest

Airlines

Strong Buy 0 9 8 0

Buy 0 4 10 9

Hold 13 4 0 3

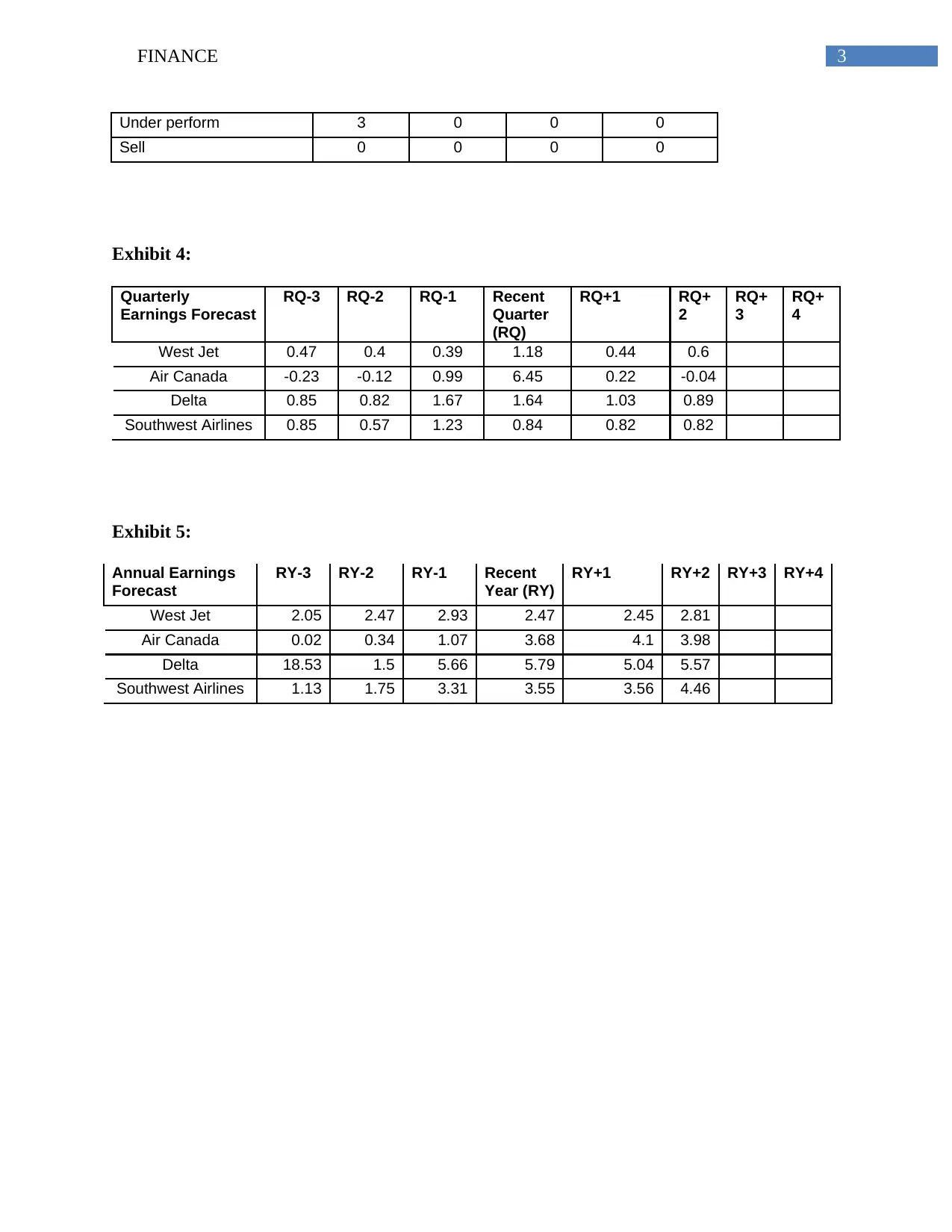

3FINANCE

Under perform 3 0 0 0

Sell 0 0 0 0

Exhibit 4:

Quarterly

Earnings Forecast

RQ-3 RQ-2 RQ-1 Recent

Quarter

(RQ)

RQ+1 RQ+

2

RQ+

3

RQ+

4

West Jet 0.47 0.4 0.39 1.18 0.44 0.6

Air Canada -0.23 -0.12 0.99 6.45 0.22 -0.04

Delta 0.85 0.82 1.67 1.64 1.03 0.89

Southwest Airlines 0.85 0.57 1.23 0.84 0.82 0.82

Exhibit 5:

Annual Earnings

Forecast

RY-3 RY-2 RY-1 Recent

Year (RY)

RY+1 RY+2 RY+3 RY+4

West Jet 2.05 2.47 2.93 2.47 2.45 2.81

Air Canada 0.02 0.34 1.07 3.68 4.1 3.98

Delta 18.53 1.5 5.66 5.79 5.04 5.57

Southwest Airlines 1.13 1.75 3.31 3.55 3.56 4.46

Under perform 3 0 0 0

Sell 0 0 0 0

Exhibit 4:

Quarterly

Earnings Forecast

RQ-3 RQ-2 RQ-1 Recent

Quarter

(RQ)

RQ+1 RQ+

2

RQ+

3

RQ+

4

West Jet 0.47 0.4 0.39 1.18 0.44 0.6

Air Canada -0.23 -0.12 0.99 6.45 0.22 -0.04

Delta 0.85 0.82 1.67 1.64 1.03 0.89

Southwest Airlines 0.85 0.57 1.23 0.84 0.82 0.82

Exhibit 5:

Annual Earnings

Forecast

RY-3 RY-2 RY-1 Recent

Year (RY)

RY+1 RY+2 RY+3 RY+4

West Jet 2.05 2.47 2.93 2.47 2.45 2.81

Air Canada 0.02 0.34 1.07 3.68 4.1 3.98

Delta 18.53 1.5 5.66 5.79 5.04 5.57

Southwest Airlines 1.13 1.75 3.31 3.55 3.56 4.46

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4FINANCE

Bibliography:

Brigham, E. F., & Ehrhardt, M. C. (2013). Financial management: Theory & practice. Cengage

Learning.

Delen, D., Kuzey, C., & Uyar, A. (2013). Measuring firm performance using financial ratios: A

decision tree approach. Expert Systems with Applications, 40(10), 3970-3983.

Jordan, B. (2014). Fundamentals of investments. McGraw-Hill Higher Education

Bibliography:

Brigham, E. F., & Ehrhardt, M. C. (2013). Financial management: Theory & practice. Cengage

Learning.

Delen, D., Kuzey, C., & Uyar, A. (2013). Measuring firm performance using financial ratios: A

decision tree approach. Expert Systems with Applications, 40(10), 3970-3983.

Jordan, B. (2014). Fundamentals of investments. McGraw-Hill Higher Education

1 out of 5

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.