Financial Performance Analysis of Gulf Cement and RAK Cement Companies

VerifiedAdded on 2021/04/19

|18

|3860

|43

Report

AI Summary

This report presents a comprehensive financial analysis of Gulf Cement Company P.S.C and Ras Al Khaimah Co. For White Cement & Construction Materials (RAK), both UAE-based firms in the cement industry. It examines their financial performance from 2014 to 2016 through ratio analysis, covering liquidity, leverage, efficiency, and profitability. The report compares the companies, contrasting their strengths and weaknesses based on key financial metrics. It includes an industry comparison and applies DuPont analysis to assess Return on Equity (ROE) drivers. Furthermore, the report employs the Dividend Discount Model to evaluate the intrinsic value of both companies' shares. The analysis reveals insights into each company's financial health, providing a basis for investment considerations.

RUNNING HEAD: FINANCE

Financial analysis

Financial analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance 1

Contents

Financial overview......................................................................................................................................2

Change in ratios...........................................................................................................................................2

Comparison – Gulf VS RAK.......................................................................................................................4

Companies VS Industry...............................................................................................................................5

DuPont Analysis..........................................................................................................................................6

Dividend Discount Model...........................................................................................................................6

References...................................................................................................................................................7

Appendix 1..................................................................................................................................................8

Appendix 2................................................................................................................................................13

Appendix 3................................................................................................................................................16

Contents

Financial overview......................................................................................................................................2

Change in ratios...........................................................................................................................................2

Comparison – Gulf VS RAK.......................................................................................................................4

Companies VS Industry...............................................................................................................................5

DuPont Analysis..........................................................................................................................................6

Dividend Discount Model...........................................................................................................................6

References...................................................................................................................................................7

Appendix 1..................................................................................................................................................8

Appendix 2................................................................................................................................................13

Appendix 3................................................................................................................................................16

Finance 2

Financial overview

Gulf Cement Company P.S.C is a UAE based manufacturing firm that is engaged in the

production and marketing of all types of cements. It makes ordinary Portland cement, sulphate

resisting Portland cement and many more. The company made revenue of AED 583.20 million in

year 2017 (Reuters.com. 2018).

Ras Al Khaimah Co. For White Cement & Construction Materials also operates in the same

industry and deals with the production and distribution of white cements, lime and concrete

blocks. It is also situated in UAE and had made revenue worth AED 307 million in year 2016

(Rakwhitecement.ae. 2018).

Change in ratios

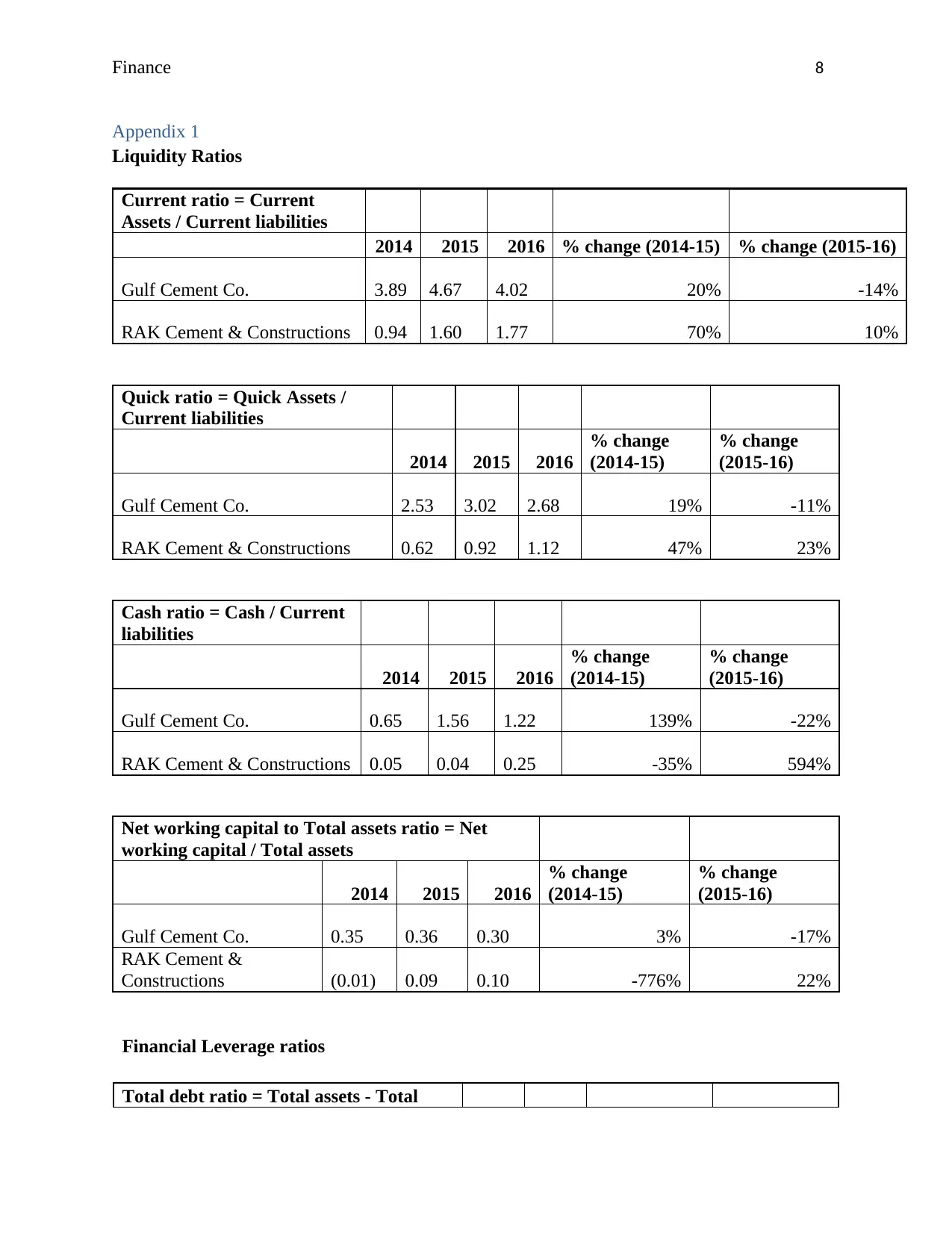

Referring to the calculation in Appendix 1, it can be said that the current and quick ratio of Gulf

Co. has reduced in 2016 by 14% and 11% respectively. Along with this, a reduction in the cash

ratio and net working capital to total asset ratio was also noticed by 22% and 17% in 2016,

respectively. This is because Gulf’s annual report recorded a decrease in its current assets and

current liabilities. A reverse trend was observed in RAK’s current and quick ratios, as both of

them increased by 10% and 23% in 2016 as compare to 2015. A major change was there in

RAK’s cash ratio as it increases by 594% in 2016, whereas the same figure reduces by 35% in

2015. Reason being, a huge increase was there in the amount of cash in 2016. Its NWC/TA ratio

has also rises by 22% due to an increase in the total assets of the company.

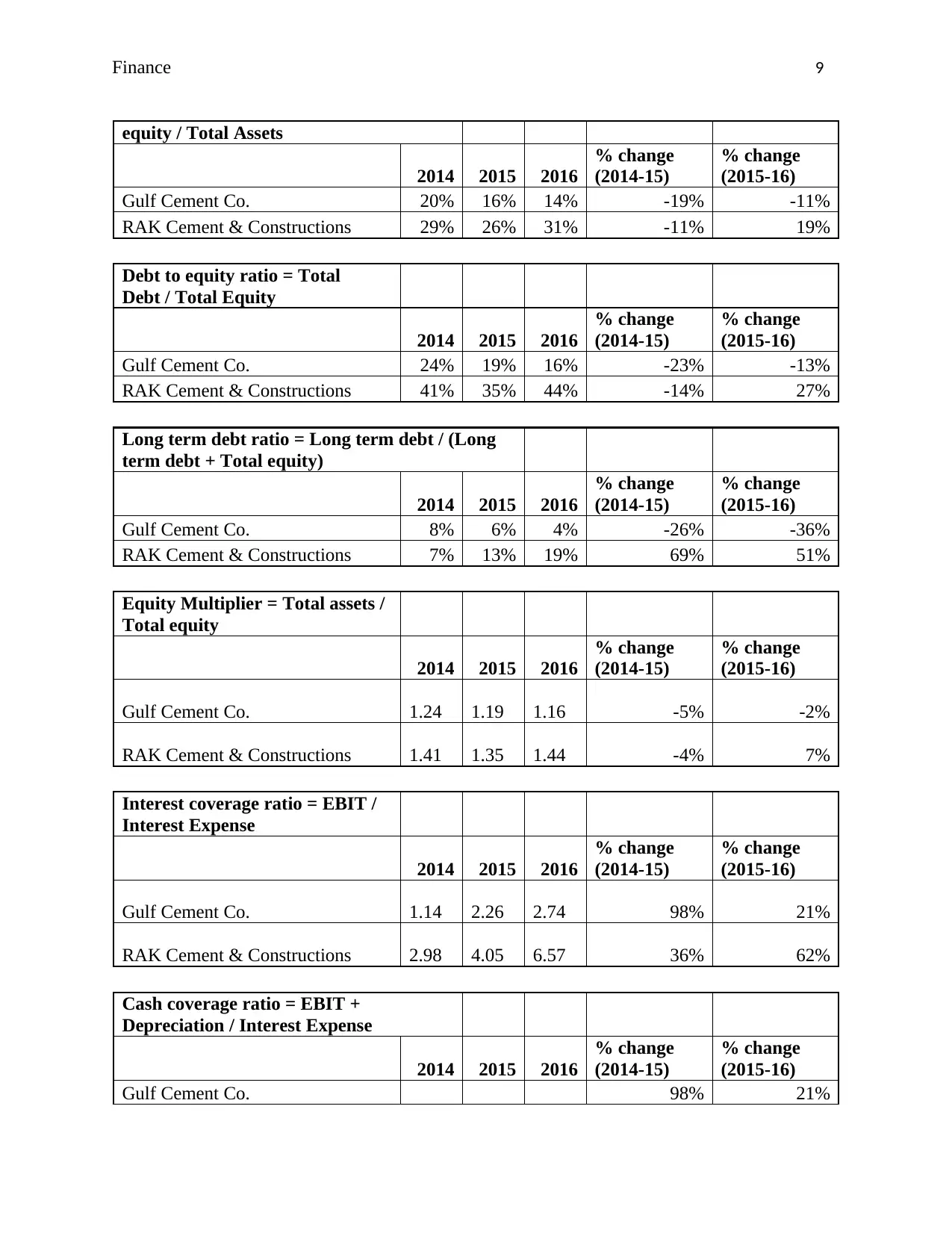

Talking about the leverage ratios, Gulf Co. had less financial risk as a continuous decrease is

noticed in the ratios over the three years. Its total debt ratio, D/E ratio, Long term debt ratio and

equity multiplier reduces by 11%, 13%, 36% and 2% respectively. This is due to the consistent

Financial overview

Gulf Cement Company P.S.C is a UAE based manufacturing firm that is engaged in the

production and marketing of all types of cements. It makes ordinary Portland cement, sulphate

resisting Portland cement and many more. The company made revenue of AED 583.20 million in

year 2017 (Reuters.com. 2018).

Ras Al Khaimah Co. For White Cement & Construction Materials also operates in the same

industry and deals with the production and distribution of white cements, lime and concrete

blocks. It is also situated in UAE and had made revenue worth AED 307 million in year 2016

(Rakwhitecement.ae. 2018).

Change in ratios

Referring to the calculation in Appendix 1, it can be said that the current and quick ratio of Gulf

Co. has reduced in 2016 by 14% and 11% respectively. Along with this, a reduction in the cash

ratio and net working capital to total asset ratio was also noticed by 22% and 17% in 2016,

respectively. This is because Gulf’s annual report recorded a decrease in its current assets and

current liabilities. A reverse trend was observed in RAK’s current and quick ratios, as both of

them increased by 10% and 23% in 2016 as compare to 2015. A major change was there in

RAK’s cash ratio as it increases by 594% in 2016, whereas the same figure reduces by 35% in

2015. Reason being, a huge increase was there in the amount of cash in 2016. Its NWC/TA ratio

has also rises by 22% due to an increase in the total assets of the company.

Talking about the leverage ratios, Gulf Co. had less financial risk as a continuous decrease is

noticed in the ratios over the three years. Its total debt ratio, D/E ratio, Long term debt ratio and

equity multiplier reduces by 11%, 13%, 36% and 2% respectively. This is due to the consistent

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance 3

fall in the total liabilities of the company. The ICR and Cash coverage ratio of Gulf co. was same

as there was no depreciation expense reported in firm’s income statement. However, both these

ratios show an upsurge of 21% in 2016. In contrast to it, RAK’s debt has been increased in the

past years which boosted up its ratios in 2016. The debt ratio and D/E ratio rise by 19% and 27%

along with an increase of 51% in Long term debt ratio. This is because of the increased bank

borrowings of the company in 2016. (Lee & Lee, 2016)

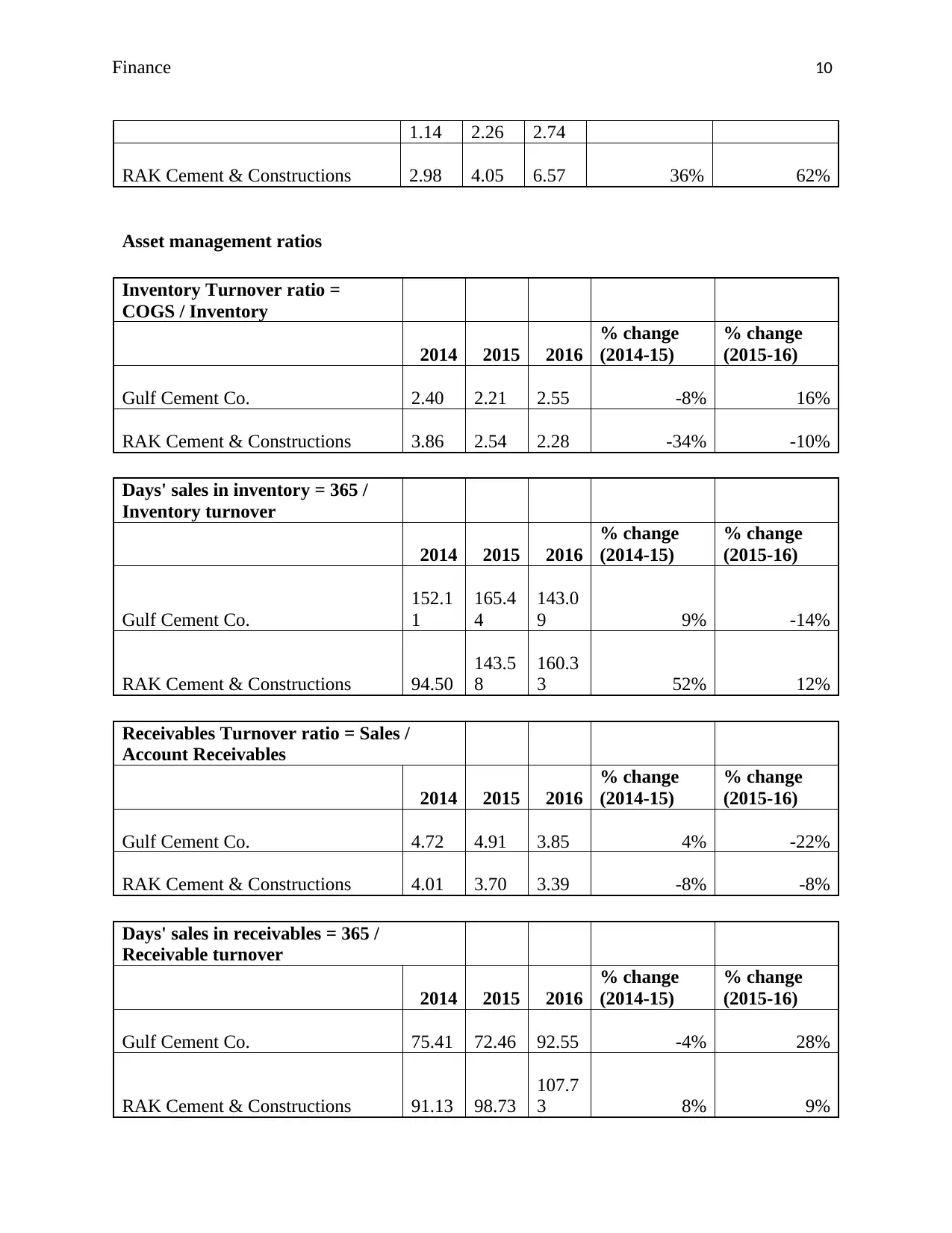

Gulf’s Co. efficiency has reduced during the years, apart from its Inventory turnover ratio which

shows a slightest increase in 2016 by 16%. Also its days Sales in inventory has reduced by 14%

in 2016. But apart from this, its DTR, TATR and FATR, all reduces by 22%, 4% and 14%

respectively. The reason behind this is the downfall in the overall turnover of company. Looking

at RAK’s efficiency ratios, the same trend follows. It’s ITR and DTR both reduce by 10% and

8% as well as an increase of 12% and 9% was observed in its days’ sales in inventory and

receivables. The TATR, FATR and NWCTR also reported a downfall in year 2016. Reason was

the reduction in amount of total assets and total revenue over the years.

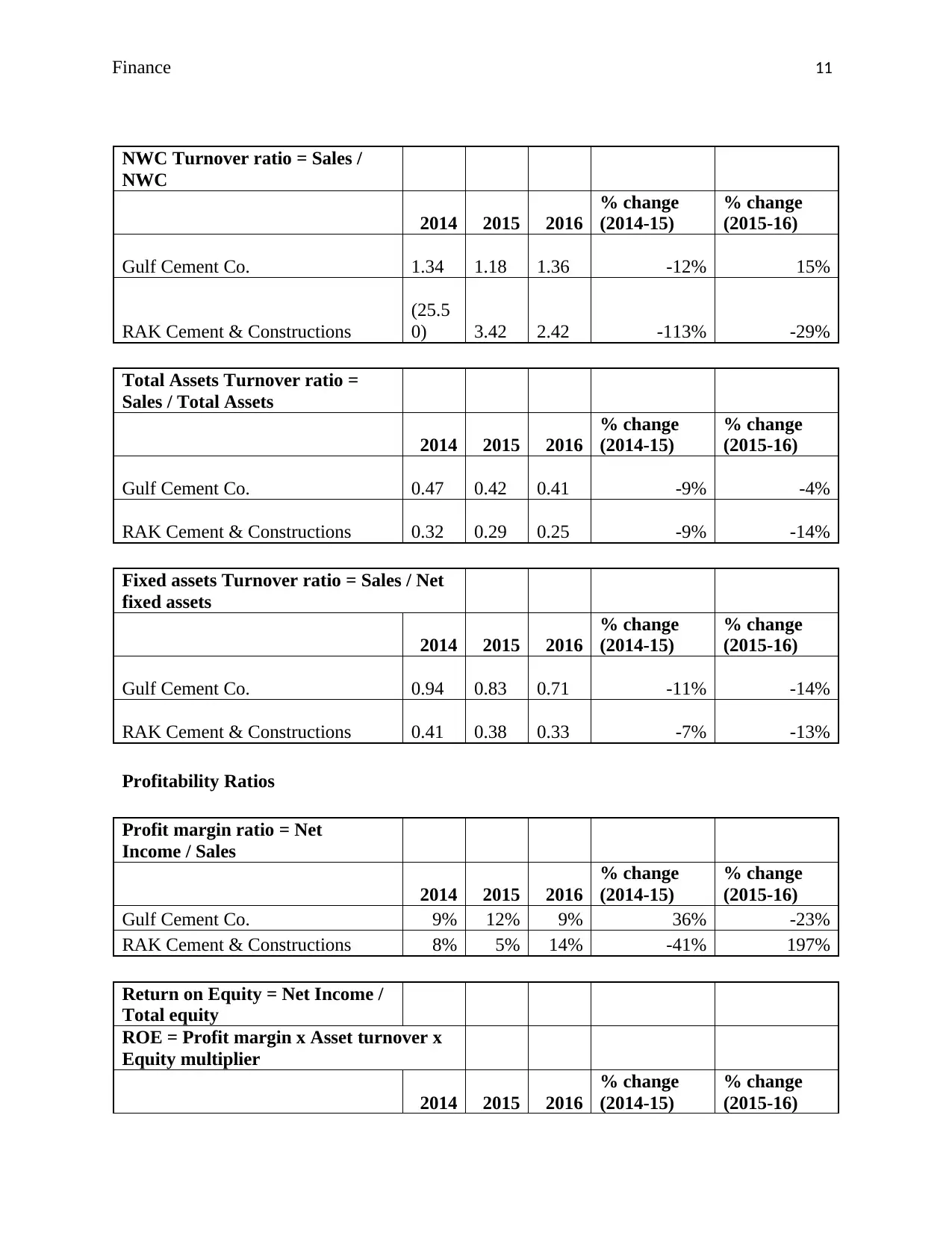

As far as profitability is concerned, the net profit margin of Gulf Co. has reduced by 23% in

2016 as compare to 2015. As a result of which, it’s ROA and ROE has decreased by 28% and

27% in year 2016, respectively. This is due to the decline in the net income earned by the firm.

While, RAK shows an increasing trend in all of its profitability ratios because of the huge

increase in its net profit in 2016 as compare to 2015. The net profit margin was increased to a

great extent of 197% in 2016 while the same figure reduces by 41% in 2015. Similarly, its ROA

and ROE also reported a huge upsurge of 173% and 155% in 2016.

fall in the total liabilities of the company. The ICR and Cash coverage ratio of Gulf co. was same

as there was no depreciation expense reported in firm’s income statement. However, both these

ratios show an upsurge of 21% in 2016. In contrast to it, RAK’s debt has been increased in the

past years which boosted up its ratios in 2016. The debt ratio and D/E ratio rise by 19% and 27%

along with an increase of 51% in Long term debt ratio. This is because of the increased bank

borrowings of the company in 2016. (Lee & Lee, 2016)

Gulf’s Co. efficiency has reduced during the years, apart from its Inventory turnover ratio which

shows a slightest increase in 2016 by 16%. Also its days Sales in inventory has reduced by 14%

in 2016. But apart from this, its DTR, TATR and FATR, all reduces by 22%, 4% and 14%

respectively. The reason behind this is the downfall in the overall turnover of company. Looking

at RAK’s efficiency ratios, the same trend follows. It’s ITR and DTR both reduce by 10% and

8% as well as an increase of 12% and 9% was observed in its days’ sales in inventory and

receivables. The TATR, FATR and NWCTR also reported a downfall in year 2016. Reason was

the reduction in amount of total assets and total revenue over the years.

As far as profitability is concerned, the net profit margin of Gulf Co. has reduced by 23% in

2016 as compare to 2015. As a result of which, it’s ROA and ROE has decreased by 28% and

27% in year 2016, respectively. This is due to the decline in the net income earned by the firm.

While, RAK shows an increasing trend in all of its profitability ratios because of the huge

increase in its net profit in 2016 as compare to 2015. The net profit margin was increased to a

great extent of 197% in 2016 while the same figure reduces by 41% in 2015. Similarly, its ROA

and ROE also reported a huge upsurge of 173% and 155% in 2016.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance 4

The P/E ratio of Gulf has increased by 47% in 2016 along with an increase of 7% in it price to

sales ratio. However its PEG ratio reported a huge downfall of 188% in 2016 and 140% in 2015.

This is because of the negative growth in its earnings. No change was notice in its Market to

book ratio due the same number of shares issued. On other hand, reverse trend was observed in

RAK’s market ratios. Its P/E ratio, PEG ratio, Price to sales and Market to book ratio, all reduces

by 69%, 109%, 10%, and 17% respectively. Reason being the reduced market price of the share

and the number of shares issued.

Comparison – Gulf VS RAK

In order to compare the financial performance of both the companies, ratio analysis is done.

Referring to Appendix 2, it is observed that the liquidity position of RAK Company is much

better than Gulf Cement Co. This is due to increase in its current and quick ratio. This implies

that company has enough cash and current assets to meet its current liabilities. Unlike liquidity,

RAK involves a huge financial risk as compare to Gulf Co. because of the increased debt ratios.

The total debt Ratio of RAK was 31% whereas the same reported by Gulf was only 14%. RAK’s

debt to equity was 44% in 2016 which is more than double of Gulf’s D/E ratio. This implies that

most of the assets of RAK are financed through debt and thus the company has greater risk.

Talking about the efficiency, Gulf is much more efficient in utilizing its assets than RAK for the

purpose of generating revenue. The total asset and fixed assets turnover, DTR, ITR of Gulf is

slightly more than RAK’s ratio. Also the company takes less time to collect its debtors and

convert its inventory into cash. Thus it can be said that Gulf Cement Co. is more efficient than

RAK. The profitability position of RAK is better because of the 8% increase in its net profits.

This upsurge boosted up its profit margin and the company made more returns on its assets and

The P/E ratio of Gulf has increased by 47% in 2016 along with an increase of 7% in it price to

sales ratio. However its PEG ratio reported a huge downfall of 188% in 2016 and 140% in 2015.

This is because of the negative growth in its earnings. No change was notice in its Market to

book ratio due the same number of shares issued. On other hand, reverse trend was observed in

RAK’s market ratios. Its P/E ratio, PEG ratio, Price to sales and Market to book ratio, all reduces

by 69%, 109%, 10%, and 17% respectively. Reason being the reduced market price of the share

and the number of shares issued.

Comparison – Gulf VS RAK

In order to compare the financial performance of both the companies, ratio analysis is done.

Referring to Appendix 2, it is observed that the liquidity position of RAK Company is much

better than Gulf Cement Co. This is due to increase in its current and quick ratio. This implies

that company has enough cash and current assets to meet its current liabilities. Unlike liquidity,

RAK involves a huge financial risk as compare to Gulf Co. because of the increased debt ratios.

The total debt Ratio of RAK was 31% whereas the same reported by Gulf was only 14%. RAK’s

debt to equity was 44% in 2016 which is more than double of Gulf’s D/E ratio. This implies that

most of the assets of RAK are financed through debt and thus the company has greater risk.

Talking about the efficiency, Gulf is much more efficient in utilizing its assets than RAK for the

purpose of generating revenue. The total asset and fixed assets turnover, DTR, ITR of Gulf is

slightly more than RAK’s ratio. Also the company takes less time to collect its debtors and

convert its inventory into cash. Thus it can be said that Gulf Cement Co. is more efficient than

RAK. The profitability position of RAK is better because of the 8% increase in its net profits.

This upsurge boosted up its profit margin and the company made more returns on its assets and

Finance 5

equity in year 2016. As far as, share price is concerned, RAK’ shares has a high market price as

compared to Gulf Co. However, its market value ratios have reduced to the low number of shares

issued and reduction in the market price (Tracy, 2012).

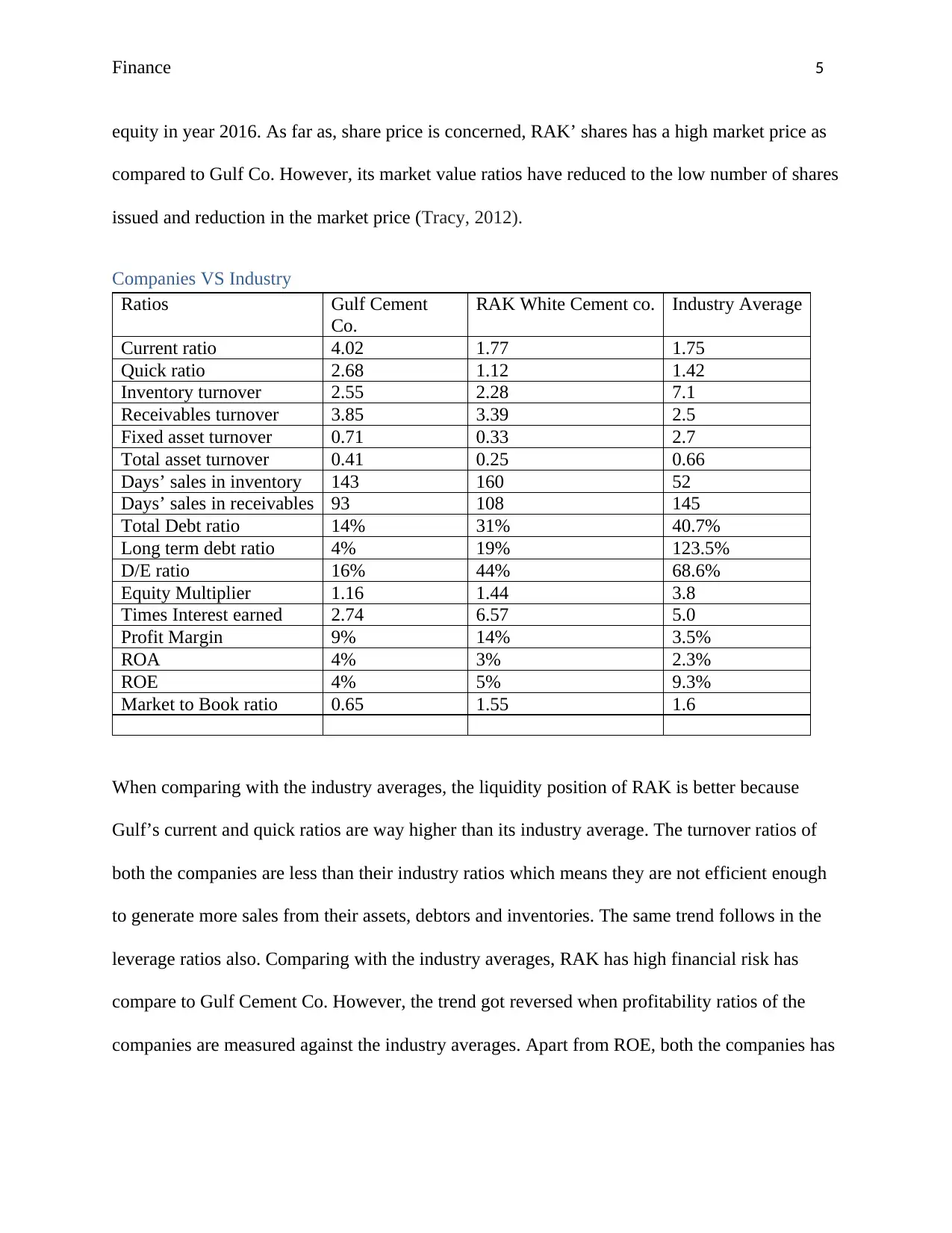

Companies VS Industry

Ratios Gulf Cement

Co.

RAK White Cement co. Industry Average

Current ratio 4.02 1.77 1.75

Quick ratio 2.68 1.12 1.42

Inventory turnover 2.55 2.28 7.1

Receivables turnover 3.85 3.39 2.5

Fixed asset turnover 0.71 0.33 2.7

Total asset turnover 0.41 0.25 0.66

Days’ sales in inventory 143 160 52

Days’ sales in receivables 93 108 145

Total Debt ratio 14% 31% 40.7%

Long term debt ratio 4% 19% 123.5%

D/E ratio 16% 44% 68.6%

Equity Multiplier 1.16 1.44 3.8

Times Interest earned 2.74 6.57 5.0

Profit Margin 9% 14% 3.5%

ROA 4% 3% 2.3%

ROE 4% 5% 9.3%

Market to Book ratio 0.65 1.55 1.6

When comparing with the industry averages, the liquidity position of RAK is better because

Gulf’s current and quick ratios are way higher than its industry average. The turnover ratios of

both the companies are less than their industry ratios which means they are not efficient enough

to generate more sales from their assets, debtors and inventories. The same trend follows in the

leverage ratios also. Comparing with the industry averages, RAK has high financial risk has

compare to Gulf Cement Co. However, the trend got reversed when profitability ratios of the

companies are measured against the industry averages. Apart from ROE, both the companies has

equity in year 2016. As far as, share price is concerned, RAK’ shares has a high market price as

compared to Gulf Co. However, its market value ratios have reduced to the low number of shares

issued and reduction in the market price (Tracy, 2012).

Companies VS Industry

Ratios Gulf Cement

Co.

RAK White Cement co. Industry Average

Current ratio 4.02 1.77 1.75

Quick ratio 2.68 1.12 1.42

Inventory turnover 2.55 2.28 7.1

Receivables turnover 3.85 3.39 2.5

Fixed asset turnover 0.71 0.33 2.7

Total asset turnover 0.41 0.25 0.66

Days’ sales in inventory 143 160 52

Days’ sales in receivables 93 108 145

Total Debt ratio 14% 31% 40.7%

Long term debt ratio 4% 19% 123.5%

D/E ratio 16% 44% 68.6%

Equity Multiplier 1.16 1.44 3.8

Times Interest earned 2.74 6.57 5.0

Profit Margin 9% 14% 3.5%

ROA 4% 3% 2.3%

ROE 4% 5% 9.3%

Market to Book ratio 0.65 1.55 1.6

When comparing with the industry averages, the liquidity position of RAK is better because

Gulf’s current and quick ratios are way higher than its industry average. The turnover ratios of

both the companies are less than their industry ratios which means they are not efficient enough

to generate more sales from their assets, debtors and inventories. The same trend follows in the

leverage ratios also. Comparing with the industry averages, RAK has high financial risk has

compare to Gulf Cement Co. However, the trend got reversed when profitability ratios of the

companies are measured against the industry averages. Apart from ROE, both the companies has

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance 6

high profit margin and ROA, as compare to industry. This means they have a good profitability

position in the market.

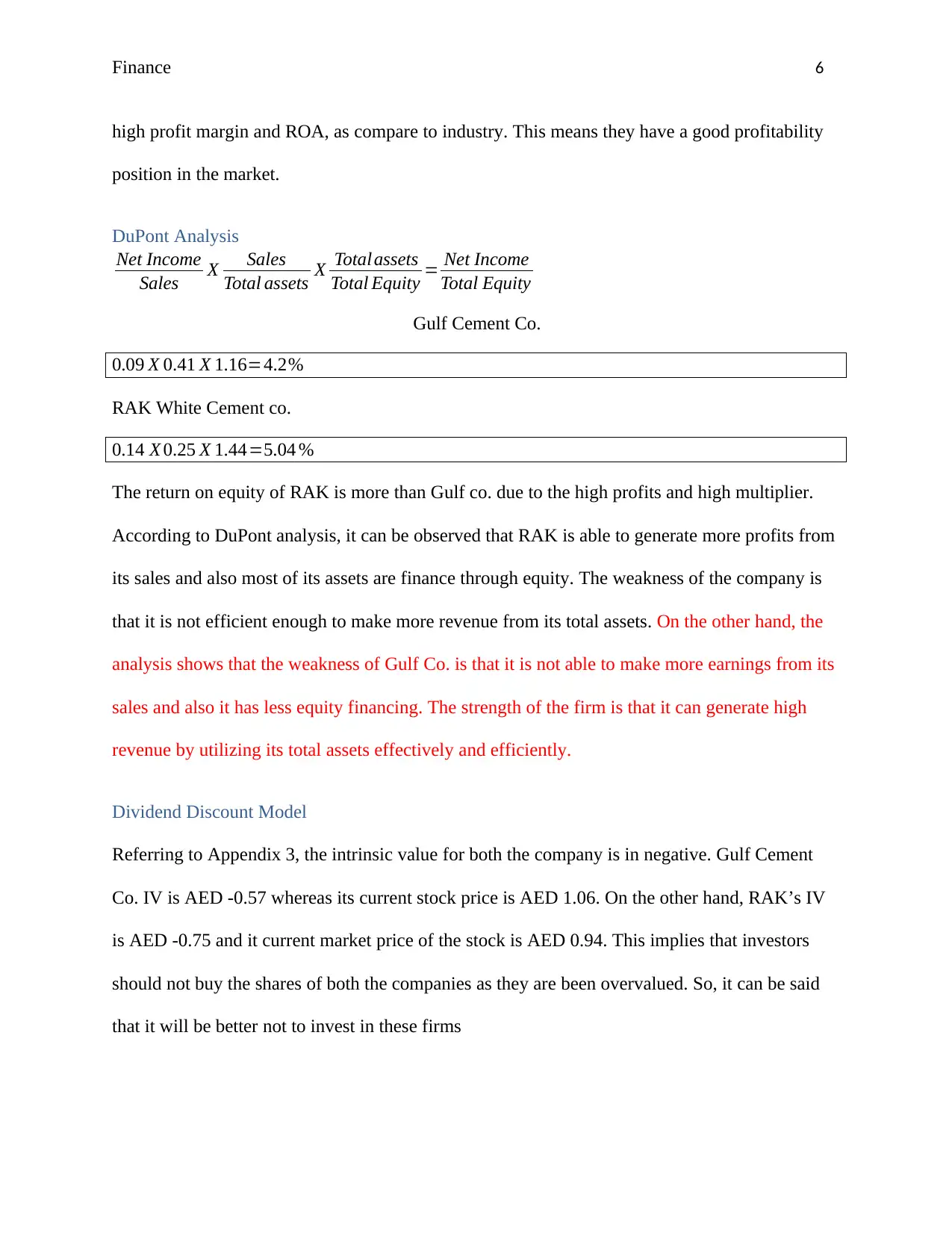

DuPont Analysis

Net Income

Sales X Sales

Total assets X Totalassets

Total Equity = Net Income

Total Equity

Gulf Cement Co.

0.09 X 0.41 X 1.16=4.2%

RAK White Cement co.

0.14 X 0.25 X 1.44=5.04 %

The return on equity of RAK is more than Gulf co. due to the high profits and high multiplier.

According to DuPont analysis, it can be observed that RAK is able to generate more profits from

its sales and also most of its assets are finance through equity. The weakness of the company is

that it is not efficient enough to make more revenue from its total assets. On the other hand, the

analysis shows that the weakness of Gulf Co. is that it is not able to make more earnings from its

sales and also it has less equity financing. The strength of the firm is that it can generate high

revenue by utilizing its total assets effectively and efficiently.

Dividend Discount Model

Referring to Appendix 3, the intrinsic value for both the company is in negative. Gulf Cement

Co. IV is AED -0.57 whereas its current stock price is AED 1.06. On the other hand, RAK’s IV

is AED -0.75 and it current market price of the stock is AED 0.94. This implies that investors

should not buy the shares of both the companies as they are been overvalued. So, it can be said

that it will be better not to invest in these firms

high profit margin and ROA, as compare to industry. This means they have a good profitability

position in the market.

DuPont Analysis

Net Income

Sales X Sales

Total assets X Totalassets

Total Equity = Net Income

Total Equity

Gulf Cement Co.

0.09 X 0.41 X 1.16=4.2%

RAK White Cement co.

0.14 X 0.25 X 1.44=5.04 %

The return on equity of RAK is more than Gulf co. due to the high profits and high multiplier.

According to DuPont analysis, it can be observed that RAK is able to generate more profits from

its sales and also most of its assets are finance through equity. The weakness of the company is

that it is not efficient enough to make more revenue from its total assets. On the other hand, the

analysis shows that the weakness of Gulf Co. is that it is not able to make more earnings from its

sales and also it has less equity financing. The strength of the firm is that it can generate high

revenue by utilizing its total assets effectively and efficiently.

Dividend Discount Model

Referring to Appendix 3, the intrinsic value for both the company is in negative. Gulf Cement

Co. IV is AED -0.57 whereas its current stock price is AED 1.06. On the other hand, RAK’s IV

is AED -0.75 and it current market price of the stock is AED 0.94. This implies that investors

should not buy the shares of both the companies as they are been overvalued. So, it can be said

that it will be better not to invest in these firms

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance 7

References

Lee, J. C., & Lee, C. F. (2016). Financial Analysis, Planning & Forecasting: Theory and

Application Third. 3rd ed. Singapore: World Scientific Publishing Company.

Rakwhitecement.ae. (2018). About Us. Retrieved from http://www.rakwhitecement.ae/company-

profile/

Reuters.com. (2018). Gulf Cement Co PSC (GCEM.KW). Retrieved from

https://www.reuters.com/finance/stocks/overview/GCEM.KW

Tracy, A. (2012). Ratio analysis fundamentals: how 17 financial ratios can allow you to analyse

any business on the planet. RatioAnalysis. net.

References

Lee, J. C., & Lee, C. F. (2016). Financial Analysis, Planning & Forecasting: Theory and

Application Third. 3rd ed. Singapore: World Scientific Publishing Company.

Rakwhitecement.ae. (2018). About Us. Retrieved from http://www.rakwhitecement.ae/company-

profile/

Reuters.com. (2018). Gulf Cement Co PSC (GCEM.KW). Retrieved from

https://www.reuters.com/finance/stocks/overview/GCEM.KW

Tracy, A. (2012). Ratio analysis fundamentals: how 17 financial ratios can allow you to analyse

any business on the planet. RatioAnalysis. net.

Finance 8

Appendix 1

Liquidity Ratios

Current ratio = Current

Assets / Current liabilities

2014 2015 2016 % change (2014-15) % change (2015-16)

Gulf Cement Co. 3.89 4.67 4.02 20% -14%

RAK Cement & Constructions 0.94 1.60 1.77 70% 10%

Quick ratio = Quick Assets /

Current liabilities

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 2.53 3.02 2.68 19% -11%

RAK Cement & Constructions 0.62 0.92 1.12 47% 23%

Cash ratio = Cash / Current

liabilities

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 0.65 1.56 1.22 139% -22%

RAK Cement & Constructions 0.05 0.04 0.25 -35% 594%

Net working capital to Total assets ratio = Net

working capital / Total assets

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 0.35 0.36 0.30 3% -17%

RAK Cement &

Constructions (0.01) 0.09 0.10 -776% 22%

Financial Leverage ratios

Total debt ratio = Total assets - Total

Appendix 1

Liquidity Ratios

Current ratio = Current

Assets / Current liabilities

2014 2015 2016 % change (2014-15) % change (2015-16)

Gulf Cement Co. 3.89 4.67 4.02 20% -14%

RAK Cement & Constructions 0.94 1.60 1.77 70% 10%

Quick ratio = Quick Assets /

Current liabilities

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 2.53 3.02 2.68 19% -11%

RAK Cement & Constructions 0.62 0.92 1.12 47% 23%

Cash ratio = Cash / Current

liabilities

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 0.65 1.56 1.22 139% -22%

RAK Cement & Constructions 0.05 0.04 0.25 -35% 594%

Net working capital to Total assets ratio = Net

working capital / Total assets

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 0.35 0.36 0.30 3% -17%

RAK Cement &

Constructions (0.01) 0.09 0.10 -776% 22%

Financial Leverage ratios

Total debt ratio = Total assets - Total

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance 9

equity / Total Assets

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 20% 16% 14% -19% -11%

RAK Cement & Constructions 29% 26% 31% -11% 19%

Debt to equity ratio = Total

Debt / Total Equity

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 24% 19% 16% -23% -13%

RAK Cement & Constructions 41% 35% 44% -14% 27%

Long term debt ratio = Long term debt / (Long

term debt + Total equity)

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 8% 6% 4% -26% -36%

RAK Cement & Constructions 7% 13% 19% 69% 51%

Equity Multiplier = Total assets /

Total equity

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 1.24 1.19 1.16 -5% -2%

RAK Cement & Constructions 1.41 1.35 1.44 -4% 7%

Interest coverage ratio = EBIT /

Interest Expense

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 1.14 2.26 2.74 98% 21%

RAK Cement & Constructions 2.98 4.05 6.57 36% 62%

Cash coverage ratio = EBIT +

Depreciation / Interest Expense

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 98% 21%

equity / Total Assets

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 20% 16% 14% -19% -11%

RAK Cement & Constructions 29% 26% 31% -11% 19%

Debt to equity ratio = Total

Debt / Total Equity

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 24% 19% 16% -23% -13%

RAK Cement & Constructions 41% 35% 44% -14% 27%

Long term debt ratio = Long term debt / (Long

term debt + Total equity)

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 8% 6% 4% -26% -36%

RAK Cement & Constructions 7% 13% 19% 69% 51%

Equity Multiplier = Total assets /

Total equity

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 1.24 1.19 1.16 -5% -2%

RAK Cement & Constructions 1.41 1.35 1.44 -4% 7%

Interest coverage ratio = EBIT /

Interest Expense

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 1.14 2.26 2.74 98% 21%

RAK Cement & Constructions 2.98 4.05 6.57 36% 62%

Cash coverage ratio = EBIT +

Depreciation / Interest Expense

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 98% 21%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance 10

1.14 2.26 2.74

RAK Cement & Constructions 2.98 4.05 6.57 36% 62%

Asset management ratios

Inventory Turnover ratio =

COGS / Inventory

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 2.40 2.21 2.55 -8% 16%

RAK Cement & Constructions 3.86 2.54 2.28 -34% -10%

Days' sales in inventory = 365 /

Inventory turnover

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co.

152.1

1

165.4

4

143.0

9 9% -14%

RAK Cement & Constructions 94.50

143.5

8

160.3

3 52% 12%

Receivables Turnover ratio = Sales /

Account Receivables

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 4.72 4.91 3.85 4% -22%

RAK Cement & Constructions 4.01 3.70 3.39 -8% -8%

Days' sales in receivables = 365 /

Receivable turnover

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 75.41 72.46 92.55 -4% 28%

RAK Cement & Constructions 91.13 98.73

107.7

3 8% 9%

1.14 2.26 2.74

RAK Cement & Constructions 2.98 4.05 6.57 36% 62%

Asset management ratios

Inventory Turnover ratio =

COGS / Inventory

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 2.40 2.21 2.55 -8% 16%

RAK Cement & Constructions 3.86 2.54 2.28 -34% -10%

Days' sales in inventory = 365 /

Inventory turnover

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co.

152.1

1

165.4

4

143.0

9 9% -14%

RAK Cement & Constructions 94.50

143.5

8

160.3

3 52% 12%

Receivables Turnover ratio = Sales /

Account Receivables

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 4.72 4.91 3.85 4% -22%

RAK Cement & Constructions 4.01 3.70 3.39 -8% -8%

Days' sales in receivables = 365 /

Receivable turnover

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 75.41 72.46 92.55 -4% 28%

RAK Cement & Constructions 91.13 98.73

107.7

3 8% 9%

Finance 11

NWC Turnover ratio = Sales /

NWC

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 1.34 1.18 1.36 -12% 15%

RAK Cement & Constructions

(25.5

0) 3.42 2.42 -113% -29%

Total Assets Turnover ratio =

Sales / Total Assets

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 0.47 0.42 0.41 -9% -4%

RAK Cement & Constructions 0.32 0.29 0.25 -9% -14%

Fixed assets Turnover ratio = Sales / Net

fixed assets

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 0.94 0.83 0.71 -11% -14%

RAK Cement & Constructions 0.41 0.38 0.33 -7% -13%

Profitability Ratios

Profit margin ratio = Net

Income / Sales

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 9% 12% 9% 36% -23%

RAK Cement & Constructions 8% 5% 14% -41% 197%

Return on Equity = Net Income /

Total equity

ROE = Profit margin x Asset turnover x

Equity multiplier

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

NWC Turnover ratio = Sales /

NWC

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 1.34 1.18 1.36 -12% 15%

RAK Cement & Constructions

(25.5

0) 3.42 2.42 -113% -29%

Total Assets Turnover ratio =

Sales / Total Assets

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 0.47 0.42 0.41 -9% -4%

RAK Cement & Constructions 0.32 0.29 0.25 -9% -14%

Fixed assets Turnover ratio = Sales / Net

fixed assets

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 0.94 0.83 0.71 -11% -14%

RAK Cement & Constructions 0.41 0.38 0.33 -7% -13%

Profitability Ratios

Profit margin ratio = Net

Income / Sales

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

Gulf Cement Co. 9% 12% 9% 36% -23%

RAK Cement & Constructions 8% 5% 14% -41% 197%

Return on Equity = Net Income /

Total equity

ROE = Profit margin x Asset turnover x

Equity multiplier

2014 2015 2016

% change

(2014-15)

% change

(2015-16)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.