MAF101 Fundamentals of Finance: Investment, Bonds and Stock Valuation

VerifiedAdded on 2023/04/21

|11

|2672

|116

Homework Assignment

AI Summary

This assignment covers key concepts in finance, including investment analysis, portfolio management, and risk assessment. Part 1 focuses on calculating investment accumulation, determining investment needs for future payments, and valuing bonds and stocks under varying interest rate scenarios. Part 2 delves into historical portfolio returns, expected return and risk analysis, diversification strategies, systematic risk measurement, and risk aversion. The assignment also recommends suitable portfolios for different customer profiles based on their investment goals and risk tolerance. Desklib offers a wealth of similar solved assignments and study resources for students.

Running head: FINANCE

Finance

Name of the Student:

Name of the University:

Authors Note:

Finance

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

1

Table of Contents

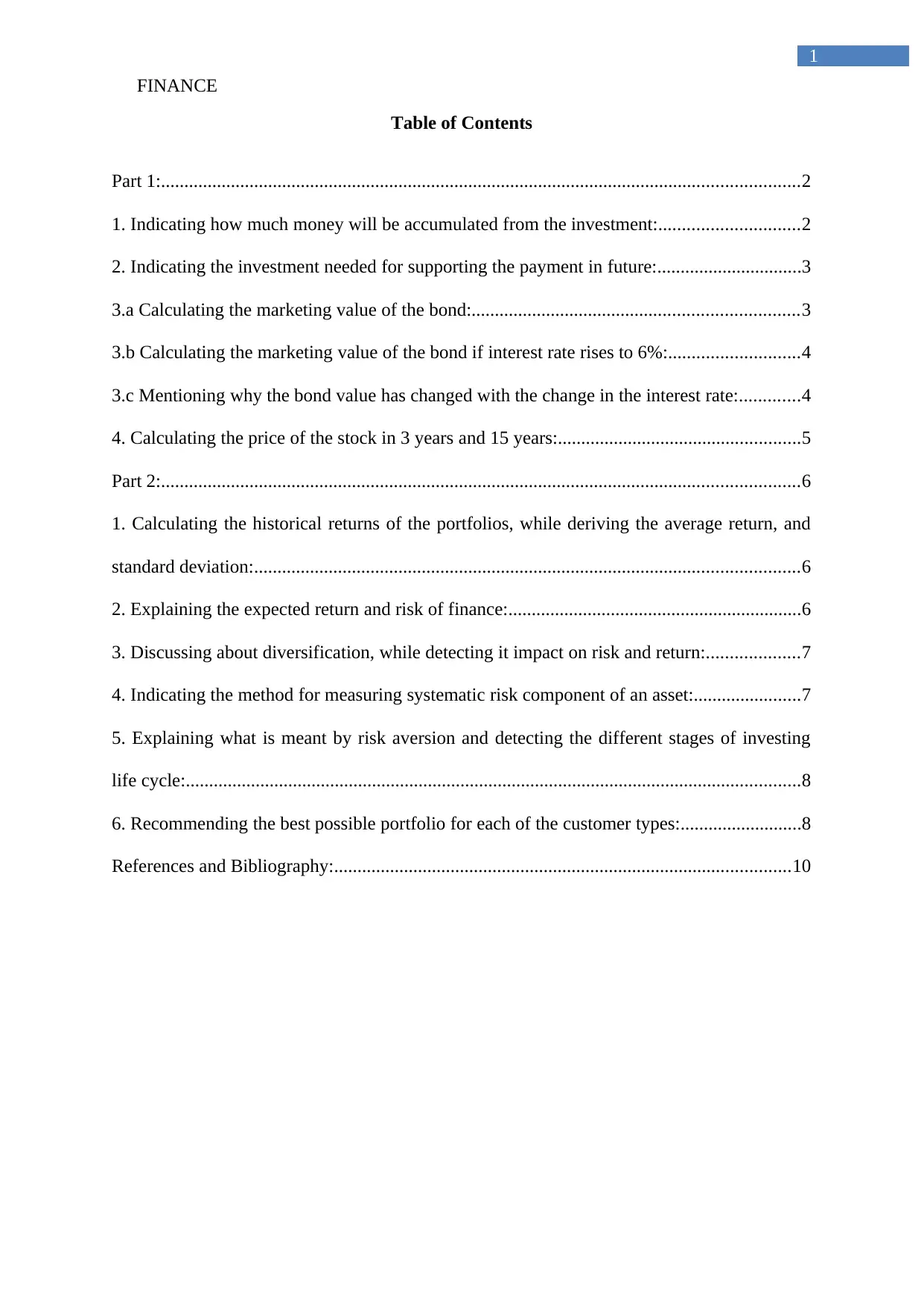

Part 1:.........................................................................................................................................2

1. Indicating how much money will be accumulated from the investment:..............................2

2. Indicating the investment needed for supporting the payment in future:...............................3

3.a Calculating the marketing value of the bond:......................................................................3

3.b Calculating the marketing value of the bond if interest rate rises to 6%:............................4

3.c Mentioning why the bond value has changed with the change in the interest rate:.............4

4. Calculating the price of the stock in 3 years and 15 years:....................................................5

Part 2:.........................................................................................................................................6

1. Calculating the historical returns of the portfolios, while deriving the average return, and

standard deviation:.....................................................................................................................6

2. Explaining the expected return and risk of finance:...............................................................6

3. Discussing about diversification, while detecting it impact on risk and return:....................7

4. Indicating the method for measuring systematic risk component of an asset:.......................7

5. Explaining what is meant by risk aversion and detecting the different stages of investing

life cycle:....................................................................................................................................8

6. Recommending the best possible portfolio for each of the customer types:..........................8

References and Bibliography:..................................................................................................10

1

Table of Contents

Part 1:.........................................................................................................................................2

1. Indicating how much money will be accumulated from the investment:..............................2

2. Indicating the investment needed for supporting the payment in future:...............................3

3.a Calculating the marketing value of the bond:......................................................................3

3.b Calculating the marketing value of the bond if interest rate rises to 6%:............................4

3.c Mentioning why the bond value has changed with the change in the interest rate:.............4

4. Calculating the price of the stock in 3 years and 15 years:....................................................5

Part 2:.........................................................................................................................................6

1. Calculating the historical returns of the portfolios, while deriving the average return, and

standard deviation:.....................................................................................................................6

2. Explaining the expected return and risk of finance:...............................................................6

3. Discussing about diversification, while detecting it impact on risk and return:....................7

4. Indicating the method for measuring systematic risk component of an asset:.......................7

5. Explaining what is meant by risk aversion and detecting the different stages of investing

life cycle:....................................................................................................................................8

6. Recommending the best possible portfolio for each of the customer types:..........................8

References and Bibliography:..................................................................................................10

FINANCE

2

Part 1:

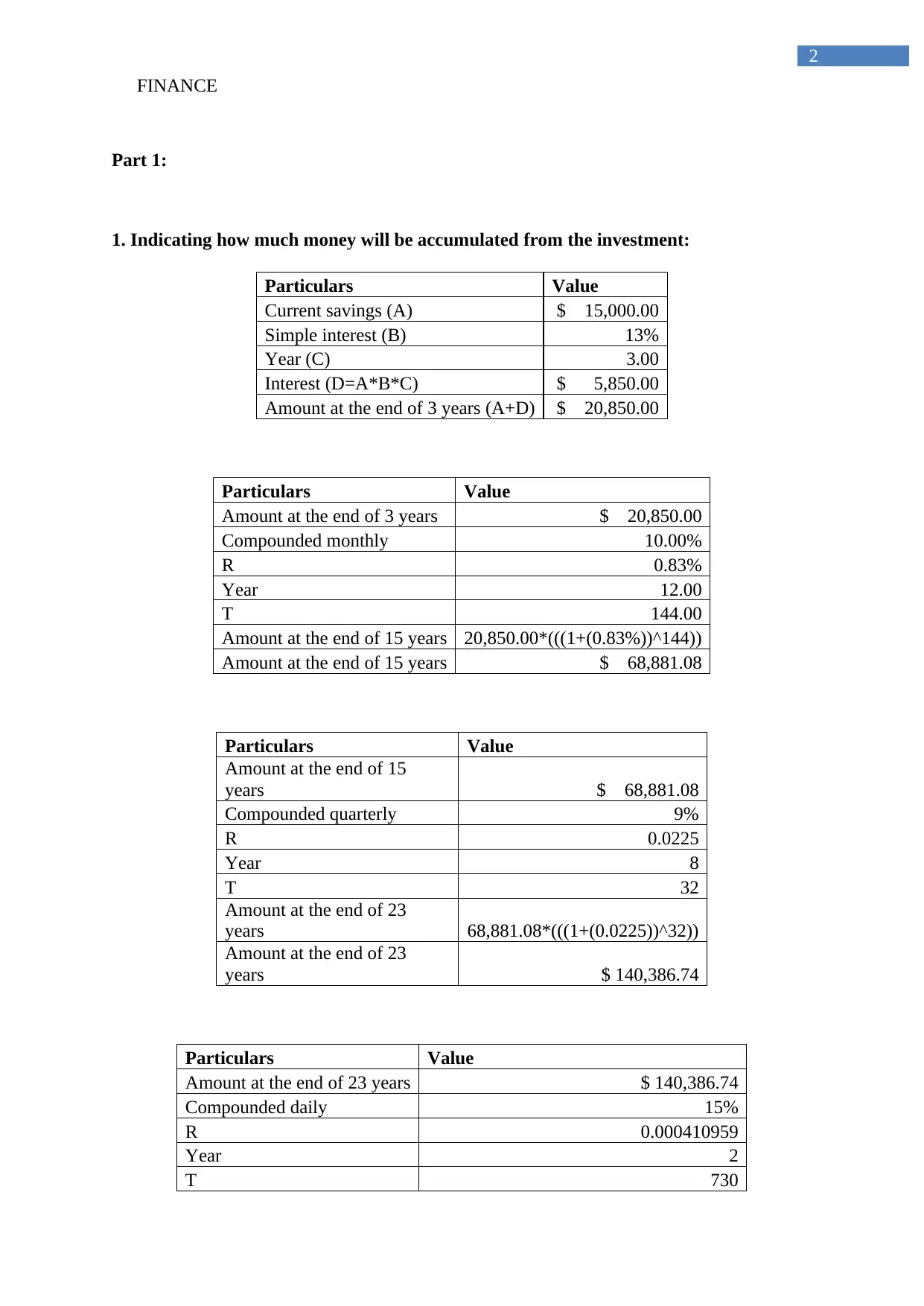

1. Indicating how much money will be accumulated from the investment:

Particulars Value

Current savings (A) $ 15,000.00

Simple interest (B) 13%

Year (C) 3.00

Interest (D=A*B*C) $ 5,850.00

Amount at the end of 3 years (A+D) $ 20,850.00

Particulars Value

Amount at the end of 3 years $ 20,850.00

Compounded monthly 10.00%

R 0.83%

Year 12.00

T 144.00

Amount at the end of 15 years 20,850.00*(((1+(0.83%))^144))

Amount at the end of 15 years $ 68,881.08

Particulars Value

Amount at the end of 15

years $ 68,881.08

Compounded quarterly 9%

R 0.0225

Year 8

T 32

Amount at the end of 23

years 68,881.08*(((1+(0.0225))^32))

Amount at the end of 23

years $ 140,386.74

Particulars Value

Amount at the end of 23 years $ 140,386.74

Compounded daily 15%

R 0.000410959

Year 2

T 730

2

Part 1:

1. Indicating how much money will be accumulated from the investment:

Particulars Value

Current savings (A) $ 15,000.00

Simple interest (B) 13%

Year (C) 3.00

Interest (D=A*B*C) $ 5,850.00

Amount at the end of 3 years (A+D) $ 20,850.00

Particulars Value

Amount at the end of 3 years $ 20,850.00

Compounded monthly 10.00%

R 0.83%

Year 12.00

T 144.00

Amount at the end of 15 years 20,850.00*(((1+(0.83%))^144))

Amount at the end of 15 years $ 68,881.08

Particulars Value

Amount at the end of 15

years $ 68,881.08

Compounded quarterly 9%

R 0.0225

Year 8

T 32

Amount at the end of 23

years 68,881.08*(((1+(0.0225))^32))

Amount at the end of 23

years $ 140,386.74

Particulars Value

Amount at the end of 23 years $ 140,386.74

Compounded daily 15%

R 0.000410959

Year 2

T 730

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE

3

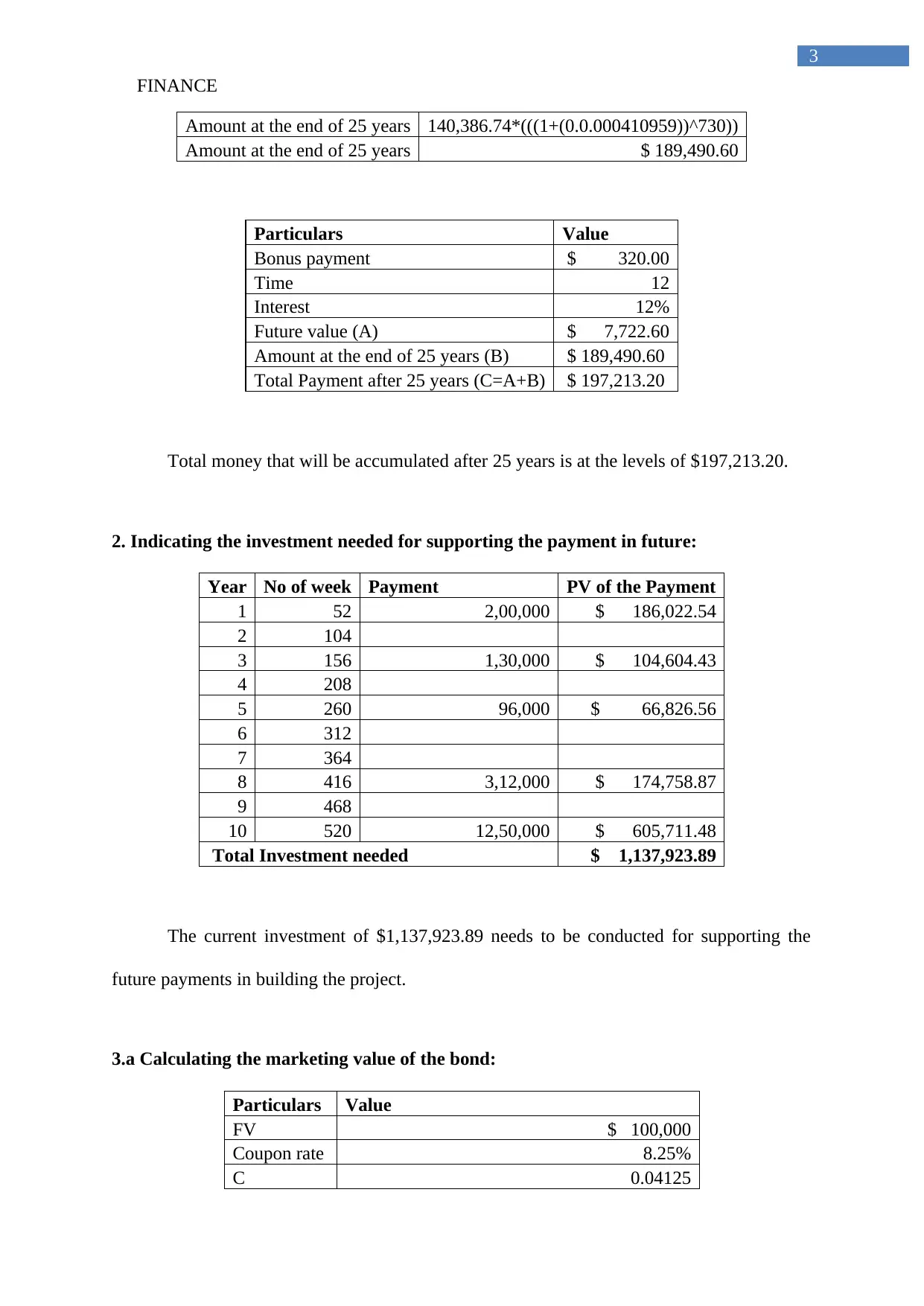

Amount at the end of 25 years 140,386.74*(((1+(0.0.000410959))^730))

Amount at the end of 25 years $ 189,490.60

Particulars Value

Bonus payment $ 320.00

Time 12

Interest 12%

Future value (A) $ 7,722.60

Amount at the end of 25 years (B) $ 189,490.60

Total Payment after 25 years (C=A+B) $ 197,213.20

Total money that will be accumulated after 25 years is at the levels of $197,213.20.

2. Indicating the investment needed for supporting the payment in future:

Year No of week Payment PV of the Payment

1 52 2,00,000 $ 186,022.54

2 104

3 156 1,30,000 $ 104,604.43

4 208

5 260 96,000 $ 66,826.56

6 312

7 364

8 416 3,12,000 $ 174,758.87

9 468

10 520 12,50,000 $ 605,711.48

Total Investment needed $ 1,137,923.89

The current investment of $1,137,923.89 needs to be conducted for supporting the

future payments in building the project.

3.a Calculating the marketing value of the bond:

Particulars Value

FV $ 100,000

Coupon rate 8.25%

C 0.04125

3

Amount at the end of 25 years 140,386.74*(((1+(0.0.000410959))^730))

Amount at the end of 25 years $ 189,490.60

Particulars Value

Bonus payment $ 320.00

Time 12

Interest 12%

Future value (A) $ 7,722.60

Amount at the end of 25 years (B) $ 189,490.60

Total Payment after 25 years (C=A+B) $ 197,213.20

Total money that will be accumulated after 25 years is at the levels of $197,213.20.

2. Indicating the investment needed for supporting the payment in future:

Year No of week Payment PV of the Payment

1 52 2,00,000 $ 186,022.54

2 104

3 156 1,30,000 $ 104,604.43

4 208

5 260 96,000 $ 66,826.56

6 312

7 364

8 416 3,12,000 $ 174,758.87

9 468

10 520 12,50,000 $ 605,711.48

Total Investment needed $ 1,137,923.89

The current investment of $1,137,923.89 needs to be conducted for supporting the

future payments in building the project.

3.a Calculating the marketing value of the bond:

Particulars Value

FV $ 100,000

Coupon rate 8.25%

C 0.04125

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

4

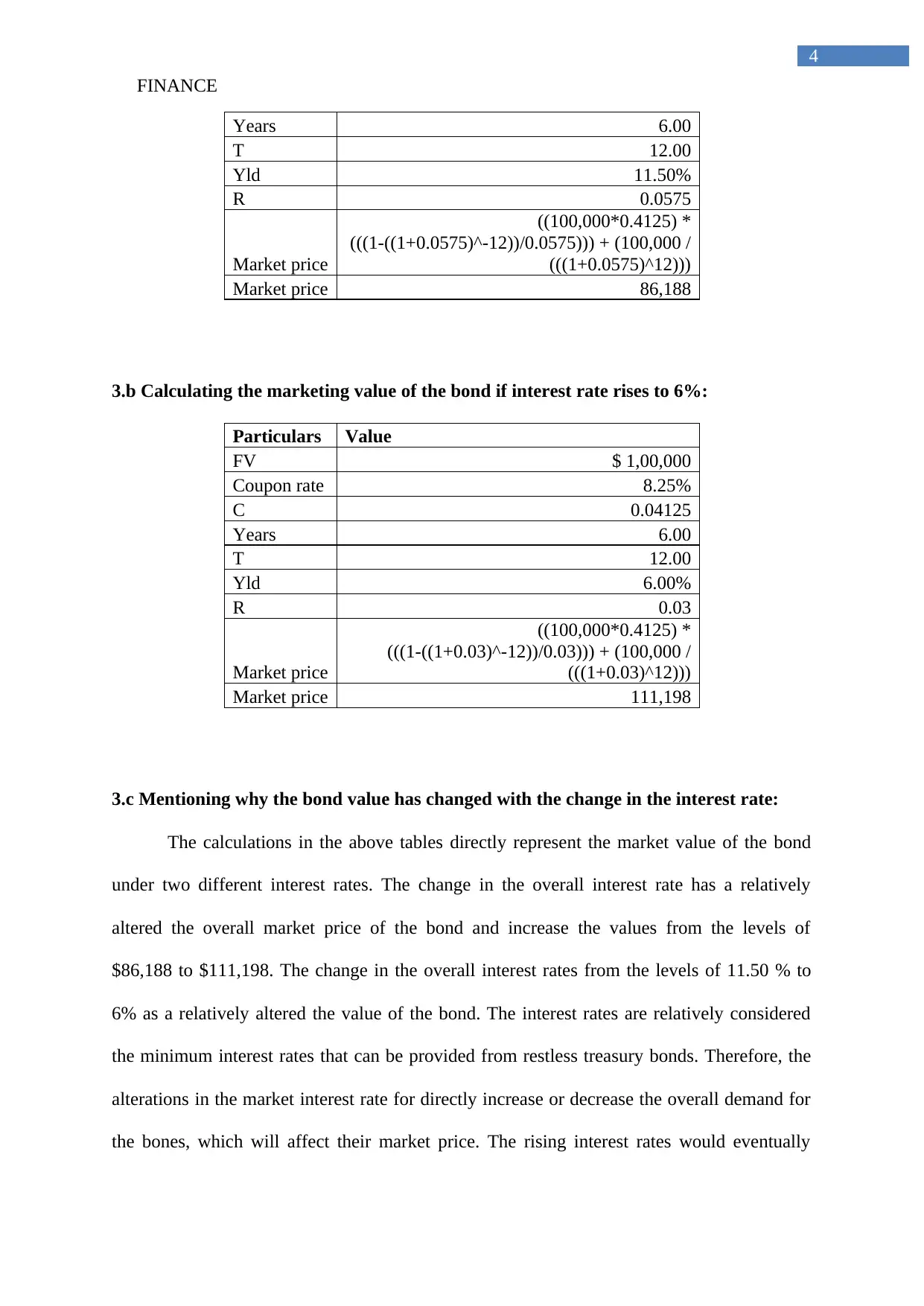

Years 6.00

T 12.00

Yld 11.50%

R 0.0575

Market price

((100,000*0.4125) *

(((1-((1+0.0575)^-12))/0.0575))) + (100,000 /

(((1+0.0575)^12)))

Market price 86,188

3.b Calculating the marketing value of the bond if interest rate rises to 6%:

Particulars Value

FV $ 1,00,000

Coupon rate 8.25%

C 0.04125

Years 6.00

T 12.00

Yld 6.00%

R 0.03

Market price

((100,000*0.4125) *

(((1-((1+0.03)^-12))/0.03))) + (100,000 /

(((1+0.03)^12)))

Market price 111,198

3.c Mentioning why the bond value has changed with the change in the interest rate:

The calculations in the above tables directly represent the market value of the bond

under two different interest rates. The change in the overall interest rate has a relatively

altered the overall market price of the bond and increase the values from the levels of

$86,188 to $111,198. The change in the overall interest rates from the levels of 11.50 % to

6% as a relatively altered the value of the bond. The interest rates are relatively considered

the minimum interest rates that can be provided from restless treasury bonds. Therefore, the

alterations in the market interest rate for directly increase or decrease the overall demand for

the bones, which will affect their market price. The rising interest rates would eventually

4

Years 6.00

T 12.00

Yld 11.50%

R 0.0575

Market price

((100,000*0.4125) *

(((1-((1+0.0575)^-12))/0.0575))) + (100,000 /

(((1+0.0575)^12)))

Market price 86,188

3.b Calculating the marketing value of the bond if interest rate rises to 6%:

Particulars Value

FV $ 1,00,000

Coupon rate 8.25%

C 0.04125

Years 6.00

T 12.00

Yld 6.00%

R 0.03

Market price

((100,000*0.4125) *

(((1-((1+0.03)^-12))/0.03))) + (100,000 /

(((1+0.03)^12)))

Market price 111,198

3.c Mentioning why the bond value has changed with the change in the interest rate:

The calculations in the above tables directly represent the market value of the bond

under two different interest rates. The change in the overall interest rate has a relatively

altered the overall market price of the bond and increase the values from the levels of

$86,188 to $111,198. The change in the overall interest rates from the levels of 11.50 % to

6% as a relatively altered the value of the bond. The interest rates are relatively considered

the minimum interest rates that can be provided from restless treasury bonds. Therefore, the

alterations in the market interest rate for directly increase or decrease the overall demand for

the bones, which will affect their market price. The rising interest rates would eventually

FINANCE

5

reduce the level of Bond price to the levels of $86,188, as the interest rates are higher than the

coupon payments. Therefore, rising interest rates would reduce the bond price as risk free

interest is more profitable than the corporate Bonds (Weber, Duffy & Schram, 2018). In the

similar instance, the decline in interest rates would eventually increase the attractiveness of

the corporate bonds as higher coupon payments are conducted in comparison to the risk free

interests.

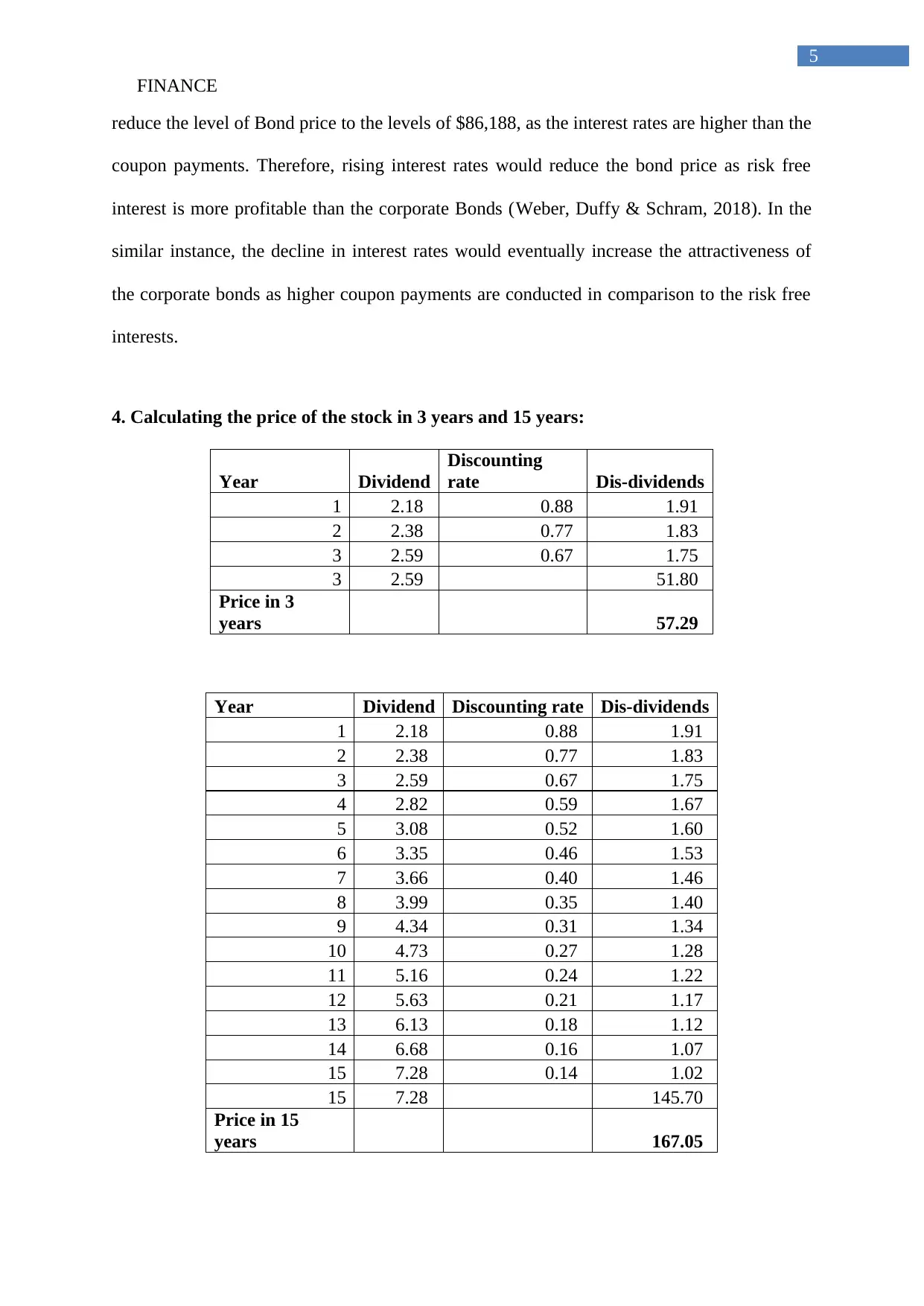

4. Calculating the price of the stock in 3 years and 15 years:

Year Dividend

Discounting

rate Dis-dividends

1 2.18 0.88 1.91

2 2.38 0.77 1.83

3 2.59 0.67 1.75

3 2.59 51.80

Price in 3

years 57.29

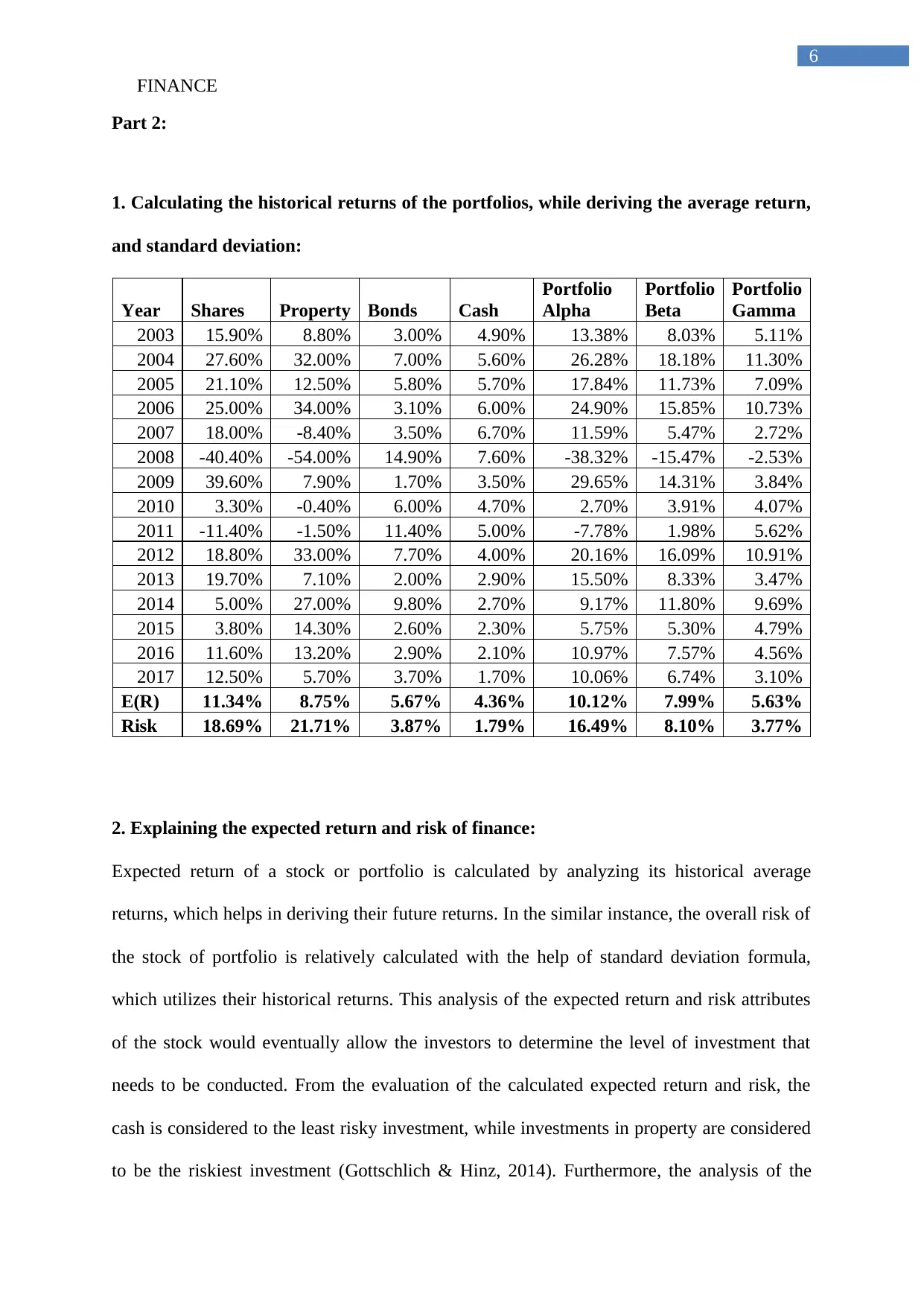

Year Dividend Discounting rate Dis-dividends

1 2.18 0.88 1.91

2 2.38 0.77 1.83

3 2.59 0.67 1.75

4 2.82 0.59 1.67

5 3.08 0.52 1.60

6 3.35 0.46 1.53

7 3.66 0.40 1.46

8 3.99 0.35 1.40

9 4.34 0.31 1.34

10 4.73 0.27 1.28

11 5.16 0.24 1.22

12 5.63 0.21 1.17

13 6.13 0.18 1.12

14 6.68 0.16 1.07

15 7.28 0.14 1.02

15 7.28 145.70

Price in 15

years 167.05

5

reduce the level of Bond price to the levels of $86,188, as the interest rates are higher than the

coupon payments. Therefore, rising interest rates would reduce the bond price as risk free

interest is more profitable than the corporate Bonds (Weber, Duffy & Schram, 2018). In the

similar instance, the decline in interest rates would eventually increase the attractiveness of

the corporate bonds as higher coupon payments are conducted in comparison to the risk free

interests.

4. Calculating the price of the stock in 3 years and 15 years:

Year Dividend

Discounting

rate Dis-dividends

1 2.18 0.88 1.91

2 2.38 0.77 1.83

3 2.59 0.67 1.75

3 2.59 51.80

Price in 3

years 57.29

Year Dividend Discounting rate Dis-dividends

1 2.18 0.88 1.91

2 2.38 0.77 1.83

3 2.59 0.67 1.75

4 2.82 0.59 1.67

5 3.08 0.52 1.60

6 3.35 0.46 1.53

7 3.66 0.40 1.46

8 3.99 0.35 1.40

9 4.34 0.31 1.34

10 4.73 0.27 1.28

11 5.16 0.24 1.22

12 5.63 0.21 1.17

13 6.13 0.18 1.12

14 6.68 0.16 1.07

15 7.28 0.14 1.02

15 7.28 145.70

Price in 15

years 167.05

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE

6

Part 2:

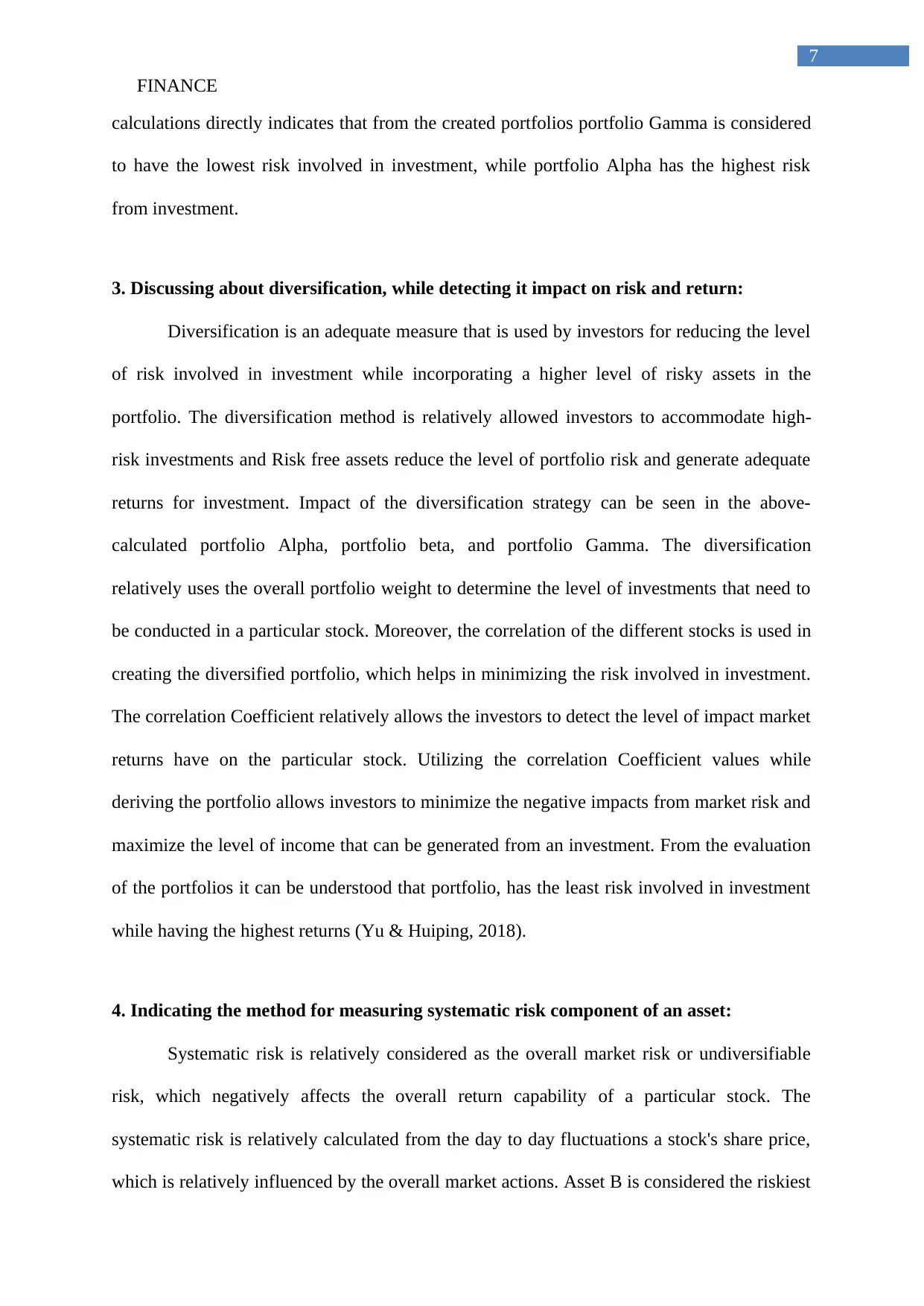

1. Calculating the historical returns of the portfolios, while deriving the average return,

and standard deviation:

Year Shares Property Bonds Cash

Portfolio

Alpha

Portfolio

Beta

Portfolio

Gamma

2003 15.90% 8.80% 3.00% 4.90% 13.38% 8.03% 5.11%

2004 27.60% 32.00% 7.00% 5.60% 26.28% 18.18% 11.30%

2005 21.10% 12.50% 5.80% 5.70% 17.84% 11.73% 7.09%

2006 25.00% 34.00% 3.10% 6.00% 24.90% 15.85% 10.73%

2007 18.00% -8.40% 3.50% 6.70% 11.59% 5.47% 2.72%

2008 -40.40% -54.00% 14.90% 7.60% -38.32% -15.47% -2.53%

2009 39.60% 7.90% 1.70% 3.50% 29.65% 14.31% 3.84%

2010 3.30% -0.40% 6.00% 4.70% 2.70% 3.91% 4.07%

2011 -11.40% -1.50% 11.40% 5.00% -7.78% 1.98% 5.62%

2012 18.80% 33.00% 7.70% 4.00% 20.16% 16.09% 10.91%

2013 19.70% 7.10% 2.00% 2.90% 15.50% 8.33% 3.47%

2014 5.00% 27.00% 9.80% 2.70% 9.17% 11.80% 9.69%

2015 3.80% 14.30% 2.60% 2.30% 5.75% 5.30% 4.79%

2016 11.60% 13.20% 2.90% 2.10% 10.97% 7.57% 4.56%

2017 12.50% 5.70% 3.70% 1.70% 10.06% 6.74% 3.10%

E(R) 11.34% 8.75% 5.67% 4.36% 10.12% 7.99% 5.63%

Risk 18.69% 21.71% 3.87% 1.79% 16.49% 8.10% 3.77%

2. Explaining the expected return and risk of finance:

Expected return of a stock or portfolio is calculated by analyzing its historical average

returns, which helps in deriving their future returns. In the similar instance, the overall risk of

the stock of portfolio is relatively calculated with the help of standard deviation formula,

which utilizes their historical returns. This analysis of the expected return and risk attributes

of the stock would eventually allow the investors to determine the level of investment that

needs to be conducted. From the evaluation of the calculated expected return and risk, the

cash is considered to the least risky investment, while investments in property are considered

to be the riskiest investment (Gottschlich & Hinz, 2014). Furthermore, the analysis of the

6

Part 2:

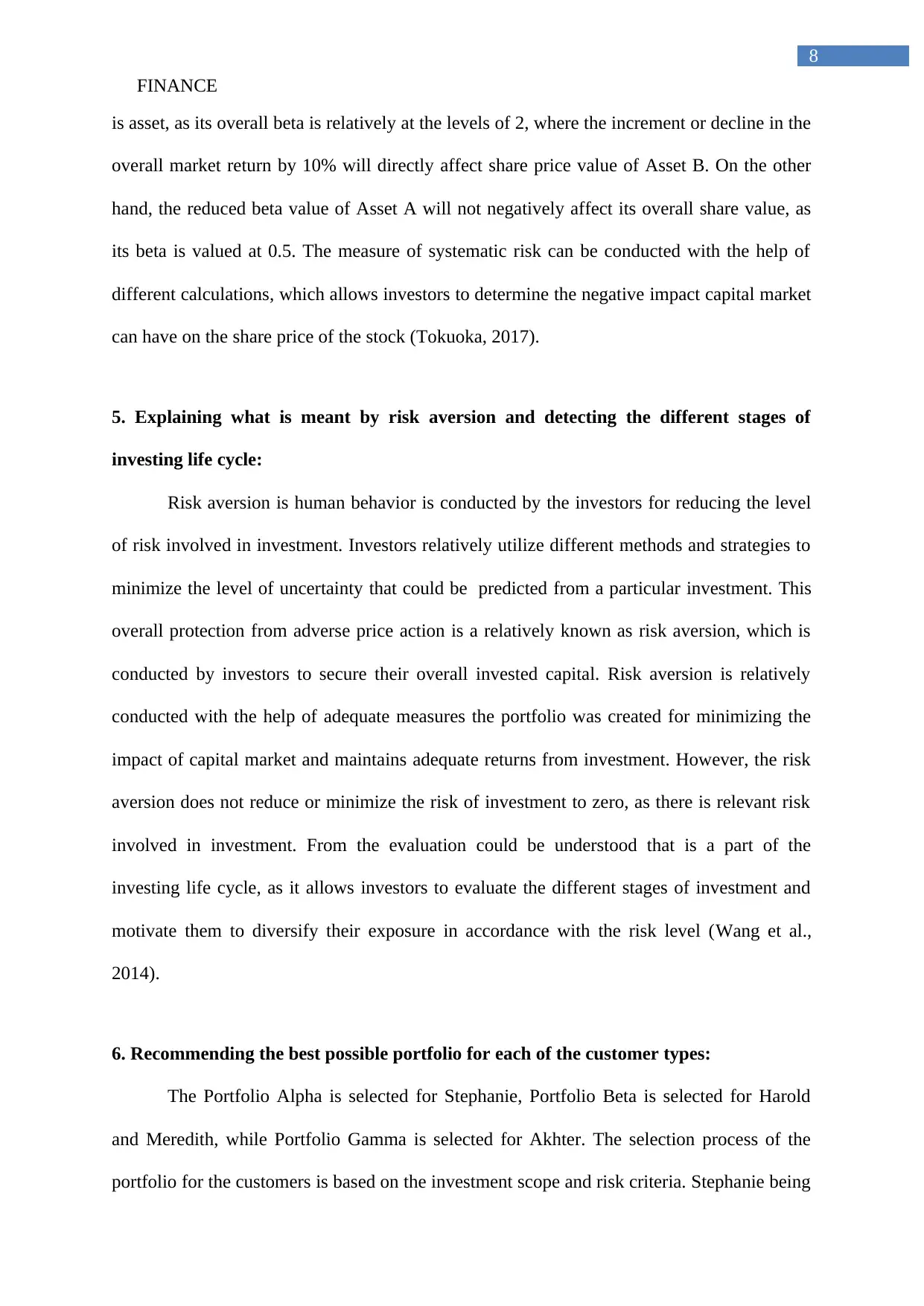

1. Calculating the historical returns of the portfolios, while deriving the average return,

and standard deviation:

Year Shares Property Bonds Cash

Portfolio

Alpha

Portfolio

Beta

Portfolio

Gamma

2003 15.90% 8.80% 3.00% 4.90% 13.38% 8.03% 5.11%

2004 27.60% 32.00% 7.00% 5.60% 26.28% 18.18% 11.30%

2005 21.10% 12.50% 5.80% 5.70% 17.84% 11.73% 7.09%

2006 25.00% 34.00% 3.10% 6.00% 24.90% 15.85% 10.73%

2007 18.00% -8.40% 3.50% 6.70% 11.59% 5.47% 2.72%

2008 -40.40% -54.00% 14.90% 7.60% -38.32% -15.47% -2.53%

2009 39.60% 7.90% 1.70% 3.50% 29.65% 14.31% 3.84%

2010 3.30% -0.40% 6.00% 4.70% 2.70% 3.91% 4.07%

2011 -11.40% -1.50% 11.40% 5.00% -7.78% 1.98% 5.62%

2012 18.80% 33.00% 7.70% 4.00% 20.16% 16.09% 10.91%

2013 19.70% 7.10% 2.00% 2.90% 15.50% 8.33% 3.47%

2014 5.00% 27.00% 9.80% 2.70% 9.17% 11.80% 9.69%

2015 3.80% 14.30% 2.60% 2.30% 5.75% 5.30% 4.79%

2016 11.60% 13.20% 2.90% 2.10% 10.97% 7.57% 4.56%

2017 12.50% 5.70% 3.70% 1.70% 10.06% 6.74% 3.10%

E(R) 11.34% 8.75% 5.67% 4.36% 10.12% 7.99% 5.63%

Risk 18.69% 21.71% 3.87% 1.79% 16.49% 8.10% 3.77%

2. Explaining the expected return and risk of finance:

Expected return of a stock or portfolio is calculated by analyzing its historical average

returns, which helps in deriving their future returns. In the similar instance, the overall risk of

the stock of portfolio is relatively calculated with the help of standard deviation formula,

which utilizes their historical returns. This analysis of the expected return and risk attributes

of the stock would eventually allow the investors to determine the level of investment that

needs to be conducted. From the evaluation of the calculated expected return and risk, the

cash is considered to the least risky investment, while investments in property are considered

to be the riskiest investment (Gottschlich & Hinz, 2014). Furthermore, the analysis of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

7

calculations directly indicates that from the created portfolios portfolio Gamma is considered

to have the lowest risk involved in investment, while portfolio Alpha has the highest risk

from investment.

3. Discussing about diversification, while detecting it impact on risk and return:

Diversification is an adequate measure that is used by investors for reducing the level

of risk involved in investment while incorporating a higher level of risky assets in the

portfolio. The diversification method is relatively allowed investors to accommodate high-

risk investments and Risk free assets reduce the level of portfolio risk and generate adequate

returns for investment. Impact of the diversification strategy can be seen in the above-

calculated portfolio Alpha, portfolio beta, and portfolio Gamma. The diversification

relatively uses the overall portfolio weight to determine the level of investments that need to

be conducted in a particular stock. Moreover, the correlation of the different stocks is used in

creating the diversified portfolio, which helps in minimizing the risk involved in investment.

The correlation Coefficient relatively allows the investors to detect the level of impact market

returns have on the particular stock. Utilizing the correlation Coefficient values while

deriving the portfolio allows investors to minimize the negative impacts from market risk and

maximize the level of income that can be generated from an investment. From the evaluation

of the portfolios it can be understood that portfolio, has the least risk involved in investment

while having the highest returns (Yu & Huiping, 2018).

4. Indicating the method for measuring systematic risk component of an asset:

Systematic risk is relatively considered as the overall market risk or undiversifiable

risk, which negatively affects the overall return capability of a particular stock. The

systematic risk is relatively calculated from the day to day fluctuations a stock's share price,

which is relatively influenced by the overall market actions. Asset B is considered the riskiest

7

calculations directly indicates that from the created portfolios portfolio Gamma is considered

to have the lowest risk involved in investment, while portfolio Alpha has the highest risk

from investment.

3. Discussing about diversification, while detecting it impact on risk and return:

Diversification is an adequate measure that is used by investors for reducing the level

of risk involved in investment while incorporating a higher level of risky assets in the

portfolio. The diversification method is relatively allowed investors to accommodate high-

risk investments and Risk free assets reduce the level of portfolio risk and generate adequate

returns for investment. Impact of the diversification strategy can be seen in the above-

calculated portfolio Alpha, portfolio beta, and portfolio Gamma. The diversification

relatively uses the overall portfolio weight to determine the level of investments that need to

be conducted in a particular stock. Moreover, the correlation of the different stocks is used in

creating the diversified portfolio, which helps in minimizing the risk involved in investment.

The correlation Coefficient relatively allows the investors to detect the level of impact market

returns have on the particular stock. Utilizing the correlation Coefficient values while

deriving the portfolio allows investors to minimize the negative impacts from market risk and

maximize the level of income that can be generated from an investment. From the evaluation

of the portfolios it can be understood that portfolio, has the least risk involved in investment

while having the highest returns (Yu & Huiping, 2018).

4. Indicating the method for measuring systematic risk component of an asset:

Systematic risk is relatively considered as the overall market risk or undiversifiable

risk, which negatively affects the overall return capability of a particular stock. The

systematic risk is relatively calculated from the day to day fluctuations a stock's share price,

which is relatively influenced by the overall market actions. Asset B is considered the riskiest

FINANCE

8

is asset, as its overall beta is relatively at the levels of 2, where the increment or decline in the

overall market return by 10% will directly affect share price value of Asset B. On the other

hand, the reduced beta value of Asset A will not negatively affect its overall share value, as

its beta is valued at 0.5. The measure of systematic risk can be conducted with the help of

different calculations, which allows investors to determine the negative impact capital market

can have on the share price of the stock (Tokuoka, 2017).

5. Explaining what is meant by risk aversion and detecting the different stages of

investing life cycle:

Risk aversion is human behavior is conducted by the investors for reducing the level

of risk involved in investment. Investors relatively utilize different methods and strategies to

minimize the level of uncertainty that could be predicted from a particular investment. This

overall protection from adverse price action is a relatively known as risk aversion, which is

conducted by investors to secure their overall invested capital. Risk aversion is relatively

conducted with the help of adequate measures the portfolio was created for minimizing the

impact of capital market and maintains adequate returns from investment. However, the risk

aversion does not reduce or minimize the risk of investment to zero, as there is relevant risk

involved in investment. From the evaluation could be understood that is a part of the

investing life cycle, as it allows investors to evaluate the different stages of investment and

motivate them to diversify their exposure in accordance with the risk level (Wang et al.,

2014).

6. Recommending the best possible portfolio for each of the customer types:

The Portfolio Alpha is selected for Stephanie, Portfolio Beta is selected for Harold

and Meredith, while Portfolio Gamma is selected for Akhter. The selection process of the

portfolio for the customers is based on the investment scope and risk criteria. Stephanie being

8

is asset, as its overall beta is relatively at the levels of 2, where the increment or decline in the

overall market return by 10% will directly affect share price value of Asset B. On the other

hand, the reduced beta value of Asset A will not negatively affect its overall share value, as

its beta is valued at 0.5. The measure of systematic risk can be conducted with the help of

different calculations, which allows investors to determine the negative impact capital market

can have on the share price of the stock (Tokuoka, 2017).

5. Explaining what is meant by risk aversion and detecting the different stages of

investing life cycle:

Risk aversion is human behavior is conducted by the investors for reducing the level

of risk involved in investment. Investors relatively utilize different methods and strategies to

minimize the level of uncertainty that could be predicted from a particular investment. This

overall protection from adverse price action is a relatively known as risk aversion, which is

conducted by investors to secure their overall invested capital. Risk aversion is relatively

conducted with the help of adequate measures the portfolio was created for minimizing the

impact of capital market and maintains adequate returns from investment. However, the risk

aversion does not reduce or minimize the risk of investment to zero, as there is relevant risk

involved in investment. From the evaluation could be understood that is a part of the

investing life cycle, as it allows investors to evaluate the different stages of investment and

motivate them to diversify their exposure in accordance with the risk level (Wang et al.,

2014).

6. Recommending the best possible portfolio for each of the customer types:

The Portfolio Alpha is selected for Stephanie, Portfolio Beta is selected for Harold

and Meredith, while Portfolio Gamma is selected for Akhter. The selection process of the

portfolio for the customers is based on the investment scope and risk criteria. Stephanie being

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE

9

young with a long and successful career will eventually have high-risk capability, where his

aims would be to generate higher income and growth from investment, which is why

Portfolio Alpha is best, suited for his investment criteria. In addition, the middle-aged couple

would like to have secure investment with high growth prospects, which is why Portfolio

Beta is best, suited for them. Lastly, Akhter will be retired in 18 months where his investment

aim is to secure the capital and generate adequate constant returns to support his retirement,

which is why Portfolio Gamma is selected for him.

9

young with a long and successful career will eventually have high-risk capability, where his

aims would be to generate higher income and growth from investment, which is why

Portfolio Alpha is best, suited for his investment criteria. In addition, the middle-aged couple

would like to have secure investment with high growth prospects, which is why Portfolio

Beta is best, suited for them. Lastly, Akhter will be retired in 18 months where his investment

aim is to secure the capital and generate adequate constant returns to support his retirement,

which is why Portfolio Gamma is selected for him.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

10

References and Bibliography:

Gottschlich, J., & Hinz, O. (2014). A decision support system for stock investment

recommendations using collective wisdom. Decision support systems, 59, 52-62.

Hu, Y., Feng, B., Zhang, X., Ngai, E. W. T., & Liu, M. (2015). Stock trading rule discovery

with an evolutionary trend following model. Expert Systems with Applications, 42(1),

212-222.

Sumaji, Y. M. P., Hsu, W. H. L., & Salim, U. (2017). Analysıs of Market Rısk in Stock

Investment Usıng Value at Rısk Method (Study on Manufacturıng Companıes in Lq-

45 Lısted on Indonesıa Stock Exchange). Asia-Pacific Management and Business

Application, 6(1), 1-14.

Tokuoka, K. (2017). Is stock investment contagious among siblings?. Empirical

Economics, 52(4), 1505-1528.

Wang, H., Zhang, J., Wang, L., & Liu, S. (2014). Emotion and investment returns: Situation

and personality as moderators in a stock market. Social Behavior and Personality: an

international journal, 42(4), 561-569.

Weber, M., Duffy, J., & Schram, A. (2018). An experimental study of bond market

pricing. The Journal of Finance, 73(4), 1857-1892.

Yang, Y., & Wang, Q. (2018). Insurance Inclusion, Time Preference And Stock Investment

Of The Chinese Households. The Singapore Economic Review, 63(01), 27-44.

Yu, J. I. A. N. G., & Huiping, J. I. (2018). Are securities companies' stock investment ratings

helpful? Evidence from A-share market. China Economic Studies, 4, 010.

10

References and Bibliography:

Gottschlich, J., & Hinz, O. (2014). A decision support system for stock investment

recommendations using collective wisdom. Decision support systems, 59, 52-62.

Hu, Y., Feng, B., Zhang, X., Ngai, E. W. T., & Liu, M. (2015). Stock trading rule discovery

with an evolutionary trend following model. Expert Systems with Applications, 42(1),

212-222.

Sumaji, Y. M. P., Hsu, W. H. L., & Salim, U. (2017). Analysıs of Market Rısk in Stock

Investment Usıng Value at Rısk Method (Study on Manufacturıng Companıes in Lq-

45 Lısted on Indonesıa Stock Exchange). Asia-Pacific Management and Business

Application, 6(1), 1-14.

Tokuoka, K. (2017). Is stock investment contagious among siblings?. Empirical

Economics, 52(4), 1505-1528.

Wang, H., Zhang, J., Wang, L., & Liu, S. (2014). Emotion and investment returns: Situation

and personality as moderators in a stock market. Social Behavior and Personality: an

international journal, 42(4), 561-569.

Weber, M., Duffy, J., & Schram, A. (2018). An experimental study of bond market

pricing. The Journal of Finance, 73(4), 1857-1892.

Yang, Y., & Wang, Q. (2018). Insurance Inclusion, Time Preference And Stock Investment

Of The Chinese Households. The Singapore Economic Review, 63(01), 27-44.

Yu, J. I. A. N. G., & Huiping, J. I. (2018). Are securities companies' stock investment ratings

helpful? Evidence from A-share market. China Economic Studies, 4, 010.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.