Business Case Studies Finance Report: University Analysis

VerifiedAdded on 2023/01/19

|8

|1596

|52

Report

AI Summary

This finance report provides a comprehensive analysis of several business case studies. It begins by determining the present value of an investment and analyzing the revenue growth of a company over a five-year period. The report then calculates the effective annual rate (EAR) for different investment scenarios and determines the total payments required for an amortizing loan. Furthermore, the yield to maturity (YTM) on a bond and the amount of coupon payments are calculated. The report also applies the Capital Asset Pricing Model (CAPM) to determine the required rate of return for two stocks, Cochlear Ltd and a hypothetical company, and constructs a portfolio with both stocks, analyzing the portfolio's risk and return. The report concludes with a discussion of risk and return analysis, beta, and the benefits of diversification, using data from the Cochlear stock and market index to illustrate key financial concepts.

Running head: FINANCE

Finance

Name of the Student:

Name of the University:

Author’s Note:

Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1BUSINESS CASE STUDIES

Table of Contents

In Response to Question 1...............................................................................................................2

In Response to Question 2...............................................................................................................4

In Response to Question 3...............................................................................................................5

References........................................................................................................................................7

Table of Contents

In Response to Question 1...............................................................................................................2

In Response to Question 2...............................................................................................................4

In Response to Question 3...............................................................................................................5

References........................................................................................................................................7

2BUSINESS CASE STUDIES

In Response to Question 1

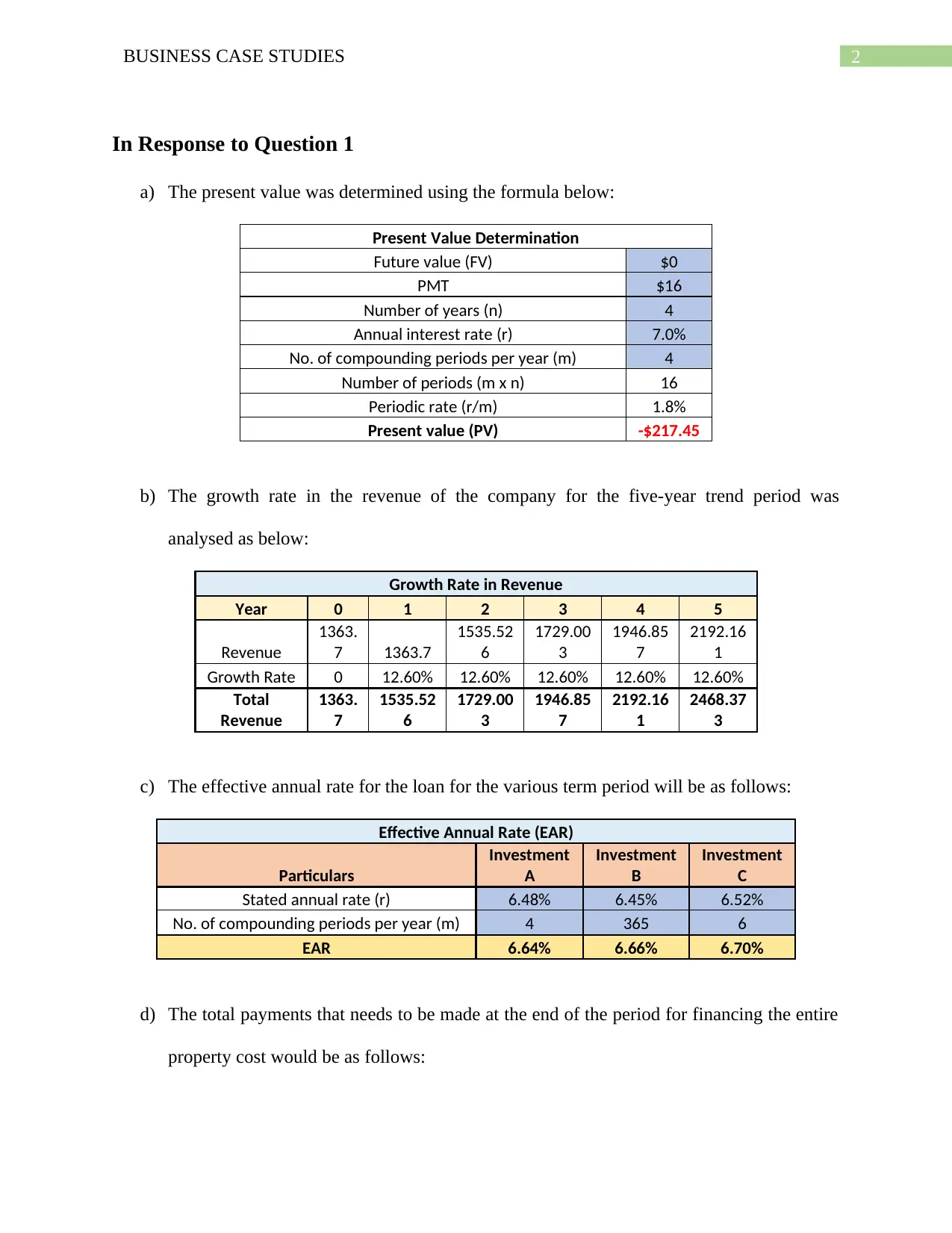

a) The present value was determined using the formula below:

Present Value Determination

Future value (FV) $0

PMT $16

Number of years (n) 4

Annual interest rate (r) 7.0%

No. of compounding periods per year (m) 4

Number of periods (m x n) 16

Periodic rate (r/m) 1.8%

Present value (PV) -$217.45

b) The growth rate in the revenue of the company for the five-year trend period was

analysed as below:

Growth Rate in Revenue

Year 0 1 2 3 4 5

Revenue

1363.

7 1363.7

1535.52

6

1729.00

3

1946.85

7

2192.16

1

Growth Rate 0 12.60% 12.60% 12.60% 12.60% 12.60%

Total

Revenue

1363.

7

1535.52

6

1729.00

3

1946.85

7

2192.16

1

2468.37

3

c) The effective annual rate for the loan for the various term period will be as follows:

Effective Annual Rate (EAR)

Particulars

Investment

A

Investment

B

Investment

C

Stated annual rate (r) 6.48% 6.45% 6.52%

No. of compounding periods per year (m) 4 365 6

EAR 6.64% 6.66% 6.70%

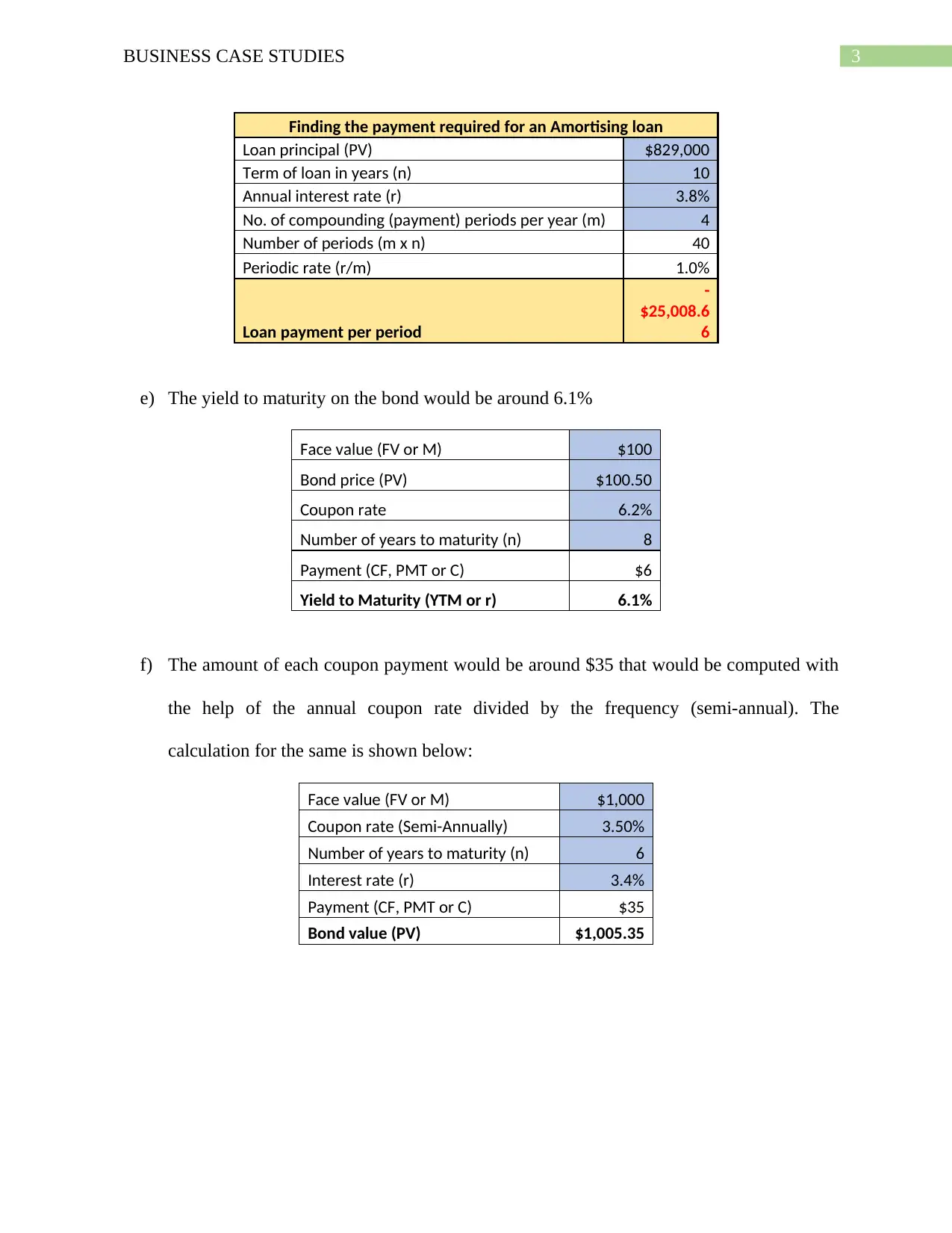

d) The total payments that needs to be made at the end of the period for financing the entire

property cost would be as follows:

In Response to Question 1

a) The present value was determined using the formula below:

Present Value Determination

Future value (FV) $0

PMT $16

Number of years (n) 4

Annual interest rate (r) 7.0%

No. of compounding periods per year (m) 4

Number of periods (m x n) 16

Periodic rate (r/m) 1.8%

Present value (PV) -$217.45

b) The growth rate in the revenue of the company for the five-year trend period was

analysed as below:

Growth Rate in Revenue

Year 0 1 2 3 4 5

Revenue

1363.

7 1363.7

1535.52

6

1729.00

3

1946.85

7

2192.16

1

Growth Rate 0 12.60% 12.60% 12.60% 12.60% 12.60%

Total

Revenue

1363.

7

1535.52

6

1729.00

3

1946.85

7

2192.16

1

2468.37

3

c) The effective annual rate for the loan for the various term period will be as follows:

Effective Annual Rate (EAR)

Particulars

Investment

A

Investment

B

Investment

C

Stated annual rate (r) 6.48% 6.45% 6.52%

No. of compounding periods per year (m) 4 365 6

EAR 6.64% 6.66% 6.70%

d) The total payments that needs to be made at the end of the period for financing the entire

property cost would be as follows:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3BUSINESS CASE STUDIES

Finding the payment required for an Amortising loan

Loan principal (PV) $829,000

Term of loan in years (n) 10

Annual interest rate (r) 3.8%

No. of compounding (payment) periods per year (m) 4

Number of periods (m x n) 40

Periodic rate (r/m) 1.0%

Loan payment per period

-

$25,008.6

6

e) The yield to maturity on the bond would be around 6.1%

Face value (FV or M) $100

Bond price (PV) $100.50

Coupon rate 6.2%

Number of years to maturity (n) 8

Payment (CF, PMT or C) $6

Yield to Maturity (YTM or r) 6.1%

f) The amount of each coupon payment would be around $35 that would be computed with

the help of the annual coupon rate divided by the frequency (semi-annual). The

calculation for the same is shown below:

Face value (FV or M) $1,000

Coupon rate (Semi-Annually) 3.50%

Number of years to maturity (n) 6

Interest rate (r) 3.4%

Payment (CF, PMT or C) $35

Bond value (PV) $1,005.35

Finding the payment required for an Amortising loan

Loan principal (PV) $829,000

Term of loan in years (n) 10

Annual interest rate (r) 3.8%

No. of compounding (payment) periods per year (m) 4

Number of periods (m x n) 40

Periodic rate (r/m) 1.0%

Loan payment per period

-

$25,008.6

6

e) The yield to maturity on the bond would be around 6.1%

Face value (FV or M) $100

Bond price (PV) $100.50

Coupon rate 6.2%

Number of years to maturity (n) 8

Payment (CF, PMT or C) $6

Yield to Maturity (YTM or r) 6.1%

f) The amount of each coupon payment would be around $35 that would be computed with

the help of the annual coupon rate divided by the frequency (semi-annual). The

calculation for the same is shown below:

Face value (FV or M) $1,000

Coupon rate (Semi-Annually) 3.50%

Number of years to maturity (n) 6

Interest rate (r) 3.4%

Payment (CF, PMT or C) $35

Bond value (PV) $1,005.35

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4BUSINESS CASE STUDIES

In Response to Question 2

a) The Capital Asset Pricing Model was applied for determining the required rate of return

of the Cochlear Company. The required rate of return for both the stocks were generated

by the following formula:

Capital Asset Pricing Model (Re) = Risk Free Rate of Return + (Beta*(Return on

Market-Risk Free Rate of Return)).

The Risk free rate of return taken for the analysis of the stock was around 1.95% and the

beta of the stock was determined by regressing the returns generated from the COH Stock

over the ASX 200 Index. The beta for the stock was determined to be around 0.98 times

and the same was determined to be somewhat positively contributed with the stock

(Bhattacharyya 2016). The required rate of return for the stock was determined to be

around 3.27% and the required return for the hypothetical company was determined to be

around 1.68% (Aliu, Pavelkova and Dehning 2017).

Cochlear Ltd ASX 200 Index

Capital Asset Pricing Model Capital Asset Pricing Model

Beta

0.986157

6 Beta -0.2

Risk Free Rate 1.95% Risk Free Rate 1.95%

Return on Market 3.29% Return on Market 3.29%

Required Rate of Return 3.27% Required Rate of Return

1.68

%

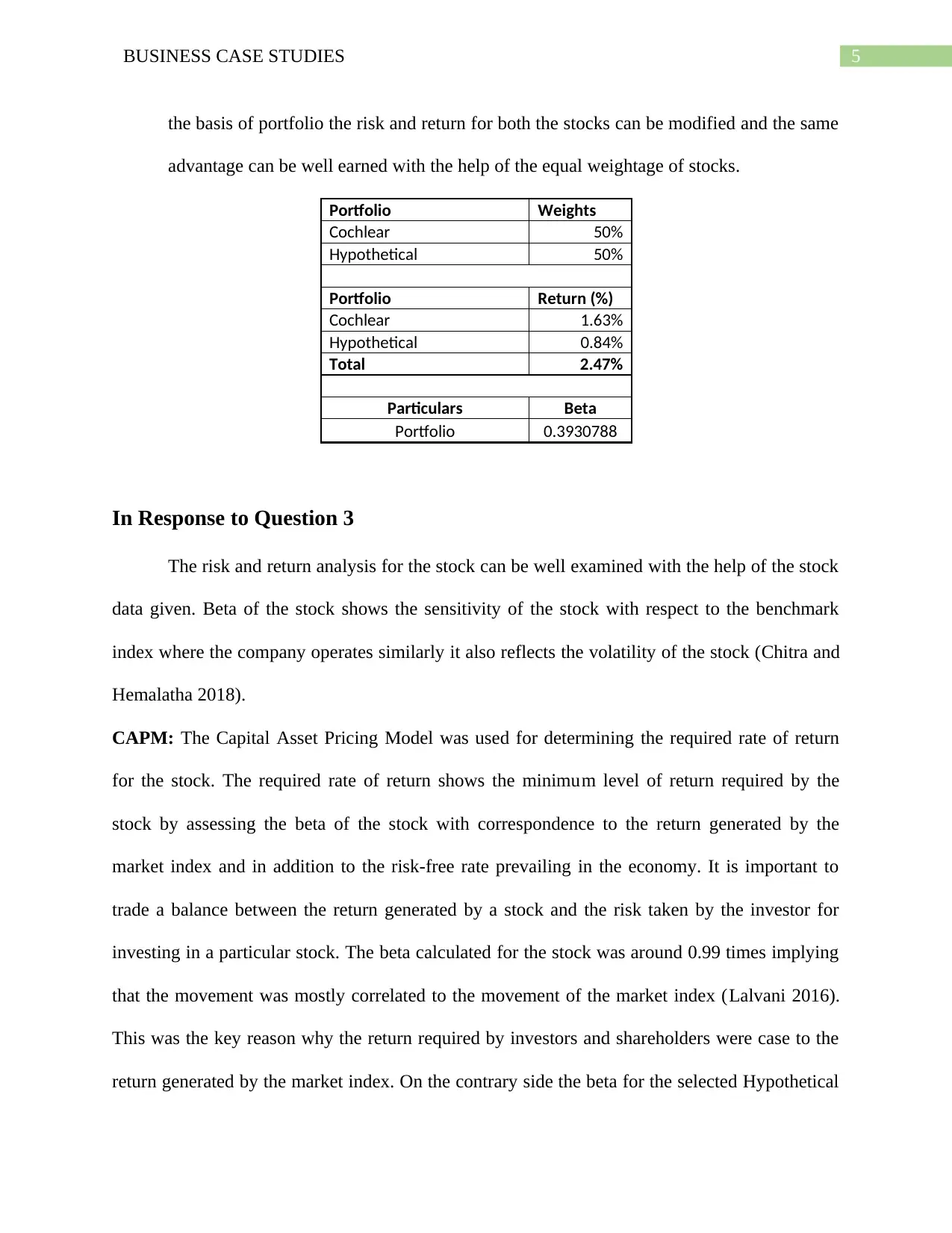

b) The portfolio was constructed by including both stocks in the form of Cochlear Ltd and

Hypothetical Company. The weights given to each of the stock was around 50% for each

of the stocks. The required rate of return generated by each of the stocks were taken into

consideration while determining the required return of the stocks. The required rate of

return of the portfolio is around 2.47% and the beta of the stock is around 0.39 times. On

In Response to Question 2

a) The Capital Asset Pricing Model was applied for determining the required rate of return

of the Cochlear Company. The required rate of return for both the stocks were generated

by the following formula:

Capital Asset Pricing Model (Re) = Risk Free Rate of Return + (Beta*(Return on

Market-Risk Free Rate of Return)).

The Risk free rate of return taken for the analysis of the stock was around 1.95% and the

beta of the stock was determined by regressing the returns generated from the COH Stock

over the ASX 200 Index. The beta for the stock was determined to be around 0.98 times

and the same was determined to be somewhat positively contributed with the stock

(Bhattacharyya 2016). The required rate of return for the stock was determined to be

around 3.27% and the required return for the hypothetical company was determined to be

around 1.68% (Aliu, Pavelkova and Dehning 2017).

Cochlear Ltd ASX 200 Index

Capital Asset Pricing Model Capital Asset Pricing Model

Beta

0.986157

6 Beta -0.2

Risk Free Rate 1.95% Risk Free Rate 1.95%

Return on Market 3.29% Return on Market 3.29%

Required Rate of Return 3.27% Required Rate of Return

1.68

%

b) The portfolio was constructed by including both stocks in the form of Cochlear Ltd and

Hypothetical Company. The weights given to each of the stock was around 50% for each

of the stocks. The required rate of return generated by each of the stocks were taken into

consideration while determining the required return of the stocks. The required rate of

return of the portfolio is around 2.47% and the beta of the stock is around 0.39 times. On

5BUSINESS CASE STUDIES

the basis of portfolio the risk and return for both the stocks can be modified and the same

advantage can be well earned with the help of the equal weightage of stocks.

Portfolio Weights

Cochlear 50%

Hypothetical 50%

Portfolio Return (%)

Cochlear 1.63%

Hypothetical 0.84%

Total 2.47%

Particulars Beta

Portfolio 0.3930788

In Response to Question 3

The risk and return analysis for the stock can be well examined with the help of the stock

data given. Beta of the stock shows the sensitivity of the stock with respect to the benchmark

index where the company operates similarly it also reflects the volatility of the stock (Chitra and

Hemalatha 2018).

CAPM: The Capital Asset Pricing Model was used for determining the required rate of return

for the stock. The required rate of return shows the minimum level of return required by the

stock by assessing the beta of the stock with correspondence to the return generated by the

market index and in addition to the risk-free rate prevailing in the economy. It is important to

trade a balance between the return generated by a stock and the risk taken by the investor for

investing in a particular stock. The beta calculated for the stock was around 0.99 times implying

that the movement was mostly correlated to the movement of the market index (Lalvani 2016).

This was the key reason why the return required by investors and shareholders were case to the

return generated by the market index. On the contrary side the beta for the selected Hypothetical

the basis of portfolio the risk and return for both the stocks can be modified and the same

advantage can be well earned with the help of the equal weightage of stocks.

Portfolio Weights

Cochlear 50%

Hypothetical 50%

Portfolio Return (%)

Cochlear 1.63%

Hypothetical 0.84%

Total 2.47%

Particulars Beta

Portfolio 0.3930788

In Response to Question 3

The risk and return analysis for the stock can be well examined with the help of the stock

data given. Beta of the stock shows the sensitivity of the stock with respect to the benchmark

index where the company operates similarly it also reflects the volatility of the stock (Chitra and

Hemalatha 2018).

CAPM: The Capital Asset Pricing Model was used for determining the required rate of return

for the stock. The required rate of return shows the minimum level of return required by the

stock by assessing the beta of the stock with correspondence to the return generated by the

market index and in addition to the risk-free rate prevailing in the economy. It is important to

trade a balance between the return generated by a stock and the risk taken by the investor for

investing in a particular stock. The beta calculated for the stock was around 0.99 times implying

that the movement was mostly correlated to the movement of the market index (Lalvani 2016).

This was the key reason why the return required by investors and shareholders were case to the

return generated by the market index. On the contrary side the beta for the selected Hypothetical

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6BUSINESS CASE STUDIES

Company was around -0.20 times, which shows negative correlation with the market index. The

risk level was comparatively less from the Cochlear Ltd Company which was the key reason

where shareholders and investors wanted a lessor amount of required rate of return from the

stock (Jensen and Maheu 2018).

Combining stocks in a portfolio modifies the risk return benefit giving the benefit of

diversification in a portfolio. The risk return benefit from the portfolio could be well observed

where the beta of the portfolio was around 0.39 times and the combined return of the portfolio

was around 2.47%. It is crucial to note that with the modification in the return generated from the

portfolio the risk of the portfolio also got modified allowing the investor enjoy the benefit of

diversification (Ren and Dewan 2015).

The return generated from the Cochlear stock for the five-year trend period was around

27% from the trend period of 2014-2019. On the contrary side when comparing the return of the

stock with the return of the market index was just around 3.29%. The return was definitely

higher for the Cochlear stock but the standard deviation measuring the risk of the stock was

comparatively much higher. The standard deviation for the Cochlear Stock was around 25% and

on the other hand side the standard deviation for the market index was around 18%.

Thus it is essential to incorporate various factors and condition while assessing he risk

and return factors of a stock over a trend period of time.

Company was around -0.20 times, which shows negative correlation with the market index. The

risk level was comparatively less from the Cochlear Ltd Company which was the key reason

where shareholders and investors wanted a lessor amount of required rate of return from the

stock (Jensen and Maheu 2018).

Combining stocks in a portfolio modifies the risk return benefit giving the benefit of

diversification in a portfolio. The risk return benefit from the portfolio could be well observed

where the beta of the portfolio was around 0.39 times and the combined return of the portfolio

was around 2.47%. It is crucial to note that with the modification in the return generated from the

portfolio the risk of the portfolio also got modified allowing the investor enjoy the benefit of

diversification (Ren and Dewan 2015).

The return generated from the Cochlear stock for the five-year trend period was around

27% from the trend period of 2014-2019. On the contrary side when comparing the return of the

stock with the return of the market index was just around 3.29%. The return was definitely

higher for the Cochlear stock but the standard deviation measuring the risk of the stock was

comparatively much higher. The standard deviation for the Cochlear Stock was around 25% and

on the other hand side the standard deviation for the market index was around 18%.

Thus it is essential to incorporate various factors and condition while assessing he risk

and return factors of a stock over a trend period of time.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7BUSINESS CASE STUDIES

References

Aliu, F., Pavelkova, D. and Dehning, B., 2017. Portfolio risk-return analysis: The case of the

automotive industry in the Czech Republic. Journal of International Studies, 10(4), pp.72-83.

Bhattacharyya, T., 2016. Risk and Return Profile Analysis of Selected Mutual Fund Product of

Indian Mutual Fund Industry. Available at SSRN 2812519.

Chitra, V. and Hemalatha, T., 2018. Risk & return analysis of performance of mutual fund

schemes in India. IJAR, 4(1), pp.279-283.

Jensen, M. and Maheu, J., 2018. Risk, Return and Volatility Feedback: A Bayesian

Nonparametric Analysis. Journal of Risk and Financial Management, 11(3), p.52.

Lalvani, A., 2016. An Analysis of International Hedge Fund Risk and Return.

Ren, F. and Dewan, S., 2015. Industry-level analysis of information technology return and risk:

What explains the variation?. Journal of Management Information Systems, 32(2), pp.71-103.

References

Aliu, F., Pavelkova, D. and Dehning, B., 2017. Portfolio risk-return analysis: The case of the

automotive industry in the Czech Republic. Journal of International Studies, 10(4), pp.72-83.

Bhattacharyya, T., 2016. Risk and Return Profile Analysis of Selected Mutual Fund Product of

Indian Mutual Fund Industry. Available at SSRN 2812519.

Chitra, V. and Hemalatha, T., 2018. Risk & return analysis of performance of mutual fund

schemes in India. IJAR, 4(1), pp.279-283.

Jensen, M. and Maheu, J., 2018. Risk, Return and Volatility Feedback: A Bayesian

Nonparametric Analysis. Journal of Risk and Financial Management, 11(3), p.52.

Lalvani, A., 2016. An Analysis of International Hedge Fund Risk and Return.

Ren, F. and Dewan, S., 2015. Industry-level analysis of information technology return and risk:

What explains the variation?. Journal of Management Information Systems, 32(2), pp.71-103.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.