Comprehensive Financial Analysis: Budget Report for 'On The Beach'

VerifiedAdded on 2023/04/21

|11

|2085

|288

Report

AI Summary

This report provides a detailed financial analysis of 'On The Beach', a company manufacturing swimwear and accessories. It includes a review of various budgets prepared in Excel for January to December 2019, covering sales forecasts, production requirements, direct material and labor costs, and manufacturing overhead. The analysis focuses on the contribution margin of different products, revealing that while one-piece swimsuits are the most profitable, beach bags generate a negative contribution margin. The report also examines the company's cash position, recommending the discontinuation of beach bag production to improve cash flow. Furthermore, it assesses the current market conditions in the Australian clothing and accessory industry, highlighting factors impacting the company's financial performance and offering recommendations for future budgeting and strategic decision-making. The report concludes that the company is expected to have positive cashflow overall, but needs to consider the economic factors while preparing budget for the year 2020.

Running head: FINANCE

Finance

Name of the student

Name of the university

Student ID

Author note

Finance

Name of the student

Name of the university

Student ID

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCE

Table of Contents

Introduction................................................................................................................................2

Overview of the expected result.................................................................................................2

Analysis of contribution margin.................................................................................................3

Recommendation regarding cash position.................................................................................5

Analysis of present market condition.........................................................................................5

Conclusion and recommendation...............................................................................................7

Reference....................................................................................................................................9

Table of Contents

Introduction................................................................................................................................2

Overview of the expected result.................................................................................................2

Analysis of contribution margin.................................................................................................3

Recommendation regarding cash position.................................................................................5

Analysis of present market condition.........................................................................................5

Conclusion and recommendation...............................................................................................7

Reference....................................................................................................................................9

2FINANCE

Introduction

On The Beach is engaged in manufacturing swimwear and accessories for women as

well as men. The company operates in the rented premises located in Currumbin Creek Road

and the factory is split into the storage and manufacturing area and the retail space. Main 4

products dealt by the company are one-piece swimsuits for women, beach bags, Beach towels

and board shorts for men. The main purpose of the report is to focus on various budgets that

will be prepared in excel sheet for the period covering January 2019 to December 2019. The

report will provide the overview regarding the expected performance of the entity over the

period under consideration (Weygandt, Kimmel and Kieso 2015).

Overview of the expected result

From the given information it has been identified that the one piece sales for the

budgeted period will be 12500 units at the rate of $ 100 per unit that will make sales revenue

from one piece sales amounting to $ 12,50,000. Board shorts sales for the budgeted period

will be 11420 units at the rate of $ 80 per unit that will make sales revenue from one Board

shorts sales amounting to $ 913,600. Towel sales for the budgeted period will be 1560 units

at the rate of $ 50 per unit that will make sales revenue from Towel sales amounting to $

78,000. Beach bags sales for the budgeted period will be 2600 units at the rate of $ 40 per

unit that will make sales revenue from one Beach bags amounting to $ 117,000

(Wijayasundara et al. 2016). The company prefers to keep 50% of the next months budgeted

sales as closing finished goods inventory. After taking into consideration the fact total

production requirement for one piece will be 7750 units, for board shorts it will be 11320

units, towel will be 1950 units and for beach bags it will be 2620 units. Machine hours

required for each product will be 1 hour for one piece, 0.75 hours for board shorts, 0.4 hours

for towel and 0.6 hours for beach bags (Tekin and Konina 2017). Direct material requirement

Introduction

On The Beach is engaged in manufacturing swimwear and accessories for women as

well as men. The company operates in the rented premises located in Currumbin Creek Road

and the factory is split into the storage and manufacturing area and the retail space. Main 4

products dealt by the company are one-piece swimsuits for women, beach bags, Beach towels

and board shorts for men. The main purpose of the report is to focus on various budgets that

will be prepared in excel sheet for the period covering January 2019 to December 2019. The

report will provide the overview regarding the expected performance of the entity over the

period under consideration (Weygandt, Kimmel and Kieso 2015).

Overview of the expected result

From the given information it has been identified that the one piece sales for the

budgeted period will be 12500 units at the rate of $ 100 per unit that will make sales revenue

from one piece sales amounting to $ 12,50,000. Board shorts sales for the budgeted period

will be 11420 units at the rate of $ 80 per unit that will make sales revenue from one Board

shorts sales amounting to $ 913,600. Towel sales for the budgeted period will be 1560 units

at the rate of $ 50 per unit that will make sales revenue from Towel sales amounting to $

78,000. Beach bags sales for the budgeted period will be 2600 units at the rate of $ 40 per

unit that will make sales revenue from one Beach bags amounting to $ 117,000

(Wijayasundara et al. 2016). The company prefers to keep 50% of the next months budgeted

sales as closing finished goods inventory. After taking into consideration the fact total

production requirement for one piece will be 7750 units, for board shorts it will be 11320

units, towel will be 1950 units and for beach bags it will be 2620 units. Machine hours

required for each product will be 1 hour for one piece, 0.75 hours for board shorts, 0.4 hours

for towel and 0.6 hours for beach bags (Tekin and Konina 2017). Direct material requirement

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCE

including fabric and trim or elastic will cost $ 34.25 for one piece and board shorts, $ 31.50

for towels and $ 26.50 for beach bags. Further, the expected labour cost will be $ 28 for one

piece, $ 21 for board shorts, $ 11.20 for towel and $ 16.80 for beach bags. Variable

manufacturing costs involved with the production are direct material cost, direct as well as

indirect labour cost. On the other hand, fixed manufacturing costs involved with the

production includes utilities cost amounting to $ 5400, insurance cost amounting to $ 2200,

factory supervisors salary amounting to $ 54,000, rent amounting to $ 67,200 and repairs and

maintenance costs to be paid at $ 2500 quarterly (Mohan 2018). Further, the operating costs

will involve utilities amounting to $ 600, insurance cost amounting to $ 6,000, administration

staff wages amounting to $ 30,0000, rent amounting to $ 16,800. Other expenses will include

interest expenses at 8% on loan and depreciation amounting to $ 10,000 on equipment.

Looking into the income statement it is identified that the gross profit margin of the company

amounted to $ 911,361 after deducting cost of sales amounting to $ 14,47,239 from sales

revenue amounting to $ 23,58,600. After deducting all the expenses amounting to $ 96,200

from the gross profit margin, the expected net income for the company is amounting to $

815,161 (Dasari, Jigeesh and Prabhukumar 2015).

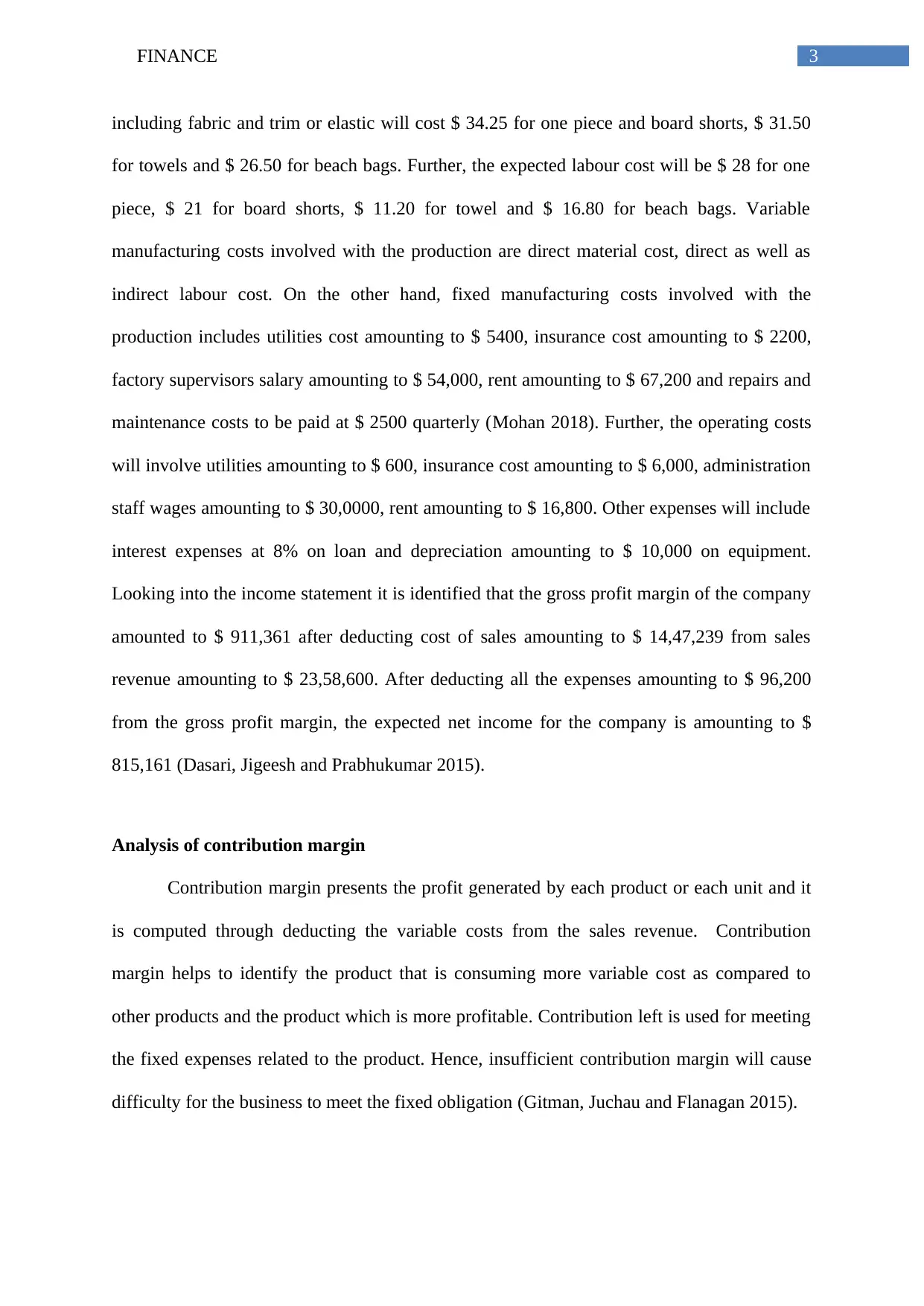

Analysis of contribution margin

Contribution margin presents the profit generated by each product or each unit and it

is computed through deducting the variable costs from the sales revenue. Contribution

margin helps to identify the product that is consuming more variable cost as compared to

other products and the product which is more profitable. Contribution left is used for meeting

the fixed expenses related to the product. Hence, insufficient contribution margin will cause

difficulty for the business to meet the fixed obligation (Gitman, Juchau and Flanagan 2015).

including fabric and trim or elastic will cost $ 34.25 for one piece and board shorts, $ 31.50

for towels and $ 26.50 for beach bags. Further, the expected labour cost will be $ 28 for one

piece, $ 21 for board shorts, $ 11.20 for towel and $ 16.80 for beach bags. Variable

manufacturing costs involved with the production are direct material cost, direct as well as

indirect labour cost. On the other hand, fixed manufacturing costs involved with the

production includes utilities cost amounting to $ 5400, insurance cost amounting to $ 2200,

factory supervisors salary amounting to $ 54,000, rent amounting to $ 67,200 and repairs and

maintenance costs to be paid at $ 2500 quarterly (Mohan 2018). Further, the operating costs

will involve utilities amounting to $ 600, insurance cost amounting to $ 6,000, administration

staff wages amounting to $ 30,0000, rent amounting to $ 16,800. Other expenses will include

interest expenses at 8% on loan and depreciation amounting to $ 10,000 on equipment.

Looking into the income statement it is identified that the gross profit margin of the company

amounted to $ 911,361 after deducting cost of sales amounting to $ 14,47,239 from sales

revenue amounting to $ 23,58,600. After deducting all the expenses amounting to $ 96,200

from the gross profit margin, the expected net income for the company is amounting to $

815,161 (Dasari, Jigeesh and Prabhukumar 2015).

Analysis of contribution margin

Contribution margin presents the profit generated by each product or each unit and it

is computed through deducting the variable costs from the sales revenue. Contribution

margin helps to identify the product that is consuming more variable cost as compared to

other products and the product which is more profitable. Contribution left is used for meeting

the fixed expenses related to the product. Hence, insufficient contribution margin will cause

difficulty for the business to meet the fixed obligation (Gitman, Juchau and Flanagan 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCE

One-piece

Board

shorts Towels

Beach

Bags Total

Units 12500 11420 1560 2600 28080

Sales revenue

$

1,250,000.00

$

913,600.00

$

78,000.00

$

117,000.00

$

2,358,600.00

Variable cost

Direct material

$

428,125.00

$

391,135.00

$

49,140.00

$

68,900.00

$

937,300.00

Direct labour

$

350,000.00

$

239,820.00

$

17,472.00

$

43,680.00

$

650,972.00

Indirect labour

$

15,500.00

$

22,640.00

$

3,900.00

$

5,240.00

$

47,280.00

Total variable cost

$

793,625.00

$

653,595.00

$

70,512.00

$

117,820.00

$

1,635,552.00

Contribution

$

456,375.00

$

260,005.00

$

7,488.00

$

(820.00)

$

723,048.00

Contribution

margin 36.51% 28.46% 9.60% -0.70% 30.66%

One-

piece

Board

shorts

Towels Beach

Bags

-5.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

35.00%

40.00%

Contribution margin

Contribution margin

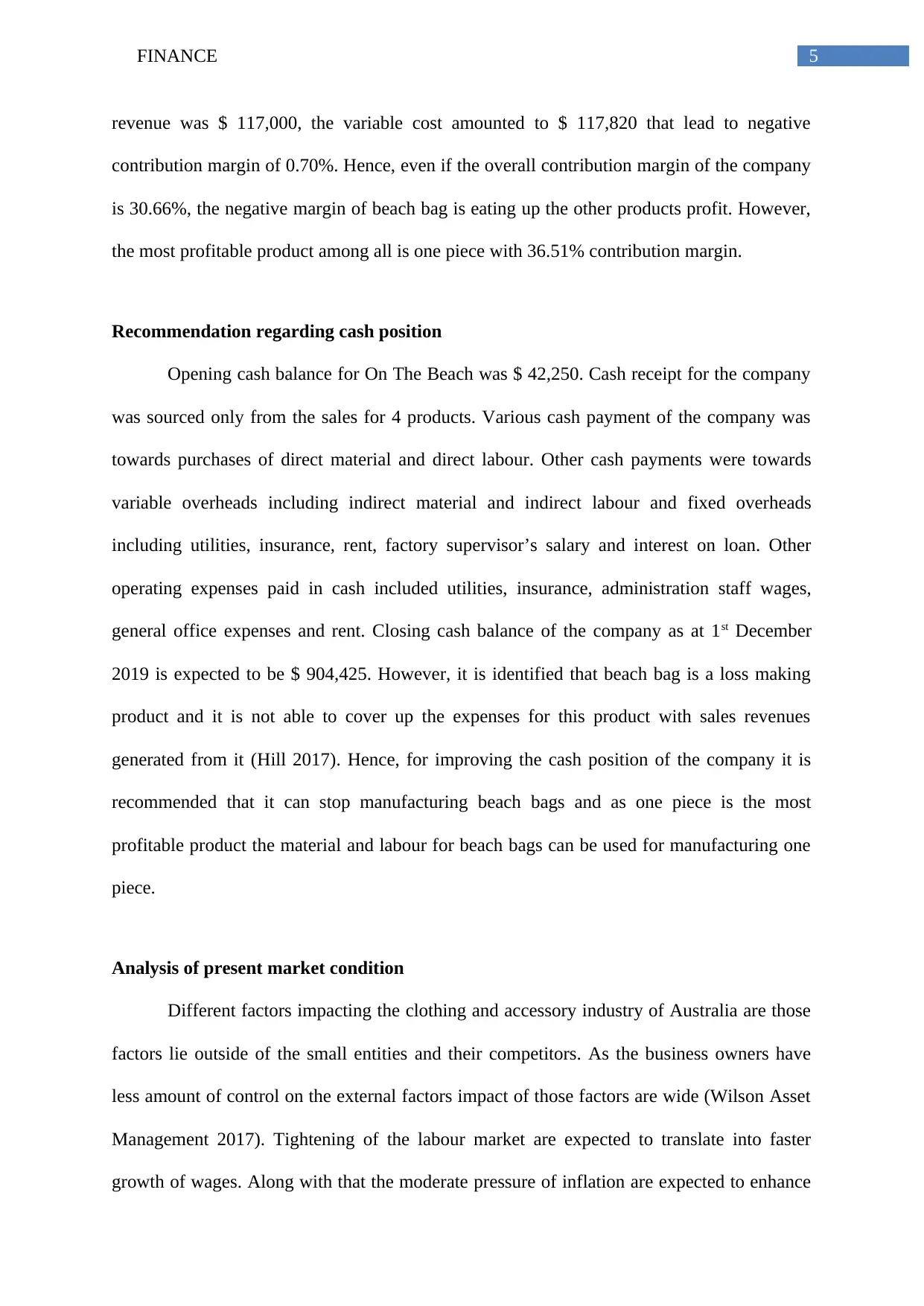

Looking into the above table and graph it can be determined that total sales revenue

for one piece was $12,50,000 whereas the total variable cost was $ 793,625 and the resultant

contribution margin was 36.51%. Total sales revenue for board shorts was $913,600 whereas

the total variable cost was $ 633,595 and the resultant contribution margin was 28.64%. Total

sales revenue for towels was $ 78,000 whereas the total variable cost was $ 70,512 and the

resultant contribution margin was 9.60%. However, in case of beach bags the variable cost

was more than the sales revenue (Gitman, Juchau and Flanagan 2015). Whereas the sales

One-piece

Board

shorts Towels

Beach

Bags Total

Units 12500 11420 1560 2600 28080

Sales revenue

$

1,250,000.00

$

913,600.00

$

78,000.00

$

117,000.00

$

2,358,600.00

Variable cost

Direct material

$

428,125.00

$

391,135.00

$

49,140.00

$

68,900.00

$

937,300.00

Direct labour

$

350,000.00

$

239,820.00

$

17,472.00

$

43,680.00

$

650,972.00

Indirect labour

$

15,500.00

$

22,640.00

$

3,900.00

$

5,240.00

$

47,280.00

Total variable cost

$

793,625.00

$

653,595.00

$

70,512.00

$

117,820.00

$

1,635,552.00

Contribution

$

456,375.00

$

260,005.00

$

7,488.00

$

(820.00)

$

723,048.00

Contribution

margin 36.51% 28.46% 9.60% -0.70% 30.66%

One-

piece

Board

shorts

Towels Beach

Bags

-5.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

35.00%

40.00%

Contribution margin

Contribution margin

Looking into the above table and graph it can be determined that total sales revenue

for one piece was $12,50,000 whereas the total variable cost was $ 793,625 and the resultant

contribution margin was 36.51%. Total sales revenue for board shorts was $913,600 whereas

the total variable cost was $ 633,595 and the resultant contribution margin was 28.64%. Total

sales revenue for towels was $ 78,000 whereas the total variable cost was $ 70,512 and the

resultant contribution margin was 9.60%. However, in case of beach bags the variable cost

was more than the sales revenue (Gitman, Juchau and Flanagan 2015). Whereas the sales

5FINANCE

revenue was $ 117,000, the variable cost amounted to $ 117,820 that lead to negative

contribution margin of 0.70%. Hence, even if the overall contribution margin of the company

is 30.66%, the negative margin of beach bag is eating up the other products profit. However,

the most profitable product among all is one piece with 36.51% contribution margin.

Recommendation regarding cash position

Opening cash balance for On The Beach was $ 42,250. Cash receipt for the company

was sourced only from the sales for 4 products. Various cash payment of the company was

towards purchases of direct material and direct labour. Other cash payments were towards

variable overheads including indirect material and indirect labour and fixed overheads

including utilities, insurance, rent, factory supervisor’s salary and interest on loan. Other

operating expenses paid in cash included utilities, insurance, administration staff wages,

general office expenses and rent. Closing cash balance of the company as at 1st December

2019 is expected to be $ 904,425. However, it is identified that beach bag is a loss making

product and it is not able to cover up the expenses for this product with sales revenues

generated from it (Hill 2017). Hence, for improving the cash position of the company it is

recommended that it can stop manufacturing beach bags and as one piece is the most

profitable product the material and labour for beach bags can be used for manufacturing one

piece.

Analysis of present market condition

Different factors impacting the clothing and accessory industry of Australia are those

factors lie outside of the small entities and their competitors. As the business owners have

less amount of control on the external factors impact of those factors are wide (Wilson Asset

Management 2017). Tightening of the labour market are expected to translate into faster

growth of wages. Along with that the moderate pressure of inflation are expected to enhance

revenue was $ 117,000, the variable cost amounted to $ 117,820 that lead to negative

contribution margin of 0.70%. Hence, even if the overall contribution margin of the company

is 30.66%, the negative margin of beach bag is eating up the other products profit. However,

the most profitable product among all is one piece with 36.51% contribution margin.

Recommendation regarding cash position

Opening cash balance for On The Beach was $ 42,250. Cash receipt for the company

was sourced only from the sales for 4 products. Various cash payment of the company was

towards purchases of direct material and direct labour. Other cash payments were towards

variable overheads including indirect material and indirect labour and fixed overheads

including utilities, insurance, rent, factory supervisor’s salary and interest on loan. Other

operating expenses paid in cash included utilities, insurance, administration staff wages,

general office expenses and rent. Closing cash balance of the company as at 1st December

2019 is expected to be $ 904,425. However, it is identified that beach bag is a loss making

product and it is not able to cover up the expenses for this product with sales revenues

generated from it (Hill 2017). Hence, for improving the cash position of the company it is

recommended that it can stop manufacturing beach bags and as one piece is the most

profitable product the material and labour for beach bags can be used for manufacturing one

piece.

Analysis of present market condition

Different factors impacting the clothing and accessory industry of Australia are those

factors lie outside of the small entities and their competitors. As the business owners have

less amount of control on the external factors impact of those factors are wide (Wilson Asset

Management 2017). Tightening of the labour market are expected to translate into faster

growth of wages. Along with that the moderate pressure of inflation are expected to enhance

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCE

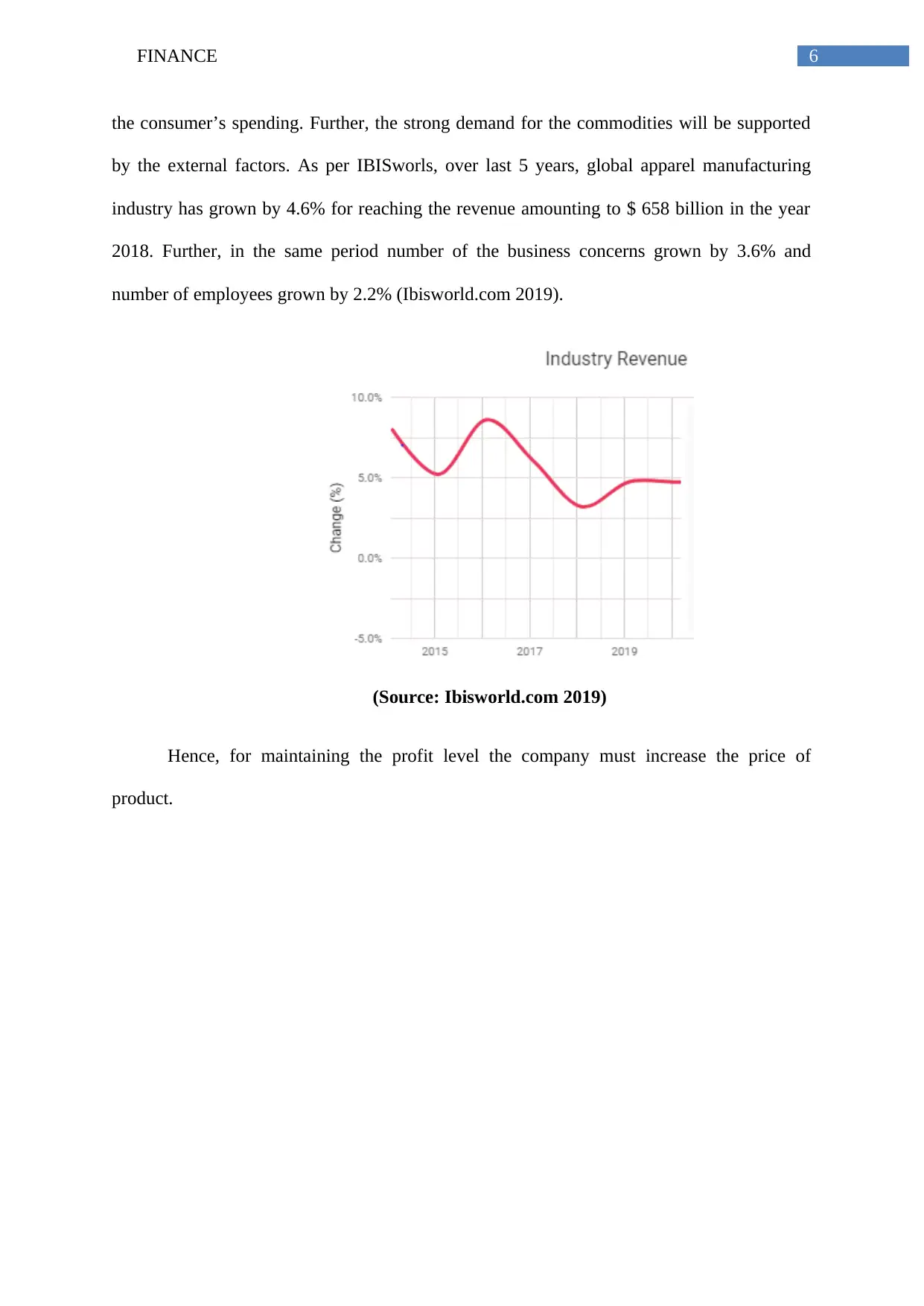

the consumer’s spending. Further, the strong demand for the commodities will be supported

by the external factors. As per IBISworls, over last 5 years, global apparel manufacturing

industry has grown by 4.6% for reaching the revenue amounting to $ 658 billion in the year

2018. Further, in the same period number of the business concerns grown by 3.6% and

number of employees grown by 2.2% (Ibisworld.com 2019).

(Source: Ibisworld.com 2019)

Hence, for maintaining the profit level the company must increase the price of

product.

the consumer’s spending. Further, the strong demand for the commodities will be supported

by the external factors. As per IBISworls, over last 5 years, global apparel manufacturing

industry has grown by 4.6% for reaching the revenue amounting to $ 658 billion in the year

2018. Further, in the same period number of the business concerns grown by 3.6% and

number of employees grown by 2.2% (Ibisworld.com 2019).

(Source: Ibisworld.com 2019)

Hence, for maintaining the profit level the company must increase the price of

product.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCE

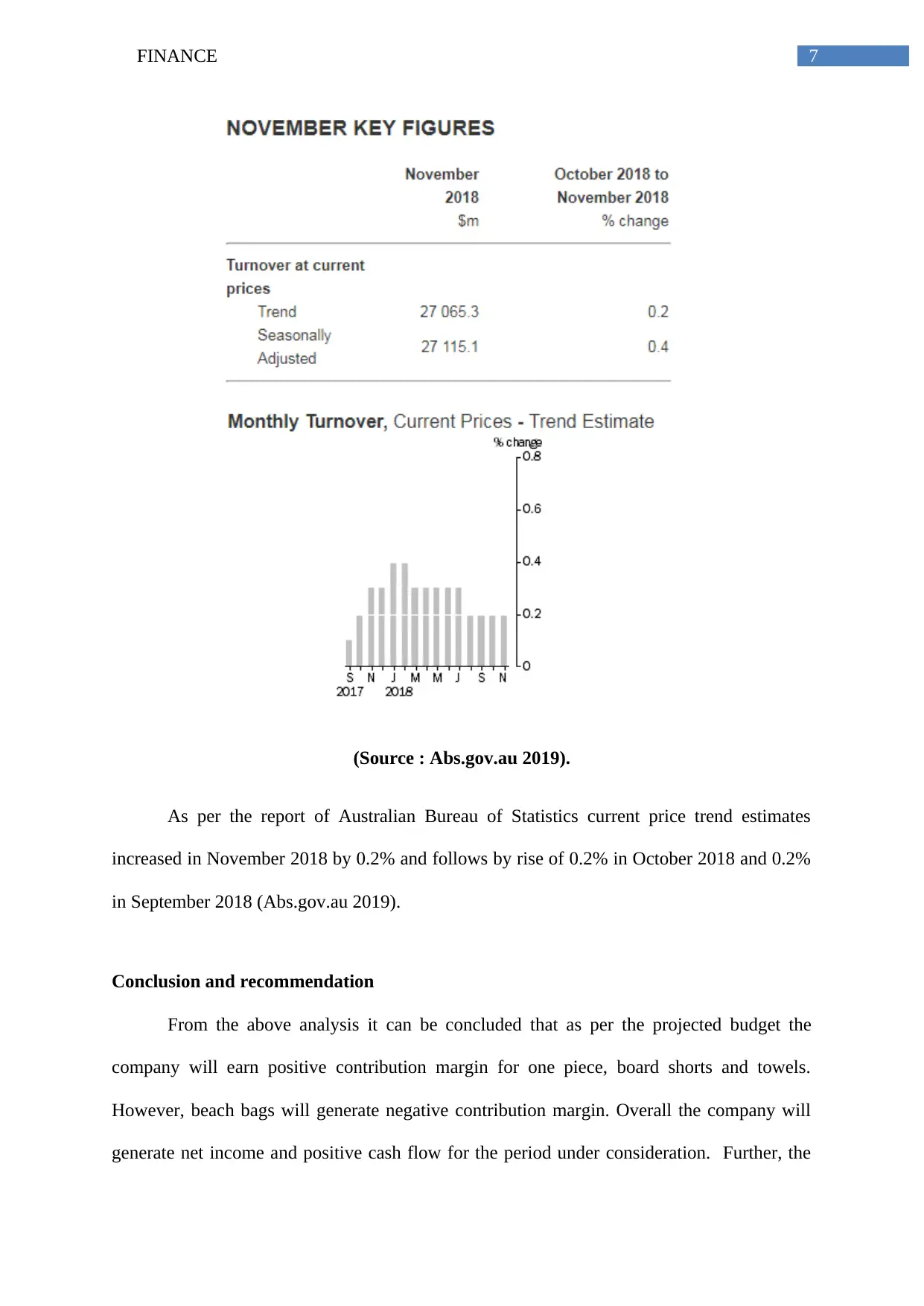

(Source : Abs.gov.au 2019).

As per the report of Australian Bureau of Statistics current price trend estimates

increased in November 2018 by 0.2% and follows by rise of 0.2% in October 2018 and 0.2%

in September 2018 (Abs.gov.au 2019).

Conclusion and recommendation

From the above analysis it can be concluded that as per the projected budget the

company will earn positive contribution margin for one piece, board shorts and towels.

However, beach bags will generate negative contribution margin. Overall the company will

generate net income and positive cash flow for the period under consideration. Further, the

(Source : Abs.gov.au 2019).

As per the report of Australian Bureau of Statistics current price trend estimates

increased in November 2018 by 0.2% and follows by rise of 0.2% in October 2018 and 0.2%

in September 2018 (Abs.gov.au 2019).

Conclusion and recommendation

From the above analysis it can be concluded that as per the projected budget the

company will earn positive contribution margin for one piece, board shorts and towels.

However, beach bags will generate negative contribution margin. Overall the company will

generate net income and positive cash flow for the period under consideration. Further, the

8FINANCE

overall outlook for Australian economy is seems to be positive. Range of the macro factors

will be continued to shape the Australian entity’s operating environment and will influence

the share prices. However, the investors shall consider and monitor the big picture economic

trends and issues considering their impact on the Australian economy. Hence, it is

recommended that while preparing the budget for the year 2020, On The Beach shall consider

all the economic factors those may have affect on its business. Further, the company shall be

kept in mind the fact that the beach bag product is not profitable and is eating up the profits

generated from other products.

overall outlook for Australian economy is seems to be positive. Range of the macro factors

will be continued to shape the Australian entity’s operating environment and will influence

the share prices. However, the investors shall consider and monitor the big picture economic

trends and issues considering their impact on the Australian economy. Hence, it is

recommended that while preparing the budget for the year 2020, On The Beach shall consider

all the economic factors those may have affect on its business. Further, the company shall be

kept in mind the fact that the beach bag product is not profitable and is eating up the profits

generated from other products.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCE

Reference

Abs.gov.au., 2019. 8501.0 - Retail Trade, Australia, Nov 2018. [online] Available at:

http://www.abs.gov.au/ausstats/abs@.nsf/mf/8501.0 [Accessed 12 Jan. 2019].

Dasari, S., Jigeesh, N. and Prabhukumar, A., 2015. Analysis of project success issues: The

case of a manufacturing SME. IUP Journal of Operations Management, 14(1), p.32.

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

Hill, T., 2017. Manufacturing strategy: the strategic management of the manufacturing

function. Macmillan International Higher Education.

Ibisworld.com., 2019. Global Apparel Manufacturing. Industry Market Research Reports,

Trends, Statistics, Data, Forecasts . [online] Available at:

https://www.ibisworld.com/industry-trends/global-industry-reports/manufacturing/apparel-

manufacturing.html [Accessed 12 Jan. 2019].

Mohan, D., 2018. Budget 2018: A Case for (Restrained) Economic Populism?.

Tekin, A.V. and Konina, O.V., 2017, December. The Role of Information and

Communication Technologies in the Process of Strategic Management of Entrepreneurial

Structures Activities: The Budget and Financial Aspect. In Perspectives on the use of New

Information and Communication Technology (ICT) in the Modern Economy (pp. 269-278).

Springer, Cham.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting.

John Wiley & Sons.

Reference

Abs.gov.au., 2019. 8501.0 - Retail Trade, Australia, Nov 2018. [online] Available at:

http://www.abs.gov.au/ausstats/abs@.nsf/mf/8501.0 [Accessed 12 Jan. 2019].

Dasari, S., Jigeesh, N. and Prabhukumar, A., 2015. Analysis of project success issues: The

case of a manufacturing SME. IUP Journal of Operations Management, 14(1), p.32.

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

Hill, T., 2017. Manufacturing strategy: the strategic management of the manufacturing

function. Macmillan International Higher Education.

Ibisworld.com., 2019. Global Apparel Manufacturing. Industry Market Research Reports,

Trends, Statistics, Data, Forecasts . [online] Available at:

https://www.ibisworld.com/industry-trends/global-industry-reports/manufacturing/apparel-

manufacturing.html [Accessed 12 Jan. 2019].

Mohan, D., 2018. Budget 2018: A Case for (Restrained) Economic Populism?.

Tekin, A.V. and Konina, O.V., 2017, December. The Role of Information and

Communication Technologies in the Process of Strategic Management of Entrepreneurial

Structures Activities: The Budget and Financial Aspect. In Perspectives on the use of New

Information and Communication Technology (ICT) in the Modern Economy (pp. 269-278).

Springer, Cham.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting.

John Wiley & Sons.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCE

Wijayasundara, M., Mendis, P., Zhang, L. and Sofi, M., 2016. Financial assessment of

manufacturing recycled aggregate concrete in ready-mix concrete plants. Resources,

Conservation and Recycling, 109, pp.187-201.

Wilson Asset Management., 2017. 3 macro-economic factors to impact your portfolio —

Wilson Asset Management. [online] Available at:

https://wilsonassetmanagement.com.au/2017/09/07/3-macro-economic-factors-impact-

portfolio/ [Accessed 12 Jan. 2019].

Wijayasundara, M., Mendis, P., Zhang, L. and Sofi, M., 2016. Financial assessment of

manufacturing recycled aggregate concrete in ready-mix concrete plants. Resources,

Conservation and Recycling, 109, pp.187-201.

Wilson Asset Management., 2017. 3 macro-economic factors to impact your portfolio —

Wilson Asset Management. [online] Available at:

https://wilsonassetmanagement.com.au/2017/09/07/3-macro-economic-factors-impact-

portfolio/ [Accessed 12 Jan. 2019].

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.