Detailed Financial Analysis Report on Abacus Property Group

VerifiedAdded on 2021/06/17

Finance for Business

Name of the Student

Name of the University

Authors Note

Couse ID

Paraphrase This Document

Table of Contents

Introduction:...............................................................................................................................2

Description of the company:......................................................................................................3

Ownership governance structure:...............................................................................................4

Main substantial shareholders:...............................................................................................4

Main people involved in firm Governance:...........................................................................5

Fundamental Calculations of Ratios:.........................................................................................6

Short Term Solvency Ratios:.................................................................................................6

Long Term Solvency Ratios:.................................................................................................6

Asset Utilisation Ratios:.........................................................................................................7

Profitability Ratios:................................................................................................................7

Market Value Ratios:.............................................................................................................7

Graphical Description of Share Price Results:...........................................................................8

Share Price Movement Analysis:...........................................................................................8

Comparative Analysis of the Share Price Movement against the All Ords Index:....................8

Factors influencing the stock price movement of the company:..............................................10

Calculations of beta values and required rate of return:......................................................11

Calculations of Beta:................................................................................................................11

Calculations of required rate of return:....................................................................................11

Conservative for Investment:...............................................................................................11

WACC of the Company:..........................................................................................................12

Calculations of the WACC for the Company:.....................................................................12

Implications of higher WACC:............................................................................................12

Debt Ratio:...............................................................................................................................13

Dividend policy:.......................................................................................................................14

Letter of Recommendations:....................................................................................................14

Conclusion:..............................................................................................................................15

References................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction:

The business report is prepared to provide the probable investors with the detailed

understanding of the company financial environment. The business report would be based on

the Abacus Property Group to investigate and analyse the financial position of the company.

The basic objective of the report is to simplify the portfolio of the investors and provide them

with the appropriate recommendations regarding the viability of making investment in the

company.

The report would be providing the descriptive understanding of the company, the

market in which it operates and the major products in which it deals. Furthermore, an

identification of the company corporate ownership structure along with main people that are

involved in the governance of the organization would be provided. The report would further

accompany the computation of significant ratios to understand the overall financial health of

the Abacus Group Property.

A graphical plot would be developed to understand the movement in the share price of

the company against the all ordinary index. Further reference would also be made towards the

major factors that create an influence in the share price of the company. For any making any

investment investors usually prefers the required rate of return of an entity. Likewise, the

report would also provide the understanding of the WACC and calculate the required rate of

return for the Abacus Property Group by employing the tools of weighted average cost of

capital.

A look into the dividend and debt structure of the Abacus Property Group would also

be made to understand the viability of the making investment. Finally the report would be

following the letter of recommendations for the potential investors regarding the prospects of

making investment in the Abacus Group Property.

Paraphrase This Document

Description of the company:

Abacus Property Group is regarded as one of the diversified group of property. The

company specialises in making an investment in the core plus property opportunities in

Australia (Abacus Property Group 2018). Abacus Property Group was established in the year

1996 and the company became listed in the Australian Stock Exchange during the year 2002

and the company is included in the S&P/ASX 200 index.

Abacus is the stable entity that holds a combination of securities in three companies.

This includes the Abacus Holdings Limited, Abacus Project Limited and the Abacus Storage

Operations limited. Apart from this company also has three trusts and they are Abacus Trust,

Abacus Income Trust and Abacus Storage Property Trust (Abacus Property Group 2018).

Investors of the company usually acquire the stapled securities that consists of the securities

of the listed six companies.

The strategy of the Abacus is to invest is core plus properties. The company takes the

advantage of its value adding opportunities so that it can generate long term capital returns

and increase the security holder’s value. The objective of the company investment is to offers

its investors with the reliable and increasing amount of returns (Abacus Property Group

2018). The company looks in to the property assets which is capable of providing growth to

the rental income and value of assets.

The company has the successful track record in acquiring the property that is based on

the assets and manages its assets actively in order to improve the income and the capital

growth. Abacus Property Group core existence and the joint venture has resulted in the

growth of several sophisticated global third party capital providers (Abacus Property Group

2018). Abacus Property Group looks for those assets and projects that are typically eastern

seaboard that are mispriced by the market and has the potential for capital growth. Abacus

Property Group participates in wide range of projects by combining its capital and property

expertise with the regional and sector specific experts to grow its business. By the year ended

June 2017 the company reported a total of $448 million in the form of development and

financing projects in its balance sheet.

Ownership governance structure:

Main substantial shareholders:

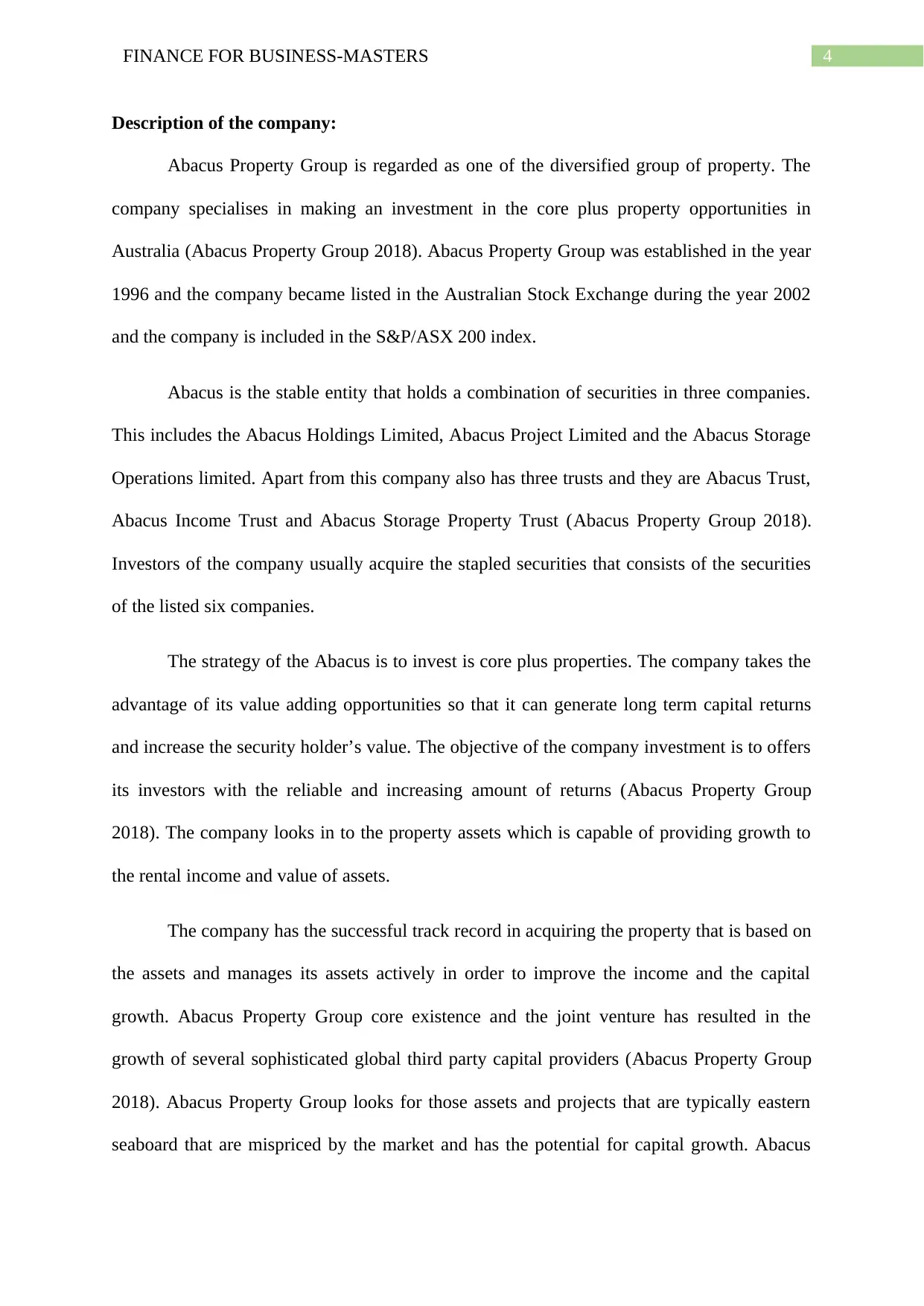

The main substantial security holders for the Abacus Property Group is stated below

Name of the Security Holders Number of Securities Percentage of Securities

held

Calculator Australia Pty

Limited

252,981,605 43.95%

Investor Mutual Limited 29,523,171 5.13%

As evident from the above stated tabular representation the main substantial

shareholder for the company stood Calculator Australia Pty Limited as the company held

252,981,605 of the total securities which comprised of 43.95% of the total issued securities

(Abacus Property Group 2018). Apart from that Investor Mutual Limited held 29,523,171 of

the securities that comprised of 5.13% of the total shareholdings for the Abacus Group

Property. Based on the substantial shareholdings it can be stated that the company cannot be

classified as family company.

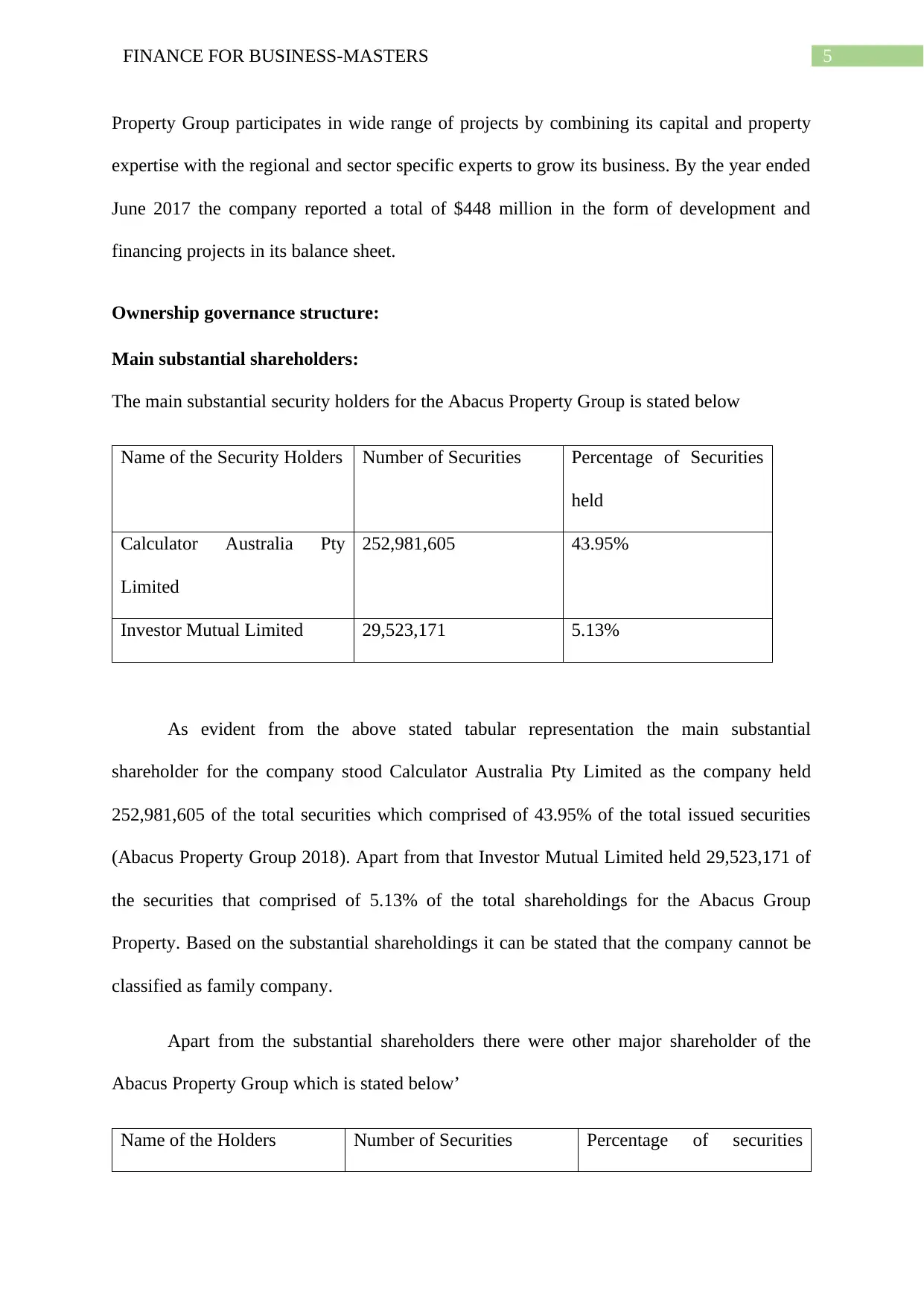

Apart from the substantial shareholders there were other major shareholder of the

Abacus Property Group which is stated below’

Name of the Holders Number of Securities Percentage of securities

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

issued

CITICORP NOMINEES

PTY LIMITED

190,498,670 33.097%

HSBC CUSTODY

NOMINEES

96,089,134 16.695%

J P MORGAN NOMINEES

AUSTRALIA

58,054,301 10.086%

CALCULATOR

AUSTRALIA PTY

LIMITED

57,750,613 10.034%

CALCULATOR

AUSTRALIA PTY

LIMITED

45,547,846 7.914%

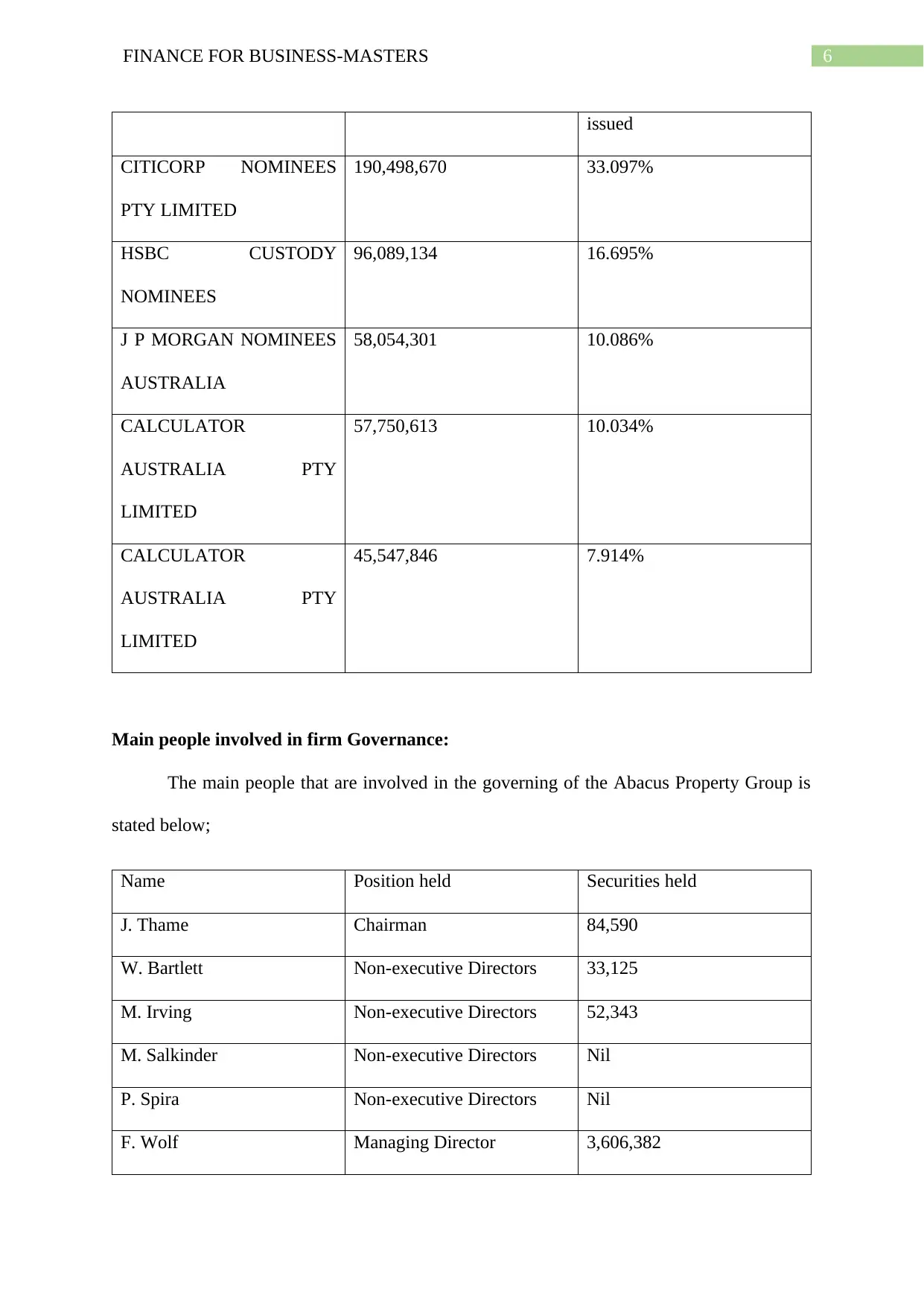

Main people involved in firm Governance:

The main people that are involved in the governing of the Abacus Property Group is

stated below;

Name Position held Securities held

J. Thame Chairman 84,590

W. Bartlett Non-executive Directors 33,125

M. Irving Non-executive Directors 52,343

M. Salkinder Non-executive Directors Nil

P. Spira Non-executive Directors Nil

F. Wolf Managing Director 3,606,382

Paraphrase This Document

R. Baulderstone Chief Financial Officer Nil

C. Laird Director Property

Development

Nil

P. Strain Director Property

Investments

Nil

As it is stated from the above stated it can be stated that none of the individuals that

are involved in the governance of the Abacus Property Group held more than 5% of the

issued securities. Based on the classifications it can be stated that there is not such existence

of family members in the governance of the company. Abacus Property Group is entirely a

non-family company.

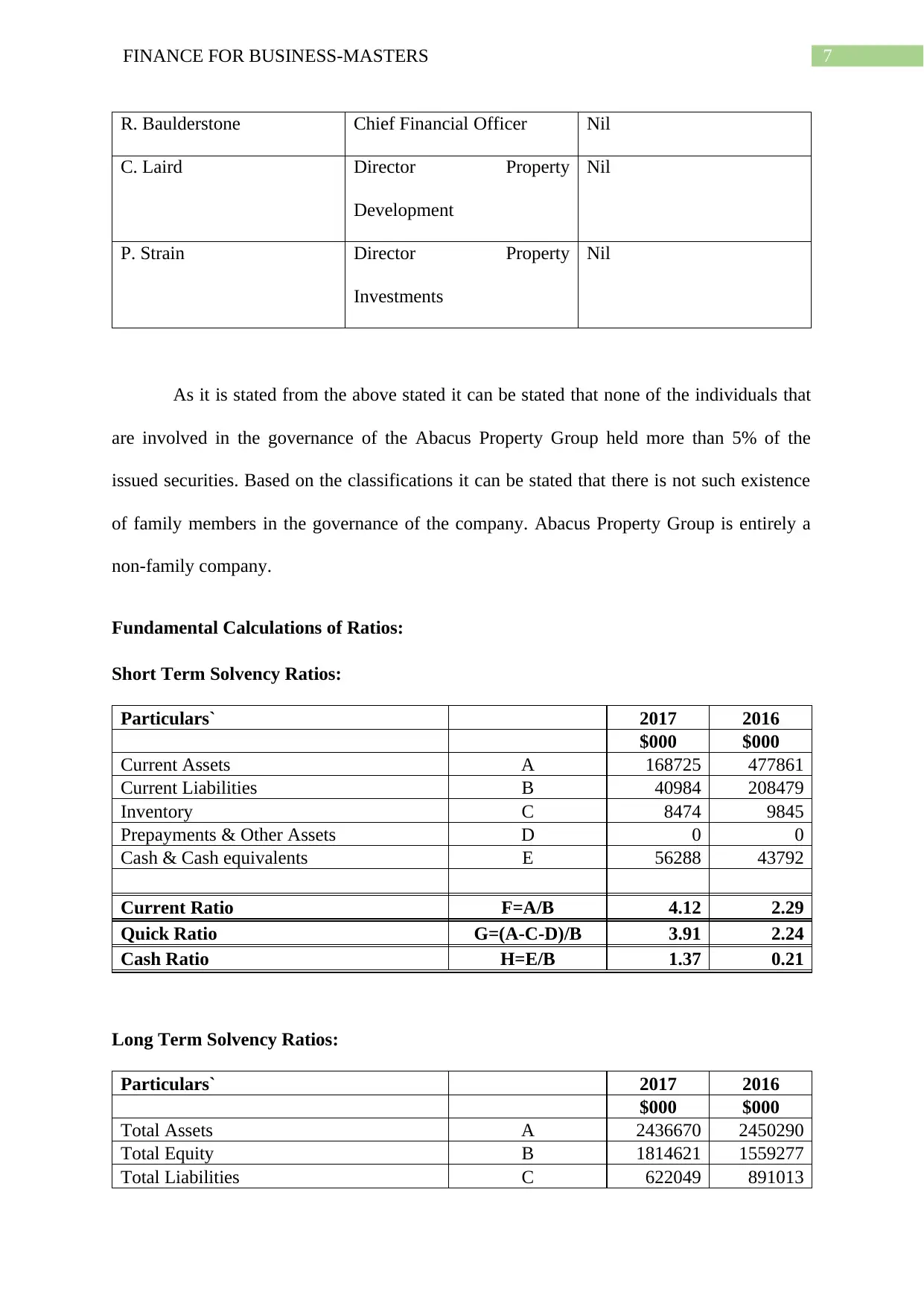

Fundamental Calculations of Ratios:

Short Term Solvency Ratios:

Particulars` 2017 2016

$000 $000

Current Assets A 168725 477861

Current Liabilities B 40984 208479

Inventory C 8474 9845

Prepayments & Other Assets D 0 0

Cash & Cash equivalents E 56288 43792

Current Ratio F=A/B 4.12 2.29

Quick Ratio G=(A-C-D)/B 3.91 2.24

Cash Ratio H=E/B 1.37 0.21

Long Term Solvency Ratios:

Particulars` 2017 2016

$000 $000

Total Assets A 2436670 2450290

Total Equity B 1814621 1559277

Total Liabilities C 622049 891013

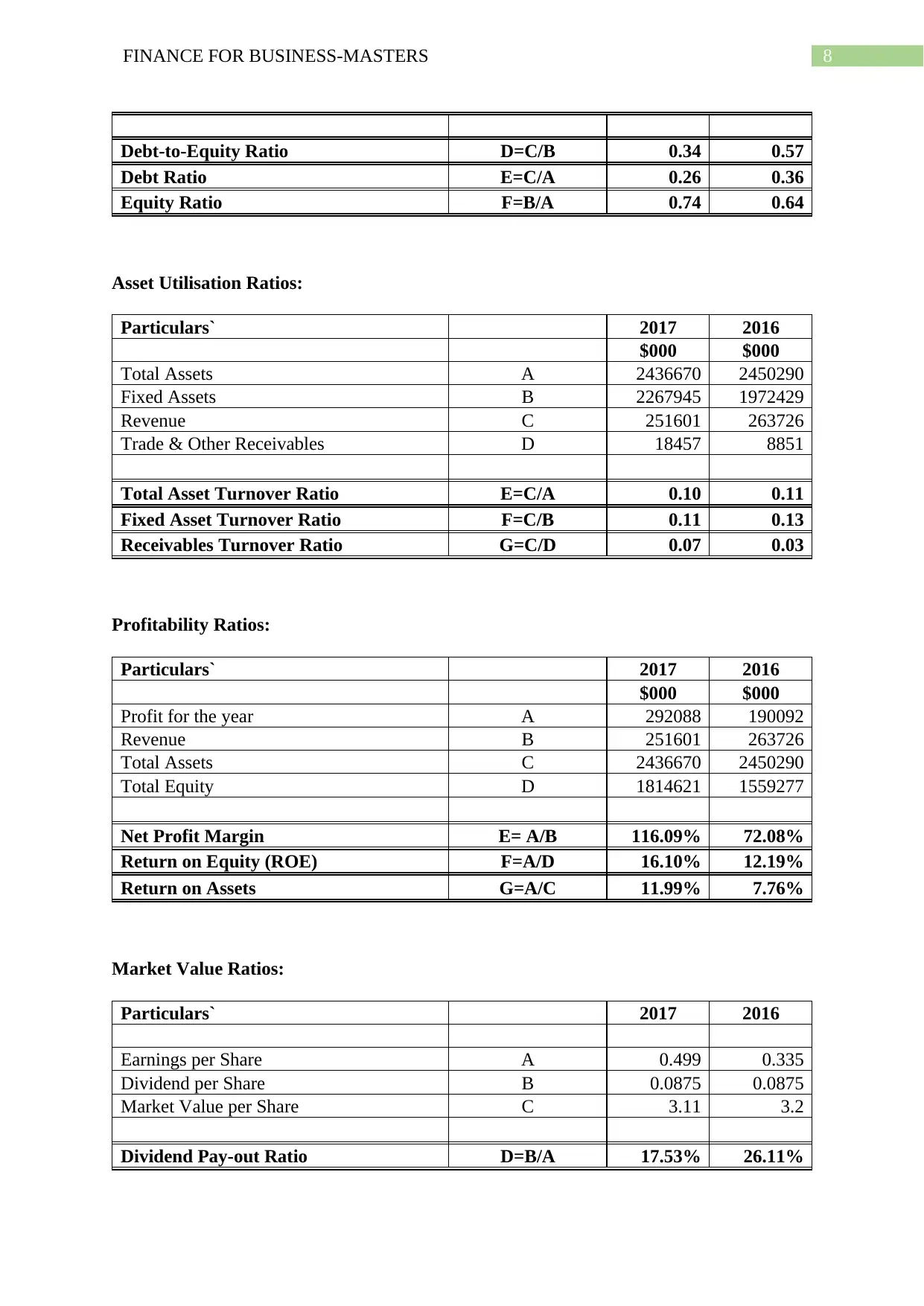

Debt-to-Equity Ratio D=C/B 0.34 0.57

Debt Ratio E=C/A 0.26 0.36

Equity Ratio F=B/A 0.74 0.64

Asset Utilisation Ratios:

Particulars` 2017 2016

$000 $000

Total Assets A 2436670 2450290

Fixed Assets B 2267945 1972429

Revenue C 251601 263726

Trade & Other Receivables D 18457 8851

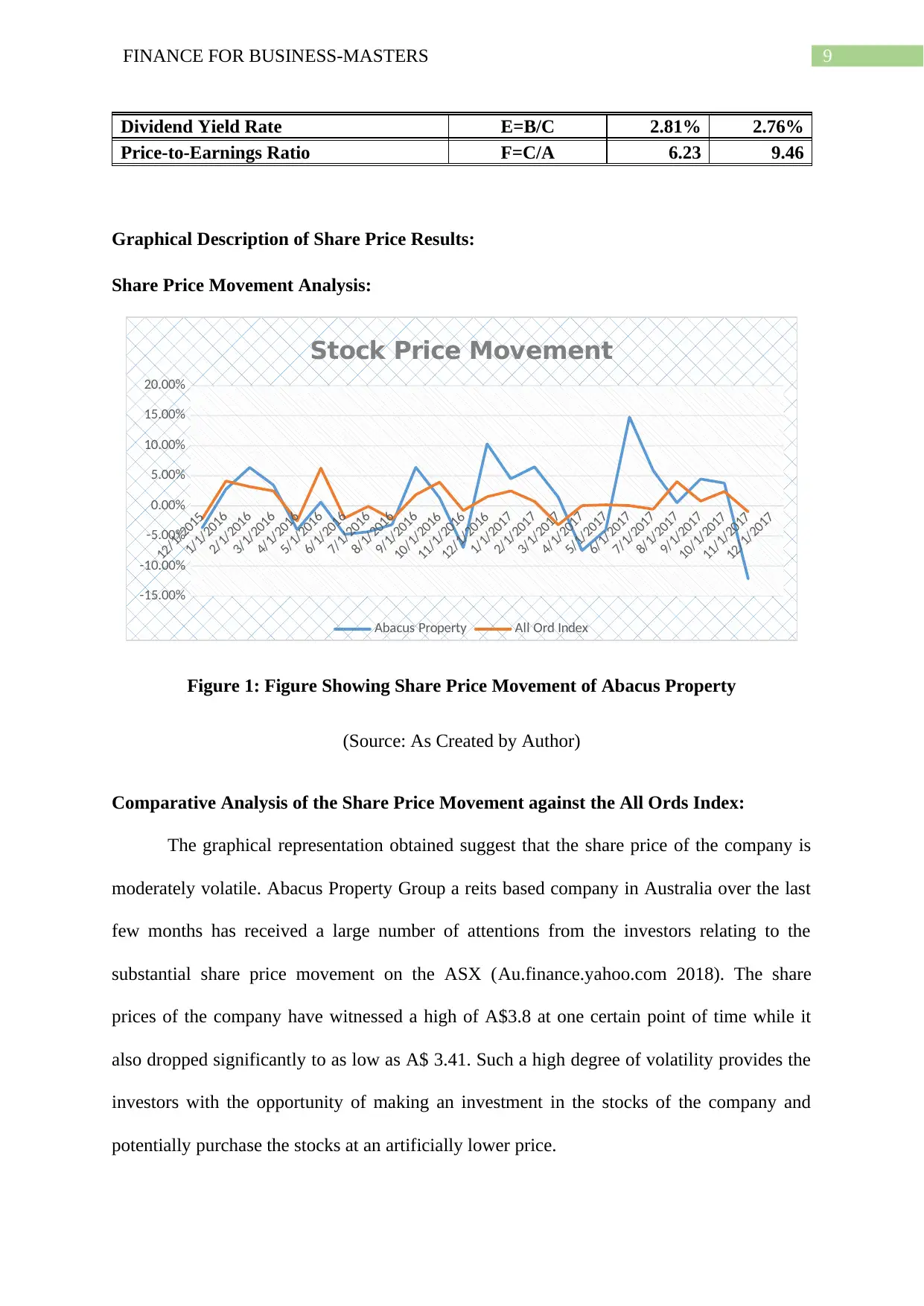

Total Asset Turnover Ratio E=C/A 0.10 0.11

Fixed Asset Turnover Ratio F=C/B 0.11 0.13

Receivables Turnover Ratio G=C/D 0.07 0.03

Profitability Ratios:

Particulars` 2017 2016

$000 $000

Profit for the year A 292088 190092

Revenue B 251601 263726

Total Assets C 2436670 2450290

Total Equity D 1814621 1559277

Net Profit Margin E= A/B 116.09% 72.08%

Return on Equity (ROE) F=A/D 16.10% 12.19%

Return on Assets G=A/C 11.99% 7.76%

Market Value Ratios:

Particulars` 2017 2016

Earnings per Share A 0.499 0.335

Dividend per Share B 0.0875 0.0875

Market Value per Share C 3.11 3.2

Dividend Pay-out Ratio D=B/A 17.53% 26.11%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Dividend Yield Rate E=B/C 2.81% 2.76%

Price-to-Earnings Ratio F=C/A 6.23 9.46

Graphical Description of Share Price Results:

Share Price Movement Analysis:

12/1/2015

1/1/2016

2/1/2016

3/1/2016

4/1/2016

5/1/2016

6/1/2016

7/1/2016

8/1/2016

9/1/2016

10/1/2016

11/1/2016

12/1/2016

1/1/2017

2/1/2017

3/1/2017

4/1/2017

5/1/2017

6/1/2017

7/1/2017

8/1/2017

9/1/2017

10/1/2017

11/1/2017

12/1/2017

-15.00%

-10.00%

-5.00%

0.00%

5.00%

10.00%

15.00%

20.00%

Stock Price Movement

Abacus Property All Ord Index

Figure 1: Figure Showing Share Price Movement of Abacus Property

(Source: As Created by Author)

Comparative Analysis of the Share Price Movement against the All Ords Index:

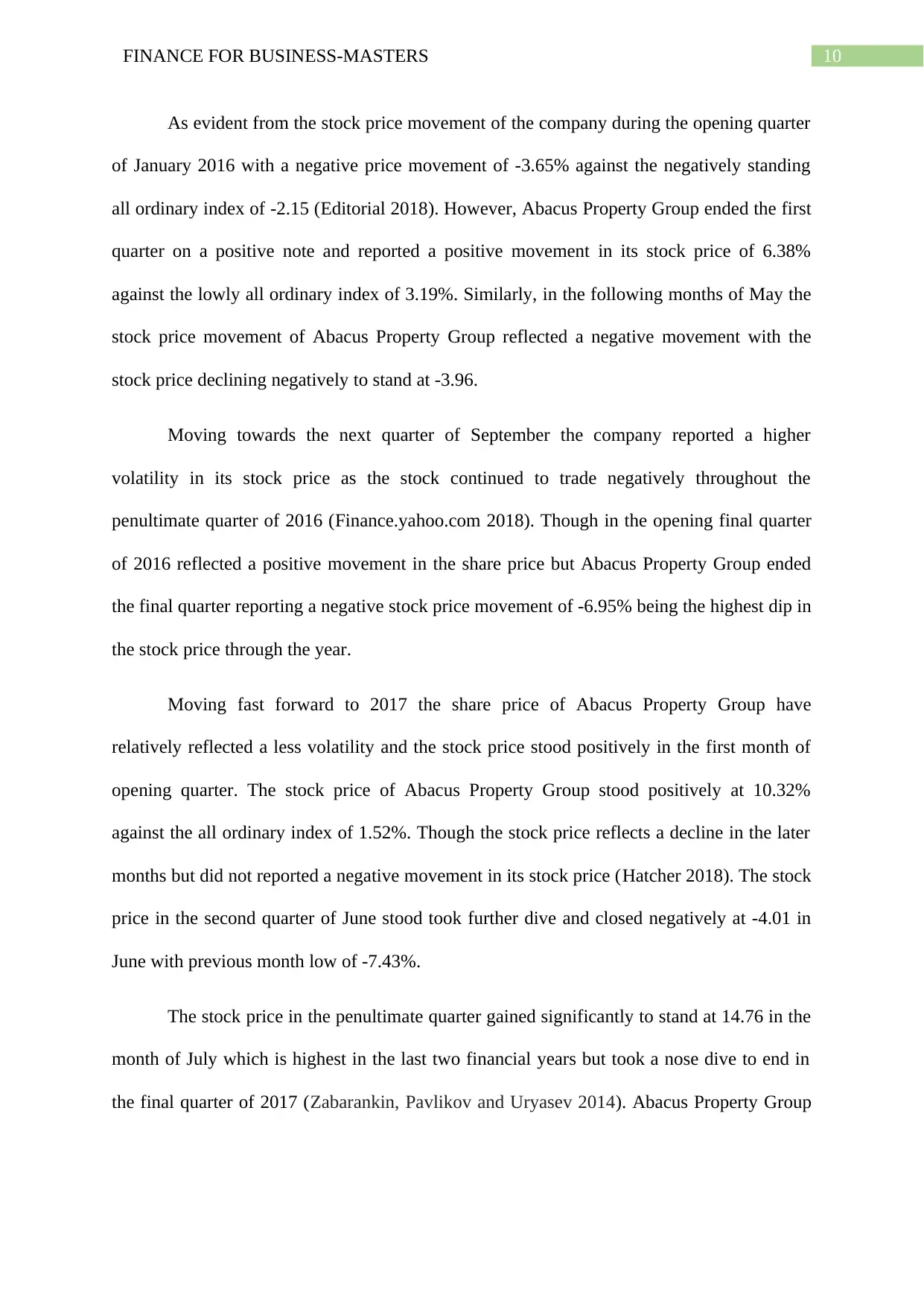

The graphical representation obtained suggest that the share price of the company is

moderately volatile. Abacus Property Group a reits based company in Australia over the last

few months has received a large number of attentions from the investors relating to the

substantial share price movement on the ASX (Au.finance.yahoo.com 2018). The share

prices of the company have witnessed a high of A$3.8 at one certain point of time while it

also dropped significantly to as low as A$ 3.41. Such a high degree of volatility provides the

investors with the opportunity of making an investment in the stocks of the company and

potentially purchase the stocks at an artificially lower price.

Paraphrase This Document

As evident from the stock price movement of the company during the opening quarter

of January 2016 with a negative price movement of -3.65% against the negatively standing

all ordinary index of -2.15 (Editorial 2018). However, Abacus Property Group ended the first

quarter on a positive note and reported a positive movement in its stock price of 6.38%

against the lowly all ordinary index of 3.19%. Similarly, in the following months of May the

stock price movement of Abacus Property Group reflected a negative movement with the

stock price declining negatively to stand at -3.96.

Moving towards the next quarter of September the company reported a higher

volatility in its stock price as the stock continued to trade negatively throughout the

penultimate quarter of 2016 (Finance.yahoo.com 2018). Though in the opening final quarter

of 2016 reflected a positive movement in the share price but Abacus Property Group ended

the final quarter reporting a negative stock price movement of -6.95% being the highest dip in

the stock price through the year.

Moving fast forward to 2017 the share price of Abacus Property Group have

relatively reflected a less volatility and the stock price stood positively in the first month of

opening quarter. The stock price of Abacus Property Group stood positively at 10.32%

against the all ordinary index of 1.52%. Though the stock price reflects a decline in the later

months but did not reported a negative movement in its stock price (Hatcher 2018). The stock

price in the second quarter of June stood took further dive and closed negatively at -4.01 in

June with previous month low of -7.43%.

The stock price in the penultimate quarter gained significantly to stand at 14.76 in the

month of July which is highest in the last two financial years but took a nose dive to end in

the final quarter of 2017 (Zabarankin, Pavlikov and Uryasev 2014). Abacus Property Group

final quarter stock price stood negatively at 12.14% against the negatively standing all

ordinary index of -0.99.

The overall analysis of the stock price movement suggest that the company has

reported a moderately volatile movement in its stock price over the last two years. Except on

certain occasions the stock price for the Abacus Property Group stood positively and higher

than the all ordinary index (Barberies et al. 2015). The share of the Abacus Property Group is

currently undervalued and as the potential investors it might be a great time for increasing the

holdings of the stock.

Factors influencing the stock price movement of the company:

The major factor that create an influence in the share price movement of the company

is the changes in the forecast of the analyst (Evstigneev et al. 2015). The analyst forecast

suggest that the Abacus Property Group short term trend is upward rising and with the nearest

possible share price target of $3 (Mayes 2018). The share price of Abacus Property Group is

currently trending at $2.89 and given the trend stays reserved from this point forward the

future target price could be around $2.86.

The industry wide factors include the high rise demand for the properties in the

market. In the latest report of the Abacus Property Group suggest that the company has

experienced a sizeable tailwinds resulting in higher double digit earnings growth for the

company to stand at 53.37% (Mock 2018). The market analyst prospects have stated that in

the coming years they seem to be pessimistic about the earnings of the company since it has

declined to -33.30% (Merkl et al. 2016). The negative earnings of the company has

significantly created an impact on the share price of the company.

Another significant factors that creates an influence on the share price of the Abacus

Property Group is the impact is the competitors (Simply Wall St 2018). The company faces

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

intense competitions from the Mirvac group, Charter Hall Group and GPT Group. With the

company reporting 11.31% which is line with the industry average over the past one year the

company shown the ability of generating better amounts of earnings to return the amount of

equity which it has raised from the its investors (Martin and Roychowdhury 2015). Based on

the above stated analysis it can be stated that the company is one of the better stocks for the

investors to make an investment. The share prices of the company has been currently low and

it is good buy for the investors.

Calculations of beta values and required rate of return:

Calculations of Beta:

The calculated beta for the Abacus Property Group stands 0.59.

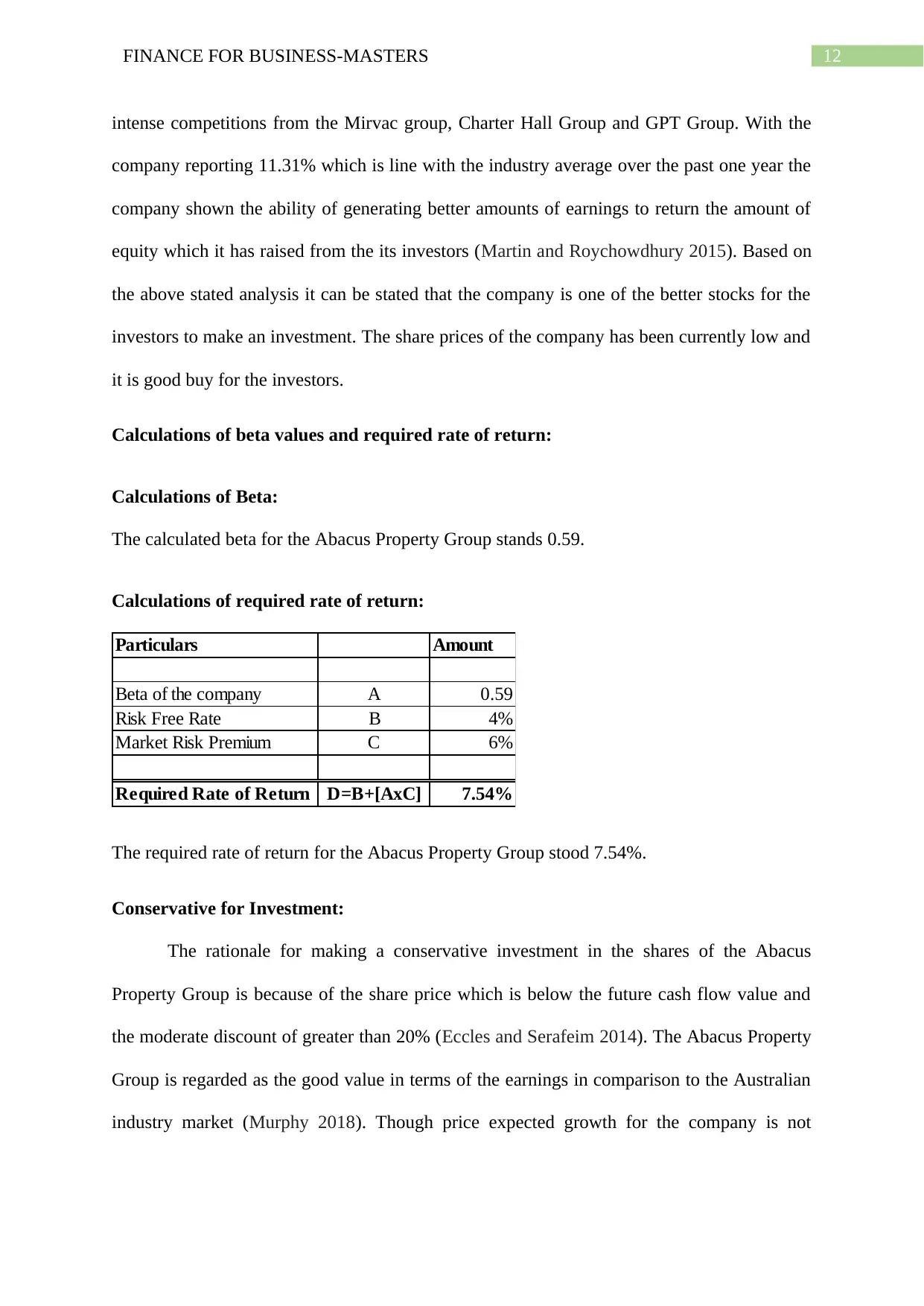

Calculations of required rate of return:

Particulars Amount

Beta of the company A 0.59

Risk Free Rate B 4%

Market Risk Premium C 6%

Required Rate of Return D=B+[AxC] 7.54%

The required rate of return for the Abacus Property Group stood 7.54%.

Conservative for Investment:

The rationale for making a conservative investment in the shares of the Abacus

Property Group is because of the share price which is below the future cash flow value and

the moderate discount of greater than 20% (Eccles and Serafeim 2014). The Abacus Property

Group is regarded as the good value in terms of the earnings in comparison to the Australian

industry market (Murphy 2018). Though price expected growth for the company is not

Paraphrase This Document

regarded good based on the anticipated growth but Abacus Property Group over the years has

delivered more than 20% of the year on year earnings rise in the last five years.

The company though does not makes a sufficient use of the shareholders’ funds as the

return on equity of the company stands less 20%. The company has effectively used its assets

than other Australian REIT’s industry average in respect of the return on equity (Zeff 2016).

The Abacus Property Group has significant enhanced its capital last year based on the last

three years return on capital employed. The company is better placed to meets is short term

commitments with company has sufficient amount of cash holdings and other short term

assets to meet its liabilities (Hermason, Edwards and Maher 2016). The company has very

low level of unsold amount of assets. Furthermore, the rationale for making an investment in

the shares of the Abacus Property Group is its dividend which is beyond the low risk saving

rate of 2.48%.

WACC of the Company:

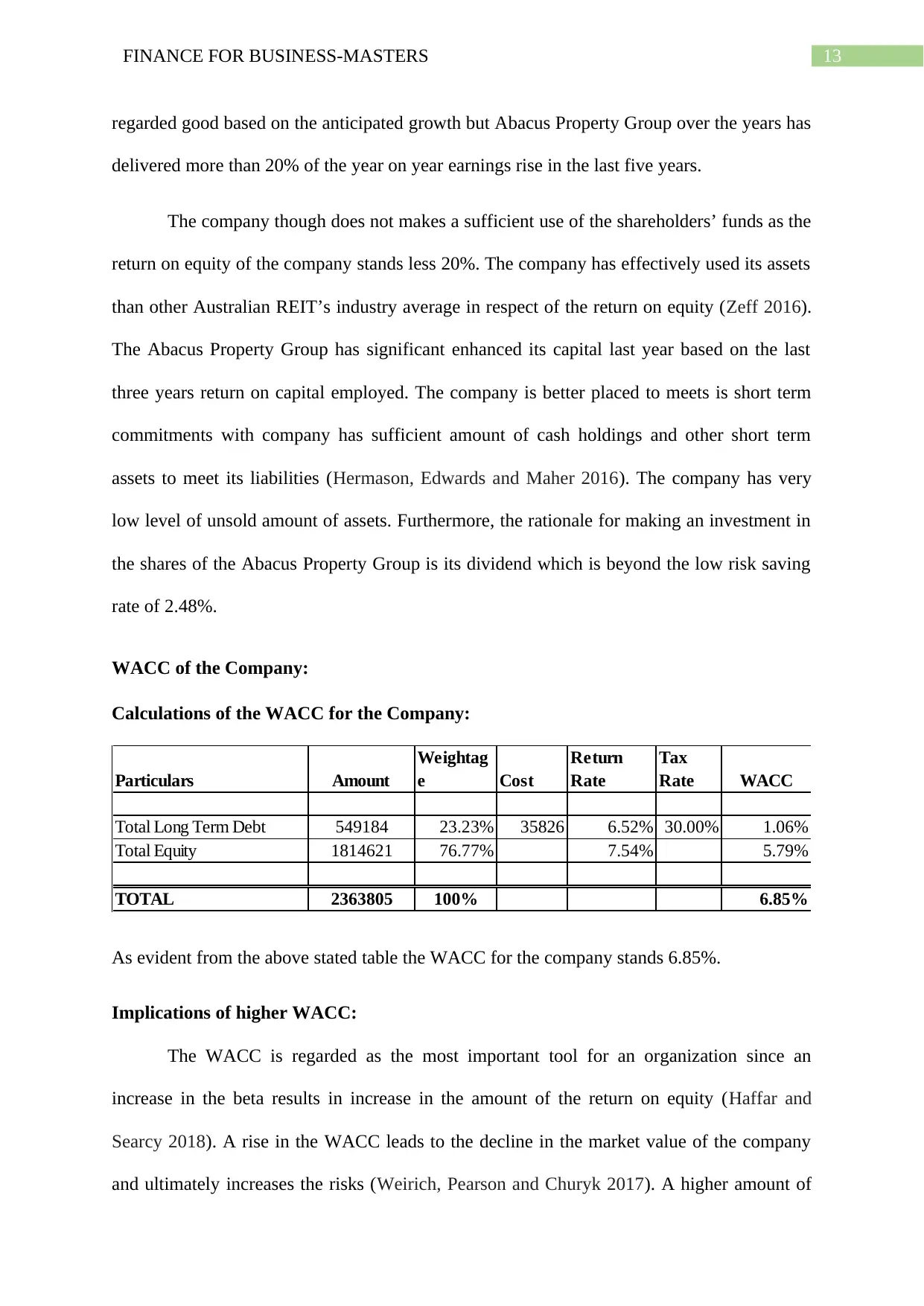

Calculations of the WACC for the Company:

Particulars Amount

Weightag

e Cost

Return

Rate

Tax

Rate WACC

Total Long Term Debt 549184 23.23% 35826 6.52% 30.00% 1.06%

Total Equity 1814621 76.77% 7.54% 5.79%

TOTAL 2363805 100% 6.85%

As evident from the above stated table the WACC for the company stands 6.85%.

Implications of higher WACC:

The WACC is regarded as the most important tool for an organization since an

increase in the beta results in increase in the amount of the return on equity (Haffar and

Searcy 2018). A rise in the WACC leads to the decline in the market value of the company

and ultimately increases the risks (Weirich, Pearson and Churyk 2017). A higher amount of

weighed average cost of capital holds higher implications on the assessment of the

management prospects of investment. This serves as an alarm for the investors that there is a

higher amount of risk in the organization functions.

A large number of the public listed companies possess numerous sources of funds

there WACC attempts to create a balance among the relative costs and different sources in

order to produce singular cost of capital figures (Peng et al. 2017). The WACC also forms an

important considerations in the loan valuations of the company and its functional

assessments. Investors generally express their concern if the WACC of the company is on the

higher side (Adams 2017). The company may be lose its value and the investors may move

towards somewhere else to gain efficient return in the market.

Debt Ratio:

The debt ratio for the company stands 0.36 during the year 2016 while in the later

year of 2017 the debt ratio for the company has declined (Jefrey 2018). The company has

been efficiently managing its debts structure and is in the direction of maintaining adequate

capital structure. The Abacus Property Group level of debt in respect of its net worth has

been reduced over the period of five years. The debt of the company is adequately covered by

its operating cash flow. Therefore, the Abacus Property Group level of debt in compare to the

net worth appears to be satisfactory.

Moving towards the capital gearing of the company the company has issued stapled

securities to adjust its gearing ratio (Crowther 2016). The balance sheet of the company has

remained strong with the gearing ratio remaining conservative at 20.5%.

Dividend policy:

The dividends declared by the company for the year 2017 stands 9 cents per share.

The dividend policy of the company includes creating a liability for the dividend and the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

same is recognized by the company in the balance sheet given the dividends are distributed or

recommended publicly before the balance date.

Letter of Recommendations:

To Client Company

From Financial Consultative Group

Dear Sir,

Our letter of recommendations is based on providing you valuable advice regarding

your diversified portfolio. The share price of the Abacus Property Group is currently trading

at below the future cash flow value with a moderate discount of greater than 20%. The

company has ROE of 11.31% which is line with the industry average over the past five years.

A recommendations can be provided that though the share prices of the company has been

moderately volatile over the period of last few months but the company is good value based

on earnings in comparison to its peers in the Australian market. Over the period of five years

the company has delivered growth in its earnings.

Abacus Property Group makes an effective use of its assets than the other AU REIT’s

industry average based on the previous year’s return on assets. The company has significantly

improved its capital over the last three years furthermore, it has been successful in meetings

its short term commitments with better holdings of cash and short term assets. The debt of the

company is well covered by its operating cash flow. Furthermore the company has declared

dividends of 9 cents which is above the low risk savings rate of 2.48%.

On a conclusive note making an investment in the shares of Abacus Property Group is

a viable when the share prices of the company is current trading a lower price. We anticipate

the recommendations provided has helped in serving your purpose.

Paraphrase This Document

Thank You

Conclusion:

Arriving at the conclusion from the above stated analysis it can be stated that the

company has experienced sizeable amount of tailwinds that have resulted the company in

higher double digit earnings growth of 53.37%. The company though does not makes a

sufficient use of the shareholders’ funds as the return on equity of the company stands less

20%. The company has effectively used its assets than other Australian REIT’s industry

average in respect of the return on equity. Investors may find this figures useful in making

their investment in the company.

References

Abacus Property Group. (2018). About Us. [online] Available at:

http://www.abacusproperty.com.au/about-us [Accessed 19 May 2018].

Abacus Property Group. (2018). Investors. [online] Available at:

http://www.abacusproperty.com.au/investors [Accessed 19 May 2018].

Adams, C., 2017. Understanding integrated reporting: The concise guide to integrated

thinking and the future of corporate reporting. Routledge.

Au.finance.yahoo.com. (2018). ^AORD Historical prices | ALL ORDINARIES Stock - Yahoo

Finance. [online] Available at: https://au.finance.yahoo.com/quote/%5EAORD/history?

p=^AORD [Accessed 19 May 2018].

Barberies, N., Greenwood, R., Jin, L. and Shleifer, A., 2015. X-CAPM: An Extrapolative

Capital Asset Pricing Model. Journal of Financial Economics, 115, pp.1-24.

Crowther, D., 2016. A social critique of corporate reporting: Semiotics and web-based

integrated reporting. Routledge.

Eccles, R.G. and Serafeim, G., 2014. Corporate and integrated reporting: A functional

perspective.

Editorial, R. (2018). ${Instrument_CompanyName} ${Instrument_Ric} Quote| Reuters.com.

[online] U.S. Available at: https://www.reuters.com/finance/stocks/overview/ABP.AX

[Accessed 19 May 2018].

Evstigneev, I.V., Hens, T. and Schenk-Hoppé, K.R., 2015. Capital Asset Pricing Model

(CAPM). In Mathematical Financial Economics (pp. 53-59). Springer, Cham.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance.yahoo.com. (2018). ABP.AX Historical Prices | ABACUS STAPLED Stock - Yahoo

Finance. [online] Available at: https://finance.yahoo.com/quote/ABP.AX/history?

period1=1448649000&period2=1517509800&interval=1mo&filter=history&frequency=1mo

[Accessed 19 May 2018].

Haffar, M. and Searcy, C., 2018. The Use of Context-Based Environmental Indicators in

Corporate Reporting. Journal of Cleaner Production.

Hatcher, B. (2018). What You Must Know About Abacus Property Group’s (ASX:ABP) ROE.

[online] Simply Wall St. Available at:

https://simplywall.st/stocks/au/real-estate/asx-abp/abacus-property-group-shares/news/what-

you-must-know-about-abacus-property-groups-asxabp-roe/ [Accessed 19 May 2018].

Hermason, R., Edwards, J. and Maher, M., 2016. Accounting Principles: Managerial

Accounting.

Jefrey, C. ed., 2018. Research on professional responsibility and ethics in accounting.

Emerald Publishing Limited.

Martin, X. and Roychowdhury, S., 2015. Do financial market developments influence

accounting practices? Credit default swaps and borrowers׳ reporting conservatism. Journal of

Accounting and Economics, 59(1), pp.80-104.

Mayes, B. (2018). At $3.64, Is Abacus Property Group (ASX:ABP) A Buy?. [online] Simply

Wall St. Available at: https://simplywall.st/stocks/au/real-estate/asx-abp/abacus-property-

group-shares/news/at-3-64-is-abacus-property-group-asxabp-a-buy/ [Accessed 19 May

2018].

Merkl-Davies, D.M., Brennan, N.M. and Vourvachis, P., 2016. Text Analysis Methodologies

in Corporate Reporting Narratives Research. In Conference Paper. Retrieved February 15th.

Paraphrase This Document

Mock, D. (2018). What Should Investors Know About Abacus Property Group’s (ASX:ABP)

Future?. [online] Simply Wall St. Available at:

https://simplywall.st/stocks/au/real-estate/asx-abp/abacus-property-group-shares/news/what-

should-investors-know-about-abacus-property-groups-asxabp-future/ [Accessed 19 May

2018].

Murphy, K.C., 2018. Understanding the Basic Principles of Accounting: A Case-by-Case

Application (Doctoral dissertation, University of Mississippi).

Peng, B., Cheng, C.S.A. and Li, X., 2017. Effects of rules-based versus principles-based

accounting standards on accounting quality.

Simply Wall St. (2018). Abacus Property Group (ASX:ABP) - Share price, News & Analysis.

[online] Available at: https://simplywall.st/stocks/au/real-estate/asx-abp/abacus-property-

group-shares [Accessed 19 May 2018].

Weirich, T.R., Pearson, T.C. and Churyk, N.T., 2017. Accounting and Auditing Research:

Tools and Strategies. Wiley Global Education.

Zabarankin, M., Pavlikov, K. and Uryasev, S., 2014. Capital asset pricing model (CAPM)

with drawdown measure. European Journal of Operational Research, 234(2), pp.508-517.

Zeff, S.A., 2016. Forging accounting principles in five countries: A history and an analysis

of trends. Routledge.

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.