Financial Management: Reporting, Analysis and Decision Making

VerifiedAdded on 2023/06/18

|23

|7155

|387

Report

AI Summary

This report focuses on finance for managers, emphasizing financial record maintenance, accounting techniques, and organizational requirements for financial reporting. It discusses the usefulness of financial statements for stakeholders, performs ratio analysis on a competitor's working capital, and illustrates effective working capital management strategies. The report also differentiates between financial and management accounting, explains budgetary control, and includes numerical examples of absorption and marginal costing. Project appraisal techniques are assessed, and recommendations for the best investment analysis method are provided, along with an emphasis on internal and external finance sources.

FINANCE FOR MANAGERS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

ACTIVITY 1...................................................................................................................................3

ACTIVITY 2...................................................................................................................................6

ACTIVITY 3...................................................................................................................................9

ACTIVITY 4.................................................................................................................................11

ACTIVITY 5.................................................................................................................................16

ACTIVITY 6.................................................................................................................................17

CONCLUSION..............................................................................................................................20

REFERENCES..............................................................................................................................21

2

INTRODUCTION...........................................................................................................................3

ACTIVITY 1...................................................................................................................................3

ACTIVITY 2...................................................................................................................................6

ACTIVITY 3...................................................................................................................................9

ACTIVITY 4.................................................................................................................................11

ACTIVITY 5.................................................................................................................................16

ACTIVITY 6.................................................................................................................................17

CONCLUSION..............................................................................................................................20

REFERENCES..............................................................................................................................21

2

INTRODUCTION

The report is on Finance for managers. It emphasizes on various aspects of finance required in

report. The purpose and requirements of business organization maintaining financial records has

been given. The techniques of accounting systems have been illustrated. The organizational and

legal requirements for financial reporting in business organizations has been discussed. The

financial statements usefulness for range of stakeholder groups has been emphasized. The ratio

analysis for the working capital components of competitor has been described. The ways in

which organizations can manage working capital effectively has been illustrated. The difference

between financial and management accounting was provided. The budgetary control was

explained. Numerical of absorption and marginal costing has been done with evaluation of

techniques of costing used for pricing purposes. The project appraisal techniques have been

assessed with recommendation of the best investment analysis method. The internal and external

finance sources used for financing the project have been emphasized.

ACTIVITY 1

Purpose and requirements of business organisation maintaining financial records

Financial recording is procedure used by organisation for finance controlling and accountability.

The process involves recording, timely reporting of transactions affecting revenues, liabilities

and assets. For developing business financial records have to be maintained. There are

techniques used for recording of financial information such as:

A) Double entry book keeping: This accounting technique records each transaction as debit

and credit.

B) Day books and ledgers: A book having account of sales and purchases each day is called

day books (Power, M., 2021).

C) Trial balance: The total of debit and credit balance for making the total debit equalling

total credit. From the trial balance figure, organisation can make balance sheet of the

business for depiction of financial position at the moment.

Manual and computerized systems: Manual systems mean the transactions which are

entered manually in the systems. It is risky for business as there are lot of chances for

3

The report is on Finance for managers. It emphasizes on various aspects of finance required in

report. The purpose and requirements of business organization maintaining financial records has

been given. The techniques of accounting systems have been illustrated. The organizational and

legal requirements for financial reporting in business organizations has been discussed. The

financial statements usefulness for range of stakeholder groups has been emphasized. The ratio

analysis for the working capital components of competitor has been described. The ways in

which organizations can manage working capital effectively has been illustrated. The difference

between financial and management accounting was provided. The budgetary control was

explained. Numerical of absorption and marginal costing has been done with evaluation of

techniques of costing used for pricing purposes. The project appraisal techniques have been

assessed with recommendation of the best investment analysis method. The internal and external

finance sources used for financing the project have been emphasized.

ACTIVITY 1

Purpose and requirements of business organisation maintaining financial records

Financial recording is procedure used by organisation for finance controlling and accountability.

The process involves recording, timely reporting of transactions affecting revenues, liabilities

and assets. For developing business financial records have to be maintained. There are

techniques used for recording of financial information such as:

A) Double entry book keeping: This accounting technique records each transaction as debit

and credit.

B) Day books and ledgers: A book having account of sales and purchases each day is called

day books (Power, M., 2021).

C) Trial balance: The total of debit and credit balance for making the total debit equalling

total credit. From the trial balance figure, organisation can make balance sheet of the

business for depiction of financial position at the moment.

Manual and computerized systems: Manual systems mean the transactions which are

entered manually in the systems. It is risky for business as there are lot of chances for

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

making mistakes. On one hand the transactions which are entered by computer is known

as computerized system. It is a very safe system and does not make errors. Now most

businesses are computerized systems. As it can also keep more records than manual

system.

In business there are many requirements and purposes to keep financial records among of those

this three are mainly important. That’s are:

Legal requirements: It says when people start a business they require to follow business

rules, laws and regulations and laws for running their businesses. Almost every firm has a

legal ruling of some sort. To begin, specific paperwork, licences, and other

documentation are filed with state and municipal government authorities. These

documents could include tax paperwork, shareholder agreements, and payments, among

other things. You may decide not to open if you don't have this documentation.

Tax requirements: Every firm must pay tax, and the amount of tax varies depending on

the business structure. This tax is referred to as a tax requirement. This tax is sometimes

determined by the profit of the business, the type of business, and the quality of the

business, among other factors.

Requirements for internal controls: Internal controls are policies, procedures, and

methods that are utilised to reduce corporate risk. Control must be extensive and

widespread in order to prevent employees and members from engaging in dishonest

behaviour. It assists businesses in running smoothly and achieving their objectives, as

well as fostering positive relationships among all employees (Power, M., 2021).

Financial reporting standards exist in the business world, and these financial reporting

obligations apply to single traders, partnerships, limited corporations, and public limited

companies, among others. Financial reports are documents and records that show how

much money your business makes or does not make, how much money your business has

to pay or has already paid, and so on. Essentially, it is the documentation of all money

transactions for all reasons in which your company invests money. Financial reports and

statements come in a variety of formats.

These financial statements can include a cash flow statement, which is a summary of a

company's real cash inflows and outflows during a given accounting period (month,

4

as computerized system. It is a very safe system and does not make errors. Now most

businesses are computerized systems. As it can also keep more records than manual

system.

In business there are many requirements and purposes to keep financial records among of those

this three are mainly important. That’s are:

Legal requirements: It says when people start a business they require to follow business

rules, laws and regulations and laws for running their businesses. Almost every firm has a

legal ruling of some sort. To begin, specific paperwork, licences, and other

documentation are filed with state and municipal government authorities. These

documents could include tax paperwork, shareholder agreements, and payments, among

other things. You may decide not to open if you don't have this documentation.

Tax requirements: Every firm must pay tax, and the amount of tax varies depending on

the business structure. This tax is referred to as a tax requirement. This tax is sometimes

determined by the profit of the business, the type of business, and the quality of the

business, among other factors.

Requirements for internal controls: Internal controls are policies, procedures, and

methods that are utilised to reduce corporate risk. Control must be extensive and

widespread in order to prevent employees and members from engaging in dishonest

behaviour. It assists businesses in running smoothly and achieving their objectives, as

well as fostering positive relationships among all employees (Power, M., 2021).

Financial reporting standards exist in the business world, and these financial reporting

obligations apply to single traders, partnerships, limited corporations, and public limited

companies, among others. Financial reports are documents and records that show how

much money your business makes or does not make, how much money your business has

to pay or has already paid, and so on. Essentially, it is the documentation of all money

transactions for all reasons in which your company invests money. Financial reports and

statements come in a variety of formats.

These financial statements can include a cash flow statement, which is a summary of a

company's real cash inflows and outflows during a given accounting period (month,

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

quarter, or year), as well as a profit and loss account, which shows how much money

your company makes or loses. The balance sheet is the final statement. It focuses on the

assets that the company possesses, how much it paid for them, how much profit or loss it

made, and so on. At the conclusion of the year, this statement is prepared. The goal of

financial reporting is to get this information to your business's lenders and shareholders

(stakeholders). Because there are two types of stakeholders in business: internal and

external. Internal stakeholders are those who reside within the organisation, such as

managers, employees, and board members. External stakeholders, on the other hand, are

those who are not directly affiliated with a company, such as shareholders, consumers,

and suppliers. Financial reporting must be a requirement of your contract with them. The

lenders and investors have a right to know whether their money is being used properly

and profitably. Furthermore, financial statements are useful in the following ways: As a

result, stakeholders are aware of the amount of profit or loss, how assets are allocated to

liabilities, where the company obtains cash, and how money is spent efficiently, how

much cash flow from net profit did the company generate throughout the time, does it

reinvest all profits, and does it have enough money to expand in the future.

The balance sheet shows the assets and liabilities. Current and long-term assets are included in

assets, and current and long-term liabilities are included in liabilities. Assets and liabilities are

equal according to accounting principles. Fixed assets, such as land and buildings, as well as

machinery, are considered assets of a company. Recognized accounts receivable and payable,

which show the company's credit and liabilities, are also included on the balance sheet. Before

making an investment decision, investors look at the balance sheet's current assets and liabilities

for the last five years (Herath, S.K. and Albarqi, N., 2017).

The income statement is a financial statement that displays the profit and loss of a firm. It shows

how much money was made, how much the corporation spent on products, and how much

money was made. It details variable and fixed expenses, as well as overhead, sales, and

administrative costs. Finally, the net income is computed after all expenses have been deducted

from receipts. Because net profit is a major factor in assessing investment and the company's

efficiency in regulating operational costs, this statement is critical.

The cash flow statement shows how much money comes in and goes out, as well as the sources

of revenue and expenses. It shows how well a company spends money and whether cash inflow

5

your company makes or loses. The balance sheet is the final statement. It focuses on the

assets that the company possesses, how much it paid for them, how much profit or loss it

made, and so on. At the conclusion of the year, this statement is prepared. The goal of

financial reporting is to get this information to your business's lenders and shareholders

(stakeholders). Because there are two types of stakeholders in business: internal and

external. Internal stakeholders are those who reside within the organisation, such as

managers, employees, and board members. External stakeholders, on the other hand, are

those who are not directly affiliated with a company, such as shareholders, consumers,

and suppliers. Financial reporting must be a requirement of your contract with them. The

lenders and investors have a right to know whether their money is being used properly

and profitably. Furthermore, financial statements are useful in the following ways: As a

result, stakeholders are aware of the amount of profit or loss, how assets are allocated to

liabilities, where the company obtains cash, and how money is spent efficiently, how

much cash flow from net profit did the company generate throughout the time, does it

reinvest all profits, and does it have enough money to expand in the future.

The balance sheet shows the assets and liabilities. Current and long-term assets are included in

assets, and current and long-term liabilities are included in liabilities. Assets and liabilities are

equal according to accounting principles. Fixed assets, such as land and buildings, as well as

machinery, are considered assets of a company. Recognized accounts receivable and payable,

which show the company's credit and liabilities, are also included on the balance sheet. Before

making an investment decision, investors look at the balance sheet's current assets and liabilities

for the last five years (Herath, S.K. and Albarqi, N., 2017).

The income statement is a financial statement that displays the profit and loss of a firm. It shows

how much money was made, how much the corporation spent on products, and how much

money was made. It details variable and fixed expenses, as well as overhead, sales, and

administrative costs. Finally, the net income is computed after all expenses have been deducted

from receipts. Because net profit is a major factor in assessing investment and the company's

efficiency in regulating operational costs, this statement is critical.

The cash flow statement shows how much money comes in and goes out, as well as the sources

of revenue and expenses. It shows how well a company spends money and whether cash inflow

5

surpasses cash outflow, demonstrating that funds are sufficient to run the business. It also

displays which ventures have yielded investment returns and which are now seeking funds or

cash outflow.

ACTIVITY 2

Relevance of financial information reporting for stakeholders

There are two types of stakeholders such as internal and external stakeholders. Internal

stakeholders mean stakeholders dwelling in the company for instance: employees, managers,

board members etc. On another hand there are stakeholders who are not directly part of the

company and are called external stakeholders for example: customers, suppliers etc. The

shareholders would like to see their investment use and assess the management through

financials. Financial statements are useful for the business.

Stakeholders of company have requirement of the financial information for the reasons

following:

a) To assess the performance of the company.

b) To know the earnings of the company more than their spending.

c) To know an idea about tactical and strategic management plans.

d) To give information for making decisions about investment.

e) Avoiding dissimulations within organization (Herath, S.K. and Albarqi, N., 2017).

The use of financials for different stakeholders is as below:

Managers and Directors

About continuing and discontinuing operations.

Dividend decision-making.

New investment and decision of project appreciation.

Business decision that is diversified.

Decision winding up.

For establishing periodical targets and objectives overall.

For avoiding dissimulation.

For increasing organisation’s level of productivity.

6

displays which ventures have yielded investment returns and which are now seeking funds or

cash outflow.

ACTIVITY 2

Relevance of financial information reporting for stakeholders

There are two types of stakeholders such as internal and external stakeholders. Internal

stakeholders mean stakeholders dwelling in the company for instance: employees, managers,

board members etc. On another hand there are stakeholders who are not directly part of the

company and are called external stakeholders for example: customers, suppliers etc. The

shareholders would like to see their investment use and assess the management through

financials. Financial statements are useful for the business.

Stakeholders of company have requirement of the financial information for the reasons

following:

a) To assess the performance of the company.

b) To know the earnings of the company more than their spending.

c) To know an idea about tactical and strategic management plans.

d) To give information for making decisions about investment.

e) Avoiding dissimulations within organization (Herath, S.K. and Albarqi, N., 2017).

The use of financials for different stakeholders is as below:

Managers and Directors

About continuing and discontinuing operations.

Dividend decision-making.

New investment and decision of project appreciation.

Business decision that is diversified.

Decision winding up.

For establishing periodical targets and objectives overall.

For avoiding dissimulation.

For increasing organisation’s level of productivity.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Shareholders

For determination as to whether investment shall be sold, halted or buying shares of

the organization.

For deciding the fairness of investments’ return.

For determining the organisation’s going concern.

For obtaining knowledge widely about activities of organization.

For comparison of investing and benefits with competitive industries and

organisations.

Employees

For knowing the profitability and stableness of the organization.

For knowing about salary, benefits of retirement and opportunities of employment in

organization.

For ensuring job security with current organization.

For ensuring the fairness of wages and earnings obtained from the company.

For having a view which is clear of other operations of organization.

Suppliers

For ensuring the supply of payments which shall be received on due.

For ensuring the customers’ stability.

For having knowledge about suppliers of organization and other products.

For comparison of transaction with existing and other companies (Lambovska, M.,

Rajnoha, R. and Dobrovič, J., 2019).

For finding competitive suppliers and contribution towards organization.

For finding opportunities for supplying more.

Government

For collection of accurate tax and amount from organisations on due dates.

For providing government benefit for improving their business.

For obtaining non-financial and financial help for government development projects.

7

For determination as to whether investment shall be sold, halted or buying shares of

the organization.

For deciding the fairness of investments’ return.

For determining the organisation’s going concern.

For obtaining knowledge widely about activities of organization.

For comparison of investing and benefits with competitive industries and

organisations.

Employees

For knowing the profitability and stableness of the organization.

For knowing about salary, benefits of retirement and opportunities of employment in

organization.

For ensuring job security with current organization.

For ensuring the fairness of wages and earnings obtained from the company.

For having a view which is clear of other operations of organization.

Suppliers

For ensuring the supply of payments which shall be received on due.

For ensuring the customers’ stability.

For having knowledge about suppliers of organization and other products.

For comparison of transaction with existing and other companies (Lambovska, M.,

Rajnoha, R. and Dobrovič, J., 2019).

For finding competitive suppliers and contribution towards organization.

For finding opportunities for supplying more.

Government

For collection of accurate tax and amount from organisations on due dates.

For providing government benefit for improving their business.

For obtaining non-financial and financial help for government development projects.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

For ensuring organisations overseeing the employees in reasonable way.

For ensuring compliance of organisations with rules and regulations of government

and acts government has established.

Consumers

For having knowledge about products’ cost structure that the organization has been

producing.

For ensuring organisation’s stability.

For knowing about profitability of organization, as profitability helps to know about

product improvements, best customer service and strategic implications that are of

low price.

For knowing about CSR programs organization has conducted.

Public

For being aware about substantial contribution of organization towards society.

For knowing about opportunities for linking with organization (Lambovska, M.,

Rajnoha, R. and Dobrovič, J., 2019).

For knowing about CSR contribution towards country.

To make conscious activities that can be affected to nature’s interest and of the

country.

ACTIVITY 3

Ratio analysis of Competitor Alpha Limited

2019 2020

8

For ensuring compliance of organisations with rules and regulations of government

and acts government has established.

Consumers

For having knowledge about products’ cost structure that the organization has been

producing.

For ensuring organisation’s stability.

For knowing about profitability of organization, as profitability helps to know about

product improvements, best customer service and strategic implications that are of

low price.

For knowing about CSR programs organization has conducted.

Public

For being aware about substantial contribution of organization towards society.

For knowing about opportunities for linking with organization (Lambovska, M.,

Rajnoha, R. and Dobrovič, J., 2019).

For knowing about CSR contribution towards country.

To make conscious activities that can be affected to nature’s interest and of the

country.

ACTIVITY 3

Ratio analysis of Competitor Alpha Limited

2019 2020

8

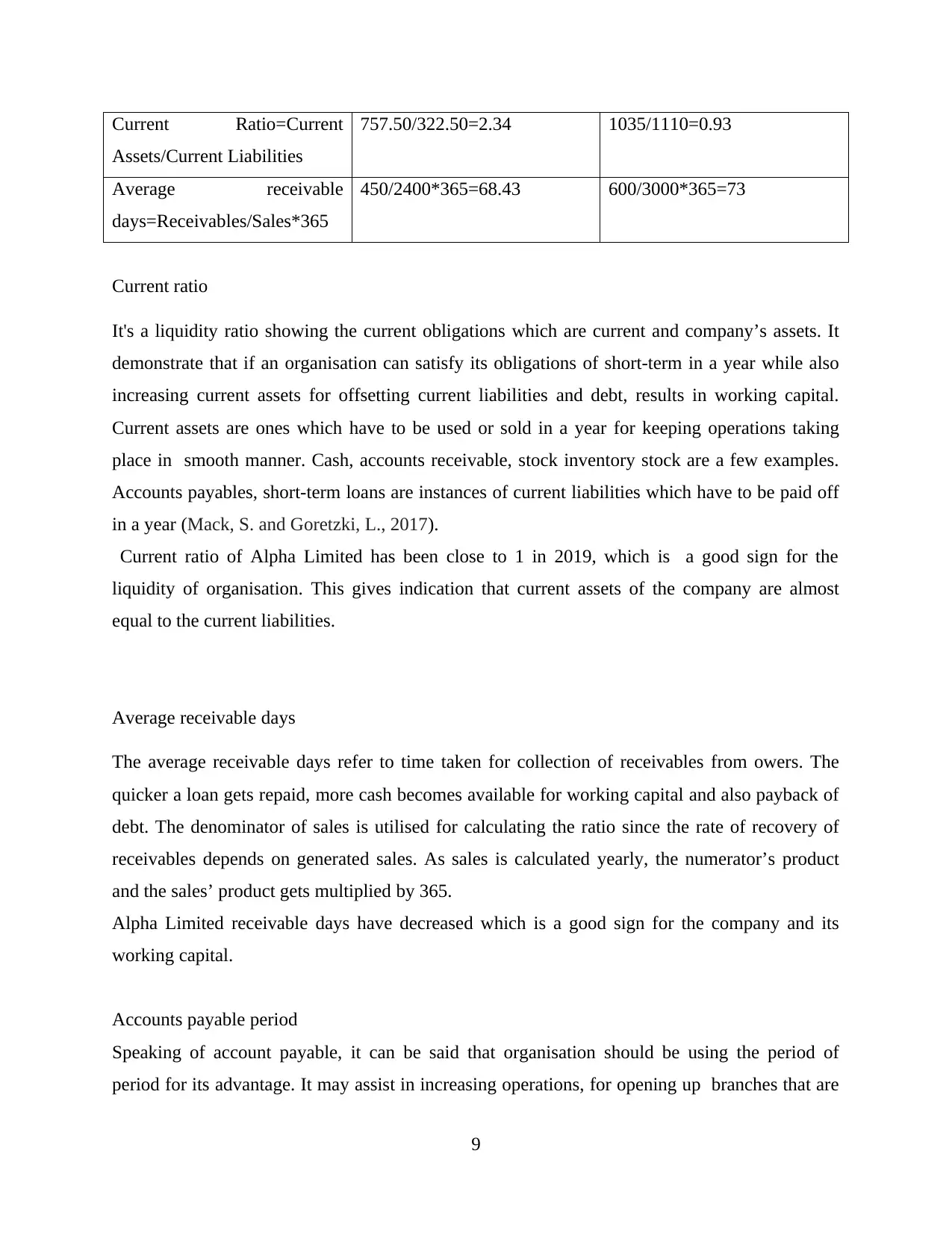

Current Ratio=Current

Assets/Current Liabilities

757.50/322.50=2.34 1035/1110=0.93

Average receivable

days=Receivables/Sales*365

450/2400*365=68.43 600/3000*365=73

Current ratio

It's a liquidity ratio showing the current obligations which are current and company’s assets. It

demonstrate that if an organisation can satisfy its obligations of short-term in a year while also

increasing current assets for offsetting current liabilities and debt, results in working capital.

Current assets are ones which have to be used or sold in a year for keeping operations taking

place in smooth manner. Cash, accounts receivable, stock inventory stock are a few examples.

Accounts payables, short-term loans are instances of current liabilities which have to be paid off

in a year (Mack, S. and Goretzki, L., 2017).

Current ratio of Alpha Limited has been close to 1 in 2019, which is a good sign for the

liquidity of organisation. This gives indication that current assets of the company are almost

equal to the current liabilities.

Average receivable days

The average receivable days refer to time taken for collection of receivables from owers. The

quicker a loan gets repaid, more cash becomes available for working capital and also payback of

debt. The denominator of sales is utilised for calculating the ratio since the rate of recovery of

receivables depends on generated sales. As sales is calculated yearly, the numerator’s product

and the sales’ product gets multiplied by 365.

Alpha Limited receivable days have decreased which is a good sign for the company and its

working capital.

Accounts payable period

Speaking of account payable, it can be said that organisation should be using the period of

period for its advantage. It may assist in increasing operations, for opening up branches that are

9

Assets/Current Liabilities

757.50/322.50=2.34 1035/1110=0.93

Average receivable

days=Receivables/Sales*365

450/2400*365=68.43 600/3000*365=73

Current ratio

It's a liquidity ratio showing the current obligations which are current and company’s assets. It

demonstrate that if an organisation can satisfy its obligations of short-term in a year while also

increasing current assets for offsetting current liabilities and debt, results in working capital.

Current assets are ones which have to be used or sold in a year for keeping operations taking

place in smooth manner. Cash, accounts receivable, stock inventory stock are a few examples.

Accounts payables, short-term loans are instances of current liabilities which have to be paid off

in a year (Mack, S. and Goretzki, L., 2017).

Current ratio of Alpha Limited has been close to 1 in 2019, which is a good sign for the

liquidity of organisation. This gives indication that current assets of the company are almost

equal to the current liabilities.

Average receivable days

The average receivable days refer to time taken for collection of receivables from owers. The

quicker a loan gets repaid, more cash becomes available for working capital and also payback of

debt. The denominator of sales is utilised for calculating the ratio since the rate of recovery of

receivables depends on generated sales. As sales is calculated yearly, the numerator’s product

and the sales’ product gets multiplied by 365.

Alpha Limited receivable days have decreased which is a good sign for the company and its

working capital.

Accounts payable period

Speaking of account payable, it can be said that organisation should be using the period of

period for its advantage. It may assist in increasing operations, for opening up branches that are

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

new and expansion of business. Although, it has to be kept in view that financial leverage

financial has to be not high and the ratio has to be in accordance with equity capital. More Debt

can initially help however it may become burden as to when it has interest alongside to pay for

longer periods. This may raise issues of solvency for the organisation. Also it has to be bore in

mind that organisation ethically pays dues following ethics. This can assist in maintaining a

relationship that is good with the creditors and may be of help when organisation need to

increase the credit limit from them. Banks shall lend to an organisation if there is a credit history

that is good and overdraft limit is extended (Mack, S. and Goretzki, L., 2017).

Ways of Working capital management

Working capital is the money used in daily operations of the company. It can fluctuate with the

operations of the company going on. Thus, there is a need to maintain balance of working capital

in the organization. Working capital is the difference of current liabilities from current assets.

The ideal working capital ratio is said to be 1 where current assets equal current liabilities

meaning current assets are sufficient enough to cover current liabilities. Current assets thus,

being maintained and current liabilities kept in check can help maintain working capital

(Boisjoly, R.P., Conine Jr, T.E. and McDonald IV, M.B., 2020). Cash in hand, cash at bank are

some of the current assets while accounts payable are one of the current liabilities. The ways in

which working capital can be maintained is:

a) The company has to look for measures to increase liquidity which can be done by

increasing source of funds. By making investment options attractive, more investors can

be joined and company would benefit in raising capital.

b) Measures like IPOs can be a way of getting investment from the public and can help in

solving working capital issues. A successful IPO can boost capital many times and

company can expand its operations too.

c) Trading in bonds and securities that are risk-weighted can help in getting capital in short

and long term. The interest money can serve as monetary value for the working capital.

d) Credit policy has to be checked of the company. If the debtors are defaulting or extending

credit period largely, it is time for credit policy renewal for the management of the

organization. Credit will then have to be given by checking on the credit rating of the

individual and history of credit payments. This will help in minimizing the risks and help

10

financial has to be not high and the ratio has to be in accordance with equity capital. More Debt

can initially help however it may become burden as to when it has interest alongside to pay for

longer periods. This may raise issues of solvency for the organisation. Also it has to be bore in

mind that organisation ethically pays dues following ethics. This can assist in maintaining a

relationship that is good with the creditors and may be of help when organisation need to

increase the credit limit from them. Banks shall lend to an organisation if there is a credit history

that is good and overdraft limit is extended (Mack, S. and Goretzki, L., 2017).

Ways of Working capital management

Working capital is the money used in daily operations of the company. It can fluctuate with the

operations of the company going on. Thus, there is a need to maintain balance of working capital

in the organization. Working capital is the difference of current liabilities from current assets.

The ideal working capital ratio is said to be 1 where current assets equal current liabilities

meaning current assets are sufficient enough to cover current liabilities. Current assets thus,

being maintained and current liabilities kept in check can help maintain working capital

(Boisjoly, R.P., Conine Jr, T.E. and McDonald IV, M.B., 2020). Cash in hand, cash at bank are

some of the current assets while accounts payable are one of the current liabilities. The ways in

which working capital can be maintained is:

a) The company has to look for measures to increase liquidity which can be done by

increasing source of funds. By making investment options attractive, more investors can

be joined and company would benefit in raising capital.

b) Measures like IPOs can be a way of getting investment from the public and can help in

solving working capital issues. A successful IPO can boost capital many times and

company can expand its operations too.

c) Trading in bonds and securities that are risk-weighted can help in getting capital in short

and long term. The interest money can serve as monetary value for the working capital.

d) Credit policy has to be checked of the company. If the debtors are defaulting or extending

credit period largely, it is time for credit policy renewal for the management of the

organization. Credit will then have to be given by checking on the credit rating of the

individual and history of credit payments. This will help in minimizing the risks and help

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

to get credit back on time thus, it will help in the working capital get increased and also

receive money with interest to help further in daily operations of the company.

e) Company taking credit for own operations has to use the credit period judiciously as

working capital. Credit taken has to be for a term that is enough for the duration of

project’s operations. This way, project reaping benefits in monetary value can be paid

back as credit repayment and rest profits can be used for investors and organization. A

small credit period can affect the working capital and is not appropriate. The company

can earn profits and also repay the creditors back on time, with the right deal.

f) The company has to maintain the right financial leverage of debt and equity. Piling debt

can be a cause of concern to repay later. Thus, focusing on equity increase can help

maintain the solvency and working capital balance too of the organization.

g) Stock control measures of inventory have to be taken in a way which improves working

capital condition. Inventory if bought in excess, can be cause of monetary concern for the

company. There are costs of storing inventory and also if there is a damage, company has

to bear the loss. Getting right amount of inventory using method of Economic Order

Quantity can help in maintaining the stock with getting just the right amount of inventory

needed and thus saving on the additional costs of storage which can decrease cash in

current assets. This will increase working capital as inventories add to current assets

without bearing losses. Company can also go for the Just in Time Inventory approach as

per the requirement (Boisjoly and et.al.,2020).

h) Overdrafts taken from bank can help in increase for working capital. Company’s

management has to get in touch with the bank in this aspect so, credit limit is increased

and also there is sufficient time period in which company can repay the same through

profits earned by the projects.

ACTIVITY 4

Difference between financial and management accounting

Financial accounting concerns with financial transaction and statement which have taken

place already. It implies information gathering about transactions of business. For instance:

loss and gain. The process is controlled by manager of finance.

11

receive money with interest to help further in daily operations of the company.

e) Company taking credit for own operations has to use the credit period judiciously as

working capital. Credit taken has to be for a term that is enough for the duration of

project’s operations. This way, project reaping benefits in monetary value can be paid

back as credit repayment and rest profits can be used for investors and organization. A

small credit period can affect the working capital and is not appropriate. The company

can earn profits and also repay the creditors back on time, with the right deal.

f) The company has to maintain the right financial leverage of debt and equity. Piling debt

can be a cause of concern to repay later. Thus, focusing on equity increase can help

maintain the solvency and working capital balance too of the organization.

g) Stock control measures of inventory have to be taken in a way which improves working

capital condition. Inventory if bought in excess, can be cause of monetary concern for the

company. There are costs of storing inventory and also if there is a damage, company has

to bear the loss. Getting right amount of inventory using method of Economic Order

Quantity can help in maintaining the stock with getting just the right amount of inventory

needed and thus saving on the additional costs of storage which can decrease cash in

current assets. This will increase working capital as inventories add to current assets

without bearing losses. Company can also go for the Just in Time Inventory approach as

per the requirement (Boisjoly and et.al.,2020).

h) Overdrafts taken from bank can help in increase for working capital. Company’s

management has to get in touch with the bank in this aspect so, credit limit is increased

and also there is sufficient time period in which company can repay the same through

profits earned by the projects.

ACTIVITY 4

Difference between financial and management accounting

Financial accounting concerns with financial transaction and statement which have taken

place already. It implies information gathering about transactions of business. For instance:

loss and gain. The process is controlled by manager of finance.

11

Management accounting is providing organisation’s management with recommendations

that are accounting information based, in order for assisting in day-to-day decision-making

and in planning of long term. The process is controlled by finance manager. Financial and

management accounting gives information in two different user groups. Financial accounting

provides information for accounting data’s external users of data of accounting like creditors

and investors. On other hand, management accounting provide information for accounting

data’s internal users. Internal users have inclusion of managers, executives and employees of

the company. Financial accounting reports on information which is historical. Information is

regularly reported. It is broken in quarterly, annual and monthly periods of reporting. On

another aspect, information of management accounting is reported on continuous basis.

Internal users need evaluation of present, past and future information potential in order for

making decisions. Thus, these users need information on continuous basis for making

decisions which are appropriate. These two accounting systems have their own importance in

business. Without these businesses cannot operate smoothly and make profits (Nastiti,

P.K.Y., Atahau, A.D.R. and Supramono, S., 2019).

Financial accounting presents reports annually while management accounting reports are of

long and short durations. Financial accounting covers entire organization whereas

management accounting are prepared for organization as well as segments.

It emphasizes facts’ accuracy while management accounting require quick and on time

reporting of facts if they are less accurate.

Focus- Financial accounting emphasizes accounting data’s external use and main focus of

this form of accounting is on balance sheet preparation and resources and obligations’ state.

The purpose of management accounting reports and collects information which is relevant

for making of decisions for ensuring firm’s resources being used optimally.

Principles- The financial accounting adherence is for the generally accepted accounting

principles. This gives introduction to consistency and data meaningfulness from view point

of investors. Inter firm comparisons of performance and performance trend is analyzed over

period of time when some set of GAAP is followed by firms. Management accounting is not

based on the set of rules that are accepted. Each enterprise, depends on requirement for facts,

evolving own principles and procedures for preparation of reports for internal uses. The

information has to be of relevance and help management in decision-making.

12

that are accounting information based, in order for assisting in day-to-day decision-making

and in planning of long term. The process is controlled by finance manager. Financial and

management accounting gives information in two different user groups. Financial accounting

provides information for accounting data’s external users of data of accounting like creditors

and investors. On other hand, management accounting provide information for accounting

data’s internal users. Internal users have inclusion of managers, executives and employees of

the company. Financial accounting reports on information which is historical. Information is

regularly reported. It is broken in quarterly, annual and monthly periods of reporting. On

another aspect, information of management accounting is reported on continuous basis.

Internal users need evaluation of present, past and future information potential in order for

making decisions. Thus, these users need information on continuous basis for making

decisions which are appropriate. These two accounting systems have their own importance in

business. Without these businesses cannot operate smoothly and make profits (Nastiti,

P.K.Y., Atahau, A.D.R. and Supramono, S., 2019).

Financial accounting presents reports annually while management accounting reports are of

long and short durations. Financial accounting covers entire organization whereas

management accounting are prepared for organization as well as segments.

It emphasizes facts’ accuracy while management accounting require quick and on time

reporting of facts if they are less accurate.

Focus- Financial accounting emphasizes accounting data’s external use and main focus of

this form of accounting is on balance sheet preparation and resources and obligations’ state.

The purpose of management accounting reports and collects information which is relevant

for making of decisions for ensuring firm’s resources being used optimally.

Principles- The financial accounting adherence is for the generally accepted accounting

principles. This gives introduction to consistency and data meaningfulness from view point

of investors. Inter firm comparisons of performance and performance trend is analyzed over

period of time when some set of GAAP is followed by firms. Management accounting is not

based on the set of rules that are accepted. Each enterprise, depends on requirement for facts,

evolving own principles and procedures for preparation of reports for internal uses. The

information has to be of relevance and help management in decision-making.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.