Finance for Strategic Managers - Desklib

VerifiedAdded on 2023/06/18

|17

|3235

|189

AI Summary

This report evaluates the financial performance of Samsung Plc by interpreting its financial statements and analyzing financial data using ratio analysis. It also provides recommendations to improve the financial position of the company. The report discusses the impact of creative accounting technique, limitations of ratio analysis, and importance of cash flow management while evaluating proposals of capital expenditure.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Finance for Strategic

Managers

Managers

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

TASK 2............................................................................................................................................3

2.1 Interpreting financial statements of Samsung Plc for year 2020..........................................3

2.2 Analysing financial data using ratio analysis for Samsung PLC..........................................4

2.3 Recommendations to Samsung PLC.....................................................................................5

TASK 3............................................................................................................................................7

3.1 Impact of 'creative accounting' technique when making strategic decisions........................7

3.2 Limitations of ratio analysis as a tool for strategic decision-making....................................8

3.3 Importance of cash flow management when evaluating proposals for capital expenditure. 8

3.4 Methods and tools used by organization to examine financial data for strategic decision-

making process............................................................................................................................7

TASK 4............................................................................................................................................9

4.1 Evaluating capital expenditure proposals using various techniques.....................................9

4.2 Assessing the impact of business proposal on strategic direction of company...................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

TASK 2............................................................................................................................................3

2.1 Interpreting financial statements of Samsung Plc for year 2020..........................................3

2.2 Analysing financial data using ratio analysis for Samsung PLC..........................................4

2.3 Recommendations to Samsung PLC.....................................................................................5

TASK 3............................................................................................................................................7

3.1 Impact of 'creative accounting' technique when making strategic decisions........................7

3.2 Limitations of ratio analysis as a tool for strategic decision-making....................................8

3.3 Importance of cash flow management when evaluating proposals for capital expenditure. 8

3.4 Methods and tools used by organization to examine financial data for strategic decision-

making process............................................................................................................................7

TASK 4............................................................................................................................................9

4.1 Evaluating capital expenditure proposals using various techniques.....................................9

4.2 Assessing the impact of business proposal on strategic direction of company...................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Finance is important to set financial goals of company for longer periods. Strategies

regarding financial management are formulated and implemented to generate profits and ROI.

The present case scenario is based upon evaluation of Samsung Plc's performance to provide

useful learnings. Initially, the report will evaluate the need and sources of financial data used to

frame business strategy along with the risks related to financial business decisions. It will also

review the methods that are used for appraising capital expenditure projects.

Further, report will interpret financial statements of company to examine viability of it.

The study will also perform comparative analysis of financial data by applying ratios and

providing suggestions to improve performance. In addition to this, study will produce an

information leaflet which will assess impact of accounting techniques while making strategic

decisions, limitations of ratio analysis and importance of cash flow management while

evaluating proposals of capital expenditure. Lastly, report will evaluate investment proposals

using financial techniques.

TASK 1

Incorporated in PPT

TASK 2

2.1 Interpreting financial statements of Samsung Plc for year 2020

Annual report is very important document published by company in order to provide vital

information about company to all major stakeholders. The annual report of Samsung plc for the

year 2020 is interpreted to examine financial performance and position of company and also to

identify viability of organisation.

First of all, gross profit earned by company has increased from previous year which

shows that company is making good sales to cover up all cost of sales and generate sufficient

profits. Samsung Plc is trying to increase its sales by reducing cost by applying cost effective

techniques of production and acquiring basic resources at low price in bulk quantities. On the

other hand, the huge difference between net profit and gross profit shows that company is

incurring large amount of indirect expenses.

At the time of balance sheet interpretation, it was noted that company is having enough

current assets to meet its short term obligations on time. Company has made no changes in its

Finance is important to set financial goals of company for longer periods. Strategies

regarding financial management are formulated and implemented to generate profits and ROI.

The present case scenario is based upon evaluation of Samsung Plc's performance to provide

useful learnings. Initially, the report will evaluate the need and sources of financial data used to

frame business strategy along with the risks related to financial business decisions. It will also

review the methods that are used for appraising capital expenditure projects.

Further, report will interpret financial statements of company to examine viability of it.

The study will also perform comparative analysis of financial data by applying ratios and

providing suggestions to improve performance. In addition to this, study will produce an

information leaflet which will assess impact of accounting techniques while making strategic

decisions, limitations of ratio analysis and importance of cash flow management while

evaluating proposals of capital expenditure. Lastly, report will evaluate investment proposals

using financial techniques.

TASK 1

Incorporated in PPT

TASK 2

2.1 Interpreting financial statements of Samsung Plc for year 2020

Annual report is very important document published by company in order to provide vital

information about company to all major stakeholders. The annual report of Samsung plc for the

year 2020 is interpreted to examine financial performance and position of company and also to

identify viability of organisation.

First of all, gross profit earned by company has increased from previous year which

shows that company is making good sales to cover up all cost of sales and generate sufficient

profits. Samsung Plc is trying to increase its sales by reducing cost by applying cost effective

techniques of production and acquiring basic resources at low price in bulk quantities. On the

other hand, the huge difference between net profit and gross profit shows that company is

incurring large amount of indirect expenses.

At the time of balance sheet interpretation, it was noted that company is having enough

current assets to meet its short term obligations on time. Company has made no changes in its

equities and has retained his profits in business for expansion purpose. Samsung Plc has also

paid back its debentures and long term loans which shows decreased burden of company on

external finance.

Cash Flow statement depicts that company is generating adequate cash from its basic

operational activities which increased from previous year. On contrary, company is utilizing its

cash in acquiring investment and financial assets which means it is investing in newer

technologies to create smart solutions to issues. It will also help in achieving economies of scale

which increases profits on long run. Samsung Plc has also used its cash to pay back its loans and

advances and dividend payments (Financial Statements, 2021).

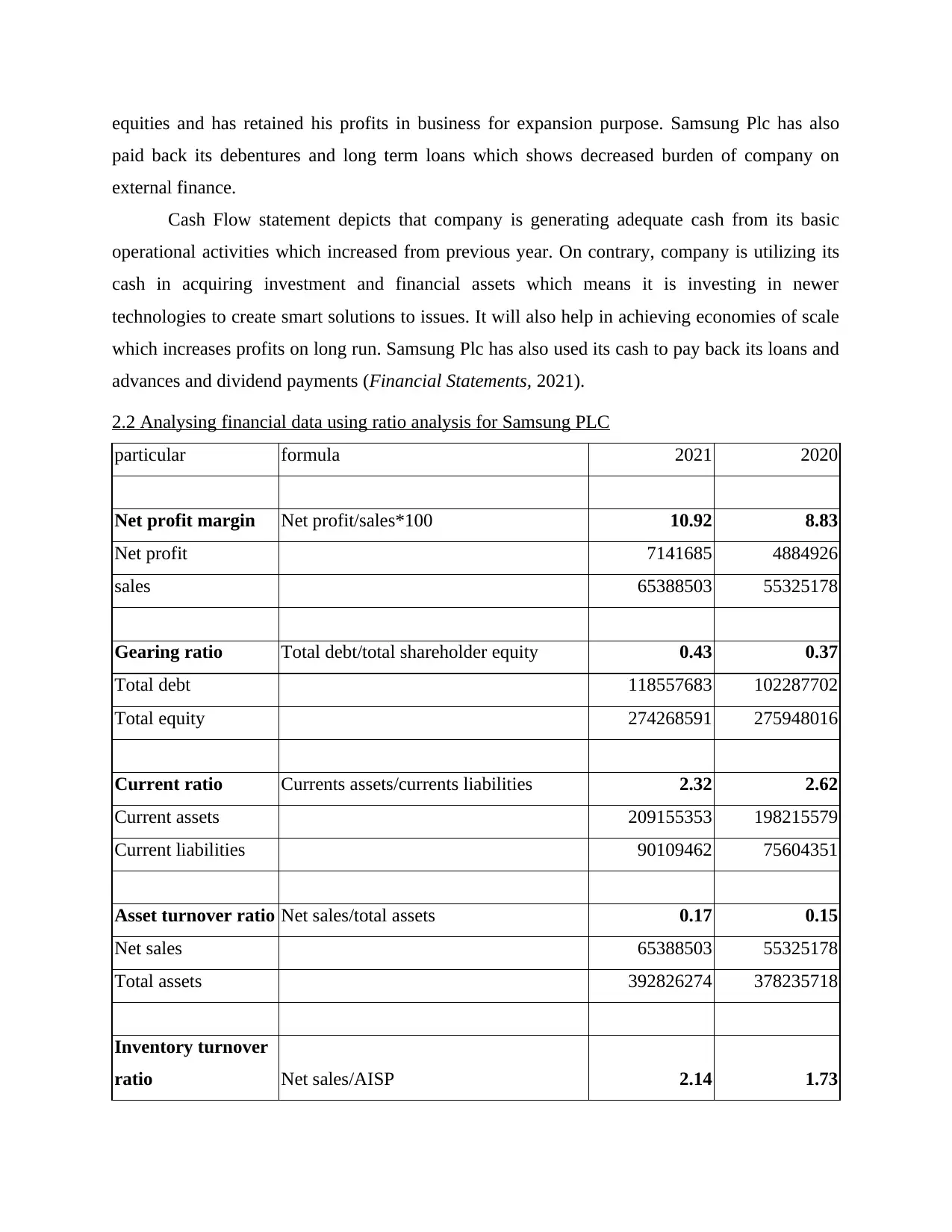

2.2 Analysing financial data using ratio analysis for Samsung PLC

particular formula 2021 2020

Net profit margin Net profit/sales*100 10.92 8.83

Net profit 7141685 4884926

sales 65388503 55325178

Gearing ratio Total debt/total shareholder equity 0.43 0.37

Total debt 118557683 102287702

Total equity 274268591 275948016

Current ratio Currents assets/currents liabilities 2.32 2.62

Current assets 209155353 198215579

Current liabilities 90109462 75604351

Asset turnover ratio Net sales/total assets 0.17 0.15

Net sales 65388503 55325178

Total assets 392826274 378235718

Inventory turnover

ratio Net sales/AISP 2.14 1.73

paid back its debentures and long term loans which shows decreased burden of company on

external finance.

Cash Flow statement depicts that company is generating adequate cash from its basic

operational activities which increased from previous year. On contrary, company is utilizing its

cash in acquiring investment and financial assets which means it is investing in newer

technologies to create smart solutions to issues. It will also help in achieving economies of scale

which increases profits on long run. Samsung Plc has also used its cash to pay back its loans and

advances and dividend payments (Financial Statements, 2021).

2.2 Analysing financial data using ratio analysis for Samsung PLC

particular formula 2021 2020

Net profit margin Net profit/sales*100 10.92 8.83

Net profit 7141685 4884926

sales 65388503 55325178

Gearing ratio Total debt/total shareholder equity 0.43 0.37

Total debt 118557683 102287702

Total equity 274268591 275948016

Current ratio Currents assets/currents liabilities 2.32 2.62

Current assets 209155353 198215579

Current liabilities 90109462 75604351

Asset turnover ratio Net sales/total assets 0.17 0.15

Net sales 65388503 55325178

Total assets 392826274 378235718

Inventory turnover

ratio Net sales/AISP 2.14 1.73

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Net sales 65388503 55325178

Average inventory at

selling price 30619976 32043145

The above mentioned table highlights the ratio analysis of Samsung PLC year 2021 and

2020. The net profit margin in the year 2021 is higher as compared to 2020 which is 10.92 and

8.83. Because indirect expenses are less in the year 2021 thus, this company attains high

profitability. The current ratio in the year 2021 is 2.32 which is less than 2.62 in the year 2020. A

ratio analysis indicates that the firm has enough funds in the short term to pay its obligations.

Samsung PLC is advised to manage its working capital to run into short term liquidity issues.

The gearing ratio in the year 2020 is 0.37 which is less than 0.43 in the year 2021. A low gearing

ratio means company has a low proportion of debt which is good.

In the above mentioned table in year 2021 company would be at optimal financial risk its

means company needs to pay higher interest. The firm is suggested to increase profitability ratio

by negotiating with lenders for shares. Inventory turnover ratio determine the company sells

inventory. In the year 2021 inventory ratio is 2.14 which is good sales performance as compared

to 2020 in which popularity of stock is 1.73. It is advised to improve forecasting methods and

focus on top products with better price. Asset turnover ratio represents efficiency of the

organization assets and shows revenue earned. In the year 2021 and 2020 asset ratio is 0.17 and

0.15 which means Samsung PLC has low asset efficiency. The company is advised to improve

its ineffective assets management by elaborating debtor’s collection and take assets on lease.

2.3 Recommendations to Samsung PLC

It is recommended to Samsung PLC to improve current ratio and gearing ratio both. The

management needs to focus on faster rolling of money via debtors in this way firm can control

current ratio. Regularly follow up with the debtors will improve the collections of funds from

them. Another improvement which the organization needs to follow is to sell unused fixed assets.

Hence, the management should try to cut down on hard cash levels and keep the funds in bank

accounts. Thus, this process is known as sweeping accounts.

It is also suggested to Samsung PLC to upgrade gearing ratio analysis by reducing

working capital. The management should negotiate with lenders to swap up the debt for shares in

Average inventory at

selling price 30619976 32043145

The above mentioned table highlights the ratio analysis of Samsung PLC year 2021 and

2020. The net profit margin in the year 2021 is higher as compared to 2020 which is 10.92 and

8.83. Because indirect expenses are less in the year 2021 thus, this company attains high

profitability. The current ratio in the year 2021 is 2.32 which is less than 2.62 in the year 2020. A

ratio analysis indicates that the firm has enough funds in the short term to pay its obligations.

Samsung PLC is advised to manage its working capital to run into short term liquidity issues.

The gearing ratio in the year 2020 is 0.37 which is less than 0.43 in the year 2021. A low gearing

ratio means company has a low proportion of debt which is good.

In the above mentioned table in year 2021 company would be at optimal financial risk its

means company needs to pay higher interest. The firm is suggested to increase profitability ratio

by negotiating with lenders for shares. Inventory turnover ratio determine the company sells

inventory. In the year 2021 inventory ratio is 2.14 which is good sales performance as compared

to 2020 in which popularity of stock is 1.73. It is advised to improve forecasting methods and

focus on top products with better price. Asset turnover ratio represents efficiency of the

organization assets and shows revenue earned. In the year 2021 and 2020 asset ratio is 0.17 and

0.15 which means Samsung PLC has low asset efficiency. The company is advised to improve

its ineffective assets management by elaborating debtor’s collection and take assets on lease.

2.3 Recommendations to Samsung PLC

It is recommended to Samsung PLC to improve current ratio and gearing ratio both. The

management needs to focus on faster rolling of money via debtors in this way firm can control

current ratio. Regularly follow up with the debtors will improve the collections of funds from

them. Another improvement which the organization needs to follow is to sell unused fixed assets.

Hence, the management should try to cut down on hard cash levels and keep the funds in bank

accounts. Thus, this process is known as sweeping accounts.

It is also suggested to Samsung PLC to upgrade gearing ratio analysis by reducing

working capital. The management should negotiate with lenders to swap up the debt for shares in

the organization. Along with that management must reduce the amount of outgoing cash and

increase the profits to achieve financial targets.

increase the profits to achieve financial targets.

TASK 3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3.1 Impact of 'creative

accounting' technique when

making strategic decisions

Creative accounting

is a popular technique to

manipulate the profit figures

to avoid extra taxation in the

future. Tax figures are mostly

not correct in the books of

accounts, in this way

manipulation is done at very

primary level. Samsung PLC

adopts creative accounting at

very basic stage to pretend

that the financial condition is

good and people can invest in

this company. Samsung PLC

follows manipulation

technique by booking less

expense and lowering

personal liabilities of

company.

Features & impact of creative

accounting

1. Wrong estimation is

being provided to

avoid excessive tax in

the future.

2. Manipulative

information about

revenues and sales

Limitations

All the information used

in ratio analysis is obtained

from previous data. Thus, it

increases unusual ratio results

while taking strategic decisions.

Accounting policies are

different in company for

recording accounting data. This

means comparing the ratio

analysis may be lengthy and

time-consuming process. If

Samsung PLC shows unusual

information this can impact the

outcome of the ratio analysis to

take strategic decision process.

Operational changes are a major

drawback of ratio analysis as a

company changes its

operational structure. It may

increase wrong conclusion

about financial conditions and

actual performance of

organization. The inability to

arrange the ratio analysis to the

seasonal effects may increases

the manipulation of financial

data.

3.4 Methods and tools used by

organization to examine

financial data for strategic

decision-making process.

Ratio analysis

It is advisable to Samsung

PLC that they must use the

traditional tools to analyse

financial data for strategic

decision. Ratio analysis investigate

various aspects of the

organizational condition. Ratio

analysis assist Samsung PLC to

compare one company against

another and it can also help

management to determine the

actual financial position of

company by adopting previous

data. Trend analysis suitable to the

company because it helps to

examine the financial statements of

the firm. A small change in

financial data will give actual trend

of the company. The trend ratio

shows whether the business is

trending upward or downward.

Balance sheet

Balance sheet is a report card of

company's financial position in

terms of book value. Samsung

PLC must note down the detailed

accounting' technique when

making strategic decisions

Creative accounting

is a popular technique to

manipulate the profit figures

to avoid extra taxation in the

future. Tax figures are mostly

not correct in the books of

accounts, in this way

manipulation is done at very

primary level. Samsung PLC

adopts creative accounting at

very basic stage to pretend

that the financial condition is

good and people can invest in

this company. Samsung PLC

follows manipulation

technique by booking less

expense and lowering

personal liabilities of

company.

Features & impact of creative

accounting

1. Wrong estimation is

being provided to

avoid excessive tax in

the future.

2. Manipulative

information about

revenues and sales

Limitations

All the information used

in ratio analysis is obtained

from previous data. Thus, it

increases unusual ratio results

while taking strategic decisions.

Accounting policies are

different in company for

recording accounting data. This

means comparing the ratio

analysis may be lengthy and

time-consuming process. If

Samsung PLC shows unusual

information this can impact the

outcome of the ratio analysis to

take strategic decision process.

Operational changes are a major

drawback of ratio analysis as a

company changes its

operational structure. It may

increase wrong conclusion

about financial conditions and

actual performance of

organization. The inability to

arrange the ratio analysis to the

seasonal effects may increases

the manipulation of financial

data.

3.4 Methods and tools used by

organization to examine

financial data for strategic

decision-making process.

Ratio analysis

It is advisable to Samsung

PLC that they must use the

traditional tools to analyse

financial data for strategic

decision. Ratio analysis investigate

various aspects of the

organizational condition. Ratio

analysis assist Samsung PLC to

compare one company against

another and it can also help

management to determine the

actual financial position of

company by adopting previous

data. Trend analysis suitable to the

company because it helps to

examine the financial statements of

the firm. A small change in

financial data will give actual trend

of the company. The trend ratio

shows whether the business is

trending upward or downward.

Balance sheet

Balance sheet is a report card of

company's financial position in

terms of book value. Samsung

PLC must note down the detailed

figure.

3. Contingent liabilities

are not shown in

exact figures thus it

will give good sense

that the company is

not having any

liabilities.

4. Creative accounting

promotes company's

fair image in front of

customers. Therefore,

company shows

increase in total debts

but it is not reflected

in books of accounts.

3.2 Limitations of ratio

analysis as a tool for

strategic decision-

making.

Ratio analysis refers

to the calculation of ratios

from financial statements of

a business to make strategic

decision. It provides overall

information about the

company's financial position

showing profitability and

liquidity. Ratio analysis

assist Samsung PLC to

3.3 Importance of cash flow

management when

evaluating proposals for

capital expenditure.

Cash flow refers to the

inflow and outflow of cash in

terms of income and

expenditure. It is important for

the organization as it assist

them in evaluating the

projecting on the basis of higher

return which is determined by

cash inflows. At the time of

evaluation proposal for capital

expenditure cash flow statement

determine the use of cash basis

data which can be taken into

consideration to evaluate high

returns. This method helps to

reduce negative cash flow in the

organization to achieve

financial support. Cash flow

management assist Samsung

PLC to reduce unnecessary

costs and produce regular sales

information of shareholder’s

equity, accounts receivable to

evaluate the operational efficiency

of company. The management of

Samsung must adopt balance sheet

to attain strategic decision by

giving deep information of capital

investments for financial activities

of business. It is recommended to

company because balance sheet

will help company in maintaining

assets and liabilities in books of

accounts. This in turn will improve

the strategic decision-making

process of the company.

3. Contingent liabilities

are not shown in

exact figures thus it

will give good sense

that the company is

not having any

liabilities.

4. Creative accounting

promotes company's

fair image in front of

customers. Therefore,

company shows

increase in total debts

but it is not reflected

in books of accounts.

3.2 Limitations of ratio

analysis as a tool for

strategic decision-

making.

Ratio analysis refers

to the calculation of ratios

from financial statements of

a business to make strategic

decision. It provides overall

information about the

company's financial position

showing profitability and

liquidity. Ratio analysis

assist Samsung PLC to

3.3 Importance of cash flow

management when

evaluating proposals for

capital expenditure.

Cash flow refers to the

inflow and outflow of cash in

terms of income and

expenditure. It is important for

the organization as it assist

them in evaluating the

projecting on the basis of higher

return which is determined by

cash inflows. At the time of

evaluation proposal for capital

expenditure cash flow statement

determine the use of cash basis

data which can be taken into

consideration to evaluate high

returns. This method helps to

reduce negative cash flow in the

organization to achieve

financial support. Cash flow

management assist Samsung

PLC to reduce unnecessary

costs and produce regular sales

information of shareholder’s

equity, accounts receivable to

evaluate the operational efficiency

of company. The management of

Samsung must adopt balance sheet

to attain strategic decision by

giving deep information of capital

investments for financial activities

of business. It is recommended to

company because balance sheet

will help company in maintaining

assets and liabilities in books of

accounts. This in turn will improve

the strategic decision-making

process of the company.

analysis comparisons and

identify market gaps between

two companies. The

management of Samsung

PLC can also use ratio

analysis to determine the

efficiency level of assets and

liabilities. Trend line is being

adopted by Samsung PLC to

predict the direction of future

performance.

estimation. By adopting this

method Samsung financial

flexibility can take benefit of

profitable investments. It is

suggested to have a credit

policy and manage payments in

the organization. Along with

that company must take care of

inventories for future needs.

TASK 4

4.1 Evaluating capital expenditure proposals using various techniques

CURRENT MACHINE

Cash Inflow

Year Inflow

1 450000

2 250000

3 150000

Cash Outflow

Particulars Year 1 (90000 units) Year 2 (50000 units) Year3 (30000 units)

Direct material 1.8 1.89 1.98

Direct labour 0.75 0.79 0.83

Variable overheads 0.45 0.45 0.45

identify market gaps between

two companies. The

management of Samsung

PLC can also use ratio

analysis to determine the

efficiency level of assets and

liabilities. Trend line is being

adopted by Samsung PLC to

predict the direction of future

performance.

estimation. By adopting this

method Samsung financial

flexibility can take benefit of

profitable investments. It is

suggested to have a credit

policy and manage payments in

the organization. Along with

that company must take care of

inventories for future needs.

TASK 4

4.1 Evaluating capital expenditure proposals using various techniques

CURRENT MACHINE

Cash Inflow

Year Inflow

1 450000

2 250000

3 150000

Cash Outflow

Particulars Year 1 (90000 units) Year 2 (50000 units) Year3 (30000 units)

Direct material 1.8 1.89 1.98

Direct labour 0.75 0.79 0.83

Variable overheads 0.45 0.45 0.45

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

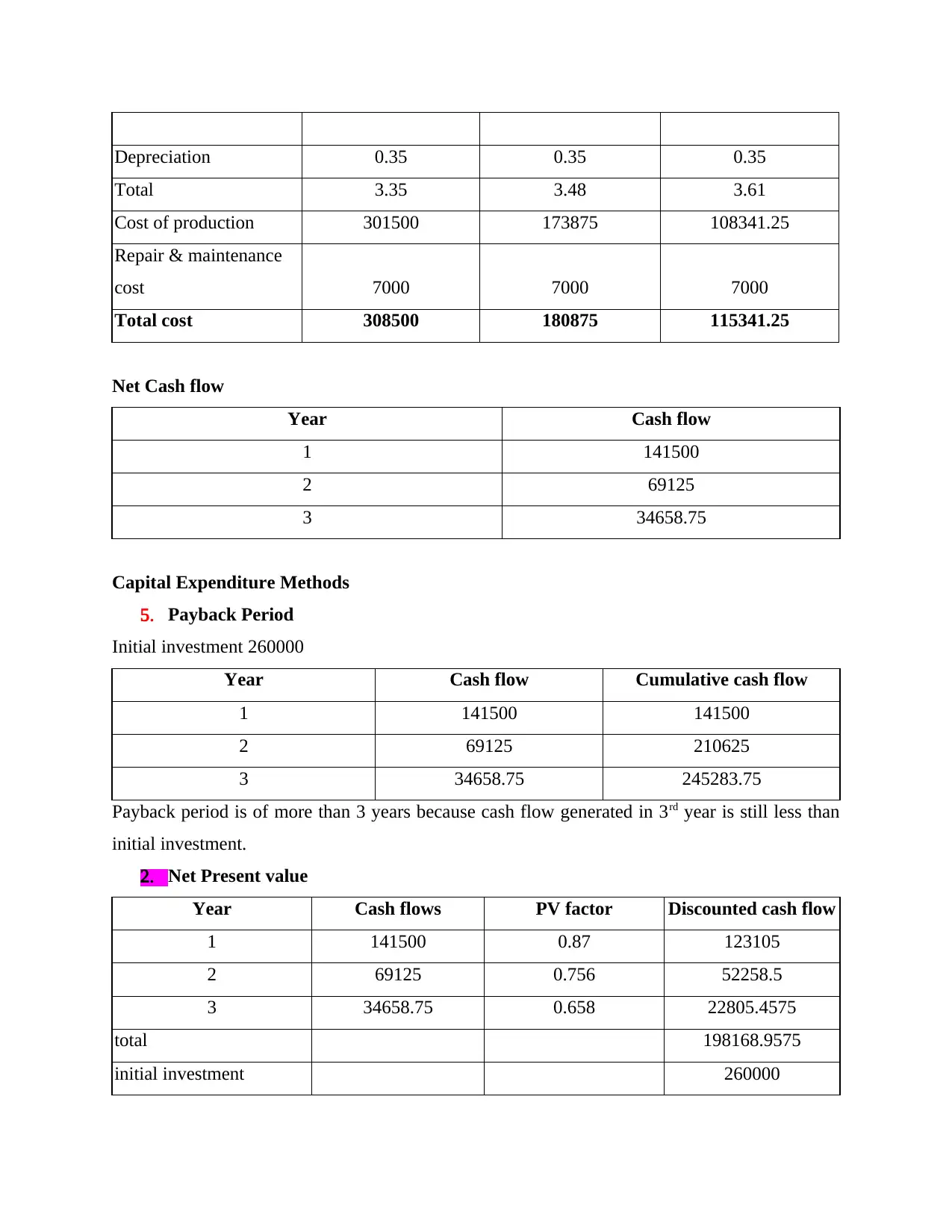

Depreciation 0.35 0.35 0.35

Total 3.35 3.48 3.61

Cost of production 301500 173875 108341.25

Repair & maintenance

cost 7000 7000 7000

Total cost 308500 180875 115341.25

Net Cash flow

Year Cash flow

1 141500

2 69125

3 34658.75

Capital Expenditure Methods

5. Payback Period

Initial investment 260000

Year Cash flow Cumulative cash flow

1 141500 141500

2 69125 210625

3 34658.75 245283.75

Payback period is of more than 3 years because cash flow generated in 3rd year is still less than

initial investment.

2. Net Present value

Year Cash flows PV factor Discounted cash flow

1 141500 0.87 123105

2 69125 0.756 52258.5

3 34658.75 0.658 22805.4575

total 198168.9575

initial investment 260000

Total 3.35 3.48 3.61

Cost of production 301500 173875 108341.25

Repair & maintenance

cost 7000 7000 7000

Total cost 308500 180875 115341.25

Net Cash flow

Year Cash flow

1 141500

2 69125

3 34658.75

Capital Expenditure Methods

5. Payback Period

Initial investment 260000

Year Cash flow Cumulative cash flow

1 141500 141500

2 69125 210625

3 34658.75 245283.75

Payback period is of more than 3 years because cash flow generated in 3rd year is still less than

initial investment.

2. Net Present value

Year Cash flows PV factor Discounted cash flow

1 141500 0.87 123105

2 69125 0.756 52258.5

3 34658.75 0.658 22805.4575

total 198168.9575

initial investment 260000

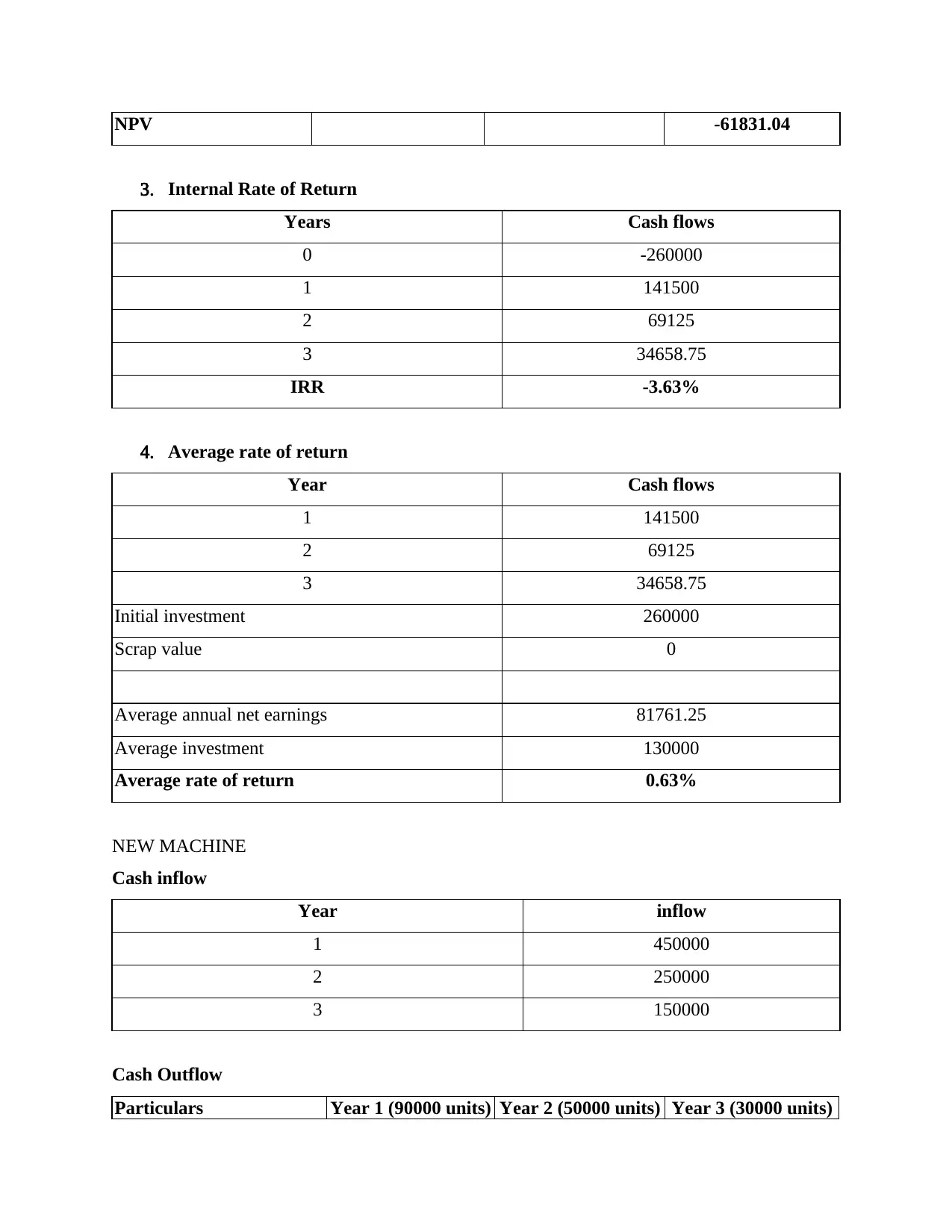

NPV -61831.04

3. Internal Rate of Return

Years Cash flows

0 -260000

1 141500

2 69125

3 34658.75

IRR -3.63%

4. Average rate of return

Year Cash flows

1 141500

2 69125

3 34658.75

Initial investment 260000

Scrap value 0

Average annual net earnings 81761.25

Average investment 130000

Average rate of return 0.63%

NEW MACHINE

Cash inflow

Year inflow

1 450000

2 250000

3 150000

Cash Outflow

Particulars Year 1 (90000 units) Year 2 (50000 units) Year 3 (30000 units)

3. Internal Rate of Return

Years Cash flows

0 -260000

1 141500

2 69125

3 34658.75

IRR -3.63%

4. Average rate of return

Year Cash flows

1 141500

2 69125

3 34658.75

Initial investment 260000

Scrap value 0

Average annual net earnings 81761.25

Average investment 130000

Average rate of return 0.63%

NEW MACHINE

Cash inflow

Year inflow

1 450000

2 250000

3 150000

Cash Outflow

Particulars Year 1 (90000 units) Year 2 (50000 units) Year 3 (30000 units)

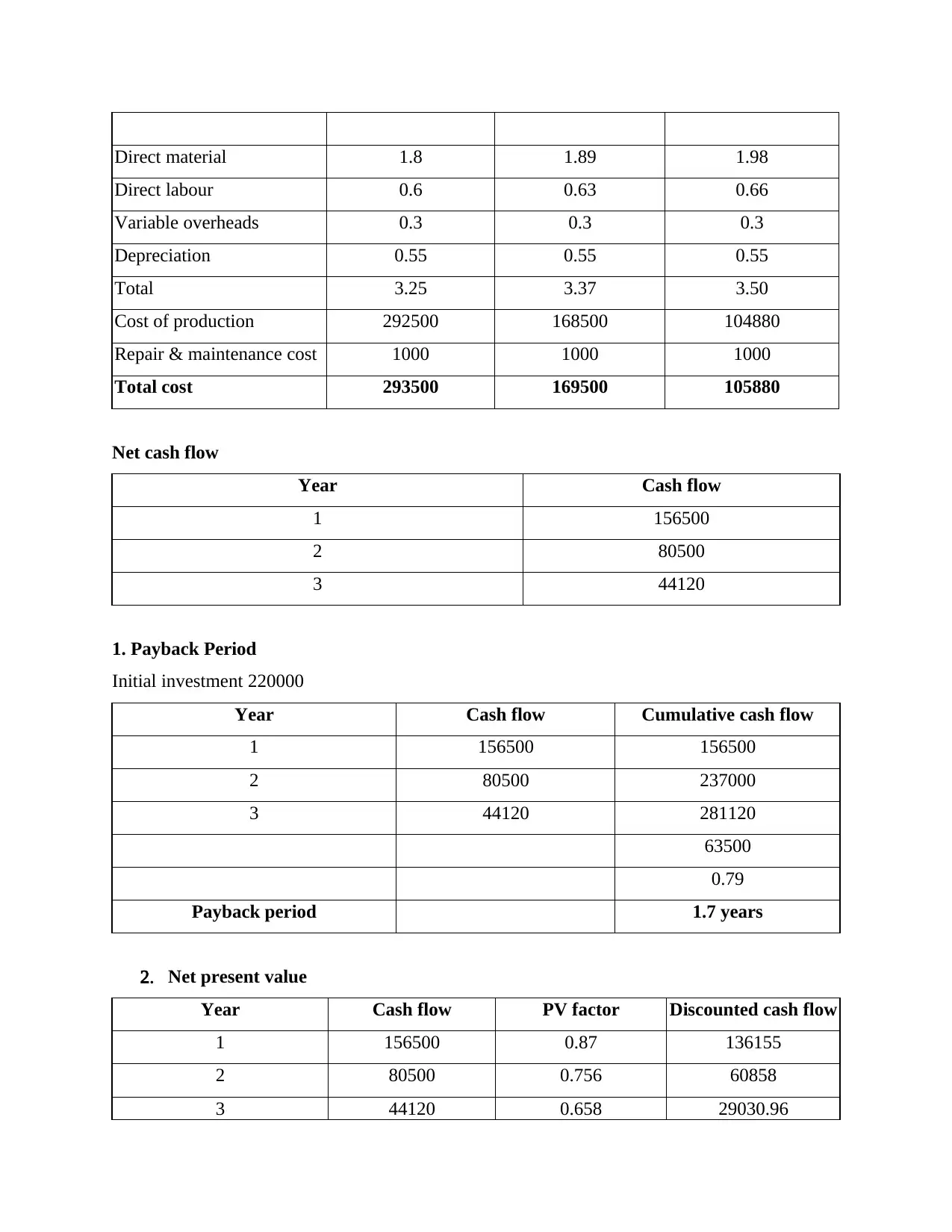

Direct material 1.8 1.89 1.98

Direct labour 0.6 0.63 0.66

Variable overheads 0.3 0.3 0.3

Depreciation 0.55 0.55 0.55

Total 3.25 3.37 3.50

Cost of production 292500 168500 104880

Repair & maintenance cost 1000 1000 1000

Total cost 293500 169500 105880

Net cash flow

Year Cash flow

1 156500

2 80500

3 44120

1. Payback Period

Initial investment 220000

Year Cash flow Cumulative cash flow

1 156500 156500

2 80500 237000

3 44120 281120

63500

0.79

Payback period 1.7 years

2. Net present value

Year Cash flow PV factor Discounted cash flow

1 156500 0.87 136155

2 80500 0.756 60858

3 44120 0.658 29030.96

Direct labour 0.6 0.63 0.66

Variable overheads 0.3 0.3 0.3

Depreciation 0.55 0.55 0.55

Total 3.25 3.37 3.50

Cost of production 292500 168500 104880

Repair & maintenance cost 1000 1000 1000

Total cost 293500 169500 105880

Net cash flow

Year Cash flow

1 156500

2 80500

3 44120

1. Payback Period

Initial investment 220000

Year Cash flow Cumulative cash flow

1 156500 156500

2 80500 237000

3 44120 281120

63500

0.79

Payback period 1.7 years

2. Net present value

Year Cash flow PV factor Discounted cash flow

1 156500 0.87 136155

2 80500 0.756 60858

3 44120 0.658 29030.96

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

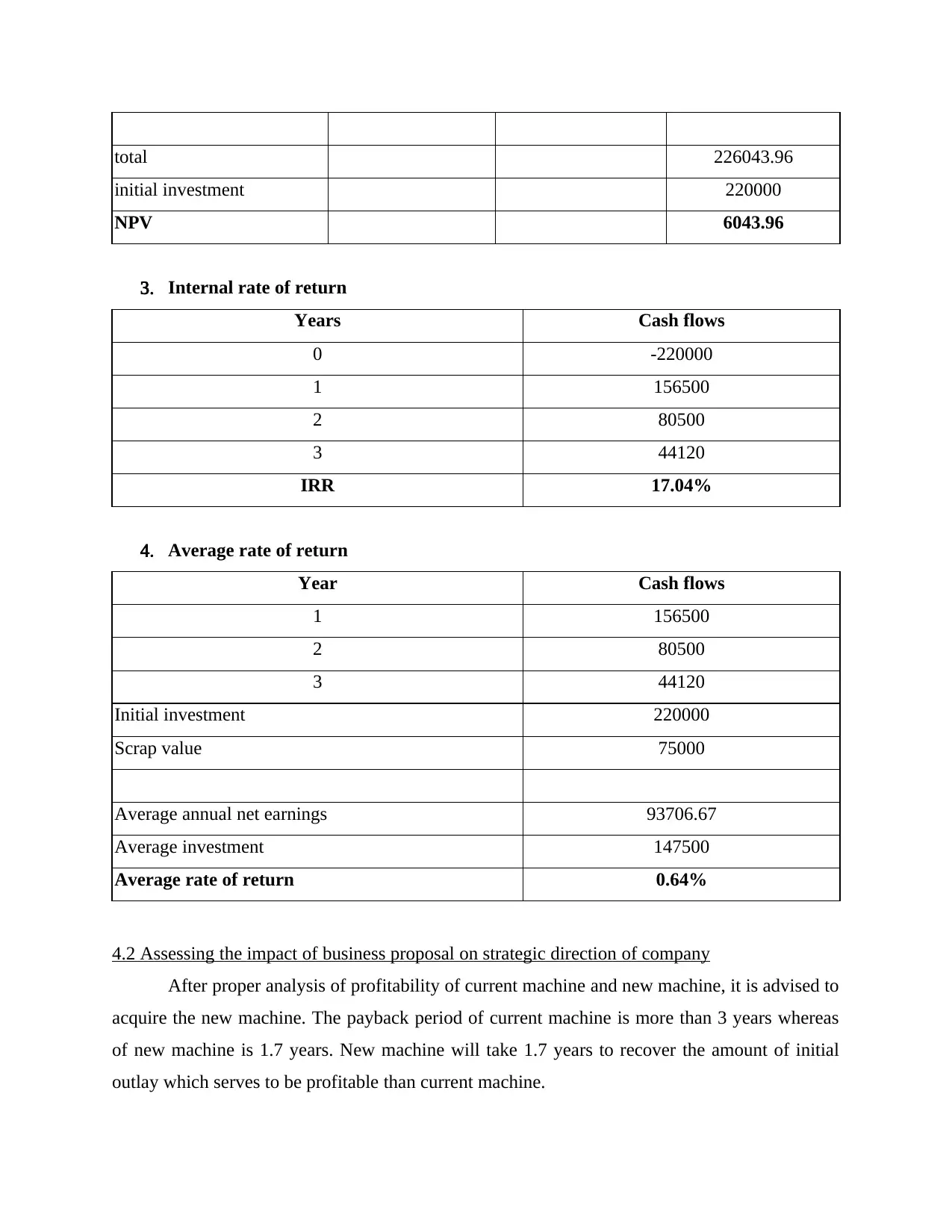

total 226043.96

initial investment 220000

NPV 6043.96

3. Internal rate of return

Years Cash flows

0 -220000

1 156500

2 80500

3 44120

IRR 17.04%

4. Average rate of return

Year Cash flows

1 156500

2 80500

3 44120

Initial investment 220000

Scrap value 75000

Average annual net earnings 93706.67

Average investment 147500

Average rate of return 0.64%

4.2 Assessing the impact of business proposal on strategic direction of company

After proper analysis of profitability of current machine and new machine, it is advised to

acquire the new machine. The payback period of current machine is more than 3 years whereas

of new machine is 1.7 years. New machine will take 1.7 years to recover the amount of initial

outlay which serves to be profitable than current machine.

initial investment 220000

NPV 6043.96

3. Internal rate of return

Years Cash flows

0 -220000

1 156500

2 80500

3 44120

IRR 17.04%

4. Average rate of return

Year Cash flows

1 156500

2 80500

3 44120

Initial investment 220000

Scrap value 75000

Average annual net earnings 93706.67

Average investment 147500

Average rate of return 0.64%

4.2 Assessing the impact of business proposal on strategic direction of company

After proper analysis of profitability of current machine and new machine, it is advised to

acquire the new machine. The payback period of current machine is more than 3 years whereas

of new machine is 1.7 years. New machine will take 1.7 years to recover the amount of initial

outlay which serves to be profitable than current machine.

When Net Present Value of 2 machines was calculated, new machine proves better

because it is providing positive present value as compared to negative present value of current

machine.

On the other hand, internal rate of return of current machine is -3.63% and that of new

machine is 17.04%. Hence, new machine is efficient to use which will provide good return in the

future.

In addition to this, when another capital budgeting technique of average rate of return

was applied, it was analysed that new machine is better than current one because new machine is

providing return of 64% and current is providing 63% (Pradnyawati, Putrayasa and Sudiadnyani,

2021).

Therefore, company must decide to invest in new machine because of capital budgeting

methods applied proves to be beneficial for company as compared to current machine.

CONCLUSION

From the above mentioned report it is analysed that financial data is essential to make

strategic decision which includes balance sheet and others. Along with that reports takes a brief

note on various risk and creative accounting while framing financial data to achieve strategic

decisions. The company used different ideas and technique for capital appraisal like payback and

others. The report evaluates ratio analysis and its drawback. At last report determined various

tools to examine business data for decision-making process.

because it is providing positive present value as compared to negative present value of current

machine.

On the other hand, internal rate of return of current machine is -3.63% and that of new

machine is 17.04%. Hence, new machine is efficient to use which will provide good return in the

future.

In addition to this, when another capital budgeting technique of average rate of return

was applied, it was analysed that new machine is better than current one because new machine is

providing return of 64% and current is providing 63% (Pradnyawati, Putrayasa and Sudiadnyani,

2021).

Therefore, company must decide to invest in new machine because of capital budgeting

methods applied proves to be beneficial for company as compared to current machine.

CONCLUSION

From the above mentioned report it is analysed that financial data is essential to make

strategic decision which includes balance sheet and others. Along with that reports takes a brief

note on various risk and creative accounting while framing financial data to achieve strategic

decisions. The company used different ideas and technique for capital appraisal like payback and

others. The report evaluates ratio analysis and its drawback. At last report determined various

tools to examine business data for decision-making process.

REFERENCES

Books and Journals

Abousaidi, M., Moeinadin, M. and Heyrani, F., 2021. Evaluation of the Financial Literacy of the

Managers of the Private sector Companies. Financial Accounting Knowledge. 8(2).

pp.195-219.

Abutabenjeh, S., 2021. Strategic management in state government two servants of the same

master: Procurement and finance. International Journal of Public Administration. 44(7).

pp.607-621.

AHMED, S. F., ABDULJABBAR, B. T. and ABED HUSSEIN, A. A., 2021. Strategic

Intelligence and Sustainable Competitive Advantage of Small and Medium Enterprises: An

Exploratory Study in Iraq. The Journal of Asian Finance, Economics and Business. 8(6).

pp.721-729.

Al_Duhaidahawi, H. M. K. and et.al., 2020. An efficient model for financial risks assessment

based on artificial neural networks. Journal of Southwest Jiaotong University. 55(3).

Durana, P. and et.al., 2020. Disclosure of strategic managers’ factotum: Behavioral incentives of

innovative business. International Journal of Financial Studies. 8(1). p.17.

Harahap, M. N., 2020. Analysis of Payback Period, Net Present Value and Internal Rate of

Return on hotel business in Kepulauan Seribu. Accounthink: Journal of Accounting and

Finance. 5(02).

Hasanaj, P. and Kuqi, B., 2019. Analysis of financial statements. Humanities and Social Science

Research. 2(2). pp.p17-p17.

HOANG, T. G., NGUYEN, T. Q. and GEORGE, M., 2020. Business Partner Roles of

Management Accountants Through the Emergence of Sustainability Disclosures. The

Journal of Asian Finance, Economics, and Business. 7(12). pp.365-376.

Kumar, R., Soomro, K. A. and Aqil, M., 2021. Impact of Holistic Approach of Managers’

Systems Thinking Skills on Strategic Performance of Organization–A case of Banking

Industry. GMJACS. 11(1). pp.19-19.

Lynn, T. and et.al., 2019. Disrupting finance: FinTech and strategy in the 21st century (p. 175).

Springer Nature.

Pelekh, U., Khocha, N. and Holovchak, H., 2020. Financial statements as a management

tool. Management Science Letters. 10(1). pp.197-208.

Pradnyawati, N. L. G. W., Putrayasa, I. M. A. and Sudiadnyani, I. G. A. O., 2021. Application of

Capital Budgeting Method to Evaluate Investment Decisions on Additions to Fixed Assets

at PT Hatten Bali. Journal of Applied Sciences in Accounting, Finance, and Tax. 4(1).

pp.69-76.

Sarwary, Z., 2020. Strategy and capital budgeting techniques: the moderating role of

entrepreneurial structure. International Journal of Managerial and Financial Accounting.

12(1). pp.48-70.

Online

Books and Journals

Abousaidi, M., Moeinadin, M. and Heyrani, F., 2021. Evaluation of the Financial Literacy of the

Managers of the Private sector Companies. Financial Accounting Knowledge. 8(2).

pp.195-219.

Abutabenjeh, S., 2021. Strategic management in state government two servants of the same

master: Procurement and finance. International Journal of Public Administration. 44(7).

pp.607-621.

AHMED, S. F., ABDULJABBAR, B. T. and ABED HUSSEIN, A. A., 2021. Strategic

Intelligence and Sustainable Competitive Advantage of Small and Medium Enterprises: An

Exploratory Study in Iraq. The Journal of Asian Finance, Economics and Business. 8(6).

pp.721-729.

Al_Duhaidahawi, H. M. K. and et.al., 2020. An efficient model for financial risks assessment

based on artificial neural networks. Journal of Southwest Jiaotong University. 55(3).

Durana, P. and et.al., 2020. Disclosure of strategic managers’ factotum: Behavioral incentives of

innovative business. International Journal of Financial Studies. 8(1). p.17.

Harahap, M. N., 2020. Analysis of Payback Period, Net Present Value and Internal Rate of

Return on hotel business in Kepulauan Seribu. Accounthink: Journal of Accounting and

Finance. 5(02).

Hasanaj, P. and Kuqi, B., 2019. Analysis of financial statements. Humanities and Social Science

Research. 2(2). pp.p17-p17.

HOANG, T. G., NGUYEN, T. Q. and GEORGE, M., 2020. Business Partner Roles of

Management Accountants Through the Emergence of Sustainability Disclosures. The

Journal of Asian Finance, Economics, and Business. 7(12). pp.365-376.

Kumar, R., Soomro, K. A. and Aqil, M., 2021. Impact of Holistic Approach of Managers’

Systems Thinking Skills on Strategic Performance of Organization–A case of Banking

Industry. GMJACS. 11(1). pp.19-19.

Lynn, T. and et.al., 2019. Disrupting finance: FinTech and strategy in the 21st century (p. 175).

Springer Nature.

Pelekh, U., Khocha, N. and Holovchak, H., 2020. Financial statements as a management

tool. Management Science Letters. 10(1). pp.197-208.

Pradnyawati, N. L. G. W., Putrayasa, I. M. A. and Sudiadnyani, I. G. A. O., 2021. Application of

Capital Budgeting Method to Evaluate Investment Decisions on Additions to Fixed Assets

at PT Hatten Bali. Journal of Applied Sciences in Accounting, Finance, and Tax. 4(1).

pp.69-76.

Sarwary, Z., 2020. Strategy and capital budgeting techniques: the moderating role of

entrepreneurial structure. International Journal of Managerial and Financial Accounting.

12(1). pp.48-70.

Online

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Financial Statements. 2021. [Online]. Available through: <https://www.samsung.com/global/ir/>

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.