Strategic Finance Report: Financial Analysis, Decisions, and Ratios

VerifiedAdded on 2019/12/03

|15

|4375

|30

Report

AI Summary

This report delves into the realm of finance for strategic managers, using Sainsbury as a case study to illustrate key concepts. It begins by examining the necessity of financial information in business, emphasizing its role in stakeholder trust and effective decision-making. The report then identifies various business risks related to financial decisions, including strategic, compliance, financial, and operational risks, highlighting their impact on profitability. Furthermore, it summarizes the crucial financial information needed for strategic decisions, such as income statements, cash flow statements, and balance sheets, and explains the purpose, structure, and content of published accounts. The analysis extends to calculating and interpreting financial ratios, such as profitability, liquidity, efficiency, and gearing ratios, to support strategic decision-making. The report also explores long and short-term financial requirements, sources of finance, and cash flow management techniques. Lastly, it evaluates corporate governance, legal, and regulatory requirements, along with methods for appraising strategic capital or investment projects, providing a comprehensive understanding of financial management in a strategic context.

Finance for Strategic Managers

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................4

ACTIVITY 1....................................................................................................................................4

1. Assessing why financial information is needed in business....................................................4

2. Identification of the business risks related to financial decisions............................................5

3. Summary of financial information needed to make strategic business decisions....................5

ACTIVITY 2....................................................................................................................................6

1. Explanation of the purpose, structure and content of published accounts...............................6

2. Interpretation of the financial information in these accounts..................................................7

3. Calculation of financial ratios from the accounts and explanation of ways they support

strategic decision making.............................................................................................................7

ACTIVITY 3....................................................................................................................................9

1. Difference between long and short term financial requirements for businesses.....................9

2. Comparison of sources of long and short term finance for businesses....................................9

3. Cash flow management techniques and assessing why its management is important...........10

ACTIVITY 4 .................................................................................................................................10

1. Analysis of corporate governance, legal and regulatory requirements of different ownership

structure......................................................................................................................................10

2. Evaluating methods of appraising strategic capital or investment projects...........................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

2

INTRODUCTION...........................................................................................................................4

ACTIVITY 1....................................................................................................................................4

1. Assessing why financial information is needed in business....................................................4

2. Identification of the business risks related to financial decisions............................................5

3. Summary of financial information needed to make strategic business decisions....................5

ACTIVITY 2....................................................................................................................................6

1. Explanation of the purpose, structure and content of published accounts...............................6

2. Interpretation of the financial information in these accounts..................................................7

3. Calculation of financial ratios from the accounts and explanation of ways they support

strategic decision making.............................................................................................................7

ACTIVITY 3....................................................................................................................................9

1. Difference between long and short term financial requirements for businesses.....................9

2. Comparison of sources of long and short term finance for businesses....................................9

3. Cash flow management techniques and assessing why its management is important...........10

ACTIVITY 4 .................................................................................................................................10

1. Analysis of corporate governance, legal and regulatory requirements of different ownership

structure......................................................................................................................................10

2. Evaluating methods of appraising strategic capital or investment projects...........................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

2

Index of Tables

Table 1: Financial ratios of Sainsbury ............................................................................................7

Table 2: Proposal information ......................................................................................................11

Table 3: NPV of Project A.............................................................................................................11

Table 4: NPV of Project B.............................................................................................................11

Table 5: Pay back period of Project B...........................................................................................12

Table 6: Pay back period of Project A...........................................................................................12

3

Table 1: Financial ratios of Sainsbury ............................................................................................7

Table 2: Proposal information ......................................................................................................11

Table 3: NPV of Project A.............................................................................................................11

Table 4: NPV of Project B.............................................................................................................11

Table 5: Pay back period of Project B...........................................................................................12

Table 6: Pay back period of Project A...........................................................................................12

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Finance is considered as the life blood of the business which plays an imperative role in

success of the organization to a greater extent. With the assistance of financial information

organization's manager can take appropriate decisions that can act as an aid in achievement of

organizational targets (Hershey, Austin and Gutierrez, 2015). For the present study, finance for

strategic manager would be discussed with reference to Sainsbury. The present study entails to

understand the reason due to which financial information is being gathered. Further, it explains

the purpose, structure and content of the published accounts. Lastly, the report involves

evaluation of the methods for appraising strategic capital.

ACTIVITY 1

1. Assessing why financial information is needed in business

It is important for each and every business to prepare financial statements with the aim to

offer useful information about financial status of the organization. In order to build and maintain

the faith of stakeholders within the organization, they are required to prepare as well as publish

financial statement of the organization (Cox, 2004). With the assistance of financial information,

decision making can be effectively done by the financial manager. Through this, proper

utilization of the fund is ensured which results in achievement of success by the firm. Financial

statement offers wide range of useful information to several users. This includes: Managers: The executive of Sainsbury needs financial information with an aim to

manage the affairs of organization. This can be done by assessing the financial position

as well as performance. Thus, it assists in taking important decisions by the business. Shareholders: They require financial statements to assess the risk and return on their

investment within the organization (Barton and Wiseman, 2014). On the basis of analysis

they take investment decisions. Customers: These users of information require financial information to assess whether

the supplier possess resources to ensure quick supply of the products in future course of

time. Customers of Sainsbury have greater needs of financial data with an aim to take

appropriate decisions.

4

Finance is considered as the life blood of the business which plays an imperative role in

success of the organization to a greater extent. With the assistance of financial information

organization's manager can take appropriate decisions that can act as an aid in achievement of

organizational targets (Hershey, Austin and Gutierrez, 2015). For the present study, finance for

strategic manager would be discussed with reference to Sainsbury. The present study entails to

understand the reason due to which financial information is being gathered. Further, it explains

the purpose, structure and content of the published accounts. Lastly, the report involves

evaluation of the methods for appraising strategic capital.

ACTIVITY 1

1. Assessing why financial information is needed in business

It is important for each and every business to prepare financial statements with the aim to

offer useful information about financial status of the organization. In order to build and maintain

the faith of stakeholders within the organization, they are required to prepare as well as publish

financial statement of the organization (Cox, 2004). With the assistance of financial information,

decision making can be effectively done by the financial manager. Through this, proper

utilization of the fund is ensured which results in achievement of success by the firm. Financial

statement offers wide range of useful information to several users. This includes: Managers: The executive of Sainsbury needs financial information with an aim to

manage the affairs of organization. This can be done by assessing the financial position

as well as performance. Thus, it assists in taking important decisions by the business. Shareholders: They require financial statements to assess the risk and return on their

investment within the organization (Barton and Wiseman, 2014). On the basis of analysis

they take investment decisions. Customers: These users of information require financial information to assess whether

the supplier possess resources to ensure quick supply of the products in future course of

time. Customers of Sainsbury have greater needs of financial data with an aim to take

appropriate decisions.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Government: Financial information is required by the legal authority to assess the

correctness of tax amount that is declared in tax returns (Users of Financial Statements,

2015). Moreover, government also keeps track on economic progress by analyzing

financial statements.

2. Identification of the business risks related to financial decisions

Risk is considered as the major factor that affects activities of the organization like

productivity as well as performance. There are several types of business risks that are related to

financial decisions. This includes the risks such as: Strategic risk: Such type of business risk results from operating in any particular industry

at a point of time. For the firm like Sainsbury, this risk has greater impact on the financial

decision (Kroes and Manikas, 2014). With the emergence of new technology, the existing

product of the business becomes obsolete which affects performance of the organization

to a significant level. Compliance risk: Such risks are related to legislative or bureaucratic rule and regulation.

Further, it also includes risks which are associated with suitable practices for the purpose

of investment. Financial risk: This kind of risk includes the manner in which the business handles its

funds. It also considers the rate of interest in case of international trade (Valentin and

Mihaela–Andreea, 2015). Such business risk is associated with financial decision as it

affects decision making of the firm to a greater extent.

Operational risk: This type of business risk leads to internal failure which includes

failure of internal processes, people or system within the organization. Operational risk

can take place from unforeseen external events that include breaking down of

transportation system as well as supplier failing to deliver goods. It is important for the

financial manager of the Sainsbury to consider all the risk factors as it impact the

profitability as well as productivity of the organization.

3. Summary of financial information needed to make strategic business decisions

Financial manager requires variety of information that includes analysis of the financial

statements by the business. Such offers suitable data to the organization about financial activities

5

correctness of tax amount that is declared in tax returns (Users of Financial Statements,

2015). Moreover, government also keeps track on economic progress by analyzing

financial statements.

2. Identification of the business risks related to financial decisions

Risk is considered as the major factor that affects activities of the organization like

productivity as well as performance. There are several types of business risks that are related to

financial decisions. This includes the risks such as: Strategic risk: Such type of business risk results from operating in any particular industry

at a point of time. For the firm like Sainsbury, this risk has greater impact on the financial

decision (Kroes and Manikas, 2014). With the emergence of new technology, the existing

product of the business becomes obsolete which affects performance of the organization

to a significant level. Compliance risk: Such risks are related to legislative or bureaucratic rule and regulation.

Further, it also includes risks which are associated with suitable practices for the purpose

of investment. Financial risk: This kind of risk includes the manner in which the business handles its

funds. It also considers the rate of interest in case of international trade (Valentin and

Mihaela–Andreea, 2015). Such business risk is associated with financial decision as it

affects decision making of the firm to a greater extent.

Operational risk: This type of business risk leads to internal failure which includes

failure of internal processes, people or system within the organization. Operational risk

can take place from unforeseen external events that include breaking down of

transportation system as well as supplier failing to deliver goods. It is important for the

financial manager of the Sainsbury to consider all the risk factors as it impact the

profitability as well as productivity of the organization.

3. Summary of financial information needed to make strategic business decisions

Financial manager requires variety of information that includes analysis of the financial

statements by the business. Such offers suitable data to the organization about financial activities

5

as well as utilization of funds. The success of the business depends on effective use of the funds.

With this, management of the company can take suitable decisions which can assist in gaining

competitive edge. The financial information taken into account by Sainsbury for the purpose of

making strategic decision has been enumerated below: Income statement: Income statement of the Sainsbury consists of information regarding

the income and expenses of the organization. The expenditure of the business involves

offices expenses, commission paid, salary and wages as well as advertising expenses

(Drury, 2009). In contrast to this, income is earned through interest and commission

received. With this, firm can take strategic decisions by reflecting on the areas in which

the firm needs to control its expenditures. It offers greater benefit to the company by

increasing profit. Cash flow statement: It offers information regarding cash inflow and outflow within the

firm. With this, firm can make investment and financial decision which are profitable for

the business (Minnis and Sutherland, 2014). It reflects the cash position of the

organization that assist the business in development of competent strategies for growth of

organization.

Balance sheet: This reflects the financial health of the business. It demonstrates the

obligation that firm is required to bear within the accounting year. Apart from this, it also

provides ideas regarding liquidity and soundness of business performance.

ACTIVITY 2

1. Explanation of the purpose, structure and content of published accounts

The accounts are published for particular purpose that plays significant role in assisting

business to gain an insight to the financial status of the company. The main purpose of which

Sainsbury publishes its financial statements is to offer information with respect to financial

health as well as performance of the organization. With the assistance of this, it is able to get

faith and trust of the several stakeholders that includes customers, shareholders, government and

suppliers. In addition to this, financial statements provide greater help in attracting the potential

base of customers to a greater extent (Bull, 2007). Apart from this, its major purpose is to

enhance the image of the brand and publish the business information in an accurate manner.

6

With this, management of the company can take suitable decisions which can assist in gaining

competitive edge. The financial information taken into account by Sainsbury for the purpose of

making strategic decision has been enumerated below: Income statement: Income statement of the Sainsbury consists of information regarding

the income and expenses of the organization. The expenditure of the business involves

offices expenses, commission paid, salary and wages as well as advertising expenses

(Drury, 2009). In contrast to this, income is earned through interest and commission

received. With this, firm can take strategic decisions by reflecting on the areas in which

the firm needs to control its expenditures. It offers greater benefit to the company by

increasing profit. Cash flow statement: It offers information regarding cash inflow and outflow within the

firm. With this, firm can make investment and financial decision which are profitable for

the business (Minnis and Sutherland, 2014). It reflects the cash position of the

organization that assist the business in development of competent strategies for growth of

organization.

Balance sheet: This reflects the financial health of the business. It demonstrates the

obligation that firm is required to bear within the accounting year. Apart from this, it also

provides ideas regarding liquidity and soundness of business performance.

ACTIVITY 2

1. Explanation of the purpose, structure and content of published accounts

The accounts are published for particular purpose that plays significant role in assisting

business to gain an insight to the financial status of the company. The main purpose of which

Sainsbury publishes its financial statements is to offer information with respect to financial

health as well as performance of the organization. With the assistance of this, it is able to get

faith and trust of the several stakeholders that includes customers, shareholders, government and

suppliers. In addition to this, financial statements provide greater help in attracting the potential

base of customers to a greater extent (Bull, 2007). Apart from this, its major purpose is to

enhance the image of the brand and publish the business information in an accurate manner.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Firm like Sainsbury includes content in the published accounts which is being

demonstrated on large level. This includes analysis of the income statement, cash flow statement,

segmental reporting, non-recruiting profit and loss as well as balance sheet. Further, it also

includes new and discounted operations of the firm. The structure of the published accounts is

categorized into two. This provides annual report of the firm which starts with overview of

chairman of Sainsbury that states strategies and policies of the organization. Along with this, it

also presents goals and objectives that have been attained by the business (Ville, 2014). Further,

the published accounts of Sainsbury also represents facts and figures with the assistance of pie

chart as they portrait better understanding. Annual report of the company also includes summary

of balance sheet, cash flow as well as income statement which provides better knowledge

regarding liquidity position of the organization.

2. Interpretation of the financial information in these accounts

Annual report of Sainsbury offers useful information to the organization as well as its

shareholders. It acts as an aid for the organization in developing suitable strategies and policies

that result in achievement of pre-defined organizational goals and targets. Apart from this, it also

helps the business in gaining competitive edge. It can be determined that, income statement

provides information in relation to income and expenses of the business. In contrast to this, cash

flow statement of the organization provides sufficient knowledge in relation to liquidity position

of the business (Portz and Lere, 2010). With this, Sainsbury can make essential decision such as

investment and dividend. This in-turn results in increasing the productivity of the firm. The

balance sheet of Sainsbury reflects sound position of the business. Balance sheet includes assets

and liabilities of the company on a particular date. It is effective in offering greater knowledge to

the shareholders, government as well as suppliers regarding carrying out financial operations

within the firm. It has been gained that, financial as well as liquidity position of Sainsbury is

sound thus it is able to attract investors as this would result in increasing the revenue of the

organization to a greater extent.

7

demonstrated on large level. This includes analysis of the income statement, cash flow statement,

segmental reporting, non-recruiting profit and loss as well as balance sheet. Further, it also

includes new and discounted operations of the firm. The structure of the published accounts is

categorized into two. This provides annual report of the firm which starts with overview of

chairman of Sainsbury that states strategies and policies of the organization. Along with this, it

also presents goals and objectives that have been attained by the business (Ville, 2014). Further,

the published accounts of Sainsbury also represents facts and figures with the assistance of pie

chart as they portrait better understanding. Annual report of the company also includes summary

of balance sheet, cash flow as well as income statement which provides better knowledge

regarding liquidity position of the organization.

2. Interpretation of the financial information in these accounts

Annual report of Sainsbury offers useful information to the organization as well as its

shareholders. It acts as an aid for the organization in developing suitable strategies and policies

that result in achievement of pre-defined organizational goals and targets. Apart from this, it also

helps the business in gaining competitive edge. It can be determined that, income statement

provides information in relation to income and expenses of the business. In contrast to this, cash

flow statement of the organization provides sufficient knowledge in relation to liquidity position

of the business (Portz and Lere, 2010). With this, Sainsbury can make essential decision such as

investment and dividend. This in-turn results in increasing the productivity of the firm. The

balance sheet of Sainsbury reflects sound position of the business. Balance sheet includes assets

and liabilities of the company on a particular date. It is effective in offering greater knowledge to

the shareholders, government as well as suppliers regarding carrying out financial operations

within the firm. It has been gained that, financial as well as liquidity position of Sainsbury is

sound thus it is able to attract investors as this would result in increasing the revenue of the

organization to a greater extent.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

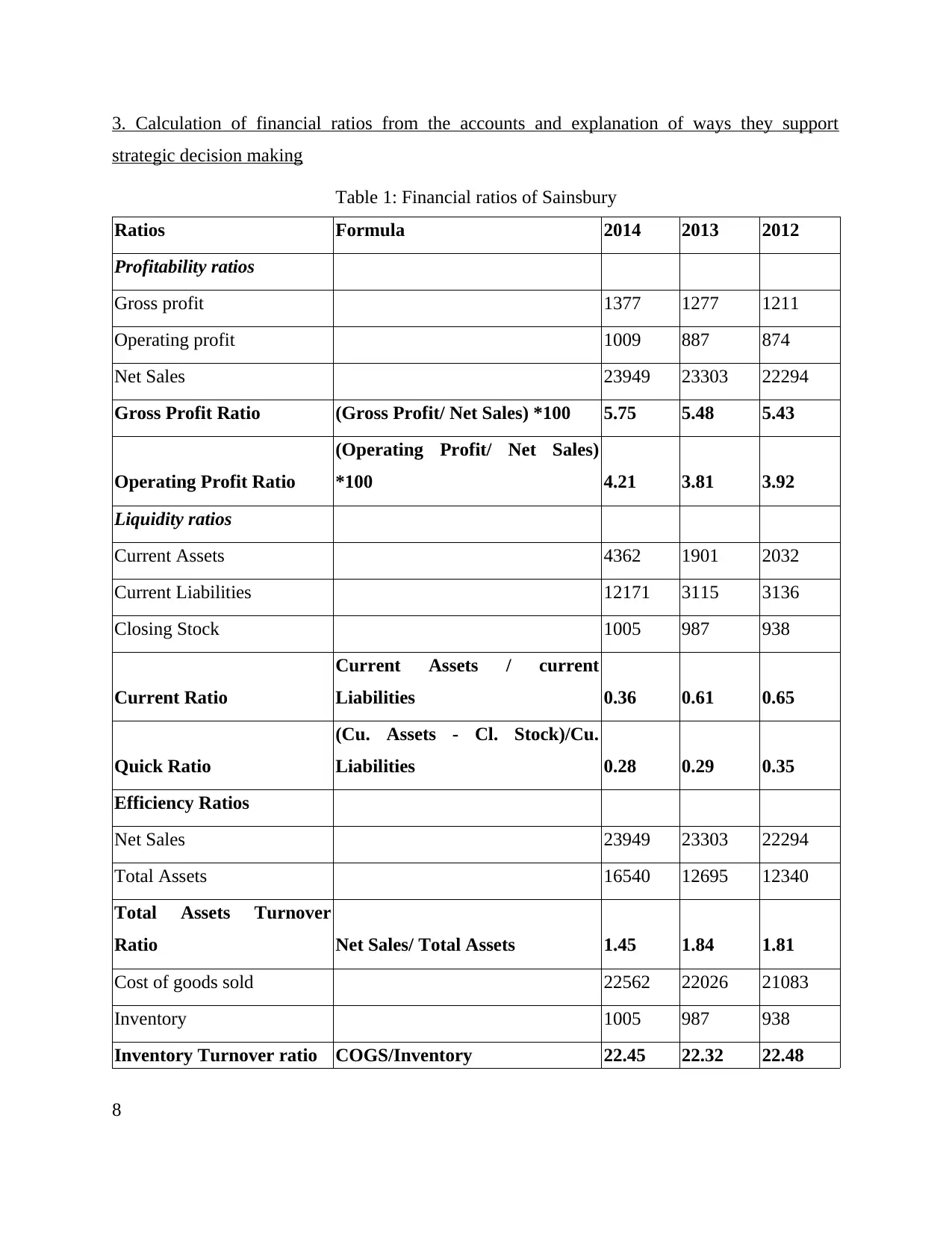

3. Calculation of financial ratios from the accounts and explanation of ways they support

strategic decision making

Table 1: Financial ratios of Sainsbury

Ratios Formula 2014 2013 2012

Profitability ratios

Gross profit 1377 1277 1211

Operating profit 1009 887 874

Net Sales 23949 23303 22294

Gross Profit Ratio (Gross Profit/ Net Sales) *100 5.75 5.48 5.43

Operating Profit Ratio

(Operating Profit/ Net Sales)

*100 4.21 3.81 3.92

Liquidity ratios

Current Assets 4362 1901 2032

Current Liabilities 12171 3115 3136

Closing Stock 1005 987 938

Current Ratio

Current Assets / current

Liabilities 0.36 0.61 0.65

Quick Ratio

(Cu. Assets - Cl. Stock)/Cu.

Liabilities 0.28 0.29 0.35

Efficiency Ratios

Net Sales 23949 23303 22294

Total Assets 16540 12695 12340

Total Assets Turnover

Ratio Net Sales/ Total Assets 1.45 1.84 1.81

Cost of goods sold 22562 22026 21083

Inventory 1005 987 938

Inventory Turnover ratio COGS/Inventory 22.45 22.32 22.48

8

strategic decision making

Table 1: Financial ratios of Sainsbury

Ratios Formula 2014 2013 2012

Profitability ratios

Gross profit 1377 1277 1211

Operating profit 1009 887 874

Net Sales 23949 23303 22294

Gross Profit Ratio (Gross Profit/ Net Sales) *100 5.75 5.48 5.43

Operating Profit Ratio

(Operating Profit/ Net Sales)

*100 4.21 3.81 3.92

Liquidity ratios

Current Assets 4362 1901 2032

Current Liabilities 12171 3115 3136

Closing Stock 1005 987 938

Current Ratio

Current Assets / current

Liabilities 0.36 0.61 0.65

Quick Ratio

(Cu. Assets - Cl. Stock)/Cu.

Liabilities 0.28 0.29 0.35

Efficiency Ratios

Net Sales 23949 23303 22294

Total Assets 16540 12695 12340

Total Assets Turnover

Ratio Net Sales/ Total Assets 1.45 1.84 1.81

Cost of goods sold 22562 22026 21083

Inventory 1005 987 938

Inventory Turnover ratio COGS/Inventory 22.45 22.32 22.48

8

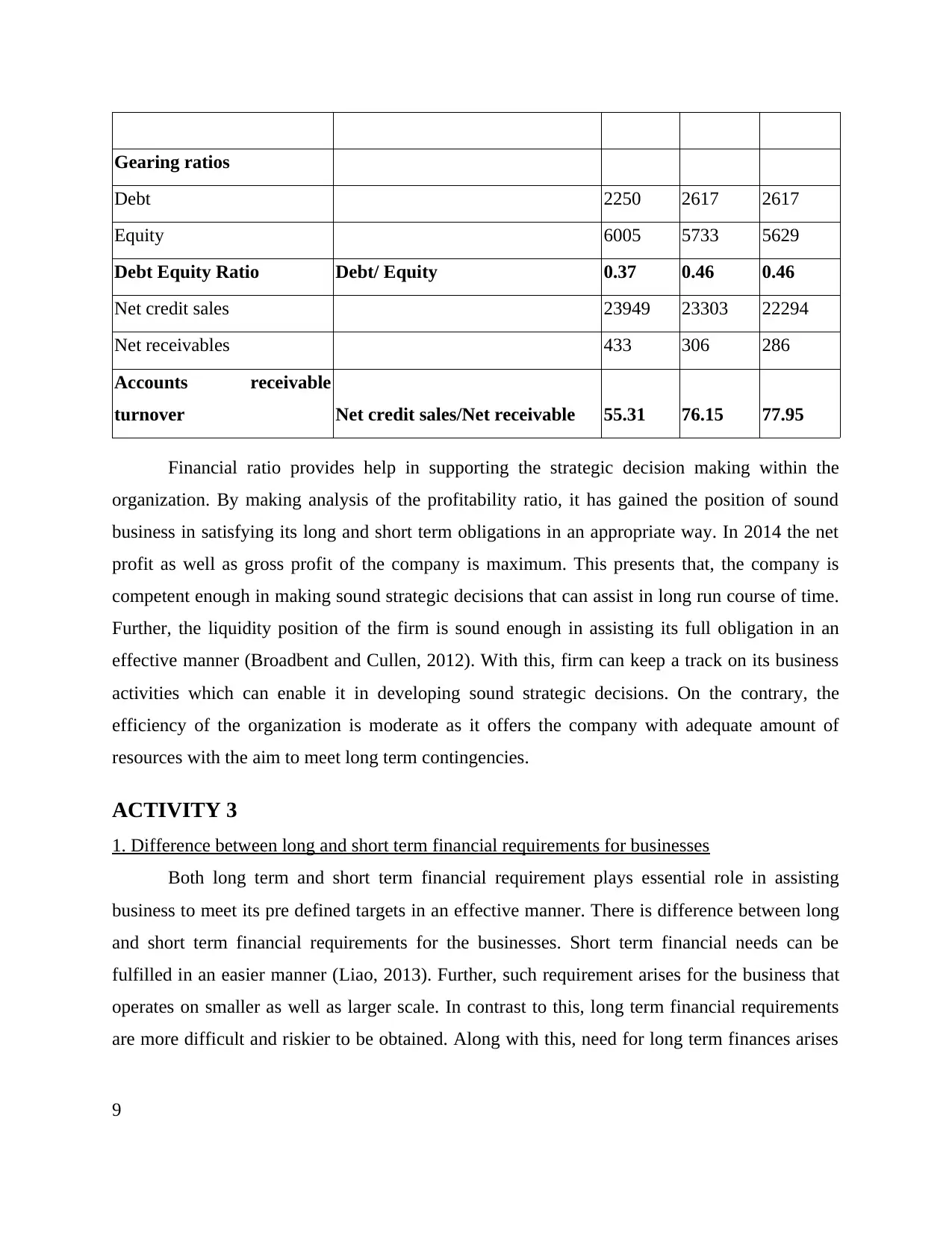

Gearing ratios

Debt 2250 2617 2617

Equity 6005 5733 5629

Debt Equity Ratio Debt/ Equity 0.37 0.46 0.46

Net credit sales 23949 23303 22294

Net receivables 433 306 286

Accounts receivable

turnover Net credit sales/Net receivable 55.31 76.15 77.95

Financial ratio provides help in supporting the strategic decision making within the

organization. By making analysis of the profitability ratio, it has gained the position of sound

business in satisfying its long and short term obligations in an appropriate way. In 2014 the net

profit as well as gross profit of the company is maximum. This presents that, the company is

competent enough in making sound strategic decisions that can assist in long run course of time.

Further, the liquidity position of the firm is sound enough in assisting its full obligation in an

effective manner (Broadbent and Cullen, 2012). With this, firm can keep a track on its business

activities which can enable it in developing sound strategic decisions. On the contrary, the

efficiency of the organization is moderate as it offers the company with adequate amount of

resources with the aim to meet long term contingencies.

ACTIVITY 3

1. Difference between long and short term financial requirements for businesses

Both long term and short term financial requirement plays essential role in assisting

business to meet its pre defined targets in an effective manner. There is difference between long

and short term financial requirements for the businesses. Short term financial needs can be

fulfilled in an easier manner (Liao, 2013). Further, such requirement arises for the business that

operates on smaller as well as larger scale. In contrast to this, long term financial requirements

are more difficult and riskier to be obtained. Along with this, need for long term finances arises

9

Debt 2250 2617 2617

Equity 6005 5733 5629

Debt Equity Ratio Debt/ Equity 0.37 0.46 0.46

Net credit sales 23949 23303 22294

Net receivables 433 306 286

Accounts receivable

turnover Net credit sales/Net receivable 55.31 76.15 77.95

Financial ratio provides help in supporting the strategic decision making within the

organization. By making analysis of the profitability ratio, it has gained the position of sound

business in satisfying its long and short term obligations in an appropriate way. In 2014 the net

profit as well as gross profit of the company is maximum. This presents that, the company is

competent enough in making sound strategic decisions that can assist in long run course of time.

Further, the liquidity position of the firm is sound enough in assisting its full obligation in an

effective manner (Broadbent and Cullen, 2012). With this, firm can keep a track on its business

activities which can enable it in developing sound strategic decisions. On the contrary, the

efficiency of the organization is moderate as it offers the company with adequate amount of

resources with the aim to meet long term contingencies.

ACTIVITY 3

1. Difference between long and short term financial requirements for businesses

Both long term and short term financial requirement plays essential role in assisting

business to meet its pre defined targets in an effective manner. There is difference between long

and short term financial requirements for the businesses. Short term financial needs can be

fulfilled in an easier manner (Liao, 2013). Further, such requirement arises for the business that

operates on smaller as well as larger scale. In contrast to this, long term financial requirements

are more difficult and riskier to be obtained. Along with this, need for long term finances arises

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

among firms which are performing on larger scale and possess strong collateral so as to gain

long term loans.

Another major difference among both the requirements is that short term needs are for

shorter term. Moreover, it is obtained to relief temporary financial requirement. On the other

hand, long term financing is utilized for larger investments which requires huge amount of funds.

For the purpose of expanding the business operations, Sainsbury would have long term financial

requirement (Siano, Kitchen and Confetto, 2010). But for the purpose of meeting needs of the

business short term financial requirement plays crucial role. Long term financial requirements of

the business can be fulfilled through equity issued, corporate bonds as well as capital. On the

contrary, short term needs can be met by asset based loans, letter of credit, commercial papers

and promissory notes etc.

2. Comparison of sources of long and short term finance for businesses

Firm like Sainsbury can take benefit from wide range of short term financial sources.

Financial institutions offer loan for shorter term. Further, the business can also avail the overdraft

facility. In contrast to this, long term financial sources are scarce as it is important for lender to

keep cash reserve to sustain loan. Short term sources provides credit for shorter term that can be

for 12 months or lesser. On the other hand, long term bank loan taken by business includes the

repayment terms of 10 to 20 years. The sources of long term finance include bank loan, issue of

shares and debentures etc. With this, the company can attain its long term targets which ensure

its survival for longer term (Beaver, 2005). Short term sources of finance include bank overdraft,

bank loan, installment credit and trade credit facilities etc. With the assistance of this,

organization can meet its daily requirement. Thus this assists in carrying out business activities

in an effective manner. It has been determined that, both short and long term sources of finance

facilitates firm in meeting their needs for finance. Further, this would help the business in

carrying out its business activities in a smooth manner.

3. Cash flow management techniques and assessing why its management is important

There is existence of several cash flow techniques which can be used by the firm like

Sainsbury in order to manage its cash flow.. It is important for the business to lay emphasis on

cash flow management and not on profits. The inflow and outflow of cash is needed to be

10

long term loans.

Another major difference among both the requirements is that short term needs are for

shorter term. Moreover, it is obtained to relief temporary financial requirement. On the other

hand, long term financing is utilized for larger investments which requires huge amount of funds.

For the purpose of expanding the business operations, Sainsbury would have long term financial

requirement (Siano, Kitchen and Confetto, 2010). But for the purpose of meeting needs of the

business short term financial requirement plays crucial role. Long term financial requirements of

the business can be fulfilled through equity issued, corporate bonds as well as capital. On the

contrary, short term needs can be met by asset based loans, letter of credit, commercial papers

and promissory notes etc.

2. Comparison of sources of long and short term finance for businesses

Firm like Sainsbury can take benefit from wide range of short term financial sources.

Financial institutions offer loan for shorter term. Further, the business can also avail the overdraft

facility. In contrast to this, long term financial sources are scarce as it is important for lender to

keep cash reserve to sustain loan. Short term sources provides credit for shorter term that can be

for 12 months or lesser. On the other hand, long term bank loan taken by business includes the

repayment terms of 10 to 20 years. The sources of long term finance include bank loan, issue of

shares and debentures etc. With this, the company can attain its long term targets which ensure

its survival for longer term (Beaver, 2005). Short term sources of finance include bank overdraft,

bank loan, installment credit and trade credit facilities etc. With the assistance of this,

organization can meet its daily requirement. Thus this assists in carrying out business activities

in an effective manner. It has been determined that, both short and long term sources of finance

facilitates firm in meeting their needs for finance. Further, this would help the business in

carrying out its business activities in a smooth manner.

3. Cash flow management techniques and assessing why its management is important

There is existence of several cash flow techniques which can be used by the firm like

Sainsbury in order to manage its cash flow.. It is important for the business to lay emphasis on

cash flow management and not on profits. The inflow and outflow of cash is needed to be

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

managed in an accurate manner as such this would assist the organization in sustaining within

the market for longer term (Nobes, 2014). Further, in order to manage the cash flow the

organization is required to maintain certain cash reserves. It is essential for the purpose of

meeting shortfalls which can affect the performance of the firm to a greater extent.

It is significant Sainsbury to focus on cash flow management. This is because it assists

the organization in expanding its operations in future course of time. Along with this, the cash

flow management is important as it offers greater flexibility to the firm in responding towards

emerging dilemmas. This assists in ensuring sound decision making which results in achieving

organizational targets. Cash flow management assists the business in improving its promotional

activities that can result in attaining business goals to a significant level.

ACTIVITY 4

1. Analysis of corporate governance, legal and regulatory requirements of different ownership

structure

There is several types’ corporate governance, legal and regulatory requirements for

public as well as private firms. In order to start up new venture private companies needs share

capital of £1. In contrast to this, public limited business requires share capital for £50000 with

the aim to form share capital for starting up new business. In addition to this, public limited is

required to denominate shares of the firm in home currency. But such kind of legal requirement

is not essential is case of private limited organizations (Palepu and Healy, 2007). Apart from this,

in order start up new business it is important for both public and private firms to reflect on the

memorandum and article of association in an effective manner so as to register the business in an

effective manner. Further, in order to start up new firm it is essential for the enterprise to comply

with procedures which have been presented by the government of UK.

2. Evaluating methods of appraising strategic capital or investment projects

Investment appraisal techniques are regarded as the process that can be used to assess

whether or not the investment proposal is worth of being carried out (Cottrell, 2011). The

techniques of capital budgeting includes net present value as well as payback period.

11

the market for longer term (Nobes, 2014). Further, in order to manage the cash flow the

organization is required to maintain certain cash reserves. It is essential for the purpose of

meeting shortfalls which can affect the performance of the firm to a greater extent.

It is significant Sainsbury to focus on cash flow management. This is because it assists

the organization in expanding its operations in future course of time. Along with this, the cash

flow management is important as it offers greater flexibility to the firm in responding towards

emerging dilemmas. This assists in ensuring sound decision making which results in achieving

organizational targets. Cash flow management assists the business in improving its promotional

activities that can result in attaining business goals to a significant level.

ACTIVITY 4

1. Analysis of corporate governance, legal and regulatory requirements of different ownership

structure

There is several types’ corporate governance, legal and regulatory requirements for

public as well as private firms. In order to start up new venture private companies needs share

capital of £1. In contrast to this, public limited business requires share capital for £50000 with

the aim to form share capital for starting up new business. In addition to this, public limited is

required to denominate shares of the firm in home currency. But such kind of legal requirement

is not essential is case of private limited organizations (Palepu and Healy, 2007). Apart from this,

in order start up new business it is important for both public and private firms to reflect on the

memorandum and article of association in an effective manner so as to register the business in an

effective manner. Further, in order to start up new firm it is essential for the enterprise to comply

with procedures which have been presented by the government of UK.

2. Evaluating methods of appraising strategic capital or investment projects

Investment appraisal techniques are regarded as the process that can be used to assess

whether or not the investment proposal is worth of being carried out (Cottrell, 2011). The

techniques of capital budgeting includes net present value as well as payback period.

11

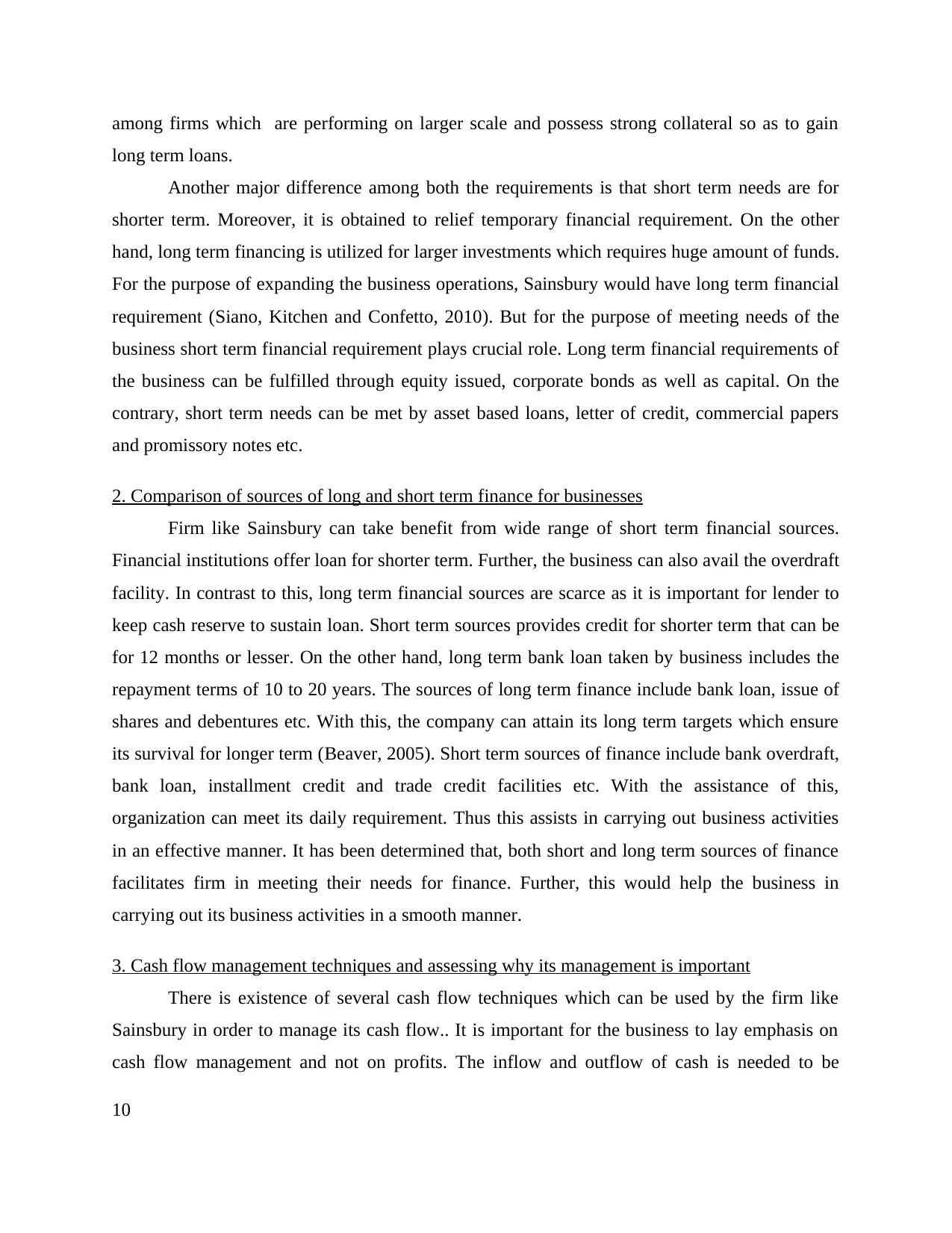

Table 2: Proposal information

Year Proposal A (£) Proposal B (£)

1 17500 23750

2 25000 23750

3 20000 23750

4 32500 23750

Initial investment 50000 50000

Net present value

Table 3: NPV of Project A

Year Cash flow

of A (£)

P.V factor

@ 10%

Present Value

(£)

1 17500 0.909 15907.5

2 25000 0.826 20650

3 20000 0.751 15020

4 32500 0.683 22198

Total present

value (£)

73775.5

Initial

investment (£)

50000

Net present value

(£)

23775.5

Table 4: NPV of Project B

Year Cash

flow of A

(£)

P.V factor @

10%

Present

Value (£)

1 23750 0.909 21589

2 23750 0.826 19618

3 23750 0.751 17836

4 23750 0.683 16221

Total present value

(£)

75264

Initial investment (£) 50000

Net present value (£) 25264

Interpretation: It can be interpreted from the calculation carried above that both the project has

positive NPV. After making comparison among the two it can be assessed that, Project B has

higher NPV as compared with Project A. Thus this presents that; it would be beneficial for

Sainsbury to invest in this project. This is because it would yield maximum return to the business

12

Year Proposal A (£) Proposal B (£)

1 17500 23750

2 25000 23750

3 20000 23750

4 32500 23750

Initial investment 50000 50000

Net present value

Table 3: NPV of Project A

Year Cash flow

of A (£)

P.V factor

@ 10%

Present Value

(£)

1 17500 0.909 15907.5

2 25000 0.826 20650

3 20000 0.751 15020

4 32500 0.683 22198

Total present

value (£)

73775.5

Initial

investment (£)

50000

Net present value

(£)

23775.5

Table 4: NPV of Project B

Year Cash

flow of A

(£)

P.V factor @

10%

Present

Value (£)

1 23750 0.909 21589

2 23750 0.826 19618

3 23750 0.751 17836

4 23750 0.683 16221

Total present value

(£)

75264

Initial investment (£) 50000

Net present value (£) 25264

Interpretation: It can be interpreted from the calculation carried above that both the project has

positive NPV. After making comparison among the two it can be assessed that, Project B has

higher NPV as compared with Project A. Thus this presents that; it would be beneficial for

Sainsbury to invest in this project. This is because it would yield maximum return to the business

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.