Finance Report: Evaluating Funds, Costing, and Financial Analysis, XYZ

VerifiedAdded on 2020/09/17

|24

|7452

|240

Report

AI Summary

This finance report examines critical financial aspects relevant to the hospitality industry. It begins by exploring various funding sources available to businesses, differentiating between short-term and long-term capital, and evaluating the contributions of income generation. The report then delves into costing methods, including direct and indirect costs, and calculates gross profit percentages. It also covers methods for controlling cash and stock. Furthermore, the report analyzes budgetary control procedures and variance analysis, followed by an examination of trial balances and account adjustments. Financial ratios are calculated and analyzed to inform future strategies, and the report concludes with a discussion of cost classification, break-even point calculations, and the selection of appropriate financial proposals. The report utilizes examples from XYZ Pvt Ltd to illustrate key concepts.

FINANCE HI

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Funds available from various sources to businesses.............................................................1

1.2 Evaluate various contribution made from income generation..............................................3

TASK 2............................................................................................................................................4

2.1 Key elements of costing, gross profit and selling price........................................................4

2.2 Evaluate various method to control cash and stock..............................................................5

TASK3.............................................................................................................................................6

3.3 Procedure and importance of budgetary control...................................................................6

3.4 Analysis of variances of Yuri................................................................................................8

TASK 4............................................................................................................................................8

3.1 Sources and structure of trail balance...................................................................................8

3.2 Account adjustment of business transactions......................................................................10

4.1 Ratios calculation and its analysis.......................................................................................11

4.2 Findings for making future strategies.................................................................................13

TASK 5..........................................................................................................................................14

5.1 Grouping of Variable, fixed and mixed cost.......................................................................14

5.2 BEP calculation at various units.........................................................................................14

5.3 Selection of appropriate proposal........................................................................................17

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Funds available from various sources to businesses.............................................................1

1.2 Evaluate various contribution made from income generation..............................................3

TASK 2............................................................................................................................................4

2.1 Key elements of costing, gross profit and selling price........................................................4

2.2 Evaluate various method to control cash and stock..............................................................5

TASK3.............................................................................................................................................6

3.3 Procedure and importance of budgetary control...................................................................6

3.4 Analysis of variances of Yuri................................................................................................8

TASK 4............................................................................................................................................8

3.1 Sources and structure of trail balance...................................................................................8

3.2 Account adjustment of business transactions......................................................................10

4.1 Ratios calculation and its analysis.......................................................................................11

4.2 Findings for making future strategies.................................................................................13

TASK 5..........................................................................................................................................14

5.1 Grouping of Variable, fixed and mixed cost.......................................................................14

5.2 BEP calculation at various units.........................................................................................14

5.3 Selection of appropriate proposal........................................................................................17

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Finance is vital portion which is required to run a new venture or business and make it

operate successfully as without monetary resource it will not be able to do the day to day

transaction (Schuckert, Liu and Law, 2015). In hospitality industries, it covers wide range of

financial assistance to manage the overall resource and services that are delivered by the

company. As there are various financial and non financial transaction that are required to be done

in hospitality industry. For the maintenance of proper flow of cash they are required to be

maintained and recorded in the accounts book.

There are several sources from which company will be capable to secure wealth and for

that it will be required that suitable decisions are taken in this respect. Under this project report,

various task being covered. In first stage of project deals with different sources of fund available

to hospitality industries to managed its financial operations. In order to make decisions it is

needed that accurate financial documents are present.

In middle stages, various costing method are used by company is being highlighted.

And, in the later stages, various used method are evaluated and analysed with the help of

different ratios (Spowart, 2011). By taking support of all the problems and calculation all the

major decision are taken. The hospitality industry is widely categorised in relation to service

sectors which includes several events, additional segments which are associated to the various

section of the tourism industries.

Financial management identified different concepts and techniques that can be used by

hospitality industry in their daily operation of managing financial services. The project

assignment will also be helpful to make various adjustment with regard to ratio's, which can help

in making comparison between company stability in the coming future and its current potions in

the market.

TASK 1

1.1 Funds available from various sources to businesses

Capital is the main aspect that is required to be taken into consideration for successful

operation of any business. It require fund from various sources. Availability of fund to

hospitality sectors is depend upon quality of services provided by then to its customers. There are

mainly two sources from which fund could be made available to industries. short term capital is

1

Finance is vital portion which is required to run a new venture or business and make it

operate successfully as without monetary resource it will not be able to do the day to day

transaction (Schuckert, Liu and Law, 2015). In hospitality industries, it covers wide range of

financial assistance to manage the overall resource and services that are delivered by the

company. As there are various financial and non financial transaction that are required to be done

in hospitality industry. For the maintenance of proper flow of cash they are required to be

maintained and recorded in the accounts book.

There are several sources from which company will be capable to secure wealth and for

that it will be required that suitable decisions are taken in this respect. Under this project report,

various task being covered. In first stage of project deals with different sources of fund available

to hospitality industries to managed its financial operations. In order to make decisions it is

needed that accurate financial documents are present.

In middle stages, various costing method are used by company is being highlighted.

And, in the later stages, various used method are evaluated and analysed with the help of

different ratios (Spowart, 2011). By taking support of all the problems and calculation all the

major decision are taken. The hospitality industry is widely categorised in relation to service

sectors which includes several events, additional segments which are associated to the various

section of the tourism industries.

Financial management identified different concepts and techniques that can be used by

hospitality industry in their daily operation of managing financial services. The project

assignment will also be helpful to make various adjustment with regard to ratio's, which can help

in making comparison between company stability in the coming future and its current potions in

the market.

TASK 1

1.1 Funds available from various sources to businesses

Capital is the main aspect that is required to be taken into consideration for successful

operation of any business. It require fund from various sources. Availability of fund to

hospitality sectors is depend upon quality of services provided by then to its customers. There are

mainly two sources from which fund could be made available to industries. short term capital is

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

required to cover working management of several operations while, long term sources are

required for expansion of business operations. Fund collected from different sources are as

mentioned below:

Owner's capital: They are also said to be owner's equity, which indicate owners stake in

industry (Theodosiou and Katsikea, 2012). It shows how much of company properties are

owned by owner's instead of creditors. They are only associated with the sole traders. It is said

to be an important source of finance because, they are less risky that is shared by owner itself.

Retained earning: It refers to net income which is kept by company that are arises from profit

as a reserved. It is that part of dividend which is not paid to the shareholders. But, used or

reinvested in companies core areas to pay their liabilities. It is mentioned under shareholder's

equity on balance sheet.

Debt financing: It is said to be borrowing capital from external sources or outsiders. It associate

with the interest amount that is to be paid by company during the period. It also incudes

principle amount at the end of accounting year. It occurs when company raised capitals by

selling bonds, bills to single investors.

Equity financing: these are those sources of funds which are used by raising funds by issuing

shares in the market. It is costly, as it involve payment of dividend to the shareholder's from the

Net profit after adjusting all taxes, interest on outstanding debts or other preferred sources. In

return for investment, shareholders obtain ownership interest in hospitality industry.

Leasing: It is written, contract in which an owner of specific property like, building, equipment,

or machinery etc. Grant a other party a right to use for a certain duration under a specified terms

and conditions.

Government grants: It is monetary award given to local or state government to and desirable

term. These are given to promote and enhance business. The funds are allotted only to arts,

educational and other required concern.

Bank loan: It is the most common type of sources of funds as a loan for particular industries. It

help to provide medium and long term finance with fixed rate of interest over loan duration.

Sale of fixed assets: It is a kind of long term internal sources of finance that are used in the

production of its financial gain and it is not expectable to be converted into cash in at least one

year of time (Tsai and et. al., 2010).

2

required for expansion of business operations. Fund collected from different sources are as

mentioned below:

Owner's capital: They are also said to be owner's equity, which indicate owners stake in

industry (Theodosiou and Katsikea, 2012). It shows how much of company properties are

owned by owner's instead of creditors. They are only associated with the sole traders. It is said

to be an important source of finance because, they are less risky that is shared by owner itself.

Retained earning: It refers to net income which is kept by company that are arises from profit

as a reserved. It is that part of dividend which is not paid to the shareholders. But, used or

reinvested in companies core areas to pay their liabilities. It is mentioned under shareholder's

equity on balance sheet.

Debt financing: It is said to be borrowing capital from external sources or outsiders. It associate

with the interest amount that is to be paid by company during the period. It also incudes

principle amount at the end of accounting year. It occurs when company raised capitals by

selling bonds, bills to single investors.

Equity financing: these are those sources of funds which are used by raising funds by issuing

shares in the market. It is costly, as it involve payment of dividend to the shareholder's from the

Net profit after adjusting all taxes, interest on outstanding debts or other preferred sources. In

return for investment, shareholders obtain ownership interest in hospitality industry.

Leasing: It is written, contract in which an owner of specific property like, building, equipment,

or machinery etc. Grant a other party a right to use for a certain duration under a specified terms

and conditions.

Government grants: It is monetary award given to local or state government to and desirable

term. These are given to promote and enhance business. The funds are allotted only to arts,

educational and other required concern.

Bank loan: It is the most common type of sources of funds as a loan for particular industries. It

help to provide medium and long term finance with fixed rate of interest over loan duration.

Sale of fixed assets: It is a kind of long term internal sources of finance that are used in the

production of its financial gain and it is not expectable to be converted into cash in at least one

year of time (Tsai and et. al., 2010).

2

1.2 Evaluate various contribution made from income generation

XYZ Pvt Ltd, is tiny business unit which is handled by the sole proprietors. They are

eyeing to buy a building worth of £450,00. but company has two options which can be used by

them to purchased that building. The various sources of finance available to owner is internal and

external (Tse, 2012). Being a manager, of business I would planning to adopt that option which

is most economical and under the budget of company to buy that building. So , I would

preferred to go with internal sources because, it can easily be available with minimum risky.

There are five major internal sources of finance that can be used by the owners to purchased that

building:

Owner's investment which is said to be start up and additional capital which is brought by

the owner into its business.

Retained profit.

Sale of profit.

Sale of fixed assets or properties

Debt collection.

Depending on services and goods of company such as hospitality sectors, most of the profit is

collected from its core activities. So, if goods produce by the company is helpful in generating

funds from marketing of its core operations. From the above mentioned conditions owners have

the option to raised most of capital through financing of its activities through internal sources.

Capital investment appraisal is a situation in which organisation long time investments

are associated in purchasing building and replacement of machinery worth costing through

capitalization composition. Retained profit and income are mainly collected and analysed at

various level. On the basis of internal source it will easy to make appropriate decision for

increasing fund to a particular business concern (Zaitseva, 2013). There are certain advantages of

taking internal sources of finance:

Ease of cash flow problems that are arise from the internal sources of debt financing.

Venture capital are also used to raise large amount of fund and good way for expansion

if, there is perfect idea behind purchasing assets.

By issuing shares it will also help to be the part of owner's capital.

Control of situation are mostly in the hand's of sole traders about investing the fund with

limited assess.

3

XYZ Pvt Ltd, is tiny business unit which is handled by the sole proprietors. They are

eyeing to buy a building worth of £450,00. but company has two options which can be used by

them to purchased that building. The various sources of finance available to owner is internal and

external (Tse, 2012). Being a manager, of business I would planning to adopt that option which

is most economical and under the budget of company to buy that building. So , I would

preferred to go with internal sources because, it can easily be available with minimum risky.

There are five major internal sources of finance that can be used by the owners to purchased that

building:

Owner's investment which is said to be start up and additional capital which is brought by

the owner into its business.

Retained profit.

Sale of profit.

Sale of fixed assets or properties

Debt collection.

Depending on services and goods of company such as hospitality sectors, most of the profit is

collected from its core activities. So, if goods produce by the company is helpful in generating

funds from marketing of its core operations. From the above mentioned conditions owners have

the option to raised most of capital through financing of its activities through internal sources.

Capital investment appraisal is a situation in which organisation long time investments

are associated in purchasing building and replacement of machinery worth costing through

capitalization composition. Retained profit and income are mainly collected and analysed at

various level. On the basis of internal source it will easy to make appropriate decision for

increasing fund to a particular business concern (Zaitseva, 2013). There are certain advantages of

taking internal sources of finance:

Ease of cash flow problems that are arise from the internal sources of debt financing.

Venture capital are also used to raise large amount of fund and good way for expansion

if, there is perfect idea behind purchasing assets.

By issuing shares it will also help to be the part of owner's capital.

Control of situation are mostly in the hand's of sole traders about investing the fund with

limited assess.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

There are various methods with the help of which income will be generated and they are

provided below:

Increase in sales: This is most common method in which the amount of sales which will be made

by the business will be enhanced. By that the overall earnings of the business will be increased

and that will be used for further growth.

Commissions: In business there are various aspects which can be used to earn more income and

one of them is commission in which the extra charge is placed on the services which are

provided.

Sale of unused assets: There are various such assets which are lying idle in the company and are

not being used by them. They shall be sold so that the amount which will be derived can be used

in the business operations.

Controlling cost: In order to generate the income, it is not always necessary to increase the

earning as it can also be achieved by decreasing the amount spend which will affect the profits.

This will be because by reduction in cost, profits will be increased simultaneously.

TASK 2

2.1 Key elements of costing, gross profit and selling price

Hospitality industry could be analysed to follow as its separation of expenses that help

the activities to be in active manner (Sources of Finance, 2017). Hospitality business cost varies

from that of retail sector which is given in below:

Goods cost – It includes manufacturing price which is incurred directly on production

process. For instance unfinished goods, raw material to be converted into final products.

Working class cost – When labour work wages are given to them for the same. It is total

of wages paid to employee's, as well as cost of employee advantages and taxes that are

paid by an employer.

Operational expenses – Those expenses which a business incurred in any activities that

are not directly linked with production process. These include cost which is incurred

directly by entity. Different expenditure like obtaining new machinery, tools etc.

Marketing cost – It is the cost incurred for deducting various factory cost or other

overhead costs. In order to achieved high sales, cost will be obtain. It is mostly depend on

what are the selling method used by the company.

4

provided below:

Increase in sales: This is most common method in which the amount of sales which will be made

by the business will be enhanced. By that the overall earnings of the business will be increased

and that will be used for further growth.

Commissions: In business there are various aspects which can be used to earn more income and

one of them is commission in which the extra charge is placed on the services which are

provided.

Sale of unused assets: There are various such assets which are lying idle in the company and are

not being used by them. They shall be sold so that the amount which will be derived can be used

in the business operations.

Controlling cost: In order to generate the income, it is not always necessary to increase the

earning as it can also be achieved by decreasing the amount spend which will affect the profits.

This will be because by reduction in cost, profits will be increased simultaneously.

TASK 2

2.1 Key elements of costing, gross profit and selling price

Hospitality industry could be analysed to follow as its separation of expenses that help

the activities to be in active manner (Sources of Finance, 2017). Hospitality business cost varies

from that of retail sector which is given in below:

Goods cost – It includes manufacturing price which is incurred directly on production

process. For instance unfinished goods, raw material to be converted into final products.

Working class cost – When labour work wages are given to them for the same. It is total

of wages paid to employee's, as well as cost of employee advantages and taxes that are

paid by an employer.

Operational expenses – Those expenses which a business incurred in any activities that

are not directly linked with production process. These include cost which is incurred

directly by entity. Different expenditure like obtaining new machinery, tools etc.

Marketing cost – It is the cost incurred for deducting various factory cost or other

overhead costs. In order to achieved high sales, cost will be obtain. It is mostly depend on

what are the selling method used by the company.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Direct cost - All those cost which are directly linked in manufacturing process as they are

increase or decrease the profitability of company. such as repair and maintenance etc.

from the above mentioned cost element that are divided into several department that are

associated with direct,indirect and fixed cost.

The cost which will be incurred will be including following:

Direct material cost: This is that cost which will be incurred in acquiring the material which will

be used in the business in direct manner which means that goods and services cannot be provided

without them.

Indirect material cost: the cost of the material which will be used to provide the additional or

complementary services will be included in this. It will be related to the product but in indirect

manner.

Direct labour: The amount which will be spend on the staff who will be involved in the provision

of the services by which the products will be made or services will be provided and by which

profits will be affected directly will be covered under this.

Direct overheads: The expenses other then material and labour which will be incurred in the

process of production of the product will be the ones that will be included in this.

Gross profit percentages: It is the accounting measured used to assess a company

financial business possibility by revealing the ratio of fund left over from revenues after

adjusting COGS(cost of good sold). It is also said to be gross margin. It is useful indicator for

increasing business effectiveness. The percentage of ratio is expressed in absolute terms.

GPP(Gross profit percentage) = Gross profit *100

Total sales

“Note: Gross profit: Total revenue- COGS”

Cost of good sold are direct costs those are related to the manufacturing of the product

sold by a company. The cost include material used in formulating goods along with direct labour

cost used to make the products.

Selling Price: It refers to price for which it is sold. The difference between selling cost is

known as spread.

Selling price + COGS + Mark up (GP)

Net gain is calculated from gross profit after deducting all overhead, such as rent, salaries

and taxes and it combines the current amount received. Firstly, buying and selling of product at

5

increase or decrease the profitability of company. such as repair and maintenance etc.

from the above mentioned cost element that are divided into several department that are

associated with direct,indirect and fixed cost.

The cost which will be incurred will be including following:

Direct material cost: This is that cost which will be incurred in acquiring the material which will

be used in the business in direct manner which means that goods and services cannot be provided

without them.

Indirect material cost: the cost of the material which will be used to provide the additional or

complementary services will be included in this. It will be related to the product but in indirect

manner.

Direct labour: The amount which will be spend on the staff who will be involved in the provision

of the services by which the products will be made or services will be provided and by which

profits will be affected directly will be covered under this.

Direct overheads: The expenses other then material and labour which will be incurred in the

process of production of the product will be the ones that will be included in this.

Gross profit percentages: It is the accounting measured used to assess a company

financial business possibility by revealing the ratio of fund left over from revenues after

adjusting COGS(cost of good sold). It is also said to be gross margin. It is useful indicator for

increasing business effectiveness. The percentage of ratio is expressed in absolute terms.

GPP(Gross profit percentage) = Gross profit *100

Total sales

“Note: Gross profit: Total revenue- COGS”

Cost of good sold are direct costs those are related to the manufacturing of the product

sold by a company. The cost include material used in formulating goods along with direct labour

cost used to make the products.

Selling Price: It refers to price for which it is sold. The difference between selling cost is

known as spread.

Selling price + COGS + Mark up (GP)

Net gain is calculated from gross profit after deducting all overhead, such as rent, salaries

and taxes and it combines the current amount received. Firstly, buying and selling of product at

5

account which is prepares to estimate GP, after that profit and loss statement is being prepared to

find out Net Profit.

2.2 Evaluate various method to control cash and stock

These are the major component of the working capital, is the cash is associated with

monetary transactions which includes trade receivables and payables. While, stock are the

company important part that can't be ignored (Variable, fixed and mixed (semi-variable) costs,

2017). But with respect to business and service, there are various level of properties depend upon

nature of industries. Moreover, hospitality industry is dealing with best service should be

delivered to customers.

For this, cash are utilized in effective manner with relation to the suppliers. On the other

ways, a distributor can be completed depend upon cash motivated. As for perfect coordination

and communication it is necessary to assure that there is no ideal cash, which control the excess

of cost investment and gain interest from operations.

Following are the various methods to control cash in the businesses:

Separation of duties: It means dividing the role or responsibilities fro bookkeeping,

deposits, auditing etc. it will protect the misuse of cash in financial transactions. The

responsibility can be shared between two or more people (Altinay, 2015).

Certain amount of packages is to be provide to the guest: By offering fixed amount of

packages can protect cash. These are most easy method which adopted by most of the

company.

Economical payment mode to customers: The customer all want is to make their payment

more easy and economical, as the result they don't want to avoid cheques because, cash is

not received at the same time.

Future forecasting: The most important ways to control cash is by setting up the future

target at regular duration.

Cash discount: whenever, customers make payment they are liable to get discount at their

purchase of goods and services.

Methods of controlling inventories:

Optimising Purchasing process: Under this, inventory is under effective control,

management should adopt purchasing process that align with actual sales background and

demand pattern.

6

find out Net Profit.

2.2 Evaluate various method to control cash and stock

These are the major component of the working capital, is the cash is associated with

monetary transactions which includes trade receivables and payables. While, stock are the

company important part that can't be ignored (Variable, fixed and mixed (semi-variable) costs,

2017). But with respect to business and service, there are various level of properties depend upon

nature of industries. Moreover, hospitality industry is dealing with best service should be

delivered to customers.

For this, cash are utilized in effective manner with relation to the suppliers. On the other

ways, a distributor can be completed depend upon cash motivated. As for perfect coordination

and communication it is necessary to assure that there is no ideal cash, which control the excess

of cost investment and gain interest from operations.

Following are the various methods to control cash in the businesses:

Separation of duties: It means dividing the role or responsibilities fro bookkeeping,

deposits, auditing etc. it will protect the misuse of cash in financial transactions. The

responsibility can be shared between two or more people (Altinay, 2015).

Certain amount of packages is to be provide to the guest: By offering fixed amount of

packages can protect cash. These are most easy method which adopted by most of the

company.

Economical payment mode to customers: The customer all want is to make their payment

more easy and economical, as the result they don't want to avoid cheques because, cash is

not received at the same time.

Future forecasting: The most important ways to control cash is by setting up the future

target at regular duration.

Cash discount: whenever, customers make payment they are liable to get discount at their

purchase of goods and services.

Methods of controlling inventories:

Optimising Purchasing process: Under this, inventory is under effective control,

management should adopt purchasing process that align with actual sales background and

demand pattern.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ABC analysis: As, most of the selecting activities is performed in most smaller areas,

where warehouses layout should be used to overcome time spent at looking for good in

back of the warehouse. Under this stocks are categorised according to their sustainability.

Inventory turnover ratio: It is used to calculate how stocks are turned over in allotted

duration of time. The high will be ratio means shorter the life of stocks and leads to more

sales.

TASK3

3.3 Procedure and importance of budgetary control.

Budgetary control: It refers to how well managers manage budget to guide and control

costs and operations in an particular time duration. In other words, it said to be the process for

managers to fixed financial and action goal with comparing actual result to budgeted results.

Purpose of Budgetary control:

Planning: It is the process of conducting a budget and then commute it to control the

operations of the company ( Paraskevas and Jang, 2015). Before, preparing any kind any

plan all the aspects of management operation has to be analysed properly.

Idea generation: Each and every member of department must know about their role and

how to perform it in effective manner.

Cooperative task: It is a group activity as all the department of their particular areas are

present their views about the capital requirement to finished the tasks.

Controlling and monitoring system: Implementation of proper plan should be made that

would help to manage the overall budget with its observations and comments.

Procedure of Budgetary control:

Expenditure aspects from various department: In the first step of budget control all the

issues are asked from various department (Bar-Tal, 2012).

Revenue estimation based on particular project: In the next stages, total revenues used

revenue in the project activities are estimated and developed.

Evaluation of report: After collecting all the information the management evaluate the

cause of budget dis balance.

Discuss problems with the higher authority: From the evaluation it's time to discussed it

with management how to over come these situation.

7

where warehouses layout should be used to overcome time spent at looking for good in

back of the warehouse. Under this stocks are categorised according to their sustainability.

Inventory turnover ratio: It is used to calculate how stocks are turned over in allotted

duration of time. The high will be ratio means shorter the life of stocks and leads to more

sales.

TASK3

3.3 Procedure and importance of budgetary control.

Budgetary control: It refers to how well managers manage budget to guide and control

costs and operations in an particular time duration. In other words, it said to be the process for

managers to fixed financial and action goal with comparing actual result to budgeted results.

Purpose of Budgetary control:

Planning: It is the process of conducting a budget and then commute it to control the

operations of the company ( Paraskevas and Jang, 2015). Before, preparing any kind any

plan all the aspects of management operation has to be analysed properly.

Idea generation: Each and every member of department must know about their role and

how to perform it in effective manner.

Cooperative task: It is a group activity as all the department of their particular areas are

present their views about the capital requirement to finished the tasks.

Controlling and monitoring system: Implementation of proper plan should be made that

would help to manage the overall budget with its observations and comments.

Procedure of Budgetary control:

Expenditure aspects from various department: In the first step of budget control all the

issues are asked from various department (Bar-Tal, 2012).

Revenue estimation based on particular project: In the next stages, total revenues used

revenue in the project activities are estimated and developed.

Evaluation of report: After collecting all the information the management evaluate the

cause of budget dis balance.

Discuss problems with the higher authority: From the evaluation it's time to discussed it

with management how to over come these situation.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finalized budget: After the complete overlook on the control measure about to control

budget the actual results are finalised.

Provide continuous result: On the basis of the working operational budget regular report

is being prepared.

Conduct final reviews: In the last stage, final review are conducted from various feedback

as from different department.

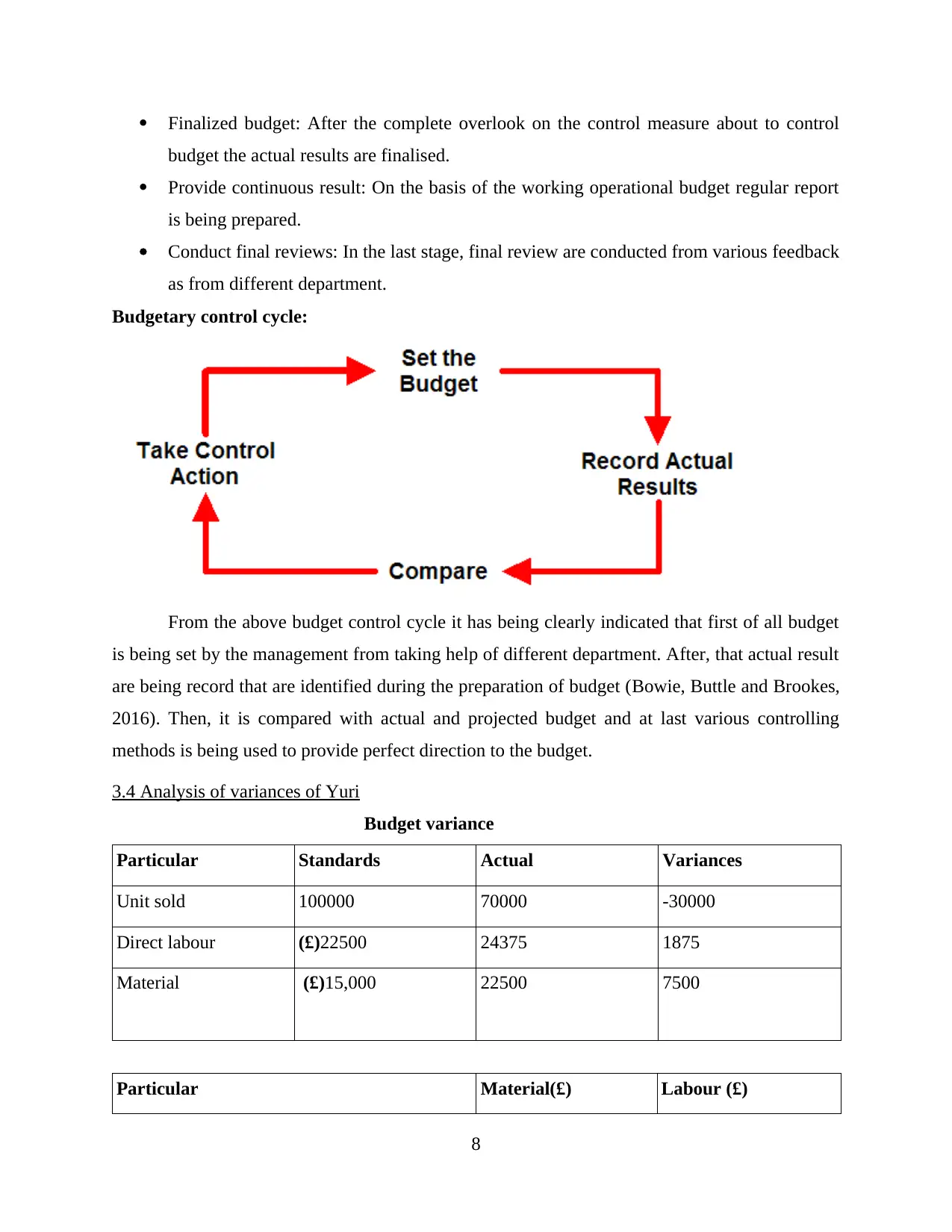

Budgetary control cycle:

From the above budget control cycle it has being clearly indicated that first of all budget

is being set by the management from taking help of different department. After, that actual result

are being record that are identified during the preparation of budget (Bowie, Buttle and Brookes,

2016). Then, it is compared with actual and projected budget and at last various controlling

methods is being used to provide perfect direction to the budget.

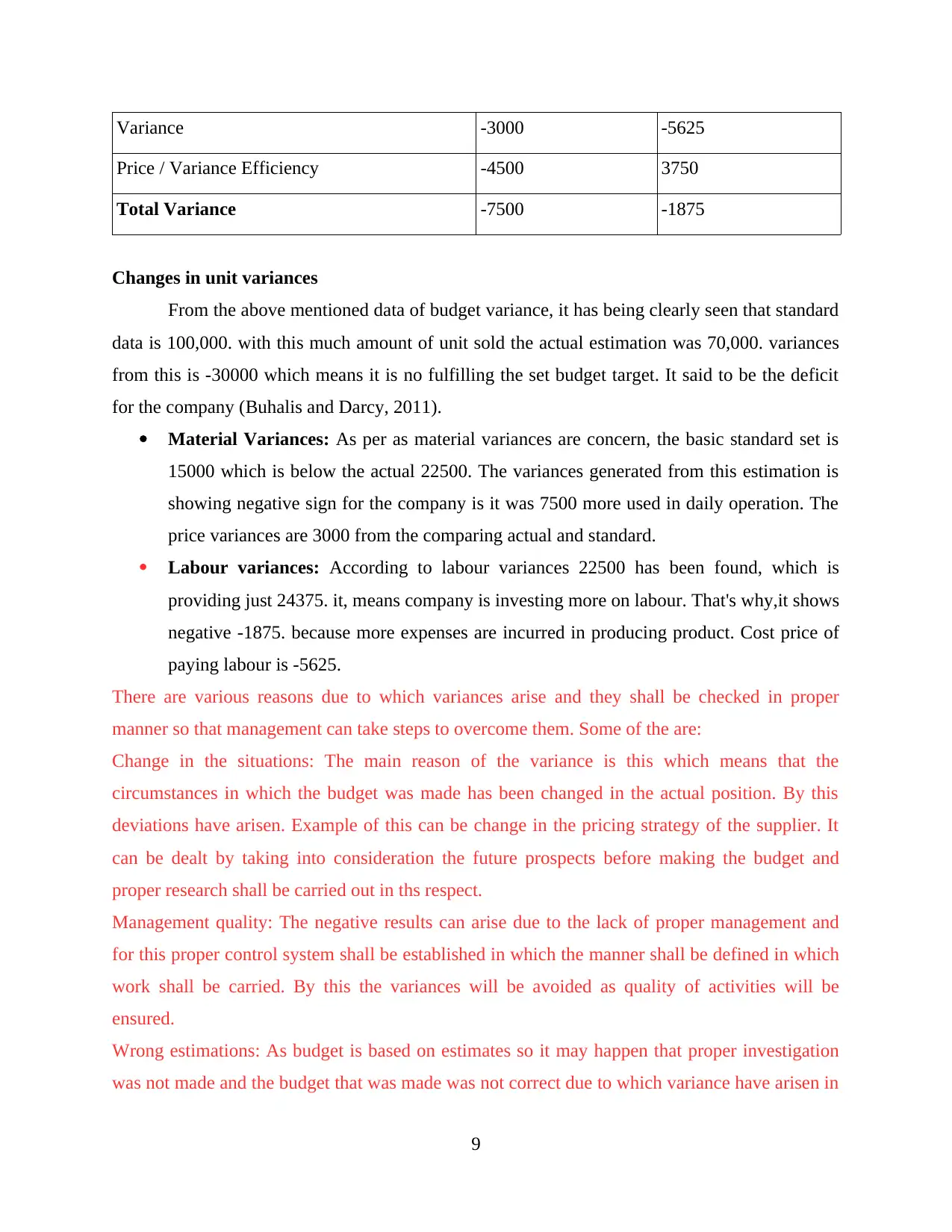

3.4 Analysis of variances of Yuri

Budget variance

Particular Standards Actual Variances

Unit sold 100000 70000 -30000

Direct labour (£)22500 24375 1875

Material (£)15,000 22500 7500

Particular Material(£) Labour (£)

8

budget the actual results are finalised.

Provide continuous result: On the basis of the working operational budget regular report

is being prepared.

Conduct final reviews: In the last stage, final review are conducted from various feedback

as from different department.

Budgetary control cycle:

From the above budget control cycle it has being clearly indicated that first of all budget

is being set by the management from taking help of different department. After, that actual result

are being record that are identified during the preparation of budget (Bowie, Buttle and Brookes,

2016). Then, it is compared with actual and projected budget and at last various controlling

methods is being used to provide perfect direction to the budget.

3.4 Analysis of variances of Yuri

Budget variance

Particular Standards Actual Variances

Unit sold 100000 70000 -30000

Direct labour (£)22500 24375 1875

Material (£)15,000 22500 7500

Particular Material(£) Labour (£)

8

Variance -3000 -5625

Price / Variance Efficiency -4500 3750

Total Variance -7500 -1875

Changes in unit variances

From the above mentioned data of budget variance, it has being clearly seen that standard

data is 100,000. with this much amount of unit sold the actual estimation was 70,000. variances

from this is -30000 which means it is no fulfilling the set budget target. It said to be the deficit

for the company (Buhalis and Darcy, 2011).

Material Variances: As per as material variances are concern, the basic standard set is

15000 which is below the actual 22500. The variances generated from this estimation is

showing negative sign for the company is it was 7500 more used in daily operation. The

price variances are 3000 from the comparing actual and standard.

Labour variances: According to labour variances 22500 has been found, which is

providing just 24375. it, means company is investing more on labour. That's why,it shows

negative -1875. because more expenses are incurred in producing product. Cost price of

paying labour is -5625.

There are various reasons due to which variances arise and they shall be checked in proper

manner so that management can take steps to overcome them. Some of the are:

Change in the situations: The main reason of the variance is this which means that the

circumstances in which the budget was made has been changed in the actual position. By this

deviations have arisen. Example of this can be change in the pricing strategy of the supplier. It

can be dealt by taking into consideration the future prospects before making the budget and

proper research shall be carried out in ths respect.

Management quality: The negative results can arise due to the lack of proper management and

for this proper control system shall be established in which the manner shall be defined in which

work shall be carried. By this the variances will be avoided as quality of activities will be

ensured.

Wrong estimations: As budget is based on estimates so it may happen that proper investigation

was not made and the budget that was made was not correct due to which variance have arisen in

9

Price / Variance Efficiency -4500 3750

Total Variance -7500 -1875

Changes in unit variances

From the above mentioned data of budget variance, it has being clearly seen that standard

data is 100,000. with this much amount of unit sold the actual estimation was 70,000. variances

from this is -30000 which means it is no fulfilling the set budget target. It said to be the deficit

for the company (Buhalis and Darcy, 2011).

Material Variances: As per as material variances are concern, the basic standard set is

15000 which is below the actual 22500. The variances generated from this estimation is

showing negative sign for the company is it was 7500 more used in daily operation. The

price variances are 3000 from the comparing actual and standard.

Labour variances: According to labour variances 22500 has been found, which is

providing just 24375. it, means company is investing more on labour. That's why,it shows

negative -1875. because more expenses are incurred in producing product. Cost price of

paying labour is -5625.

There are various reasons due to which variances arise and they shall be checked in proper

manner so that management can take steps to overcome them. Some of the are:

Change in the situations: The main reason of the variance is this which means that the

circumstances in which the budget was made has been changed in the actual position. By this

deviations have arisen. Example of this can be change in the pricing strategy of the supplier. It

can be dealt by taking into consideration the future prospects before making the budget and

proper research shall be carried out in ths respect.

Management quality: The negative results can arise due to the lack of proper management and

for this proper control system shall be established in which the manner shall be defined in which

work shall be carried. By this the variances will be avoided as quality of activities will be

ensured.

Wrong estimations: As budget is based on estimates so it may happen that proper investigation

was not made and the budget that was made was not correct due to which variance have arisen in

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.