Artic PLC Financial Report: Analysis, Recommendations, and Investment

VerifiedAdded on 2022/11/26

|27

|5619

|207

Report

AI Summary

This report provides a comprehensive financial analysis of Artic PLC, a company manufacturing electronic components. The analysis encompasses five key financial areas: profitability, liquidity, efficiency, investment, and gearing, using ratio analysis to assess performance over four years and compare it to competitors and industry norms. The report evaluates the company's strengths and weaknesses, offering recommendations for improvement in each area. Furthermore, it explores capital project appraisal models, including NPV, IRR, and payback period, to assess potential investment opportunities. The report critically evaluates each model and applies them to specific investment scenarios, considering factors like divisibility and optimal investment policies. It also addresses difficulties in appraising capital investments and suggests ways to overcome them, providing a complete financial overview and strategic guidance for Artic PLC's future.

Running head: FINANCIAL MANAGEMENT

Accounting & Financial Management

Accounting & Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE MANAGEMENT 2

Table of Contents

Ratio analysis..............................................................................................................................................2

Analysis.......................................................................................................................................................3

i) Profitability Ratio.................................................................................................................................4

ii) Liquidity Ratio....................................................................................................................................4

iii) Efficiency Ratio.................................................................................................................................5

iv) Investment Ratio................................................................................................................................5

v) Gearing Ratio......................................................................................................................................6

Conclusion and Suggestion for improvement in ratio..................................................................................6

i) Profitability Ratio.................................................................................................................................6

ii) Liquidity Ratio....................................................................................................................................6

iii) Efficiency Ratio.................................................................................................................................7

iv) Investment Ratio................................................................................................................................7

v) Gearing Ratio......................................................................................................................................8

Three key capital project appraisal models/ techniques...............................................................................8

Evaluate critically each of the three capital evaluation models..................................................................11

NPV.......................................................................................................................................................11

IRR (internal rate of return)...................................................................................................................12

Payback period......................................................................................................................................12

Feasible decision.......................................................................................................................................12

Reason for decision...................................................................................................................................13

Factors should be considered before an investment decision is made........................................................13

Projects D and E are divisible....................................................................................................................14

i) The optimal investment policy...........................................................................................................14

ii) The resulting total NPV from your investment policy.......................................................................14

If projects D and E were indivisible projects.............................................................................................15

Main difficulties encountered in appraising capital investment projects....................................................15

Ways of overcoming the above difficulties...............................................................................................16

References.................................................................................................................................................18

Appendix...................................................................................................................................................22

Ratio analysis............................................................................................................................................22

Table of Contents

Ratio analysis..............................................................................................................................................2

Analysis.......................................................................................................................................................3

i) Profitability Ratio.................................................................................................................................4

ii) Liquidity Ratio....................................................................................................................................4

iii) Efficiency Ratio.................................................................................................................................5

iv) Investment Ratio................................................................................................................................5

v) Gearing Ratio......................................................................................................................................6

Conclusion and Suggestion for improvement in ratio..................................................................................6

i) Profitability Ratio.................................................................................................................................6

ii) Liquidity Ratio....................................................................................................................................6

iii) Efficiency Ratio.................................................................................................................................7

iv) Investment Ratio................................................................................................................................7

v) Gearing Ratio......................................................................................................................................8

Three key capital project appraisal models/ techniques...............................................................................8

Evaluate critically each of the three capital evaluation models..................................................................11

NPV.......................................................................................................................................................11

IRR (internal rate of return)...................................................................................................................12

Payback period......................................................................................................................................12

Feasible decision.......................................................................................................................................12

Reason for decision...................................................................................................................................13

Factors should be considered before an investment decision is made........................................................13

Projects D and E are divisible....................................................................................................................14

i) The optimal investment policy...........................................................................................................14

ii) The resulting total NPV from your investment policy.......................................................................14

If projects D and E were indivisible projects.............................................................................................15

Main difficulties encountered in appraising capital investment projects....................................................15

Ways of overcoming the above difficulties...............................................................................................16

References.................................................................................................................................................18

Appendix...................................................................................................................................................22

Ratio analysis............................................................................................................................................22

FINANCE MANAGEMENT 3

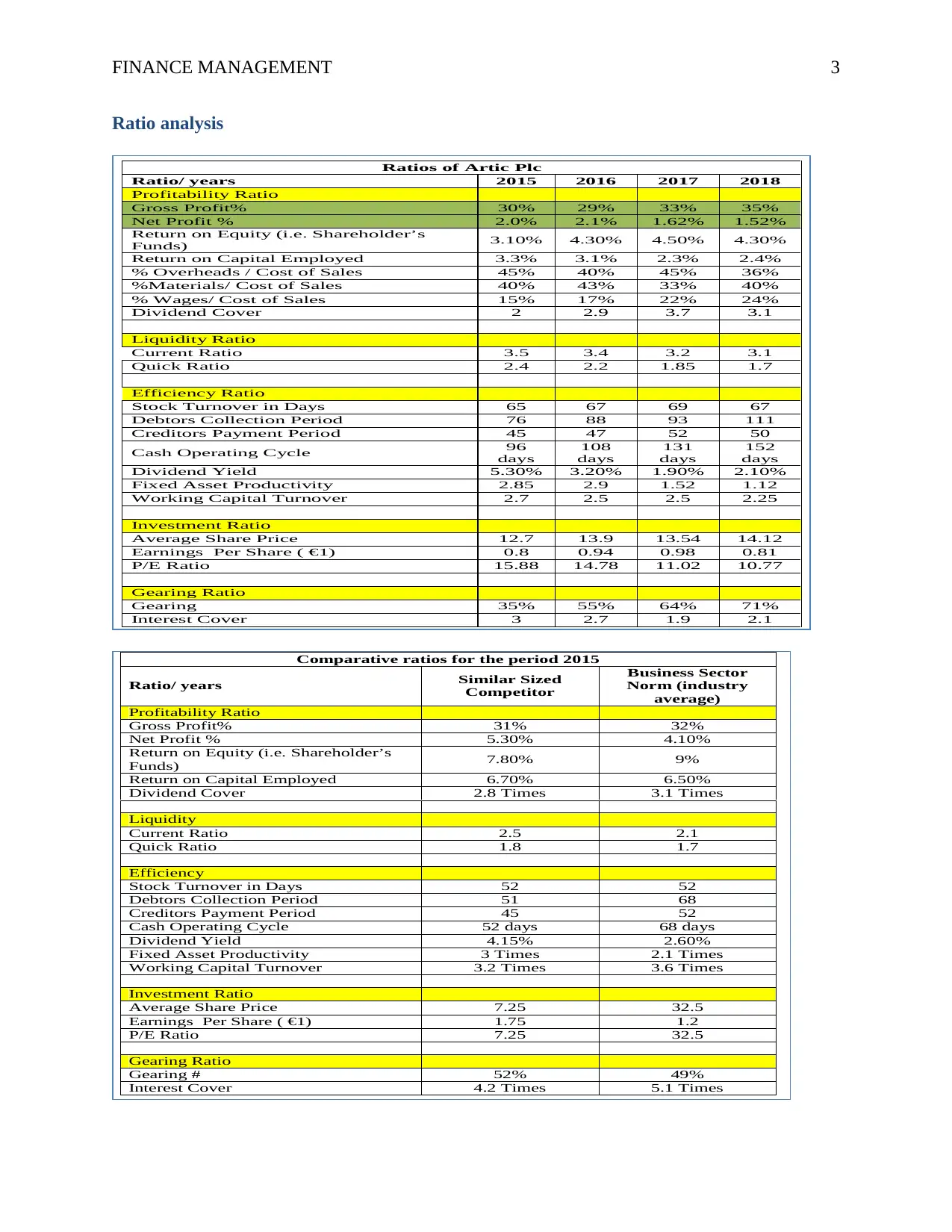

Ratio analysis

Ratios of Artic Plc

Ratio/ years 2015 2016 2017 2018

Profitability Ratio

Gross Profit% 30% 29% 33% 35%

Net Profit % 2.0% 2.1% 1.62% 1.52%

Return on Equity (i.e. Shareholder’s

Funds) 3.10% 4.30% 4.50% 4.30%

Return on Capital Employed 3.3% 3.1% 2.3% 2.4%

% Overheads / Cost of Sales 45% 40% 45% 36%

%Materials/ Cost of Sales 40% 43% 33% 40%

% Wages/ Cost of Sales 15% 17% 22% 24%

Dividend Cover 2 2.9 3.7 3.1

Liquidity Ratio

Current Ratio 3.5 3.4 3.2 3.1

Quick Ratio 2.4 2.2 1.85 1.7

Efficiency Ratio

Stock Turnover in Days 65 67 69 67

Debtors Collection Period 76 88 93 111

Creditors Payment Period 45 47 52 50

Cash Operating Cycle 96

days

108

days

131

days

152

days

Dividend Yield 5.30% 3.20% 1.90% 2.10%

Fixed Asset Productivity 2.85 2.9 1.52 1.12

Working Capital Turnover 2.7 2.5 2.5 2.25

Investment Ratio

Average Share Price 12.7 13.9 13.54 14.12

Earnings Per Share ( €1) 0.8 0.94 0.98 0.81

P/E Ratio 15.88 14.78 11.02 10.77

Gearing Ratio

Gearing 35% 55% 64% 71%

Interest Cover 3 2.7 1.9 2.1

Comparative ratios for the period 2015

Ratio/ years Similar Sized

Competitor

Business Sector

Norm (industry

average)

Profitability Ratio

Gross Profit% 31% 32%

Net Profit % 5.30% 4.10%

Return on Equity (i.e. Shareholder’s

Funds) 7.80% 9%

Return on Capital Employed 6.70% 6.50%

Dividend Cover 2.8 Times 3.1 Times

Liquidity

Current Ratio 2.5 2.1

Quick Ratio 1.8 1.7

Efficiency

Stock Turnover in Days 52 52

Debtors Collection Period 51 68

Creditors Payment Period 45 52

Cash Operating Cycle 52 days 68 days

Dividend Yield 4.15% 2.60%

Fixed Asset Productivity 3 Times 2.1 Times

Working Capital Turnover 3.2 Times 3.6 Times

Investment Ratio

Average Share Price 7.25 32.5

Earnings Per Share ( €1) 1.75 1.2

P/E Ratio 7.25 32.5

Gearing Ratio

Gearing # 52% 49%

Interest Cover 4.2 Times 5.1 Times

Ratio analysis

Ratios of Artic Plc

Ratio/ years 2015 2016 2017 2018

Profitability Ratio

Gross Profit% 30% 29% 33% 35%

Net Profit % 2.0% 2.1% 1.62% 1.52%

Return on Equity (i.e. Shareholder’s

Funds) 3.10% 4.30% 4.50% 4.30%

Return on Capital Employed 3.3% 3.1% 2.3% 2.4%

% Overheads / Cost of Sales 45% 40% 45% 36%

%Materials/ Cost of Sales 40% 43% 33% 40%

% Wages/ Cost of Sales 15% 17% 22% 24%

Dividend Cover 2 2.9 3.7 3.1

Liquidity Ratio

Current Ratio 3.5 3.4 3.2 3.1

Quick Ratio 2.4 2.2 1.85 1.7

Efficiency Ratio

Stock Turnover in Days 65 67 69 67

Debtors Collection Period 76 88 93 111

Creditors Payment Period 45 47 52 50

Cash Operating Cycle 96

days

108

days

131

days

152

days

Dividend Yield 5.30% 3.20% 1.90% 2.10%

Fixed Asset Productivity 2.85 2.9 1.52 1.12

Working Capital Turnover 2.7 2.5 2.5 2.25

Investment Ratio

Average Share Price 12.7 13.9 13.54 14.12

Earnings Per Share ( €1) 0.8 0.94 0.98 0.81

P/E Ratio 15.88 14.78 11.02 10.77

Gearing Ratio

Gearing 35% 55% 64% 71%

Interest Cover 3 2.7 1.9 2.1

Comparative ratios for the period 2015

Ratio/ years Similar Sized

Competitor

Business Sector

Norm (industry

average)

Profitability Ratio

Gross Profit% 31% 32%

Net Profit % 5.30% 4.10%

Return on Equity (i.e. Shareholder’s

Funds) 7.80% 9%

Return on Capital Employed 6.70% 6.50%

Dividend Cover 2.8 Times 3.1 Times

Liquidity

Current Ratio 2.5 2.1

Quick Ratio 1.8 1.7

Efficiency

Stock Turnover in Days 52 52

Debtors Collection Period 51 68

Creditors Payment Period 45 52

Cash Operating Cycle 52 days 68 days

Dividend Yield 4.15% 2.60%

Fixed Asset Productivity 3 Times 2.1 Times

Working Capital Turnover 3.2 Times 3.6 Times

Investment Ratio

Average Share Price 7.25 32.5

Earnings Per Share ( €1) 1.75 1.2

P/E Ratio 7.25 32.5

Gearing Ratio

Gearing # 52% 49%

Interest Cover 4.2 Times 5.1 Times

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE MANAGEMENT 4

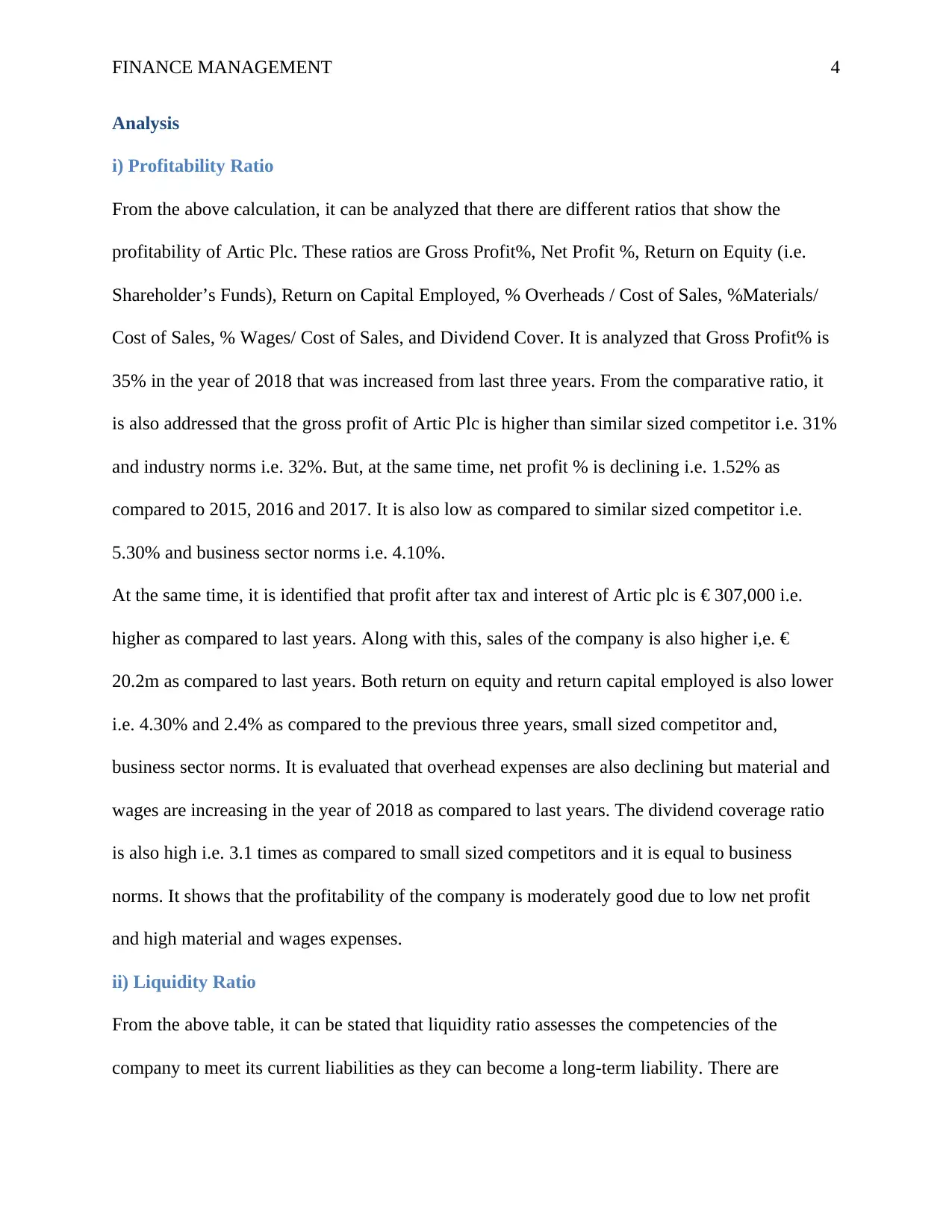

Analysis

i) Profitability Ratio

From the above calculation, it can be analyzed that there are different ratios that show the

profitability of Artic Plc. These ratios are Gross Profit%, Net Profit %, Return on Equity (i.e.

Shareholder’s Funds), Return on Capital Employed, % Overheads / Cost of Sales, %Materials/

Cost of Sales, % Wages/ Cost of Sales, and Dividend Cover. It is analyzed that Gross Profit% is

35% in the year of 2018 that was increased from last three years. From the comparative ratio, it

is also addressed that the gross profit of Artic Plc is higher than similar sized competitor i.e. 31%

and industry norms i.e. 32%. But, at the same time, net profit % is declining i.e. 1.52% as

compared to 2015, 2016 and 2017. It is also low as compared to similar sized competitor i.e.

5.30% and business sector norms i.e. 4.10%.

At the same time, it is identified that profit after tax and interest of Artic plc is € 307,000 i.e.

higher as compared to last years. Along with this, sales of the company is also higher i,e. €

20.2m as compared to last years. Both return on equity and return capital employed is also lower

i.e. 4.30% and 2.4% as compared to the previous three years, small sized competitor and,

business sector norms. It is evaluated that overhead expenses are also declining but material and

wages are increasing in the year of 2018 as compared to last years. The dividend coverage ratio

is also high i.e. 3.1 times as compared to small sized competitors and it is equal to business

norms. It shows that the profitability of the company is moderately good due to low net profit

and high material and wages expenses.

ii) Liquidity Ratio

From the above table, it can be stated that liquidity ratio assesses the competencies of the

company to meet its current liabilities as they can become a long-term liability. There are

Analysis

i) Profitability Ratio

From the above calculation, it can be analyzed that there are different ratios that show the

profitability of Artic Plc. These ratios are Gross Profit%, Net Profit %, Return on Equity (i.e.

Shareholder’s Funds), Return on Capital Employed, % Overheads / Cost of Sales, %Materials/

Cost of Sales, % Wages/ Cost of Sales, and Dividend Cover. It is analyzed that Gross Profit% is

35% in the year of 2018 that was increased from last three years. From the comparative ratio, it

is also addressed that the gross profit of Artic Plc is higher than similar sized competitor i.e. 31%

and industry norms i.e. 32%. But, at the same time, net profit % is declining i.e. 1.52% as

compared to 2015, 2016 and 2017. It is also low as compared to similar sized competitor i.e.

5.30% and business sector norms i.e. 4.10%.

At the same time, it is identified that profit after tax and interest of Artic plc is € 307,000 i.e.

higher as compared to last years. Along with this, sales of the company is also higher i,e. €

20.2m as compared to last years. Both return on equity and return capital employed is also lower

i.e. 4.30% and 2.4% as compared to the previous three years, small sized competitor and,

business sector norms. It is evaluated that overhead expenses are also declining but material and

wages are increasing in the year of 2018 as compared to last years. The dividend coverage ratio

is also high i.e. 3.1 times as compared to small sized competitors and it is equal to business

norms. It shows that the profitability of the company is moderately good due to low net profit

and high material and wages expenses.

ii) Liquidity Ratio

From the above table, it can be stated that liquidity ratio assesses the competencies of the

company to meet its current liabilities as they can become a long-term liability. There are

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE MANAGEMENT 5

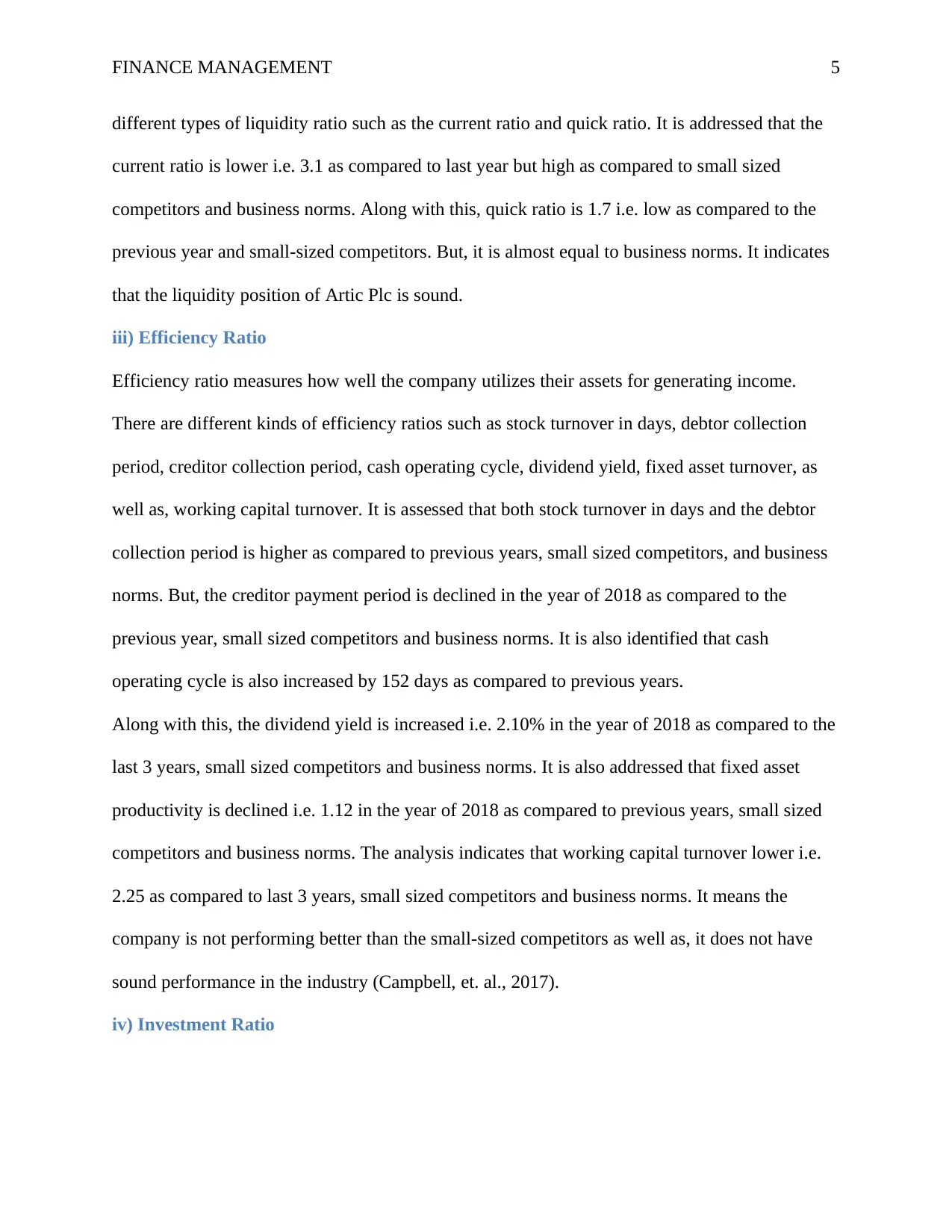

different types of liquidity ratio such as the current ratio and quick ratio. It is addressed that the

current ratio is lower i.e. 3.1 as compared to last year but high as compared to small sized

competitors and business norms. Along with this, quick ratio is 1.7 i.e. low as compared to the

previous year and small-sized competitors. But, it is almost equal to business norms. It indicates

that the liquidity position of Artic Plc is sound.

iii) Efficiency Ratio

Efficiency ratio measures how well the company utilizes their assets for generating income.

There are different kinds of efficiency ratios such as stock turnover in days, debtor collection

period, creditor collection period, cash operating cycle, dividend yield, fixed asset turnover, as

well as, working capital turnover. It is assessed that both stock turnover in days and the debtor

collection period is higher as compared to previous years, small sized competitors, and business

norms. But, the creditor payment period is declined in the year of 2018 as compared to the

previous year, small sized competitors and business norms. It is also identified that cash

operating cycle is also increased by 152 days as compared to previous years.

Along with this, the dividend yield is increased i.e. 2.10% in the year of 2018 as compared to the

last 3 years, small sized competitors and business norms. It is also addressed that fixed asset

productivity is declined i.e. 1.12 in the year of 2018 as compared to previous years, small sized

competitors and business norms. The analysis indicates that working capital turnover lower i.e.

2.25 as compared to last 3 years, small sized competitors and business norms. It means the

company is not performing better than the small-sized competitors as well as, it does not have

sound performance in the industry (Campbell, et. al., 2017).

iv) Investment Ratio

different types of liquidity ratio such as the current ratio and quick ratio. It is addressed that the

current ratio is lower i.e. 3.1 as compared to last year but high as compared to small sized

competitors and business norms. Along with this, quick ratio is 1.7 i.e. low as compared to the

previous year and small-sized competitors. But, it is almost equal to business norms. It indicates

that the liquidity position of Artic Plc is sound.

iii) Efficiency Ratio

Efficiency ratio measures how well the company utilizes their assets for generating income.

There are different kinds of efficiency ratios such as stock turnover in days, debtor collection

period, creditor collection period, cash operating cycle, dividend yield, fixed asset turnover, as

well as, working capital turnover. It is assessed that both stock turnover in days and the debtor

collection period is higher as compared to previous years, small sized competitors, and business

norms. But, the creditor payment period is declined in the year of 2018 as compared to the

previous year, small sized competitors and business norms. It is also identified that cash

operating cycle is also increased by 152 days as compared to previous years.

Along with this, the dividend yield is increased i.e. 2.10% in the year of 2018 as compared to the

last 3 years, small sized competitors and business norms. It is also addressed that fixed asset

productivity is declined i.e. 1.12 in the year of 2018 as compared to previous years, small sized

competitors and business norms. The analysis indicates that working capital turnover lower i.e.

2.25 as compared to last 3 years, small sized competitors and business norms. It means the

company is not performing better than the small-sized competitors as well as, it does not have

sound performance in the industry (Campbell, et. al., 2017).

iv) Investment Ratio

FINANCE MANAGEMENT 6

Investment ratio is used to contrast the stock prices of publicly traded companies with other

financial measures such as dividend rates and earnings. There are different types of ratios such as

average share price, earning per share, and P/E ratio. The average share price is increased by

14.12 in the year of 2018 as compared to previous years. Along with this, it is higher than the

smaller competitor that means the company is not performing well as compared to its

competitors as well as, it has not sound share price within the industry (Herasymovych, 2017).

v) Gearing Ratio

Gearing ratio measures the ability of a company for sustaining the operation indefinitely by

contrasting the debt level with earnings, assets, and equality. There are types of gearing ratio of

Artic plc such as Gearing and interest coverage ratio. Along with this, the gearing ratio is

increased by 71% in the year of 2018. Moreover, the interest coverage ratio is also increased by

2.1times in the year of 2018 as compared to the previous year but low as compared to small sized

competitors and business norms. It means the company is performing well as compared to its

competitors and, within the industry (Rossi, et. al., 2016).

Conclusion and Suggestion for improvement in ratio

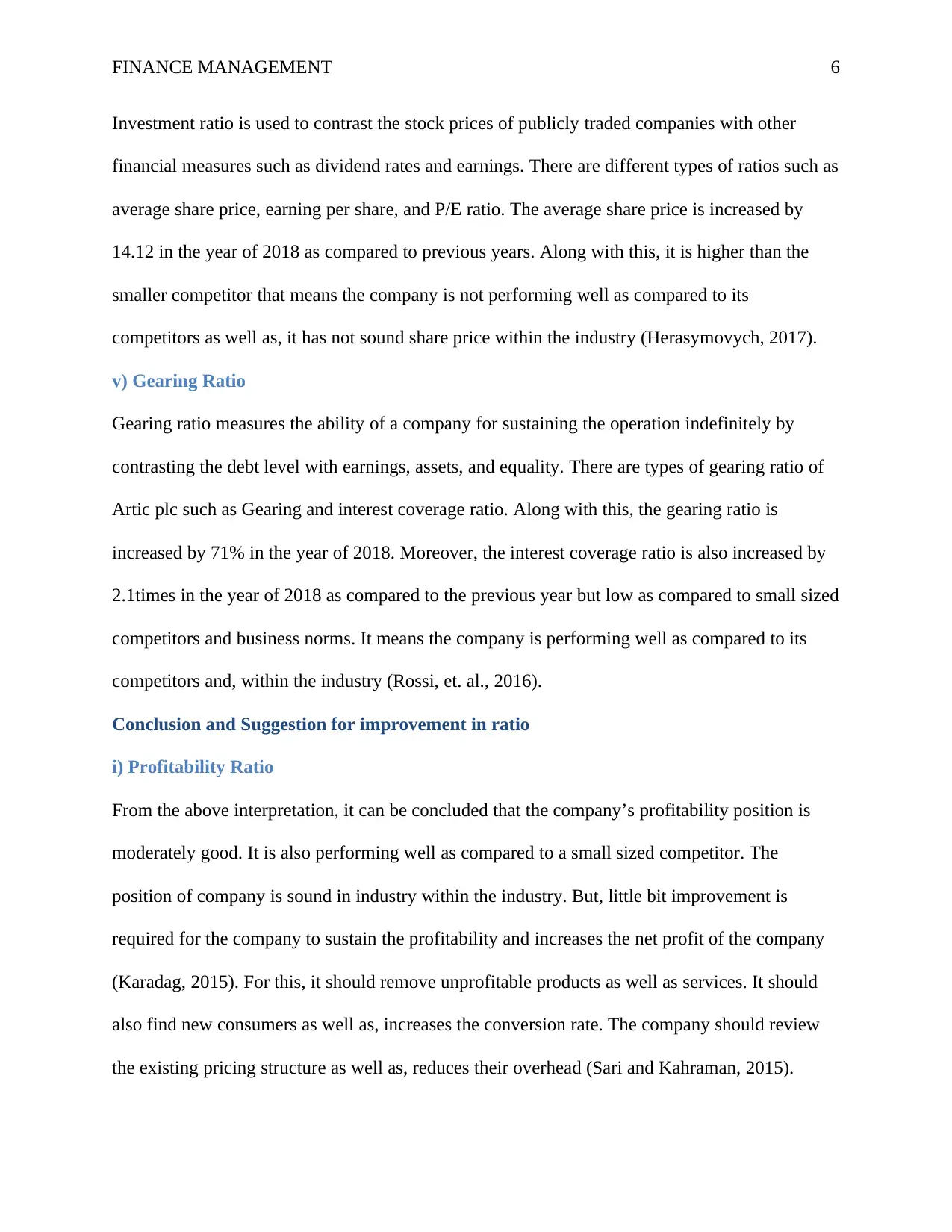

i) Profitability Ratio

From the above interpretation, it can be concluded that the company’s profitability position is

moderately good. It is also performing well as compared to a small sized competitor. The

position of company is sound in industry within the industry. But, little bit improvement is

required for the company to sustain the profitability and increases the net profit of the company

(Karadag, 2015). For this, it should remove unprofitable products as well as services. It should

also find new consumers as well as, increases the conversion rate. The company should review

the existing pricing structure as well as, reduces their overhead (Sari and Kahraman, 2015).

Investment ratio is used to contrast the stock prices of publicly traded companies with other

financial measures such as dividend rates and earnings. There are different types of ratios such as

average share price, earning per share, and P/E ratio. The average share price is increased by

14.12 in the year of 2018 as compared to previous years. Along with this, it is higher than the

smaller competitor that means the company is not performing well as compared to its

competitors as well as, it has not sound share price within the industry (Herasymovych, 2017).

v) Gearing Ratio

Gearing ratio measures the ability of a company for sustaining the operation indefinitely by

contrasting the debt level with earnings, assets, and equality. There are types of gearing ratio of

Artic plc such as Gearing and interest coverage ratio. Along with this, the gearing ratio is

increased by 71% in the year of 2018. Moreover, the interest coverage ratio is also increased by

2.1times in the year of 2018 as compared to the previous year but low as compared to small sized

competitors and business norms. It means the company is performing well as compared to its

competitors and, within the industry (Rossi, et. al., 2016).

Conclusion and Suggestion for improvement in ratio

i) Profitability Ratio

From the above interpretation, it can be concluded that the company’s profitability position is

moderately good. It is also performing well as compared to a small sized competitor. The

position of company is sound in industry within the industry. But, little bit improvement is

required for the company to sustain the profitability and increases the net profit of the company

(Karadag, 2015). For this, it should remove unprofitable products as well as services. It should

also find new consumers as well as, increases the conversion rate. The company should review

the existing pricing structure as well as, reduces their overhead (Sari and Kahraman, 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE MANAGEMENT 7

ii) Liquidity Ratio

From the above interpretation, it can be concluded that Artic Plc has maintained low liquidity

position as it has low liquidity ratio as compared to competitor and industry standard. It also

shows that company is facing struggling to meet their short-term liability. Hence, the company

should emphasize on early invoice submission, controlling the overhead expenses, and switch

from short-term debt to long-term debt (Alkhamis, et. al., 2017).

iii) Efficiency Ratio

As per the above interpretation, it can be concluded that the company is not much efficient to

utilize their assets for generating income. It has longer cash operating cycle period and dividend

yield. Hence, the company should train and develop workforces, keep goals clear as well as,

communicate effectively (Whittington, 2016). The company should also match the task to skills

in order to improve the efficiency of people. It should also incentivize the workforces and cut out

the excess. Thus, it would lead to enhancing the efficiency of the company (Lin, and Pan, 2017).

iv) Investment Ratio

As per the above analysis, it is assessed that company average per share price is not effective as

compared to the earlier time period. It is also not performing well as compared to its key

competitor and also moderately performed well within the industry. From an investor point of

view, company’s position is not sound. Hence, the company should focus on clarifying the

mission of the company. It should also break the mission into particular goals (Renz, 2016). It

should write-down the activity goals day, referral per call, and proposal per months as it could be

controlled by them. The company should also sell to the customer requirements. It should

prospect that the company would sell the product as per the need of customers. The company

ii) Liquidity Ratio

From the above interpretation, it can be concluded that Artic Plc has maintained low liquidity

position as it has low liquidity ratio as compared to competitor and industry standard. It also

shows that company is facing struggling to meet their short-term liability. Hence, the company

should emphasize on early invoice submission, controlling the overhead expenses, and switch

from short-term debt to long-term debt (Alkhamis, et. al., 2017).

iii) Efficiency Ratio

As per the above interpretation, it can be concluded that the company is not much efficient to

utilize their assets for generating income. It has longer cash operating cycle period and dividend

yield. Hence, the company should train and develop workforces, keep goals clear as well as,

communicate effectively (Whittington, 2016). The company should also match the task to skills

in order to improve the efficiency of people. It should also incentivize the workforces and cut out

the excess. Thus, it would lead to enhancing the efficiency of the company (Lin, and Pan, 2017).

iv) Investment Ratio

As per the above analysis, it is assessed that company average per share price is not effective as

compared to the earlier time period. It is also not performing well as compared to its key

competitor and also moderately performed well within the industry. From an investor point of

view, company’s position is not sound. Hence, the company should focus on clarifying the

mission of the company. It should also break the mission into particular goals (Renz, 2016). It

should write-down the activity goals day, referral per call, and proposal per months as it could be

controlled by them. The company should also sell to the customer requirements. It should

prospect that the company would sell the product as per the need of customers. The company

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE MANAGEMENT 8

should create and maintain positive attention by using effective marketing, referrals, and strong

sales competencies (Kaplan, and Atkinson, 2015).

v) Gearing Ratio

As per the above interpretation, it can be concluded that gearing ratio is higher than previous

years, small sized competitors and business norms. It indicates that Artic plc has higher

competency for covering its liabilities over the long-term. But, the company should use effective

strategies for maintaining its solvency (vanHelden, and Uddin, 2016). In this way, the company

should increase owner equity, reorganize its business structure; reinvest money as well as, assets

in the business. Along with this, the company should eliminate to take on new debts until

improvement of solvency ratio (Fourie, et. al., 2015).

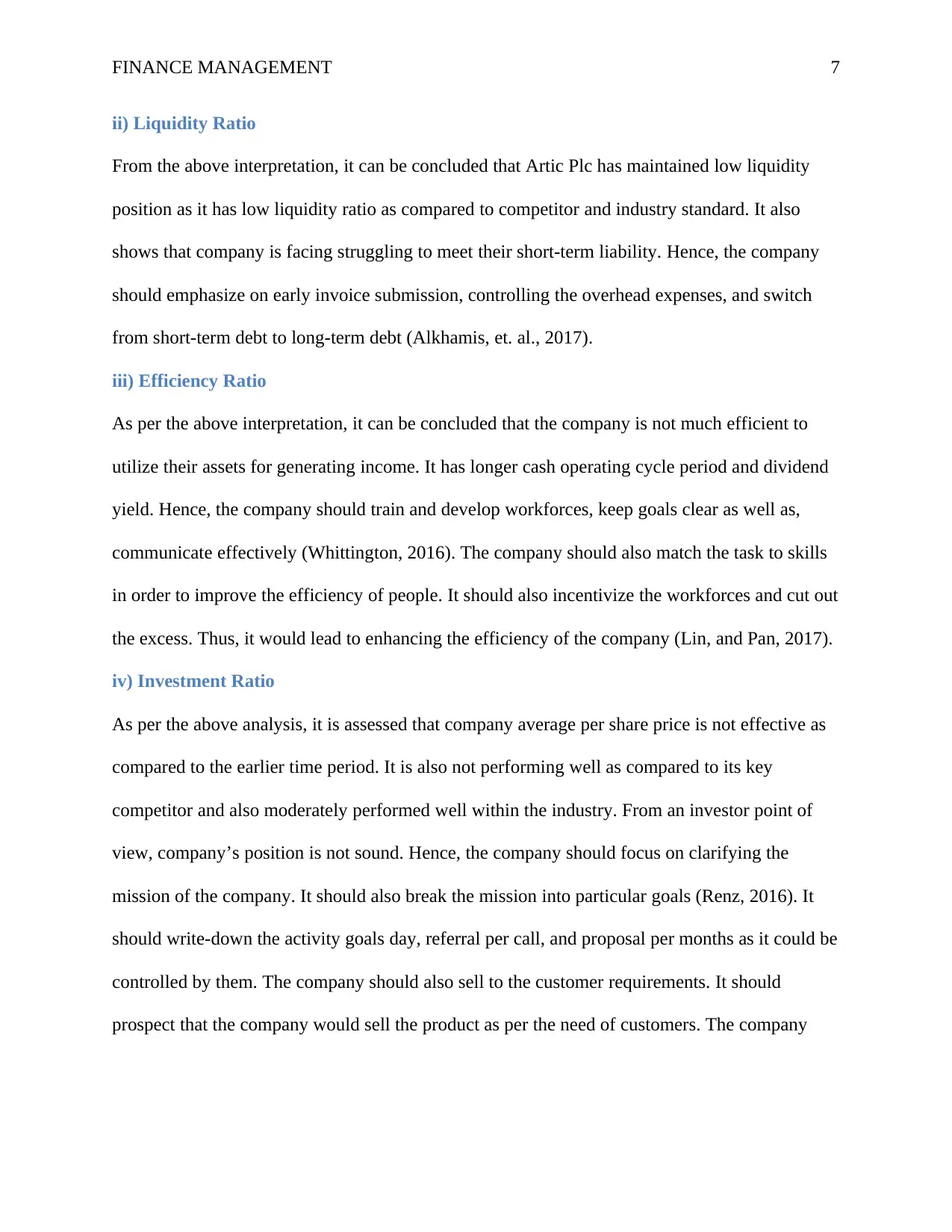

Three key capital project appraisal models/ techniques

Net present value

Project D(€) Rate

@10%

PV of cash

inflow

Initial capital

expenditure -145 1 -145

Net cash flows

Year 1 78 0.909 70.902

Year 2 72 0.826 59.472

Year 3 42 0.753 31.626

Year 4 8 0.683 5.464

Estimated resale

value end of year 4 10 0.683 6.83

NPV 29.294

Net present value

Project

E €)

Rate

@10%

PV of cash

inflow

Initial capital

expenditure -115 1 -115

Net cash flows

Year 1 38 0.909 34.542

Year 2 36 0.826 29.736

Year 3 45 0.753 33.885

Year 4 32 0.683 21.856

Estimated resale

value end of year 4 10 0.683 6.83

NPV 11.849

should create and maintain positive attention by using effective marketing, referrals, and strong

sales competencies (Kaplan, and Atkinson, 2015).

v) Gearing Ratio

As per the above interpretation, it can be concluded that gearing ratio is higher than previous

years, small sized competitors and business norms. It indicates that Artic plc has higher

competency for covering its liabilities over the long-term. But, the company should use effective

strategies for maintaining its solvency (vanHelden, and Uddin, 2016). In this way, the company

should increase owner equity, reorganize its business structure; reinvest money as well as, assets

in the business. Along with this, the company should eliminate to take on new debts until

improvement of solvency ratio (Fourie, et. al., 2015).

Three key capital project appraisal models/ techniques

Net present value

Project D(€) Rate

@10%

PV of cash

inflow

Initial capital

expenditure -145 1 -145

Net cash flows

Year 1 78 0.909 70.902

Year 2 72 0.826 59.472

Year 3 42 0.753 31.626

Year 4 8 0.683 5.464

Estimated resale

value end of year 4 10 0.683 6.83

NPV 29.294

Net present value

Project

E €)

Rate

@10%

PV of cash

inflow

Initial capital

expenditure -115 1 -115

Net cash flows

Year 1 38 0.909 34.542

Year 2 36 0.826 29.736

Year 3 45 0.753 33.885

Year 4 32 0.683 21.856

Estimated resale

value end of year 4 10 0.683 6.83

NPV 11.849

FINANCE MANAGEMENT 9

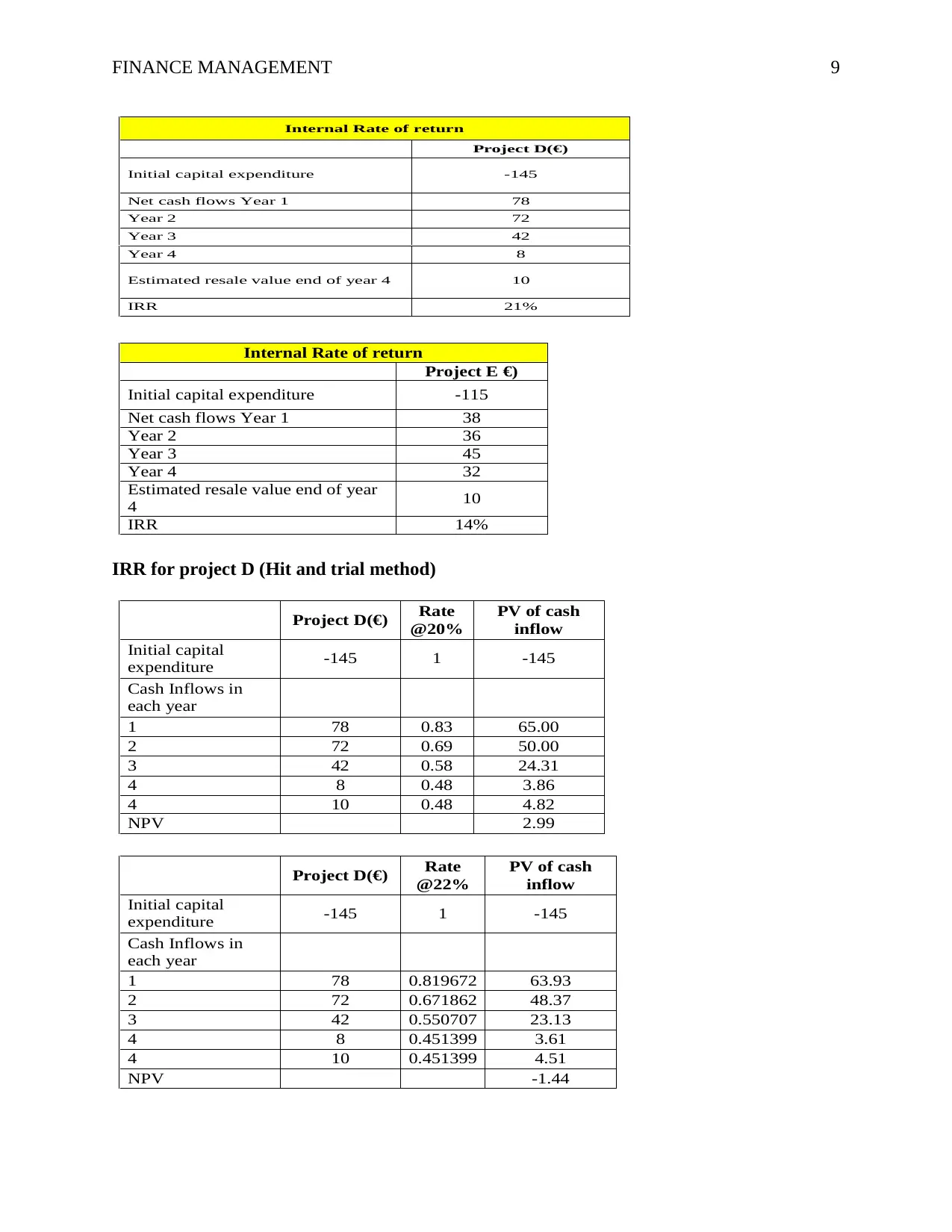

Internal Rate of return

Project D(€)

Initial capital expenditure -145

Net cash flows Year 1 78

Year 2 72

Year 3 42

Year 4 8

Estimated resale value end of year 4 10

IRR 21%

Internal Rate of return

Project E €)

Initial capital expenditure -115

Net cash flows Year 1 38

Year 2 36

Year 3 45

Year 4 32

Estimated resale value end of year

4 10

IRR 14%

IRR for project D (Hit and trial method)

Project D(€) Rate

@20%

PV of cash

inflow

Initial capital

expenditure -145 1 -145

Cash Inflows in

each year

1 78 0.83 65.00

2 72 0.69 50.00

3 42 0.58 24.31

4 8 0.48 3.86

4 10 0.48 4.82

NPV 2.99

Project D(€) Rate

@22%

PV of cash

inflow

Initial capital

expenditure -145 1 -145

Cash Inflows in

each year

1 78 0.819672 63.93

2 72 0.671862 48.37

3 42 0.550707 23.13

4 8 0.451399 3.61

4 10 0.451399 4.51

NPV -1.44

Internal Rate of return

Project D(€)

Initial capital expenditure -145

Net cash flows Year 1 78

Year 2 72

Year 3 42

Year 4 8

Estimated resale value end of year 4 10

IRR 21%

Internal Rate of return

Project E €)

Initial capital expenditure -115

Net cash flows Year 1 38

Year 2 36

Year 3 45

Year 4 32

Estimated resale value end of year

4 10

IRR 14%

IRR for project D (Hit and trial method)

Project D(€) Rate

@20%

PV of cash

inflow

Initial capital

expenditure -145 1 -145

Cash Inflows in

each year

1 78 0.83 65.00

2 72 0.69 50.00

3 42 0.58 24.31

4 8 0.48 3.86

4 10 0.48 4.82

NPV 2.99

Project D(€) Rate

@22%

PV of cash

inflow

Initial capital

expenditure -145 1 -145

Cash Inflows in

each year

1 78 0.819672 63.93

2 72 0.671862 48.37

3 42 0.550707 23.13

4 8 0.451399 3.61

4 10 0.451399 4.51

NPV -1.44

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE MANAGEMENT 10

IRR=ra+ NPVa(rb−ra)

(NPVa−NPVb)

ra = lower discount rate

rb= higher discount rate

NPVa= NPV using the lower discount rate

NPVb= NPV using the higher discount rate

RR=20+ 2.99(22−20)

(2.99−(−1.44)) = 21.35%

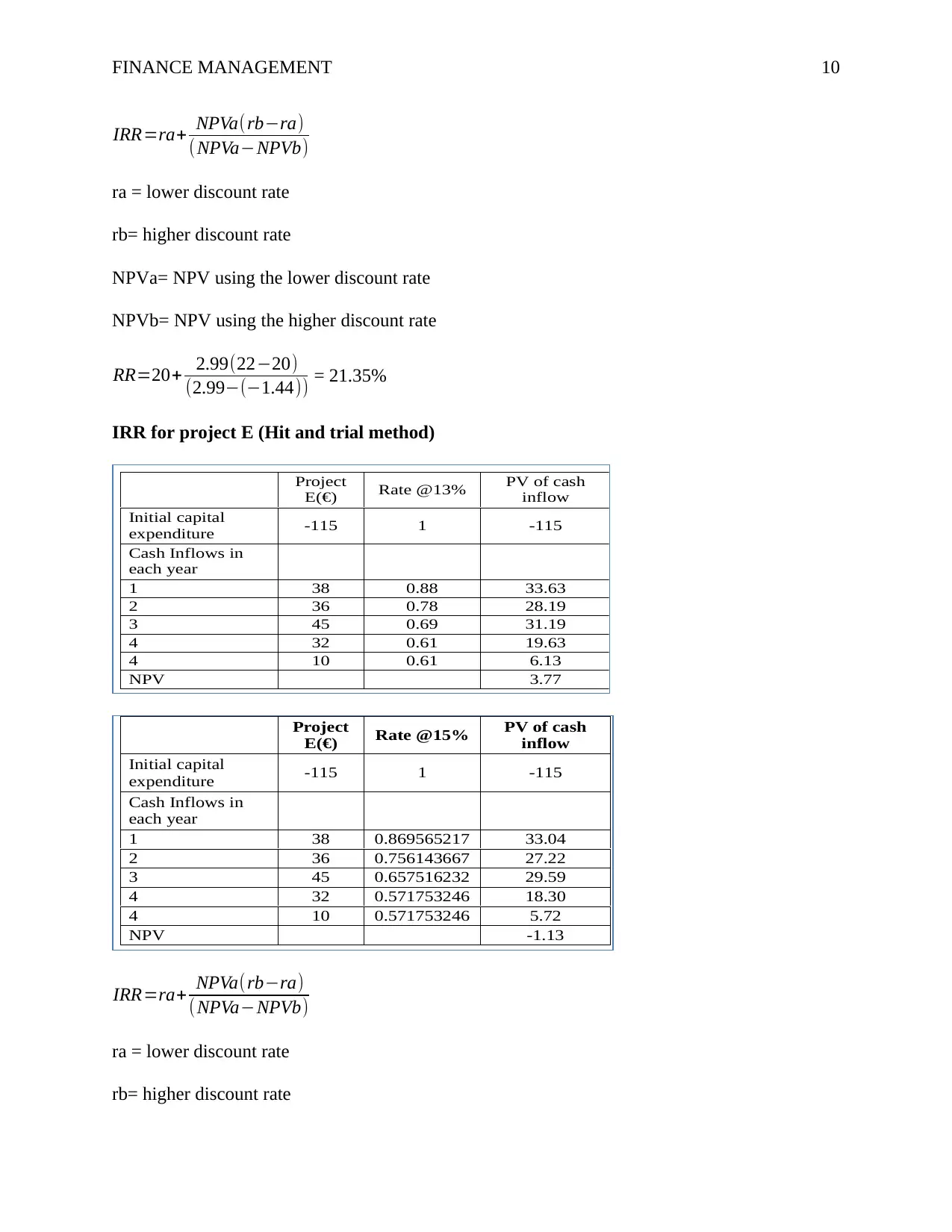

IRR for project E (Hit and trial method)

Project

E(€) Rate @13% PV of cash

inflow

Initial capital

expenditure -115 1 -115

Cash Inflows in

each year

1 38 0.88 33.63

2 36 0.78 28.19

3 45 0.69 31.19

4 32 0.61 19.63

4 10 0.61 6.13

NPV 3.77

Project

E(€) Rate @15% PV of cash

inflow

Initial capital

expenditure -115 1 -115

Cash Inflows in

each year

1 38 0.869565217 33.04

2 36 0.756143667 27.22

3 45 0.657516232 29.59

4 32 0.571753246 18.30

4 10 0.571753246 5.72

NPV -1.13

IRR=ra+ NPVa(rb−ra)

(NPVa−NPVb)

ra = lower discount rate

rb= higher discount rate

IRR=ra+ NPVa(rb−ra)

(NPVa−NPVb)

ra = lower discount rate

rb= higher discount rate

NPVa= NPV using the lower discount rate

NPVb= NPV using the higher discount rate

RR=20+ 2.99(22−20)

(2.99−(−1.44)) = 21.35%

IRR for project E (Hit and trial method)

Project

E(€) Rate @13% PV of cash

inflow

Initial capital

expenditure -115 1 -115

Cash Inflows in

each year

1 38 0.88 33.63

2 36 0.78 28.19

3 45 0.69 31.19

4 32 0.61 19.63

4 10 0.61 6.13

NPV 3.77

Project

E(€) Rate @15% PV of cash

inflow

Initial capital

expenditure -115 1 -115

Cash Inflows in

each year

1 38 0.869565217 33.04

2 36 0.756143667 27.22

3 45 0.657516232 29.59

4 32 0.571753246 18.30

4 10 0.571753246 5.72

NPV -1.13

IRR=ra+ NPVa(rb−ra)

(NPVa−NPVb)

ra = lower discount rate

rb= higher discount rate

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE MANAGEMENT 11

NPVa= NPV using the lower discount rate

NPVb= NPV using the higher discount rate

RR=13+ 3.77(15−13)

(3.77−(−1.13)) = 14.54%

Payback period

Project D(€)

Initial capital expenditure -145 -145

Cash inflows

Year 1 78 -67

Year 2 72 5

Year 3 42 47

Year 4 8 55

Estimated resale value end

of year 4 10 65

Payback period 1.9

Payback period

Project E €)

Initial capital expenditure -115 -115

Cash inflows

Year 1 38 -77

Year 2 36 -41

Year 3 45 4

Year 4 32 36

Estimated resale value end of

year 4 10 46

Payback period 2.9

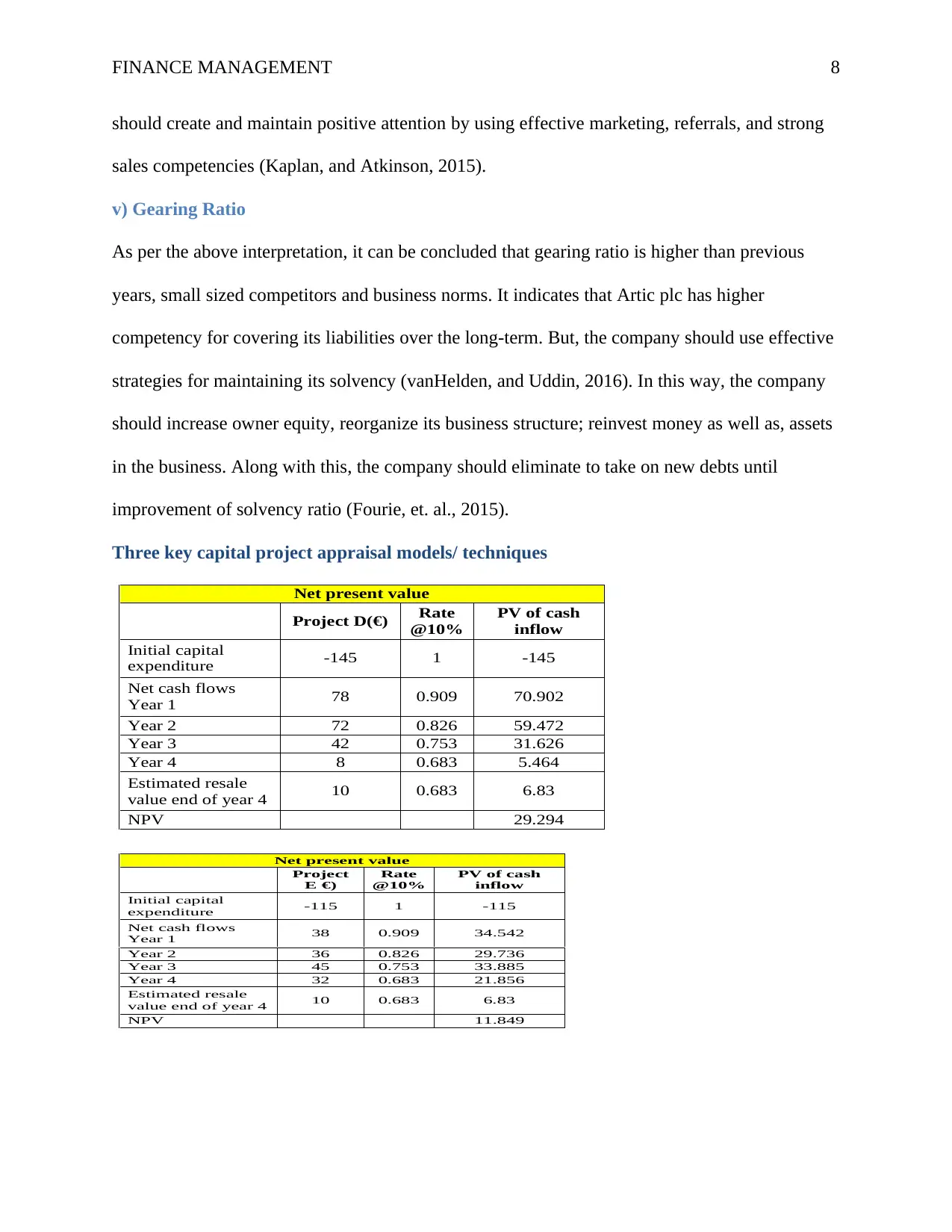

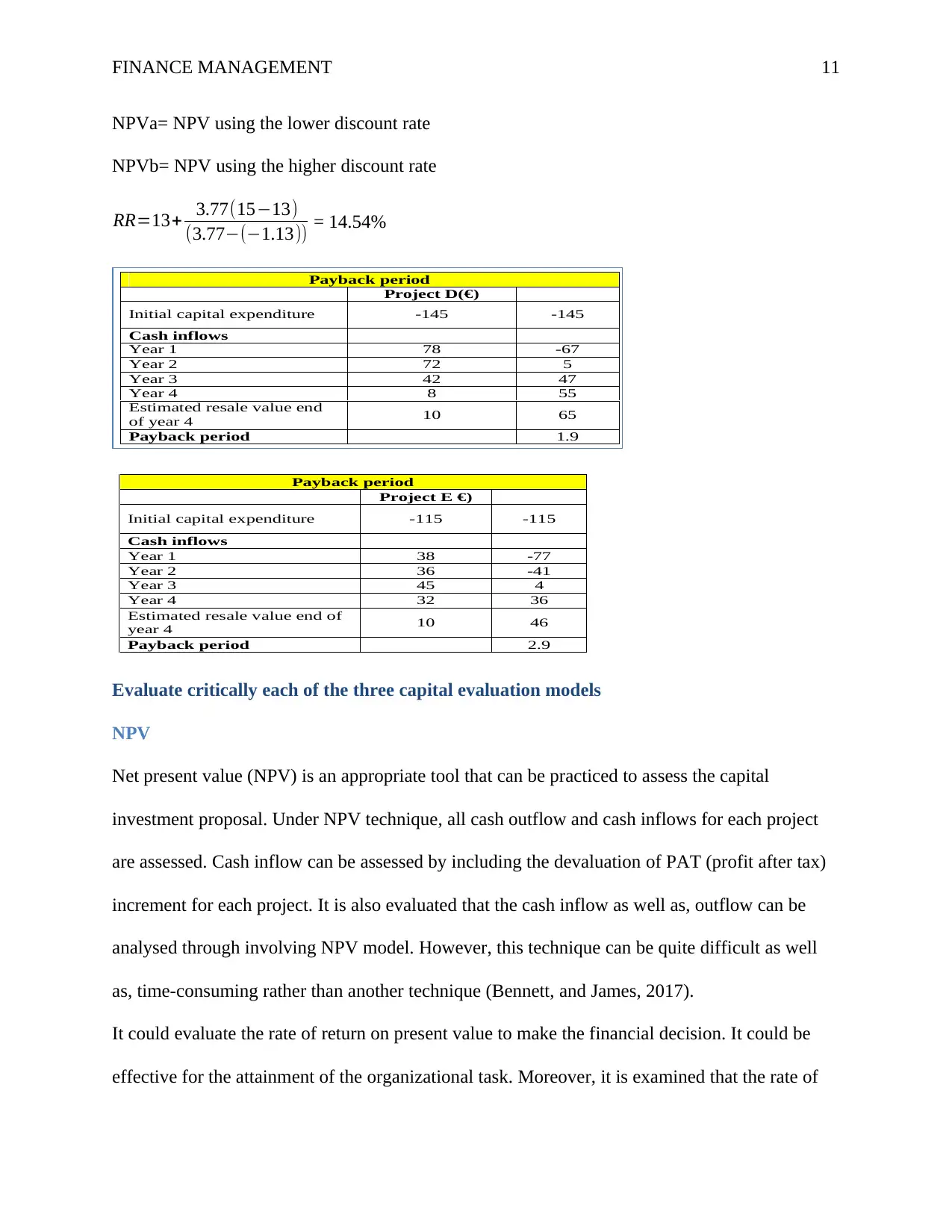

Evaluate critically each of the three capital evaluation models

NPV

Net present value (NPV) is an appropriate tool that can be practiced to assess the capital

investment proposal. Under NPV technique, all cash outflow and cash inflows for each project

are assessed. Cash inflow can be assessed by including the devaluation of PAT (profit after tax)

increment for each project. It is also evaluated that the cash inflow as well as, outflow can be

analysed through involving NPV model. However, this technique can be quite difficult as well

as, time-consuming rather than another technique (Bennett, and James, 2017).

It could evaluate the rate of return on present value to make the financial decision. It could be

effective for the attainment of the organizational task. Moreover, it is examined that the rate of

NPVa= NPV using the lower discount rate

NPVb= NPV using the higher discount rate

RR=13+ 3.77(15−13)

(3.77−(−1.13)) = 14.54%

Payback period

Project D(€)

Initial capital expenditure -145 -145

Cash inflows

Year 1 78 -67

Year 2 72 5

Year 3 42 47

Year 4 8 55

Estimated resale value end

of year 4 10 65

Payback period 1.9

Payback period

Project E €)

Initial capital expenditure -115 -115

Cash inflows

Year 1 38 -77

Year 2 36 -41

Year 3 45 4

Year 4 32 36

Estimated resale value end of

year 4 10 46

Payback period 2.9

Evaluate critically each of the three capital evaluation models

NPV

Net present value (NPV) is an appropriate tool that can be practiced to assess the capital

investment proposal. Under NPV technique, all cash outflow and cash inflows for each project

are assessed. Cash inflow can be assessed by including the devaluation of PAT (profit after tax)

increment for each project. It is also evaluated that the cash inflow as well as, outflow can be

analysed through involving NPV model. However, this technique can be quite difficult as well

as, time-consuming rather than another technique (Bennett, and James, 2017).

It could evaluate the rate of return on present value to make the financial decision. It could be

effective for the attainment of the organizational task. Moreover, it is examined that the rate of

FINANCE MANAGEMENT 12

return could be effective for evaluating the opportunity for the firm by determining the difference

between total of PV of upcoming inflow and outflow of cash (Otley, 2016).

IRR (internal rate of return)

It is defined as rate that connects present value of cash inflows with cash outflows. It is the rate

where, NPV of an investment can be zero. When NPV (net present value) is favorable, a higher

discount rate could be implemented to bring it down in order to match the discount cash inflows

as well as vice versa. Hence, IRR (internal rate of return) is illustrated as break-even financing

rate related to the project (Finkler, Smith, and Calabrese, 2018).

Payback period

This tool determines the time essential by project for recovering, through cash inflows, and

initial cost of company. Company should start the project with shortest payout period hence; it

can assess several projects as per required time for recovering the initial cost. The payback

period for each investment plan compared to maximum period is acceptable to proposals as well

as, management. After that, the project would be ranked as well as, selected of those having

minimum payout time (Lafond, McAleer, and Wentzel, 2016).

Feasible decision

Decision Rule for the Payback Method:

The company would accept project if payback period measured for it is less than higher

determined by management. It would reject project in case of vice-versa situation. At the time of

several projects, projects that have a shorter payback period would be chosen. Furthermore, the

payback period depicts break-even point in which, cash inflows are equal with the cash outflows.

Any inflows that would be beyond this project would be surplus inflows (Zietlow, et. al., 2018).

Decision Rule for IRR:

return could be effective for evaluating the opportunity for the firm by determining the difference

between total of PV of upcoming inflow and outflow of cash (Otley, 2016).

IRR (internal rate of return)

It is defined as rate that connects present value of cash inflows with cash outflows. It is the rate

where, NPV of an investment can be zero. When NPV (net present value) is favorable, a higher

discount rate could be implemented to bring it down in order to match the discount cash inflows

as well as vice versa. Hence, IRR (internal rate of return) is illustrated as break-even financing

rate related to the project (Finkler, Smith, and Calabrese, 2018).

Payback period

This tool determines the time essential by project for recovering, through cash inflows, and

initial cost of company. Company should start the project with shortest payout period hence; it

can assess several projects as per required time for recovering the initial cost. The payback

period for each investment plan compared to maximum period is acceptable to proposals as well

as, management. After that, the project would be ranked as well as, selected of those having

minimum payout time (Lafond, McAleer, and Wentzel, 2016).

Feasible decision

Decision Rule for the Payback Method:

The company would accept project if payback period measured for it is less than higher

determined by management. It would reject project in case of vice-versa situation. At the time of

several projects, projects that have a shorter payback period would be chosen. Furthermore, the

payback period depicts break-even point in which, cash inflows are equal with the cash outflows.

Any inflows that would be beyond this project would be surplus inflows (Zietlow, et. al., 2018).

Decision Rule for IRR:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 27

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.