Financial Analysis and Recommendations for Hattie's Geodes Business

VerifiedAdded on 2022/12/27

|33

|6973

|37

Report

AI Summary

This report presents a comprehensive financial analysis of Hattie's proposed Geodes business venture. It begins with an introduction outlining the need for a detailed financial assessment to determine the viability of the business plan, focusing on future earnings and profitability. The report includes a summary of key assumptions and estimates, such as funding sources, purchase prices, freight costs, and sales projections, with justifications for each. It delves into profit and loss items, break-even analysis for both internet and cabinet sales, monthly and annual cash flow statements, required capital, sensitivity analysis, and discounted cash flow (DCF) calculations. Financial ratio analysis is performed to interpret the financial results and assess the business's performance. The report concludes with recommendations for Hattie based on the financial analysis and incorporates a critical reflection on the overall project, aiming to provide a comprehensive understanding of the business's potential for success.

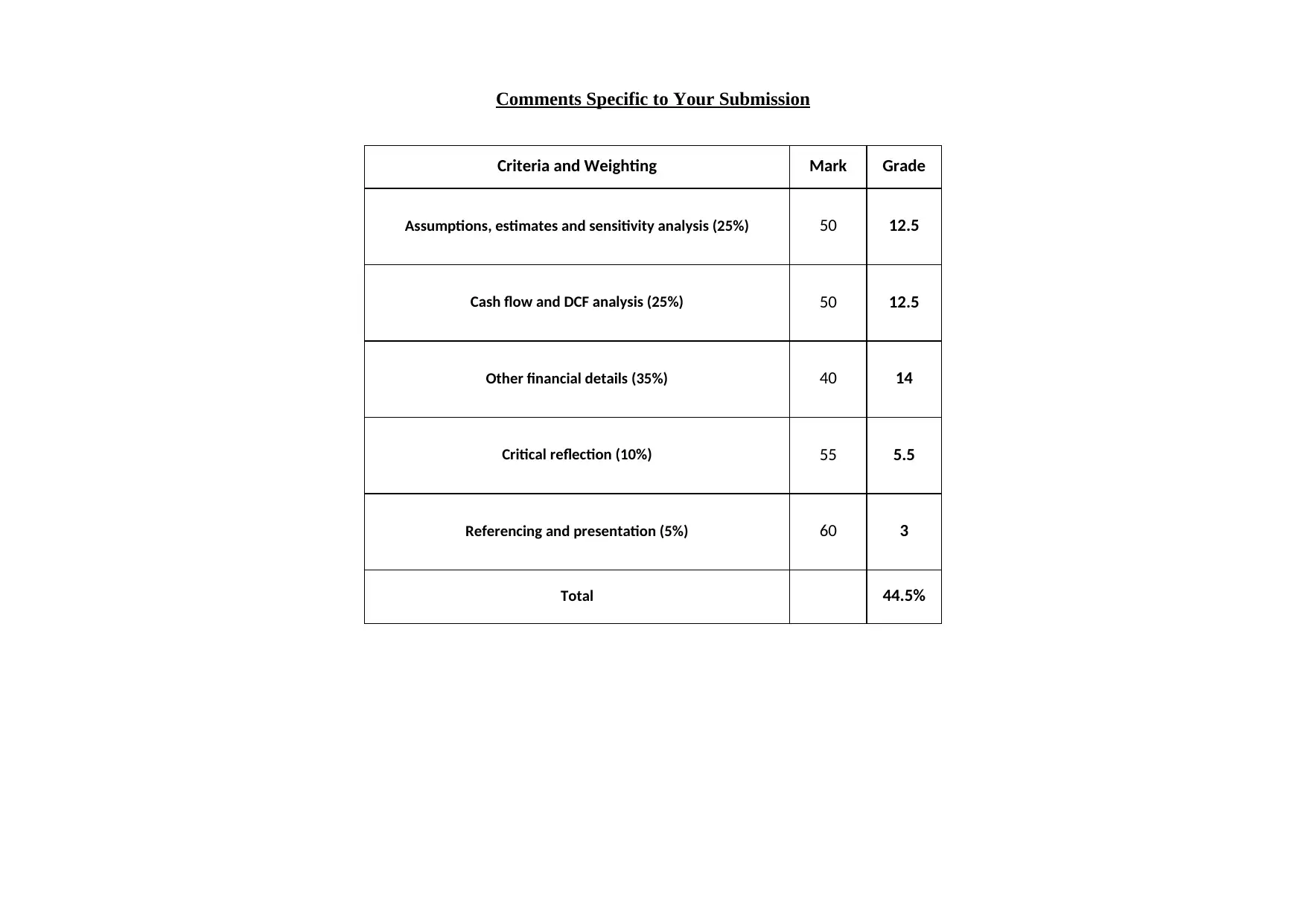

Comments Specific to Your Submission

Criteria and Weighting Mark Grade

Assumptions, estimates and sensitivity analysis (25%) 50 12.5

Cash flow and DCF analysis (25%) 50 12.5

Other financial details (35%) 40 14

Critical reflection (10%) 55 5.5

Referencing and presentation (5%) 60 3

Total 44.5%

Criteria and Weighting Mark Grade

Assumptions, estimates and sensitivity analysis (25%) 50 12.5

Cash flow and DCF analysis (25%) 50 12.5

Other financial details (35%) 40 14

Critical reflection (10%) 55 5.5

Referencing and presentation (5%) 60 3

Total 44.5%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Grading Policy

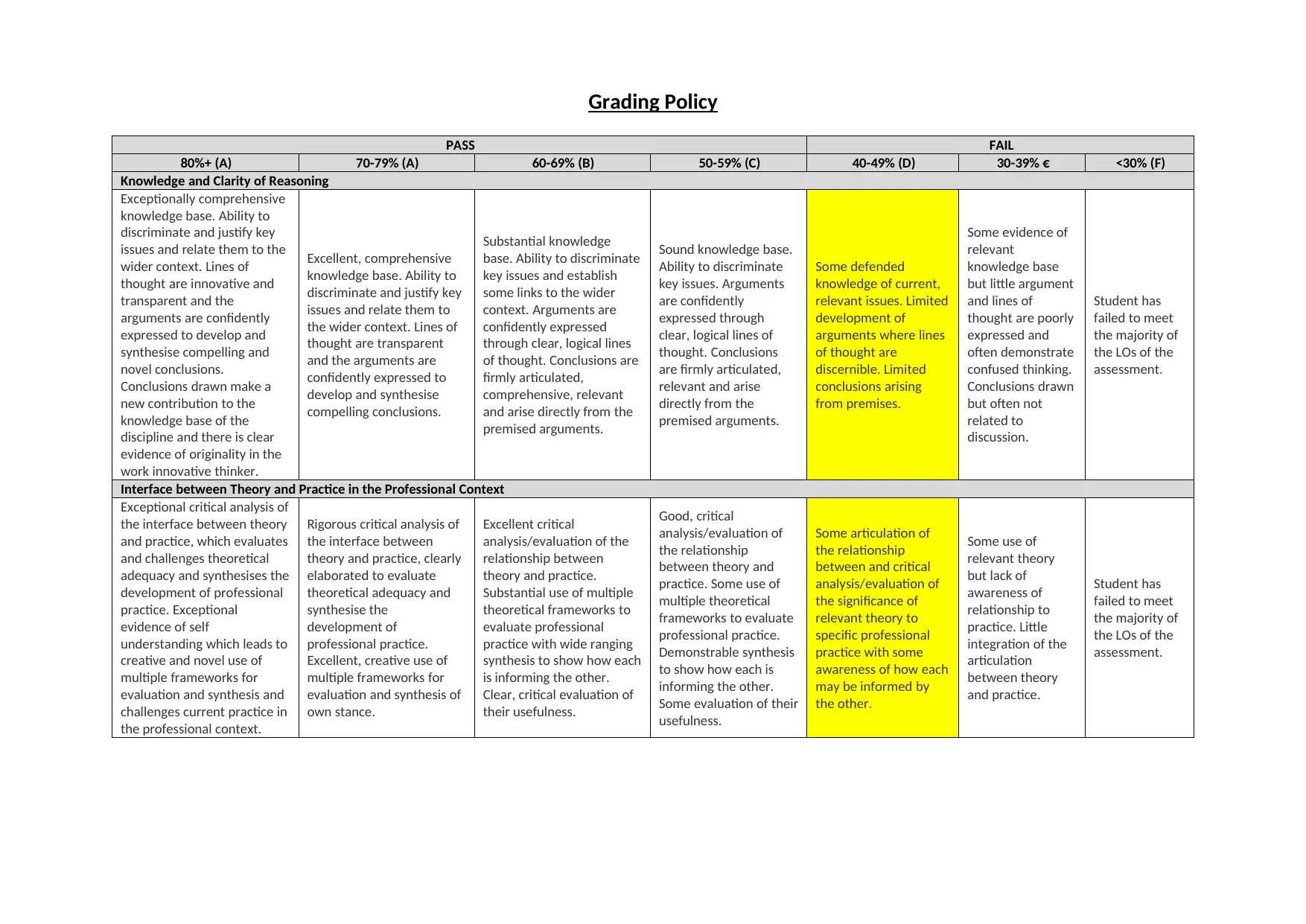

PASS FAIL

80%+ (A) 70-79% (A) 60-69% (B) 50-59% (C) 40-49% (D) 30-39% € <30% (F)

Knowledge and Clarity of Reasoning

Exceptionally comprehensive

knowledge base. Ability to

discriminate and justify key

issues and relate them to the

wider context. Lines of

thought are innovative and

transparent and the

arguments are confidently

expressed to develop and

synthesise compelling and

novel conclusions.

Conclusions drawn make a

new contribution to the

knowledge base of the

discipline and there is clear

evidence of originality in the

work innovative thinker.

Excellent, comprehensive

knowledge base. Ability to

discriminate and justify key

issues and relate them to

the wider context. Lines of

thought are transparent

and the arguments are

confidently expressed to

develop and synthesise

compelling conclusions.

Substantial knowledge

base. Ability to discriminate

key issues and establish

some links to the wider

context. Arguments are

confidently expressed

through clear, logical lines

of thought. Conclusions are

firmly articulated,

comprehensive, relevant

and arise directly from the

premised arguments.

Sound knowledge base.

Ability to discriminate

key issues. Arguments

are confidently

expressed through

clear, logical lines of

thought. Conclusions

are firmly articulated,

relevant and arise

directly from the

premised arguments.

Some defended

knowledge of current,

relevant issues. Limited

development of

arguments where lines

of thought are

discernible. Limited

conclusions arising

from premises.

Some evidence of

relevant

knowledge base

but little argument

and lines of

thought are poorly

expressed and

often demonstrate

confused thinking.

Conclusions drawn

but often not

related to

discussion.

Student has

failed to meet

the majority of

the LOs of the

assessment.

Interface between Theory and Practice in the Professional Context

Exceptional critical analysis of

the interface between theory

and practice, which evaluates

and challenges theoretical

adequacy and synthesises the

development of professional

practice. Exceptional

evidence of self

understanding which leads to

creative and novel use of

multiple frameworks for

evaluation and synthesis and

challenges current practice in

the professional context.

Rigorous critical analysis of

the interface between

theory and practice, clearly

elaborated to evaluate

theoretical adequacy and

synthesise the

development of

professional practice.

Excellent, creative use of

multiple frameworks for

evaluation and synthesis of

own stance.

Excellent critical

analysis/evaluation of the

relationship between

theory and practice.

Substantial use of multiple

theoretical frameworks to

evaluate professional

practice with wide ranging

synthesis to show how each

is informing the other.

Clear, critical evaluation of

their usefulness.

Good, critical

analysis/evaluation of

the relationship

between theory and

practice. Some use of

multiple theoretical

frameworks to evaluate

professional practice.

Demonstrable synthesis

to show how each is

informing the other.

Some evaluation of their

usefulness.

Some articulation of

the relationship

between and critical

analysis/evaluation of

the significance of

relevant theory to

specific professional

practice with some

awareness of how each

may be informed by

the other.

Some use of

relevant theory

but lack of

awareness of

relationship to

practice. Little

integration of the

articulation

between theory

and practice.

Student has

failed to meet

the majority of

the LOs of the

assessment.

PASS FAIL

80%+ (A) 70-79% (A) 60-69% (B) 50-59% (C) 40-49% (D) 30-39% € <30% (F)

Knowledge and Clarity of Reasoning

Exceptionally comprehensive

knowledge base. Ability to

discriminate and justify key

issues and relate them to the

wider context. Lines of

thought are innovative and

transparent and the

arguments are confidently

expressed to develop and

synthesise compelling and

novel conclusions.

Conclusions drawn make a

new contribution to the

knowledge base of the

discipline and there is clear

evidence of originality in the

work innovative thinker.

Excellent, comprehensive

knowledge base. Ability to

discriminate and justify key

issues and relate them to

the wider context. Lines of

thought are transparent

and the arguments are

confidently expressed to

develop and synthesise

compelling conclusions.

Substantial knowledge

base. Ability to discriminate

key issues and establish

some links to the wider

context. Arguments are

confidently expressed

through clear, logical lines

of thought. Conclusions are

firmly articulated,

comprehensive, relevant

and arise directly from the

premised arguments.

Sound knowledge base.

Ability to discriminate

key issues. Arguments

are confidently

expressed through

clear, logical lines of

thought. Conclusions

are firmly articulated,

relevant and arise

directly from the

premised arguments.

Some defended

knowledge of current,

relevant issues. Limited

development of

arguments where lines

of thought are

discernible. Limited

conclusions arising

from premises.

Some evidence of

relevant

knowledge base

but little argument

and lines of

thought are poorly

expressed and

often demonstrate

confused thinking.

Conclusions drawn

but often not

related to

discussion.

Student has

failed to meet

the majority of

the LOs of the

assessment.

Interface between Theory and Practice in the Professional Context

Exceptional critical analysis of

the interface between theory

and practice, which evaluates

and challenges theoretical

adequacy and synthesises the

development of professional

practice. Exceptional

evidence of self

understanding which leads to

creative and novel use of

multiple frameworks for

evaluation and synthesis and

challenges current practice in

the professional context.

Rigorous critical analysis of

the interface between

theory and practice, clearly

elaborated to evaluate

theoretical adequacy and

synthesise the

development of

professional practice.

Excellent, creative use of

multiple frameworks for

evaluation and synthesis of

own stance.

Excellent critical

analysis/evaluation of the

relationship between

theory and practice.

Substantial use of multiple

theoretical frameworks to

evaluate professional

practice with wide ranging

synthesis to show how each

is informing the other.

Clear, critical evaluation of

their usefulness.

Good, critical

analysis/evaluation of

the relationship

between theory and

practice. Some use of

multiple theoretical

frameworks to evaluate

professional practice.

Demonstrable synthesis

to show how each is

informing the other.

Some evaluation of their

usefulness.

Some articulation of

the relationship

between and critical

analysis/evaluation of

the significance of

relevant theory to

specific professional

practice with some

awareness of how each

may be informed by

the other.

Some use of

relevant theory

but lack of

awareness of

relationship to

practice. Little

integration of the

articulation

between theory

and practice.

Student has

failed to meet

the majority of

the LOs of the

assessment.

PASS FAIL

80%+ (A) 70-79% (A) 60-69% (B) 50-59% (C) 40-49% (D) 30-39% € <30% (F)

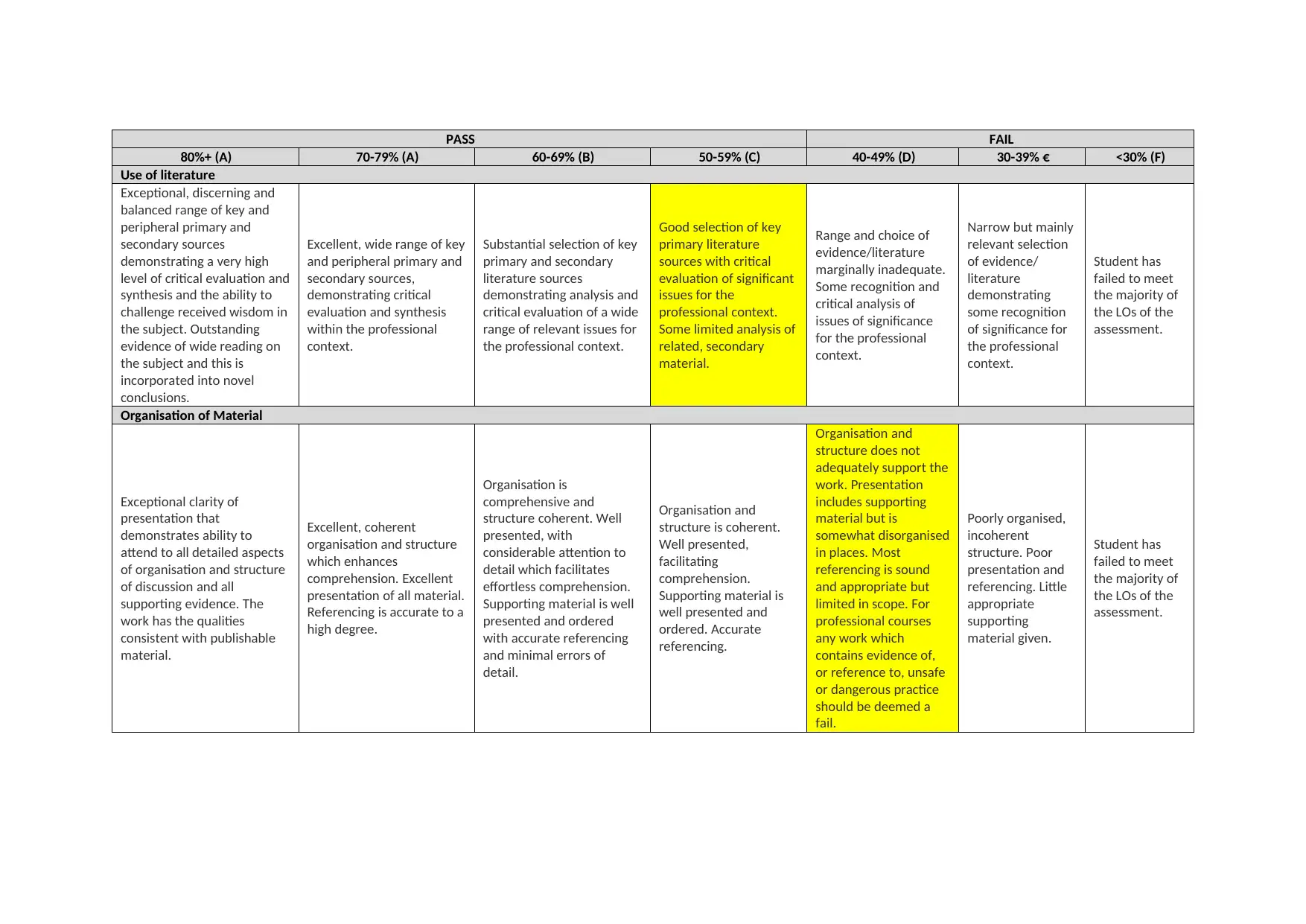

Use of literature

Exceptional, discerning and

balanced range of key and

peripheral primary and

secondary sources

demonstrating a very high

level of critical evaluation and

synthesis and the ability to

challenge received wisdom in

the subject. Outstanding

evidence of wide reading on

the subject and this is

incorporated into novel

conclusions.

Excellent, wide range of key

and peripheral primary and

secondary sources,

demonstrating critical

evaluation and synthesis

within the professional

context.

Substantial selection of key

primary and secondary

literature sources

demonstrating analysis and

critical evaluation of a wide

range of relevant issues for

the professional context.

Good selection of key

primary literature

sources with critical

evaluation of significant

issues for the

professional context.

Some limited analysis of

related, secondary

material.

Range and choice of

evidence/literature

marginally inadequate.

Some recognition and

critical analysis of

issues of significance

for the professional

context.

Narrow but mainly

relevant selection

of evidence/

literature

demonstrating

some recognition

of significance for

the professional

context.

Student has

failed to meet

the majority of

the LOs of the

assessment.

Organisation of Material

Exceptional clarity of

presentation that

demonstrates ability to

attend to all detailed aspects

of organisation and structure

of discussion and all

supporting evidence. The

work has the qualities

consistent with publishable

material.

Excellent, coherent

organisation and structure

which enhances

comprehension. Excellent

presentation of all material.

Referencing is accurate to a

high degree.

Organisation is

comprehensive and

structure coherent. Well

presented, with

considerable attention to

detail which facilitates

effortless comprehension.

Supporting material is well

presented and ordered

with accurate referencing

and minimal errors of

detail.

Organisation and

structure is coherent.

Well presented,

facilitating

comprehension.

Supporting material is

well presented and

ordered. Accurate

referencing.

Organisation and

structure does not

adequately support the

work. Presentation

includes supporting

material but is

somewhat disorganised

in places. Most

referencing is sound

and appropriate but

limited in scope. For

professional courses

any work which

contains evidence of,

or reference to, unsafe

or dangerous practice

should be deemed a

fail.

Poorly organised,

incoherent

structure. Poor

presentation and

referencing. Little

appropriate

supporting

material given.

Student has

failed to meet

the majority of

the LOs of the

assessment.

80%+ (A) 70-79% (A) 60-69% (B) 50-59% (C) 40-49% (D) 30-39% € <30% (F)

Use of literature

Exceptional, discerning and

balanced range of key and

peripheral primary and

secondary sources

demonstrating a very high

level of critical evaluation and

synthesis and the ability to

challenge received wisdom in

the subject. Outstanding

evidence of wide reading on

the subject and this is

incorporated into novel

conclusions.

Excellent, wide range of key

and peripheral primary and

secondary sources,

demonstrating critical

evaluation and synthesis

within the professional

context.

Substantial selection of key

primary and secondary

literature sources

demonstrating analysis and

critical evaluation of a wide

range of relevant issues for

the professional context.

Good selection of key

primary literature

sources with critical

evaluation of significant

issues for the

professional context.

Some limited analysis of

related, secondary

material.

Range and choice of

evidence/literature

marginally inadequate.

Some recognition and

critical analysis of

issues of significance

for the professional

context.

Narrow but mainly

relevant selection

of evidence/

literature

demonstrating

some recognition

of significance for

the professional

context.

Student has

failed to meet

the majority of

the LOs of the

assessment.

Organisation of Material

Exceptional clarity of

presentation that

demonstrates ability to

attend to all detailed aspects

of organisation and structure

of discussion and all

supporting evidence. The

work has the qualities

consistent with publishable

material.

Excellent, coherent

organisation and structure

which enhances

comprehension. Excellent

presentation of all material.

Referencing is accurate to a

high degree.

Organisation is

comprehensive and

structure coherent. Well

presented, with

considerable attention to

detail which facilitates

effortless comprehension.

Supporting material is well

presented and ordered

with accurate referencing

and minimal errors of

detail.

Organisation and

structure is coherent.

Well presented,

facilitating

comprehension.

Supporting material is

well presented and

ordered. Accurate

referencing.

Organisation and

structure does not

adequately support the

work. Presentation

includes supporting

material but is

somewhat disorganised

in places. Most

referencing is sound

and appropriate but

limited in scope. For

professional courses

any work which

contains evidence of,

or reference to, unsafe

or dangerous practice

should be deemed a

fail.

Poorly organised,

incoherent

structure. Poor

presentation and

referencing. Little

appropriate

supporting

material given.

Student has

failed to meet

the majority of

the LOs of the

assessment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial analysis of the business of Hattie geodes

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

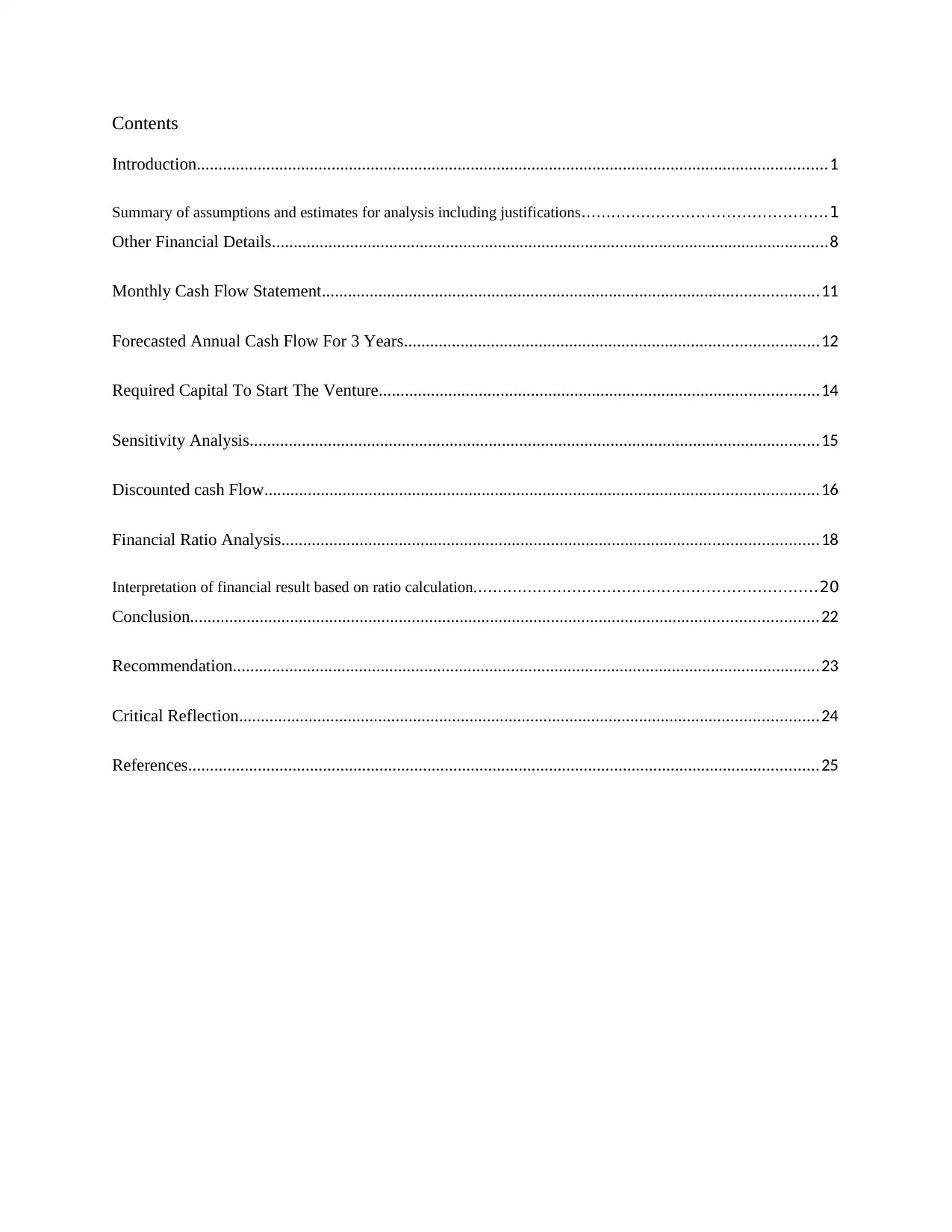

Contents

Introduction.................................................................................................................................................1

Summary of assumptions and estimates for analysis including justifications.................................................1

Other Financial Details................................................................................................................................8

Monthly Cash Flow Statement..................................................................................................................11

Forecasted Annual Cash Flow For 3 Years...............................................................................................12

Required Capital To Start The Venture.....................................................................................................14

Sensitivity Analysis...................................................................................................................................15

Discounted cash Flow...............................................................................................................................16

Financial Ratio Analysis...........................................................................................................................18

Interpretation of financial result based on ratio calculation.....................................................................20

Conclusion................................................................................................................................................22

Recommendation.......................................................................................................................................23

Critical Reflection.....................................................................................................................................24

References.................................................................................................................................................25

Introduction.................................................................................................................................................1

Summary of assumptions and estimates for analysis including justifications.................................................1

Other Financial Details................................................................................................................................8

Monthly Cash Flow Statement..................................................................................................................11

Forecasted Annual Cash Flow For 3 Years...............................................................................................12

Required Capital To Start The Venture.....................................................................................................14

Sensitivity Analysis...................................................................................................................................15

Discounted cash Flow...............................................................................................................................16

Financial Ratio Analysis...........................................................................................................................18

Interpretation of financial result based on ratio calculation.....................................................................20

Conclusion................................................................................................................................................22

Recommendation.......................................................................................................................................23

Critical Reflection.....................................................................................................................................24

References.................................................................................................................................................25

As a student at the University of Cumbria I uphold and defend academic integrity, academic

rigor and academic liberty as core values of higher learning. I attest, on my word of honour, that

work submitted in my name is my own work, and that any ideas or materials used in support of

this work which are not originally my own are cited and referenced accordingly.

rigor and academic liberty as core values of higher learning. I attest, on my word of honour, that

work submitted in my name is my own work, and that any ideas or materials used in support of

this work which are not originally my own are cited and referenced accordingly.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

Starting a new business require a proper analysis. Thus, financial analysis of the business

plan pertaining to the new venture should be properly analyzed, which assist in determining the

viability of the overall business plan in respect to the future earnings. This business report is

being prepared which analysis the business plan being proposed pertaining to the Geodes

business. It involves the break-even point analysis, preparation of the cash flow statement along

with the other financial statement which is important for the new business venture plan. This will

result in better and effective analysis of the plan developed along with understanding the

viability of the business for the long run is also measured and monitored. Along with this, certain

estimations and assumptions have been made in preparation of the financial statement of the

business. This will help in framing certain recommendations in respect to the business plan based

upon the information provided. At last, the critical reflection of the report is presented which will

be provided to Hattie in order to make the project a success.

Summary of assumptions and estimates for analysis including justifications

Sources of Funding

It is being clear from the case study, that Hattie has already received a lump sum amount

of 450,000 pounds after leaving the company. This amount can be utilized by Hattie pertaining

to the business operation of the Geodes. In terms of requirement of additional funds, Hattie is

willing to take 40,000 pounds as loan at the rate of 7% interest. In addition to this, it is also

assumed that the company can also borrow funds from the capital market pertaining to the

business operation of Geodes. The last option which is available to Hattie is to add partners to

the venture who will bring in their share of capital to the business and will also have a share in

the profits of the company. This will help in decreasing the financial burden of Hattie to a great

extent.

1

Starting a new business require a proper analysis. Thus, financial analysis of the business

plan pertaining to the new venture should be properly analyzed, which assist in determining the

viability of the overall business plan in respect to the future earnings. This business report is

being prepared which analysis the business plan being proposed pertaining to the Geodes

business. It involves the break-even point analysis, preparation of the cash flow statement along

with the other financial statement which is important for the new business venture plan. This will

result in better and effective analysis of the plan developed along with understanding the

viability of the business for the long run is also measured and monitored. Along with this, certain

estimations and assumptions have been made in preparation of the financial statement of the

business. This will help in framing certain recommendations in respect to the business plan based

upon the information provided. At last, the critical reflection of the report is presented which will

be provided to Hattie in order to make the project a success.

Summary of assumptions and estimates for analysis including justifications

Sources of Funding

It is being clear from the case study, that Hattie has already received a lump sum amount

of 450,000 pounds after leaving the company. This amount can be utilized by Hattie pertaining

to the business operation of the Geodes. In terms of requirement of additional funds, Hattie is

willing to take 40,000 pounds as loan at the rate of 7% interest. In addition to this, it is also

assumed that the company can also borrow funds from the capital market pertaining to the

business operation of Geodes. The last option which is available to Hattie is to add partners to

the venture who will bring in their share of capital to the business and will also have a share in

the profits of the company. This will help in decreasing the financial burden of Hattie to a great

extent.

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Profit and Loss Items

Purchase of Geodes

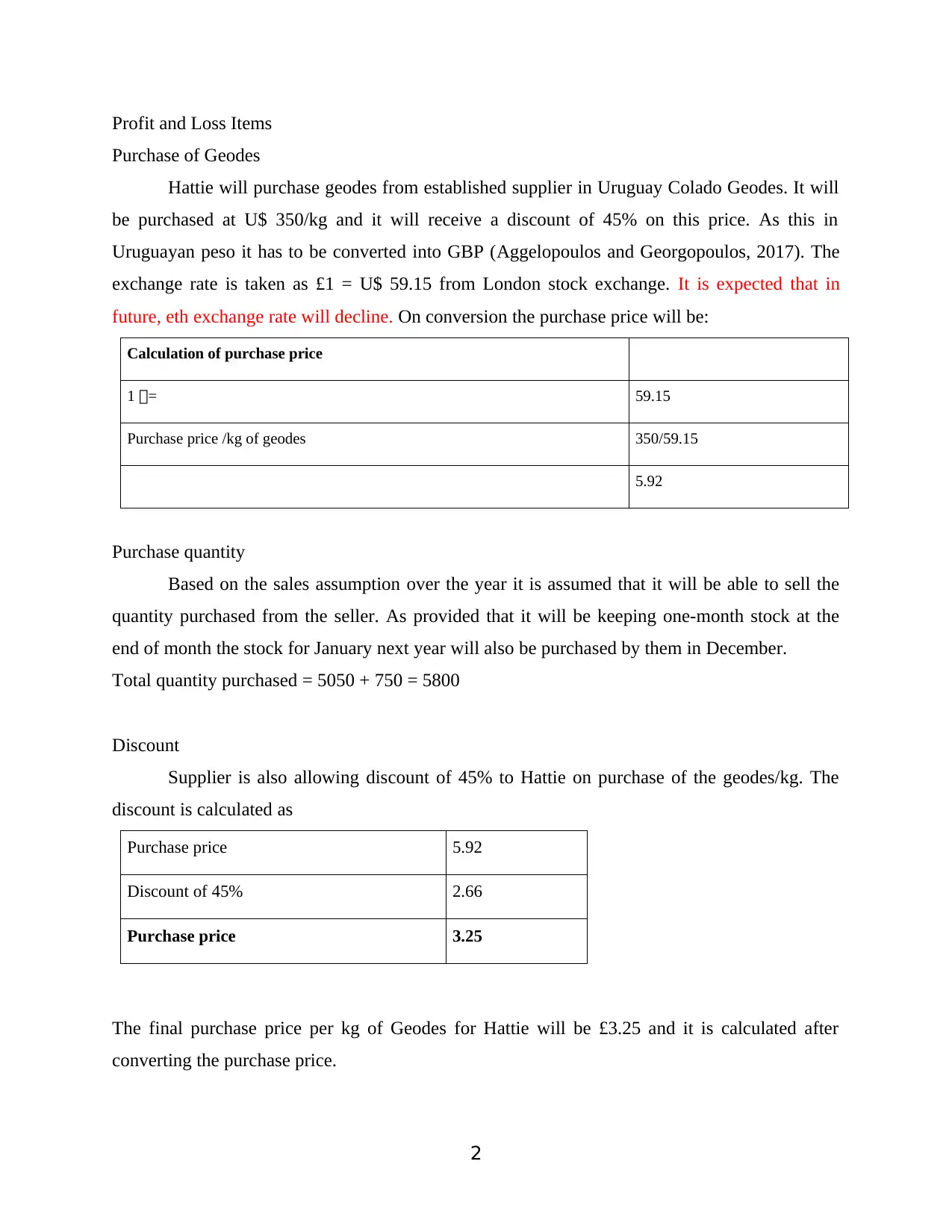

Hattie will purchase geodes from established supplier in Uruguay Colado Geodes. It will

be purchased at U$ 350/kg and it will receive a discount of 45% on this price. As this in

Uruguayan peso it has to be converted into GBP (Aggelopoulos and Georgopoulos, 2017). The

exchange rate is taken as £1 = U$ 59.15 from London stock exchange. It is expected that in

future, eth exchange rate will decline. On conversion the purchase price will be:

Calculation of purchase price

1 £= 59.15

Purchase price /kg of geodes 350/59.15

5.92

Purchase quantity

Based on the sales assumption over the year it is assumed that it will be able to sell the

quantity purchased from the seller. As provided that it will be keeping one-month stock at the

end of month the stock for January next year will also be purchased by them in December.

Total quantity purchased = 5050 + 750 = 5800

Discount

Supplier is also allowing discount of 45% to Hattie on purchase of the geodes/kg. The

discount is calculated as

Purchase price 5.92

Discount of 45% 2.66

Purchase price 3.25

The final purchase price per kg of Geodes for Hattie will be £3.25 and it is calculated after

converting the purchase price.

2

Purchase of Geodes

Hattie will purchase geodes from established supplier in Uruguay Colado Geodes. It will

be purchased at U$ 350/kg and it will receive a discount of 45% on this price. As this in

Uruguayan peso it has to be converted into GBP (Aggelopoulos and Georgopoulos, 2017). The

exchange rate is taken as £1 = U$ 59.15 from London stock exchange. It is expected that in

future, eth exchange rate will decline. On conversion the purchase price will be:

Calculation of purchase price

1 £= 59.15

Purchase price /kg of geodes 350/59.15

5.92

Purchase quantity

Based on the sales assumption over the year it is assumed that it will be able to sell the

quantity purchased from the seller. As provided that it will be keeping one-month stock at the

end of month the stock for January next year will also be purchased by them in December.

Total quantity purchased = 5050 + 750 = 5800

Discount

Supplier is also allowing discount of 45% to Hattie on purchase of the geodes/kg. The

discount is calculated as

Purchase price 5.92

Discount of 45% 2.66

Purchase price 3.25

The final purchase price per kg of Geodes for Hattie will be £3.25 and it is calculated after

converting the purchase price.

2

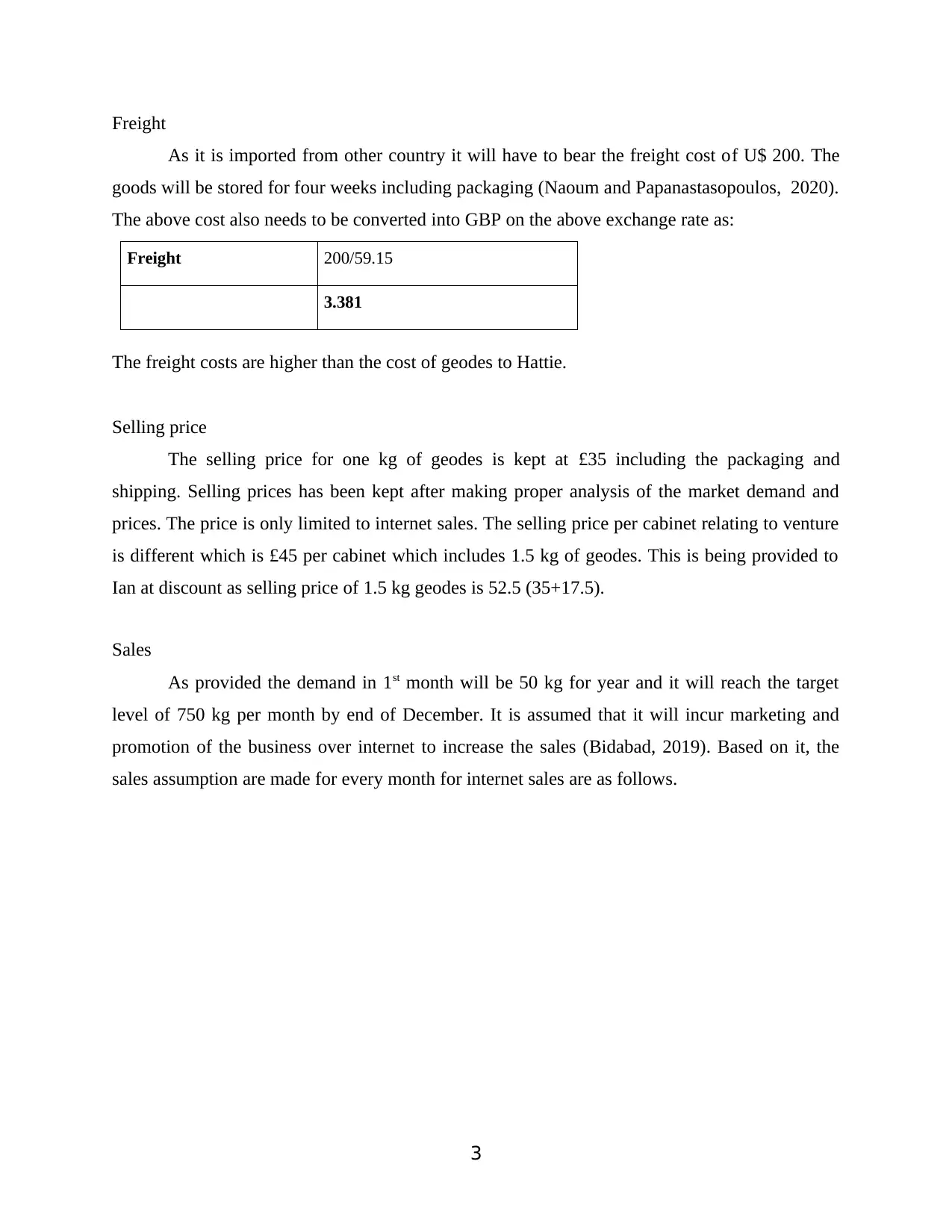

Freight

As it is imported from other country it will have to bear the freight cost of U$ 200. The

goods will be stored for four weeks including packaging (Naoum and Papanastasopoulos, 2020).

The above cost also needs to be converted into GBP on the above exchange rate as:

Freight 200/59.15

3.381

The freight costs are higher than the cost of geodes to Hattie.

Selling price

The selling price for one kg of geodes is kept at £35 including the packaging and

shipping. Selling prices has been kept after making proper analysis of the market demand and

prices. The price is only limited to internet sales. The selling price per cabinet relating to venture

is different which is £45 per cabinet which includes 1.5 kg of geodes. This is being provided to

Ian at discount as selling price of 1.5 kg geodes is 52.5 (35+17.5).

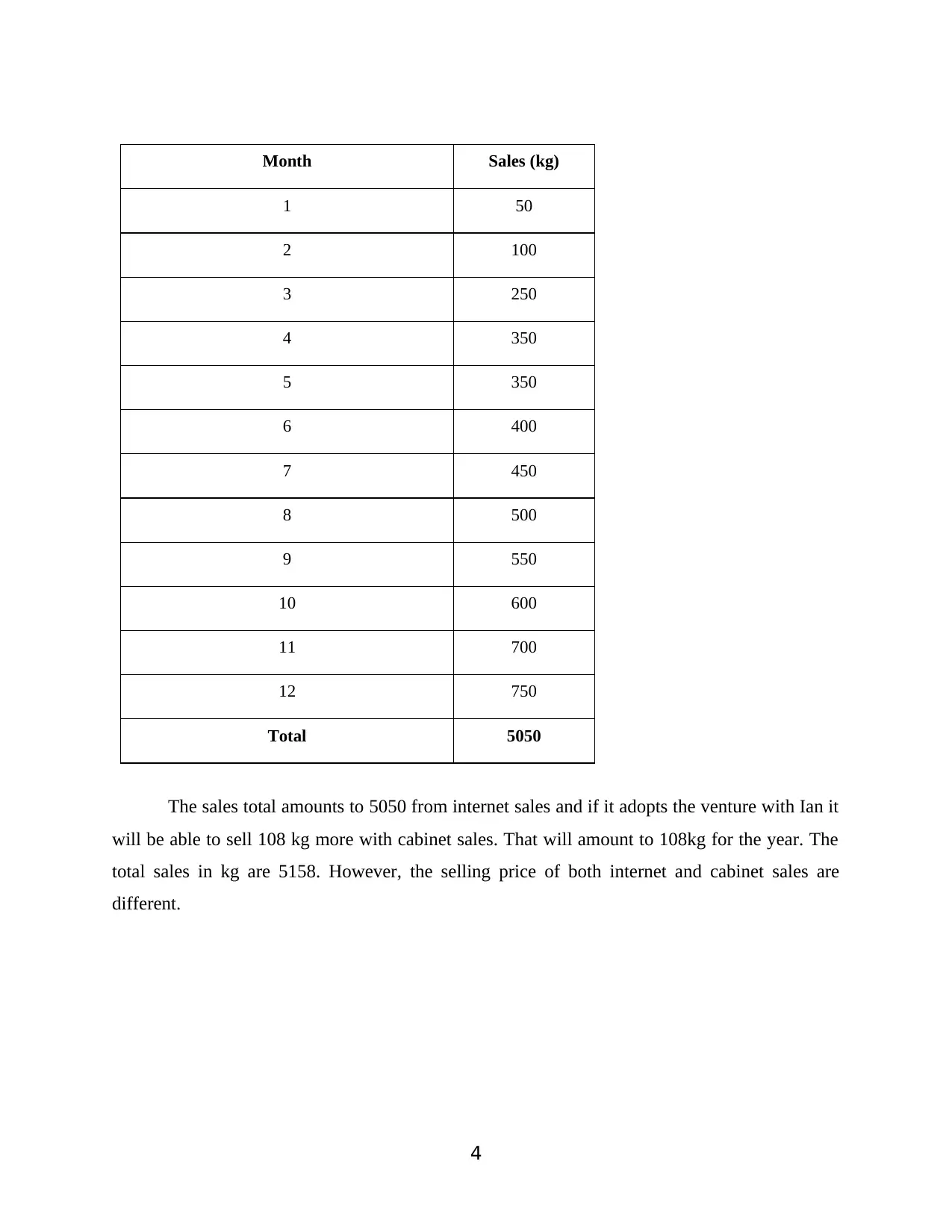

Sales

As provided the demand in 1st month will be 50 kg for year and it will reach the target

level of 750 kg per month by end of December. It is assumed that it will incur marketing and

promotion of the business over internet to increase the sales (Bidabad, 2019). Based on it, the

sales assumption are made for every month for internet sales are as follows.

3

As it is imported from other country it will have to bear the freight cost of U$ 200. The

goods will be stored for four weeks including packaging (Naoum and Papanastasopoulos, 2020).

The above cost also needs to be converted into GBP on the above exchange rate as:

Freight 200/59.15

3.381

The freight costs are higher than the cost of geodes to Hattie.

Selling price

The selling price for one kg of geodes is kept at £35 including the packaging and

shipping. Selling prices has been kept after making proper analysis of the market demand and

prices. The price is only limited to internet sales. The selling price per cabinet relating to venture

is different which is £45 per cabinet which includes 1.5 kg of geodes. This is being provided to

Ian at discount as selling price of 1.5 kg geodes is 52.5 (35+17.5).

Sales

As provided the demand in 1st month will be 50 kg for year and it will reach the target

level of 750 kg per month by end of December. It is assumed that it will incur marketing and

promotion of the business over internet to increase the sales (Bidabad, 2019). Based on it, the

sales assumption are made for every month for internet sales are as follows.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Month Sales (kg)

1 50

2 100

3 250

4 350

5 350

6 400

7 450

8 500

9 550

10 600

11 700

12 750

Total 5050

The sales total amounts to 5050 from internet sales and if it adopts the venture with Ian it

will be able to sell 108 kg more with cabinet sales. That will amount to 108kg for the year. The

total sales in kg are 5158. However, the selling price of both internet and cabinet sales are

different.

4

1 50

2 100

3 250

4 350

5 350

6 400

7 450

8 500

9 550

10 600

11 700

12 750

Total 5050

The sales total amounts to 5050 from internet sales and if it adopts the venture with Ian it

will be able to sell 108 kg more with cabinet sales. That will amount to 108kg for the year. The

total sales in kg are 5158. However, the selling price of both internet and cabinet sales are

different.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

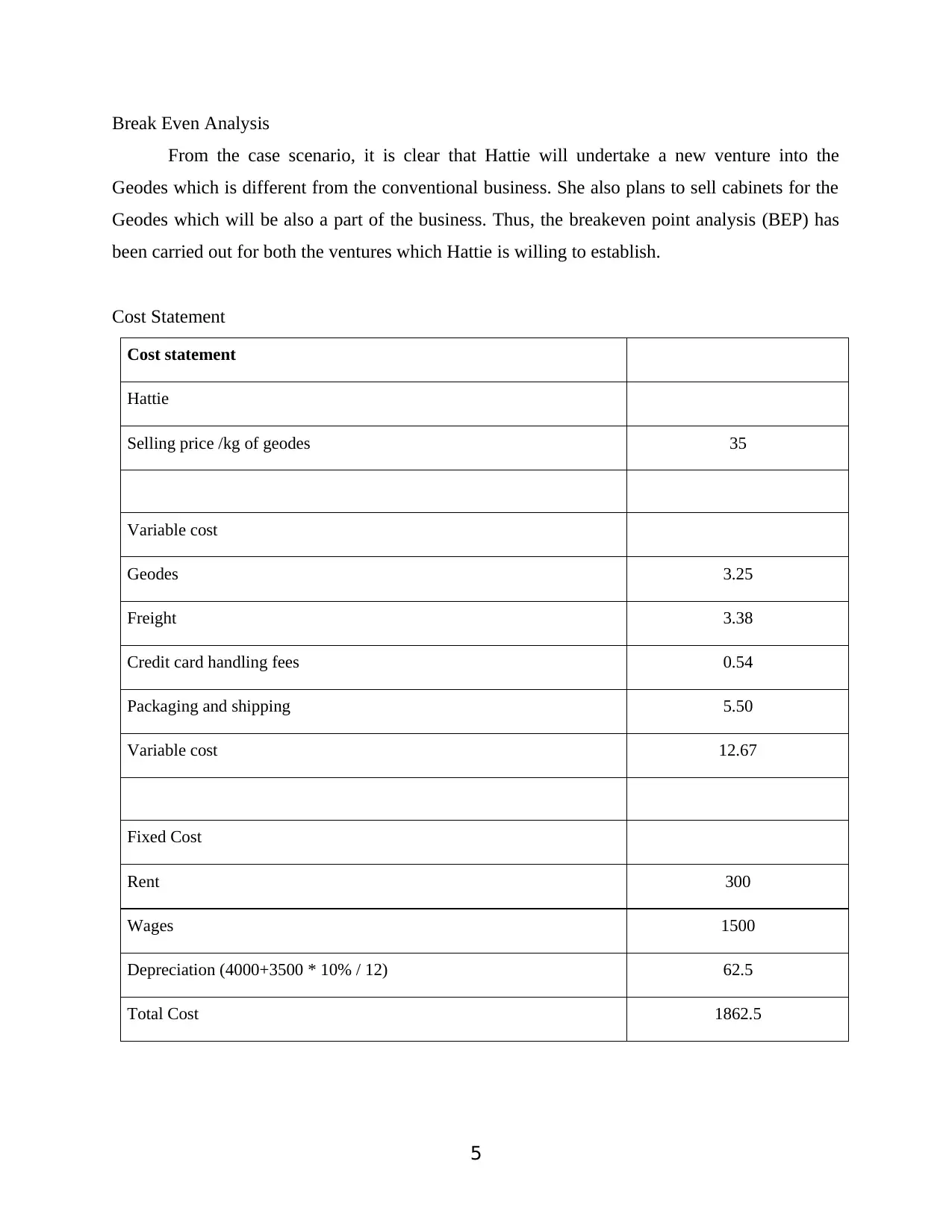

Break Even Analysis

From the case scenario, it is clear that Hattie will undertake a new venture into the

Geodes which is different from the conventional business. She also plans to sell cabinets for the

Geodes which will be also a part of the business. Thus, the breakeven point analysis (BEP) has

been carried out for both the ventures which Hattie is willing to establish.

Cost Statement

Cost statement

Hattie

Selling price /kg of geodes 35

Variable cost

Geodes 3.25

Freight 3.38

Credit card handling fees 0.54

Packaging and shipping 5.50

Variable cost 12.67

Fixed Cost

Rent 300

Wages 1500

Depreciation (4000+3500 * 10% / 12) 62.5

Total Cost 1862.5

5

From the case scenario, it is clear that Hattie will undertake a new venture into the

Geodes which is different from the conventional business. She also plans to sell cabinets for the

Geodes which will be also a part of the business. Thus, the breakeven point analysis (BEP) has

been carried out for both the ventures which Hattie is willing to establish.

Cost Statement

Cost statement

Hattie

Selling price /kg of geodes 35

Variable cost

Geodes 3.25

Freight 3.38

Credit card handling fees 0.54

Packaging and shipping 5.50

Variable cost 12.67

Fixed Cost

Rent 300

Wages 1500

Depreciation (4000+3500 * 10% / 12) 62.5

Total Cost 1862.5

5

Break Even Calculation per kg

Selling Price 35

Variable cost 12.67

Fixed Cost 1862.5

BEP 1862.5 /

(35 – 12.67)

BEP in kgs 83.41

BEP in amount 2919.27

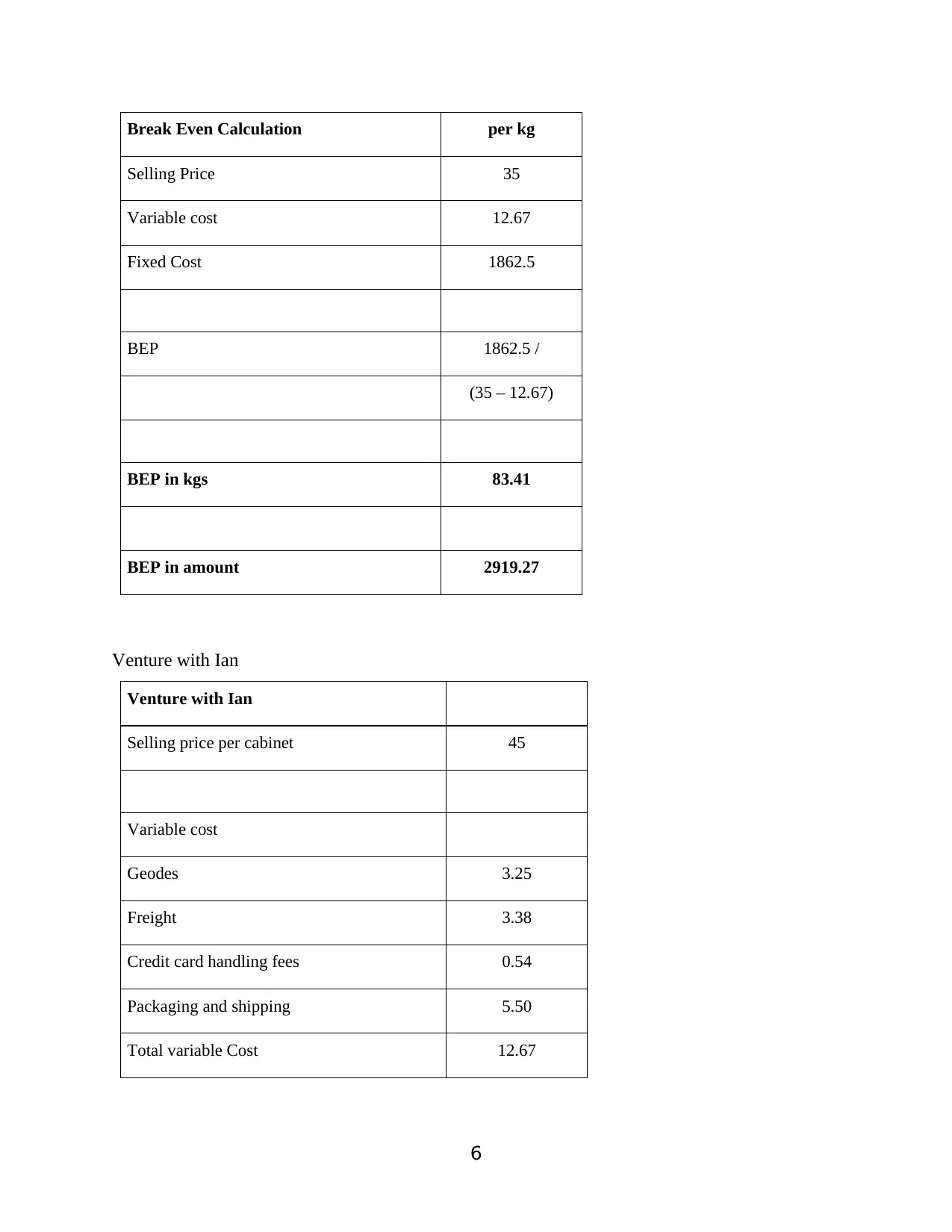

Venture with Ian

Venture with Ian

Selling price per cabinet 45

Variable cost

Geodes 3.25

Freight 3.38

Credit card handling fees 0.54

Packaging and shipping 5.50

Total variable Cost 12.67

6

Selling Price 35

Variable cost 12.67

Fixed Cost 1862.5

BEP 1862.5 /

(35 – 12.67)

BEP in kgs 83.41

BEP in amount 2919.27

Venture with Ian

Venture with Ian

Selling price per cabinet 45

Variable cost

Geodes 3.25

Freight 3.38

Credit card handling fees 0.54

Packaging and shipping 5.50

Total variable Cost 12.67

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 33

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.