Report on Financial Performance, Investment Appraisal, and Acquisition

VerifiedAdded on 2023/01/11

|15

|4015

|30

Report

AI Summary

This report analyzes the financial performance of Burberry Group Plc from 2015 to 2019, evaluating its profitability and liquidity through ratio analysis. It examines future investment opportunities using Net Present Value (NPV) and Internal Rate of Return (IRR) techniques, providing investment appraisal results. The report also explores the potential acquisition of a Leather Goods factory, considering its rationale, synergistic gains, financing, risks, and implications. The analysis reveals Burberry's strong financial position and growth, supporting its investment plans and acquisition strategy, while also highlighting the limitations of ratio analysis and the importance of efficient resource management.

Finance of decision making

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

TABLE OF CONTENTS................................................................................................................2

1. INTRODUCTION.......................................................................................................................1

1.1 Rationale................................................................................................................................1

1.2 Background of the company..................................................................................................1

1.3 Main Findings........................................................................................................................1

1.4 Structure of the report............................................................................................................1

2. Evaluation of the current financial performance of the company. (2015 -2019)........................1

2.1 Profitability............................................................................................................................2

2.2 Liquidity................................................................................................................................4

2.3 Evaluation of ratio analysis...................................................................................................6

2.4 Limitation of the ratio analysis..............................................................................................6

3 Future investment appraisals........................................................................................................7

3.1 Evaluation of NPV techniques...............................................................................................7

3.2 Evaluation of IRR techniques................................................................................................7

3.3 Investment appraisal results...................................................................................................8

3.4 Potential implication of investment.....................................................................................10

4. Potential acquisition of Leather Goods factory.........................................................................10

4.1 Rationale for choosing the target company.........................................................................10

4.2 Synergistic gain on acquisition............................................................................................11

4.3 Evaluation of the financing of acquisition...........................................................................12

4.4 Risks and uncertainties........................................................................................................12

4.5 Potential implication over the performance of the firm.......................................................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

TABLE OF CONTENTS................................................................................................................2

1. INTRODUCTION.......................................................................................................................1

1.1 Rationale................................................................................................................................1

1.2 Background of the company..................................................................................................1

1.3 Main Findings........................................................................................................................1

1.4 Structure of the report............................................................................................................1

2. Evaluation of the current financial performance of the company. (2015 -2019)........................1

2.1 Profitability............................................................................................................................2

2.2 Liquidity................................................................................................................................4

2.3 Evaluation of ratio analysis...................................................................................................6

2.4 Limitation of the ratio analysis..............................................................................................6

3 Future investment appraisals........................................................................................................7

3.1 Evaluation of NPV techniques...............................................................................................7

3.2 Evaluation of IRR techniques................................................................................................7

3.3 Investment appraisal results...................................................................................................8

3.4 Potential implication of investment.....................................................................................10

4. Potential acquisition of Leather Goods factory.........................................................................10

4.1 Rationale for choosing the target company.........................................................................10

4.2 Synergistic gain on acquisition............................................................................................11

4.3 Evaluation of the financing of acquisition...........................................................................12

4.4 Risks and uncertainties........................................................................................................12

4.5 Potential implication over the performance of the firm.......................................................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

1. INTRODUCTION

1.1 Rationale

Burberry group plc is big luxury brand fashion company that is headquartered in

England, London. Company is doing well in the market from last many years. The company is

planning to expand its business by the investments or acquisition. This will help the company to

increase its growth by the acquisition. Report has summarised the current financial position and

performance of the company for the last five year’s data.

1.2 Background of the company

Burberry Group Plc is the fashion house which focusses on distributing ready to wear

clothes and outer wear. It also provides fashion accessories, beauty care products and sunglasses.

The company has been using varied technology for providing ever lasting customer experience.

Currently, it is suing AR tool which allows customers to experience company’s product in tehri

surrounding. Its total revenue in 2019 was £2,720m, along with net cash of £837m. in the year

2017, it has set a strategy to establish as the luxury fashion firm and delivering long-term

sustainable value to its shareholders.

1.3 Main Findings

Burberry Plc is doing the good and is growth at high rate over the last 5 years. By looking at its

revenue, it can eb said that the company is having enough amount for carrying out its further

investment plan and also acquiring another company while maintaining the performance of the

business.

1.4 Structure of the report

Section 2 analysis the financial performance of Burberry Plc.

Section 3 covers the evaluation of the NPV and IRR techniques of investment in relation to

investment.

Section 4 provides a description about the potential acquisition of Leather Goods factory.

Section 5 covers the overall conclusion of the report.

2. Evaluation of the current financial performance of the company. (2015 -

2019)

2019 2018 2017 2016 2015

1

1.1 Rationale

Burberry group plc is big luxury brand fashion company that is headquartered in

England, London. Company is doing well in the market from last many years. The company is

planning to expand its business by the investments or acquisition. This will help the company to

increase its growth by the acquisition. Report has summarised the current financial position and

performance of the company for the last five year’s data.

1.2 Background of the company

Burberry Group Plc is the fashion house which focusses on distributing ready to wear

clothes and outer wear. It also provides fashion accessories, beauty care products and sunglasses.

The company has been using varied technology for providing ever lasting customer experience.

Currently, it is suing AR tool which allows customers to experience company’s product in tehri

surrounding. Its total revenue in 2019 was £2,720m, along with net cash of £837m. in the year

2017, it has set a strategy to establish as the luxury fashion firm and delivering long-term

sustainable value to its shareholders.

1.3 Main Findings

Burberry Plc is doing the good and is growth at high rate over the last 5 years. By looking at its

revenue, it can eb said that the company is having enough amount for carrying out its further

investment plan and also acquiring another company while maintaining the performance of the

business.

1.4 Structure of the report

Section 2 analysis the financial performance of Burberry Plc.

Section 3 covers the evaluation of the NPV and IRR techniques of investment in relation to

investment.

Section 4 provides a description about the potential acquisition of Leather Goods factory.

Section 5 covers the overall conclusion of the report.

2. Evaluation of the current financial performance of the company. (2015 -

2019)

2019 2018 2017 2016 2015

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

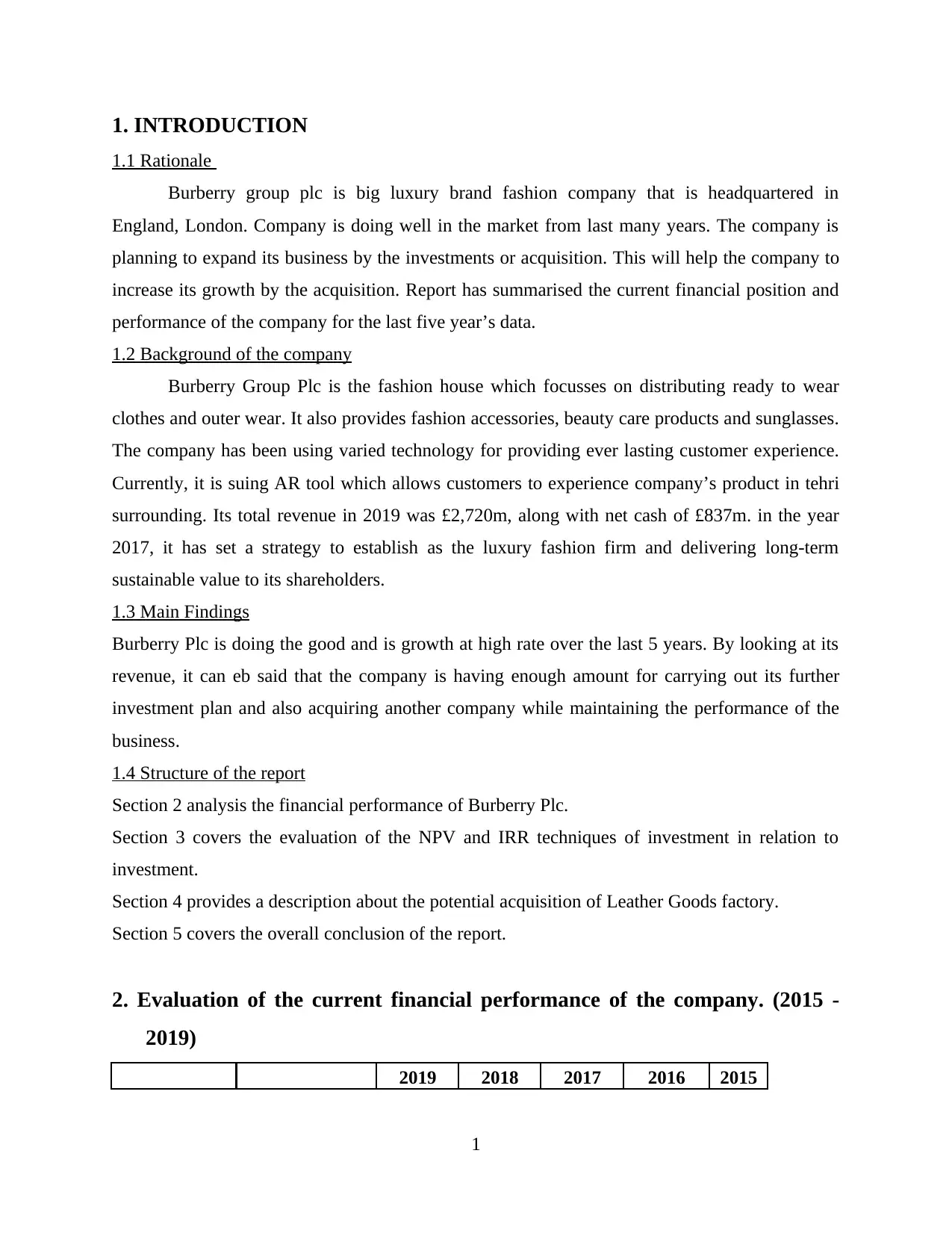

Employed

Capital

(Total Assets -

Current

Liabilities) 1692100 1670100 1848300 1775300 n/a

Net profit 339300 293500 286800 309500 n/a

Return on

capital

employed

Net operating

profit/Employed

Capital 20.05% 17.57% 15.52% 17.43% n/a

n/a

Net Income 339300 293500 286800 309500 n/a

Shareholder's

Equity 1455000 1420500 1692500 1565000 n/a

Return on

Equity

Net Income /

Shareholder's

Equity 23.32% 20.66% 16.95% 19.78% n/a

2019 2018 2017 2016 2015

Cost of Sales 859400 835400 832900 752000 757700

Sales 2720200 2732800 2766000 2514700 2523200

Gross Margin 68.41% 69.43% 69.89% 70.10% 69.97%

Net profit 339300 293500 286800 309500 336300

Sales 2720200 2732800 2766000 2514700 2523200

Net profit

ratio 12.47% 10.74% 10.37% 12.31% 13.33%

From the above tables it could be seen that there is a fluctuating trend with growth the

period of 5 years. Company has achieved expansion by maintaining the constant growth rate and

market performance (Kirchler, Lindner and Weitzel, 2019). Current performance of the company

has shown significant growth with strong financial position.

2.1 Profitability

It is the most important ration that is required to be assessed by the decision makers before

planning to invest or acquire.

2

Capital

(Total Assets -

Current

Liabilities) 1692100 1670100 1848300 1775300 n/a

Net profit 339300 293500 286800 309500 n/a

Return on

capital

employed

Net operating

profit/Employed

Capital 20.05% 17.57% 15.52% 17.43% n/a

n/a

Net Income 339300 293500 286800 309500 n/a

Shareholder's

Equity 1455000 1420500 1692500 1565000 n/a

Return on

Equity

Net Income /

Shareholder's

Equity 23.32% 20.66% 16.95% 19.78% n/a

2019 2018 2017 2016 2015

Cost of Sales 859400 835400 832900 752000 757700

Sales 2720200 2732800 2766000 2514700 2523200

Gross Margin 68.41% 69.43% 69.89% 70.10% 69.97%

Net profit 339300 293500 286800 309500 336300

Sales 2720200 2732800 2766000 2514700 2523200

Net profit

ratio 12.47% 10.74% 10.37% 12.31% 13.33%

From the above tables it could be seen that there is a fluctuating trend with growth the

period of 5 years. Company has achieved expansion by maintaining the constant growth rate and

market performance (Kirchler, Lindner and Weitzel, 2019). Current performance of the company

has shown significant growth with strong financial position.

2.1 Profitability

It is the most important ration that is required to be assessed by the decision makers before

planning to invest or acquire.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2019 2018 2017 2016

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

20.05%

17.57%

15.52%

17.43%

Return on capital employed

Return on capital

employed

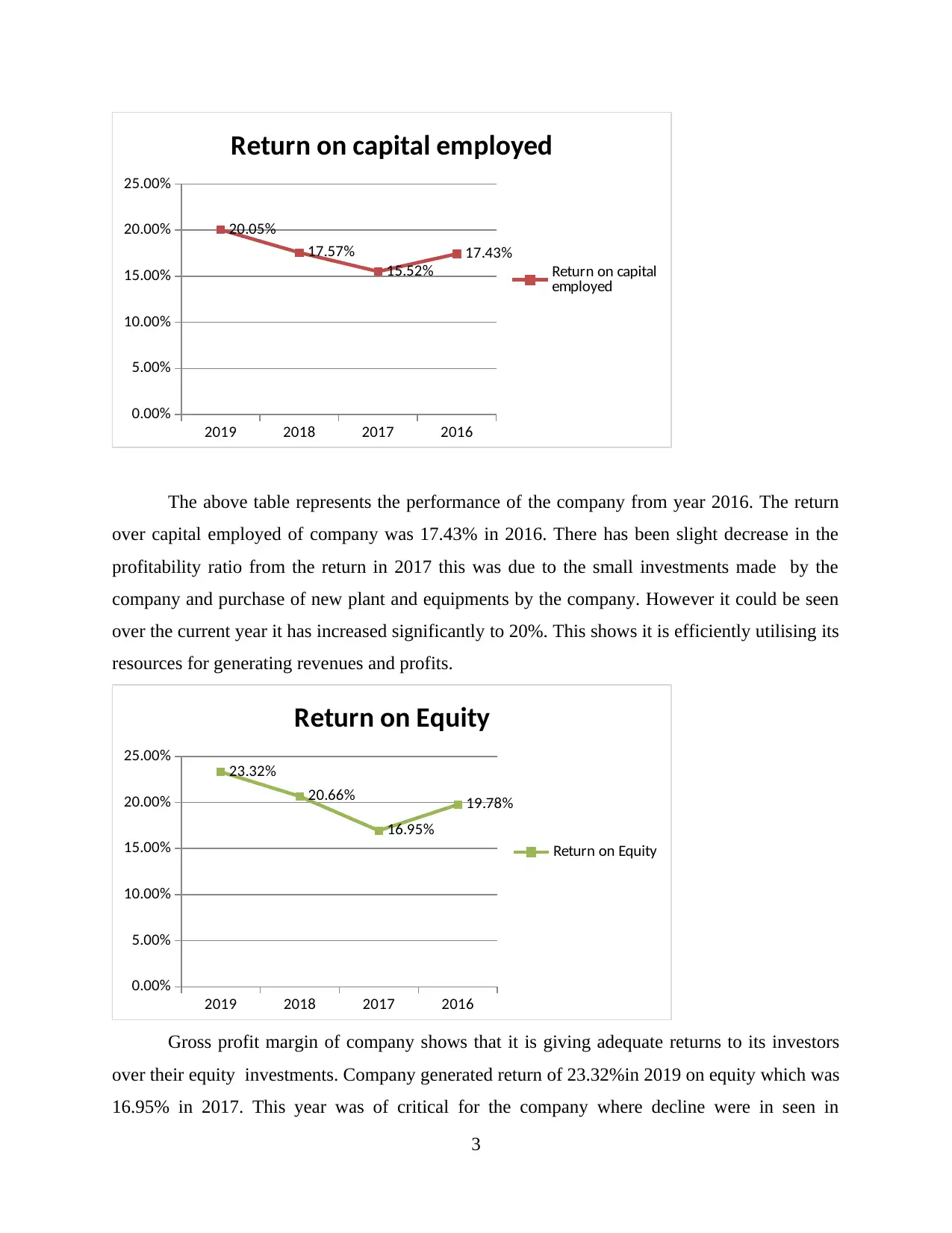

The above table represents the performance of the company from year 2016. The return

over capital employed of company was 17.43% in 2016. There has been slight decrease in the

profitability ratio from the return in 2017 this was due to the small investments made by the

company and purchase of new plant and equipments by the company. However it could be seen

over the current year it has increased significantly to 20%. This shows it is efficiently utilising its

resources for generating revenues and profits.

2019 2018 2017 2016

0.00%

5.00%

10.00%

15.00%

20.00%

25.00% 23.32%

20.66%

16.95%

19.78%

Return on Equity

Return on Equity

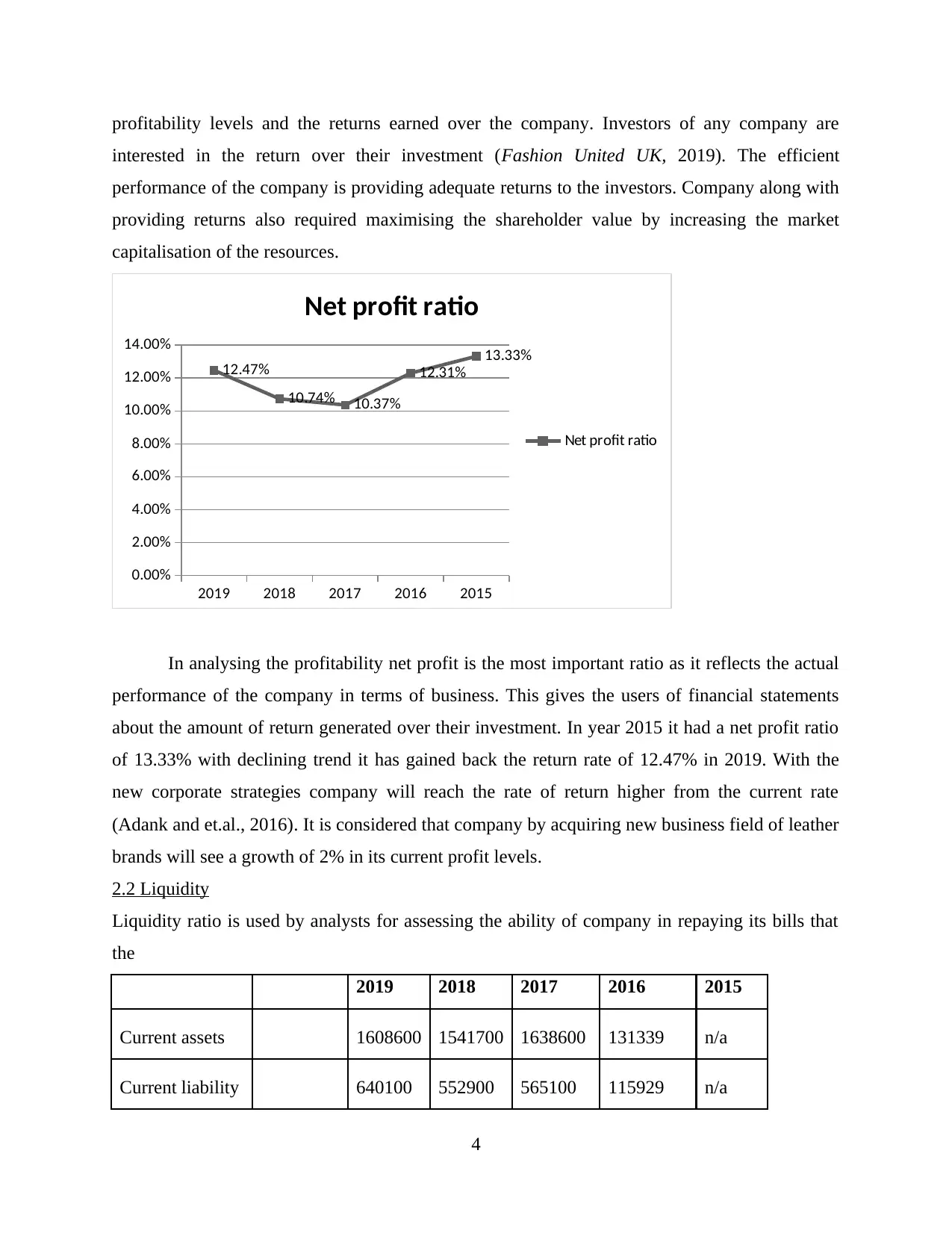

Gross profit margin of company shows that it is giving adequate returns to its investors

over their equity investments. Company generated return of 23.32%in 2019 on equity which was

16.95% in 2017. This year was of critical for the company where decline were in seen in

3

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

20.05%

17.57%

15.52%

17.43%

Return on capital employed

Return on capital

employed

The above table represents the performance of the company from year 2016. The return

over capital employed of company was 17.43% in 2016. There has been slight decrease in the

profitability ratio from the return in 2017 this was due to the small investments made by the

company and purchase of new plant and equipments by the company. However it could be seen

over the current year it has increased significantly to 20%. This shows it is efficiently utilising its

resources for generating revenues and profits.

2019 2018 2017 2016

0.00%

5.00%

10.00%

15.00%

20.00%

25.00% 23.32%

20.66%

16.95%

19.78%

Return on Equity

Return on Equity

Gross profit margin of company shows that it is giving adequate returns to its investors

over their equity investments. Company generated return of 23.32%in 2019 on equity which was

16.95% in 2017. This year was of critical for the company where decline were in seen in

3

profitability levels and the returns earned over the company. Investors of any company are

interested in the return over their investment (Fashion United UK, 2019). The efficient

performance of the company is providing adequate returns to the investors. Company along with

providing returns also required maximising the shareholder value by increasing the market

capitalisation of the resources.

2019 2018 2017 2016 2015

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

12.47%

10.74% 10.37%

12.31%

13.33%

Net profit ratio

Net profit ratio

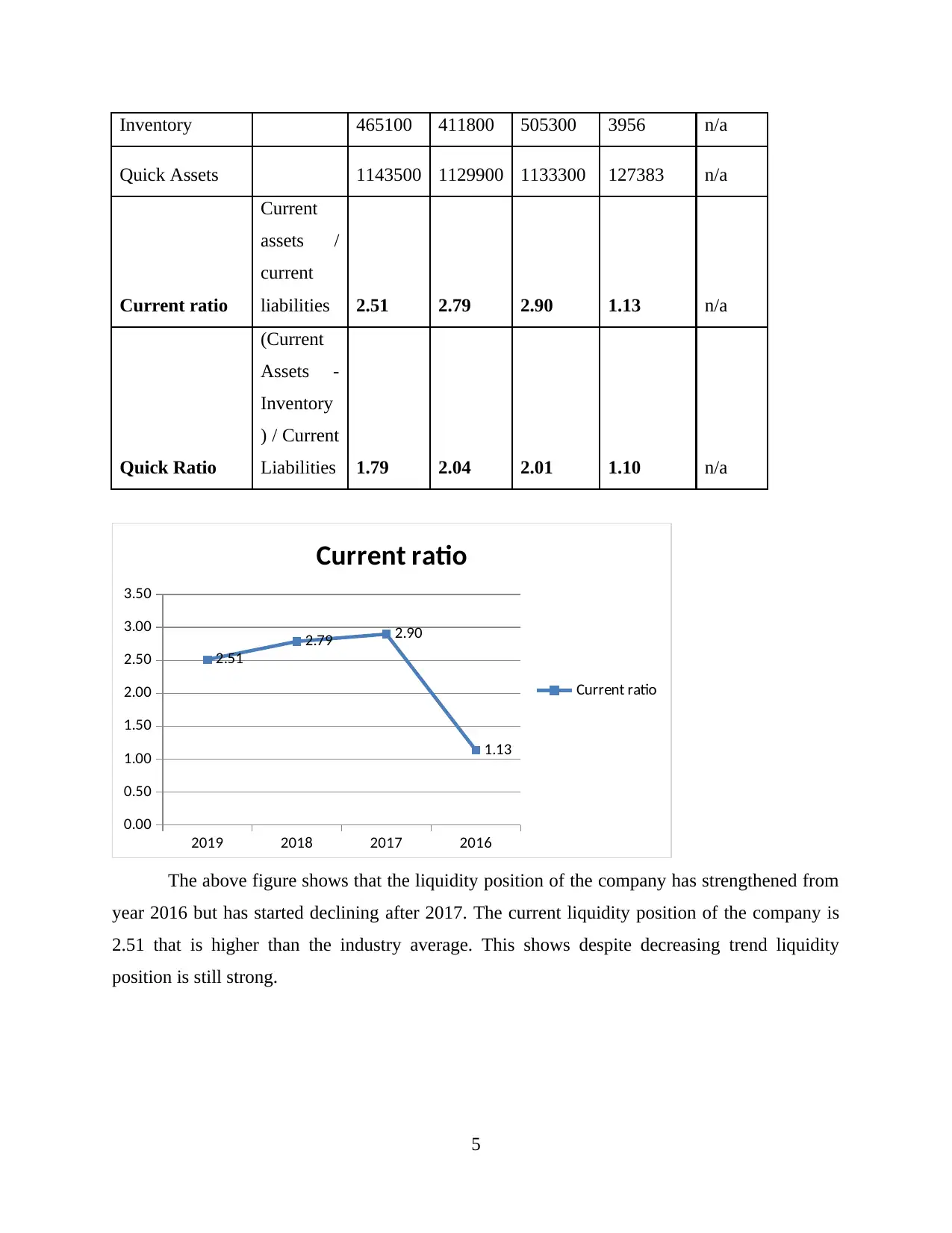

In analysing the profitability net profit is the most important ratio as it reflects the actual

performance of the company in terms of business. This gives the users of financial statements

about the amount of return generated over their investment. In year 2015 it had a net profit ratio

of 13.33% with declining trend it has gained back the return rate of 12.47% in 2019. With the

new corporate strategies company will reach the rate of return higher from the current rate

(Adank and et.al., 2016). It is considered that company by acquiring new business field of leather

brands will see a growth of 2% in its current profit levels.

2.2 Liquidity

Liquidity ratio is used by analysts for assessing the ability of company in repaying its bills that

the

2019 2018 2017 2016 2015

Current assets 1608600 1541700 1638600 131339 n/a

Current liability 640100 552900 565100 115929 n/a

4

interested in the return over their investment (Fashion United UK, 2019). The efficient

performance of the company is providing adequate returns to the investors. Company along with

providing returns also required maximising the shareholder value by increasing the market

capitalisation of the resources.

2019 2018 2017 2016 2015

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

12.47%

10.74% 10.37%

12.31%

13.33%

Net profit ratio

Net profit ratio

In analysing the profitability net profit is the most important ratio as it reflects the actual

performance of the company in terms of business. This gives the users of financial statements

about the amount of return generated over their investment. In year 2015 it had a net profit ratio

of 13.33% with declining trend it has gained back the return rate of 12.47% in 2019. With the

new corporate strategies company will reach the rate of return higher from the current rate

(Adank and et.al., 2016). It is considered that company by acquiring new business field of leather

brands will see a growth of 2% in its current profit levels.

2.2 Liquidity

Liquidity ratio is used by analysts for assessing the ability of company in repaying its bills that

the

2019 2018 2017 2016 2015

Current assets 1608600 1541700 1638600 131339 n/a

Current liability 640100 552900 565100 115929 n/a

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

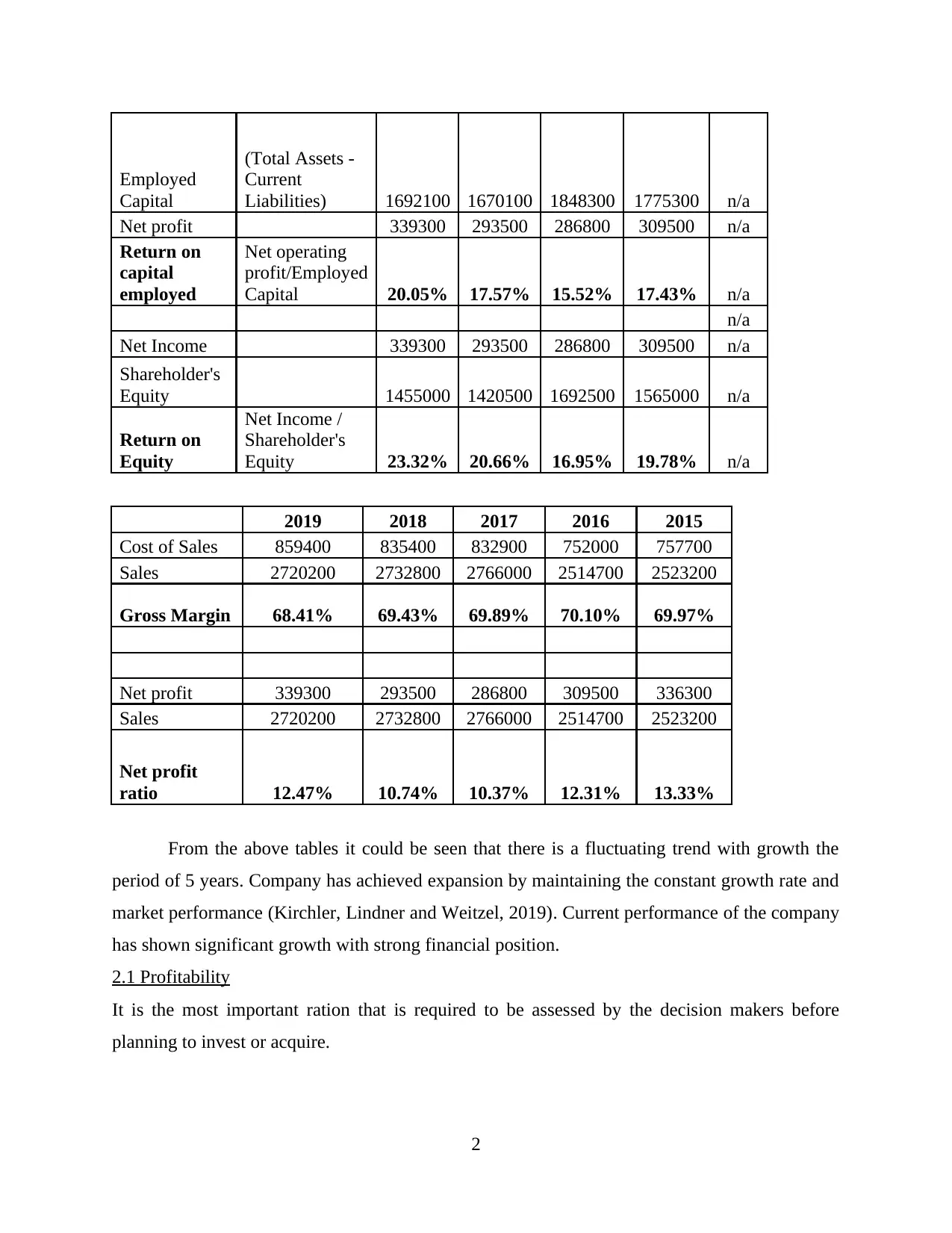

Inventory 465100 411800 505300 3956 n/a

Quick Assets 1143500 1129900 1133300 127383 n/a

Current ratio

Current

assets /

current

liabilities 2.51 2.79 2.90 1.13 n/a

Quick Ratio

(Current

Assets -

Inventory

) / Current

Liabilities 1.79 2.04 2.01 1.10 n/a

2019 2018 2017 2016

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

2.51

2.79 2.90

1.13

Current ratio

Current ratio

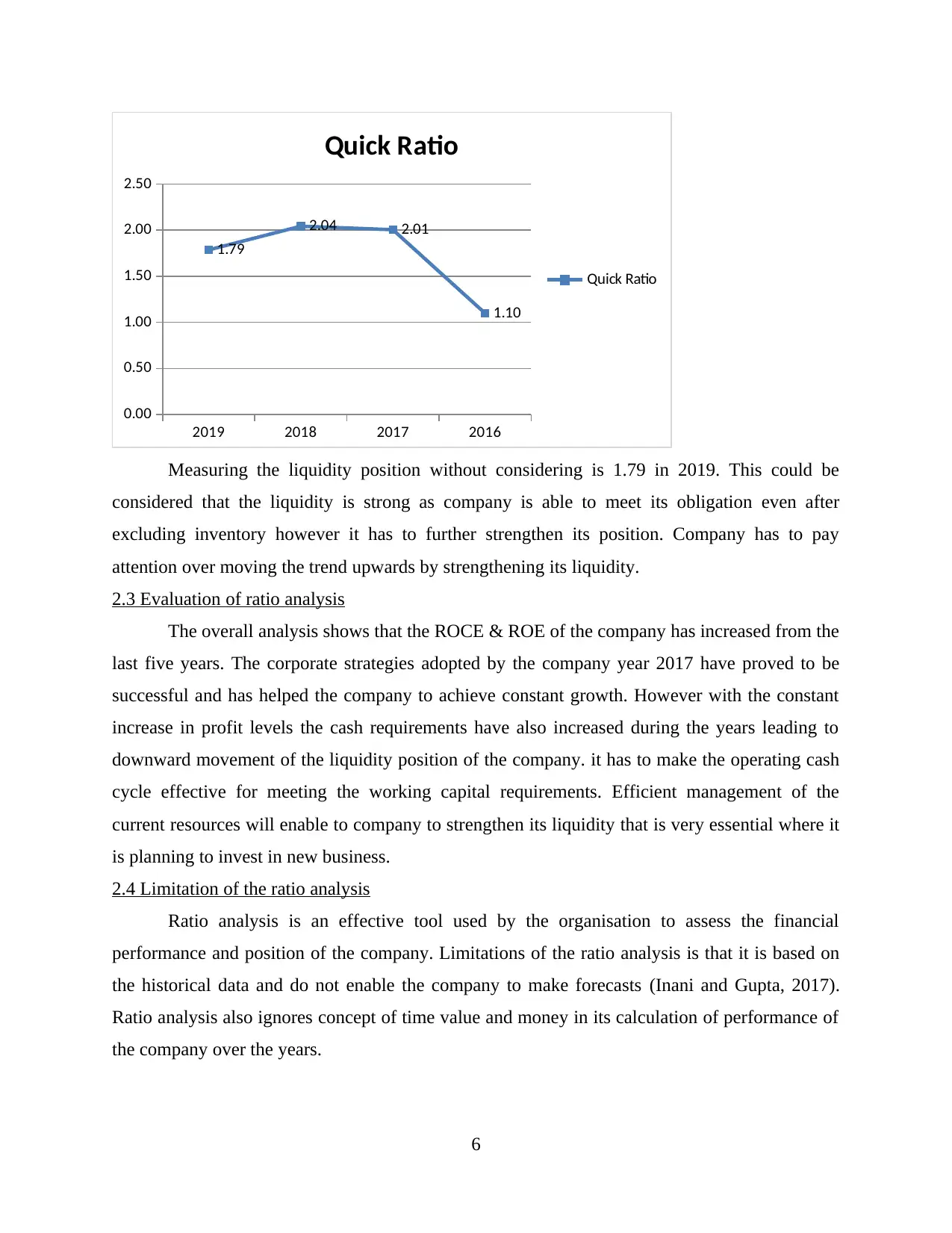

The above figure shows that the liquidity position of the company has strengthened from

year 2016 but has started declining after 2017. The current liquidity position of the company is

2.51 that is higher than the industry average. This shows despite decreasing trend liquidity

position is still strong.

5

Quick Assets 1143500 1129900 1133300 127383 n/a

Current ratio

Current

assets /

current

liabilities 2.51 2.79 2.90 1.13 n/a

Quick Ratio

(Current

Assets -

Inventory

) / Current

Liabilities 1.79 2.04 2.01 1.10 n/a

2019 2018 2017 2016

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

2.51

2.79 2.90

1.13

Current ratio

Current ratio

The above figure shows that the liquidity position of the company has strengthened from

year 2016 but has started declining after 2017. The current liquidity position of the company is

2.51 that is higher than the industry average. This shows despite decreasing trend liquidity

position is still strong.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2019 2018 2017 2016

0.00

0.50

1.00

1.50

2.00

2.50

1.79

2.04 2.01

1.10

Quick Ratio

Quick Ratio

Measuring the liquidity position without considering is 1.79 in 2019. This could be

considered that the liquidity is strong as company is able to meet its obligation even after

excluding inventory however it has to further strengthen its position. Company has to pay

attention over moving the trend upwards by strengthening its liquidity.

2.3 Evaluation of ratio analysis

The overall analysis shows that the ROCE & ROE of the company has increased from the

last five years. The corporate strategies adopted by the company year 2017 have proved to be

successful and has helped the company to achieve constant growth. However with the constant

increase in profit levels the cash requirements have also increased during the years leading to

downward movement of the liquidity position of the company. it has to make the operating cash

cycle effective for meeting the working capital requirements. Efficient management of the

current resources will enable to company to strengthen its liquidity that is very essential where it

is planning to invest in new business.

2.4 Limitation of the ratio analysis

Ratio analysis is an effective tool used by the organisation to assess the financial

performance and position of the company. Limitations of the ratio analysis is that it is based on

the historical data and do not enable the company to make forecasts (Inani and Gupta, 2017).

Ratio analysis also ignores concept of time value and money in its calculation of performance of

the company over the years.

6

0.00

0.50

1.00

1.50

2.00

2.50

1.79

2.04 2.01

1.10

Quick Ratio

Quick Ratio

Measuring the liquidity position without considering is 1.79 in 2019. This could be

considered that the liquidity is strong as company is able to meet its obligation even after

excluding inventory however it has to further strengthen its position. Company has to pay

attention over moving the trend upwards by strengthening its liquidity.

2.3 Evaluation of ratio analysis

The overall analysis shows that the ROCE & ROE of the company has increased from the

last five years. The corporate strategies adopted by the company year 2017 have proved to be

successful and has helped the company to achieve constant growth. However with the constant

increase in profit levels the cash requirements have also increased during the years leading to

downward movement of the liquidity position of the company. it has to make the operating cash

cycle effective for meeting the working capital requirements. Efficient management of the

current resources will enable to company to strengthen its liquidity that is very essential where it

is planning to invest in new business.

2.4 Limitation of the ratio analysis

Ratio analysis is an effective tool used by the organisation to assess the financial

performance and position of the company. Limitations of the ratio analysis is that it is based on

the historical data and do not enable the company to make forecasts (Inani and Gupta, 2017).

Ratio analysis also ignores concept of time value and money in its calculation of performance of

the company over the years.

6

3 Future investment appraisals

There are three most important tools that are used for evaluating the capital investment

proposals of the business, which are, payback period (PBP), net present value (NPV) and internal

rate of return (IRR).

3.1 Evaluation of NPV techniques

The net present value is basically the difference between the present value of cash inflow

and cash outflow. It is widely used method in capital budgeting and planning which helps in

analysing the profitability of the projected investment. The positive net present value means that

the projected earnings form the project is exceeding the anticipated expenses or cost (Hopkinson,

2017). It is the rule to accept the proposal only when the NPV is positive. On the other hand,

negative NPV indicates that the project is running loss and it is not feasible to continue with it.

The NPV considers time value of money while evaluating the projects and also it assists the

management in making decisions between multiple projects of same size by comparing tehri

profitability (Leyman and Vanhoucke, 2016). It takes into account capital cost as the discounting

rate for evaluating the projects which is the minimum rate shareholders needs to invest in the

company. In contrast to its benefits, it has certain drawbacks as well. It considers only the cash

flows of the project which means it does not consider other cost that can have an impact over it.

Also, it assumes the same discount rate over the life of the investment.

3.2 Evaluation of IRR techniques

It is the discounted rate at which NPV is zero. IRR is used to measure and compare the

growth of multiple projects and investment plans. This investment appraisal technique is the

common measure used by the management to decide which project is yielding higher return. IRR

gives accurate rate of return for every project which is very useful for the investors (Magni,

2020). IRR takes into account time value of money that helps in evaluating the accurate rate.

This technique helps in maximizing the profitability and shareholder’s wealth. On the other

hand, it has certain disadvantages as well. It is based on trial and error approach and ignores

economies of scale. It requires cost of capital for taking decisions. Also, it is based on the

assumption that all the cash flows will be reinvested in the market at the IRR. Another drawback

is that a project may have varying IRR values over the life of the project.

There are situations when the there is low IRR and NPV but the company can still

continue with the project may be because of diversification of risk, the investment can eb

7

There are three most important tools that are used for evaluating the capital investment

proposals of the business, which are, payback period (PBP), net present value (NPV) and internal

rate of return (IRR).

3.1 Evaluation of NPV techniques

The net present value is basically the difference between the present value of cash inflow

and cash outflow. It is widely used method in capital budgeting and planning which helps in

analysing the profitability of the projected investment. The positive net present value means that

the projected earnings form the project is exceeding the anticipated expenses or cost (Hopkinson,

2017). It is the rule to accept the proposal only when the NPV is positive. On the other hand,

negative NPV indicates that the project is running loss and it is not feasible to continue with it.

The NPV considers time value of money while evaluating the projects and also it assists the

management in making decisions between multiple projects of same size by comparing tehri

profitability (Leyman and Vanhoucke, 2016). It takes into account capital cost as the discounting

rate for evaluating the projects which is the minimum rate shareholders needs to invest in the

company. In contrast to its benefits, it has certain drawbacks as well. It considers only the cash

flows of the project which means it does not consider other cost that can have an impact over it.

Also, it assumes the same discount rate over the life of the investment.

3.2 Evaluation of IRR techniques

It is the discounted rate at which NPV is zero. IRR is used to measure and compare the

growth of multiple projects and investment plans. This investment appraisal technique is the

common measure used by the management to decide which project is yielding higher return. IRR

gives accurate rate of return for every project which is very useful for the investors (Magni,

2020). IRR takes into account time value of money that helps in evaluating the accurate rate.

This technique helps in maximizing the profitability and shareholder’s wealth. On the other

hand, it has certain disadvantages as well. It is based on trial and error approach and ignores

economies of scale. It requires cost of capital for taking decisions. Also, it is based on the

assumption that all the cash flows will be reinvested in the market at the IRR. Another drawback

is that a project may have varying IRR values over the life of the project.

There are situations when the there is low IRR and NPV but the company can still

continue with the project may be because of diversification of risk, the investment can eb

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

profitable in later stage etc.

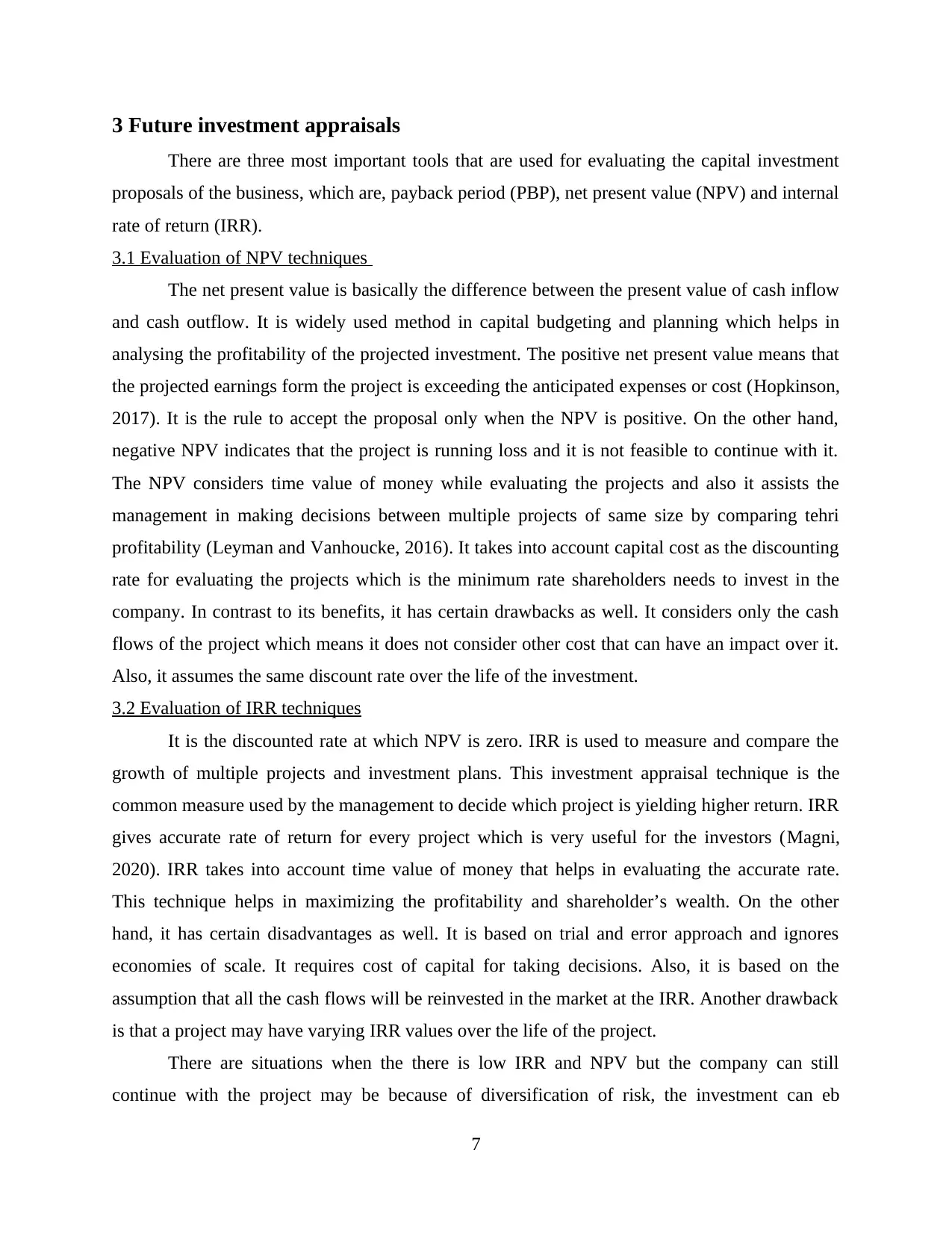

3.3 Investment appraisal results

In this section, the company is looking to make a further investment in the current

product of £40m with the expected life of the project to be 10 years and the discounting rate is

12%, ignoring inflation and tax. It is assumed that the cash inflow is 25% of initial investment

for 10 years.

Calculation of NPV at £40m investment

Year

Cash inflows

in £

PV

facto

r @

12%

Discounte

d cash

inflows in

£

1 10000000 0.893 8928571

2 10000000 0.797 7971939

3 10000000 0.712 7117802

4 10000000 0.636 6355181

5 10000000 0.567 5674269

6 10000000 0.507 5066311

7 10000000 0.452 4523492

8 10000000 0.404 4038832

9 10000000 0.361 3606100

10 10000000 0.322 3219732

Total discounted cash

inflow 56502230

Initial investment 40000000

NPV (Total discounted

cash inflows - initial

investment) 16502230

From the above, it can be seen that the payback period for this investment is 4 years. It is also the

8

3.3 Investment appraisal results

In this section, the company is looking to make a further investment in the current

product of £40m with the expected life of the project to be 10 years and the discounting rate is

12%, ignoring inflation and tax. It is assumed that the cash inflow is 25% of initial investment

for 10 years.

Calculation of NPV at £40m investment

Year

Cash inflows

in £

PV

facto

r @

12%

Discounte

d cash

inflows in

£

1 10000000 0.893 8928571

2 10000000 0.797 7971939

3 10000000 0.712 7117802

4 10000000 0.636 6355181

5 10000000 0.567 5674269

6 10000000 0.507 5066311

7 10000000 0.452 4523492

8 10000000 0.404 4038832

9 10000000 0.361 3606100

10 10000000 0.322 3219732

Total discounted cash

inflow 56502230

Initial investment 40000000

NPV (Total discounted

cash inflows - initial

investment) 16502230

From the above, it can be seen that the payback period for this investment is 4 years. It is also the

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

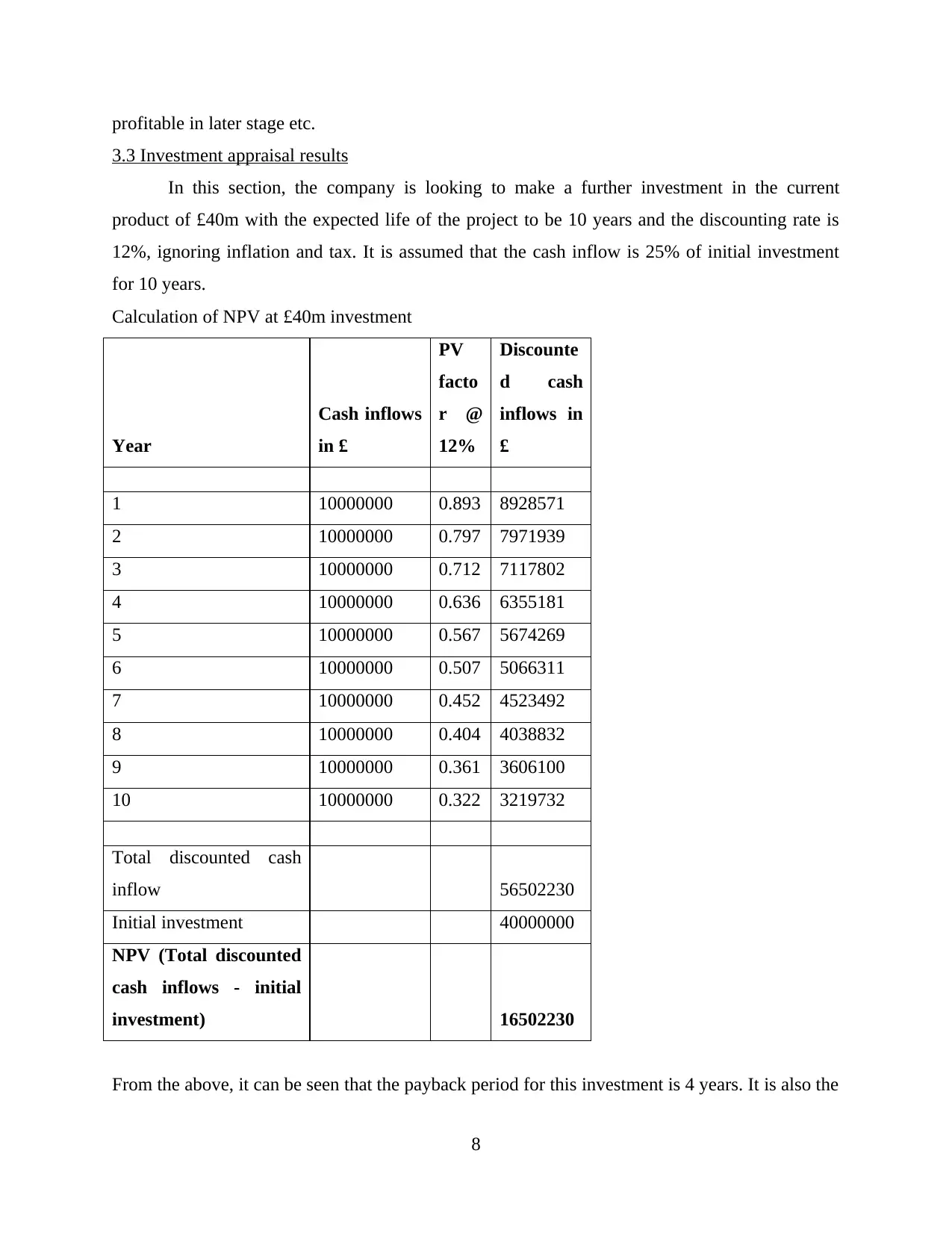

most common method of investment appraisal.

Calculating IRR for £40m investment

In this the discounting factor is 23% and the NPV for the same is given below.

Year

Cash inflows

in £

PV

facto

r @

23%

Discounte

d cash

inflows in

£

1 10000000 0.813 8130081

2 10000000 0.661 6609822

3 10000000 0.537 5373839

4 10000000 0.437 4368975

5 10000000 0.355 3552012

6 10000000 0.289 2887815

7 10000000 0.235 2347817

8 10000000 0.191 1908794

9 10000000 0.155 1551865

10 10000000 0.126 1261679

Total discounted cash

inflow 37992700

Initial investment 40000000

NPV (Total discounted

cash inflows - initial

investment) -2007300

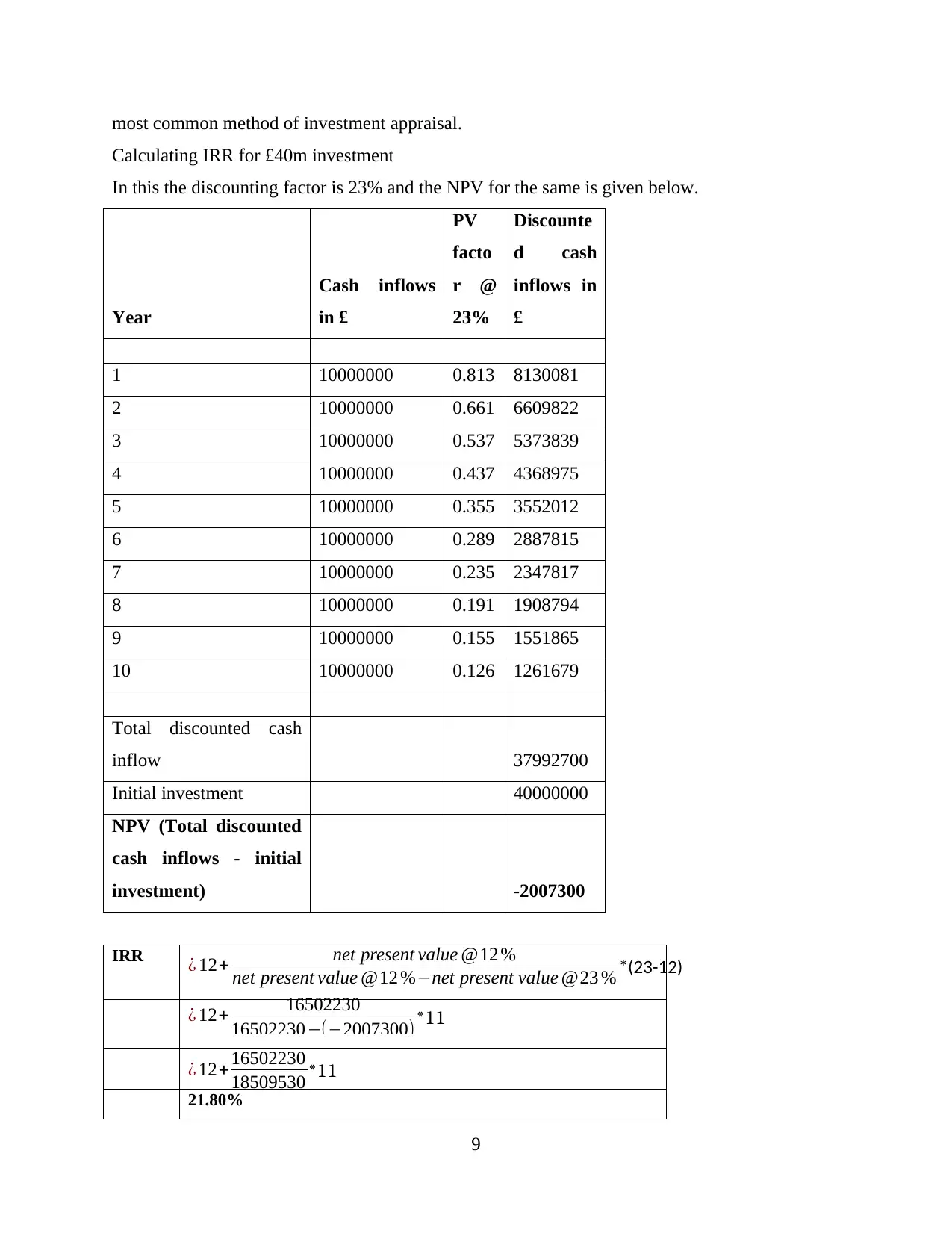

IRR

21.80%

9

¿ 12+ net present value @12 %

net present value @12 %−net present value @23 % *(23-12)

¿ 12+ 16502230

16502230−(−2007300)*11

¿ 12+16502230

18509530 *11

Calculating IRR for £40m investment

In this the discounting factor is 23% and the NPV for the same is given below.

Year

Cash inflows

in £

PV

facto

r @

23%

Discounte

d cash

inflows in

£

1 10000000 0.813 8130081

2 10000000 0.661 6609822

3 10000000 0.537 5373839

4 10000000 0.437 4368975

5 10000000 0.355 3552012

6 10000000 0.289 2887815

7 10000000 0.235 2347817

8 10000000 0.191 1908794

9 10000000 0.155 1551865

10 10000000 0.126 1261679

Total discounted cash

inflow 37992700

Initial investment 40000000

NPV (Total discounted

cash inflows - initial

investment) -2007300

IRR

21.80%

9

¿ 12+ net present value @12 %

net present value @12 %−net present value @23 % *(23-12)

¿ 12+ 16502230

16502230−(−2007300)*11

¿ 12+16502230

18509530 *11

3.4 Potential implication of investment

Based on the above calculations, this investment plan should be accepted as the payback

period is only 4 years with the NPV of £16.5m and IRR of 21.8% approximately after 10 years.

Along with that it will still have this asset after 10 years for the purpose of sale or rental fee,

which due o inflation and it will increase over the long term.

4. Potential acquisition of Leather Goods factory

It has been evaluated from the research that Burberry is thinking of acquiring Coach.

Company has been working with financial advisors for the potential acquisition. The company is

basically an Italian factory who is been involved in selling out the luxurious hand bags. They

have segmented high income based consumers in order to increase the sales and profitability

related to firm (Costa and et.al., 2017). The CEO of the firm is responsible for taking various

financial decisions. This acquisition will help Burberry in making and representing them as a

strong player in market. It will also assist them in gaining large amount of market share which is

necessary for their growth. It has also been analysed that small part of the factory will remain

independent. The factory consists of some 800 employees who are working with them. All of the

workers will be now working for Burberry.

4.1 Rationale for choosing the target company

The Italian leather good factory is going to be acquired by Burberry because the owner of

the firm is been involved in making high quality of leather products and continuously investing

in it. This can act as a potential benefit for Burberry and can also assist firm in growing and

achieving their goals and objectives. It has also been analysed from the research that sales of

factory done by its owner is been done at right price. There will be a friendly acquisition rather

than hostile one. It has also been analysed that the employees working in leather goods factory

are also really skilled, so this will also act as a benefit for Burberry to grow and enhance their

financial position in the market. It has also been analysed that Burberry can also invest in long

term growth strategies. This will assist them in increasing the market share as well as their

profitability aspects. It will also help firm in growing and becoming financially viable.

The reason for selecting leather good factory in Italy can also be fully understand by

making use of the SWOT model. It includes the following:

10

Based on the above calculations, this investment plan should be accepted as the payback

period is only 4 years with the NPV of £16.5m and IRR of 21.8% approximately after 10 years.

Along with that it will still have this asset after 10 years for the purpose of sale or rental fee,

which due o inflation and it will increase over the long term.

4. Potential acquisition of Leather Goods factory

It has been evaluated from the research that Burberry is thinking of acquiring Coach.

Company has been working with financial advisors for the potential acquisition. The company is

basically an Italian factory who is been involved in selling out the luxurious hand bags. They

have segmented high income based consumers in order to increase the sales and profitability

related to firm (Costa and et.al., 2017). The CEO of the firm is responsible for taking various

financial decisions. This acquisition will help Burberry in making and representing them as a

strong player in market. It will also assist them in gaining large amount of market share which is

necessary for their growth. It has also been analysed that small part of the factory will remain

independent. The factory consists of some 800 employees who are working with them. All of the

workers will be now working for Burberry.

4.1 Rationale for choosing the target company

The Italian leather good factory is going to be acquired by Burberry because the owner of

the firm is been involved in making high quality of leather products and continuously investing

in it. This can act as a potential benefit for Burberry and can also assist firm in growing and

achieving their goals and objectives. It has also been analysed from the research that sales of

factory done by its owner is been done at right price. There will be a friendly acquisition rather

than hostile one. It has also been analysed that the employees working in leather goods factory

are also really skilled, so this will also act as a benefit for Burberry to grow and enhance their

financial position in the market. It has also been analysed that Burberry can also invest in long

term growth strategies. This will assist them in increasing the market share as well as their

profitability aspects. It will also help firm in growing and becoming financially viable.

The reason for selecting leather good factory in Italy can also be fully understand by

making use of the SWOT model. It includes the following:

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.