MSIN0021 Finance I: Investment Analysis and Portfolio Management

VerifiedAdded on 2023/04/23

|15

|3162

|366

Homework Assignment

AI Summary

This assignment delves into various aspects of finance, focusing on investment analysis and portfolio management. It includes calculations of expected returns and standard deviations for stocks, covariance, correlation coefficients, and Sharpe ratios. The assignment explores risk aversion, portfolio price of risk, and capital allocation strategies. It further discusses efficient frontiers, minimum variance portfolios, and optimal portfolios, including computations of expected returns, standard deviations, and reward-to-volatility ratios. The analysis also considers the validity of including gold in an efficient frontier. Desklib provides a platform to explore more solved assignments and past papers.

Running head: FINANCE

Finance

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Finance

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCE

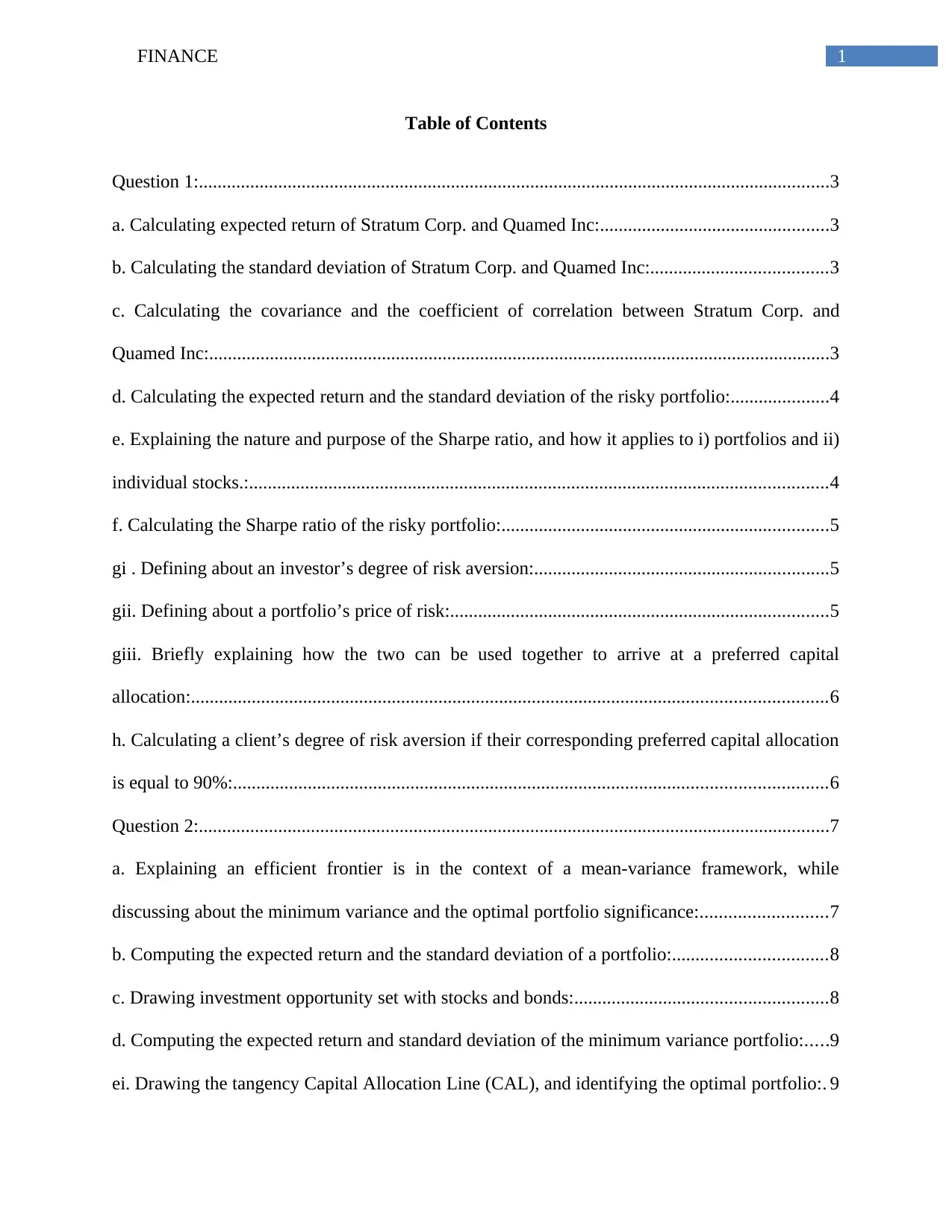

Table of Contents

Question 1:.......................................................................................................................................3

a. Calculating expected return of Stratum Corp. and Quamed Inc:.................................................3

b. Calculating the standard deviation of Stratum Corp. and Quamed Inc:......................................3

c. Calculating the covariance and the coefficient of correlation between Stratum Corp. and

Quamed Inc:.....................................................................................................................................3

d. Calculating the expected return and the standard deviation of the risky portfolio:.....................4

e. Explaining the nature and purpose of the Sharpe ratio, and how it applies to i) portfolios and ii)

individual stocks.:............................................................................................................................4

f. Calculating the Sharpe ratio of the risky portfolio:......................................................................5

gi . Defining about an investor’s degree of risk aversion:...............................................................5

gii. Defining about a portfolio’s price of risk:.................................................................................5

giii. Briefly explaining how the two can be used together to arrive at a preferred capital

allocation:........................................................................................................................................6

h. Calculating a client’s degree of risk aversion if their corresponding preferred capital allocation

is equal to 90%:...............................................................................................................................6

Question 2:.......................................................................................................................................7

a. Explaining an efficient frontier is in the context of a mean-variance framework, while

discussing about the minimum variance and the optimal portfolio significance:...........................7

b. Computing the expected return and the standard deviation of a portfolio:.................................8

c. Drawing investment opportunity set with stocks and bonds:......................................................8

d. Computing the expected return and standard deviation of the minimum variance portfolio:.....9

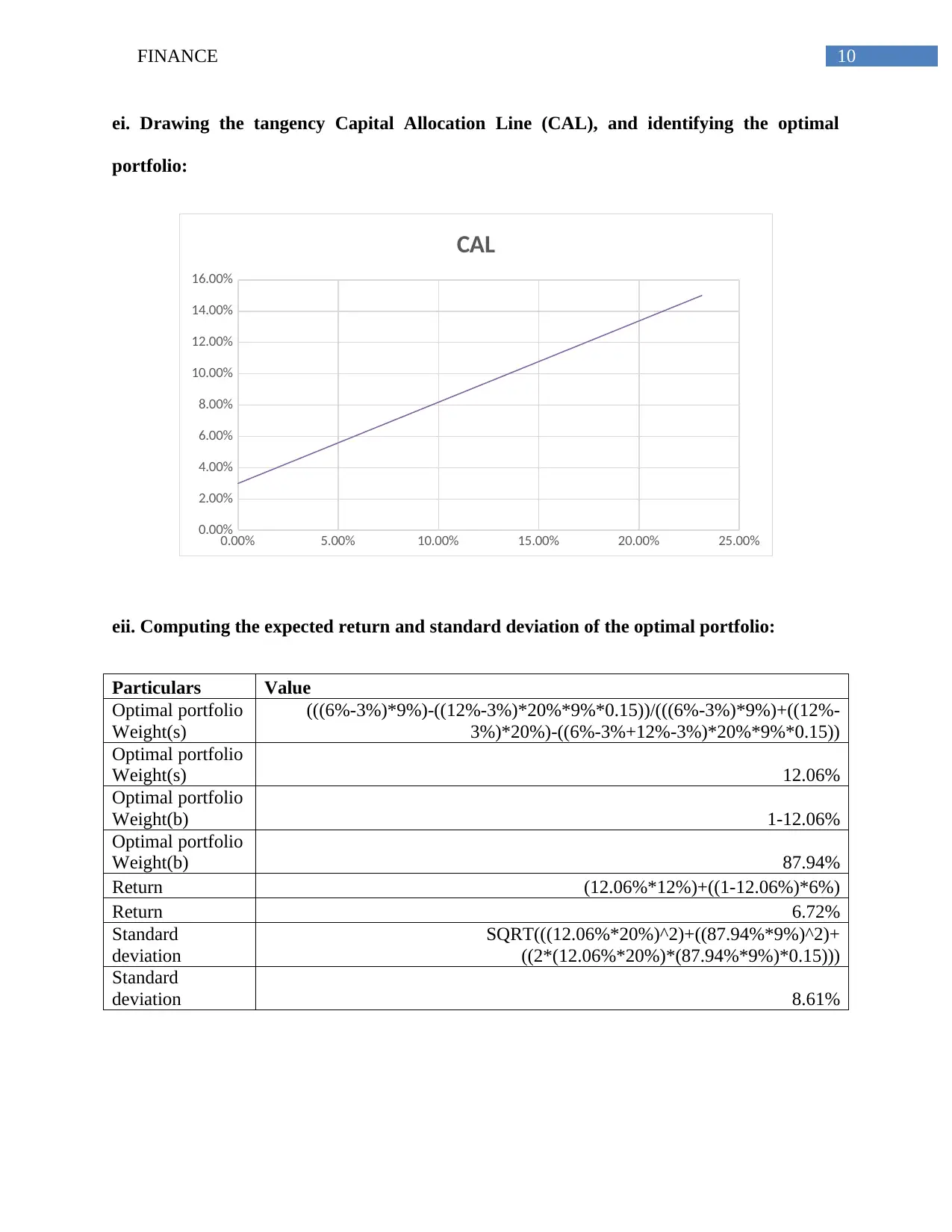

ei. Drawing the tangency Capital Allocation Line (CAL), and identifying the optimal portfolio:. 9

Table of Contents

Question 1:.......................................................................................................................................3

a. Calculating expected return of Stratum Corp. and Quamed Inc:.................................................3

b. Calculating the standard deviation of Stratum Corp. and Quamed Inc:......................................3

c. Calculating the covariance and the coefficient of correlation between Stratum Corp. and

Quamed Inc:.....................................................................................................................................3

d. Calculating the expected return and the standard deviation of the risky portfolio:.....................4

e. Explaining the nature and purpose of the Sharpe ratio, and how it applies to i) portfolios and ii)

individual stocks.:............................................................................................................................4

f. Calculating the Sharpe ratio of the risky portfolio:......................................................................5

gi . Defining about an investor’s degree of risk aversion:...............................................................5

gii. Defining about a portfolio’s price of risk:.................................................................................5

giii. Briefly explaining how the two can be used together to arrive at a preferred capital

allocation:........................................................................................................................................6

h. Calculating a client’s degree of risk aversion if their corresponding preferred capital allocation

is equal to 90%:...............................................................................................................................6

Question 2:.......................................................................................................................................7

a. Explaining an efficient frontier is in the context of a mean-variance framework, while

discussing about the minimum variance and the optimal portfolio significance:...........................7

b. Computing the expected return and the standard deviation of a portfolio:.................................8

c. Drawing investment opportunity set with stocks and bonds:......................................................8

d. Computing the expected return and standard deviation of the minimum variance portfolio:.....9

ei. Drawing the tangency Capital Allocation Line (CAL), and identifying the optimal portfolio:. 9

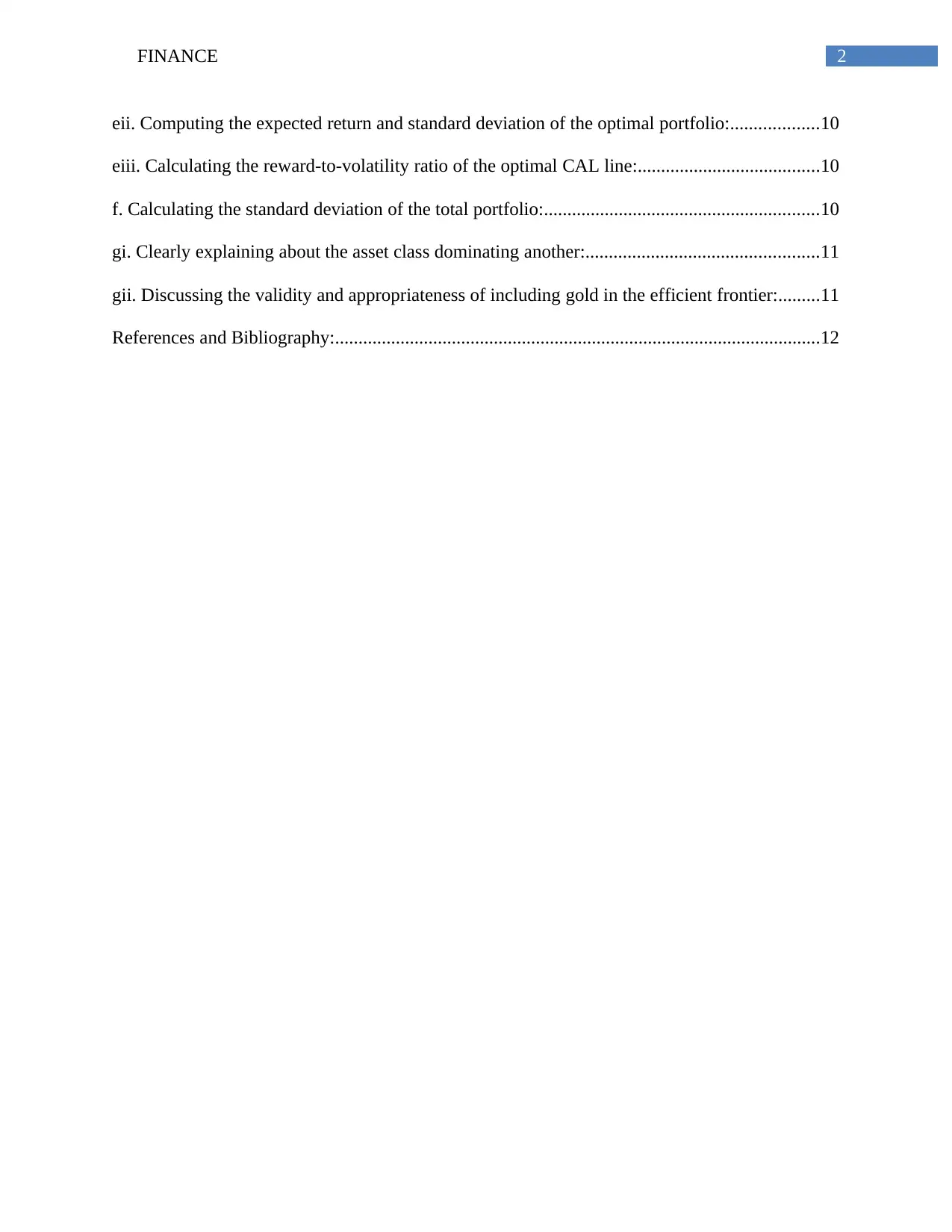

2FINANCE

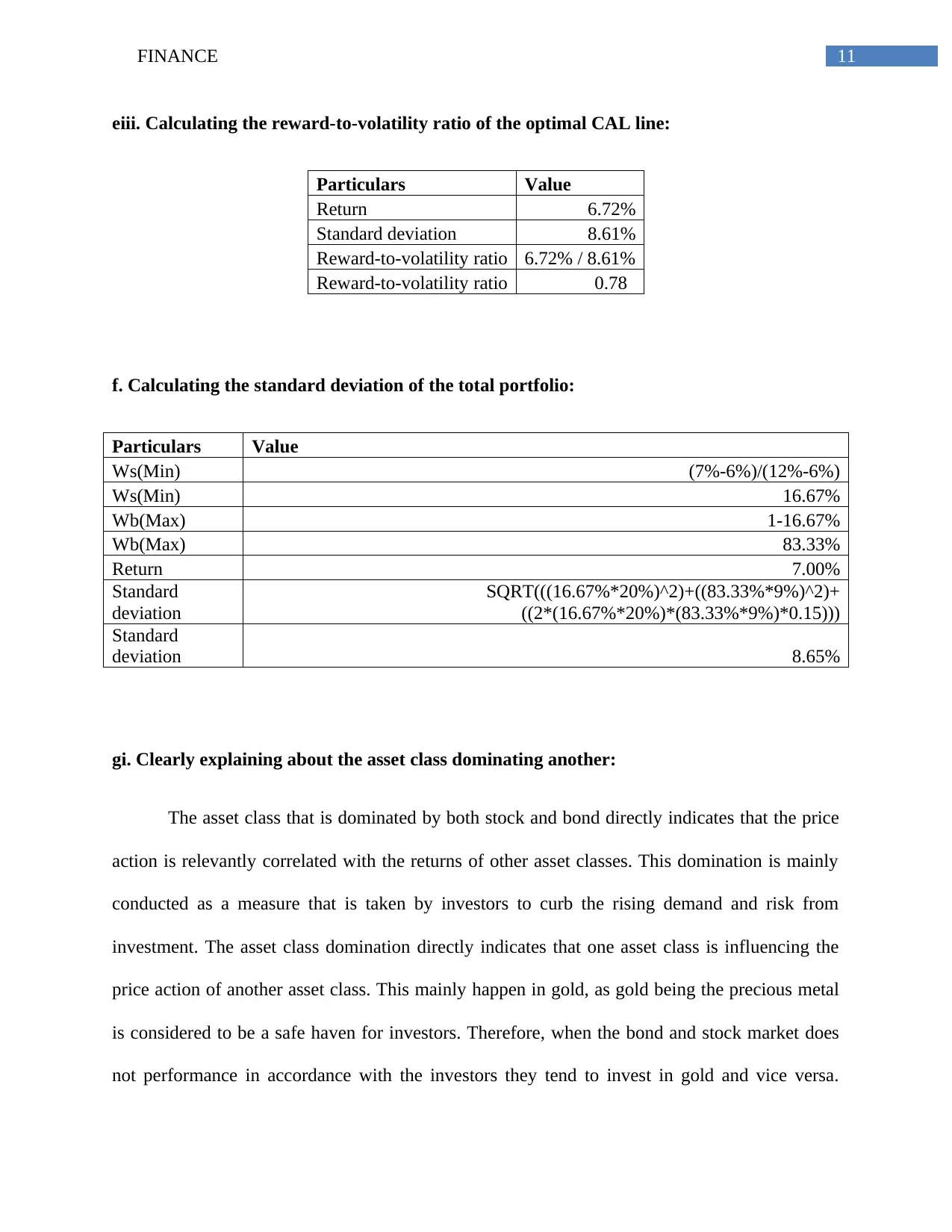

eii. Computing the expected return and standard deviation of the optimal portfolio:...................10

eiii. Calculating the reward-to-volatility ratio of the optimal CAL line:.......................................10

f. Calculating the standard deviation of the total portfolio:...........................................................10

gi. Clearly explaining about the asset class dominating another:..................................................11

gii. Discussing the validity and appropriateness of including gold in the efficient frontier:.........11

References and Bibliography:........................................................................................................12

eii. Computing the expected return and standard deviation of the optimal portfolio:...................10

eiii. Calculating the reward-to-volatility ratio of the optimal CAL line:.......................................10

f. Calculating the standard deviation of the total portfolio:...........................................................10

gi. Clearly explaining about the asset class dominating another:..................................................11

gii. Discussing the validity and appropriateness of including gold in the efficient frontier:.........11

References and Bibliography:........................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCE

Question 1:

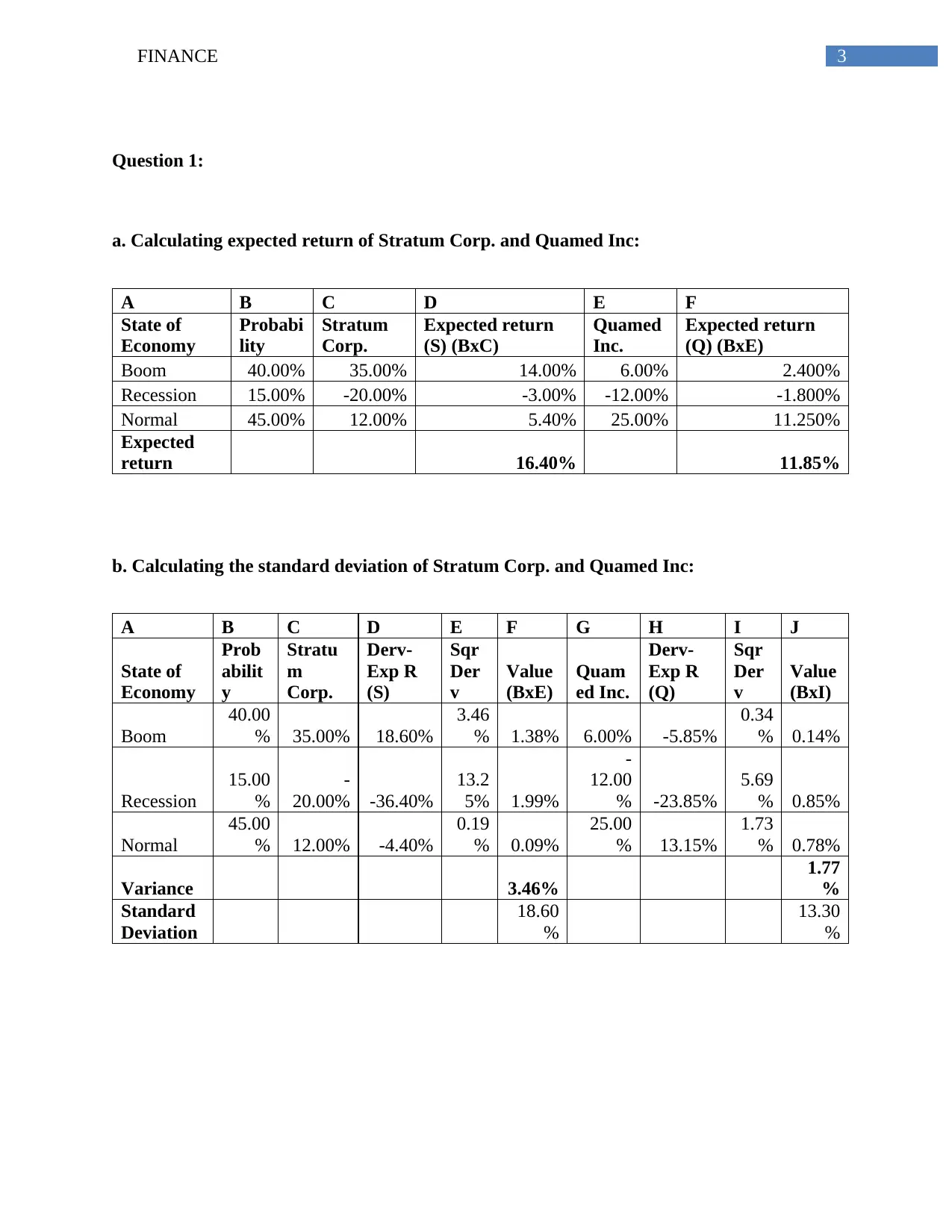

a. Calculating expected return of Stratum Corp. and Quamed Inc:

A B C D E F

State of

Economy

Probabi

lity

Stratum

Corp.

Expected return

(S) (BxC)

Quamed

Inc.

Expected return

(Q) (BxE)

Boom 40.00% 35.00% 14.00% 6.00% 2.400%

Recession 15.00% -20.00% -3.00% -12.00% -1.800%

Normal 45.00% 12.00% 5.40% 25.00% 11.250%

Expected

return 16.40% 11.85%

b. Calculating the standard deviation of Stratum Corp. and Quamed Inc:

A B C D E F G H I J

State of

Economy

Prob

abilit

y

Stratu

m

Corp.

Derv-

Exp R

(S)

Sqr

Der

v

Value

(BxE)

Quam

ed Inc.

Derv-

Exp R

(Q)

Sqr

Der

v

Value

(BxI)

Boom

40.00

% 35.00% 18.60%

3.46

% 1.38% 6.00% -5.85%

0.34

% 0.14%

Recession

15.00

%

-

20.00% -36.40%

13.2

5% 1.99%

-

12.00

% -23.85%

5.69

% 0.85%

Normal

45.00

% 12.00% -4.40%

0.19

% 0.09%

25.00

% 13.15%

1.73

% 0.78%

Variance 3.46%

1.77

%

Standard

Deviation

18.60

%

13.30

%

Question 1:

a. Calculating expected return of Stratum Corp. and Quamed Inc:

A B C D E F

State of

Economy

Probabi

lity

Stratum

Corp.

Expected return

(S) (BxC)

Quamed

Inc.

Expected return

(Q) (BxE)

Boom 40.00% 35.00% 14.00% 6.00% 2.400%

Recession 15.00% -20.00% -3.00% -12.00% -1.800%

Normal 45.00% 12.00% 5.40% 25.00% 11.250%

Expected

return 16.40% 11.85%

b. Calculating the standard deviation of Stratum Corp. and Quamed Inc:

A B C D E F G H I J

State of

Economy

Prob

abilit

y

Stratu

m

Corp.

Derv-

Exp R

(S)

Sqr

Der

v

Value

(BxE)

Quam

ed Inc.

Derv-

Exp R

(Q)

Sqr

Der

v

Value

(BxI)

Boom

40.00

% 35.00% 18.60%

3.46

% 1.38% 6.00% -5.85%

0.34

% 0.14%

Recession

15.00

%

-

20.00% -36.40%

13.2

5% 1.99%

-

12.00

% -23.85%

5.69

% 0.85%

Normal

45.00

% 12.00% -4.40%

0.19

% 0.09%

25.00

% 13.15%

1.73

% 0.78%

Variance 3.46%

1.77

%

Standard

Deviation

18.60

%

13.30

%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCE

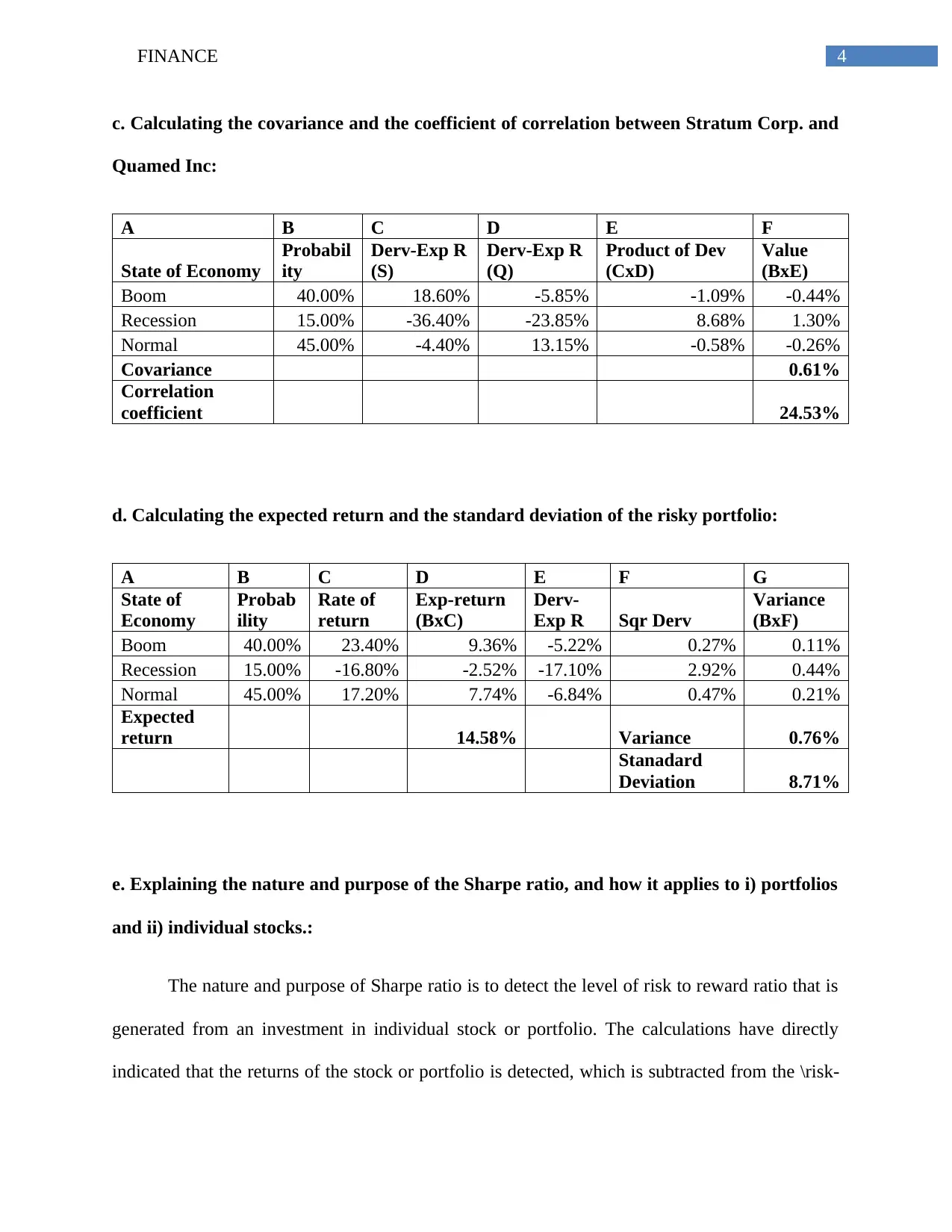

c. Calculating the covariance and the coefficient of correlation between Stratum Corp. and

Quamed Inc:

A B C D E F

State of Economy

Probabil

ity

Derv-Exp R

(S)

Derv-Exp R

(Q)

Product of Dev

(CxD)

Value

(BxE)

Boom 40.00% 18.60% -5.85% -1.09% -0.44%

Recession 15.00% -36.40% -23.85% 8.68% 1.30%

Normal 45.00% -4.40% 13.15% -0.58% -0.26%

Covariance 0.61%

Correlation

coefficient 24.53%

d. Calculating the expected return and the standard deviation of the risky portfolio:

A B C D E F G

State of

Economy

Probab

ility

Rate of

return

Exp-return

(BxC)

Derv-

Exp R Sqr Derv

Variance

(BxF)

Boom 40.00% 23.40% 9.36% -5.22% 0.27% 0.11%

Recession 15.00% -16.80% -2.52% -17.10% 2.92% 0.44%

Normal 45.00% 17.20% 7.74% -6.84% 0.47% 0.21%

Expected

return 14.58% Variance 0.76%

Stanadard

Deviation 8.71%

e. Explaining the nature and purpose of the Sharpe ratio, and how it applies to i) portfolios

and ii) individual stocks.:

The nature and purpose of Sharpe ratio is to detect the level of risk to reward ratio that is

generated from an investment in individual stock or portfolio. The calculations have directly

indicated that the returns of the stock or portfolio is detected, which is subtracted from the \risk-

c. Calculating the covariance and the coefficient of correlation between Stratum Corp. and

Quamed Inc:

A B C D E F

State of Economy

Probabil

ity

Derv-Exp R

(S)

Derv-Exp R

(Q)

Product of Dev

(CxD)

Value

(BxE)

Boom 40.00% 18.60% -5.85% -1.09% -0.44%

Recession 15.00% -36.40% -23.85% 8.68% 1.30%

Normal 45.00% -4.40% 13.15% -0.58% -0.26%

Covariance 0.61%

Correlation

coefficient 24.53%

d. Calculating the expected return and the standard deviation of the risky portfolio:

A B C D E F G

State of

Economy

Probab

ility

Rate of

return

Exp-return

(BxC)

Derv-

Exp R Sqr Derv

Variance

(BxF)

Boom 40.00% 23.40% 9.36% -5.22% 0.27% 0.11%

Recession 15.00% -16.80% -2.52% -17.10% 2.92% 0.44%

Normal 45.00% 17.20% 7.74% -6.84% 0.47% 0.21%

Expected

return 14.58% Variance 0.76%

Stanadard

Deviation 8.71%

e. Explaining the nature and purpose of the Sharpe ratio, and how it applies to i) portfolios

and ii) individual stocks.:

The nature and purpose of Sharpe ratio is to detect the level of risk to reward ratio that is

generated from an investment in individual stock or portfolio. The calculations have directly

indicated that the returns of the stock or portfolio is detected, which is subtracted from the \risk-

5FINANCE

free rate that is being providing in the current period. Moreover, after deriving the values the

whole value is divided by the standard deviation of the portfolio or stock. This mainly helps in

detecting the level of risk to reward ratio from an investment. There, it could be understood that

there is no difference between the calculation of Sharpe ratio in terms of stock or portfolio

(Chandra 2017).

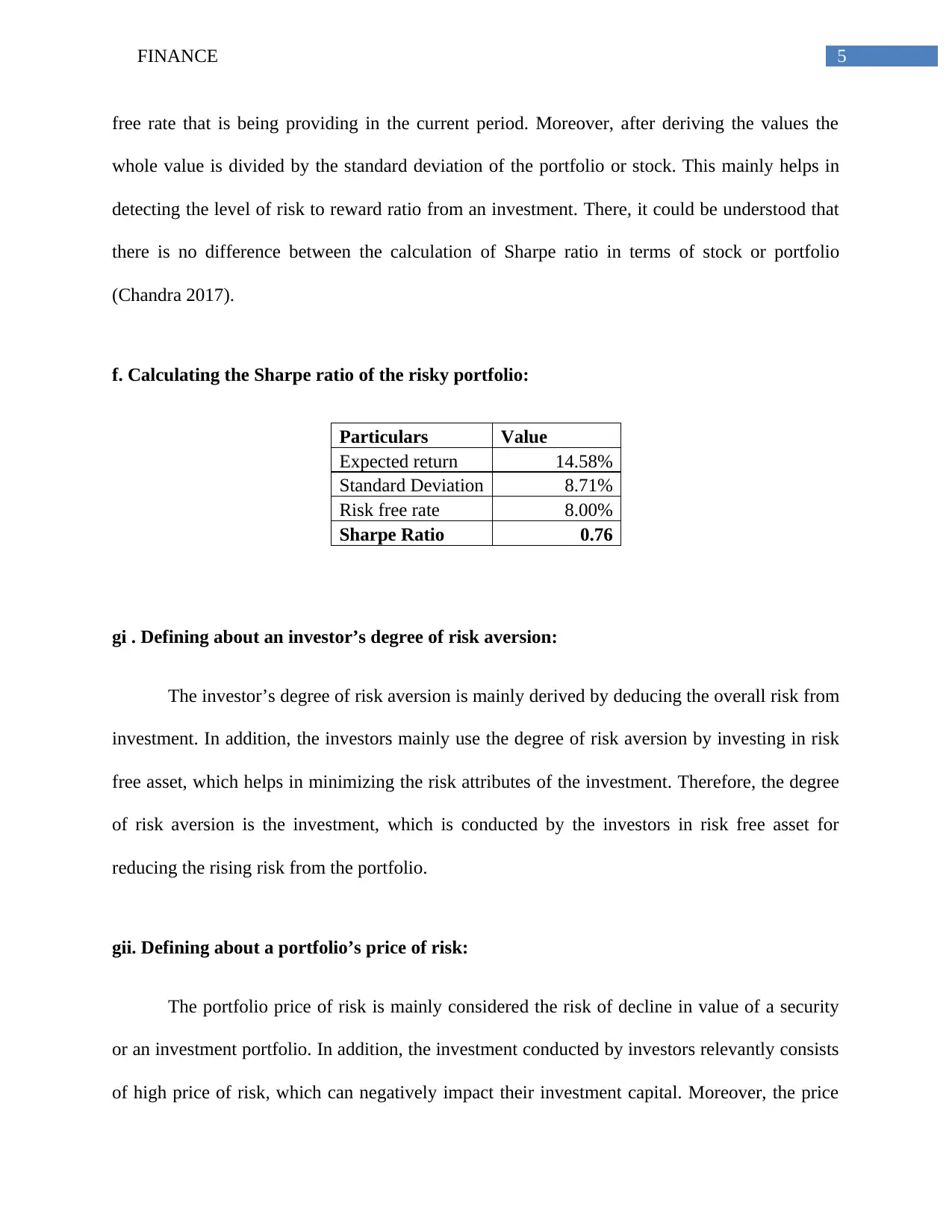

f. Calculating the Sharpe ratio of the risky portfolio:

Particulars Value

Expected return 14.58%

Standard Deviation 8.71%

Risk free rate 8.00%

Sharpe Ratio 0.76

gi . Defining about an investor’s degree of risk aversion:

The investor’s degree of risk aversion is mainly derived by deducing the overall risk from

investment. In addition, the investors mainly use the degree of risk aversion by investing in risk

free asset, which helps in minimizing the risk attributes of the investment. Therefore, the degree

of risk aversion is the investment, which is conducted by the investors in risk free asset for

reducing the rising risk from the portfolio.

gii. Defining about a portfolio’s price of risk:

The portfolio price of risk is mainly considered the risk of decline in value of a security

or an investment portfolio. In addition, the investment conducted by investors relevantly consists

of high price of risk, which can negatively impact their investment capital. Moreover, the price

free rate that is being providing in the current period. Moreover, after deriving the values the

whole value is divided by the standard deviation of the portfolio or stock. This mainly helps in

detecting the level of risk to reward ratio from an investment. There, it could be understood that

there is no difference between the calculation of Sharpe ratio in terms of stock or portfolio

(Chandra 2017).

f. Calculating the Sharpe ratio of the risky portfolio:

Particulars Value

Expected return 14.58%

Standard Deviation 8.71%

Risk free rate 8.00%

Sharpe Ratio 0.76

gi . Defining about an investor’s degree of risk aversion:

The investor’s degree of risk aversion is mainly derived by deducing the overall risk from

investment. In addition, the investors mainly use the degree of risk aversion by investing in risk

free asset, which helps in minimizing the risk attributes of the investment. Therefore, the degree

of risk aversion is the investment, which is conducted by the investors in risk free asset for

reducing the rising risk from the portfolio.

gii. Defining about a portfolio’s price of risk:

The portfolio price of risk is mainly considered the risk of decline in value of a security

or an investment portfolio. In addition, the investment conducted by investors relevantly consists

of high price of risk, which can negatively impact their investment capital. Moreover, the price

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCE

of risk is mainly low in blue-chip stocks, as they are considered to be less volatile in nature.

Therefore, it can be assumed that the share price of maximum companies has high price of risk,

which needs to be mitigated by conducting adequate diversified investments. Chen, Yongjian

and Jun (2018) mentioned that investors use of the diversification method for minimizing the

negative impact on their investment, while generating adequate returns to support their

investment scope.

giii. Briefly explaining how the two can be used together to arrive at a preferred capital

allocation:

With the help of degree of risk aversion and price of risk investors are able to arrive at a

prefeed capital allocation, which is suitable for investment. In addition, the calculations directly

provide insight to the investors are regarding the risk conditions of the investment, which needs

to be mitigated for securing the investment capital. Hence, the price of risk mainly provides the

investors with adequate information regarding the risk attributes of the investment. Therefore,

the investor can adequately use the measure for generating high level of income from

investment, while minimizing the anticipated risk attributes of investment. Kindig and Bobby

(2018) mentioned that the combination of risk aversion method directly allows the organization

to increase their return generation capability by accommodating high risky stock in the portfolio.

h. Calculating a client’s degree of risk aversion if their corresponding preferred capital

allocation is equal to 90%:

Particulars Value

Risky Portfolio return 14.58%

Risk free rate return 8.00%

of risk is mainly low in blue-chip stocks, as they are considered to be less volatile in nature.

Therefore, it can be assumed that the share price of maximum companies has high price of risk,

which needs to be mitigated by conducting adequate diversified investments. Chen, Yongjian

and Jun (2018) mentioned that investors use of the diversification method for minimizing the

negative impact on their investment, while generating adequate returns to support their

investment scope.

giii. Briefly explaining how the two can be used together to arrive at a preferred capital

allocation:

With the help of degree of risk aversion and price of risk investors are able to arrive at a

prefeed capital allocation, which is suitable for investment. In addition, the calculations directly

provide insight to the investors are regarding the risk conditions of the investment, which needs

to be mitigated for securing the investment capital. Hence, the price of risk mainly provides the

investors with adequate information regarding the risk attributes of the investment. Therefore,

the investor can adequately use the measure for generating high level of income from

investment, while minimizing the anticipated risk attributes of investment. Kindig and Bobby

(2018) mentioned that the combination of risk aversion method directly allows the organization

to increase their return generation capability by accommodating high risky stock in the portfolio.

h. Calculating a client’s degree of risk aversion if their corresponding preferred capital

allocation is equal to 90%:

Particulars Value

Risky Portfolio return 14.58%

Risk free rate return 8.00%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCE

Risky Portfolio variance 0.76%

Risk aversion 10.00%

Degree of risk aversion 0.0050%

Question 2:

a. Explaining an efficient frontier is in the context of a mean-variance framework, while

discussing about the minimum variance and the optimal portfolio significance:

Efficient frontier is a graphical representation of different risk and return attributes of a

portfolio created under alternative weights. The efficient frontier graph provides an infographic

knowledge about the risk and return contributions of the overall stocks in a portfolio, which

allows them to make adequate investment decisions. This calculation directly helps in improving

the level of income from investment, as it allows the investor to detect the level of returns that

will be generated from the investment. The mean variance calculation provides information

about the overall return and risk that will be generated from the combination of the stocks.

Moreover, there are other calculation such as minimum variance portfolio, which allows the

investors to detect the minimum risk attributes of an investment opportunity. This calculation

provides relevant information to the investors regarding the weights in the portfolio, which can

produce the lowest risk to the investment capital (Grant and Robert 2016).

The optimal portfolio calculation is based on the adequate measure, which allows the

investors to detect the investment scope, which can increase the maximum returns by reducing

the risk to the minimum level. The optimal portfolio calculation mainly helps in investors to

understand the highest return to risk combination given by a specific investor’s tolerance of risk.

Risky Portfolio variance 0.76%

Risk aversion 10.00%

Degree of risk aversion 0.0050%

Question 2:

a. Explaining an efficient frontier is in the context of a mean-variance framework, while

discussing about the minimum variance and the optimal portfolio significance:

Efficient frontier is a graphical representation of different risk and return attributes of a

portfolio created under alternative weights. The efficient frontier graph provides an infographic

knowledge about the risk and return contributions of the overall stocks in a portfolio, which

allows them to make adequate investment decisions. This calculation directly helps in improving

the level of income from investment, as it allows the investor to detect the level of returns that

will be generated from the investment. The mean variance calculation provides information

about the overall return and risk that will be generated from the combination of the stocks.

Moreover, there are other calculation such as minimum variance portfolio, which allows the

investors to detect the minimum risk attributes of an investment opportunity. This calculation

provides relevant information to the investors regarding the weights in the portfolio, which can

produce the lowest risk to the investment capital (Grant and Robert 2016).

The optimal portfolio calculation is based on the adequate measure, which allows the

investors to detect the investment scope, which can increase the maximum returns by reducing

the risk to the minimum level. The optimal portfolio calculation mainly helps in investors to

understand the highest return to risk combination given by a specific investor’s tolerance of risk.

8FINANCE

These minimum risk portfolio and optimal portfolio allows the investors to maximize their

income, while reducing the level of risk involved in investment.

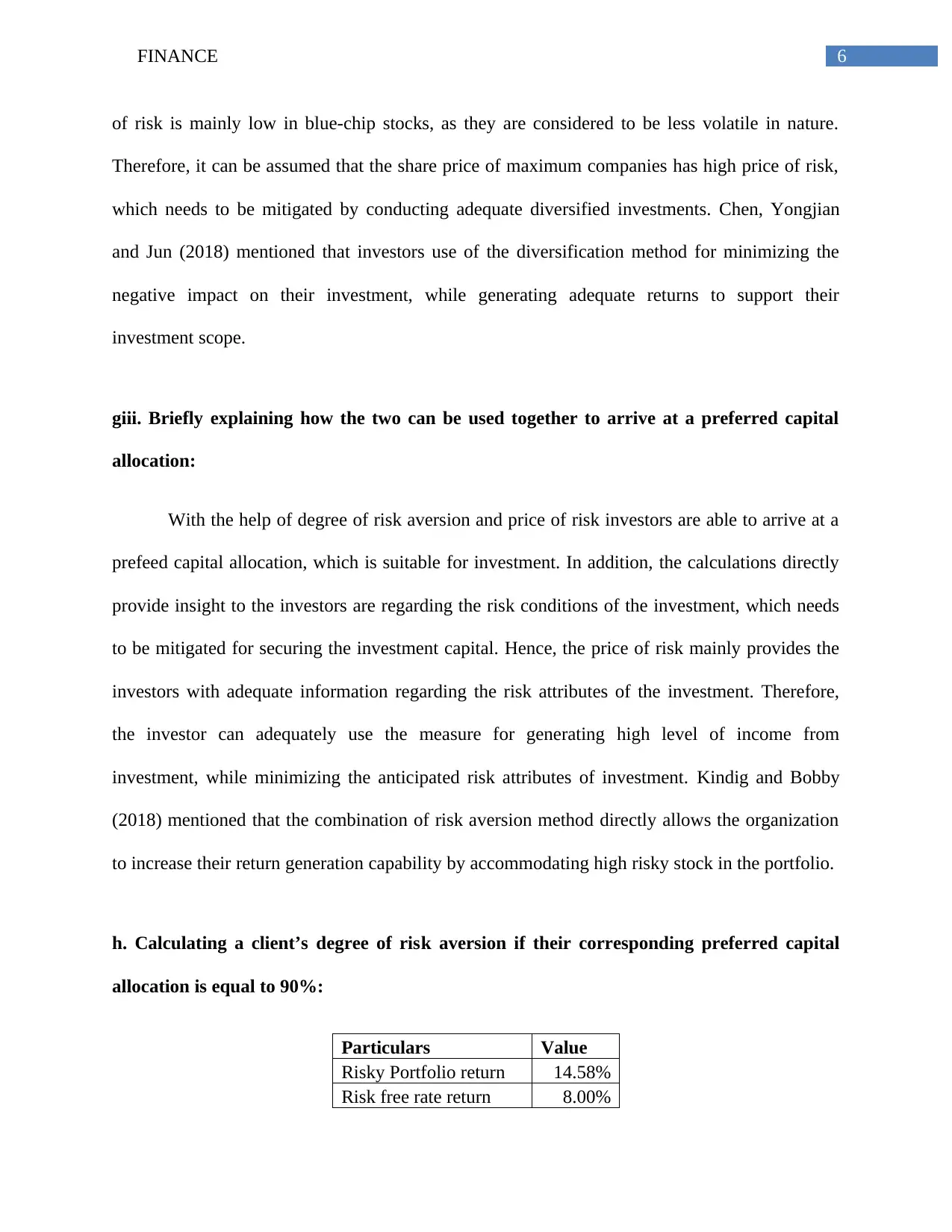

b. Computing the expected return and the standard deviation of a portfolio:

Portfolio Weights

Stocks Bonds

Expected

return Standard deviation

0 1 6.00% 9.00%

0.1 0.9 6.60% 8.63%

0.2 0.8 7.20% 8.75%

0.3 0.7 7.80% 9.33%

0.4 0.6 8.40% 10.30%

0.5 0.5 9.00% 11.57%

0.6 0.4 9.60% 13.04%

0.7 0.3 10.20% 14.65%

0.8 0.2 10.80% 16.37%

0.9 0.1 11.40% 18.16%

1 0 12.00% 20.00%

These minimum risk portfolio and optimal portfolio allows the investors to maximize their

income, while reducing the level of risk involved in investment.

b. Computing the expected return and the standard deviation of a portfolio:

Portfolio Weights

Stocks Bonds

Expected

return Standard deviation

0 1 6.00% 9.00%

0.1 0.9 6.60% 8.63%

0.2 0.8 7.20% 8.75%

0.3 0.7 7.80% 9.33%

0.4 0.6 8.40% 10.30%

0.5 0.5 9.00% 11.57%

0.6 0.4 9.60% 13.04%

0.7 0.3 10.20% 14.65%

0.8 0.2 10.80% 16.37%

0.9 0.1 11.40% 18.16%

1 0 12.00% 20.00%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCE

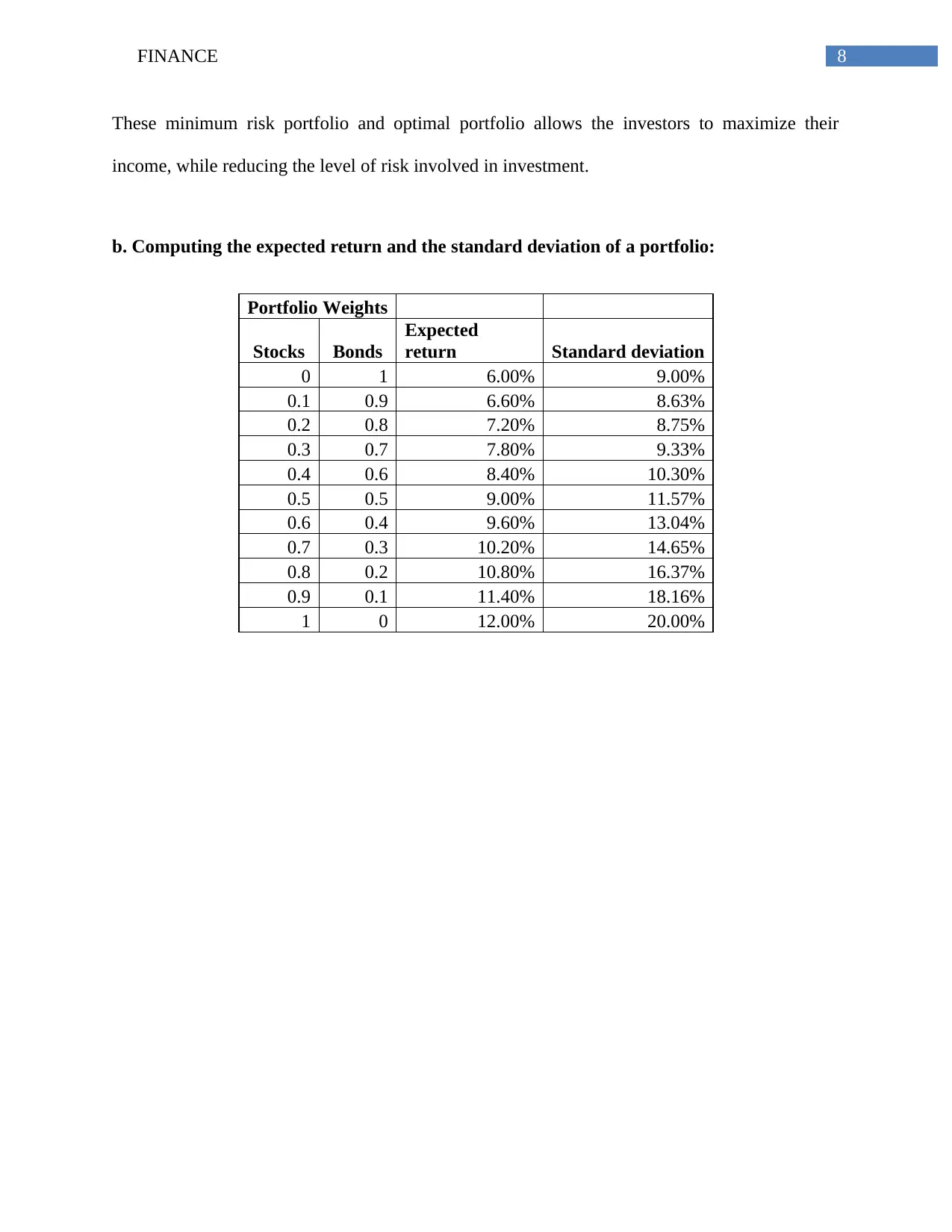

c. Drawing investment opportunity set with stocks and bonds:

7.00% 9.00% 11.00% 13.00% 15.00% 17.00% 19.00% 21.00%

5.00%

6.00%

7.00%

8.00%

9.00%

10.00%

11.00%

12.00%

13.00%

Bonds

Stocks

Investment Opportunity Set

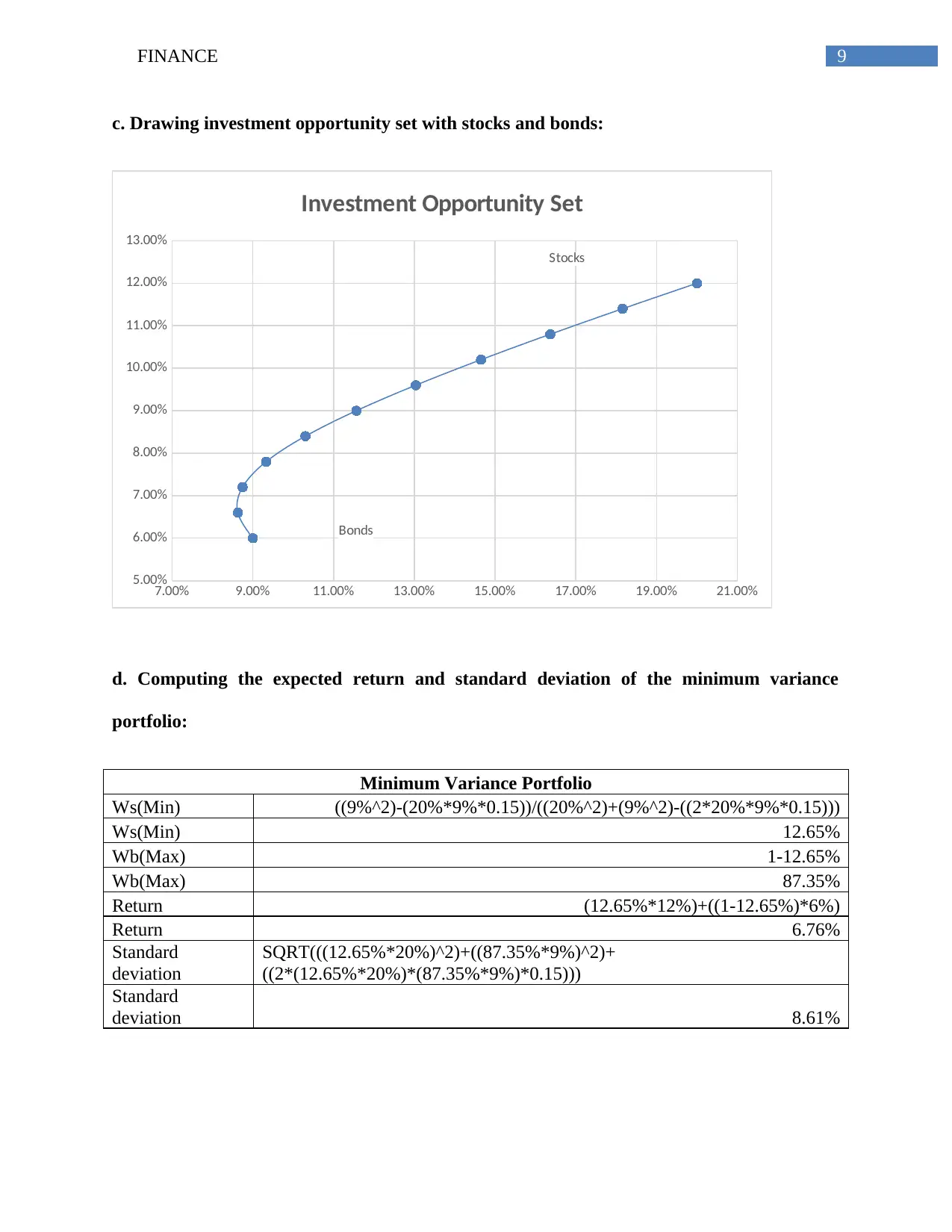

d. Computing the expected return and standard deviation of the minimum variance

portfolio:

Minimum Variance Portfolio

Ws(Min) ((9%^2)-(20%*9%*0.15))/((20%^2)+(9%^2)-((2*20%*9%*0.15)))

Ws(Min) 12.65%

Wb(Max) 1-12.65%

Wb(Max) 87.35%

Return (12.65%*12%)+((1-12.65%)*6%)

Return 6.76%

Standard

deviation

SQRT(((12.65%*20%)^2)+((87.35%*9%)^2)+

((2*(12.65%*20%)*(87.35%*9%)*0.15)))

Standard

deviation 8.61%

c. Drawing investment opportunity set with stocks and bonds:

7.00% 9.00% 11.00% 13.00% 15.00% 17.00% 19.00% 21.00%

5.00%

6.00%

7.00%

8.00%

9.00%

10.00%

11.00%

12.00%

13.00%

Bonds

Stocks

Investment Opportunity Set

d. Computing the expected return and standard deviation of the minimum variance

portfolio:

Minimum Variance Portfolio

Ws(Min) ((9%^2)-(20%*9%*0.15))/((20%^2)+(9%^2)-((2*20%*9%*0.15)))

Ws(Min) 12.65%

Wb(Max) 1-12.65%

Wb(Max) 87.35%

Return (12.65%*12%)+((1-12.65%)*6%)

Return 6.76%

Standard

deviation

SQRT(((12.65%*20%)^2)+((87.35%*9%)^2)+

((2*(12.65%*20%)*(87.35%*9%)*0.15)))

Standard

deviation 8.61%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCE

ei. Drawing the tangency Capital Allocation Line (CAL), and identifying the optimal

portfolio:

0.00% 5.00% 10.00% 15.00% 20.00% 25.00%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

CAL

eii. Computing the expected return and standard deviation of the optimal portfolio:

Particulars Value

Optimal portfolio

Weight(s)

(((6%-3%)*9%)-((12%-3%)*20%*9%*0.15))/(((6%-3%)*9%)+((12%-

3%)*20%)-((6%-3%+12%-3%)*20%*9%*0.15))

Optimal portfolio

Weight(s) 12.06%

Optimal portfolio

Weight(b) 1-12.06%

Optimal portfolio

Weight(b) 87.94%

Return (12.06%*12%)+((1-12.06%)*6%)

Return 6.72%

Standard

deviation

SQRT(((12.06%*20%)^2)+((87.94%*9%)^2)+

((2*(12.06%*20%)*(87.94%*9%)*0.15)))

Standard

deviation 8.61%

ei. Drawing the tangency Capital Allocation Line (CAL), and identifying the optimal

portfolio:

0.00% 5.00% 10.00% 15.00% 20.00% 25.00%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

CAL

eii. Computing the expected return and standard deviation of the optimal portfolio:

Particulars Value

Optimal portfolio

Weight(s)

(((6%-3%)*9%)-((12%-3%)*20%*9%*0.15))/(((6%-3%)*9%)+((12%-

3%)*20%)-((6%-3%+12%-3%)*20%*9%*0.15))

Optimal portfolio

Weight(s) 12.06%

Optimal portfolio

Weight(b) 1-12.06%

Optimal portfolio

Weight(b) 87.94%

Return (12.06%*12%)+((1-12.06%)*6%)

Return 6.72%

Standard

deviation

SQRT(((12.06%*20%)^2)+((87.94%*9%)^2)+

((2*(12.06%*20%)*(87.94%*9%)*0.15)))

Standard

deviation 8.61%

11FINANCE

eiii. Calculating the reward-to-volatility ratio of the optimal CAL line:

Particulars Value

Return 6.72%

Standard deviation 8.61%

Reward-to-volatility ratio 6.72% / 8.61%

Reward-to-volatility ratio 0.78

f. Calculating the standard deviation of the total portfolio:

Particulars Value

Ws(Min) (7%-6%)/(12%-6%)

Ws(Min) 16.67%

Wb(Max) 1-16.67%

Wb(Max) 83.33%

Return 7.00%

Standard

deviation

SQRT(((16.67%*20%)^2)+((83.33%*9%)^2)+

((2*(16.67%*20%)*(83.33%*9%)*0.15)))

Standard

deviation 8.65%

gi. Clearly explaining about the asset class dominating another:

The asset class that is dominated by both stock and bond directly indicates that the price

action is relevantly correlated with the returns of other asset classes. This domination is mainly

conducted as a measure that is taken by investors to curb the rising demand and risk from

investment. The asset class domination directly indicates that one asset class is influencing the

price action of another asset class. This mainly happen in gold, as gold being the precious metal

is considered to be a safe haven for investors. Therefore, when the bond and stock market does

not performance in accordance with the investors they tend to invest in gold and vice versa.

eiii. Calculating the reward-to-volatility ratio of the optimal CAL line:

Particulars Value

Return 6.72%

Standard deviation 8.61%

Reward-to-volatility ratio 6.72% / 8.61%

Reward-to-volatility ratio 0.78

f. Calculating the standard deviation of the total portfolio:

Particulars Value

Ws(Min) (7%-6%)/(12%-6%)

Ws(Min) 16.67%

Wb(Max) 1-16.67%

Wb(Max) 83.33%

Return 7.00%

Standard

deviation

SQRT(((16.67%*20%)^2)+((83.33%*9%)^2)+

((2*(16.67%*20%)*(83.33%*9%)*0.15)))

Standard

deviation 8.65%

gi. Clearly explaining about the asset class dominating another:

The asset class that is dominated by both stock and bond directly indicates that the price

action is relevantly correlated with the returns of other asset classes. This domination is mainly

conducted as a measure that is taken by investors to curb the rising demand and risk from

investment. The asset class domination directly indicates that one asset class is influencing the

price action of another asset class. This mainly happen in gold, as gold being the precious metal

is considered to be a safe haven for investors. Therefore, when the bond and stock market does

not performance in accordance with the investors they tend to invest in gold and vice versa.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.