Case Study: Risk and Return Measures of JB-HiFi - ACC00716 Finance

VerifiedAdded on 2023/06/14

|7

|1398

|239

Case Study

AI Summary

This finance case study analyzes risk and return measures, focusing on JB-HiFi and a hypothetical company. It uses the Capital Asset Pricing Model (CAPM) to evaluate expected returns based on beta values, demonstrating how risk influences investment decisions. The study constructs a portfolio with b...

Running head: FINANCE

Finance

Name of the Student:

Name of the University:

Authors Note:

Finance

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

1

Table of Contents

3.a Drawing on the expectations from their and incorporating the overall context of the

chosen company, while discussing and interpreting the risk and return measures:...................2

Reference and Bibliography:......................................................................................................6

1

Table of Contents

3.a Drawing on the expectations from their and incorporating the overall context of the

chosen company, while discussing and interpreting the risk and return measures:...................2

Reference and Bibliography:......................................................................................................6

FINANCE

2

3.a Drawing on the expectations from their and incorporating the overall context of the

chosen company, while discussing and interpreting the risk and return measures:

The overall expectation theory mainly indicates the overall minimum returns, which is

expected by the company to provide over the period. The expectation theory is mainly reliant

on the CAPM formula, where the expected return of an organisation estimated by the

investor. The theory relevantly compliments the expectation theory, which allows the

investor to detect the minimum requirements from their investment. In this context, Aliu,

Pavelkova and Dehning (2017) stated that expectation theory only detects the behaviour of an

individual regarding certain measures, while it does not depict the exact response of the

individual. In addition, the expectation theory does not allow investor to understand the

minimum requirements, which needs to be provided, while it does not depict the actual

returns that might be generated by the organisation. Moreover, the use of CAPM model

relevantly evaluates the financial performance of new risk involved in investment with the

risk-free rate and market premium to determine the minimum return that could be generated

from investment.

The overall chosen company JH-HI-FI relevantly has a beta of 0.45, which is derived

from relevant source. Moreover, the beta indicates overall risk involved in investment, which

could directly affect returns from investment. In addition, beta evaluation of the company

indicates that the risk provisions of the company are relevantly low in comprising with the

overall market risk. Therefore, with the evaluation of beta overall expected return form

investment can be identified, which might help in improving the level of returns from

investment. In this context, Hoffmann and Post (2017) stated that with the expected theory

condition investors can evaluate the risk and return of an investment.

Particulars Value

2

3.a Drawing on the expectations from their and incorporating the overall context of the

chosen company, while discussing and interpreting the risk and return measures:

The overall expectation theory mainly indicates the overall minimum returns, which is

expected by the company to provide over the period. The expectation theory is mainly reliant

on the CAPM formula, where the expected return of an organisation estimated by the

investor. The theory relevantly compliments the expectation theory, which allows the

investor to detect the minimum requirements from their investment. In this context, Aliu,

Pavelkova and Dehning (2017) stated that expectation theory only detects the behaviour of an

individual regarding certain measures, while it does not depict the exact response of the

individual. In addition, the expectation theory does not allow investor to understand the

minimum requirements, which needs to be provided, while it does not depict the actual

returns that might be generated by the organisation. Moreover, the use of CAPM model

relevantly evaluates the financial performance of new risk involved in investment with the

risk-free rate and market premium to determine the minimum return that could be generated

from investment.

The overall chosen company JH-HI-FI relevantly has a beta of 0.45, which is derived

from relevant source. Moreover, the beta indicates overall risk involved in investment, which

could directly affect returns from investment. In addition, beta evaluation of the company

indicates that the risk provisions of the company are relevantly low in comprising with the

overall market risk. Therefore, with the evaluation of beta overall expected return form

investment can be identified, which might help in improving the level of returns from

investment. In this context, Hoffmann and Post (2017) stated that with the expected theory

condition investors can evaluate the risk and return of an investment.

Particulars Value

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE

3

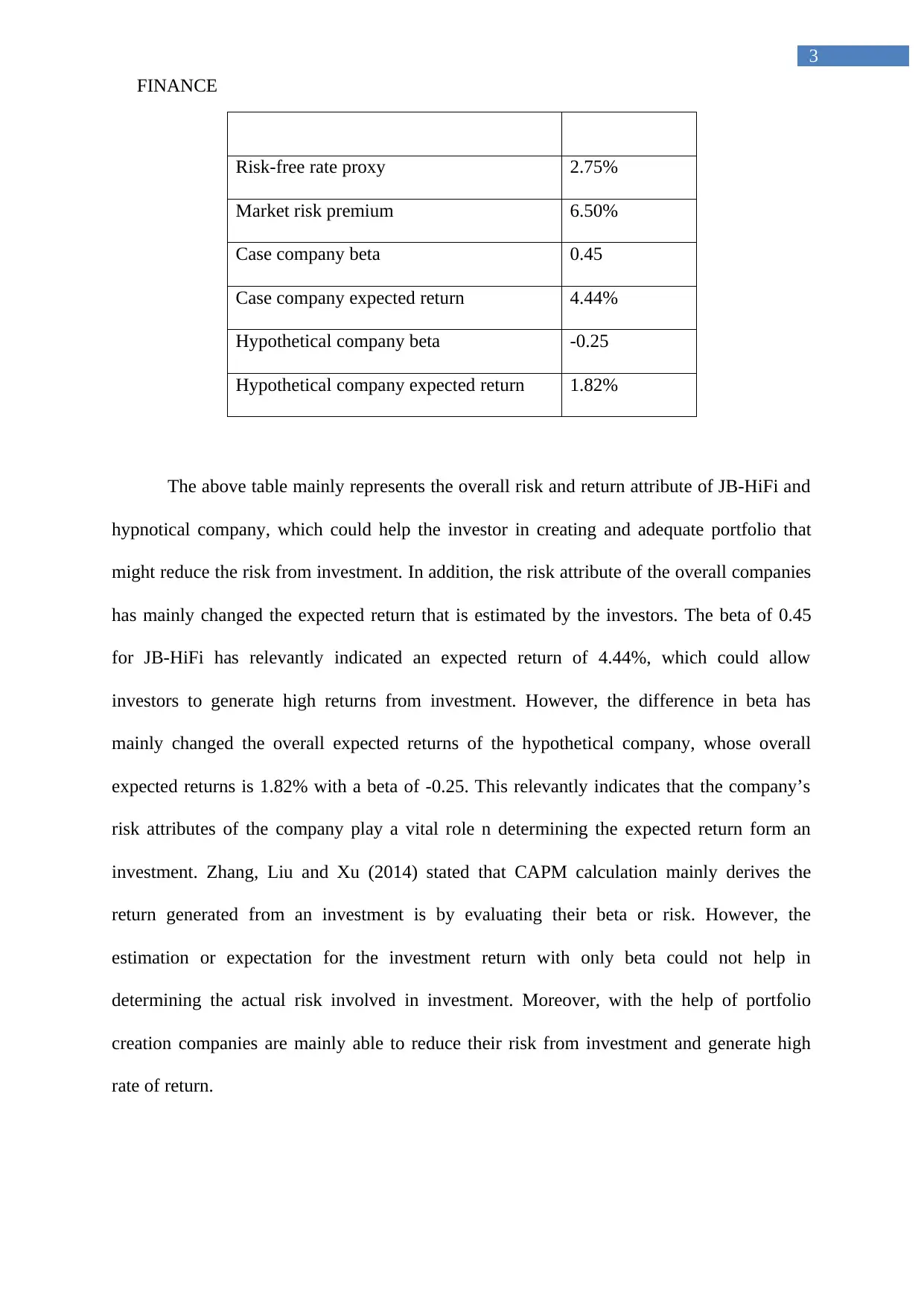

Risk-free rate proxy 2.75%

Market risk premium 6.50%

Case company beta 0.45

Case company expected return 4.44%

Hypothetical company beta -0.25

Hypothetical company expected return 1.82%

The above table mainly represents the overall risk and return attribute of JB-HiFi and

hypnotical company, which could help the investor in creating and adequate portfolio that

might reduce the risk from investment. In addition, the risk attribute of the overall companies

has mainly changed the expected return that is estimated by the investors. The beta of 0.45

for JB-HiFi has relevantly indicated an expected return of 4.44%, which could allow

investors to generate high returns from investment. However, the difference in beta has

mainly changed the overall expected returns of the hypothetical company, whose overall

expected returns is 1.82% with a beta of -0.25. This relevantly indicates that the company’s

risk attributes of the company play a vital role n determining the expected return form an

investment. Zhang, Liu and Xu (2014) stated that CAPM calculation mainly derives the

return generated from an investment is by evaluating their beta or risk. However, the

estimation or expectation for the investment return with only beta could not help in

determining the actual risk involved in investment. Moreover, with the help of portfolio

creation companies are mainly able to reduce their risk from investment and generate high

rate of return.

3

Risk-free rate proxy 2.75%

Market risk premium 6.50%

Case company beta 0.45

Case company expected return 4.44%

Hypothetical company beta -0.25

Hypothetical company expected return 1.82%

The above table mainly represents the overall risk and return attribute of JB-HiFi and

hypnotical company, which could help the investor in creating and adequate portfolio that

might reduce the risk from investment. In addition, the risk attribute of the overall companies

has mainly changed the expected return that is estimated by the investors. The beta of 0.45

for JB-HiFi has relevantly indicated an expected return of 4.44%, which could allow

investors to generate high returns from investment. However, the difference in beta has

mainly changed the overall expected returns of the hypothetical company, whose overall

expected returns is 1.82% with a beta of -0.25. This relevantly indicates that the company’s

risk attributes of the company play a vital role n determining the expected return form an

investment. Zhang, Liu and Xu (2014) stated that CAPM calculation mainly derives the

return generated from an investment is by evaluating their beta or risk. However, the

estimation or expectation for the investment return with only beta could not help in

determining the actual risk involved in investment. Moreover, with the help of portfolio

creation companies are mainly able to reduce their risk from investment and generate high

rate of return.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

4

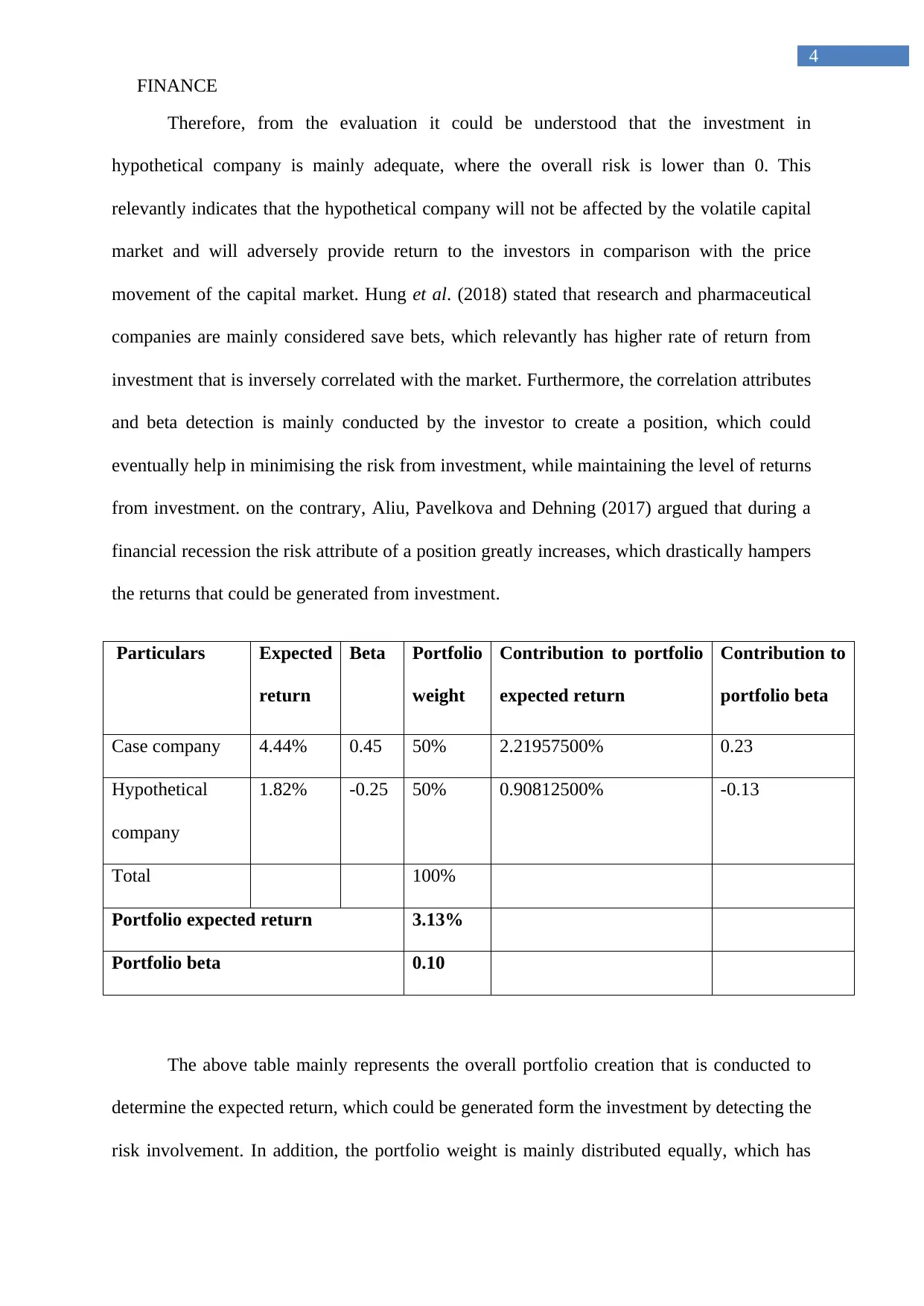

Therefore, from the evaluation it could be understood that the investment in

hypothetical company is mainly adequate, where the overall risk is lower than 0. This

relevantly indicates that the hypothetical company will not be affected by the volatile capital

market and will adversely provide return to the investors in comparison with the price

movement of the capital market. Hung et al. (2018) stated that research and pharmaceutical

companies are mainly considered save bets, which relevantly has higher rate of return from

investment that is inversely correlated with the market. Furthermore, the correlation attributes

and beta detection is mainly conducted by the investor to create a position, which could

eventually help in minimising the risk from investment, while maintaining the level of returns

from investment. on the contrary, Aliu, Pavelkova and Dehning (2017) argued that during a

financial recession the risk attribute of a position greatly increases, which drastically hampers

the returns that could be generated from investment.

Particulars Expected

return

Beta Portfolio

weight

Contribution to portfolio

expected return

Contribution to

portfolio beta

Case company 4.44% 0.45 50% 2.21957500% 0.23

Hypothetical

company

1.82% -0.25 50% 0.90812500% -0.13

Total 100%

Portfolio expected return 3.13%

Portfolio beta 0.10

The above table mainly represents the overall portfolio creation that is conducted to

determine the expected return, which could be generated form the investment by detecting the

risk involvement. In addition, the portfolio weight is mainly distributed equally, which has

4

Therefore, from the evaluation it could be understood that the investment in

hypothetical company is mainly adequate, where the overall risk is lower than 0. This

relevantly indicates that the hypothetical company will not be affected by the volatile capital

market and will adversely provide return to the investors in comparison with the price

movement of the capital market. Hung et al. (2018) stated that research and pharmaceutical

companies are mainly considered save bets, which relevantly has higher rate of return from

investment that is inversely correlated with the market. Furthermore, the correlation attributes

and beta detection is mainly conducted by the investor to create a position, which could

eventually help in minimising the risk from investment, while maintaining the level of returns

from investment. on the contrary, Aliu, Pavelkova and Dehning (2017) argued that during a

financial recession the risk attribute of a position greatly increases, which drastically hampers

the returns that could be generated from investment.

Particulars Expected

return

Beta Portfolio

weight

Contribution to portfolio

expected return

Contribution to

portfolio beta

Case company 4.44% 0.45 50% 2.21957500% 0.23

Hypothetical

company

1.82% -0.25 50% 0.90812500% -0.13

Total 100%

Portfolio expected return 3.13%

Portfolio beta 0.10

The above table mainly represents the overall portfolio creation that is conducted to

determine the expected return, which could be generated form the investment by detecting the

risk involvement. In addition, the portfolio weight is mainly distributed equally, which has

FINANCE

5

substantially reduced the risk from investment, while raising the level of returns.

Furthermore, the created portfolio is also able to generate high rate of return in comparison

with both the stock, which allows the investor to increase their financial performance. The

overall portfolio returns are at the level of 3.13%, while the portfolio beta is at the levels of

0.10. The changes in weight could also alter the overall risk attributes of the investor for

generating high level of returns from investment. Therefore, it could be understood that the

risk attributes of the current portfolio are relevantly low, which changes with weight and

could allow the investor to generate high rate of returns from investment. Zhang, Liu and Xu

(2014) mentioned that portfolio is mainly created in accordance with the risk attributes of an

investor, which could help in generating high level of returns from investment.

In addition, the changes in weights of the portfolio could directly alter the risk and

return attributes of the portfolio. This relevantly indicates that investor according to their risk

attribute could alter the changes in their portfolio. In this context, Hoffmann and Post (2017)

stated that portfolio creation is mainly conducted based on risk and return attributes of an

investment, which could be combined to reduce risk from investment. On the other hand,

Hung et al. (2018) argued that the portfolio creation without conducting adequate research

could increase risk from investment and hamper the investment capital.

5

substantially reduced the risk from investment, while raising the level of returns.

Furthermore, the created portfolio is also able to generate high rate of return in comparison

with both the stock, which allows the investor to increase their financial performance. The

overall portfolio returns are at the level of 3.13%, while the portfolio beta is at the levels of

0.10. The changes in weight could also alter the overall risk attributes of the investor for

generating high level of returns from investment. Therefore, it could be understood that the

risk attributes of the current portfolio are relevantly low, which changes with weight and

could allow the investor to generate high rate of returns from investment. Zhang, Liu and Xu

(2014) mentioned that portfolio is mainly created in accordance with the risk attributes of an

investor, which could help in generating high level of returns from investment.

In addition, the changes in weights of the portfolio could directly alter the risk and

return attributes of the portfolio. This relevantly indicates that investor according to their risk

attribute could alter the changes in their portfolio. In this context, Hoffmann and Post (2017)

stated that portfolio creation is mainly conducted based on risk and return attributes of an

investment, which could be combined to reduce risk from investment. On the other hand,

Hung et al. (2018) argued that the portfolio creation without conducting adequate research

could increase risk from investment and hamper the investment capital.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE

6

Reference and Bibliography:

Aliu, F., Pavelková, D. and Dehning, B., 2017. Portfolio risk-return analysis: The case of the

automotive industry in the Czech Republic.

Reuters.com. (2018). ${Instrument_CompanyName} ${Instrument_Ric} Quote| Reuters.com.

[online] U.S. Available at: https://www.reuters.com/finance/stocks/overview/JBH.AX

[Accessed 18 Apr. 2018].

Hoffmann, A.O. and Post, T., 2017. How return and risk experiences shape investor beliefs

and preferences. Accounting & Finance, 57(3), pp.759-788.

Hung, K., Yang, C.W., Zhao, Y. and Lee, K.H., 2018. Risk Return Relationship in the

Portfolio Selection Models. Theoretical Economics Letters, 8(03), p.358.

investing.com. (2018). Australia 10-Year Bond Yield - Investing.com. [online] Available at:

https://www.investing.com/rates-bonds/australia-10-year-bond-yield [Accessed 18 Apr.

2018].

Zhang, W.G., Liu, Y.J. and Xu, W.J., 2014. A new fuzzy programming approach for multi-

period portfolio optimization with return demand and risk control. Fuzzy Sets and

Systems, 246, pp.107-126.

6

Reference and Bibliography:

Aliu, F., Pavelková, D. and Dehning, B., 2017. Portfolio risk-return analysis: The case of the

automotive industry in the Czech Republic.

Reuters.com. (2018). ${Instrument_CompanyName} ${Instrument_Ric} Quote| Reuters.com.

[online] U.S. Available at: https://www.reuters.com/finance/stocks/overview/JBH.AX

[Accessed 18 Apr. 2018].

Hoffmann, A.O. and Post, T., 2017. How return and risk experiences shape investor beliefs

and preferences. Accounting & Finance, 57(3), pp.759-788.

Hung, K., Yang, C.W., Zhao, Y. and Lee, K.H., 2018. Risk Return Relationship in the

Portfolio Selection Models. Theoretical Economics Letters, 8(03), p.358.

investing.com. (2018). Australia 10-Year Bond Yield - Investing.com. [online] Available at:

https://www.investing.com/rates-bonds/australia-10-year-bond-yield [Accessed 18 Apr.

2018].

Zhang, W.G., Liu, Y.J. and Xu, W.J., 2014. A new fuzzy programming approach for multi-

period portfolio optimization with return demand and risk control. Fuzzy Sets and

Systems, 246, pp.107-126.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.