PHONE: Investment Project Analysis Report, WACC, NPV, IRR

VerifiedAdded on 2020/07/22

|11

|2904

|48

Report

AI Summary

This report provides a comprehensive financial analysis of two investment projects (A and B) for PHONE, focusing on the potential launch of a new silicon cover product. The analysis includes the calculation of the Weighted Average Cost of Capital (WACC), incremental cash flow projections, and the determination of Net Present Values (NPV) and Internal Rates of Return (IRR) under various scenarios. The report also considers the impact of unequal project lives, employing the replacement chain method, as well as sensitivity and break-even analyses to assess the risks and potential returns of each project. The findings suggest that while Project A offers a higher NPV in the long term, Project B presents a more favorable IRR and payback period, especially when considering the limited lifespan of the old machinery. The report ultimately recommends a cautious approach, suggesting that PHONE initially purchase the old machine (Project B) to mitigate financial risks associated with the new product launch and postpone the leasing option until market success is assured.

FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Executive Summary.........................................................................................................................3

INTRODUCTION ..........................................................................................................................4

a) Calculation of Weighted Average Cost of Capital(WACC) for PHONE...............................4

b) Incremental cash flow tables for Proposal A and B................................................................5

c) Base-case scenario's and calculation of NPVs and IRRs........................................................6

d) Impact of unequal lives for Options A and B.........................................................................7

e) Sensitivity Analysis of both the projects A and B..................................................................8

f) Break Even Analysis for sales price, sale units and variable cost:..........................................8

g) Decision on whether it should be lease or not........................................................................9

Recommendations:.........................................................................................................................10

REFERENCES..............................................................................................................................11

Executive Summary.........................................................................................................................3

INTRODUCTION ..........................................................................................................................4

a) Calculation of Weighted Average Cost of Capital(WACC) for PHONE...............................4

b) Incremental cash flow tables for Proposal A and B................................................................5

c) Base-case scenario's and calculation of NPVs and IRRs........................................................6

d) Impact of unequal lives for Options A and B.........................................................................7

e) Sensitivity Analysis of both the projects A and B..................................................................8

f) Break Even Analysis for sales price, sale units and variable cost:..........................................8

g) Decision on whether it should be lease or not........................................................................9

Recommendations:.........................................................................................................................10

REFERENCES..............................................................................................................................11

Executive Summary

This report gives an analysis and comparison of two investment projects with aim of

deciding the most beneficial option, considering PHONE's project A has 10 years remaining

useful lifetime.

Specially, the options analysed were whether PHONE should select the option A or

Option B, methods of analysis include break-even point, sensitivity, WACC and NPV.

It was found that option of Project A offers an NPV of $2266945.4 which is much higher

than Project B in long term. The IRR of project B is 119% which is much higher than project A.

When considering the Replacement method for unequal life, project B's has a NPV of

$2688561.92 which is higher than project A.

Based on these findings, it is recommended that PHONE should purchase old machine

for its remaining 4 years of useful lifetime as it is not sure about the success of new product

which is silicon cover for Iphones. The option of leasing should not be pursued at this initial

stage of launching a product as it is not sure about its success.

Thus it is recommended to stay with project B, to avoid the risk of high loss in money,

after the failure of the project. As in pessimistic analyses its clearly given that any decrease in its

expected sales and units can impact the PHONE into negative cash flows. So purchasing the old

machine can help the company to avoid such risks. Because in second option or in project B, the

initial investment is only $470000 which is lesser than project A.

This report gives an analysis and comparison of two investment projects with aim of

deciding the most beneficial option, considering PHONE's project A has 10 years remaining

useful lifetime.

Specially, the options analysed were whether PHONE should select the option A or

Option B, methods of analysis include break-even point, sensitivity, WACC and NPV.

It was found that option of Project A offers an NPV of $2266945.4 which is much higher

than Project B in long term. The IRR of project B is 119% which is much higher than project A.

When considering the Replacement method for unequal life, project B's has a NPV of

$2688561.92 which is higher than project A.

Based on these findings, it is recommended that PHONE should purchase old machine

for its remaining 4 years of useful lifetime as it is not sure about the success of new product

which is silicon cover for Iphones. The option of leasing should not be pursued at this initial

stage of launching a product as it is not sure about its success.

Thus it is recommended to stay with project B, to avoid the risk of high loss in money,

after the failure of the project. As in pessimistic analyses its clearly given that any decrease in its

expected sales and units can impact the PHONE into negative cash flows. So purchasing the old

machine can help the company to avoid such risks. Because in second option or in project B, the

initial investment is only $470000 which is lesser than project A.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

PHONE is popular for its Iphone covers and it already got big hit in its sales which is

around 3 Millions. It is earning good profits which is $1 Million, so overall PHONE is in good

position. But still it wants to expand its business through launching new product which is Silicon

cover for Iphone. But this new product is costlier than previous one. In this case study several

risk analyses, sensitivity analyses and break-even analyses has been done to give proper reason

and evidences behind any recommendations. In this case study PHONE has two choices to

produce its new product which is silicon cover: whether to purchase new machine which has a

cost around $935000 with a 10 years of life span. This project has named project A on the other

hand the other alternative available is to purchase old machinery at less price $470000 but its life

span is only 4 years. This project has named project B. In this case study, it is explained and

discussed well about which project is beneficial for PHONE.

a) Calculation of Weighted Average Cost of Capital(WACC) for PHONE

WACC – Weighted average cost of capital is the average rate of return which a investor

expects from the company in which it has invested (Brealey and Mohanty, 2012). The weights

are the fraction of rate of returns on the basis of each financing source such as equity and debt.

WACC = ((E/V)*Re)+[((D/V)*Rd)*(1-T)]

E= Market value of the company's equity= $8 Million

D= Market value of the company's debt = $2 Million

V= Total market value of the company(E+D) = $10 Million

Re= Cost of Equity = 14%

Rd= Cost of Debt = 9%

T= Tax Rate = 27.5%

Hence the calculations are as follows:

WACC = ((8/10)*.14)+[((2/10)*.9)*(1-.275)]

= 0.2425 or 24.25%

So, PHONE's weighted average cost of capital is 24.25%, this means that for every $1 fund

raises by PHONE from investors, it must pay $0.24 in return annually. Which is equivalent to

$0.2 monthly.

PHONE is popular for its Iphone covers and it already got big hit in its sales which is

around 3 Millions. It is earning good profits which is $1 Million, so overall PHONE is in good

position. But still it wants to expand its business through launching new product which is Silicon

cover for Iphone. But this new product is costlier than previous one. In this case study several

risk analyses, sensitivity analyses and break-even analyses has been done to give proper reason

and evidences behind any recommendations. In this case study PHONE has two choices to

produce its new product which is silicon cover: whether to purchase new machine which has a

cost around $935000 with a 10 years of life span. This project has named project A on the other

hand the other alternative available is to purchase old machinery at less price $470000 but its life

span is only 4 years. This project has named project B. In this case study, it is explained and

discussed well about which project is beneficial for PHONE.

a) Calculation of Weighted Average Cost of Capital(WACC) for PHONE

WACC – Weighted average cost of capital is the average rate of return which a investor

expects from the company in which it has invested (Brealey and Mohanty, 2012). The weights

are the fraction of rate of returns on the basis of each financing source such as equity and debt.

WACC = ((E/V)*Re)+[((D/V)*Rd)*(1-T)]

E= Market value of the company's equity= $8 Million

D= Market value of the company's debt = $2 Million

V= Total market value of the company(E+D) = $10 Million

Re= Cost of Equity = 14%

Rd= Cost of Debt = 9%

T= Tax Rate = 27.5%

Hence the calculations are as follows:

WACC = ((8/10)*.14)+[((2/10)*.9)*(1-.275)]

= 0.2425 or 24.25%

So, PHONE's weighted average cost of capital is 24.25%, this means that for every $1 fund

raises by PHONE from investors, it must pay $0.24 in return annually. Which is equivalent to

$0.2 monthly.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

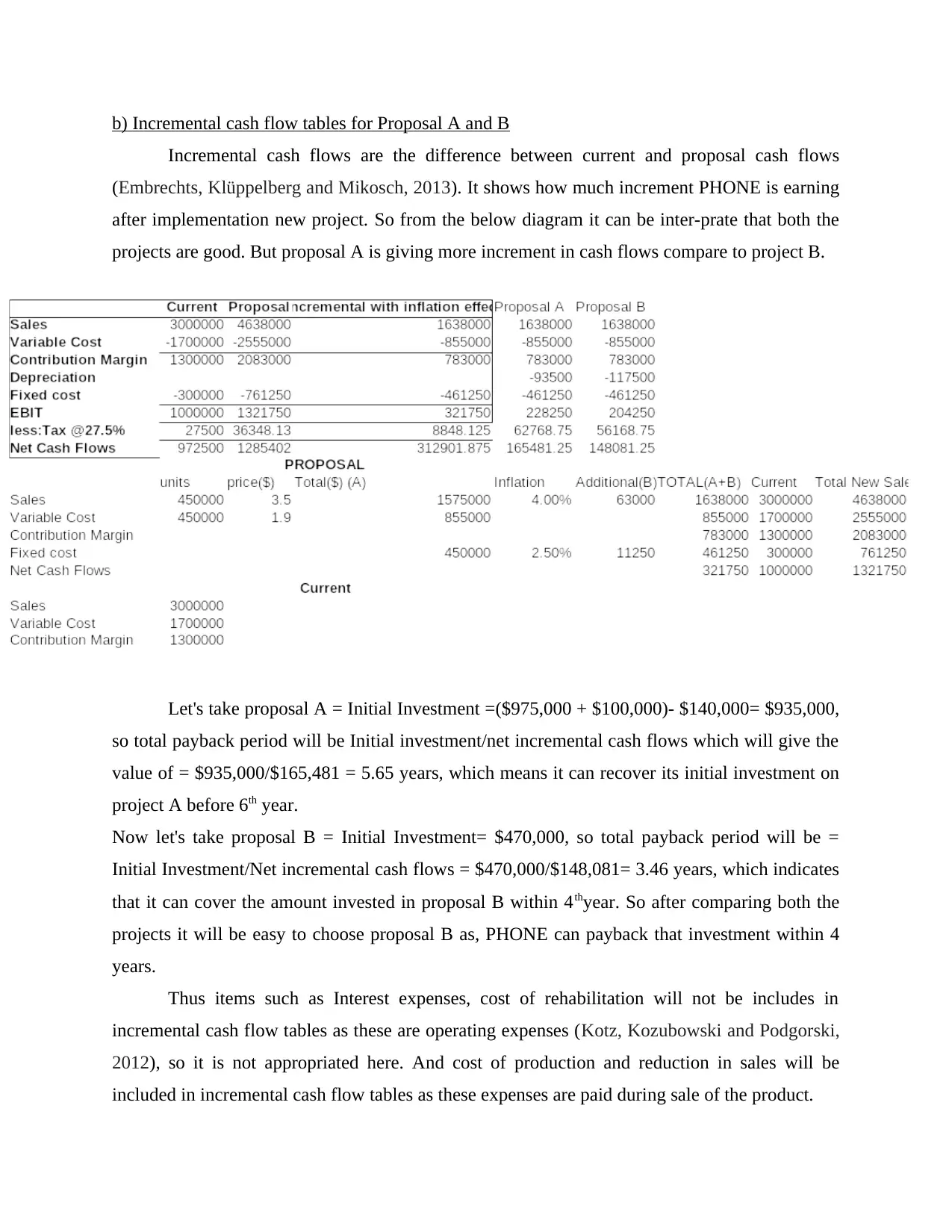

b) Incremental cash flow tables for Proposal A and B

Incremental cash flows are the difference between current and proposal cash flows

(Embrechts, Klüppelberg and Mikosch, 2013). It shows how much increment PHONE is earning

after implementation new project. So from the below diagram it can be inter-prate that both the

projects are good. But proposal A is giving more increment in cash flows compare to project B.

Let's take proposal A = Initial Investment =($975,000 + $100,000)- $140,000= $935,000,

so total payback period will be Initial investment/net incremental cash flows which will give the

value of = $935,000/$165,481 = 5.65 years, which means it can recover its initial investment on

project A before 6th year.

Now let's take proposal B = Initial Investment= $470,000, so total payback period will be =

Initial Investment/Net incremental cash flows = $470,000/$148,081= 3.46 years, which indicates

that it can cover the amount invested in proposal B within 4thyear. So after comparing both the

projects it will be easy to choose proposal B as, PHONE can payback that investment within 4

years.

Thus items such as Interest expenses, cost of rehabilitation will not be includes in

incremental cash flow tables as these are operating expenses (Kotz, Kozubowski and Podgorski,

2012), so it is not appropriated here. And cost of production and reduction in sales will be

included in incremental cash flow tables as these expenses are paid during sale of the product.

Incremental cash flows are the difference between current and proposal cash flows

(Embrechts, Klüppelberg and Mikosch, 2013). It shows how much increment PHONE is earning

after implementation new project. So from the below diagram it can be inter-prate that both the

projects are good. But proposal A is giving more increment in cash flows compare to project B.

Let's take proposal A = Initial Investment =($975,000 + $100,000)- $140,000= $935,000,

so total payback period will be Initial investment/net incremental cash flows which will give the

value of = $935,000/$165,481 = 5.65 years, which means it can recover its initial investment on

project A before 6th year.

Now let's take proposal B = Initial Investment= $470,000, so total payback period will be =

Initial Investment/Net incremental cash flows = $470,000/$148,081= 3.46 years, which indicates

that it can cover the amount invested in proposal B within 4thyear. So after comparing both the

projects it will be easy to choose proposal B as, PHONE can payback that investment within 4

years.

Thus items such as Interest expenses, cost of rehabilitation will not be includes in

incremental cash flow tables as these are operating expenses (Kotz, Kozubowski and Podgorski,

2012), so it is not appropriated here. And cost of production and reduction in sales will be

included in incremental cash flow tables as these expenses are paid during sale of the product.

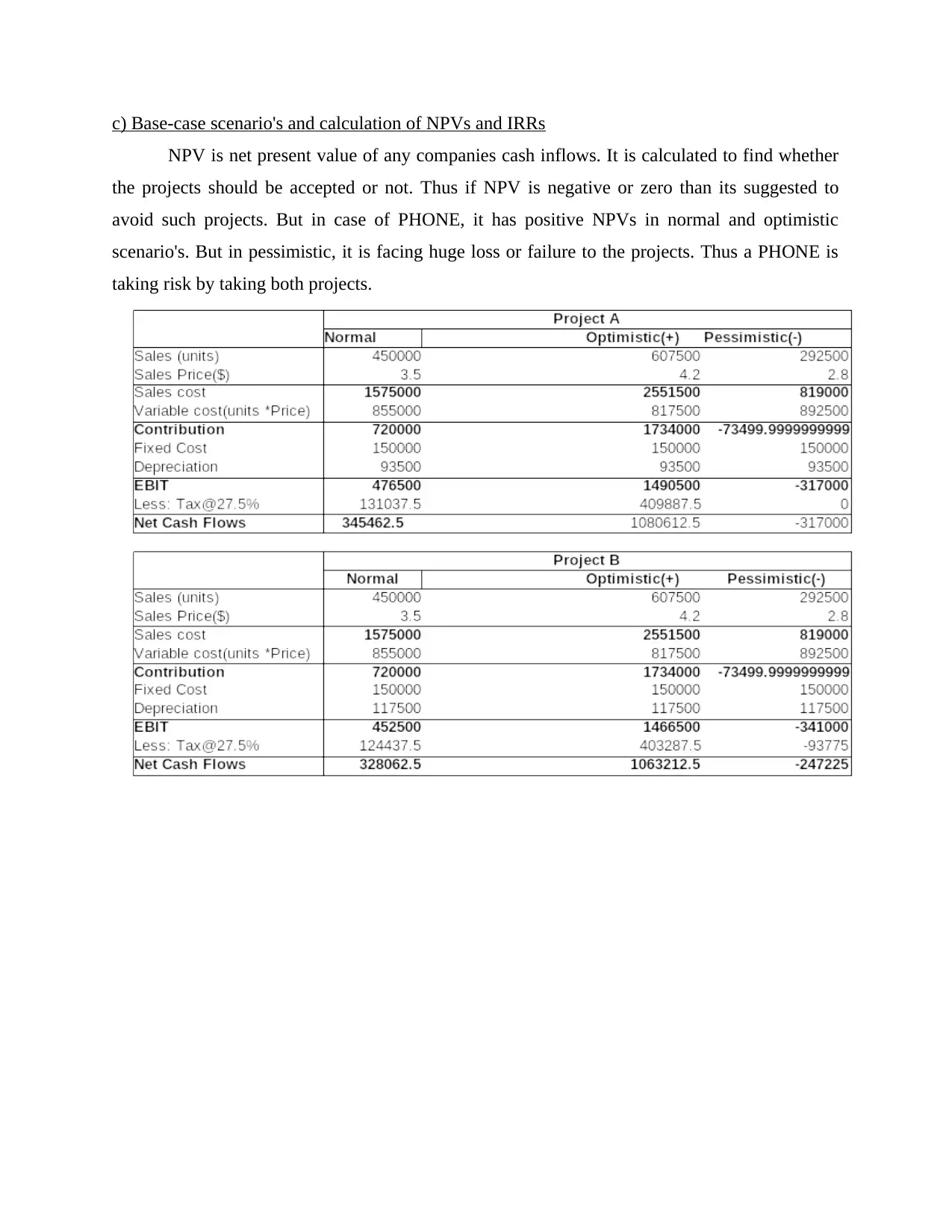

c) Base-case scenario's and calculation of NPVs and IRRs

NPV is net present value of any companies cash inflows. It is calculated to find whether

the projects should be accepted or not. Thus if NPV is negative or zero than its suggested to

avoid such projects. But in case of PHONE, it has positive NPVs in normal and optimistic

scenario's. But in pessimistic, it is facing huge loss or failure to the projects. Thus a PHONE is

taking risk by taking both projects.

NPV is net present value of any companies cash inflows. It is calculated to find whether

the projects should be accepted or not. Thus if NPV is negative or zero than its suggested to

avoid such projects. But in case of PHONE, it has positive NPVs in normal and optimistic

scenario's. But in pessimistic, it is facing huge loss or failure to the projects. Thus a PHONE is

taking risk by taking both projects.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

NPV of the projects A and B has been calculated, where project A's NPV is equals to

3201945.4 – 935000 = 2266945.4 on the other hand NPV for project B = Net present cash flows

– Initial Investment = 2243587.5 – 270000 = 1973587.5, hence from the above data project A is

giving more return than project B. IRR is been calculated through financial calculator, so IRR for

project A at normal sales will be 24.68% which is greater than its required rate of return 14%. In

case of Project B, IRR at normal scenario's will be 119 % which is much greater than of project

A. Calculation of IRR has been done for 5years. Therefore project B is more suitable than project

A.

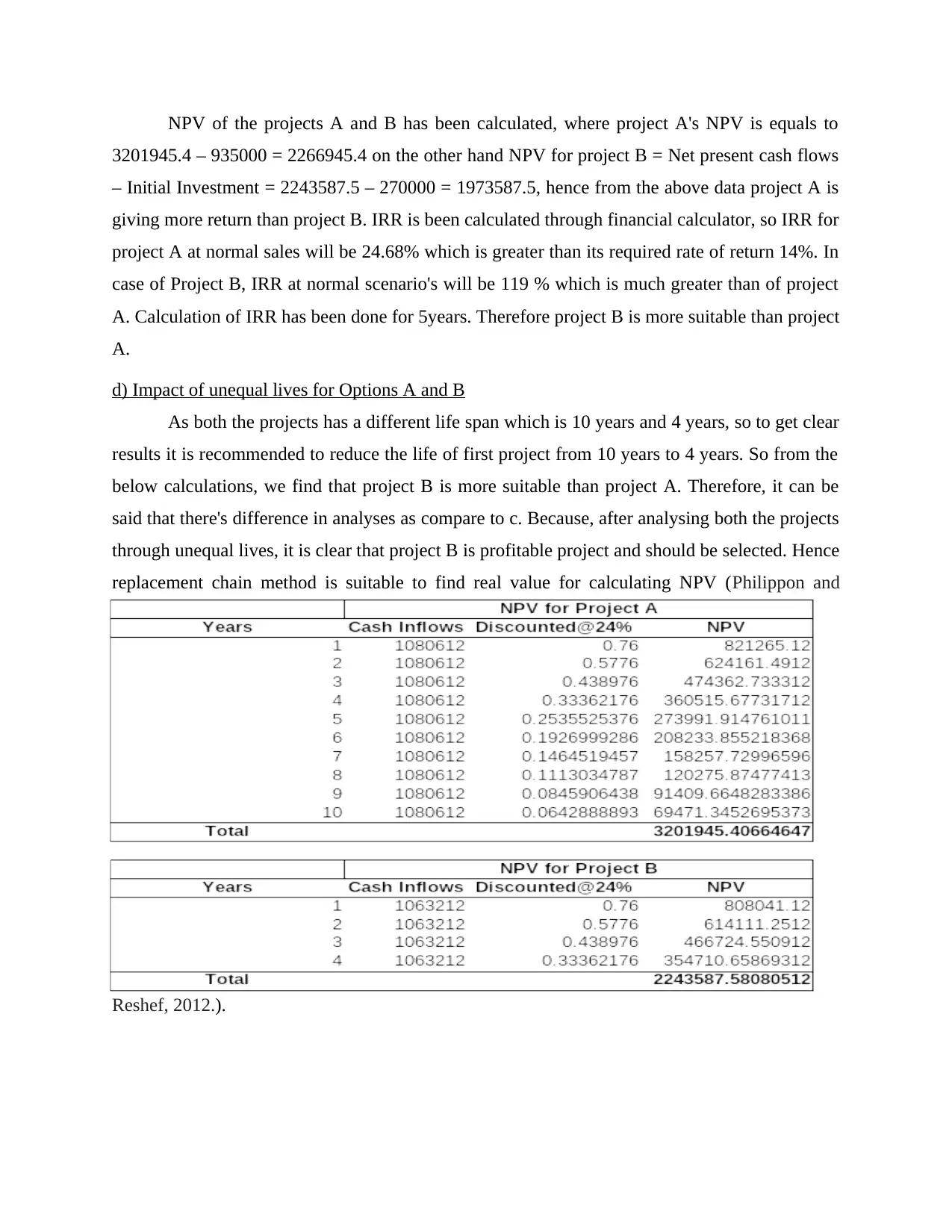

d) Impact of unequal lives for Options A and B

As both the projects has a different life span which is 10 years and 4 years, so to get clear

results it is recommended to reduce the life of first project from 10 years to 4 years. So from the

below calculations, we find that project B is more suitable than project A. Therefore, it can be

said that there's difference in analyses as compare to c. Because, after analysing both the projects

through unequal lives, it is clear that project B is profitable project and should be selected. Hence

replacement chain method is suitable to find real value for calculating NPV (Philippon and

Reshef, 2012.).

3201945.4 – 935000 = 2266945.4 on the other hand NPV for project B = Net present cash flows

– Initial Investment = 2243587.5 – 270000 = 1973587.5, hence from the above data project A is

giving more return than project B. IRR is been calculated through financial calculator, so IRR for

project A at normal sales will be 24.68% which is greater than its required rate of return 14%. In

case of Project B, IRR at normal scenario's will be 119 % which is much greater than of project

A. Calculation of IRR has been done for 5years. Therefore project B is more suitable than project

A.

d) Impact of unequal lives for Options A and B

As both the projects has a different life span which is 10 years and 4 years, so to get clear

results it is recommended to reduce the life of first project from 10 years to 4 years. So from the

below calculations, we find that project B is more suitable than project A. Therefore, it can be

said that there's difference in analyses as compare to c. Because, after analysing both the projects

through unequal lives, it is clear that project B is profitable project and should be selected. Hence

replacement chain method is suitable to find real value for calculating NPV (Philippon and

Reshef, 2012.).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

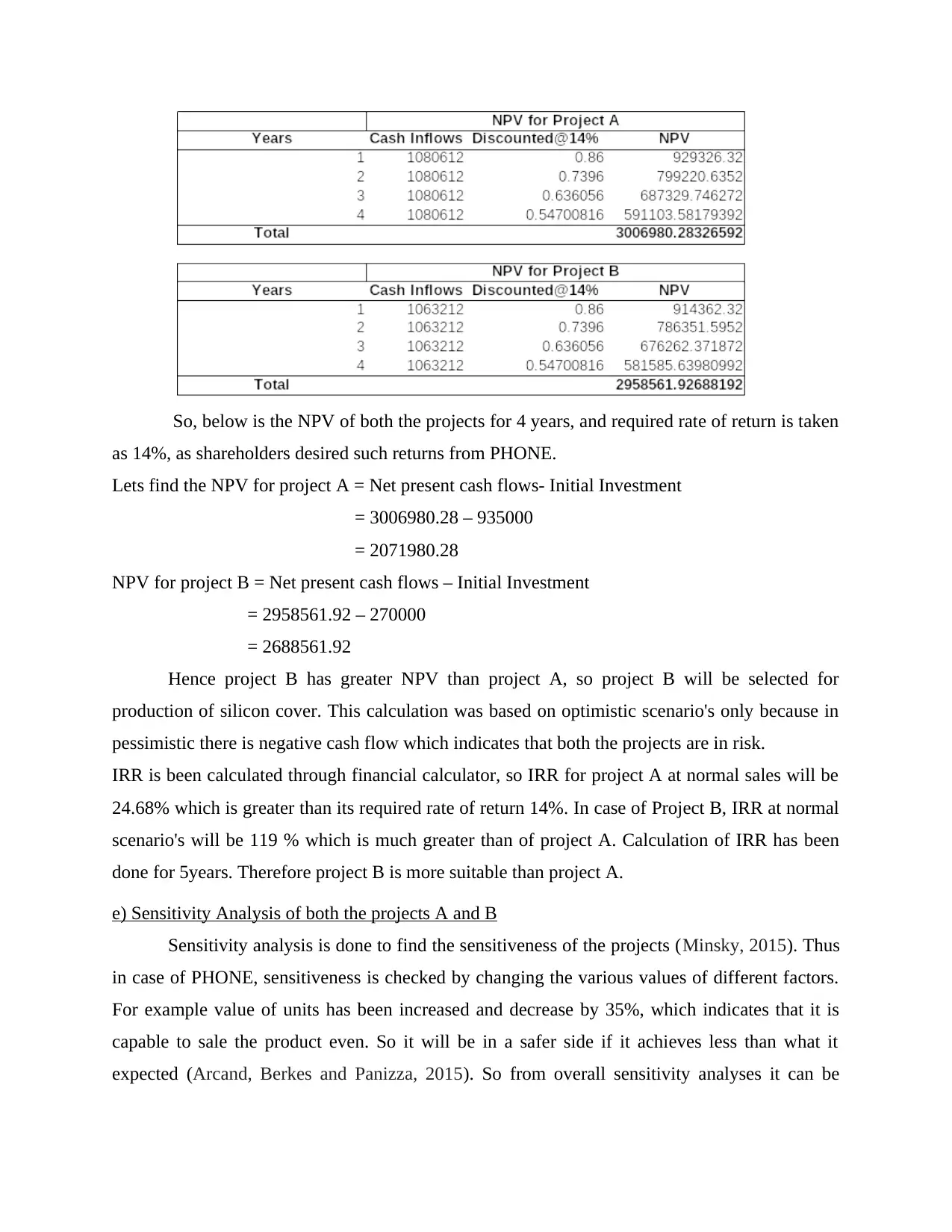

So, below is the NPV of both the projects for 4 years, and required rate of return is taken

as 14%, as shareholders desired such returns from PHONE.

Lets find the NPV for project A = Net present cash flows- Initial Investment

= 3006980.28 – 935000

= 2071980.28

NPV for project B = Net present cash flows – Initial Investment

= 2958561.92 – 270000

= 2688561.92

Hence project B has greater NPV than project A, so project B will be selected for

production of silicon cover. This calculation was based on optimistic scenario's only because in

pessimistic there is negative cash flow which indicates that both the projects are in risk.

IRR is been calculated through financial calculator, so IRR for project A at normal sales will be

24.68% which is greater than its required rate of return 14%. In case of Project B, IRR at normal

scenario's will be 119 % which is much greater than of project A. Calculation of IRR has been

done for 5years. Therefore project B is more suitable than project A.

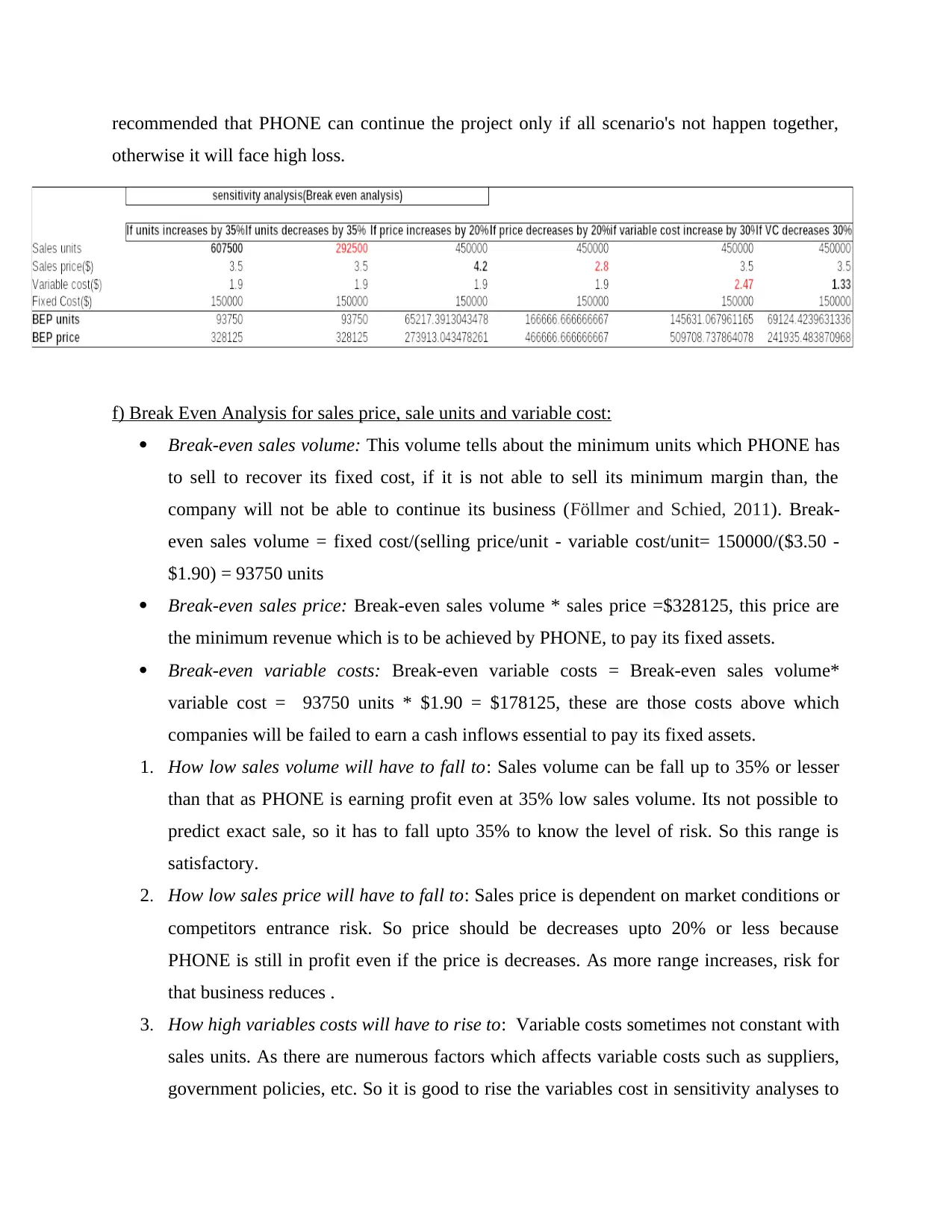

e) Sensitivity Analysis of both the projects A and B

Sensitivity analysis is done to find the sensitiveness of the projects (Minsky, 2015). Thus

in case of PHONE, sensitiveness is checked by changing the various values of different factors.

For example value of units has been increased and decrease by 35%, which indicates that it is

capable to sale the product even. So it will be in a safer side if it achieves less than what it

expected (Arcand, Berkes and Panizza, 2015). So from overall sensitivity analyses it can be

as 14%, as shareholders desired such returns from PHONE.

Lets find the NPV for project A = Net present cash flows- Initial Investment

= 3006980.28 – 935000

= 2071980.28

NPV for project B = Net present cash flows – Initial Investment

= 2958561.92 – 270000

= 2688561.92

Hence project B has greater NPV than project A, so project B will be selected for

production of silicon cover. This calculation was based on optimistic scenario's only because in

pessimistic there is negative cash flow which indicates that both the projects are in risk.

IRR is been calculated through financial calculator, so IRR for project A at normal sales will be

24.68% which is greater than its required rate of return 14%. In case of Project B, IRR at normal

scenario's will be 119 % which is much greater than of project A. Calculation of IRR has been

done for 5years. Therefore project B is more suitable than project A.

e) Sensitivity Analysis of both the projects A and B

Sensitivity analysis is done to find the sensitiveness of the projects (Minsky, 2015). Thus

in case of PHONE, sensitiveness is checked by changing the various values of different factors.

For example value of units has been increased and decrease by 35%, which indicates that it is

capable to sale the product even. So it will be in a safer side if it achieves less than what it

expected (Arcand, Berkes and Panizza, 2015). So from overall sensitivity analyses it can be

recommended that PHONE can continue the project only if all scenario's not happen together,

otherwise it will face high loss.

f) Break Even Analysis for sales price, sale units and variable cost:

Break-even sales volume: This volume tells about the minimum units which PHONE has

to sell to recover its fixed cost, if it is not able to sell its minimum margin than, the

company will not be able to continue its business (Föllmer and Schied, 2011). Break-

even sales volume = fixed cost/(selling price/unit - variable cost/unit= 150000/($3.50 -

$1.90) = 93750 units

Break-even sales price: Break-even sales volume * sales price =$328125, this price are

the minimum revenue which is to be achieved by PHONE, to pay its fixed assets.

Break-even variable costs: Break-even variable costs = Break-even sales volume*

variable cost = 93750 units * $1.90 = $178125, these are those costs above which

companies will be failed to earn a cash inflows essential to pay its fixed assets.

1. How low sales volume will have to fall to: Sales volume can be fall up to 35% or lesser

than that as PHONE is earning profit even at 35% low sales volume. Its not possible to

predict exact sale, so it has to fall upto 35% to know the level of risk. So this range is

satisfactory.

2. How low sales price will have to fall to: Sales price is dependent on market conditions or

competitors entrance risk. So price should be decreases upto 20% or less because

PHONE is still in profit even if the price is decreases. As more range increases, risk for

that business reduces .

3. How high variables costs will have to rise to: Variable costs sometimes not constant with

sales units. As there are numerous factors which affects variable costs such as suppliers,

government policies, etc. So it is good to rise the variables cost in sensitivity analyses to

otherwise it will face high loss.

f) Break Even Analysis for sales price, sale units and variable cost:

Break-even sales volume: This volume tells about the minimum units which PHONE has

to sell to recover its fixed cost, if it is not able to sell its minimum margin than, the

company will not be able to continue its business (Föllmer and Schied, 2011). Break-

even sales volume = fixed cost/(selling price/unit - variable cost/unit= 150000/($3.50 -

$1.90) = 93750 units

Break-even sales price: Break-even sales volume * sales price =$328125, this price are

the minimum revenue which is to be achieved by PHONE, to pay its fixed assets.

Break-even variable costs: Break-even variable costs = Break-even sales volume*

variable cost = 93750 units * $1.90 = $178125, these are those costs above which

companies will be failed to earn a cash inflows essential to pay its fixed assets.

1. How low sales volume will have to fall to: Sales volume can be fall up to 35% or lesser

than that as PHONE is earning profit even at 35% low sales volume. Its not possible to

predict exact sale, so it has to fall upto 35% to know the level of risk. So this range is

satisfactory.

2. How low sales price will have to fall to: Sales price is dependent on market conditions or

competitors entrance risk. So price should be decreases upto 20% or less because

PHONE is still in profit even if the price is decreases. As more range increases, risk for

that business reduces .

3. How high variables costs will have to rise to: Variable costs sometimes not constant with

sales units. As there are numerous factors which affects variable costs such as suppliers,

government policies, etc. So it is good to rise the variables cost in sensitivity analyses to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

find the risk apatite of PHONE. And to know whether this project is safe to launch or not.

Risk and level of risk should be known before launching any new product (Billio,

Getmansky and Pelizzon, 2012Duchinand Sensoy2010).

Above while doing unequal life analysis, it was recommended to choose option B, but if the

project B is choose than the regular cash inflows is only for 4 years. So if the feasible factor is

concerned than project A will be prove to be best option as it will help PHONE to get regular

cash inflows for longer time. On the other hand, a market demand is not constant (Billio,

Getmansky and Pelizzon, 2012), so taking project A to aim long term objective can prove to be

wrong decision.

g) Decision on whether it should be lease or not

Lease means an agreement, in which two parties are involved. One is who gives his

property on lease for particular time period and another is who uses that property for particular

time period and promise to pay rent (Mandelbrot, 2013.). So here PHONE has still risk to have

loses so it can't afford Lease, as in the failure of new product it has to give regular cash outflows.

Recommendations:

Hence it is recommended to go for project B, as its initial investment is very low. And

also the old machine can be sold out in case the project failed. But leasing can be good option if

the company is confident about its new and latest products. So it depends on the company and its

researches. Because after deep research, PHONE can decide which decisions or alternatives it

should choose. For example of Company is confident that in long run, demand for the new

product will remain same or a minor modification in the product can remain the demand of the

product constant than it should choose project A, and if the company is focusing on short term

objectives or it just wants short term cash inflows. Than the company should go for project B. At

last, if the company is confident about the success of its new product than it can go for leasing

the product. Overall it is recommended to do proper market and risk analysis on the basis of

appropriate data to make a aim. And to identify whether long term objectives is beneficiary for

the company or not.

Risk and level of risk should be known before launching any new product (Billio,

Getmansky and Pelizzon, 2012Duchinand Sensoy2010).

Above while doing unequal life analysis, it was recommended to choose option B, but if the

project B is choose than the regular cash inflows is only for 4 years. So if the feasible factor is

concerned than project A will be prove to be best option as it will help PHONE to get regular

cash inflows for longer time. On the other hand, a market demand is not constant (Billio,

Getmansky and Pelizzon, 2012), so taking project A to aim long term objective can prove to be

wrong decision.

g) Decision on whether it should be lease or not

Lease means an agreement, in which two parties are involved. One is who gives his

property on lease for particular time period and another is who uses that property for particular

time period and promise to pay rent (Mandelbrot, 2013.). So here PHONE has still risk to have

loses so it can't afford Lease, as in the failure of new product it has to give regular cash outflows.

Recommendations:

Hence it is recommended to go for project B, as its initial investment is very low. And

also the old machine can be sold out in case the project failed. But leasing can be good option if

the company is confident about its new and latest products. So it depends on the company and its

researches. Because after deep research, PHONE can decide which decisions or alternatives it

should choose. For example of Company is confident that in long run, demand for the new

product will remain same or a minor modification in the product can remain the demand of the

product constant than it should choose project A, and if the company is focusing on short term

objectives or it just wants short term cash inflows. Than the company should go for project B. At

last, if the company is confident about the success of its new product than it can go for leasing

the product. Overall it is recommended to do proper market and risk analysis on the basis of

appropriate data to make a aim. And to identify whether long term objectives is beneficiary for

the company or not.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Brealey, R. A., and et. al., 2012. Principles of corporate finance. Tata McGraw-Hill Education.

Embrechts, P., Klüppelberg, C. and Mikosch, T., 2013. Modelling extremal events: for insurance

and finance (Vol. 33). Springer Science & Business Media.

Kotz, S., Kozubowski, T. and Podgorski, K., 2012. The Laplace distribution and generalizations:

a revisit with applications to communications, economics, engineering, and finance.

Springer Science & Business Media.

Minsky, H. P., 2015. Can" it" happen again?: essays on instability and finance. Routledge.

Föllmer, H. and Schied, A., 2011. Stochastic finance: an introduction in discrete time. Walter de

Gruyter.

Mandelbrot, B. B., 2013. Fractals and Scaling in Finance: Discontinuity, Concentration, Risk.

Selecta Volume E. Springer Science & Business Media.

Billio, M. and et. al. , 2012. Econometric measures of connectedness and systemic risk in the

finance and insurance sectors. Journal of Financial Economics. 104(3). pp.535-559.

Duchin, R., Ozbas, O. and Sensoy, B. A., 2010. Costly external finance, corporate investment,

and the subprime mortgage credit crisis. Journal of Financial Economics. 97(3). pp.418-

435.

Arcand, J.L., Berkes, E. and Panizza, U., 2015. Too much finance?. Journal of Economic

Growth. 20(2). pp.105-148.

Philippon, T. and Reshef, A., 2012. Wages and human capital in the US finance industry: 1909–

2006. The Quarterly Journal of Economics. 127(4). pp.1551-1609.

Books and Journals

Brealey, R. A., and et. al., 2012. Principles of corporate finance. Tata McGraw-Hill Education.

Embrechts, P., Klüppelberg, C. and Mikosch, T., 2013. Modelling extremal events: for insurance

and finance (Vol. 33). Springer Science & Business Media.

Kotz, S., Kozubowski, T. and Podgorski, K., 2012. The Laplace distribution and generalizations:

a revisit with applications to communications, economics, engineering, and finance.

Springer Science & Business Media.

Minsky, H. P., 2015. Can" it" happen again?: essays on instability and finance. Routledge.

Föllmer, H. and Schied, A., 2011. Stochastic finance: an introduction in discrete time. Walter de

Gruyter.

Mandelbrot, B. B., 2013. Fractals and Scaling in Finance: Discontinuity, Concentration, Risk.

Selecta Volume E. Springer Science & Business Media.

Billio, M. and et. al. , 2012. Econometric measures of connectedness and systemic risk in the

finance and insurance sectors. Journal of Financial Economics. 104(3). pp.535-559.

Duchin, R., Ozbas, O. and Sensoy, B. A., 2010. Costly external finance, corporate investment,

and the subprime mortgage credit crisis. Journal of Financial Economics. 97(3). pp.418-

435.

Arcand, J.L., Berkes, E. and Panizza, U., 2015. Too much finance?. Journal of Economic

Growth. 20(2). pp.105-148.

Philippon, T. and Reshef, A., 2012. Wages and human capital in the US finance industry: 1909–

2006. The Quarterly Journal of Economics. 127(4). pp.1551-1609.

1 out of 11

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.