Financial Analysis Report: Assessing H&M's Performance

VerifiedAdded on 2020/06/06

|13

|3565

|404

Report

AI Summary

This report presents a detailed financial analysis of the H&M Group, examining its performance through various financial statements and ratios. The analysis begins with an overview of the company, its expansion strategies, and its financial performance. It then delves into the sales performance, gross ...

FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK A...........................................................................................................................................1

Overview of company............................................................................................................1

Financial statement analysis...................................................................................................2

Sales performance of H&M....................................................................................................2

Gross profit and margin .........................................................................................................3

Profit and loss statement analysis...........................................................................................4

Balance sheet..........................................................................................................................5

Cash flow statement analysis .................................................................................................6

Ratio analysis .........................................................................................................................7

Limitations .............................................................................................................................8

Recommendations..................................................................................................................8

TASK B...........................................................................................................................................8

Pricing methodologies............................................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION...........................................................................................................................1

TASK A...........................................................................................................................................1

Overview of company............................................................................................................1

Financial statement analysis...................................................................................................2

Sales performance of H&M....................................................................................................2

Gross profit and margin .........................................................................................................3

Profit and loss statement analysis...........................................................................................4

Balance sheet..........................................................................................................................5

Cash flow statement analysis .................................................................................................6

Ratio analysis .........................................................................................................................7

Limitations .............................................................................................................................8

Recommendations..................................................................................................................8

TASK B...........................................................................................................................................8

Pricing methodologies............................................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION

Finance is an essential aspect for every business organisation. It is required by companies

to manage their daily financial transactions. Without sufficient amount of finance, managers are

not able to manage and plan their project in an effective and efficient manner. This particular

project report is based on the financial analysis of H&M Company. It consists of useful

statements like profit and loss, balance sheet and cash-flows. In order to ascertain outside

investors to analyse the profitability and interest of a business. Investors can use to identify

performance of H&M during the year for the purpose of determining current position of the

company (Bäuerle and Rieder, 2011). H&S expansion planning is to capture maximum market

both online and offline mode. They want to make sustainable product to get effective growth in

near future. This particular analysis covers various analysis by using ratios. It will also examine

various risks and opportunities about company and take measures to resolve uncertainties. On the

basis of financial information, evaluation is done to provide necessary suggestions that are

beneficial for decision-making in business.

TASK A

Overview of company

H&M is a leading group in fashion industry by offering plenty of attractive brands and

home care products to the customers. Every products those are develop by the company is having

their own unique identity All brands are connected by a feeling for fashion and superior quality.

They derive to make customers feel in a sustainable manner so that they look more pleasant in

there dress. It was started with a single women's wear store in Sweden. It was established in 1947

and now, in the current scenario, group is having various availability of fashion brands and large

international presence. There long term expansion is made by targeting both online and offline

customers. The main aim is to make deliver the best quality of products and services to

customers so that they can enhance their productivity. With 13000 new colleagues in 2016, they

are planning to expand their business at every place. According to the last year of sales which is

recorded as SEK 223 billion. They are having 43 online markets and approximately 4500 stores

in 69 markets.

1

Finance is an essential aspect for every business organisation. It is required by companies

to manage their daily financial transactions. Without sufficient amount of finance, managers are

not able to manage and plan their project in an effective and efficient manner. This particular

project report is based on the financial analysis of H&M Company. It consists of useful

statements like profit and loss, balance sheet and cash-flows. In order to ascertain outside

investors to analyse the profitability and interest of a business. Investors can use to identify

performance of H&M during the year for the purpose of determining current position of the

company (Bäuerle and Rieder, 2011). H&S expansion planning is to capture maximum market

both online and offline mode. They want to make sustainable product to get effective growth in

near future. This particular analysis covers various analysis by using ratios. It will also examine

various risks and opportunities about company and take measures to resolve uncertainties. On the

basis of financial information, evaluation is done to provide necessary suggestions that are

beneficial for decision-making in business.

TASK A

Overview of company

H&M is a leading group in fashion industry by offering plenty of attractive brands and

home care products to the customers. Every products those are develop by the company is having

their own unique identity All brands are connected by a feeling for fashion and superior quality.

They derive to make customers feel in a sustainable manner so that they look more pleasant in

there dress. It was started with a single women's wear store in Sweden. It was established in 1947

and now, in the current scenario, group is having various availability of fashion brands and large

international presence. There long term expansion is made by targeting both online and offline

customers. The main aim is to make deliver the best quality of products and services to

customers so that they can enhance their productivity. With 13000 new colleagues in 2016, they

are planning to expand their business at every place. According to the last year of sales which is

recorded as SEK 223 billion. They are having 43 online markets and approximately 4500 stores

in 69 markets.

1

You're viewing a preview

Unlock full access by subscribing today!

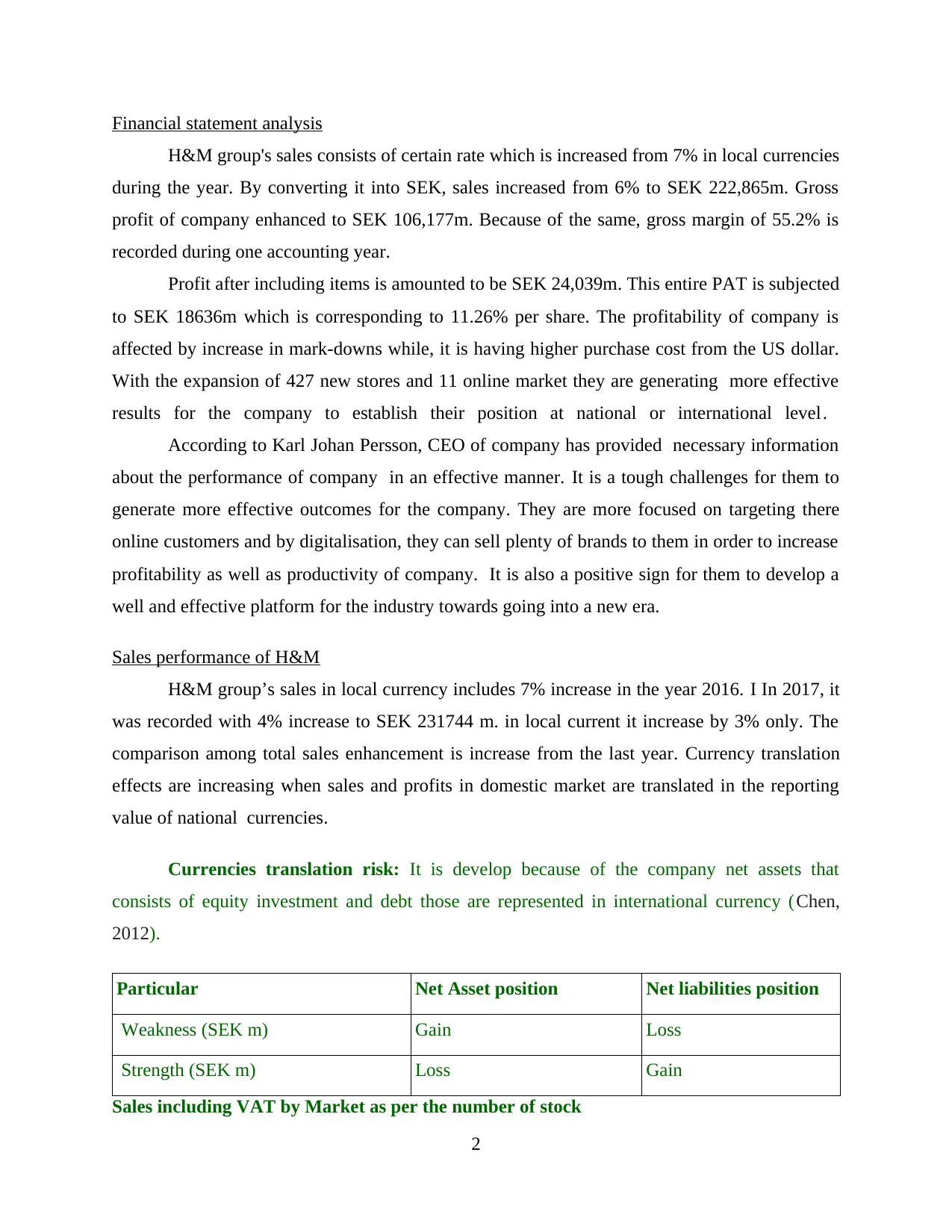

Financial statement analysis

H&M group's sales consists of certain rate which is increased from 7% in local currencies

during the year. By converting it into SEK, sales increased from 6% to SEK 222,865m. Gross

profit of company enhanced to SEK 106,177m. Because of the same, gross margin of 55.2% is

recorded during one accounting year.

Profit after including items is amounted to be SEK 24,039m. This entire PAT is subjected

to SEK 18636m which is corresponding to 11.26% per share. The profitability of company is

affected by increase in mark-downs while, it is having higher purchase cost from the US dollar.

With the expansion of 427 new stores and 11 online market they are generating more effective

results for the company to establish their position at national or international level.

According to Karl Johan Persson, CEO of company has provided necessary information

about the performance of company in an effective manner. It is a tough challenges for them to

generate more effective outcomes for the company. They are more focused on targeting there

online customers and by digitalisation, they can sell plenty of brands to them in order to increase

profitability as well as productivity of company. It is also a positive sign for them to develop a

well and effective platform for the industry towards going into a new era.

Sales performance of H&M

H&M group’s sales in local currency includes 7% increase in the year 2016. I In 2017, it

was recorded with 4% increase to SEK 231744 m. in local current it increase by 3% only. The

comparison among total sales enhancement is increase from the last year. Currency translation

effects are increasing when sales and profits in domestic market are translated in the reporting

value of national currencies.

Currencies translation risk: It is develop because of the company net assets that

consists of equity investment and debt those are represented in international currency (Chen,

2012).

Particular Net Asset position Net liabilities position

Weakness (SEK m) Gain Loss

Strength (SEK m) Loss Gain

Sales including VAT by Market as per the number of stock

2

H&M group's sales consists of certain rate which is increased from 7% in local currencies

during the year. By converting it into SEK, sales increased from 6% to SEK 222,865m. Gross

profit of company enhanced to SEK 106,177m. Because of the same, gross margin of 55.2% is

recorded during one accounting year.

Profit after including items is amounted to be SEK 24,039m. This entire PAT is subjected

to SEK 18636m which is corresponding to 11.26% per share. The profitability of company is

affected by increase in mark-downs while, it is having higher purchase cost from the US dollar.

With the expansion of 427 new stores and 11 online market they are generating more effective

results for the company to establish their position at national or international level.

According to Karl Johan Persson, CEO of company has provided necessary information

about the performance of company in an effective manner. It is a tough challenges for them to

generate more effective outcomes for the company. They are more focused on targeting there

online customers and by digitalisation, they can sell plenty of brands to them in order to increase

profitability as well as productivity of company. It is also a positive sign for them to develop a

well and effective platform for the industry towards going into a new era.

Sales performance of H&M

H&M group’s sales in local currency includes 7% increase in the year 2016. I In 2017, it

was recorded with 4% increase to SEK 231744 m. in local current it increase by 3% only. The

comparison among total sales enhancement is increase from the last year. Currency translation

effects are increasing when sales and profits in domestic market are translated in the reporting

value of national currencies.

Currencies translation risk: It is develop because of the company net assets that

consists of equity investment and debt those are represented in international currency (Chen,

2012).

Particular Net Asset position Net liabilities position

Weakness (SEK m) Gain Loss

Strength (SEK m) Loss Gain

Sales including VAT by Market as per the number of stock

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

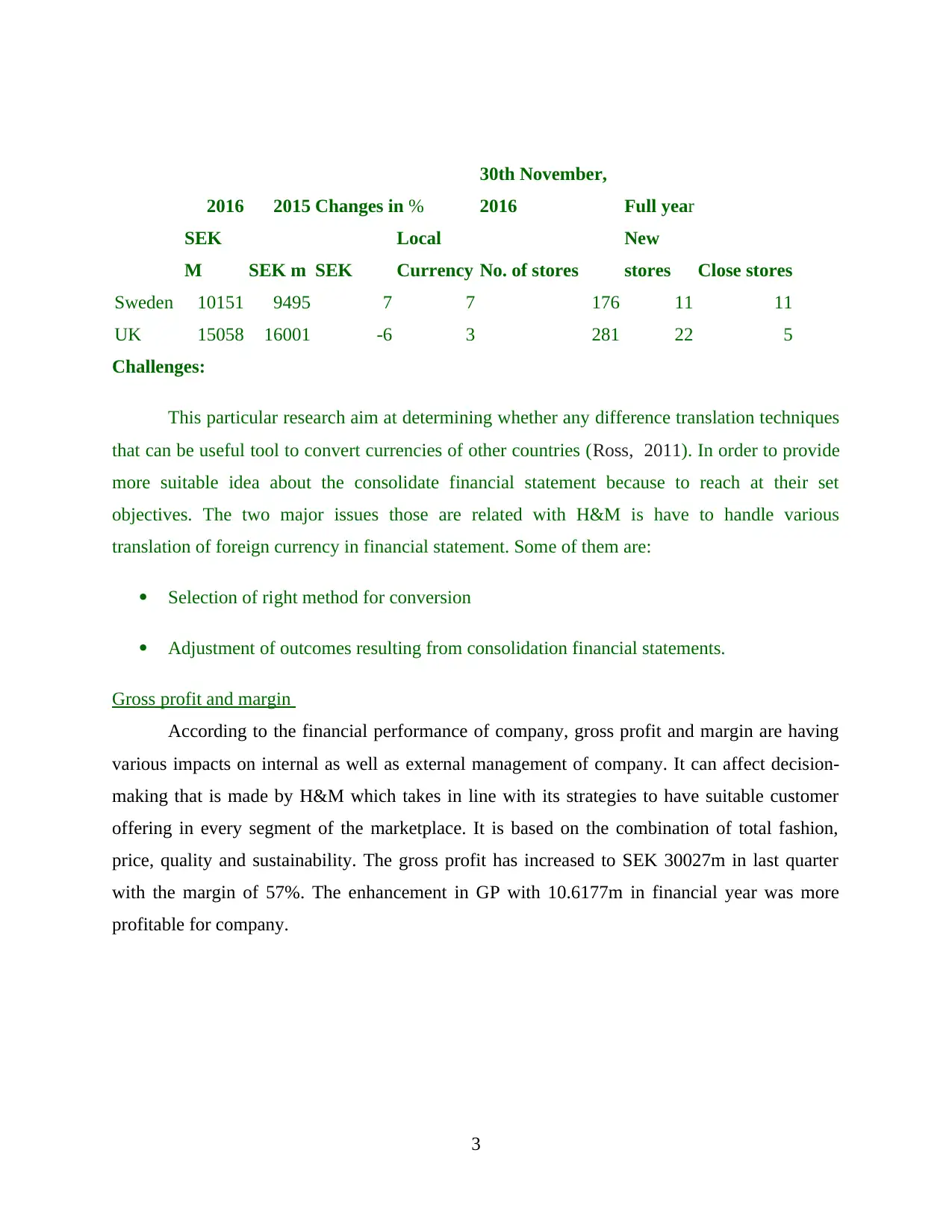

2016 2015 Changes in %

30th November,

2016 Full year

SEK

M SEK m SEK

Local

Currency No. of stores

New

stores Close stores

Sweden 10151 9495 7 7 176 11 11

UK 15058 16001 -6 3 281 22 5

Challenges:

This particular research aim at determining whether any difference translation techniques

that can be useful tool to convert currencies of other countries (Ross, 2011). In order to provide

more suitable idea about the consolidate financial statement because to reach at their set

objectives. The two major issues those are related with H&M is have to handle various

translation of foreign currency in financial statement. Some of them are:

Selection of right method for conversion

Adjustment of outcomes resulting from consolidation financial statements.

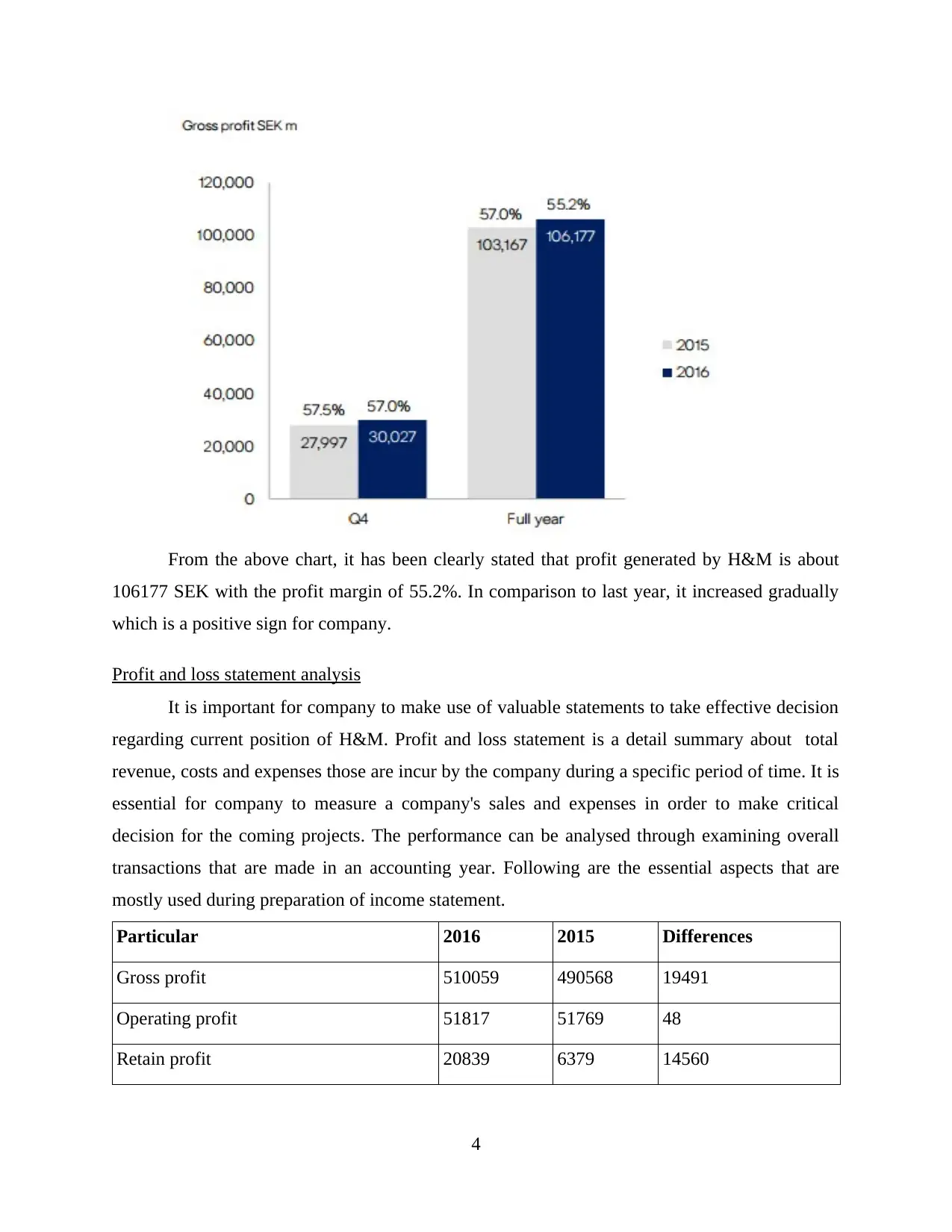

Gross profit and margin

According to the financial performance of company, gross profit and margin are having

various impacts on internal as well as external management of company. It can affect decision-

making that is made by H&M which takes in line with its strategies to have suitable customer

offering in every segment of the marketplace. It is based on the combination of total fashion,

price, quality and sustainability. The gross profit has increased to SEK 30027m in last quarter

with the margin of 57%. The enhancement in GP with 10.6177m in financial year was more

profitable for company.

3

30th November,

2016 Full year

SEK

M SEK m SEK

Local

Currency No. of stores

New

stores Close stores

Sweden 10151 9495 7 7 176 11 11

UK 15058 16001 -6 3 281 22 5

Challenges:

This particular research aim at determining whether any difference translation techniques

that can be useful tool to convert currencies of other countries (Ross, 2011). In order to provide

more suitable idea about the consolidate financial statement because to reach at their set

objectives. The two major issues those are related with H&M is have to handle various

translation of foreign currency in financial statement. Some of them are:

Selection of right method for conversion

Adjustment of outcomes resulting from consolidation financial statements.

Gross profit and margin

According to the financial performance of company, gross profit and margin are having

various impacts on internal as well as external management of company. It can affect decision-

making that is made by H&M which takes in line with its strategies to have suitable customer

offering in every segment of the marketplace. It is based on the combination of total fashion,

price, quality and sustainability. The gross profit has increased to SEK 30027m in last quarter

with the margin of 57%. The enhancement in GP with 10.6177m in financial year was more

profitable for company.

3

From the above chart, it has been clearly stated that profit generated by H&M is about

106177 SEK with the profit margin of 55.2%. In comparison to last year, it increased gradually

which is a positive sign for company.

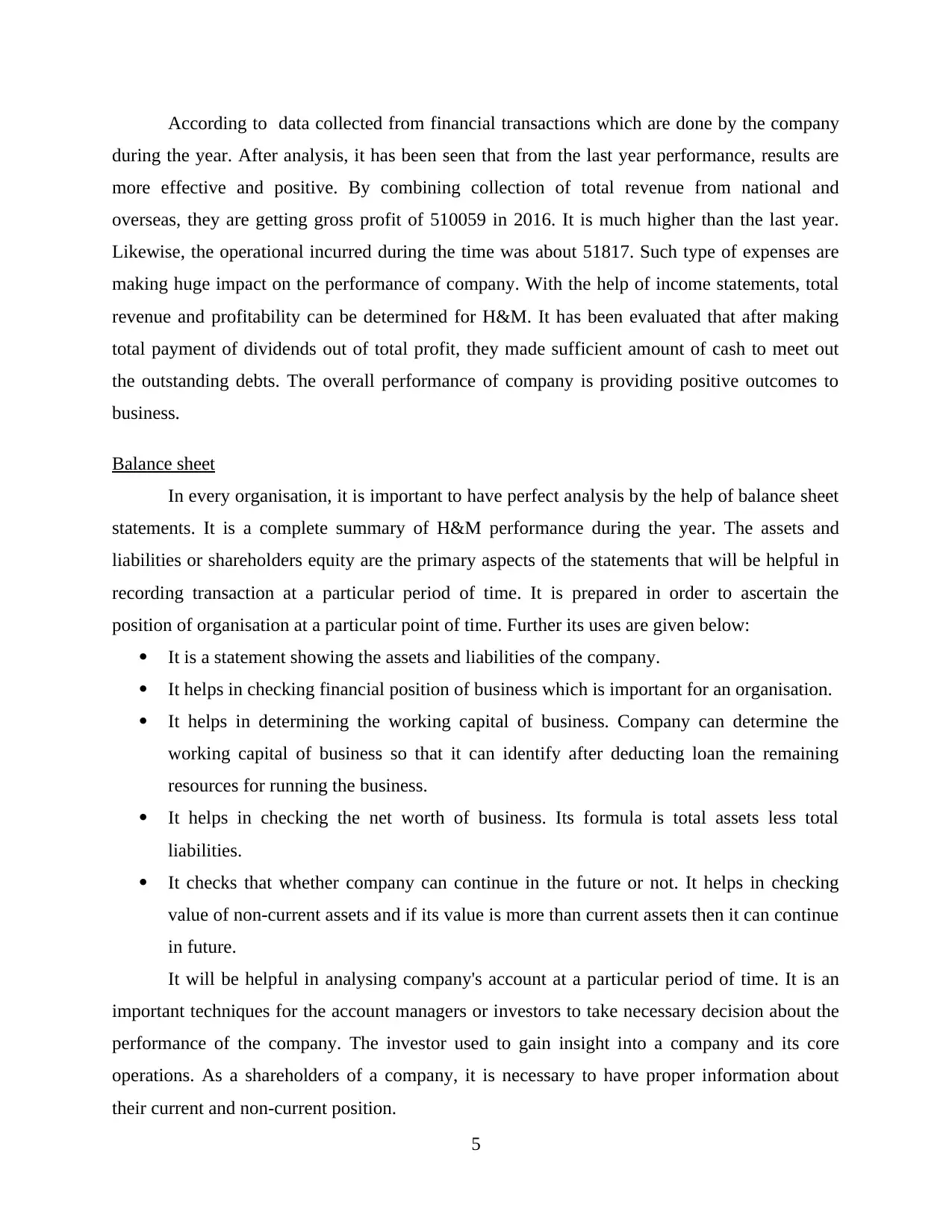

Profit and loss statement analysis

It is important for company to make use of valuable statements to take effective decision

regarding current position of H&M. Profit and loss statement is a detail summary about total

revenue, costs and expenses those are incur by the company during a specific period of time. It is

essential for company to measure a company's sales and expenses in order to make critical

decision for the coming projects. The performance can be analysed through examining overall

transactions that are made in an accounting year. Following are the essential aspects that are

mostly used during preparation of income statement.

Particular 2016 2015 Differences

Gross profit 510059 490568 19491

Operating profit 51817 51769 48

Retain profit 20839 6379 14560

4

106177 SEK with the profit margin of 55.2%. In comparison to last year, it increased gradually

which is a positive sign for company.

Profit and loss statement analysis

It is important for company to make use of valuable statements to take effective decision

regarding current position of H&M. Profit and loss statement is a detail summary about total

revenue, costs and expenses those are incur by the company during a specific period of time. It is

essential for company to measure a company's sales and expenses in order to make critical

decision for the coming projects. The performance can be analysed through examining overall

transactions that are made in an accounting year. Following are the essential aspects that are

mostly used during preparation of income statement.

Particular 2016 2015 Differences

Gross profit 510059 490568 19491

Operating profit 51817 51769 48

Retain profit 20839 6379 14560

4

You're viewing a preview

Unlock full access by subscribing today!

According to data collected from financial transactions which are done by the company

during the year. After analysis, it has been seen that from the last year performance, results are

more effective and positive. By combining collection of total revenue from national and

overseas, they are getting gross profit of 510059 in 2016. It is much higher than the last year.

Likewise, the operational incurred during the time was about 51817. Such type of expenses are

making huge impact on the performance of company. With the help of income statements, total

revenue and profitability can be determined for H&M. It has been evaluated that after making

total payment of dividends out of total profit, they made sufficient amount of cash to meet out

the outstanding debts. The overall performance of company is providing positive outcomes to

business.

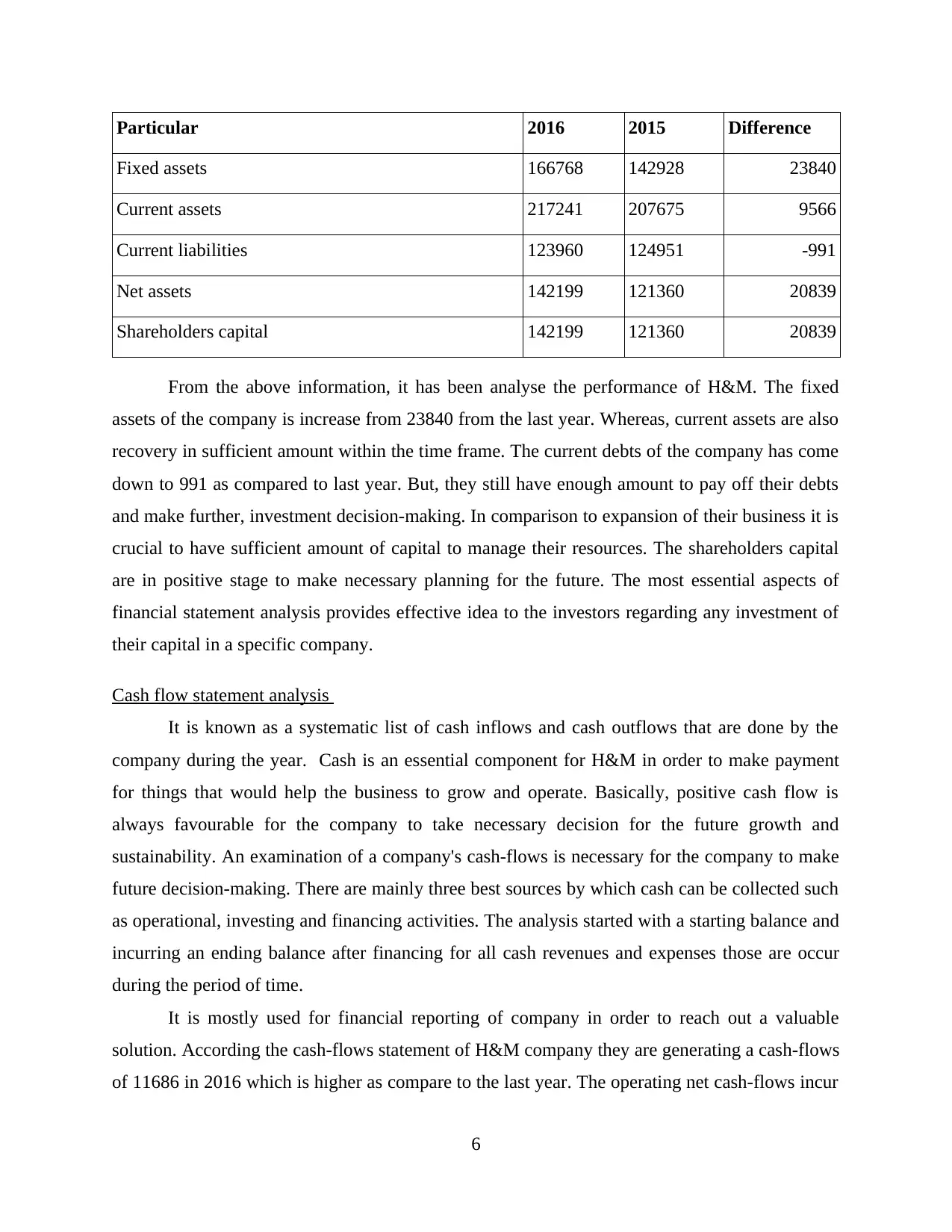

Balance sheet

In every organisation, it is important to have perfect analysis by the help of balance sheet

statements. It is a complete summary of H&M performance during the year. The assets and

liabilities or shareholders equity are the primary aspects of the statements that will be helpful in

recording transaction at a particular period of time. It is prepared in order to ascertain the

position of organisation at a particular point of time. Further its uses are given below:

It is a statement showing the assets and liabilities of the company.

It helps in checking financial position of business which is important for an organisation.

It helps in determining the working capital of business. Company can determine the

working capital of business so that it can identify after deducting loan the remaining

resources for running the business.

It helps in checking the net worth of business. Its formula is total assets less total

liabilities.

It checks that whether company can continue in the future or not. It helps in checking

value of non-current assets and if its value is more than current assets then it can continue

in future.

It will be helpful in analysing company's account at a particular period of time. It is an

important techniques for the account managers or investors to take necessary decision about the

performance of the company. The investor used to gain insight into a company and its core

operations. As a shareholders of a company, it is necessary to have proper information about

their current and non-current position.

5

during the year. After analysis, it has been seen that from the last year performance, results are

more effective and positive. By combining collection of total revenue from national and

overseas, they are getting gross profit of 510059 in 2016. It is much higher than the last year.

Likewise, the operational incurred during the time was about 51817. Such type of expenses are

making huge impact on the performance of company. With the help of income statements, total

revenue and profitability can be determined for H&M. It has been evaluated that after making

total payment of dividends out of total profit, they made sufficient amount of cash to meet out

the outstanding debts. The overall performance of company is providing positive outcomes to

business.

Balance sheet

In every organisation, it is important to have perfect analysis by the help of balance sheet

statements. It is a complete summary of H&M performance during the year. The assets and

liabilities or shareholders equity are the primary aspects of the statements that will be helpful in

recording transaction at a particular period of time. It is prepared in order to ascertain the

position of organisation at a particular point of time. Further its uses are given below:

It is a statement showing the assets and liabilities of the company.

It helps in checking financial position of business which is important for an organisation.

It helps in determining the working capital of business. Company can determine the

working capital of business so that it can identify after deducting loan the remaining

resources for running the business.

It helps in checking the net worth of business. Its formula is total assets less total

liabilities.

It checks that whether company can continue in the future or not. It helps in checking

value of non-current assets and if its value is more than current assets then it can continue

in future.

It will be helpful in analysing company's account at a particular period of time. It is an

important techniques for the account managers or investors to take necessary decision about the

performance of the company. The investor used to gain insight into a company and its core

operations. As a shareholders of a company, it is necessary to have proper information about

their current and non-current position.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Particular 2016 2015 Difference

Fixed assets 166768 142928 23840

Current assets 217241 207675 9566

Current liabilities 123960 124951 -991

Net assets 142199 121360 20839

Shareholders capital 142199 121360 20839

From the above information, it has been analyse the performance of H&M. The fixed

assets of the company is increase from 23840 from the last year. Whereas, current assets are also

recovery in sufficient amount within the time frame. The current debts of the company has come

down to 991 as compared to last year. But, they still have enough amount to pay off their debts

and make further, investment decision-making. In comparison to expansion of their business it is

crucial to have sufficient amount of capital to manage their resources. The shareholders capital

are in positive stage to make necessary planning for the future. The most essential aspects of

financial statement analysis provides effective idea to the investors regarding any investment of

their capital in a specific company.

Cash flow statement analysis

It is known as a systematic list of cash inflows and cash outflows that are done by the

company during the year. Cash is an essential component for H&M in order to make payment

for things that would help the business to grow and operate. Basically, positive cash flow is

always favourable for the company to take necessary decision for the future growth and

sustainability. An examination of a company's cash-flows is necessary for the company to make

future decision-making. There are mainly three best sources by which cash can be collected such

as operational, investing and financing activities. The analysis started with a starting balance and

incurring an ending balance after financing for all cash revenues and expenses those are occur

during the period of time.

It is mostly used for financial reporting of company in order to reach out a valuable

solution. According the cash-flows statement of H&M company they are generating a cash-flows

of 11686 in 2016 which is higher as compare to the last year. The operating net cash-flows incur

6

Fixed assets 166768 142928 23840

Current assets 217241 207675 9566

Current liabilities 123960 124951 -991

Net assets 142199 121360 20839

Shareholders capital 142199 121360 20839

From the above information, it has been analyse the performance of H&M. The fixed

assets of the company is increase from 23840 from the last year. Whereas, current assets are also

recovery in sufficient amount within the time frame. The current debts of the company has come

down to 991 as compared to last year. But, they still have enough amount to pay off their debts

and make further, investment decision-making. In comparison to expansion of their business it is

crucial to have sufficient amount of capital to manage their resources. The shareholders capital

are in positive stage to make necessary planning for the future. The most essential aspects of

financial statement analysis provides effective idea to the investors regarding any investment of

their capital in a specific company.

Cash flow statement analysis

It is known as a systematic list of cash inflows and cash outflows that are done by the

company during the year. Cash is an essential component for H&M in order to make payment

for things that would help the business to grow and operate. Basically, positive cash flow is

always favourable for the company to take necessary decision for the future growth and

sustainability. An examination of a company's cash-flows is necessary for the company to make

future decision-making. There are mainly three best sources by which cash can be collected such

as operational, investing and financing activities. The analysis started with a starting balance and

incurring an ending balance after financing for all cash revenues and expenses those are occur

during the period of time.

It is mostly used for financial reporting of company in order to reach out a valuable

solution. According the cash-flows statement of H&M company they are generating a cash-flows

of 11686 in 2016 which is higher as compare to the last year. The operating net cash-flows incur

6

by during the time is about 99199. Whereas, total cash collected as return on investment is -1482

because the last year performance was not having any cash amount. The overall performance of

the company is sufficient enough to meet out there motive which is to increase the profitability.

Cash-flows from investment is used to examine level of net capital expenses those are required

to maintain and grow the performance of H&M group. Interest paid is a cash outflows that is

included in order to get a valuable cash-flows that is presented to every suppliers of capital

amount to the company.

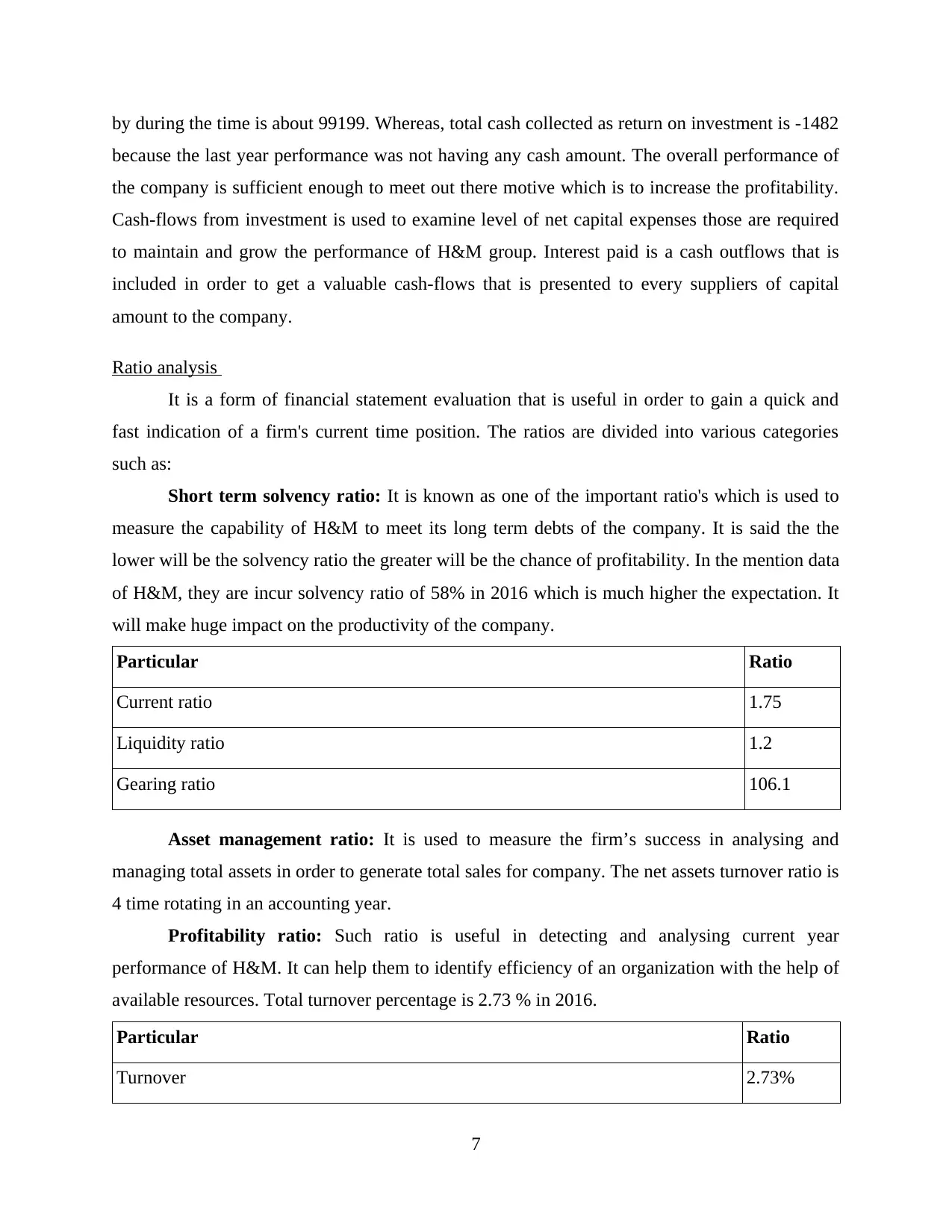

Ratio analysis

It is a form of financial statement evaluation that is useful in order to gain a quick and

fast indication of a firm's current time position. The ratios are divided into various categories

such as:

Short term solvency ratio: It is known as one of the important ratio's which is used to

measure the capability of H&M to meet its long term debts of the company. It is said the the

lower will be the solvency ratio the greater will be the chance of profitability. In the mention data

of H&M, they are incur solvency ratio of 58% in 2016 which is much higher the expectation. It

will make huge impact on the productivity of the company.

Particular Ratio

Current ratio 1.75

Liquidity ratio 1.2

Gearing ratio 106.1

Asset management ratio: It is used to measure the firm’s success in analysing and

managing total assets in order to generate total sales for company. The net assets turnover ratio is

4 time rotating in an accounting year.

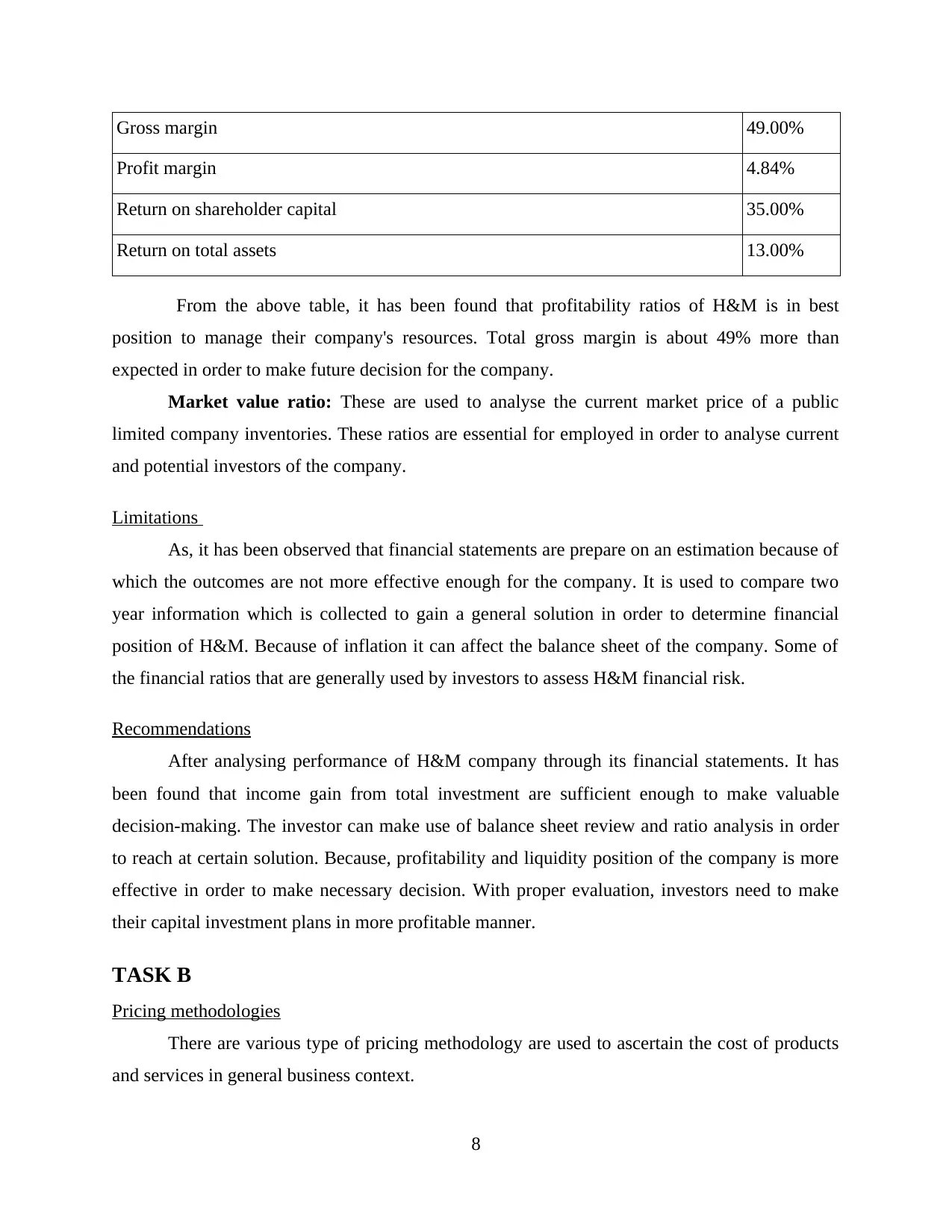

Profitability ratio: Such ratio is useful in detecting and analysing current year

performance of H&M. It can help them to identify efficiency of an organization with the help of

available resources. Total turnover percentage is 2.73 % in 2016.

Particular Ratio

Turnover 2.73%

7

because the last year performance was not having any cash amount. The overall performance of

the company is sufficient enough to meet out there motive which is to increase the profitability.

Cash-flows from investment is used to examine level of net capital expenses those are required

to maintain and grow the performance of H&M group. Interest paid is a cash outflows that is

included in order to get a valuable cash-flows that is presented to every suppliers of capital

amount to the company.

Ratio analysis

It is a form of financial statement evaluation that is useful in order to gain a quick and

fast indication of a firm's current time position. The ratios are divided into various categories

such as:

Short term solvency ratio: It is known as one of the important ratio's which is used to

measure the capability of H&M to meet its long term debts of the company. It is said the the

lower will be the solvency ratio the greater will be the chance of profitability. In the mention data

of H&M, they are incur solvency ratio of 58% in 2016 which is much higher the expectation. It

will make huge impact on the productivity of the company.

Particular Ratio

Current ratio 1.75

Liquidity ratio 1.2

Gearing ratio 106.1

Asset management ratio: It is used to measure the firm’s success in analysing and

managing total assets in order to generate total sales for company. The net assets turnover ratio is

4 time rotating in an accounting year.

Profitability ratio: Such ratio is useful in detecting and analysing current year

performance of H&M. It can help them to identify efficiency of an organization with the help of

available resources. Total turnover percentage is 2.73 % in 2016.

Particular Ratio

Turnover 2.73%

7

You're viewing a preview

Unlock full access by subscribing today!

Gross margin 49.00%

Profit margin 4.84%

Return on shareholder capital 35.00%

Return on total assets 13.00%

From the above table, it has been found that profitability ratios of H&M is in best

position to manage their company's resources. Total gross margin is about 49% more than

expected in order to make future decision for the company.

Market value ratio: These are used to analyse the current market price of a public

limited company inventories. These ratios are essential for employed in order to analyse current

and potential investors of the company.

Limitations

As, it has been observed that financial statements are prepare on an estimation because of

which the outcomes are not more effective enough for the company. It is used to compare two

year information which is collected to gain a general solution in order to determine financial

position of H&M. Because of inflation it can affect the balance sheet of the company. Some of

the financial ratios that are generally used by investors to assess H&M financial risk.

Recommendations

After analysing performance of H&M company through its financial statements. It has

been found that income gain from total investment are sufficient enough to make valuable

decision-making. The investor can make use of balance sheet review and ratio analysis in order

to reach at certain solution. Because, profitability and liquidity position of the company is more

effective in order to make necessary decision. With proper evaluation, investors need to make

their capital investment plans in more profitable manner.

TASK B

Pricing methodologies

There are various type of pricing methodology are used to ascertain the cost of products

and services in general business context.

8

Profit margin 4.84%

Return on shareholder capital 35.00%

Return on total assets 13.00%

From the above table, it has been found that profitability ratios of H&M is in best

position to manage their company's resources. Total gross margin is about 49% more than

expected in order to make future decision for the company.

Market value ratio: These are used to analyse the current market price of a public

limited company inventories. These ratios are essential for employed in order to analyse current

and potential investors of the company.

Limitations

As, it has been observed that financial statements are prepare on an estimation because of

which the outcomes are not more effective enough for the company. It is used to compare two

year information which is collected to gain a general solution in order to determine financial

position of H&M. Because of inflation it can affect the balance sheet of the company. Some of

the financial ratios that are generally used by investors to assess H&M financial risk.

Recommendations

After analysing performance of H&M company through its financial statements. It has

been found that income gain from total investment are sufficient enough to make valuable

decision-making. The investor can make use of balance sheet review and ratio analysis in order

to reach at certain solution. Because, profitability and liquidity position of the company is more

effective in order to make necessary decision. With proper evaluation, investors need to make

their capital investment plans in more profitable manner.

TASK B

Pricing methodologies

There are various type of pricing methodology are used to ascertain the cost of products

and services in general business context.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cost plus pricing – This pricing method is used to set desired profit margin and

percentage of profit on cost of the product. This is one of the convenient and simplest method

used in manufacturing and production companies. Profit margin is set on cost of the product. As

sale price of products are ascertained after adding profit percentages or profit margin. There is

following formula is used to ascertain the cost of product.

Price = Average variable cost + Average variable cost with markup percentage

= AVC + AVC(M)

Where mark up percentage remain fixed and net profit margin is covered.

AVC (M) = AFC + NPM

Markup pricing – This is one of the common method which used to decide the selling

price of product and services. Selling price and profit margin is set in the basis of amount of

sellers and retailers. There is a specific share is set upon the cost of the product. For example a

retail price of shirt is £250 and retails keep the share as £20 per shirt then the overall cost of the

shirt would be £270. there is a formula used to calculate the markup percentage:

a. Markup percentage of cost = (Markup / cost) * 100

b. Markup percentage at selling price = (Markup / Selling price) * 100

Target return pricing – a specific amount of profit is estimated and target set to achieve

that desired profit. In simple words the price of product is decided on the basis of expected or

estimated amount of profit.

Going rate pricing – Price of product is decided on the basis of market trends and

demand of product. This pricing methodology is used when company has large product market

and monopolistic situations.

CONCLUSION

From the above information, it has been concluded that finance is an effective aspects for

any business organization in order to manage their business operations. The report provide

complete business analyses of financial statement of H&M. It has been evaluated that

performance of the company is more effective for the investors in order to make their future

investment planning.

9

percentage of profit on cost of the product. This is one of the convenient and simplest method

used in manufacturing and production companies. Profit margin is set on cost of the product. As

sale price of products are ascertained after adding profit percentages or profit margin. There is

following formula is used to ascertain the cost of product.

Price = Average variable cost + Average variable cost with markup percentage

= AVC + AVC(M)

Where mark up percentage remain fixed and net profit margin is covered.

AVC (M) = AFC + NPM

Markup pricing – This is one of the common method which used to decide the selling

price of product and services. Selling price and profit margin is set in the basis of amount of

sellers and retailers. There is a specific share is set upon the cost of the product. For example a

retail price of shirt is £250 and retails keep the share as £20 per shirt then the overall cost of the

shirt would be £270. there is a formula used to calculate the markup percentage:

a. Markup percentage of cost = (Markup / cost) * 100

b. Markup percentage at selling price = (Markup / Selling price) * 100

Target return pricing – a specific amount of profit is estimated and target set to achieve

that desired profit. In simple words the price of product is decided on the basis of expected or

estimated amount of profit.

Going rate pricing – Price of product is decided on the basis of market trends and

demand of product. This pricing methodology is used when company has large product market

and monopolistic situations.

CONCLUSION

From the above information, it has been concluded that finance is an effective aspects for

any business organization in order to manage their business operations. The report provide

complete business analyses of financial statement of H&M. It has been evaluated that

performance of the company is more effective for the investors in order to make their future

investment planning.

9

REFERENCES

Books and Journals

Gatti, S., 2013. Project finance in theory and practice: designing, structuring, and financing

private and public projects. Academic Press.

Gundlach, M. and Lehrbass, F. eds., 2013. CreditRisk+ in the banking industry. Springer Science

& Business Media.

Harvey, C. R., 2011. Report of the Editor of The Journal of Finance for the Year 2010. The

Journal of Finance. 66(4). pp.1439-1452.

Kim, J. H. and Ji, P. I., 2015. Significance testing in empirical finance: A critical review and

assessment. Journal of Empirical Finance. 34. pp.1-14.

Salzmann, A. J., 2013. The integration of sustainability into the theory and practice of finance:

an overview of the state of the art and outline of future developments. Journal of business

economics. 83(6). pp.555-576.

Schaub, M., 2013. Latin American ADR performance: how do issue type and issue date affect

long term excess returns? International Journal of Managerial Finance. 9(1). pp.4-12.

Shiller, R. J., 2013. Finance and the good society. Princeton University Press.

Taani, K., 2014. Capital structure effects on banking performance: A case study of Jordan.

International Journal of Economics, Finance and Management Sciences. 1(5). p.227.

Taylor, J., 2011. The assessment of research quality in UK universities: Peer review or metrics?

British Journal of Management. 22(2). pp.202-217.

Wilmott, P., 2013. Paul Wilmott on quantitative finance. John Wiley & Sons.

Bäuerle, N. and Rieder, U., 2011. Markov decision processes with applications to finance.

Springer Science & Business Media.

Chen, S.H. ed., 2012. Genetic algorithms and genetic programming in computational finance.

Springer Science & Business Media.

Ross, S.M., 2011. An elementary introduction to mathematical finance. Cambridge University

Press.

Online

Key Ratios to Analyze Business Risk. 2011.[Online]. Available through:

<https://www.stocktrader.com/2009/06/22/business-risk-analysis-calculate-ratios-debt-

equity-earnings-interest/>.

10

Books and Journals

Gatti, S., 2013. Project finance in theory and practice: designing, structuring, and financing

private and public projects. Academic Press.

Gundlach, M. and Lehrbass, F. eds., 2013. CreditRisk+ in the banking industry. Springer Science

& Business Media.

Harvey, C. R., 2011. Report of the Editor of The Journal of Finance for the Year 2010. The

Journal of Finance. 66(4). pp.1439-1452.

Kim, J. H. and Ji, P. I., 2015. Significance testing in empirical finance: A critical review and

assessment. Journal of Empirical Finance. 34. pp.1-14.

Salzmann, A. J., 2013. The integration of sustainability into the theory and practice of finance:

an overview of the state of the art and outline of future developments. Journal of business

economics. 83(6). pp.555-576.

Schaub, M., 2013. Latin American ADR performance: how do issue type and issue date affect

long term excess returns? International Journal of Managerial Finance. 9(1). pp.4-12.

Shiller, R. J., 2013. Finance and the good society. Princeton University Press.

Taani, K., 2014. Capital structure effects on banking performance: A case study of Jordan.

International Journal of Economics, Finance and Management Sciences. 1(5). p.227.

Taylor, J., 2011. The assessment of research quality in UK universities: Peer review or metrics?

British Journal of Management. 22(2). pp.202-217.

Wilmott, P., 2013. Paul Wilmott on quantitative finance. John Wiley & Sons.

Bäuerle, N. and Rieder, U., 2011. Markov decision processes with applications to finance.

Springer Science & Business Media.

Chen, S.H. ed., 2012. Genetic algorithms and genetic programming in computational finance.

Springer Science & Business Media.

Ross, S.M., 2011. An elementary introduction to mathematical finance. Cambridge University

Press.

Online

Key Ratios to Analyze Business Risk. 2011.[Online]. Available through:

<https://www.stocktrader.com/2009/06/22/business-risk-analysis-calculate-ratios-debt-

equity-earnings-interest/>.

10

You're viewing a preview

Unlock full access by subscribing today!

11

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.