University Finance Assignment: Eviews Analysis of Time Series Data

VerifiedAdded on 2020/05/28

|31

|5859

|216

Homework Assignment

AI Summary

This finance assignment focuses on time series analysis using Eviews software. The analysis begins with an examination of the G10 series, including its trends and fluctuations. The assignment then delves into testing whether the G10 variable follows a martingale process, employing both Chow-Denning and Wild Bootstrap tests. The order of integration is determined using correlograms and Augmented Dickey-Fuller (ADF) tests. The ADF test is performed with different specifications to confirm the order of integration. Further analysis includes the examination of cointegration and the development of an error correction model. The solution provides detailed regression outputs, test statistics, and interpretations to support the conclusions drawn about the time series properties of the data.

Running Head: FINANCE WITH EVIEWS

Finance with Eviews

Name of the Student

Name of the University

Author note

Finance with Eviews

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

FINANCE WITH EVIEWS

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................3

Martingale test.............................................................................................................................4

Answer 3..........................................................................................................................................6

Answer 4........................................................................................................................................16

Order of integration for SPREAD.............................................................................................16

Co-integration test.....................................................................................................................22

Answer 5........................................................................................................................................27

Error Correction Model.............................................................................................................27

FINANCE WITH EVIEWS

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................3

Martingale test.............................................................................................................................4

Answer 3..........................................................................................................................................6

Answer 4........................................................................................................................................16

Order of integration for SPREAD.............................................................................................16

Co-integration test.....................................................................................................................22

Answer 5........................................................................................................................................27

Error Correction Model.............................................................................................................27

2

FINANCE WITH EVIEWS

Answer 1

0

2

4

6

8

10

12

14

16

60 65 70 75 80 85 90 95 00 05 10

G10

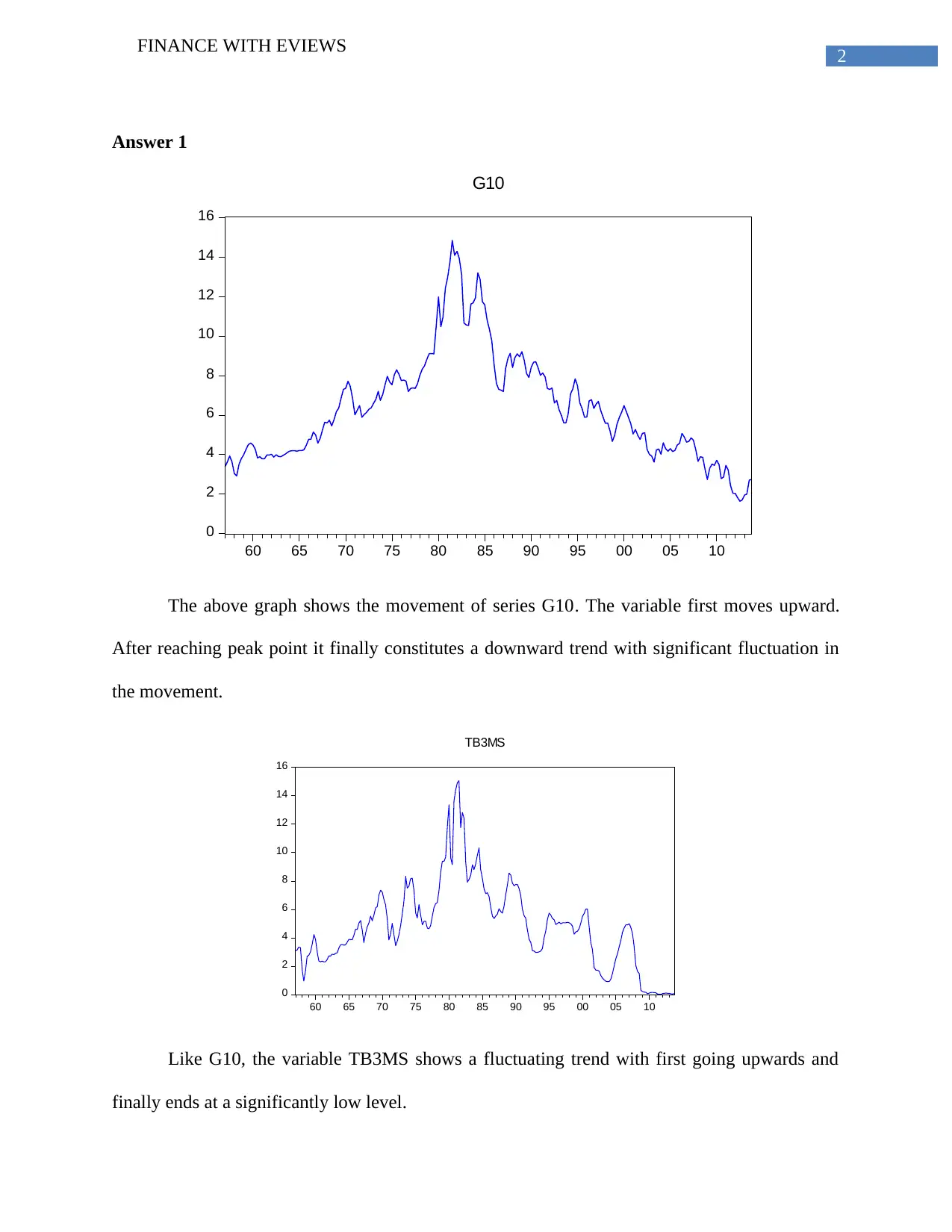

The above graph shows the movement of series G10. The variable first moves upward.

After reaching peak point it finally constitutes a downward trend with significant fluctuation in

the movement.

0

2

4

6

8

10

12

14

16

60 65 70 75 80 85 90 95 00 05 10

TB3MS

Like G10, the variable TB3MS shows a fluctuating trend with first going upwards and

finally ends at a significantly low level.

FINANCE WITH EVIEWS

Answer 1

0

2

4

6

8

10

12

14

16

60 65 70 75 80 85 90 95 00 05 10

G10

The above graph shows the movement of series G10. The variable first moves upward.

After reaching peak point it finally constitutes a downward trend with significant fluctuation in

the movement.

0

2

4

6

8

10

12

14

16

60 65 70 75 80 85 90 95 00 05 10

TB3MS

Like G10, the variable TB3MS shows a fluctuating trend with first going upwards and

finally ends at a significantly low level.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

FINANCE WITH EVIEWS

Answer 2

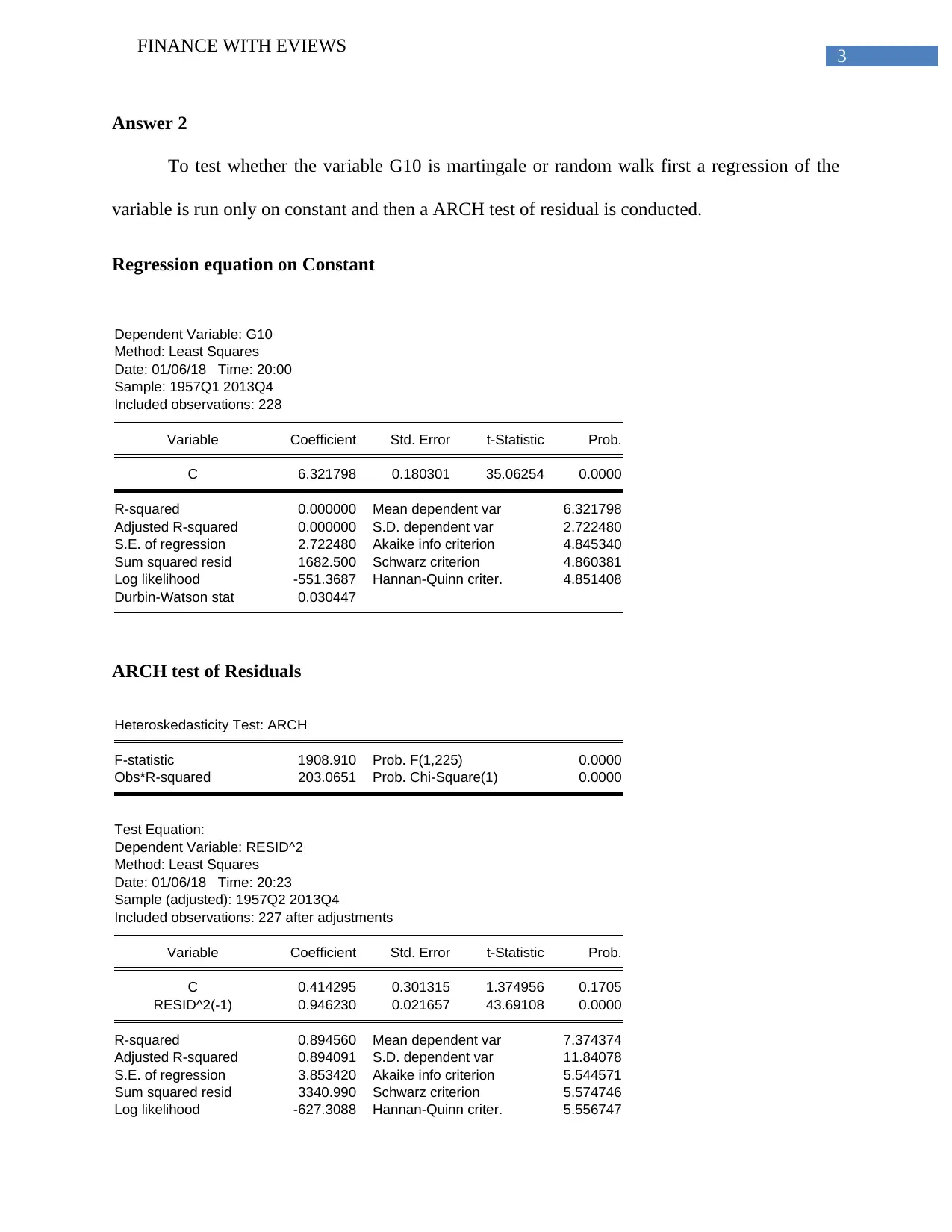

To test whether the variable G10 is martingale or random walk first a regression of the

variable is run only on constant and then a ARCH test of residual is conducted.

Regression equation on Constant

Dependent Variable: G10

Method: Least Squares

Date: 01/06/18 Time: 20:00

Sample: 1957Q1 2013Q4

Included observations: 228

Variable Coefficient Std. Error t-Statistic Prob.

C 6.321798 0.180301 35.06254 0.0000

R-squared 0.000000 Mean dependent var 6.321798

Adjusted R-squared 0.000000 S.D. dependent var 2.722480

S.E. of regression 2.722480 Akaike info criterion 4.845340

Sum squared resid 1682.500 Schwarz criterion 4.860381

Log likelihood -551.3687 Hannan-Quinn criter. 4.851408

Durbin-Watson stat 0.030447

ARCH test of Residuals

Heteroskedasticity Test: ARCH

F-statistic 1908.910 Prob. F(1,225) 0.0000

Obs*R-squared 203.0651 Prob. Chi-Square(1) 0.0000

Test Equation:

Dependent Variable: RESID^2

Method: Least Squares

Date: 01/06/18 Time: 20:23

Sample (adjusted): 1957Q2 2013Q4

Included observations: 227 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

C 0.414295 0.301315 1.374956 0.1705

RESID^2(-1) 0.946230 0.021657 43.69108 0.0000

R-squared 0.894560 Mean dependent var 7.374374

Adjusted R-squared 0.894091 S.D. dependent var 11.84078

S.E. of regression 3.853420 Akaike info criterion 5.544571

Sum squared resid 3340.990 Schwarz criterion 5.574746

Log likelihood -627.3088 Hannan-Quinn criter. 5.556747

FINANCE WITH EVIEWS

Answer 2

To test whether the variable G10 is martingale or random walk first a regression of the

variable is run only on constant and then a ARCH test of residual is conducted.

Regression equation on Constant

Dependent Variable: G10

Method: Least Squares

Date: 01/06/18 Time: 20:00

Sample: 1957Q1 2013Q4

Included observations: 228

Variable Coefficient Std. Error t-Statistic Prob.

C 6.321798 0.180301 35.06254 0.0000

R-squared 0.000000 Mean dependent var 6.321798

Adjusted R-squared 0.000000 S.D. dependent var 2.722480

S.E. of regression 2.722480 Akaike info criterion 4.845340

Sum squared resid 1682.500 Schwarz criterion 4.860381

Log likelihood -551.3687 Hannan-Quinn criter. 4.851408

Durbin-Watson stat 0.030447

ARCH test of Residuals

Heteroskedasticity Test: ARCH

F-statistic 1908.910 Prob. F(1,225) 0.0000

Obs*R-squared 203.0651 Prob. Chi-Square(1) 0.0000

Test Equation:

Dependent Variable: RESID^2

Method: Least Squares

Date: 01/06/18 Time: 20:23

Sample (adjusted): 1957Q2 2013Q4

Included observations: 227 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

C 0.414295 0.301315 1.374956 0.1705

RESID^2(-1) 0.946230 0.021657 43.69108 0.0000

R-squared 0.894560 Mean dependent var 7.374374

Adjusted R-squared 0.894091 S.D. dependent var 11.84078

S.E. of regression 3.853420 Akaike info criterion 5.544571

Sum squared resid 3340.990 Schwarz criterion 5.574746

Log likelihood -627.3088 Hannan-Quinn criter. 5.556747

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

FINANCE WITH EVIEWS

F-statistic 1908.910 Durbin-Watson stat 1.563370

Prob(F-statistic) 0.000000

The p value of the ARCH test statistics is less than the value of significance level. This

indicates rejection of the null hypothesis stating the absence of auto regressive heteroskadasticy.

Henceforth, the hypothesis of whether G10 is martingale is tested.

Martingale test

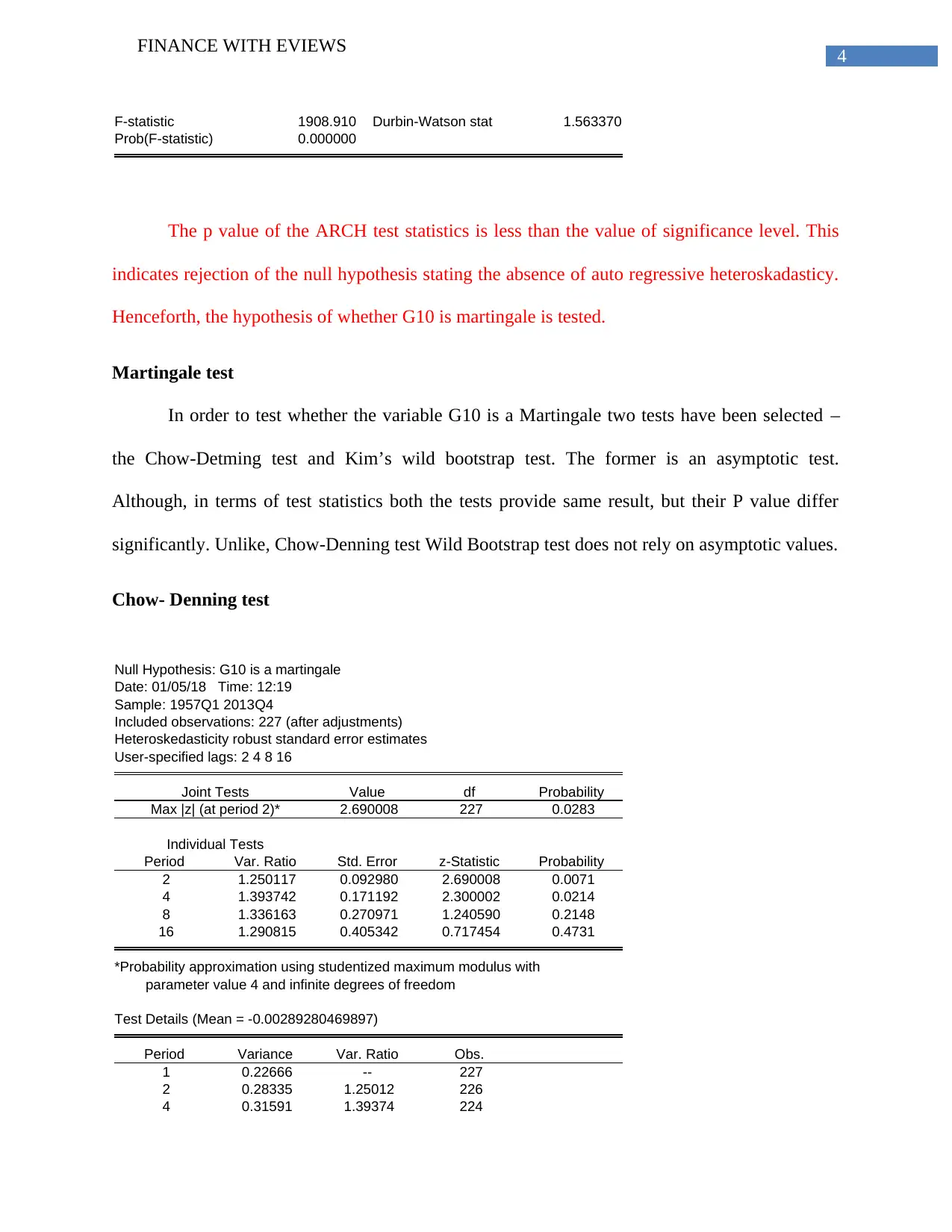

In order to test whether the variable G10 is a Martingale two tests have been selected –

the Chow-Detming test and Kim’s wild bootstrap test. The former is an asymptotic test.

Although, in terms of test statistics both the tests provide same result, but their P value differ

significantly. Unlike, Chow-Denning test Wild Bootstrap test does not rely on asymptotic values.

Chow- Denning test

Null Hypothesis: G10 is a martingale

Date: 01/05/18 Time: 12:19

Sample: 1957Q1 2013Q4

Included observations: 227 (after adjustments)

Heteroskedasticity robust standard error estimates

User-specified lags: 2 4 8 16

Joint Tests Value df Probability

Max |z| (at period 2)* 2.690008 227 0.0283

Individual Tests

Period Var. Ratio Std. Error z-Statistic Probability

2 1.250117 0.092980 2.690008 0.0071

4 1.393742 0.171192 2.300002 0.0214

8 1.336163 0.270971 1.240590 0.2148

16 1.290815 0.405342 0.717454 0.4731

*Probability approximation using studentized maximum modulus with

parameter value 4 and infinite degrees of freedom

Test Details (Mean = -0.00289280469897)

Period Variance Var. Ratio Obs.

1 0.22666 -- 227

2 0.28335 1.25012 226

4 0.31591 1.39374 224

FINANCE WITH EVIEWS

F-statistic 1908.910 Durbin-Watson stat 1.563370

Prob(F-statistic) 0.000000

The p value of the ARCH test statistics is less than the value of significance level. This

indicates rejection of the null hypothesis stating the absence of auto regressive heteroskadasticy.

Henceforth, the hypothesis of whether G10 is martingale is tested.

Martingale test

In order to test whether the variable G10 is a Martingale two tests have been selected –

the Chow-Detming test and Kim’s wild bootstrap test. The former is an asymptotic test.

Although, in terms of test statistics both the tests provide same result, but their P value differ

significantly. Unlike, Chow-Denning test Wild Bootstrap test does not rely on asymptotic values.

Chow- Denning test

Null Hypothesis: G10 is a martingale

Date: 01/05/18 Time: 12:19

Sample: 1957Q1 2013Q4

Included observations: 227 (after adjustments)

Heteroskedasticity robust standard error estimates

User-specified lags: 2 4 8 16

Joint Tests Value df Probability

Max |z| (at period 2)* 2.690008 227 0.0283

Individual Tests

Period Var. Ratio Std. Error z-Statistic Probability

2 1.250117 0.092980 2.690008 0.0071

4 1.393742 0.171192 2.300002 0.0214

8 1.336163 0.270971 1.240590 0.2148

16 1.290815 0.405342 0.717454 0.4731

*Probability approximation using studentized maximum modulus with

parameter value 4 and infinite degrees of freedom

Test Details (Mean = -0.00289280469897)

Period Variance Var. Ratio Obs.

1 0.22666 -- 227

2 0.28335 1.25012 226

4 0.31591 1.39374 224

5

FINANCE WITH EVIEWS

8 0.30286 1.33616 220

16 0.29258 1.29081 212

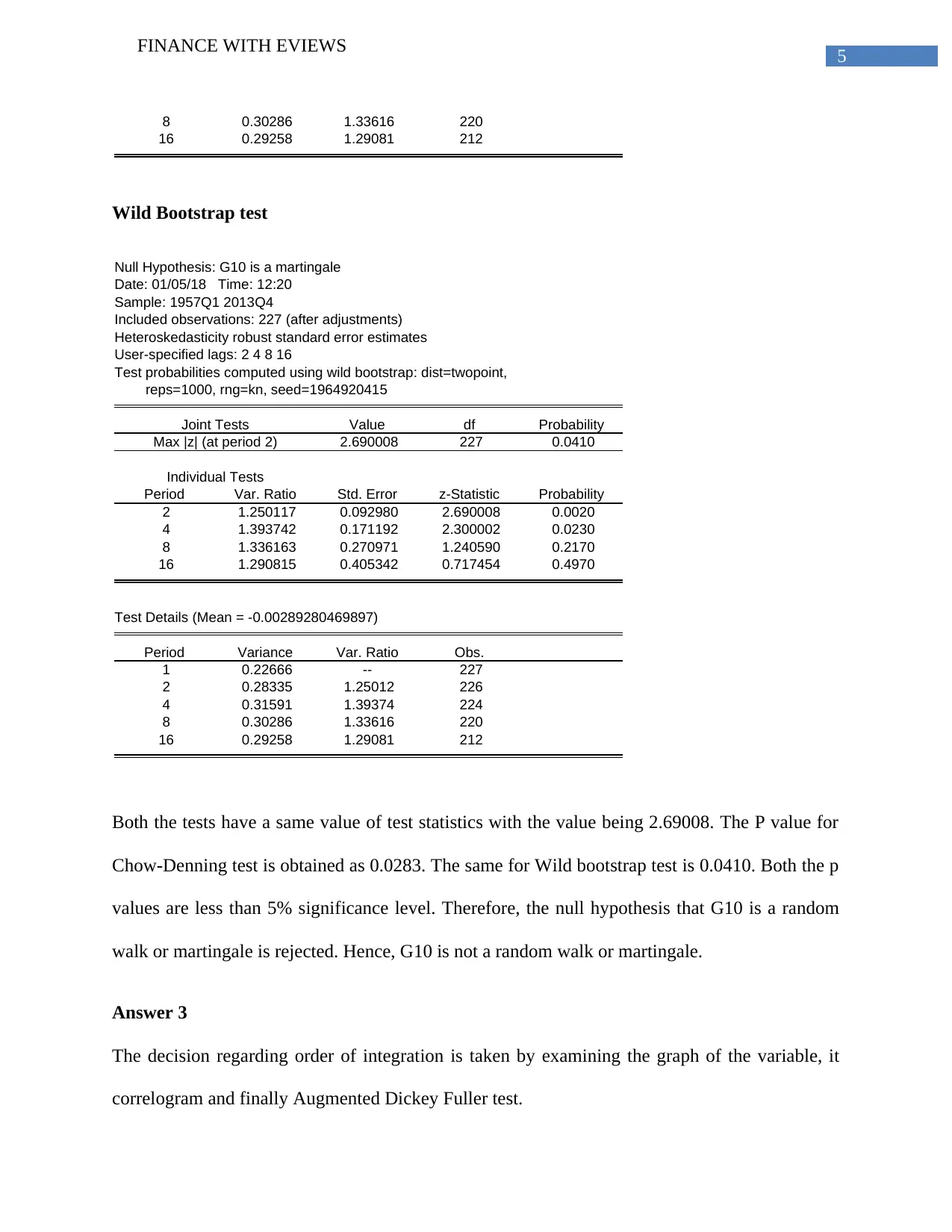

Wild Bootstrap test

Null Hypothesis: G10 is a martingale

Date: 01/05/18 Time: 12:20

Sample: 1957Q1 2013Q4

Included observations: 227 (after adjustments)

Heteroskedasticity robust standard error estimates

User-specified lags: 2 4 8 16

Test probabilities computed using wild bootstrap: dist=twopoint,

reps=1000, rng=kn, seed=1964920415

Joint Tests Value df Probability

Max |z| (at period 2) 2.690008 227 0.0410

Individual Tests

Period Var. Ratio Std. Error z-Statistic Probability

2 1.250117 0.092980 2.690008 0.0020

4 1.393742 0.171192 2.300002 0.0230

8 1.336163 0.270971 1.240590 0.2170

16 1.290815 0.405342 0.717454 0.4970

Test Details (Mean = -0.00289280469897)

Period Variance Var. Ratio Obs.

1 0.22666 -- 227

2 0.28335 1.25012 226

4 0.31591 1.39374 224

8 0.30286 1.33616 220

16 0.29258 1.29081 212

Both the tests have a same value of test statistics with the value being 2.69008. The P value for

Chow-Denning test is obtained as 0.0283. The same for Wild bootstrap test is 0.0410. Both the p

values are less than 5% significance level. Therefore, the null hypothesis that G10 is a random

walk or martingale is rejected. Hence, G10 is not a random walk or martingale.

Answer 3

The decision regarding order of integration is taken by examining the graph of the variable, it

correlogram and finally Augmented Dickey Fuller test.

FINANCE WITH EVIEWS

8 0.30286 1.33616 220

16 0.29258 1.29081 212

Wild Bootstrap test

Null Hypothesis: G10 is a martingale

Date: 01/05/18 Time: 12:20

Sample: 1957Q1 2013Q4

Included observations: 227 (after adjustments)

Heteroskedasticity robust standard error estimates

User-specified lags: 2 4 8 16

Test probabilities computed using wild bootstrap: dist=twopoint,

reps=1000, rng=kn, seed=1964920415

Joint Tests Value df Probability

Max |z| (at period 2) 2.690008 227 0.0410

Individual Tests

Period Var. Ratio Std. Error z-Statistic Probability

2 1.250117 0.092980 2.690008 0.0020

4 1.393742 0.171192 2.300002 0.0230

8 1.336163 0.270971 1.240590 0.2170

16 1.290815 0.405342 0.717454 0.4970

Test Details (Mean = -0.00289280469897)

Period Variance Var. Ratio Obs.

1 0.22666 -- 227

2 0.28335 1.25012 226

4 0.31591 1.39374 224

8 0.30286 1.33616 220

16 0.29258 1.29081 212

Both the tests have a same value of test statistics with the value being 2.69008. The P value for

Chow-Denning test is obtained as 0.0283. The same for Wild bootstrap test is 0.0410. Both the p

values are less than 5% significance level. Therefore, the null hypothesis that G10 is a random

walk or martingale is rejected. Hence, G10 is not a random walk or martingale.

Answer 3

The decision regarding order of integration is taken by examining the graph of the variable, it

correlogram and finally Augmented Dickey Fuller test.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

FINANCE WITH EVIEWS

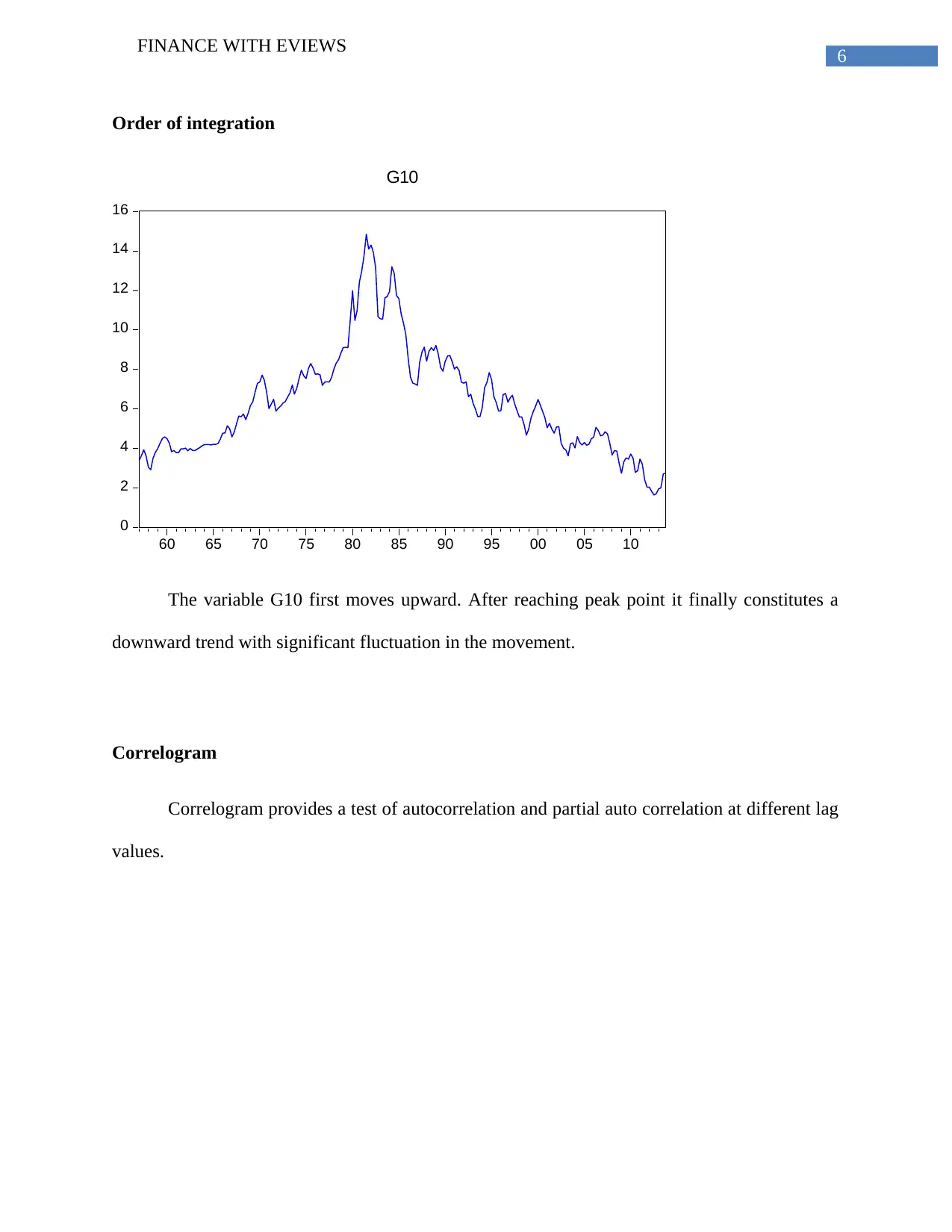

Order of integration

0

2

4

6

8

10

12

14

16

60 65 70 75 80 85 90 95 00 05 10

G10

The variable G10 first moves upward. After reaching peak point it finally constitutes a

downward trend with significant fluctuation in the movement.

Correlogram

Correlogram provides a test of autocorrelation and partial auto correlation at different lag

values.

FINANCE WITH EVIEWS

Order of integration

0

2

4

6

8

10

12

14

16

60 65 70 75 80 85 90 95 00 05 10

G10

The variable G10 first moves upward. After reaching peak point it finally constitutes a

downward trend with significant fluctuation in the movement.

Correlogram

Correlogram provides a test of autocorrelation and partial auto correlation at different lag

values.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

FINANCE WITH EVIEWS

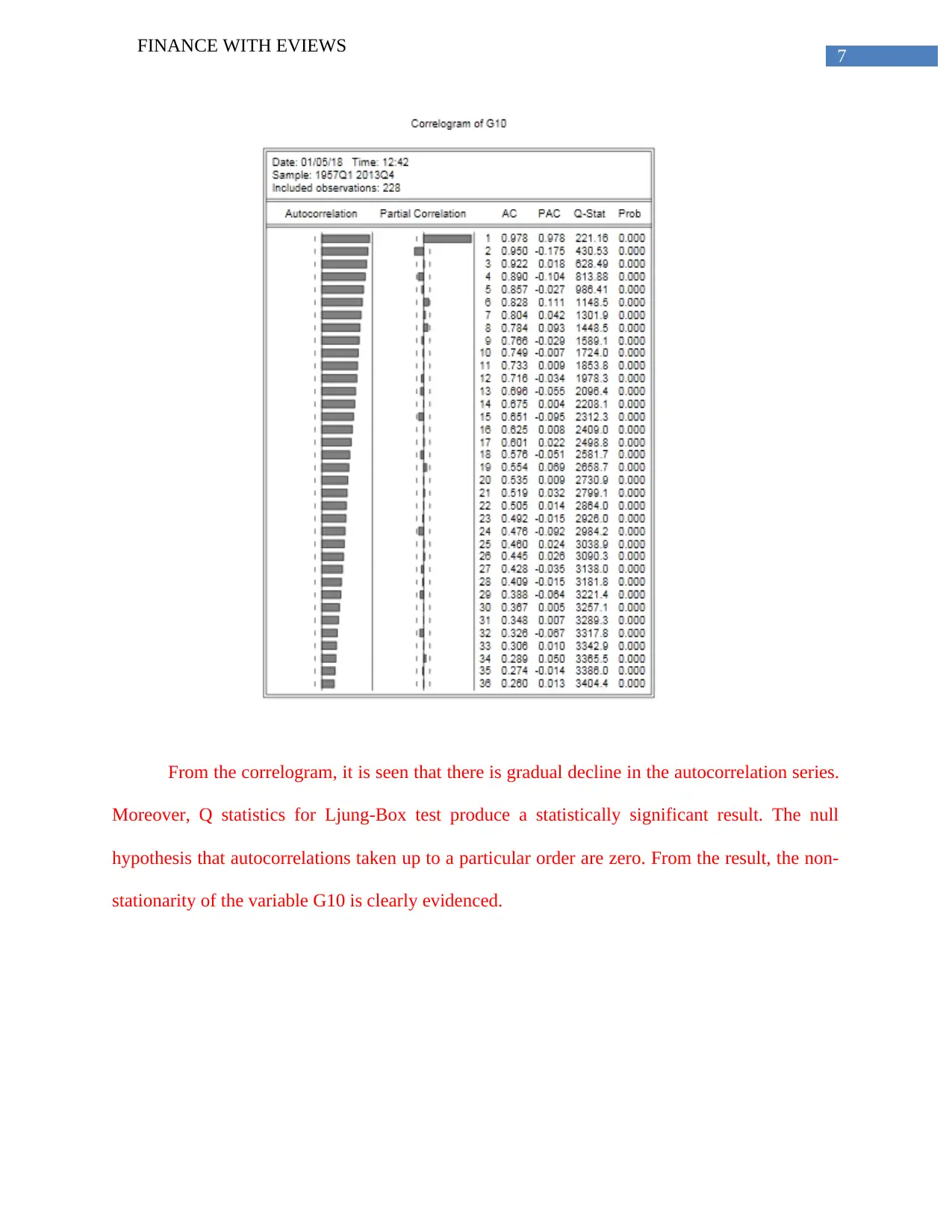

From the correlogram, it is seen that there is gradual decline in the autocorrelation series.

Moreover, Q statistics for Ljung-Box test produce a statistically significant result. The null

hypothesis that autocorrelations taken up to a particular order are zero. From the result, the non-

stationarity of the variable G10 is clearly evidenced.

FINANCE WITH EVIEWS

From the correlogram, it is seen that there is gradual decline in the autocorrelation series.

Moreover, Q statistics for Ljung-Box test produce a statistically significant result. The null

hypothesis that autocorrelations taken up to a particular order are zero. From the result, the non-

stationarity of the variable G10 is clearly evidenced.

8

FINANCE WITH EVIEWS

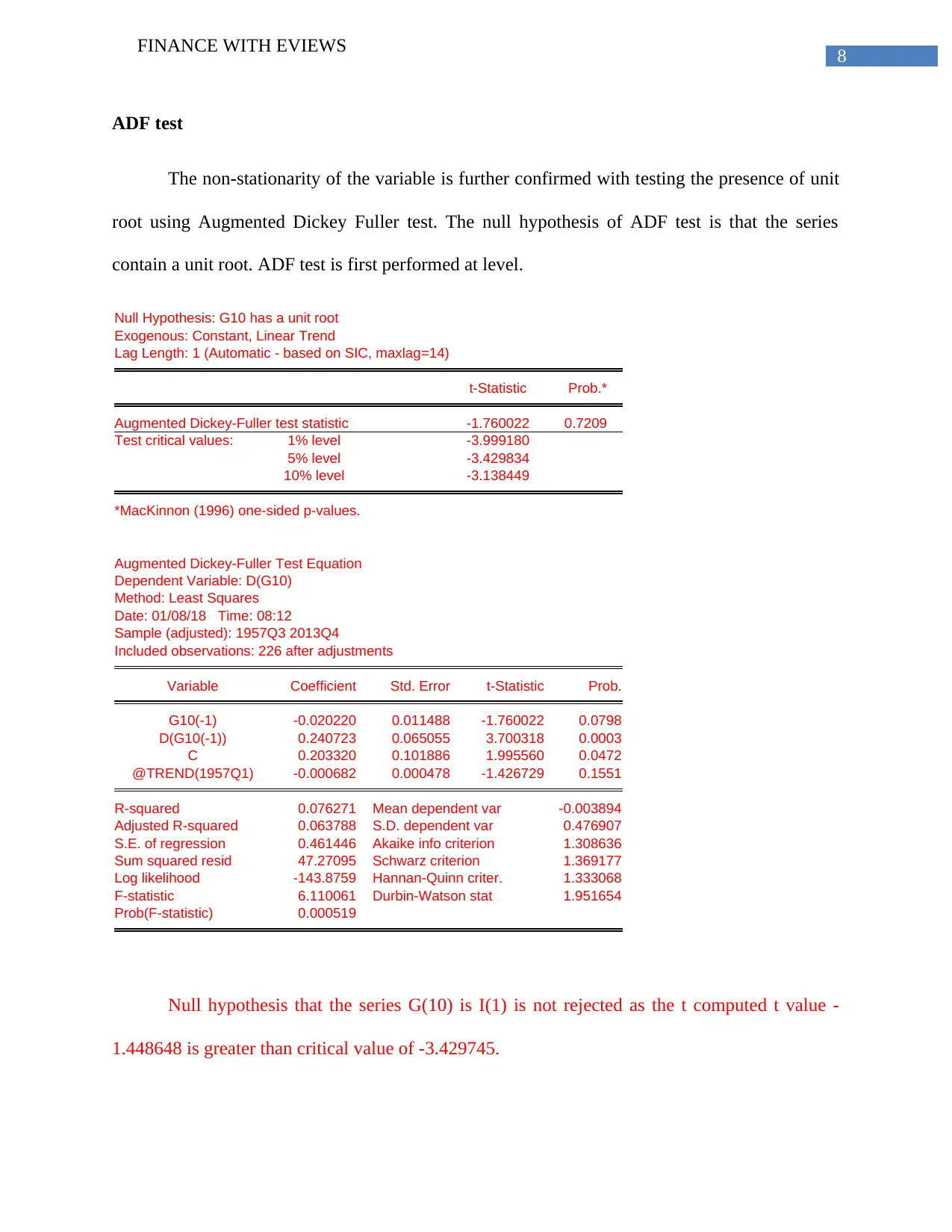

ADF test

The non-stationarity of the variable is further confirmed with testing the presence of unit

root using Augmented Dickey Fuller test. The null hypothesis of ADF test is that the series

contain a unit root. ADF test is first performed at level.

Null Hypothesis: G10 has a unit root

Exogenous: Constant, Linear Trend

Lag Length: 1 (Automatic - based on SIC, maxlag=14)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -1.760022 0.7209

Test critical values: 1% level -3.999180

5% level -3.429834

10% level -3.138449

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Dependent Variable: D(G10)

Method: Least Squares

Date: 01/08/18 Time: 08:12

Sample (adjusted): 1957Q3 2013Q4

Included observations: 226 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

G10(-1) -0.020220 0.011488 -1.760022 0.0798

D(G10(-1)) 0.240723 0.065055 3.700318 0.0003

C 0.203320 0.101886 1.995560 0.0472

@TREND(1957Q1) -0.000682 0.000478 -1.426729 0.1551

R-squared 0.076271 Mean dependent var -0.003894

Adjusted R-squared 0.063788 S.D. dependent var 0.476907

S.E. of regression 0.461446 Akaike info criterion 1.308636

Sum squared resid 47.27095 Schwarz criterion 1.369177

Log likelihood -143.8759 Hannan-Quinn criter. 1.333068

F-statistic 6.110061 Durbin-Watson stat 1.951654

Prob(F-statistic) 0.000519

Null hypothesis that the series G(10) is I(1) is not rejected as the t computed t value -

1.448648 is greater than critical value of -3.429745.

FINANCE WITH EVIEWS

ADF test

The non-stationarity of the variable is further confirmed with testing the presence of unit

root using Augmented Dickey Fuller test. The null hypothesis of ADF test is that the series

contain a unit root. ADF test is first performed at level.

Null Hypothesis: G10 has a unit root

Exogenous: Constant, Linear Trend

Lag Length: 1 (Automatic - based on SIC, maxlag=14)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -1.760022 0.7209

Test critical values: 1% level -3.999180

5% level -3.429834

10% level -3.138449

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Dependent Variable: D(G10)

Method: Least Squares

Date: 01/08/18 Time: 08:12

Sample (adjusted): 1957Q3 2013Q4

Included observations: 226 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

G10(-1) -0.020220 0.011488 -1.760022 0.0798

D(G10(-1)) 0.240723 0.065055 3.700318 0.0003

C 0.203320 0.101886 1.995560 0.0472

@TREND(1957Q1) -0.000682 0.000478 -1.426729 0.1551

R-squared 0.076271 Mean dependent var -0.003894

Adjusted R-squared 0.063788 S.D. dependent var 0.476907

S.E. of regression 0.461446 Akaike info criterion 1.308636

Sum squared resid 47.27095 Schwarz criterion 1.369177

Log likelihood -143.8759 Hannan-Quinn criter. 1.333068

F-statistic 6.110061 Durbin-Watson stat 1.951654

Prob(F-statistic) 0.000519

Null hypothesis that the series G(10) is I(1) is not rejected as the t computed t value -

1.448648 is greater than critical value of -3.429745.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

FINANCE WITH EVIEWS

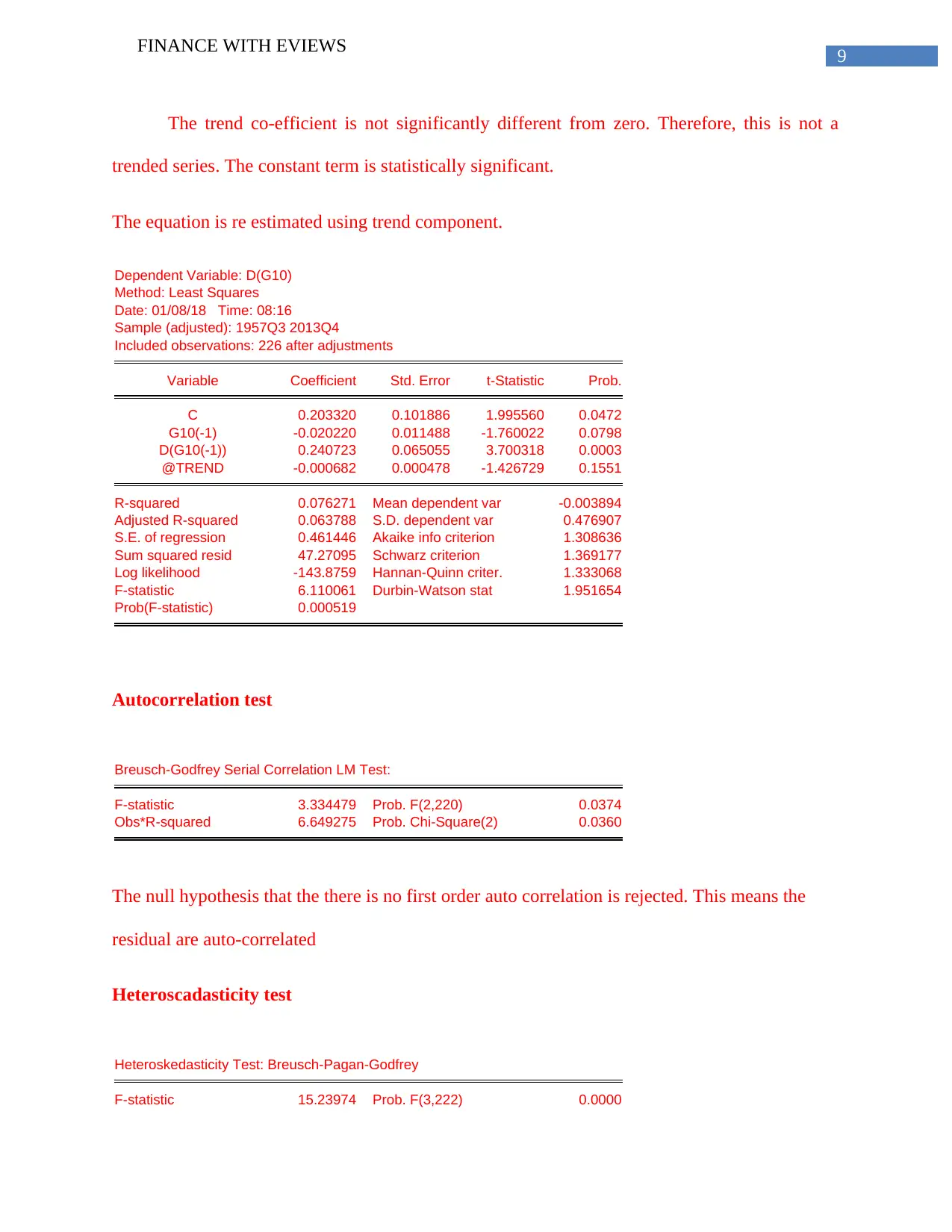

The trend co-efficient is not significantly different from zero. Therefore, this is not a

trended series. The constant term is statistically significant.

The equation is re estimated using trend component.

Dependent Variable: D(G10)

Method: Least Squares

Date: 01/08/18 Time: 08:16

Sample (adjusted): 1957Q3 2013Q4

Included observations: 226 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

C 0.203320 0.101886 1.995560 0.0472

G10(-1) -0.020220 0.011488 -1.760022 0.0798

D(G10(-1)) 0.240723 0.065055 3.700318 0.0003

@TREND -0.000682 0.000478 -1.426729 0.1551

R-squared 0.076271 Mean dependent var -0.003894

Adjusted R-squared 0.063788 S.D. dependent var 0.476907

S.E. of regression 0.461446 Akaike info criterion 1.308636

Sum squared resid 47.27095 Schwarz criterion 1.369177

Log likelihood -143.8759 Hannan-Quinn criter. 1.333068

F-statistic 6.110061 Durbin-Watson stat 1.951654

Prob(F-statistic) 0.000519

Autocorrelation test

Breusch-Godfrey Serial Correlation LM Test:

F-statistic 3.334479 Prob. F(2,220) 0.0374

Obs*R-squared 6.649275 Prob. Chi-Square(2) 0.0360

The null hypothesis that the there is no first order auto correlation is rejected. This means the

residual are auto-correlated

Heteroscadasticity test

Heteroskedasticity Test: Breusch-Pagan-Godfrey

F-statistic 15.23974 Prob. F(3,222) 0.0000

FINANCE WITH EVIEWS

The trend co-efficient is not significantly different from zero. Therefore, this is not a

trended series. The constant term is statistically significant.

The equation is re estimated using trend component.

Dependent Variable: D(G10)

Method: Least Squares

Date: 01/08/18 Time: 08:16

Sample (adjusted): 1957Q3 2013Q4

Included observations: 226 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

C 0.203320 0.101886 1.995560 0.0472

G10(-1) -0.020220 0.011488 -1.760022 0.0798

D(G10(-1)) 0.240723 0.065055 3.700318 0.0003

@TREND -0.000682 0.000478 -1.426729 0.1551

R-squared 0.076271 Mean dependent var -0.003894

Adjusted R-squared 0.063788 S.D. dependent var 0.476907

S.E. of regression 0.461446 Akaike info criterion 1.308636

Sum squared resid 47.27095 Schwarz criterion 1.369177

Log likelihood -143.8759 Hannan-Quinn criter. 1.333068

F-statistic 6.110061 Durbin-Watson stat 1.951654

Prob(F-statistic) 0.000519

Autocorrelation test

Breusch-Godfrey Serial Correlation LM Test:

F-statistic 3.334479 Prob. F(2,220) 0.0374

Obs*R-squared 6.649275 Prob. Chi-Square(2) 0.0360

The null hypothesis that the there is no first order auto correlation is rejected. This means the

residual are auto-correlated

Heteroscadasticity test

Heteroskedasticity Test: Breusch-Pagan-Godfrey

F-statistic 15.23974 Prob. F(3,222) 0.0000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

FINANCE WITH EVIEWS

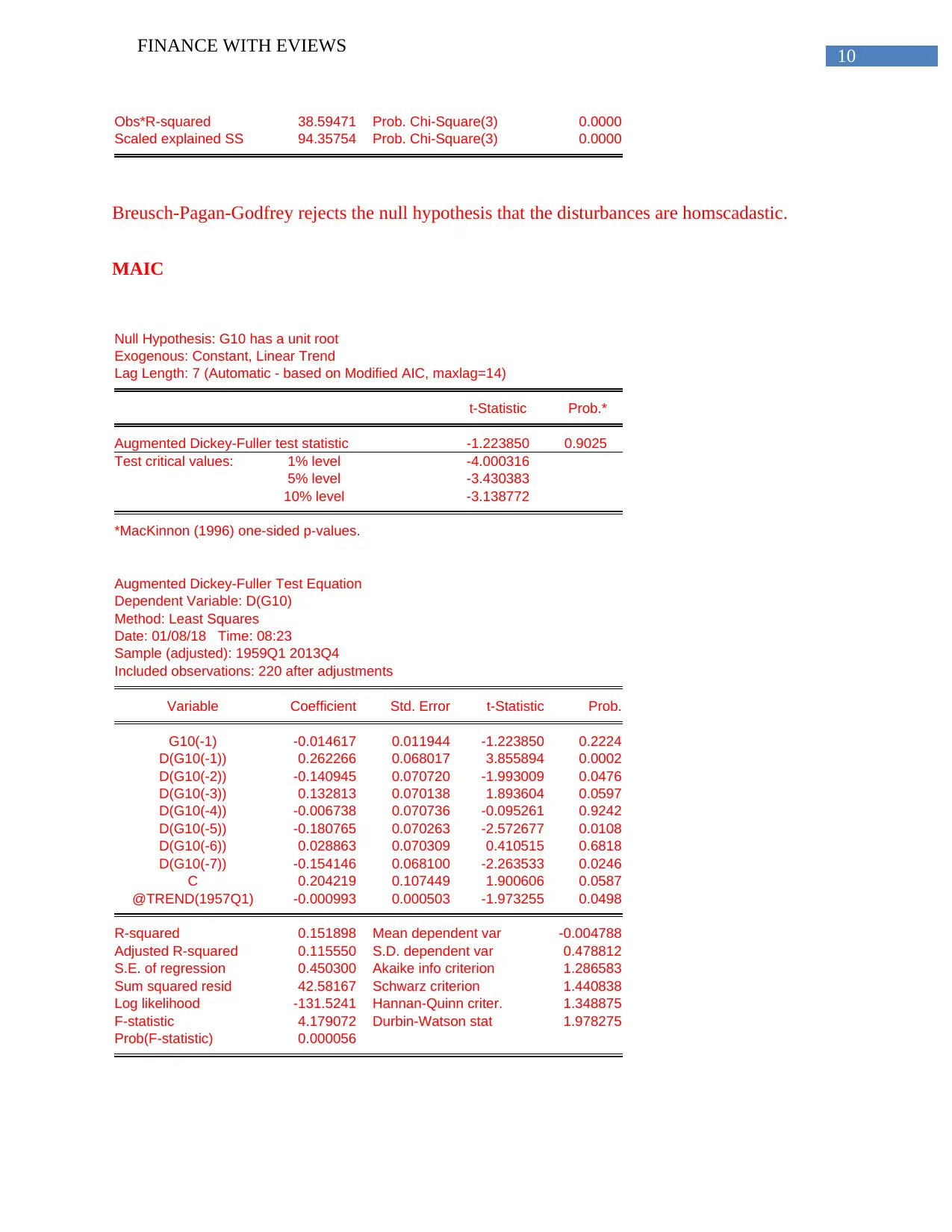

Obs*R-squared 38.59471 Prob. Chi-Square(3) 0.0000

Scaled explained SS 94.35754 Prob. Chi-Square(3) 0.0000

Breusch-Pagan-Godfrey rejects the null hypothesis that the disturbances are homscadastic.

MAIC

Null Hypothesis: G10 has a unit root

Exogenous: Constant, Linear Trend

Lag Length: 7 (Automatic - based on Modified AIC, maxlag=14)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -1.223850 0.9025

Test critical values: 1% level -4.000316

5% level -3.430383

10% level -3.138772

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Dependent Variable: D(G10)

Method: Least Squares

Date: 01/08/18 Time: 08:23

Sample (adjusted): 1959Q1 2013Q4

Included observations: 220 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

G10(-1) -0.014617 0.011944 -1.223850 0.2224

D(G10(-1)) 0.262266 0.068017 3.855894 0.0002

D(G10(-2)) -0.140945 0.070720 -1.993009 0.0476

D(G10(-3)) 0.132813 0.070138 1.893604 0.0597

D(G10(-4)) -0.006738 0.070736 -0.095261 0.9242

D(G10(-5)) -0.180765 0.070263 -2.572677 0.0108

D(G10(-6)) 0.028863 0.070309 0.410515 0.6818

D(G10(-7)) -0.154146 0.068100 -2.263533 0.0246

C 0.204219 0.107449 1.900606 0.0587

@TREND(1957Q1) -0.000993 0.000503 -1.973255 0.0498

R-squared 0.151898 Mean dependent var -0.004788

Adjusted R-squared 0.115550 S.D. dependent var 0.478812

S.E. of regression 0.450300 Akaike info criterion 1.286583

Sum squared resid 42.58167 Schwarz criterion 1.440838

Log likelihood -131.5241 Hannan-Quinn criter. 1.348875

F-statistic 4.179072 Durbin-Watson stat 1.978275

Prob(F-statistic) 0.000056

FINANCE WITH EVIEWS

Obs*R-squared 38.59471 Prob. Chi-Square(3) 0.0000

Scaled explained SS 94.35754 Prob. Chi-Square(3) 0.0000

Breusch-Pagan-Godfrey rejects the null hypothesis that the disturbances are homscadastic.

MAIC

Null Hypothesis: G10 has a unit root

Exogenous: Constant, Linear Trend

Lag Length: 7 (Automatic - based on Modified AIC, maxlag=14)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -1.223850 0.9025

Test critical values: 1% level -4.000316

5% level -3.430383

10% level -3.138772

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Dependent Variable: D(G10)

Method: Least Squares

Date: 01/08/18 Time: 08:23

Sample (adjusted): 1959Q1 2013Q4

Included observations: 220 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

G10(-1) -0.014617 0.011944 -1.223850 0.2224

D(G10(-1)) 0.262266 0.068017 3.855894 0.0002

D(G10(-2)) -0.140945 0.070720 -1.993009 0.0476

D(G10(-3)) 0.132813 0.070138 1.893604 0.0597

D(G10(-4)) -0.006738 0.070736 -0.095261 0.9242

D(G10(-5)) -0.180765 0.070263 -2.572677 0.0108

D(G10(-6)) 0.028863 0.070309 0.410515 0.6818

D(G10(-7)) -0.154146 0.068100 -2.263533 0.0246

C 0.204219 0.107449 1.900606 0.0587

@TREND(1957Q1) -0.000993 0.000503 -1.973255 0.0498

R-squared 0.151898 Mean dependent var -0.004788

Adjusted R-squared 0.115550 S.D. dependent var 0.478812

S.E. of regression 0.450300 Akaike info criterion 1.286583

Sum squared resid 42.58167 Schwarz criterion 1.440838

Log likelihood -131.5241 Hannan-Quinn criter. 1.348875

F-statistic 4.179072 Durbin-Watson stat 1.978275

Prob(F-statistic) 0.000056

11

FINANCE WITH EVIEWS

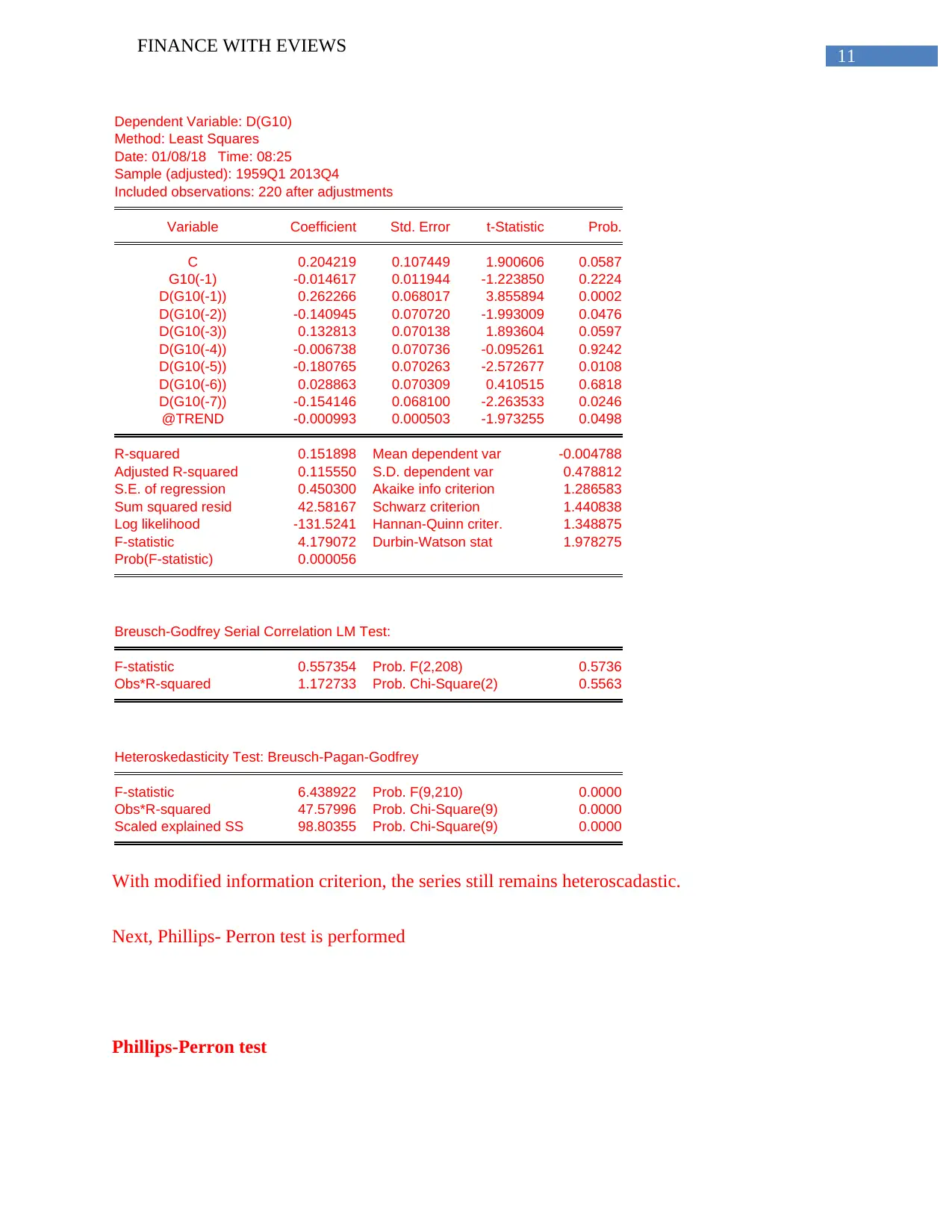

Dependent Variable: D(G10)

Method: Least Squares

Date: 01/08/18 Time: 08:25

Sample (adjusted): 1959Q1 2013Q4

Included observations: 220 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

C 0.204219 0.107449 1.900606 0.0587

G10(-1) -0.014617 0.011944 -1.223850 0.2224

D(G10(-1)) 0.262266 0.068017 3.855894 0.0002

D(G10(-2)) -0.140945 0.070720 -1.993009 0.0476

D(G10(-3)) 0.132813 0.070138 1.893604 0.0597

D(G10(-4)) -0.006738 0.070736 -0.095261 0.9242

D(G10(-5)) -0.180765 0.070263 -2.572677 0.0108

D(G10(-6)) 0.028863 0.070309 0.410515 0.6818

D(G10(-7)) -0.154146 0.068100 -2.263533 0.0246

@TREND -0.000993 0.000503 -1.973255 0.0498

R-squared 0.151898 Mean dependent var -0.004788

Adjusted R-squared 0.115550 S.D. dependent var 0.478812

S.E. of regression 0.450300 Akaike info criterion 1.286583

Sum squared resid 42.58167 Schwarz criterion 1.440838

Log likelihood -131.5241 Hannan-Quinn criter. 1.348875

F-statistic 4.179072 Durbin-Watson stat 1.978275

Prob(F-statistic) 0.000056

Breusch-Godfrey Serial Correlation LM Test:

F-statistic 0.557354 Prob. F(2,208) 0.5736

Obs*R-squared 1.172733 Prob. Chi-Square(2) 0.5563

Heteroskedasticity Test: Breusch-Pagan-Godfrey

F-statistic 6.438922 Prob. F(9,210) 0.0000

Obs*R-squared 47.57996 Prob. Chi-Square(9) 0.0000

Scaled explained SS 98.80355 Prob. Chi-Square(9) 0.0000

With modified information criterion, the series still remains heteroscadastic.

Next, Phillips- Perron test is performed

Phillips-Perron test

FINANCE WITH EVIEWS

Dependent Variable: D(G10)

Method: Least Squares

Date: 01/08/18 Time: 08:25

Sample (adjusted): 1959Q1 2013Q4

Included observations: 220 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

C 0.204219 0.107449 1.900606 0.0587

G10(-1) -0.014617 0.011944 -1.223850 0.2224

D(G10(-1)) 0.262266 0.068017 3.855894 0.0002

D(G10(-2)) -0.140945 0.070720 -1.993009 0.0476

D(G10(-3)) 0.132813 0.070138 1.893604 0.0597

D(G10(-4)) -0.006738 0.070736 -0.095261 0.9242

D(G10(-5)) -0.180765 0.070263 -2.572677 0.0108

D(G10(-6)) 0.028863 0.070309 0.410515 0.6818

D(G10(-7)) -0.154146 0.068100 -2.263533 0.0246

@TREND -0.000993 0.000503 -1.973255 0.0498

R-squared 0.151898 Mean dependent var -0.004788

Adjusted R-squared 0.115550 S.D. dependent var 0.478812

S.E. of regression 0.450300 Akaike info criterion 1.286583

Sum squared resid 42.58167 Schwarz criterion 1.440838

Log likelihood -131.5241 Hannan-Quinn criter. 1.348875

F-statistic 4.179072 Durbin-Watson stat 1.978275

Prob(F-statistic) 0.000056

Breusch-Godfrey Serial Correlation LM Test:

F-statistic 0.557354 Prob. F(2,208) 0.5736

Obs*R-squared 1.172733 Prob. Chi-Square(2) 0.5563

Heteroskedasticity Test: Breusch-Pagan-Godfrey

F-statistic 6.438922 Prob. F(9,210) 0.0000

Obs*R-squared 47.57996 Prob. Chi-Square(9) 0.0000

Scaled explained SS 98.80355 Prob. Chi-Square(9) 0.0000

With modified information criterion, the series still remains heteroscadastic.

Next, Phillips- Perron test is performed

Phillips-Perron test

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 31

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.