APC308 Financial Management: Valuation and Investment Analysis Report

VerifiedAdded on 2023/01/10

|15

|3794

|35

Report

AI Summary

This report analyzes key financial management concepts, focusing on valuation techniques and investment appraisal methods. The report begins by exploring three primary valuation techniques: the price/earnings (P/E) ratio, the dividend valuation method, and the discounted cash flow (DCF) method, providing detailed explanations and practical examples for each. It then offers a critical evaluation of these techniques, highlighting their strengths and weaknesses. The second part of the report delves into investment appraisal techniques, including the payback period, accounting rate of return (ARR), and net present value (NPV), with calculations and interpretations. The report also provides an application of different investment appraisal techniques and discusses their respective benefits and limitations. This comprehensive analysis aims to equip readers with a solid understanding of financial decision-making tools.

Financial

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Question 2..................................................................................................................................3

a)Price/earnings ratio.............................................................................................................3

b) Dividend valuation method................................................................................................3

c) Discounted cash flow method............................................................................................4

d) Critical evaluation of various valuation techniques...........................................................5

Question 3..................................................................................................................................7

1. Application of different investment appraisal techniques..................................................7

2. Benefits and limitations of different investment appraisal techniques............................10

REFERENCES.........................................................................................................................13

Question 2..................................................................................................................................3

a)Price/earnings ratio.............................................................................................................3

b) Dividend valuation method................................................................................................3

c) Discounted cash flow method............................................................................................4

d) Critical evaluation of various valuation techniques...........................................................5

Question 3..................................................................................................................................7

1. Application of different investment appraisal techniques..................................................7

2. Benefits and limitations of different investment appraisal techniques............................10

REFERENCES.........................................................................................................................13

Question 2

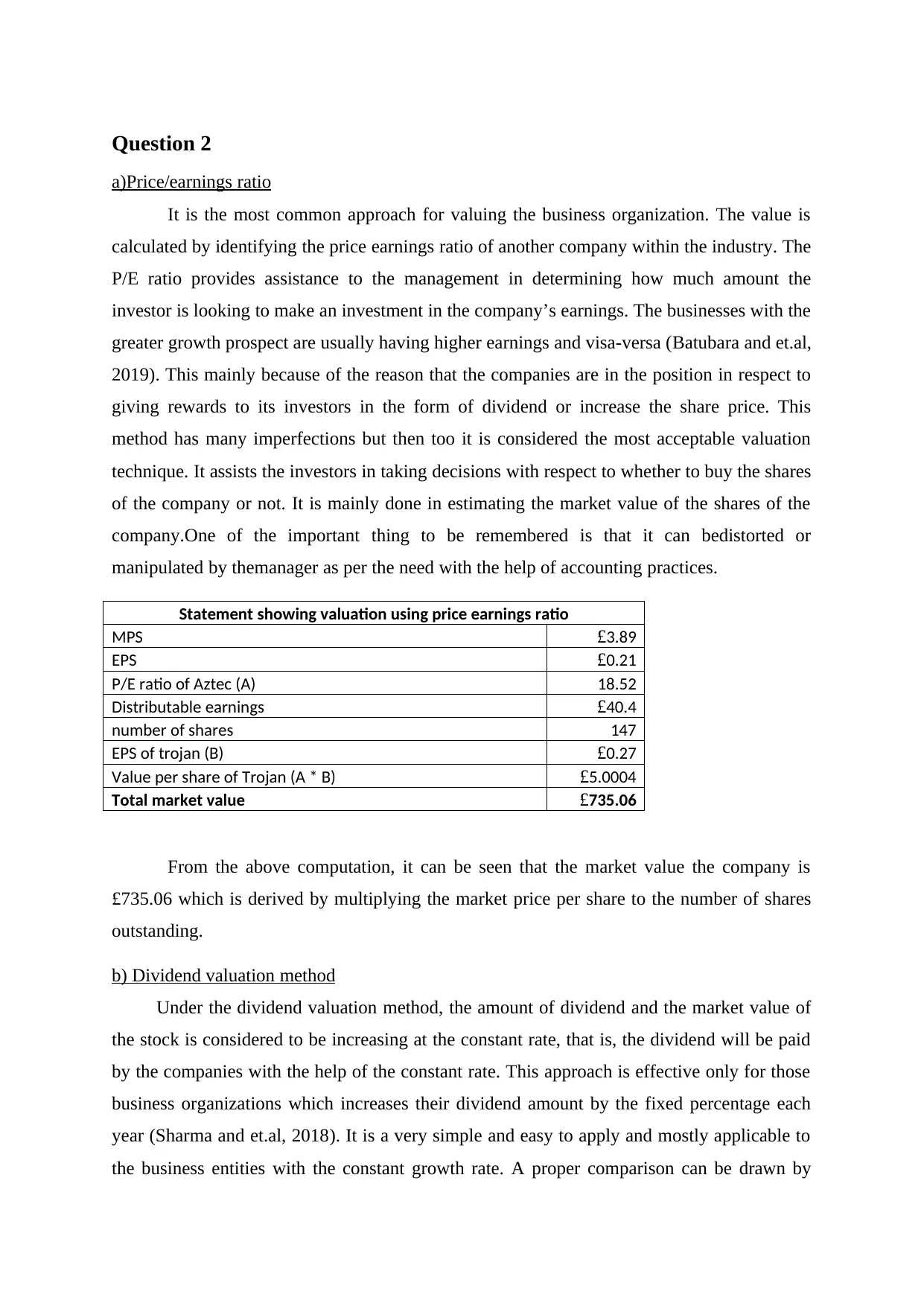

a)Price/earnings ratio

It is the most common approach for valuing the business organization. The value is

calculated by identifying the price earnings ratio of another company within the industry. The

P/E ratio provides assistance to the management in determining how much amount the

investor is looking to make an investment in the company’s earnings. The businesses with the

greater growth prospect are usually having higher earnings and visa-versa (Batubara and et.al,

2019). This mainly because of the reason that the companies are in the position in respect to

giving rewards to its investors in the form of dividend or increase the share price. This

method has many imperfections but then too it is considered the most acceptable valuation

technique. It assists the investors in taking decisions with respect to whether to buy the shares

of the company or not. It is mainly done in estimating the market value of the shares of the

company.One of the important thing to be remembered is that it can bedistorted or

manipulated by themanager as per the need with the help of accounting practices.

Statement showing valuation using price earnings ratio

MPS £3.89

EPS £0.21

P/E ratio of Aztec (A) 18.52

Distributable earnings £40.4

number of shares 147

EPS of trojan (B) £0.27

Value per share of Trojan (A * B) £5.0004

Total market value £735.06

From the above computation, it can be seen that the market value the company is

£735.06 which is derived by multiplying the market price per share to the number of shares

outstanding.

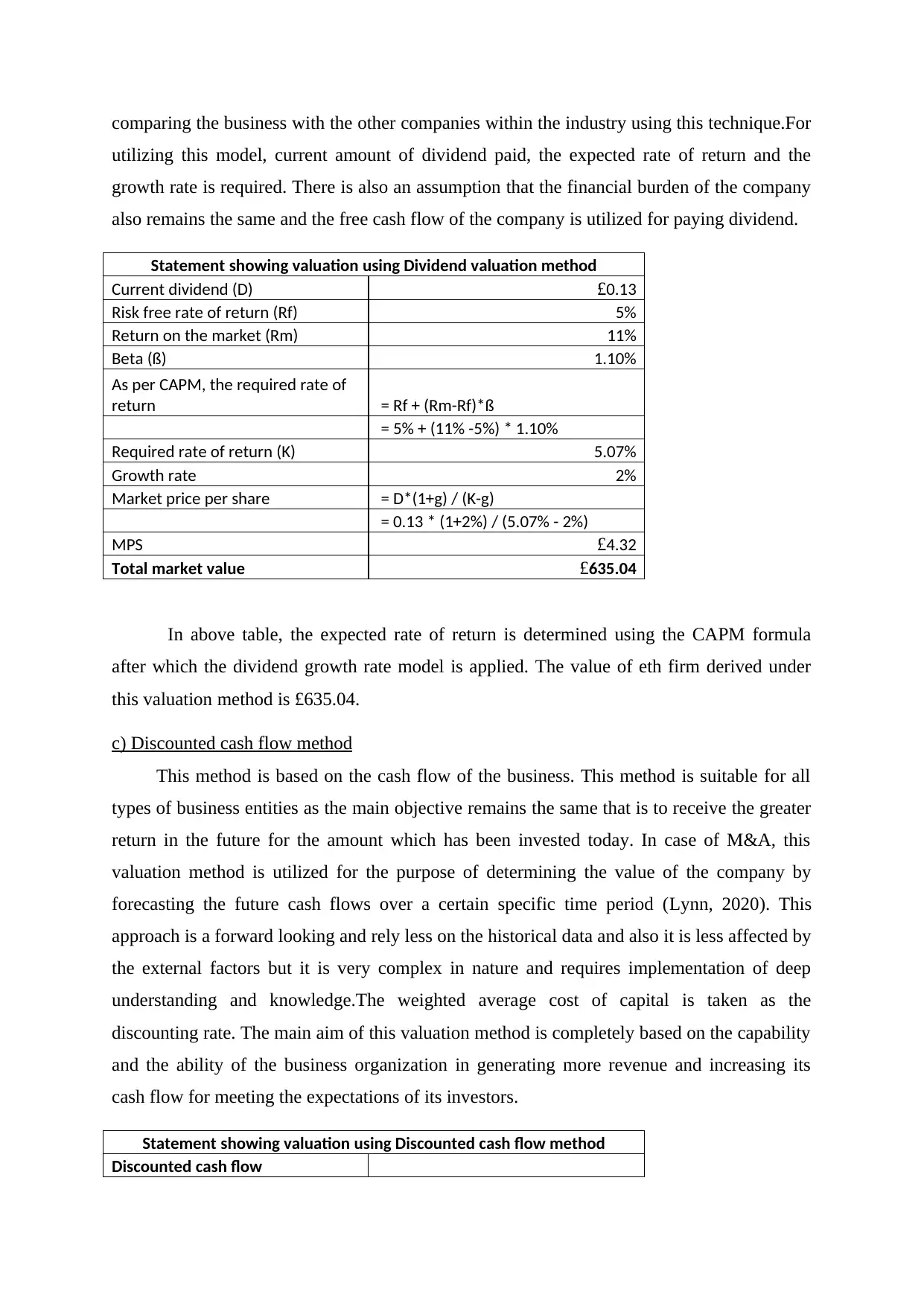

b) Dividend valuation method

Under the dividend valuation method, the amount of dividend and the market value of

the stock is considered to be increasing at the constant rate, that is, the dividend will be paid

by the companies with the help of the constant rate. This approach is effective only for those

business organizations which increases their dividend amount by the fixed percentage each

year (Sharma and et.al, 2018). It is a very simple and easy to apply and mostly applicable to

the business entities with the constant growth rate. A proper comparison can be drawn by

a)Price/earnings ratio

It is the most common approach for valuing the business organization. The value is

calculated by identifying the price earnings ratio of another company within the industry. The

P/E ratio provides assistance to the management in determining how much amount the

investor is looking to make an investment in the company’s earnings. The businesses with the

greater growth prospect are usually having higher earnings and visa-versa (Batubara and et.al,

2019). This mainly because of the reason that the companies are in the position in respect to

giving rewards to its investors in the form of dividend or increase the share price. This

method has many imperfections but then too it is considered the most acceptable valuation

technique. It assists the investors in taking decisions with respect to whether to buy the shares

of the company or not. It is mainly done in estimating the market value of the shares of the

company.One of the important thing to be remembered is that it can bedistorted or

manipulated by themanager as per the need with the help of accounting practices.

Statement showing valuation using price earnings ratio

MPS £3.89

EPS £0.21

P/E ratio of Aztec (A) 18.52

Distributable earnings £40.4

number of shares 147

EPS of trojan (B) £0.27

Value per share of Trojan (A * B) £5.0004

Total market value £735.06

From the above computation, it can be seen that the market value the company is

£735.06 which is derived by multiplying the market price per share to the number of shares

outstanding.

b) Dividend valuation method

Under the dividend valuation method, the amount of dividend and the market value of

the stock is considered to be increasing at the constant rate, that is, the dividend will be paid

by the companies with the help of the constant rate. This approach is effective only for those

business organizations which increases their dividend amount by the fixed percentage each

year (Sharma and et.al, 2018). It is a very simple and easy to apply and mostly applicable to

the business entities with the constant growth rate. A proper comparison can be drawn by

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

comparing the business with the other companies within the industry using this technique.For

utilizing this model, current amount of dividend paid, the expected rate of return and the

growth rate is required. There is also an assumption that the financial burden of the company

also remains the same and the free cash flow of the company is utilized for paying dividend.

Statement showing valuation using Dividend valuation method

Current dividend (D) £0.13

Risk free rate of return (Rf) 5%

Return on the market (Rm) 11%

Beta (ß) 1.10%

As per CAPM, the required rate of

return = Rf + (Rm-Rf)*ß

= 5% + (11% -5%) * 1.10%

Required rate of return (K) 5.07%

Growth rate 2%

Market price per share = D*(1+g) / (K-g)

= 0.13 * (1+2%) / (5.07% - 2%)

MPS £4.32

Total market value £635.04

In above table, the expected rate of return is determined using the CAPM formula

after which the dividend growth rate model is applied. The value of eth firm derived under

this valuation method is £635.04.

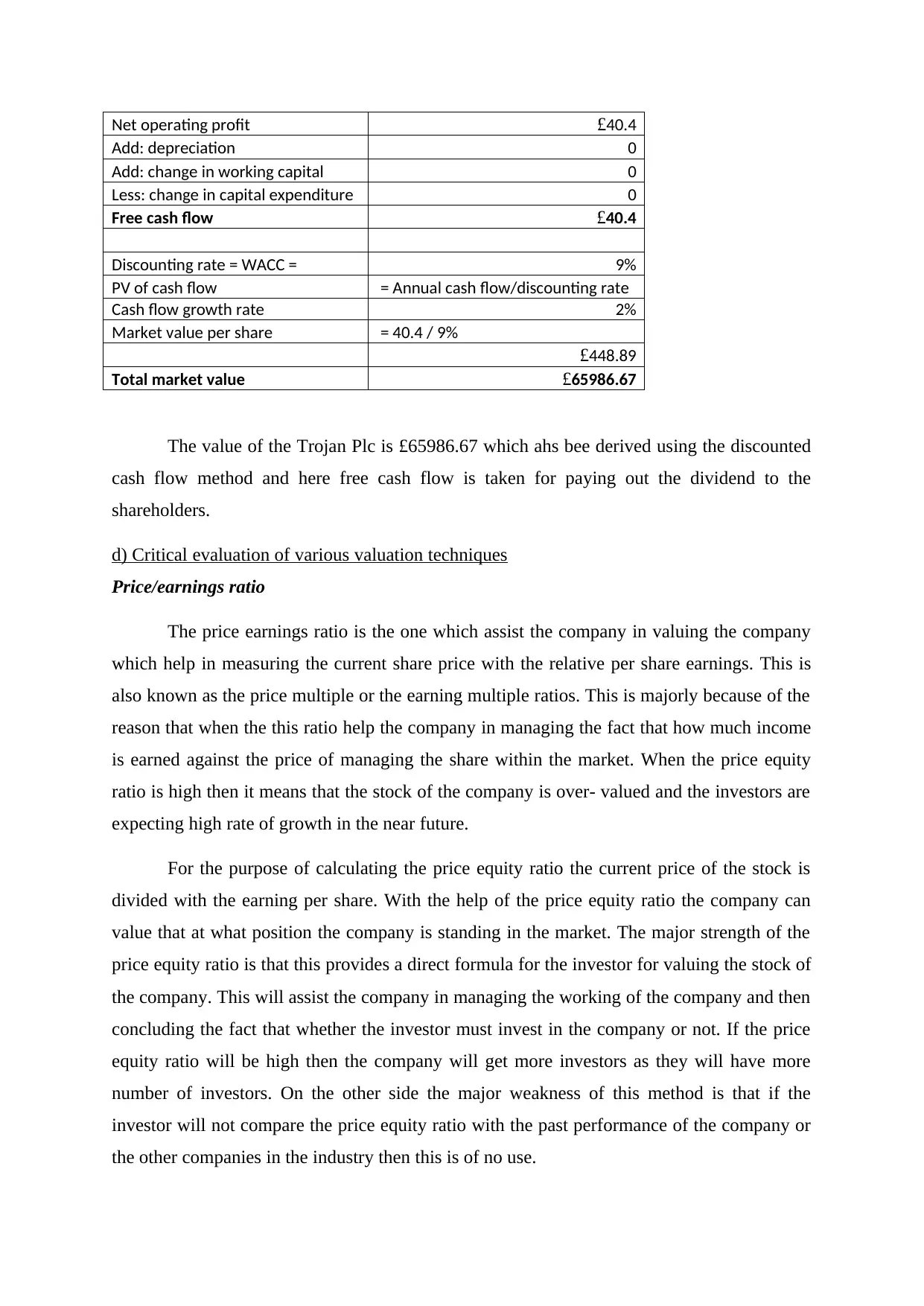

c) Discounted cash flow method

This method is based on the cash flow of the business. This method is suitable for all

types of business entities as the main objective remains the same that is to receive the greater

return in the future for the amount which has been invested today. In case of M&A, this

valuation method is utilized for the purpose of determining the value of the company by

forecasting the future cash flows over a certain specific time period (Lynn, 2020). This

approach is a forward looking and rely less on the historical data and also it is less affected by

the external factors but it is very complex in nature and requires implementation of deep

understanding and knowledge.The weighted average cost of capital is taken as the

discounting rate. The main aim of this valuation method is completely based on the capability

and the ability of the business organization in generating more revenue and increasing its

cash flow for meeting the expectations of its investors.

Statement showing valuation using Discounted cash flow method

Discounted cash flow

utilizing this model, current amount of dividend paid, the expected rate of return and the

growth rate is required. There is also an assumption that the financial burden of the company

also remains the same and the free cash flow of the company is utilized for paying dividend.

Statement showing valuation using Dividend valuation method

Current dividend (D) £0.13

Risk free rate of return (Rf) 5%

Return on the market (Rm) 11%

Beta (ß) 1.10%

As per CAPM, the required rate of

return = Rf + (Rm-Rf)*ß

= 5% + (11% -5%) * 1.10%

Required rate of return (K) 5.07%

Growth rate 2%

Market price per share = D*(1+g) / (K-g)

= 0.13 * (1+2%) / (5.07% - 2%)

MPS £4.32

Total market value £635.04

In above table, the expected rate of return is determined using the CAPM formula

after which the dividend growth rate model is applied. The value of eth firm derived under

this valuation method is £635.04.

c) Discounted cash flow method

This method is based on the cash flow of the business. This method is suitable for all

types of business entities as the main objective remains the same that is to receive the greater

return in the future for the amount which has been invested today. In case of M&A, this

valuation method is utilized for the purpose of determining the value of the company by

forecasting the future cash flows over a certain specific time period (Lynn, 2020). This

approach is a forward looking and rely less on the historical data and also it is less affected by

the external factors but it is very complex in nature and requires implementation of deep

understanding and knowledge.The weighted average cost of capital is taken as the

discounting rate. The main aim of this valuation method is completely based on the capability

and the ability of the business organization in generating more revenue and increasing its

cash flow for meeting the expectations of its investors.

Statement showing valuation using Discounted cash flow method

Discounted cash flow

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Net operating profit £40.4

Add: depreciation 0

Add: change in working capital 0

Less: change in capital expenditure 0

Free cash flow £40.4

Discounting rate = WACC = 9%

PV of cash flow = Annual cash flow/discounting rate

Cash flow growth rate 2%

Market value per share = 40.4 / 9%

£448.89

Total market value £65986.67

The value of the Trojan Plc is £65986.67 which ahs bee derived using the discounted

cash flow method and here free cash flow is taken for paying out the dividend to the

shareholders.

d) Critical evaluation of various valuation techniques

Price/earnings ratio

The price earnings ratio is the one which assist the company in valuing the company

which help in measuring the current share price with the relative per share earnings. This is

also known as the price multiple or the earning multiple ratios. This is majorly because of the

reason that when the this ratio help the company in managing the fact that how much income

is earned against the price of managing the share within the market. When the price equity

ratio is high then it means that the stock of the company is over- valued and the investors are

expecting high rate of growth in the near future.

For the purpose of calculating the price equity ratio the current price of the stock is

divided with the earning per share. With the help of the price equity ratio the company can

value that at what position the company is standing in the market. The major strength of the

price equity ratio is that this provides a direct formula for the investor for valuing the stock of

the company. This will assist the company in managing the working of the company and then

concluding the fact that whether the investor must invest in the company or not. If the price

equity ratio will be high then the company will get more investors as they will have more

number of investors. On the other side the major weakness of this method is that if the

investor will not compare the price equity ratio with the past performance of the company or

the other companies in the industry then this is of no use.

Add: depreciation 0

Add: change in working capital 0

Less: change in capital expenditure 0

Free cash flow £40.4

Discounting rate = WACC = 9%

PV of cash flow = Annual cash flow/discounting rate

Cash flow growth rate 2%

Market value per share = 40.4 / 9%

£448.89

Total market value £65986.67

The value of the Trojan Plc is £65986.67 which ahs bee derived using the discounted

cash flow method and here free cash flow is taken for paying out the dividend to the

shareholders.

d) Critical evaluation of various valuation techniques

Price/earnings ratio

The price earnings ratio is the one which assist the company in valuing the company

which help in measuring the current share price with the relative per share earnings. This is

also known as the price multiple or the earning multiple ratios. This is majorly because of the

reason that when the this ratio help the company in managing the fact that how much income

is earned against the price of managing the share within the market. When the price equity

ratio is high then it means that the stock of the company is over- valued and the investors are

expecting high rate of growth in the near future.

For the purpose of calculating the price equity ratio the current price of the stock is

divided with the earning per share. With the help of the price equity ratio the company can

value that at what position the company is standing in the market. The major strength of the

price equity ratio is that this provides a direct formula for the investor for valuing the stock of

the company. This will assist the company in managing the working of the company and then

concluding the fact that whether the investor must invest in the company or not. If the price

equity ratio will be high then the company will get more investors as they will have more

number of investors. On the other side the major weakness of this method is that if the

investor will not compare the price equity ratio with the past performance of the company or

the other companies in the industry then this is of no use.

Dividend valuation method

The dividend discount model is the method which is quantitative method for the

valuation of the company stock price which is based on the assumption that current price of

stock is equal to the sum of company’s future dividend discounted back to the present value.

This whole model is developed under the assumption that the intrinsic value of the stock

reflects the fact that present value of the future cash flow is generated by the security (Iachan,

2020). In general terms this model help and provides for a simple method to calculate the

stock price which is fair and which have less variable input.

With the analysis of this model it was found that the major advantage of using this

model is that this is very conservative model for valuing the stock of the company. This is

majorly because of the reason that this model does not require any growth assumptions to be

undertaken for the growth or valuation of the company. In addition to this the major

advantage of using this model is that this is very easy to handle and understand and calculate

the value of the company and the stock price of the company. On the flip side the major

weakness of the company is that this method is applicable over only those stocks which are

paying dividend and not on the remaining stocks. Also, in addition to this the method of

dividend discount model it only values the payment of the dividend as a return on the

investment and not any other income or expense.

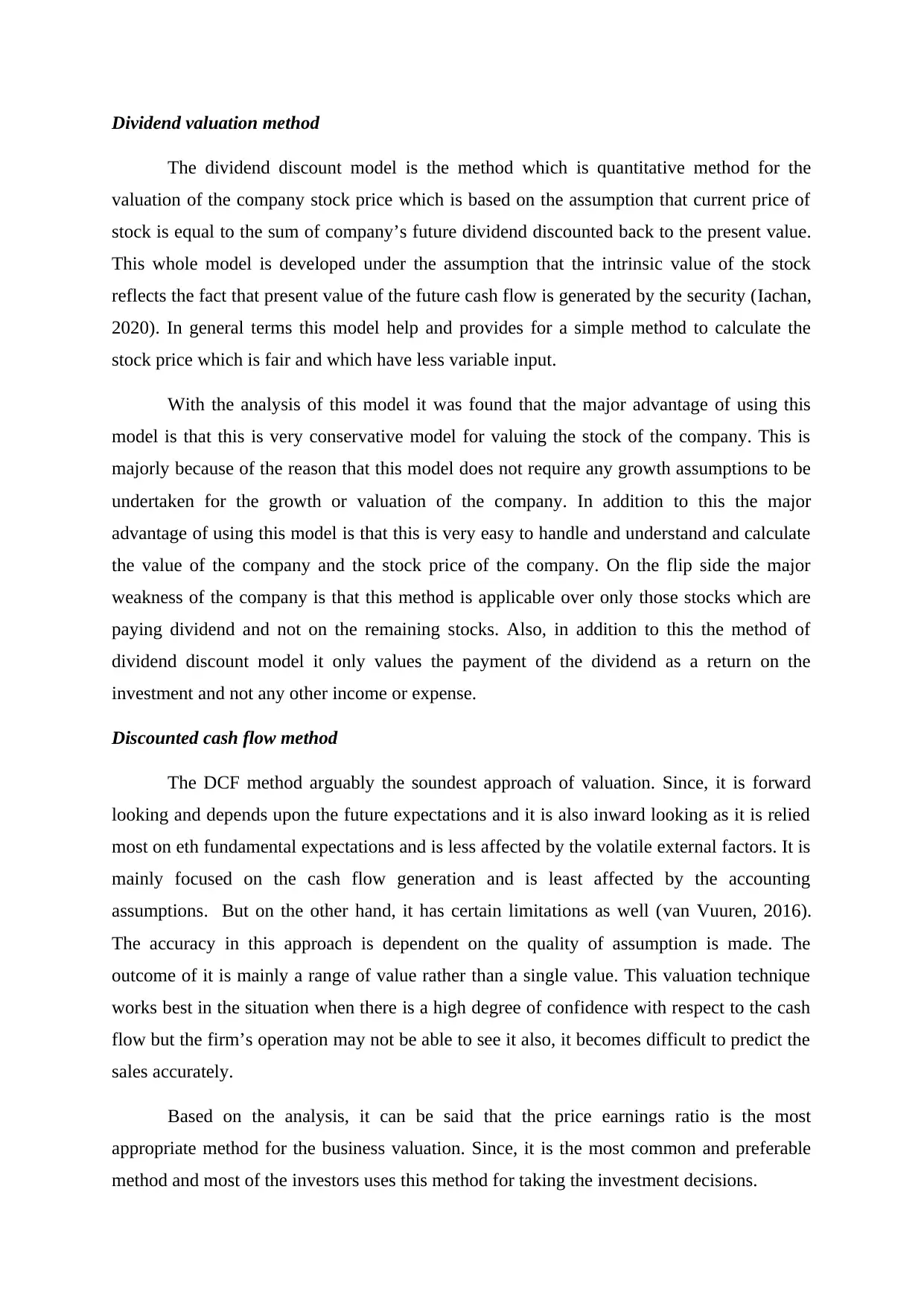

Discounted cash flow method

The DCF method arguably the soundest approach of valuation. Since, it is forward

looking and depends upon the future expectations and it is also inward looking as it is relied

most on eth fundamental expectations and is less affected by the volatile external factors. It is

mainly focused on the cash flow generation and is least affected by the accounting

assumptions. But on the other hand, it has certain limitations as well (van Vuuren, 2016).

The accuracy in this approach is dependent on the quality of assumption is made. The

outcome of it is mainly a range of value rather than a single value. This valuation technique

works best in the situation when there is a high degree of confidence with respect to the cash

flow but the firm’s operation may not be able to see it also, it becomes difficult to predict the

sales accurately.

Based on the analysis, it can be said that the price earnings ratio is the most

appropriate method for the business valuation. Since, it is the most common and preferable

method and most of the investors uses this method for taking the investment decisions.

The dividend discount model is the method which is quantitative method for the

valuation of the company stock price which is based on the assumption that current price of

stock is equal to the sum of company’s future dividend discounted back to the present value.

This whole model is developed under the assumption that the intrinsic value of the stock

reflects the fact that present value of the future cash flow is generated by the security (Iachan,

2020). In general terms this model help and provides for a simple method to calculate the

stock price which is fair and which have less variable input.

With the analysis of this model it was found that the major advantage of using this

model is that this is very conservative model for valuing the stock of the company. This is

majorly because of the reason that this model does not require any growth assumptions to be

undertaken for the growth or valuation of the company. In addition to this the major

advantage of using this model is that this is very easy to handle and understand and calculate

the value of the company and the stock price of the company. On the flip side the major

weakness of the company is that this method is applicable over only those stocks which are

paying dividend and not on the remaining stocks. Also, in addition to this the method of

dividend discount model it only values the payment of the dividend as a return on the

investment and not any other income or expense.

Discounted cash flow method

The DCF method arguably the soundest approach of valuation. Since, it is forward

looking and depends upon the future expectations and it is also inward looking as it is relied

most on eth fundamental expectations and is less affected by the volatile external factors. It is

mainly focused on the cash flow generation and is least affected by the accounting

assumptions. But on the other hand, it has certain limitations as well (van Vuuren, 2016).

The accuracy in this approach is dependent on the quality of assumption is made. The

outcome of it is mainly a range of value rather than a single value. This valuation technique

works best in the situation when there is a high degree of confidence with respect to the cash

flow but the firm’s operation may not be able to see it also, it becomes difficult to predict the

sales accurately.

Based on the analysis, it can be said that the price earnings ratio is the most

appropriate method for the business valuation. Since, it is the most common and preferable

method and most of the investors uses this method for taking the investment decisions.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Question 3

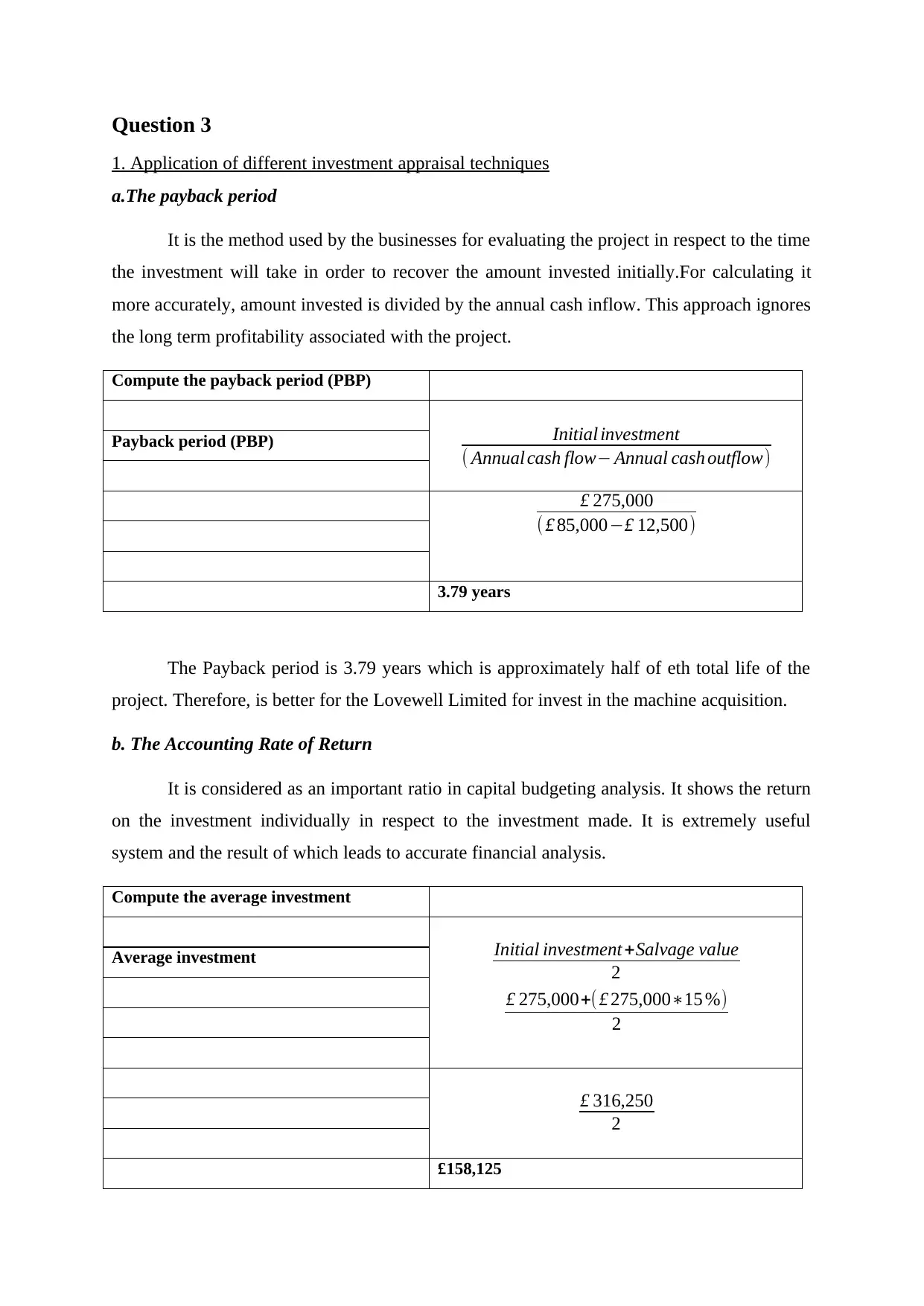

1. Application of different investment appraisal techniques

a.The payback period

It is the method used by the businesses for evaluating the project in respect to the time

the investment will take in order to recover the amount invested initially.For calculating it

more accurately, amount invested is divided by the annual cash inflow. This approach ignores

the long term profitability associated with the project.

Compute the payback period (PBP)

Payback period (PBP)

3.79 years

The Payback period is 3.79 years which is approximately half of eth total life of the

project. Therefore, is better for the Lovewell Limited for invest in the machine acquisition.

b. The Accounting Rate of Return

It is considered as an important ratio in capital budgeting analysis. It shows the return

on the investment individually in respect to the investment made. It is extremely useful

system and the result of which leads to accurate financial analysis.

Compute the average investment

Average investment

£158,125

£ 275,000

( £ 85,000−£ 12,500)

Initial investment

( Annual cash flow− Annual cash outflow)

Initial investment +Salvage value

2

£ 275,000+( £ 275,000∗15 %)

2

£ 316,250

2

1. Application of different investment appraisal techniques

a.The payback period

It is the method used by the businesses for evaluating the project in respect to the time

the investment will take in order to recover the amount invested initially.For calculating it

more accurately, amount invested is divided by the annual cash inflow. This approach ignores

the long term profitability associated with the project.

Compute the payback period (PBP)

Payback period (PBP)

3.79 years

The Payback period is 3.79 years which is approximately half of eth total life of the

project. Therefore, is better for the Lovewell Limited for invest in the machine acquisition.

b. The Accounting Rate of Return

It is considered as an important ratio in capital budgeting analysis. It shows the return

on the investment individually in respect to the investment made. It is extremely useful

system and the result of which leads to accurate financial analysis.

Compute the average investment

Average investment

£158,125

£ 275,000

( £ 85,000−£ 12,500)

Initial investment

( Annual cash flow− Annual cash outflow)

Initial investment +Salvage value

2

£ 275,000+( £ 275,000∗15 %)

2

£ 316,250

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Compute the accounting rate of return

(ARR)

Accounting rate of return

ARR 45.85%

The ARR of the project is 45.85% which is much more than the cost of capital

therefore, it is favourable to the Lovewell Limited for the purpose of investing in it.

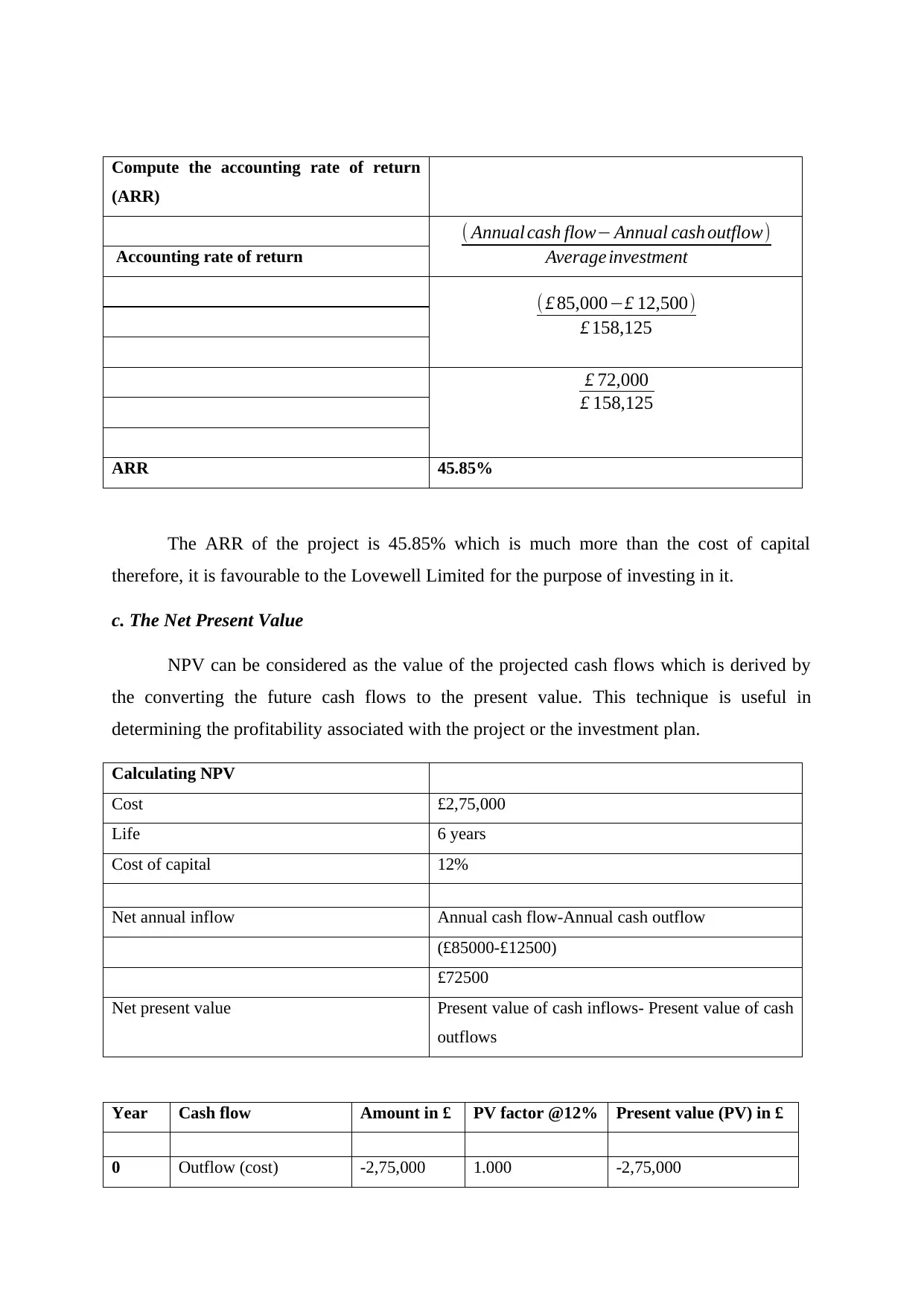

c. The Net Present Value

NPV can be considered as the value of the projected cash flows which is derived by

the converting the future cash flows to the present value. This technique is useful in

determining the profitability associated with the project or the investment plan.

Calculating NPV

Cost £2,75,000

Life 6 years

Cost of capital 12%

Net annual inflow Annual cash flow-Annual cash outflow

(£85000-£12500)

£72500

Net present value Present value of cash inflows- Present value of cash

outflows

Year Cash flow Amount in £ PV factor @12% Present value (PV) in £

0 Outflow (cost) -2,75,000 1.000 -2,75,000

( Annual cash flow− Annual cash outflow)

Average investment

( £ 85,000−£ 12,500)

£ 158,125

£ 72,000

£ 158,125

(ARR)

Accounting rate of return

ARR 45.85%

The ARR of the project is 45.85% which is much more than the cost of capital

therefore, it is favourable to the Lovewell Limited for the purpose of investing in it.

c. The Net Present Value

NPV can be considered as the value of the projected cash flows which is derived by

the converting the future cash flows to the present value. This technique is useful in

determining the profitability associated with the project or the investment plan.

Calculating NPV

Cost £2,75,000

Life 6 years

Cost of capital 12%

Net annual inflow Annual cash flow-Annual cash outflow

(£85000-£12500)

£72500

Net present value Present value of cash inflows- Present value of cash

outflows

Year Cash flow Amount in £ PV factor @12% Present value (PV) in £

0 Outflow (cost) -2,75,000 1.000 -2,75,000

( Annual cash flow− Annual cash outflow)

Average investment

( £ 85,000−£ 12,500)

£ 158,125

£ 72,000

£ 158,125

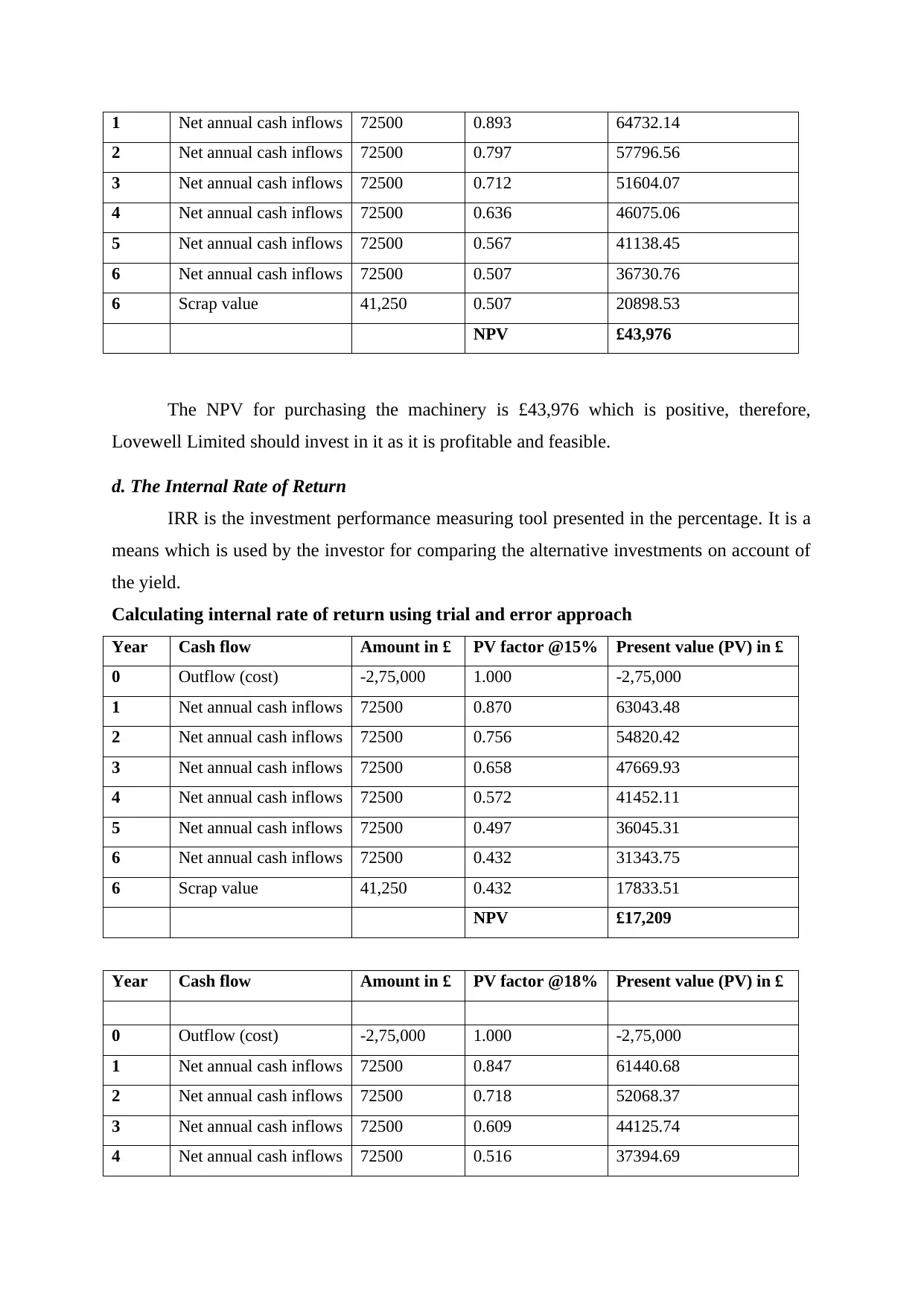

1 Net annual cash inflows 72500 0.893 64732.14

2 Net annual cash inflows 72500 0.797 57796.56

3 Net annual cash inflows 72500 0.712 51604.07

4 Net annual cash inflows 72500 0.636 46075.06

5 Net annual cash inflows 72500 0.567 41138.45

6 Net annual cash inflows 72500 0.507 36730.76

6 Scrap value 41,250 0.507 20898.53

NPV £43,976

The NPV for purchasing the machinery is £43,976 which is positive, therefore,

Lovewell Limited should invest in it as it is profitable and feasible.

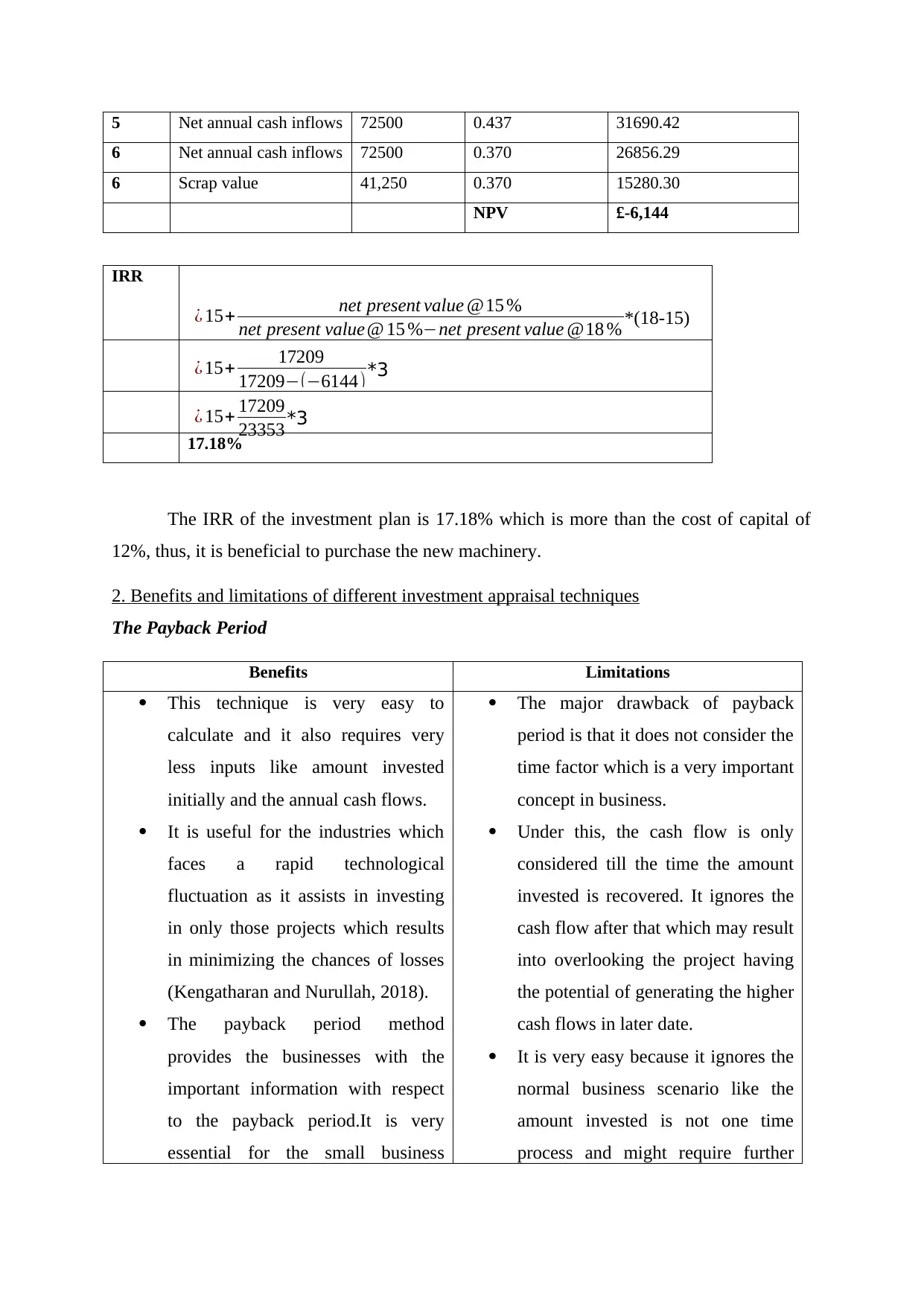

d. The Internal Rate of Return

IRR is the investment performance measuring tool presented in the percentage. It is a

means which is used by the investor for comparing the alternative investments on account of

the yield.

Calculating internal rate of return using trial and error approach

Year Cash flow Amount in £ PV factor @15% Present value (PV) in £

0 Outflow (cost) -2,75,000 1.000 -2,75,000

1 Net annual cash inflows 72500 0.870 63043.48

2 Net annual cash inflows 72500 0.756 54820.42

3 Net annual cash inflows 72500 0.658 47669.93

4 Net annual cash inflows 72500 0.572 41452.11

5 Net annual cash inflows 72500 0.497 36045.31

6 Net annual cash inflows 72500 0.432 31343.75

6 Scrap value 41,250 0.432 17833.51

NPV £17,209

Year Cash flow Amount in £ PV factor @18% Present value (PV) in £

0 Outflow (cost) -2,75,000 1.000 -2,75,000

1 Net annual cash inflows 72500 0.847 61440.68

2 Net annual cash inflows 72500 0.718 52068.37

3 Net annual cash inflows 72500 0.609 44125.74

4 Net annual cash inflows 72500 0.516 37394.69

2 Net annual cash inflows 72500 0.797 57796.56

3 Net annual cash inflows 72500 0.712 51604.07

4 Net annual cash inflows 72500 0.636 46075.06

5 Net annual cash inflows 72500 0.567 41138.45

6 Net annual cash inflows 72500 0.507 36730.76

6 Scrap value 41,250 0.507 20898.53

NPV £43,976

The NPV for purchasing the machinery is £43,976 which is positive, therefore,

Lovewell Limited should invest in it as it is profitable and feasible.

d. The Internal Rate of Return

IRR is the investment performance measuring tool presented in the percentage. It is a

means which is used by the investor for comparing the alternative investments on account of

the yield.

Calculating internal rate of return using trial and error approach

Year Cash flow Amount in £ PV factor @15% Present value (PV) in £

0 Outflow (cost) -2,75,000 1.000 -2,75,000

1 Net annual cash inflows 72500 0.870 63043.48

2 Net annual cash inflows 72500 0.756 54820.42

3 Net annual cash inflows 72500 0.658 47669.93

4 Net annual cash inflows 72500 0.572 41452.11

5 Net annual cash inflows 72500 0.497 36045.31

6 Net annual cash inflows 72500 0.432 31343.75

6 Scrap value 41,250 0.432 17833.51

NPV £17,209

Year Cash flow Amount in £ PV factor @18% Present value (PV) in £

0 Outflow (cost) -2,75,000 1.000 -2,75,000

1 Net annual cash inflows 72500 0.847 61440.68

2 Net annual cash inflows 72500 0.718 52068.37

3 Net annual cash inflows 72500 0.609 44125.74

4 Net annual cash inflows 72500 0.516 37394.69

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

5 Net annual cash inflows 72500 0.437 31690.42

6 Net annual cash inflows 72500 0.370 26856.29

6 Scrap value 41,250 0.370 15280.30

NPV £-6,144

IRR

17.18%

The IRR of the investment plan is 17.18% which is more than the cost of capital of

12%, thus, it is beneficial to purchase the new machinery.

2. Benefits and limitations of different investment appraisal techniques

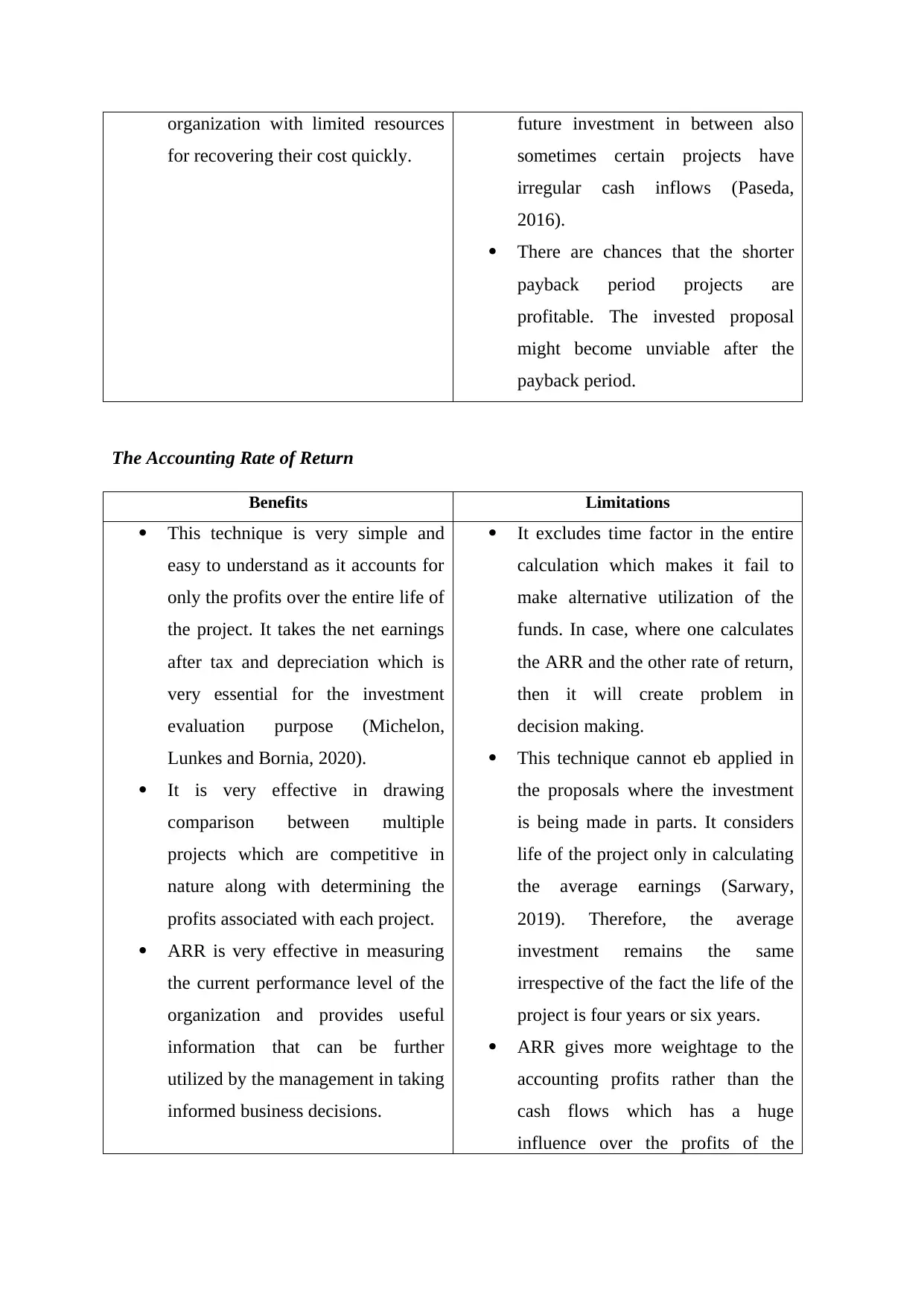

The Payback Period

Benefits Limitations

This technique is very easy to

calculate and it also requires very

less inputs like amount invested

initially and the annual cash flows.

It is useful for the industries which

faces a rapid technological

fluctuation as it assists in investing

in only those projects which results

in minimizing the chances of losses

(Kengatharan and Nurullah, 2018).

The payback period method

provides the businesses with the

important information with respect

to the payback period.It is very

essential for the small business

The major drawback of payback

period is that it does not consider the

time factor which is a very important

concept in business.

Under this, the cash flow is only

considered till the time the amount

invested is recovered. It ignores the

cash flow after that which may result

into overlooking the project having

the potential of generating the higher

cash flows in later date.

It is very easy because it ignores the

normal business scenario like the

amount invested is not one time

process and might require further

¿ 15+ net present value @15 %

net present value@ 15 %−net present value @18 % *(18-15)

¿ 15+ 17209

17209−(−6144)*3

¿ 15+ 17209

23353 *3

6 Net annual cash inflows 72500 0.370 26856.29

6 Scrap value 41,250 0.370 15280.30

NPV £-6,144

IRR

17.18%

The IRR of the investment plan is 17.18% which is more than the cost of capital of

12%, thus, it is beneficial to purchase the new machinery.

2. Benefits and limitations of different investment appraisal techniques

The Payback Period

Benefits Limitations

This technique is very easy to

calculate and it also requires very

less inputs like amount invested

initially and the annual cash flows.

It is useful for the industries which

faces a rapid technological

fluctuation as it assists in investing

in only those projects which results

in minimizing the chances of losses

(Kengatharan and Nurullah, 2018).

The payback period method

provides the businesses with the

important information with respect

to the payback period.It is very

essential for the small business

The major drawback of payback

period is that it does not consider the

time factor which is a very important

concept in business.

Under this, the cash flow is only

considered till the time the amount

invested is recovered. It ignores the

cash flow after that which may result

into overlooking the project having

the potential of generating the higher

cash flows in later date.

It is very easy because it ignores the

normal business scenario like the

amount invested is not one time

process and might require further

¿ 15+ net present value @15 %

net present value@ 15 %−net present value @18 % *(18-15)

¿ 15+ 17209

17209−(−6144)*3

¿ 15+ 17209

23353 *3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

organization with limited resources

for recovering their cost quickly.

future investment in between also

sometimes certain projects have

irregular cash inflows (Paseda,

2016).

There are chances that the shorter

payback period projects are

profitable. The invested proposal

might become unviable after the

payback period.

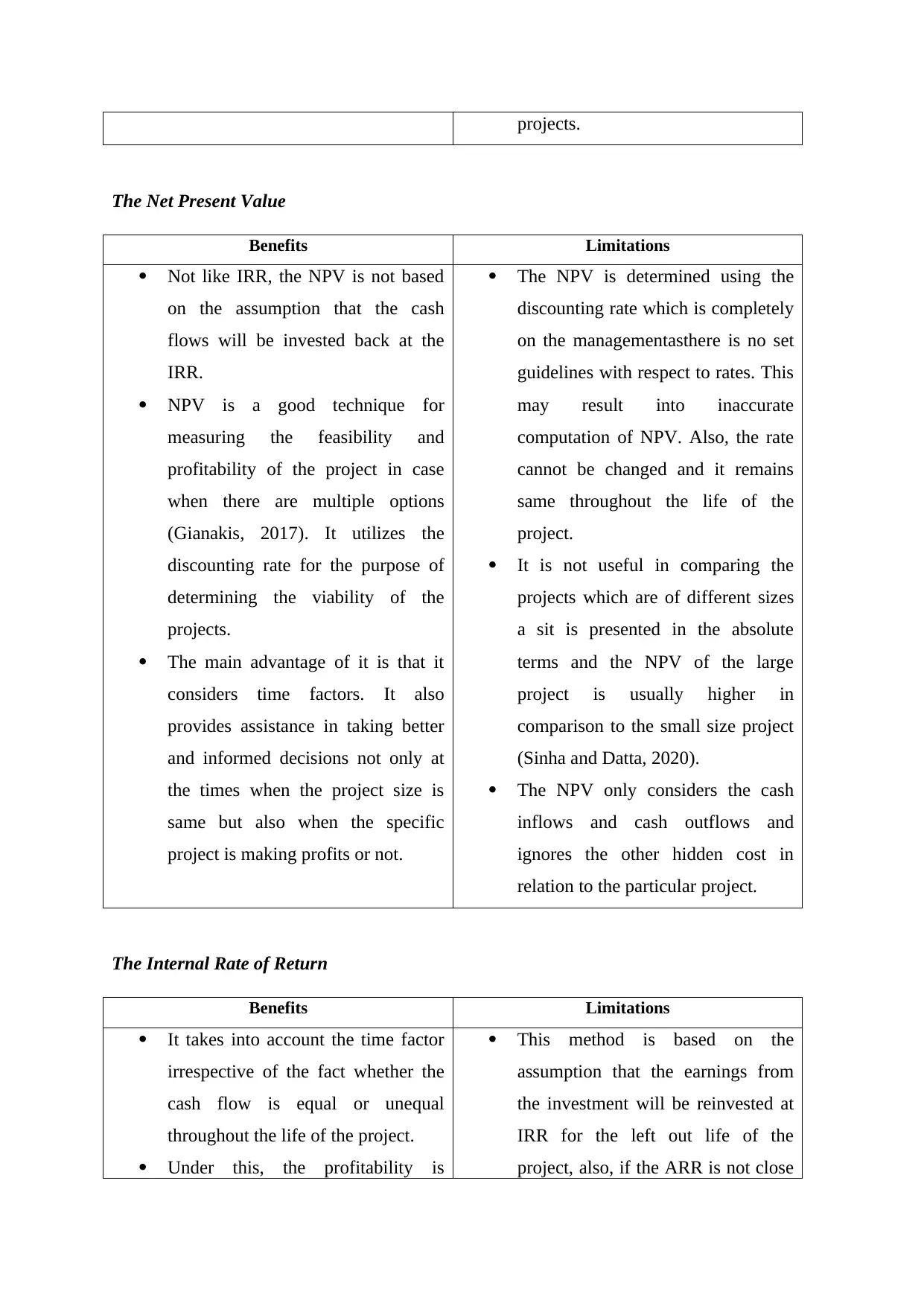

The Accounting Rate of Return

Benefits Limitations

This technique is very simple and

easy to understand as it accounts for

only the profits over the entire life of

the project. It takes the net earnings

after tax and depreciation which is

very essential for the investment

evaluation purpose (Michelon,

Lunkes and Bornia, 2020).

It is very effective in drawing

comparison between multiple

projects which are competitive in

nature along with determining the

profits associated with each project.

ARR is very effective in measuring

the current performance level of the

organization and provides useful

information that can be further

utilized by the management in taking

informed business decisions.

It excludes time factor in the entire

calculation which makes it fail to

make alternative utilization of the

funds. In case, where one calculates

the ARR and the other rate of return,

then it will create problem in

decision making.

This technique cannot eb applied in

the proposals where the investment

is being made in parts. It considers

life of the project only in calculating

the average earnings (Sarwary,

2019). Therefore, the average

investment remains the same

irrespective of the fact the life of the

project is four years or six years.

ARR gives more weightage to the

accounting profits rather than the

cash flows which has a huge

influence over the profits of the

for recovering their cost quickly.

future investment in between also

sometimes certain projects have

irregular cash inflows (Paseda,

2016).

There are chances that the shorter

payback period projects are

profitable. The invested proposal

might become unviable after the

payback period.

The Accounting Rate of Return

Benefits Limitations

This technique is very simple and

easy to understand as it accounts for

only the profits over the entire life of

the project. It takes the net earnings

after tax and depreciation which is

very essential for the investment

evaluation purpose (Michelon,

Lunkes and Bornia, 2020).

It is very effective in drawing

comparison between multiple

projects which are competitive in

nature along with determining the

profits associated with each project.

ARR is very effective in measuring

the current performance level of the

organization and provides useful

information that can be further

utilized by the management in taking

informed business decisions.

It excludes time factor in the entire

calculation which makes it fail to

make alternative utilization of the

funds. In case, where one calculates

the ARR and the other rate of return,

then it will create problem in

decision making.

This technique cannot eb applied in

the proposals where the investment

is being made in parts. It considers

life of the project only in calculating

the average earnings (Sarwary,

2019). Therefore, the average

investment remains the same

irrespective of the fact the life of the

project is four years or six years.

ARR gives more weightage to the

accounting profits rather than the

cash flows which has a huge

influence over the profits of the

projects.

The Net Present Value

Benefits Limitations

Not like IRR, the NPV is not based

on the assumption that the cash

flows will be invested back at the

IRR.

NPV is a good technique for

measuring the feasibility and

profitability of the project in case

when there are multiple options

(Gianakis, 2017). It utilizes the

discounting rate for the purpose of

determining the viability of the

projects.

The main advantage of it is that it

considers time factors. It also

provides assistance in taking better

and informed decisions not only at

the times when the project size is

same but also when the specific

project is making profits or not.

The NPV is determined using the

discounting rate which is completely

on the managementasthere is no set

guidelines with respect to rates. This

may result into inaccurate

computation of NPV. Also, the rate

cannot be changed and it remains

same throughout the life of the

project.

It is not useful in comparing the

projects which are of different sizes

a sit is presented in the absolute

terms and the NPV of the large

project is usually higher in

comparison to the small size project

(Sinha and Datta, 2020).

The NPV only considers the cash

inflows and cash outflows and

ignores the other hidden cost in

relation to the particular project.

The Internal Rate of Return

Benefits Limitations

It takes into account the time factor

irrespective of the fact whether the

cash flow is equal or unequal

throughout the life of the project.

Under this, the profitability is

This method is based on the

assumption that the earnings from

the investment will be reinvested at

IRR for the left out life of the

project, also, if the ARR is not close

The Net Present Value

Benefits Limitations

Not like IRR, the NPV is not based

on the assumption that the cash

flows will be invested back at the

IRR.

NPV is a good technique for

measuring the feasibility and

profitability of the project in case

when there are multiple options

(Gianakis, 2017). It utilizes the

discounting rate for the purpose of

determining the viability of the

projects.

The main advantage of it is that it

considers time factors. It also

provides assistance in taking better

and informed decisions not only at

the times when the project size is

same but also when the specific

project is making profits or not.

The NPV is determined using the

discounting rate which is completely

on the managementasthere is no set

guidelines with respect to rates. This

may result into inaccurate

computation of NPV. Also, the rate

cannot be changed and it remains

same throughout the life of the

project.

It is not useful in comparing the

projects which are of different sizes

a sit is presented in the absolute

terms and the NPV of the large

project is usually higher in

comparison to the small size project

(Sinha and Datta, 2020).

The NPV only considers the cash

inflows and cash outflows and

ignores the other hidden cost in

relation to the particular project.

The Internal Rate of Return

Benefits Limitations

It takes into account the time factor

irrespective of the fact whether the

cash flow is equal or unequal

throughout the life of the project.

Under this, the profitability is

This method is based on the

assumption that the earnings from

the investment will be reinvested at

IRR for the left out life of the

project, also, if the ARR is not close

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.