Financial Health of Tesco: Key Trends and Ratio Analysis Report

VerifiedAdded on 2023/04/22

|10

|2998

|92

Report

AI Summary

This report provides a detailed financial analysis of Tesco, a leading UK retailer. It begins with an overview of Tesco's background, key announcements, and events impacting its financial performance. The report then delves into a comprehensive analysis of Tesco's financial health, calculating and interpreting key financial ratios, including liquidity, efficiency, gearing, and profitability ratios for the years 2015 and 2016. The analysis includes asset turnover, inventory turnover, current, quick, and debt-equity ratios, alongside gross profit, net profit, operating margin, return on equity, and return on investment. The report identifies trends, assesses the company's ability to meet financial ambitions, and provides insights into Tesco's strengths and weaknesses. The report also discusses the implications of these financial metrics for potential investors and the company's future prospects. The report is based on the assignment question that focuses on capital investment appraisal and its methods within an organization.

INTRODUCTION

Financial account management refers to the process of effective and efficient

management of funds for the purpose of meeting organizational objectives (Brigham and

Ehrhardt, 2013). This aspect is applied for effective management of long as well as short term

resources for successful operation of business. Present report is based on Tesco a British

multinational grocery and general merchandise retailer of UK. This corporation is second largest

retailer in world in accordance with revenue and third largest retailer on the basis of profit.

Furthermore, financial trends of company are identified which rationale of change as result of

internal and external environmental actions. In addition to this, financial ratios of company are

calculated and analyzed in relation to its ability to meet financial ambitions. Moreover,

recommendations have also been provided to prospective investors for business by focusing

upon its strength and weaknesses.

PART A OVERVIEW

Background to the company & why it was selected

The current report is based on Tesco, British multinational grocery retailer. It is grocery

market leader in UK with market share around 28.4%. This corporation was founded in 1919 by

Jack Cohen in the form of market stall. However, the first store of Tesco opened in 1929 in Burnt

Oak, Barnet which was expanded rapidly. During 1990s Tesco diversified itself into several

areas such as retailing, furniture, electronics and clothing as well as financial services. Along

with that, telecom, internet services, petrol and software are also included. This organization is

listed on London Stock Exchange and had market capitalization of £18.1 billion s of 22 April

2015. Tesco introduced loyalty card in 1995 for attracting more buyers and persuading them to

take quick purchase decision. It was considered as the most effective strategy of marketing for

retaining buyers for longer time span.

Furthermore, in 2013 Tesco purchased the restaurant and cafe china Giraffe for £48.6

million and then during 2014 it started to open restaurant in some of its stores. However, at

present corporation is facing issue because of low profitability. In current financial year shares of

Tesco were the biggest faller in the FTSE 100. Here, investors were threaten because of

uncertain and deflationary market where discounting stores are outtperforming. Owing to this,

company is cutting prices and also planning to sell of some of its other side businesses. It shows

that company is unable to manage its rate of return due to shifting of customers from one to

Financial account management refers to the process of effective and efficient

management of funds for the purpose of meeting organizational objectives (Brigham and

Ehrhardt, 2013). This aspect is applied for effective management of long as well as short term

resources for successful operation of business. Present report is based on Tesco a British

multinational grocery and general merchandise retailer of UK. This corporation is second largest

retailer in world in accordance with revenue and third largest retailer on the basis of profit.

Furthermore, financial trends of company are identified which rationale of change as result of

internal and external environmental actions. In addition to this, financial ratios of company are

calculated and analyzed in relation to its ability to meet financial ambitions. Moreover,

recommendations have also been provided to prospective investors for business by focusing

upon its strength and weaknesses.

PART A OVERVIEW

Background to the company & why it was selected

The current report is based on Tesco, British multinational grocery retailer. It is grocery

market leader in UK with market share around 28.4%. This corporation was founded in 1919 by

Jack Cohen in the form of market stall. However, the first store of Tesco opened in 1929 in Burnt

Oak, Barnet which was expanded rapidly. During 1990s Tesco diversified itself into several

areas such as retailing, furniture, electronics and clothing as well as financial services. Along

with that, telecom, internet services, petrol and software are also included. This organization is

listed on London Stock Exchange and had market capitalization of £18.1 billion s of 22 April

2015. Tesco introduced loyalty card in 1995 for attracting more buyers and persuading them to

take quick purchase decision. It was considered as the most effective strategy of marketing for

retaining buyers for longer time span.

Furthermore, in 2013 Tesco purchased the restaurant and cafe china Giraffe for £48.6

million and then during 2014 it started to open restaurant in some of its stores. However, at

present corporation is facing issue because of low profitability. In current financial year shares of

Tesco were the biggest faller in the FTSE 100. Here, investors were threaten because of

uncertain and deflationary market where discounting stores are outtperforming. Owing to this,

company is cutting prices and also planning to sell of some of its other side businesses. It shows

that company is unable to manage its rate of return due to shifting of customers from one to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

another brand. For this purpose, Tesco has been selected as there are variations in its financial

performance over recent years (http://www.ft.com/fastft/2016/04/13/tesco-hails-progress-as-uk-

business-returns-to-sales-growth/). Owing to this, Tesco has been selected for the current report

for assessing its financial performance over last years.

Identification of key announcements or events 300

According to Chairman, John Allan, year 2015 was the challenging year for Tesco,

however, company remain extremely positive and confident about the future. The company is

proved to be an iconic brand and an enormous employer, which has huge responsibilities towards

customers, business partners, employees and shareholders as well as suppliers. Tesco is focused

towards corporate governance as it has a solid governance framework which is extremely

transparent. In the last year, company continued with range of corporate renewal plans that have

provided great success to company. The corporate entity puts customers at the heart of business

and makes decisions based on their needs and wants. Recently, company has sold its Homeplus

business in Korea which was a difficult decision, but was important for company to reposition

the finances of the Group by generating £3.3bn of funds (Annual Report and Financial

Statements 2016). This decision taken by company enabled company to strengthen the balance

sheet of company. The decision taken for replacing the UK defined benefit pension scheme with

a defined contribution scheme seen as the most important step which is taken by company in

respect to be competitive and sustainable for business partners over in long run. Tesco got its

images back as an investment grade and paying dividends. The main focus of company is on

achieving business goals for the long-term success. The corporate entity is evident for

stable pricing, investing in lower, improving services as it has simplified every food ranges on

shop floor for improving customer service which directly affects financial position of business.

In the month of October 2015, Tesco was the first and sole retailer within the United

Kingdom to offer customers an immediate price along with brand guarantee. Through this,

company does not charge more in case competitors such Asda, Morrisons or Sainsbury’s are

offering it in less. Recently, business entity has launched a new fresh food brands which are

offered at great prices. This is the way, company attracts customers by providing them great

value for money and fresh food under a roof. The company has made improvements across

offers which has strengthened market, along with this, in Europe and Asia, Tesco has built strong

performance over recent years (http://www.ft.com/fastft/2016/04/13/tesco-hails-progress-as-uk-

business-returns-to-sales-growth/). Owing to this, Tesco has been selected for the current report

for assessing its financial performance over last years.

Identification of key announcements or events 300

According to Chairman, John Allan, year 2015 was the challenging year for Tesco,

however, company remain extremely positive and confident about the future. The company is

proved to be an iconic brand and an enormous employer, which has huge responsibilities towards

customers, business partners, employees and shareholders as well as suppliers. Tesco is focused

towards corporate governance as it has a solid governance framework which is extremely

transparent. In the last year, company continued with range of corporate renewal plans that have

provided great success to company. The corporate entity puts customers at the heart of business

and makes decisions based on their needs and wants. Recently, company has sold its Homeplus

business in Korea which was a difficult decision, but was important for company to reposition

the finances of the Group by generating £3.3bn of funds (Annual Report and Financial

Statements 2016). This decision taken by company enabled company to strengthen the balance

sheet of company. The decision taken for replacing the UK defined benefit pension scheme with

a defined contribution scheme seen as the most important step which is taken by company in

respect to be competitive and sustainable for business partners over in long run. Tesco got its

images back as an investment grade and paying dividends. The main focus of company is on

achieving business goals for the long-term success. The corporate entity is evident for

stable pricing, investing in lower, improving services as it has simplified every food ranges on

shop floor for improving customer service which directly affects financial position of business.

In the month of October 2015, Tesco was the first and sole retailer within the United

Kingdom to offer customers an immediate price along with brand guarantee. Through this,

company does not charge more in case competitors such Asda, Morrisons or Sainsbury’s are

offering it in less. Recently, business entity has launched a new fresh food brands which are

offered at great prices. This is the way, company attracts customers by providing them great

value for money and fresh food under a roof. The company has made improvements across

offers which has strengthened market, along with this, in Europe and Asia, Tesco has built strong

and positive sales momentum in the last year (Annual Report and Financial Statements. 2016).

In Thailand, the company has captured higher market share and transformation programme

in Europe has boosted business growth while reducing operating expense.

Changes in key financial trends 300

PART B FINANCIAL HEALTH

Computing and analyzing key financial ratios for the company

Financial ratios are very important for assessing financial position of an organization for

certain time span. It enables corporation in arranging appropriate sources of finance by providing

right information to all important stakeholders (Brigham and Ehrhardt, 2013). Also, important

information related to liquidity and operational performance of Tesco can be extracted with ratio

analysis. It includes several ratios such as liquidity, risk expectations, profitability and

price/earning ratio. These are explained below along with calculation-

1 Meeting liquidity needs (liquidity ratios)

Liquidity ratio is helpful to assess ability of corporation to pay off its short as well as

long term debt. In common parlance, higher liquidity ratio tends to enhance margin of safety for

corporation in order to cover short-term debts. Furthermore,

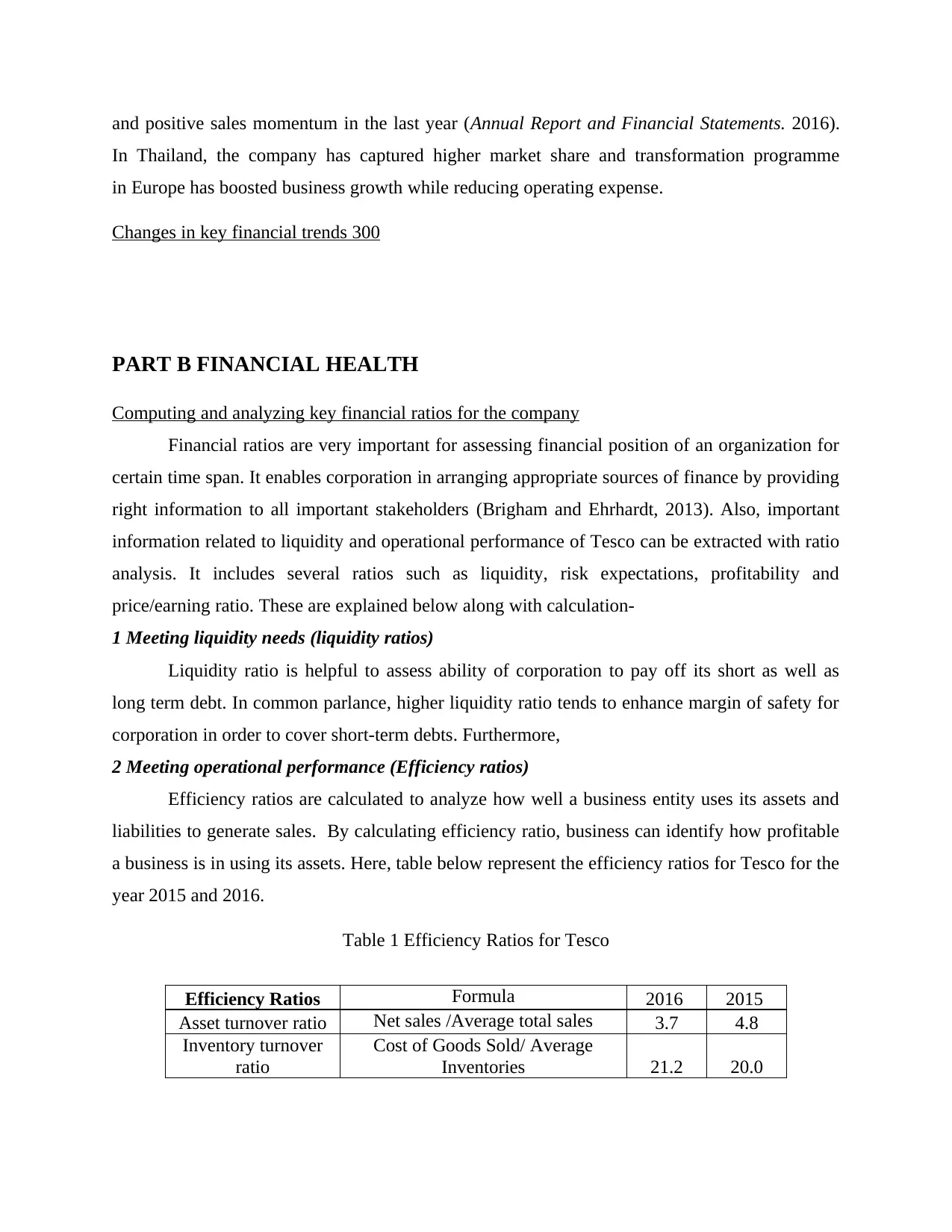

2 Meeting operational performance (Efficiency ratios)

Efficiency ratios are calculated to analyze how well a business entity uses its assets and

liabilities to generate sales. By calculating efficiency ratio, business can identify how profitable

a business is in using its assets. Here, table below represent the efficiency ratios for Tesco for the

year 2015 and 2016.

Table 1 Efficiency Ratios for Tesco

Efficiency Ratios Formula 2016 2015

Asset turnover ratio Net sales /Average total sales 3.7 4.8

Inventory turnover

ratio

Cost of Goods Sold/ Average

Inventories 21.2 20.0

In Thailand, the company has captured higher market share and transformation programme

in Europe has boosted business growth while reducing operating expense.

Changes in key financial trends 300

PART B FINANCIAL HEALTH

Computing and analyzing key financial ratios for the company

Financial ratios are very important for assessing financial position of an organization for

certain time span. It enables corporation in arranging appropriate sources of finance by providing

right information to all important stakeholders (Brigham and Ehrhardt, 2013). Also, important

information related to liquidity and operational performance of Tesco can be extracted with ratio

analysis. It includes several ratios such as liquidity, risk expectations, profitability and

price/earning ratio. These are explained below along with calculation-

1 Meeting liquidity needs (liquidity ratios)

Liquidity ratio is helpful to assess ability of corporation to pay off its short as well as

long term debt. In common parlance, higher liquidity ratio tends to enhance margin of safety for

corporation in order to cover short-term debts. Furthermore,

2 Meeting operational performance (Efficiency ratios)

Efficiency ratios are calculated to analyze how well a business entity uses its assets and

liabilities to generate sales. By calculating efficiency ratio, business can identify how profitable

a business is in using its assets. Here, table below represent the efficiency ratios for Tesco for the

year 2015 and 2016.

Table 1 Efficiency Ratios for Tesco

Efficiency Ratios Formula 2016 2015

Asset turnover ratio Net sales /Average total sales 3.7 4.8

Inventory turnover

ratio

Cost of Goods Sold/ Average

Inventories 21.2 20.0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Inventory turnover ratio

Inventory turnover is said as an important efficiency ratio on which basis the frequency

and number of time for which business sells and replaces its inventory. The ratio is calculated by

cost of goods sold by average inventory during an accounting period. The inventory turnover

ratio for Tesco for 2015 was 20 times which in increased to 21.2 times in 2016 representing that

the business is efficiently managing its inventories in current years but in in previous year it

faced some issues. Low ratio for the previous year indicating a slow demand or over-stocking of

inventories and poor inventories management which had lead to increase in inventory holding

costs. However, this year business has effectively used is inventory.

Asset turnover ratio

Through calculating asset turnover ratio business entity measures ability to generate sales

from an effective use of assets. This ratio indicates how efficiently a business is using its assets

to earn revenues (Brigham and Ehrhardt, 2013). The higher assets turnover ratio is more

favorable for the business. The asset turnover ratio for 2015 was 4.8 and for 2016 it decreases to

3.7. From the analysis, it can be seen that in previous years, the company has effectively uses its

assets to generate higher sales, hence, higher ratio is previous years was more favorable. In the

previous year, higher turnover ratio indicted that company has earned good revenues by using its

assets efficiently. This year company has faced some issues regarding management or production

problems that have affects its asset turnover ratio.

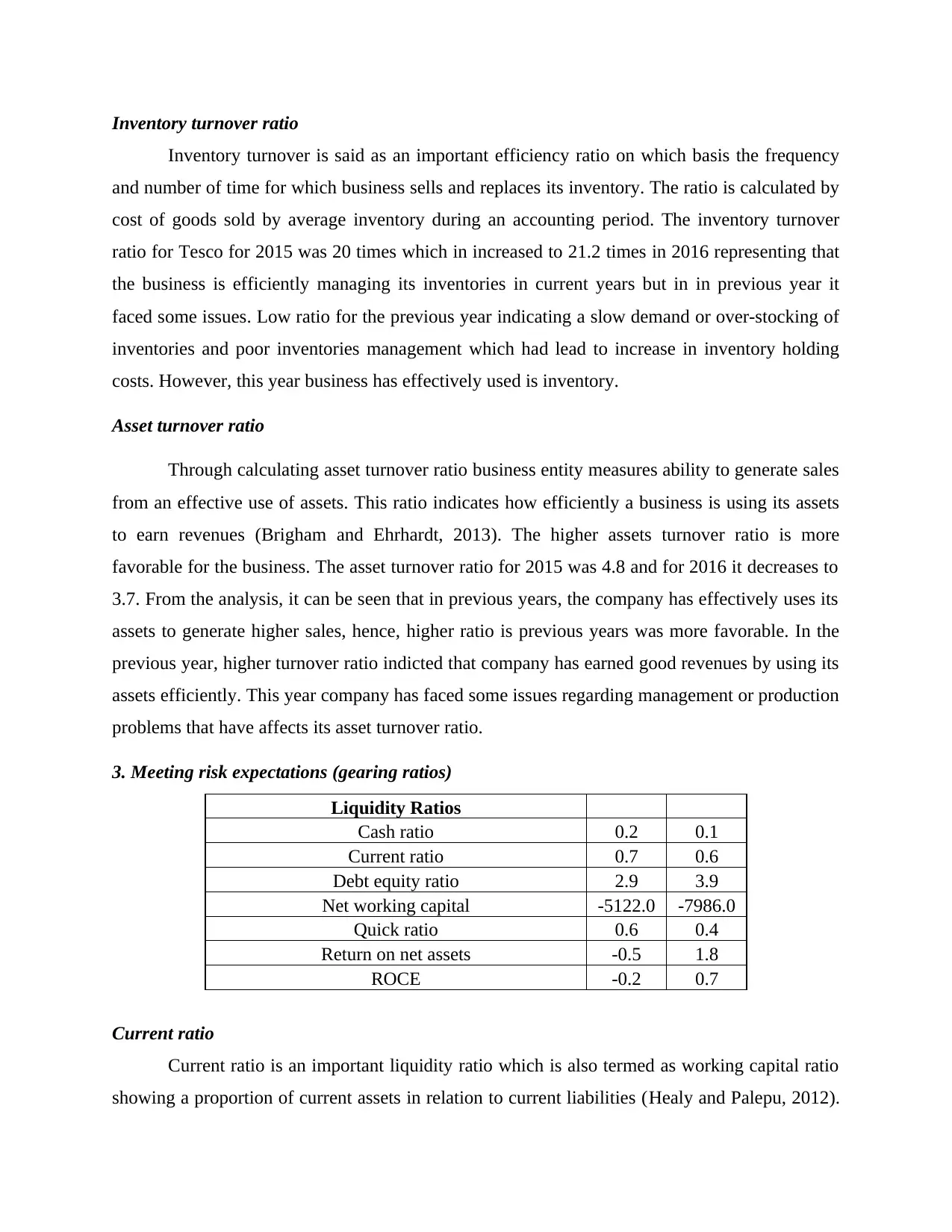

3. Meeting risk expectations (gearing ratios)

Liquidity Ratios

Cash ratio 0.2 0.1

Current ratio 0.7 0.6

Debt equity ratio 2.9 3.9

Net working capital -5122.0 -7986.0

Quick ratio 0.6 0.4

Return on net assets -0.5 1.8

ROCE -0.2 0.7

Current ratio

Current ratio is an important liquidity ratio which is also termed as working capital ratio

showing a proportion of current assets in relation to current liabilities (Healy and Palepu, 2012).

Inventory turnover is said as an important efficiency ratio on which basis the frequency

and number of time for which business sells and replaces its inventory. The ratio is calculated by

cost of goods sold by average inventory during an accounting period. The inventory turnover

ratio for Tesco for 2015 was 20 times which in increased to 21.2 times in 2016 representing that

the business is efficiently managing its inventories in current years but in in previous year it

faced some issues. Low ratio for the previous year indicating a slow demand or over-stocking of

inventories and poor inventories management which had lead to increase in inventory holding

costs. However, this year business has effectively used is inventory.

Asset turnover ratio

Through calculating asset turnover ratio business entity measures ability to generate sales

from an effective use of assets. This ratio indicates how efficiently a business is using its assets

to earn revenues (Brigham and Ehrhardt, 2013). The higher assets turnover ratio is more

favorable for the business. The asset turnover ratio for 2015 was 4.8 and for 2016 it decreases to

3.7. From the analysis, it can be seen that in previous years, the company has effectively uses its

assets to generate higher sales, hence, higher ratio is previous years was more favorable. In the

previous year, higher turnover ratio indicted that company has earned good revenues by using its

assets efficiently. This year company has faced some issues regarding management or production

problems that have affects its asset turnover ratio.

3. Meeting risk expectations (gearing ratios)

Liquidity Ratios

Cash ratio 0.2 0.1

Current ratio 0.7 0.6

Debt equity ratio 2.9 3.9

Net working capital -5122.0 -7986.0

Quick ratio 0.6 0.4

Return on net assets -0.5 1.8

ROCE -0.2 0.7

Current ratio

Current ratio is an important liquidity ratio which is also termed as working capital ratio

showing a proportion of current assets in relation to current liabilities (Healy and Palepu, 2012).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

This ratio of business is used to measure of liquidity of a business for a certain time period. The

current ratio for business is 0.7 in 2016 which was found to be .6 in 2015. The analysis indicates

that the liquidity performance of company is improved as compared to previous years. It can

also be said that the company has used a more conservative approach to working capital

management as a result liquidity performance of company is improved.

Debt equity ratio

`Debt to equity ratio is a financial ratio used for finding out the liquidity of business and

compared total debt to total equity. This is all around percentage of business financing that arises

from creditors and investors (Brigham and Ehrhardt, 2013). The debt equity ratio for Tesco in

2015 was 3.9 which indicates that business in previous year company has used more creditor

financing or bank loans as compared to shareholders financing. The debt equity ratio for 2016 is

2.9 which indicates that now company is using more equity financing as compared to debt. The

financial position of business is improved as compared to previous year.

Quick ratio

`Quick ratio is also known as acid test ratio is a measurement of company’s l ability of a

company to pay its current liabilities with quick assets when liabilities are due. In other words, it

is a measurement of how company is able to pay short term liabilities with cash, cash

equivalents, short-term investments such as marketable securities, current accounts receivable

etc. The quick ratio for Tesco in 2015 was .4 which is improved to .6 in 2016. It can be said that

liquidity position of company is improved as compared to previous year. The higher quick ratio

is favorable for companies.

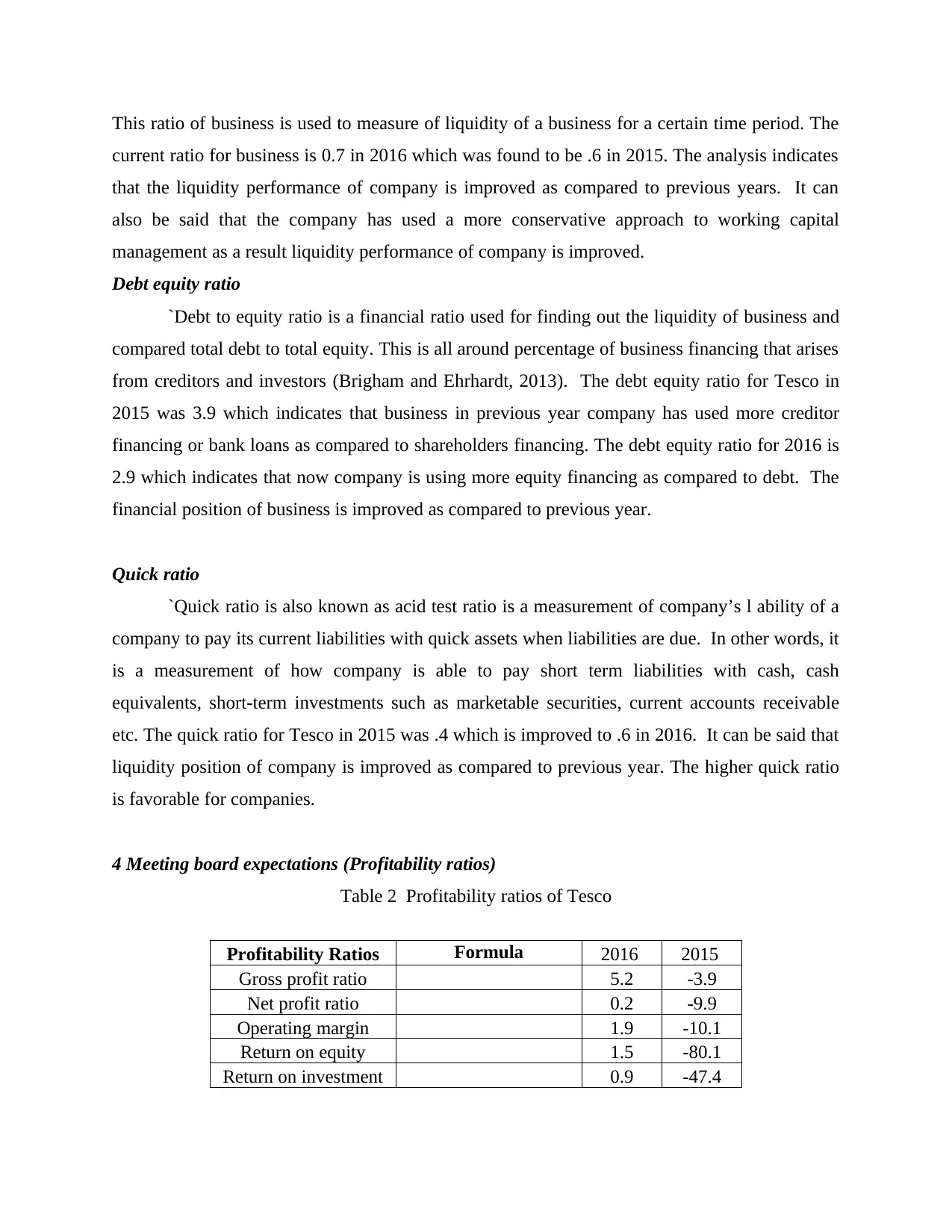

4 Meeting board expectations (Profitability ratios)

Table 2 Profitability ratios of Tesco

Profitability Ratios Formula 2016 2015

Gross profit ratio 5.2 -3.9

Net profit ratio 0.2 -9.9

Operating margin 1.9 -10.1

Return on equity 1.5 -80.1

Return on investment 0.9 -47.4

current ratio for business is 0.7 in 2016 which was found to be .6 in 2015. The analysis indicates

that the liquidity performance of company is improved as compared to previous years. It can

also be said that the company has used a more conservative approach to working capital

management as a result liquidity performance of company is improved.

Debt equity ratio

`Debt to equity ratio is a financial ratio used for finding out the liquidity of business and

compared total debt to total equity. This is all around percentage of business financing that arises

from creditors and investors (Brigham and Ehrhardt, 2013). The debt equity ratio for Tesco in

2015 was 3.9 which indicates that business in previous year company has used more creditor

financing or bank loans as compared to shareholders financing. The debt equity ratio for 2016 is

2.9 which indicates that now company is using more equity financing as compared to debt. The

financial position of business is improved as compared to previous year.

Quick ratio

`Quick ratio is also known as acid test ratio is a measurement of company’s l ability of a

company to pay its current liabilities with quick assets when liabilities are due. In other words, it

is a measurement of how company is able to pay short term liabilities with cash, cash

equivalents, short-term investments such as marketable securities, current accounts receivable

etc. The quick ratio for Tesco in 2015 was .4 which is improved to .6 in 2016. It can be said that

liquidity position of company is improved as compared to previous year. The higher quick ratio

is favorable for companies.

4 Meeting board expectations (Profitability ratios)

Table 2 Profitability ratios of Tesco

Profitability Ratios Formula 2016 2015

Gross profit ratio 5.2 -3.9

Net profit ratio 0.2 -9.9

Operating margin 1.9 -10.1

Return on equity 1.5 -80.1

Return on investment 0.9 -47.4

Gross profit ratio

Gross profit ratio is a measure of sales that surpass the cost of goods sold. The ratio is

used to measure, how the material and labour resources of business are used to produce and sell

products. The amount of money from product sales is left over excluding all direct costs related

to production. The ratio is used for shareholders to identify the profits from core business

activities while leaving behind the indirect costs. The gross profit ratio for Tesco is 5.2 which is

improved from last year as in last year, it was negative due to losses earned by company (Tesco

PLC – TSCO. Morning star. 2016).. In the previous years, the direct expenses of company were

too high. It can be said that there is a huge improvements in business from previous year and

now business has become profitable in core business activities.

Net profit Ratio

Net Profit Margin is a percentage of net profit which is earned by business in previous

years. This is a major key performance indicator of the profitability of a company. In 2015 the

Net profit margin of Tesco was -9.9 indicated a huge loss for business (Tesco PLC – TSCO.

Morning star. 2016).. However, for the current year the ratio is improved to 0.2, represents that

that indirect expenses have been declined. On the basis of net profit margin, company identifies

performance gaps that should be overcome so as to improve the profitability of Tesco. The

reason behind improved profitability of cited company is its declining, in-direct costs.

Operating profit ratio:

The operating profit ratio is significantly known as operating profit margin, through

which profitability is measured a profitability in terms of operating cost are paid in business

(Brigham and Ehrhardt, 2013). The operating ratio represents a portion of revenues available to

cover other cost such as interest expense etc. The ratio for 2015 was -10.1 which is significantly

improved in 2016 and reached to 1.9, as business has earned good revenues. This all due to huge

decrease in operating expenses of business in this year.

Return on equity

Return on equity ratio is also termed as ROE ratio used for measuring the ability of firm

to generate profits on the investments made by shareholders in the organization (Baležentis,

Baležentis and Misiunas, 2012). The amount of return on equity shows that how much a return

is to be paid on an equity invested by shareholders. The return on equity for 2016 was 1.5

Gross profit ratio is a measure of sales that surpass the cost of goods sold. The ratio is

used to measure, how the material and labour resources of business are used to produce and sell

products. The amount of money from product sales is left over excluding all direct costs related

to production. The ratio is used for shareholders to identify the profits from core business

activities while leaving behind the indirect costs. The gross profit ratio for Tesco is 5.2 which is

improved from last year as in last year, it was negative due to losses earned by company (Tesco

PLC – TSCO. Morning star. 2016).. In the previous years, the direct expenses of company were

too high. It can be said that there is a huge improvements in business from previous year and

now business has become profitable in core business activities.

Net profit Ratio

Net Profit Margin is a percentage of net profit which is earned by business in previous

years. This is a major key performance indicator of the profitability of a company. In 2015 the

Net profit margin of Tesco was -9.9 indicated a huge loss for business (Tesco PLC – TSCO.

Morning star. 2016).. However, for the current year the ratio is improved to 0.2, represents that

that indirect expenses have been declined. On the basis of net profit margin, company identifies

performance gaps that should be overcome so as to improve the profitability of Tesco. The

reason behind improved profitability of cited company is its declining, in-direct costs.

Operating profit ratio:

The operating profit ratio is significantly known as operating profit margin, through

which profitability is measured a profitability in terms of operating cost are paid in business

(Brigham and Ehrhardt, 2013). The operating ratio represents a portion of revenues available to

cover other cost such as interest expense etc. The ratio for 2015 was -10.1 which is significantly

improved in 2016 and reached to 1.9, as business has earned good revenues. This all due to huge

decrease in operating expenses of business in this year.

Return on equity

Return on equity ratio is also termed as ROE ratio used for measuring the ability of firm

to generate profits on the investments made by shareholders in the organization (Baležentis,

Baležentis and Misiunas, 2012). The amount of return on equity shows that how much a return

is to be paid on an equity invested by shareholders. The return on equity for 2016 was 1.5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

however, it was negative in 2015 a -80.1. The ratio represents how much of profits are to be

attained by stakeholders on investment. In the last years, the company was paying negative

return to the stakeholders, however, the returns have been improved in this years that grabs the

attention of shareholders in business. It can be said that, in the present years the business has

earned good returns on equity as it found efficiently to generate profits.

Return on investment

Profitability ratio includes return on investment which is the measure of firm’s profits on

investment as a portion of original cost. The ratio measures how business is effectively making

money on the investment. The return on investment ratio for Tesco in 2015 was -47.4, which

was unfavorable. Business got such ratio due to declining earning and negative profits.

However, in the previous year, the company has ROI of .9 which is improved as compared to

previous year, just due to increased profits and sales (Tesco PLC – TSCO. Morning star. 2016).

This is to be witnessed that the improved ROI ratio is effective in attracting investors as it will

provides good return ion their investments. The investments of company are effective to earn

good amount in each dollar invested in a project, hence, produces good profits.

5. Meeting shareholder expectations (Price/earnings ratio, dividend yield)

(Price/earnings ratio, dividend yield)

2016 :25.55

2015:

attained by stakeholders on investment. In the last years, the company was paying negative

return to the stakeholders, however, the returns have been improved in this years that grabs the

attention of shareholders in business. It can be said that, in the present years the business has

earned good returns on equity as it found efficiently to generate profits.

Return on investment

Profitability ratio includes return on investment which is the measure of firm’s profits on

investment as a portion of original cost. The ratio measures how business is effectively making

money on the investment. The return on investment ratio for Tesco in 2015 was -47.4, which

was unfavorable. Business got such ratio due to declining earning and negative profits.

However, in the previous year, the company has ROI of .9 which is improved as compared to

previous year, just due to increased profits and sales (Tesco PLC – TSCO. Morning star. 2016).

This is to be witnessed that the improved ROI ratio is effective in attracting investors as it will

provides good return ion their investments. The investments of company are effective to earn

good amount in each dollar invested in a project, hence, produces good profits.

5. Meeting shareholder expectations (Price/earnings ratio, dividend yield)

(Price/earnings ratio, dividend yield)

2016 :25.55

2015:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PART C

Financial strengths and weaknesses 500

Conclusions and recommendations 600

REFERENCES

Annual Report and Financial Statements 2016. [Online]. Available through: <

https://www.tescoplc.com/media/264194/annual-report-2016.pdf> [Accessed on 17th June,

2016].

Tesco PLC – TSCO. Morning star. 2016. [Online]. Available through: <

http://financials.morningstar.com/ratios/r.html?t=TSCDY®ion=usa&culture=en-US>

[Accessed on 17th June, 2016].

Healy, P. and Palepu, K., 2012. Business Analysis Valuation: Using Financial Statements.

Cengage Learning.

Baležentis, A., Baležentis, T. and Misiunas, A., 2012. An integrated assessment of Lithuanian

economic sectors based on financial ratios and fuzzy MCDM methods. Technological and

Economic Development of Economy, 18(1), pp.34-53.

Brigham, E. and Ehrhardt, M., 2013. Financial management: Theory & practice. Cengage

Learning.

http://financials.morningstar.com/ratios/r.html?t=TSCDY®ion=usa&culture=en-US

http://tools.morningstar.co.uk/uk/stockreport/default.aspx?SecurityToken=0P00007OYV

%5D3%5D0%5DE0WWE$$ALL

https://www.tescoplc.com/media/264194/annual-report-2016.pdf

Financial strengths and weaknesses 500

Conclusions and recommendations 600

REFERENCES

Annual Report and Financial Statements 2016. [Online]. Available through: <

https://www.tescoplc.com/media/264194/annual-report-2016.pdf> [Accessed on 17th June,

2016].

Tesco PLC – TSCO. Morning star. 2016. [Online]. Available through: <

http://financials.morningstar.com/ratios/r.html?t=TSCDY®ion=usa&culture=en-US>

[Accessed on 17th June, 2016].

Healy, P. and Palepu, K., 2012. Business Analysis Valuation: Using Financial Statements.

Cengage Learning.

Baležentis, A., Baležentis, T. and Misiunas, A., 2012. An integrated assessment of Lithuanian

economic sectors based on financial ratios and fuzzy MCDM methods. Technological and

Economic Development of Economy, 18(1), pp.34-53.

Brigham, E. and Ehrhardt, M., 2013. Financial management: Theory & practice. Cengage

Learning.

http://financials.morningstar.com/ratios/r.html?t=TSCDY®ion=usa&culture=en-US

http://tools.morningstar.co.uk/uk/stockreport/default.aspx?SecurityToken=0P00007OYV

%5D3%5D0%5DE0WWE$$ALL

https://www.tescoplc.com/media/264194/annual-report-2016.pdf

https://ycharts.com/companies/TESO/pe_ratio

http://www.londonstockexchange.com/exchange/prices/stocks/summary/fundamentals.html?

fourWayKey=GB00088https://ycharts.com/companies/TESO/pe_ratio47096GBGBXSET0

http://financials.morningstar.com/ratios/r.html?t=TSCDY®ion=usa&culture=en-US

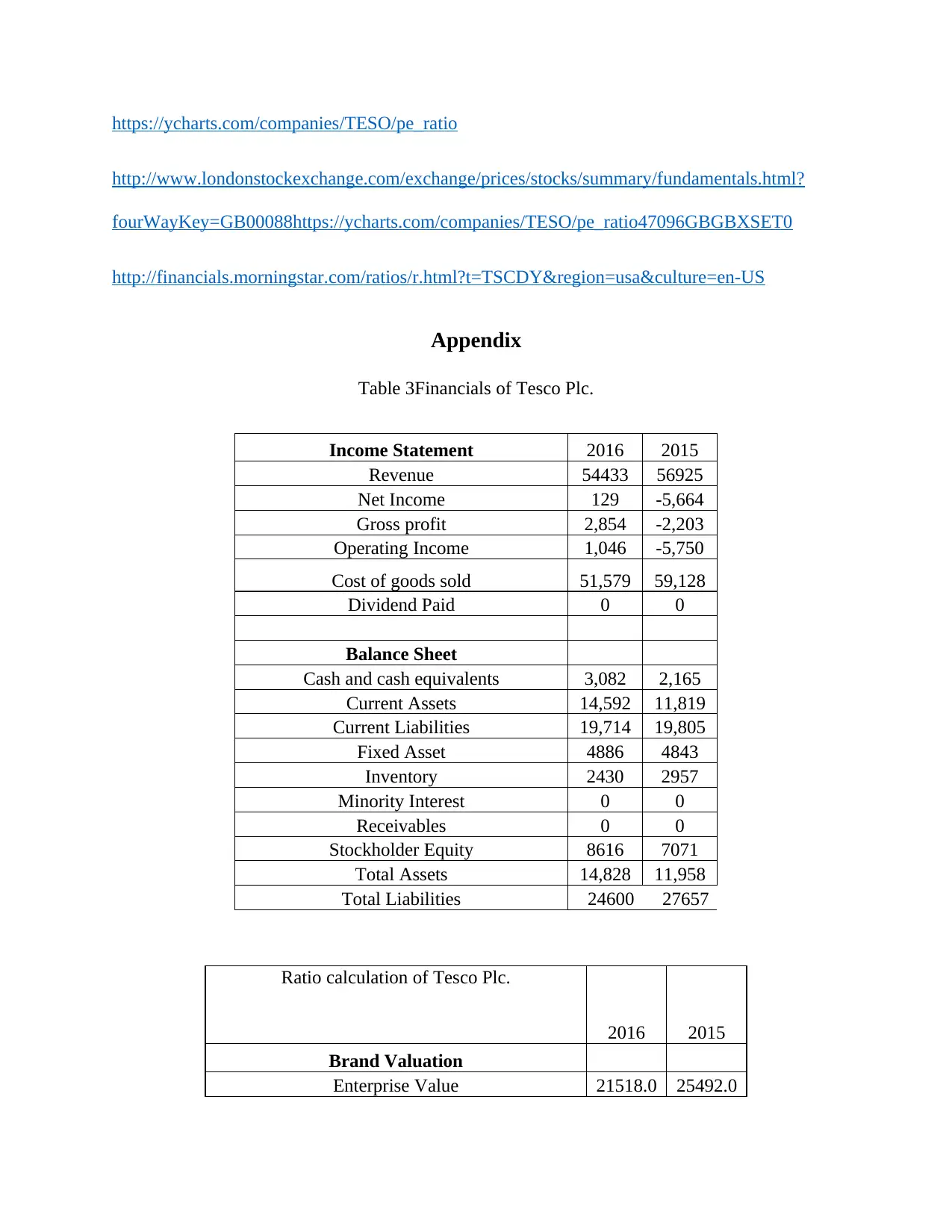

Appendix

Table 3Financials of Tesco Plc.

Income Statement 2016 2015

Revenue 54433 56925

Net Income 129 -5,664

Gross profit 2,854 -2,203

Operating Income 1,046 -5,750

Cost of goods sold 51,579 59,128

Dividend Paid 0 0

Balance Sheet

Cash and cash equivalents 3,082 2,165

Current Assets 14,592 11,819

Current Liabilities 19,714 19,805

Fixed Asset 4886 4843

Inventory 2430 2957

Minority Interest 0 0

Receivables 0 0

Stockholder Equity 8616 7071

Total Assets 14,828 11,958

Total Liabilities 24600 27657

Ratio calculation of Tesco Plc.

2016 2015

Brand Valuation

Enterprise Value 21518.0 25492.0

http://www.londonstockexchange.com/exchange/prices/stocks/summary/fundamentals.html?

fourWayKey=GB00088https://ycharts.com/companies/TESO/pe_ratio47096GBGBXSET0

http://financials.morningstar.com/ratios/r.html?t=TSCDY®ion=usa&culture=en-US

Appendix

Table 3Financials of Tesco Plc.

Income Statement 2016 2015

Revenue 54433 56925

Net Income 129 -5,664

Gross profit 2,854 -2,203

Operating Income 1,046 -5,750

Cost of goods sold 51,579 59,128

Dividend Paid 0 0

Balance Sheet

Cash and cash equivalents 3,082 2,165

Current Assets 14,592 11,819

Current Liabilities 19,714 19,805

Fixed Asset 4886 4843

Inventory 2430 2957

Minority Interest 0 0

Receivables 0 0

Stockholder Equity 8616 7071

Total Assets 14,828 11,958

Total Liabilities 24600 27657

Ratio calculation of Tesco Plc.

2016 2015

Brand Valuation

Enterprise Value 21518.0 25492.0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

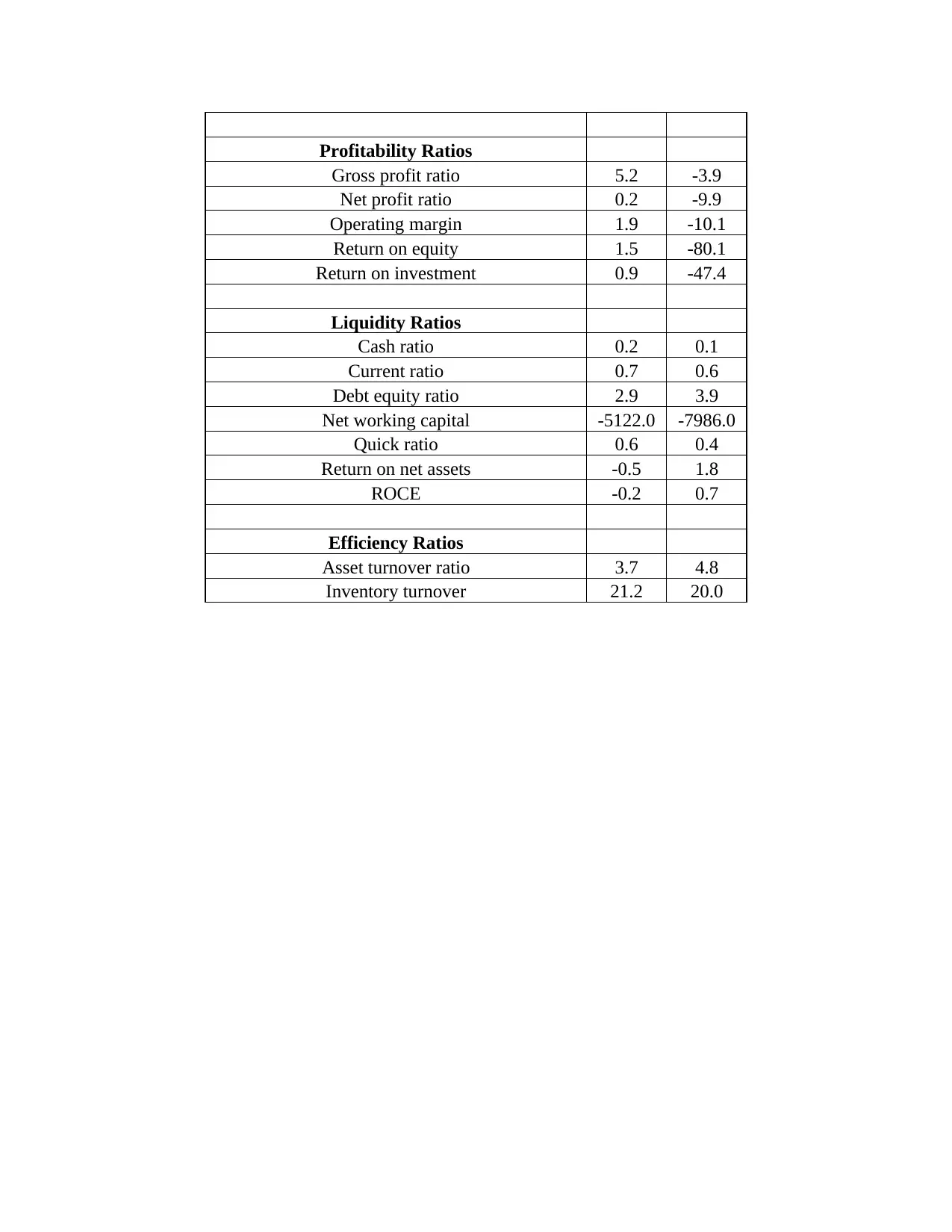

Profitability Ratios

Gross profit ratio 5.2 -3.9

Net profit ratio 0.2 -9.9

Operating margin 1.9 -10.1

Return on equity 1.5 -80.1

Return on investment 0.9 -47.4

Liquidity Ratios

Cash ratio 0.2 0.1

Current ratio 0.7 0.6

Debt equity ratio 2.9 3.9

Net working capital -5122.0 -7986.0

Quick ratio 0.6 0.4

Return on net assets -0.5 1.8

ROCE -0.2 0.7

Efficiency Ratios

Asset turnover ratio 3.7 4.8

Inventory turnover 21.2 20.0

Gross profit ratio 5.2 -3.9

Net profit ratio 0.2 -9.9

Operating margin 1.9 -10.1

Return on equity 1.5 -80.1

Return on investment 0.9 -47.4

Liquidity Ratios

Cash ratio 0.2 0.1

Current ratio 0.7 0.6

Debt equity ratio 2.9 3.9

Net working capital -5122.0 -7986.0

Quick ratio 0.6 0.4

Return on net assets -0.5 1.8

ROCE -0.2 0.7

Efficiency Ratios

Asset turnover ratio 3.7 4.8

Inventory turnover 21.2 20.0

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.