Control Account Reconciliation and Accurate Financial Statements

VerifiedAdded on 2020/07/23

|22

|3942

|57

AI Summary

This assignment covers various types of control accounts, including purchase ledger control account and sales ledger control account. It provides a step-by-step guide on reconciling these accounts, identifying errors, and preparing accurate financial statements. The assignment also discusses the importance of control accounts in detecting fraud and providing total figures for debtors and creditors. It includes examples and references to relevant accounting theories and practices.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

FINANCIAL ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

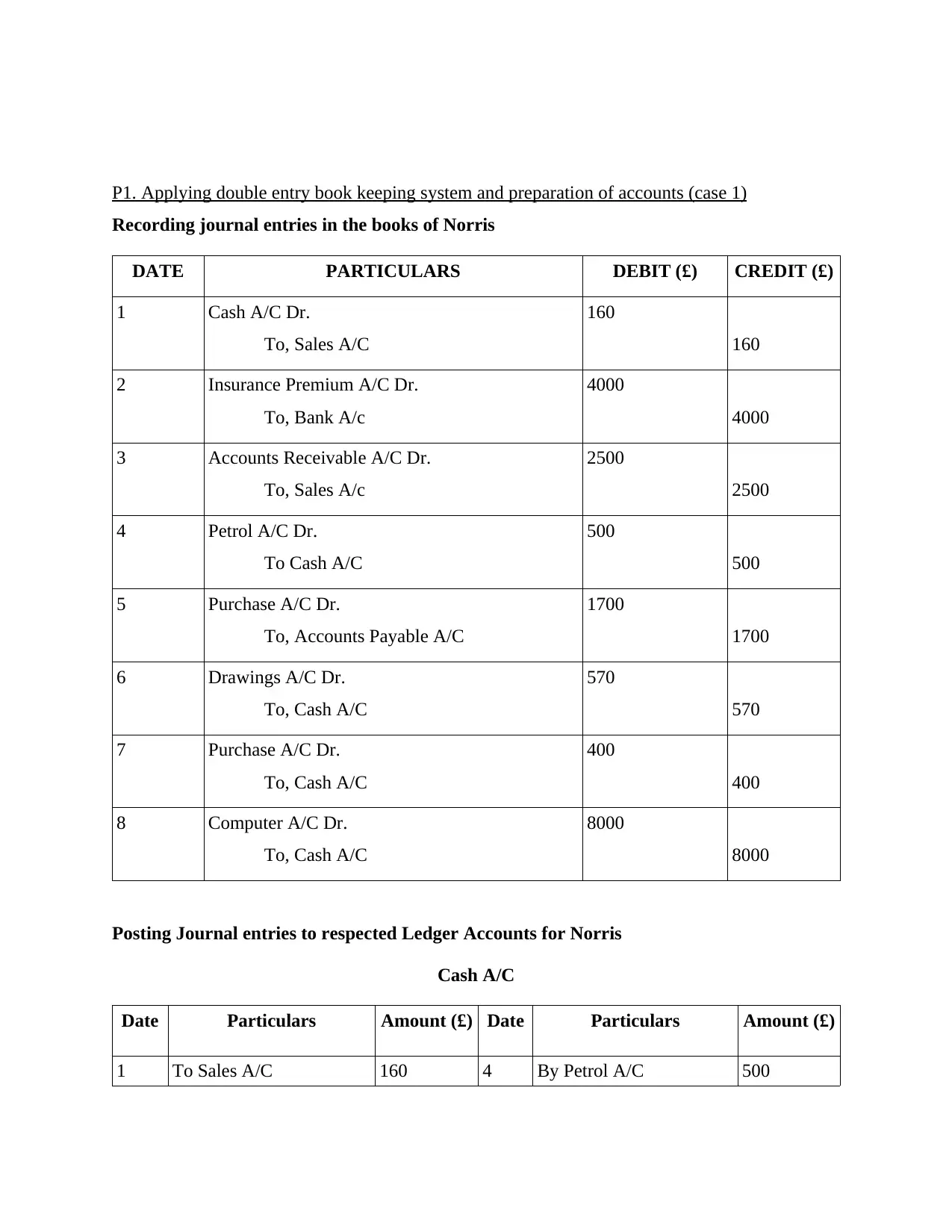

P1. Applying double entry book keeping system and preparation of accounts (case 1)

Recording journal entries in the books of Norris

DATE PARTICULARS DEBIT (£) CREDIT (£)

1 Cash A/C Dr.

To, Sales A/C

160

160

2 Insurance Premium A/C Dr.

To, Bank A/c

4000

4000

3 Accounts Receivable A/C Dr.

To, Sales A/c

2500

2500

4 Petrol A/C Dr.

To Cash A/C

500

500

5 Purchase A/C Dr.

To, Accounts Payable A/C

1700

1700

6 Drawings A/C Dr.

To, Cash A/C

570

570

7 Purchase A/C Dr.

To, Cash A/C

400

400

8 Computer A/C Dr.

To, Cash A/C

8000

8000

Posting Journal entries to respected Ledger Accounts for Norris

Cash A/C

Date Particulars Amount (£) Date Particulars Amount (£)

1 To Sales A/C 160 4 By Petrol A/C 500

Recording journal entries in the books of Norris

DATE PARTICULARS DEBIT (£) CREDIT (£)

1 Cash A/C Dr.

To, Sales A/C

160

160

2 Insurance Premium A/C Dr.

To, Bank A/c

4000

4000

3 Accounts Receivable A/C Dr.

To, Sales A/c

2500

2500

4 Petrol A/C Dr.

To Cash A/C

500

500

5 Purchase A/C Dr.

To, Accounts Payable A/C

1700

1700

6 Drawings A/C Dr.

To, Cash A/C

570

570

7 Purchase A/C Dr.

To, Cash A/C

400

400

8 Computer A/C Dr.

To, Cash A/C

8000

8000

Posting Journal entries to respected Ledger Accounts for Norris

Cash A/C

Date Particulars Amount (£) Date Particulars Amount (£)

1 To Sales A/C 160 4 By Petrol A/C 500

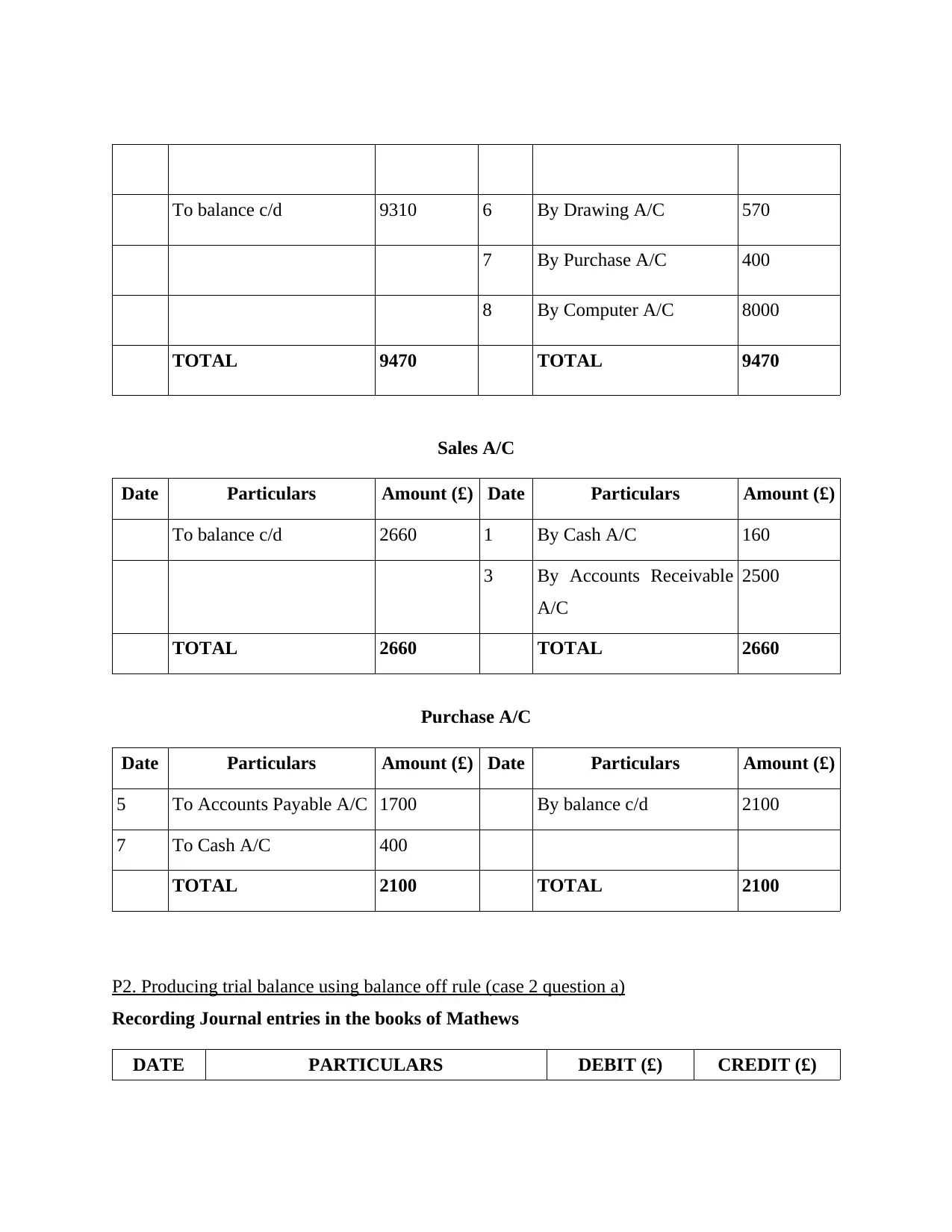

To balance c/d 9310 6 By Drawing A/C 570

7 By Purchase A/C 400

8 By Computer A/C 8000

TOTAL 9470 TOTAL 9470

Sales A/C

Date Particulars Amount (£) Date Particulars Amount (£)

To balance c/d 2660 1 By Cash A/C 160

3 By Accounts Receivable

A/C

2500

TOTAL 2660 TOTAL 2660

Purchase A/C

Date Particulars Amount (£) Date Particulars Amount (£)

5 To Accounts Payable A/C 1700 By balance c/d 2100

7 To Cash A/C 400

TOTAL 2100 TOTAL 2100

P2. Producing trial balance using balance off rule (case 2 question a)

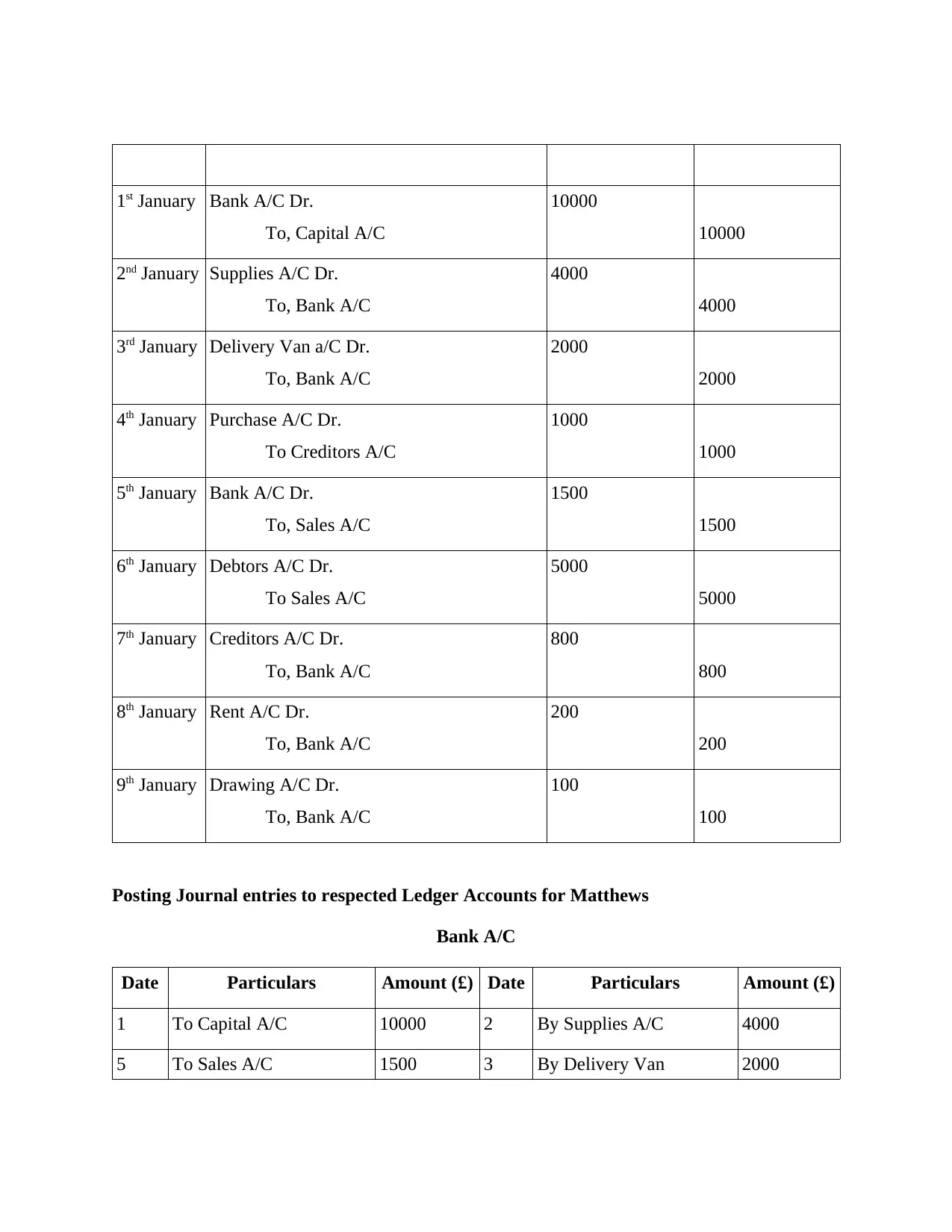

Recording Journal entries in the books of Mathews

DATE PARTICULARS DEBIT (£) CREDIT (£)

7 By Purchase A/C 400

8 By Computer A/C 8000

TOTAL 9470 TOTAL 9470

Sales A/C

Date Particulars Amount (£) Date Particulars Amount (£)

To balance c/d 2660 1 By Cash A/C 160

3 By Accounts Receivable

A/C

2500

TOTAL 2660 TOTAL 2660

Purchase A/C

Date Particulars Amount (£) Date Particulars Amount (£)

5 To Accounts Payable A/C 1700 By balance c/d 2100

7 To Cash A/C 400

TOTAL 2100 TOTAL 2100

P2. Producing trial balance using balance off rule (case 2 question a)

Recording Journal entries in the books of Mathews

DATE PARTICULARS DEBIT (£) CREDIT (£)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1st January Bank A/C Dr.

To, Capital A/C

10000

10000

2nd January Supplies A/C Dr.

To, Bank A/C

4000

4000

3rd January Delivery Van a/C Dr.

To, Bank A/C

2000

2000

4th January Purchase A/C Dr.

To Creditors A/C

1000

1000

5th January Bank A/C Dr.

To, Sales A/C

1500

1500

6th January Debtors A/C Dr.

To Sales A/C

5000

5000

7th January Creditors A/C Dr.

To, Bank A/C

800

800

8th January Rent A/C Dr.

To, Bank A/C

200

200

9th January Drawing A/C Dr.

To, Bank A/C

100

100

Posting Journal entries to respected Ledger Accounts for Matthews

Bank A/C

Date Particulars Amount (£) Date Particulars Amount (£)

1 To Capital A/C 10000 2 By Supplies A/C 4000

5 To Sales A/C 1500 3 By Delivery Van 2000

To, Capital A/C

10000

10000

2nd January Supplies A/C Dr.

To, Bank A/C

4000

4000

3rd January Delivery Van a/C Dr.

To, Bank A/C

2000

2000

4th January Purchase A/C Dr.

To Creditors A/C

1000

1000

5th January Bank A/C Dr.

To, Sales A/C

1500

1500

6th January Debtors A/C Dr.

To Sales A/C

5000

5000

7th January Creditors A/C Dr.

To, Bank A/C

800

800

8th January Rent A/C Dr.

To, Bank A/C

200

200

9th January Drawing A/C Dr.

To, Bank A/C

100

100

Posting Journal entries to respected Ledger Accounts for Matthews

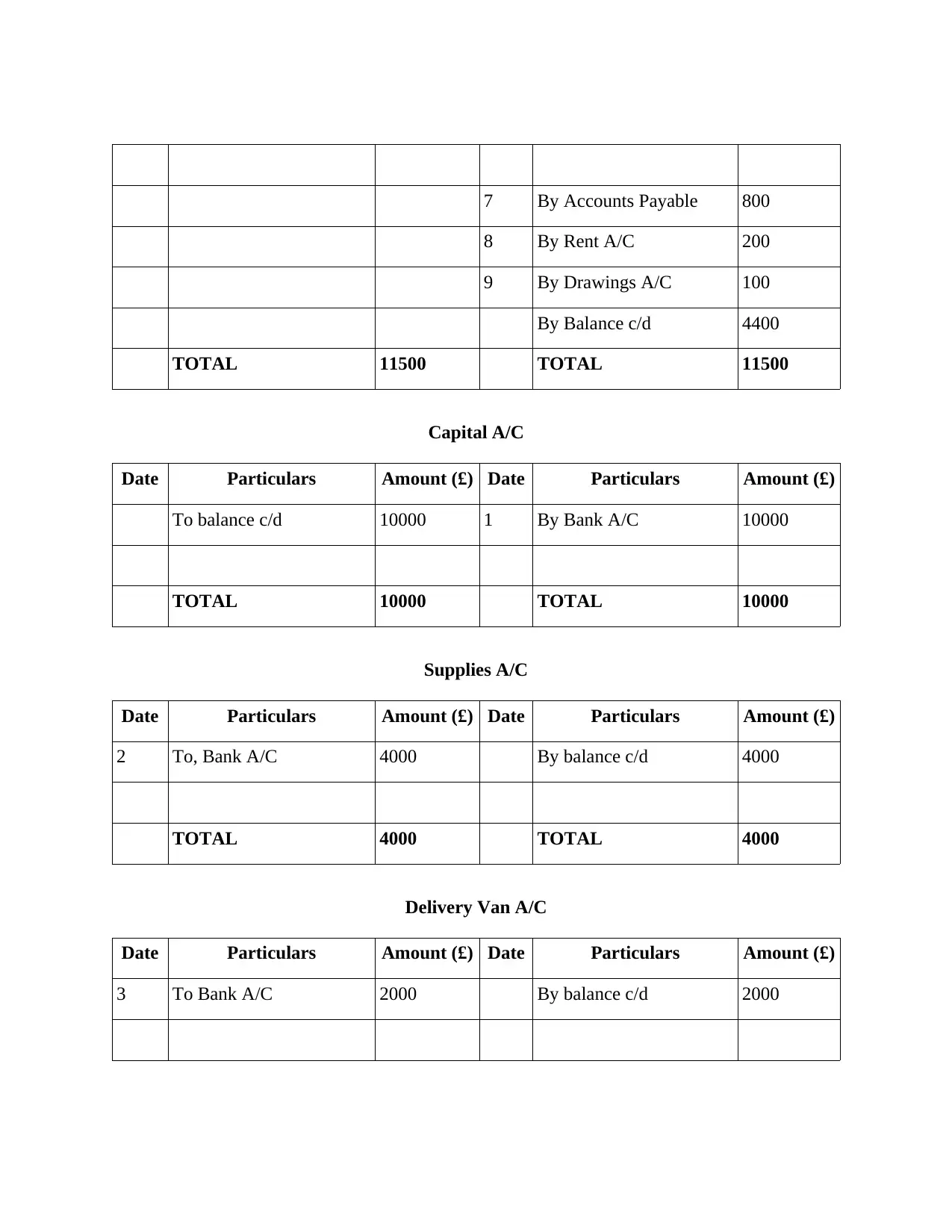

Bank A/C

Date Particulars Amount (£) Date Particulars Amount (£)

1 To Capital A/C 10000 2 By Supplies A/C 4000

5 To Sales A/C 1500 3 By Delivery Van 2000

7 By Accounts Payable 800

8 By Rent A/C 200

9 By Drawings A/C 100

By Balance c/d 4400

TOTAL 11500 TOTAL 11500

Capital A/C

Date Particulars Amount (£) Date Particulars Amount (£)

To balance c/d 10000 1 By Bank A/C 10000

TOTAL 10000 TOTAL 10000

Supplies A/C

Date Particulars Amount (£) Date Particulars Amount (£)

2 To, Bank A/C 4000 By balance c/d 4000

TOTAL 4000 TOTAL 4000

Delivery Van A/C

Date Particulars Amount (£) Date Particulars Amount (£)

3 To Bank A/C 2000 By balance c/d 2000

8 By Rent A/C 200

9 By Drawings A/C 100

By Balance c/d 4400

TOTAL 11500 TOTAL 11500

Capital A/C

Date Particulars Amount (£) Date Particulars Amount (£)

To balance c/d 10000 1 By Bank A/C 10000

TOTAL 10000 TOTAL 10000

Supplies A/C

Date Particulars Amount (£) Date Particulars Amount (£)

2 To, Bank A/C 4000 By balance c/d 4000

TOTAL 4000 TOTAL 4000

Delivery Van A/C

Date Particulars Amount (£) Date Particulars Amount (£)

3 To Bank A/C 2000 By balance c/d 2000

TOTAL 2000 TOTAL 2000

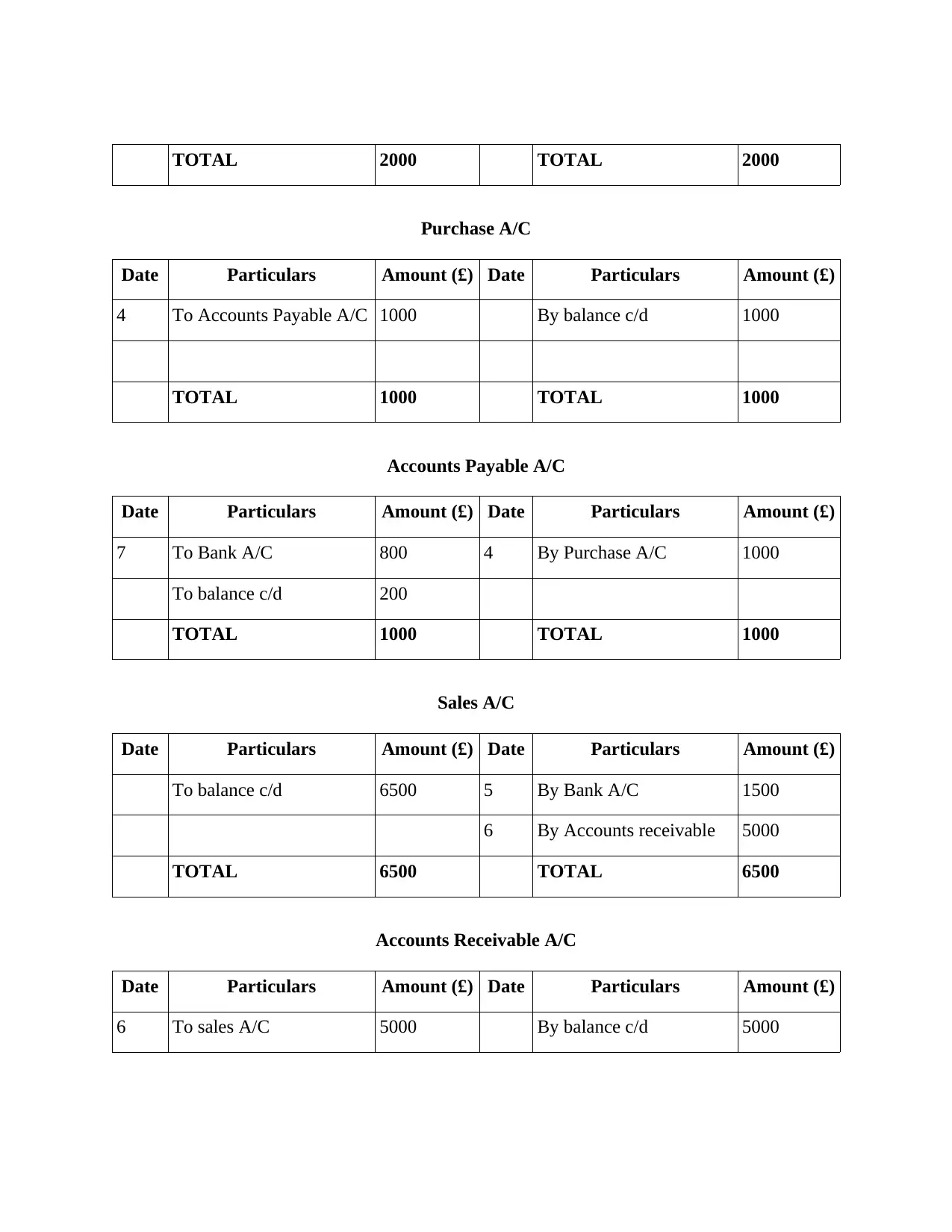

Purchase A/C

Date Particulars Amount (£) Date Particulars Amount (£)

4 To Accounts Payable A/C 1000 By balance c/d 1000

TOTAL 1000 TOTAL 1000

Accounts Payable A/C

Date Particulars Amount (£) Date Particulars Amount (£)

7 To Bank A/C 800 4 By Purchase A/C 1000

To balance c/d 200

TOTAL 1000 TOTAL 1000

Sales A/C

Date Particulars Amount (£) Date Particulars Amount (£)

To balance c/d 6500 5 By Bank A/C 1500

6 By Accounts receivable 5000

TOTAL 6500 TOTAL 6500

Accounts Receivable A/C

Date Particulars Amount (£) Date Particulars Amount (£)

6 To sales A/C 5000 By balance c/d 5000

Purchase A/C

Date Particulars Amount (£) Date Particulars Amount (£)

4 To Accounts Payable A/C 1000 By balance c/d 1000

TOTAL 1000 TOTAL 1000

Accounts Payable A/C

Date Particulars Amount (£) Date Particulars Amount (£)

7 To Bank A/C 800 4 By Purchase A/C 1000

To balance c/d 200

TOTAL 1000 TOTAL 1000

Sales A/C

Date Particulars Amount (£) Date Particulars Amount (£)

To balance c/d 6500 5 By Bank A/C 1500

6 By Accounts receivable 5000

TOTAL 6500 TOTAL 6500

Accounts Receivable A/C

Date Particulars Amount (£) Date Particulars Amount (£)

6 To sales A/C 5000 By balance c/d 5000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

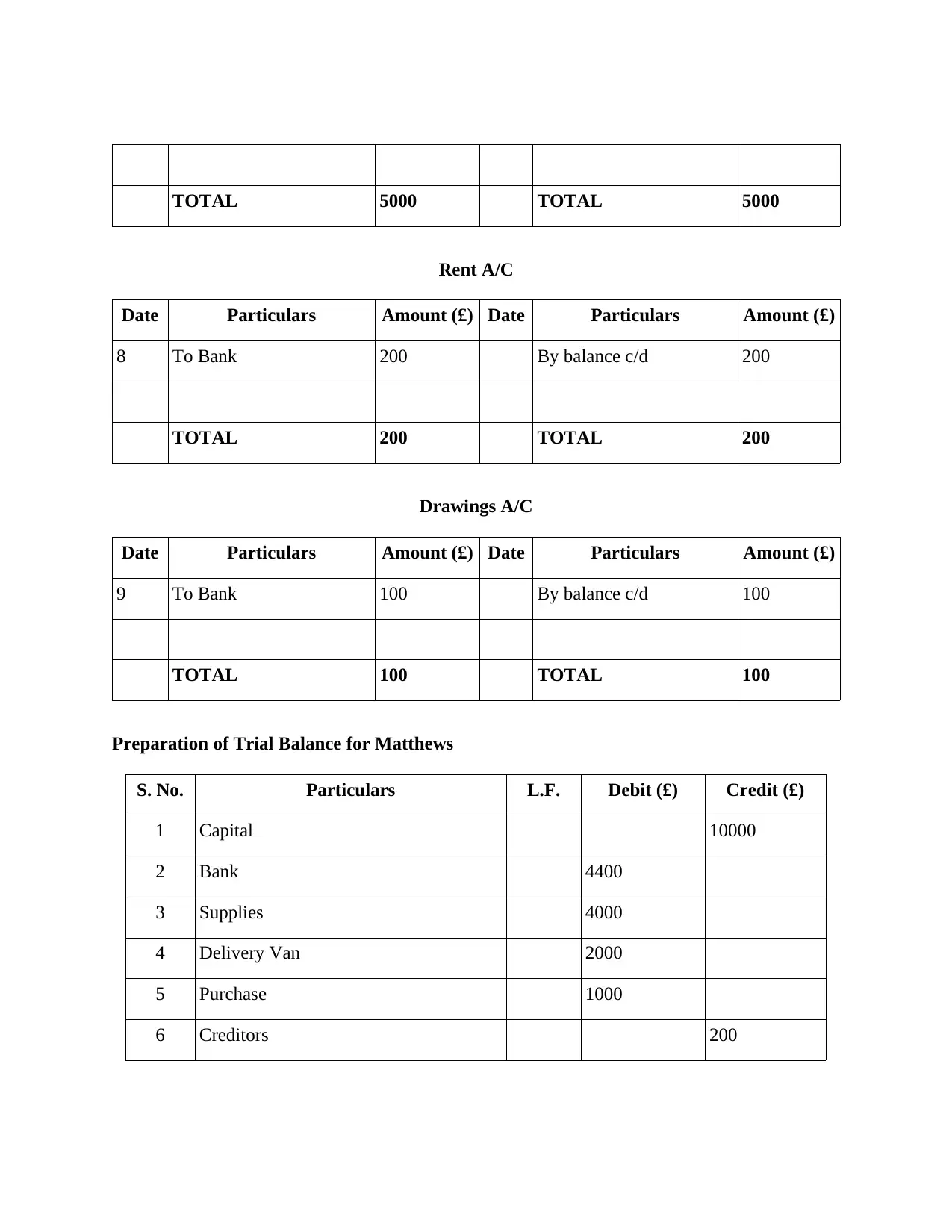

TOTAL 5000 TOTAL 5000

Rent A/C

Date Particulars Amount (£) Date Particulars Amount (£)

8 To Bank 200 By balance c/d 200

TOTAL 200 TOTAL 200

Drawings A/C

Date Particulars Amount (£) Date Particulars Amount (£)

9 To Bank 100 By balance c/d 100

TOTAL 100 TOTAL 100

Preparation of Trial Balance for Matthews

S. No. Particulars L.F. Debit (£) Credit (£)

1 Capital 10000

2 Bank 4400

3 Supplies 4000

4 Delivery Van 2000

5 Purchase 1000

6 Creditors 200

Rent A/C

Date Particulars Amount (£) Date Particulars Amount (£)

8 To Bank 200 By balance c/d 200

TOTAL 200 TOTAL 200

Drawings A/C

Date Particulars Amount (£) Date Particulars Amount (£)

9 To Bank 100 By balance c/d 100

TOTAL 100 TOTAL 100

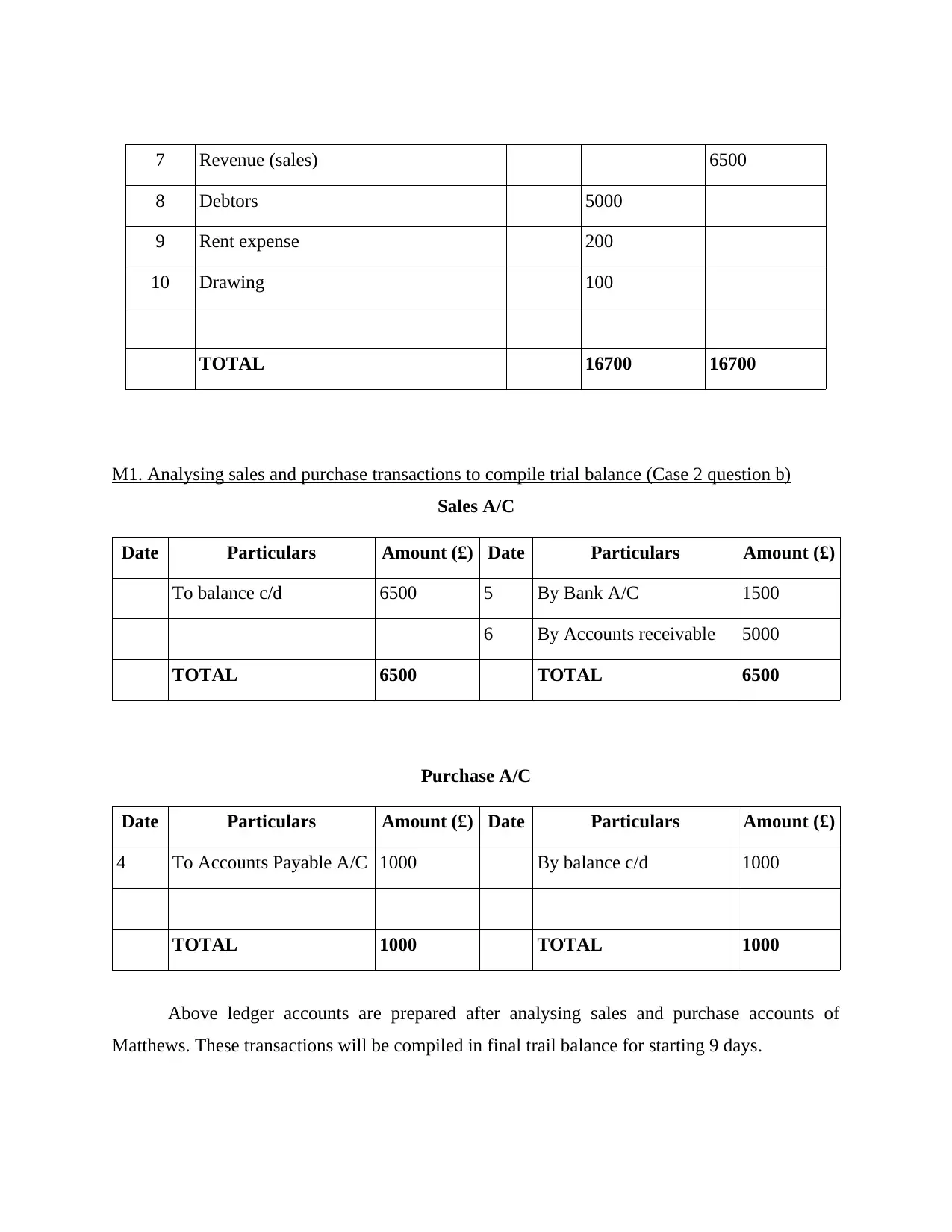

Preparation of Trial Balance for Matthews

S. No. Particulars L.F. Debit (£) Credit (£)

1 Capital 10000

2 Bank 4400

3 Supplies 4000

4 Delivery Van 2000

5 Purchase 1000

6 Creditors 200

7 Revenue (sales) 6500

8 Debtors 5000

9 Rent expense 200

10 Drawing 100

TOTAL 16700 16700

M1. Analysing sales and purchase transactions to compile trial balance (Case 2 question b)

Sales A/C

Date Particulars Amount (£) Date Particulars Amount (£)

To balance c/d 6500 5 By Bank A/C 1500

6 By Accounts receivable 5000

TOTAL 6500 TOTAL 6500

Purchase A/C

Date Particulars Amount (£) Date Particulars Amount (£)

4 To Accounts Payable A/C 1000 By balance c/d 1000

TOTAL 1000 TOTAL 1000

Above ledger accounts are prepared after analysing sales and purchase accounts of

Matthews. These transactions will be compiled in final trail balance for starting 9 days.

8 Debtors 5000

9 Rent expense 200

10 Drawing 100

TOTAL 16700 16700

M1. Analysing sales and purchase transactions to compile trial balance (Case 2 question b)

Sales A/C

Date Particulars Amount (£) Date Particulars Amount (£)

To balance c/d 6500 5 By Bank A/C 1500

6 By Accounts receivable 5000

TOTAL 6500 TOTAL 6500

Purchase A/C

Date Particulars Amount (£) Date Particulars Amount (£)

4 To Accounts Payable A/C 1000 By balance c/d 1000

TOTAL 1000 TOTAL 1000

Above ledger accounts are prepared after analysing sales and purchase accounts of

Matthews. These transactions will be compiled in final trail balance for starting 9 days.

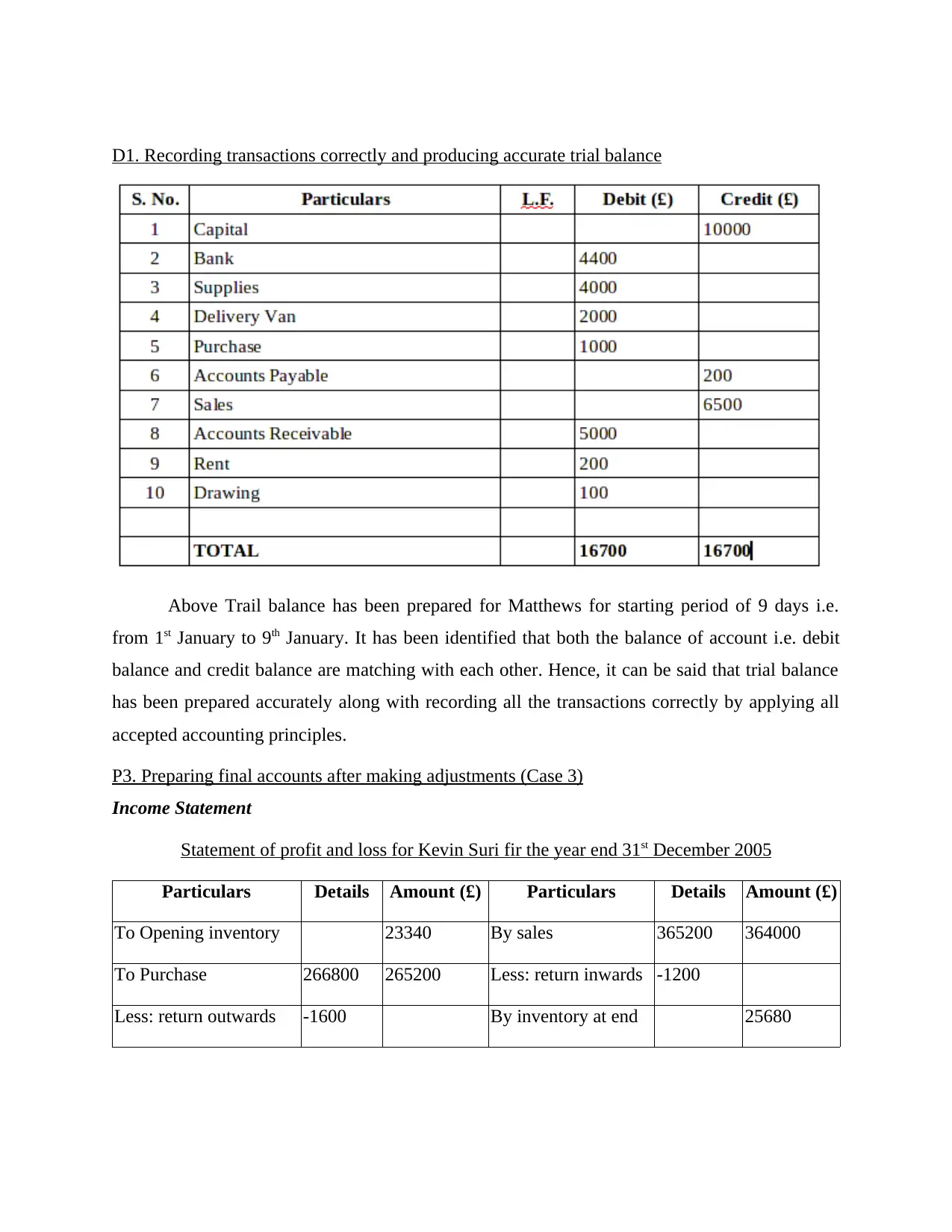

D1. Recording transactions correctly and producing accurate trial balance

Above Trail balance has been prepared for Matthews for starting period of 9 days i.e.

from 1st January to 9th January. It has been identified that both the balance of account i.e. debit

balance and credit balance are matching with each other. Hence, it can be said that trial balance

has been prepared accurately along with recording all the transactions correctly by applying all

accepted accounting principles.

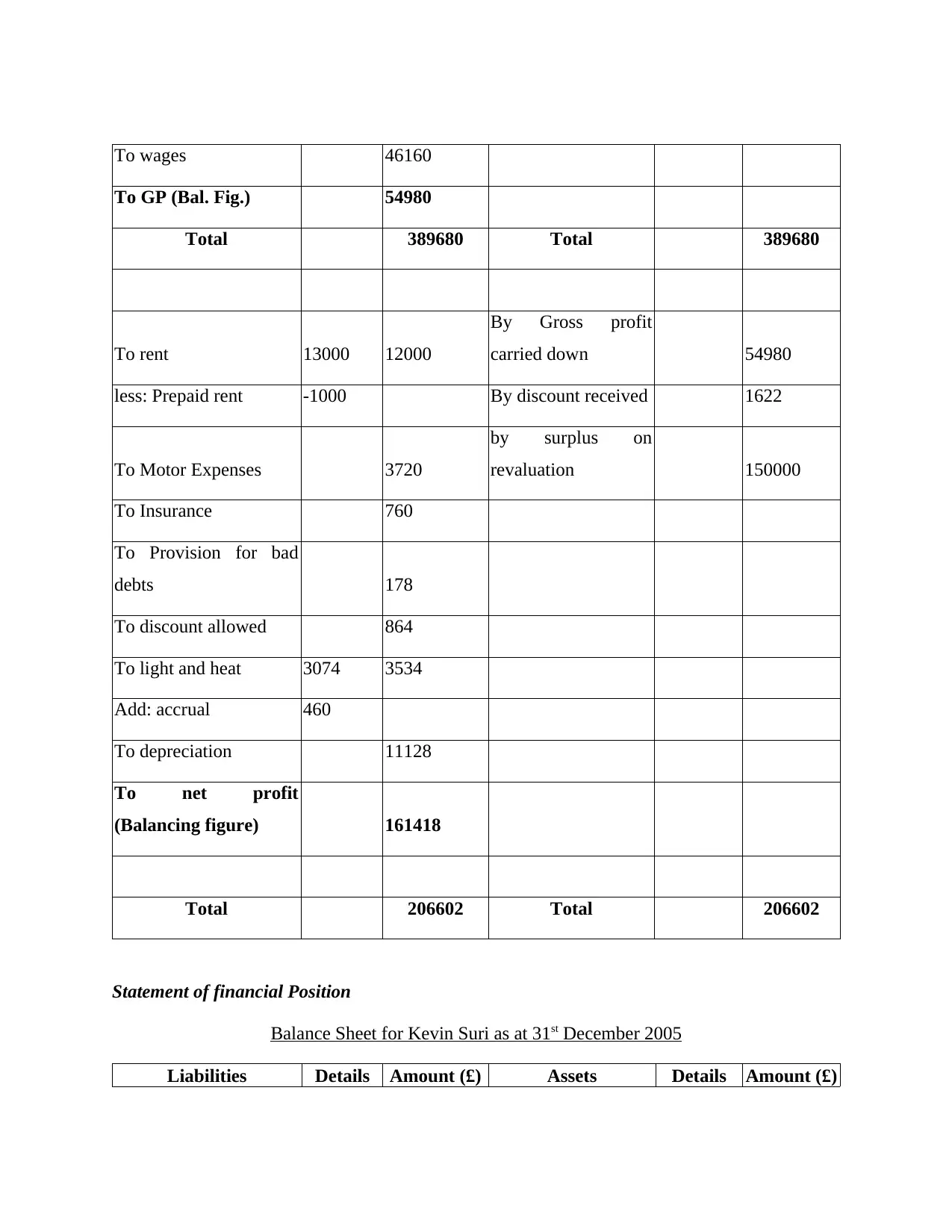

P3. Preparing final accounts after making adjustments (Case 3)

Income Statement

Statement of profit and loss for Kevin Suri fir the year end 31st December 2005

Particulars Details Amount (£) Particulars Details Amount (£)

To Opening inventory 23340 By sales 365200 364000

To Purchase 266800 265200 Less: return inwards -1200

Less: return outwards -1600 By inventory at end 25680

Above Trail balance has been prepared for Matthews for starting period of 9 days i.e.

from 1st January to 9th January. It has been identified that both the balance of account i.e. debit

balance and credit balance are matching with each other. Hence, it can be said that trial balance

has been prepared accurately along with recording all the transactions correctly by applying all

accepted accounting principles.

P3. Preparing final accounts after making adjustments (Case 3)

Income Statement

Statement of profit and loss for Kevin Suri fir the year end 31st December 2005

Particulars Details Amount (£) Particulars Details Amount (£)

To Opening inventory 23340 By sales 365200 364000

To Purchase 266800 265200 Less: return inwards -1200

Less: return outwards -1600 By inventory at end 25680

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

To wages 46160

To GP (Bal. Fig.) 54980

Total 389680 Total 389680

To rent 13000 12000

By Gross profit

carried down 54980

less: Prepaid rent -1000 By discount received 1622

To Motor Expenses 3720

by surplus on

revaluation 150000

To Insurance 760

To Provision for bad

debts 178

To discount allowed 864

To light and heat 3074 3534

Add: accrual 460

To depreciation 11128

To net profit

(Balancing figure) 161418

Total 206602 Total 206602

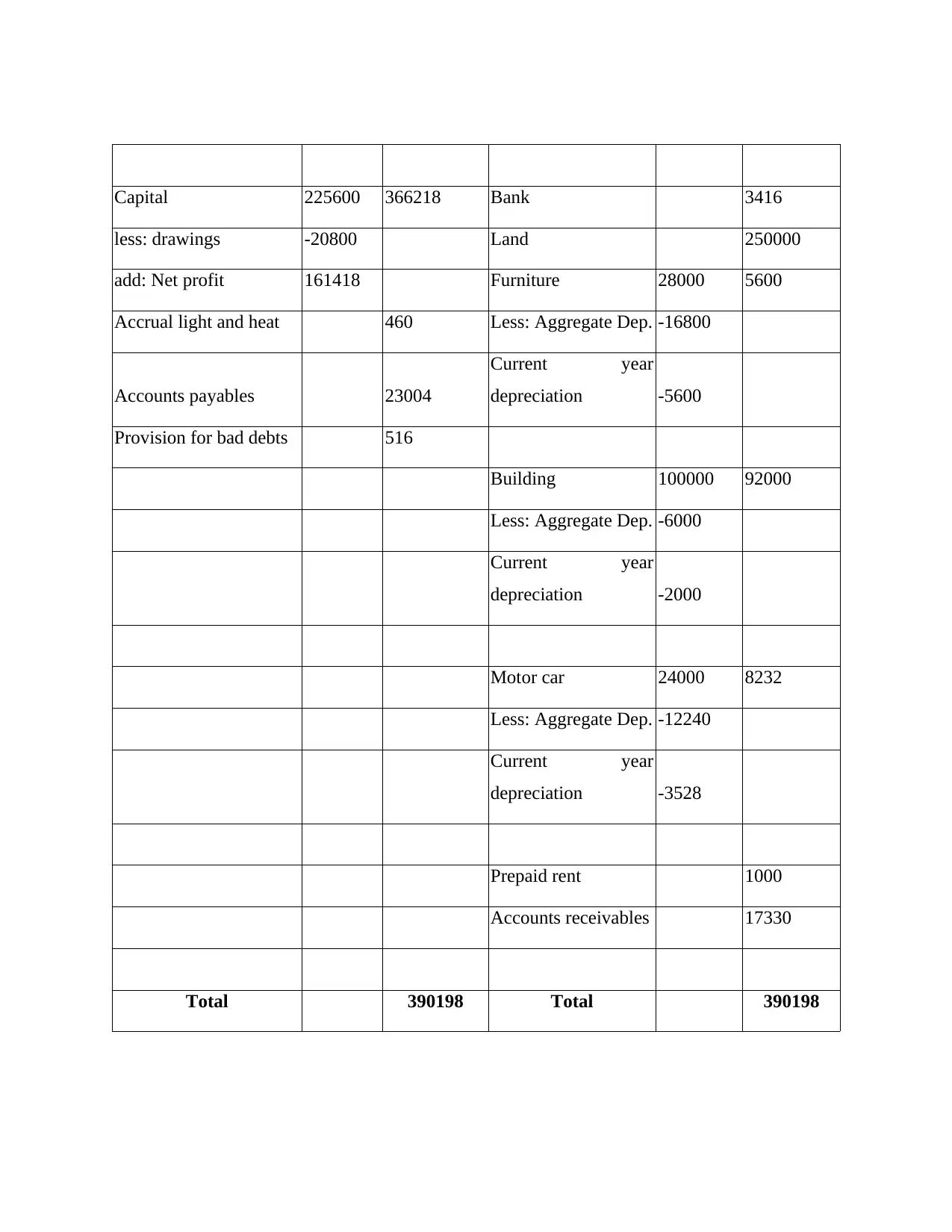

Statement of financial Position

Balance Sheet for Kevin Suri as at 31st December 2005

Liabilities Details Amount (£) Assets Details Amount (£)

To GP (Bal. Fig.) 54980

Total 389680 Total 389680

To rent 13000 12000

By Gross profit

carried down 54980

less: Prepaid rent -1000 By discount received 1622

To Motor Expenses 3720

by surplus on

revaluation 150000

To Insurance 760

To Provision for bad

debts 178

To discount allowed 864

To light and heat 3074 3534

Add: accrual 460

To depreciation 11128

To net profit

(Balancing figure) 161418

Total 206602 Total 206602

Statement of financial Position

Balance Sheet for Kevin Suri as at 31st December 2005

Liabilities Details Amount (£) Assets Details Amount (£)

Capital 225600 366218 Bank 3416

less: drawings -20800 Land 250000

add: Net profit 161418 Furniture 28000 5600

Accrual light and heat 460 Less: Aggregate Dep. -16800

Accounts payables 23004

Current year

depreciation -5600

Provision for bad debts 516

Building 100000 92000

Less: Aggregate Dep. -6000

Current year

depreciation -2000

Motor car 24000 8232

Less: Aggregate Dep. -12240

Current year

depreciation -3528

Prepaid rent 1000

Accounts receivables 17330

Total 390198 Total 390198

less: drawings -20800 Land 250000

add: Net profit 161418 Furniture 28000 5600

Accrual light and heat 460 Less: Aggregate Dep. -16800

Accounts payables 23004

Current year

depreciation -5600

Provision for bad debts 516

Building 100000 92000

Less: Aggregate Dep. -6000

Current year

depreciation -2000

Motor car 24000 8232

Less: Aggregate Dep. -12240

Current year

depreciation -3528

Prepaid rent 1000

Accounts receivables 17330

Total 390198 Total 390198

P4. Producing final accounts for sole trader and partnership (Case 3)

Financial accounts of Sole Trader

Sole trader is the person who is the single owner of a business also known as sole

proprietorship (Deegan, 2013). Main purpose of sole traders is profit earning and are also not

legally required to prepare and present their accounts. Main financial accounts that are prepared

by sole trader are:

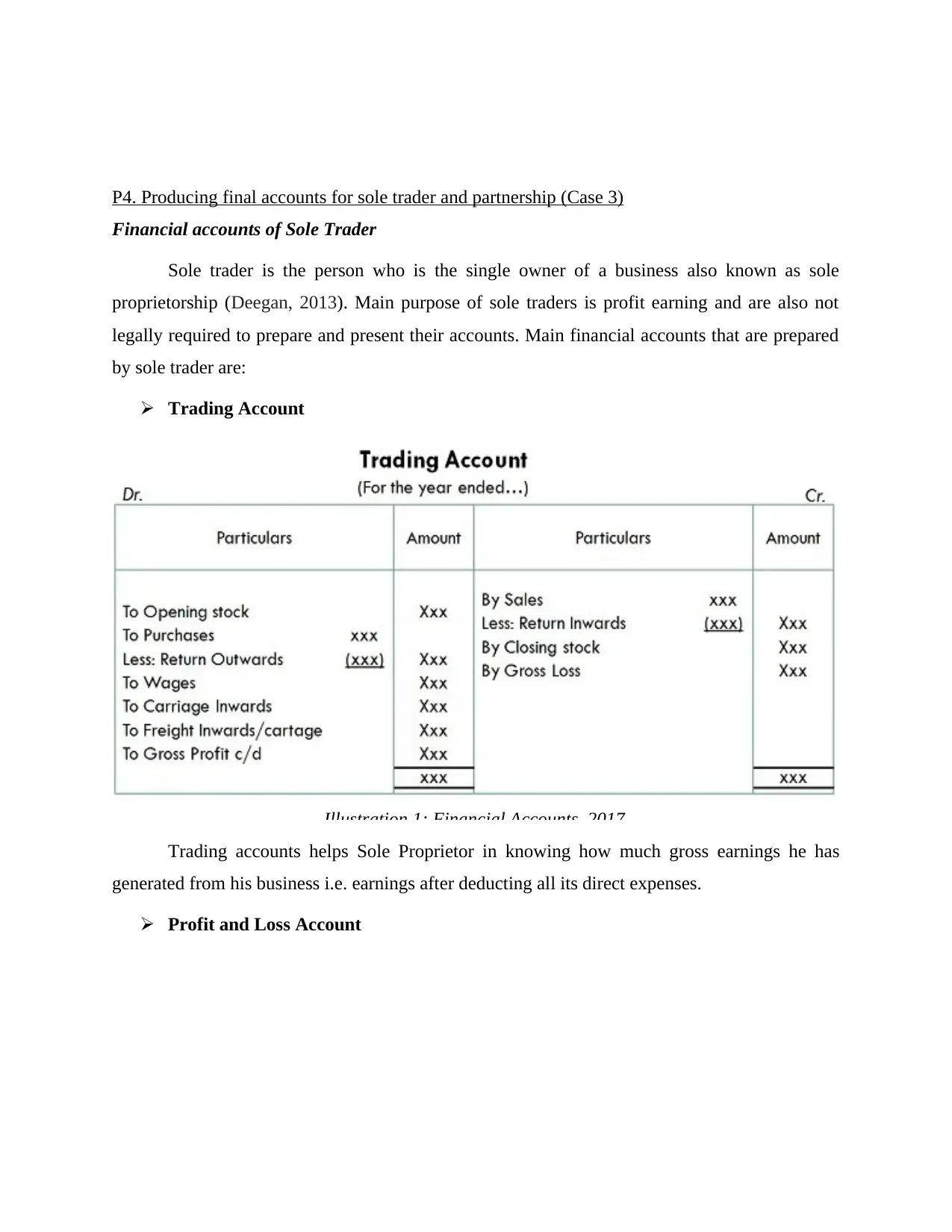

Trading Account

Illustration 1: Financial Accounts, 2017

Trading accounts helps Sole Proprietor in knowing how much gross earnings he has

generated from his business i.e. earnings after deducting all its direct expenses.

Profit and Loss Account

Financial accounts of Sole Trader

Sole trader is the person who is the single owner of a business also known as sole

proprietorship (Deegan, 2013). Main purpose of sole traders is profit earning and are also not

legally required to prepare and present their accounts. Main financial accounts that are prepared

by sole trader are:

Trading Account

Illustration 1: Financial Accounts, 2017

Trading accounts helps Sole Proprietor in knowing how much gross earnings he has

generated from his business i.e. earnings after deducting all its direct expenses.

Profit and Loss Account

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

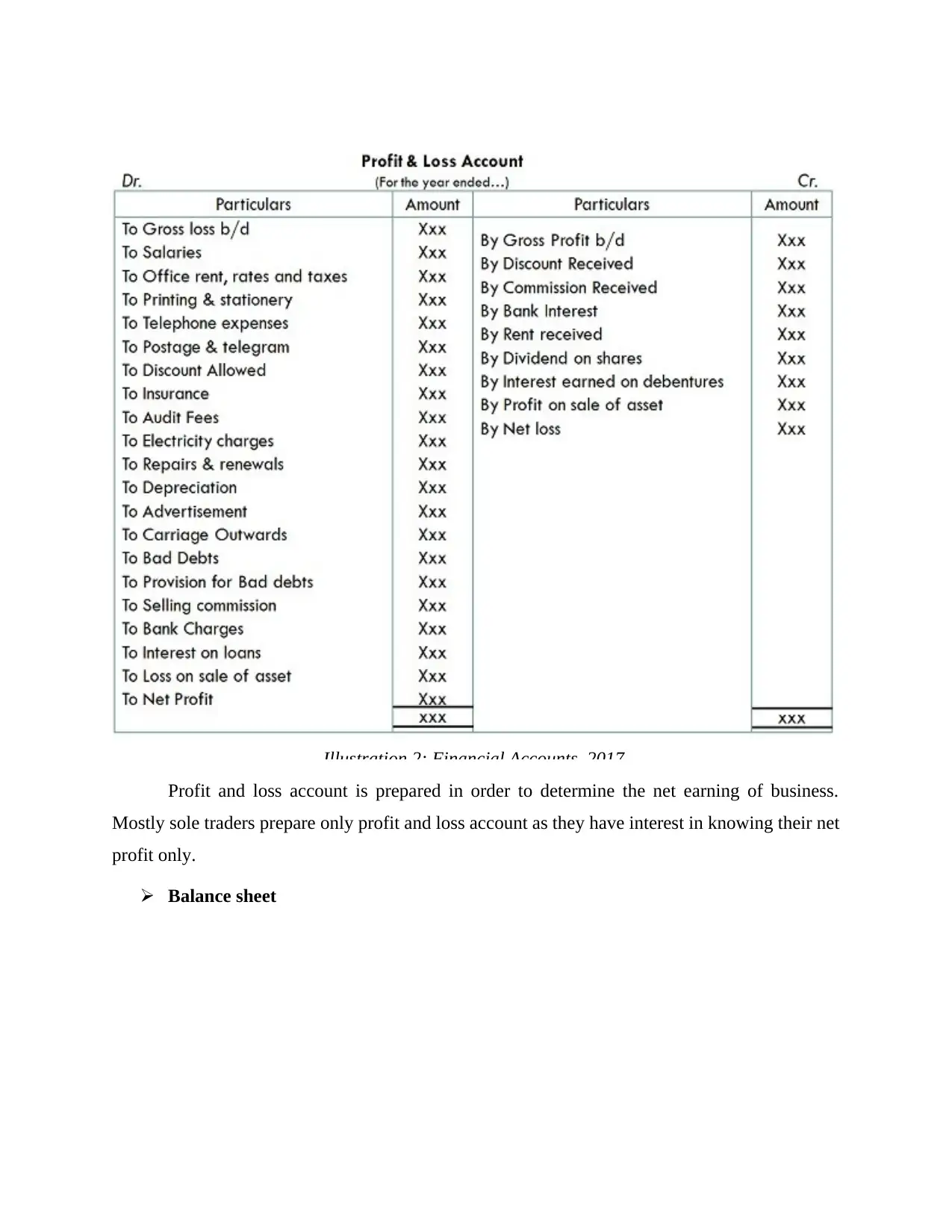

Illustration 2: Financial Accounts, 2017

Profit and loss account is prepared in order to determine the net earning of business.

Mostly sole traders prepare only profit and loss account as they have interest in knowing their net

profit only.

Balance sheet

Profit and loss account is prepared in order to determine the net earning of business.

Mostly sole traders prepare only profit and loss account as they have interest in knowing their net

profit only.

Balance sheet

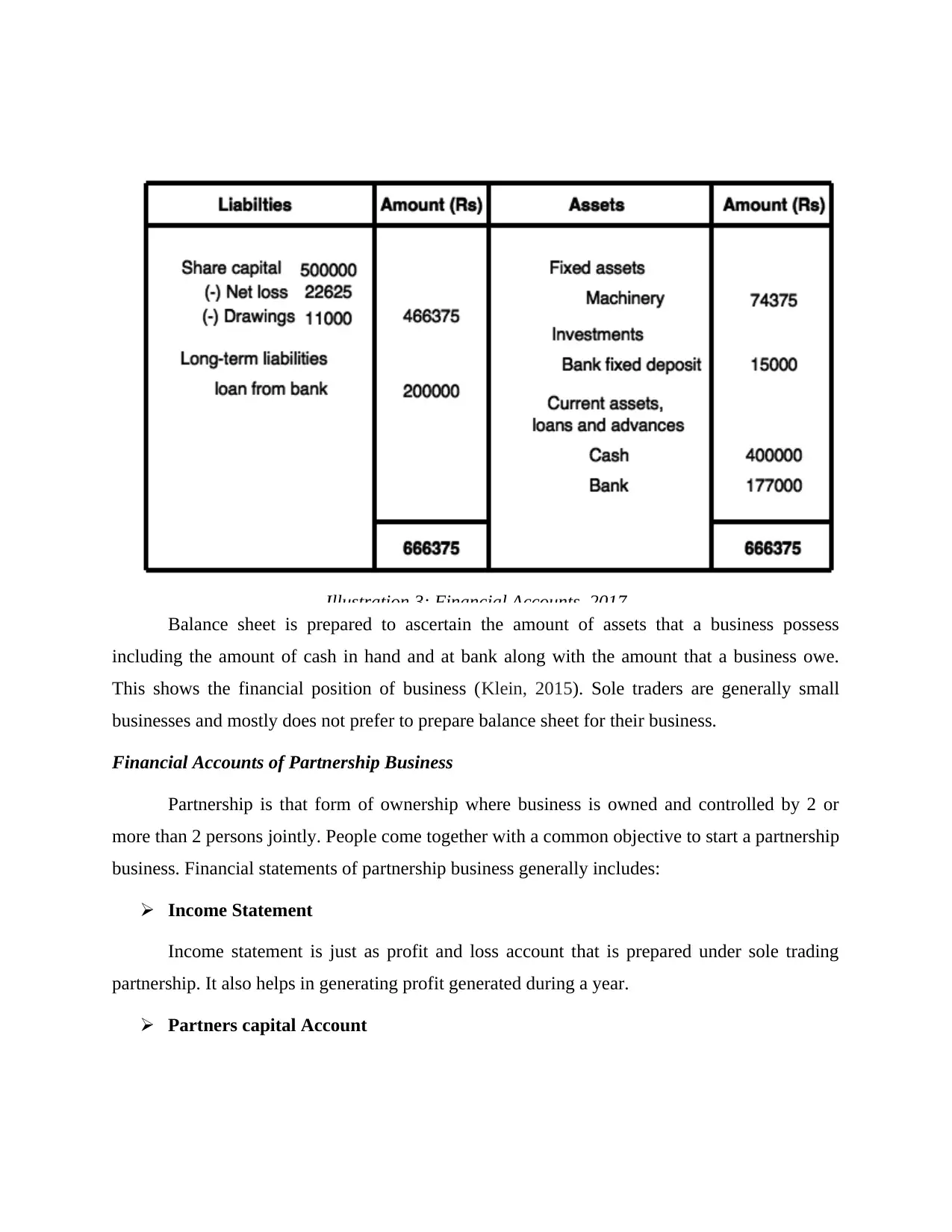

Balance sheet is prepared to ascertain the amount of assets that a business possess

including the amount of cash in hand and at bank along with the amount that a business owe.

This shows the financial position of business (Klein, 2015). Sole traders are generally small

businesses and mostly does not prefer to prepare balance sheet for their business.

Financial Accounts of Partnership Business

Partnership is that form of ownership where business is owned and controlled by 2 or

more than 2 persons jointly. People come together with a common objective to start a partnership

business. Financial statements of partnership business generally includes:

Income Statement

Income statement is just as profit and loss account that is prepared under sole trading

partnership. It also helps in generating profit generated during a year.

Partners capital Account

Illustration 3: Financial Accounts, 2017

including the amount of cash in hand and at bank along with the amount that a business owe.

This shows the financial position of business (Klein, 2015). Sole traders are generally small

businesses and mostly does not prefer to prepare balance sheet for their business.

Financial Accounts of Partnership Business

Partnership is that form of ownership where business is owned and controlled by 2 or

more than 2 persons jointly. People come together with a common objective to start a partnership

business. Financial statements of partnership business generally includes:

Income Statement

Income statement is just as profit and loss account that is prepared under sole trading

partnership. It also helps in generating profit generated during a year.

Partners capital Account

Illustration 3: Financial Accounts, 2017

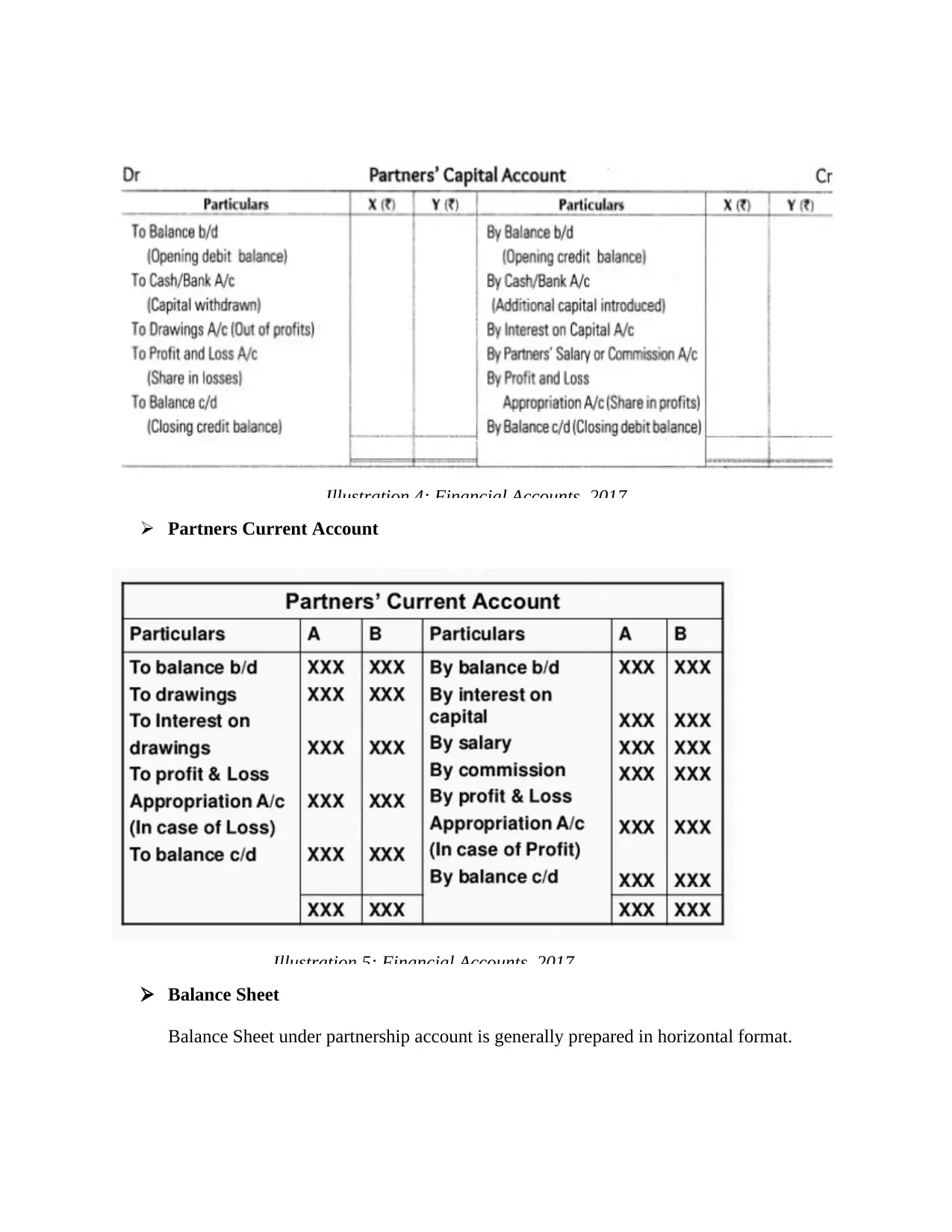

Illustration 4: Financial Accounts, 2017

Partners Current Account

Illustration 5: Financial Accounts, 2017

Balance Sheet

Balance Sheet under partnership account is generally prepared in horizontal format.

Partners Current Account

Illustration 5: Financial Accounts, 2017

Balance Sheet

Balance Sheet under partnership account is generally prepared in horizontal format.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

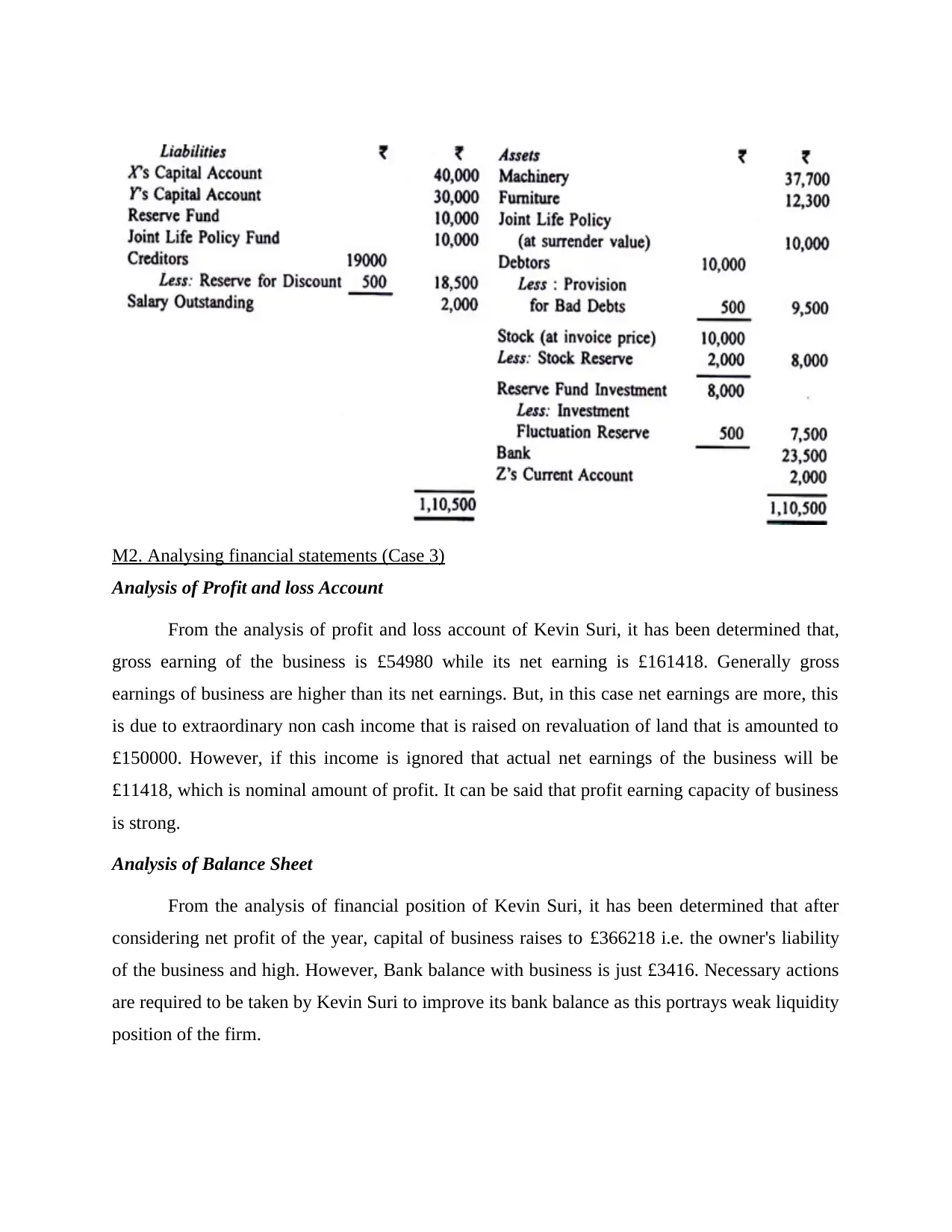

M2. Analysing financial statements (Case 3)

Analysis of Profit and loss Account

From the analysis of profit and loss account of Kevin Suri, it has been determined that,

gross earning of the business is £54980 while its net earning is £161418. Generally gross

earnings of business are higher than its net earnings. But, in this case net earnings are more, this

is due to extraordinary non cash income that is raised on revaluation of land that is amounted to

£150000. However, if this income is ignored that actual net earnings of the business will be

£11418, which is nominal amount of profit. It can be said that profit earning capacity of business

is strong.

Analysis of Balance Sheet

From the analysis of financial position of Kevin Suri, it has been determined that after

considering net profit of the year, capital of business raises to £366218 i.e. the owner's liability

of the business and high. However, Bank balance with business is just £3416. Necessary actions

are required to be taken by Kevin Suri to improve its bank balance as this portrays weak liquidity

position of the firm.

Analysis of Profit and loss Account

From the analysis of profit and loss account of Kevin Suri, it has been determined that,

gross earning of the business is £54980 while its net earning is £161418. Generally gross

earnings of business are higher than its net earnings. But, in this case net earnings are more, this

is due to extraordinary non cash income that is raised on revaluation of land that is amounted to

£150000. However, if this income is ignored that actual net earnings of the business will be

£11418, which is nominal amount of profit. It can be said that profit earning capacity of business

is strong.

Analysis of Balance Sheet

From the analysis of financial position of Kevin Suri, it has been determined that after

considering net profit of the year, capital of business raises to £366218 i.e. the owner's liability

of the business and high. However, Bank balance with business is just £3416. Necessary actions

are required to be taken by Kevin Suri to improve its bank balance as this portrays weak liquidity

position of the firm.

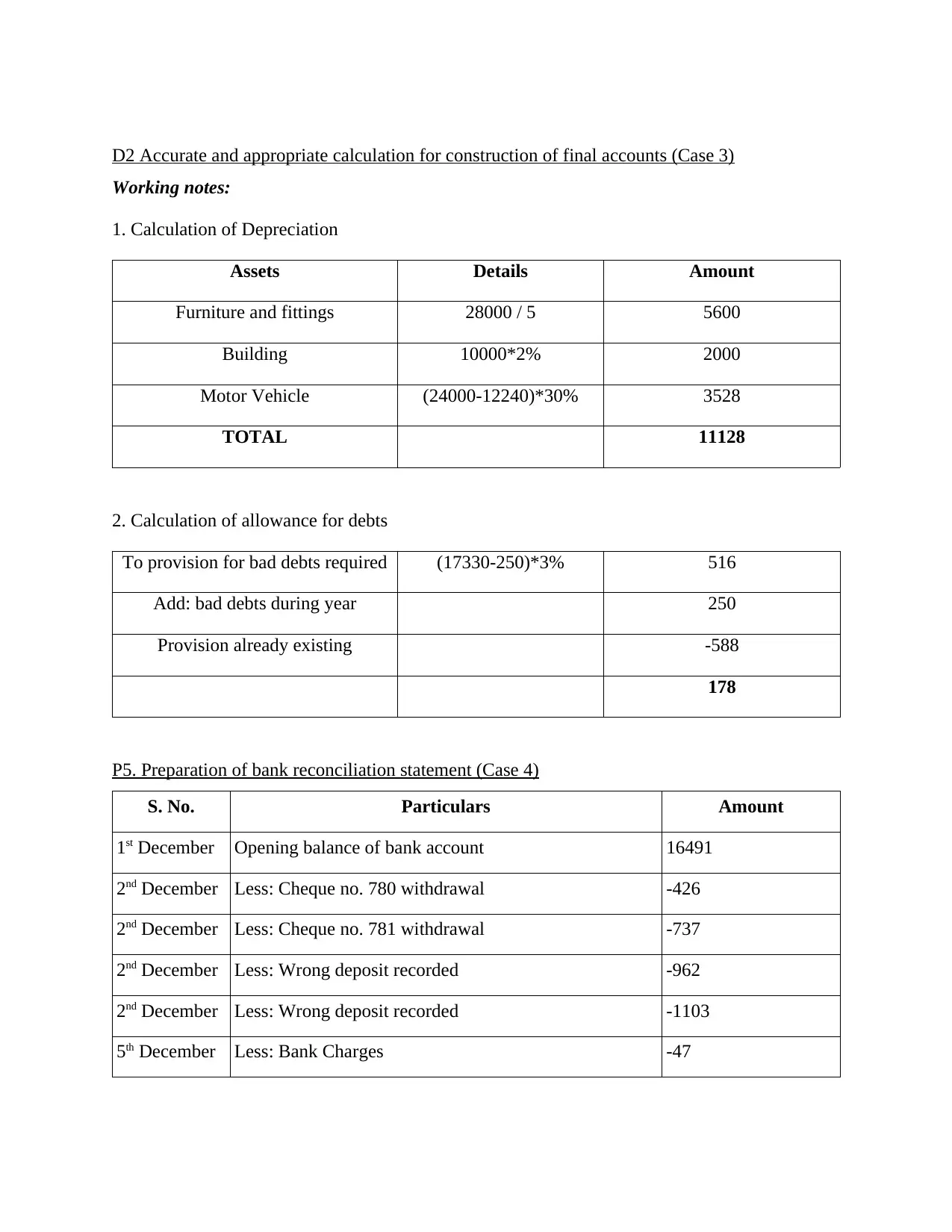

D2 Accurate and appropriate calculation for construction of final accounts (Case 3)

Working notes:

1. Calculation of Depreciation

Assets Details Amount

Furniture and fittings 28000 / 5 5600

Building 10000*2% 2000

Motor Vehicle (24000-12240)*30% 3528

TOTAL 11128

2. Calculation of allowance for debts

To provision for bad debts required (17330-250)*3% 516

Add: bad debts during year 250

Provision already existing -588

178

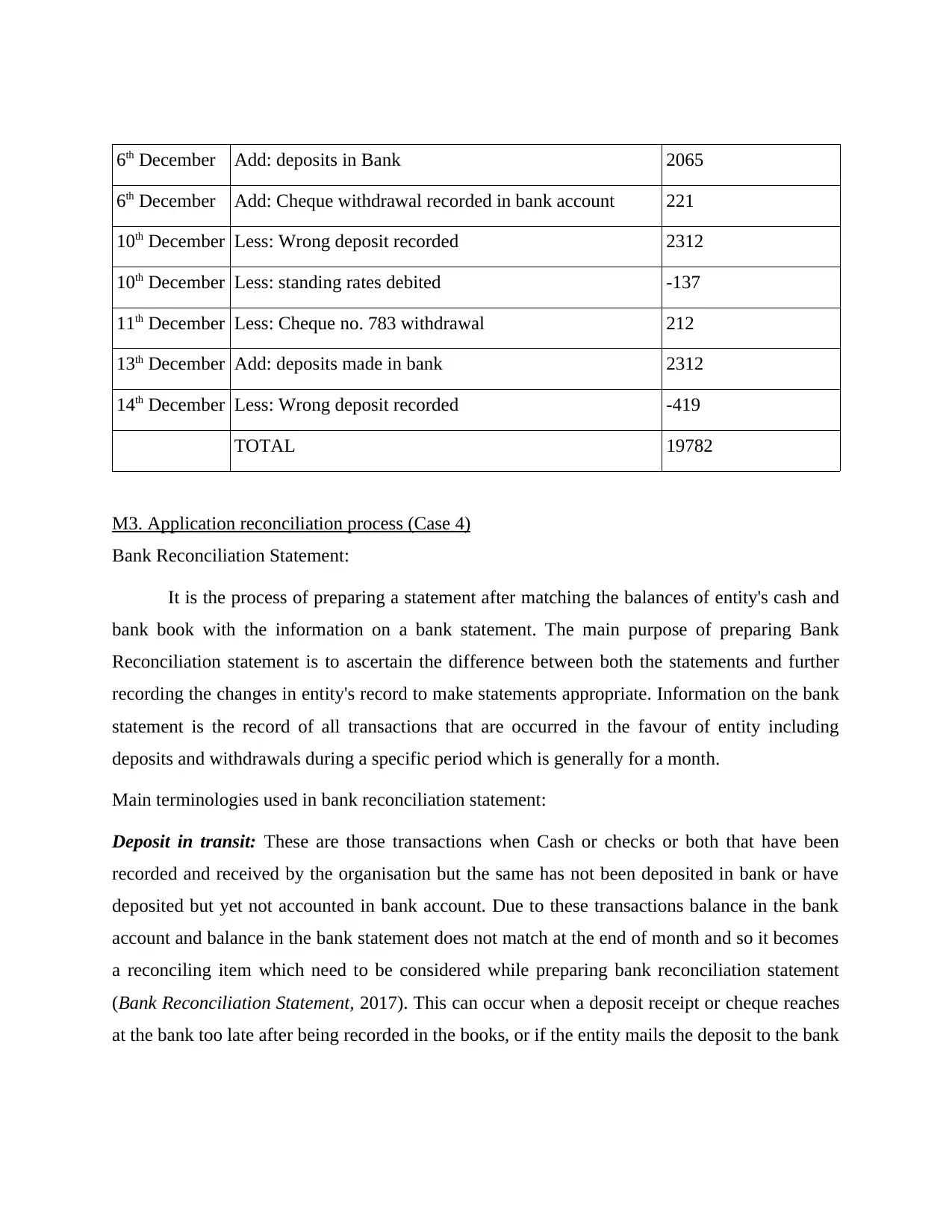

P5. Preparation of bank reconciliation statement (Case 4)

S. No. Particulars Amount

1st December Opening balance of bank account 16491

2nd December Less: Cheque no. 780 withdrawal -426

2nd December Less: Cheque no. 781 withdrawal -737

2nd December Less: Wrong deposit recorded -962

2nd December Less: Wrong deposit recorded -1103

5th December Less: Bank Charges -47

Working notes:

1. Calculation of Depreciation

Assets Details Amount

Furniture and fittings 28000 / 5 5600

Building 10000*2% 2000

Motor Vehicle (24000-12240)*30% 3528

TOTAL 11128

2. Calculation of allowance for debts

To provision for bad debts required (17330-250)*3% 516

Add: bad debts during year 250

Provision already existing -588

178

P5. Preparation of bank reconciliation statement (Case 4)

S. No. Particulars Amount

1st December Opening balance of bank account 16491

2nd December Less: Cheque no. 780 withdrawal -426

2nd December Less: Cheque no. 781 withdrawal -737

2nd December Less: Wrong deposit recorded -962

2nd December Less: Wrong deposit recorded -1103

5th December Less: Bank Charges -47

6th December Add: deposits in Bank 2065

6th December Add: Cheque withdrawal recorded in bank account 221

10th December Less: Wrong deposit recorded 2312

10th December Less: standing rates debited -137

11th December Less: Cheque no. 783 withdrawal 212

13th December Add: deposits made in bank 2312

14th December Less: Wrong deposit recorded -419

TOTAL 19782

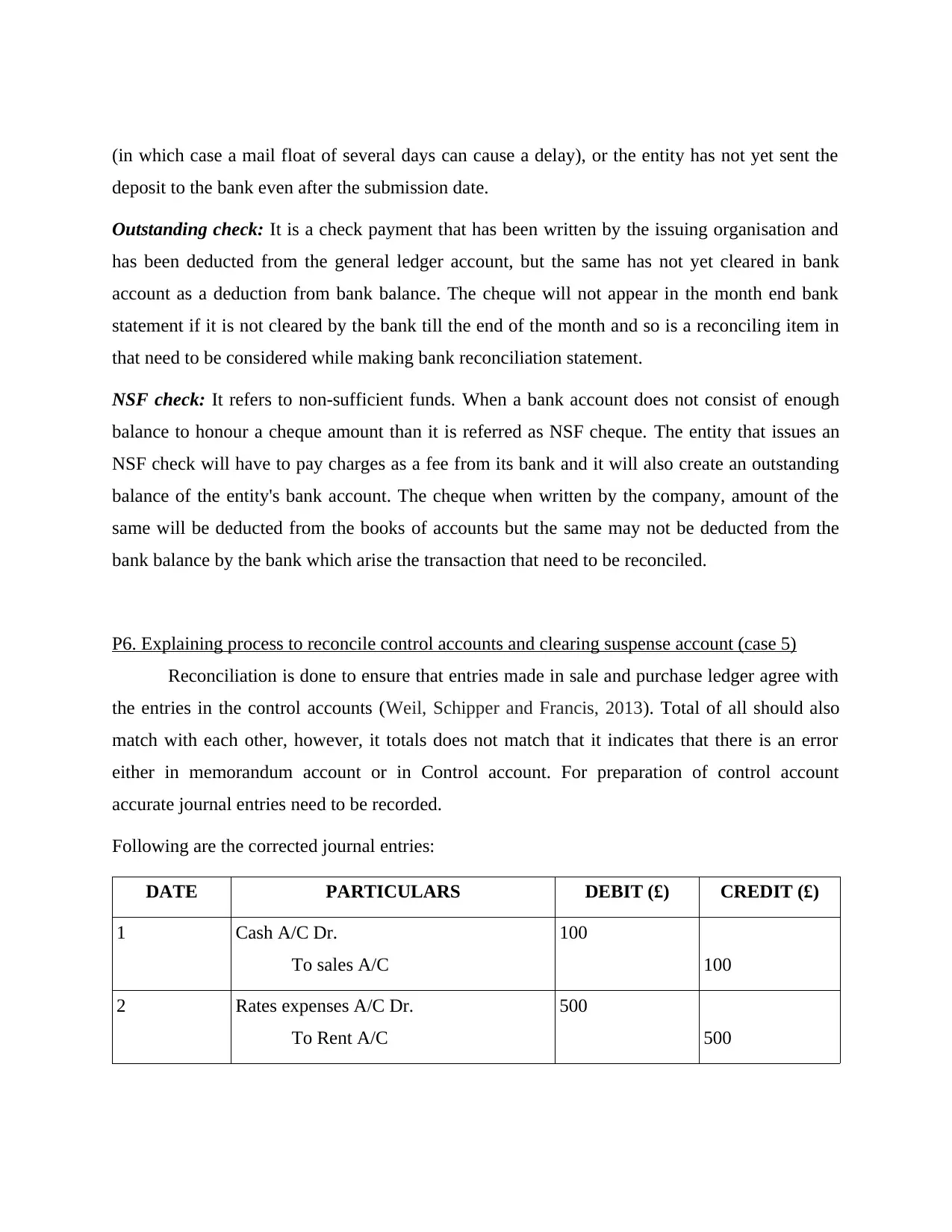

M3. Application reconciliation process (Case 4)

Bank Reconciliation Statement:

It is the process of preparing a statement after matching the balances of entity's cash and

bank book with the information on a bank statement. The main purpose of preparing Bank

Reconciliation statement is to ascertain the difference between both the statements and further

recording the changes in entity's record to make statements appropriate. Information on the bank

statement is the record of all transactions that are occurred in the favour of entity including

deposits and withdrawals during a specific period which is generally for a month.

Main terminologies used in bank reconciliation statement:

Deposit in transit: These are those transactions when Cash or checks or both that have been

recorded and received by the organisation but the same has not been deposited in bank or have

deposited but yet not accounted in bank account. Due to these transactions balance in the bank

account and balance in the bank statement does not match at the end of month and so it becomes

a reconciling item which need to be considered while preparing bank reconciliation statement

(Bank Reconciliation Statement, 2017). This can occur when a deposit receipt or cheque reaches

at the bank too late after being recorded in the books, or if the entity mails the deposit to the bank

6th December Add: Cheque withdrawal recorded in bank account 221

10th December Less: Wrong deposit recorded 2312

10th December Less: standing rates debited -137

11th December Less: Cheque no. 783 withdrawal 212

13th December Add: deposits made in bank 2312

14th December Less: Wrong deposit recorded -419

TOTAL 19782

M3. Application reconciliation process (Case 4)

Bank Reconciliation Statement:

It is the process of preparing a statement after matching the balances of entity's cash and

bank book with the information on a bank statement. The main purpose of preparing Bank

Reconciliation statement is to ascertain the difference between both the statements and further

recording the changes in entity's record to make statements appropriate. Information on the bank

statement is the record of all transactions that are occurred in the favour of entity including

deposits and withdrawals during a specific period which is generally for a month.

Main terminologies used in bank reconciliation statement:

Deposit in transit: These are those transactions when Cash or checks or both that have been

recorded and received by the organisation but the same has not been deposited in bank or have

deposited but yet not accounted in bank account. Due to these transactions balance in the bank

account and balance in the bank statement does not match at the end of month and so it becomes

a reconciling item which need to be considered while preparing bank reconciliation statement

(Bank Reconciliation Statement, 2017). This can occur when a deposit receipt or cheque reaches

at the bank too late after being recorded in the books, or if the entity mails the deposit to the bank

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(in which case a mail float of several days can cause a delay), or the entity has not yet sent the

deposit to the bank even after the submission date.

Outstanding check: It is a check payment that has been written by the issuing organisation and

has been deducted from the general ledger account, but the same has not yet cleared in bank

account as a deduction from bank balance. The cheque will not appear in the month end bank

statement if it is not cleared by the bank till the end of the month and so is a reconciling item in

that need to be considered while making bank reconciliation statement.

NSF check: It refers to non-sufficient funds. When a bank account does not consist of enough

balance to honour a cheque amount than it is referred as NSF cheque. The entity that issues an

NSF check will have to pay charges as a fee from its bank and it will also create an outstanding

balance of the entity's bank account. The cheque when written by the company, amount of the

same will be deducted from the books of accounts but the same may not be deducted from the

bank balance by the bank which arise the transaction that need to be reconciled.

P6. Explaining process to reconcile control accounts and clearing suspense account (case 5)

Reconciliation is done to ensure that entries made in sale and purchase ledger agree with

the entries in the control accounts (Weil, Schipper and Francis, 2013). Total of all should also

match with each other, however, it totals does not match that it indicates that there is an error

either in memorandum account or in Control account. For preparation of control account

accurate journal entries need to be recorded.

Following are the corrected journal entries:

DATE PARTICULARS DEBIT (£) CREDIT (£)

1 Cash A/C Dr.

To sales A/C

100

100

2 Rates expenses A/C Dr.

To Rent A/C

500

500

deposit to the bank even after the submission date.

Outstanding check: It is a check payment that has been written by the issuing organisation and

has been deducted from the general ledger account, but the same has not yet cleared in bank

account as a deduction from bank balance. The cheque will not appear in the month end bank

statement if it is not cleared by the bank till the end of the month and so is a reconciling item in

that need to be considered while making bank reconciliation statement.

NSF check: It refers to non-sufficient funds. When a bank account does not consist of enough

balance to honour a cheque amount than it is referred as NSF cheque. The entity that issues an

NSF check will have to pay charges as a fee from its bank and it will also create an outstanding

balance of the entity's bank account. The cheque when written by the company, amount of the

same will be deducted from the books of accounts but the same may not be deducted from the

bank balance by the bank which arise the transaction that need to be reconciled.

P6. Explaining process to reconcile control accounts and clearing suspense account (case 5)

Reconciliation is done to ensure that entries made in sale and purchase ledger agree with

the entries in the control accounts (Weil, Schipper and Francis, 2013). Total of all should also

match with each other, however, it totals does not match that it indicates that there is an error

either in memorandum account or in Control account. For preparation of control account

accurate journal entries need to be recorded.

Following are the corrected journal entries:

DATE PARTICULARS DEBIT (£) CREDIT (£)

1 Cash A/C Dr.

To sales A/C

100

100

2 Rates expenses A/C Dr.

To Rent A/C

500

500

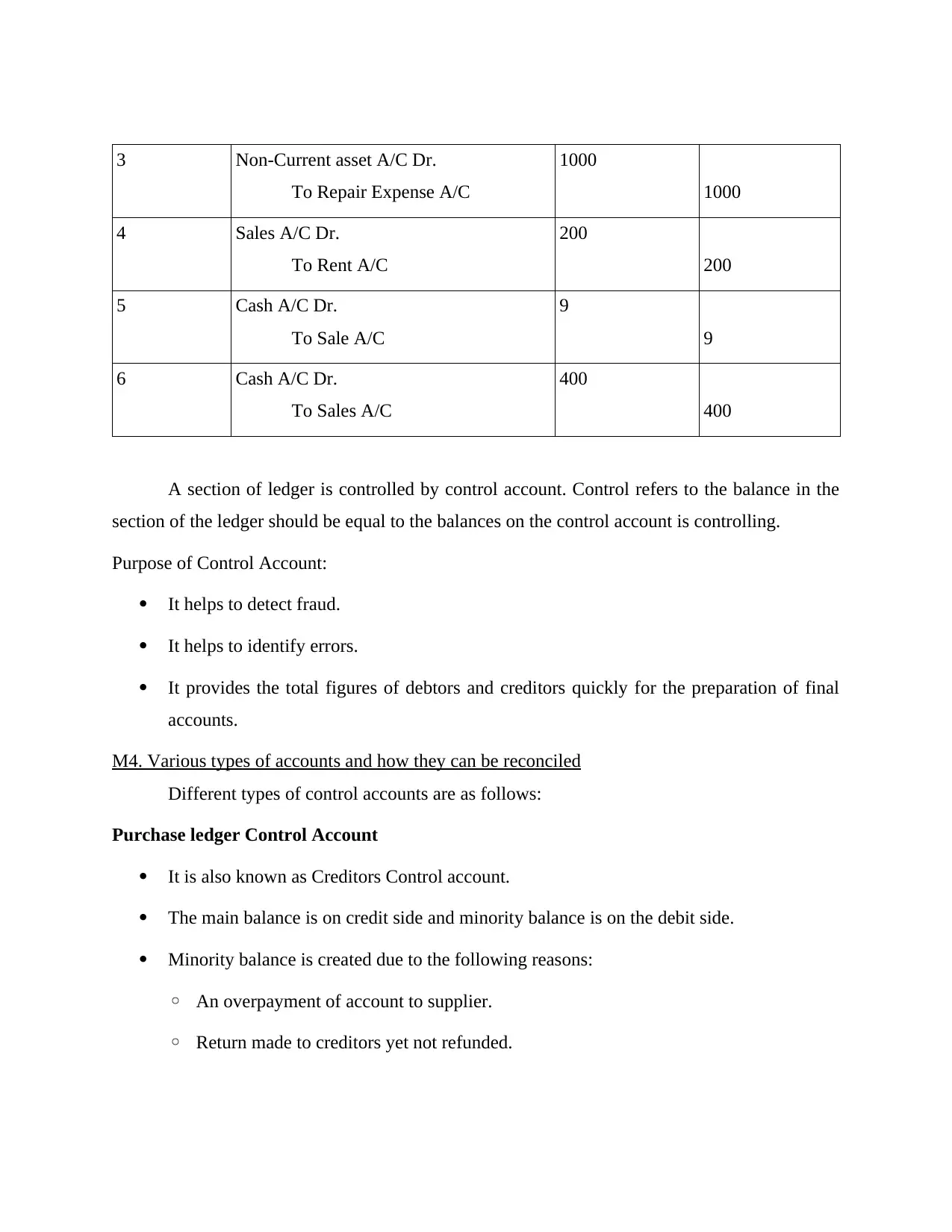

3 Non-Current asset A/C Dr.

To Repair Expense A/C

1000

1000

4 Sales A/C Dr.

To Rent A/C

200

200

5 Cash A/C Dr.

To Sale A/C

9

9

6 Cash A/C Dr.

To Sales A/C

400

400

A section of ledger is controlled by control account. Control refers to the balance in the

section of the ledger should be equal to the balances on the control account is controlling.

Purpose of Control Account:

It helps to detect fraud.

It helps to identify errors.

It provides the total figures of debtors and creditors quickly for the preparation of final

accounts.

M4. Various types of accounts and how they can be reconciled

Different types of control accounts are as follows:

Purchase ledger Control Account

It is also known as Creditors Control account.

The main balance is on credit side and minority balance is on the debit side.

Minority balance is created due to the following reasons:

◦ An overpayment of account to supplier.

◦ Return made to creditors yet not refunded.

To Repair Expense A/C

1000

1000

4 Sales A/C Dr.

To Rent A/C

200

200

5 Cash A/C Dr.

To Sale A/C

9

9

6 Cash A/C Dr.

To Sales A/C

400

400

A section of ledger is controlled by control account. Control refers to the balance in the

section of the ledger should be equal to the balances on the control account is controlling.

Purpose of Control Account:

It helps to detect fraud.

It helps to identify errors.

It provides the total figures of debtors and creditors quickly for the preparation of final

accounts.

M4. Various types of accounts and how they can be reconciled

Different types of control accounts are as follows:

Purchase ledger Control Account

It is also known as Creditors Control account.

The main balance is on credit side and minority balance is on the debit side.

Minority balance is created due to the following reasons:

◦ An overpayment of account to supplier.

◦ Return made to creditors yet not refunded.

◦ Deposit made to suppliers.

Sales ledger Control Account

It is also known as Debtor control account.

It has the main balance in the debit side and minority balance on the credit side

(Williams, 2014).

Minority balance is created due to the following reasons:

◦ An Overpayment of account by the customers.

◦ Return Made by Debtors not yet refunded.

◦ Deposit made by customers

Cash sales are not recorded in the sales ledger control account.

Provision for doubtful debts also is not considered in sales ledger control account because

provision accounts are considered in general ledger account.

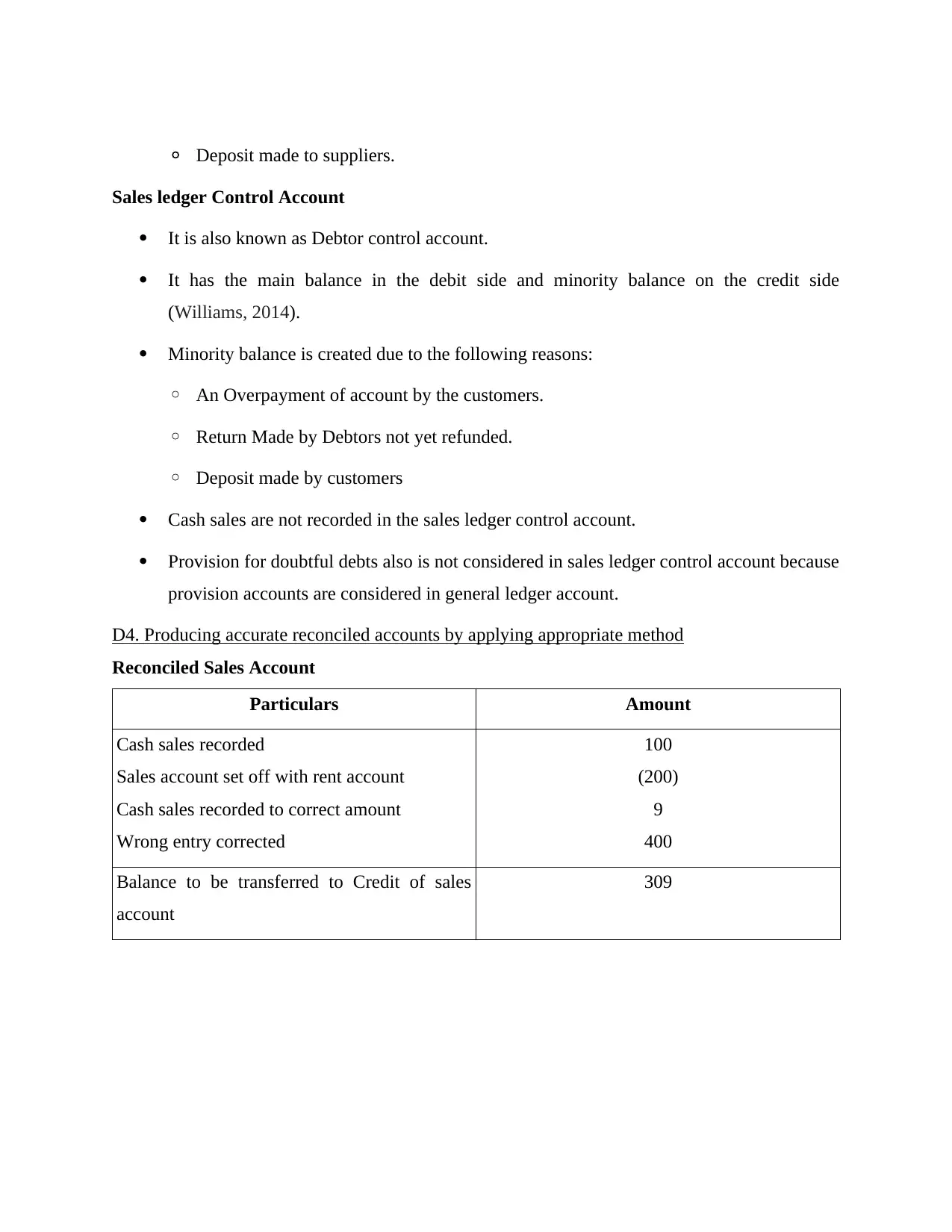

D4. Producing accurate reconciled accounts by applying appropriate method

Reconciled Sales Account

Particulars Amount

Cash sales recorded

Sales account set off with rent account

Cash sales recorded to correct amount

Wrong entry corrected

100

(200)

9

400

Balance to be transferred to Credit of sales

account

309

Sales ledger Control Account

It is also known as Debtor control account.

It has the main balance in the debit side and minority balance on the credit side

(Williams, 2014).

Minority balance is created due to the following reasons:

◦ An Overpayment of account by the customers.

◦ Return Made by Debtors not yet refunded.

◦ Deposit made by customers

Cash sales are not recorded in the sales ledger control account.

Provision for doubtful debts also is not considered in sales ledger control account because

provision accounts are considered in general ledger account.

D4. Producing accurate reconciled accounts by applying appropriate method

Reconciled Sales Account

Particulars Amount

Cash sales recorded

Sales account set off with rent account

Cash sales recorded to correct amount

Wrong entry corrected

100

(200)

9

400

Balance to be transferred to Credit of sales

account

309

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.