Financial Accounting: Comprehensive Review of Client Transactions

VerifiedAdded on 2020/06/04

|23

|7737

|49

Homework Assignment

AI Summary

This financial accounting assignment presents a detailed exploration of accounting principles through the analysis of client transactions. It includes journal entries, covering various financial activities such as purchases, sales, payments, and returns. The assignment also incorporates the application of accounting rules and principles like GAAP, entity rules, and measurement rules to different client scenarios. The solution provides a comprehensive overview of how to record and interpret financial transactions, including the creation of financial statements and the application of accounting conventions. The assignment covers a wide range of transactions, from initial capital investments to day-to-day operational expenses, and illustrates the importance of accurate financial reporting for decision-making and compliance with accounting standards. It also encompasses the preparation of journal entries for the month of May 2016 and May 2017, offering insights into the practical application of financial accounting concepts.

Financial Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MEANING OF FINANCIAL ACCOUNTING...............................................................................1

REGULATIONS RELATED TO FINANCIAL ACCOUNTING..................................................2

ACCOUNTING RULES AND PRINCIPLES................................................................................2

CONVENTIONS & CONCEPTS RELATED TO CONSISTENCY & MATERIAL

DISCLOSURE ................................................................................................................................3

CLIENT 1........................................................................................................................................4

CLIENT 2......................................................................................................................................13

CLIENT 3......................................................................................................................................15

CLIENT 4 ...................................................................................................................................16

CLIENT 5......................................................................................................................................17

CLIENT 6......................................................................................................................................17

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

INTRODUCTION...........................................................................................................................1

MEANING OF FINANCIAL ACCOUNTING...............................................................................1

REGULATIONS RELATED TO FINANCIAL ACCOUNTING..................................................2

ACCOUNTING RULES AND PRINCIPLES................................................................................2

CONVENTIONS & CONCEPTS RELATED TO CONSISTENCY & MATERIAL

DISCLOSURE ................................................................................................................................3

CLIENT 1........................................................................................................................................4

CLIENT 2......................................................................................................................................13

CLIENT 3......................................................................................................................................15

CLIENT 4 ...................................................................................................................................16

CLIENT 5......................................................................................................................................17

CLIENT 6......................................................................................................................................17

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

INTRODUCTION

Financial accounting is a process which is used to disc the financial and accounting

information of an organisation in a specified structure. Financial accounting is a procedure of

recording, summarising and transcript the information as per accounting principles and

standards. Business operations contains various type of activities and financial transactions.

These transactions are required to be recorded in a specific format and structure (Ball, 2013).

Financial standards and accounting principles provide a structure to record these transactions in a

specific format. Financial position statement, cash flow and fund flow statement, balance sheet

as well as income statements are the formats which are followed in general business.

MEANING OF FINANCIAL ACCOUNTING

Financial accounting is considered as a series of set of rules, standards, regulations and

principles. Financial accounting standards are given by Financial Standards Boards and GAAP

(Generally Accepted Accounting Principles). It is one of the branches of evaluation and reporting

of financial statements and reports. Recording the monetary and non-monetary transactions in

books, preparing financial statements and cost accounting are the main areas considered in

financial accounting (Ball, Kothari and Nikolaev, 2013)

Financial reporting is one of the key criteria which help in managerial accounting.

Financial reporting helps in summarising the records and information to finalise the conclusion.

These information are also used in decision making strategies (Radebaugh, 2014). It is a style of

presenting financial information in the form of financial statements. These information are useful

for stakeholders, investors, financiers and for public. Basically, Historical Cost Accounting

(HCA) or Constant Purchasing Power Accounting (CPPA) are used while preparing financial

accounts. Cash flow statement, profit and loss account or income and expenditure statement as

well as financial position statement are considered in the financial statements.

Systematic recording and storing of information, determine the results as per the

transactions, define the financial position of business, providing required information to

managers for making strategies and plans, find out solvency position of organisation are the main

objective of financial accounting (Brown and et. al., 2015). There are five main bifurcations

made subject to financial transactions like revenues, expenses, assets, liabilities and equity,

revenue and expenditures. There are two type of transactions are fund such as capital nature

1

Financial accounting is a process which is used to disc the financial and accounting

information of an organisation in a specified structure. Financial accounting is a procedure of

recording, summarising and transcript the information as per accounting principles and

standards. Business operations contains various type of activities and financial transactions.

These transactions are required to be recorded in a specific format and structure (Ball, 2013).

Financial standards and accounting principles provide a structure to record these transactions in a

specific format. Financial position statement, cash flow and fund flow statement, balance sheet

as well as income statements are the formats which are followed in general business.

MEANING OF FINANCIAL ACCOUNTING

Financial accounting is considered as a series of set of rules, standards, regulations and

principles. Financial accounting standards are given by Financial Standards Boards and GAAP

(Generally Accepted Accounting Principles). It is one of the branches of evaluation and reporting

of financial statements and reports. Recording the monetary and non-monetary transactions in

books, preparing financial statements and cost accounting are the main areas considered in

financial accounting (Ball, Kothari and Nikolaev, 2013)

Financial reporting is one of the key criteria which help in managerial accounting.

Financial reporting helps in summarising the records and information to finalise the conclusion.

These information are also used in decision making strategies (Radebaugh, 2014). It is a style of

presenting financial information in the form of financial statements. These information are useful

for stakeholders, investors, financiers and for public. Basically, Historical Cost Accounting

(HCA) or Constant Purchasing Power Accounting (CPPA) are used while preparing financial

accounts. Cash flow statement, profit and loss account or income and expenditure statement as

well as financial position statement are considered in the financial statements.

Systematic recording and storing of information, determine the results as per the

transactions, define the financial position of business, providing required information to

managers for making strategies and plans, find out solvency position of organisation are the main

objective of financial accounting (Brown and et. al., 2015). There are five main bifurcations

made subject to financial transactions like revenues, expenses, assets, liabilities and equity,

revenue and expenditures. There are two type of transactions are fund such as capital nature

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

transaction and revenue nature transaction. As per rules, principles provided by GAAP, capital

expenditures and incomes must be presented in the balance sheet and financial position

statements and revenue nature income and expenditures must be shown in profit and loss

statements or income statements. All the current and non current liabilities and assets are shown

in balance sheet(Francis, Hasan and Wu, 2013).

REGULATIONS RELATED TO FINANCIAL ACCOUNTING

Financial accounting rules and principles are controlled and sans action by both general

and international accounting standard boards (DRURY, 2013). GAAP (Generally Accepted

Accounting Principles) is one of the authorised bodies which provide standards and principles

regarding financial and accounting (Nilsson and Stockenstrand, 2015). It provides guidelines

which are used in the organisational context. International Financial Reporting Standards (IFRS)

is one of the governed authorities which issued rules and standards subjected to financial and

accounting reporting. It is a set of passionate accounting standards which help to bifurcate the

nature of transactions in different sections. International Accounting Standards Board (IASB)

issue the IFRS rules and regulations.

ACCOUNTING RULES AND PRINCIPLES

Accounting rules and principles are also known as GAAP.

(a) Boundary rules

Entity rules: This rule tells the definition of an entity and separates the existence of

organisation from the owner. It indicates towards the ownership and responsibilities of entity and

bifurcate the owner’s role in organisation.

Periodicity rule: As per this rule, all the transactions and records must be maintained for

annual basis. Period of maintaining records is 12 months (Gaffikin, 2014).

Going concern: It is an assumption subjected to existence of organisation. As per this

assumption, it is estimated that organisation will exist forever and all the transactions will be

made for the future growth.

Quantitative rules: There must be countable information recorded in books no any kind

of assumptions and perspective to be used in while preparing financial statements (Vogel, 2014).

(b) Measurement rules

2

expenditures and incomes must be presented in the balance sheet and financial position

statements and revenue nature income and expenditures must be shown in profit and loss

statements or income statements. All the current and non current liabilities and assets are shown

in balance sheet(Francis, Hasan and Wu, 2013).

REGULATIONS RELATED TO FINANCIAL ACCOUNTING

Financial accounting rules and principles are controlled and sans action by both general

and international accounting standard boards (DRURY, 2013). GAAP (Generally Accepted

Accounting Principles) is one of the authorised bodies which provide standards and principles

regarding financial and accounting (Nilsson and Stockenstrand, 2015). It provides guidelines

which are used in the organisational context. International Financial Reporting Standards (IFRS)

is one of the governed authorities which issued rules and standards subjected to financial and

accounting reporting. It is a set of passionate accounting standards which help to bifurcate the

nature of transactions in different sections. International Accounting Standards Board (IASB)

issue the IFRS rules and regulations.

ACCOUNTING RULES AND PRINCIPLES

Accounting rules and principles are also known as GAAP.

(a) Boundary rules

Entity rules: This rule tells the definition of an entity and separates the existence of

organisation from the owner. It indicates towards the ownership and responsibilities of entity and

bifurcate the owner’s role in organisation.

Periodicity rule: As per this rule, all the transactions and records must be maintained for

annual basis. Period of maintaining records is 12 months (Gaffikin, 2014).

Going concern: It is an assumption subjected to existence of organisation. As per this

assumption, it is estimated that organisation will exist forever and all the transactions will be

made for the future growth.

Quantitative rules: There must be countable information recorded in books no any kind

of assumptions and perspective to be used in while preparing financial statements (Vogel, 2014).

(b) Measurement rules

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

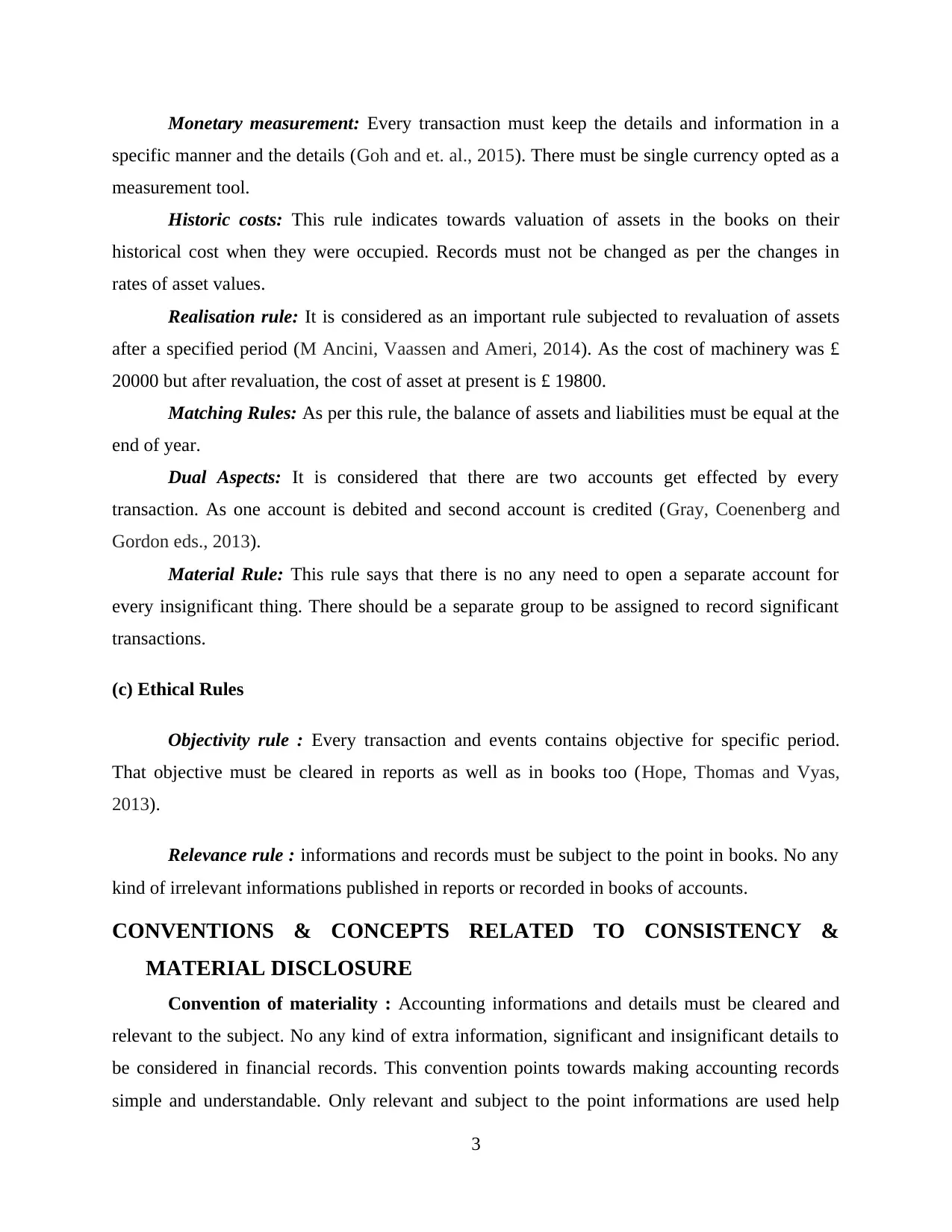

Monetary measurement: Every transaction must keep the details and information in a

specific manner and the details (Goh and et. al., 2015). There must be single currency opted as a

measurement tool.

Historic costs: This rule indicates towards valuation of assets in the books on their

historical cost when they were occupied. Records must not be changed as per the changes in

rates of asset values.

Realisation rule: It is considered as an important rule subjected to revaluation of assets

after a specified period (M Ancini, Vaassen and Ameri, 2014). As the cost of machinery was £

20000 but after revaluation, the cost of asset at present is £ 19800.

Matching Rules: As per this rule, the balance of assets and liabilities must be equal at the

end of year.

Dual Aspects: It is considered that there are two accounts get effected by every

transaction. As one account is debited and second account is credited (Gray, Coenenberg and

Gordon eds., 2013).

Material Rule: This rule says that there is no any need to open a separate account for

every insignificant thing. There should be a separate group to be assigned to record significant

transactions.

(c) Ethical Rules

Objectivity rule : Every transaction and events contains objective for specific period.

That objective must be cleared in reports as well as in books too (Hope, Thomas and Vyas,

2013).

Relevance rule : informations and records must be subject to the point in books. No any

kind of irrelevant informations published in reports or recorded in books of accounts.

CONVENTIONS & CONCEPTS RELATED TO CONSISTENCY &

MATERIAL DISCLOSURE

Convention of materiality : Accounting informations and details must be cleared and

relevant to the subject. No any kind of extra information, significant and insignificant details to

be considered in financial records. This convention points towards making accounting records

simple and understandable. Only relevant and subject to the point informations are used help

3

specific manner and the details (Goh and et. al., 2015). There must be single currency opted as a

measurement tool.

Historic costs: This rule indicates towards valuation of assets in the books on their

historical cost when they were occupied. Records must not be changed as per the changes in

rates of asset values.

Realisation rule: It is considered as an important rule subjected to revaluation of assets

after a specified period (M Ancini, Vaassen and Ameri, 2014). As the cost of machinery was £

20000 but after revaluation, the cost of asset at present is £ 19800.

Matching Rules: As per this rule, the balance of assets and liabilities must be equal at the

end of year.

Dual Aspects: It is considered that there are two accounts get effected by every

transaction. As one account is debited and second account is credited (Gray, Coenenberg and

Gordon eds., 2013).

Material Rule: This rule says that there is no any need to open a separate account for

every insignificant thing. There should be a separate group to be assigned to record significant

transactions.

(c) Ethical Rules

Objectivity rule : Every transaction and events contains objective for specific period.

That objective must be cleared in reports as well as in books too (Hope, Thomas and Vyas,

2013).

Relevance rule : informations and records must be subject to the point in books. No any

kind of irrelevant informations published in reports or recorded in books of accounts.

CONVENTIONS & CONCEPTS RELATED TO CONSISTENCY &

MATERIAL DISCLOSURE

Convention of materiality : Accounting informations and details must be cleared and

relevant to the subject. No any kind of extra information, significant and insignificant details to

be considered in financial records. This convention points towards making accounting records

simple and understandable. Only relevant and subject to the point informations are used help

3

managers to make strategies and plans. It helps to able provide fair judgement and make

decisions (Kuper, 2013).

Convention of Consistency : This accounting rule signify the scope of accounting

policies in organisation. This convention says that the policies and regulations regarding

accounting policies and financial standards must be remain unchanged for specific duration and

period (Convention related to consistency and materiality, 2018). As if an organisation uses

FIFO method to calculate the cost of closing inventory then this method must be followed at

least for 12 months (Lawrence, 2013).

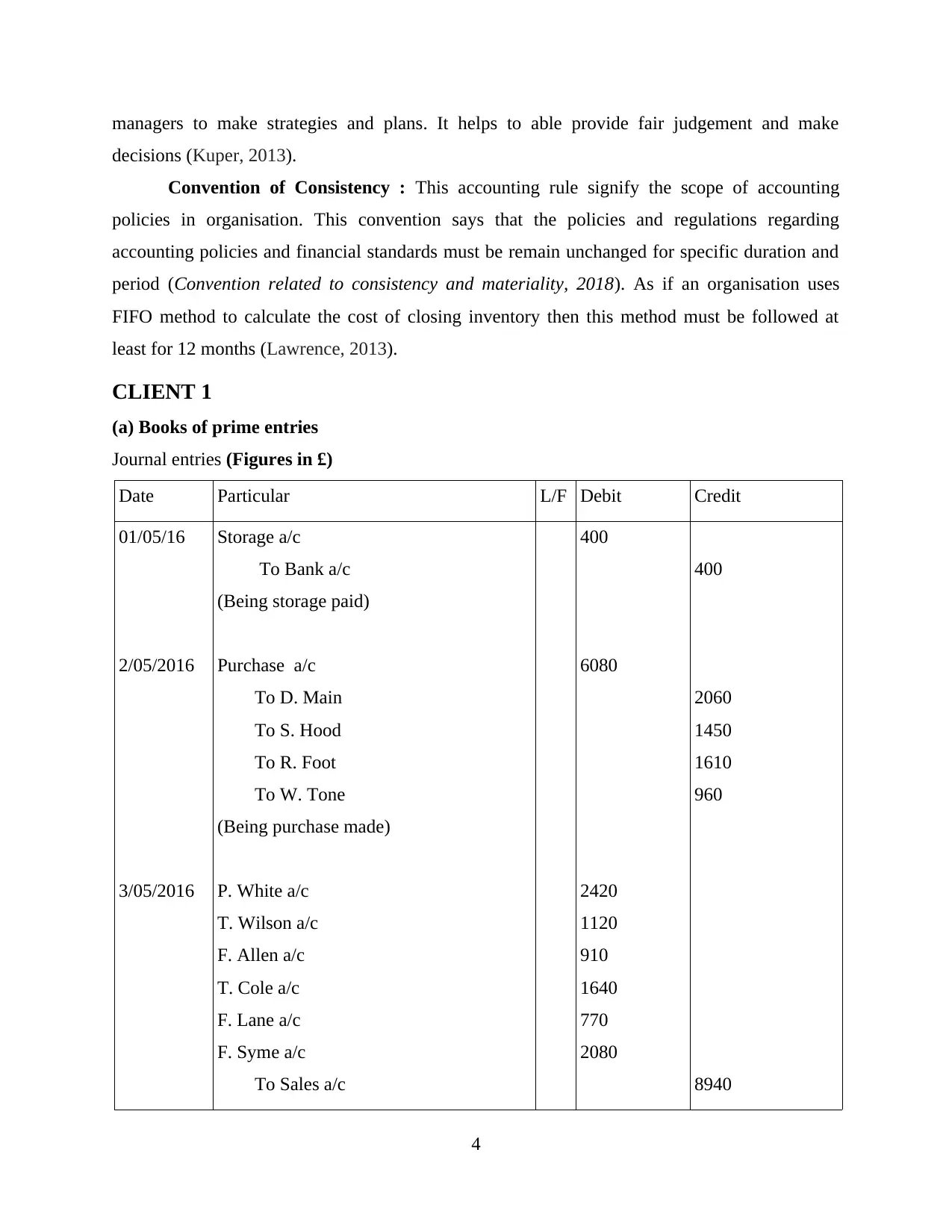

CLIENT 1

(a) Books of prime entries

Journal entries (Figures in £)

Date Particular L/F Debit Credit

01/05/16

2/05/2016

3/05/2016

Storage a/c

To Bank a/c

(Being storage paid)

Purchase a/c

To D. Main

To S. Hood

To R. Foot

To W. Tone

(Being purchase made)

P. White a/c

T. Wilson a/c

F. Allen a/c

T. Cole a/c

F. Lane a/c

F. Syme a/c

To Sales a/c

400

6080

2420

1120

910

1640

770

2080

400

2060

1450

1610

960

8940

4

decisions (Kuper, 2013).

Convention of Consistency : This accounting rule signify the scope of accounting

policies in organisation. This convention says that the policies and regulations regarding

accounting policies and financial standards must be remain unchanged for specific duration and

period (Convention related to consistency and materiality, 2018). As if an organisation uses

FIFO method to calculate the cost of closing inventory then this method must be followed at

least for 12 months (Lawrence, 2013).

CLIENT 1

(a) Books of prime entries

Journal entries (Figures in £)

Date Particular L/F Debit Credit

01/05/16

2/05/2016

3/05/2016

Storage a/c

To Bank a/c

(Being storage paid)

Purchase a/c

To D. Main

To S. Hood

To R. Foot

To W. Tone

(Being purchase made)

P. White a/c

T. Wilson a/c

F. Allen a/c

T. Cole a/c

F. Lane a/c

F. Syme a/c

To Sales a/c

400

6080

2420

1120

910

1640

770

2080

400

2060

1450

1610

960

8940

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

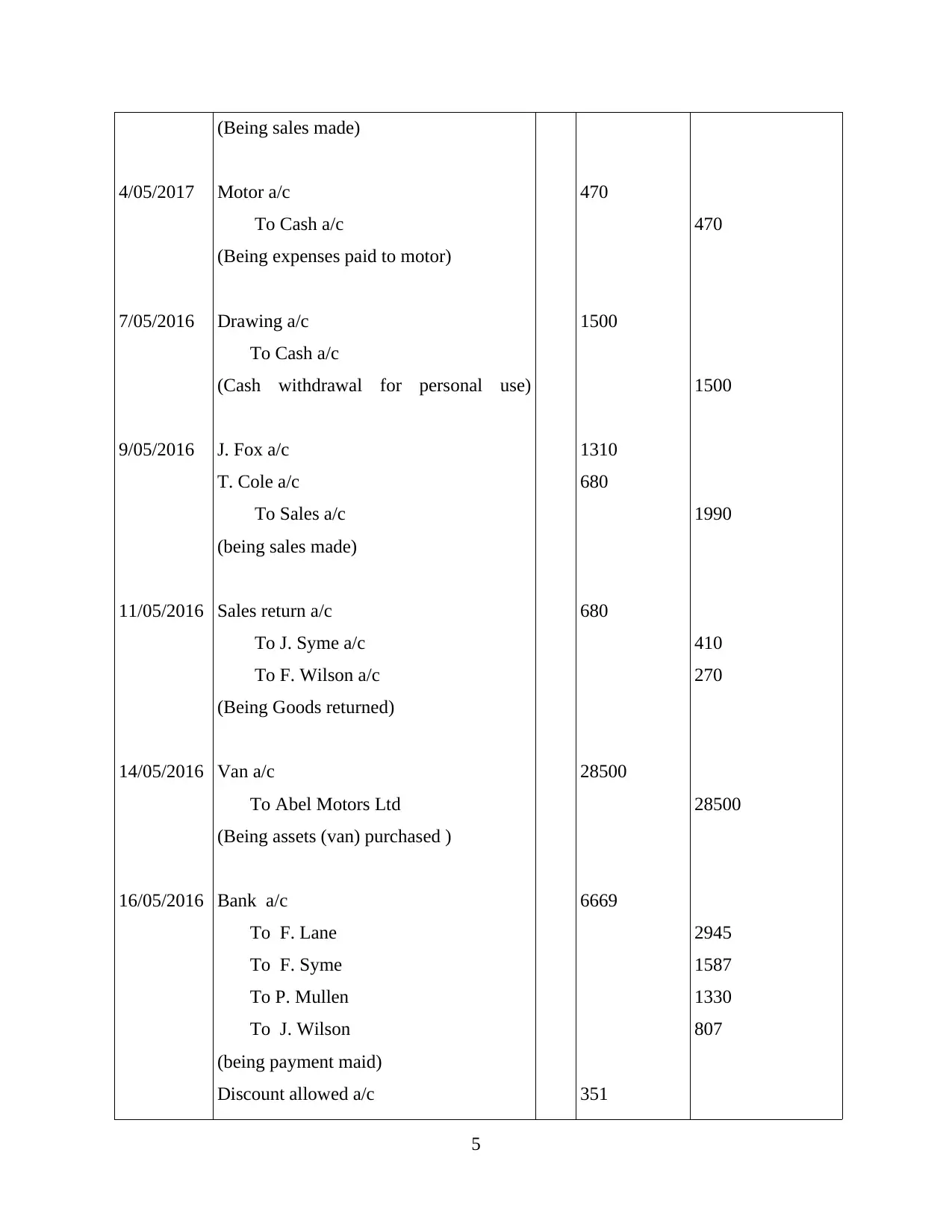

4/05/2017

7/05/2016

9/05/2016

11/05/2016

14/05/2016

16/05/2016

(Being sales made)

Motor a/c

To Cash a/c

(Being expenses paid to motor)

Drawing a/c

To Cash a/c

(Cash withdrawal for personal use)

J. Fox a/c

T. Cole a/c

To Sales a/c

(being sales made)

Sales return a/c

To J. Syme a/c

To F. Wilson a/c

(Being Goods returned)

Van a/c

To Abel Motors Ltd

(Being assets (van) purchased )

Bank a/c

To F. Lane

To F. Syme

To P. Mullen

To J. Wilson

(being payment maid)

Discount allowed a/c

470

1500

1310

680

680

28500

6669

351

470

1500

1990

410

270

28500

2945

1587

1330

807

5

7/05/2016

9/05/2016

11/05/2016

14/05/2016

16/05/2016

(Being sales made)

Motor a/c

To Cash a/c

(Being expenses paid to motor)

Drawing a/c

To Cash a/c

(Cash withdrawal for personal use)

J. Fox a/c

T. Cole a/c

To Sales a/c

(being sales made)

Sales return a/c

To J. Syme a/c

To F. Wilson a/c

(Being Goods returned)

Van a/c

To Abel Motors Ltd

(Being assets (van) purchased )

Bank a/c

To F. Lane

To F. Syme

To P. Mullen

To J. Wilson

(being payment maid)

Discount allowed a/c

470

1500

1310

680

680

28500

6669

351

470

1500

1990

410

270

28500

2945

1587

1330

807

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

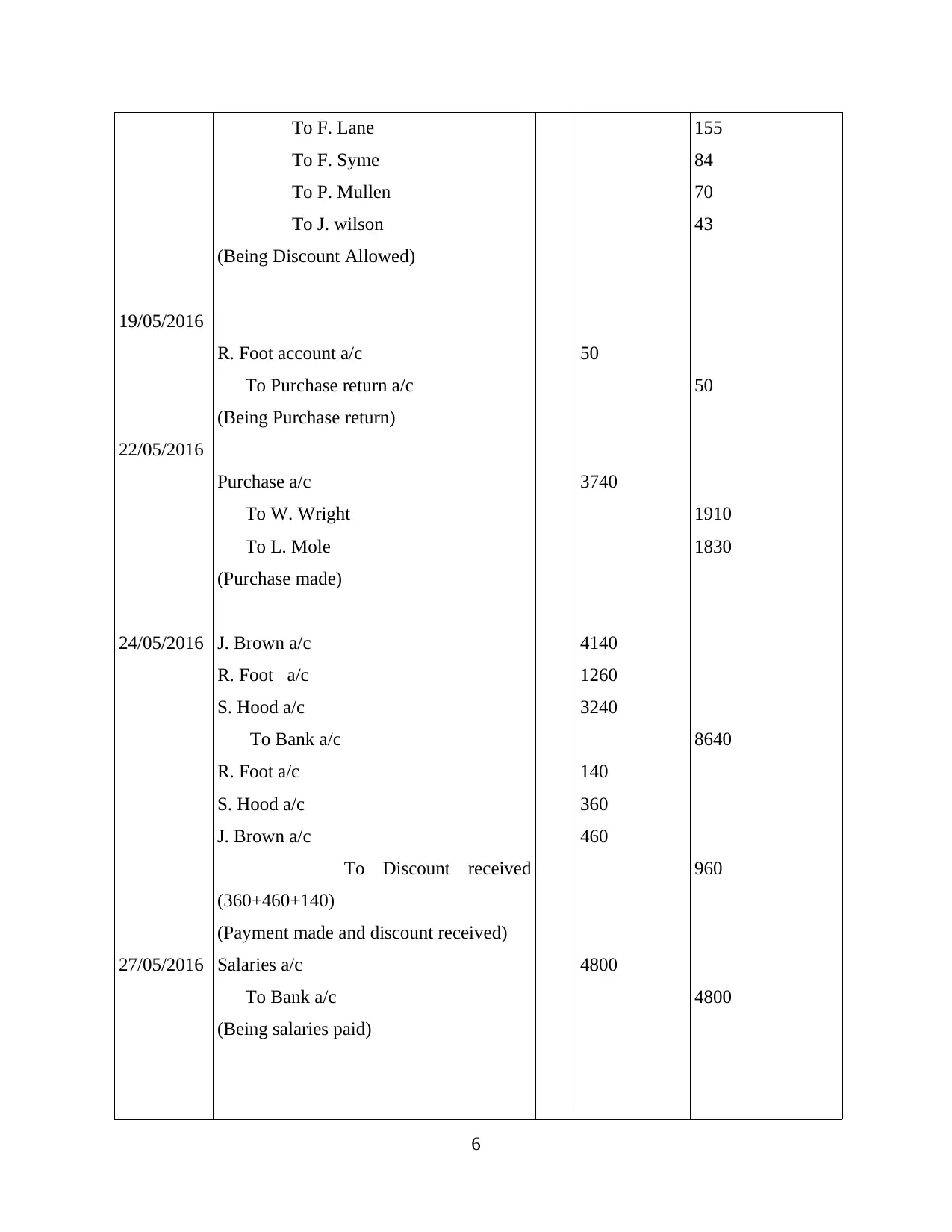

19/05/2016

22/05/2016

24/05/2016

27/05/2016

To F. Lane

To F. Syme

To P. Mullen

To J. wilson

(Being Discount Allowed)

R. Foot account a/c

To Purchase return a/c

(Being Purchase return)

Purchase a/c

To W. Wright

To L. Mole

(Purchase made)

J. Brown a/c

R. Foot a/c

S. Hood a/c

To Bank a/c

R. Foot a/c

S. Hood a/c

J. Brown a/c

To Discount received

(360+460+140)

(Payment made and discount received)

Salaries a/c

To Bank a/c

(Being salaries paid)

50

3740

4140

1260

3240

140

360

460

4800

155

84

70

43

50

1910

1830

8640

960

4800

6

22/05/2016

24/05/2016

27/05/2016

To F. Lane

To F. Syme

To P. Mullen

To J. wilson

(Being Discount Allowed)

R. Foot account a/c

To Purchase return a/c

(Being Purchase return)

Purchase a/c

To W. Wright

To L. Mole

(Purchase made)

J. Brown a/c

R. Foot a/c

S. Hood a/c

To Bank a/c

R. Foot a/c

S. Hood a/c

J. Brown a/c

To Discount received

(360+460+140)

(Payment made and discount received)

Salaries a/c

To Bank a/c

(Being salaries paid)

50

3740

4140

1260

3240

140

360

460

4800

155

84

70

43

50

1910

1830

8640

960

4800

6

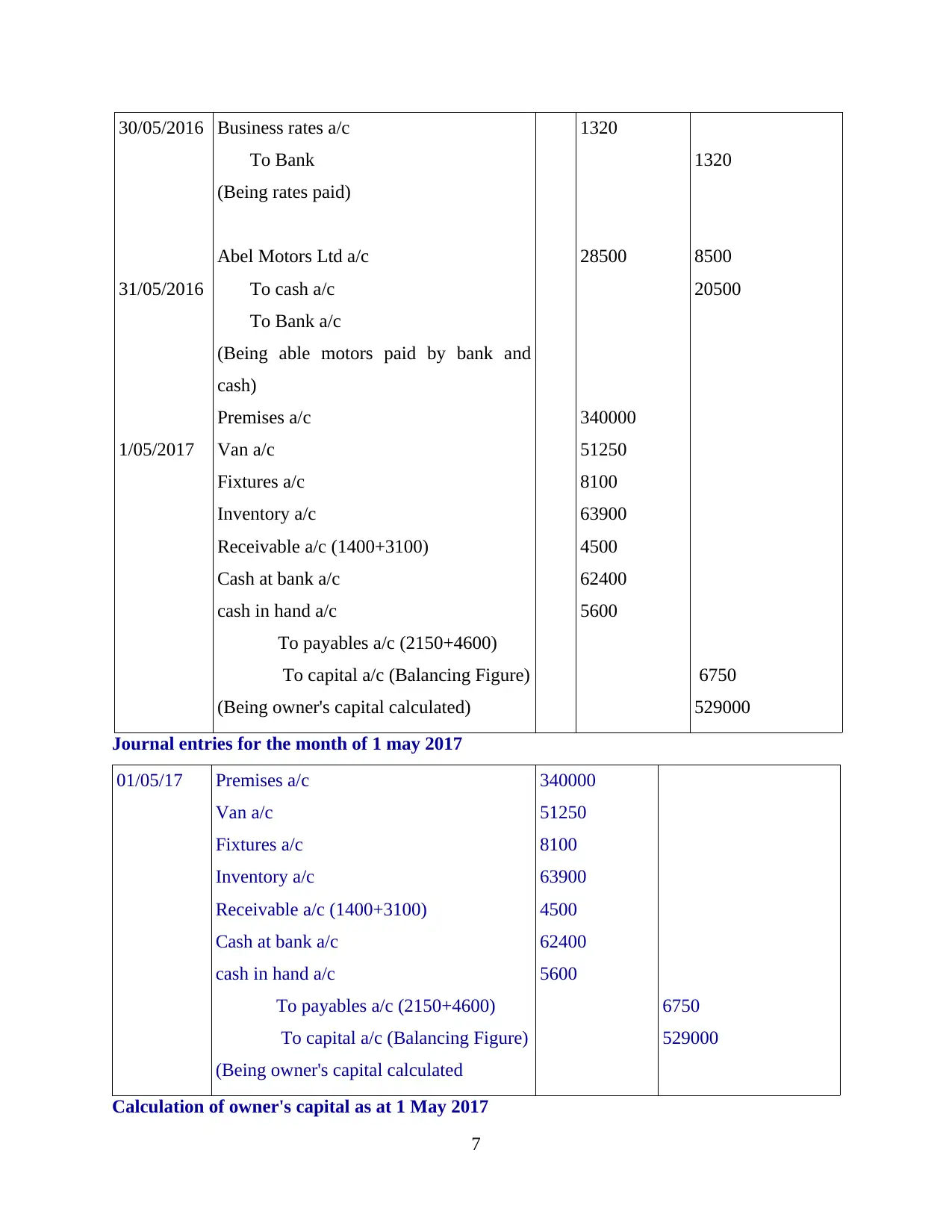

30/05/2016

31/05/2016

1/05/2017

Business rates a/c

To Bank

(Being rates paid)

Abel Motors Ltd a/c

To cash a/c

To Bank a/c

(Being able motors paid by bank and

cash)

Premises a/c

Van a/c

Fixtures a/c

Inventory a/c

Receivable a/c (1400+3100)

Cash at bank a/c

cash in hand a/c

To payables a/c (2150+4600)

To capital a/c (Balancing Figure)

(Being owner's capital calculated)

1320

28500

340000

51250

8100

63900

4500

62400

5600

1320

8500

20500

6750

529000

Journal entries for the month of 1 may 2017

01/05/17 Premises a/c

Van a/c

Fixtures a/c

Inventory a/c

Receivable a/c (1400+3100)

Cash at bank a/c

cash in hand a/c

To payables a/c (2150+4600)

To capital a/c (Balancing Figure)

(Being owner's capital calculated

340000

51250

8100

63900

4500

62400

5600

6750

529000

Calculation of owner's capital as at 1 May 2017

7

31/05/2016

1/05/2017

Business rates a/c

To Bank

(Being rates paid)

Abel Motors Ltd a/c

To cash a/c

To Bank a/c

(Being able motors paid by bank and

cash)

Premises a/c

Van a/c

Fixtures a/c

Inventory a/c

Receivable a/c (1400+3100)

Cash at bank a/c

cash in hand a/c

To payables a/c (2150+4600)

To capital a/c (Balancing Figure)

(Being owner's capital calculated)

1320

28500

340000

51250

8100

63900

4500

62400

5600

1320

8500

20500

6750

529000

Journal entries for the month of 1 may 2017

01/05/17 Premises a/c

Van a/c

Fixtures a/c

Inventory a/c

Receivable a/c (1400+3100)

Cash at bank a/c

cash in hand a/c

To payables a/c (2150+4600)

To capital a/c (Balancing Figure)

(Being owner's capital calculated

340000

51250

8100

63900

4500

62400

5600

6750

529000

Calculation of owner's capital as at 1 May 2017

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

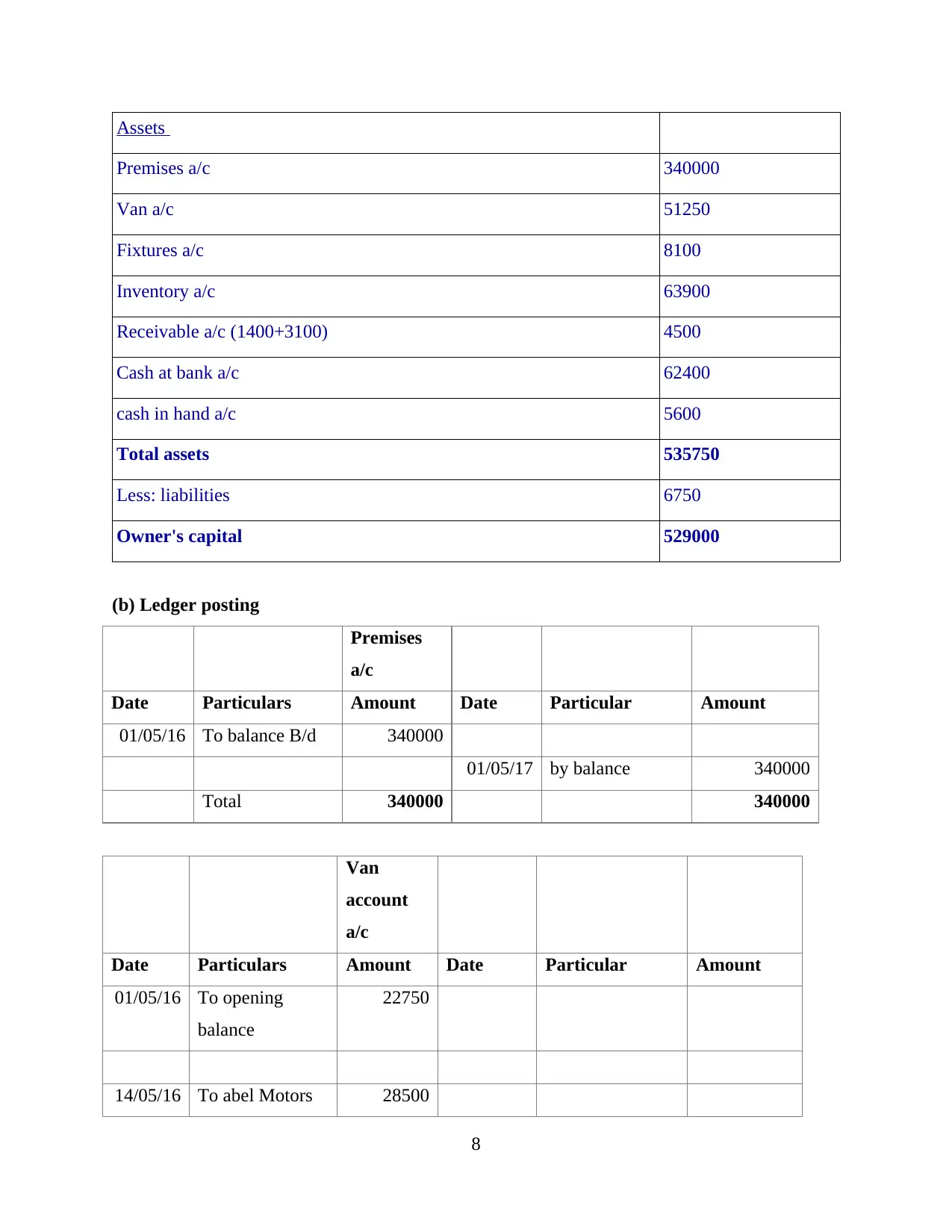

Assets

Premises a/c 340000

Van a/c 51250

Fixtures a/c 8100

Inventory a/c 63900

Receivable a/c (1400+3100) 4500

Cash at bank a/c 62400

cash in hand a/c 5600

Total assets 535750

Less: liabilities 6750

Owner's capital 529000

(b) Ledger posting

Premises

a/c

Date Particulars Amount Date Particular Amount

01/05/16 To balance B/d 340000

01/05/17 by balance 340000

Total 340000 340000

Van

account

a/c

Date Particulars Amount Date Particular Amount

01/05/16 To opening

balance

22750

14/05/16 To abel Motors 28500

8

Premises a/c 340000

Van a/c 51250

Fixtures a/c 8100

Inventory a/c 63900

Receivable a/c (1400+3100) 4500

Cash at bank a/c 62400

cash in hand a/c 5600

Total assets 535750

Less: liabilities 6750

Owner's capital 529000

(b) Ledger posting

Premises

a/c

Date Particulars Amount Date Particular Amount

01/05/16 To balance B/d 340000

01/05/17 by balance 340000

Total 340000 340000

Van

account

a/c

Date Particulars Amount Date Particular Amount

01/05/16 To opening

balance

22750

14/05/16 To abel Motors 28500

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

01/05/17 by balance 51250

51250 51250

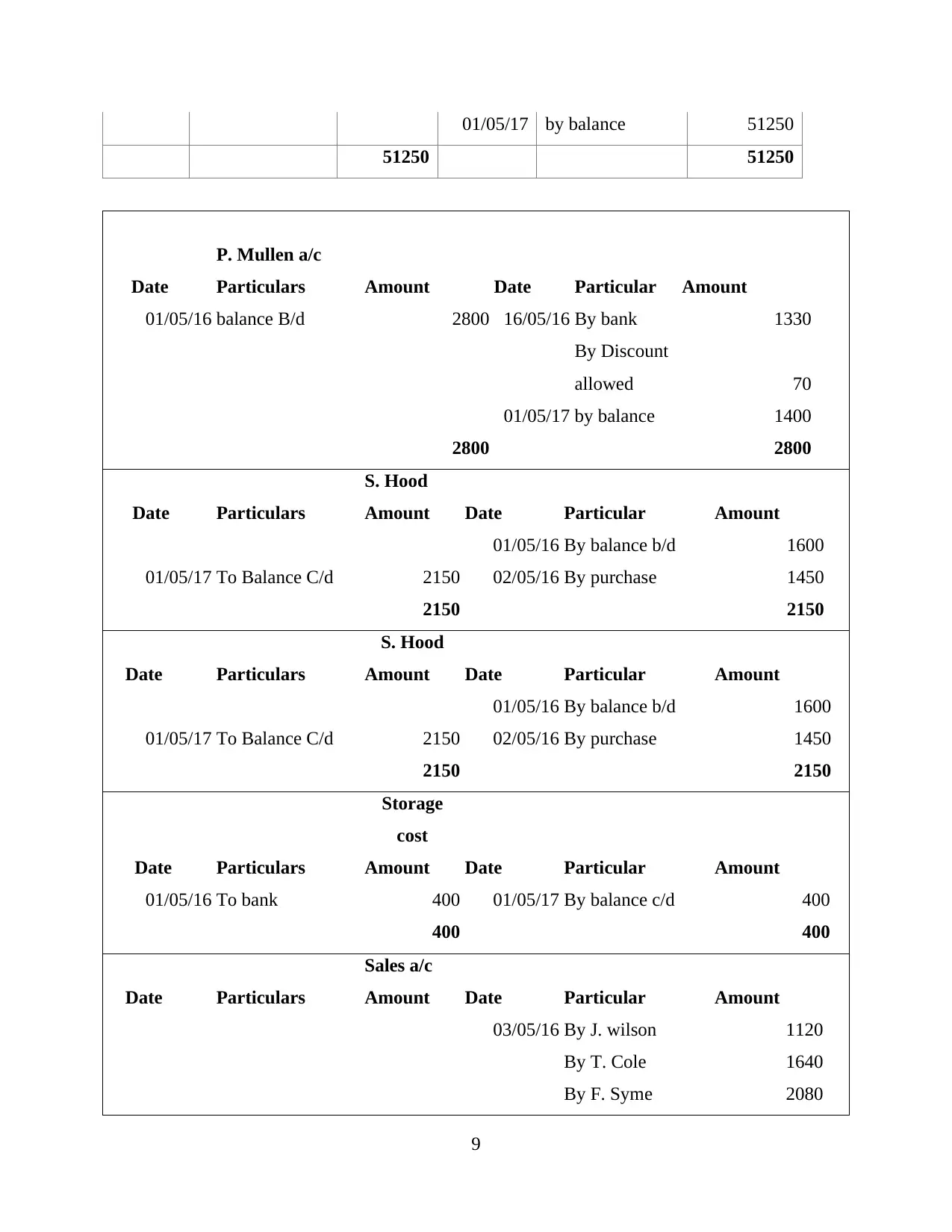

P. Mullen a/c

Date Particulars Amount Date Particular Amount

01/05/16 balance B/d 2800 16/05/16 By bank 1330

By Discount

allowed 70

01/05/17 by balance 1400

2800 2800

S. Hood

Date Particulars Amount Date Particular Amount

01/05/16 By balance b/d 1600

01/05/17 To Balance C/d 2150 02/05/16 By purchase 1450

2150 2150

S. Hood

Date Particulars Amount Date Particular Amount

01/05/16 By balance b/d 1600

01/05/17 To Balance C/d 2150 02/05/16 By purchase 1450

2150 2150

Storage

cost

Date Particulars Amount Date Particular Amount

01/05/16 To bank 400 01/05/17 By balance c/d 400

400 400

Sales a/c

Date Particulars Amount Date Particular Amount

03/05/16 By J. wilson 1120

By T. Cole 1640

By F. Syme 2080

9

51250 51250

P. Mullen a/c

Date Particulars Amount Date Particular Amount

01/05/16 balance B/d 2800 16/05/16 By bank 1330

By Discount

allowed 70

01/05/17 by balance 1400

2800 2800

S. Hood

Date Particulars Amount Date Particular Amount

01/05/16 By balance b/d 1600

01/05/17 To Balance C/d 2150 02/05/16 By purchase 1450

2150 2150

S. Hood

Date Particulars Amount Date Particular Amount

01/05/16 By balance b/d 1600

01/05/17 To Balance C/d 2150 02/05/16 By purchase 1450

2150 2150

Storage

cost

Date Particulars Amount Date Particular Amount

01/05/16 To bank 400 01/05/17 By balance c/d 400

400 400

Sales a/c

Date Particulars Amount Date Particular Amount

03/05/16 By J. wilson 1120

By T. Cole 1640

By F. Syme 2080

9

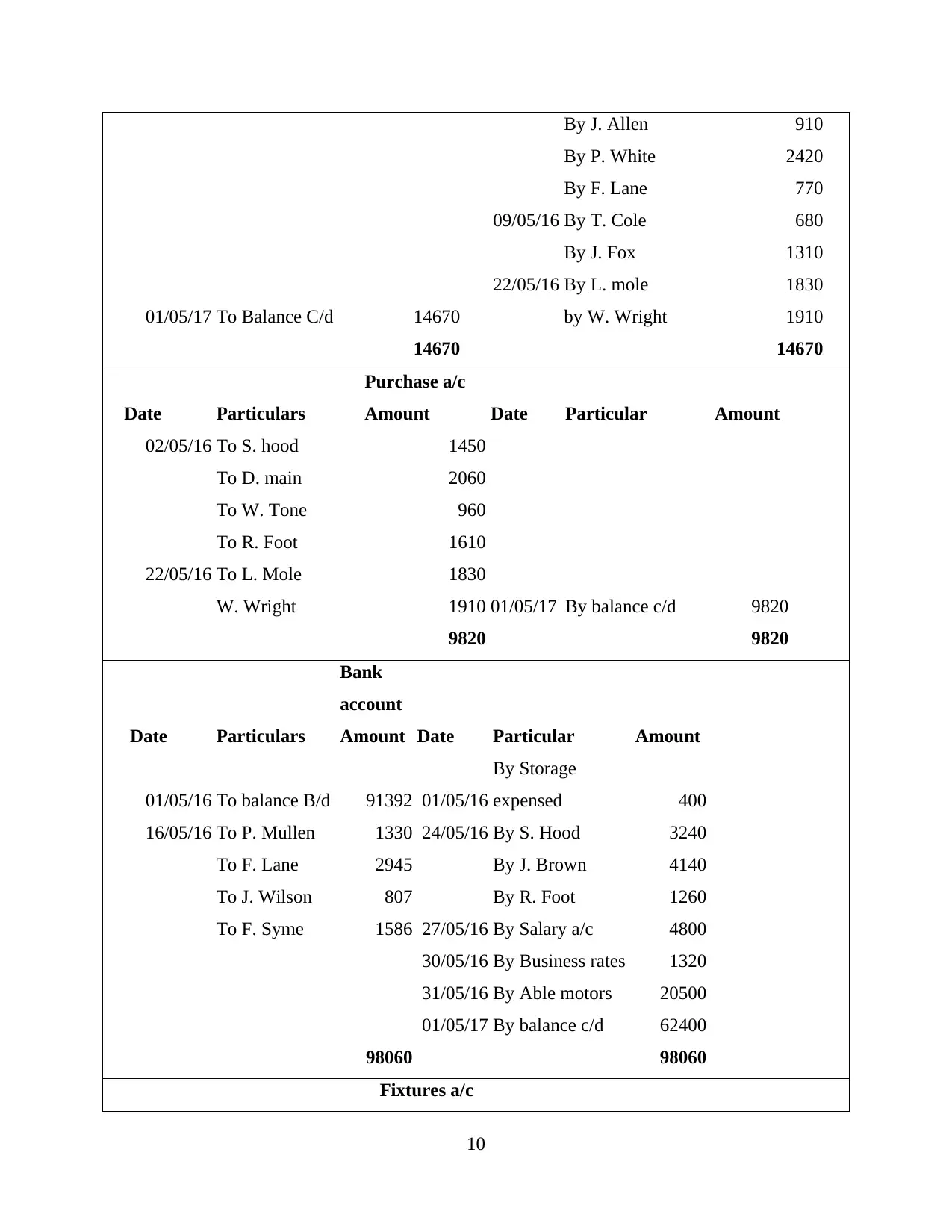

By J. Allen 910

By P. White 2420

By F. Lane 770

09/05/16 By T. Cole 680

By J. Fox 1310

22/05/16 By L. mole 1830

01/05/17 To Balance C/d 14670 by W. Wright 1910

14670 14670

Purchase a/c

Date Particulars Amount Date Particular Amount

02/05/16 To S. hood 1450

To D. main 2060

To W. Tone 960

To R. Foot 1610

22/05/16 To L. Mole 1830

W. Wright 1910 01/05/17 By balance c/d 9820

9820 9820

Bank

account

Date Particulars Amount Date Particular Amount

01/05/16 To balance B/d 91392 01/05/16

By Storage

expensed 400

16/05/16 To P. Mullen 1330 24/05/16 By S. Hood 3240

To F. Lane 2945 By J. Brown 4140

To J. Wilson 807 By R. Foot 1260

To F. Syme 1586 27/05/16 By Salary a/c 4800

30/05/16 By Business rates 1320

31/05/16 By Able motors 20500

01/05/17 By balance c/d 62400

98060 98060

Fixtures a/c

10

By P. White 2420

By F. Lane 770

09/05/16 By T. Cole 680

By J. Fox 1310

22/05/16 By L. mole 1830

01/05/17 To Balance C/d 14670 by W. Wright 1910

14670 14670

Purchase a/c

Date Particulars Amount Date Particular Amount

02/05/16 To S. hood 1450

To D. main 2060

To W. Tone 960

To R. Foot 1610

22/05/16 To L. Mole 1830

W. Wright 1910 01/05/17 By balance c/d 9820

9820 9820

Bank

account

Date Particulars Amount Date Particular Amount

01/05/16 To balance B/d 91392 01/05/16

By Storage

expensed 400

16/05/16 To P. Mullen 1330 24/05/16 By S. Hood 3240

To F. Lane 2945 By J. Brown 4140

To J. Wilson 807 By R. Foot 1260

To F. Syme 1586 27/05/16 By Salary a/c 4800

30/05/16 By Business rates 1320

31/05/16 By Able motors 20500

01/05/17 By balance c/d 62400

98060 98060

Fixtures a/c

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.