Financial Accounting: Business Transactions, Single Entry and Double Entry System, Trial Balance

VerifiedAdded on 2023/01/10

|21

|4113

|31

AI Summary

This document provides an introduction to financial bookkeeping and the concept of journal entries. It discusses the single entry and double entry system of bookkeeping, as well as the importance and maintenance of trial balance. The document also covers the identification of business transactions and their types, as well as the major differences between financial reports and statements and their importance for stakeholders. The subject is Financial Accounting.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Financial Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

INTRODUCTION...........................................................................................................................3

TASK1.............................................................................................................................................3

Question 1. Identification of business transaction and their type also discussion about the

single entry and double entry system of bookkeeping buy land in term of trial balance.......3

Question 3: Identify major differences in financial reports and statements and why these are

important for various stakeholders?.......................................................................................8

Question 4: explain different fundamental principles of accounting...................................10

Question 5:Prepare a profit and loss account for the year ended 31 December 2017 and

balance sheet at that date......................................................................................................10

TASK2...........................................................................................................................................12

Question1: What is meant by bank reconciliation and why is it required? How is this

achieved? Why is this necessary?.........................................................................................12

Question 2: what are control accounts? Explain the role of control accounts in financial

management..........................................................................................................................13

Question 3: what is suspense account? What are the reasons for drafting suspense accounts?

..............................................................................................................................................13

Question 3 prepare cash book...............................................................................................14

Question 4 Prepare a bank reconciliation statement.............................................................14

REFRENCES.................................................................................................................................16

Books and journal..........................................................................................................................16

INTRODUCTION...........................................................................................................................3

TASK1.............................................................................................................................................3

Question 1. Identification of business transaction and their type also discussion about the

single entry and double entry system of bookkeeping buy land in term of trial balance.......3

Question 3: Identify major differences in financial reports and statements and why these are

important for various stakeholders?.......................................................................................8

Question 4: explain different fundamental principles of accounting...................................10

Question 5:Prepare a profit and loss account for the year ended 31 December 2017 and

balance sheet at that date......................................................................................................10

TASK2...........................................................................................................................................12

Question1: What is meant by bank reconciliation and why is it required? How is this

achieved? Why is this necessary?.........................................................................................12

Question 2: what are control accounts? Explain the role of control accounts in financial

management..........................................................................................................................13

Question 3: what is suspense account? What are the reasons for drafting suspense accounts?

..............................................................................................................................................13

Question 3 prepare cash book...............................................................................................14

Question 4 Prepare a bank reconciliation statement.............................................................14

REFRENCES.................................................................................................................................16

Books and journal..........................................................................................................................16

INTRODUCTION

Financial bookkeeping can be defined as a combination of different account and financial

information which are related to development of a proper system by the organisation with the

help of tools and techniques related to accounting and business records for analysing and

interpreting information and using it for the further benefit. In this report which is an

organisation is Ray finance limited. Present report have been considered, the sense and concept

of journal entries, how they apply in the organization their use in formulating trial balance and

financial statements. This reports their discussion about the importance and maintenance of trial

balance and various accounts which are required to the organisation for controlling its cash flow

and bank reconciliation statement. is also discussion about how the bank reconciliation statement

are prepared by the organisation and how it can be used in day to day operations and activities of

the firm.

TASK1

Question 1. Identification of business transaction and their type also discussion about the single

entry and double entry system of bookkeeping buy land in term of trial balance.

Commercial transaction: It includes those activities or deals which measure in monetary

term and indirectly affect processes of business. There dealings direct affect on assets, liabilities,

expense and income of the business organization. Business transactions are the activity which is

related with business and record in periodicals of the organization. The transactions rare divided

into 2 parts which are Cash transactions and credit business transaction(Nicholls and Mastrolia,

2015).

Cash transaction: Activities which are related to flow of cash inward and outward. It

includes sales, purchase, purchase of investment etc.

Credit deal: It considered that kind of activities in which there is no need of cash at the

time when transaction incurred. Examples, goods purchase on credit, stock sold on credit,.

These transaction directly as credit purchase increase obligation of organization and affect on

asset and liability and decent sold on praise enhance the possessions of the organization

Internal and External deals: Theses deal has separate part. .

External deal: It is related with activities which are related with external parties. Business

dealings, purchase of assets, issuing shares, purchase raw material etc.

Financial bookkeeping can be defined as a combination of different account and financial

information which are related to development of a proper system by the organisation with the

help of tools and techniques related to accounting and business records for analysing and

interpreting information and using it for the further benefit. In this report which is an

organisation is Ray finance limited. Present report have been considered, the sense and concept

of journal entries, how they apply in the organization their use in formulating trial balance and

financial statements. This reports their discussion about the importance and maintenance of trial

balance and various accounts which are required to the organisation for controlling its cash flow

and bank reconciliation statement. is also discussion about how the bank reconciliation statement

are prepared by the organisation and how it can be used in day to day operations and activities of

the firm.

TASK1

Question 1. Identification of business transaction and their type also discussion about the single

entry and double entry system of bookkeeping buy land in term of trial balance.

Commercial transaction: It includes those activities or deals which measure in monetary

term and indirectly affect processes of business. There dealings direct affect on assets, liabilities,

expense and income of the business organization. Business transactions are the activity which is

related with business and record in periodicals of the organization. The transactions rare divided

into 2 parts which are Cash transactions and credit business transaction(Nicholls and Mastrolia,

2015).

Cash transaction: Activities which are related to flow of cash inward and outward. It

includes sales, purchase, purchase of investment etc.

Credit deal: It considered that kind of activities in which there is no need of cash at the

time when transaction incurred. Examples, goods purchase on credit, stock sold on credit,.

These transaction directly as credit purchase increase obligation of organization and affect on

asset and liability and decent sold on praise enhance the possessions of the organization

Internal and External deals: Theses deal has separate part. .

External deal: It is related with activities which are related with external parties. Business

dealings, purchase of assets, issuing shares, purchase raw material etc.

Internal transaction: Theses are non enhance transactions . In internal transactions only internal

parties of business are involved. It does not considered transactions which are related with

exchange of good. There are different Internal transaction considered, devaluation charge on

secure asset, repayment loss of asset as due to on fire.

Single entry book keeping: Under single entry accounting system organisation has to

record each and every transaction on the basis of proper record with the financial information.

this is the transaction is recorded from the one side which also generate the incomplete

transactions. System of accounting is used by sole proprietor firm where the organisation has no

legal authority apply this system. is completely different from double entry system where the

ride it of the transactions are recorded for each and every transaction. (Elefterie and Badea, ,

2016).

Double entry accounting system: In this system of accounting transaction or business

activities are record on 2 sided thus it is known as double entry book keeping system. According

to the rules, every business transaction have 2 sided effects, it affect asset and liabilities also.

Every transaction is recorded in debit or credit side. This is the official and authorise format of

recording entry which is applicable in the entire world as it precedes base for formulating

financial statement and the whole accounting system is based on book keeping it is the source of

staring of recording all the transaction of business (Mangala, and Kumari, 2017).

Trail balance: It is statement which show list of all account related wit business transactions

which contains in the books of ledger statements. In this all accounts with their balance have

been show in debit or credit side of the statement. In other words trial balance is the format

which is formulated at the end of the account years to identify the debit and credit balance of the

accounts with the help of leader Import in context of trial balance.

Manager of organization use trial balance to identify the debit and credit balance of accounts.

It is useful to organtional in finding out error during journal entry.

It is help in providing basic for formation of financial statement.

Auditors use it as base of recordings.

Trail balance help in deifying the end balance.

It is provides various mathematical impartialities which are associated with debit and credit side

of accounts.

parties of business are involved. It does not considered transactions which are related with

exchange of good. There are different Internal transaction considered, devaluation charge on

secure asset, repayment loss of asset as due to on fire.

Single entry book keeping: Under single entry accounting system organisation has to

record each and every transaction on the basis of proper record with the financial information.

this is the transaction is recorded from the one side which also generate the incomplete

transactions. System of accounting is used by sole proprietor firm where the organisation has no

legal authority apply this system. is completely different from double entry system where the

ride it of the transactions are recorded for each and every transaction. (Elefterie and Badea, ,

2016).

Double entry accounting system: In this system of accounting transaction or business

activities are record on 2 sided thus it is known as double entry book keeping system. According

to the rules, every business transaction have 2 sided effects, it affect asset and liabilities also.

Every transaction is recorded in debit or credit side. This is the official and authorise format of

recording entry which is applicable in the entire world as it precedes base for formulating

financial statement and the whole accounting system is based on book keeping it is the source of

staring of recording all the transaction of business (Mangala, and Kumari, 2017).

Trail balance: It is statement which show list of all account related wit business transactions

which contains in the books of ledger statements. In this all accounts with their balance have

been show in debit or credit side of the statement. In other words trial balance is the format

which is formulated at the end of the account years to identify the debit and credit balance of the

accounts with the help of leader Import in context of trial balance.

Manager of organization use trial balance to identify the debit and credit balance of accounts.

It is useful to organtional in finding out error during journal entry.

It is help in providing basic for formation of financial statement.

Auditors use it as base of recordings.

Trail balance help in deifying the end balance.

It is provides various mathematical impartialities which are associated with debit and credit side

of accounts.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

It is used in finding out the absent quantity and also uses to reduce the different of asset and

accountabilities side.

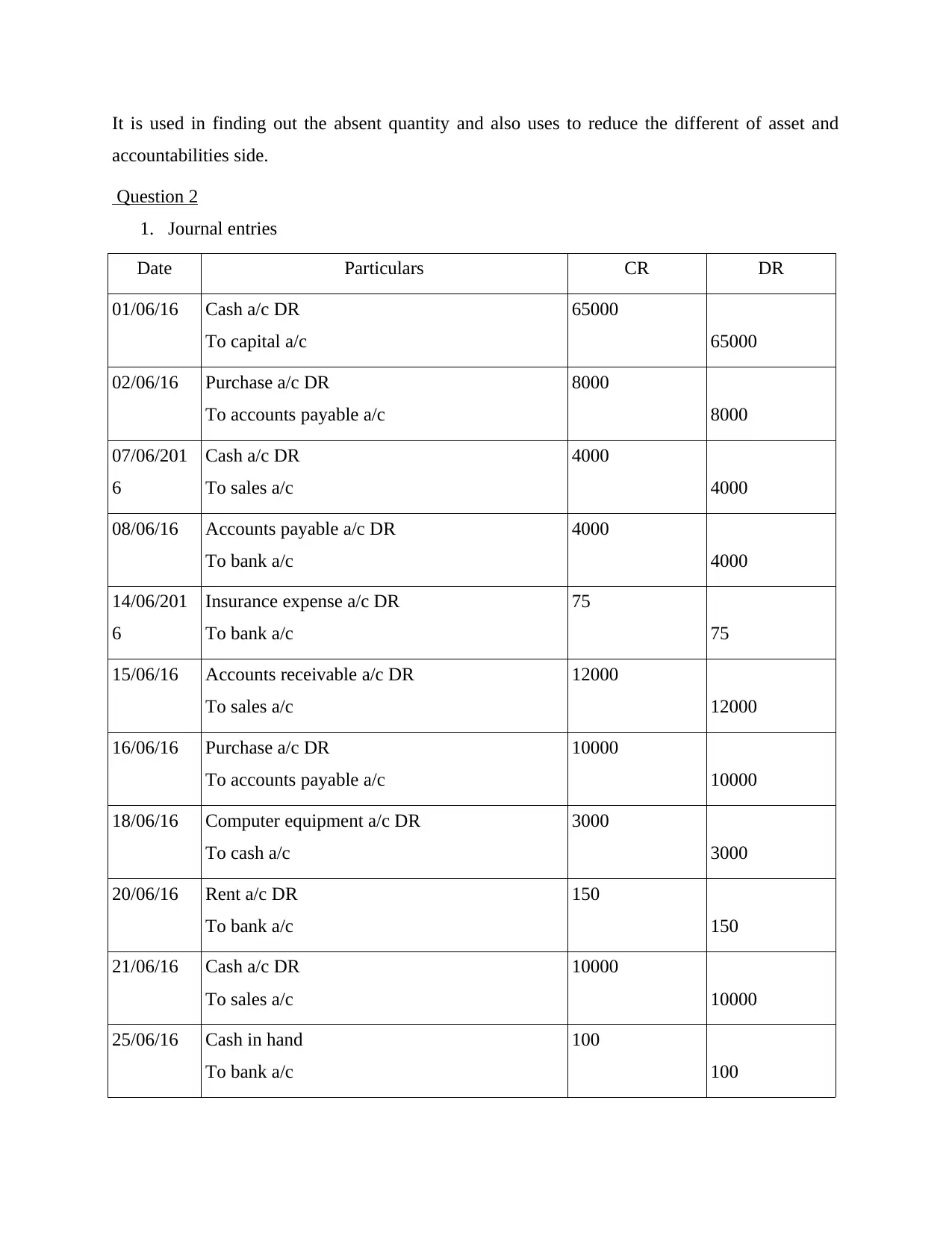

Question 2

1. Journal entries

Date Particulars CR DR

01/06/16 Cash a/c DR

To capital a/c

65000

65000

02/06/16 Purchase a/c DR

To accounts payable a/c

8000

8000

07/06/201

6

Cash a/c DR

To sales a/c

4000

4000

08/06/16 Accounts payable a/c DR

To bank a/c

4000

4000

14/06/201

6

Insurance expense a/c DR

To bank a/c

75

75

15/06/16 Accounts receivable a/c DR

To sales a/c

12000

12000

16/06/16 Purchase a/c DR

To accounts payable a/c

10000

10000

18/06/16 Computer equipment a/c DR

To cash a/c

3000

3000

20/06/16 Rent a/c DR

To bank a/c

150

150

21/06/16 Cash a/c DR

To sales a/c

10000

10000

25/06/16 Cash in hand

To bank a/c

100

100

accountabilities side.

Question 2

1. Journal entries

Date Particulars CR DR

01/06/16 Cash a/c DR

To capital a/c

65000

65000

02/06/16 Purchase a/c DR

To accounts payable a/c

8000

8000

07/06/201

6

Cash a/c DR

To sales a/c

4000

4000

08/06/16 Accounts payable a/c DR

To bank a/c

4000

4000

14/06/201

6

Insurance expense a/c DR

To bank a/c

75

75

15/06/16 Accounts receivable a/c DR

To sales a/c

12000

12000

16/06/16 Purchase a/c DR

To accounts payable a/c

10000

10000

18/06/16 Computer equipment a/c DR

To cash a/c

3000

3000

20/06/16 Rent a/c DR

To bank a/c

150

150

21/06/16 Cash a/c DR

To sales a/c

10000

10000

25/06/16 Cash in hand

To bank a/c

100

100

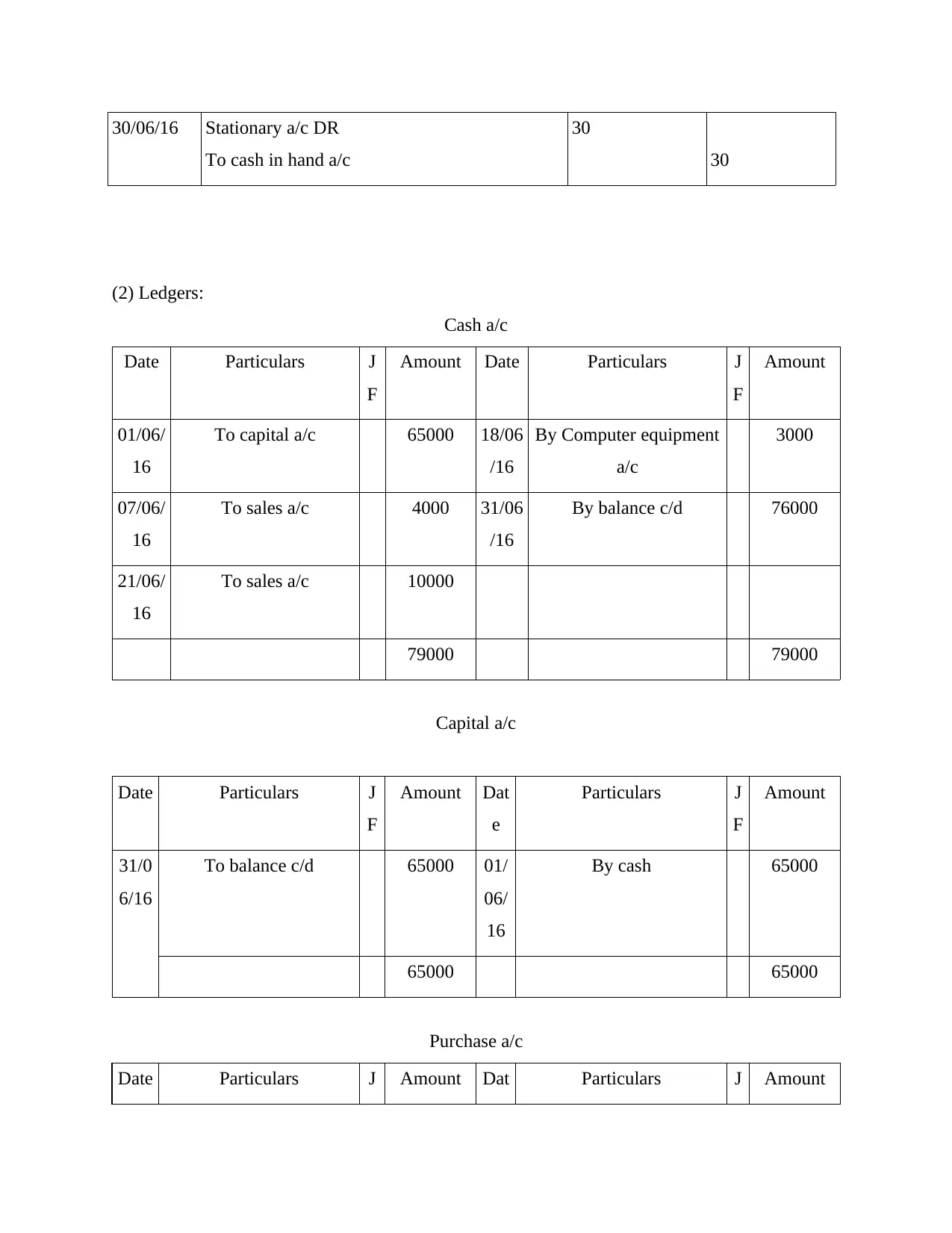

30/06/16 Stationary a/c DR

To cash in hand a/c

30

30

(2) Ledgers:

Cash a/c

Date Particulars J

F

Amount Date Particulars J

F

Amount

01/06/

16

To capital a/c 65000 18/06

/16

By Computer equipment

a/c

3000

07/06/

16

To sales a/c 4000 31/06

/16

By balance c/d 76000

21/06/

16

To sales a/c 10000

79000 79000

Capital a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

31/0

6/16

To balance c/d 65000 01/

06/

16

By cash 65000

65000 65000

Purchase a/c

Date Particulars J Amount Dat Particulars J Amount

To cash in hand a/c

30

30

(2) Ledgers:

Cash a/c

Date Particulars J

F

Amount Date Particulars J

F

Amount

01/06/

16

To capital a/c 65000 18/06

/16

By Computer equipment

a/c

3000

07/06/

16

To sales a/c 4000 31/06

/16

By balance c/d 76000

21/06/

16

To sales a/c 10000

79000 79000

Capital a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

31/0

6/16

To balance c/d 65000 01/

06/

16

By cash 65000

65000 65000

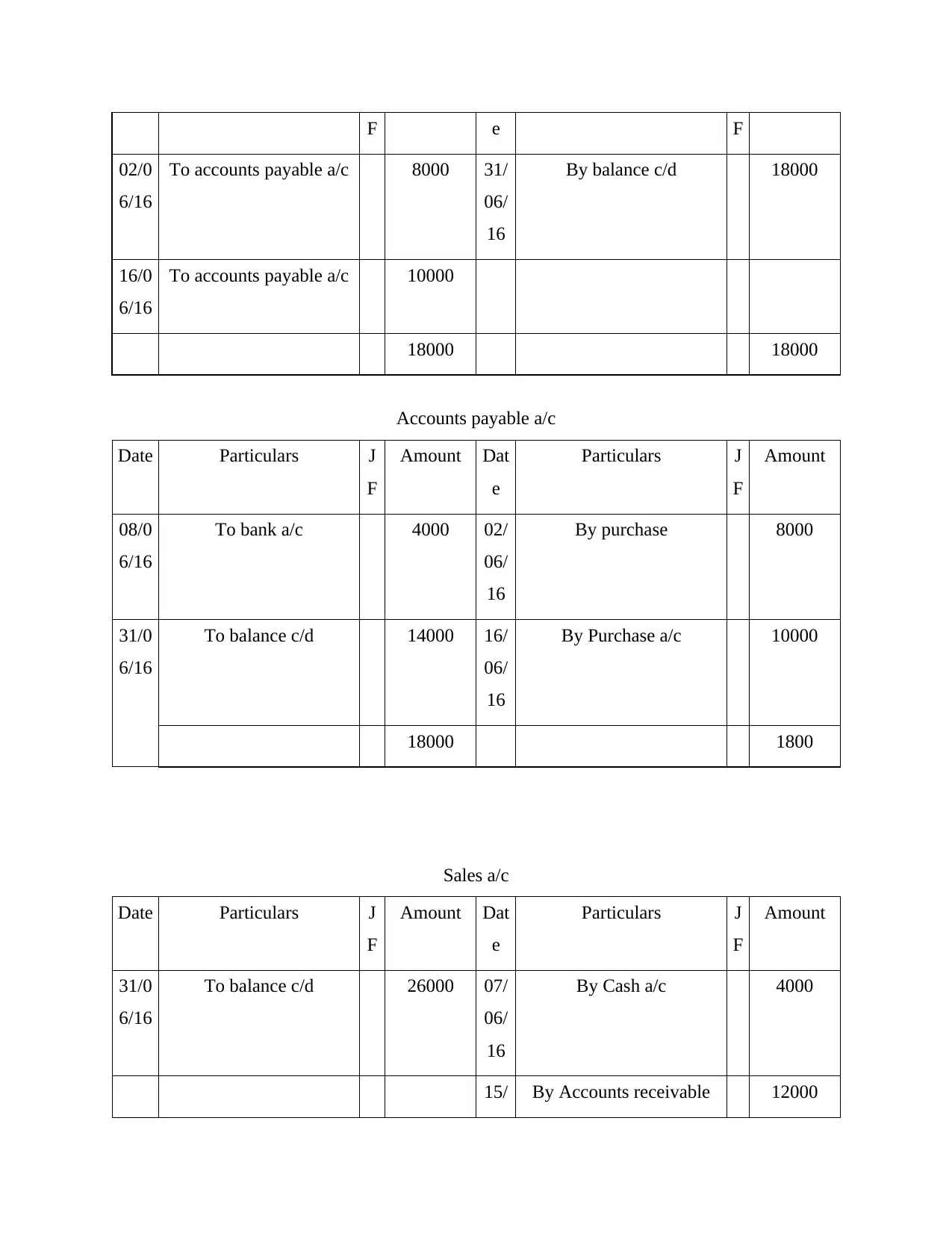

Purchase a/c

Date Particulars J Amount Dat Particulars J Amount

F e F

02/0

6/16

To accounts payable a/c 8000 31/

06/

16

By balance c/d 18000

16/0

6/16

To accounts payable a/c 10000

18000 18000

Accounts payable a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

08/0

6/16

To bank a/c 4000 02/

06/

16

By purchase 8000

31/0

6/16

To balance c/d 14000 16/

06/

16

By Purchase a/c 10000

18000 1800

Sales a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

31/0

6/16

To balance c/d 26000 07/

06/

16

By Cash a/c 4000

15/ By Accounts receivable 12000

02/0

6/16

To accounts payable a/c 8000 31/

06/

16

By balance c/d 18000

16/0

6/16

To accounts payable a/c 10000

18000 18000

Accounts payable a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

08/0

6/16

To bank a/c 4000 02/

06/

16

By purchase 8000

31/0

6/16

To balance c/d 14000 16/

06/

16

By Purchase a/c 10000

18000 1800

Sales a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

31/0

6/16

To balance c/d 26000 07/

06/

16

By Cash a/c 4000

15/ By Accounts receivable 12000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

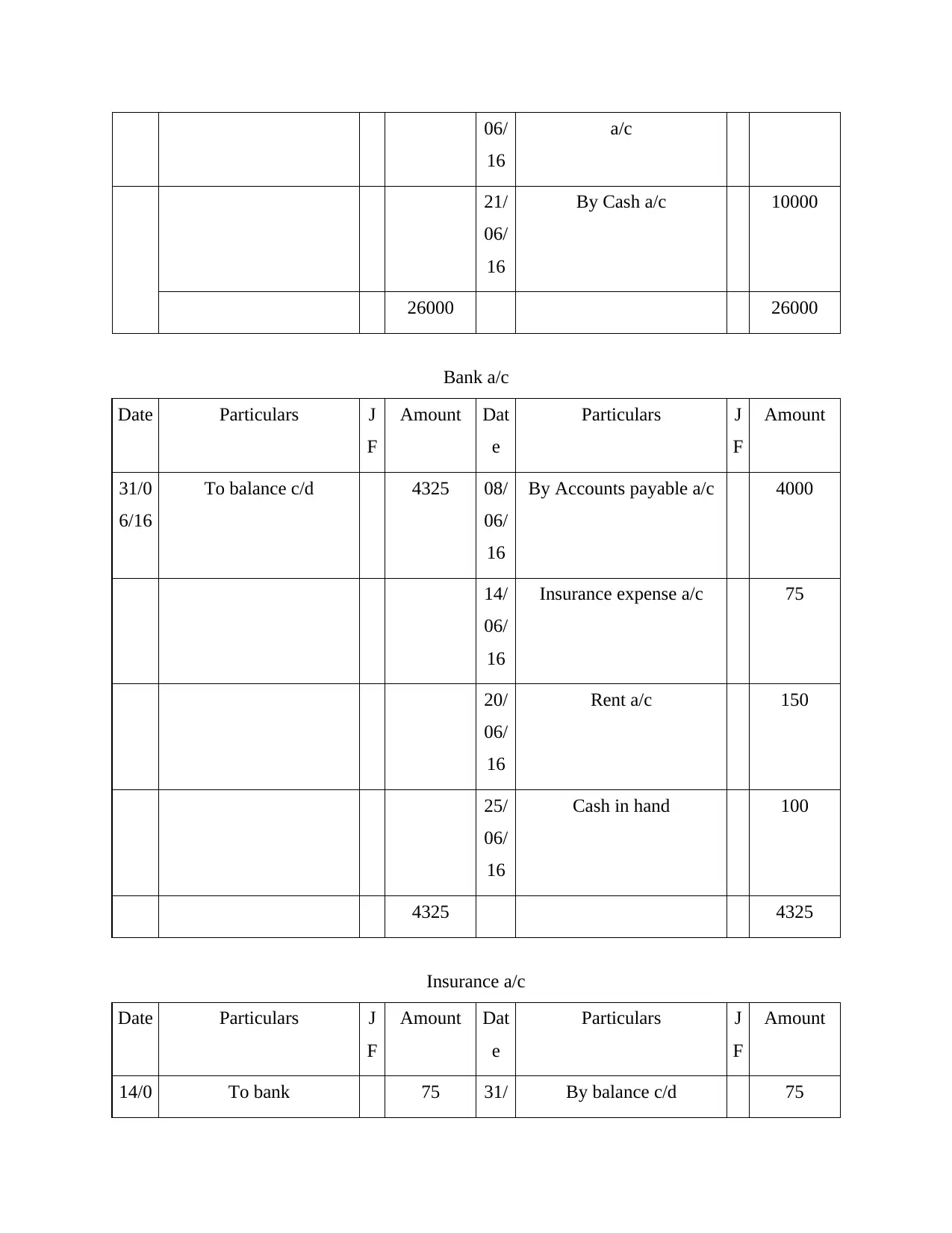

06/

16

a/c

21/

06/

16

By Cash a/c 10000

26000 26000

Bank a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

31/0

6/16

To balance c/d 4325 08/

06/

16

By Accounts payable a/c 4000

14/

06/

16

Insurance expense a/c 75

20/

06/

16

Rent a/c 150

25/

06/

16

Cash in hand 100

4325 4325

Insurance a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

14/0 To bank 75 31/ By balance c/d 75

16

a/c

21/

06/

16

By Cash a/c 10000

26000 26000

Bank a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

31/0

6/16

To balance c/d 4325 08/

06/

16

By Accounts payable a/c 4000

14/

06/

16

Insurance expense a/c 75

20/

06/

16

Rent a/c 150

25/

06/

16

Cash in hand 100

4325 4325

Insurance a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

14/0 To bank 75 31/ By balance c/d 75

6/16 06/

16

75 75

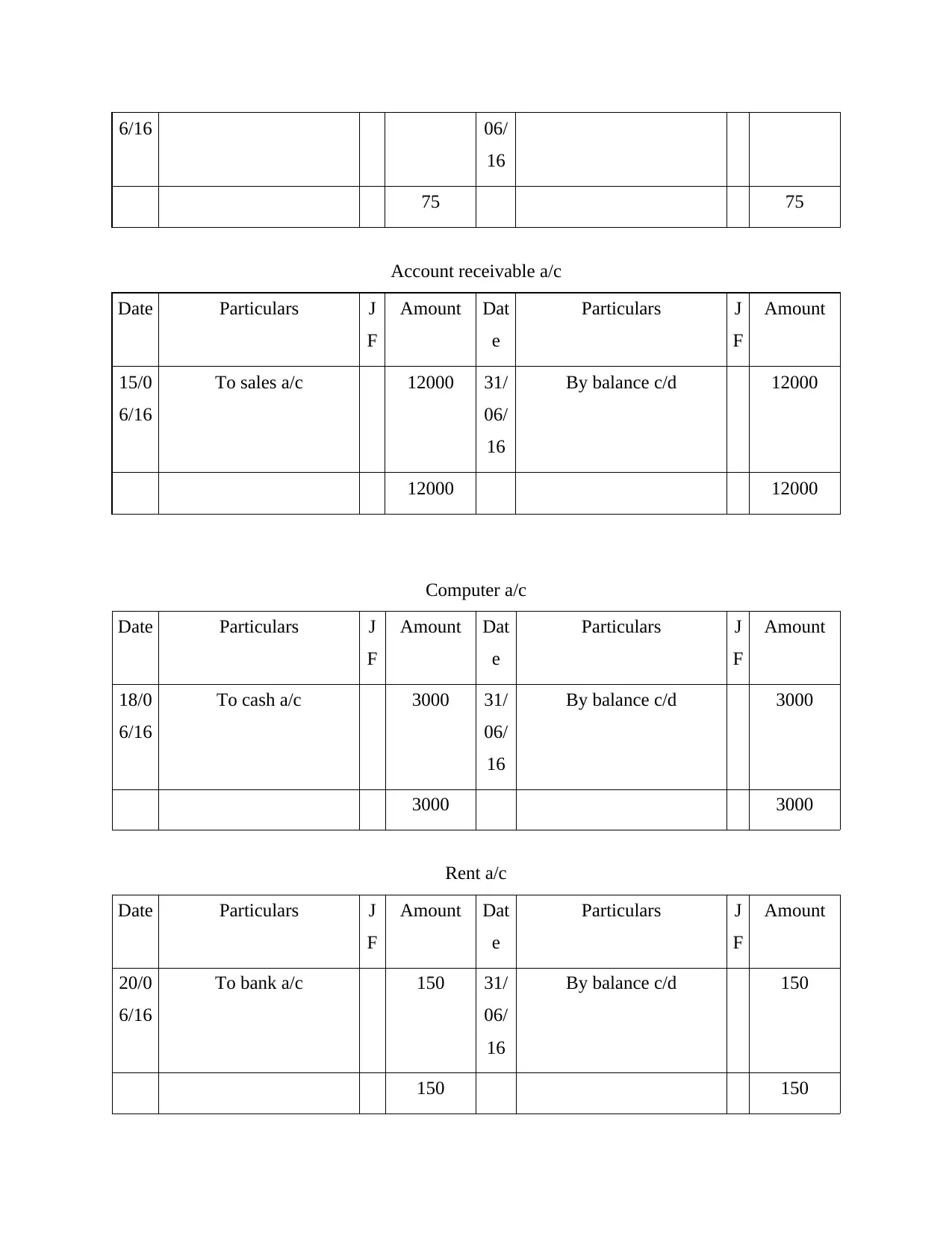

Account receivable a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

15/0

6/16

To sales a/c 12000 31/

06/

16

By balance c/d 12000

12000 12000

Computer a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

18/0

6/16

To cash a/c 3000 31/

06/

16

By balance c/d 3000

3000 3000

Rent a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

20/0

6/16

To bank a/c 150 31/

06/

16

By balance c/d 150

150 150

16

75 75

Account receivable a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

15/0

6/16

To sales a/c 12000 31/

06/

16

By balance c/d 12000

12000 12000

Computer a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

18/0

6/16

To cash a/c 3000 31/

06/

16

By balance c/d 3000

3000 3000

Rent a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

20/0

6/16

To bank a/c 150 31/

06/

16

By balance c/d 150

150 150

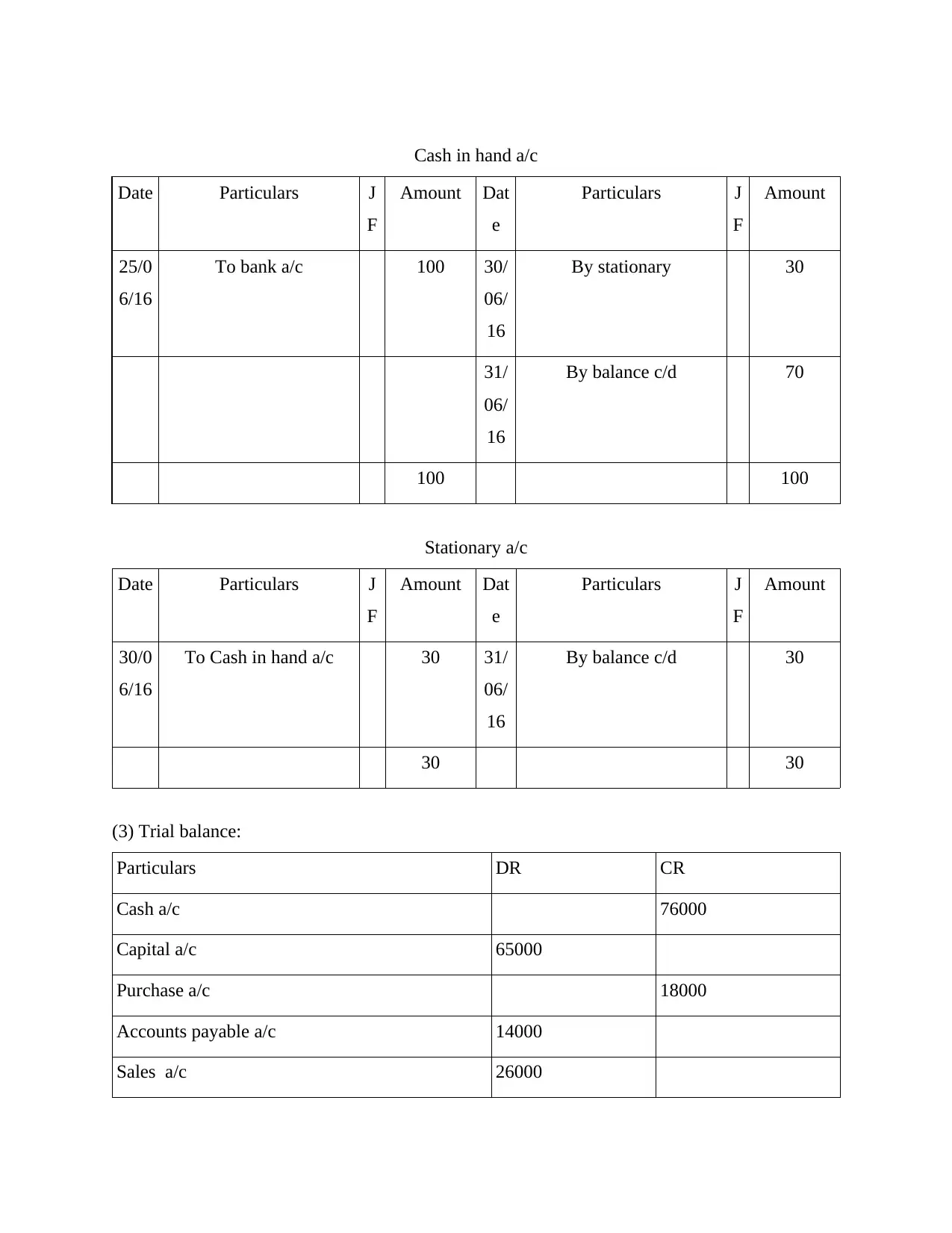

Cash in hand a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

25/0

6/16

To bank a/c 100 30/

06/

16

By stationary 30

31/

06/

16

By balance c/d 70

100 100

Stationary a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

30/0

6/16

To Cash in hand a/c 30 31/

06/

16

By balance c/d 30

30 30

(3) Trial balance:

Particulars DR CR

Cash a/c 76000

Capital a/c 65000

Purchase a/c 18000

Accounts payable a/c 14000

Sales a/c 26000

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

25/0

6/16

To bank a/c 100 30/

06/

16

By stationary 30

31/

06/

16

By balance c/d 70

100 100

Stationary a/c

Date Particulars J

F

Amount Dat

e

Particulars J

F

Amount

30/0

6/16

To Cash in hand a/c 30 31/

06/

16

By balance c/d 30

30 30

(3) Trial balance:

Particulars DR CR

Cash a/c 76000

Capital a/c 65000

Purchase a/c 18000

Accounts payable a/c 14000

Sales a/c 26000

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Bank a/c 4325

Insurance a/c 75

Account receivable a/c 12000

Computer a/c 3000

Rent a/c 150

Cash in hand a/c 70

stationary a/c 30

Total 109325 109325

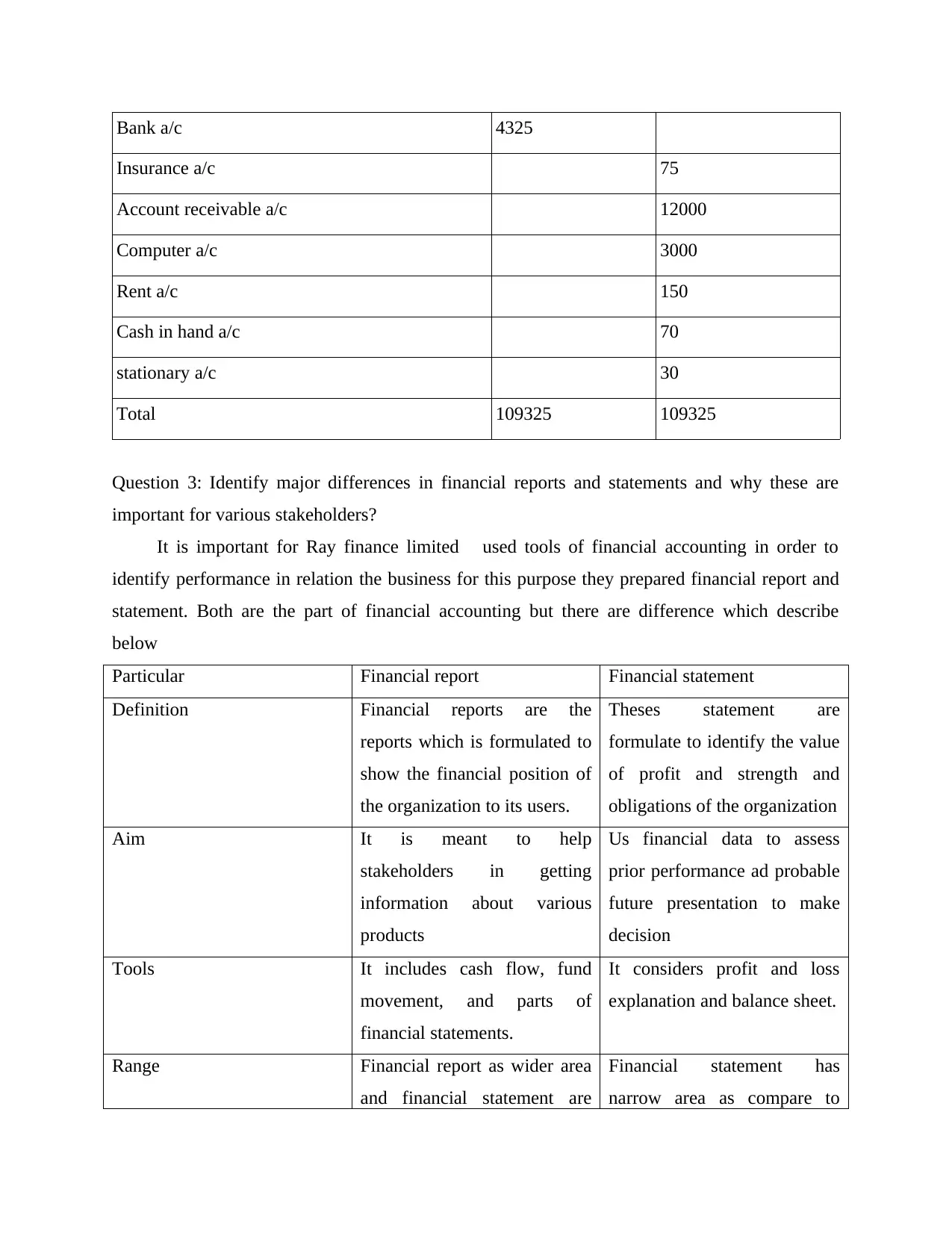

Question 3: Identify major differences in financial reports and statements and why these are

important for various stakeholders?

It is important for Ray finance limited used tools of financial accounting in order to

identify performance in relation the business for this purpose they prepared financial report and

statement. Both are the part of financial accounting but there are difference which describe

below

Particular Financial report Financial statement

Definition Financial reports are the

reports which is formulated to

show the financial position of

the organization to its users.

Theses statement are

formulate to identify the value

of profit and strength and

obligations of the organization

Aim It is meant to help

stakeholders in getting

information about various

products

Us financial data to assess

prior performance ad probable

future presentation to make

decision

Tools It includes cash flow, fund

movement, and parts of

financial statements.

It considers profit and loss

explanation and balance sheet.

Range Financial report as wider area

and financial statement are

Financial statement has

narrow area as compare to

Insurance a/c 75

Account receivable a/c 12000

Computer a/c 3000

Rent a/c 150

Cash in hand a/c 70

stationary a/c 30

Total 109325 109325

Question 3: Identify major differences in financial reports and statements and why these are

important for various stakeholders?

It is important for Ray finance limited used tools of financial accounting in order to

identify performance in relation the business for this purpose they prepared financial report and

statement. Both are the part of financial accounting but there are difference which describe

below

Particular Financial report Financial statement

Definition Financial reports are the

reports which is formulated to

show the financial position of

the organization to its users.

Theses statement are

formulate to identify the value

of profit and strength and

obligations of the organization

Aim It is meant to help

stakeholders in getting

information about various

products

Us financial data to assess

prior performance ad probable

future presentation to make

decision

Tools It includes cash flow, fund

movement, and parts of

financial statements.

It considers profit and loss

explanation and balance sheet.

Range Financial report as wider area

and financial statement are

Financial statement has

narrow area as compare to

part of it financial reports.

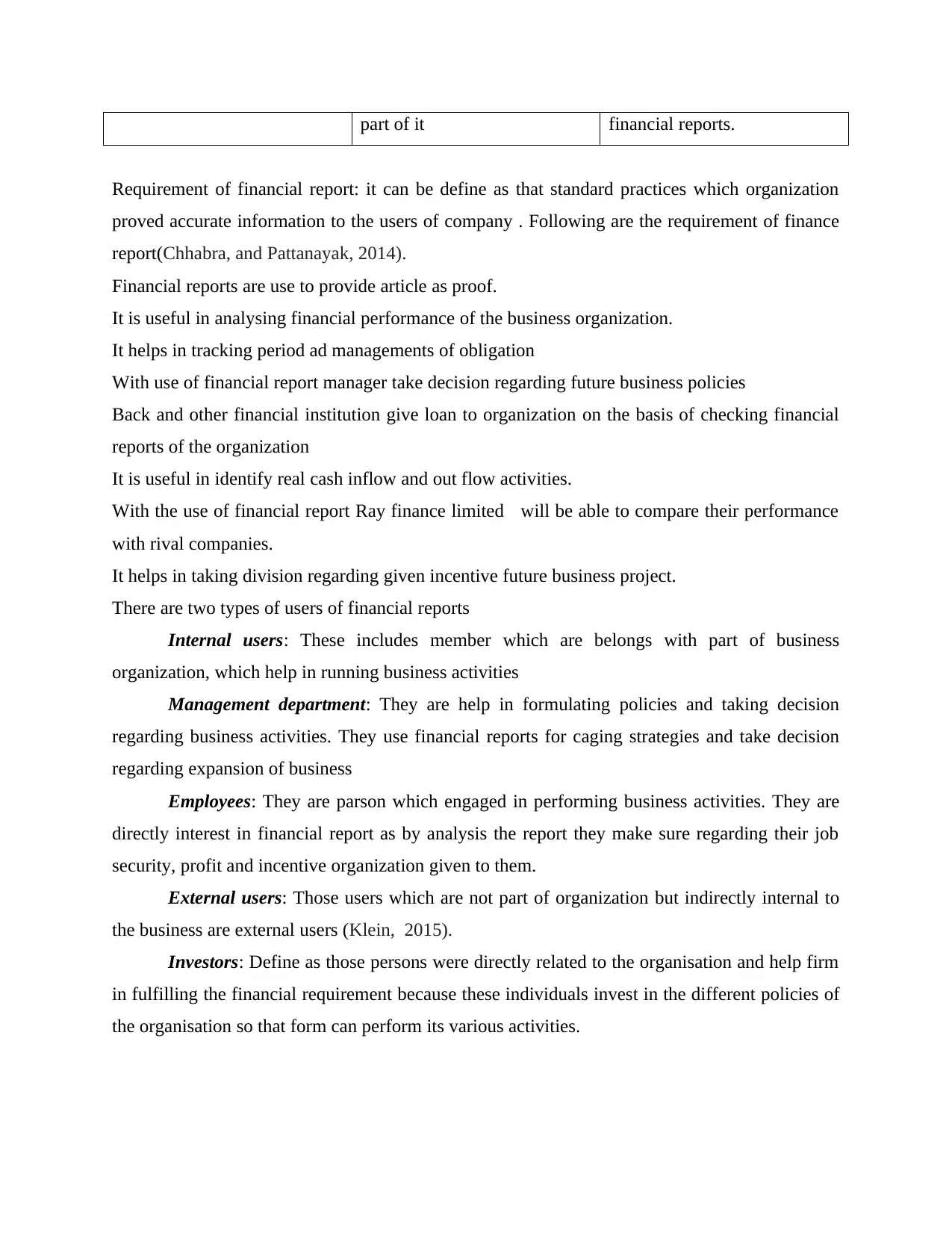

Requirement of financial report: it can be define as that standard practices which organization

proved accurate information to the users of company . Following are the requirement of finance

report(Chhabra, and Pattanayak, 2014).

Financial reports are use to provide article as proof.

It is useful in analysing financial performance of the business organization.

It helps in tracking period ad managements of obligation

With use of financial report manager take decision regarding future business policies

Back and other financial institution give loan to organization on the basis of checking financial

reports of the organization

It is useful in identify real cash inflow and out flow activities.

With the use of financial report Ray finance limited will be able to compare their performance

with rival companies.

It helps in taking division regarding given incentive future business project.

There are two types of users of financial reports

Internal users: These includes member which are belongs with part of business

organization, which help in running business activities

Management department: They are help in formulating policies and taking decision

regarding business activities. They use financial reports for caging strategies and take decision

regarding expansion of business

Employees: They are parson which engaged in performing business activities. They are

directly interest in financial report as by analysis the report they make sure regarding their job

security, profit and incentive organization given to them.

External users: Those users which are not part of organization but indirectly internal to

the business are external users (Klein, 2015).

Investors: Define as those persons were directly related to the organisation and help firm

in fulfilling the financial requirement because these individuals invest in the different policies of

the organisation so that form can perform its various activities.

Requirement of financial report: it can be define as that standard practices which organization

proved accurate information to the users of company . Following are the requirement of finance

report(Chhabra, and Pattanayak, 2014).

Financial reports are use to provide article as proof.

It is useful in analysing financial performance of the business organization.

It helps in tracking period ad managements of obligation

With use of financial report manager take decision regarding future business policies

Back and other financial institution give loan to organization on the basis of checking financial

reports of the organization

It is useful in identify real cash inflow and out flow activities.

With the use of financial report Ray finance limited will be able to compare their performance

with rival companies.

It helps in taking division regarding given incentive future business project.

There are two types of users of financial reports

Internal users: These includes member which are belongs with part of business

organization, which help in running business activities

Management department: They are help in formulating policies and taking decision

regarding business activities. They use financial reports for caging strategies and take decision

regarding expansion of business

Employees: They are parson which engaged in performing business activities. They are

directly interest in financial report as by analysis the report they make sure regarding their job

security, profit and incentive organization given to them.

External users: Those users which are not part of organization but indirectly internal to

the business are external users (Klein, 2015).

Investors: Define as those persons were directly related to the organisation and help firm

in fulfilling the financial requirement because these individuals invest in the different policies of

the organisation so that form can perform its various activities.

Public: public can define a journal people which are directly related to the organisation

help the organisation in fulfilling its different functional requirements related to employment

goodwill and performance of the fall within the market..

Government: They supervisors all organization and give permission of foreign trade and

expanding business in other countries or place on the basis of analysis the overall performance

and financial report of the organizations.

Competitors: Rival industries, compare them self by identifying the financial

performance and profit ratios of the organizations

Suppliers: it includes person who helps the organisation in identifying the requirements

related to raw materials as well as different working items which are required to perform the

functions related to selling of goods and services.

Financial institutions: Theses institution are proved loan to business organization. They

include, banks, mutual fund,, insurance companies etc. They proved loan on the basis of

reputation and financial perforce of the company.

Question 4: explain different fundamental principles of accounting.

Fundamental principles of accounting: These are general functions which rules and

benchmark in the field of accounting which is based on various kinds of principles of GAAP.

Economic entity: According to this principle organization and business are 2 different

things.

Conservatism: If a situation arises where there are 2 acceptable options for reporting an

item accounting goes for less favourable option.

Materiality: The information which will have a material effete should form a part in

foreseeable future (Baban and Sharma, 2015).

Reliability: Only those transactions should be recorded that can proven and has significant

evidence.

Revenue recoganization: Recognition of revenue should be o accrual basis of accounting

Consistency: It is usage of method, principles until another method comes proves to be

better.

Full disclosure: Employers should be disclosing all relevant information regarding

business.

help the organisation in fulfilling its different functional requirements related to employment

goodwill and performance of the fall within the market..

Government: They supervisors all organization and give permission of foreign trade and

expanding business in other countries or place on the basis of analysis the overall performance

and financial report of the organizations.

Competitors: Rival industries, compare them self by identifying the financial

performance and profit ratios of the organizations

Suppliers: it includes person who helps the organisation in identifying the requirements

related to raw materials as well as different working items which are required to perform the

functions related to selling of goods and services.

Financial institutions: Theses institution are proved loan to business organization. They

include, banks, mutual fund,, insurance companies etc. They proved loan on the basis of

reputation and financial perforce of the company.

Question 4: explain different fundamental principles of accounting.

Fundamental principles of accounting: These are general functions which rules and

benchmark in the field of accounting which is based on various kinds of principles of GAAP.

Economic entity: According to this principle organization and business are 2 different

things.

Conservatism: If a situation arises where there are 2 acceptable options for reporting an

item accounting goes for less favourable option.

Materiality: The information which will have a material effete should form a part in

foreseeable future (Baban and Sharma, 2015).

Reliability: Only those transactions should be recorded that can proven and has significant

evidence.

Revenue recoganization: Recognition of revenue should be o accrual basis of accounting

Consistency: It is usage of method, principles until another method comes proves to be

better.

Full disclosure: Employers should be disclosing all relevant information regarding

business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Monetary unit: Transactions that carry monetary value and statement in terms of currency

should be recorded.

Time: There should be standardize time period of reporting the financial statements’

usually monthly quarterly and annually.

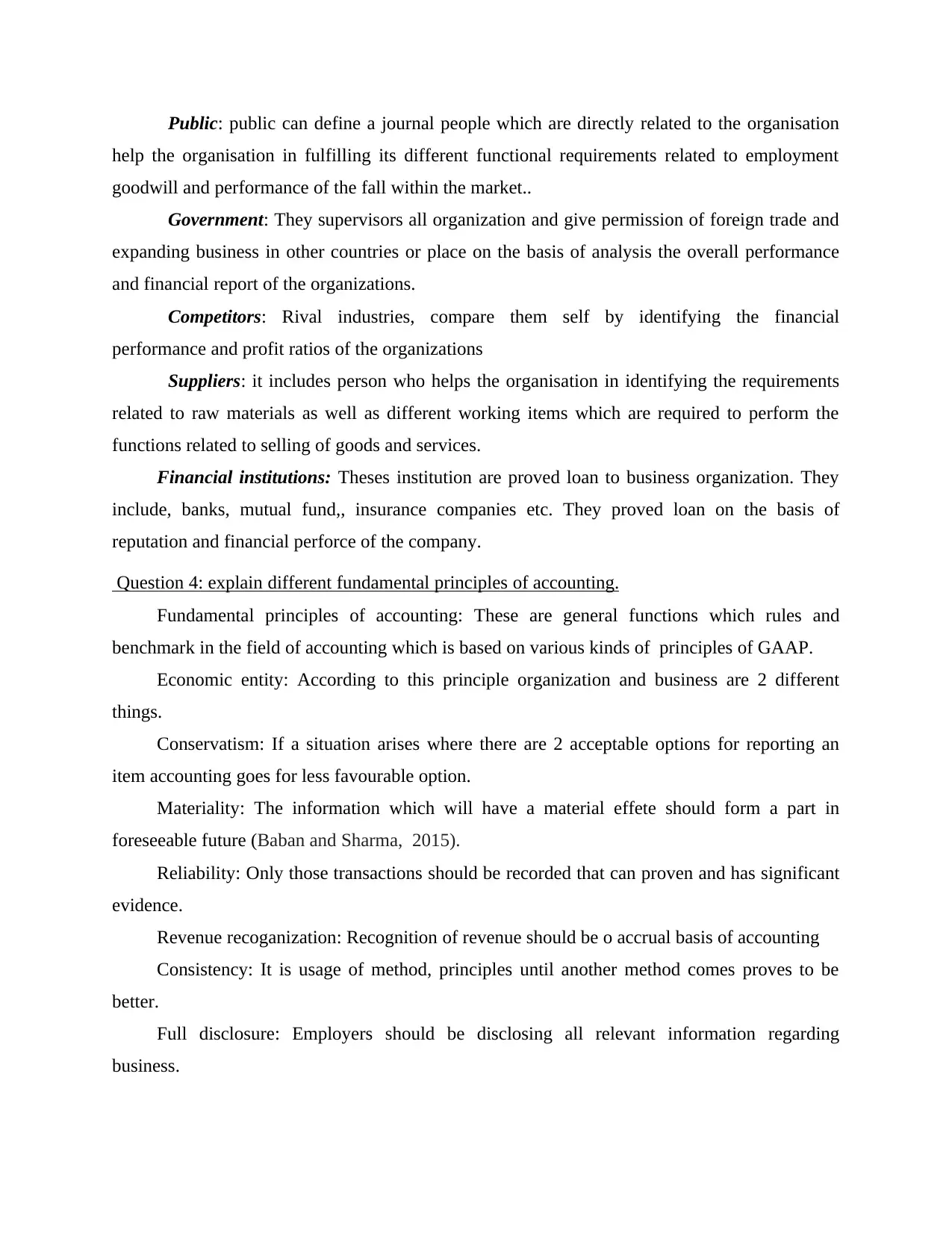

Question 5:Prepare a profit and loss account for the year ended 31 December 2017 and balance

sheet at that date.

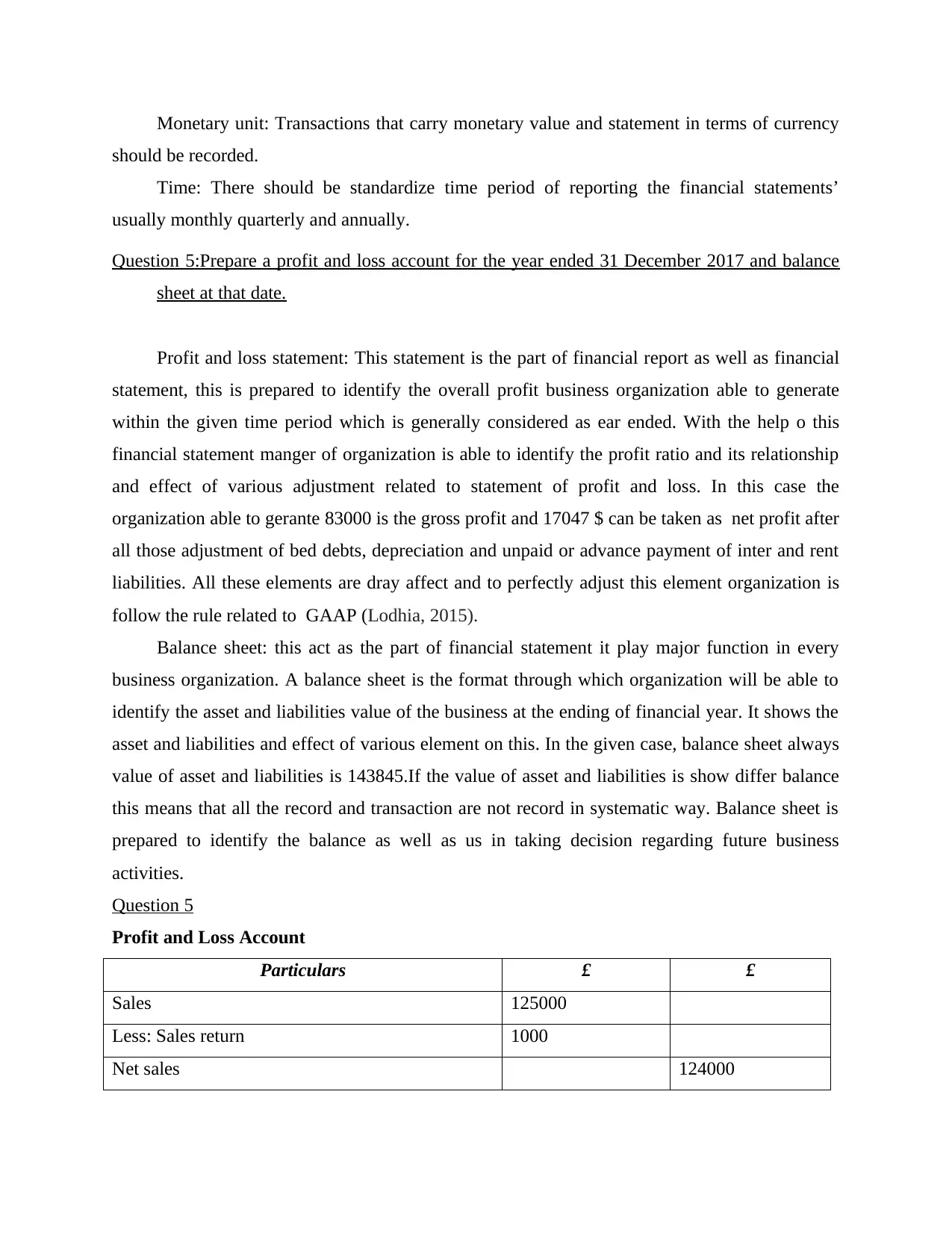

Profit and loss statement: This statement is the part of financial report as well as financial

statement, this is prepared to identify the overall profit business organization able to generate

within the given time period which is generally considered as ear ended. With the help o this

financial statement manger of organization is able to identify the profit ratio and its relationship

and effect of various adjustment related to statement of profit and loss. In this case the

organization able to gerante 83000 is the gross profit and 17047 $ can be taken as net profit after

all those adjustment of bed debts, depreciation and unpaid or advance payment of inter and rent

liabilities. All these elements are dray affect and to perfectly adjust this element organization is

follow the rule related to GAAP (Lodhia, 2015).

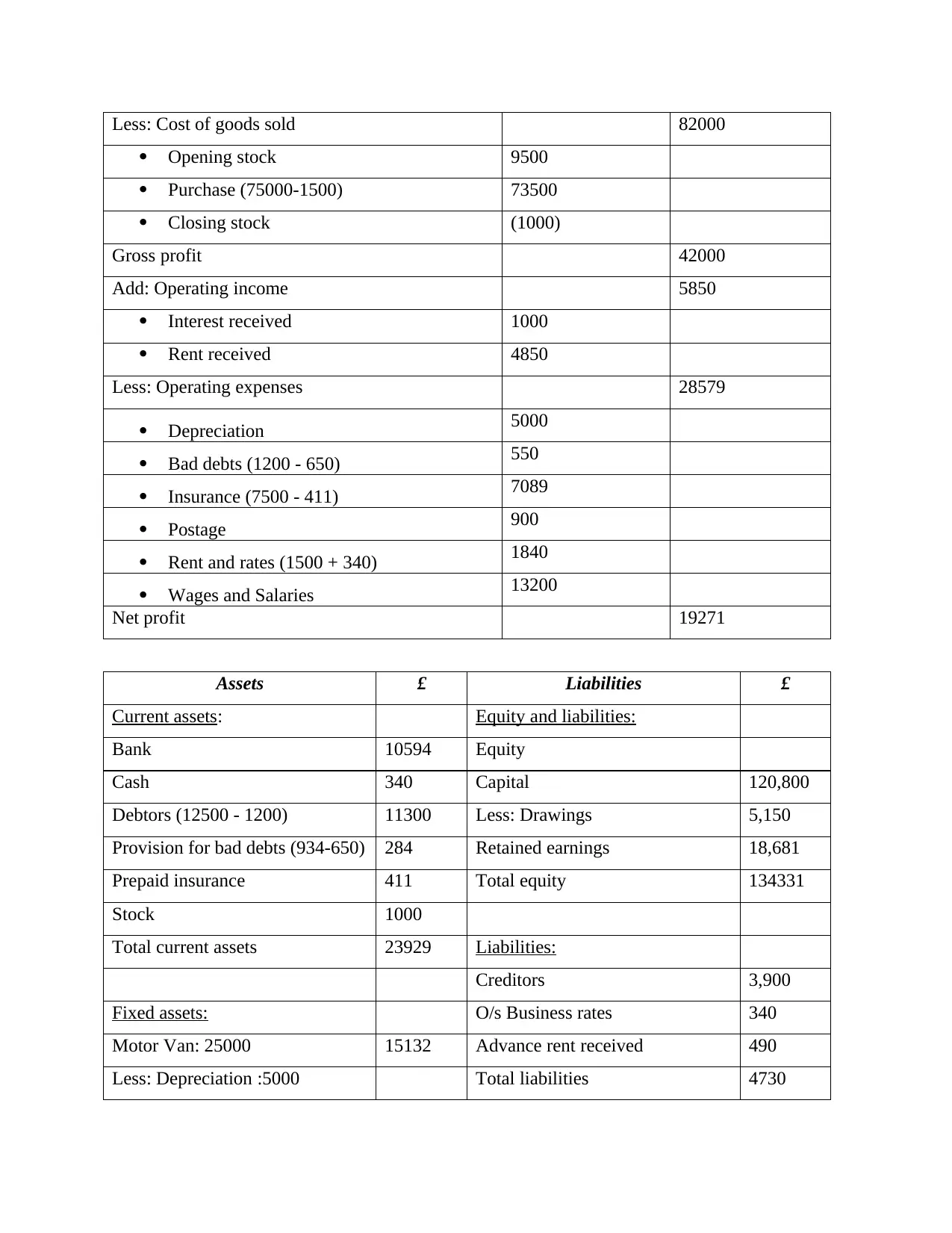

Balance sheet: this act as the part of financial statement it play major function in every

business organization. A balance sheet is the format through which organization will be able to

identify the asset and liabilities value of the business at the ending of financial year. It shows the

asset and liabilities and effect of various element on this. In the given case, balance sheet always

value of asset and liabilities is 143845.If the value of asset and liabilities is show differ balance

this means that all the record and transaction are not record in systematic way. Balance sheet is

prepared to identify the balance as well as us in taking decision regarding future business

activities.

Question 5

Profit and Loss Account

Particulars £ £

Sales 125000

Less: Sales return 1000

Net sales 124000

should be recorded.

Time: There should be standardize time period of reporting the financial statements’

usually monthly quarterly and annually.

Question 5:Prepare a profit and loss account for the year ended 31 December 2017 and balance

sheet at that date.

Profit and loss statement: This statement is the part of financial report as well as financial

statement, this is prepared to identify the overall profit business organization able to generate

within the given time period which is generally considered as ear ended. With the help o this

financial statement manger of organization is able to identify the profit ratio and its relationship

and effect of various adjustment related to statement of profit and loss. In this case the

organization able to gerante 83000 is the gross profit and 17047 $ can be taken as net profit after

all those adjustment of bed debts, depreciation and unpaid or advance payment of inter and rent

liabilities. All these elements are dray affect and to perfectly adjust this element organization is

follow the rule related to GAAP (Lodhia, 2015).

Balance sheet: this act as the part of financial statement it play major function in every

business organization. A balance sheet is the format through which organization will be able to

identify the asset and liabilities value of the business at the ending of financial year. It shows the

asset and liabilities and effect of various element on this. In the given case, balance sheet always

value of asset and liabilities is 143845.If the value of asset and liabilities is show differ balance

this means that all the record and transaction are not record in systematic way. Balance sheet is

prepared to identify the balance as well as us in taking decision regarding future business

activities.

Question 5

Profit and Loss Account

Particulars £ £

Sales 125000

Less: Sales return 1000

Net sales 124000

Less: Cost of goods sold 82000

Opening stock 9500

Purchase (75000-1500) 73500

Closing stock (1000)

Gross profit 42000

Add: Operating income 5850

Interest received 1000

Rent received 4850

Less: Operating expenses 28579

Depreciation 5000

Bad debts (1200 - 650) 550

Insurance (7500 - 411) 7089

Postage 900

Rent and rates (1500 + 340) 1840

Wages and Salaries 13200

Net profit 19271

Assets £ Liabilities £

Current assets: Equity and liabilities:

Bank 10594 Equity

Cash 340 Capital 120,800

Debtors (12500 - 1200) 11300 Less: Drawings 5,150

Provision for bad debts (934-650) 284 Retained earnings 18,681

Prepaid insurance 411 Total equity 134331

Stock 1000

Total current assets 23929 Liabilities:

Creditors 3,900

Fixed assets: O/s Business rates 340

Motor Van: 25000 15132 Advance rent received 490

Less: Depreciation :5000 Total liabilities 4730

Opening stock 9500

Purchase (75000-1500) 73500

Closing stock (1000)

Gross profit 42000

Add: Operating income 5850

Interest received 1000

Rent received 4850

Less: Operating expenses 28579

Depreciation 5000

Bad debts (1200 - 650) 550

Insurance (7500 - 411) 7089

Postage 900

Rent and rates (1500 + 340) 1840

Wages and Salaries 13200

Net profit 19271

Assets £ Liabilities £

Current assets: Equity and liabilities:

Bank 10594 Equity

Cash 340 Capital 120,800

Debtors (12500 - 1200) 11300 Less: Drawings 5,150

Provision for bad debts (934-650) 284 Retained earnings 18,681

Prepaid insurance 411 Total equity 134331

Stock 1000

Total current assets 23929 Liabilities:

Creditors 3,900

Fixed assets: O/s Business rates 340

Motor Van: 25000 15132 Advance rent received 490

Less: Depreciation :5000 Total liabilities 4730

Less: Accumulated depreciation:

4868

Loan given 100000

Total fixed assets 115132

Total assets 139061 Total equity and liabilities 139061

TASK2

Question1: What is meant by bank reconciliation and why is it required? How is this achieved?

Why is this necessary?

Bank reconciliation: This can defined as the statement through where organization has to

match its cash account with different financial bank account information. In other words it is the

procedure in which bank balance as per business organization’s records are matched with

balance of the bank account. It is essential to check the balance of cash book and bank statement

with given time period other with differences amount is high .The main purpose of preparing ban

reconciliation statement is to identify the difference between cash book and bank passbook , in

order to reduce the difference. It will help in controlling illegal and fraudulent business activities

and managements department have reliable information regarding bank. Once the organization

repaired the statement they match every transaction though leader and identify entries and on the

basis of that they find out those entries which are the reason of arriving deviations between

actual cash book and bank statement (Kurosaki, and Usami, 2016).

It is essential for preparation of bank reconciliation statement, without in manger never able to

identify the reason of difference and also they don’t have any proof regarding how many time

transaction of bank is incurred the reason. It may increase fraudulent business activities in the

organization. To overcome this entire problem is require by organza to prepared in on annual

timely basis. For reducing gap manager need to prepare back reconciliation statement within

week of time. If they don’t create this statement then there will be multiple problems has been

arise in from of the organization. With the use of bank reconciliation Ray finance limited able

to reduce their errors and all the cash book transaction with their original bank statement.

4868

Loan given 100000

Total fixed assets 115132

Total assets 139061 Total equity and liabilities 139061

TASK2

Question1: What is meant by bank reconciliation and why is it required? How is this achieved?

Why is this necessary?

Bank reconciliation: This can defined as the statement through where organization has to

match its cash account with different financial bank account information. In other words it is the

procedure in which bank balance as per business organization’s records are matched with

balance of the bank account. It is essential to check the balance of cash book and bank statement

with given time period other with differences amount is high .The main purpose of preparing ban

reconciliation statement is to identify the difference between cash book and bank passbook , in

order to reduce the difference. It will help in controlling illegal and fraudulent business activities

and managements department have reliable information regarding bank. Once the organization

repaired the statement they match every transaction though leader and identify entries and on the

basis of that they find out those entries which are the reason of arriving deviations between

actual cash book and bank statement (Kurosaki, and Usami, 2016).

It is essential for preparation of bank reconciliation statement, without in manger never able to

identify the reason of difference and also they don’t have any proof regarding how many time

transaction of bank is incurred the reason. It may increase fraudulent business activities in the

organization. To overcome this entire problem is require by organza to prepared in on annual

timely basis. For reducing gap manager need to prepare back reconciliation statement within

week of time. If they don’t create this statement then there will be multiple problems has been

arise in from of the organization. With the use of bank reconciliation Ray finance limited able

to reduce their errors and all the cash book transaction with their original bank statement.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Question 2: what are control accounts? Explain the role of control accounts in financial

management.

Control accounts: Theses are also define as adjustment account, they are call controlling

accrue because for these activity transaction, manger create a separate subsidiary leader account,

it will help in tracking all the business transactions in more detail form. Individual transaction of

these account are posted in correspondent and subsidiary account. For example, account revel,

accountant formulate it separate account and it will also be show in each debtors account. These

are the summery of all the individual transactions.

Controlling accounts play essential and major role in financial managements with the se of these

transactions mangers will be able to identify the summery of all the relevant business

transactions through which financial manger take decision regarding formulation of business

policies.

It helps in specialization of work by dividing and separating accounts. It useful in saving time

and reducing error.

Control account proved base to Ray finance limited for formulating profit and loss statements.

It helped in controlling internal check and is also proved greater accuracy of all the record of

accounts.

Control account is provides base to the preparation of reconciliation of finance and cost account

and statements.

Question 3: what is suspense account? What are the reasons for drafting suspense accounts?

Suspense account: These accounts are prepared to carry doubtful entire in record. These

entire are recorded on temporary basis. It is made because the ledger and journal entry not

recorded transaction at the time they arrived. These are types of unsure business accounts. It is

essential for accountant to prepare suspense account as it will help in maintaining the balance of

ledger, if accountant is not clear regarding any that where from cash has been receive then

suspense account is formulated by organization to create the suspense and fulfil the barriers of

the entry. Business account gave time place to that transaction until accountant found their real

place of which account can easily match back and complete their task at the time They required.

it is useful in fond out the reason of omission entry (Ushad, and Ramen, , 2017).

management.

Control accounts: Theses are also define as adjustment account, they are call controlling

accrue because for these activity transaction, manger create a separate subsidiary leader account,

it will help in tracking all the business transactions in more detail form. Individual transaction of

these account are posted in correspondent and subsidiary account. For example, account revel,

accountant formulate it separate account and it will also be show in each debtors account. These

are the summery of all the individual transactions.

Controlling accounts play essential and major role in financial managements with the se of these

transactions mangers will be able to identify the summery of all the relevant business

transactions through which financial manger take decision regarding formulation of business

policies.

It helps in specialization of work by dividing and separating accounts. It useful in saving time

and reducing error.

Control account proved base to Ray finance limited for formulating profit and loss statements.

It helped in controlling internal check and is also proved greater accuracy of all the record of

accounts.

Control account is provides base to the preparation of reconciliation of finance and cost account

and statements.

Question 3: what is suspense account? What are the reasons for drafting suspense accounts?

Suspense account: These accounts are prepared to carry doubtful entire in record. These

entire are recorded on temporary basis. It is made because the ledger and journal entry not

recorded transaction at the time they arrived. These are types of unsure business accounts. It is

essential for accountant to prepare suspense account as it will help in maintaining the balance of

ledger, if accountant is not clear regarding any that where from cash has been receive then

suspense account is formulated by organization to create the suspense and fulfil the barriers of

the entry. Business account gave time place to that transaction until accountant found their real

place of which account can easily match back and complete their task at the time They required.

it is useful in fond out the reason of omission entry (Ushad, and Ramen, , 2017).

Question 3 prepare cash book

Cashbook: It is statements which show only cash transaction it also know as cash ledger

which only considered the cash inflows and cash out flow related business transaction. Business

organization prepared cash book to identify their cash activities balance these are properly

formulate to detect the error and control any illegally activities incurred during busies run their

cycle. It is useful in cutting time also usefully identify cost incurred in business activities and

those activities through which business able to generate more cash as compare to other business

activities (Agwu, 2014).

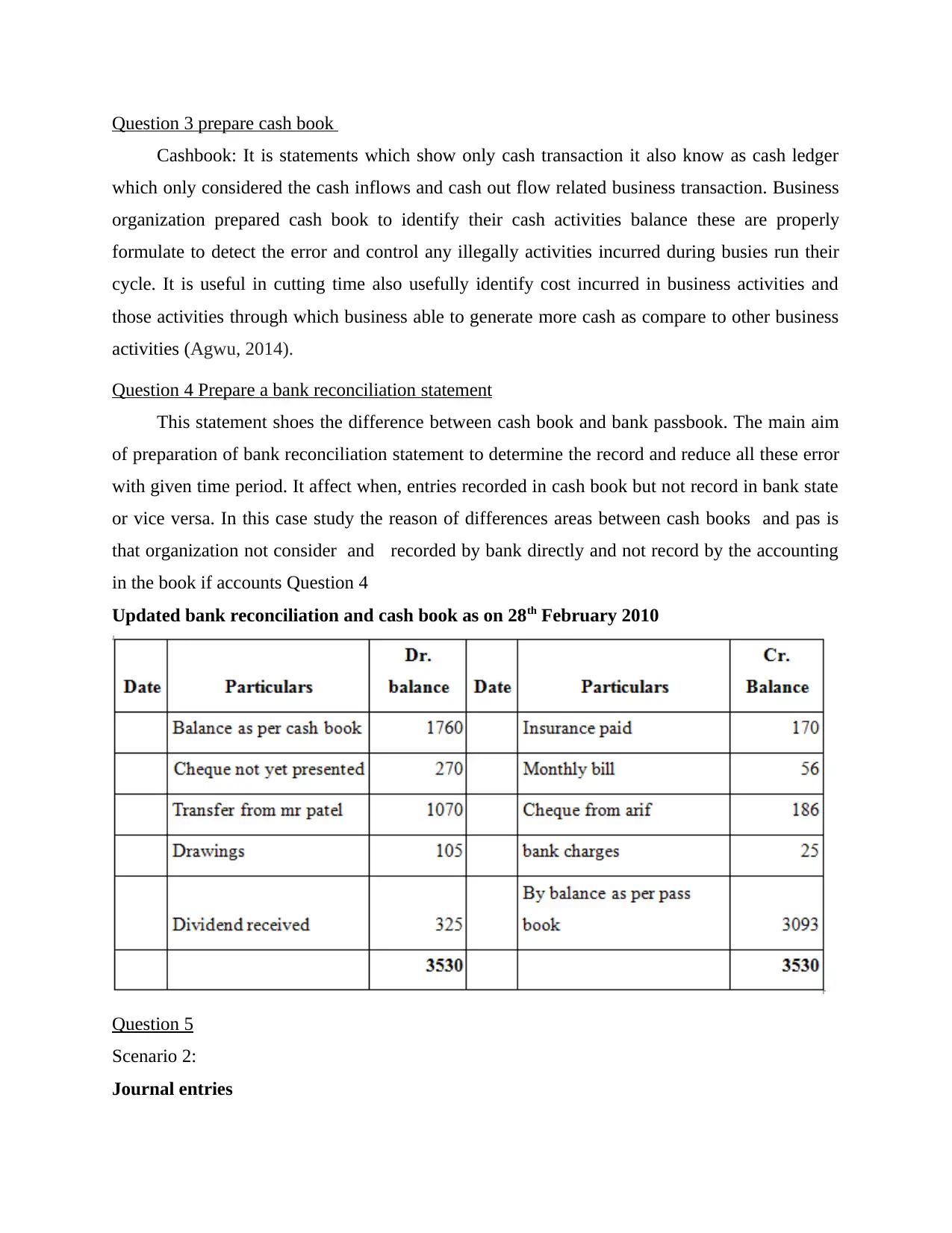

Question 4 Prepare a bank reconciliation statement

This statement shoes the difference between cash book and bank passbook. The main aim

of preparation of bank reconciliation statement to determine the record and reduce all these error

with given time period. It affect when, entries recorded in cash book but not record in bank state

or vice versa. In this case study the reason of differences areas between cash books and pas is

that organization not consider and recorded by bank directly and not record by the accounting

in the book if accounts Question 4

Updated bank reconciliation and cash book as on 28th February 2010

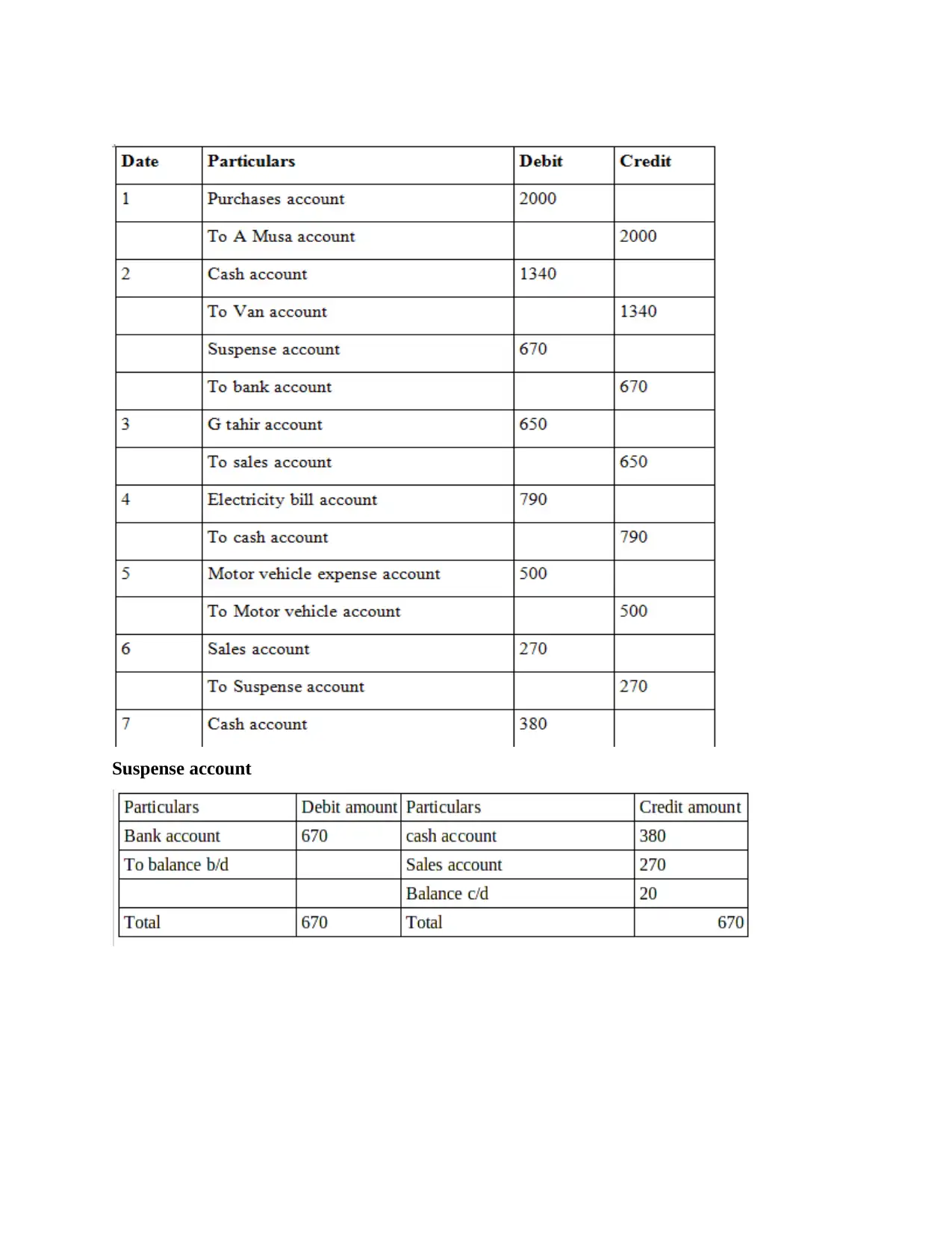

Question 5

Scenario 2:

Journal entries

Cashbook: It is statements which show only cash transaction it also know as cash ledger

which only considered the cash inflows and cash out flow related business transaction. Business

organization prepared cash book to identify their cash activities balance these are properly

formulate to detect the error and control any illegally activities incurred during busies run their

cycle. It is useful in cutting time also usefully identify cost incurred in business activities and

those activities through which business able to generate more cash as compare to other business

activities (Agwu, 2014).

Question 4 Prepare a bank reconciliation statement

This statement shoes the difference between cash book and bank passbook. The main aim

of preparation of bank reconciliation statement to determine the record and reduce all these error

with given time period. It affect when, entries recorded in cash book but not record in bank state

or vice versa. In this case study the reason of differences areas between cash books and pas is

that organization not consider and recorded by bank directly and not record by the accounting

in the book if accounts Question 4

Updated bank reconciliation and cash book as on 28th February 2010

Question 5

Scenario 2:

Journal entries

Suspense account

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONCLUSION

From the above analysis’ it has been identifying that accounting play major role in

running business organization. Without accounting , business not able to run their activities as

they don’t have any idea regarding the profit, loss how to formulate policies and they don’t have

any report which they present to external world. Accounting is started with journal entries, these

provides base to prepare other ledger, trial balance and financial statement. Trial balance and

bank reconciliations are prepared to reduce errors of back and other accounts of leader with the

use of suspense and control accounts. Management department uses financial report to represent

it in form of internal and external users does them takes decision and recognize the performance

of the business organization. These are also useful in solving financial problems by using tools of

financial managements.

From the above analysis’ it has been identifying that accounting play major role in

running business organization. Without accounting , business not able to run their activities as

they don’t have any idea regarding the profit, loss how to formulate policies and they don’t have

any report which they present to external world. Accounting is started with journal entries, these

provides base to prepare other ledger, trial balance and financial statement. Trial balance and

bank reconciliations are prepared to reduce errors of back and other accounts of leader with the

use of suspense and control accounts. Management department uses financial report to represent

it in form of internal and external users does them takes decision and recognize the performance

of the business organization. These are also useful in solving financial problems by using tools of

financial managements.

REFRENCES

Books and journal

Berry, L.E., 2018. Financial accounting demystified. McGraw-Hill,

Books and journal

Berry, L.E., 2018. Financial accounting demystified. McGraw-Hill,

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.