University of Sunderland Financial Accounting Assignment - UGB105

VerifiedAdded on 2022/11/29

|15

|3810

|288

Homework Assignment

AI Summary

This assignment provides a comprehensive solution to a financial accounting problem, focusing on the analysis of Bob Peterson's fabric shop. The solution includes the preparation of a trading account, profit and loss account, and statement of financial position. It also covers the calculation and inter...

FINANCIAL ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

QUESTION 1A)..............................................................................................................................3

a. Trading account for the year ended 30 April 2020..................................................................3

b. Profit and loss account for the year ended 30 April 2020.......................................................3

c. Statement of financial position as at 30 April 2020.................................................................4

QUESTION 1B)..............................................................................................................................4

Features of information with the context of financial statement:................................................4

QUESTION 2 A).............................................................................................................................7

Calculation of different types of the ratios..................................................................................7

QUESTION 2B)..............................................................................................................................8

a. Bank account at the end of every month..................................................................................8

b. Other accounts and balancing them.........................................................................................9

c. Extraction of the trial balance as at 30 April 2020................................................................12

QUESTION 2C)............................................................................................................................12

i) Straight line method @ 12.5% per annum.............................................................................12

ii) Reducing balance method @ 15% per annum......................................................................13

iii) Meaning and significance accounting concept....................................................................13

CONCLUSION..............................................................................................................................14

REFERENCES................................................................................................................................1

INTRODUCTION...........................................................................................................................3

QUESTION 1A)..............................................................................................................................3

a. Trading account for the year ended 30 April 2020..................................................................3

b. Profit and loss account for the year ended 30 April 2020.......................................................3

c. Statement of financial position as at 30 April 2020.................................................................4

QUESTION 1B)..............................................................................................................................4

Features of information with the context of financial statement:................................................4

QUESTION 2 A).............................................................................................................................7

Calculation of different types of the ratios..................................................................................7

QUESTION 2B)..............................................................................................................................8

a. Bank account at the end of every month..................................................................................8

b. Other accounts and balancing them.........................................................................................9

c. Extraction of the trial balance as at 30 April 2020................................................................12

QUESTION 2C)............................................................................................................................12

i) Straight line method @ 12.5% per annum.............................................................................12

ii) Reducing balance method @ 15% per annum......................................................................13

iii) Meaning and significance accounting concept....................................................................13

CONCLUSION..............................................................................................................................14

REFERENCES................................................................................................................................1

INTRODUCTION

Financial accounting is one of the essential parts of accounting and accounting department.

As per this accounting financial statement with regard to the company’s financial position is

being prepared followed by its analysis so that the company and its concerned stakeholders can

take the adequate and appropriate decision (Warren, Jonick and Schneider, 2020). This report

will discuss about the various aspect of financial accounting and the preparation of financial

accounts. Here in this report a section of ratio analysis is also included along with the detailed

explanation of depreciation accounts and the concept of accounting concepts.

QUESTION 1A)

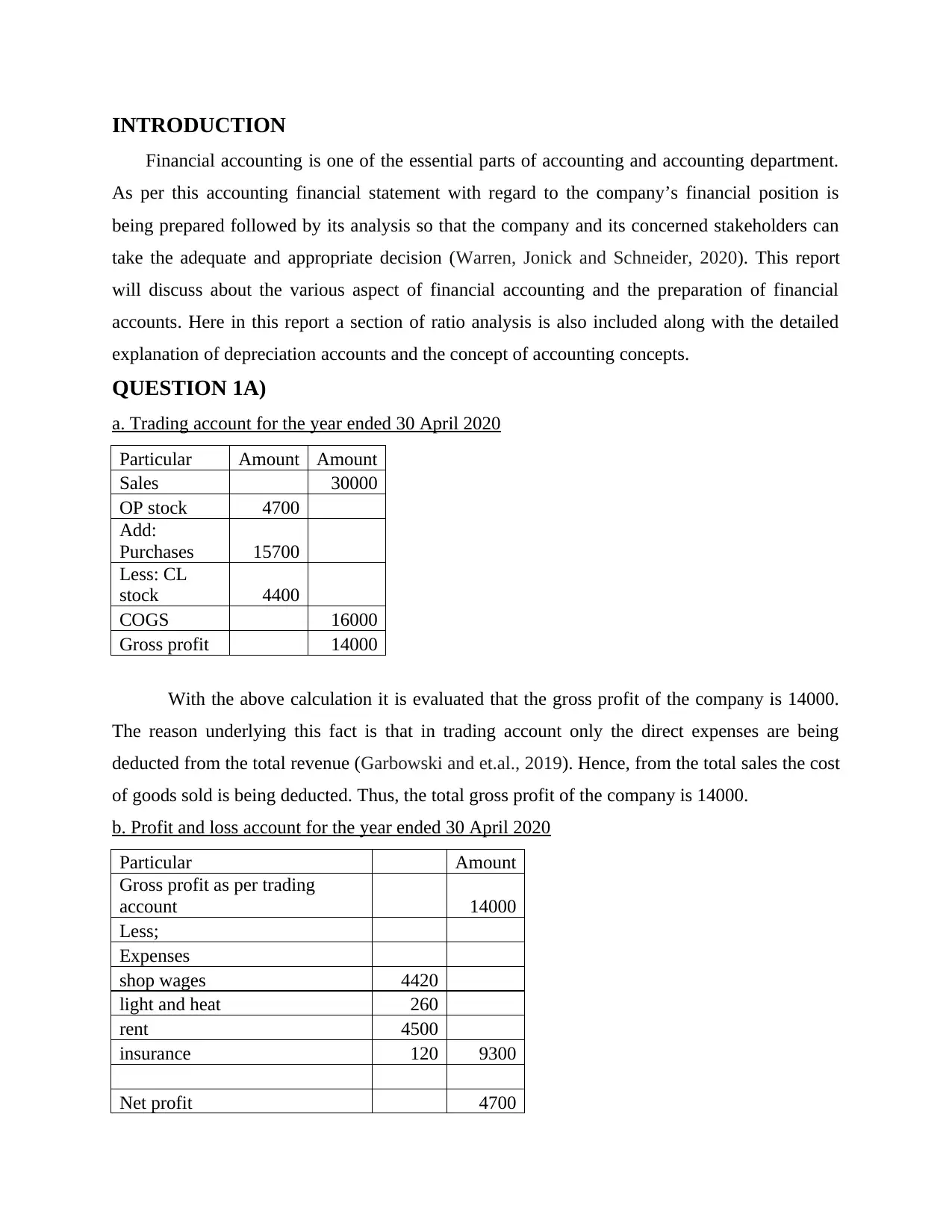

a. Trading account for the year ended 30 April 2020

Particular Amount Amount

Sales 30000

OP stock 4700

Add:

Purchases 15700

Less: CL

stock 4400

COGS 16000

Gross profit 14000

With the above calculation it is evaluated that the gross profit of the company is 14000.

The reason underlying this fact is that in trading account only the direct expenses are being

deducted from the total revenue (Garbowski and et.al., 2019). Hence, from the total sales the cost

of goods sold is being deducted. Thus, the total gross profit of the company is 14000.

b. Profit and loss account for the year ended 30 April 2020

Particular Amount

Gross profit as per trading

account 14000

Less;

Expenses

shop wages 4420

light and heat 260

rent 4500

insurance 120 9300

Net profit 4700

Financial accounting is one of the essential parts of accounting and accounting department.

As per this accounting financial statement with regard to the company’s financial position is

being prepared followed by its analysis so that the company and its concerned stakeholders can

take the adequate and appropriate decision (Warren, Jonick and Schneider, 2020). This report

will discuss about the various aspect of financial accounting and the preparation of financial

accounts. Here in this report a section of ratio analysis is also included along with the detailed

explanation of depreciation accounts and the concept of accounting concepts.

QUESTION 1A)

a. Trading account for the year ended 30 April 2020

Particular Amount Amount

Sales 30000

OP stock 4700

Add:

Purchases 15700

Less: CL

stock 4400

COGS 16000

Gross profit 14000

With the above calculation it is evaluated that the gross profit of the company is 14000.

The reason underlying this fact is that in trading account only the direct expenses are being

deducted from the total revenue (Garbowski and et.al., 2019). Hence, from the total sales the cost

of goods sold is being deducted. Thus, the total gross profit of the company is 14000.

b. Profit and loss account for the year ended 30 April 2020

Particular Amount

Gross profit as per trading

account 14000

Less;

Expenses

shop wages 4420

light and heat 260

rent 4500

insurance 120 9300

Net profit 4700

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Further after the calculation of the trading account the profit and loss is being made under

which all the other indirect expenses are being deducted from the gross profit. Hence, after this

deduction the total net profit which is attributable to the company is 4700.

c. Statement of financial position as at 30 April 2020

Balance sheet

Particular Amount

Assets

Shop fitting 13000

bank 610

cash 100

debtors 120

CL stock 4400

Total assets 18230

Liabilities

creditors 2030

Capital 15000

Less: Drawing 3500

Add: net profit 4700 16200

Total liabilities and

equity 18230

Further after making the profit and loss account the statement of financial position is being made.

Under this all the asset and liabilities of the company are being listed and evaluated.

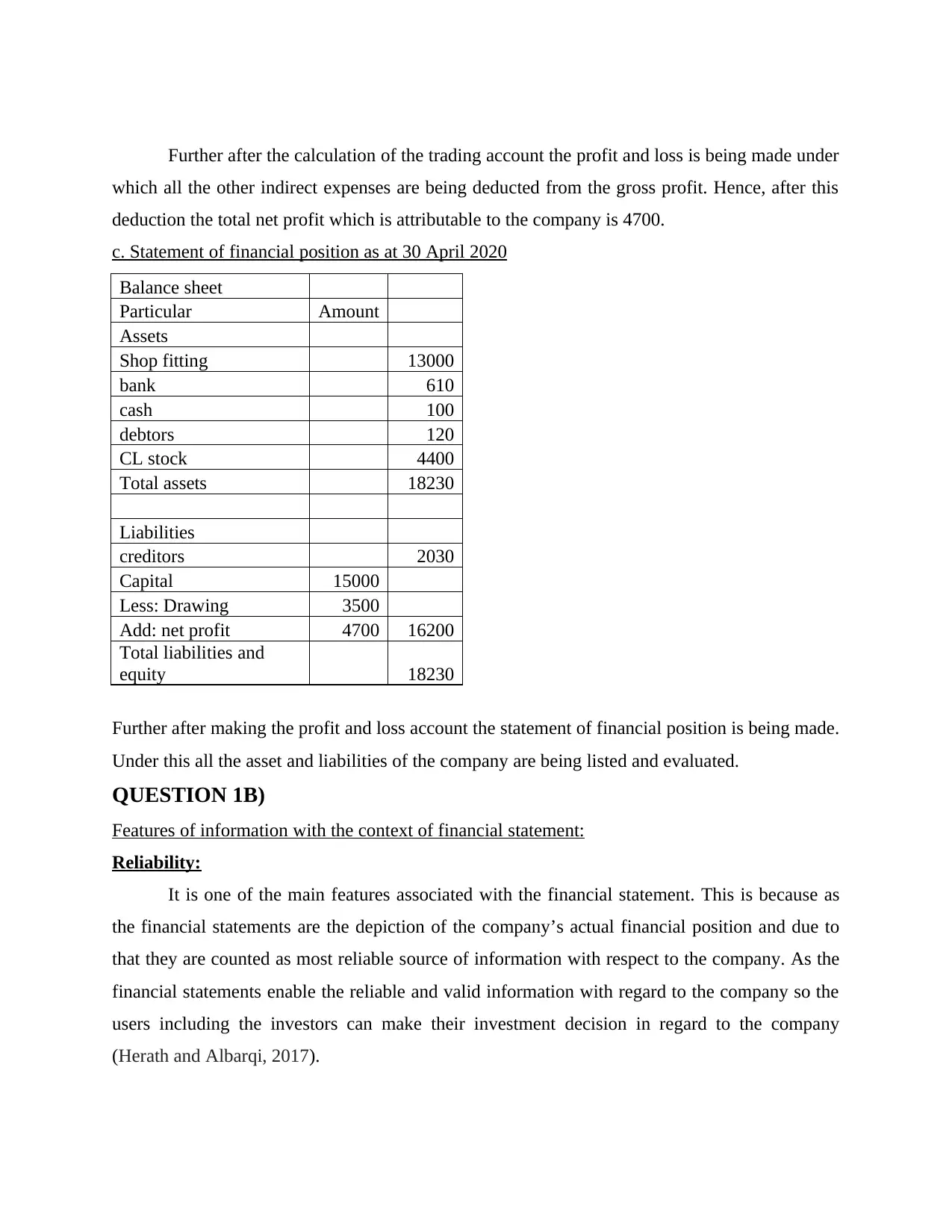

QUESTION 1B)

Features of information with the context of financial statement:

Reliability:

It is one of the main features associated with the financial statement. This is because as

the financial statements are the depiction of the company’s actual financial position and due to

that they are counted as most reliable source of information with respect to the company. As the

financial statements enable the reliable and valid information with regard to the company so the

users including the investors can make their investment decision in regard to the company

(Herath and Albarqi, 2017).

which all the other indirect expenses are being deducted from the gross profit. Hence, after this

deduction the total net profit which is attributable to the company is 4700.

c. Statement of financial position as at 30 April 2020

Balance sheet

Particular Amount

Assets

Shop fitting 13000

bank 610

cash 100

debtors 120

CL stock 4400

Total assets 18230

Liabilities

creditors 2030

Capital 15000

Less: Drawing 3500

Add: net profit 4700 16200

Total liabilities and

equity 18230

Further after making the profit and loss account the statement of financial position is being made.

Under this all the asset and liabilities of the company are being listed and evaluated.

QUESTION 1B)

Features of information with the context of financial statement:

Reliability:

It is one of the main features associated with the financial statement. This is because as

the financial statements are the depiction of the company’s actual financial position and due to

that they are counted as most reliable source of information with respect to the company. As the

financial statements enable the reliable and valid information with regard to the company so the

users including the investors can make their investment decision in regard to the company

(Herath and Albarqi, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

However, on a critical note it is to be noted that as every company wants that its financial

information and the statement will depict the best profitable situation and image so it would be

wrong to said that the financial information are 100% reliable because there are many chances

that the companies can make changes and display the wrong information. Hence, taking of

decision on the basis of financial statement are said to be not adequately appropriate.

Comparability:

It is also an important feature of the financial information that is being predicted from

financial statements. This is because it enables the user to have a detailed analysis of the

financial position on the basis of making comparison of the financial statements of the past year.

This means that by having a comparative analysis of the financial details of the company with

the past year the user can determine that whether the company is efficiently operating its

business operations and not. Thus, it is important for the user because on the basis of

comparison, they can take financial and investment decision.

However, critically it can be said that the analysis of performance of the company on the

basis of the comparison of the past year financial statement is not correct. This is because there

are many chances that the company is moving and raising its business of operation, which may

include moving and headed towards the direction of success. So taking of decision of the basis of

the past performance would be not be an appropriate base of decision making.

Understandability:

It is also a major and main feature of the financial information that is being displayed

through financial statements. As the financial statements bears every single information about

the company’s financial position right from the debts to equity, liabilities to assets, profits to loss

and various others. So it would not be wrong to said that the financial statements enable the user

to have a clear and detailed understanding of the financial statement and the information (Birt,

Muthusamy and Bir, 2017). This is an important feature because it makes a user aware about the

real situation and performance of the company.

However, on a critical note, it is to be noted that the information which is displayed and

presented by the company may be wring and vague and it may also lead to the creation of wrong

understanding about the company and its position. This may also lead to have a taking of wrong

decision too.

Relevance:

information and the statement will depict the best profitable situation and image so it would be

wrong to said that the financial information are 100% reliable because there are many chances

that the companies can make changes and display the wrong information. Hence, taking of

decision on the basis of financial statement are said to be not adequately appropriate.

Comparability:

It is also an important feature of the financial information that is being predicted from

financial statements. This is because it enables the user to have a detailed analysis of the

financial position on the basis of making comparison of the financial statements of the past year.

This means that by having a comparative analysis of the financial details of the company with

the past year the user can determine that whether the company is efficiently operating its

business operations and not. Thus, it is important for the user because on the basis of

comparison, they can take financial and investment decision.

However, critically it can be said that the analysis of performance of the company on the

basis of the comparison of the past year financial statement is not correct. This is because there

are many chances that the company is moving and raising its business of operation, which may

include moving and headed towards the direction of success. So taking of decision of the basis of

the past performance would be not be an appropriate base of decision making.

Understandability:

It is also a major and main feature of the financial information that is being displayed

through financial statements. As the financial statements bears every single information about

the company’s financial position right from the debts to equity, liabilities to assets, profits to loss

and various others. So it would not be wrong to said that the financial statements enable the user

to have a clear and detailed understanding of the financial statement and the information (Birt,

Muthusamy and Bir, 2017). This is an important feature because it makes a user aware about the

real situation and performance of the company.

However, on a critical note, it is to be noted that the information which is displayed and

presented by the company may be wring and vague and it may also lead to the creation of wrong

understanding about the company and its position. This may also lead to have a taking of wrong

decision too.

Relevance:

It is to be noted that the information that is being provided and displayed by the financial

statement of the company are most relevant to the user. This means that the information which is

concerned with the financial statement are most relevant information with respect to the users

because it will act as a base for their perspective and decision making with regard to the

company (Moskalenko, Vasyukova and Chestnykh, 2020). Likewise, the relevant factor itself

becomes an important feature of the financial statement because only the useful information is

the part of them.

On the other hand, it is to be considering that the information is relevant but any small

error and mis-information may lead to reduce the entire authenticity and relevancy of the

financial statement. Thus, considering the financial statements as base is right but looking at non-

financial information including the company’s way of operation is also very important to know.

Verifiability:

This is also an important feature of the financial information which is enabled by the

company. as per this feature the financial information is verified with some other alternative

methods too. This can be understood as if the company depict some information and if the user

want to verify it against some other alternative then, it is possible with respect to the financial

information.

However, it is to be considered that the verifiability of the statement requires time an in

case if the information that is verified come different from the depicted financial information

then it will not only affect the user but the company’s image will also be affected.

Timeliness:

It is also an important feature associated with the financial statement. This is because if

the time taken by the company in order to display its financial information is short then there are

chances that the less relevant and useful information will be depicted. However, if the company

takes more time say publishing financial statements after the completion of the accounting year

then it becomes difficult for the user to determine the actual position of the company. Thus,

regular publishing of the financial statements on adequate time will lead to the easy

determination of the company’s performance (Ramadhan and Sugandi, 2020).

However, critically it is to be noted that the publishing of financial information on regular

interval may also lead to the occurrence of wrong depiction and publication.

statement of the company are most relevant to the user. This means that the information which is

concerned with the financial statement are most relevant information with respect to the users

because it will act as a base for their perspective and decision making with regard to the

company (Moskalenko, Vasyukova and Chestnykh, 2020). Likewise, the relevant factor itself

becomes an important feature of the financial statement because only the useful information is

the part of them.

On the other hand, it is to be considering that the information is relevant but any small

error and mis-information may lead to reduce the entire authenticity and relevancy of the

financial statement. Thus, considering the financial statements as base is right but looking at non-

financial information including the company’s way of operation is also very important to know.

Verifiability:

This is also an important feature of the financial information which is enabled by the

company. as per this feature the financial information is verified with some other alternative

methods too. This can be understood as if the company depict some information and if the user

want to verify it against some other alternative then, it is possible with respect to the financial

information.

However, it is to be considered that the verifiability of the statement requires time an in

case if the information that is verified come different from the depicted financial information

then it will not only affect the user but the company’s image will also be affected.

Timeliness:

It is also an important feature associated with the financial statement. This is because if

the time taken by the company in order to display its financial information is short then there are

chances that the less relevant and useful information will be depicted. However, if the company

takes more time say publishing financial statements after the completion of the accounting year

then it becomes difficult for the user to determine the actual position of the company. Thus,

regular publishing of the financial statements on adequate time will lead to the easy

determination of the company’s performance (Ramadhan and Sugandi, 2020).

However, critically it is to be noted that the publishing of financial information on regular

interval may also lead to the occurrence of wrong depiction and publication.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

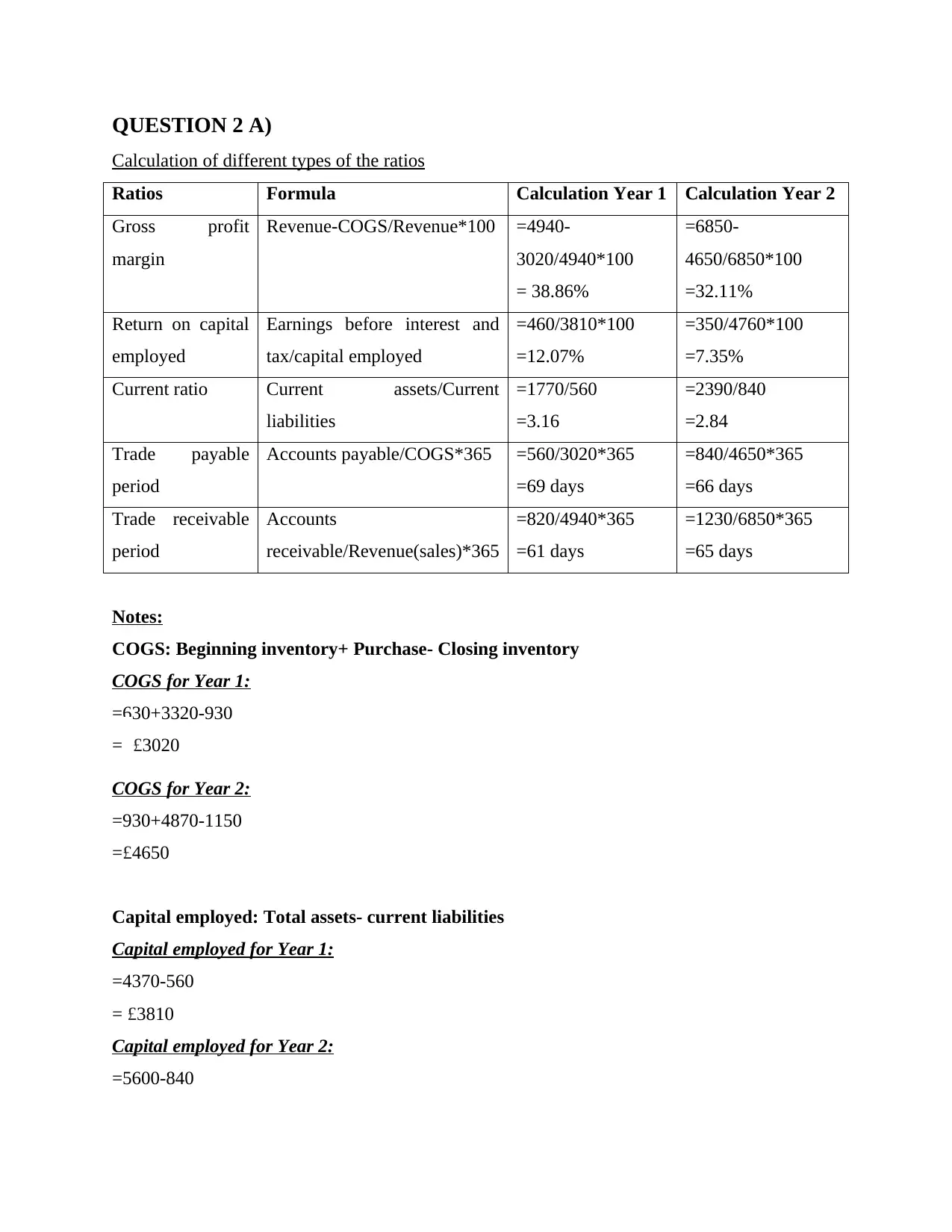

QUESTION 2 A)

Calculation of different types of the ratios

Ratios Formula Calculation Year 1 Calculation Year 2

Gross profit

margin

Revenue-COGS/Revenue*100 =4940-

3020/4940*100

= 38.86%

=6850-

4650/6850*100

=32.11%

Return on capital

employed

Earnings before interest and

tax/capital employed

=460/3810*100

=12.07%

=350/4760*100

=7.35%

Current ratio Current assets/Current

liabilities

=1770/560

=3.16

=2390/840

=2.84

Trade payable

period

Accounts payable/COGS*365 =560/3020*365

=69 days

=840/4650*365

=66 days

Trade receivable

period

Accounts

receivable/Revenue(sales)*365

=820/4940*365

=61 days

=1230/6850*365

=65 days

Notes:

COGS: Beginning inventory+ Purchase- Closing inventory

COGS for Year 1:

=630+3320-930

= £3020

COGS for Year 2:

=930+4870-1150

=£4650

Capital employed: Total assets- current liabilities

Capital employed for Year 1:

=4370-560

= £3810

Capital employed for Year 2:

=5600-840

Calculation of different types of the ratios

Ratios Formula Calculation Year 1 Calculation Year 2

Gross profit

margin

Revenue-COGS/Revenue*100 =4940-

3020/4940*100

= 38.86%

=6850-

4650/6850*100

=32.11%

Return on capital

employed

Earnings before interest and

tax/capital employed

=460/3810*100

=12.07%

=350/4760*100

=7.35%

Current ratio Current assets/Current

liabilities

=1770/560

=3.16

=2390/840

=2.84

Trade payable

period

Accounts payable/COGS*365 =560/3020*365

=69 days

=840/4650*365

=66 days

Trade receivable

period

Accounts

receivable/Revenue(sales)*365

=820/4940*365

=61 days

=1230/6850*365

=65 days

Notes:

COGS: Beginning inventory+ Purchase- Closing inventory

COGS for Year 1:

=630+3320-930

= £3020

COGS for Year 2:

=930+4870-1150

=£4650

Capital employed: Total assets- current liabilities

Capital employed for Year 1:

=4370-560

= £3810

Capital employed for Year 2:

=5600-840

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

=£4760

Interpretation:

Gross profit margin:

It refers to the percentage of the sales revenue that the company has earned and keeps

after covering its overall cost of operation. from the above analysis it can be interpreted that the

ratio is declining from 38 to 32%. This means that the amount of revenue with respect to the

company is running low and declining along with raising the percentage of cost.

Return on capital employed:

This ratio shows the percentage of return that the company has earned over its capital. It

means the percentage of return over the utilization of capital by the company (Das and Swain,

2018). While comparing ratio of 2 year it can be analysed that percentage is declining from 12.07

to 7.35 from 1st to 2nd year. This means that the company’s efficiency with respect to deploying

of capital is reducing.

Current ratio:

It is the ratio concerning with the liquidity position of the company. This ratio shows that

how readily company can pay off its short term obligations. While comparing the ratio of 1st and

2nd tear it is found that the ratio is reducing from 3.16 to 2.84. This clearly interprets the low and

declining liquidity position.

Trade payable period:

This ratio shows the number of days the company requires in order to pay off its debts

and debtors. In the analysis of the above calculation it is analysed that the period is declining

from 69 to 66 days. This means that the company’s policy with regard to making of payment of

its debtors is raising.

Trade receivable period:

This ratio shows the number of days the company requires collecting the debts from the

market. In case of analysis of the above figures it is found that the period is rising from 61 to 65

days. This means that the company’s efficiency with respect to the collection of debts or its

credit policy is not good enough.

Interpretation:

Gross profit margin:

It refers to the percentage of the sales revenue that the company has earned and keeps

after covering its overall cost of operation. from the above analysis it can be interpreted that the

ratio is declining from 38 to 32%. This means that the amount of revenue with respect to the

company is running low and declining along with raising the percentage of cost.

Return on capital employed:

This ratio shows the percentage of return that the company has earned over its capital. It

means the percentage of return over the utilization of capital by the company (Das and Swain,

2018). While comparing ratio of 2 year it can be analysed that percentage is declining from 12.07

to 7.35 from 1st to 2nd year. This means that the company’s efficiency with respect to deploying

of capital is reducing.

Current ratio:

It is the ratio concerning with the liquidity position of the company. This ratio shows that

how readily company can pay off its short term obligations. While comparing the ratio of 1st and

2nd tear it is found that the ratio is reducing from 3.16 to 2.84. This clearly interprets the low and

declining liquidity position.

Trade payable period:

This ratio shows the number of days the company requires in order to pay off its debts

and debtors. In the analysis of the above calculation it is analysed that the period is declining

from 69 to 66 days. This means that the company’s policy with regard to making of payment of

its debtors is raising.

Trade receivable period:

This ratio shows the number of days the company requires collecting the debts from the

market. In case of analysis of the above figures it is found that the period is rising from 61 to 65

days. This means that the company’s efficiency with respect to the collection of debts or its

credit policy is not good enough.

QUESTION 2B)

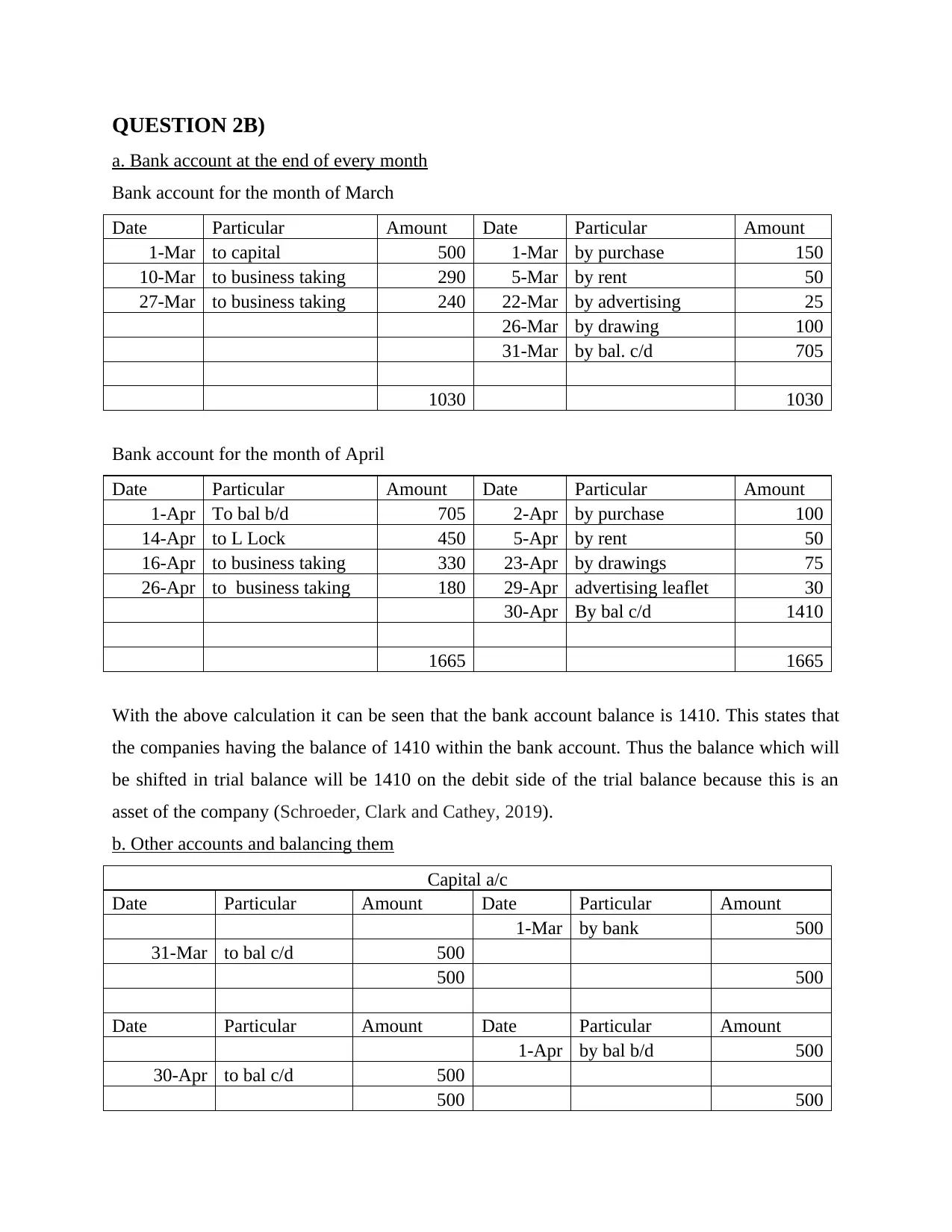

a. Bank account at the end of every month

Bank account for the month of March

Date Particular Amount Date Particular Amount

1-Mar to capital 500 1-Mar by purchase 150

10-Mar to business taking 290 5-Mar by rent 50

27-Mar to business taking 240 22-Mar by advertising 25

26-Mar by drawing 100

31-Mar by bal. c/d 705

1030 1030

Bank account for the month of April

Date Particular Amount Date Particular Amount

1-Apr To bal b/d 705 2-Apr by purchase 100

14-Apr to L Lock 450 5-Apr by rent 50

16-Apr to business taking 330 23-Apr by drawings 75

26-Apr to business taking 180 29-Apr advertising leaflet 30

30-Apr By bal c/d 1410

1665 1665

With the above calculation it can be seen that the bank account balance is 1410. This states that

the companies having the balance of 1410 within the bank account. Thus the balance which will

be shifted in trial balance will be 1410 on the debit side of the trial balance because this is an

asset of the company (Schroeder, Clark and Cathey, 2019).

b. Other accounts and balancing them

Capital a/c

Date Particular Amount Date Particular Amount

1-Mar by bank 500

31-Mar to bal c/d 500

500 500

Date Particular Amount Date Particular Amount

1-Apr by bal b/d 500

30-Apr to bal c/d 500

500 500

a. Bank account at the end of every month

Bank account for the month of March

Date Particular Amount Date Particular Amount

1-Mar to capital 500 1-Mar by purchase 150

10-Mar to business taking 290 5-Mar by rent 50

27-Mar to business taking 240 22-Mar by advertising 25

26-Mar by drawing 100

31-Mar by bal. c/d 705

1030 1030

Bank account for the month of April

Date Particular Amount Date Particular Amount

1-Apr To bal b/d 705 2-Apr by purchase 100

14-Apr to L Lock 450 5-Apr by rent 50

16-Apr to business taking 330 23-Apr by drawings 75

26-Apr to business taking 180 29-Apr advertising leaflet 30

30-Apr By bal c/d 1410

1665 1665

With the above calculation it can be seen that the bank account balance is 1410. This states that

the companies having the balance of 1410 within the bank account. Thus the balance which will

be shifted in trial balance will be 1410 on the debit side of the trial balance because this is an

asset of the company (Schroeder, Clark and Cathey, 2019).

b. Other accounts and balancing them

Capital a/c

Date Particular Amount Date Particular Amount

1-Mar by bank 500

31-Mar to bal c/d 500

500 500

Date Particular Amount Date Particular Amount

1-Apr by bal b/d 500

30-Apr to bal c/d 500

500 500

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

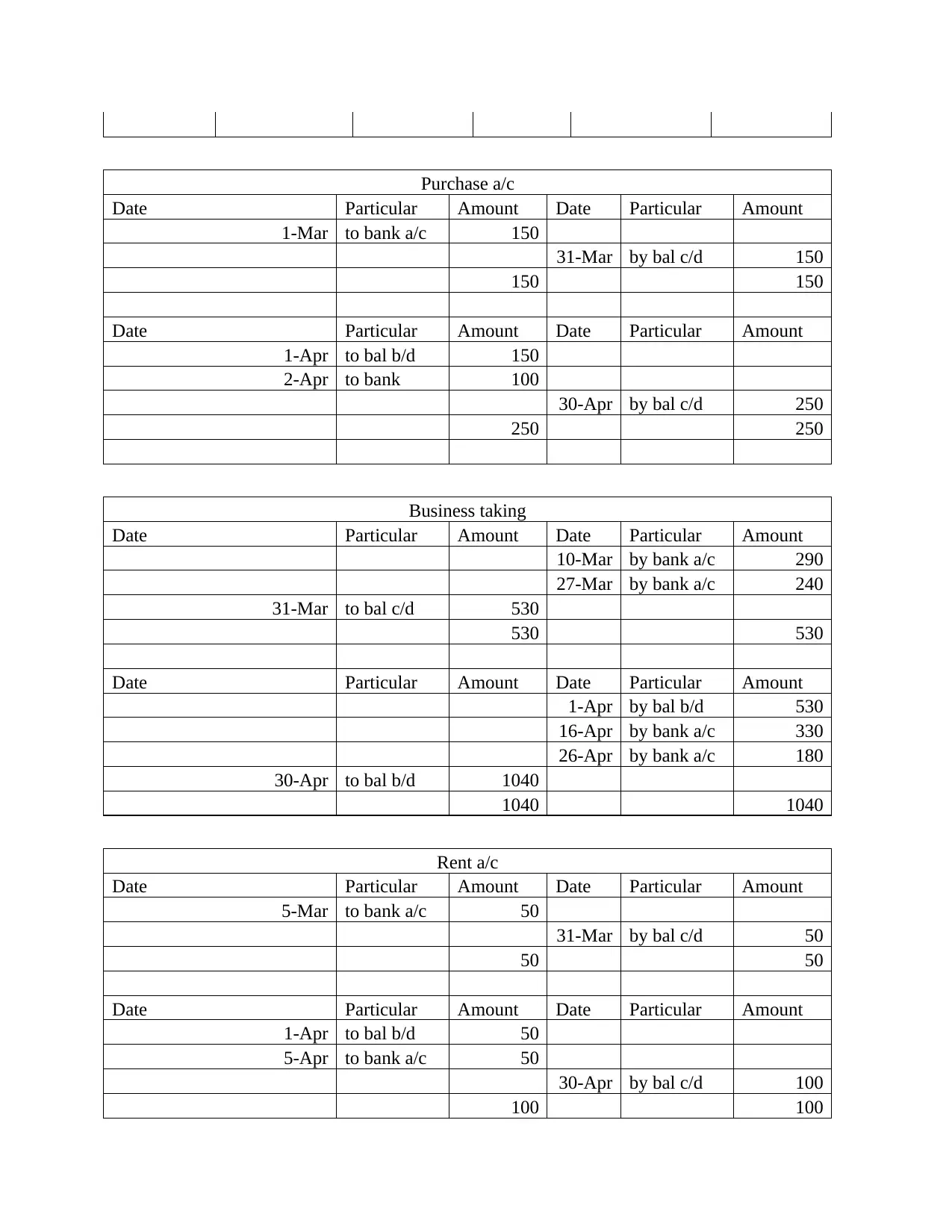

Purchase a/c

Date Particular Amount Date Particular Amount

1-Mar to bank a/c 150

31-Mar by bal c/d 150

150 150

Date Particular Amount Date Particular Amount

1-Apr to bal b/d 150

2-Apr to bank 100

30-Apr by bal c/d 250

250 250

Business taking

Date Particular Amount Date Particular Amount

10-Mar by bank a/c 290

27-Mar by bank a/c 240

31-Mar to bal c/d 530

530 530

Date Particular Amount Date Particular Amount

1-Apr by bal b/d 530

16-Apr by bank a/c 330

26-Apr by bank a/c 180

30-Apr to bal b/d 1040

1040 1040

Rent a/c

Date Particular Amount Date Particular Amount

5-Mar to bank a/c 50

31-Mar by bal c/d 50

50 50

Date Particular Amount Date Particular Amount

1-Apr to bal b/d 50

5-Apr to bank a/c 50

30-Apr by bal c/d 100

100 100

Date Particular Amount Date Particular Amount

1-Mar to bank a/c 150

31-Mar by bal c/d 150

150 150

Date Particular Amount Date Particular Amount

1-Apr to bal b/d 150

2-Apr to bank 100

30-Apr by bal c/d 250

250 250

Business taking

Date Particular Amount Date Particular Amount

10-Mar by bank a/c 290

27-Mar by bank a/c 240

31-Mar to bal c/d 530

530 530

Date Particular Amount Date Particular Amount

1-Apr by bal b/d 530

16-Apr by bank a/c 330

26-Apr by bank a/c 180

30-Apr to bal b/d 1040

1040 1040

Rent a/c

Date Particular Amount Date Particular Amount

5-Mar to bank a/c 50

31-Mar by bal c/d 50

50 50

Date Particular Amount Date Particular Amount

1-Apr to bal b/d 50

5-Apr to bank a/c 50

30-Apr by bal c/d 100

100 100

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

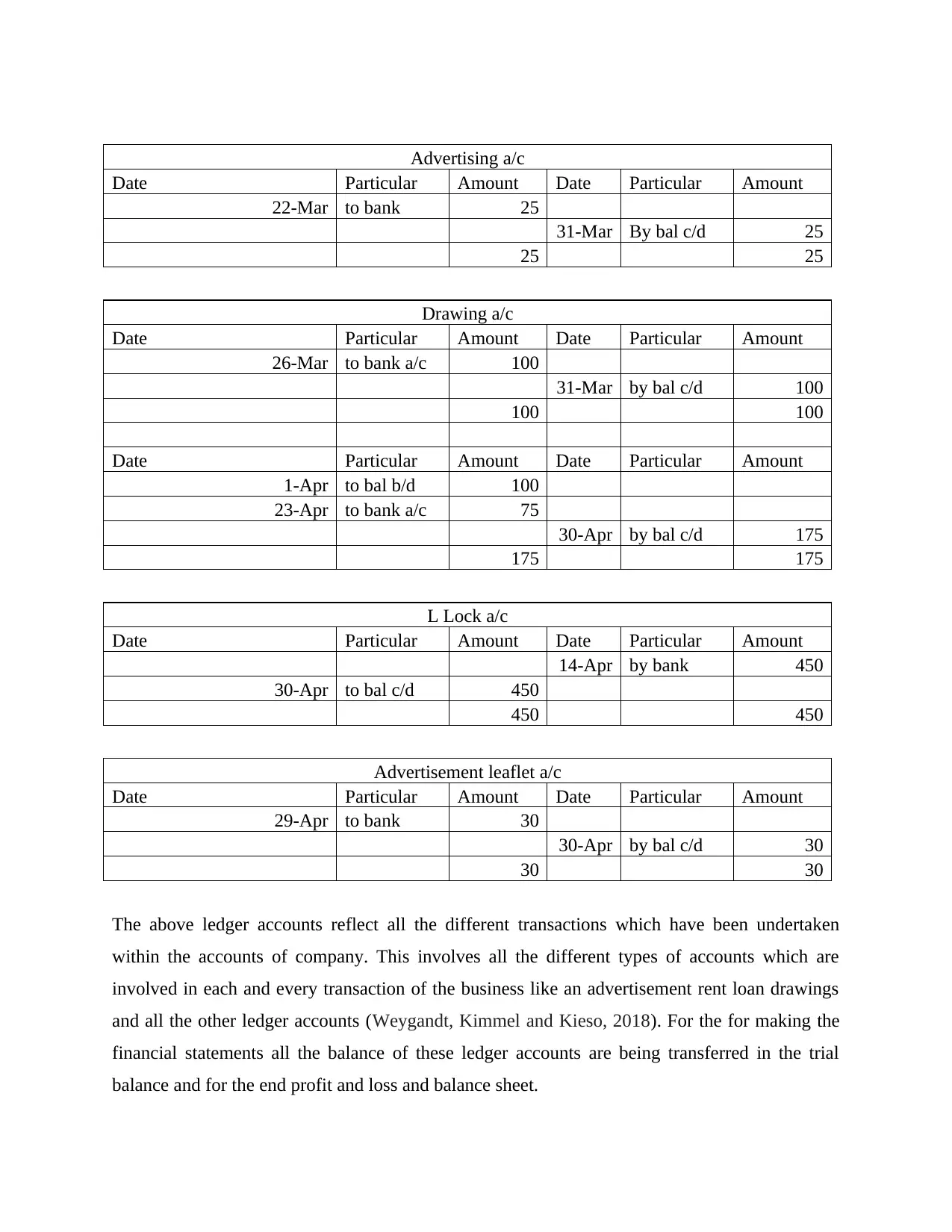

Advertising a/c

Date Particular Amount Date Particular Amount

22-Mar to bank 25

31-Mar By bal c/d 25

25 25

Drawing a/c

Date Particular Amount Date Particular Amount

26-Mar to bank a/c 100

31-Mar by bal c/d 100

100 100

Date Particular Amount Date Particular Amount

1-Apr to bal b/d 100

23-Apr to bank a/c 75

30-Apr by bal c/d 175

175 175

L Lock a/c

Date Particular Amount Date Particular Amount

14-Apr by bank 450

30-Apr to bal c/d 450

450 450

Advertisement leaflet a/c

Date Particular Amount Date Particular Amount

29-Apr to bank 30

30-Apr by bal c/d 30

30 30

The above ledger accounts reflect all the different transactions which have been undertaken

within the accounts of company. This involves all the different types of accounts which are

involved in each and every transaction of the business like an advertisement rent loan drawings

and all the other ledger accounts (Weygandt, Kimmel and Kieso, 2018). For the for making the

financial statements all the balance of these ledger accounts are being transferred in the trial

balance and for the end profit and loss and balance sheet.

Date Particular Amount Date Particular Amount

22-Mar to bank 25

31-Mar By bal c/d 25

25 25

Drawing a/c

Date Particular Amount Date Particular Amount

26-Mar to bank a/c 100

31-Mar by bal c/d 100

100 100

Date Particular Amount Date Particular Amount

1-Apr to bal b/d 100

23-Apr to bank a/c 75

30-Apr by bal c/d 175

175 175

L Lock a/c

Date Particular Amount Date Particular Amount

14-Apr by bank 450

30-Apr to bal c/d 450

450 450

Advertisement leaflet a/c

Date Particular Amount Date Particular Amount

29-Apr to bank 30

30-Apr by bal c/d 30

30 30

The above ledger accounts reflect all the different transactions which have been undertaken

within the accounts of company. This involves all the different types of accounts which are

involved in each and every transaction of the business like an advertisement rent loan drawings

and all the other ledger accounts (Weygandt, Kimmel and Kieso, 2018). For the for making the

financial statements all the balance of these ledger accounts are being transferred in the trial

balance and for the end profit and loss and balance sheet.

c. Extraction of the trial balance as at 30 April 2020

Particular Debit Credit

Bank 1410

Capital 500

Purchase 250

Business taking 1040

Rent 100

advertising 25

Drawings 175

L Lock 450

Advertising leaflet 30

Total 1990 1990

After making all the ledger account in next step is to prepare the trial balance. the reason

underlying this part is that with help of the trial balance for the balances of the ledger accounts

are being transferred to give relevant please like within the profit and loss account and the

balance sheet. All this balance is a transferred by company in making effective financial

statements of the company (McCallig, Robb and Rohde, 2019).

QUESTION 2C)

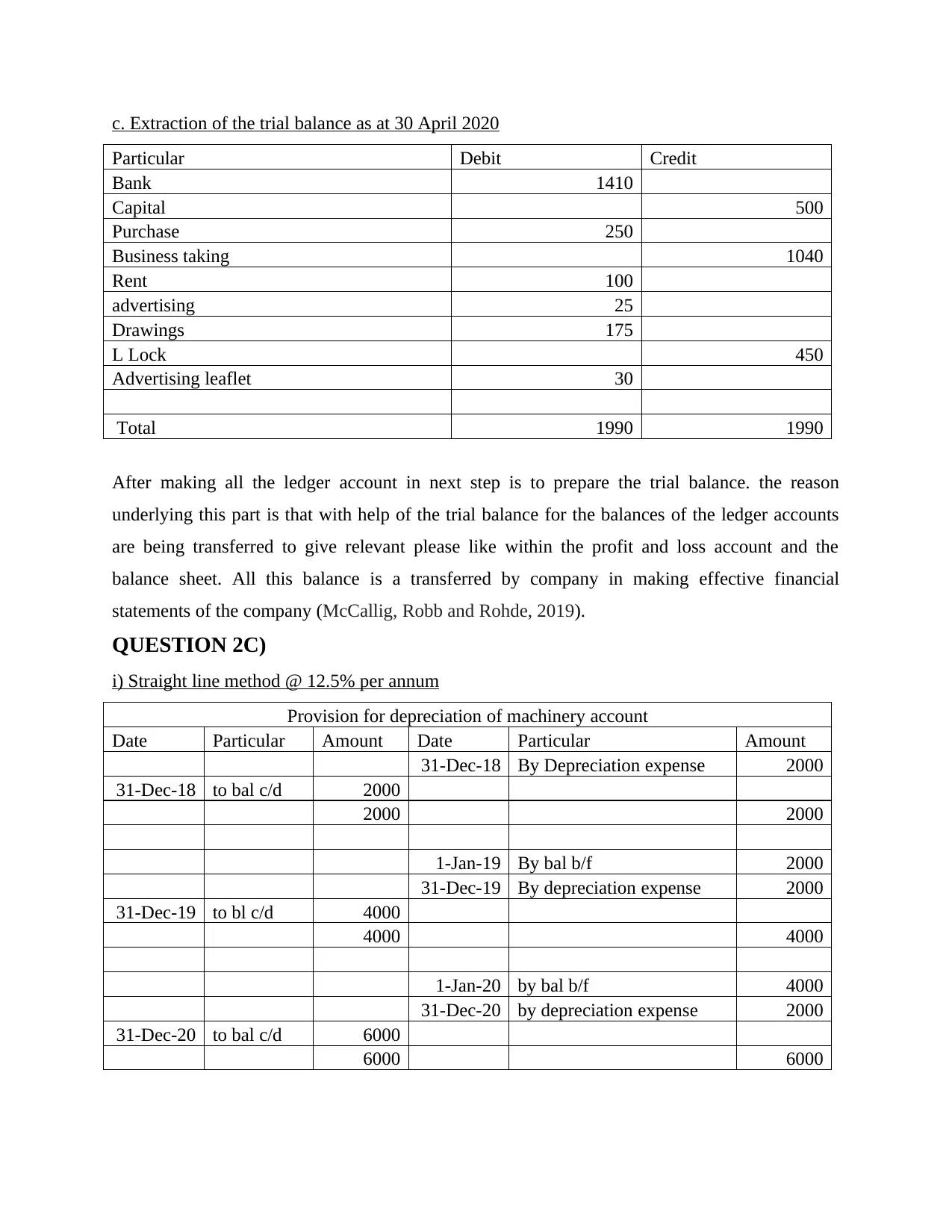

i) Straight line method @ 12.5% per annum

Provision for depreciation of machinery account

Date Particular Amount Date Particular Amount

31-Dec-18 By Depreciation expense 2000

31-Dec-18 to bal c/d 2000

2000 2000

1-Jan-19 By bal b/f 2000

31-Dec-19 By depreciation expense 2000

31-Dec-19 to bl c/d 4000

4000 4000

1-Jan-20 by bal b/f 4000

31-Dec-20 by depreciation expense 2000

31-Dec-20 to bal c/d 6000

6000 6000

Particular Debit Credit

Bank 1410

Capital 500

Purchase 250

Business taking 1040

Rent 100

advertising 25

Drawings 175

L Lock 450

Advertising leaflet 30

Total 1990 1990

After making all the ledger account in next step is to prepare the trial balance. the reason

underlying this part is that with help of the trial balance for the balances of the ledger accounts

are being transferred to give relevant please like within the profit and loss account and the

balance sheet. All this balance is a transferred by company in making effective financial

statements of the company (McCallig, Robb and Rohde, 2019).

QUESTION 2C)

i) Straight line method @ 12.5% per annum

Provision for depreciation of machinery account

Date Particular Amount Date Particular Amount

31-Dec-18 By Depreciation expense 2000

31-Dec-18 to bal c/d 2000

2000 2000

1-Jan-19 By bal b/f 2000

31-Dec-19 By depreciation expense 2000

31-Dec-19 to bl c/d 4000

4000 4000

1-Jan-20 by bal b/f 4000

31-Dec-20 by depreciation expense 2000

31-Dec-20 to bal c/d 6000

6000 6000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The above machinery account is based on the straight line method of charging depreciation. This

is a method under which same amount of depreciation is being charged within the depreciating

of the machinery. The reason underlying this fact is that when the machinery is being used then

some value of the machine is being depreciated (Wild, 2019). With the calculation of the

depreciation with straight line method with the rate of 12.5% the depreciation of 6000 per year.

Hence for the complete life of the machinery depreciation is been charged at 2000 every year.

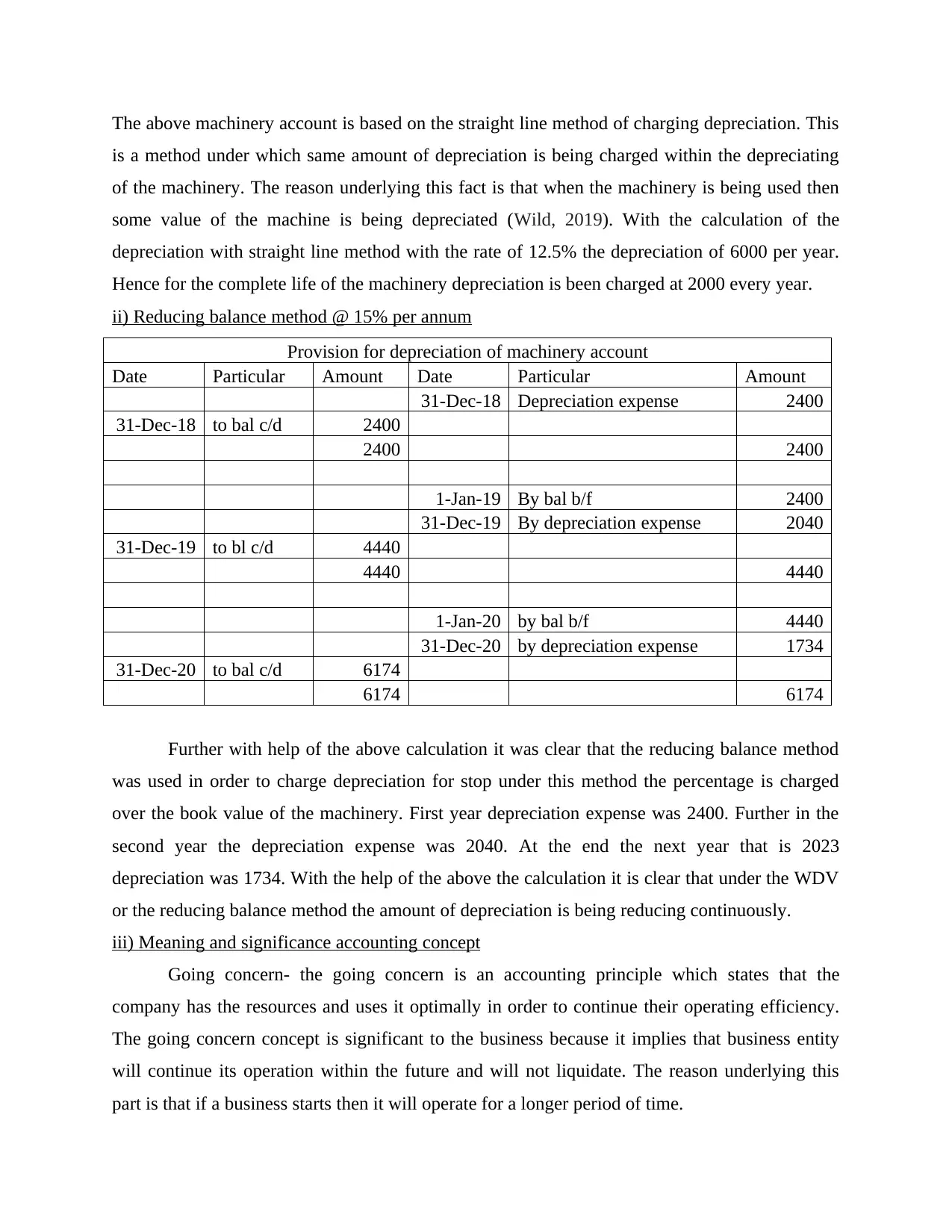

ii) Reducing balance method @ 15% per annum

Provision for depreciation of machinery account

Date Particular Amount Date Particular Amount

31-Dec-18 Depreciation expense 2400

31-Dec-18 to bal c/d 2400

2400 2400

1-Jan-19 By bal b/f 2400

31-Dec-19 By depreciation expense 2040

31-Dec-19 to bl c/d 4440

4440 4440

1-Jan-20 by bal b/f 4440

31-Dec-20 by depreciation expense 1734

31-Dec-20 to bal c/d 6174

6174 6174

Further with help of the above calculation it was clear that the reducing balance method

was used in order to charge depreciation for stop under this method the percentage is charged

over the book value of the machinery. First year depreciation expense was 2400. Further in the

second year the depreciation expense was 2040. At the end the next year that is 2023

depreciation was 1734. With the help of the above the calculation it is clear that under the WDV

or the reducing balance method the amount of depreciation is being reducing continuously.

iii) Meaning and significance accounting concept

Going concern- the going concern is an accounting principle which states that the

company has the resources and uses it optimally in order to continue their operating efficiency.

The going concern concept is significant to the business because it implies that business entity

will continue its operation within the future and will not liquidate. The reason underlying this

part is that if a business starts then it will operate for a longer period of time.

is a method under which same amount of depreciation is being charged within the depreciating

of the machinery. The reason underlying this fact is that when the machinery is being used then

some value of the machine is being depreciated (Wild, 2019). With the calculation of the

depreciation with straight line method with the rate of 12.5% the depreciation of 6000 per year.

Hence for the complete life of the machinery depreciation is been charged at 2000 every year.

ii) Reducing balance method @ 15% per annum

Provision for depreciation of machinery account

Date Particular Amount Date Particular Amount

31-Dec-18 Depreciation expense 2400

31-Dec-18 to bal c/d 2400

2400 2400

1-Jan-19 By bal b/f 2400

31-Dec-19 By depreciation expense 2040

31-Dec-19 to bl c/d 4440

4440 4440

1-Jan-20 by bal b/f 4440

31-Dec-20 by depreciation expense 1734

31-Dec-20 to bal c/d 6174

6174 6174

Further with help of the above calculation it was clear that the reducing balance method

was used in order to charge depreciation for stop under this method the percentage is charged

over the book value of the machinery. First year depreciation expense was 2400. Further in the

second year the depreciation expense was 2040. At the end the next year that is 2023

depreciation was 1734. With the help of the above the calculation it is clear that under the WDV

or the reducing balance method the amount of depreciation is being reducing continuously.

iii) Meaning and significance accounting concept

Going concern- the going concern is an accounting principle which states that the

company has the resources and uses it optimally in order to continue their operating efficiency.

The going concern concept is significant to the business because it implies that business entity

will continue its operation within the future and will not liquidate. The reason underlying this

part is that if a business starts then it will operate for a longer period of time.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Materiality- The materiality concept of the accounting principle states that all the material

and relevant information relating to the business and its operation must be provider to the

intended users through the financial statements (Kimmel, Weygandt and Kieso, 2018). The

reason underline this part is that all the material information must be communicated with the

required parties. When the required parties will have the necessary information then this will

assist and proper business decision taking and will result in success of the company.

Business entity concept- The business entity concept is a type of concept the accounting

principle which states that the transaction is associated with the business should be separately

recorded from the owner of the business page through the reason underlying these factors that

both the business and the owner are different entities. All the assets and liabilities belong to the

business and the profits are also being undertaken by the business itself. Both the business and

the owner are different and hence all the liabilities and assets are of business and not of the

owner.

CONCLUSION

From the above report it can be concluded that an analysis of the financial statement is act as

a base for taking decision with regard to the company. It will also enable the investor to analyse

the financial performance of the company. It is also understood that the financial statement are

the depiction of the company’s financial position and capability. An understanding regarding the

preparation of financial statement and the interpretation with the help of important ratio

including gross profit, ROCE and various others is also created within this report. Likewise,

importance and concepts of accounting principles like going concern, materiality and business

entity is also created in this report.

and relevant information relating to the business and its operation must be provider to the

intended users through the financial statements (Kimmel, Weygandt and Kieso, 2018). The

reason underline this part is that all the material information must be communicated with the

required parties. When the required parties will have the necessary information then this will

assist and proper business decision taking and will result in success of the company.

Business entity concept- The business entity concept is a type of concept the accounting

principle which states that the transaction is associated with the business should be separately

recorded from the owner of the business page through the reason underlying these factors that

both the business and the owner are different entities. All the assets and liabilities belong to the

business and the profits are also being undertaken by the business itself. Both the business and

the owner are different and hence all the liabilities and assets are of business and not of the

owner.

CONCLUSION

From the above report it can be concluded that an analysis of the financial statement is act as

a base for taking decision with regard to the company. It will also enable the investor to analyse

the financial performance of the company. It is also understood that the financial statement are

the depiction of the company’s financial position and capability. An understanding regarding the

preparation of financial statement and the interpretation with the help of important ratio

including gross profit, ROCE and various others is also created within this report. Likewise,

importance and concepts of accounting principles like going concern, materiality and business

entity is also created in this report.

REFERENCES

Books and journals

Birt, J.L., Muthusamy, K. and Bir, P., 2017. XBRL and the qualitative characteristics of useful

financial information. Accounting Research Journal.

Das, C.P. and Swain, R.K., 2018. INFLUENCE OF CAPITAL STRUCTURE ON FINANCIAL

PERFORMANCE. Parikalpana: KIIT Journal of Management. 14(1).

Garbowski, M., and et.al., 2019. Financial accounting of E-business enterprises. Academy of

Accounting and Financial Studies Journal, 23, pp.1-5.

Herath, S.K. and Albarqi, N., 2017. Financial reporting quality: A literature review. International

Journal of Business Management and Commerce. 2(2). pp.1-14.

Kimmel, P.D., Weygandt, J.J. and Kieso, D.E., 2018. Financial accounting: Tools for business

decision making. John Wiley & Sons.

McCallig, J., Robb, A. and Rohde, F., 2019. Establishing the representational faithfulness of

financial accounting information using multiparty security, network analysis and a

blockchain. International Journal of Accounting Information Systems, 33, pp.47-58.

Moskalenko, N.V., Vasyukova, E.S. and Chestnykh, D.O., 2020. Features of the reflection of

inventories in the financial statements. Entrepreneur’ s Guide.

Ramadhan, Y. and Sugandi, G., 2020. Prudence in Quality of Financial Statements. Talent

Development & Excellence. 12(1).

Schroeder, R.G., Clark, M.W. and Cathey, J.M., 2019. Financial accounting theory and analysis:

text and cases. John Wiley & Sons.

Warren, C.S., Jonick, C. and Schneider, J., 2020. Financial accounting. Cengage Learning.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2018. Financial Accounting with International

Financial Reporting Standards. John Wiley & Sons.

Wild, J., 2019. Financial Accounting: Information for Decisions, 9e.

1

Books and journals

Birt, J.L., Muthusamy, K. and Bir, P., 2017. XBRL and the qualitative characteristics of useful

financial information. Accounting Research Journal.

Das, C.P. and Swain, R.K., 2018. INFLUENCE OF CAPITAL STRUCTURE ON FINANCIAL

PERFORMANCE. Parikalpana: KIIT Journal of Management. 14(1).

Garbowski, M., and et.al., 2019. Financial accounting of E-business enterprises. Academy of

Accounting and Financial Studies Journal, 23, pp.1-5.

Herath, S.K. and Albarqi, N., 2017. Financial reporting quality: A literature review. International

Journal of Business Management and Commerce. 2(2). pp.1-14.

Kimmel, P.D., Weygandt, J.J. and Kieso, D.E., 2018. Financial accounting: Tools for business

decision making. John Wiley & Sons.

McCallig, J., Robb, A. and Rohde, F., 2019. Establishing the representational faithfulness of

financial accounting information using multiparty security, network analysis and a

blockchain. International Journal of Accounting Information Systems, 33, pp.47-58.

Moskalenko, N.V., Vasyukova, E.S. and Chestnykh, D.O., 2020. Features of the reflection of

inventories in the financial statements. Entrepreneur’ s Guide.

Ramadhan, Y. and Sugandi, G., 2020. Prudence in Quality of Financial Statements. Talent

Development & Excellence. 12(1).

Schroeder, R.G., Clark, M.W. and Cathey, J.M., 2019. Financial accounting theory and analysis:

text and cases. John Wiley & Sons.

Warren, C.S., Jonick, C. and Schneider, J., 2020. Financial accounting. Cengage Learning.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2018. Financial Accounting with International

Financial Reporting Standards. John Wiley & Sons.

Wild, J., 2019. Financial Accounting: Information for Decisions, 9e.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.